Thesis

In recent years, changing consumer expectations have led to greater availability in the delivery of convenience items. With the rise of e-commerce and on-demand services, consumers now expect fast and reliable delivery of their purchases, particularly when it comes to items like groceries, meals, and household essentials. The convenience of ordering items online and having them delivered directly to their doorstep has become increasingly important to consumers who now increasingly expect an easy and intuitive delivery experience.

In the United States alone, the number of food delivery service users reached 112 million in 2021, a 17% year-over-year increase from 2019, with the industry experiencing significant growth during the pandemic due to increased demand and lockdowns. The convenience store market size was expected to increase 5.5% in 2021, reaching an estimated $33 billion in revenue. As home delivery has become the norm following the COVID-19 pandemic, convenience store delivery had become a fast-growing sector alongside the on-demand food and grocery delivery markets. In 2020, online consumer spending at convenience stores grew 346%.

Gopuff is a quick commerce company that provides speedy delivery of convenience items such as snacks, beverages, and alcohol to customers in just 30 minutes on average. It cuts intermediaries and orders products directly from brands to resell to the end customers at a premium. Its owned and operated warehouses are optimized for delivery. Over the years, the company has expanded its offerings by acquiring seven businesses, allowing them to diversify its product lines, such as Gopuff Kitchen, which it can cross-sell to its customers. Moreover, Gopuff's growth has extended beyond the United States, reaching international markets.

Founding Story

Source: Business Insider

Gopuff was founded in 2013 by Yakir Gola and Rafael Ilishayev (co-CEOs), who first met in a Business 101 class at Drexel University in 2011. Russian-born Ilishayev worked at his dad’s sandwich shop and later at a banquet hall owned by his dad. Gola, the son of an Israeli immigrant, worked at his dad’s cash-for-gold store. When the two met, they bonded over their shared immigrant backgrounds and experience working in family businesses. Their idea for Gopuff was inspired by personal experience. Gola was the only one in their college friend group with a car, and frequently made late-night convenience store runs for his friends. It occurred to them that there had to be a better way to get stuff from convenience stores. If people were already getting take-out delivered, why couldn’t they do the same with convenience goods? This led them to believe that there was an opportunity in the market to provide a convenient delivery service for everyday items.

Excited by the idea, they shared it with their friends and family but no one thought it made sense. Everyone they spoke to said they’d rather just go to a convenience store than order from an app. But the two decided to push on with their idea, figuring that other college students like them would much rather get their late-night snacks delivered than make the trip to the store themselves. Starting with a small selection of 50 items, Gopuff initially targeted college students in the Philadelphia area, with Gola and Ilishayev personally making deliveries for the first six months.

As the business grew, it faced challenges such as inventory liquidity, app development, and logistics. To bootstrap the company, they created a side hustle selling office furniture and used the $60K in profits to fund Gopuff's operations. They also engaged in grassroots marketing efforts, presenting before classes and handing out branded merchandise to attract new customers. By 2014, Gopuff had already amassed a customer base of 25K, and both Gola and Ilishayev decided to pursue the opportunity full-time. They expanded to additional campuses in Boston, Washington, DC, and Austin, targeting young adults just out of college, and began to refine their expansion strategy.

Product

Marketplace

Shoppers can order from Gopuff through its website or mobile app. After entering their delivery location, the customer is directed to the inventory and selection available from their local Gopuff warehouse. The company stores 4K products in each Gopuff location. After making their selections, customers can then add items to their cart and pay online, similar to other digital order platforms.

Source: Gopuff

Once an order is placed, warehouse workers are notified, pick the items from the warehouse shelves, and bag them. Bags are then held in bins specific to each driver, often grouping multiple deliveries to locations in close proximity when possible. Drivers then collect the bags from their bins and head out to complete the deliveries.

Shoppers are notified of each step in the delivery via text and then called by the driver upon arrival. Since their vertically integrated delivery model cuts out the middleman, Gopuff is able to deliver orders to customers as soon as they are received, usually taking under 30 minutes. Gopuff is open 24/7 in most locations and currently operates in over 1K cities. The company's value proposition revolves around convenience and speed. It offers customers the opportunity to avoid driving or leaving their location to purchase desired items and receive those items within 30 minutes.

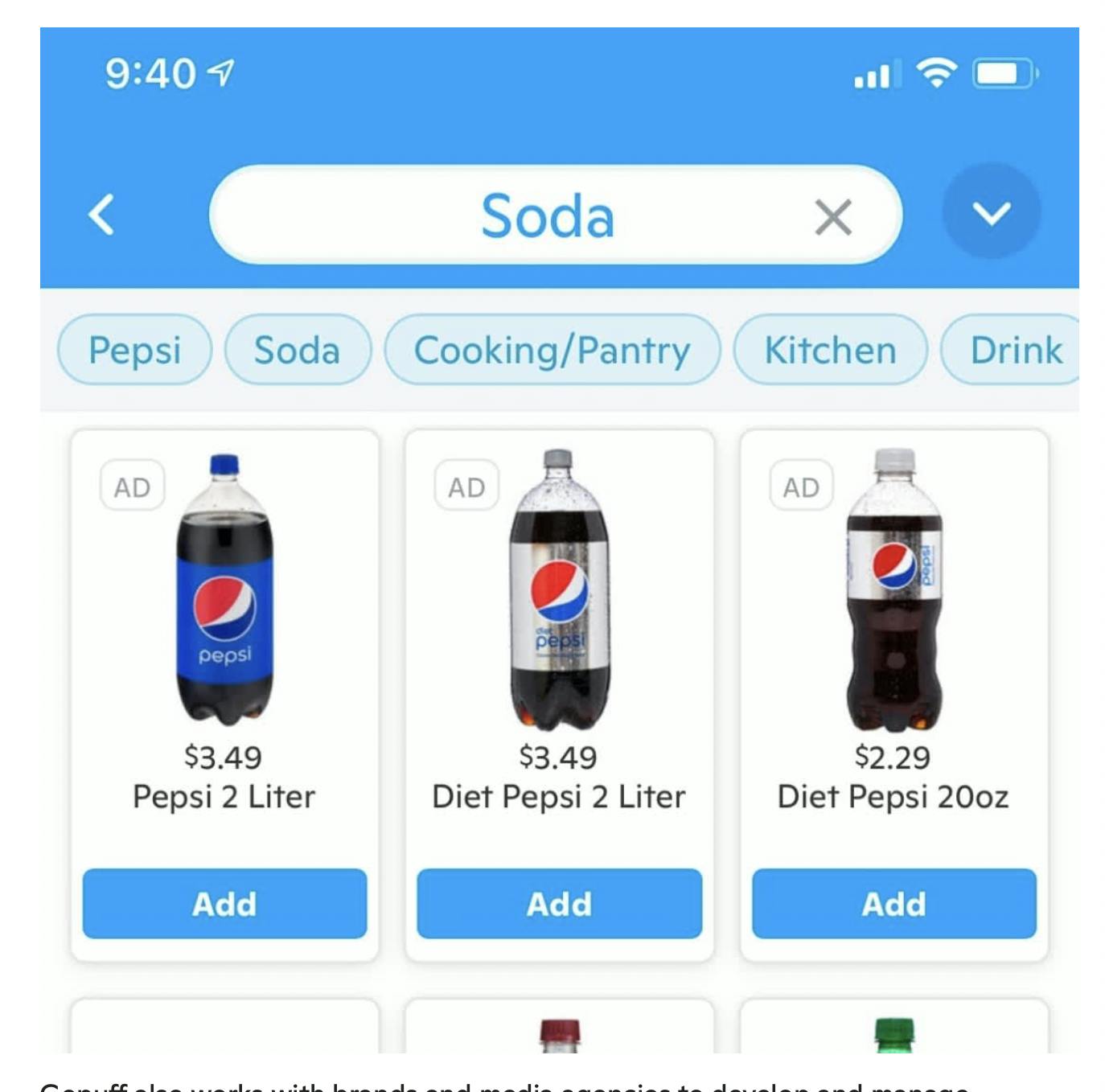

Gopuff Ads

Gopuff Ads are intended to allow brands and media agencies to roll out ad campaigns on Gopuff’s platform, turning engagements into transactions. Gopuff says its ads product allows brands to plan, buy, measure, and manage their ads on Gopuff to drive ROI.

Source : Gopuff

Gopuff Kitchens

Gopuff launched Gopuff Kitchens in July 2021. It is an all-electric mobile kitchen stationed within or adjacent to their micro-fulfillment centers to make and deliver freshly made foods. The Gopuff Kitchen menu includes pizzas, coffee, breakfast sandwiches, hot chicken tenders, salads, and more.

Market

Customer

Gopuff initially targeted college students and young adults for its earliest customer base because it was the cohort most likely to be looking for a simple way to get convenience items with potentially limited access to transportation or a vehicle. In 2017, millennials accounted for 51% of convenience store customers in the industry overall (when that generation was between 17-35 years old), indicating that young adults make up the biggest customer segment for convenience shopping. Having expanded significantly since achieving early traction with young customers, GoPuff now broadly serves people looking for easier access to convenience items, whether because they don’t have a car, are living in an urbanized area with impediments like traffic, or are otherwise inclined to prefer delivery.

Market Size

The quick commerce industry, or delivery services which deliver goods to consumers in 30 minutes or less, was valued at around $25 billion in 2021 and was expected to grow to $72 billion by 2025. The necessity of at-home shopping during the pandemic drove consumers to embrace the convenience of ordering convenience items online with rapid delivery. However, companies in this space must also contend with headwinds like the rising cost of delivery, traditional retailers embracing fast delivery, post-pandemic slowdown of online commerce, consumers going back to stores, tightening funding climate, higher expectations for profitability, and more. More broadly, the global convenience store market size was valued at $2.1 trillion in 2021 and is expected to grow at a CAGR of 5.6% from 2022 to 2028.

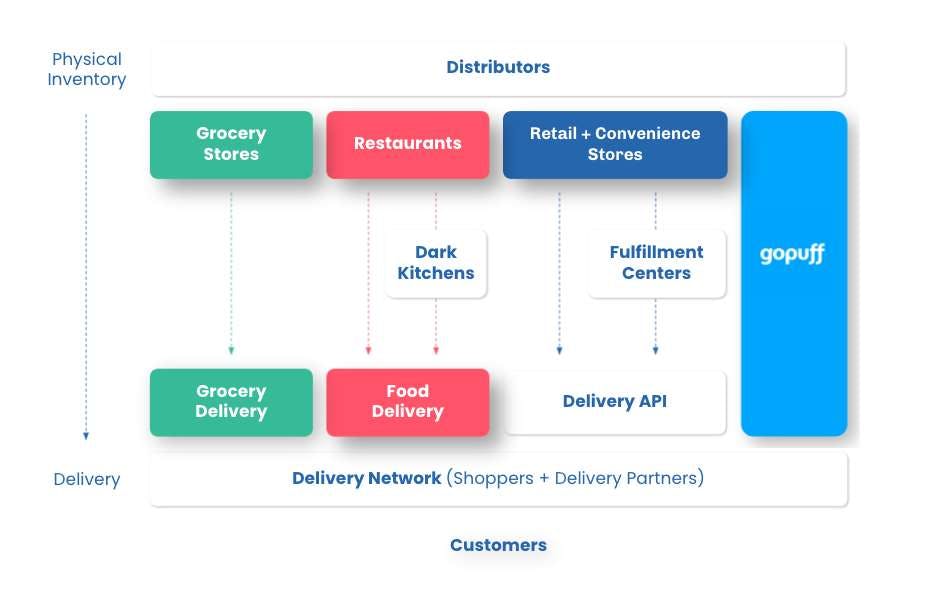

Competition

Direct competitors include vertically integrated companies, such as JOKR, Getir, and Doordash*. Fridge No More and Buyk, former competitors to Gopuff, filed for bankruptcy in 2022. In contrast, indirect competition comes from third-party delivery platforms like Uber Eats, and Instacart that don't explicitly focus on convenience store quick delivery. Most indirect competitors also follow a marketplace model, and do not build their own micro fulfillment centers (MFC). For hot food items, Uber Eats Dark Kitchens and CloudKitchens are both competitors. The advantage of the marketplace model is that it is an asset-light business, reducing inventory risk and easing scalability efforts. However, by relying on third parties, these marketplaces doesn’t fully control the user experience. Adjacent competition is posed by e-commerce players like Amazon and smaller fragmented players.

JOKR

Founded in 2021 by Ralf Wenzel and based in New York, JOKR is an online supermarket that delivers groceries in 15 minutes or less with no order minimums. The company has a net promoter score above 80 as of February 2023 and offers approximately 1.5K SKUs. In February 2023, the company raised $50 million in Series C at a post-money valuation of $1.3 billion. The round was led by G Squared and included Tiger Global, GGV Capital, and HV Capital. To date, JOKR has raised $480 million in debt and equity. Despite losing $10 million a month as of September 2022, JOKR has adjusted by discontinuing unprofitable markets, such as New York and Boston, and focusing on the Brazilian market, which accounts for 50% of the company's business and expects to reach profitability in 2024.

Getir

Getir is a Turkish startup that offers customers fast delivery of groceries and convenience items within 10 minutes. The company, founded in 2015 by Nazim Salur and Serkan Borancili, has expanded to multiple international markets, including the United States. It made its U.S. debut in 2021, starting with Chicago, and subsequently expanded to New York and Boston. Like Gopuff, the company has MFCs or "dark stores" where it procures its products and manages the entire value chain from warehouse to driver. Getir offers over 1.5K SKUs for customers, has 40 million app downloads, and managed 1.1K dark stores as of March 2022. In March 2022, the company raised $768 million in a Series E funding round led by Mubadala Investment Company and Abu Dhabi Growth, with Alpha Wave Global, Sequoia, and Tiger Global participating. The funding round raised the company's valuation to $11.8 billion, allowing it to expand its footprint and scale operations to serve more customers. In December 2022, Getir acquired Gorillas, a Gopuff competitor, to consolidate the market. The combined entity was valued at $10 billion as of December 2022. In May 2022, the company laid off 14% of its workforce and cut some of its expansion plans. Additionally, in February 2023, the company laid off 100 corporate employees.

DoorDash*

DoorDash is a food delivery marketplace founded in 2013 by Tony Xu and Stanley Tang. Initially, it competed with companies like Uber Eats and Grubhub. However, the company has since expanded by building additional services. DoorDash launched DashMart in 2020, directly competing with Gopuff. DashMart is a convenience store that delivers customers convenience, grocery, and restaurant items. DashMart carries over 2K SKUs as of February 2023 and is available in 14 major cities in the United States. The company also has partnerships with convenience stores such as 7-Eleven, Wawa, Walgreens, and CVS. In 2022, DoorDash grew its Marketplace Gross Order Value by 27% to $53.4 billion and had 32 million monthly active users, up from 25 million the previous year. As of March 2023, DoorDash has a market capitalization of $22 billion.

Uber

Uber, founded in 2009 by Garrett Camp and Travis Kalanick, has expanded its services beyond ride-sharing to include Uber Eats, an online food delivery marketplace launched in 2015. The platform allows customers to browse local restaurants and have meals delivered to their doorstep. In contrast to Gopuff, Uber Eats operates a marketplace for local restaurants and does not manage its own MFCs, resulting in delivery times between 30 to 60 minutes. While initially focused on meal delivery, the platform has expanded to include grocery, convenience items, and alcohol through acquisitions such as Drizzly and Postmates. Through the Uber One subscription that costs $9.99 a month, Uber is able to bundle Uber Eats and ride services to offer $0 delivery fees. In Q4 2022, Uber Eats gross delivery bookings reached $14.3 billion with $2.9 billion in delivery revenue. Delivery made up 34% of Uber’s overall revenue. Although Gopuff and Uber have an exclusive partnership for Gopuff to power an everyday essentials experience on Uber Eats, Uber Eats has also partnered directly with convenience stores such as BP. Uber plans to have 3K BP stores on Uber Eats by 2025.

Instacart

Instacart, founded in 2012 by Apoorva Mehta, Max Mullen, and Brandon Leonardo, specializes in grocery delivery. The company has partnerships with 1.1K retailers across more than 80K locations, offering customers access to a wide range of groceries. Instacart generated 39% revenue growth in 2022, reaching $2.5 billion, by investing in advertising despite a slowdown in order volume. The company had confidentially filed for an IPO in 2022 but has indicated that it is waiting for more favorable market conditions before going public. In May 2021, the company raised $265 million at a valuation of $39 billion, but in January 2023, the company internally reduced its valuation to $10 billion.

Business Model

Source: Gopuff

Gopuff generates revenue through multiple channels: markup, delivery, subscriptions, and advertising.

Markup: The company applies a markup to the products it procures and delivers to customers, which generates a contribution margin. This approach differs from the take-rate model used by marketplaces like Uber, which charges a 30% commission on the total order value.

Subscriptions: Gopuff offers a membership program, Gopuff Fam, for $5.95 per month, eliminating delivery fees on orders and providing additional discounts to drive order volumes.

Advertising: the company also generates revenue through product placement advertisements. For example, Gopuff earned $600K for offering ice cream startup Nightfood better product placement.

Gopuff incurs expenses when building new micro fulfillment Centers (MFCs) to expand its user base and reach new markets. Establishing a new MFC is estimated to be around $200K, including inventory and capital expenditures.

Additionally, GoPuff has pursued growth through acquisitions. Since November 2020, the company has acquired seven firms: BevMo (for alcohol delivery) for $350 million, Bandit (an app-only coffee store), Fancy (for international expansion), RideOS for $115 million (for marketplace mapping services), Liquor Barn (for liquor licenses), Dija (for groceries), and Specless (for advertising). On a per-order basis, the company spends money on inventory that it marks up to the customer, MFC employees to pack orders, and delivery partners to deliver orders to customers. As of August 2022, Gopuff generates $4 in contribution profit per order.

Traction

The company's revenue was slightly under $2 billion in 2021, a substantial increase from the $340 million and $200 million generated in 2020 and 2019, respectively. Additionally, Gopuff's user base has grown significantly, with more than 3 million yearly active users as of January 2022, up from 1.8 million in 2020 and 300K in 2019. The company's mobile application was downloaded 11 million times in 2021, up from 7.1 million in 2020 to 4.4 million in 2019. As of January 2022, Gopuff's MFCs provided coverage for 30% of the United States population, and the company held 400 alcohol licenses across 30 states. These developments have resulted in the company's estimated 73% market share in the first-party convenience delivery market.

Valuation

As of May 2022, Gopuff had raised a total of $3.4 billion and held a valuation of $15 billion. In 2021, Gopuff raised $1 billion in funding, which included participation from new investors like Blackstone's Horizons platform, Guggenheim Investments, Hedosophia, and Adage Capital, as well as previous investors Fidelity Management and Research Company, Softbank Vision Fund 1, Atreides Management, and Eldridge. In prior rounds, the company had also received funding from D1 Capital Partners, Accel, and Valor Equity Partners.

In 2021, Gopuff generated $2 billion in revenue and had a valuation of $15 billion, implying a 7.5x revenue multiple. Comparable companies in the food delivery business, such as Uber, DoorDash*, Grab, and Delivery Hero, may provide additional context for Gopuff's valuation. Uber and Doordash are trading at ~2x NTM revenue multiples as of March 2023, down from 3.6x and 8.3x from December 2021, respectively.

Source: Koyfin

Key Opportunities

Advertising

One opportunity is to expand advertising with the brands it sells by enhancing product placements and promotions or incentivizing consumers to purchase certain items through notifications or checkout experiences. This added revenue from advertising can contribute to the bottom line more quickly than the business's capital-intensive food ordering and delivering side. A good example of the potential success of this approach is Gopuff's indirect competitor Instacart, which aimed to generate $1 billion in ad revenue in 2022.

Amazon is another example of an e-commerce business that has had significant success with advertising. For many years, Amazon CEO Jeff Bezos hated the idea of advertising, considering ads to be “the price you pay when your product is unremarkable.” As Amazon has expanded its advertising offering, the company has grown ad revenue from less than $5 billion in 2017 to nearly $40 billion in 2022. This would also mean that Amazon's advertising revenue has likely surpassed revenue produced by Amazon Prime. While AWS remains Amazon's largest business in terms of revenue, expected to hit $100 billion in 2023, advertising is actually more profitable than AWS, with estimated operating margins of 50%

Product Expansion

Gopuff could expand and cross-sell its newly added Gopuff Kitchen with its core business. Since its launch in July 2021, Gopuff Kitchen has delivered freshly prepared food such as pizza, iced coffee, breakfast sandwiches, salads, and other meal items. With 20% of consolidated orders having a kitchen item attached to it as of November 2022, the company has a chance to expand Gopuff Kitchen to more markets and increase the attachment rate of kitchen items to overall orders, despite its capital-intensive nature.

International Growth

Gopuff also has the opportunity to expand internationally, as evidenced by its launch in the UK in November 2021, which led to a 10x increase in monthly order growth. With plenty of market size for the company to penetrate the UK and other international markets, Gopuff can further capitalize on its brand recognition and expertise in the convenience delivery space.

Key Risks

Consumer Demand

Given a worsening macroeconomic climate in 2023, it remains unclear how much consumer demand for quick commerce services that characterized the preceding few years is going to last. There has already been a global slowdown in online commerce in late 2022, and the quick commerce market underwent a wave of consolidations, shutdowns, and slowdowns.

Profitability

One of the main concerns regarding Gopuff's future is that the company has yet to achieve profitability despite its expansion efforts from 2020 to 2021. This is an area of concern particularly in a macroeconomic climate where investors are increasingly scrutinizing unprofitable companies. Although there are benefits to having a vertically integrated business model such as greater control over the user experience, it remains to be seen whether this will translate into long-term profitability. The company's MFCs and the associated labor costs in packaging and delivering food items require significant capital investment. In one of Gopuff's investor updates that was made public in July 2022, the company provided insights on how investors should consider its profitability situation, highlighting 10%+ EBITDA margins in the best-performing markets as well as the fact that it had four years of cash runway. The company is also actively pursuing measures to increase profitability, including the closure of 76 MFCs (12% of its network) and a 10% reduction in its global workforce. The company aims to achieve profitability by 2024.

Competition

The food delivery industry is competitive, with direct and indirect rivals vying for market share. Gopuff faces competition from direct competitors and indirect players such as Uber and DoorDash*, both of which have the resources to potentially expand more deeply into instant needs delivery. Moreover, both Uber and DoorDash* have diverse lines of business, giving them a strategic advantage in cross-selling to their customer base. While Gopuff's vertical integration may facilitate an enhanced user experience, Uber and DoorDash* can scale up their operations more quickly, intensifying competition in the market.

Non-App Revenue

As of May 2022, half of Gopuff’s entire revenue was coming from BevMo and Liquor Barn, two companies it had acquired, and not orders placed directly on Gopuff’s app. As the company attempts to reach profitability, GoPuff’s over-reliance on these revenue streams that did not originate from its core product offering could be a source of concern.

Summary

Food delivery has clearly become a meaningful part of many consumer's preferences. Gopuff was an early pioneer in the instant needs section of the food delivery market and has experienced substantial growth over the last few years. Given the large market size, Gopuff has the opportunity to grow through new markets and new product offerings. However, as the company noted in an update to investors, the expansion will be difficult if the macroeconomic environment continues to deteriorate. Not only will that economic environment impact Gopuff's ability to raise additional capital, it may also shift consumer behavior as consumers become more cost-conscious about the added cost of having convenience items delivered. Additionally, Gopuff faces competition from direct and indirect competitors. Profitability is difficult in food delivery, so watching Gopuffs EBITDA margins over the next few years will be important.

*Contrary is an investor in DoorDash through one or more affiliates.