Thesis

The launch and subsequent growth in popularity of Amazon Web Services in 2006 drove a massive shift to SaaS business models where companies could deliver their products in the cloud. The availability of infrastructure like AWS accelerated the rate at which new software businesses can launch. As a result, companies are using more software than ever before. The average company today relies on 254 SaaS tools, reporting that the primary reasons for adopting a new tool are boosting productivity, reducing costs, and improving security. For enterprises, buying software often comes down to a simple calculus: the time and effort spent building an admittedly more flexible in-house solution could be better spent perfecting the product or service offering and engaging with customers instead.

The problem: as the complexity and quantity of different software tools increase, enterprises are struggling to integrate across all these tools, leading to challenges including data synchronization, security and compliance, and authentication. 25% of organizations have a six-month backlog on workflow integration requests. 58% of organizations said that their IT staff are spending five or more hours of work each week on repetitive tasks including data entry. 47% believe that internal APIs don’t adhere to security standards and an additional 19% are unsure whether or not they do.

To address this problem, Alloy Automation* has built an integration-platform-as-a-service (iPaaS) company to act as the connective tissue for the network of software applications. Initially designed to support the ecommerce tech stack, it has since expanded to more verticals and offers integrations with over 200+ software applications across three primary products to satisfy customer needs. Alloy Automation is capitalizing on the continued proliferation of software tools used by enterprises by simplifying the integration process for everyone.

Founding Story

Source: a16z

Founded in 2019, Alloy Automation is led by co-founders and long-time friends Sara Du (CEO) and Gregg Mojica (CTO). Prior to college, Du worked as an engineer at DoNotPay, an online legal service chatbot where Du worked on robotic process automation (RPA) at the browser level, discovering how easily browser-based automations can break. She subsequently attended Harvard University before dropping out in 2019 with the goal of “building tools that other people would love”. Du shared how she decided to look deeper at API-level automation tools, realizing that “the existing options were still too hard for people to use … or too elementary”.

Mojica began coding at age 12, and had launched three different apps by age 17: Bryt, a screen-sharing tutoring service; Viper, an anonymous social networking app with 165K downloads in 2016; and Gradology, a platform that rewards students for good grades. He was accepted into Cornell but skipped university to work for a financial services company Fiserv, where he worked on API development. During this period, he gained exposure to ecommerce and began imagining new business problems to work on.

The duo met when Du invited Mojica to speak at a conference in 2016. The two of them considered their previous experiences and determined that integration and automation still presented major challenges to commerce companies. Du and Mojica decided to build a prototype of what became Alloy Automation before releasing the product on ProductHunt in 2019. In the process, the team attracted a wide range of potential users who were fascinated by the product, including a first investor in Bryant Chou, the founder of Webflow.

Du and Mojica also applied to and joined Y Combinator’s W20 cohort, where the team and sharpened the company’s positioning to focus on e-commerce. The team’s demo day coincided with the start of the COVID-19 pandemic, so the founders skipped it to continue building the product and serving early customers. As the pandemic continued, the company was able to scale the team both remotely and internationally.

Product

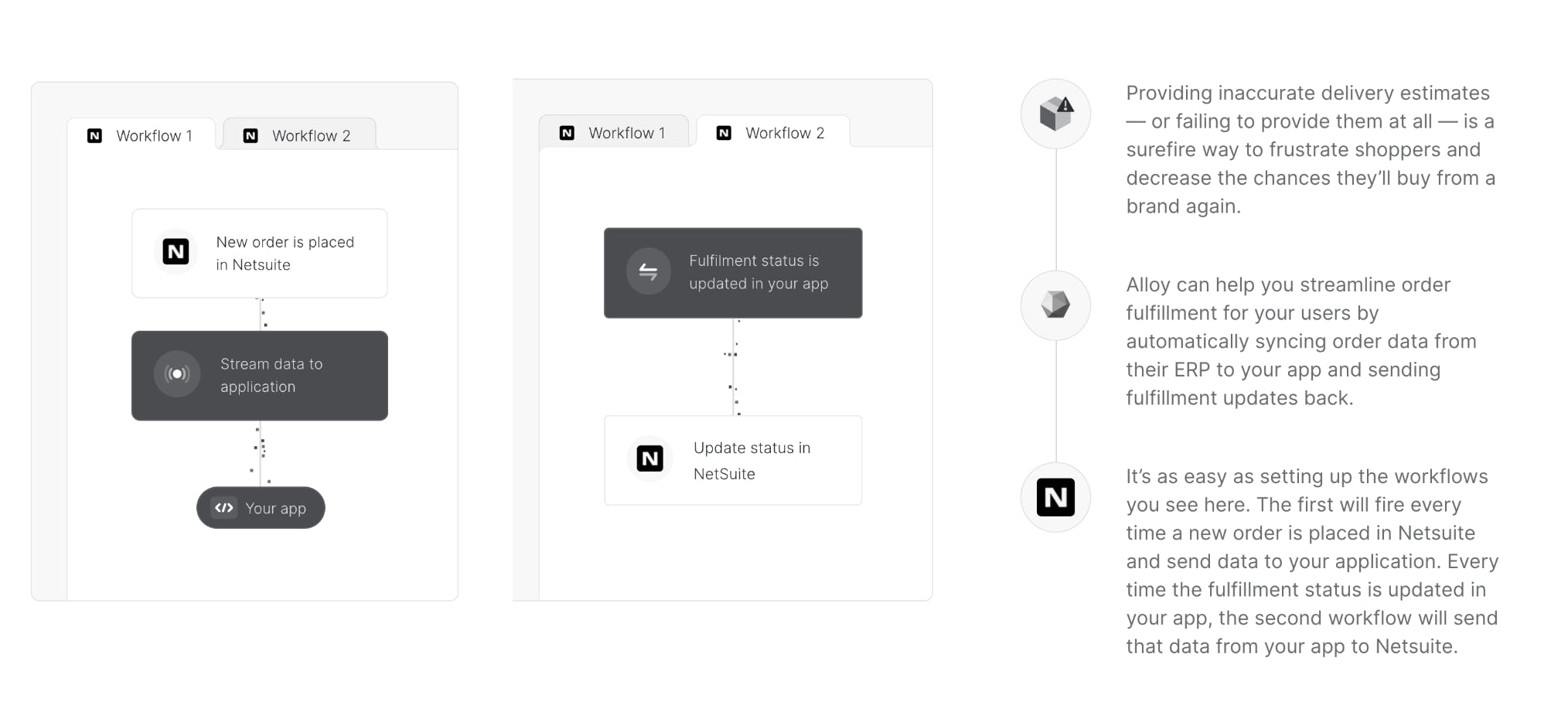

Alloy Automation’s initial product is its low-code automation solution to more effectively integrate an enterprise’s complex tech stack. Alloy Automation helps customers save time and money by automating routine tasks using workflows that integrate with third-party apps, such as Netsuite, Salesforce, and Slack, and setting up logical connections that define data transfer and synchronization across apps.

Source: Alloy Automation

Different customers need different types of support, and as Alloy Automation’s business has developed, it has segmented its offering into three distinct product lines: Alloy Unified API, Alloy Embedded, and Alloy Flow. These product lines are built on the same core functionality. They include credential and authentication management, which allows Alloy Automation’s customers to avoid signing in to many different applications; guaranteed real-time data, which ensures that customers never miss an event; and detailed error handling logs that help with debugging integrations.

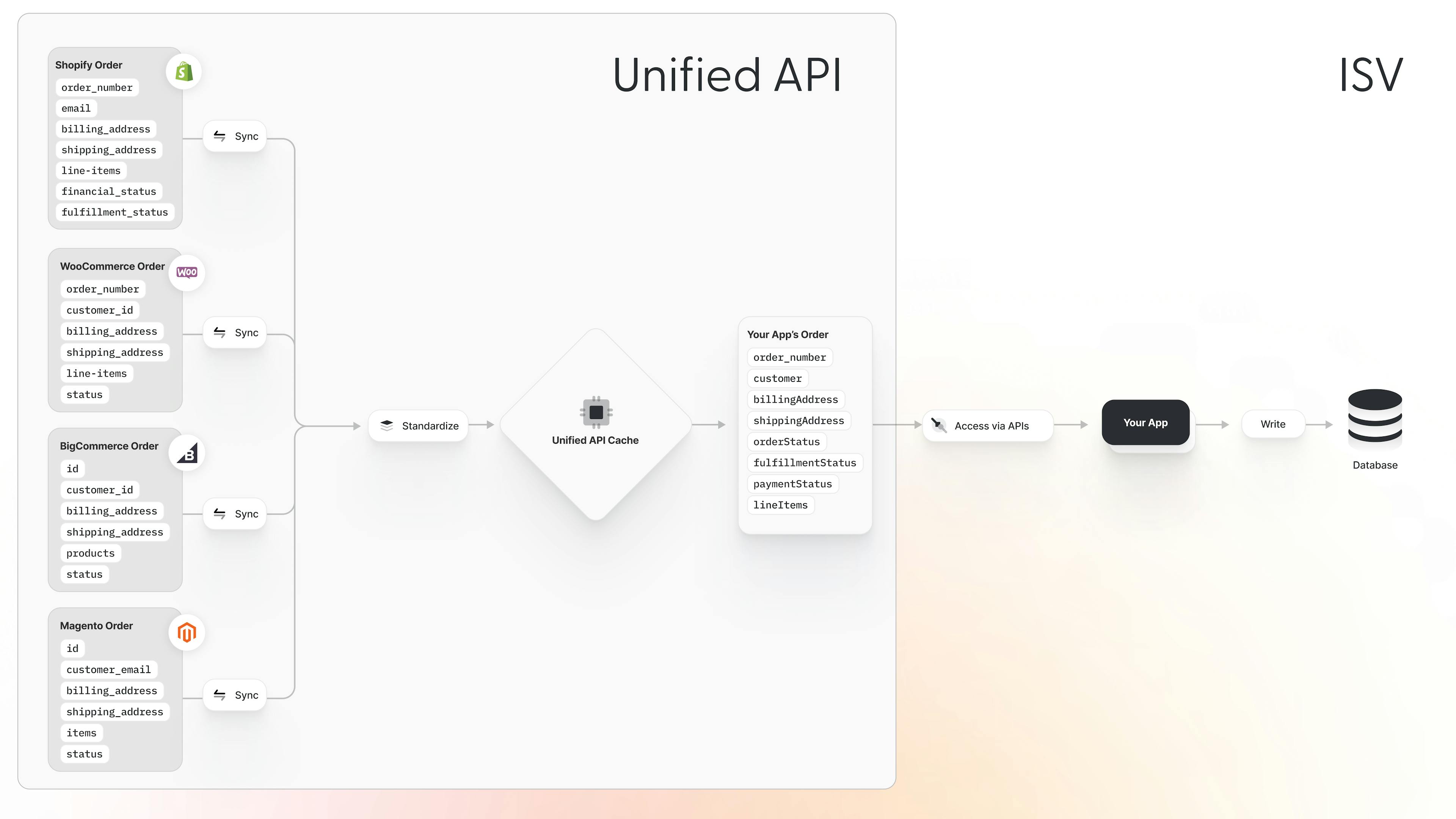

Alloy Unified API

In a September 2023 interview with Contrary Research, Du shared that Alloy Automation’s newly created Unified API is ideal for customers with simple integration needs:

“Unified API is for when you need to do quick read-and-writes in a model that takes care of relatively standard data fields.”

One ideal use case is read-write integrations, in which users might be receiving order information from Shopify, BigCommerce, and other platforms, and adding this data to an internal database. Let’s say an order is placed through Shopify. On the back end, Shopify will create a piece of data corresponding with that order, including information (fields) such as the billing address, shipping address, item ordered, etc. Orders placed through BigCommerce will also generate a piece of data, but there may be slight differences. For instance, perhaps Shopify’s data fields include the end user’s email, whereas BigCommerce instead stores a unique customer ID. That means that Shopify’s data schema differs from BigCommerce’s.

This presents a headache for companies seeking to automate their read-write operations, requiring familiarity with multiple different data schemas. When there are only a few integrations, it might be possible to keep track of everything. But as an organization scales and adds more integrations, this becomes a significant challenge. This is where Alloy Automation’s Unified API comes in, unifying the different data schemas into a common data schema. This allows Alloy Automation’s customers to be able to focus on where data actually needs to go, not wrestling with the nuances of third-party integrations.

Source: Alloy Automation

There are a few other features of Unified API to point out. First, Alloy Automation easily allows engineers to deploy webhooks that grab real-time data from Shopify and other platforms. Some platforms do not explicitly allow webhooks, but Alloy Automation uses an hourly polling system that checks for new orders periodically. This ensures that data is accurate and real-time. Furthermore, some platforms, such as Shopify, impose rate limits that prevent too many requests to Shopify’s API. Alloy Automation is able to offer better rate limits: 150 per minute for basic users and up to 1K per minute for enterprise users. This ensures quicker syncing of data, which can result in a better end-user experience.

Alloy Embedded

Alloy Embedded provides one streamlined, low-code interface for adding third-party ecommerce data and integration functionality to a SaaS platform. Alloy Embedded is best suited for customers who are moving beyond simple read-write functionality, especially more advanced logic. For instance, a customer might want to invoke an action only if a certain product is ordered. Alloy Embedded is a more robust system, built off the same technology as the Unified API but with greater flexibility. In an interview with Contrary Research, Du shared the benefits of the Unified API:

“The Unified API can handle 20% of cases that are more typical and follow more standard data fields and schemas, but 80% of cases are more complex and require something like Embedded.”

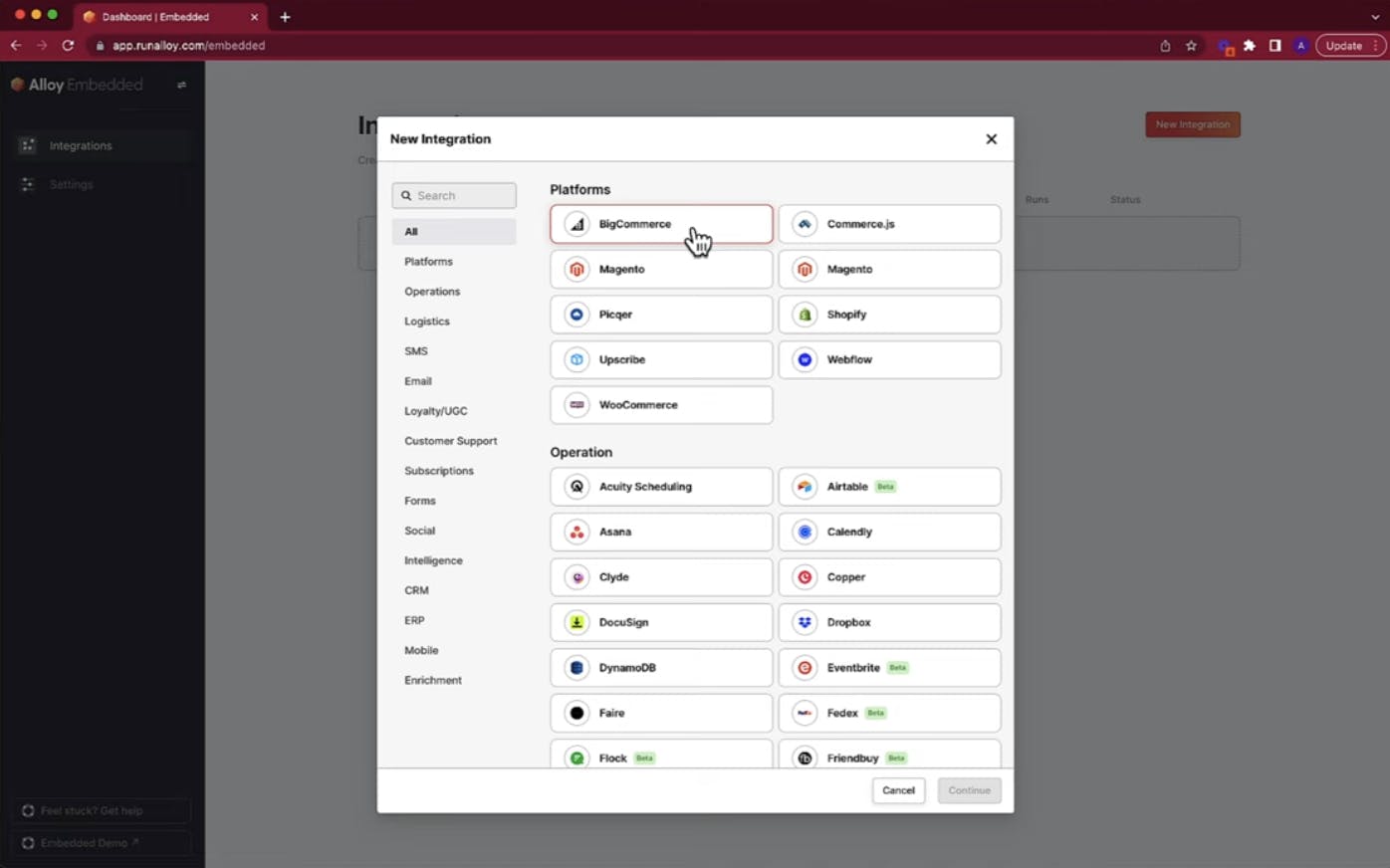

Suppose a business wanted to design its application so that it can communicate with a commerce platform such as BigCommerce. The first step would be to create a new integration with one of Alloy Automation’s 200+ supported applications that span categories ranging from data warehouse to customer support to loyalty programs.

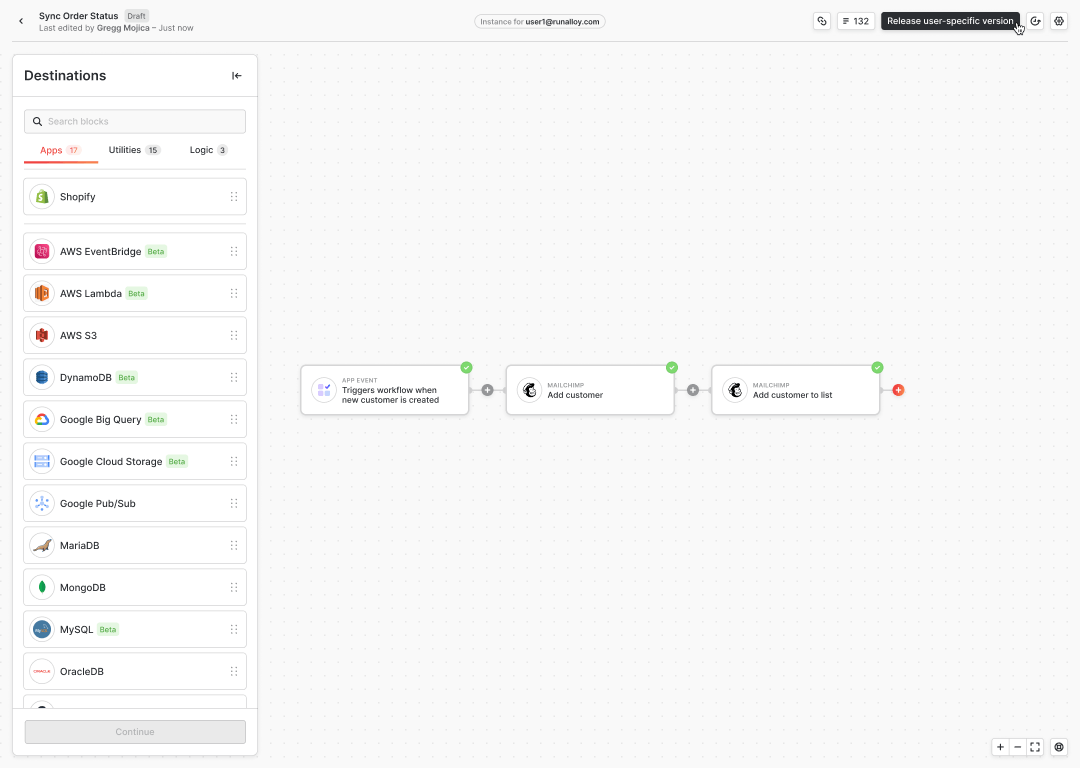

Source: Alloy Automation

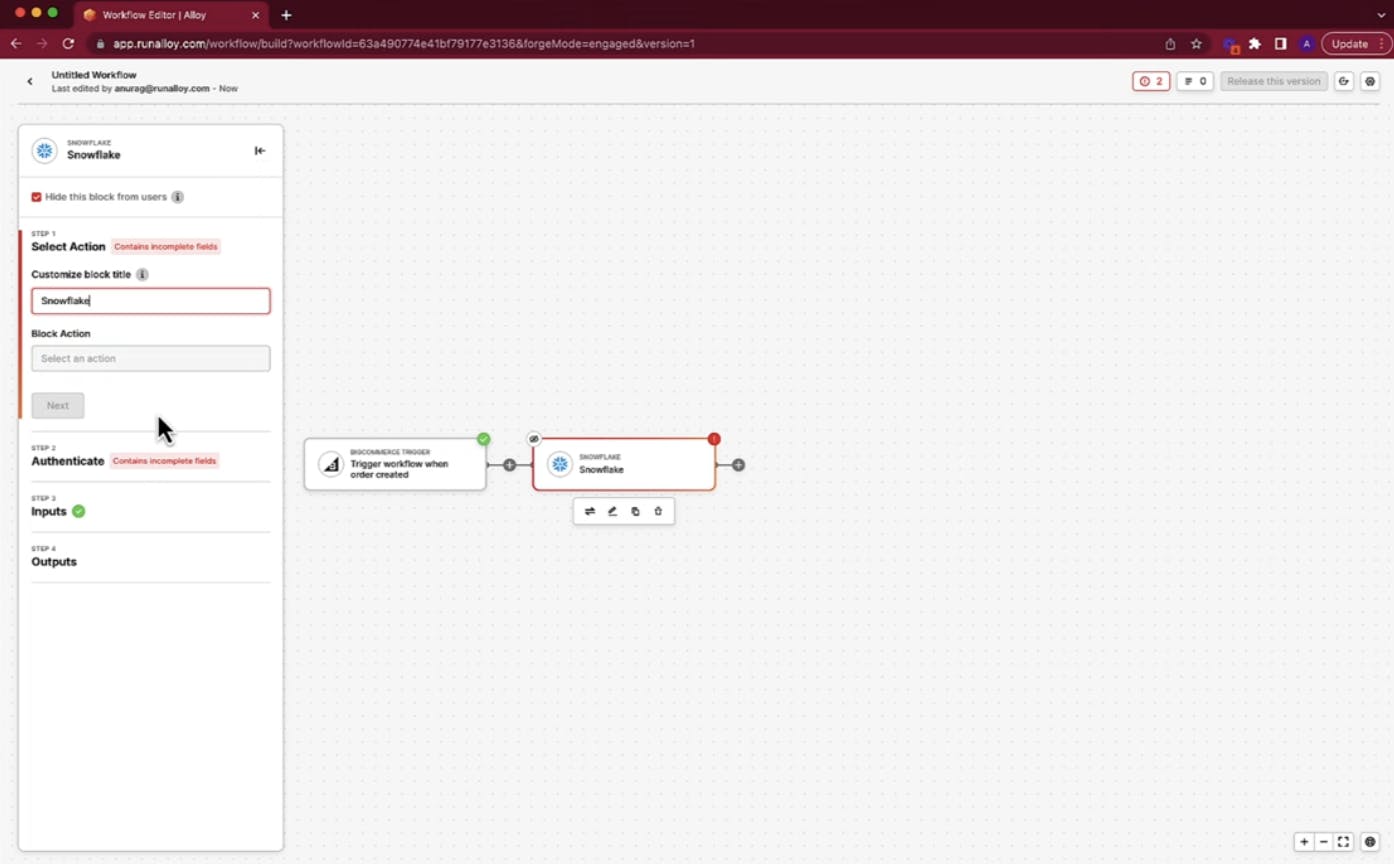

The integration isn’t useful until the company defines which workflows it should automate. To do so, a company would select the BigCommerce integration to create a new workflow. Suppose the process someone is trying to automate is the storing of the data associated with an order placed via BigCommerce to a data warehouse like Snowflake. The next action, then, is to define what event should trigger the workflow, such as an order being created on BigCommerce. The user then chooses what to do after the order is created, in this case, inserting data into Snowflake. Once this is complete, users click “Release this version”, and the workflow will be ready to go.

Source: Alloy Automation

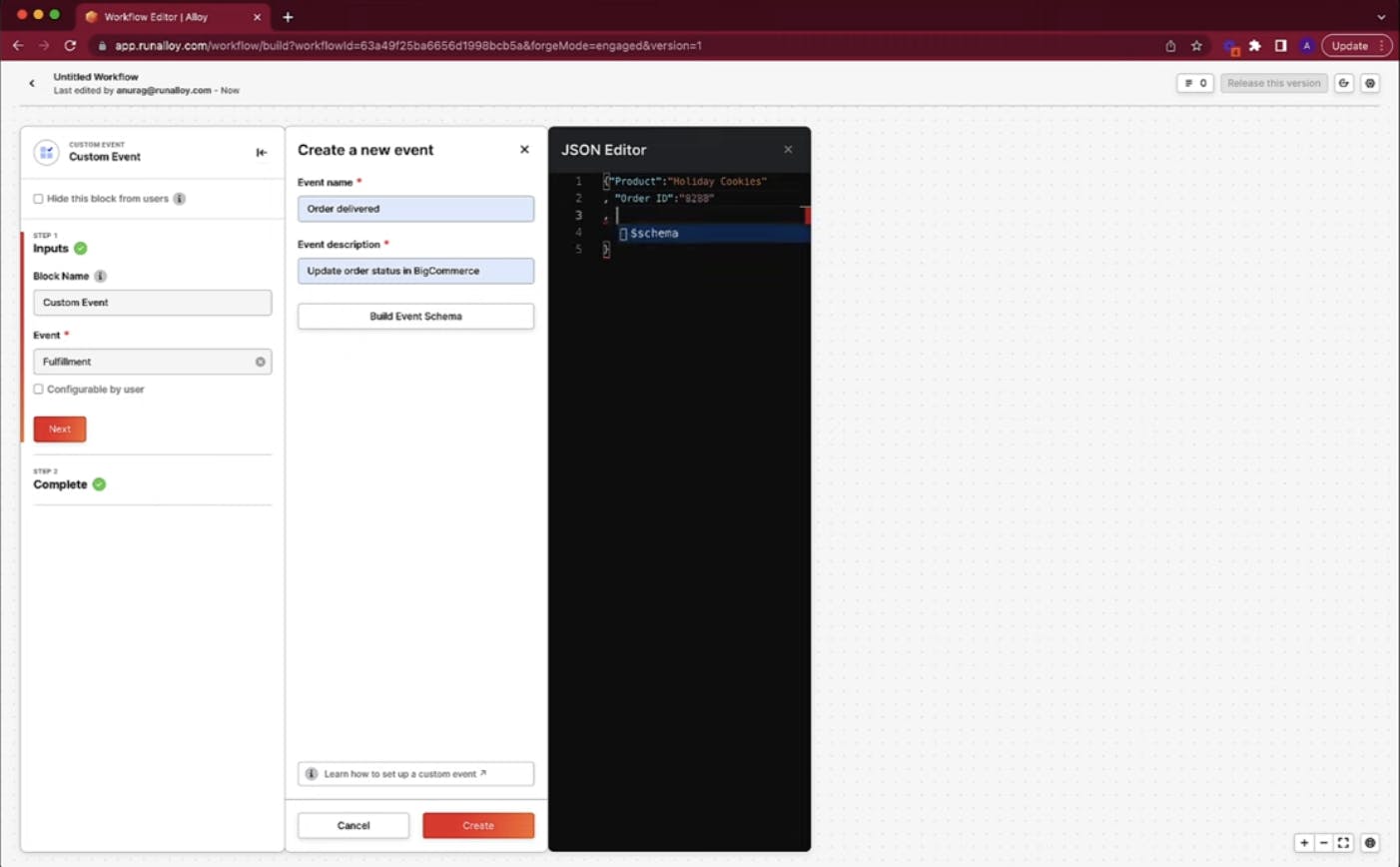

Alloy Embedded also allows for workflows that are triggered from custom events within your app, for instance pushing a status update to BigCommerce.

Source: Alloy Automation

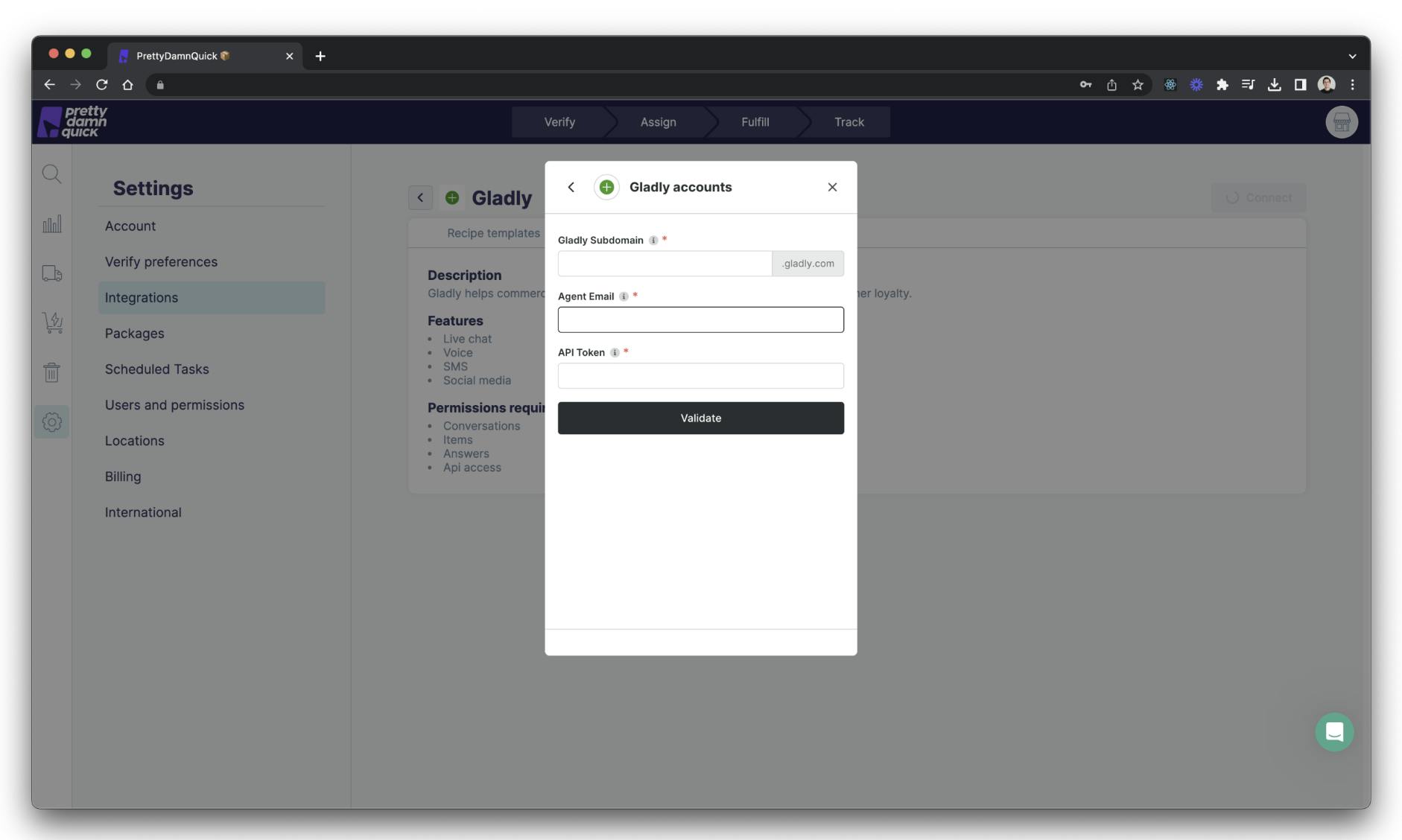

There are a few lines of code involved in setting up the software development kit (SDK) that enables Alloy Embedded to run but, after that, all of the code is abstracted away which enables enterprises to focus on building. Lastly, there is an Alloy Embedded pop-up modal that handles user authentication across all applications, so that the end-users of a product can enter their credentials. This modal can be stylized or edited depending on customer preferences.

Source: Alloy Automation

Alloy Embedded provides performance optimizations for clients. For instance, Pretty Damn Quick (PDQ), a fulfillment and delivery company, used Alloy Embedded to build their first integrations to Gorgias, Klayvio, and Gladly within two weeks and four days, saving four to six weeks of additional time and resources. This process also helped PDQ impress and onboard new merchants with a wide variety of integrations to other services.

Alloy Flow

Alloy Flow is the solution for the largest enterprise customers and offers the most powerful logic handling and support. One distinctive feature of Alloy Flow is what Alloy Automation terms OEM, which enables customization of workflows depending on the client. For instance, suppose one of Alloy Automation’s customers develops accounting software that helps large enterprises remain compliant. However, customers may start to have distinct requests that would customize their workflow. In other words, customers want a different workflow or process than other customers.

Source: Alloy Automation

Alloy Flow allows the accounting software provider to quickly spin out different workflows for each client, using the same intuitive interface that is used in Alloy Embedded.

Source: Alloy Automation

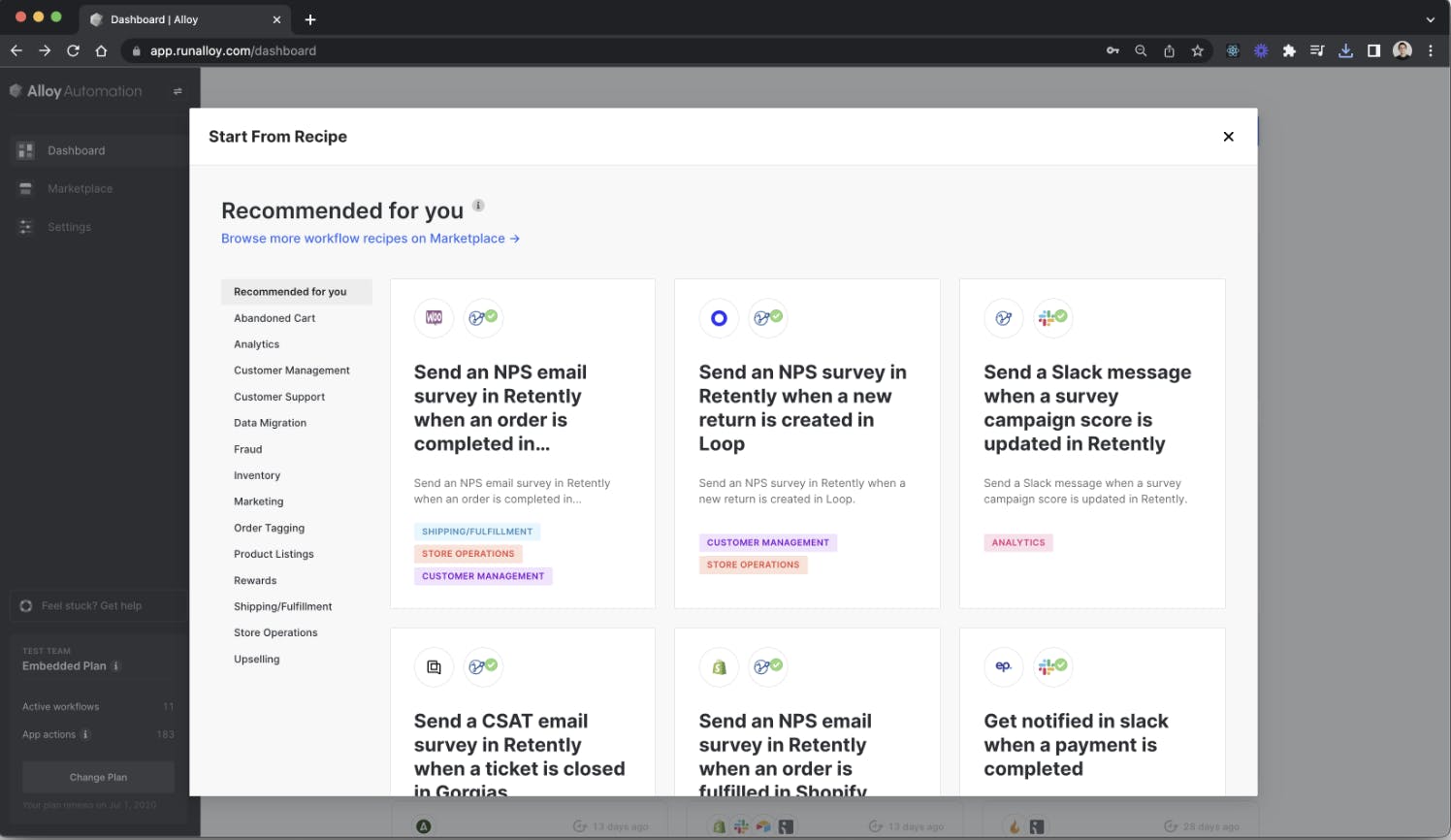

Alloy Automation has also curated a recipe book of hundreds of workflows that are commonly used, which allows for even more efficient integrations.

Source: Alloy Automation

The difference between Alloy Flow and Alloy Embedded is a matter of the “end-point” of the integrations. In Alloy Embedded, tech vendors (Alloy’s customers) want to integrate the product within their own systems. In Alloy Flow, the customers of the tech vendors (i.e. Alloy Automation’s customers’ customers) want to create customized workflows that connect to their own applications. In an interview with Contrary Research, Alloy Automation CEO Sara Du explained the product this way:

“The visual flow builder is for very enterprise users who have processes that can’t be contained in a modal, so you can capture a more complex data structure.”

Once again, there’s a natural progression here: as Alloy Automation’s customer grows and attracts larger customers with more complex needs, those customers may need to upgrade to the functionality offered by Alloy Flow.

Market

Customer

Alloy Automation’s primary customers are independent software vendors (ISVs) that sell software to customers for a variety of applications, including ecommerce, sales and marketing, shipping and logistics, and finance and accounting. Alloy Automation started out focused solely on ecommerce, so much of its current integration support is dedicated to the ecommerce tech stack. However, in June of 2023, Alloy Automation announced it was “open to business for everyone”, adding integrations and support beyond ecommerce.

Alloy Automation CEO, Sara Du, described the company’s target customer in a September 2023 interview with Contrary Research this way:

“Our ideal customers are product and engineering leads in mid-market to enterprise customers. Even though we got our start in commerce, we realized this year that it was time to expand beyond a single vertical. With that said, we don’t target SMBs in general because they typically don’t need the breadth or depth of integration coverage a tool like Alloy provides.”

Alloy Automation targets mid-sized to enterprise customers, including Amazon, Kibo, Gorgias, and Burberry.

Market Size

The global integration-platform-as-a-service (iPaaS) market size was valued at $5.3 billion in 2022, projected to reach $30.8 billion by 2028, representing a CAGR of 34.2%. Alloy Automation is focused on markets like ecommerce ($6.1 billion), CRM ($47.7 billion), ERP ($53.7 billion), and logistics ($33.4 billion). In total, Alloy Automation’s total addressable market right now includes around 30K SaaS companies worldwide, of which 6.4K are e-commerce and 8.4K are logistics; the number of SaaS companies could reach 72K by 2024. These verticals, representing Alloy Automation’s key customer base, have a combined market size of about $141.9 billion.

Competition

There are several segments of companies attempting to enable companies to better integrate their tech stacks such as (1) building a unified API, (2) enabling internal application integrations, and (3) providing self-serve integration platforms. In addition, there are a number of legacy incumbents that are adjacent competitors to Alloy Automation given their focus on enabling application integrations, but may not be as API-native.

Unified APIs

Rutter:* Founded in 2019, Rutter provides a unified API for payroll, commerce, fulfillment, and expense management. With partners and customers including Ramp*, Brother, and Mercury, Rutter has carved out a niche in payments and fintech. Rutter raised a $27 million Series A in 2022, led by a16z, with additional investors like Comma Ventures, Basis Set Ventures, and Haystack. Because its primary product is the unified API, which is better for smaller companies with less complex technological needs, most of Rutter’s customers are SMBs.

Merge: Founded in 2020, Merge provides a unified API for accounting, HR & payroll, applicant tracking, ticketing, CRM, marketing automation, and file storage. Merge has raised $74 million in total funding from investors like Accel, Addition, and NEA. Merge has customers like Drata, Navan, and Ramp*, with the majority of the company’s customers being in the early to mid-market startup phase.

Internal Application Integrations

Workato: Founded in 2013, Workato is an automation platform. When Workato announced its $200 million Series E at a $5.7 billion valuation in 2021, the company shared that it had 11K business clients. Unlike Rutter, Workato doesn’t provide a unified API, and therefore, does not attract SMBs, focusing on enterprise customers instead such as HP, Atlassian, Doordash, and Monday.com. Workato has a library of over 600K pre-built integrations across 1K applications across e-commerce, payroll, support, and IT, among others.

Tray: Founded in 2012, Tray claims to be the only AI-powered iPaaS solution in the market. When Tray announced its $40 million Series C in September of 2022, the company shared that it was growing revenue by 115% year-over-year, driven by the acquisition of large enterprise customers with over $100K+ of contract value per year. Investors include firms like the Canadian Pension Plan Investment Board, GGV, and Spark Capital.

Self-Serve Integrations

Zapier: Founded in 2011, with an estimated $5 billion valuation as of 2021, Zapier is another leader in the workflow automation space. Zapier serves over 1.8 million businesses, speeding up processes ranging from customer communication, and data management, to IT. In fact, Alloy Automation describes its fundamental business mission as similar to Zapier’s, in enabling automation, but highlights its niche position in e-commerce as one example of specialization vs. a generalized platform like Zapier.

Legacy Incumbents

MuleSoft: Founded in 2006, MuleSoft is an integration platform to connect SaaS, on-prem, and legacy software systems. The company grew to $296.5 million in revenue as of 2017 before it went public in March 2017. In March 2018, Salesforce acquired MuleSoft for $6.5 billion. MuleSoft has served several large enterprises, including Cisco Meraki, AT&T, and Siemens.

In regards to MuleSoft’s positioning in the competitive landscape with Alloy Automation, CEO Sara Du had this to say in an interview with Contrary Research:

“MuleSoft’s bread-and-butter was getting people to build out APIs, so they’re playing in a very old-school world. They’re helping people modernize APIs to begin with. So we don’t compete with them as much because they’re not supporting modern tools. They’re helping legacy companies catch up.”

Boomi: Founded in 2000, Boomi was an early player in the iPaaS market, originally serving on-prem integrations before launching a cloud-based product in 2007. In November 2010, Dell announced it was acquiring Boomi. Within Dell, Boomi grew to serve 11K customers including Bank of America Merrill Lynch, Gilead Sciences, and Comcast. In May 2021, Boomi was spun out of Dell and acquired by private equity firms Francisco Partners and TPG Capital.

Business Model

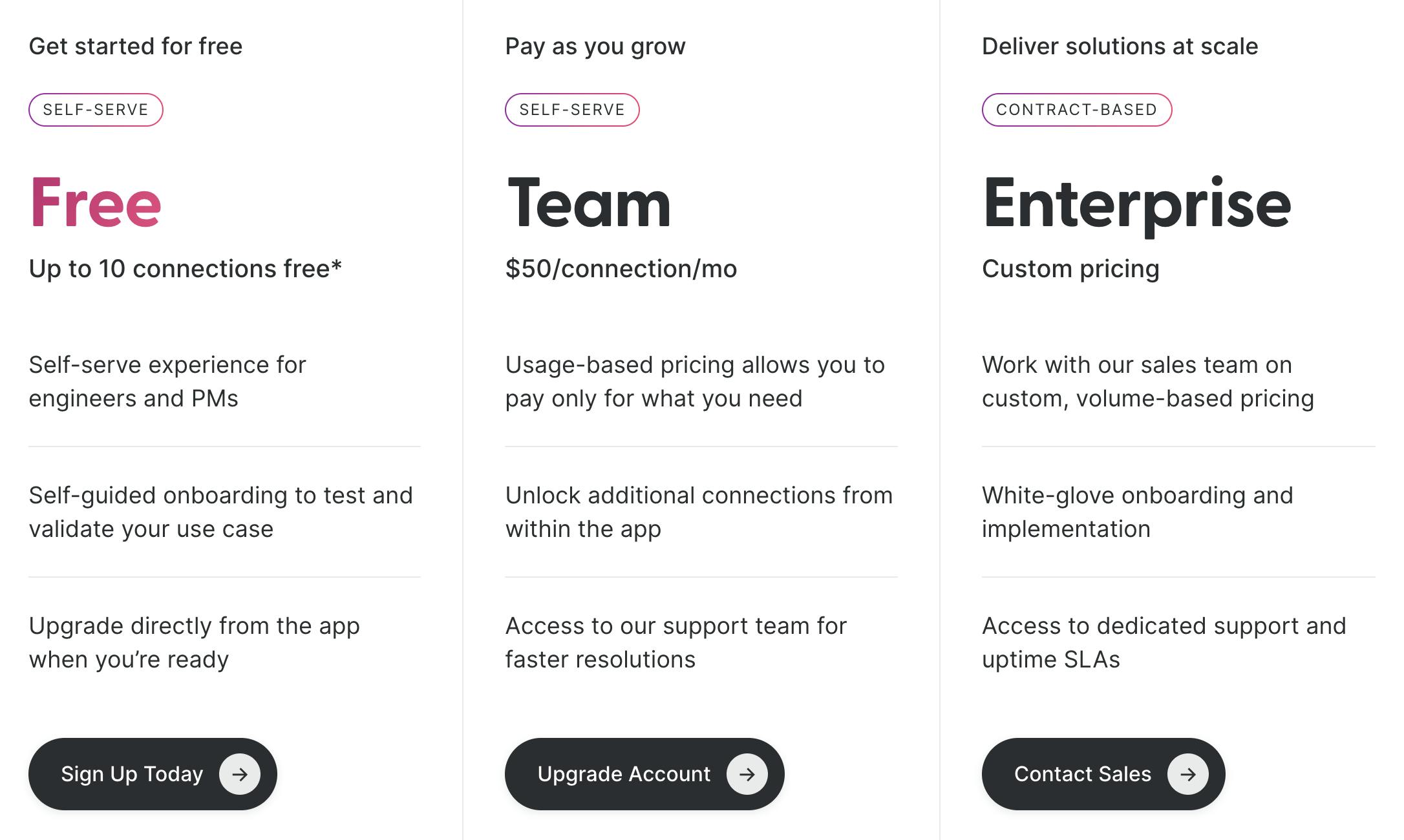

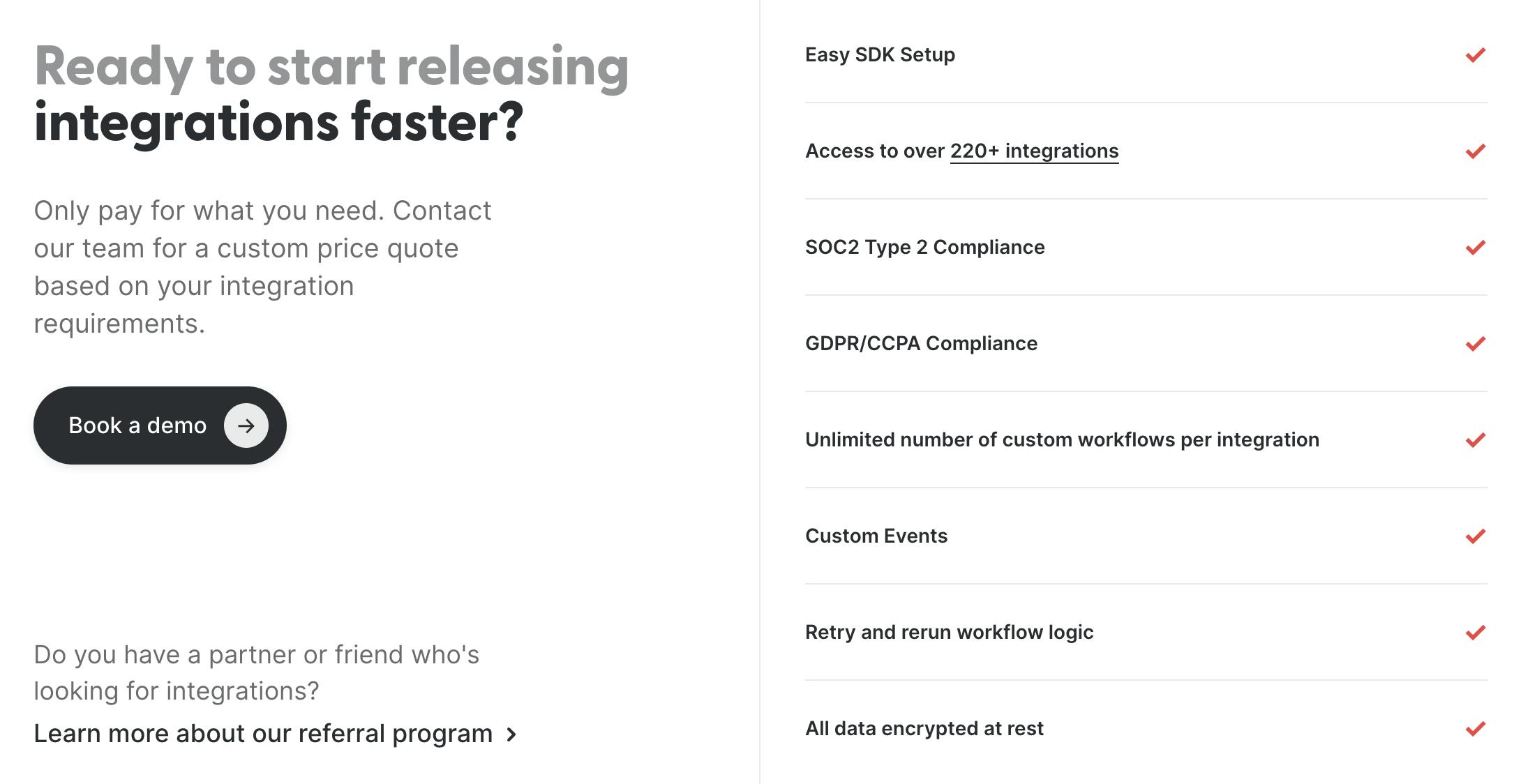

Alloy Automation offers a few different pricing plans depending on user needs and product lines across Alloy Embedded, Alloy Unified API, and Alloy Flow.

For Alloy Automation’s Unified API, customers who have less than 10 connections per month are totally free. Beyond that, teams pay $50/month. Customers can also contact Alloy Automation’s sales team to get a volume-based pricing plan.

Source: Alloy Automation

If the Unified API no longer reaches the complexity needed for an enterprise, the Alloy Embedded product is also a volume/usage-based pricing model that is more predictable for customers.

Source: Alloy Automation

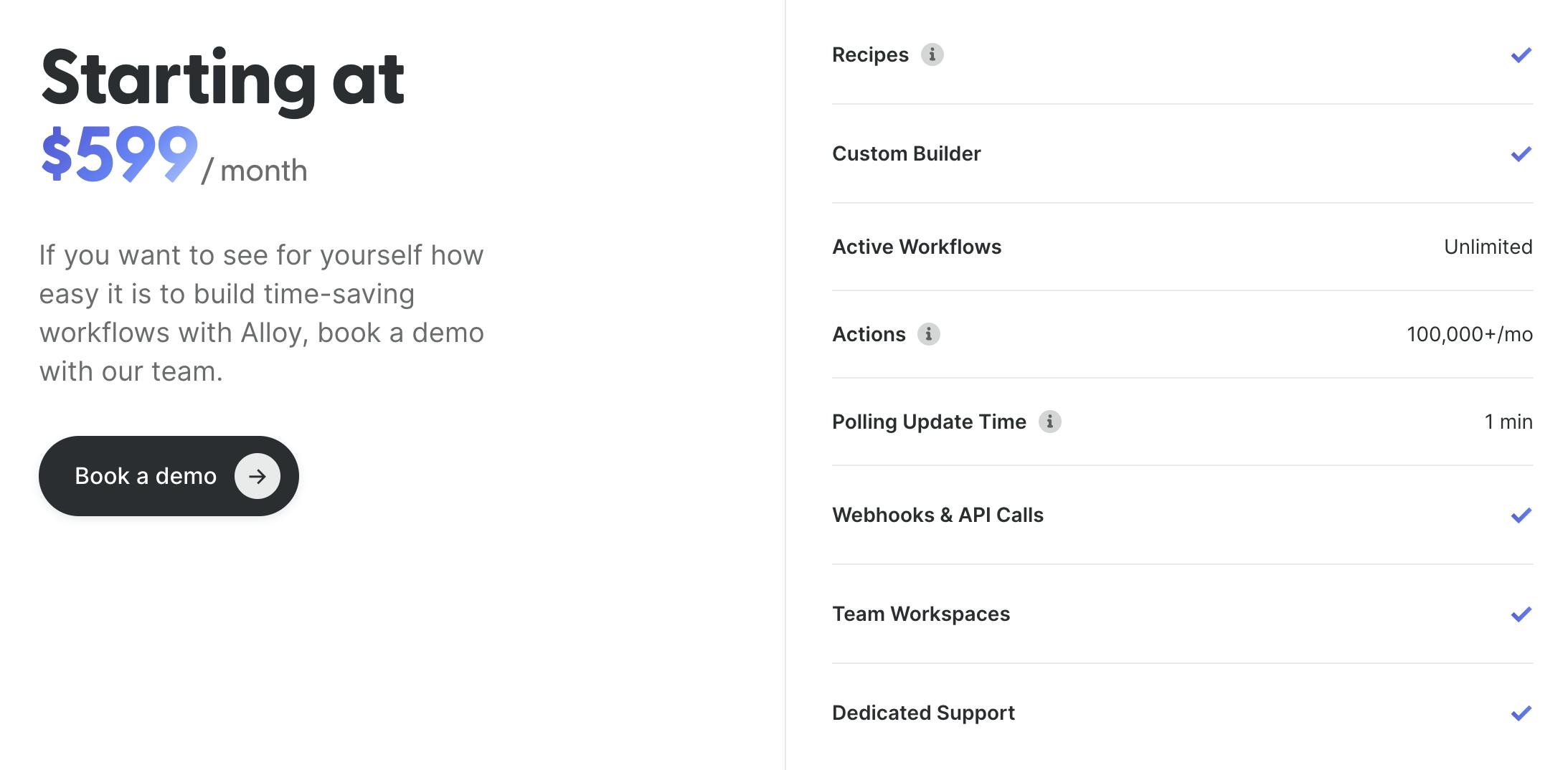

Finally, the Alloy Flow product starts at $599/month, although there may be additional costs depending on customer needs.

Source: Alloy Automation

Traction

In April 2023, Amazon announced a partnership with Alloy Automation to enable Buy With Prime. As part of the announcement, Alloy Automation co-founder and CTO Gregg Mojica described the partnership this way:

“Our integrations allow you to seamlessly connect your Buy with Prime data with your ecommerce platform. This is important because Buy with Prime sits independently from your ecommerce platform. By using Alloy apps, you can connect Buy with Prime to popular ecommerce platforms like Magento, BigCommerce, and WooCommerce to ensure you always have a single source of truth. We have apps for order syncing and catalog updating, so your critical store data is always up to date. Using the Alloy apps can save you time so you can focus on growing your business and building customer relationships.”

As Alloy Automation CEO Sara Du told Contrary Research in an interview, through having Amazon as a customer, Alloy Automation is powering trillions of API requests and indirectly enabling brands like Anker and Mr. Beast.

Valuation

In February 2022, Alloy Automation announced a $20 million Series A at an undisclosed valuation led by a16z’s David Ulevitch, with additional investors including Bain Capital Ventures, BoxGroup, and FirstMark Capital. This brought its total funding to $25 million.

Key Opportunities

The Artificial Intelligence Wave

In a September 2023 interview with Contrary Research, Du shared that she views artificial intelligence as a major opportunity for Alloy Automation’s business:

"While we manually build API connections today each time we add a new integration, AI can streamline that. We could leverage LLMs to default connect APIs when a company’s API docs become available. Eventually, even internal docs can eventually become standardized and get ingested, so it dramatically changes the onboarding engine. More APIs are going to get built, and we can be the platform to string those things together.”

Large language models are already making it much easier to design new APIs, particularly to access non-existent endpoints. For instance, one of Shopify’s users might notify them that some functionality is missing, such as getting detailed information about an order. Shopify can then generate this endpoint and ship it to the user. However, the problem is that this new endpoint is not yet integrated with the user’s other applications. As the connectivity layer for SaaS applications, Alloy Automation can provide automated connections between more endpoints as AI makes it easier to create them.

Horizontal Scaling

Alloy Automation’s expansion beyond commerce allows it to reach a new set of players in CRM, ERP, logistics, and other verticals. In July 2023, Alloy Automation announced integrations with accounting and ERP tools like Oracle Netsuite, Intuit, and Xero. In the future, connecting with different types of tools will allow Alloy Automation to become the single automation provider for enterprises with complex needs and steal market share from existing players.

Key Risks

Competitive, Fragmented Landscape

From unified APIs like Rutter and Merge to integrators like Workato and Tray, there are a number of options available for businesses grappling with integration challenges. As Alloy Automation scales, it will need to displace some of these existing solutions. One initial step the company took was broadening its addressable market outside of e-commerce. Additionally, in an interview with Contrary Research, Sara Du outlined the risk of vendor exhaustion in this category:

“There are a lot of unified API vendors that pop up all the time. Companies will be burned by smaller vendors that only have one model, and that forces customers to use more than one provider. That could sour people’s experience with integration platforms, and change people’s willingness to buy vs. feeling like they have to build.”

Consolidation of Software Spend

While the average company typically relies on 254 different SaaS tools, the macroeconomic turmoil that began in 2022 has pushed many companies to look for opportunities to consolidate their spend. As of July 2023, 75% of executives were looking to consolidate the number of software vendors they were working with, up from 29% in 2021. As businesses leverage fewer integrations, Alloy Automation will have to demonstrate continued value within core applications (e.g. CRM, HRIS, e-commerce, etc.)

Risk of In-House Integrations

The proliferation of third-party applications is the tailwind Alloy Automation capitalizes on, which relies upon the assumption that companies would prefer to buy software rather than build it in-house. Nevertheless, the introduction of LLMs might accelerate the process by which firms can build integrations in-house, which would reduce the use cases for Alloy Automation. Alternatively, an LLM might eliminate the need for these integrations in the first place. One driver of the move to build more integrations in-house is the inherent risk of using third-party software. External integrations can potentially expose a company to significant third-party risks that are difficult to mitigate, which could be exploited and cost enterprises millions of dollars per attack due to breaches in consumer data.

Summary

Alloy Automation’s Unified API, Embedded Modal, and Flow automation for enterprises accelerates and simplifies the process through which SaaS applications can be integrated together. This integration process can save hours of repetitive manual work per week, allowing Alloy Automation’s customers to focus on the clients they’re serving. At the company’s founding in 2019, Alloy Automation described itself as Zapier for e-commerce. In 2023, Alloy Automation announced plans to expand beyond commerce and into other core business functionalities.

Over time, Alloy Automation will have to demonstrate its ability to be a ubiquitous tool across categories as well as capable of competing with enterprise-grade solutions like Workato. The increasing complexity of integrating tech stacks will likely create more opportunities for Alloy Automation, but the company will also have to be watchful as some companies look to consolidate their software spend.

*Contrary is an investor in Alloy Automation, Ramp, and Rutter through one or more affiliates.