Thesis

The US film and entertainment industry paid its more than 2.7 million employees and contractors, from makeup artists to scriptwriters, more than $242 billion in wages in 2022, and the majority of those workers spent some portion of their time as freelancers. In 2021, 77% of workers in the “arts & design” industry freelanced, and a 2019 report from New York City’s Mayor’s Office showed that 61% of New Yorkers working in media and entertainment had engaged in freelance work in the past year.

With millions of freelancers working on as many as 30 projects in a calendar year, the need for transparent, efficient employee onboarding and payroll processing is complex, especially considering strict union regulations in the entertainment sector and varying tax bills for employees working in different states throughout the year. And yet, entertainment payroll processing has hardly changed over the last century. Physical time cards, which have been used to track employee hours since 1894, are still the norm in the entertainment industry, resulting in organizational bottlenecks as companies struggle to track employee wages, hours, and tax withholdings.

In 2018, Wrapbook was created to solve this problem. Wrapbook, whose motto is to “empower the project economy,” provides digital payroll, budgeting, accounting, and onboarding solutions for companies in the entertainment sector, bringing Hollywood bookkeeping into the 21st century. Wrapbook was designed to meet the needs of production companies, providing solutions not available through the industry’s existing generalist payroll software providers, such as union-compliant payroll practices, DICE and motion picture insurance coverage, and film financing solutions.

Founding Story

Source: TechCrunch

Wrapbook was founded in 2018 by Ali Javid (CEO), Cameron Woodward (CMO), Naysawn Naji (former CPO), and Hesham El-Nahhas (former CTO).

Before founding Wrapbook, Naysawn Naji was the co-founder and CPO of Arcus, a fintech company developing a Latin American-focused bill payment API. Naji first considered building products in the entertainment sector after an actor he met at a technology open mic in New York showed him “this app she had built that was helping actors book gigs.” Initially unimpressed, Naysawn grew curious after finding out that her platform had 4K paying users.

Realizing that media production was full of pain points that could be addressed with improved technology, Naji proposed the idea of building a startup in this sector to his Arcus coworker and interim CTO Hesham El-Nahhas. The two had a close relationship, with Naji noting that they had grabbed lunch together “every day for four years,” and they left Arcus to work on the premise for Wrapbook in early 2018. After prototyping and testing different concepts, they ultimately focused on payroll.

Ali Javid, meanwhile, had been the VP of Business Development at Body Labs prior to Wrapbook. Body Labs was an artificial intelligence startup that created 3D models of the human body, which Amazon acquired for between $50 million and $70 million in 2017. Reflecting on his time at Body Labs, Javid decided that three questions would determine what he worked on next: (1) who am I working with? (2) are we a fire extinguisher? and (3) do people repeatedly want it and want to pay for it?

Ultimately, these questions pushed him to the entertainment payment business. Javid explained his thinking this way:

“I was really open to problem sets and I met up with some friends. I learned about entertainment payroll from them. I was shocked to see stacks of paper time cards with SSNs laying around the office, how everyone described the same problems, and the same solutions. I found the people to build with, a need for a fire extinguisher, and something people repeatedly needed & paid for. I jumped headfirst in, focused on learning, and have never slowed down.”

After he realized there was an opportunity for a digitized product, Javid joined Naji and El-Nahhas to build Wrapbook in March 2018, assuming the role of CEO.

Cameron Woodward later joined the company as CMO in January 2019. Before joining Wrapbook, Woodward directed the marketing campaign behind the KONY2012 movement, founded an “independent, non-union” commercial production company in Oakland, and founded an agency for film casualty insurance. His time running his production company showed him first-hand how “tremendously painful” production payroll could be, and how much it distracted from his goals as a producer and creative.

Initially, Wrapbook’s founders wanted to bootstrap their startup. However, after deciding to focus on payroll, they realized they would need outside funding to build their business. They pitched investors on the premise that production companies struggle to efficiently onboard and pay contractors on a project-by-project basis, but the responses they received were pessimistic, with investors citing the presence of more established players and previous startup failures in the sector.

Failing to attract investor interest at first, Wrapbook’s founders turned to friends and family, as well as their own wallets, with one of their first investments being a blind check from a friend of Naji’s at Google. Eventually, as Wrapbook gained traction, investor interest increased, and in August 2020, the company closed a $3.6 million seed round led by Equal Ventures.

Product

Wrapbook’s approach centers around serving as “one platform” for the entire production. Wrapbook offers a suite of media production payroll solutions covering five key areas: onboarding, payroll, cost tracking, production accounting, and reporting. Information recorded in customers’ Wrapbook accounts automatically flows across all functions, simplifying employer bookkeeping. For example, when a production assistant logs their hours on Wrapbook, the employer will immediately see the pending wage expense on its payroll dashboard. After payroll is approved, wage expenses are shown under their respective line items in the company’s general ledger, making accounting easier for the finance department.

Onboarding

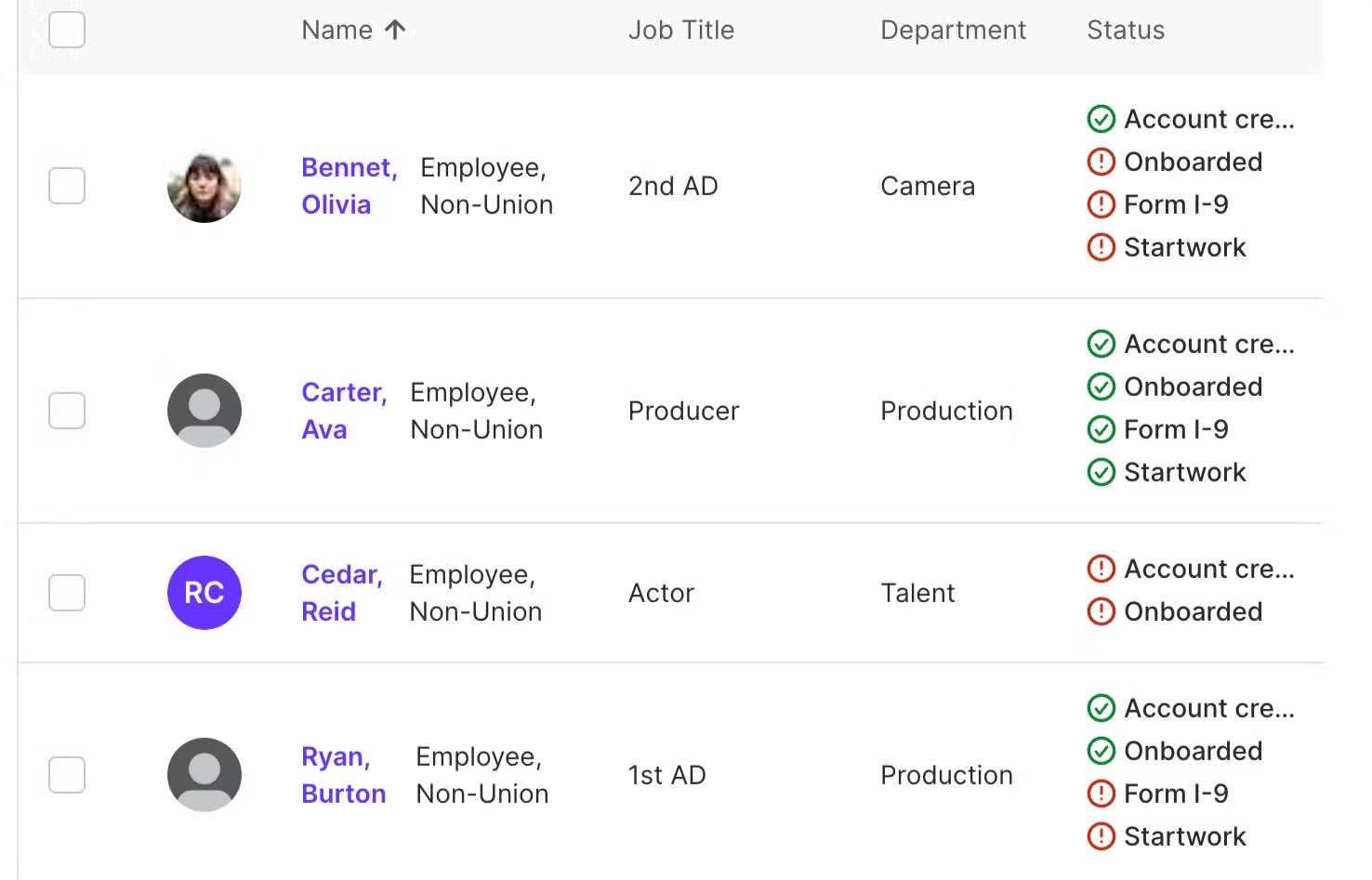

Source: Wrapbook

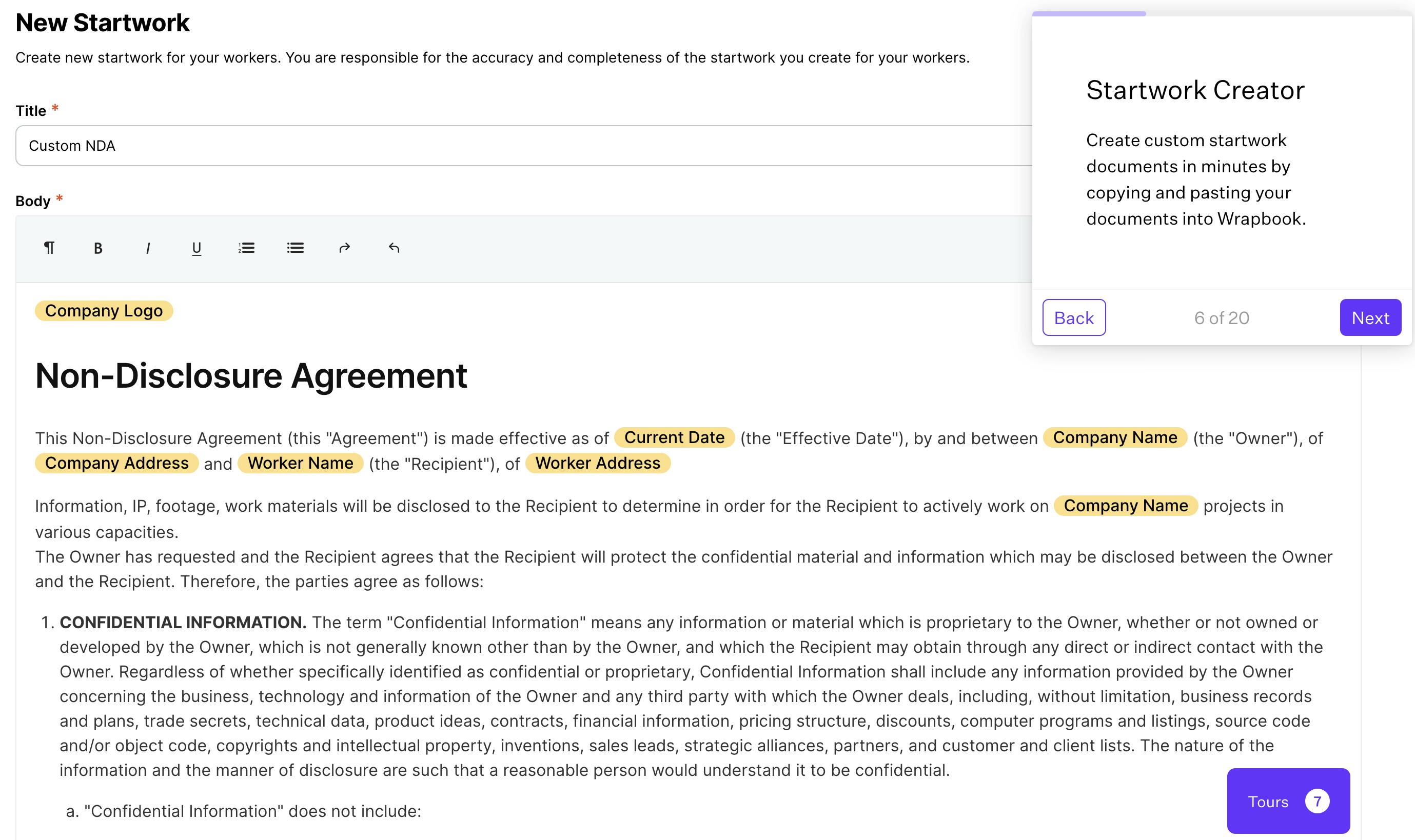

Wrapbook’s onboarding solution streamlines the hiring process by digitizing startwork and employee information. Key features include:

Digital startwork: Employers can create and send custom startwork, such as I-9s, W-4s, NDAs, and other fillable PDFS, within Wrapbook. Signatures are collected electronically in compliance with SOC-2.

Employee information database: Information for all employees with Wrapbook accounts is saved on-platform, and more than 50% of crew members hired on shoots already have Wrapbook profiles, expediting the onboarding process for repeat hires.

QR code generation: QR codes generated on Wrapbook can be printed and posted on-site, making it easy for workers to onboard themselves through their mobile devices.

Portable crew profiles: Crew profiles are stored within Wrapbook, allowing crews to be instantly re-hired for later projects.

Intuitive worker experience: Once workers receive an email to join Wrapbook, they only have to add their federal and state tax withholding information once, and it stays in Wrapbook’s database indefinitely. Hours and expenses can be submitted through Wrapbook’s mobile app as well.

Source: Wrapbook

Payroll

Source: Wrapbook

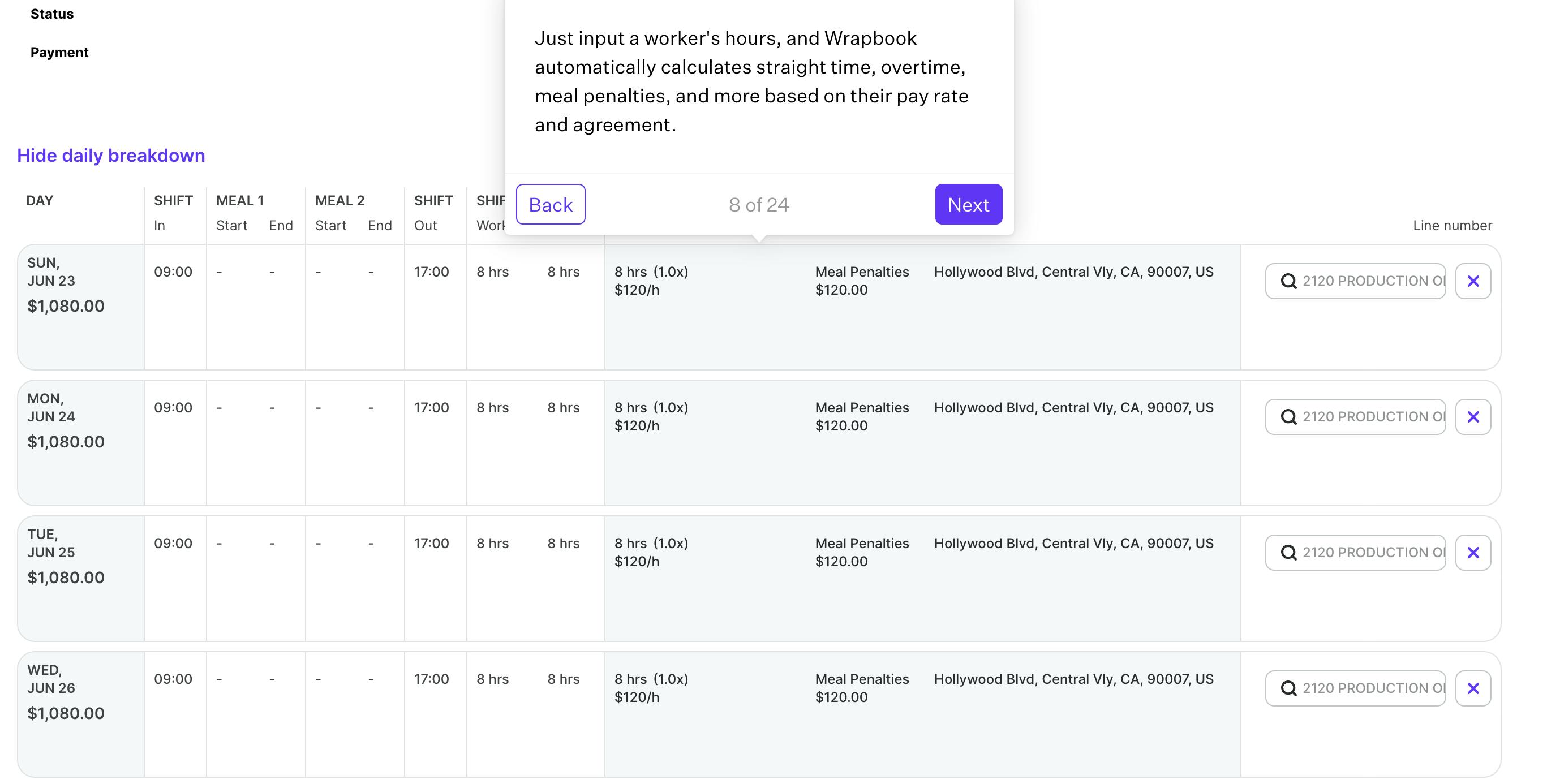

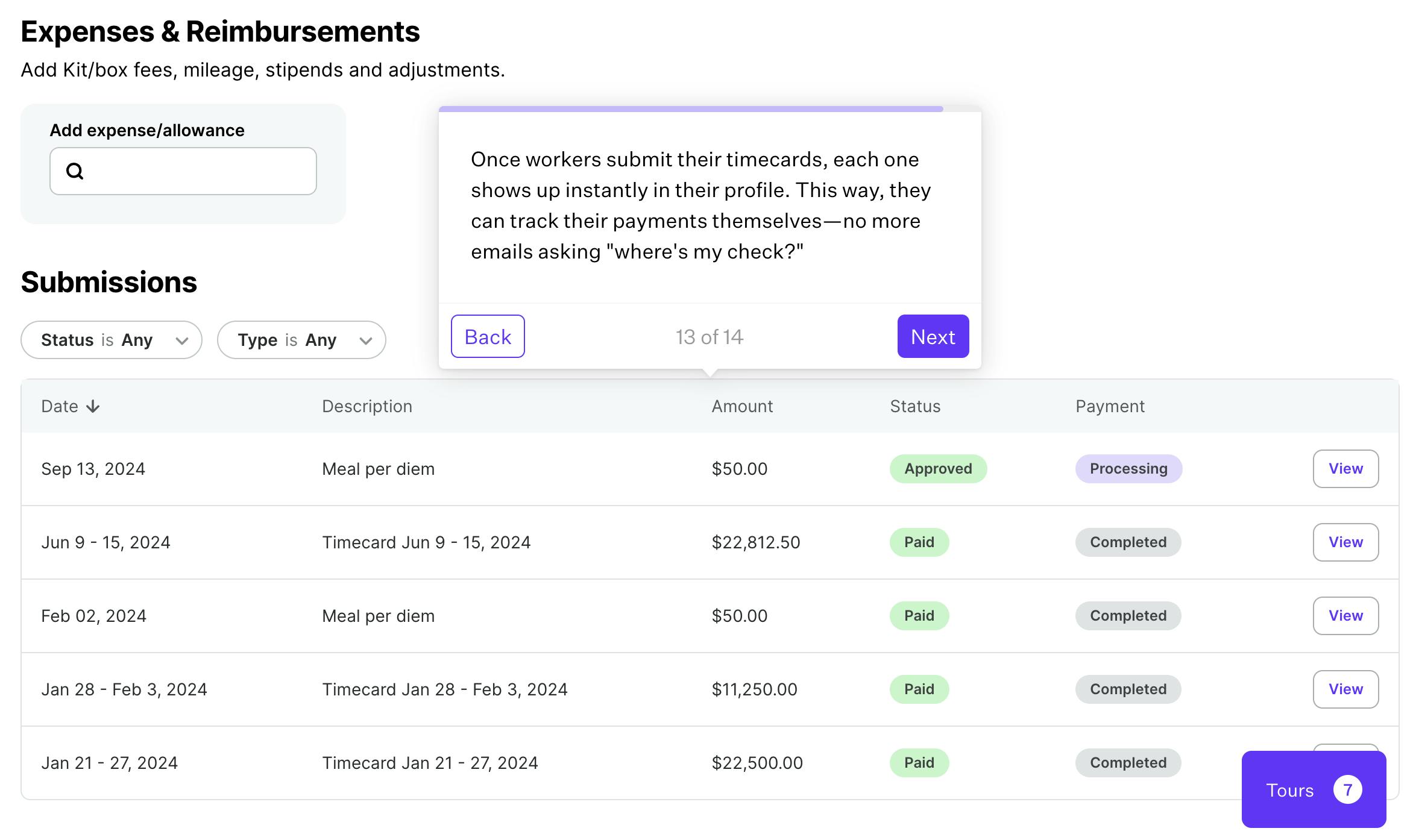

Wrapbook is an employer-of-record (EOR) payroll provider that helps production companies make timely, transparent, union-compliant payments. Employees can upload their hours from their phones, management can approve payroll with the click of a button, and overtime, straight time, taxes, and expenses are automatically calculated.

Key features include:

Robust bookkeeping: Wrapbook automatically codes time card submissions to their respective line numbers in customers’ Charts of Accounts, and it provides a full audit trail of hours logged and payroll approvals for later review.

Union compliance: Wrapbook has automated payroll compliance with 16 union collective bargaining agreements across film, commercial, and music video productions, and the platform calculates and distributes pension, health, and welfare benefits. Wrapbook also has a team of in-house union advisors to help customers navigate union contracts.

Detailed payroll reports: Payroll can be batched by department, expenses, or recipients, providing customers with flexibility on how they choose to organize and run payroll. Wrapbook also offers individual reports on different departments, allowing customers to review department-by-department payroll figures before funding.

Automated hour-to-gross time card calculations: Once workers have added their hours, Wrapbook automatically calculates wages for union and non-union workers alike, accounting for straight time, overtime, and meal penalties based on their pay rate and contracts.

Intuitive worker interface: Once workers add their tax information and sign their I-9, they can connect their bank account via Plaid and immediately begin logging hours, meal breaks, and expenses via desktop or mobile app.

Source: Wrapbook

Cost Tracking

Source: Wrapbook

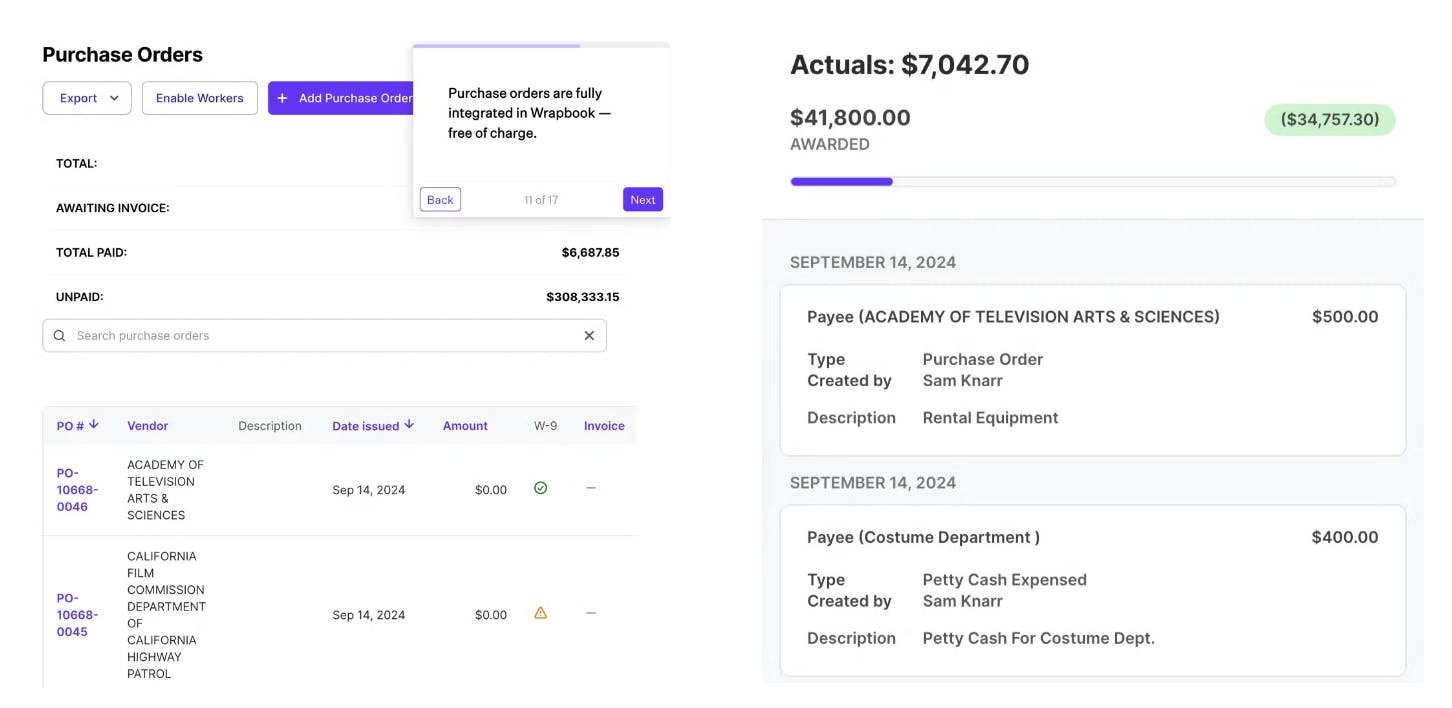

Wrapbook’s cost-tracking solution syncs time cards, expenses, purchase orders, and petty cash to customers’ budgets in real time, eliminating the need to rekey data or incorporate 3rd party expense management software. Key features include:

Budget integration: Customers can import budgets from HotBudget, Movie Magic Budgeting, or Showbiz Budgeting, and Wrapbook will code time cards and expenses to match budget line numbers.

Purchase orders: Once a team member creates a purchase order, it is instantly visible on your cost tracking dashboard and deducted from your budget.

Time card integration: Time cards and expenses are automatically coded to their respective budget line numbers, allowing customers to see real-time budget impacts when payroll is run.

Petty cash tracking: Petty cash is distributed digitally to crew members through virtual petty cash envelopes, so funds can be tracked in real time.

Cost drill downs: Customers can expand line numbers from their budgets to review every transaction associated with a particular account.

Exports: All cost reports can be easily exported to share with external stakeholders.

Production Accounting

Source: Wrapbook

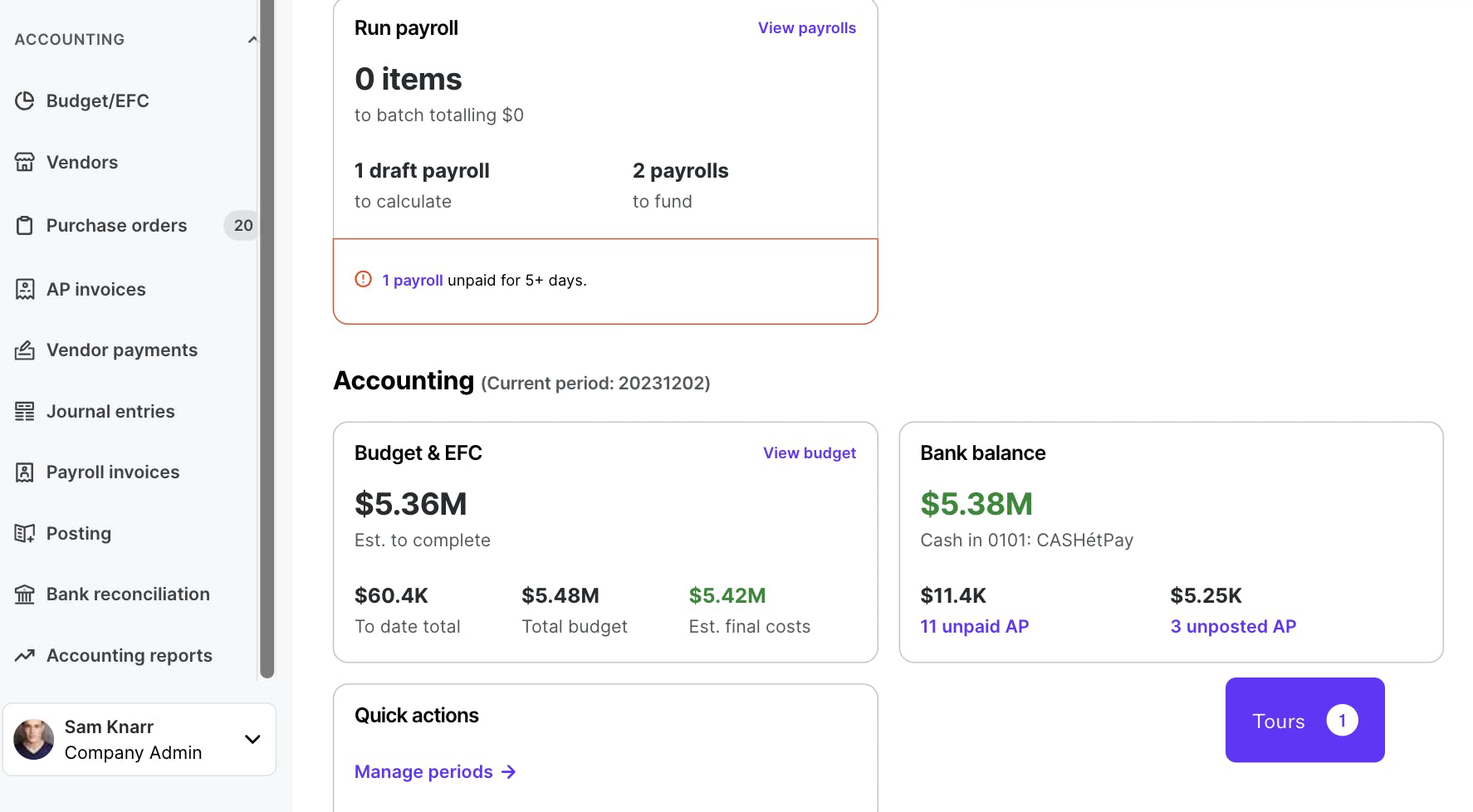

Wrapbook’s production accounting solution provides accounting teams with an all-in-one live dashboard showing project payrolls, budgets, and estimated final costs (EFCs). Key features include:

Vendor tracking: After a vendor’s information is imported for one project, it can be added to any future projects indefinitely.

Spreadsheet integration: Excel and CSV files with accounting data can be copied and pasted directly into Wrapbook.

Budget and EFC Tracker: Wrapbook’s Budget & EFC Tracker provides real-time visibility into committed, actual, and estimated final costs across all projects.

Reporting

Source: Wrapbook

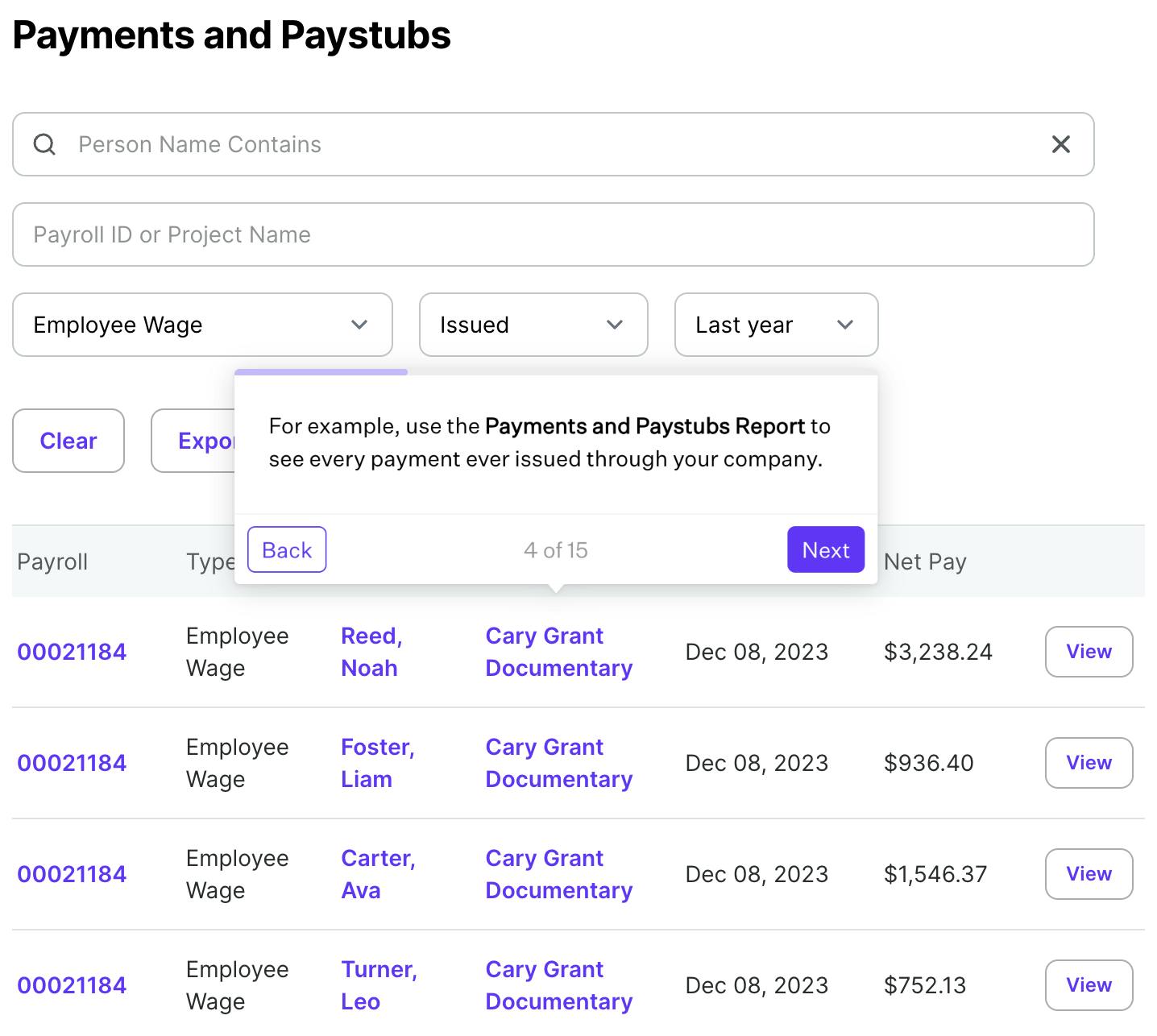

Wrapbook’s reporting dashboard provides a variety of default and customizable reports across all of a production’s departments, projects, and expenses to provide detailed visibility. Key features include:

Expansive list of default reports: Wrapbook provides all customers with detailed reports on past payroll, past payments, past team requests, tax documents, hiring demographics, and more.

Custom reports: Customers can also filter across different variables, such as Payroll ID, department, and worker type, to create custom reports that can be downloaded and shared with external stakeholders.

Audit logs: Wrapbook provides detailed audit logs that track every change made to every time card and expense.

Accounting software integrations: Production costs can be synced with different accounting software, including QuickBooks Online, Acumatica, Sage Intacct, NetSuite, and QuickBooks Enterprise.

Expert Services

Wrapbook also offers a number of on-demand services to supplement its core product offerings:

Production insurance: Wrapbook offers annual DICE coverage, as well as coverage for motion pictures and television series, errors and omissions, and drone and aerial photography.

Production incentives: Wrapbook’s tax experts can help customers optimize production budgets by qualifying for state-by-state tax credits and rebates.

Film financing: Wrapbook’s in-house financing experts can also review budgets, draft opinion letters for underwriting, and connect production companies to brokers and film financiers.

Market

Customer

Wrapbook’s customers are US-based media production companies that employ contractors, freelancers, and other part-time workers and need to navigate complex payroll practices, union CBAs, and production budgets. The company’s current clients include leading commercial companies like SMUGGLER, Greenpoint, Picture North, and Dress Code, full-service production companies like London Alley Great Guns, and creative studios like Ghost Robot.

Market Size

As of September 2024, Wrapbook only operates in the US, where the entertainment industry paid out $242 billion in annual wages to employees as of 2022.

The former director of research products at market research firm Radicle noted that Wrapbook charges “1.5% of union wages paid through its platform,” and a reviewer on software review site Capterra also stated that Wrapbook charges fees ranging from “0.75% to 1.5%” of transaction volume. Assuming an average 1% fee across all wages, the TAM for Wrapbook’s payroll solution can be estimated at $2.42 billion.

However, expansion into other contractor-heavy markets would quickly grow Wrapbook’s TAM. Take the construction market, a space noted by Naji as being ripe for disruption, for example. In 2020, 2.5 million construction workers, or 23.3% of the total workforce, were self-employed, and the median construction worker made an average of $50K per year. That represents $126 billion in total wages, or $153 billion in 2024 dollars, adjusted for inflation. Launching a construction payroll solution would increase Wrapbook’s payroll TAM by 63%.

Source: U.S. Bureau of Labor Statistics

Wrapbook also offers entertainment insurance products, giving the company access to a $27.5 billion market. While insurance commission rates vary by insurance type, the average commission rate on commercial insurance is 10-25%. Assuming that Wrapbook monetizes its insurance offerings, and applying a conservative 10% commission rate, Wrapbook’s insurance TAM represents an additional ~$2.8 billion.

Competition

Wrapbook competes with older entertainment payroll providers, as well as other startups focused on more generalist payroll solutions.

GreenSlate: Founded in 2004, GreenSlate raised strategic growth equity financing in 2018 and 2023, with VSS Capital Partners participating in both rounds. While GreenSlate’s valuation wasn’t disclosed, the company reportedly generated “more than $50 million” in revenue in 2022, up approximately 50% from the year before.

Similar to Wrapbook, GreenSlate offers solutions to streamline administrative processes within the entertainment industry, such as payroll, production accounting, tax incentive advisory, and production dashboards for project management, and GreenSlate provides payroll solutions for Canadian, British, and Australian employers as well. GreenSlate’s clients have produced films for Apple TV, Amazon Prime, and Netflix.

Cast & Crew: Founded in 1976 and based in Burbank, California, Cast & Crew provides an array of entertainment administrative solutions, such as payroll, financing, labor relations, workers’ compensation, and tax incentive advisory. Cast & Crew has been owned by three different private equity firms since 2015, with Silver Lake acquiring the firm from ZM Capital in June 2015, and Swedish investment group EQT acquiring the firm in December 2018.

Entertainment Partners: Founded in 1976, Entertainment Partners was acquired by private equity firm TPG in 2019. The company also hosts a product suite similar to Wrapbook’s, providing solutions for payroll and residuals, production finance, production management, and tax incentives, and it operates in the US, Canada, the United Kingdom, and Australia. As of September 2024, Entertainment Partners’ payroll was issuing 9.6 million paychecks annually in North America.

Gusto: Gusto, originally named “ZenPayroll,” was founded in December 2012 and was part of Y Combinator’s Winter 2012 batch. Gusto is a generalist payroll provider that also offers solutions for benefits, HR, attendance, onboarding, talent management, and workers’ compensation.

In August 2021, Gusto raised a $175 million Series E, followed by a $55 million Series E extension, at a $9.5 billion valuation, bringing its total capital raised to $746.1 million. Gusto’s valuation remained largely unchanged through 2023 when the company reached $500 million in annual revenue. While Gusto doesn’t offer the same niche entertainment solutions as the others, it is a relevant player in the broader payroll space.

Business Model

Wrapbook is a SaaS fintech platform that generates revenue through processing fees on transactions, with the company stating that “there are no monthly fees, no annual fees, and no tech fees. You only pay for what you actually process.” Exact pricing requires a quote from the company but several sources indicate that Wrapbook’s fees range from 0.75% to 1.5% of transaction volumes. Wrapbook also provides entertainment insurance products, which presumably represent another revenue stream, but the specifics of the underlying business model behind that product have not been shared publicly by the company.

Traction

Wrapbook’s 2018 launch proved to be fortuitous timing, because just two years later, the COVID-19 pandemic accelerated the entertainment market’s transition to digital time cards. In 2020, when the entertainment market shrunk by 18%, Wrapbook’s revenue increased by 7x. While Wrapbook has not publicly disclosed specific revenue or profitability metrics as of September 2024, some unverified sources indicate that Wrapbook’s 2023 revenue was $35.1 million.

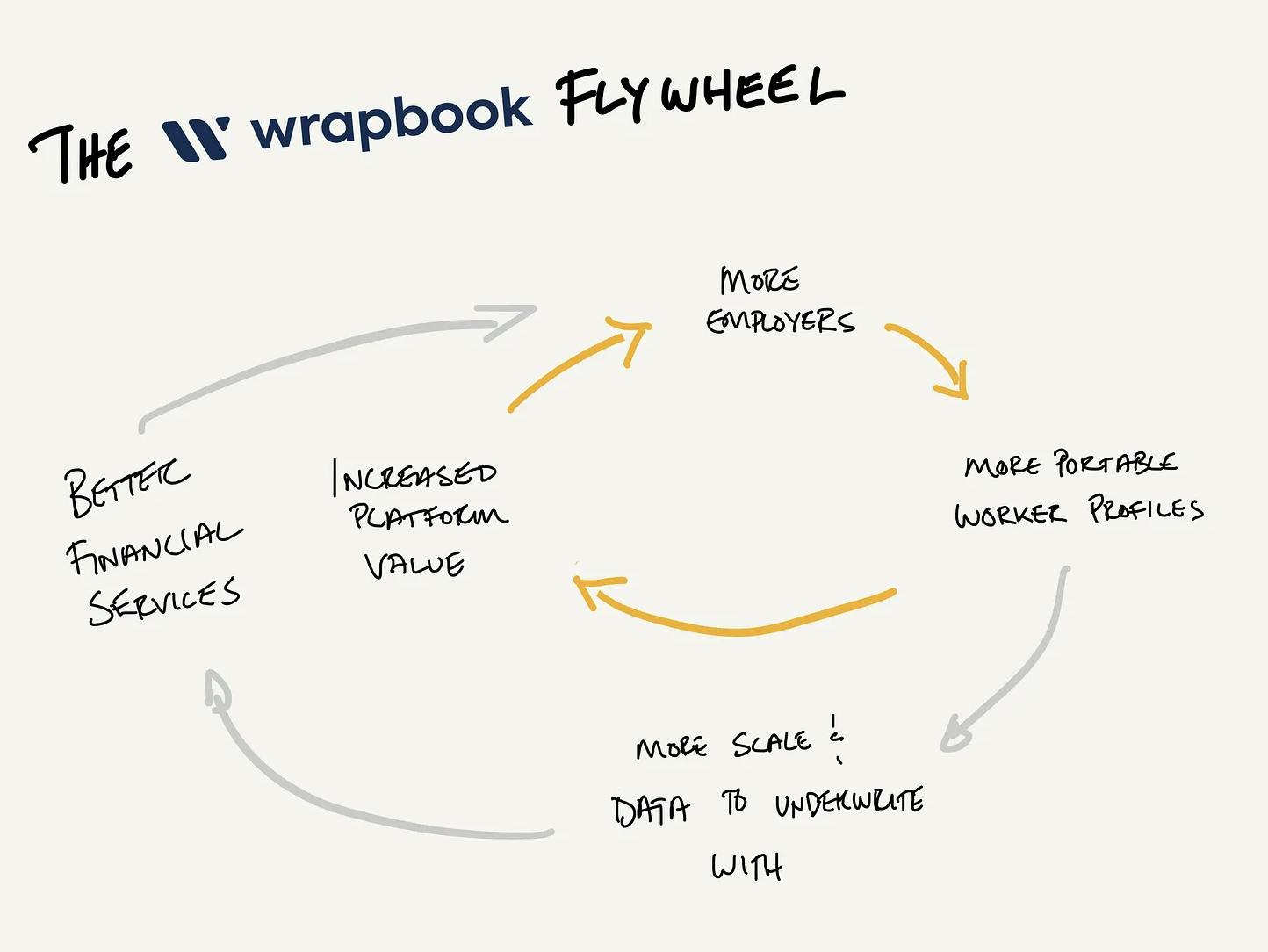

Additionally, because worker information is stored on Wrapbook, the company benefits from a strong network effect that incentivizes current customers to continue using its payroll solutions and new customers to join to minimize onboarding friction. 50% of crew members hired on shoots already have Wrapbook profiles.

Source: The Future State Substack

Valuation

In September 2024, Wrapbook raised a $20 million round of funding from Bessemer Venture Partners which valued the company at $750 million. This valuation represented a decline from its previous round of funding in November 2021, when Wrapbook raised a $100 million Series B at a $1 billion post-money valuation.

That round occurred six months after the company raised a $27 million Series A and 15 months after raising its $3.6 million seed round. Wrapbook’s Series B was led by Tiger Global Management, with participation from existing investors including Andreessen Horowitz and Equal Ventures. As of September 2024, Wrapbook has raised $150.6 million in total funding.

Key Opportunities

New Verticals

Wrapbook’s revised mission statement, to “increase the prosperity of the project economy through better financial services,” implies that the company could expand beyond media production, and Naji noted in an interview in May 2022 that the construction market, as an example, was ripe for payroll disruption. Judging from management commentary, the most likely near-term new verticals will be additional markets within the US, rather than international expansion.

Product Expansion

Wrapbook shipped 14 product updates between July and September 2024. Many of these product updates have been improvements to the company’s core offerings, such as tools to reduce manual data entry in production accounting and the ability to search for pending project tasks. However, the company’s biggest product update was launching work-from-home (WFH) location options in July 2024. Previously, production companies had to manually adjust the locations of remote employees and figure out which paperwork they needed, depending on their locations. Now, remote employees can input their own home locations when onboarding and it will populate on their time cards, and Wrapbook automatically sends these remote employees all necessary location-specific startwork.

Key Risks

Legal Issues

Michael Scott Vogel sued Wrapbook and the company’s founders in May 2022 for “misappropriation of trade secrets, breach of contract, and breach of fiduciary duty,” and he later filed an amended complaint in 2024, bringing 11 counts against the defendants.

Vogel, a media producer whose resume includes the 1998 film Pi and the 2000 film Requiem for a Dream, proposed to Naji the idea of “Tradekraft,” a software that would track hiring, payroll, budgeting, and expenses for entertainment production. The two allegedly agreed to “share everything related to Tradekraft on an equal, 50/50 basis,” and El-Nahhas later joined the project as an equal partner.

However, Vogel alleges the two altered Tradekraft’s pitch deck in December 2017 to reduce him to an advisor rather than a co-founder, and they refused to provide Vogel with access to the TradeKraft code. The partnership, which had been discussed orally but never defined by a written contract, ended in January 2018, though Vogel refused to sign an agreement that would allow Naji and El-Nahhas a release for all the “assets of the partnership,” and the latter two refused to hand over the source code to Vogel.

Naji, El-Nahhas, Woodward, and Javid went on to found Wrapbook in 2018, and Vogel claims that Wrapbook used the Tradekraft source code. While most of the defendants’ motions to dismiss with respect to Wrapbook were granted, litigation is still ongoing between Vogel, Naji, and El-Nahhas at least as of March 2024.

Executive Turnover

Despite the company only being six years old as of 2024, two of the company’s four co-founders, former CPO Naysawn Naji and former CTO Hesham El-Nahhas, left Wrapbook in 2022 to launch their own respective startups. Notably, Naji and El-Nahhas are also the two defendants at the center of the Tradekraft and Wrapbook legal troubles.

Additionally, Naji’s startup, Buildpal, is a scheduling solution for general contractors in the construction market. While he’s not building in the payroll space, Naji was the co-founder who noted the potential for Wrapbook to expand into construction, and his resignation may have slowed progress toward entering that market. Depending on the size of the departed co-founders’ equity stakes and their vesting schedules, their positions on the company’s cap table may limit also Wrapbook’s ability to offer competitive equity compensation to new hires.

Competition

Cast & Crew and Entertainment Partners, which were estimated to have generated $160 million and $171 million respectively in 2023, are Wrapbook’s strongest competitors in the entertainment payroll space. A former Netflix payroll manager, who has experience with both competitors as well as Wrapbook, believes that Cast & Crew has the “most impressive software in the market.”

Summary

Wrapbook is a fintech SaaS solution providing a variety of payroll, onboarding, and administrative solutions for media production companies. The slow adoption of digital payroll technologies in the entertainment market has made the market ripe for disruption, and with US entertainment employees earning more than $242 billion in wages in 2022 alone, the market opportunity is massive. Wrapbook also has longer-term opportunities to expand to other areas of the broader “project economy,” such as the construction industry.

Wrapbook raised a $100 million Series B at a $1 billion valuation in 2021, and more recent fundraises from competitors indicate that Wrapbook’s valuation has likely remained flat since then as of September 2024. While Wrapbook has built a healthy business in the entertainment payroll space, it faces stiff competition from other entertainment payroll solutions, as well as broader market payroll providers like Gusto. Wrapbook also faces key personnel risks, namely the legal issues concerning two of its co-founders and second-order effects related to their departure from the company.