Thesis

There are 1 billion knowledge workers that use computers as part of their jobs. However, there are only 25 million programmers who actually create software. In recent years, a new class of no-code and low-code platforms for democratizing software development have emerged. These platforms allow non-technical users to create applications with little or no programming experience.

With no-code and low-code, users can build applications through visual interfaces, drag-and-drop functions, and pre-built modules. This has the effect of abstracting away many of the technical details of software development, enabling users to focus on the functionality they want to achieve. The low-code/ no-code market is expected to grow from $25 billion in 2022 to $45 billion by 2027. While Google Docs helped pioneer real-time collaboration for word processing, solving the problem of real-time collaboration around a relational database configured by the end user is a more challenging problem. Most people avoid using databases because they can be challenging and often require SQL scripting skills. That's where Airtable comes in.

Airtable is a no-code platform for creating and sharing relational databases. It is a visual platform that connects data, people, and workflows across the organization to function as a single source of truth. In the interest of making its product feel intuitive and accessible, Airtable modeled its product on the spreadsheet, the most widely adopted programming tool worldwide. Airtable allows users to create flexible checklists, organize collections or ideas, and manage customers. It also offers a variety of templates ranging from home improvement to store inventory, enabling users to build custom applications without any prior coding experience. With Airtable, users can store their information in a format they are used to and create custom databases and applications using a drag-and-drop interface to build tables, forms, and views.

Founding Story

Source: Built on Air

Airtable was founded in 2012 by Howie Liu (CEO), Andrew Ofstad, and Emmett Nicholas (CTO). Prior to Airtable, Nicholas had spent over 3 years as a software engineer at StackOverflow. Meanwhile, Ofstad was a product manager at Google for 3 years and spearheaded the redesign of Google Maps.

Liu, meanwhile, founded a company called Etacts in 2010, seeking to build a CRM solution tailored for email contact management. However, Etacts was shut down after less than a year in operation after it was acquired by Salesforce in 2010. Liu’s time at Salesforce as a product manager helped him realize how many people were using spreadsheets solely as organizational tools. Despite their widespread use for bookkeeping and other numerical tasks, Liu concluded that most spreadsheets were little more than cluttered, haphazard containers for various data.

“Spreadsheets are really optimized for numerical analysis and financial calculations. But almost 90% of spreadsheets don’t have formulas. Most are used for organizing purposes.” - Howie Liu

Liu realized that he could create a new type of product that empowered users to create simple applications in a more intuitive way. Liu’s journey at Salesforce was short-lived, and he left after just one year to pursue his next startup, which became Airtable. The founding team then built an MVP and sought early funding from one of Liu’s former investors, Ashton Kutcher. They visited Ashton Kutcher in Los Angeles while Kutcher was filming Two and a Half Men episodes. Kutcher was so impressed with the prototype that he decided to invest in Airtable on the spot, telling the founders “I can really see this taking off, beyond Hollywood.” Airtable was officially founded in 2012, but development took place behind closed doors for two years until it officially launched its invite-only beta in 2014. The earliest versions of Airtable focused primarily on a grid concept, and the product has expanded from there.

Product

Airtable is a collaborative SaaS platform with a spreadsheet-like interface for building relational databases without code. Airtable’s main interface, where data can be entered in the form of “records,” is the table, which resembles a “sheet” in Microsoft Excel or Google Sheets. Unlike the cells of a spreadsheet, which are typically restricted to alphabetical or numerical data types, Airtable’s grid provides users with more flexibility to store different data types, including strings, numbers, files, button objects, barcodes, and more.

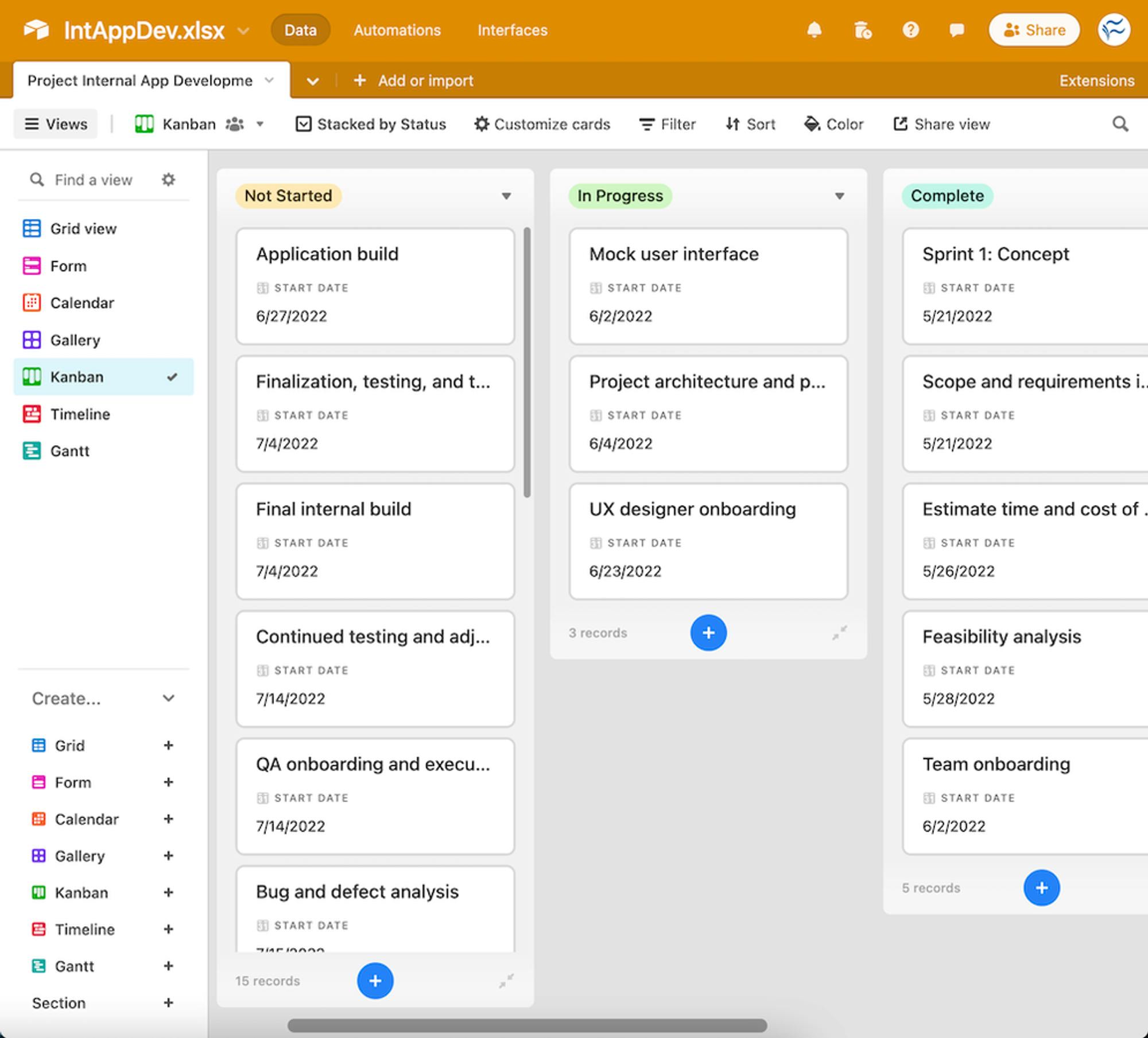

Views

Source: Tech Republic

Airtable allows users to visualize their data and the underlying relationships in different ways using Views such as kanban, calendar, list, timeline, or gallery. Views act as a filter for users to consume and update information. Users can drag and drop tasks as they change statuses and track progress, stakeholders, and other deliverables in a drag-and-drop, modifiable UI.

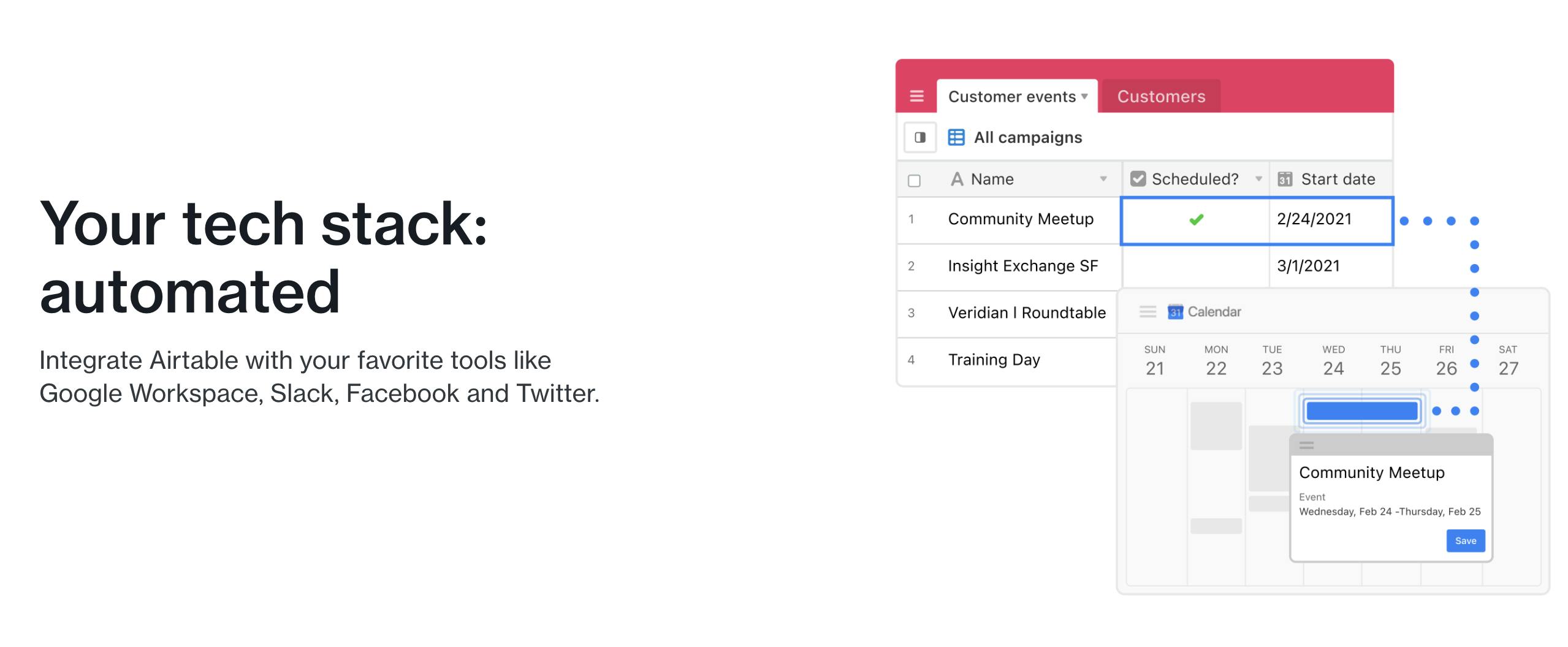

Automations

Source: Airtable

Airtable Automations helps users streamline their workflow by automating processes. A user-defined logic sets Airtable to work on tasks in the background, allowing users to leverage Airtable to automate tasks such as sending an email or updating a record every time a certain action is taken. Furthermore, users can integrate Airtable with third-party tools such as Google Workplace, Slack, Facebook, and Twitter to enhance the capabilities of Automation.

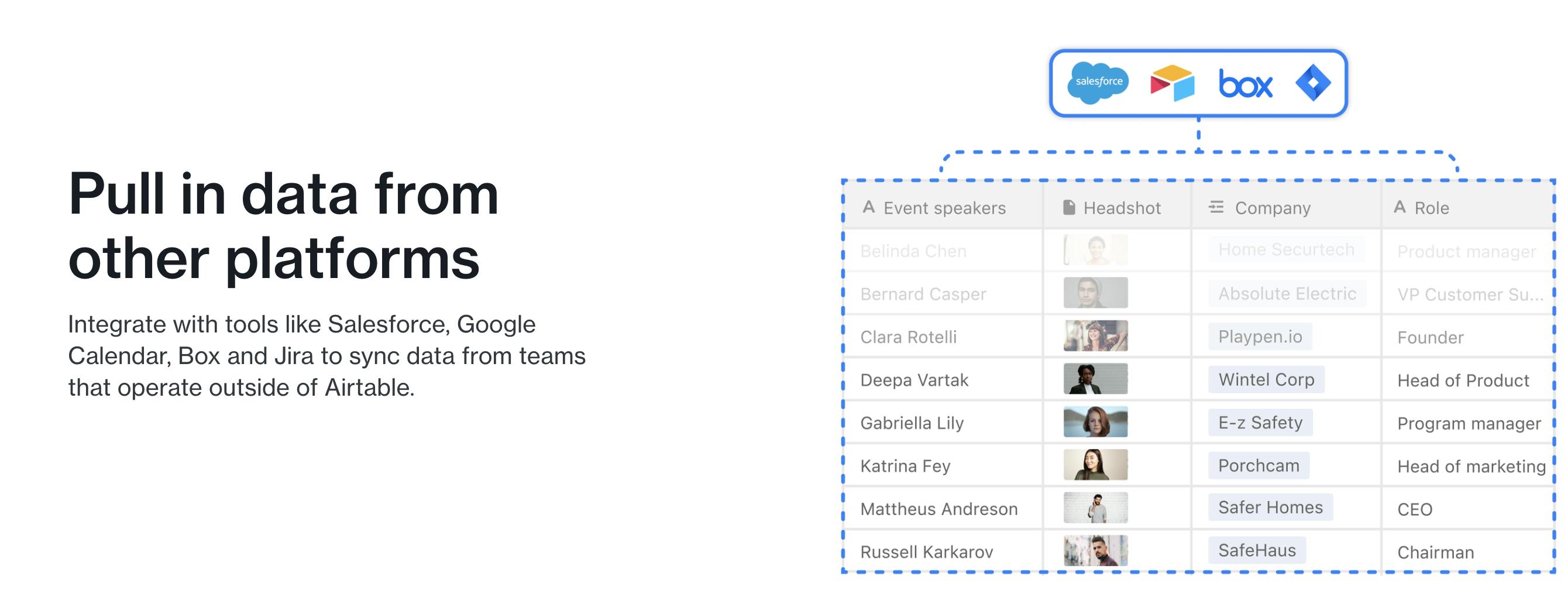

Sync

Source: Airtable

Airtable Sync allows users to sync records from a source base to one or more destination bases to build a single source of truth. Users can also pull in data from other third-party platforms and sync Airtable with tools like Salesforce, Box, and Jira. Users can collaborate on a shared view of table data with different teams using Airtable.

Reporting

Source: Airtable

Airtable Reporting offers users out-of-the-box tools to create dashboards of charts and graphs based on their reporting use cases. Airtable Reporting dashboards can be created with a no-code interface.

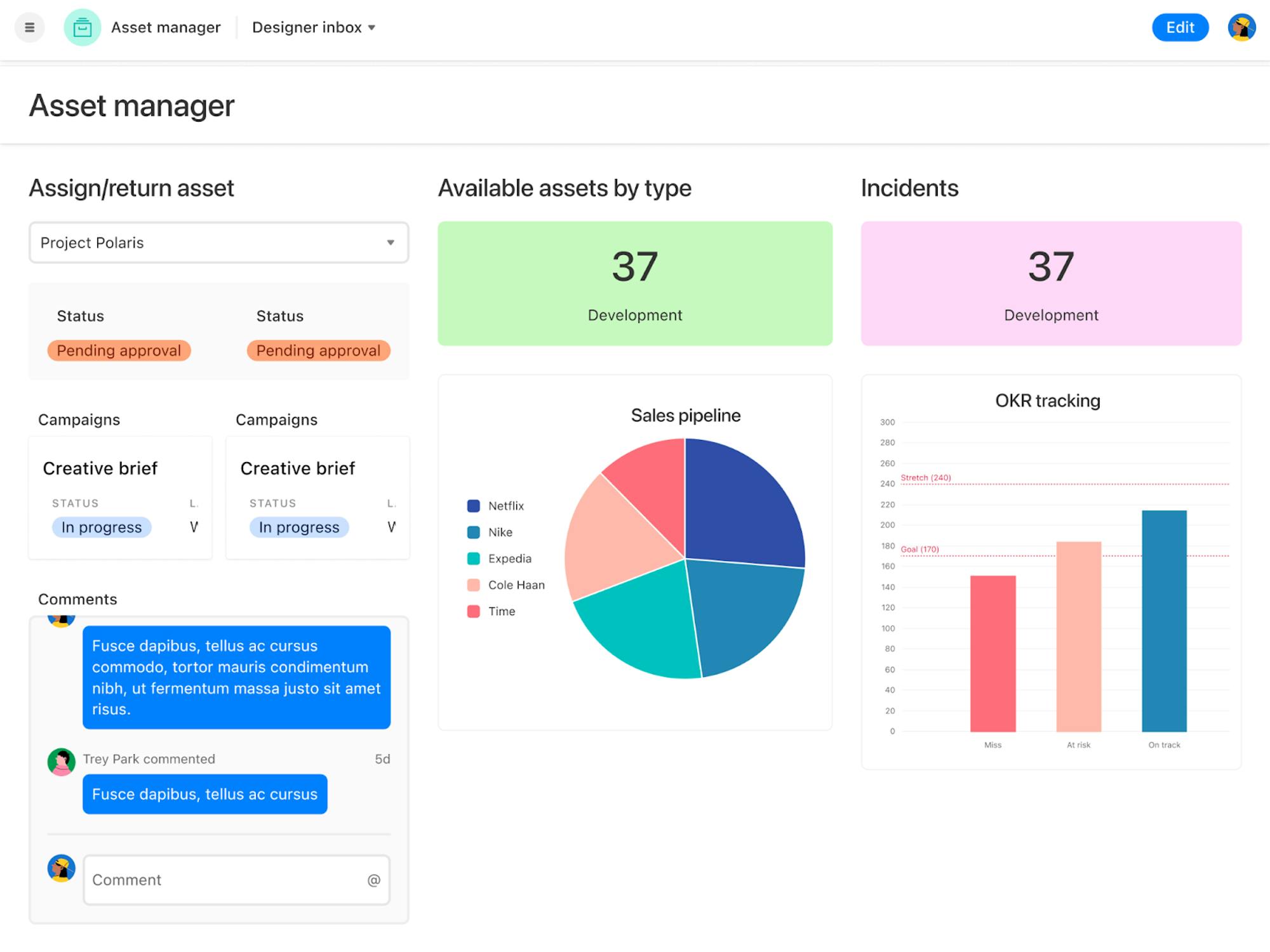

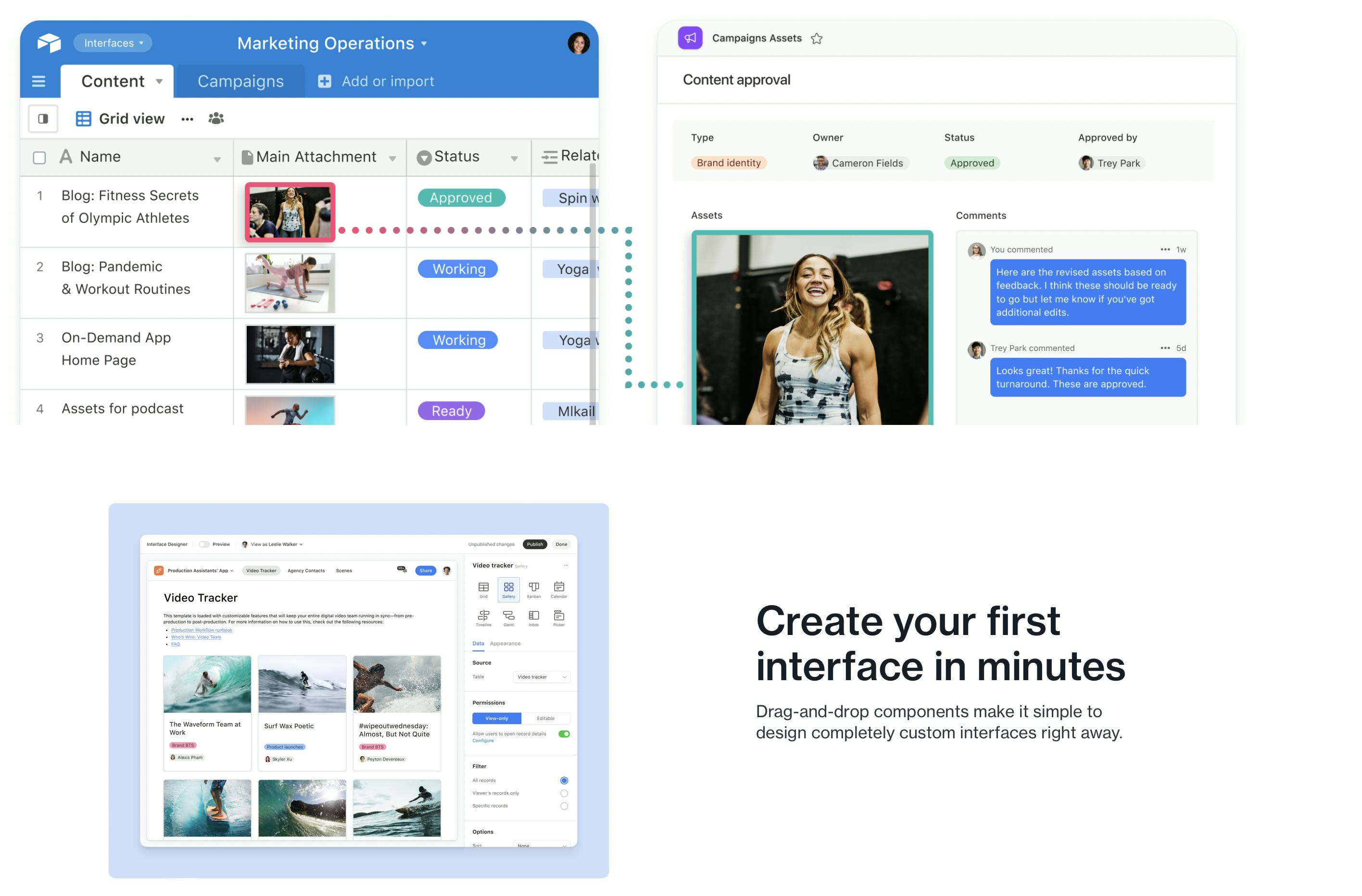

Interface Designer

Source: Airtable

Airtable’s Interface Designer enables users at any technical skill level to build and share custom interfaces without using code. A drag-and-drop builder connects with users’ base data, so any action taken from an interface automatically updates the data in the users’ bases. With Interface Designer, users can create interfaces that better enable team members to view and interact with the data. Users can also set up permissions to customize which parts of the workflow different team members have access to.

Market

Customer

Airtable's customers come from a wide range of industries and include individual users, SMBs, startups, and large enterprises. Some common use cases for Airtable include project management, customer relationship management (CRM), content creation, and more. Well-known companies that use Airtable include BlackRock, Expedia, BuzzFeed, and Shopify, and Airtable counts 80% of Fortune 100 companies among its customers.

Market Size

Airtable's approach to combining the flexibility of spreadsheets with the functionality of databases has resulted in a versatile platform that can be used for a wide range of applications, including project management, CRM, and collaboration.

The global project management software industry reached $12 billion in 2021 and will increase to about $15 billion by 2030. The global customer relationship management market was valued at $59 billion in 2022 and is expected to expand at a CAGR of 13.9% from 2023 to 2030. Additionally, the low-code and no-code markets are expected to grow from $25 billion in 2022 to $45 billion by 2027.

Competition

Spreadsheets

There are large incumbents that offer popular spreadsheet products, including Microsoft Excel with ~1.2 billion MAUs, and Google Sheets with ~2 billlion MAUs. While Airtable doesn't have the same size of user base, its approach to combining the flexibility of spreadsheets with the functionality of databases has helped it build a strong user base with over 300K organizations as customers. Airtable's approach has also led to fairly high customer praise, with 4.6 stars on G2, similar to Microsoft Excel at 4.7 and Google Sheets at 4.6.

Excel and Google Sheets are typically used for primary data management needs. Google Sheets offers 10 million rows for its free version, which is more than the 250K rows that Airtable offers for its enterprise plan. However, Airtable could be seen as a more powerful tool for complex data management with its advanced customization options and database functionality. For instance, Google Sheets supports only four data types — text, numbers, date/time, and location — while Airtable's grid enables users to store a broader range of data types, such as strings, numbers, files, button objects, barcodes, and more. Furthermore, Airtable allows users to link records across tables which allows for more complex data models.

In terms of calculations, while all three players support formulas, Airtable only offers formulas as a field type that users can set at the column level vs. the cell-level functionality offered by both Excel and Google Sheets. Lastly, Airtable is also more expensive than Google Sheets. The free version of Google Sheets comes with a massive 10 million record limit and the ability to enable up to 100 collaborators. Enterprises pay for Google Sheets at $12/user/month, which is cheaper than Airtable’s Pro plan, its second most expensive plan, at $20/user/month.

Project Management

Airtable also competes with a range of project management software, including Asana, Smartsheet, Monday.com, Notion, ClickUp, and, perhaps most notably, Atlassian, which owns both Jira and Trello. Atlassian leads the project management software market with Jira (38% market share) and Trello (2%), while Airtable sits at 7%.

Jira is a project management tool commonly used by software development teams. It offers a wide range of advanced features, such as issue tracking, agile project management, and customizable workflows. Trello is a visual tool that uses cards and boards to represent tasks and progress. It also offers basic task management features such as checklists, due dates, and attachments. The key difference between Jira and Trello is their target audience. Jira caters primarily to software developers, engineers, and product managers in medium to large organizations. In contrast, Trello aims to attract freelancers, developers, and other contributors in small businesses.

Overall, while Airtable may not offer the same level of specialization in project management as some other tools, its hybrid approach of combining spreadsheet and database functionality allows for a high degree of customization and makes it a powerful option for managing data and projects.

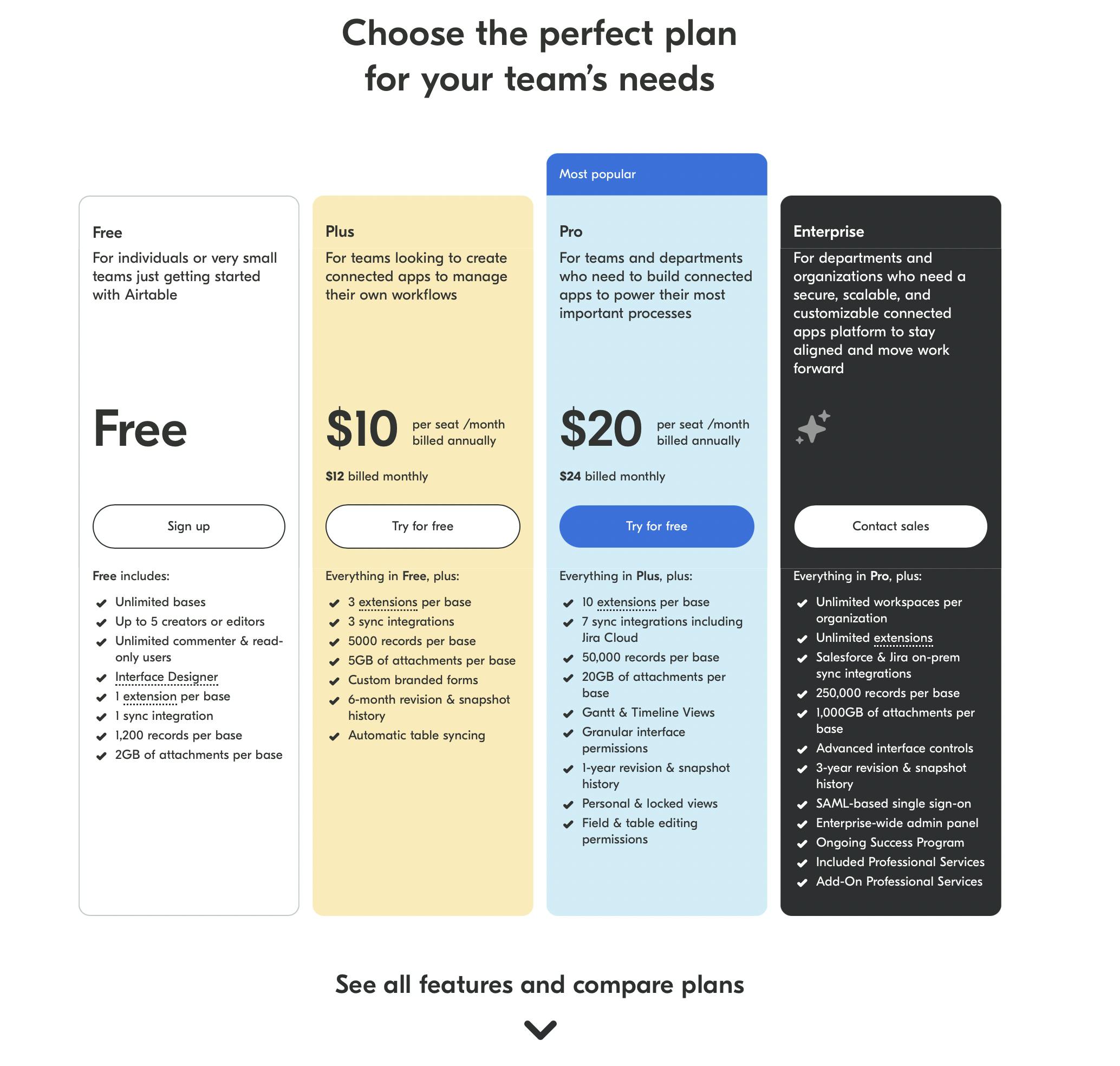

Business Model

Airtable operates on a subscription model and charges on a per-seat basis: $10 per month for the Plus plan, $20 per month for the Pro plan, and sales-negotiated pricing for the Enterprise plan.

The Pro plan is designed to meet the needs of organizations with a larger number of Airtable users. It requires more granular control over permissions and a more organized approach to information and views. For larger companies, the Enterprise plan provides additional features such as Single Sign-On (SSO), federation, an enterprise-wide admin panel, and access to consultations with the Airtable team to optimize their use of Airtable.

Airtable’s pricing plans are in line with its two primary growth drivers, namely expanding the number of its users within organizations and gradually upgrading users to more premium plans that charge a higher price per seat.

Source: Airtable

Traction

At the end of 2019, Airtable recorded $36 million ARR with 54% revenue growth. Since then, Airtable has eclipsed the $100 million ARR mark with accelerating growth due to COVID tailwinds and its aggressive push upmarket. Airtable is considered one of the fastest companies to get from $10 million to $100 million ARR, taking about 3.5 years to hit the mark.

As of December 2021, Airtable had more than 300K active customers, including IBM, Hulu, and Netflix, in addition to ~80% of companies in the Fortune 100 as paying customers.

Valuation

Airtable has raised over $1.4 billion in funding as of 2023. In December 2021, Airtable raised $735 million in a Series F funding round that valued the company at $11 billion. In March 2021, Airtable raised $270 million in a Series E funding round led by Greenoaks Capital, with participation from existing investors. This round valued the company at $5.8 billion. In September 2020, Airtable raised $185 million in a Series D funding round led by Thrive Capital, with participation from existing investors. This round valued the company at $2.5 billion.

Key Opportunities

Expansion to Additional Verticals

While Airtable has enjoyed strong adoption from departments such as marketing and operations, new verticalized packaging for Airtable like “Airtable for Marketing” hints at a path forward for Airtable in which it may develop many different verticalized Airtable products to enable it to grow beyond its initial core customer segments. Not only can these products generate higher ARPU, but they can also increase the number of seats that can be had in the enterprise. The ultimate vision for Airtable is to use those verticalized solutions as hooks into large enterprises and cross-sell other verticalized solutions to other departments.

Custom Application Development

Airtable has the potential to enter the custom application development market (also known as internal tools) by leveraging the growing trend of no- and low-code application development. Nearly 60% of all custom apps are now developed outside the IT department, and of those, 30% are built by people with limited or no technical development skills. This trend is expected to continue, with some estimates indicating that by 2023, the number of people developing software applications outside of IT at large enterprises will be at least 4x the number of professional developers. One potential avenue for Airtable to enter the custom application development market is by serving as a data source for no- and low-code application development. By allowing users to build on top of its data and connect it to other systems, Airtable could enable non-technical users to create custom applications that meet the specific needs of their teams.

Key Risks

Rise of AI

The increased utilization of AI has the potential to render no-code/low-code tools such as Airtable less useful in some cases. As AI and ML advance, they may become increasingly capable of automating many tasks that no-code/low-code tools were designed to facilitate.

For example, no-code/low-code tools allow users to create custom applications and workflows without needing to write code. However, it is becoming possible with AI models such as GPT-4 for users to describe the desired application or workflow in natural language and have an AI system generate the code automatically. This makes it even easier for non-technical users to create custom applications and reduces the need for no-code/low-code tools.

Moreover, AI/ML may also make it possible for systems to automatically generate insights and recommendations based on large datasets, reducing users' need to create custom applications to analyze data. Instead, users may describe the type of analysis they want to perform, and the AI system will generate the results automatically.

Graduation Risk

Airtable’s flexibility enables its users to build custom applications that serve multiple purposes. However, companies may graduate from the solutions they built on Airtable as they grow and seek more specialized and robust solutions.

Summary

Airtable is a collaborative SaaS platform with a spreadsheet-like interface for building relational databases without code. Compared to spreadsheets, Airtable offers users the flexibility to store more data types and even link records across separate tables, powering common use cases such as project management, CRM, content creation, and more. To drive growth, Airtable has invested in an aggressive push upmarket towards enterprise customers. It grew its headcount 8x from the end of 2019 to 2022, and was able to quickly grow from $10 million to $100 million ARR. As Airtable looks to drive growth more efficiently, it can consider developing vertical solutions that can help it expand beyond its core segments and further its vision of building a connected app platform for users to build custom applications.