Thesis

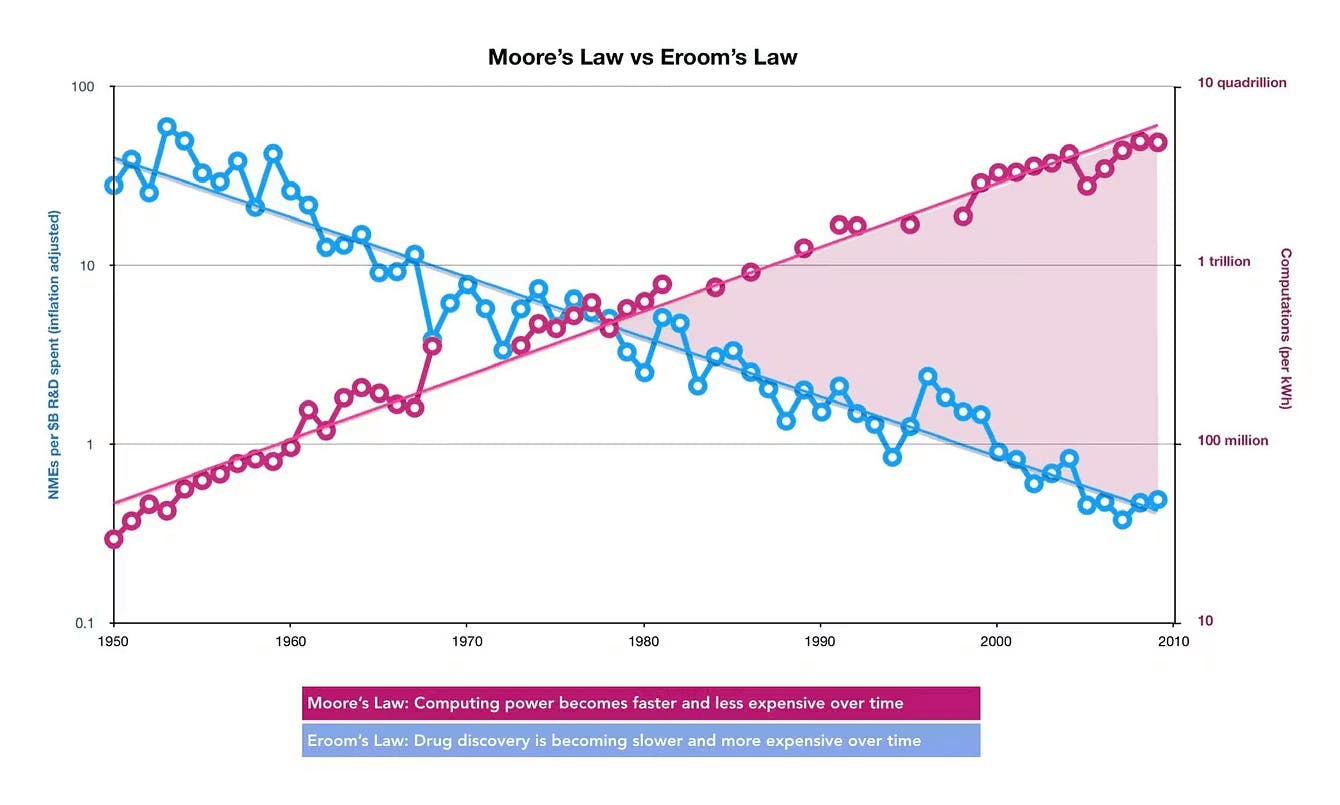

The semiconductor industry has rapidly advanced in lockstep with Moore's Law since the 1970s, which predicted the doubling of chip performance every two years. Meanwhile, the biopharmaceutical industry contends with the opposite phenomenon known as Eroom's Law. Drug development costs for a single successful drug have soared from $225 million in 1979 (adjusted for inflation) to $2.5 billion in 2023, signaling a critical decline in pharmaceutical innovation efficiency. This stagnation in biomedical productivity has driven the search for breakthrough approaches that could reverse this trend, primarily by finding solutions to improve molecular synthesis quality or reduce production costs for pharmaceutical ingredients.

Source: Unlearn.ai

One such solution is in-space manufacturing of pharmaceuticals, as the unique microgravity condition of outer space enables novel synthesis methods to produce pharmaceutical ingredients otherwise extremely difficult to generate under Earth’s gravity.

Astronauts have conducted research experiments on protein crystallization in space since the 1970s, beginning on SkyLab and continuing on the International Space Station (ISS). However, translating these scientific results into economically viable manufacturing remained largely out of reach. Early commercial efforts, most notably by a company called Made in Space, demonstrated some on-orbit manufacturing capability on the ISS but failed to achieve meaningful scale or compelling unit economics before being acquired by Redwire in 2020. By the end of the decade, commercial space manufacturing had largely been relegated to “future sci-fi” status.

Two conditions shifted this outlook. At the macro level, the Zero Interest Rate policy (ZIRP) era created a favorable funding environment for capital-intensive space companies, something specifically noted by Varda cofounder Delian Asparouhov in 2020.

Source: @zebulgar

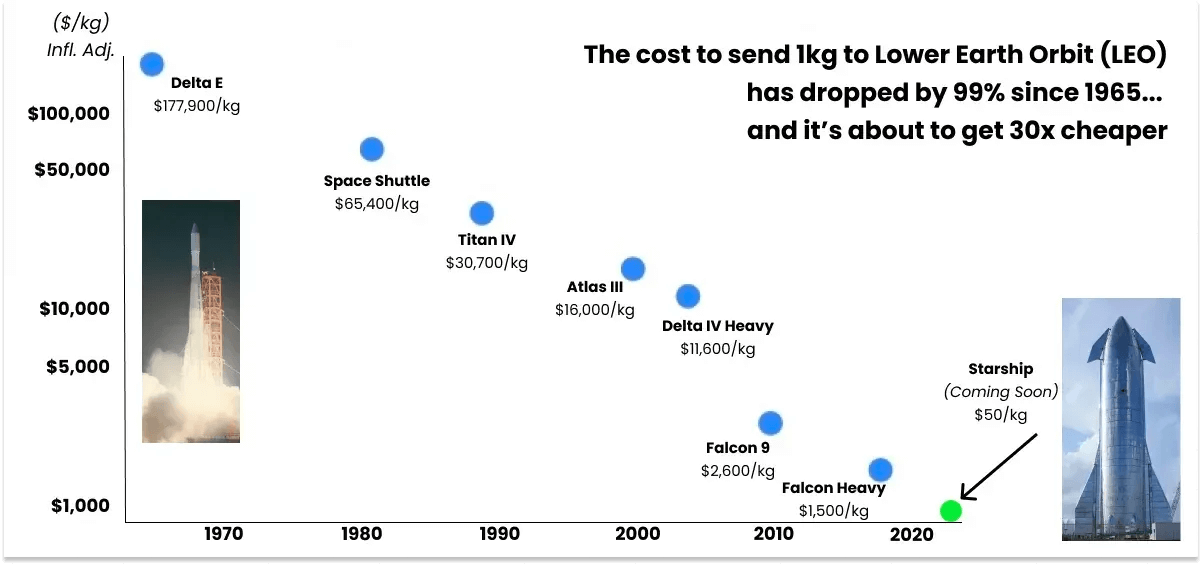

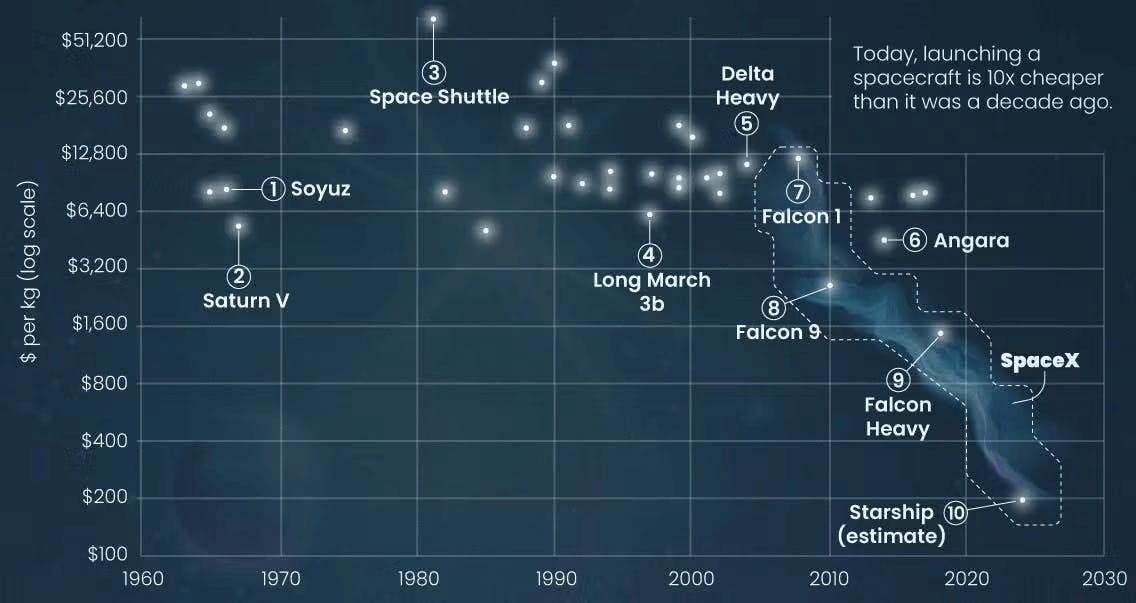

At the micro level, the rapid decline in launch costs, driven primarily by SpaceX, has created economic incentives for commercial microgravity manufacturing at scale.

Source: Get Me Flying Cars

Varda Space Industries provides a full-stack service for in-space pharmaceutical manufacturing through its Winnebago Series (W-Series) capsules. These autonomous capsules combine manufacturing and re-entry capabilities, eliminating dependency on the ISS while facilitating the development and return of space-processed pharmaceuticals. Beyond pharmaceutical clients, Varda's re-entry system doubles as a hypersonic testing platform for the military.

Founding Story

Source: CNBC

Varda Space Industries was founded in late 2020 by Will Bruey (CEO), Delian Asparouhov (Chairman and President), and Daniel Marshall (former Chief Scientist).

The original concept behind Varda was devised by Asparouhov, who was fascinated with space in his high school years and interned at NASA JPL as a high schooler. He then studied computer science at MIT and later interned at Square in 2012, which inspired Asparouhov to start his own company. He applied for and won the Thiel Fellowship, which led him to drop out and work on Nightingale, a healthcare startup. Despite receiving an initial $600K investment from Y Combinator’s 2014 Summer batch, the company flatlined at $15K MRR and could not raise a Series A, prompting Asparouhov to quit.

Although Asparouhov wanted to launch another startup immediately afterward, he was persuaded to join Khosla Ventures as the Chief of Staff to Keith Rabois and was eventually promoted to Principal in August 2018. One of his first investments at Khosla was in Akash Systems. Collaborating with its founders helped Asparouhov realize that the timeframes and costs associated with working in space could be significantly reduced due to SpaceX’s impact on space launch economics. When Keith Rabois left Khosla for Founders Fund, Asparouhov followed and became a Partner at Founders Fund in March 2019. By 2020, Asparouhov was inspired by Rabois to begin another startup and came up with the following thesis: an in-space manufacturing startup that could operate independently of the ISS. Varda was incubated and created at Founders Fund.

Asparouhov recognized that the primary engineering challenge for Varda's success was safely bringing manufactured materials back to Earth through low-cost re-entry vehicles. Through his close friend at MIT, who had become a senior executive at SpaceX, he connected with Bruey and began recruiting him as a co-founder.

Bruey graduated from Cornell in 2012, where he spent several years working on satellite systems at Cornell’s Space Systems Design Studio before working at SpaceX for over five years. There, he was the lead hardware engineer on the Falcon rocket and Dragon capsule, one of two successful re-entry vehicles designed by private companies. Bruey also flew nine missions to the ISS as a mission control spacecraft operator, making him experienced in both the design and operation of re-entry spacecraft. After his five-year stint at SpaceX, Bruey also worked as the Director of Global Equities Technology at the Bank of America to gain experience in finance before being recruited by Asparouhov to co-found Varda.

In November 2020, Asparouhov and Bruey incorporated Varda, naming it after the Queen of Valar from The Lord of the Rings, who created the stars out of morning dew. Less than a month later, they raised a $9 million seed round co-led by Founders Fund and Lux Capital, then a $42 million Series A just seven months later.

Bruey’s long-term operational vision for Varda centered on launching capsules far more frequently rather than increasing capsule size to carry larger batches. He has likened this model to his first job as a pizza delivery driver, where the objective was to deliver many small orders quickly rather than wait for a single large order requiring a semi-truck. Bruey has described a future in which a steady cadence of vehicles enters and returns from orbit, potentially weekly or even daily.

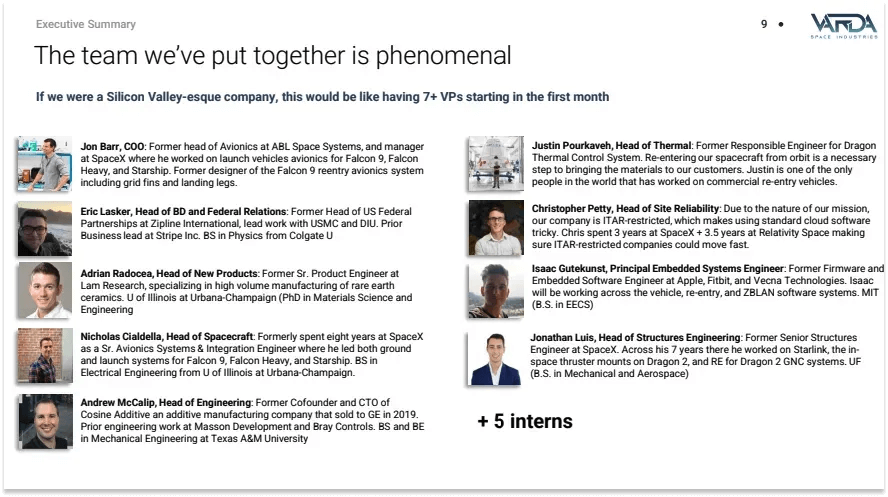

Varda formally began operations in January 2021. In addition to its founders, the initial team was comprised of Eric Lasker, Jon Barr, Adrian Rodocea and a handful of aerospace engineers. Barr joined as Chief Operating Officer (COO); he previously served as Head of Avionics at ABL Space Systems and as Manager of Launch Vehicle Avionics Systems and Integration for SpaceX’s Starship program. Rodocea transitioned from Head of Product at Varda to Chief Scientist in 2022, replacing Marshall after he left the firm. Lasker, who joined initially as Head of Business Development and Government Relations, was recruited to identify viable commercial applications for Varda’s capabilities; he was promoted to Chief Revenue Officer in 2023.

Source: Not Boring

Richard Wissemann joined as Director of Avionics in 2021, contributing hardware engineering expertise from Apple, Blue Origin, and SpaceX. In 2023, Nicholas Cialdella advanced from Head of Vehicles to Chief Technology Officer (CTO), bringing eight years of SpaceX avionics and systems integration experience.

Varda is headquartered in El Segundo, California, where its 61K square-foot facility houses the construction of its capsules and satellite buses. In July 2025, Varda leased a 10K square-foot facility near its El Segundo headquarters to support additional manufacturing needs. This location will allow more complex experimentation and enable the company to expand its work from small molecules into advanced biologics, such as monoclonal antibodies. As of August 2025, Varda had approximately 130 employees, with a projected increase to around 180 within the subsequent 12 months. Varda also maintains an office in Washington, D.C. and, in July 2025, opened an office in Huntsville, Alabama, home to NASA’s Marshall Space Flight Center.

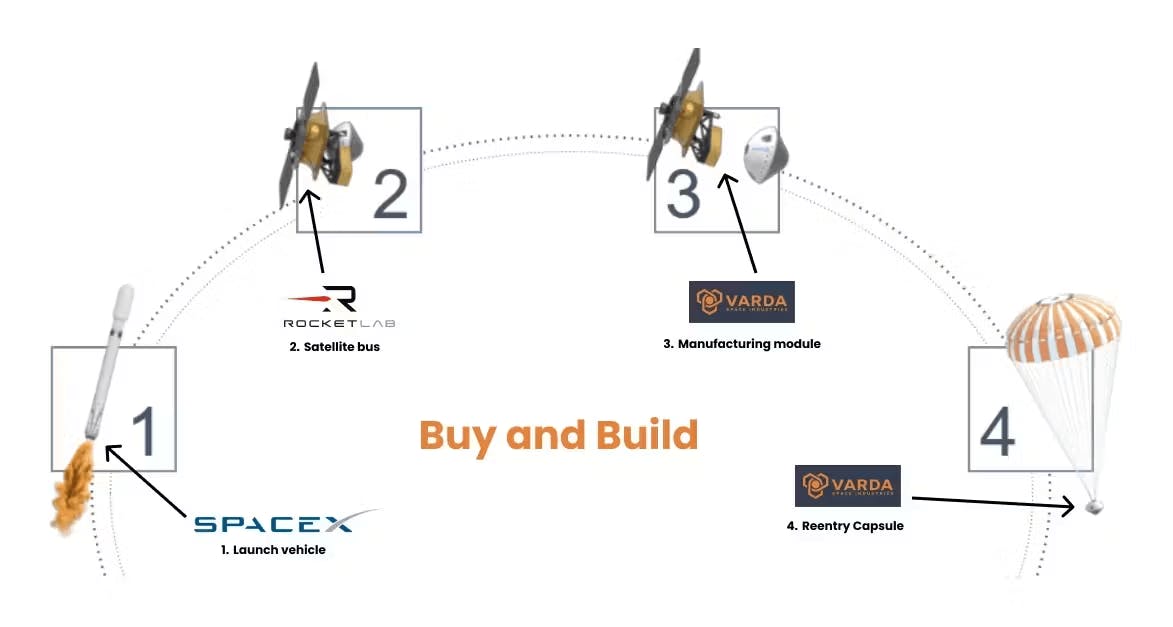

Product

Varda's factory satellites consist of a three-piece vehicle: a satellite bus, a manufacturing module, and a heat shield-protected re-entry capsule. While Varda designs and manufactures the manufacturing module and re-entry capsule internally, the company partners with SpaceX to use its Falcon 9 rockets for launch capabilities and with Rocket Lab to use its Photon spacecraft for orbital operations, including spacecraft propulsion, avionics, and communication. To return the capsule to Earth, the Photon spacecraft will slow down to de-orbit and separate from Varda’s capsule. Photon will burn up during re-entry, while the capsule will descend at hypersonic speeds, experiencing up to 12g of deceleration — high enough to kill a human within seconds. The capsule uses an ablative heat shield (made of C-PICA) that can withstand over 1K°C temperatures during the re-entry phase, keeping internal temperatures low enough to ensure that pharmaceutical samples aren’t compromised.

Source: Not Boring

Synthesizing Pharmaceutical APIs on Earth

The first step in pharmaceutical development is the discovery of a lead active pharmaceutical ingredient (API) with promising therapeutic activity. APIs, such as aspirin and penicillin, constitute the core component of any pharmaceutical product, causing the desired effect of a drug by binding to specific biological targets. Solid API chemical compounds that are identified are then mixed and heated in a solution to reach dissolution.

However, isolated APIs often face challenges, such as poor solubility, and can potentially break down into toxic byproducts, so APIs are often combined with excipients. These include fillers for tablet formation, binders for API cohesion, disintegrants for tablet breakdown, or specialized coatings for controlled release. A notable example includes semaglutide, the API used in Wegovy and Ozempic weight loss drugs. While traditionally administered through injection, Novo Nordisk developed an oral formulation by incorporating sodium N-(8-[2-hydroxybenzoyl]amino)caprylate (SNAC), a permeability enhancer that enhances semaglutide absorption.

For crystalline drugs, which constitute 60% of all pharmaceutical drugs, a crystallization step must occur to transform the dissolved APIs from their dissolved powder state into their solid, stable crystalline forms. By cooling the solution, the dissolved APIs will recrystallize, though this process is affected by temperature, pH, and convection forces, which in turn affects the purity and performance of the drug product.

By carefully manipulating these variables, pharmaceutical companies attempt to synthesize the most ideal crystal size, affecting end-product use once packaged for the consumer. For instance, a low degree of crystallinity in carbapenem antibiotics is highly correlated with poorer chemical stability.

Still, these processes are often highly variable, difficult to reproduce, and even harder to scale reliably. Usually, the solution contains a wide size distribution, necessitating milling or further processing of the product to ensure size uniformity. By the end of the process, the APIs should all be within a tight size distribution for easier dosing. This can be the difference between allowing some drugs to be self-administered at home via syringes rather than requiring IV dosing at a clinic.

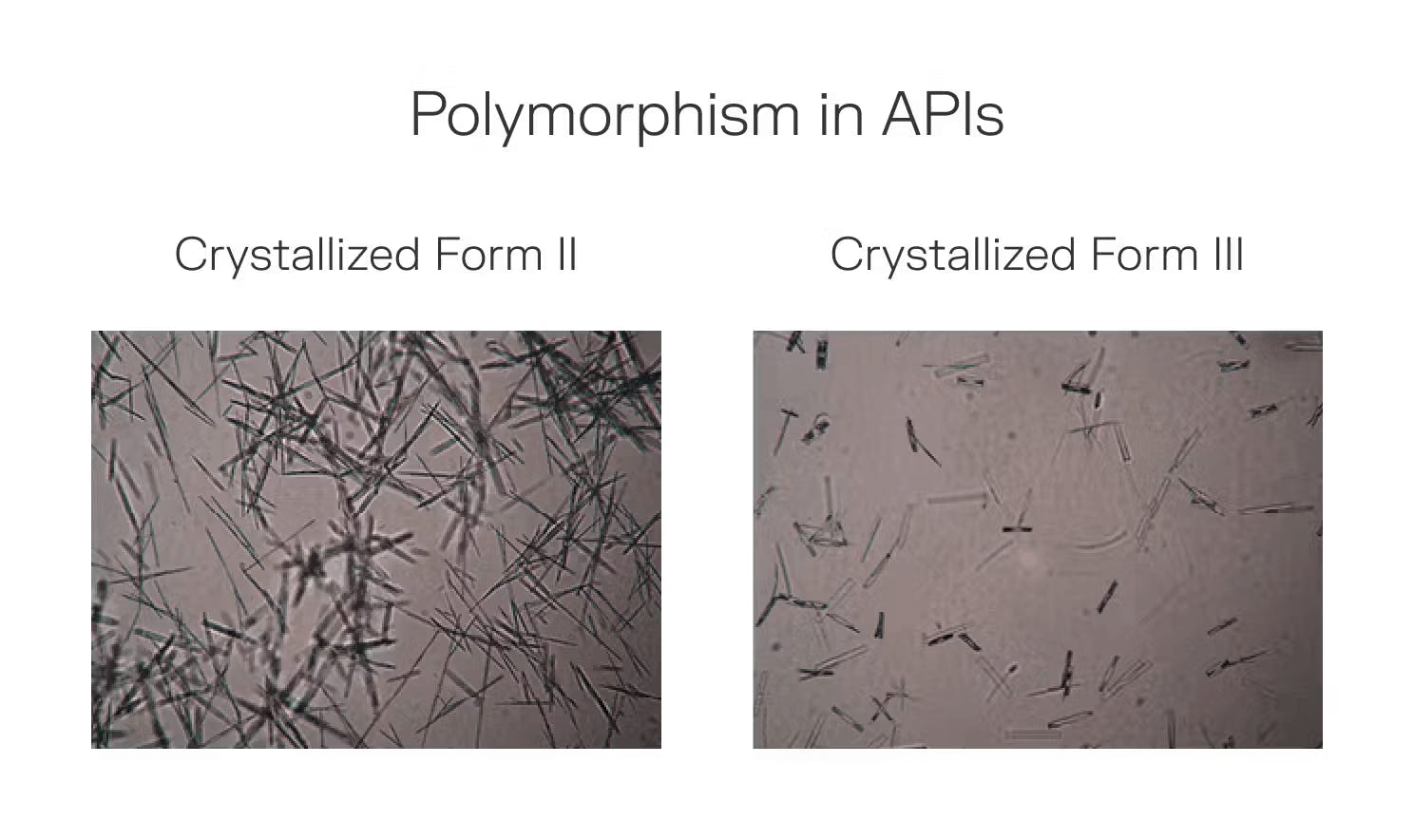

Interestingly, some APIs exhibit polymorphism and form multiple stable crystal structures depending on unique processing thermodynamics, each with distinct properties. Identifying and producing the optimal polymorph impacts drug efficacy and manufacturing costs. For instance, specific polymorphs of acetaminophen demonstrate enhanced solubility, resulting in faster pain relief onset.

Source: Microporetech, Contrary Research

Pharmaceuticals in Space

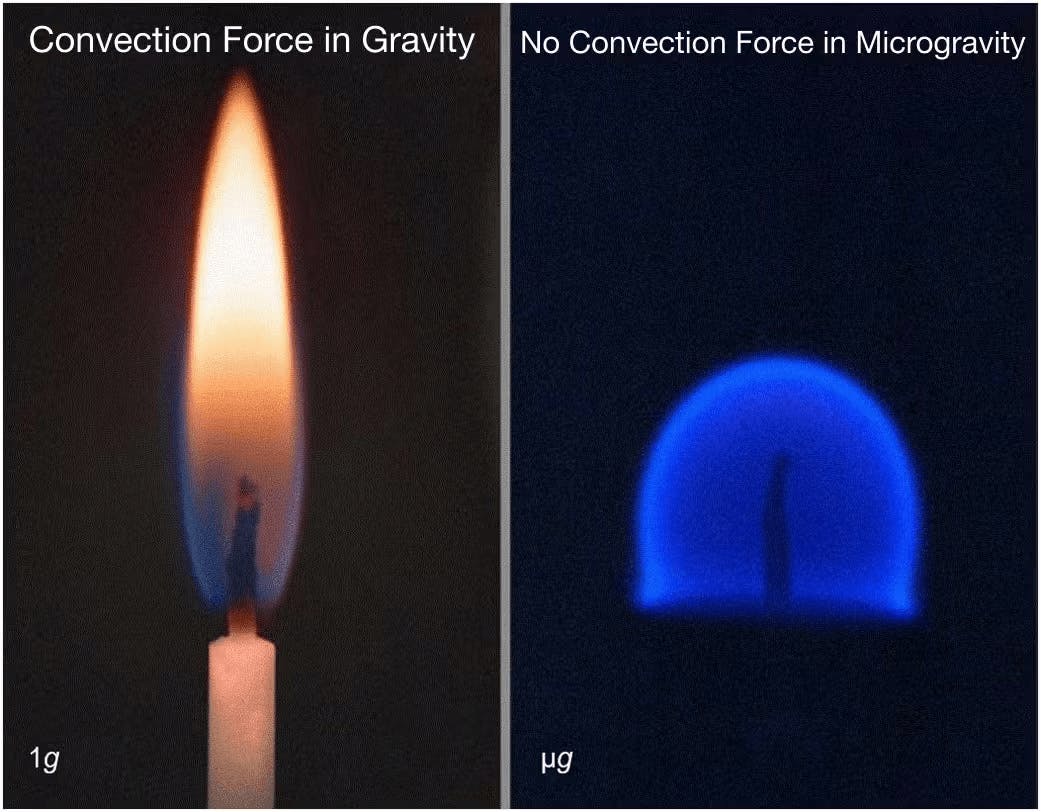

Varda’s primary product line enables pharmaceutical clients to develop drugs in microgravity, where the absence of gravitational forces reduces convection (fluid motion) and sedimentation forces.

Reducing convection forces is beneficial for API crystallization as the rapid convection currents, driven by temperature and density differences in a fluid, can disrupt crystal growth unpredictably. In microgravity, diffusion, which is slower than convection forces, governs crystal growth, enabling more controlled and consistent crystallization. In general, slower crystal growth results in higher purity crystals. Thus, through precise heating and cooling cycles, Varda utilizes the unique microgravity environment of space to control this previously chaotic crystallization process to create a larger, structurally superior, or more uniform crystallized API compound. However, other forces, such as Marangoni convection, can still occur in microgravity and influence the crystallization process.

Source: NASA

The second advantage of microgravity is the elimination of sedimentation forces during the crystallization process. Under Earth's gravity, growing crystals in a solution inevitably yield density differences with the surrounding solvent solution, causing crystals to either sediment (sink) or float based on the relative densities. This prevents uniform growth in a suspension as the settled crystals grow differently from the suspended crystals. For example, settled crystals become structurally inferior in areas where the crystals touch container surfaces, as they do not have uniform exposure to the solution, among other effects.

In a microgravity environment, there are no such sedimentation effects because there is no gravity force causing these crystals to sink. The forming API crystals remain suspended in the solution regardless of density differences with the solution, allowing each crystal to grow uniformly in all directions without interference from the container walls. As a result, uniform crystal growth results in a better crystal structure. This can lead to the possible formation of pharmaceutical drugs with superior pharmaceutical properties, such as improved stability and delivery characteristics (like viscosity for injections). Achieving these properties consistently can be challenging in terrestrial manufacturing environments.

Taken together, crystallizing APIs in space has a high probability of producing higher-quality APIs for pharmaceutical products. In 2019, a study by Merck onboard the ISS confirmed that the absence of gravitational influences during drug crystallization of its cancer treatment resulted in unusually uniform, stable, concentrated crystalline suspensions of its drug. To pharmaceutical companies, this effectively means greater purity and thus higher yields for commercialization. Furthermore, crystallization in microgravity can favor the crystallization of potentially less-stable (and thus harder to form on Earth) but superior polymorphs by preventing early sedimentation that on Earth might cause the API to quickly nucleate into the stable form.

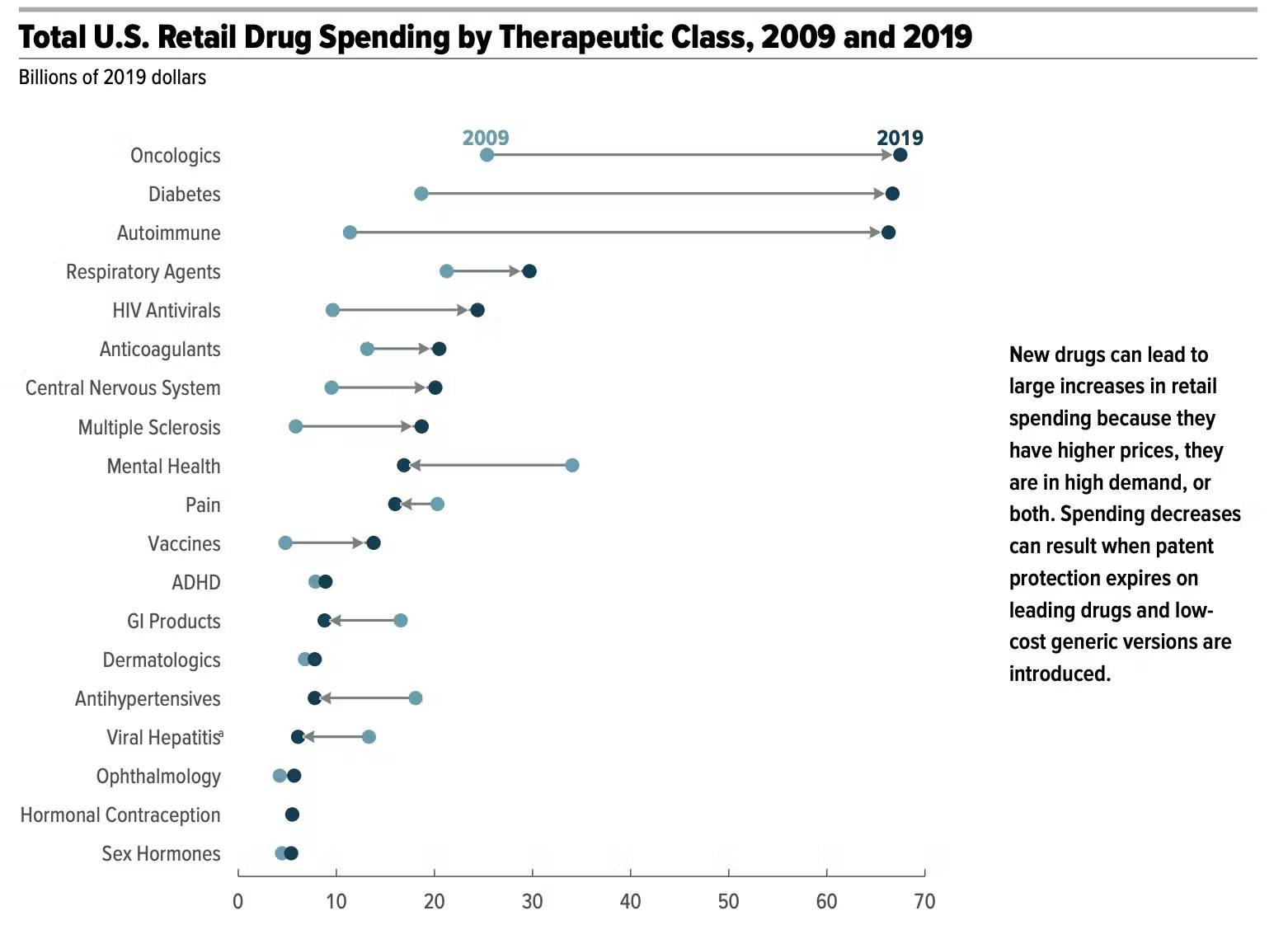

Varda is initially focused on pharmaceutical products for cancer, diabetes, and chronic pain, driven by the lucrative economics of these specific drug markets and the opportunity to produce and experiment with multiple advantageous polymorphs in microgravity.

Source: Congressional Budget Office

Compared to other space-manufacturable products – notably cell cultures, organoids, beauty products, probiotics, and semiconductors – pharmaceuticals offer particularly high margins and value density, with certain APIs generating millions of dollars in value per treatment. By partnering with established pharmaceutical companies, Varda manages the end-to-end process: sample preparation, mission execution, and post-return analysis.

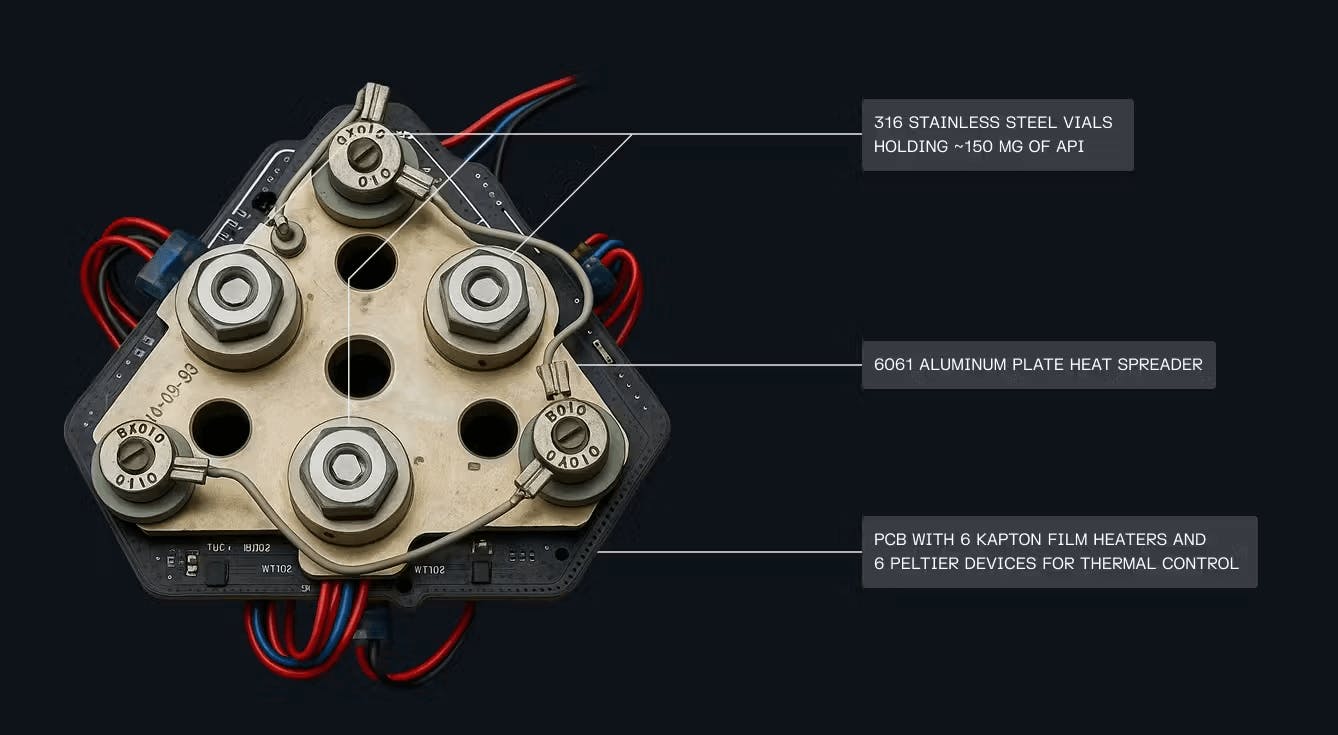

The manufacturing process begins when unprocessed APIs enter orbit within Varda's manufacturing capsule. In the microgravity environment, the module can perform various functions, such as controlling temperature and melt-cool drug production capabilities to manipulate APIs to adopt more ideal crystal forms after crystallization. These microgravity-induced changes are then permanently locked into the materials' structure and persist even after the capsule returns to Earth.

Source: Varda, Contrary Research

Once complete, Varda’s W-1 Series re-entry capsule returns crystallized APIs from space to Earth. Designed for terrestrial landings, Varda’s W-Series re-entry capsules enable simpler, cheaper recovery than traditional ocean-based recoveries. The capsules were also built for ease of manufacturing for mass production and optimized for non-human payloads, allowing for more aggressive re-entry speeds and entry profiles than human-rated capsules like SpaceX’s Dragon capsule. Taking the relaxed constraints and terrestrial design into account, Varda’s re-entry capsule is likely significantly cheaper than the $150 million it takes for SpaceX to manufacture and operate a single Dragon capsule.

Source: Varda

On the ground, Varda uses advanced methods to study how drugs form crystals and break down, ensuring high-quality drug development. Using its dedicated pharma-hypergravity facility in El Segundo, California, Varda can evaluate how microgravity affects drug development. The facility conducts drug development tests across multiple gravity levels and employs process models to predict how microgravity influences drug properties.

Source: Varda

Varda will fly four initial missions (designated as Winnebago 1, 2, 3, and 4) to test their minimum viable product and return 10 kilograms of manufactured material per flight. After the four missions, Varda aims to design a larger return capsule to return 100 kilograms of manufactured material by the end of 2025, with each mission costing approximately $12 million.

Winnebago-1: June 2023

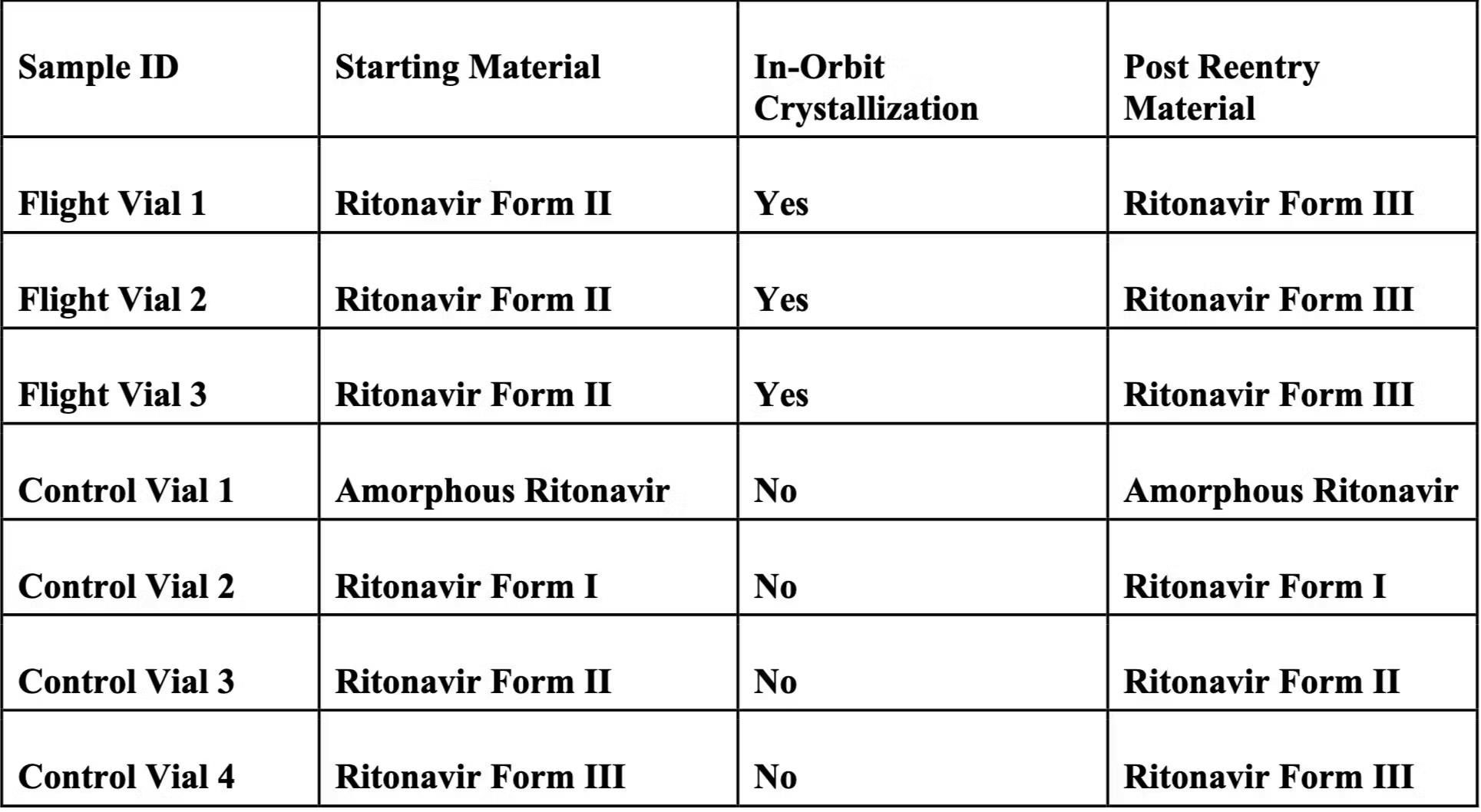

The first mission, Winnebago-1, sought to determine whether certain polymorphs of an API can be interconverted to another less stable form. Ritonavir, an HIV drug with multiple polymorphs (including the infamous disappearing Form I), was selected for its ability to synthesize and interconvert under varying conditions, making it ideal for studying microgravity’s effects on this process.

Winnebago-1 launched aboard SpaceX’s Falcon 9 Transporter-8 rideshare mission in June 2023. During a 27-hour test run, Varda’s manufacturing capsule interconverted a small amount of ritonavir Form II into its slightly less stable Form III polymorph. The capsule then landed in the Utah Testing and Training Range in February 2024, after eight months of FAA regulatory approval delays.

Source: Varda

One month later, a post-analysis by Varda and Improved Pharma through both Raman spectroscopy and powder X-ray diffraction revealed that the mission had successfully synthesized the metastable Form III polymorph of ritonavir in a microgravity environment. In its study, Varda confirms that microgravity ritonavir exhibited excellent stability compared to terrestrially synthesized ritonavir, proving its ability to produce specific polymorphs of a drug, which can be used to serve as an intermediate in future manufacturing processes.

Asparouhov also confirmed that four control vials of various ritonavir polymorphs kept at constant room temperature showed identical Raman spectra before and after flight, verifying that their molecular structure and crystalline state remained stable despite exposure to spaceborne and hypersonic re-entry temperatures, vibrations, and radiation stresses. Thus, Varda has also proven that it can return drugs from space under hypersonic conditions without compromising their integrity.

Source: Varda

While Varda's successful crystallization of ritonavir Form III in microgravity was an important first step that demonstrated the technical feasibility of space-based pharmaceutical processing and API re-entry survival, it is important to note that this achievement does not yet prove therapeutic advantages, such as enhanced bioavailability or improved pharmacokinetics, over terrestrially manufactured drug APIs. Additionally, Form III ritonavir can already be synthesized on Earth using melt crystallization techniques. For microgravity-based API production to transition from academic to commercial scale, Varda’s future missions must demonstrate clear therapeutic benefits over Earth-produced compounds, showing that space-manufactured forms offer superior clinical outcomes that justify the high costs of space processing and re-entry.

Winnebago-2: February 2025

The second mission, Winnebago-2, was launched on a Falcon 9 rocket in January 2025 after Varda secured the re-entry license from the FAA, making it the only company to obtain two such licenses. Once again, Rocket Lab’s Pioneer spacecraft provided Varda with its orbital operation capabilities, spending six weeks in orbit before re-entering over Australia in February 2025.

This time, Varda chose to land at the Koonibba Test Range in South Australia instead of the U.S. to avoid the regulatory complications they experienced with their first mission, when FAA approval delays kept Winnebago-1 in orbit for an additional eight months. The Australian landing site not only offered a larger landing site over uninhabited land and a less congested airspace, but more importantly, a streamlined regulatory framework that made it the first commercial spacecraft to return to a commercial spaceport anywhere in the world.

Source: Varda

According to Asparouhov, Winnebago-2 tested multiple APIs across six thermal profiles, with four vials per profile, compared to W-1’s seven vials of a single API under one thermal profile. Other payloads onboard included a NASA heatshield sample for advanced thermal protection system testing and government instrumentation for hypersonic reentry data collection.

This mission allowed Varda to assess drug stability under varying temperatures, measuring API degradation rates and thermal response. This is important as Varda prepares to begin clinical trials in 2027, which require extensive characterization of drug behavior under varied conditions. As of November 2025, Varda has not yet released a comprehensive research paper detailing the specific outcomes of the multiple APIs tested under varying thermal profiles during the Winnebago-2 mission.

Winnebago-3: March 2025

Varda’s third mission, Winnebago-3, was launched just 15 days after the return of Winnebago-2 in March 2025. Once again, Varda’s capsule was mounted on a Rocket Lab’s Pioneer spacecraft and was launched on a Falcon 9 rocket as part of SpaceX’s Transporter-13 rideshare mission. W-3 landed safely at the Koonibba Test Range in May 2025. This time, the W-3 mission was designed primarily to test Varda’s second product line: hypersonic flight testing for the U.S. military. The mission carried an inertial measurement unit developed in collaboration with the US Air Force and Innovative Scientific Solutions Incorporated (ISSI) under the Prometheus program.

Winnebago-4: June 2025

Varda's fourth mission, Winnebago-4, launched in June 2025 aboard a SpaceX Falcon 9 rocket as part of the Transporter-14 rideshare mission. This mission marks the first flight of Varda’s new in-house “VW-Series” satellite bus, designed, built, and operated entirely at the company’s El Segundo headquarters. With the exception of the launch, W-4 was fully operated by Varda; this represents a significant step towards in-house control over orbital manufacturing operations. W-4 is scheduled to reenter Earth’s atmosphere at the Koonibba Test Range by the end of 2025.

The mission introduced several firsts for Varda, including a heatshield produced entirely in-house, the first time Varda will make small molecule crystals using a fluid-based expanded architecture, and permission from the FAA to conduct capsule reentries through 2029 under the FAA Part 450 vehicle operator license.

Winnebago-5: November 2025

Varda’s fifth reentry mission reached orbit in November 2025 aboard a SpaceX Transporter-15 rideshare. This was the company’s fourth launch of the year, and its fifth overall. The vehicle carried a government payload funded through the Prometheus program. It joined the W‑4 already in orbit and is scheduled to reenter by the end of 2025. The sixth mission (Winnebago-6) is planned for March 2026.

Hypersonic Flight Testing

Varda’s secondary product line provides hypersonic flight testing services via its re-entry capsule, which reaches hypersonic speeds upon re-entry. This creates a real-world testing environment for companies and governments developing hypersonic re-entry vehicle components — including thermal systems, sensors, optical windows, communications, navigation, and other subsystems — to gather valuable real-world data at speeds exceeding Mach 25 during each re-entry. In reality, the US military is the only primary customer for this product line, driven by an urgent need to counter hypersonic weapons developed or claimed by China, Russia, North Korea, and Iran. These weapons, capable of carrying conventional or nuclear payloads on unpredictable trajectories, expose critical gaps in US national security.

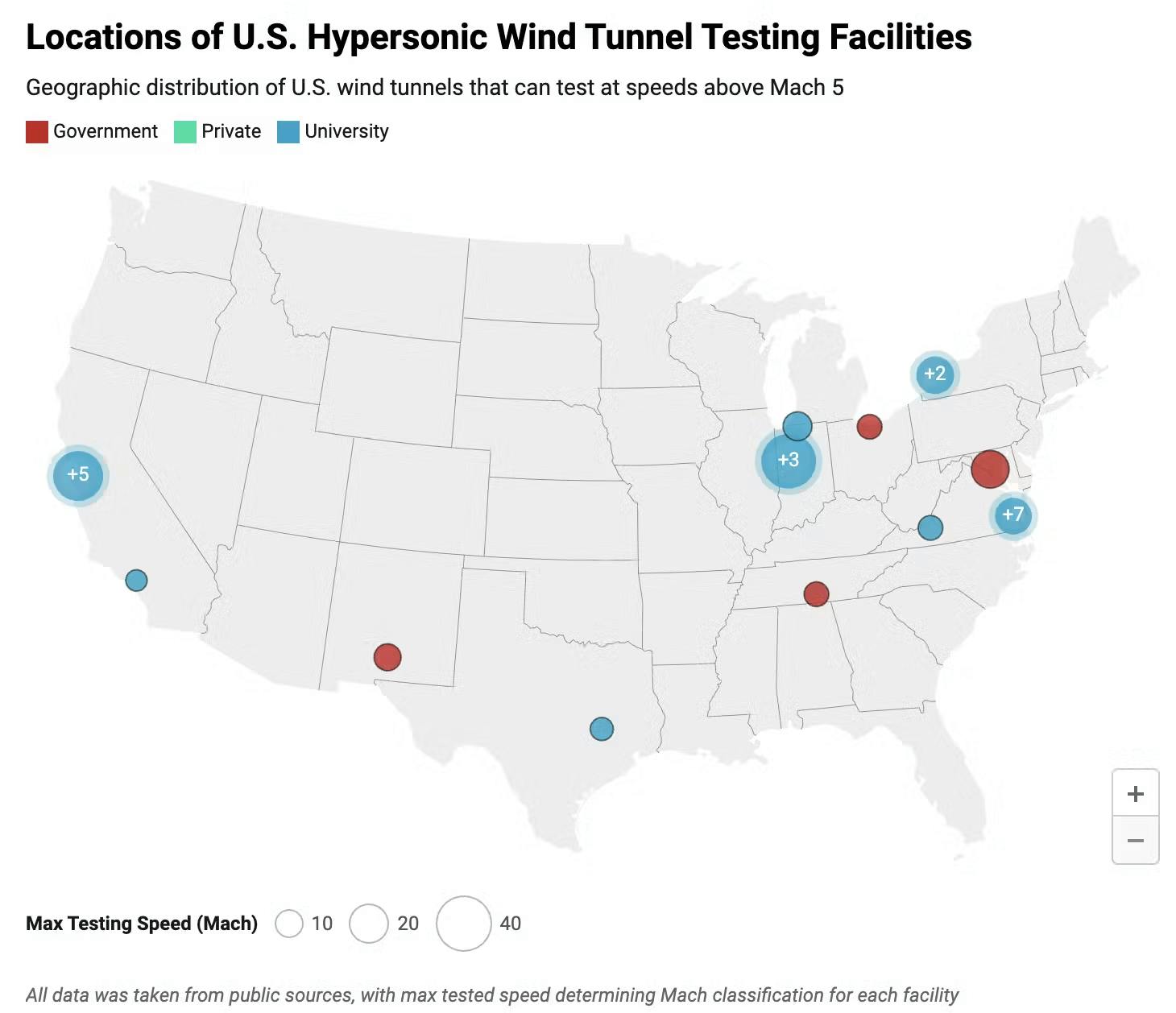

In the absence of Varda’s hypersonic testing platform, the Institute for Defense Analysis has concluded that “no facility can provide full-scale, time-dependent, coupled aerodynamic, and thermal-loading environments for flight durations necessary to evaluate these characteristics above Mach 8.” As a result, US policymakers prioritized hypersonic weapons and countermeasures. For FY2025, the Department of Defense (DoD) requested nearly $7 billion for hypersonic R&D, up from $4 billion in FY2022. Furthermore, in 2022, the Pentagon set a target cadence of eventually 50 hypersonic flights per year. However, testing infrastructure lags behind, preventing a regular cadence of hypersonic flights for testing. Thus, Varda’s hypersonic testing platform addresses two significant gaps in the current hypersonic testing landscape.

First, real representative hypersonic test flights are infrequent, with just 12 tests conducted in 2022, and are prohibitively expensive, costing roughly $40 million to $100 million per flight. This limits the ability to conduct regular testing and gather sufficient flight heritage data. Moreover, most re-entry vehicles from space follow ballistic trajectories focused on deceleration, which prevents extensive hypersonic testing to be done on those vehicles.

Second, ground-based testing facilities, such as wind tunnels, fail to fully replicate the complex flight conditions experienced at high Mach speeds, leading to oversimplifications that impact vehicle performance and reliability. For instance, wind tunnels cannot simultaneously produce accurate Reynolds number data (for shock wave interactions), enthalpy data (for thermal systems), shock layer chemistry (for hypersonic plasma formation), and provide long test durations. Furthermore, most wind tunnels in the US only operate at around Mach 10 or less, while Varda’s re-entry capsules peak at Mach 25 (about 11.4K miles per hour faster), reaching temperatures three times greater than the surface temperature of the sun. Finally, there are simply very limited wind tunnel testing facilities built in the US, with just 12 facilities well-utilized and technically competitive according to RAND.

Varda's own roadmap projects a monthly cadence of re-entry operations by 2026. Therefore, for every mission, Varda’s re-entry capsule will enter into a hypersonic flight phase that can double as a secondary hypersonic testing platform. Contracted companies can integrate test payloads – subsystem equipment, components, or material samples – into Varda’s re-entry capsules before launch. After landing, Varda can recover both its refined APIs and these test payloads to evaluate payload performance under non-simulated, true-to-flight hypersonic conditions. The end vision is for Varda to provide frequent and cost-effective access to true-to-flight hypersonic conditions.

Source: Space News

As of May 2025, the main customer for this testing platform is the US government and the DoD. Through the Prometheus program, signed in January 2025, Varda and the Air Force Research Laboratory (AFRL) announced an “Indefinite Delivery, Indefinite Quantity” contract to fund and access high-hypersonic and re-entry system test flights through 2028. This follows an earlier $60 million strategic funding agreement (STRATFI) with the Air Force, NASA, and other private investors for hypersonic flight testing in 2023. The Air Force alone contributed $15 million and plans on using Varda’s re-entry capsules to test hypersonic flight on their components and equipment. This follows a $443K SBIR contract awarded by the Air Force in 2021 to study Varda’s re-entry capsules for more economical hypersonic flight testing compared to traditional methods.

The Winnebago-2 mission in January 2025 was conducted in partnership with AFRL and NASA’s Ames Research Center. The mission used a capsule modified with NASA’s Thermal Protection System heatshield and carried an OSPREE (Optical Sensing of Plasmas in the Re-Entry Environment) spectrometer payload to collect critical data during hypersonic re-entry for future military applications. The OSPREE recorded the first in situ optical emission measurements at Mach 15.

The Winnebago-3 mission in March 2025 was funded under AFRL’s Prometheus program. W-3’s payload included an Inertial Measurement Unit (IMU), an advanced military navigation system developed by the US Air Force. This device measures an object’s motion, orientation, and velocity, data critical for navigation in military hypersonic missiles. However, the Air Force’s IMU’s survivability under high-hypersonic speeds remains unproven, so Varda will test it during re-entry from space

While national defense priorities currently drive hypersonic testing demand, focusing on offensive weapons and defensive countermeasures, private sector requirements will likely emerge as commercial applications of this technology mature. Companies like Hermeus and Reaction Engines both aim to create commercial hypersonic aircraft. As these companies progress in their development, they will need to regularly test their hypersonic technologies under real-world conditions, which Varda can provide.

Beyond W-2, Varda plans to fly three additional missions in 2025 and six in 2026, falling slightly short of its target of monthly launches by that year.

Market

Customer

Pharmaceuticals

Varda has chosen to focus primarily on pharmaceutical development due to the favorable unit economics of the market. Pharmaceutical APIs are among the highest-margin products globally, with sufficient value per kilogram to make space-based manufacturing economically viable. Even minuscule amounts of certain compounds can be incredibly valuable. As Asparouhov notes, “two milk gallon jugs of mRNA would be sufficient for all of the Pfizer vaccine doses administered to date.” This is especially critical in space manufacturing, where payload constraints fundamentally limit which products are viable.

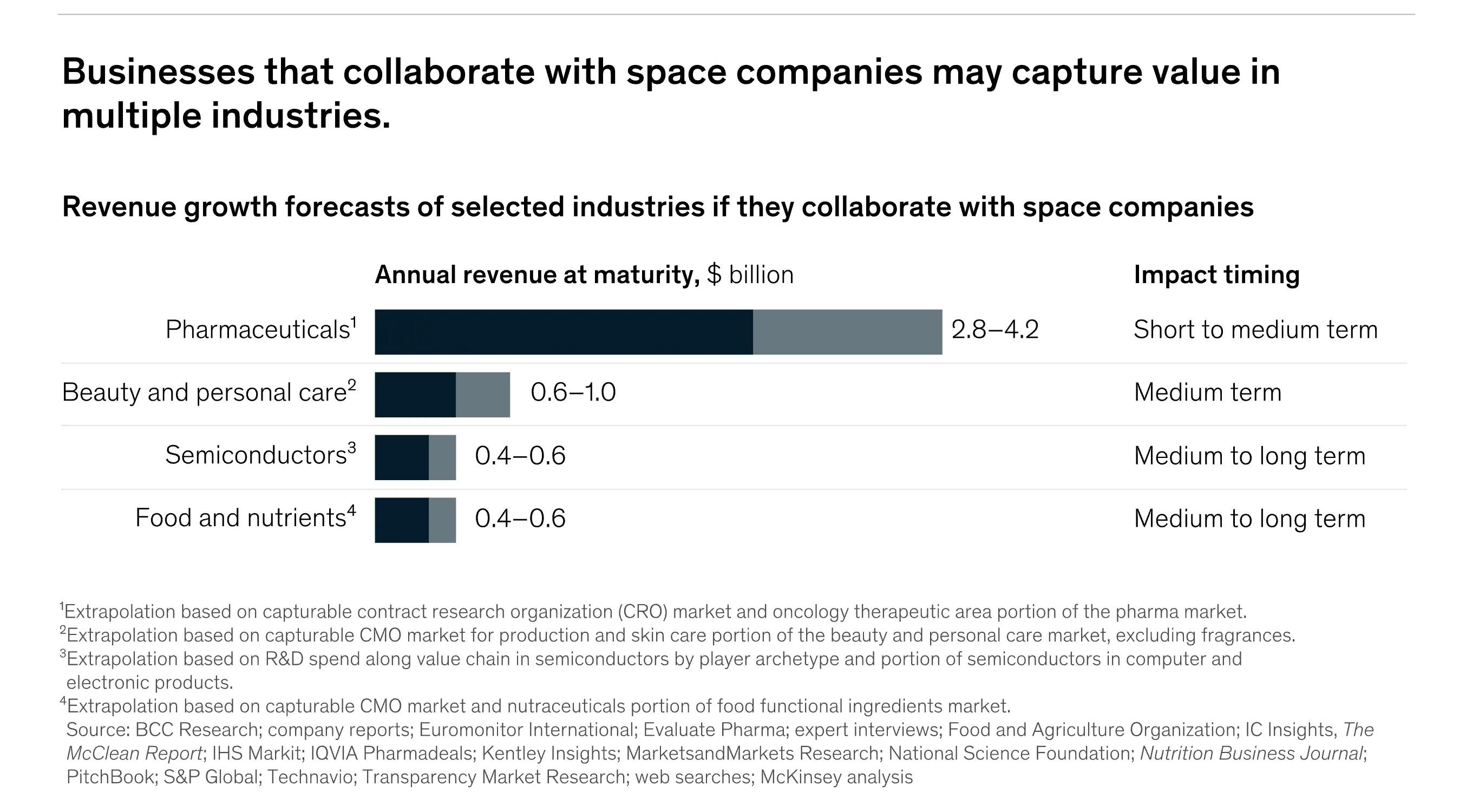

Source: McKinsey & Company

Pharmaceutical and biomaterial payloads in space are growing at roughly 25% year-over-year. This expansion is largely driven by private clients, who accounted for nearly 59% of in-space manufacturing demand as of 2025.

Within the pharmaceutical industry, oncology drugs stand out as the pharmaceutical industry’s largest product category (27% of all FDA drug approvals in 2022 were for oncology alone), yet face high development failure rates and unfavorable risk-return profiles. In this product category, pharmaceutical companies are willing to attempt space-based manufacturing to yield successful trials.

One such company includes the pharmaceutical giant Merck, which has conducted microgravity experiments on pembrolizumab, the sole active API in its blockbuster Keytruda drug. Consider that Keytruda alone generated $25 billion in revenue in 2019 for Merck and represented roughly a third of Merck’s $300 billion market cap. Even an incremental improvement in the drug, such as reformulating the drug to allow for subcutaneous injection instead of a 4-6 hour intravenous drip, would generate substantial returns for Merck.

Government & Defense for Hypersonic Testing

Varda’s secondary market is hypersonic testing for government and defense clients. Realistic hypersonic testing environments are incredibly difficult to simulate or create realistically, and is currently done using large wind tunnels. Despite reaching incredibly high speeds, this option only tests one aspect of flight (speed) and fails to capture the full flight regime that includes aircraft configuration, altitude, and pressure.

Despite the clear need for hypersonic testing, it’s hard to tell if this would become a major product line. Asparouhov has indicated that pharmaceuticals and biopharma production in space would be the main focus of the company for the next 10 to 20 years due to economic incentives, but this was in reference to producing pharmaceuticals over other materials like semiconductors, and it is not clear if he was also referring to hypersonic re-entry testing.

Asparouhov describes how the hypersonic testing mechanism with the Department of Defense “offsets a lot of the upfront research and non-recurring engineering costs and establishes a base cadence for the number of flights.” From this perspective, it seems that the re-entry system and defense contracting are aimed at securing initial cash flow as opposed to being a major business line.

Market Size

In-space Pharmaceuticals

Globally, the pharmaceutical industry is a $1.5 trillion market, making it the third most R&D intensive sector in high-income, industrialized countries, which include most of Western and Central Europe and North America. In 2022 alone, the industry spent $200 billion on R&D and an average of $80 billion every year to work with contract research organizations to conduct clinical trials. Meanwhile, total microgravity manufacturing across pharmaceuticals, beauty, semiconductors, and agricultural products is projected to produce $6.4 billion in annual revenues at market maturity. The in-space pharmaceuticals industry specifically is projected to produce $4.2 billion in annual revenues.

The broader in-space manufacturing market, across pharmaceuticals, beauty, semiconductors, and agricultural products, is forecasted to scale from $6.3 billion in 2025 to $39.2 billion by 2035, growing at a CAGR of 20%. The global microgravity pharmaceutical market was valued at $1.4 billion in 2024 and is projected to grow at a CAGR of 14.2%, reaching $4.5 billion by 2023. Pharmaceutical production is expected to grow 7-8% annually

Hypersonic Testing Market

One estimate for the growth of the hypersonic testing market size is from around $6 billion in 2023 to around $12 billion in 2033. This growth could be understated, as developing hypersonic capabilities has grown to become an important priority for the Department of Defense in response to the development of Russian and Chinese hypersonic vehicles. The Pentagon’s FY2025 budget request for hypersonic research was $6.9 billion, up from $4.7 billion in FY2023. In 2024, the Pentagon declined to disclose its breakout of funding for hypersonic research, but it was requested in its $11 billion long-range fires category.

Competition

Competitive Landscape

Traditional spacecraft designs employed a unified vehicle design philosophy where the same craft responsible for launch would be responsible for re-entry as well – a prominent example being the now-retired Space Shuttle. However, the modern commercialization of space has caused a fundamental shift in this approach. Companies now generally focus on either launch (such as Relativity Space) or re-entry capabilities (such as Sierra Space), creating specialized vehicles optimized for each phase of spaceflight. Thus, capsules with in-space manufacturing capabilities and re-entry capabilities represent a novel market with startups comprising the main competitors.

There are currently no mainstream re-entry providers for space cargo and very few pure players. As of late 2024, seven private space companies had received a Part 450 FAA re-entry license: Astra Space, ABL Space, Inversion Space, Relativity Space, SpaceX, Stratolaunch, and Varda. Among these, each re-entry capsule is also designed for different goals in mind: SpaceX’s Dragon Capsule for re-entry is designed for crewed passengers, while Varda’s re-entry system is optimized for cargo transport instead.

Regarding in-space manufacturing, there are still few pure competitors to Varda, as most re-entry providers also do not produce manufacturing capsules. Previous companies that have focused on in-space manufacturing, such as Made In Space and Space Tango, have largely stalled or failed in space launch and re-entry capabilities. Ultimately, this is a new market that is far from saturation, with few players and high barriers to entry.

In the hypersonics testing space, however, there are many players that could compete against Varda’s hypersonic testing platform. These companies compete to win the DoD’s MACH-TB (Multi-Service Advanced Capability Hypersonic Test Bed) initiative. From this initiative, numerous promising alternative technologies have been developed by competitor companies, notably pure kinetic hypersonic launch systems.

In-Space Manufacturing & Transportation Competitors

Inversion Space: Founded in 2021, Inversion Space aims to make space the new transportation layer with its re-entry Ray capsule. Inversion raised a $44 million Series A round in November 2024, with participation from Spark Capital, Adjacent, Infinite Capital, Y Combinator (YC), Lockheed Martin Ventures, and Kindred Capital. Inversion has raised a total of $54.1 million as of January 2026 from investors like Pioneer Fund, Embedded Ventures, and Funders Club. Unlike Varda, Inversion is primarily focused on re-entry to deliver cargo from space to any point on the world. Similar to Varda, Inversion has found a dual-use customer for its product, with the Space Force and Air Force providing STRATFI funding for military logistical transport.

Outpost Space: Founded in 2021, Outpost Space is focused on developing multi-ton re-entry capabilities and point-to-point delivery around the globe. Outpost’s most recent funding round was a $7.1 million seed round in 2022, led by Moonshots Capital with participation from Draper Associates, Air Capital, Starlight Ventures, Shasta Ventures, and others. Compared to Varda, Outpost Space is focused on building reusable satellites that can survive re-entry, resulting in larger payloads – its Ferryall capsule can carry 100 kg, while the Carryall can carry roughly 10K kg. Like Varda, Outpost won a $33 million Air Force contract for hypersonic testing in September 2024.

SpaceForge: Founded in 2018, SpaceForge aims to provide “microgravity as a service” with its ForgeStar Platform, a reusable and returnable orbital manufacturing capsule. The company received a £7.9 million grant from the UK Space Agency in November 2023. It has raised a total of $51.1 million, with a $29.6 million Series A round in May 2025, led by the Nato Innovation Fund. Its first launch in January 2023, the ForgeStar-0, did not achieve orbit and ended in failure.

In June 2025, however, its ForgeStar-1, the UK’s first in-space manufacturing satellite, successfully launched aboard SpaceX’s Transporter-14 mission. Initially positioned as one of Varda’s closest competitors, with an apparent focus on microgravity pharmaceutical production, SpaceForge has since shifted its focus towards space-based semiconductor manufacturing. In September 2025, it announced a strategic MoU with United Semiconductors LLC to develop III-V crystal growth and wafer processing capabilities in microgravity. The company is also integrating a semiconductor reactor into Intuitive Machines’ Zephyr return vehicle; this would enable high-purity chip manufacturing with return to Earth.

Redwire: Founded in 2020, Redwire is a space infrastructure company focused on in-space manufacturing and assembly. This includes capabilities such as robotics, sensors, solar arrays, and advanced payloads to be deployed in space. The company had a market cap of $2 billion as of January 2026. Compared to Varda, Redwire offers much broader space infrastructure capabilities, supported by multiple successful orbital deployments.

Hypersonic Testing Competitors

Rocket Lab: Founded in 2006, Rocket Lab is a publicly traded company with a market cap of $47.6 billion as of January 2026. The company offers HASTE, an Electron rocket variant optimized for hypersonic payload tests. In April 2025, Kratos selected Rocket Lab to conduct the first full-scale hypersonic flight under the $1.5 billion MACH-TB 2.0 program. HASTE demonstrated reliability through multiple successful hypersonic test launches in the MACH-TB 1.0 program, including two launches within just 21 days, and scaled to large defense contracts, including the USAF's $46 billion EWAAC IDIQ. Compared to Varda’s solution, Rocket Lab's HASTE provides shorter test durations at lower velocities and lacks the recovery capability Varda has, which enables post-flight analysis of tested components.

Stratolaunch: Founded in 2011, Stratolaunch develops the Talon-A, a reusable air-launched hypersonic test vehicle that can be deployed from any 747-capable airport, in contrast to Varda’s space-based approach. As of January 2026, the company’s only funding to date came through a $24.7 million contract from the Missile Defense Agency in January 2025. The company also secured a MACH-TB contract via Leidos, funding five Talon-A flights in November 2023. Its Talon-A2 (TA-2) vehicle completed its second hypersonic flight and runway landing in March 2025, where it reached speeds over Mach 5. Stratolaunch plans to achieve monthly Talon-A flights in 2025. Despite Stratolaunch's efficient operational flexibility, it reportedly cannot match Varda's Mach 25 re-entry speeds or replicate the extreme thermal conditions experienced by Varda’s re-entry capsules during descent.

SpinLaunch: Founded in 2014, SpinLaunch develops a 33-meter centrifugal launcher using kinetic energy to accelerate payloads to hypersonic speeds. As of January 2026, SpinLaunch had completed 10 successful test launches, with the most recent being in September 2022, but payloads reached only Mach 1.3 speeds. This is significantly below the Mach 22 hypersonic capabilities that Varda already provides. The major constraint, however, is the 10K g-force experienced by payloads under SpinLaunch’s system, which severely limits its payload testing capabilities. In April 2025, the company raised a $12 million Series C round, down from its $71 million Series B round in September 2022. A second Series C tranche followed in August 2025, adding an additional $30 million. As of January 2026, the company’s total funding is $203.2 million.

Longshot Space: Founded in 2022, Longshot Space develops a space gun that launches payloads using hydrogen gas at hypersonic speeds for testing. Longshot has built a prototype accelerator that successfully launched projectiles to Mach 4.6, though the high 600 g-forces likely limit testable payload range. Longshot is aiming to build a full-scale 500-meter demonstration gun in Nevada to reach Mach 5+ for 100-kilogram payloads. It is targeting $10/kg launch costs for high-g-compatible, rugged payloads. Longshot remains in early development with lower speed capabilities and high g-force limitations that reduce the range of testable components compared to Varda's more flight-representative conditions. As of January 2026, the company had raised approximately $6.5 million in combined venture and DoD seed funding.

Business Model

Varda’s current business model involves securing research partnerships with major pharmaceutical companies as clients. After initial experimentation on Earth, Varda manages the end-to-end process of manufacturing the drug’s primary API and receives revenue through upfront contracts and royalties.

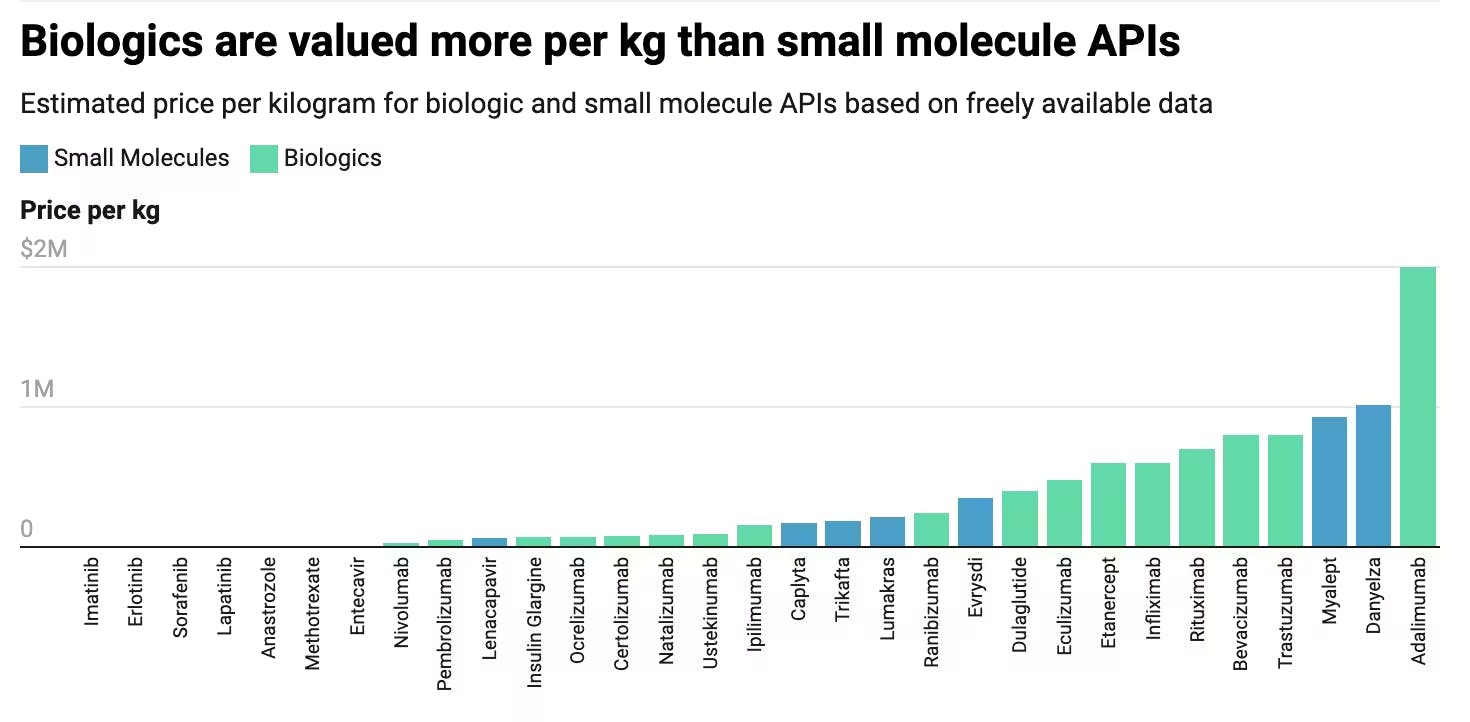

The selection of pharmaceuticals over other materials for space manufacturing stems from the lucrative nature of API production. Certain APIs in valuable drugs can net upwards of millions per kilogram of API, with few high-value APIs reaping hundreds of billions per kilogram. These high-value APIs are often biologics-based, which differ greatly from the small molecule APIs that Varda has largely focused on, though the company is expanding its capabilities to explore biologics-based development, including monoclonal antibodies.

Considering that Varda aims to use larger return capsules that can produce 100 kilograms of manufactured material by 2025, if Varda is able to successfully crystallize certain high-value APIs like Anastrozole, which is estimated to cost around $48K per kilogram as of 2016, Varda can generate $4.8 million in revenue per mission. Granted, most small molecule APIs are worth considerably less than $48K per kilogram, with most small molecule APIs clustering between $10 and $1K per kilogram.

Varda’s initial mission cost was estimated to be around $12 million, including the cost of launch, the manufacturing capsule, re-entry systems, and contracting with RocketLab for use of their satellite buses. However, the company expects the costs to drop to $5-6 million by its 4th mission and $2.5 million or less by its 10th mission if Varda manages to reuse its re-entry capsules. This remains unproven, as Varda has yet to test capsule refurbishment or the durability of its thermal shields and structure after repeated hypersonic re-entry cycles.

Optimistically, this means that Varda has a defined roadmap towards achieving profitability for each mission. Assuming Varda reaches its planned monthly cadence of operations by 2026, the company's manufacturing capabilities can generate approximately $28 million in total value annually by 2027 at best — however, Varda's actual profit will likely consist of a percentage of this value based on negotiated contract terms with pharmaceutical partners.

Once Varda starts clinical trials of space-manufactured pharmaceutical APIs in 2027, with commercialization starting in 2028, Varda will be able to expand its business model into three distinct revenue streams:

First, research partnerships during the pre-clinical phase, where the pharmaceutical partner will fund microgravity experiments to determine if their compound could benefit from in-space manufacturing. Meanwhile, Varda will likely charge upfront payments depending on the complexity of the API and its potential market value and gain valuable operational data from the mission.

Second, licensing agreements during clinical trials as pharmaceutical companies aim to secure exclusive access to Varda’s unique manufacturing capabilities that either enhance drug efficacy or create patentable improvements. This can be through milestone payments that align with clinical trial phases as a pharmaceutical company’s drug advances through Phase I, II, and III trials.

Third, full-scale manufacturing contracts upon commercialization will likely be Varda's largest revenue opportunity. Once clinical trials from pharmaceutical partners validate that space-manufactured APIs improve drug efficacy or result in novel properties, Varda can secure long-term production contracts that generate recurring revenue streams.

Traction

Prior to Varda’s first mission, the founding team raised a $9 million seed round co-led by Founders Fund and Lux Capital. This was followed by a $42 million Series A just seven months later in July 2021, enabling Varda to secure a contract with Rocket Lab to procure three Photon spacecraft to serve as satellite buses for Varda’s in-space manufacturing missions.

Two years later, in June 2023, Varda successfully launched its first capsule to space and completed its first mission in February 2024, where the company announced that it successfully grew crystals of ritonavir, a drug used to treat HIV/AIDS. For further post-flight analysis, Varda sent the space-crystallized ritonavir to Improved Pharma. According to Varda, it has signed a handful of contracts with publicly traded biotech companies.

In April 2024, two months after completing its first mission, Varda raised another $90 million in a Series B round, before launching its second mission, W-2, in January 2025. This time, Varda partnered with Australian launch company Southern Launch to land its re-entry capsule at the Kooniba Test Range. Varda noted that the purpose of this mission was to “advance pharmaceutical research as well as fly several payloads in support of NASA and other government partners.” Furthermore, Varda improved the processing capabilities of its pharmaceutical reactor within its capsule on this second mission.

In December 2024, Varda secured a $48 million contract with the US Air Force Research Laboratory. Varda’s third mission, W-3, was launched in March 2025 and was funded through this contract. The mission’s primary goal was to function as a hypersonic test-bed for military equipment.

During W-3, Varda collaborated with LeoLabs and Anduril to demonstrate tracking and monitoring of on-orbit maneuvers ahead of hypersonic reentry. Using LeoLabs’ Global Radar Network, Varda’s orbital maneuvers were tracked, and the resulting data were integrated into Anduril’s AI-enabled Lattice platform, which provided distributed users with real-time situational awareness. This demonstration validated the ability to monitor reentering capsules at Mach 25 speeds and is useful for enabling low-latency, actionable intelligence for defense and national security applications. It further highlighted Varda’s platform as a cost-effective, high-cadence testbed for hypersonic systems.

In September 2024, Varda established a research partnership with the Synthesis and Solid State Pharmaceutical Centre (SSPC) to develop mathematical models for crystallization in microgravity environments. This collaboration aims to enhance Varda’s ability to identify and produce valuable pharmaceutical polymorphs through its space manufacturing platform.

Varda had extended its partnership with Southern Launch in September 2025 to secure 20 additional reentries at the Koonibba Test Range through 2028. Capsules W-4 (launched in June 2025) and W-5 (scheduled to launch in November 2025) are scheduled to land there by the end of 2025. Near-monthly cadence is expected through 2026 and beyond.

The company had also expanded into orbital semiconductor manufacturing. In October 2025, Varda announced a joint development agreement with United Semiconductors LLC to produce high-throughput semiconductors in microgravity using its W-series vehicles. This multi-flight agreement leverages United Semiconductors’ experience with NASA-funded ISS experiments and terrestrial substrate foundries to produce crystals for next-generation autonomous systems, sensing, AI, aerospace, and defense components.

Valuation

In its Series C round in July 2025, Varda raised $187 million at an undisclosed valuation. The round was led by Natural Capital and Shrug Capital, with participation from Founders Fund, Peter Thiel, Khosla Ventures, Caffeinated Capital, Lux Capital, and Also Capital. As of January 2026, it had raised a total of $328 million in funding. Other key investors include Naval Ravikant, Side Door Ventures, and Fifty Years.

Founders Fund and Lux Capital have backed Varda since its $9 million seed round in December 2020. Prior to its most recent Series C, the company raised $42 million in a Series A round in July 2021, $90 million in Series B in April 2024 (reportedly at a valuation of $500 million).

Key Opportunities

Growing Pharmaceutical Industry Interest in Microgravity

The space manufacturing sector has seen growing commercial interest, with patent applications containing microgravity in the title or abstract increasing from 21 in 2000 to 155 in 2020. Varda's successful crystallization of metastable Form III of Ritonavir demonstrates microgravity's potential to create novel pharmaceutical compounds otherwise impossible to manufacture on Earth. This breakthrough validates the platform's capabilities in pharmaceutical manufacturing and opens doors to developing new drug formulations.

Pharmaceutical companies can partner with Varda to discover new crystal forms of existing drugs, creating compounds with enhanced properties such as increased bioavailability or stability. Second, these companies can utilize Varda's platform to produce existing drug formulations more efficiently in microgravity, optimizing manufacturing processes that prove challenging in Earth's gravity. Both approaches enable Varda to build a diversified pharmaceutical customer base while validating its manufacturing capabilities across different crystallization applications.

The emerging longevity medicine sector, from both investors and customers, presents a prime opportunity for microgravity manufacturing. Companies like Loyal and Altos Labs, which raised $27 million and $3 billion, respectively, demonstrate growing investor interest in aging-related therapeutics. Biotech firms Fauna Bio and Vaxxinity have also initiated space-based research programs to develop novel longevity treatments, indicating a growing intersection between space manufacturing and anti-aging drug development. Varda's microgravity crystallization platform positions it to serve this expanding market segment, particularly as longevity-focused pharmaceutical companies seek innovative methods to enhance drug efficacy and stability.

Expanding Product Offerings

The benefits of microgravity manufacturing extend beyond drug production to broader pharmaceutical applications. For example, in developing cell cultures for disease model prediction, the microgravity environment in space alters the growth patterns of some cells, leading to changes in cell morphology, properties, and interactions. These alterations enable deeper insights into cellular behavior compared to traditional Earth-based experiments. Varda’s newly leased laboratory space near its El Segundo headquarters expands its R&D capacity and positions the company to move beyond small-molecule crystallization into more sophisticated biologic formulations, including antibody-based therapeutics.

Another example includes organoid development – miniaturized 3D tissue models used for disease evaluation. While terrestrial laboratories rely on complex scaffold systems to achieve 3D growth, ISS studies demonstrate that microgravity environments naturally facilitate the formation of complex 3D organoids that more accurately mirror human tissue structures, enhancing both cell function studies and drug testing protocols.

Additionally, previous experiments onboard the ISS have already demonstrated the improved outcomes of semiconductor and fiber optic manufacturing in microgravity. For example, in materials like silicon carbide and gallium nitride, Earth-based manufacturing faces limitations in crystal purity and defect density. Research indicates that space-based silicon carbide produces higher-quality wafers than Earth-based manufacturing, as gravity-induced convection currents in molten silicon create material imperfections in silicon crystals.

The enhanced quality of space-manufactured wafers creates immense value for companies developing high-performance computing chips, such as Nvidia or Cerebras. Varda’s multiyear semiconductor partnership with United Semiconductors builds on this trend. As additional industries recognize the benefits of space manufacturing, Varda can leverage its proven platform across an expanded set of industries. Asparouhov has stated that he believes Varda could produce more semiconductors in space than on Earth within the next decade.

Falling Launch Costs

Launch costs have decreased from $65K to $1.5K per kilogram between 1981 and 2018, representing a 95% reduction. This trend is likely to continue as SpaceX works to commercialize Starship and as a result of increased competition from providers like Blue Origin and Rocket Lab. With partial reusability (six flights), the cost per kg could drop to $78-$94, and with very high reuse (20-70 flights), some models suggest $13-$32/kg. SpaceX’s launch rate has risen from 26 launches in 2020 to 138 in 2024, with 170+ expected in 2025.

Source: Visual Capitalist

Growing Military Interest in Hypersonic Testing

The DoD has shown increasing interest in rapid global delivery capabilities as the geopolitical tensions surrounding Russia and China worsen. For example, the Pentagon's FY2025 hypersonic research budget increased to $6.9 billion from $4.7 billion in FY2023. The Air Force's budget request in 2022 outlined requirements for delivering 100-ton cargo loads anywhere globally within one hour. Recent contracts highlight America’s growing interest in hypersonic testing:

Inversion Space secured a $71 million STRATFI award in 2024 for rapid delivery capabilities within an hour.

Varda received a $48 million, four-year contract with the Air Force to test various instruments in hypersonic conditions.

Kratos selected Rocket Lab to conduct the first full-scale hypersonic flight under the $1.5 billion MACH-TB 2.0 program.

Stratolaunch received a $24.7 million contract from the Missile Defense Agency in January 2025.

Key Risks

Unproven Applicability to the Valuable & Growing Biologics Market

The economic viability of space manufacturing depends on producing high-margin materials. While pharmaceutical drugs present lucrative opportunities, Varda’s current manufacturing capabilities only apply to small molecule APIs, which account for roughly 58% of the pharmaceutical market, and do not apply to the increasing industry focus on biologics production, such as E. coli bioreactors for insulin production.

This is likely because many biologics-based APIs derive no substantial advantage from microgravity production. Unlike small molecule APIs, many biologics-based drugs rely on cellular biosynthesis from cells rather than chemical reactions, and do not necessarily have to undergo a crystallization processing step.

Even if one were to crystallize these biologics, it is much more difficult to do so given the complexities of protein structure and chemistry. Additionally, if these biologic APIs were crystallized, many would be too unstable under normal conditions to be used, and since biologic APIs are almost exclusively injected, and thus aren’t limited by solubility or oral bioavailability, crystallization will yield little improvement towards delivery optimization. Finally, biologic APIs exhibit greater sensitivity to environmental conditions such as light and temperature variations, and their structural fragility makes them poorly suited for Varda's hypersonic re-entry system.

These biologics-based therapeutics are projected to exceed small molecule drugs by $120 billion by 2027, representing 55% of innovative drug sales. Furthermore, the most valuable APIs in the world are usually biologics, not small molecules.

However, biologics can derive some benefits from controlled crystallization. For example, converting protein-based biologics into crystallized suspensions can stabilize the molecules (leading to longer drug half-lives), enable higher concentration dosing, and allow for alternative administration methods, as demonstrated with insulin delivery and Merck's Keytruda studies. A small number of membrane proteins, critical targets for emerging drug development, also demonstrate improved crystallization quality in microgravity. Additionally, experiments have shown that crystallizing certain proteins in space, like interferon-α2b, with yields exceeding 95%, showed substantially better stability and drug half-life.

Varda aims to improve its platform to overcome the difficulties in biologics crystallization. By 2026, the company hopes to launch into biologics API manufacturing. To start, Varda can draw on over 500 protein crystal growth experiments that occurred on the International Space Station as of 2021, representing the largest category of space-based experiments.

As proof of concept, companies like MicroQuin actively utilize microgravity crystallization to develop cancer therapeutics. As pharmaceutical companies increasingly focus on biologics-based drugs, Varda's platform could be modified to support both traditional small molecule APIs and complex protein crystallization needs, though Varda must still prove this specific implementation's effectiveness and feasibility in a production setting.

Adoption Inertia & Advancing Terrestrial Crystallization Technologies

Within the pharmaceutical industry, convincing companies to turn towards space is another challenge. Despite demonstrated benefits of microgravity manufacturing, pharmaceutical companies require compelling economic justification for space-based production. Eric Lasker, Varda’s Head of Business Development, stated that “At the end of the day, pharmaceutical companies don’t care that we’re going up to space. They just care about the results on the other side of it.” As such, companies remain concerned about the return on investment for space-manufactured APIs until Varda demonstrates cost-efficient production at scale.

While the theoretical benefits of microgravity crystallization have been validated by Varda, achieving pharmaceutical adoption will solely depend on translating these benefits into tangible, clinically relevant outcomes. Varda can produce superior crystalline structures, but these structures must deliver meaningful commercial advantages, such as extended patent life through novel polymorph intellectual property or enhanced formulation properties as demonstrated in Merck's 2019 research with Keytruda.

Furthermore, there is a limited selection of high-value small molecule API candidates that offer multi-million-dollar per kilogram economics to justify Varda’s orbital manufacturing costs. Most pharmaceutical APIs cluster in the $1K-$10K per kilogram range, creating a narrow selection of economically viable candidates. Thus, Varda can only crystallize a select few small molecule APIs worth approximately $20K per kilogram that show markedly superior properties when crystallized in space versus on Earth. Given that small molecule APIs comprise roughly 70% of drugs under development, roughly 10% exceed the $20K per kilogram threshold, and optimistically 10% show superior space-crystallized properties, then hypothetically, only 0.7% of pharmaceutical APIs would be profitable for Varda to produce in space.

Pharmaceutical companies are also continuously investing in advancing terrestrial crystallization technologies. For example, the industry has been experimenting with microfluidic platforms to enable better control of API crystallization at the nano- and mesoscales. With the rapid improvement and deployment of AI, the industry is also starting to experiment with leveraging such models to enhance the crystallization process. Regardless of the technological development, Earth-bound alternatives will be logistically simpler to develop and operate and will easily integrate with existing manufacturing processes. Therefore, Varda must outcompete both basic batch crystallization and future state-of-the-art alternatives.

Finally, microgravity conditions can be artificially simulated on Earth. Partial microgravity environments can be induced through technologies such as rotating wall vessels, random positioning machines, clinostats, and diamagnetic levitation. While these methods cannot perfectly replicate microgravity conditions, they provide cost-effective alternatives. Compared to Varda’s ideal goal of $2.5 million per mission, commercial-grade clinostats and random positioning machines cost approximately $50K — a 50-fold difference. For high-value APIs, it is possible that pharmaceutical companies may find these approximations sufficient rather than committing to the inherent complexities of space manufacturing.

Regulatory Burdens

The regulatory landscape presents significant operational challenges for space manufacturing. For example, Varda's first W-1 flight was initially planned to stay in space for a month, but was delayed for over eight months until Varda was able to receive a re-entry license based on a regulatory framework known as Part 450 from the FAA. The complexity of securing necessary permits led House Representatives to characterize space manufacturing ventures as being in a "regulatory black hole," where launching products to space proves easier than bringing them back to Earth.

The FAA's recent $600K fine to SpaceX in 2024 for launch violations demonstrates the stringent regulatory oversight in the space industry. The agency also faces mounting pressure from increased activity in the sector, with license applications rising by 1,500% over the past decade. The absence of standardized safety metrics for spacecraft evaluation forces the FAA to conduct time-consuming bottom-up analyses for each application.

These regulatory complexities could impact Varda's planned expansion to monthly launches by 2026, affecting both operational efficiency and product development timelines. Yet, the FAA's recent modernization efforts signal a shift in America's policy toward space regulation. The emergence of new committees and updates to existing FAA licensing frameworks show signs of accelerated regulatory approvals for the space industry.

In August 2025, the White House issued an executive order directing the Department of Transportation to review and propose reforms to Part 450, with a report due by December 2025. This builds on prior FAA efforts, including the establishment of advisory committees like SpARC to modernize licensing rules and encourage clarity and flexibility. Data from the FAA reflects this optimistic trend: the number of FAA-licensed launches and re-entries has grown by nearly 900%, from just 14 in 2015 to 148 in 2024.

Orbital Constraints

The increasing density of objects in low Earth orbit poses escalating operational risks for space manufacturing. As of April 2025, the US Space Surveillance Network tracked over 50K pieces of space debris larger than 10 cm, alongside an estimated 1.2 million objects larger than 1 cm in size, large enough to cause catastrophic damage. By 2030, the number of tracked objects is projected to reach roughly three times the levels recorded in 2011. This problem is likely to cascade as a growing number of spacecraft are launched into orbit. Over 100K new spacecraft are projected to launch by 2030, compared to only 8K currently in orbit.

For Varda's manufacturing platform, even microscopic debris poses catastrophic risks, as impacts from particles as small as paint chips can compromise spacecraft integrity. However, the need for protective shielding against micrometeoroids and orbital debris directly impacts manufacturing capacity. Each additional layer of protection adds mass to the spacecraft, reducing the available payload for pharmaceutical production.

The risk of a cascading effect known as Kessler Syndrome presents a long-term threat to space manufacturing operations. This scenario occurs when the density of orbital debris triggers a chain reaction of collisions, potentially rendering entire orbital regions unusable. For Varda's business model, such a scenario could significantly increase operational costs through additional shielding requirements, more frequent collision avoidance maneuvers, and restricted launch windows. As the company scales toward monthly launches, these orbital constraints could challenge the economic viability of space-based manufacturing in the long term.

Alternative Hypersonic Testing Platforms

Varda's dual-use business model creates strategic vulnerabilities in the hypersonics testing market. While primarily focused on pharmaceutical manufacturing, Varda relies on defense contracts to subsidize its flight operations, creating a precarious dependency. If the DoD shifts its preference to competing platforms like Stratolaunch's Talon-A or Rocket Lab's HASTE, Varda's model faces risk. The company benefits from maintaining momentum in both business segments, as diminished military interest could directly increase pharmaceutical production costs, potentially alienating commercial clients.

Both Stratolaunch and Rocket Lab can compete against Varda with their purpose-built hypersonic test platforms. Unlike Varda's full re-entry capsule system, co-optimized for bringing crystallized APIs to Earth, Talon-A offers a dedicated testbed with superior cost-effectiveness for military applications. In contrast to Varda’s orbital system, which relies on rocket launches, the Talon-A is launched from a Stratolaunch Carrier Aircraft (Roc) or a modified Boeing 747, enabling hypersonics operations from any suitable airport. Stratolaunch is also targeting a monthly flight cadence by 2025, outpacing Varda's mission schedule. For that reason, the US Navy’s MACH-TB program has contracted Stratolaunch for five flights. Similarly, HASTE's dedicated hypersonic testing optimization has shown operational efficiency, as demonstrated by Rocket Lab’s two launches within a 21-day window in 2024, reaching speeds of Mach 22.

Emerging technologies from SpinLaunch and Longshot Space represent longer-term hypersonics testing platforms. Both companies essentially kinetically launch smaller payloads to hypersonic speed, eliminating rocket propulsion expenses, promising up to a 10-fold reduction in costs compared to Varda's complex orbital re-entry system. In the future, these technologies could threaten Varda’s hypersonic testing model, provided both companies overcome kinetic launch’s operational limits — mainly the extreme 10K g-forces, which most payloads cannot withstand.

Summary

Varda Space Industries is commercializing in-space manufacturing, starting with pharmaceuticals. Using the unique microgravity conditions of space, Varda aims to synthesize more effective pharmaceutical formulations and deliver them back to Earth. Having successfully validated this concept with its maiden W-1 flight and subsequent W-2 mission, Varda will fly future missions with pharmaceutical clients to make space-manufactured drugs commercially viable. If successful, Varda will create a commercial manufacturing platform that provides unprecedented control over material development processes, potentially transforming space manufacturing into a standard production method for high-value goods.

Varda aims to transform orbital manufacturing from experimental technology into a standardized industrial process, making space-based production as routine as traditional Earth-based manufacturing for high-value materials and consumer products. Still, numerous untested milestones remain for Varda to successfully demonstrate before this becomes both technologically and economically viable at scale.