Thesis

More than 78.8 million US households were camping yearly by 2019, marking a new all-time high. 62% of U.S. households include someone who camps at least occasionally. As of 2022, camping is mainstream. Not only does camping account for 40% of trips taken for leisure, but 80% of all travelers chose camping or glamping for at least some of their trips.

As a result of camping’s increasing popularity, the great outdoors is facing a supply and demand problem. 60% of land in the US is privately owned. Meanwhile, US national parks face underfunding, a $12 billion repair backlog, a 14% increase in visitors in the last five years, and possible budget cuts. State parks are also dealing with reduced funding and increased visitation. People visited state parks more than 786 million times from July 2019 to June 2020. In 2022, 58.4% of campers had difficulty finding a campsite that wasn’t booked, up from 10.6% in 2019. Camping is also increasingly a large group activity: the average group size for millennials camping is 10.7, compared to 8.5 for Gen Xers and 7.9 for baby boomers.

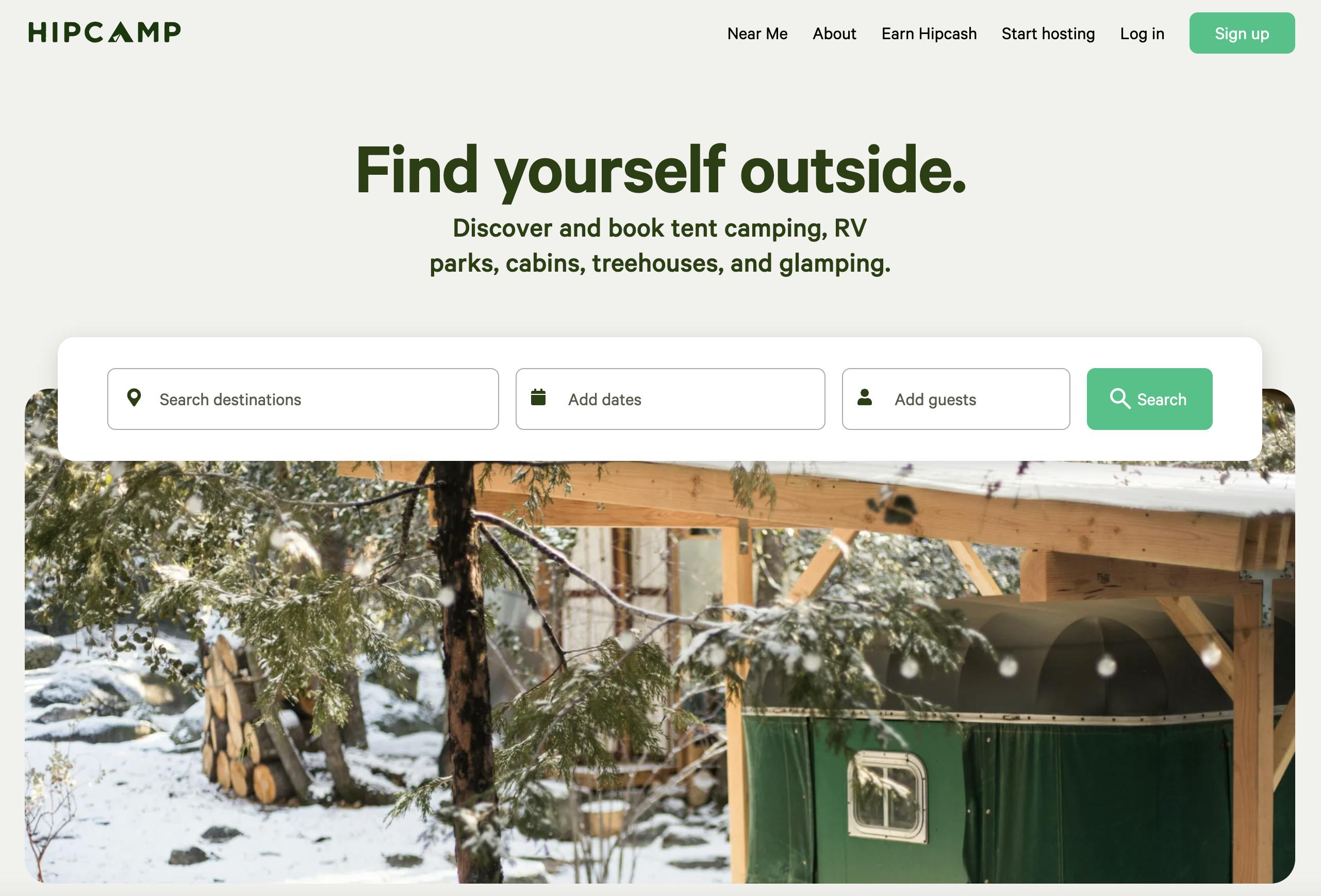

Hipcamp is a marketplace of outdoor stays. It aims to unlock more private land for camping to help address this supply and demand imbalance by connecting landowners with campers looking for unique, accessible stays. Hipcamp makes it easier for campers to list, discover, and book stays. Through Hipcamp, landowners can earn additional income from their land, and their land has a better chance of remaining protected. By unlocking access and simplifying the camping experience, Hipcamp wants to democratize the experience of getting outside, inspiring more people to enjoy and protect our world.

Founding Story

Source: Hipcamp

Founded in 2013, Hipcamp’s founding team includes Alyssa Ravasio (CEO) and Eric Bach, who left the company in 2016. While at UCLA, Ravasio created her own major to study the internet’s impact on society. She credited her college interest in the internet as a democratizing tool for helping inspire Hipcamp since it allowed her to see the potential of using the internet to make it easier for people to get outside. After college, Ravasio worked briefly for the US Department of State on international information and communication policy before leaving to help start two companies, both of which she got fired from.

Her “aha moment” that led to Hipcamp’s founding occurred while Ravasio was on a New Year’s Eve camping trip in California at a campsite she selected after hours of research. An avid surfer, Ravasio grew frustrated after learning the campsite had great waves for surfing — a feature of the site she was unaware of before arriving, which prevented her from taking advantage of it. This is when she realized how useful a campground website with relevant information and reviews could have been for her, and she decided to begin building such a website. In 2013, Ravasio began attending coding boot camps to learn how to build a basic database. She started building a site with detailed information on Californian campgrounds. Later that year, co-founder and avid backpacker Eric Bach joined the team, and the website’s research expanded to cover public lands across the US.

Hipcamp’s website launched in June 2013, and only a couple of people used the website daily over the course of its first summer. However, it took off over the course of the next year, primarily growing user traffic through SEO, word-of-mouth, and guerrilla marketing efforts by Ravasio. In 2014, the duo received $2 million in seed funding. After 1-2 years of learning about the economics and underfunding of the federal and state park systems, Ravasio realized there were more feasible strategies to solve the supply issues.

Ravasio then went to a restaurant with her then-boyfriend and began writing down “business models for Hipcamp.” She listed one idea for gear and food delivery and another for an ad-supported Yelp-like product. She also considered a private land rental idea, which Ravasio says originated when a land owner emailed her saying property taxes were tough and could be offset by earnings from a service like Hipcamp. Ravasio eventually decided to go the private land route because it was the best route forward to help Hipcamp fulfill its mission. The first private booking on Hipcamp occurred in September 2015. After that, hundreds of private landowners began listing and marketing their land on the site within a day.

Product

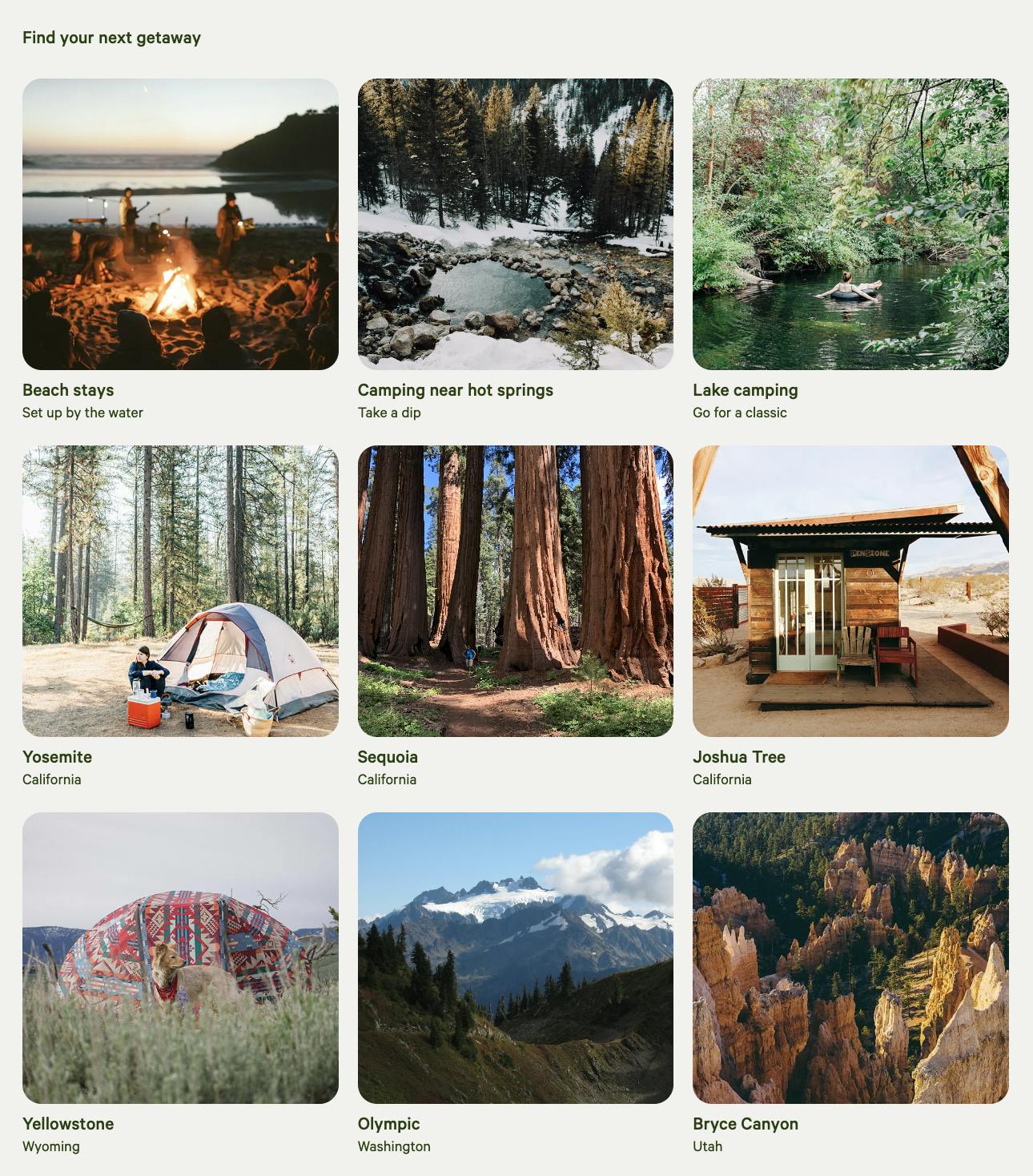

Hipcamp, sometimes referred to as the “Airbnb of camping,” offers a marketplace that connects private landowners with people looking for camping, outdoor lodging, and other outdoor living and recreational experiences. As of 2022, 80% of the more than 4 million acres owned by Hipcamp’s hosts is working land, including farms, ranches, and vineyards. As of April 2023, the company also lists detailed information on all National, State, Regional, and Army Corps Parks in all 50 States, equating to ~24.3K parks, ~39.5K campgrounds, and ~384K campsites across the US.

Source: Hipcamp

Hipcamp facilitates stays across camping, glamping, RVs, cabins, yurts, and more. It also curates and organizes stays by location, park, season, timeline, and other variables.

Source: Hipcamp

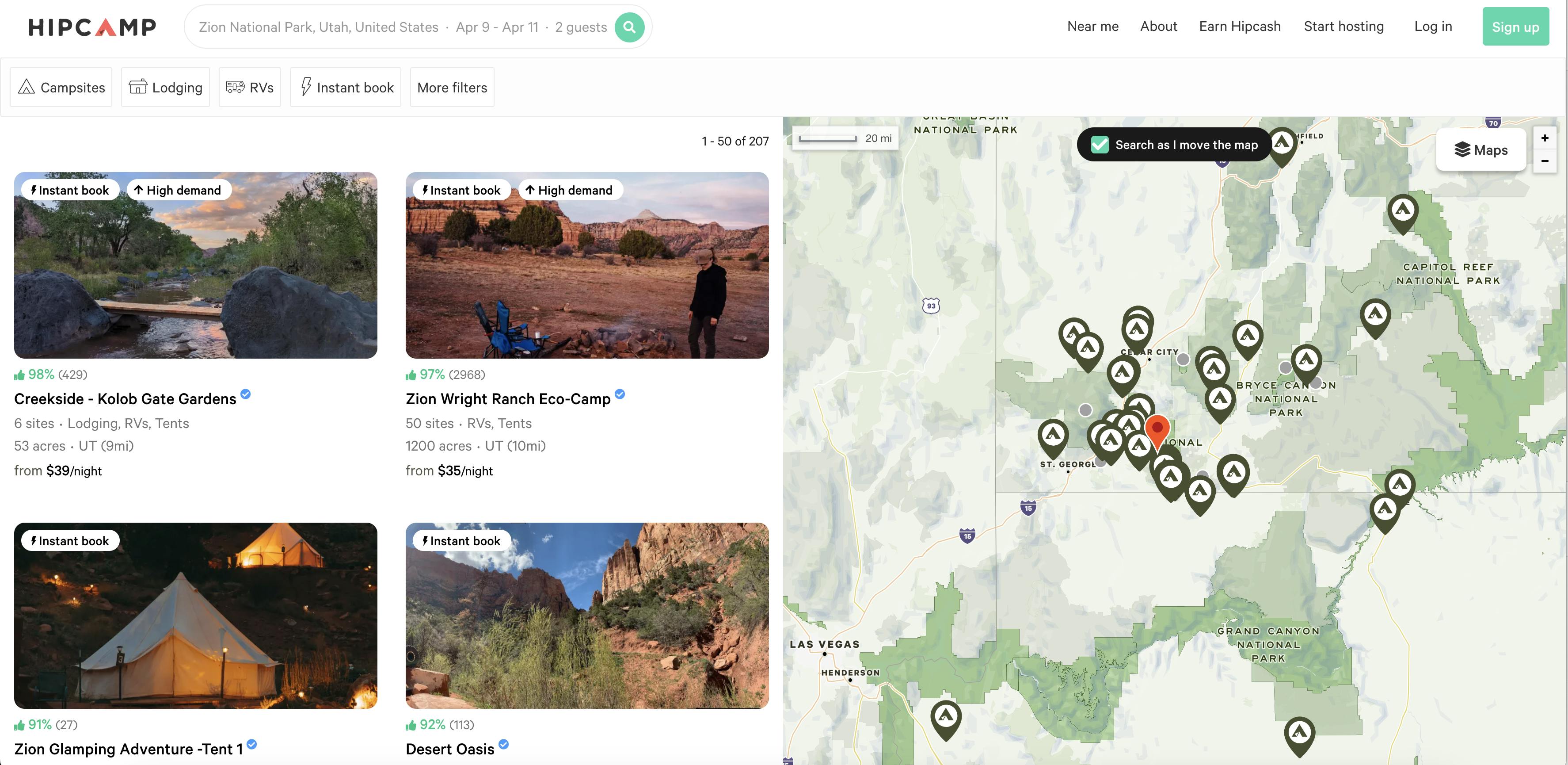

Across its demand-side website and mobile apps, Hipcamp’s goal is to be user-friendly and easy to navigate than alternative booking methods for campgrounds.

Source: Hipcamp

Users can filter stays by price, accessibility, amenities, activities, terrain, and other categories. All these options provide choices for users who may want to avoid roughing it in a tent but still want to experience the great outdoors.

Source: Hipcamp

Listings include detailed descriptions of each location, photos, and reviews from previous users, allowing potential visitors to make informed decisions about where to stay. The platform also includes a messaging system, allowing users to communicate directly with landowners to ask questions and make arrangements.

On the supply side, Hipcamp offers various useful tools and services for hosts to help monetize their camping sites. Adding a listing is free. Hipcamp helps hosts create hosting schedules and block important dates. Hosts can also set up direct deposit to start receiving earnings every week.

Hipcamp advises its hosts to price their listings at a comparable rate to similar sites in their local state park. These can range from $35 for a campsite with few amenities to $300 for group campsites with private lakes. It also developed a feature called “Extras” which enables hosts to sell experiential add-ons, such as equipment rentals, food, and firewood. Hipcamp’s insurance protects the Hosts for up to $1 million for general liability claims per occurrence on every booking.

Source: Hipcamp

Hipcamp's platform is reminiscent in some ways of Airbnb, but with more focus on its outdoorsy customer base and community of hosts. However, the company’s idea for an outdoor-focused marketplace for stays on private land was not always its plan. Hipcamp’s team shifted their product significantly over the years as they learned more about customer needs, supply and demand conditions, and other logistical factors.

Originally, Hipcamp was more of a discovery tool than a marketplace. At first, the company’s goal was to aggregate metadata on existing camping locations, including state and national parks, into a unified, organized interface. The team received positive user feedback about that product, which solved a need in its own right. At the same time, they were becoming aware of supply issues across the industry. Eventually, once it was clear that government development of more campgrounds was not a realistic option, nor one that could substantially help Hipcamp succeed financially or fulfill its mission of getting people outdoors at scale, Ravasio decided to pivot the company to a marketplace for outdoor stays on private land.

In doing so, Hipcamp experienced supply growth that saturated the platform with low-quality outdoor stays, such as listings for people’s driveways. That led Hipcamp to create a set of host standards requiring at least two acres of land, among other things. In doing so, the company had to off-board around one-quarter of its hosts at the time. As a result, 2019 was a difficult year for the company in terms of growth. However, much of this turned out to be a blessing in disguise, as it laid the groundwork for a higher-quality marketplace that later saw increased traction.

Market

Customer

As a two-sided marketplace, Hipcamp serves two types of customers — demand-side users (primarily campers) and supply-side users (hosts).

Internal surveys of 25K Hipcamp campers have shown that Hipcamp’s demand-side camper customers are primarily looking for affordable outdoor trips, motivated more than anything to get a “mental health refresh”. These users often own pets and often camp with their significant others. The average Hipcamper reportedly spends more than $300 during each stay in the local community they’re visiting.

On the other side of its marketplace, Hipcamp has tried to make it easy for a diverse set of landowners to become hosts on the platform. The primary requirement for them is to own two acres of land; they must also offer access to toilets, among other things. As of 2022, 80% of the 4 million acres of land owned by Hipcamp hosts was working land, including farms, vineyards, and ranches. Over time, Hipcamp has found some customers professionalizing into major camping businesses, using its platform to run their entire operation.

Market Size

Outdoor recreation sees $887 billion in consumer spending annually, in addition to $65.3 billion in federal tax revenue and $59.2 billion in state and local tax revenue. In 2021, there were 93.8 million active camper households in the US, up from 71.5 million in 2014. In 2021, 56.9 million households camped at least once, up from 32 million in 2014. In 2021, 25.9 million households camped three or more times, up from 10.3 million in 2014. In 2021, there were also 9.1 million first-time camper households, and 16% of campers reported having a “new” experience level, up from 4% in 2019.

Competition

Airbnb: Airbnb is one of the largest marketplaces for short-term accommodations and experiences. It has camping listed as one of its "Categories". When the company debuted its “Categories” feature in 2022, it offered 100Ks of homes across categories like A-frames, Barns, Cabins, Campers, Camping, Caves, Farms, National Parks, Off-the-grid, Treehouses, Vineyards, Yurts, and more. Despite all these options, Airbnb offers what may be seen as a less robust platform for campground information and discoverability than Hipcamp.

The Dyrt: The Dyrt is a campground discovery and booking marketplace founded in 2013. The company has raised $22.3 million and claims to support 30 million visits annually. Unlike Hipcamp, The Dyrt does not charge landowners booking commissions. Instead, it offers campers a PRO membership with special mapping features and discounts for campers. The company has been called “camping’s version of Yelp.”

Tentrr: Tentrr is a campground discovery and booking marketplace founded in 2015. The company has raised $17.9 million and has been referred to as “Camping’s version of Getaway.”

Outdoorsy: Outdoorsy is a marketplace platform that connects RV owners with other campers. It was founded in 2014 and has raised $195 million in funding. Unlike Hipcamp, it is focused on a narrower target audience of RV owners and enthusiasts.

Business Model

Hipcamp’s business model involves taking a percentage of every booking made on the platform. Originally, the company charged hosted a 15%-20% fee and placed no booking fees on campers. Eventually, following in the footsteps of Airbnb, and based on negative feedback from hosts, the company shifted to a split-fee model, placing a ~10% booking fee on campers and 10% on hosts.

Source: Hipcamp

The company says that commissions on host earnings go toward Stripe processing fees, email, and social media marketing, a complimentary insurance policy, 7-day/week customer support, and hands-on host success specialists. Hipcamp advises its hosts to price their listings at a comparable rate to similar sites in their local state park, ranging from $35 for basic sites to $300 for private group sites. It is free for hosts to sign up and list a property on Hipcamp.

CEO Alyssa Ravasio has said Hipcamp has seen an average order value of $100-$200. Within eight months of partnering with Hipcamp, the company says, several hosts have earned as much as $21K. Hipcamp has also seen interest from hosts with full-range camping businesses, requiring the company to consider different, new business models that cater to different hosts.

Traction

In 2021, 1.2 million campers spent nights using the platform. As of 2022, more than 6 million people had used the site across the US, Australia, Canada, and the UK.

Hipcamp has made two acquisitions since its founding that have helped the company expand internationally. In 2020, the company acquired Australia-based Youcamp, which at the time serviced 1K properties representing 50K campsites. In 2022, Hipcamp expanded into the UK by acquiring Cool Camping, which had 25K listings and had seen a booking growth of 340% since 2019.

In 2021, Hipcamp said it “drove more than $31 million in earnings directly to rural landowners across the United States, and $172 million in spending across local communities.” In 2023, Hipcamp launched a free public lands maps feature and announced the company had reached 600K available US sites.

Valuation

Hipcamp raised a $57 million Series C in January 2021 led by Index Ventures and Bond at a more than $300 million valuation, which more than doubled its previous valuation. As of April 2023, the company has raised a total of $97.5 million in funding.

For comparison to publicly-traded companies, Airbnb has seen its stock perform well through the first quarter of 2023, though it is down significantly from its post-IPO highs in 2021. As of April 2023, It trades at an 8.5x revenue multiple, down significantly from its highs.

Source: Koyfin

Key Opportunities

International Expansion

Hipcamp’s founder, Alyssa Ravasio, has expressed intent to significantly expand internationally over the next few years. “I'm personally very excited about that obviously, and I think as our business has shown from a financial and from just a growth standpoint, it's a huge opportunity,” Ravasio has stated. Expanding internationally could broaden Hipcamp’s customer base.

Urbanization

While 27% of US households identify as being urban households, 51% of camper households identify as urban homes, implying that city dwellers are overrepresented among the camping population. As more people move to cities, the camping industry could benefit positively, as this population is the most likely to camp frequently.

Increasing Travel and Living Costs

37% of campers say they will likely go on camping trips instead of other leisure trips because of increased travel costs. Additionally, 93.7% of American campers told Hipcamp high fuel prices impacted their travel plans in 2022, and the company has said the average price per night of camping in 2022 was just $42.03. As a result, more Americans may increasingly choose camping versus other forms of vacation and travel.

Remote Work

46% of campers work while camping, up from 37% in 2019. Among Millennials, 57% work while camping. Additionally, in 2021, 64% of campers said WiFi greatly impacts their ability to camp, up from 38% in 2017. This audience could become a growth opportunity for Hipcamp.

Key Risks

Competition

Airbnb offers outdoor-focused stays. When the company debuted its “Categories” feature in 2022, it offered hundreds of thousands of homes across categories like A-frames, Barns, Cabins, Campers, Camping, Caves, Farms, National Parks, Off-the-grid, Treehouses, Vineyards, Yurts, and more. Despite all these options, Airbnb does not offer as robust a platform for campground information and discoverability as Hipcamp (though it is easy to see how it could move further into that space). It is also possible that Airbnb could explore an acquisition of Hipcamp in the future.

Cannibalizing The Mission

As Hipcamp looks to expand global interest in camping and outdoor lodging, it may induce a new version of the same problem it is trying to solve — spurring too much demand for the available supply of outdoor stays. If this happens, prices could rise, and people’s experience satisfaction may decline, negatively impacting the number of Hipcamp’s first-time and recurring users. This already appears to be a rising issue across the industry: 44% of campers say they camped less in 2021 because of overcrowding, and 44% of experienced campers say it hurt the quality of their camping experience. Additionally, The Dyrt found that 48.6% of camping property managers raised their rates in 2022, and 46.4% plan to raise their rates in 2023. If Hipcamp succeeds at continually growing the available supply of stays so that it can meet or outpace demand, this may not be a significant issue.

Summary

Founded in 2013, Hipcamp claims to be the world’s largest marketplace for outdoor stays. The company’s mission is simple: get more people outside by making listing or discovering and booking outdoor lodging easier. About 60% of land in the US is privately owned. With rising travel costs and other consumer trends driving demand in the outdoor lodging sector, Hipcamp’s marketplace aims to unlock much of the private land worldwide by connecting landowners with campers looking for unique, accessible stays. The company has seen significant growth, having made two international acquisitions and reaching 600K US sites. While there is a risk of competition and the potential to cannibalize its own mission of affordable and easily accessible outdoor stays, the company’s focused effort has so far proven successful.