Thesis

Ecommerce in Latin America is growing quickly. One report found that the number of ecommerce transactions more than tripled between 2019 and 2023. Over 300 million people in Latin America were shopping online as of 2023, and this number was projected to increase by over 20% by 2027. As a result, the ecommerce market in Latin America was estimated by one source to be worth $509 billion in 2023 and is projected to grow to $923 billion by 2026, representing a 23% CAGR.

Digitization is a trend across the Latin American economy, encompassing not just ecommerce but food delivery, digital payments, and digital banking. The Latin American food delivery market was valued at $78.6 billion in 2023 and is expected to grow to $151.3 billion by 2030. Meanwhile, 70% of adults in Latin America had made or received payments digitally as of 2023, up from just 40% in 2014. Growth in digital banking in Latin America is being driven by the high population of unbanked people in Latin America, which number 178 million as of 2021.

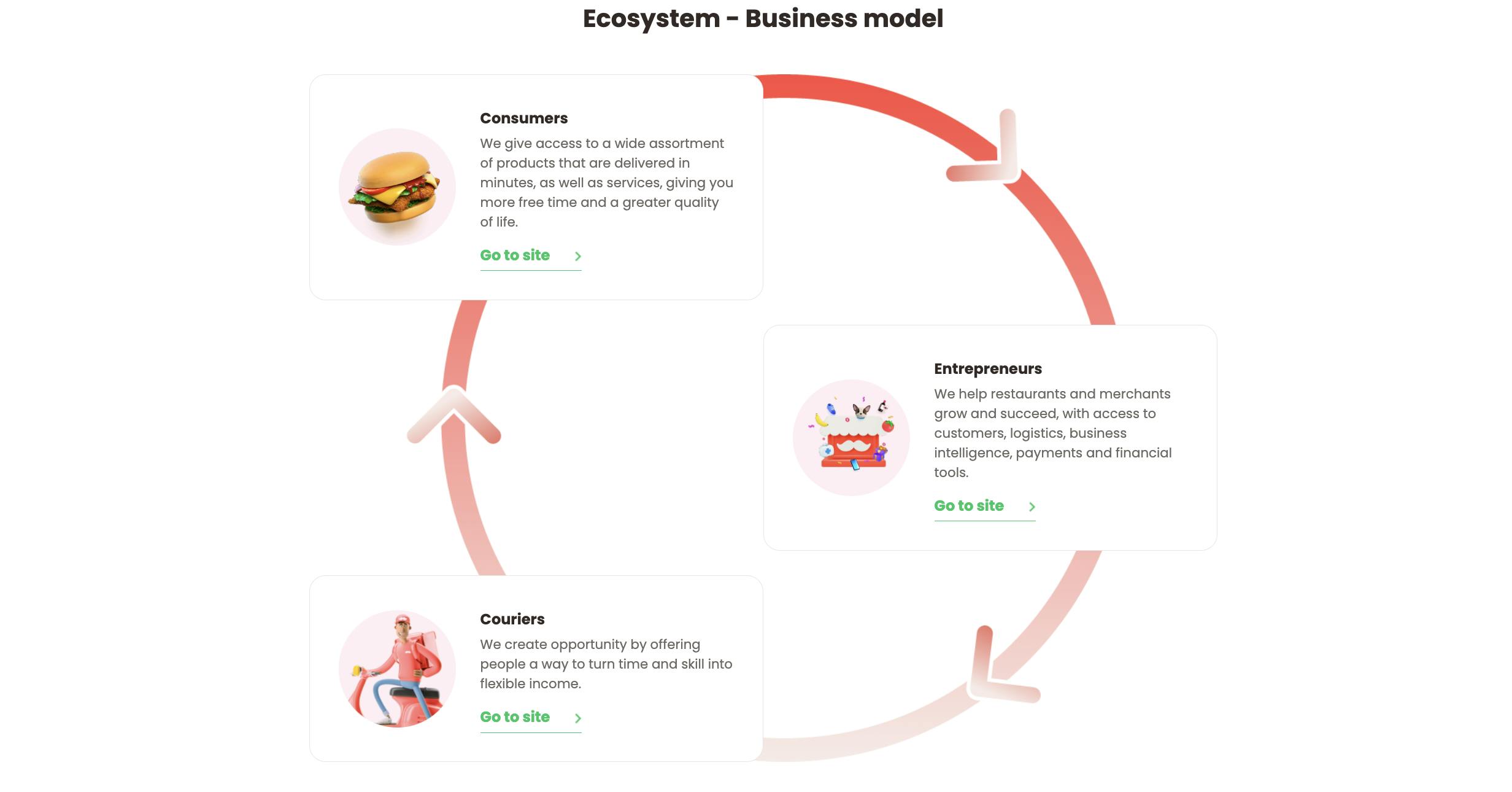

Rappi is a Latin American super app offering a variety of digital consumer services that began with food delivery and has since expanded to provide ecommerce, travel, and banking services. Its core marketplace is a three-sided marketplace between couriers, restaurants or stores, and consumers. As the company has grown, its mission has expanded; as of May 2024, the company states that “our mission is to drive economic development across cities in Latin America by accelerating e-commerce adoption… Rappi is not just a company… It's a movement for economic progress."

Founding Story

Rappi was founded in 2015 in Cali, Colombia by two high school friends, Simón Borrero (CEO) and Sebastián Mejía (President), along with a third co-founder, Felipe Villamarín. Mejía and Borrero parted ways after high school. Mejía went to a university in Spain before pursuing finance in New York City in 2011, while Borerro graduated from a university in Bogota and launched Imaginamos, a software studio in Colombia that he ran from 2007 to 2014.

The pair reunited in 2013 and came up with the idea for a new grocery delivery startup together called Grability. Villamarín joined the company in May of that year. The company raised $2 million and secured several major retail partnerships, and could be seen as a precursor to Rappi.

At Grability, Borrero and Mejía identified a larger opportunity in the on-demand delivery market, observing that consumer needs were not being fully met by existing online services, particularly in terms of delivery speed and product availability. To address this gap, they launched Rappi, a name based on the Spanish word rápido, meaning "fast.” The company’s focus was on providing faster on-demand delivery; as of 2019, its deliveries were reported to be 20% faster than its competitors.

In 2023, Felipe Criniti joined Rappi as CEO of Rappi Brazil after his startup BoxDelivery was acquired by Rappi.

Product

Source: Rappi

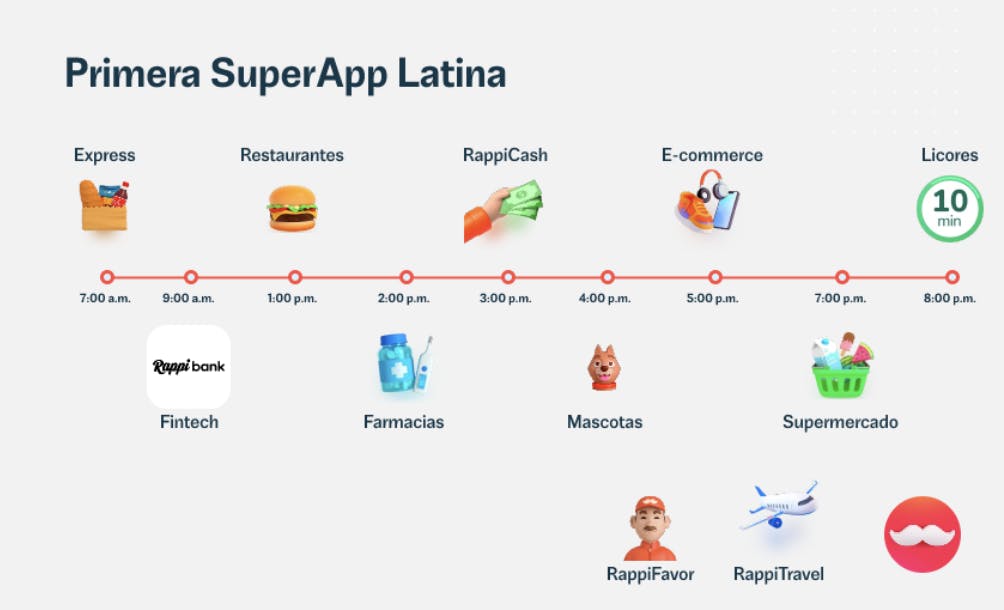

In 2015, Rappi began as an on-demand delivery app that served as a marketplace connecting consumers with small businesses or neighborhood stores. It has since expanded to include delivery from restaurants, large food chains, pharmacies, supermarkets, and other types of stores to become, in the company’s words, the “first” super app in Latin America.

While Rappi’s core business remains the on-demand delivery of goods, it has developed a suite of services to support and expand upon this. All of the company’s various product lines serve three primary stakeholders: consumers who use the app to buy, couriers who pick up and deliver goods, and suppliers (retailers, restaurants, etc.) who sell the products

Delivery

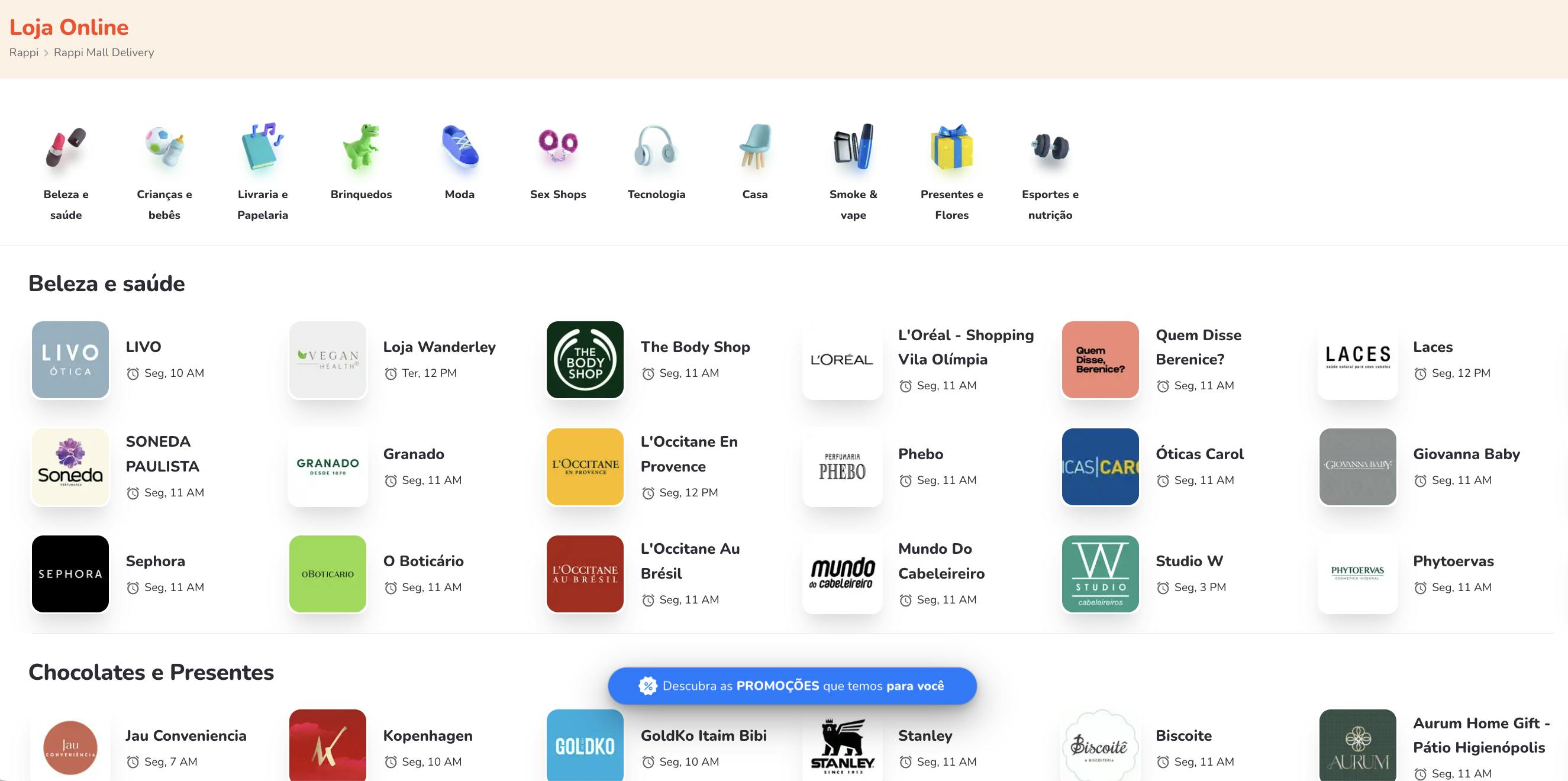

Source: Rappi Brazil

Rappi’s core offering is its delivery service, which allows customers to order a wide variety of goods across more than eight categories of products as of May 2024, including restaurant orders, groceries, pharmaceuticals, clothing, drinks, travel bookings, and electronics.

Rappi, true to its name, typically endeavors to ensure fast delivery times. For example, in Ecuador, Rappi has previously offered a promotion that guarantees delivery within 35 minutes for all customers. The Rappi Turbo service promises deliveries within 10 to 15 minutes. Access to Rappi Turbo depends on users’ locations.

RappiBank

Source: Rappi

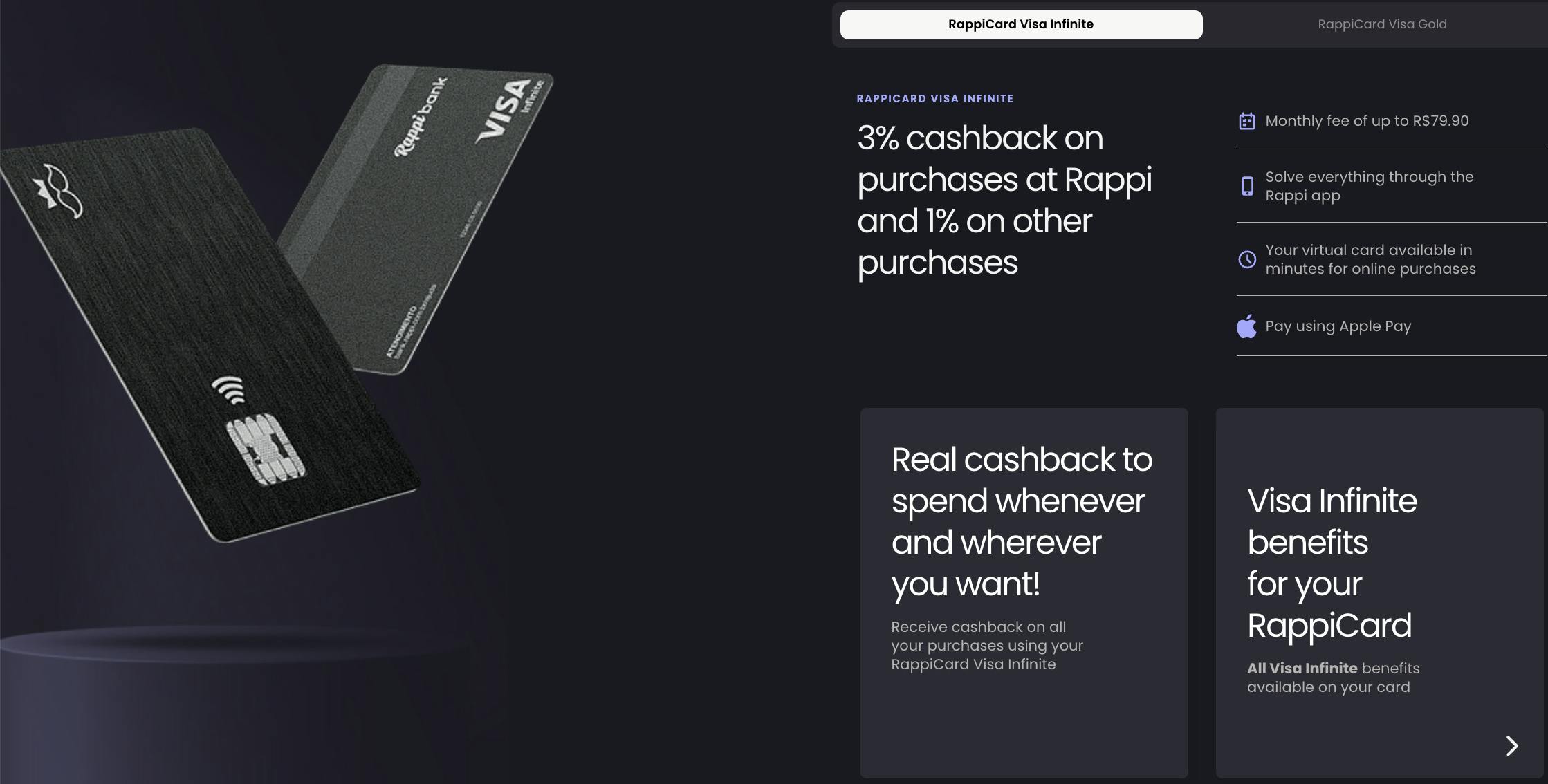

RappiBank and its financial service arm, RappiPay, operate as a fully integrated online banking platform within Rappi. Features include checking accounts, credit cards, and business loans that are intended to simplify financial management for users and enhance their overall experience. This product offering caters to a growing population of online banking service users in Latin America: 70% of adults in Latin America had made or received payments digitally as of 2023, up from just 40% in 2014.

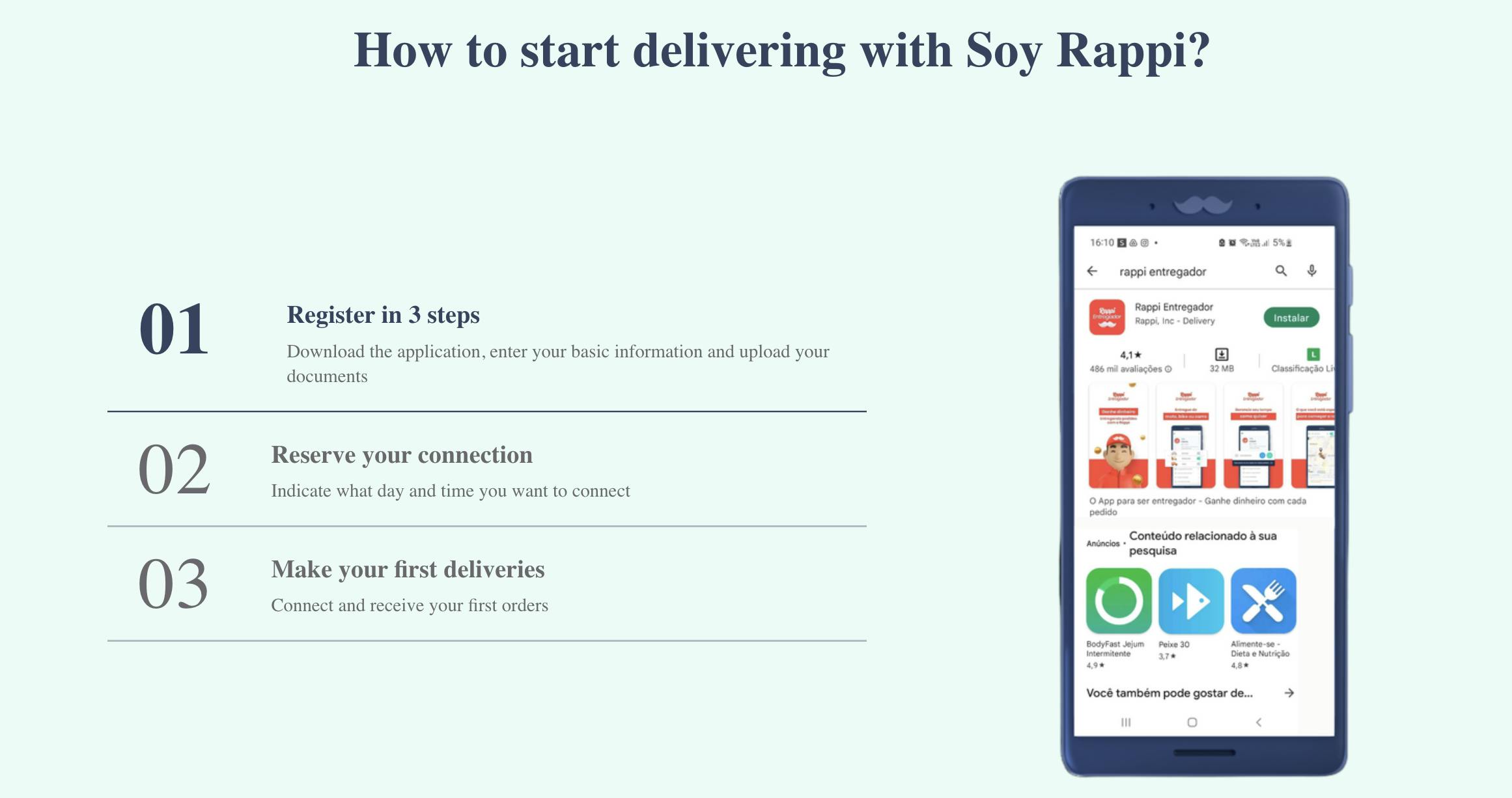

Couriers

Source: Rappi

Rappi’s couriers, known as Rappitenderos, choose their own working hours and are paid per delivery. The company supports these couriers with technology that optimizes routes and delivery assignments, intended to maximize efficiency. Couriers also have access to Rappi payment cards and can purchase thermo backpacks to maintain food temperature during deliveries, which are intended to improve service quality.

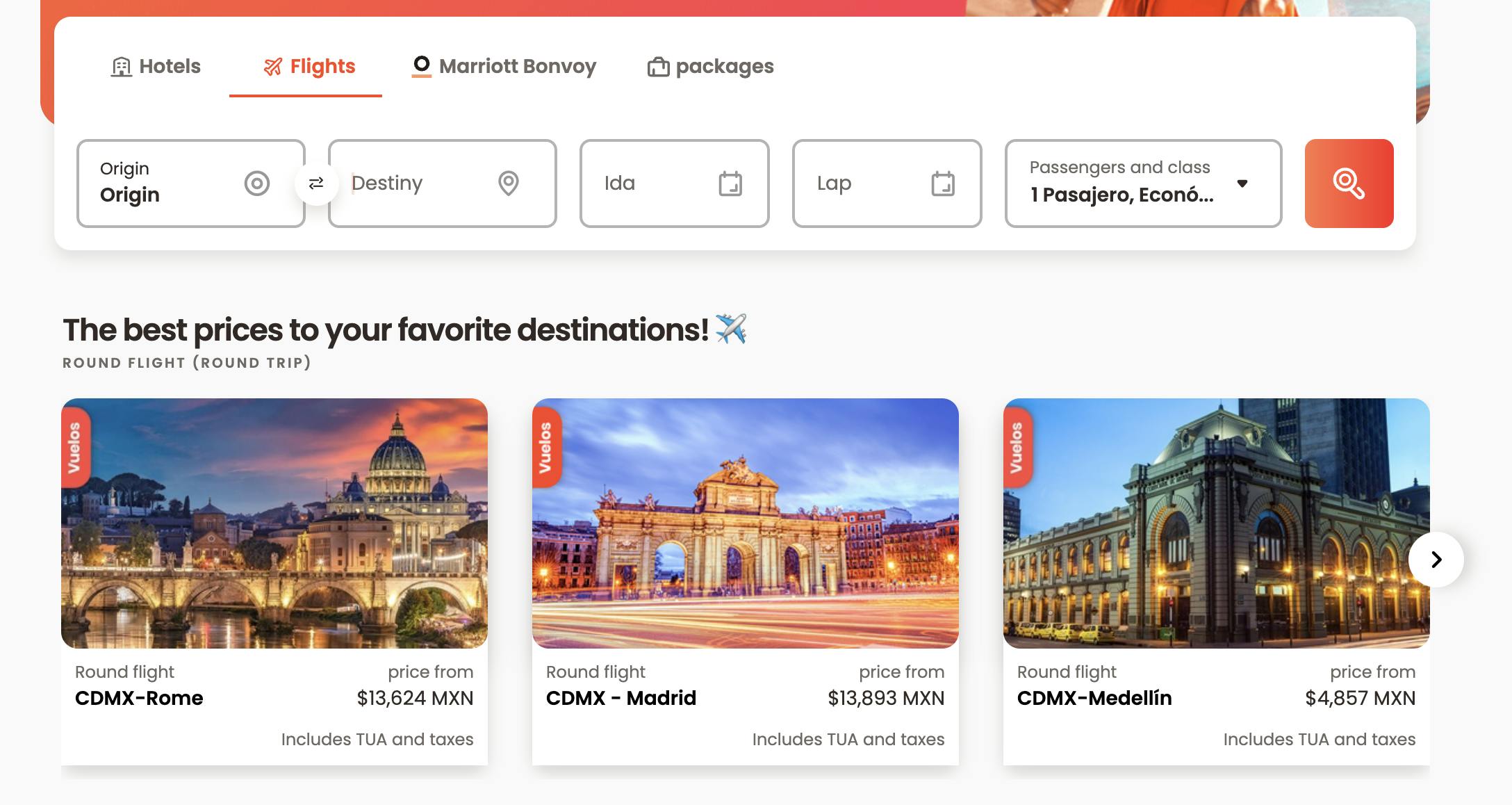

Rappi Travel

Source: Rappi

Launched in 2020, Rappi Travel offers an integrated booking service for flights, hotels, car rentals, and travel insurance. It was intended to provide and leverage convenience by allowing customers to find flight deals in the same place they make local purchases. In the same year Rappi Travel was launched, a representative of the company said:

“At Rappi we are constantly seeking to offer new solutions and innovations for the millions of users who use our application. Through Rappi Travel, and our technology, we want to support and provide incentives to the tourism sector and contribute to its reactivation for this new year.”

Suppliers

Rappi's Suppliers program provides tools and resources to enhance visibility and sales for its suppliers and partners. Its Partners Portal allows Suppliers to manage their operations, access performance metrics like RappiScore, and utilize RappiAds for enhanced promotional outreach.

Additionally, Rappi offers POS integration to streamline menu management and reduce operational issues. And, in 2023, it introduced financing solutions in partnership with FinTech R2, providing tailored loans to restaurants in key markets.

Market

Customer

Source: Rappi

Consumers

Consumers who use Rappi include people living in urban areas in Latin America who are accustomed to digital solutions and convenience, but traditionally shop through specialized apps for different products; for example, iFood for restaurants, Uber for groceries, and Mercado Libre for electronics. Urban residents in Latin America often recognize the value of on-demand goods and services and have the digital fluency required to navigate the platforms that provide them.

Similarweb data from May 2024 shows that website visitors to Rappi.com skew young, with 66.2% of traffic to the website coming from people under the age of 44. Mexican users seem to comprise the largest customer segment for Rappi, accounting for 32.7% of the company’s website traffic, followed by Colombia (25.3%) and Argentina (22.9%).

Couriers

For couriers, Rappi offers a flexible, gig employment model, allowing workers to choose their own working hours. The platform is particularly adapted to the conditions in Latin America, where traffic congestion can hinder traditional delivery methods. Three of the world’s top 10 most congested cities were in Latin America as of 2022. By employing couriers who primarily use motorcycles or bicycles, Rappi can circumvent traffic issues, thus speeding up delivery times.

Suppliers

On the supply side of Rappi’s marketplace are restaurants, retailers, and other suppliers. According to the company, suppliers can grow their reach up to 30% without substantial operational costs with Rappi, which is particularly advantageous for small to medium-sized businesses seeking to enhance their digital presence. Latin America’s food supply market is highly fragmented, which leads to many potential partners for Rappi and ample opportunities for the platform to connect businesses with a broader customer base. Rappi also helps streamline in-store operations through POS integration and delivery facilitation, allowing stores to focus more on service and less on logistics.

Market Size

The ecommerce market in Latin America was estimated to be worth $509 billion in 2023 and is projected to grow to $923 billion by 2026, representing a 23% CAGR. Beyond this, Rappi operates in several other markets. Pharmaceutical sales were valued at $90 billion in 2024 across four Latin American markets in which Rappi operates (Mexico, Brazil, Argentina, and Colombia), and this market is expected to reach $101 billion by 2027, representing a 3.7% CAGR.

The Latin American food delivery market, meanwhile, was valued at $78.6 billion in 2023 and is expected to grow to $151.3 billion by 2030, representing a 9.8% CAGR. Lastly, the Latin American online grocery market was valued at $3.4 billion in 2023 and is expected to reach $9.3 billion by 2032, an 11.5% CAGR — representing the smallest but fastest-growing market Rappi operates within.

Rappi’s product suite exposes it to markets beyond e-commerce and delivery. The Banking as a Service (BaaS) market in Latin America was estimated to be worth $2.1 billion in 2024 and is expected to reach $3.3 billion in 2029, a 7% CAGR. The logistics market — procurement, supply chain, material handling, inbound and outbound transportation, etc. — is estimated to reach $16.8 trillion worldwide by 2032.

The super app model presents its own unique challenges, but a limited market size is not one of them; they benefit from a broad market by offering multiple functionalities designed to attract a wide user base.

Competition

Rappi operates within a diverse and competitive landscape of on-demand delivery services. This landscape includes a variety of services such as food delivery, grocery shopping, and a broader array of offerings like pharmaceuticals and general merchandise. Rappi is one of only a handful of attempted “super apps” in Latin America, and most are constrained to a single country. Rappi’s primary competition includes a number of specialized players that can be mapped across two dimensions: sector and geography.

Food Delivery

Latin America is home to a number of food delivery businesses, and Rappi’s main competitor varies by country for restaurant delivery: iFood in Brazil, PedidosYa in Argentina and Nicaragua, and DiDi Food in Colombia and Mexico. On the grocery delivery side, Cornershop (acquired by Uber) has expanded into six of the same countries as Rappi — Chile, Mexico, Brazil, Colombia, Costa Rica, and Peru.

iFood

Founded in 2011 in Brazil, iFood is a leading player across the Latin American food delivery market. It specializes in restaurant delivery but has gradually expanded into adjacent areas, including grocery and essential goods. iFood has raised a total of over $2.1 billion as of May 2024. This includes a $500 million Series G round in 2018. In 2022, Just Eat Takeaway sold its stake in iFood for $1.8 billion on the secondary market.

Both iFood and Rappi employ a technology-driven approach with advanced data analytics and user-friendly platforms to improve customer experience and operational efficiency. However, where iFood focuses more intensely on its core competencies in food and grocery delivery, Rappi has used its platform to springboard into other daily life services to serve a wider range of consumer needs in a single application.

PedidosYa

PedidosYa was founded in 2009 in Uruguay and competes with Rappi in food delivery across Argentina, Chile, Costa Rica, Ecuador, Peru, and Uruguay. It raised over $328 million before being acquired by Delivery Hero in 2014 for an undisclosed amount. Notable past investors include Kaszek and Prosperitas Capital Partners. Like iFood, PedidosYa operates predominantly in the food delivery market, while Rappi has a multitude of product offerings across many markets. However, one area of overlap is that both companies seem to be expanding their dark store operations.

DiDi Food

DiDi Food, a division of China’s DiDi Global, launched in Latin America in 2017 and has expanded into Brazil, Mexico, Colombia, Chile, Panama, Costa Rica, Peru, Argentina, and the Dominican Republic. DiDi Global’s. food delivery arm leverages DiDi’s technological infrastructure and wide market reach to offer a variety of dining options. This strategy has involved actively targeting and onboarding restaurants that previously had no online presence, thereby rapidly increasing their serviceable market. DiDi Food competes directly with Rappi in some areas by providing a wide selection of restaurants, aiming to win food delivery through sheer breadth and diversity of options.

Uber Groceries (formerly Cornershop)

Cornershop is a company that was acquired by Uber in 2021. It was founded in Chile in 2015. Cornershop quickly became a notable player in Latin America's grocery delivery sector and its acquisition allowed Uber Eats to expand its service offerings beyond traditional restaurant delivery in Latin America where it had faced challenges, notably withdrawing from markets like Brazil in 2022 and Argentina and Colombia in 2020.

In 2020 it rebranded as Uber Groceries within the Uber app and operates across Chile, Mexico, Brazil, Peru, Colombia, and Costa Rica. This service competes directly with Rappi in the grocery delivery domain but not in restaurant or non-food delivery. Compared to Rappi, it has adopted a slightly different market entry strategy by going after partnerships with leading grocers to secure exclusive, reliable supply.

Ecommerce and Retail

In the ecommerce and retail sectors, Rappi competes with both local and global companies. Global competitors utilize multinational logistics and shipping networks to deliver a wide array of products. Rappi’s model, by contrast, primarily depends on a network of couriers to deliver goods within a limited geographical range.

Mercado Libre

Mercado Libre was founded in 1999. Sometimes referred to as the "Amazon of Latin America”, it is the leading ecommerce platform in the region with $14.5 billion in revenue and 218 million active users in 2023. It has a strong presence in nearly all Latin American countries where Rappi operates and offers a wide range of services, from marketplace operations to logistics and payment solutions. Mercado Libre went public in 2007 and has seen significant growth. For Rappi, it is a significant competitor in certain areas of ecommerce, including electronics and retail sales, but doesn’t compete in food and grocery delivery.

Amazon

Amazon was founded in 1994 but didn’t enter the Latin American markets until 2012. At its IPO in 1997, it had a valuation of around $300 million; by May 2024, its market cap was $1.9 trillion. As a global leader in ecommerce, Amazon brings significant technological and logistical expertise, which it leverages to offer an expansive array of products and rapid delivery services. While Rappi focuses on on-demand delivery and quick purchases, Amazon’s value proposition relies on the scale of its inventory, speed of delivery, and low prices. This allows Amazon to meet diverse consumer needs similar to those of Mercado Libre, and makes it a competitor to Rappi's retail delivery services.

Online Banking

Nubank

Launched in 2013, Nubank describes itself as the largest “digital banking platform outside of Asia” and, as of May 2024, served “over 100 million customers across Brazil, Mexico, and Colombia”. Known for its no-fee credit card and digital savings offerings, it has expanded its services to include personal loans and investment products. Nubank went public in December 2021 at a valuation of $41 billion and had a market cap of $56.3 billion as of May 2024. While its focus is on building a comprehensive financial solution, and not a delivery product or super app, it does compete with Rappi in its credit card offering, which is licensed by MasterCard.

Pharmaceuticals

Farmalisto

Established in 2013, Farmalisto is an online pharmacy, operating across Colombia, Mexico, and Peru. The platform provides pharmaceuticals, health, and wellness products directly to consumers, often at discounted rates compared to traditional pharmacies. Farmalisto has raised a total of $24.8 million in funding. Unlike Rappi, which includes pharmacy delivery as part of a larger array of services, Farmalisto focuses exclusively on healthcare products. The company was considered the largest pharmacy chain in Latin America as of January 2024.

Travel & Flights

Despegar

Founded in 1999 in Argentina, Despegar is a leading online travel agency in Latin America. The company offers a comprehensive range of travel services, including flight bookings, hotel reservations, and vacation packages. Despegar went public in 2017 and had a market cap of $1.1 billion as of May 2024. Despegar is a competitor to Rappi’s travel offerings but is again a verticalized competitor. Rappi is differentiating its travel offering against agencies like Despegar in four ways: first, by making it a mobile-first product; second, by using Rappi Card to offer 5% cash back on all travel purchases; third, by integrating it into a larger system of data collection and personalization; and fourth, by going after businesses with Rappi Travel4Business.

Business Model

Source: Rappi

Rappi capitalizes on an asset-light approach similar to other delivery marketplaces like Instacart. This model enables Rappi to leverage an extensive network of grocery stores, supermarkets, restaurants, and other retail outlets without incurring the heavy capital expenditure associated with ownership.

Delivery

The core of Rappi's business lies in the delivery sector, particularly food delivery from both restaurants and grocery stores. As of January 2021, Rappi was charging suppliers a commission of 15-25% and collected variable delivery fees from customers. One third-party source estimated that fees and commissions accounted for 75% of Rappi’s revenue as of 2021. In addition to charging customers, Rappi also appears to charge fees to its couriers. January 2024, Rappi was reported to have started charging its delivery drivers in Brazil a weekly fee of $2.40 to “pay to work”.

Rappi’s delivery model benefits significantly from Latin America’s unique market dynamics. The average order value of delivery food in the US is the highest in the world; for example, it averaged around $31 for DoorDash* in February 2023, compared to $6 for India’s Swiggy and $6.70 for China’s Meituan. Swiggy and Meituan can sustain that low AOV while still running a profitable business because labor is cheap. DoorDash* requires a higher AOV because the labor cost of delivery is about six times that of India and China. Rappi has double the AOV of China and India, at approximately $13, but similarly low labor costs. As the Generalist puts it:

“This combination is powerful: companies like Rappi can secure AOVs that approach North American rates while paying prices not too far from those of Eastern peers. The result is an incredibly favorable ratio between AOV and delivery cost.”

Other Revenue Streams

Rappi also monetizes through advertising, similar to other North American food-delivery platforms such as DoorDash*, by offering premium placement to restaurants and stores within its app that increases their visibility and sales. Advertising was reported by one third-party source to have been contributing about 13% of Rappi’s total revenues as of 2012.

Rappi also earns recurring revenue from its subscription service, Rappi Prime. For a monthly fee that varies by country, members receive benefits like waived delivery fees on orders over a certain value, exclusive deals, and enhanced customer service. In 2021, subscriptions were estimated to account for 10% of Rappi’s revenue.

Rappi has also ventured into fintech with RappiPay, partnering with local banks to introduce products like the "RappiCard," a no-fee credit card. This product is targeted at the significant unbanked population in Latin America, which numbered 178 million as of 2021. This is a small but growing part of Rappi’s business. In Colombia in 2022, around 800K people had a RappiPay account, and the company secured $112 million in funding to expand the RappiCard initiative in October 2022.

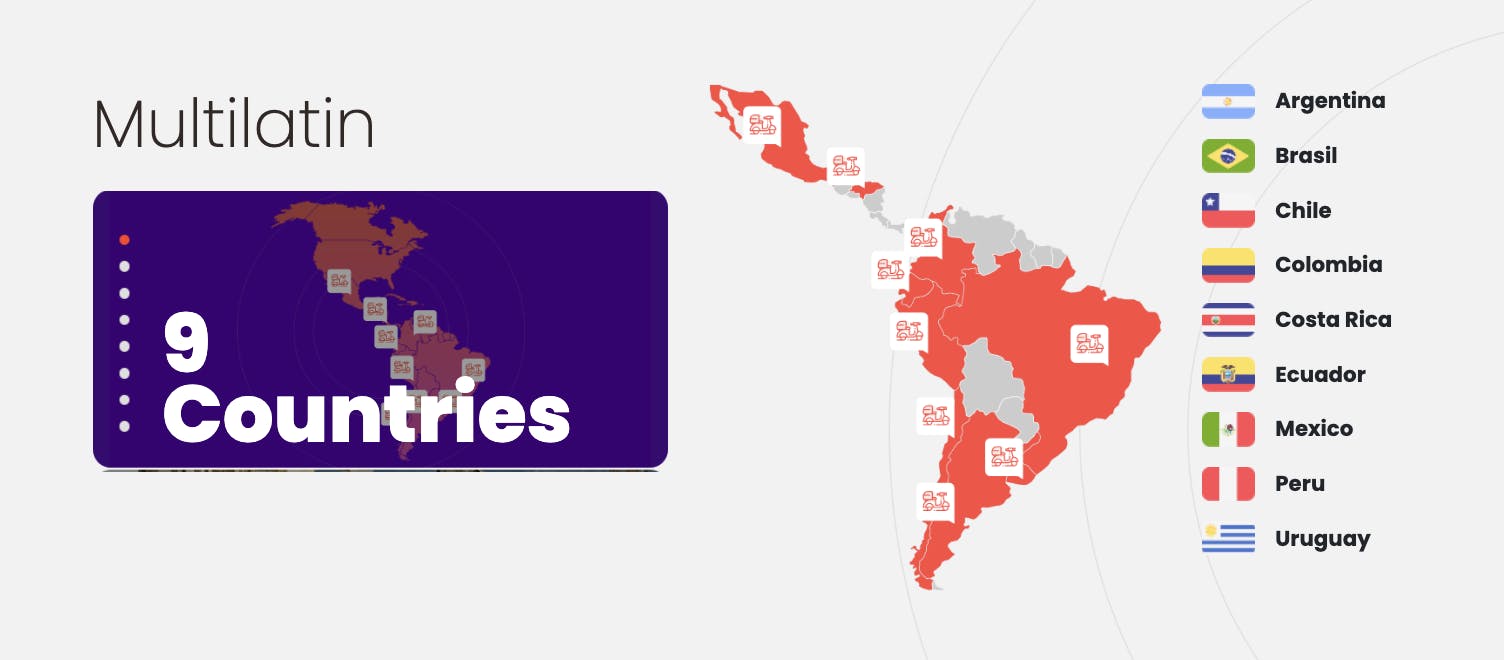

Traction

Source: Rappi

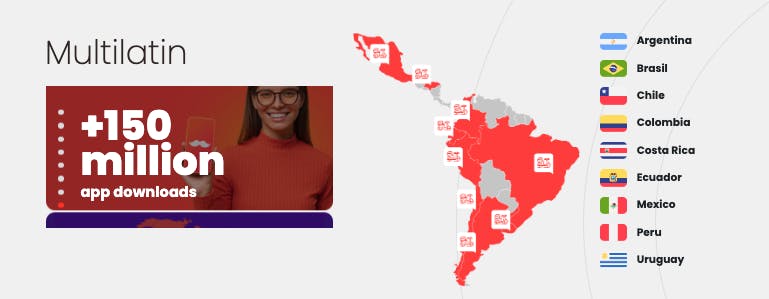

Since its launch in 2015, Rappi has expanded to nine countries and over 400 cities as of May 2024. The platform has achieved over 150 million app downloads and has a monthly average user base of 10 million, servicing 125K businesses as of May 2024. In 2022, Rappi reported 146K active users of its Rappi Card credit card.

The company’s traction can also be broken down across the markets and countries it operates in. For example, in Peru from 2022 to 2023, the Rappi Prime subscription service doubled its user base YoY, and RappiTravel saw a 260% increase. In Mexico, Rappi was reportedly active in 110 cities with 100K affiliated businesses and 120K delivery drivers in 2023.

Rappi has also conducted a number of significant acquisitions. In 2023, Rappi acquired Box Delivery, a Brazillian quick delivery company that had $39.4 million in revenue in 2022. This became Rappi Brazil. Prior to BoxDelivery, Rappi made two additional acquisitions: (1) Payit, a Mexican blockchain payments platform, in 2019 and (2) Avocado, a Brazilian grocery delivery company, in 2020. These acquisitions were aimed at enhancing the payment experience within the Rappi app and strengthening its position against major competitors like iFood in Brazil.

Valuation

Rappi has raised a total of $2.5 billion in funding. The company raised a $800 million Series F in February 2022, led by SquareOne Capital, which valued the company at around $5.3 billion. Prominent investors in earlier rounds include Y Combinator, Andreessen Horowitz, Sequoia Capital, DST Global, SoftBank, and T. Rowe Price.

One method to view the opportunity for Rappi is by using competitor valuations as benchmarks. In restaurant delivery, competitor iFood was valued at $5.4 billion in July 2022. In grocery delivery, Cornershop was valued at $3 billion in June 2021, when it was acquired by Uber. In online ecommerce, Mercado Libre, a public company, had a market cap of $86.6 billion as of May 2024. In online banking, NuBank had a market cap of $55.1 billion as of May 2024.

Key Opportunities

Continued Market Expansion

Rappi's strategic expansion into multiple high-margin categories mirrors the successful model employed by China’s super app Meituan. By continuing to broaden its service offerings, Rappi can expand its addressable market and increase its share of wallet captured for existing customers, which could potentially benefit its unit economics.

Personalized Services Through Data Collection

Rappi's ability to collect and analyze vast amounts of data presents a potentially substantial growth lever. On the customer side, by leveraging this information, Rappi can optimize its service offerings and improve the relevance of recommendations, thereby enhancing user experience and retention. On the supply side, this capability enables Rappi to attract more restaurant and retail partners by optimizing selling and advertising. Guido Becher, Rappi’s Global Head of Travel, explained how data collection works across services on the platform in June 2023:

“We want to bring brands into Rappi for them to access the best customers possible that they want to reach and the same with users to find the best brands possible… One [hotelier] said ‘I want to approach users that buy almond milk in Rappi.’ He has a hotel with a yoga retreat, so they profiled users that basically bought almond milk. “

Increasing Convenience

Rappi's "Turbo" delivery option, which guarantees deliveries within 10 minutes, has the potential to set it apart in a competitive market. By expanding its network of dark stores, which it accomplished in part through its acquisition of Avocado, Rappi can offer this expedited service across broader geographies. Rappi had at least 57 dark stores live in 2021 with 500 expected by the close of the year. In a 2021 interview, CEO Simón Borrero commented that:

“…the other service that is exploding is turbo. Beginning this year, we started to build micro warehouses that are very close to the users’ homes, at a maximum distance of 1.5 kilometers. Thanks to a real time inventory software we’re able to arrive in less than 10 minutes to the users’ homes. This is going to be a big revolution because now you can buy fresh, high quality products that are delivered in an average time of 8.3 minutes. The idea is that we become an extension of our users’ refrigerator.”

Key Risks

High Burn Rate

Rappi’s aggressive expansion has led to a high cash burn rate, reminiscent of early strategies employed by companies like Uber. Although it has raised over $2 billion, as of February 2023 the company was not yet profitable. This could jeopardize Rappi's long-term viability if continued investment fails to convert into sustainable revenue streams and operational efficiencies.

Competition

Rappi faces stiff competition from iFood, especially in Brazil which is by far the region’s largest economy — Brazil’s GDP was estimated at $1.9 trillion in 2022 making it the 11th largest in the world. iFood’s dominant position, with over 100x the number of cities covered compared to Rappi as of 2023, presents a formidable challenge. To enhance its competitive stance against iFood in Brazil, Rappi is actively pursuing strategic partnerships with major brands, as it did with the French supermarket Carrefour in 2019.

Lack of Focus

While diversifying into multiple service areas offers growth opportunities, it also complicates management and resource allocation, especially when the core delivery service is not yet profitable. One risk of the super app model is being spread too thin, leading to inefficiencies and making Rappi vulnerable to more focused competitors in specific verticals such as banking (Nubank), grocery delivery (Uber Groceries), and food delivery (iFood). This sprawling strategy requires meticulous management and clear prioritization to ensure sustainable growth. As Andres Gutierrez, the founder of a banking app and a Colombian Uber competitor, put it in 2021:

I don’t see how you can build a mobile bank while you are still building your core business. If you already have a dominant super app, like WeChat you [could do this]. But I think people fail to realize that building a valuable neobank is a lot tougher than it [seems].

Summary

Operating in nine countries and over 400 cities, Rappi offers a broad range of services including food and grocery delivery, travel, financial products, and more, positioning itself as a “super app”. Despite significant market potential, Rappi faces stiff competition from specialized and established players like iFood and Mercado Libre, challenging its market share and operational focus. The company’s expansion strategy and diversified service offerings aim to increase user engagement and market penetration but also complicate resource allocation and management. Continued growth will depend on Rappi's ability to enhance its operational efficiency and effectively capitalize on its extensive market reach.

*Contrary is an investor in DoorDash through one or more affiliates.