Thesis

The global car rental market was valued at $98.4 billion in 2021 and is projected to reach $126.6 billion by 2028. The customer experience around renting a car has historically been subpar: mired in paperwork, opaque pricing, high fees, and a very limited choice in available options of cars to rent. Car rental services typically require customers to visit an airport or office during business hours. They must wait in line to complete paperwork before receiving and returning keys in person. 1 in 6 people have changed or canceled vacation plans because of high prices or lack of availability of rental cars. 69% of people renting cars say they have had some kind of negative experience.

During the COVID-19 pandemic, pandemic-related supply chain challenges pushed car rental prices to historic levels, creating demand for other options. The car rental industry is undergoing a transformational shift driven by evolving consumer expectations and the increasing prevalence of on-demand services across various sectors, such as ride-sharing. The sharing economy popularized the idea of individuals renting out their underutilized assets to others for a fee. Additionally, declining ownership of cars and improving alternative transportation options have made renting a car attractive for an increasingly large segment of the population

Turo is a car-sharing marketplace that allows car owners to rent out their vehicles when not in use, increasing the utilization of vehicles by unlocking latent supply while providing a new source of income for car owners. Turo gives car renters access to a diverse selection of vehicles they can book at their convenience on an app, with greater flexibility and less paperwork than typically experienced with legacy car rental companies.

Founding Story

Turo was founded in 2009 by Shelby Clark (former CEO), Tara Reeves, and Nabeel Al-Kady. The founding team originally met at Harvard Business School and cofounded the company while at school.

In 2009, Clark was living in Boston and was planning to visit family for Thanksgiving, but the nearest short-term rental car was more than two miles away. As he biked through the icy streets on his way to get the rental car, he noticed all the parked cars, unused, and wondered why he couldn't just use one of those cars. Contemplating this, Clark realized that there was a need for a peer-to-peer car-sharing marketplace. He researched the market and found that insurance was the sole impediment to its existence. It took 18 months to solve the insurance dilemma. Car-sharing services were limited and primarily local at the time.

The company, originally called RelayRides, started in Boston and enabled people to rent out cars that would otherwise remain parked. This provides a source of extra income to car owners while also making car rentals more affordable for those without them. RelayRides competed with Zipcar and began to face pressure from Uber and Lyft, which newly mitigated the need for same-day car rental.

Not long after its inception, RelayRides relocated to San Francisco to pursue expansion. As the company grew, it became apparent that key operational experience was needed to support the scaling process. Around the time of its Series A funding round in 2011, the company hired former Shopping.com CEO Andre Haddad to be its new CEO. In 2013, the company acquired Wheelz, a car-sharing platform, to bolster its market presence further. To reflect its evolution and expanded vision, RelayRides rebranded as Turo in 2015. “We believe this brand reflects what we do," said Haddad, "which is focused on travel and tourism over the last few years.” The following year, Turo had its first international expansion to Canada.

Product

Hosts (Car Owners)

Source: Turo S-1

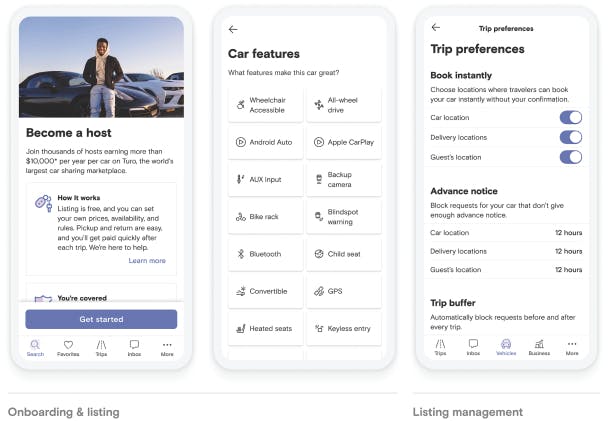

Turo provides software and services to allow car owners to list their vehicles and earn income. Hosts can be anyone from individuals looking to earn extra income to small business operators making a full-time living through Turo.

The platform is designed to make it simple for an owner to sign-up, verify their account, and create a listing. Turo enables hosts to manage their listing, availability calendar and settings, messaging, pricing and trip settings, remote and in-person check-in and checkout options, earnings payments, and post-trip incidental payments. Additionally, hosts can offer various pick-up and drop-off locations. They can also offer optional “extras” such as unlimited mileage, pre-paid refueling, bike and ski racks, camping equipment, and more.

Source: Turo S-1

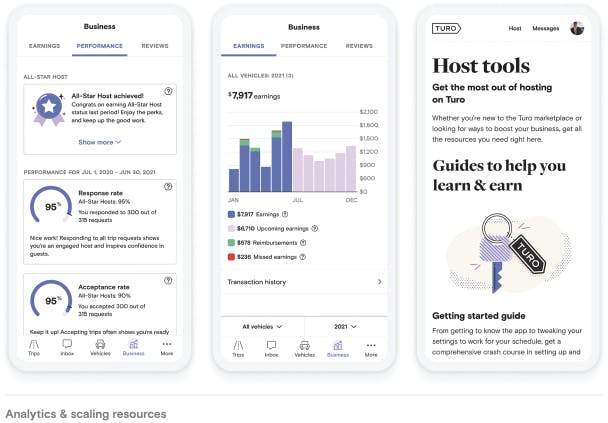

For Hosts interested in scaling their car-rental business through Turo, Turo provides business management capabilities that enable them to track performance analytics and earning estimates. Certain hosts also receive access to financing partnerships, multi-car insurance options, and account management. All host plans automatically include protection against third-party liability and compensation for vehicle damage.

Guests (Car Renters)

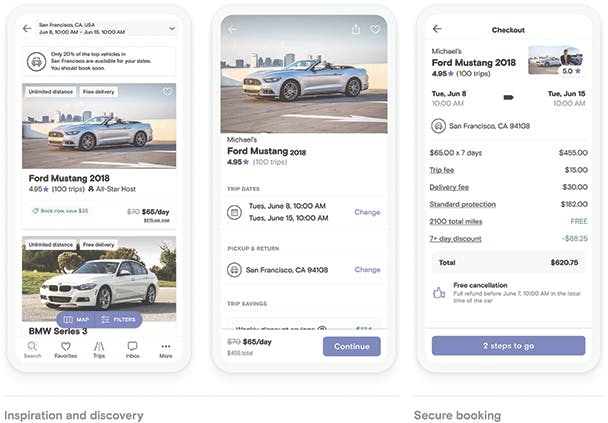

Turo offers individuals access to an extensive collection of privately-owned vehicles, with over 1.3K makes and models available on the marketplace and geographies spanning over 7.5K cities across the US, Canada, the United Kingdom, France, and Australia. Renters can book on the Turo app or online, choose a protection plan, and cancel for free up to 24 hours before their trip. Renters can have the car delivered to them or wherever they are going. Many hosts offer delivery to custom locations or popular points of interest like airports, train stations, and hotels.

Source: Turo S-1

Turo enables users to search for vehicles based on type, location, availability, ratings, and reviews. Guests can book vehicles directly on the platform, communicate with hosts through messaging, and check in and out of their trips. Guests can also access and unlock vehicles using Turo Go for many makes and models. Turo also offers insurance coverage for guests. In addition, Turo offers 24/7 customer support and 24/7 roadside assistance.

Market

Customer

Turo targets two main customer segments: car owners (hosts) who want to monetize their vehicles and individuals (guests) who need temporary access to a car for personal or professional use.

Hosts

Turo’s hosts can be categorized into three groups: consumer hosts, small business hosts, and professional hosts.

Consumer hosts typically share one or two cars with the aim of offsetting car ownership costs.

Small business hosts, often car enthusiasts, share three to nine cars to generate secondary income.

Professional hosts usually share 10 or more cars as their primary income source.

As of December 2022, Turo had over 160K active hosts who offer more than 320K active vehicle listings.

Guests

Turo’s guests seek convenient, personalized, and flexible car rental experiences. These guests include anyone on a vacation or getaway, business travelers, international travelers, and people searching for a car replacement. As of December 2022, Turo had over 3 million active guests who booked more than 19.1 million days’ worth of car rentals on the platform.

Market Size

Turo operates within the peer-to-peer car-sharing market, a broader car rental industry segment. It offers a platform for car owners to rent out their vehicles to individuals who use them for short periods. In 2021, the peer-to-peer car-sharing market was valued at $1.6 billion. It is projected to reach $7.2 billion in 2030, representing a growth rate of 17.6% during 2022-2030. The market has experienced rapid growth in recent years, driven by technological advancements by companies such as Turo and Getaround, cost-effectiveness, and a shift in consumer preferences towards services in the shared economy.

Competition

Getaround: Launched in 2011, Getaround is a peer-to-peer car-sharing digital platform that allows car owners to rent their vehicles to others when they are not in use. Getaround competes directly with Turo as both companies operate a car-sharing marketplace.

While operating with a similar concept and business model to Turo, Getaround distinguishes itself from Turo by having a stronger European presence and focusing on short rental durations. Getaround also uses its "Getaround Connect" technology, allowing renters to unlock cars with the app, eliminating the need for a physical key exchange. Conversely, Turo typically requires key handovers between the car owner and renter, although some listings may offer remote unlocking options.

As of September 2022, Getaround had over 1.7 million unique guests and 72K active cars in more than 1K cities across 8 countries, including the United States and Europe. In December 2022, Getaround went public through a SPAC with InterPrivate II Acquisition Corp, valuing the company near $1.2 billion. Since this time, the company’s market capitalization has declined significantly, and Getaround was worth ~$35 million as of April 2023. In 2022, Getaround reported $45 million in total revenue and a net loss of over -$100.6 million.

Zipcar: Founded in 2000 in Boston, Zipcar is a membership-based car-sharing service that provides vehicles for people to rent hourly or daily. With a presence in over 500 cities across nine countries, Zipcar primarily serves urban areas and college campuses. The service is designed to be a cost-effective and convenient alternative to car ownership, especially for those who only need a vehicle occasionally.

In 2013, Zipcar was acquired by Avis Budget Group International, a leading global car rental company, for $500 million. Zipcar has over 1 million members and a fleet of around 12K vehicles. The company revenue in 2021 was estimated to be nearly $300 million in 2020. Although Zipcar and Turo operate in car rentals, they cater to different customer needs and preferences. Zipcar manages and maintains its fleet and focuses on short-term rentals, while Turo serves as a marketplace that connects car owners and renters, providing a wider variety of cars and often catering to longer rental periods.

Enterprise Carshare: Enterprise CarShare, launched in 2005 as a subsidiary of Enterprise Rent-A-Car, is a car-sharing service that provides a convenient alternative to Enterprises’ traditional car rental business. CarShare allows members to rent cars hourly or daily, with fuel and insurance included. It currently operates across the US, Canada, and the United Kingdom. Unlike Turo, a peer-to-peer car-sharing platform, Enterprise CarShare leverages the fleet and resources of its parent company, Enterprise Rent-A-Car, which has over 10K locations worldwide.

Traditional Car-Rental Companies: These include companies like Hertz, Alamo, and Avis. These offer a range of vehicles for customers to rent daily, weekly, or monthly. These companies operate through a network of rental locations, often found at airports, train stations, and urban centers, where customers can pick up and drop off their rented vehicles. While Turo allows car owners to rent their vehicles, traditional rental companies own and manage their own fleets of cars.

Business Model

Turo operates a car-sharing marketplace that connects vehicle owners with individuals seeking to rent cars on demand. The platform empowers car owners (hosts) to generate income from their vehicles and provides guests with a convenient way to find and rent cars. Unlike traditional rental companies that own their vehicles, Turo has an asset-light business model and focuses on offering a curated, managed marketplace.

Turo generates revenue by charging fees to both hosts and guests. The company's primary revenue streams stem from marketplace fees and value-added service fees charged to both parties involved in a booking. When guests book a car, Turo charges them the vehicle price set by the host, a marketplace fee, and a value-added services fee for optional services like protection plans. Hosts also pay a marketplace fee based on a percentage of the vehicle price they set. Turo has often been referred to as the "Airbnb for cars" due to its similar approach to connecting hosts and guests on an online marketplace platform, and this similarity extends to its business model.

Traction

As of December 2022, Turo had over 160K active hosts and 2.9 million active guests, with a network of thousands of vehicles spanning the United States, Canada, France, the United Kingdom, and Australia.

In 2021, Turo saw significant growth, with sales increasing by over 270%. This rapid growth was due to a multitude of factors, including Hertz's brief bankruptcy, shrinking supply in the rental car market, and a boom in domestic U.S. travel. Turo continued its growth in 2022, with revenues increasing by 59% to $746.6 million, up from $469 million in 2021. In 2022, over 3 million guests booked over 19.1 million days

Valuation

In 2019, IAC led a $250 million Series E funding round for Turo, valuing it at $1 billion. Other investors included Allen & Company, Manhattan Venture Partners, August Capital, Shasta Ventures, and Kleiner Perkins.

In 2021, Turo privately filed and then released a public S-1 document in early 2022. It has published quarterly updates since then, with the latest filing providing its Q4 2022 performance.

Getaround, one of Turo's direct competitors, went public in December 2022 via a SPAC. Since then, the company has seen a significant decline in valuation, plummeting nearly 90%. This development may have influenced Turo's decision to exercise caution in pursuing an IPO.

Key Opportunities

Marketplace Network Effect

Turo’s platform benefits from the self-reinforcing value proposition between hosts and guests. Hosts are attracted to Turo’s platform due to the unique income generation opportunity that Turo provides. As Turo’s host community grows, so do the number of vehicles and locations, increasing the value proposition for guests to use Turo. This becomes a reinforcing flywheel and a mechanism for continual, organic growth and retention. Furthermore, as more hosts and guests use Turo’s services, the platform collects valuable data from bookings which are then used to power Turo’s algorithms. These algorithms then enhance Turo’s data-driven pricing, search results rankings, and vehicle recommendations, improving the overall user experience. Maintaining and strengthening its two-sided marketplace network effects is critical to Turo’s defensibility against competitors.

Partnerships

By accruing strategic partnerships, Turo can offer hosts and guests services and features that are not offered in-house. This will enable Turo to increase the value proposition of its platform and expand its market. In Turo’s S-1, it stated that it aspires to develop innovative financial arrangements with insurance providers to improve barriers that will allow it to accelerate its expansion. Some of Turo’s current partners include Michelin, Capital One, and Delta.

Key Risks

Regulation

Turo operates in a complex landscape of federal, state, and local regulations concerning insurance, taxation, and vehicle safety standards. The regulatory environment presents a risk for Turo as it could impose additional costs, constraints, and legal complexities that could hinder Turo’s operations and growth. As Turo has disrupted the car-rental business, it has also attracted regulatory scrutiny.

One example of this was a conflict between Turo and San Francisco International Airport (SFO). SFO demanded that Turo obtain the same permits and pay the same fees as traditional car rental companies, arguing that Turo’s service is essentially a car rental business. Turo responded by insisting that they are not a rental company but a technology platform. As Turo continues to expand and challenge established players in the industry, it will need to carefully manage these regulatory risks and adapt its business model to navigate the evolving legal landscape.

Liability

Turo's platform connects hosts and guests, but the company itself does not own or operate any vehicles. However, despite this, Turo faces a potential risk of liability for the activities of hosts, guests, or third parties using its platform. While there are no apparent fees or fines, in August 2022 it was reported that Turo and other peer-to-peer rental apps were found to have been used by criminals for human trafficking and other crimes. Liability claims could harm Turo's reputation, increase operating costs, and materially and adversely affect its business. To mitigate this risk, Turo has implemented safety guidelines, screening processes, and dispute resolution mechanisms to promote responsible behavior and minimize the potential for liability claims.

Competition

Turo operates in an increasingly competitive market, competing for customers with well-established traditional rental car companies and a growing number of car-sharing businesses. Turo must continuously innovate and adapt to stay ahead of its competitors to sustain and grow its market share, or it must create a strong enough moat to prevent erosion of its business due to competition.

Summary

Turo is a peer-to-peer car-sharing marketplace platform that connects car owners with renters. Through its platform, car owners can list their vehicles and rent them out to individuals who are looking for a flexible and convent car-rental solution. Turo operates in over 11K cities in the US, Canada, France, Australia, and the United Kingdom and is a prominent player in the global car-sharing industry.