Why Biotech Will Define the 21st Century

Biotech is emerging as a defining theater of 21st-century economic competition. In 2023, the global bioeconomy, which includes pharmaceuticals, medical devices, and agricultural biotech, reached a market size exceeding $4 trillion. By 2050, it is projected to surpass $30 trillion in annual value. Biotech touches what is core to human existence: food security, environmental sustainability, public health, and increasingly, national defense. In an era where the threat of the next pandemic looms and climate change exacerbates resource scarcity, the nations that lead in biotech innovation will shape humanity’s response to existential challenges.

The COVID-19 pandemic made this clear. Nations with mature biotech sectors produced novel vaccines at unprecedented speed, while others were forced to rely on foreign innovation. At the intersection of biology, engineering, computing, and artificial intelligence, biotech stands simultaneously as humanity’s next great opportunity and a strategic lever capable of redefining international power dynamics. The country that leads at these interfaces will wield asymmetrical influence over global health, agricultural productivity, and biosecurity. Scientific leadership has become, and will continue to be, inseparable from geopolitical strength, particularly during periods of instability and increasingly tense economic relations.

America’s Historical Biotech Dominance

The US has long held a leading position in the global biotech hierarchy. Synergies stemming from a unique ecosystem of public and private players are largely to thank for this. American universities lead the world in life sciences research, with more than double the number of articles of the next highest country in the Nature Index for biological sciences, as of 2024. The National Institutes of Health (NIH) alone invested over $36.9 billion in extramural biomedical research in 2024, more than the entire government research budgets of most other countries. Investors and venture capitalists provide risk-tolerant funding to commercialize discoveries across decade-long development cycles that see products validated, tested, and brought to market.

The US regulatory framework and commercial market also serve as the global gold standard. Net medicine spending in the US increased from $437 billion in 2023 to $487 billion in 2024, representing 53.2% of the global pharmaceutical market. The next leading national pharmaceutical market, China, stands at only 7.5%. In 2024, brand-named drugs in the US had an average price 422% higher than in other nations, with the US market contributing 75% of the global pharmaceutical profits. The premium pricing offers companies the strongest incentives to prioritize US approval from the Food and Drug Administration (FDA), evident from the fact that more than half of all new drugs first launch in the US, as of 2024.

The result is a biotech ecosystem that goes beyond economic returns, with the US flexing global influence in setting treatment standards and safety requirements. The United States has essentially written the rules of modern biotech while simultaneously dominating the industry that operates under them. Yet, beneath this apparent dominance, fundamental shifts are reshaping the competitive landscape in ways that threaten the US's long-held advantages. The US now faces a competitor with the resources and strategic vision to challenge its supremacy: China.

China’s Biotech Playbook

China’s biotech expansion echoes its industrial rise. Beginning in the late 1970s, China initiated a coordinated effort across state policy and private enterprise. Local and national policies fostered the development of an export-led manufacturing economy, with tax incentives that encouraged foreign investment. It offered multinational companies an expansive and inexpensive labor force, along with the necessary infrastructure and ecosystem to support production. At the same time, the country systematically acquired technical knowledge through joint ventures, closing gaps in technological capabilities. The gradual, partial privatization of state-owned enterprises created competition that improved efficiency, drawing further capital from overseas investors to accelerate private sector-led growth of industrials, and later, technology.

The intertwining of public and private execution provided a level of coordination that Western competitors could never match, hampered by short-term quarterly earnings pressures. By the time policymakers recognized the implications, global supply chains had become so dependent on Chinese production that breaking such reliance would cause tremendous economic disruptions. Beyond capturing market share, China had constructed a web of dependencies that made decoupling extraordinarily costly. Economic efficiency became a strategic leverage point, put on display in the second Trump administration's tariff policy and negotiations with China in April 2025.

China appears to adopt a similar approach to biotech competition. Historically, Chinese biotech has employed a fast follower strategy, producing copycat drugs that mimic those of leading foreign pharmaceutical companies. The transformation from this to synthesizing novel chemical matter at the scale and quality of overseas biotech companies parallels the public-private coordination that has driven China’s manufacturing rise. The 13th Five-Year Plan (2016-2020) outlined goals to develop biotech companies capable of competing globally, backed by approximately $100 billion in coordinated government investment. The 14th Five-Year Plan (2021-2025) furthers this commitment by increasing biotech-related R&D investments by over 10% annually, aiming to achieve global bioeconomy leadership by 2035.

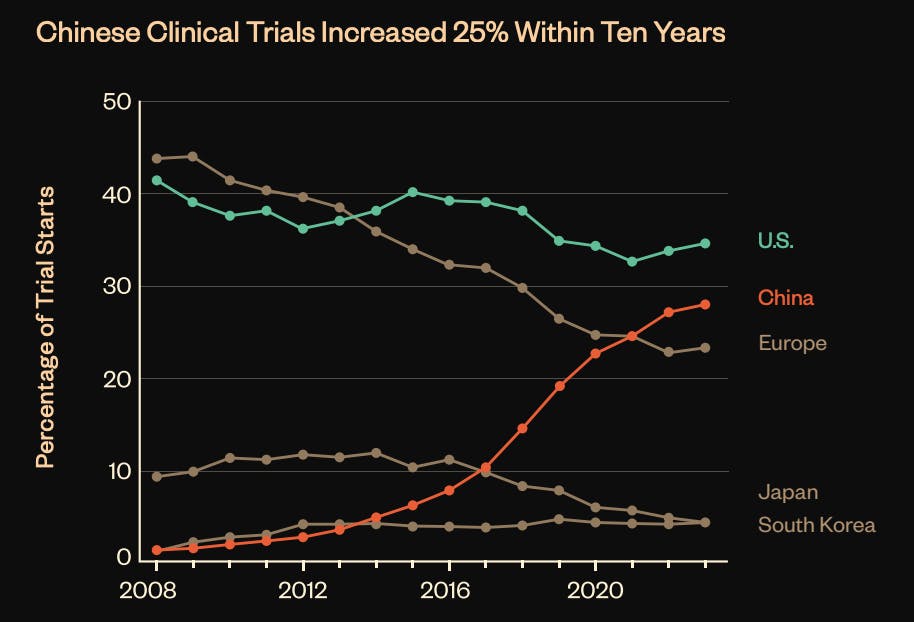

Beyond state-sponsored investment, the same ecosystem that has enabled the US biotech scene to flourish is also facilitating China’s biotech sector's rise at an even greater scale. China produces three times as many PhDs as the US. With a robust patient population, clinical trials initiated by China-headquartered companies now account for 30% of total trial starts, rivaling the 35% from US companies as of 2024. Moreover, Chinese companies leverage their homegrown clinical trial infrastructure, running 83% of their trials domestically in 2024.

Source: NSCEB

American pharmaceutical companies, focused on quarterly profits and cost savings, are increasingly shifting research and production to China. As of 2024, 74% of US biopharmaceutical companies now depend on Chinese-based manufacturers for pre-clinical and clinical services, paralleling the same dependency relationships that have entrenched Chinese manufacturing dominance. Large US and European pharmaceutical companies are also increasing their licensing and M&A activity in China, with 144 deals in 2023-2024 compared to just 104 in the two years prior. Now a robust innovation engine, China’s biotech ecosystem leverages production expertise and a deep pool of biologists and chemists as it seeks to increasingly challenge the US’s leading position as a source of novel drugs.

America’s Enduring Advantages

Some believe increased competitive pressures from China herald the decline of American biotech. These reports, however, may be underestimating the fundamental, enduring advantages of the US and discounting strategic responses aimed at bolstering them. For one, the US is not passively watching China’s biotech ascent. In September 2022, the Biden administration launched the National Biotechnology and Biomanufacturing Initiative, which increased federal investments to $3.5 billion in the following two years and aimed to produce 25% of all active pharmaceutical ingredients (APIs) for small molecule drugs domestically within five years. This further spurred $46 billion in public and private sector biomanufacturing investments. Combined with the $36.9 billion in extramural research funding from the NIH, US biotech funding remains less than that of Chinese state investment; however, it can remain competitive if properly allocated to further develop its already established bioeconomy.

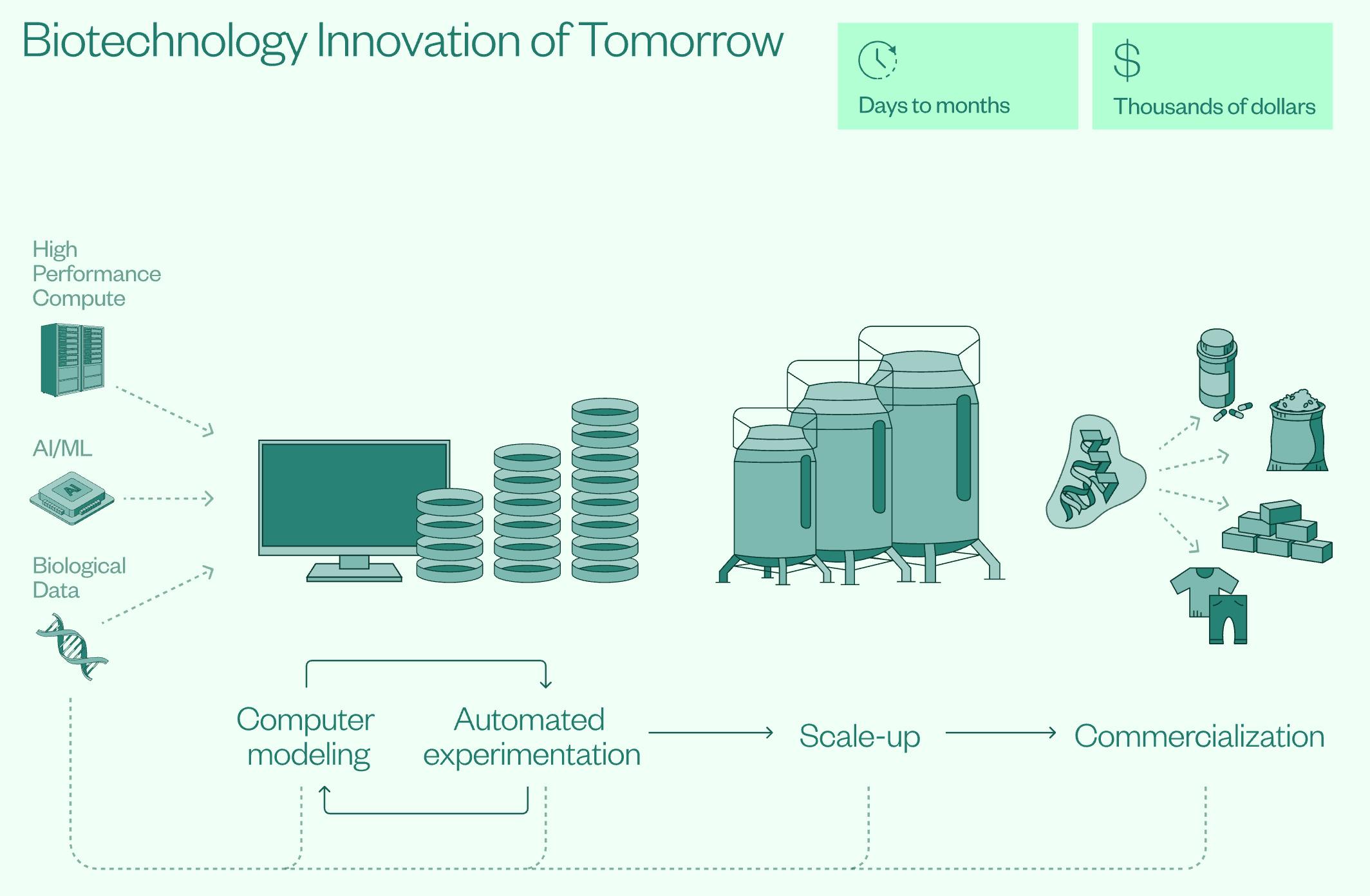

As of September 2025, four AI-biotech bills are set to be introduced with bipartisan support, bringing the federal government into a more active role in securing America’s position at the forefront of AI for the life sciences. These bills span prioritizing accessibility to high-quality biological data for researchers, cataloging genome diversity on federal lands for potential novel medicines, and establishing a national network of cloud laboratories for remote access to biotech experiments.

In January 2025, the US also imposed export controls on biotech equipment to China, including high-parameter flow cytometers and certain mass spectrometers. The cited concerns on China generating high-quality biological data for AI development signal an increasingly prominent view of Chinese biotech development through the lens of national security. China’s quality of technology and scientists rivals that of the US, and any American innovation will likely see a quick catch-up from China. Because of this, investing at the forefront of AI and novel technologies alone may prove insufficient in maintaining the US’s biotech lead.

Source: NSCEB

While American companies grow increasingly dependent on Chinese manufacturing and clinical services, Chinese biotech development’s dependencies on Western markets and regulatory approval for global commercialization persist. China’s aggressive price controls reduce healthcare costs, but also eliminate the profit margins that help sustain biotech innovation. American drug prices generate the returns necessary for decade-long development cycles and high-risk research investments, allowing for a private reinvestment ecosystem in which American pharma companies reinvest 34% of their revenue in R&D.

In this way, China’s national reimbursement negotiations, which can impose average price reductions of 60%, may undermine the economic foundations for self-sustaining innovation. This is compounded by US companies capturing 66.5% of global biotech venture capital in 2025, compared to China’s 4.1% share. However, as licensing deals between the countries increase, this funding advantage could erode if US investors increasingly look abroad for opportunities. China’s continued reliance on heavy state spending to prop up biotech ecosystem development could prove to be unsustainable, and the US’s ability to strategically restrict US-China licensing deals, investment activity, or regulatory approval is a fundamental asymmetry in the relationship.

Amidst the US-China biotech race, Europe occupies a precarious middle position that could prove decisive for American competitiveness. Europe has deepened trade relations with China, creating strategic vulnerabilities in the pharmaceutical and chemical sectors. Europe’s dependence on Russian energy, which constituted over 40% of EU gas imports before the Ukraine invasion in February 2022, demonstrated the risks of strategic dependency when geopolitical tensions escalate.

Therefore, winning European alignment is critical for the US, as coordinated Western action is far more effective than unilateral action. If Europe continues its current trajectory of deeper economic integration with China while the US pursues strategic competition, it risks creating regulatory arbitrage opportunities that Chinese companies can exploit, undermining American restrictions.

The US-EU Trade and Technology Council has identified biotech as a key area for cooperation, with joint mechanisms for developing standards and implementing dual-use controls. The EU also took steps to bar Chinese firms from most public tenders for medical devices, preventing them from accessing bids on over $69.6 billion of goods and services. Europe represents a massive biotech market, valued at over $480.2 billion in 2023, which American companies will look to avoid ceding to Chinese competitors. In this way, European market access could become the decisive factor in determining whether American or Chinese biotech companies achieve the scale necessary for global leadership.

The Three-Year Window

The US’s position, while challenging, is one of opportunity rather than inevitable decline. Fundamental advantages in market economics and regulatory influence remain structural strengths of the American biotech ecosystem that China cannot easily replicate. The ability for the US to levy targeted restrictions that exploit Chinese dependencies further complicates US-China biotech relationships as the bioeconomy becomes increasingly tied to national security. However, these advantages will only matter if America acts with the same strategic coherence and urgency that has characterized China’s approach.

The window for decisive action is narrowing. The National Security Commission on Emerging Biotechnology (NSCEB) warns that the US has three years to mount an effective response before China’s biotech capabilities become insurmountable. In a world where biotech becomes increasingly tied to geopolitical strength, the US must position itself for sustained competition through strategic investment in domestic capabilities. The outcome in this biotech race will depend not only on China’s continued growth, but on whether the US can maintain the coordinated response necessary to preserve its leadership in humanity’s next defining industry. Getting this right means an America that will continue to shape agricultural production, global health, and biosecurity. Getting it wrong means adapting to a world where China sets the terms of biological innovation.