Thesis

In recent years, the workplace has changed meaningfully due to technology. New productivity tools allow teams to improve workflow, organization, and collaboration. One area contributing to this has been the development of tools to create documents. Although these tools have advanced significantly from the days of the pen and paper and the typewriter, the most widely-used tools still look similar to technology originally developed 20-30 years ago.

The evolution of these tools began in the 70s with the digitization of documents through WordStar, VisiCalc, and Harvard Graphics. This culminated in the development of Microsoft Word and Microsoft Office in the 90s, and Google Docs/ Google Drive in the 2000s. But even though operating systems and databases have evolved significantly since then, documents retain largely the same form and structure as they did in the days of the personal computer. However, utilization has changed over time. Documents are not just used for individual record-keeping any more. They are now used as collaborative tools to run teams, and the demand for a more dynamic form-factor has emerged.

Coda is a new kind of document that brings words, data, and teams together. It comes with building blocks that anyone can combine to create a doc as powerful as an app. Coda offers a new way of working together, allowing teams to build whatever they need in order to work effectively. Providing a high degree of customizability and automation in a low-code platform, Coda enables users to create powerful workflows for their specific needs. As companies continue to embrace hybrid and remote work, Coda has established itself as a modern productivity tool for a new way of working.

Founding Story

Coda was founded in 2014 by CEO Shishir Mehrotra and CTO Alex DeNeui. The pair originally met at MIT and worked at Microsoft and Google before founding Coda. After having worked as a program manager at Microsoft, Alex co-founded his own startup, DocVerse, which he sold to Google in 2010. He then joined Google as a Staff Software Engineer. Meanwhile, as VP of Product and Engineering at YouTube, Shishir ran his team off documents and spreadsheets, but failed to find a great tool that fit his team's needs.

While at Google, Shishir and Alex had gained experience working with and building productivity tools and were familiar with the challenges involved. After leaving Google to start their own company, they evaluated the state of productivity tools and realized that despite the fact that documents and spreadsheets were the foundational building blocks of companies, they had not fundamentally changed in 40 years.

The idea for Coda came about when they thought about what documents and spreadsheets would look like if they were built from scratch. The pair built a working prototype in 2015 and began asking friends and family to test it. By 2017, Shishir and Alex launched an alpha version of Coda to a wider group of testers. The launch went well, and they went on to recruit a team of former product and engineering leaders from Google, Microsoft, Facebook, and Amazon to continue building Coda.

Product

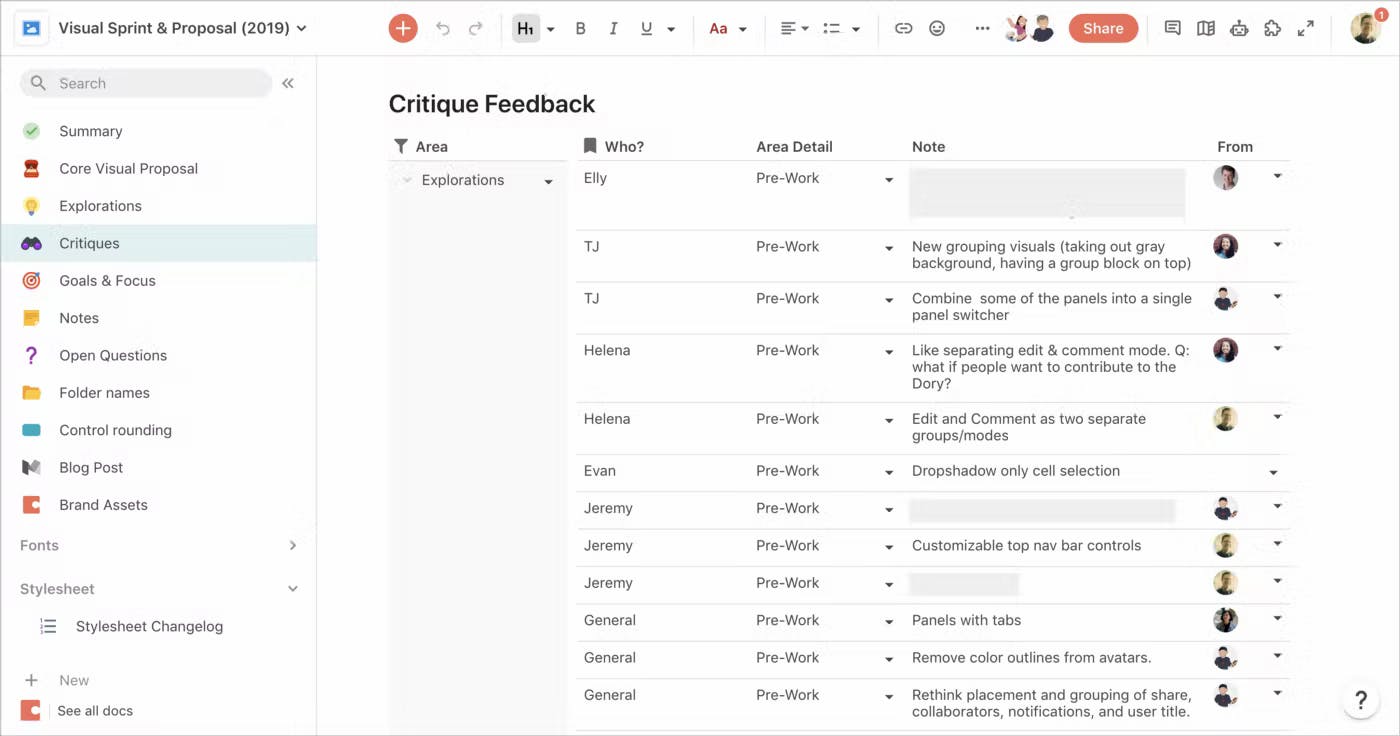

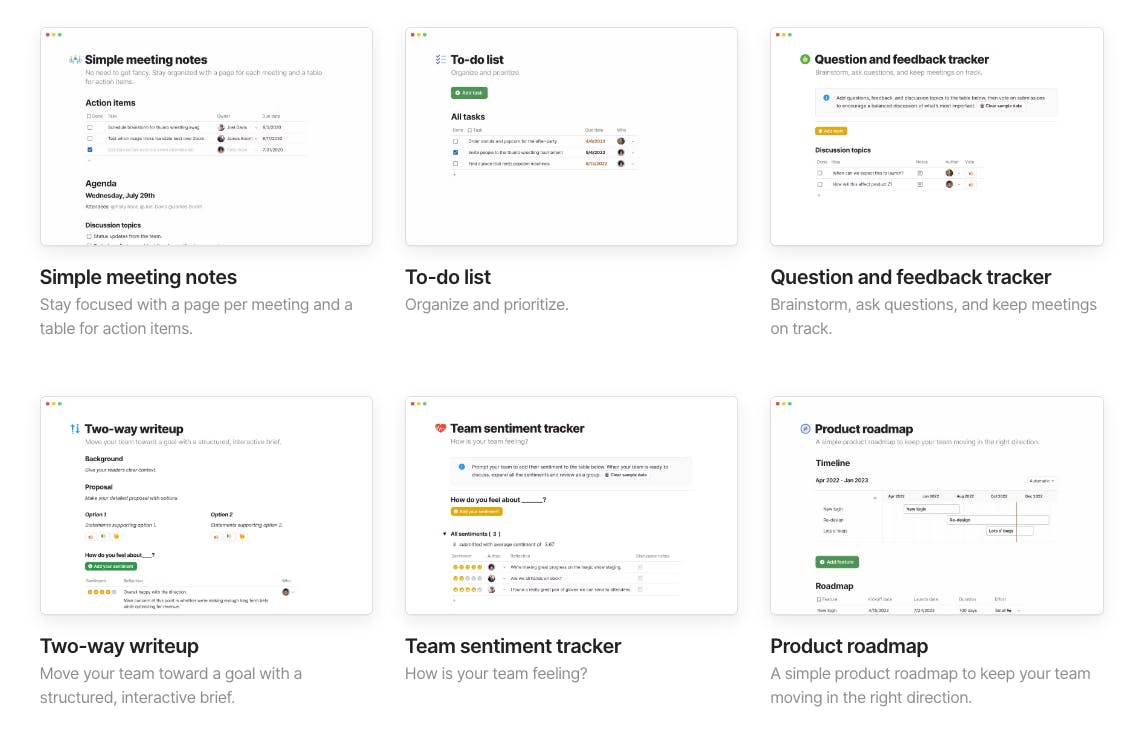

Coda Docs purports to be an all-in-one productivity tool that seeks to reimagine the document as a flexible and modular canvas. In a Coda Doc, users can do everything from writing text like in a word processor, calculating formulas in a spreadsheet, formatting information in a table, and pulling data from other apps like GitHub or Salesforce. Users can combine documents, spreadsheets, and applications into a single shared canvas that teams can collaborate on, providing flexibility to its users.

Source: Coda

Coda describes its Docs product as "Minecraft for docs," offering a no-code experience that enables makers to build project management tools, websites, wikis, and more. With Coda Docs, makers can create custom solutions tailored to their specific needs and workflows, which is meant to enable them to work more efficiently and effectively.

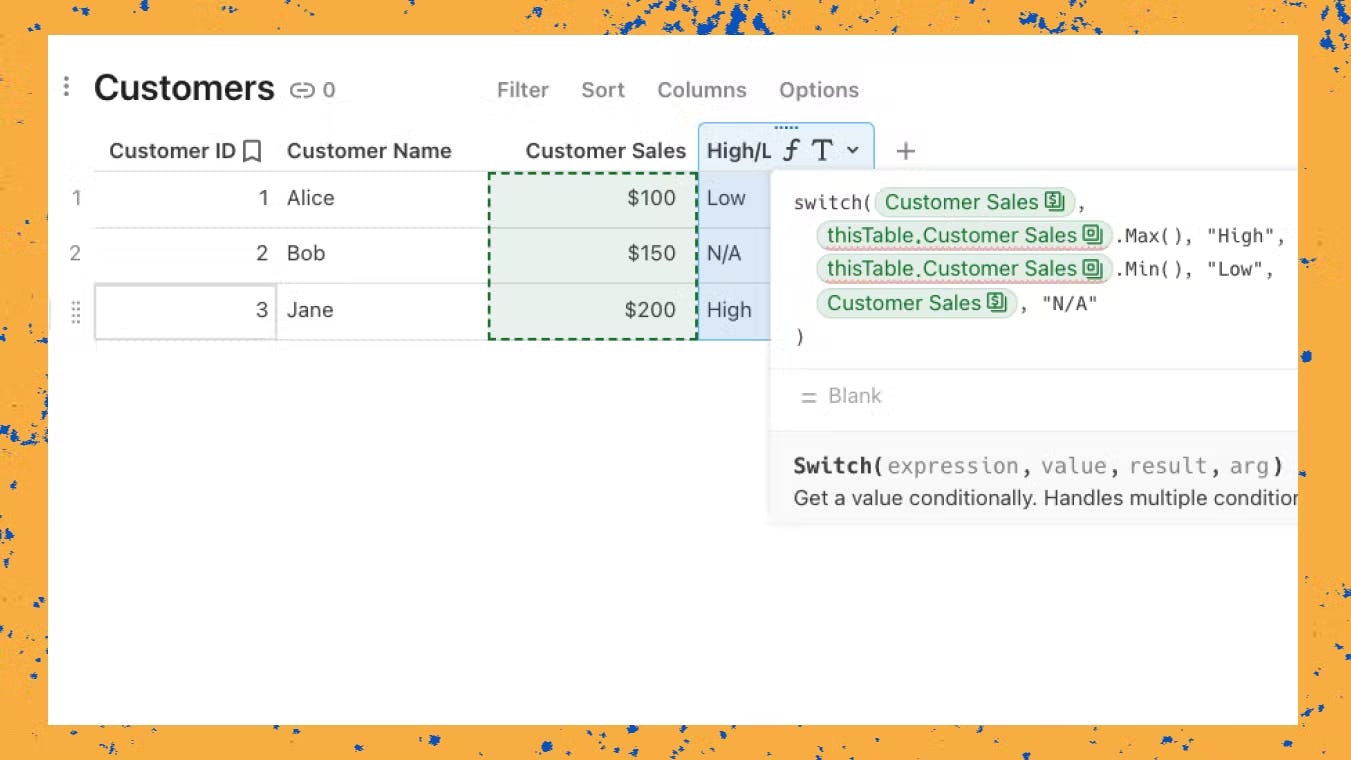

Formulas

Coda Formulas allow users to easily embed calculations, data, and dynamic content into their Coda docs. Tables, columns, rows, and references can all be used as "ingredients" inside Formulas. The formulas are similar to those found in popular spreadsheet tools such as Microsoft Excel and Google Sheets, with concepts such as filtering, arithmetic, and Boolean logic.

Source: Coda

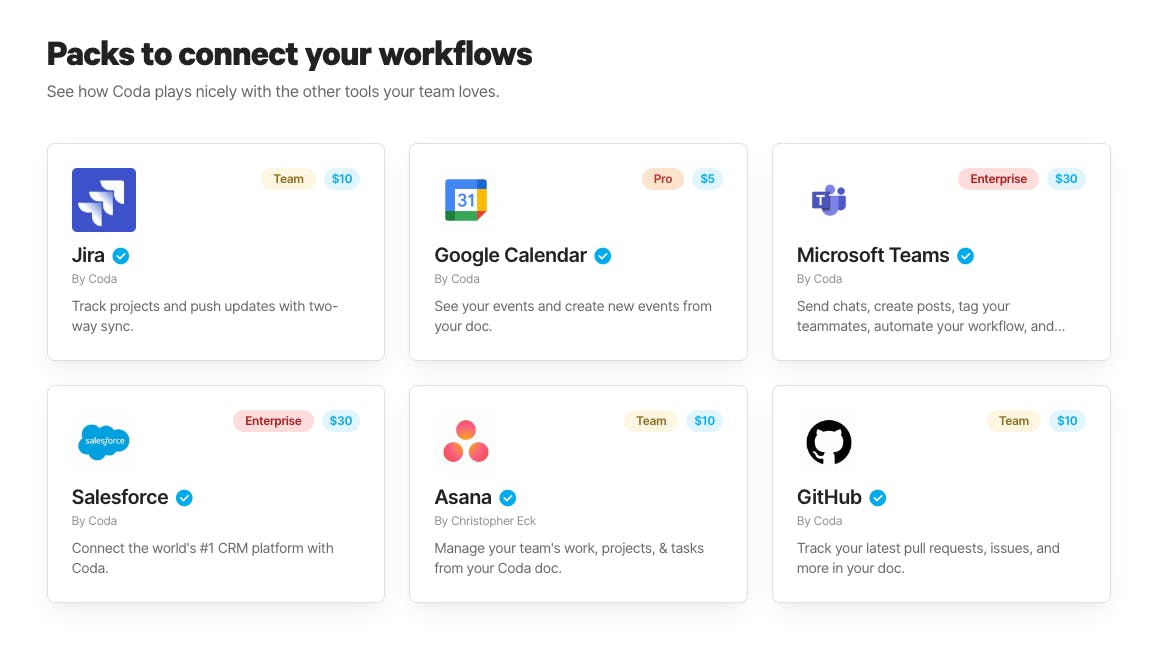

Packs

Coda Packs are pre-built integrations that enable Coda users to integrate their Coda Docs with external applications and tools. With Coda Packs, users can import data from external applications to enhance their Coda Docs and Formulas, allowing for more comprehensive and versatile content creation. Coda and third-party developers develop and maintain these pre-built integrations, including popular tools such as Slack, Github, Trello, and Google Sheets.

Source: Coda

API

The Coda API is a RESTful API that allows developers to access and interact with Coda’s platform. While Coda offers prebuilt integrations with Packs, the API provides developer tools to develop custom integrations optimized for their team’s unique needs. The API lets developers programmatically search Coda docs, create new docs and copy existing ones, share and publish docs, discover pages, tables, and formulas, and update or delete rows.

Coda AI

In February 2023, Coda launched Coda AI, an AI service that acts as a work assistant and solution builder embedded within Coda. Leveraging OpenAI's GPT models, Coda AI offers services like summarizing meeting notes, drafting customer emails, and planning travel itineraries, all of which work within Coda's existing Docs, Formulas, and Packs.

Source: Coda

Market

Customer

Coda's customer base is diverse, ranging from individuals to startups to enterprises. However, Coda's ideal customer is a company that relies heavily on documents and spreadsheets, but lacks the technical expertise or size to justify the development of custom internal tooling to streamline employee workflows. This type of customer is looking for a user-friendly alternative to complicated SaaS offerings like Jira or SharePoint. Integrating multiple tools and services can also be a hassle, requiring dedicated IT personnel for configuration and support.

Source: Coda

Coda's customer base has expanded from primary businesses to individuals who desire a powerful, no-code workspace for personal notes and projects. Coda strives to provide accessibility, user-friendly interfaces, and scalability features in order to appeal to both business and individual users.

Market Size

Coda's market size includes the productivity software, collaboration software, and no-code platform markets.

The global productivity software market was valued at $47.4 billion in 2021 and is expected to grow at a 14.4% CAGR throughout 2030.

The collaboration software market was valued at $21.7 billion in 2021 and is expected to expand at a 9.5% CAGR throughout 2030.

The no-code development platform market was valued at $12.1 billion in 2020 and is expected to grow with a 24.2% CAGR, reflecting the need for faster and easier application deployment.

Any individual who works with documents and spreadsheets is a potential customer for Coda. With the average enterprise using up to 130 SaaS apps, Coda’s emphasis on easy integration with other tools may appeal to enterprise customers as well.

Competition

Notion: Founded in 2014, Notion is a competitor offering an all-in-one collaboration workplace product. Notion’s Docs product is similar to Coda’s Docs with a composable set of “building blocks” that can be spreadsheets, project trackers, app integrations, and more. Focusing initially on the consumer market, Notion has found considerable traction among consumers, with over 25 million users. In October 2021, Notion raised $275 million at a $10 billion valuation.

Airtable: Founded in 2012, Airtable is a database and project management tool that combines a spreadsheet's simplicity with a database's scalability. Similar to Coda Packs, Airtable offers easy integrations with commonly used external apps like Dropbox, Gmail, and Slack. Airtable’s flexible database is a competitive alternative to Coda’s Docs for customers interested in organizing and managing data in tables. Airtable raised $270 million in a Series E that valued the company at $5.8 billion in March 2021.

Google: Google Workspace is the collaboration and productivity suite of apps for businesses of all sizes from Google. It includes Docs, Slides, and Sheets. It dominates the workspace productivity landscape along with Microsoft. It passed 2 billion users in 2020.

Microsoft: Microsoft 365 is a subscription-based software productivity suite that provides comprehensive work, collaboration, and communication tools. In November 2021, Microsoft announced Microsoft Loop, a productivity tool that allows users to collaborate in a flexible, visual canvas. In its FY22 Q2 earnings release, Microsoft reported 56.4 million subscribers for Microsoft 365 Consumer, representing one of the world's most commonly used productivity platforms.

Atlassian: Atlassian is a public Australian technology company that develops productivity software. Jira and Trello are project management tools used to help teams manage projects and organize their work. Confluence is a collaboration and knowledge management tool used by teams to organize and share knowledge. Collectively, Atlassian reported over 200K customers for its suite of productivity tools.

Business Model

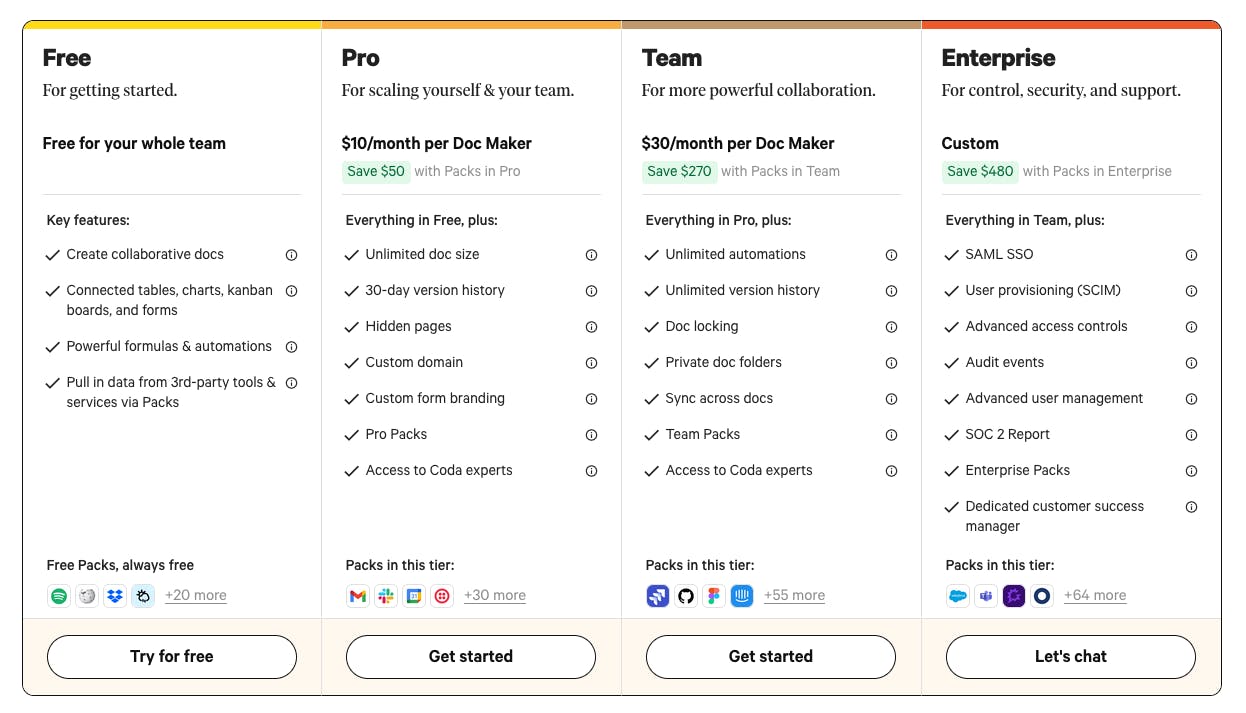

Coda operates on a subscription-based business model. Coda offers three paid plans with different features and functionality: Pro, Team, and Enterprise. The Pro plan is $10 per user per month and includes version history, custom domains, access to Pro Packs, and Coda expert support. The Team plan costs $30 per user per month. It includes unlimited version history, access to Team Packs, and the ability to manage access to documents and lift restrictions on the number of automation.

Source: Coda

Coda's Enterprise plan offers best-in-class functionality, such as SAML SSO, user provisioning, user management, access to all available Packs, and dedicated customer support. However, the pricing for the Enterprise plan is not publicly available, and interested customers must inquire on Coda's website.

Traction

Coda saw significant traction early on. Coda has been making steady progress since its alpha launch in 2017, with a strong focus on the enterprise market. In its beta launch, Coda was able to reach second place in Product Hunt’s Product of the Month list. In 2023, over 25K teams use Coda according to its website. These include major enterprise customers like Figma, Square, Uber, Robinhood, BuzzFeed, and The New York Times. Coda also highlights case studies of satisfied enterprise customers such as Pinterest, TED, Plato, and Intercom on its website.

Valuation

Coda raised a $100 million Series D in July 2021 led by the Ontario Teachers’ Pension Plan, which valued it at $1.4 billion. The round included participation from investors such as Kleiner Perkins, Greylock, Khosla Ventures, General Catalyst, and Alumni Ventures. Greylock, Khosla Ventures, and Kleiner Perkins were the lead investors in Coda's previous funding rounds. To date, Coda has raised $240 million across four funding rounds.

Key Opportunities

Category Expansion

Expanding to provide offerings in other key verticals within the SaaS productivity space represents an opportunity to tap into new markets. Coda’s flagship product is Docs, and by using Docs as an on-ramp for customer acquisition, Coda could add new capabilities like storefront hosting or photo albums that integrate well with Coda’s existing products. Other SaaS companies like Zoom and Dropbox have executed a similar roadmap, starting with a flagship offering and driving category expansion through that offering. Providing new capabilities through category expansion could help Coda make their SaaS offerings stickier with customers and grow its addressable market.

Generative AI

Coda has already launched Coda AI. Doubling down on generative AI in products could allow Coda to offer solutions like content creation and virtual assistants to provide additional value to customers. Coda’s no-code products could allow users to leverage AI to create software without requiring extensive programming knowledge.

Key Risks

SaaS Rebundling

Coda found traction between 2015-2020, a time period marked by SaaS unbundling, which involved disruption of large SaaS platforms by smaller specialized applications. During this time, enterprise customers were happy to purchase best-in-class products discovered and championed by users.

Starting in 2022, however, the global macroeconomic slowdown has caused enterprise customers to start questioning which tools they need as they seek to reduce IT budgets. Companies are increasingly consolidating previously separate tools into a single platform or suite that streamlines workflows while reducing costs.

For example, the Microsoft 365 E3 enterprise subscription costs $36 per month per user and includes the full Microsoft Office suite, Outlook, Teams, and more. When compared to the $30 per month per user Coda Team plan, IT decision-makers may be pressed to justify the cost of a Coda subscription.

Limited Distribution

Along with providing great customer value, large SaaS productivity platforms also benefit from increased distribution to customers that specialized, unbundled products do not. The SaaS market is competitive and includes many established players who can leverage their existing customer base as an on-ramp for new product offerings.

Source: CloudFuze

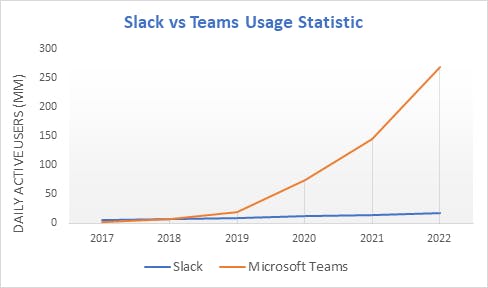

The story of Slack and Microsoft Teams provides a cautionary tale of how even one of the best SaaS products with exceptional product market fit was overtaken by a competitor with superior distribution and reach. Coda faces similar challenges in a crowded SaaS market with entrenched incumbents who may leverage their distribution and resources to seize market share.

Summary

Coda is a productivity tool that combines the accessibility of documents and the functionality of spreadsheets with the flexibility of modern web apps. This enables users to create collaborative and interactive applications. Its no-code platform makes Coda easy for users to leverage the full capabilities offered by the product. Coda has seen early success and traction with individuals, SMBs, as well as enterprise customers. Having shipped over 100 product updates in 2020 alone, Coda is building an ecosystem to support its vision for all-in-one docs.

By embracing third-party developers with its API and Packs, Coda has also demonstrated its ability to develop features that customers value. Whether Coda can overcome the distribution of entrenched incumbents who offer fully featured productivity suites at competitive prices remains an open question. As the macroeconomic slowdown forces enterprise customers to carefully consider the SaaS subscriptions they want to keep, Coda may be able to secure its foothold in the market by embracing future-facing technologies like generative AI.