Thesis

The measure of an economy’s output is its gross domestic product. For the US, that number was $25 trillion in 2022. While this is a significant quantity that makes the US the largest economy in the world, the percentage of GDP that comes from labor and wages is, on average, ~50%. Labor therefore represents a massive portion of economic productivity. However, the systems used to manage it are still fairly manual and typically outdated.

Payroll management software is dominated by old-school solutions, with 29% of companies using systems that are 10+ years old or using manual processes like spreadsheets. The average small business spent nearly five hours per pay period running payroll in 2020, and in 2019 alone, the IRS collected $13.7 billion in payroll tax penalties. Payroll automation uses software to help small businesses pay employees on time and withhold taxes correctly.

Gusto launched in 2012 when about 3 million businesses in the US were still doing their payroll manually. The company sells payroll software to SMBs. In the decade since launching, it has built a customer base of over 300K small businesses. Gusto initially launched with a payroll application and has since broadened into embedded payroll products and other finance functions with the vision of becoming a one-stop shop for its customers' administrative needs across finance, accounting, and HR.

Founding Story

Gusto, originally known as ZenPayroll, was founded by Josh Reeves (CEO), Tomer London, and Edward Kim in 2012. The company launched with a cloud-based payroll service for SMBs after graduating from YCombinator’s Winter 2012 batch and raised a $6.1 million seed round, the largest of any company in YC’s history up to that point.

As CEO Josh Reeves told Forbes, the three co-founders were initially inspired by their firsthand experience, both as former founders and as the children of small business owners, with the frustrating lack of good options for managing payroll and benefits while remaining tax-compliant. This was the pain point that drew them together and that they sought to address in launching ZenPayroll.

In 2015, ZenPayroll rebranded to Gusto as it expanded beyond payroll to health benefits and workers’ comp. As of October 2023, the three co-founders still lead Gusto. Reeves serves as the Chief Executive Officer, Kim as the Chief Technology Officer, and London as the Chief Product Officer.

Product

Gusto’s product offering is comprised of three main payroll products: (1) Gusto Payroll (payroll software for SMBs), (2) Gusto Embedded Payroll (a payroll infrastructure backend product), and (3) Gusto Wallet (consumer banking for employees). The product platform also includes modules to address employee benefits and HR.

Gusto Payroll

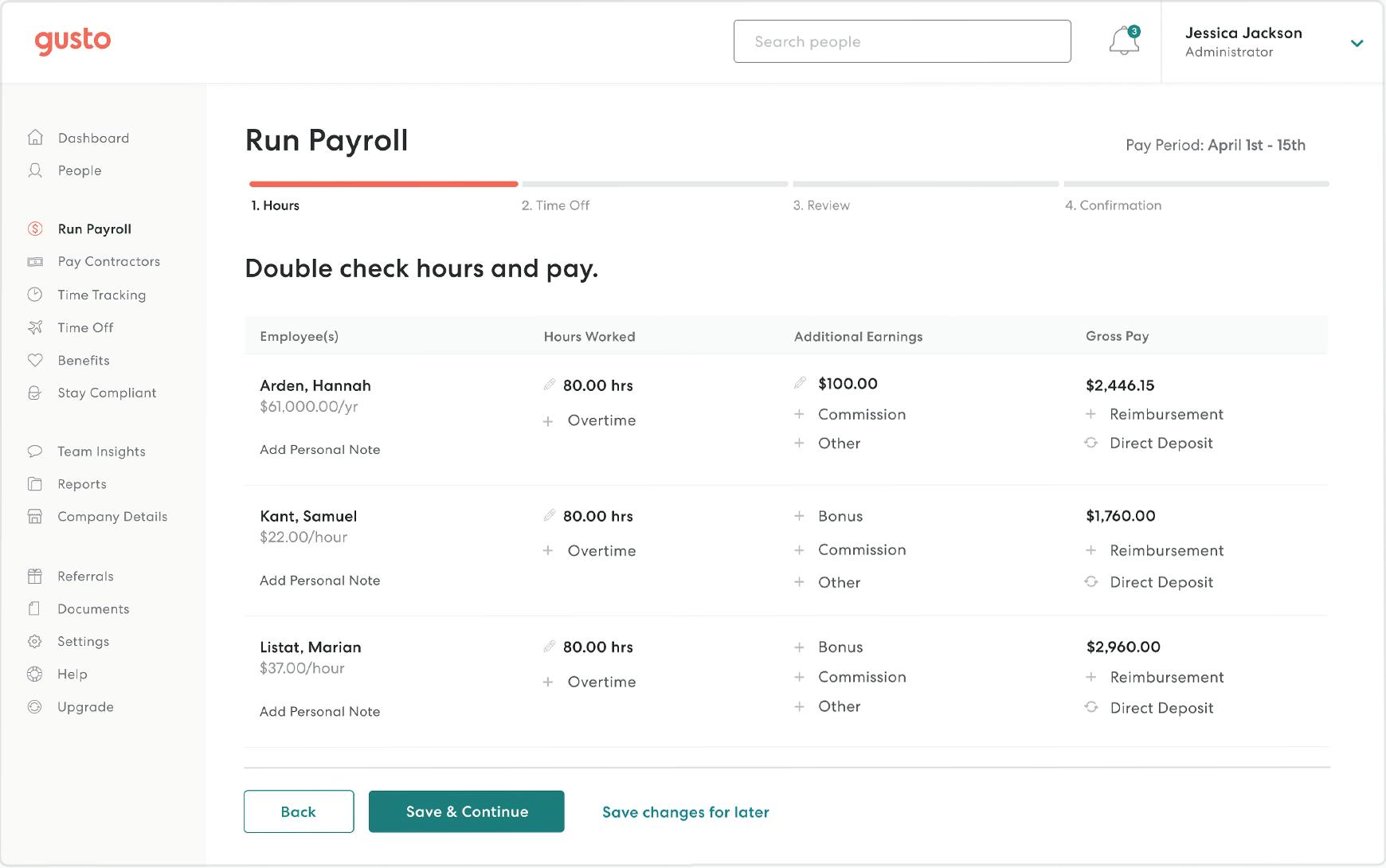

Gusto’s core offering is cloud-based payroll software for SMBs in the US. Customers use it to onboard, pay, and manage their employees and contractors.

Source: SoftwareAdvice

Payroll is a time-consuming pain point for SMBs. Given that the average small business spends nearly five hours per pay period running payroll, it’s unsurprising that ~49% of businesses found running payroll “frustrating, complicated, and confusing,” and 33% found it “uncomfortable” in a 2020 survey. By contrast, 72% of Gusto customers spent five minutes or less on payroll per pay period as of 2021, saving 100+ hours per year (assuming biweekly pay periods).

For hiring and onboarding, Gusto provides features like an application tracking system, digital document generation (e.g., offer letters and tax documents), and employee self-onboarding. Once employees join a company, Gusto takes care of payroll-related tasks, including issuing digital pay stubs, tracking time off, and handling taxes across multiple states.

Gusto partnered with Symmetry Software in 2012 to accurately calculate taxes and acquired the company in July 2021. Symmetry operates independently and can leverage Gusto’s resources for product development. To better understand their businesses, Gusto customers can run cost reports and anonymously survey employees. The org chart and performance reviews help manage employees, while e-cards and celebrations improve team morale. Businesses can save money on taxes with R&D tax credit services that scan payroll, enabled by Gusto’s June 2021 acquisition of Ardius.

Gusto also automates payroll-related compliance, which is intended to provide peace of mind and prevent fines. According to the IRS, one-third of businesses make a payroll mistake every year. In 2021, those businesses were fined almost $7 billion for payroll errors. Gusto’s automated processes save employers from fines and ensure accurate paychecks for employees. The company provides additional protection by complying with ACA, HIPAA, and ERISA regulations and issuing alerts about relevant regulation changes.

Gusto’s payroll software integrates with various other business tools. The integrations ensure that payroll-related information flows correctly into other business applications. Popular integrations include Asana, Box, and Expensify.

With the acceleration of remote work, Gusto focused on improving support for distributed workforces. In October 2021, Gusto announced support for paying international contractors and business registration in all 50 states, while also acquiring RemoteTeam, an early-stage startup helping companies manage remote, global teams with payroll management, time-tracking tools, and benefit options specifically for remote workers.

Gusto also partners with accountants who use Gusto to handle payroll for their clients. The company provides accountant partners with an accounting dashboard called Gusto Pro to help them better serve clients. Free marketing materials and one-month free trials are provided to assist accountants with client acquisition. Gusto also offers certifications (including continuing professional education credits for CPAs) and monetization training for “People Advisory" to help accountants expand beyond accounting to HR.

Gusto Embedded Payroll

In June 2021, Gusto launched Gusto Embedded Payroll to let developers embed payroll management directly into their applications, which can be thought of as payroll infrastructure or payroll-as-a-service. Gusto Embedded Payroll exposes parts of Gusto’s core infrastructure via APIs, allowing companies to dodge the technical and regulatory challenges of building payroll software. Instead, they can create a custom front end for their customers while Gusto handles the back-end logic.

Payroll and finances are intrinsically connected. With Gusto Embedded Payroll, fintech companies like Novo, a business banking platform, can infuse payroll into their products. Accounting technology firms such as Xendoo are able to augment accounting services with payroll, and time-tracking companies like busybusy retain control over their UI while automating payroll calculations.

Meanwhile, vertical SaaS companies that help SMBs manage their businesses use Gusto Embedded Payroll to incorporate industry-specific payroll functionality into their software. Their customers pay up to 40%-50% more for a product incorporating payroll. Examples include companies like Vagaro and Squire, which help salons and barbershops, respectively.

Gusto Wallet

68% of all recorded income in America came from wages and salaries paid via paychecks in 2021. Gusto facilitates employees receiving their wages with its payroll product, and it has expanded to offerings that help them manage that money. In 2020, the company partnered with nbkc Bank to launch Gusto Wallet, a digital consumer banking platform accessible via mobile app and web browser.

With Gusto Wallet, employees can clock in and out of work and view pay stubs and tax documents. They can also open FDIC-insured bank accounts with competitive interest rates and no account or overdraft fees, or open debit cards linked to their Gusto bank accounts (but not credit cards) all from the same platform. Additional features include budgeting tools and spending goals to assist in financial planning.

Employers who use Gusto can now promote Gusto Wallet as a free benefit, and employees no longer have to visit two separate platforms for banking and payroll. Gusto had previously launched Gusto Cashout, which enabled employees to receive a portion of their next paycheck early to avoid payday loans and overdraft fees. The company closed Cashout in September 2022.

Employee Benefits

Gusto can help teams manage employee benefits, such as health insurance, workers’ comp insurance, pick-your-cost health reimbursement options, and retirement and college savings. Using Gusto, businesses can tailor a benefits package best suited for their team and manage all benefits through the platform, saving an average of 7 hours per month on benefits administration. Gusto allows premium subscribers to move their existing health insurance broker to Gusto and fully integrate existing broker and eligible health plans. As of February 2023, Gusto’s health insurance benefits were only available in 38 states.

HR

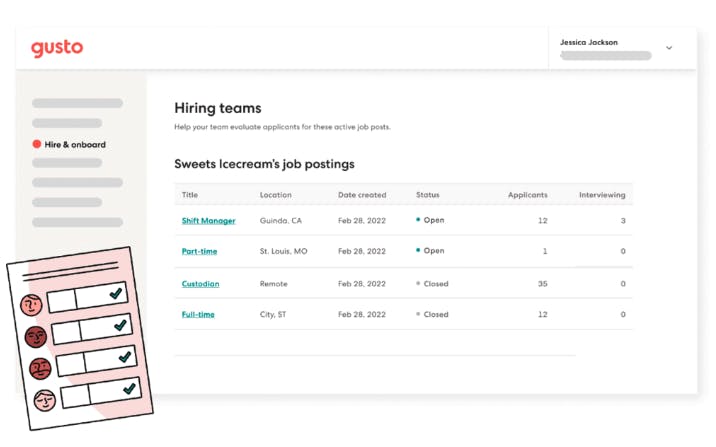

Gusto provides an HR platform to help teams manage employee-related processes other than payroll. For hiring, businesses can use Gusto to post jobs, circulate them to popular job boards such as LinkedIn and Indeed, create custom offer letter templates, and automatically track and manage applicants through a centralized applicant tracking system.

For onboarding, businesses can utilize Gusto’s custom onboarding checklists, eSignature, document storage, and background check features. Other applications include performance reviews, learning and development courses, and employee feedback. Gusto also integrates with a host of other recruiting and HR software, so companies with a pre-existing tech stack can still use Gusto’s HR features as they see fit.

Source: Gusto

Market

Customer

Up until June 2023, Gusto lacked support for international employees and large enterprises (1K+ employees), so the company’s ideal customers were US-based SMBs in markets that Gusto can continue to support as they mature and scale. Following a partnership with Remote.com in June 2023, the company began to allow its customers to hire across borders in regions such as Canada, with plans to expand to over 75 markets. As of October 2023, however, Gusto’s core customer base is still primarily in the US.

One example is Goldbelly, an online food marketplace, which used Gusto to scale from six employees to over 125 and reportedly saved 100+ hours running payroll with Gusto. Another example is Cortex Health, a company that helps medical providers measure and improve outcomes. With Gusto, Cortex scaled from 10 employees in a single state to 500+ employees in 40 states. Goldbelly and Cortex show that Gusto can effectively support small businesses as they grow into mid-sized companies. However, the company also supposedly serves a few larger customers like Segment, Accenture, Linkedin, and the University of Chicago.

Market Size

Payroll outsourcing in the US is projected to grow by 6% YoY through 2027, creating a $7 billion market. With Gusto’s recent partnership with Remote.com, the company also has the potential to tap into international markets. Some estimates indicate that the global payroll software market grew from $23.6 billion in 2021 to $28.1 billion in 2023. Manual calculation takes valuable time and risks payment and compliance errors.

Compliance is becoming increasingly difficult as companies have to comply with regulations in multiple states and countries due to geographically distributed workforces. With online payroll software like Gusto, SMBs in the US can avoid the hassle of compliance and focus on growth. Additionally, the next generation of small businesses, which is likely to be more tech-forward, is being created at a record pace: entrepreneurs filed for 5.4 million businesses in 2021, up 23% from 2020. This elevated pace was sustained in 2022, with 5 million new businesses created in that year, a 42% increase from the period preceding the COVID-19 pandemic.

Within Gusto’s consumer banking efforts, the company has a common fintech model of capturing a small percentage of the interchange fees involved with card transactions. Fintechs typically generate over 75% of their revenue from interchange. Gusto Wallet could become a multibillion-dollar product from interchange alone. Assuming an average of 15 employees per customer, nearly 50 million employees could potentially access Gusto Wallet. The average US consumer spends ~$13.5K a year via debit card, so Gusto’s debit cards could facilitate more than $677 billion in annual transaction value. One source estimates that card partners like Gusto can capture 1% of transaction value as interchange fees, which is consistent with another source’s estimate of 0.7% to1.7% of transaction value. That means Gusto Wallet’s additional revenue TAM could be between $4.7 billion and $11.5 billion in annual interchange revenue.

Competition

Payroll

The payroll software market features decades-old companies alongside younger startups. The two largest incumbents are public companies, while the market also includes a number of older companies and younger startups:

ADP: Founded in 1949 as Automatic Data Processing, Inc., ADP is a public company with a $100 billion market cap as of October 2023. The company generated $16.5 billion in 2022 revenue, serving more than 1 million customers in 140 countries. ADP’s product includes features across HR services, payroll, talent, PEO services, time management, and employee benefits.

Paychex: Founded in 1971, Paychex is a public company with a ~$42 billion market cap as of October 2023. The company generated $4.6 billion in revenue in 2022, serving 740K customers in the US and Europe. In particular, Paychex has become the preferred payroll platform for the public sector in the US, with 1 in 12 private sector employees being paid through Paychex. Since 1995, Paychex has completed 19 acquisitions. In November 2018, Paychex acquired Oasis Outsourcing Acquisition Corp for $1.2 billion, a professional employer organization (PEO) that expanded the company’s product into outsourcing.

TriNet: Founded in 1988, TriNet is a public company with a ~$7 billion market cap as of October 2023. The company generated $4.9 billion in 2022 revenue, serving 22K customers. Unlike ADP and Paychex, TriNet’s primary business is as a cloud-based PEO administering payroll and health benefits services. While Paychex and TriNet have comparable revenue, Paychex generates ~30% net income margins compared to TriNet at ~7%. In June 2023, news broke that TriNet was pursuing a buyer for the company.

Paycom: Founded in 1998, Paycom is a public company with a $16 billion market cap as of October 2023. The company generated $1.3 billion in 2022 revenue, growing ~30% YoY, serving 36K customers. Paycom’s product extends across payroll, HR, talent acquisition and management, and time management.

Paylocity: Founded in 1997, Paylocity is a public company with a ~$11 billion market cap as of October 2023. The company generated $852 million in 2022 revenue serving 36K customers.

BambooHR: Founded in 2008, BambooHR is a private company with 1K+ employees. Some estimated indicate the company had $103 million of revenue in 2020. As of October 2023, the company indicated it had 30K customers. The company has raised a limited amount of capital from investors like ICONIQ and Sorenson Capital.

Rippling: Founded in 2016, Rippling is a startup offering not only payroll and HR functionality, but also extends to IT management and expense cards. In March 2023, during the failure of SVB, Rippling raised a $500 million Series E, valuing the company at $11.3 billion. In total, the company has raised $1.2 billion in funding.

Block (fka Square): While Block is primarily known for its payments products, the company launched a payroll product in June 2015.

The payroll software market is relatively fragmented. The US’s top 10 payroll providers cover only 55% of SMBs, compared to 95% coverage for the top 10 accounting systems. ADP and Paychex each own about 10% market share compared to 1% for Gusto. Competitors differentiate themselves with payroll-adjacent products since payroll itself is difficult to differentiate. ADP and Rippling complement payroll with a full suite of HR and administrative products that allows them to cater to businesses of any size.

Gusto and Block offer more limited HR services for SMBs. Block also helps customers run other aspects of their businesses like point-of-sale, banking, and e-commerce. In addition, payroll companies often integrate with other applications that provide the functionalities they lack.

Some of Gusto’s competitors, including TriNet, ADP, and Rippling, have professional employer organization (PEO) offerings. PEOs co-employ customers’ employees, share compliance liability, and provide extensive HR services. Their scale enables them to negotiate better rates for benefits like insurance than their customers could themselves. All three companies can serve customers in both a PEO and non-PEO structure. TriNet used to only operate as a PEO, but that changed after its February 2022 acquisition of Zenefits.

To differentiate itself from other payroll products, Gusto attracts SMBs with a user-friendly UI, attractive digital content, banking for employees, and transparent and competitive pricing. However, Gusto does have limitations: it isn’t currently set up for large enterprises and global workforces, doesn’t yet provide benefits to employees in 12 states in the US, has limited HR tools, and lacks 24/7 support.

Embedded Payroll

The embedded payroll market is earlier in its lifecycle and less competitive than the direct payroll market. Most of the competitors are early-stage startups.

Check: Check*, founded in 2019, has raised $119 million in funding from investors like Index Ventures and Stripe. The company provides payroll to 250K+ businesses through its embedding partners.

Other early startups focused on the embedded payroll market include Zeal ($15 million), and Salsa ($10 million). Companies embedding payroll into their products may have customers with varied locations and needs. They need to have confidence that their embedded payroll provider will accurately handle all of them. Gusto’s extensive experience handling payroll gives them a reputational advantage against less experienced competitors, but capitalizing on this will require the company to deliver a high-quality product.

Gusto Wallet

Gusto Wallet faces competition from traditional banks (e.g., Bank of America), online banks (e.g., Ally Bank), and neobanks (e.g., Chime). Banks typically have extensive product suites complete with credit cards, loans, and investment accounts. Gusto’s offerings are most similar to neobanks’ offerings, but many neobanks offer products like credit cards that Gusto Wallet lacks.

Gusto Wallet offers the basics: FDIC-insured bank accounts and debit cards, complemented by budget and savings goal tools complement these. However, unlike competitors, Gusto provides employees access to pay stubs and banking in a single platform. For employees of companies using Gusto Payroll who only need basic banking, Gusto Wallet is a simple, low-friction choice. Once employees are using it, Gusto Wallet could improve the stickiness of Gusto Payroll. However, other payroll providers could roll out similar products, so Gusto Wallet’s success depends on how well Gusto Payroll acquires and retains customers.

Business Model

Gusto Payroll

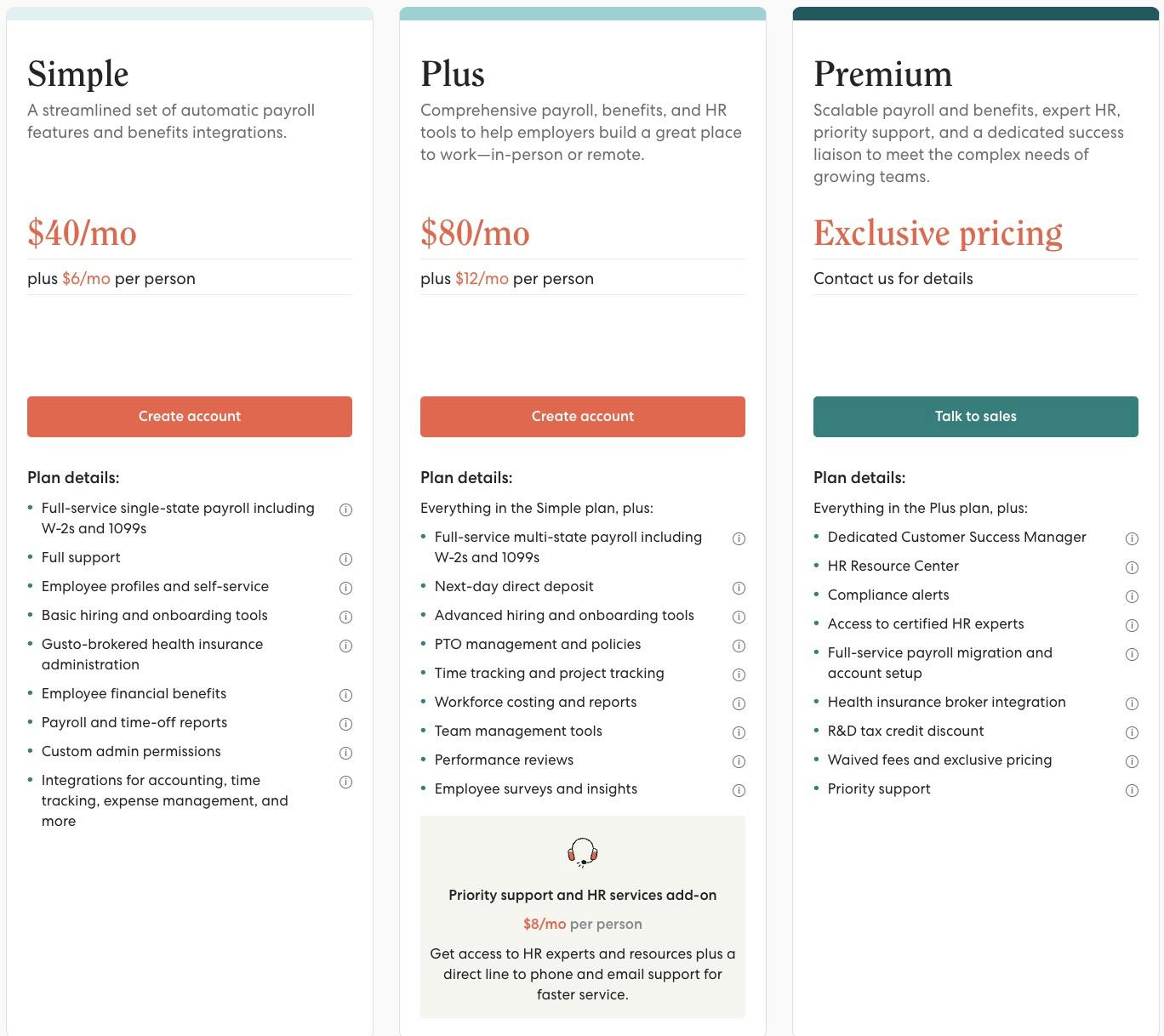

Gusto prices its payroll software as a monthly subscription broken into three tiers with available add-ons. The two lower tiers have a flat-rate monthly cost, plus a monthly fee per employee.

Source: Gusto

Add-on options include international contractor payments, state tax registration, R&D tax credit services, health benefits like health insurance, workers’ comp, life insurance, and disability insurance, savings features like 401(k) integrations and 529 savings plans, and tax-advantaged benefits such as health savings accounts (HSAs), flexible spending accounts (FSAs), and commuter benefits.

Some add-ons are priced on a per-participant basis, while other add-ons’ pricing does not vary with the number of employees, such as state tax registration and R&D tax credit services. For insurance, employers only have to pay the premiums and do not need to pay any administration fees. As an insurance broker, Gusto monetizes its insurance offerings through commissions from insurance companies.

Fragmentation and lower average contract values in the SMB market typically mean high customer acquisition costs. However, when Gusto launched, the company kept CAC low by focusing on word-of-mouth and brand-based organic marketing instead of direct outreach. In February 2019, Gusto’s CEO Josh Reeves confirmed Gusto’s continued focus on unit economics. Gusto maintains a Net Promoter Score above 70 to promote organic customer acquisition.

Gusto Embedded Payroll

Gusto Embedded Payroll operates on a B2B2B model. Gusto Embedded Payroll partners likely charge their customers for payroll functionality and divide the revenue with Gusto. An article co-authored by the CEO of a Gusto Embedded competitor, Check, suggests that embedded payroll providers take a 1/3 cut of revenue. Its B2B2B model lowers Gusto’s customer acquisition costs compared to direct, B2B payroll. Gusto only has to acquire the partner and then shares in the payroll revenue of the customers the partner acquires.

Gusto Wallet

Gusto does not directly provide details on its monetization strategy for Gusto Wallet. Other companies that white label banking products make money through interchange. Interchange comprises a small percentage of many card transactions. The fees for a transaction generally go to financial entities like the issuing bank and card networks (e.g., Visa and Mastercard). But the bank can share part of its interchange revenue with its partner (in this case, Gusto). The partner can receive about 1% of the transaction’s value, although this number varies.

Employees of Gusto’s customers gain free access to Gusto Wallet and retain it even after leaving their employer. However, people who do not work for Gusto customers cannot sign up for Gusto Wallet. Strategically, Gusto Wallet makes Gusto a more enticing payroll provider to employees and lets employers tout a convenient banking platform as a free benefit.

Accountant Partnerships

Gusto’s accountant partner program financially incentivizes accountants to bring in Gusto clients. Gusto provides accountants with a free payroll subscription as long as they bring in at least one client per year. The company also supports accountant partners with Gusto Pro, an accounting dashboard. Adding more clients to Gusto unlocks increasing benefits for these accountant partners, such as a bulk discount of up to 20% per client, VIP support, and a featured Partner Directory listing on Gusto’s website. Gusto also fosters relationships with accountants with Gusto Next, an annual conference for accountants. Tickets are free for Gusto partners. The conference features speakers, networking opportunities, and in-person People Advisory training.

Traction

As of April 2023, Gusto surpassed $500 million in revenue. This figure places Gusto among the largest private tech companies in terms of scale. Gusto CEO Reeves said in 2021 that the company was growing at 50% year-over-year. As of July 2023, over 300K businesses use Gusto for payroll, and 186K small businesses use the platform’s services through Gusto 27 Embedded Payroll partners. In June 2023, Gusto told TechCrunch that it was focused on attaining its key profitability benchmark. it anticipated reaching free cash flow positivity in the next few quarters, where it said it expected to stay thereafter.

Valuation

In August 2021, Gusto announced a $175 million Series E led by T. Rowe Price at a $9.5 billion valuation ahead of a possible 2022 IPO. At the time, CEO Josh Reeves reaffirmed that the company’s goal is to go public rather than be acquired like competitor Zenefits. Spurred by the 2022 tech pullback, Gusto announced a $55 million Series E extension at the same valuation as it had in May 2022. Investor Ken Chenault at General Catalyst stated then that he still believes Gusto is early in its journey:

“From a marketplace standpoint and penetration, they’re in the early innings. They have to establish themselves as critical infrastructure for the SMB economy, much like Shopify has done with its commerce platform.”

As of June 2023, Gusto has no plans to raise more outside capital. The company has eyes on an IPO in the near future, and TechCrunch does not expect the company to pursue a direct listing when it does go public. Based on $500 million of revenue, the company has a trailing revenue multiple of less than 20x.

The competitive landscape in the payroll space has a number of players that are public. While these companies are at various levels of revenue scale, profitability, and customer counts, these companies typically trade at ~5-10x LTM revenue (outside of TriNet which is primarily a services business, and trades at ~1.2x LTM revenue).

Source: Koyfin

Key Opportunities

Early Mover Advantage in Embedded Payroll

Traditionally, payroll software is sold directly to businesses. Payroll providers typically have high customer retention, posing customer acquisition challenges for newer companies in the space. The rise of vertical SaaS companies that provide complete platforms for SMBs to run their businesses threaten direct payroll platforms. Gusto’s opportunity is to continue to penetrate SMBs through embedded payroll.

Lifetime value for embedded payroll is favorable because it can be difficult for partners to switch embedded payroll providers. Switching would involve informing all of their customers who, in turn, would have to inform all of their employees. They could have hundreds or thousands of SMBs as customers who could each have multiple employees. That creates significant friction preventing them from switching embedded payroll providers.

Gusto’s extensive experience managing payroll may provide a key advantage. The company has handled numerous edge cases and can incorporate learnings into Gusto Embedded Payroll. Potential partners may prefer joining forces with Gusto given their established reputation. As an early player in the embedded payroll market with extensive financial resources and a reputation advantage, Gusto is well-positioned to ride a potential vertical SaaS wave.

Banking and Payroll Data for Lending

Lenders use credit scores to understand consumers’ willingness to pay. But credit scores do not provide insight into ability to pay. As a16z puts it:

“Both Jeff Bezos and your grandmother may have a 760 FICO (indicating their “willingness to pay”) but have very different incomes (their “ability to pay”).”

Payroll data can fill that gap. The only financial institutions that can directly see individuals’ paychecks are the ones receiving them. Income information is not available through credit bureaus, either, so payroll providers are uniquely positioned to monetize payroll data through lending. With hundreds of thousands of SMB customers, Gusto likely processes the paychecks of over one million employees. Gusto can access that data even when employees do not deposit their paychecks into Gusto bank accounts. The payroll data signals employees’ ability to pay, enabling safe, profitable loan underwriting extending beyond an early pay product.

Shift to Remote Work

In June 2023, Gusto announced its partnership with international payroll provider, Remote.com. The company expects that it will soon be able to offer payroll services in over 75 countries. This partnership can give Gusto an advantage over some of its biggest competitors, like Rippling and Velocity Global, because of COVID-induced shifts in workplace dynamics.

Employers must comply with a limited set of rules when employees are located in a single region. But when employees disperse geographically across municipalities, states, and countries, employers get tangled in regulations. With the COVID-19 pandemic sparking a shift towards distributed workforces, this issue has become relevant for more businesses. SMBs that handle payroll in-house may find it too complex to handle themselves moving forward. In a June 2022 survey, job-seekers ranked “flexible working arrangement” as the third-most important factor when evaluating opportunities. 35% of American workers said their employers allow them to work fully remotely. Employees are seizing these remote work opportunities. 87% of workers with a work-from-home option at least one day a week took it.

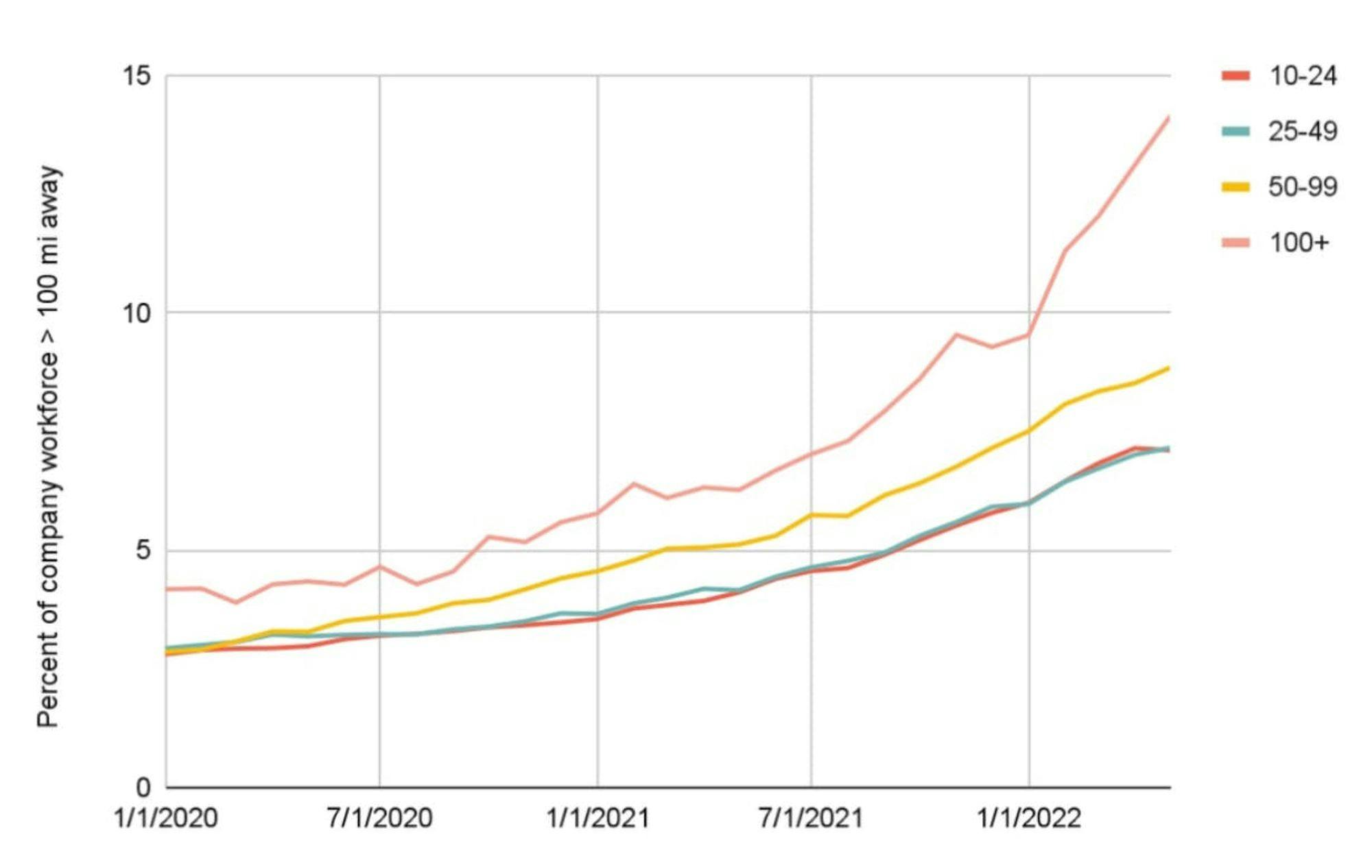

Remote work drives workers further from employers, as the number of workers living >100 miles from work increases. Greater employee distance results in more companies with multi-state workforces. Having employees dispersed across a greater number of states means dealing with more tax laws. 43% of companies with 10-24 employees have out-of-state employees. That number rises to 60% and 76% for companies with 25-50 employees and 50+ employees, respectively. Many companies, especially tech startups like VSCO, Moov, and Superhuman, have fully remote workforces that can spread internationally. Having employees in multiple countries compounds the difficulty of compliance.

Source: Gusto

Key Risks

Stickiness

As an essential product for businesses, payroll software is sticky, making customer acquisition a challenge for new entrants. As of 2022, ADP boasts a client retention rate of 90%+, and Paychex sits at around 88%. Both numbers exceed the 75% client retention rate benchmark for SMB SaaS. A shift to embedded payroll could shake up the market and create opportunities for Gusto Embedded Payroll. But without this shift, Gusto Payroll will likely struggle to poach customers from competitors.

Lack of Differentiation

Payroll products lack differentiation. Every payroll provider that wants to remain in business needs to accurately compute wages and taxes, and international payroll providers offer more flexibility in terms of coverage than domestic-focused providers. That makes it difficult for Gusto to meaningfully distinguish itself through payroll alone. Because of this, competitors in this space must turn to complementary products like HR tools to differentiate themselves.

For companies that need no or some HR help, Gusto could be the best choice. But providers like ADP and Rippling are currently better equipped for companies that need robust HR support. Companies tend to choose the payroll provider with the right suite of products for them, leading to a fragmented market. Even ADP and Paychex, the two most established players in payroll software, have only captured a combined 20% of market share, despite entering the payroll market decades ago.

Summary

Gusto is often thought of simply as a payroll software provider, but the company’s platform has extended through payroll infrastructure and financial services. If vertical SaaS applications with embedded payroll continue to become more prominent, Gusto Embedded Payroll could be a key driver of growth for the business. As a payroll provider, Gusto holds the valuable position of directing employees’ paychecks. That central positioning in the financial stack creates opportunities for lending data, and continuing to expand their product suite.