Thesis

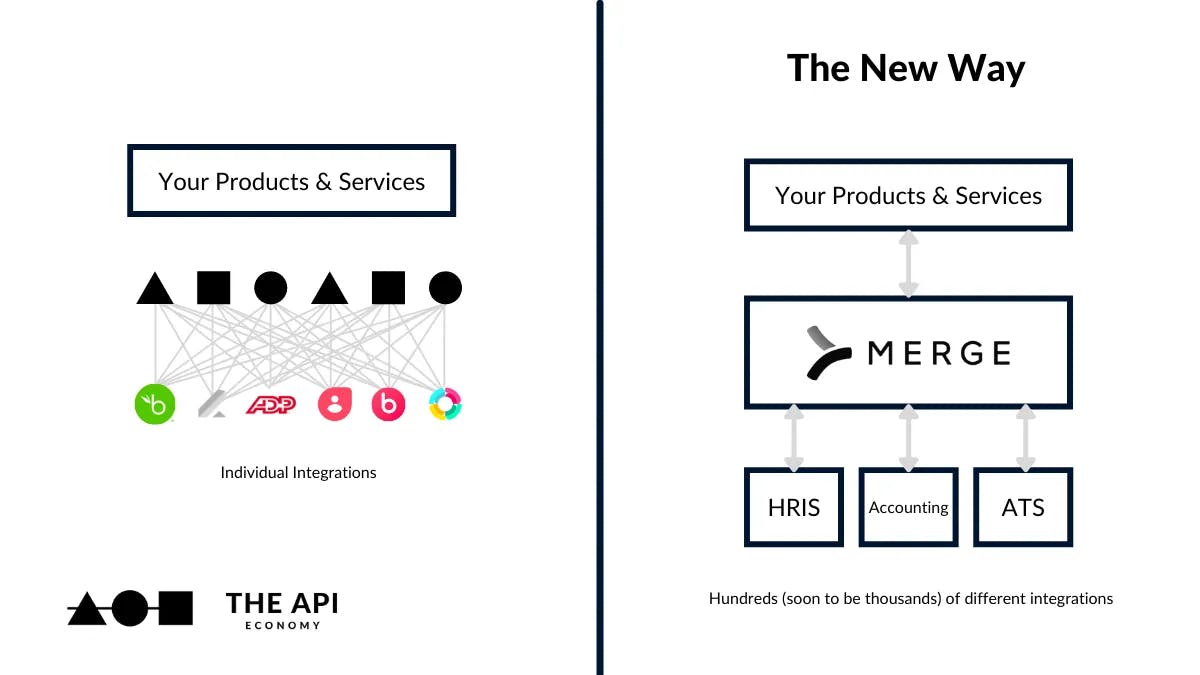

Building integrations is a key part of building enterprise software. One study reported that the average enterprise organization uses 175+ applications. Integrating with other relevant applications that organizations already use can be table stakes for enterprise companies looking to sell into these organizations.

Building and maintaining integrations can be resource-intensive and time-consuming. There’s an increasing expectation for software vendors to have an ecosystem of integrations to streamline workflows. The largest SaaS platforms, like Salesforce and Shopify, have ecosystems with 2K+ integrations.

Merge has built a Unified API that allows software companies to build and maintain key integrations with dozens of HR, CRM, and ATS systems in weeks instead of months, allowing them to build a more user-friendly product while saving time across engineering, sales, partnerships, and customer success teams. The company wants to be the integration layer for every B2B company, allowing anyone to leverage Merge’s connections to any other SaaS tool.

Founding Story

Merge co-founders Shensi Ding and Gil Feig first met in their freshman year at Columbia. They took computer science classes together and served as Class President and Vice President of the Columbia Engineering Student Council. After college, Ding and Feig both ended up at startups in San Francisco. Ding was the Chief of Staff at Expanse, a cybersecurity SaaS company, while Feig was Head of Engineering at Jumpstart, a recruiting SaaS company. Though they worked in different verticals, they both ran into the same problem — the prospective customers of their respective startups kept asking them to build more integrations.

One evening while the two friends caught up over a regularly scheduled weekly dinner, Feig vented about a project at work building a Greenhouse integration that was the “bane of his existence.” It was a critical thing that the team needed to build, but it was drawing resources away from efforts to build new features aligned with the core competency of Feig’s company.

Meanwhile, Ding’s sales team at Expanse consistently asked the executive and engineering teams to invest in building integrations because they were losing customers to other competitors that already had those integrations built. Thus, both of them stumbled upon the same problem with integrations.

They saw that this problem was not just one they faced but was generalizable across the enterprise software world. Realizing this, Ding and Feig found Merge to solve the integration problem by creating a product that allowed engineering teams to build and maintain integrations quickly. They began with integrations with Human Resources Information Systems (HRIS) and Applicant Tracking Systems (ATS) vendors.

Product

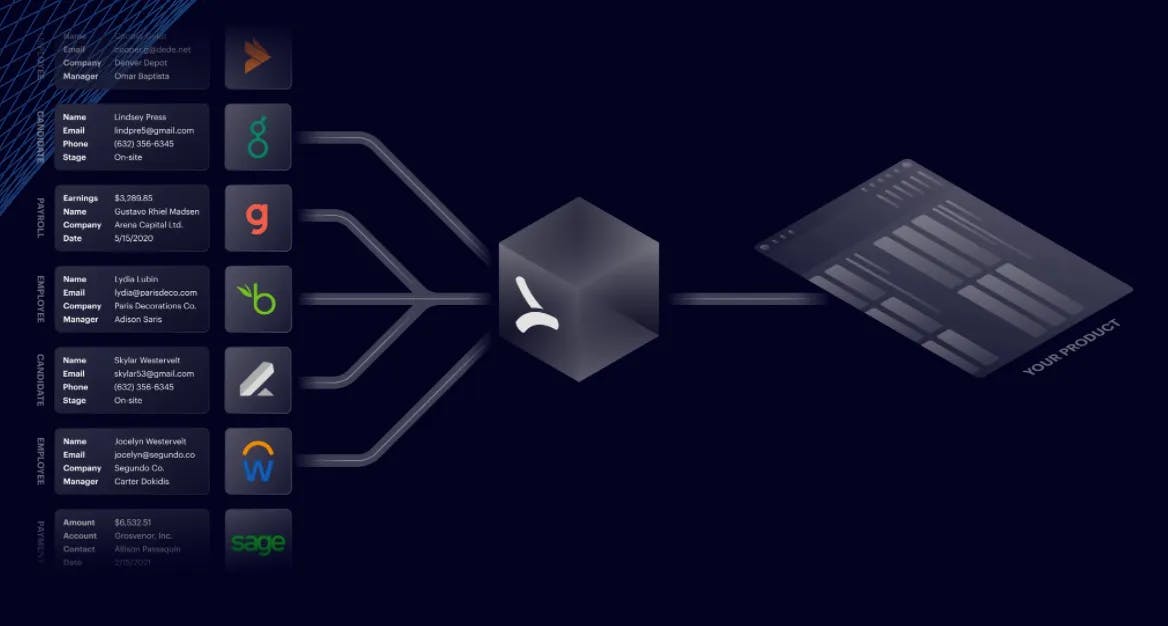

Merge’s product is built around a “Unified APIs that authenticate, normalize, and sync data across API providers so SaaS companies can easily offer multiple integrations to their end customers. Developers integrate once with Merge to offer a full category of integrations and easily maintain integration health.”

By providing this functionality, Merge allows engineering teams to speed up product roadmaps, decreases the cost for experimentation for product teams, and improves the ability of sales teams to win new customers by removing integration-related blockers to deals.

One analogy for Merge’s product is something like Plaid. Just as Plaid connects with hundreds of banks and financial institutions so that fintechs do not have to build those connections individually on their own (instead, they can just use Plaid to build connections to all of them), Merge connects with hundreds of HRIS, ATS, Accounting, Ticketing, and CRM players so that enterprise software companies can use Merge to build integrations to any of those players. This is illustrated in the diagram below:

Source: The API Economy

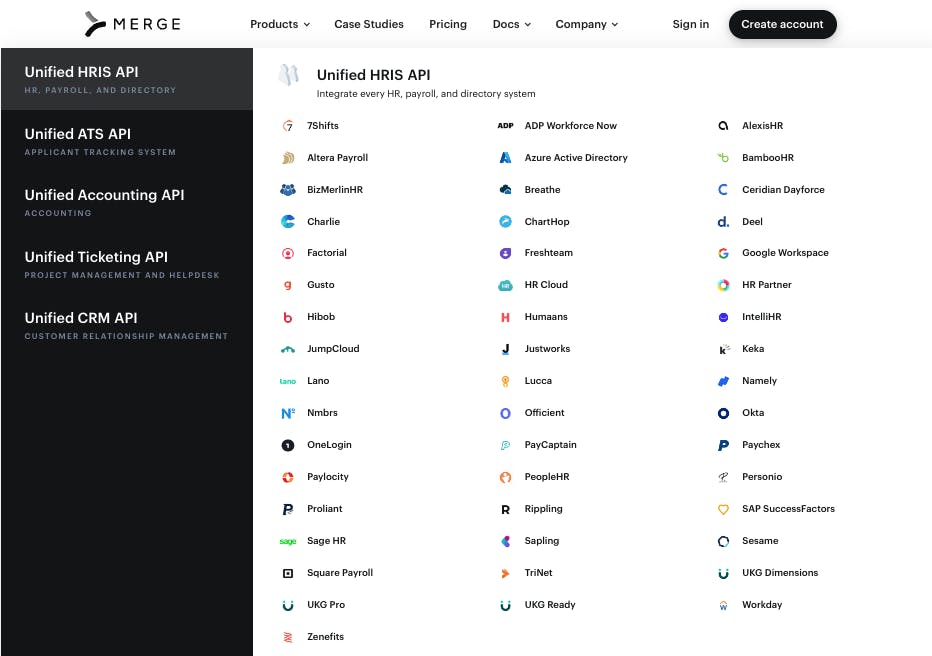

Merge has built and released 150 integrations in 2 years. The suite of integrations that Merge offers is constantly growing. Merge has intentionally invested in building integrations across multiple categories instead of focusing on one category at a time. This is because Merge realized that the market size for just one category would be too small and that most B2B companies needed to integrate with multiple categories.

Source: Merge

Merge’s product can be broken down into a few key components:

Unified API

This is a “single programming interface” that allows developers to sync data from multiple third party platforms. Merge has sought to make its Unified API easy and painless to use. It has invested in comprehensive API documentation, and security in its integrations. It has also created software development kits (SDKs) in multiple languages, allowing users to integrate Merge with just a few lines of code. Once integrated, Merge provides real-time analytics and alerting.

Additionally, beyond just helping companies with the building of these integrations, Merge places emphasis on effectively monitoring and maintaining integrations, striving to make its customer success team fully empowered to manage integrations after they go live.

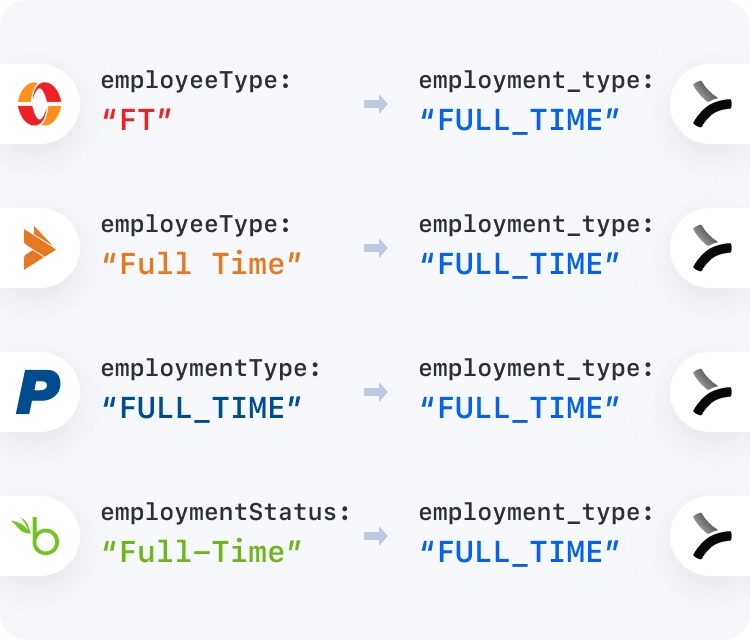

Common Model

A data model that standardizes data across multiple third party platforms. Merge users can receive and update their Common Model through the Unified API.

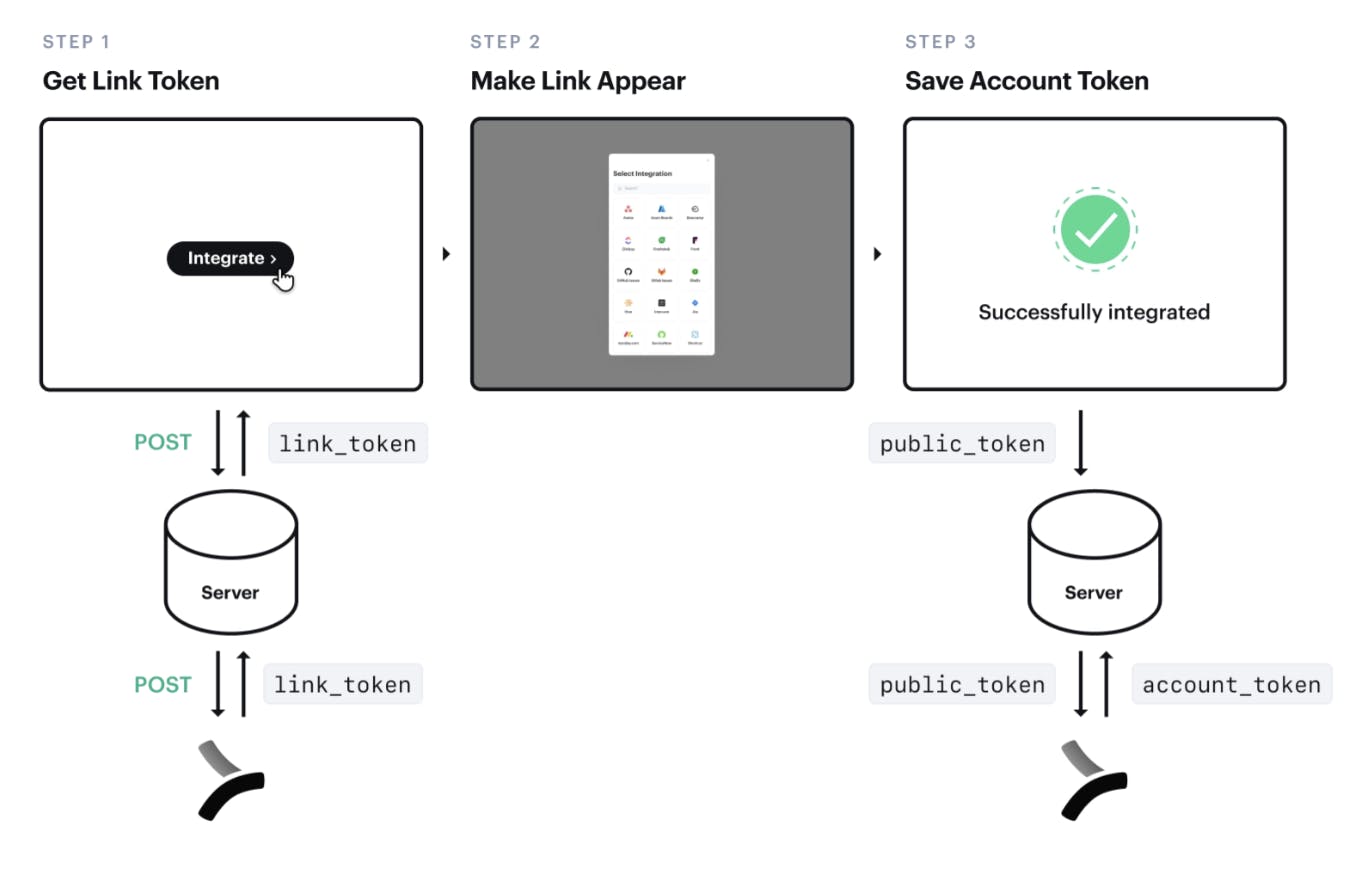

Merge Link

Source: Merge

Merge Link is a UI component hat guides the end user through connecting to the third-party platform. It’s a similar flow to Plaid link, where a user is prompted to pick their bank and provide their authentication details so that Plaid can access their bank data and feed it to the app the user is on.

Market

Customer

Merge’s customer is any enterprise software company that could improve their product offering by integrating with other software. One example is Ramp*, who used Merge to build critical HR integrations quickly. Ramp, a company that makes corporate cards, was building a new product called “Ramp for HR”, which was meant to enable a company to onboard new employees to Ramp with one-click. Legacy employee onboarding processes involved HR admins manually managing data for any new team member, but Ramp for HR sought to pull employee data instantly from the company’s existing HR platforms so that companies could more easily invite new employees to Ramp. Ramp was able to use a number of HRIS integrations from Merge Link using only two engineers.

Merge’s product seeks to provide value not just to the enterprise software user, but to the HRIS, ATS, Ticketing, and CRM platforms to which Merge has built integrations. While partnership teams at these platforms once had to wait for potential partners to spend 3+ months integrating with them, Merge has accelerated that integration process. As more software vendors are integrated with these platforms, those platforms get stickier. In the words of Merge co-founder Shensi Ding, “their product is the source of truth, and it becomes impossible for their customers to move off of them when every other vendor they use is integrated with them.”

Market Size

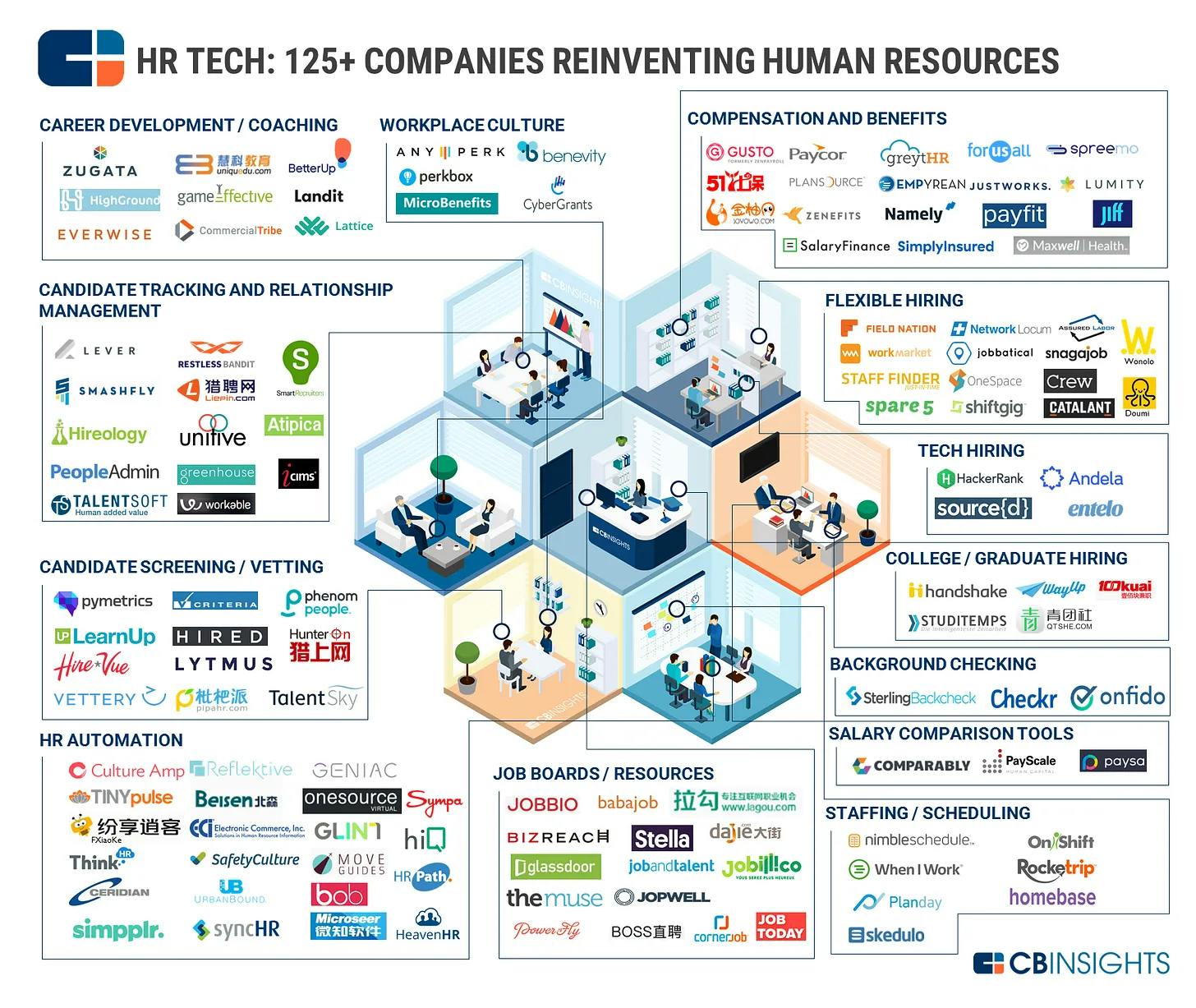

Merge’s market can reasonably be understood to be every enterprise software company that needs to build integrations. Merge’s initial integrations were focused on HRIS and ATS categories. There are hundreds of players in the HR tech market, and the best enterprise software offerings that work with HR resources would ideally integrate with as many players as possible. Workday, for example, has over 600 integrations. That means developers at 600 other software companies have each spent the time to build the same integration so that their software can work with Workday.

Merge has expanded into building integrations with Accounting, Ticketing, and CRM softwares into its Unified API. The company’s current market is more of a blue ocean — it doesn’t yet exist in a fully-formed, mature state, and Merge is creating demand for a new type of solution. One way to conceptualize the size of this new market is to consider:

The number of enterprise software companies out there that work with other enterprise software solutions

The significant quantity of integrations across HRIS, ATS, Accounting, Ticketing, CRM, and other systems that a given enterprise software solution could build

The value of engineering resources — engineering headcount is expensive. Any player, like Merge, that allows companies to significantly save on engineering resources is valuable

Source: CB Insights

Competition

There is a growing set of players that are seeking to build APIs that allow companies to integrate with other data sources. Many players have chosen to go deep in one or related verticals or broad in various categories after building momentum in one vertical. Merge is strictly focused on empowering B2B enterprise software integrations, whereas some players also enable B2C integrations.

Some notable competitors in this category include:

Rutter* — Rutter is building a universal API for commerce data. In March 2022, it announced that it raised a $27 million Series A led by Andreessen Horowitz. Rutter has previously said it launches “about five new integrations every month” and plans to support “more than 100 integrations” by the end of 2022. It also reported that the company grew 10x in revenue from Q2 2021 to March 2022.

Codat — Codat is building a universal API for small business data. In June 2022, it announced that it had raised a $100 million Series C led by JP Morgan Growth Equity Partners, with Plaid and Shopify participating as strategic investors. Codat has more funding than Merge, and is tackling the “universal API” space starting from commerce data, whereas Merge began with HR data. Merge has noted that it mainly competes with Codat in the Accounting category, and that Merge has “been able to reach feature parity with Codat in a significantly shorter period of time.”

Paragon — Paragon seeks to be the “Plaid of SaaS apps.” It announced a $13 million Series A in July 2022. Paragon has built integrations with SaaS apps like Salesforce, HubSpot, Slack and Shopify. It also launched an integration builder that allows its customers to create custom integrations. In July 2022, Paragon reported that it was servicing around 100 million API requests per month across its customer base.

Workato — Workato is a workflow automation platform that has moved into the embedded integrations space. In November 2021, it raised a $200 million Series E at a $5.7 billion valuation. In that funding announcement, Workato reported that it had 11,000 business customers.

Finch — Finch is building a universal API to connect with all payroll, HR, and benefits systems. In June 2022, it announced that it had raised a $15 million Series A led by Menlo Ventures. In the funding announcement, Finch reported that it was serving over 10K employers ranging from startups to publicly traded companies, including Pave*, Vanta, and Teampay. Merge has noted that it provides a more white glove experience and higher quality integrations, and that they have seen a number of customers switch from Finch to Merge.

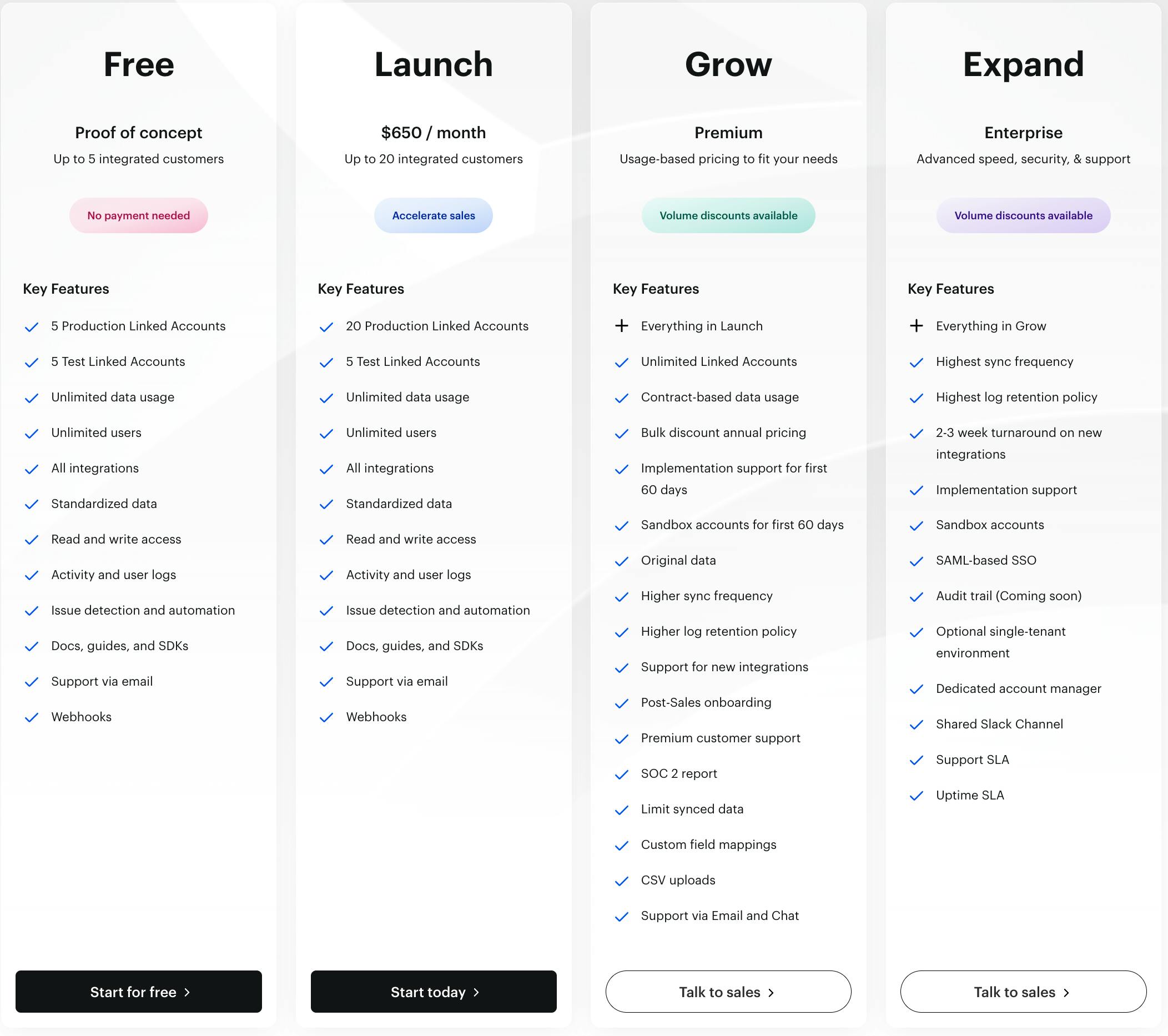

Business Model

Merge has a tiered pricing model, starting with a free tier, with the highest tier being an enterprise tier. Higher tiers offer more integrations and more white glove support. The second lowest tier, Launch, is priced at $650 per month, and pricing for the two highest tiers, Grow and Expand, are not shared publicly.

Source: Merge

Traction

In October 2022, in conjunction with its Series B funding announcement, Merge shared that it had grown ARR 30x over the past 12 months and that over 2,500 companies including TripActions, Ramp, Bill.com, Drata, AngelList, Deed, and Apollo use Merge to build integrations. The company has built and released 150 integrations in 2 years.

Merge has offices in San Francisco and New York, and the team grew from ~15 to ~55 people in 2022. It has a 100% in-person team and culture, and is looking to grow to over 100 employees over the course of 2023.

Valuation

In October 2022, Merge announced its $55 million Series B led by Accel, with participation from NEA and Addition. This brought its total funding to $75 million. Merge did not disclose the valuation for the round, but did note that the valuation 4X’ed from the Series A. If we assume a typical ~20% dilution for the Series A, then the $55 million raised implies a post-money valuation of ~$300 million.

Key Opportunities

Expanding Into New Categories

Merge’s main opportunity lies in expanding into new categories. As Ding has noted, most B2B companies need to integrate across multiple categories to unlock new use cases and further lock in a place in the tech stacks of its customers.

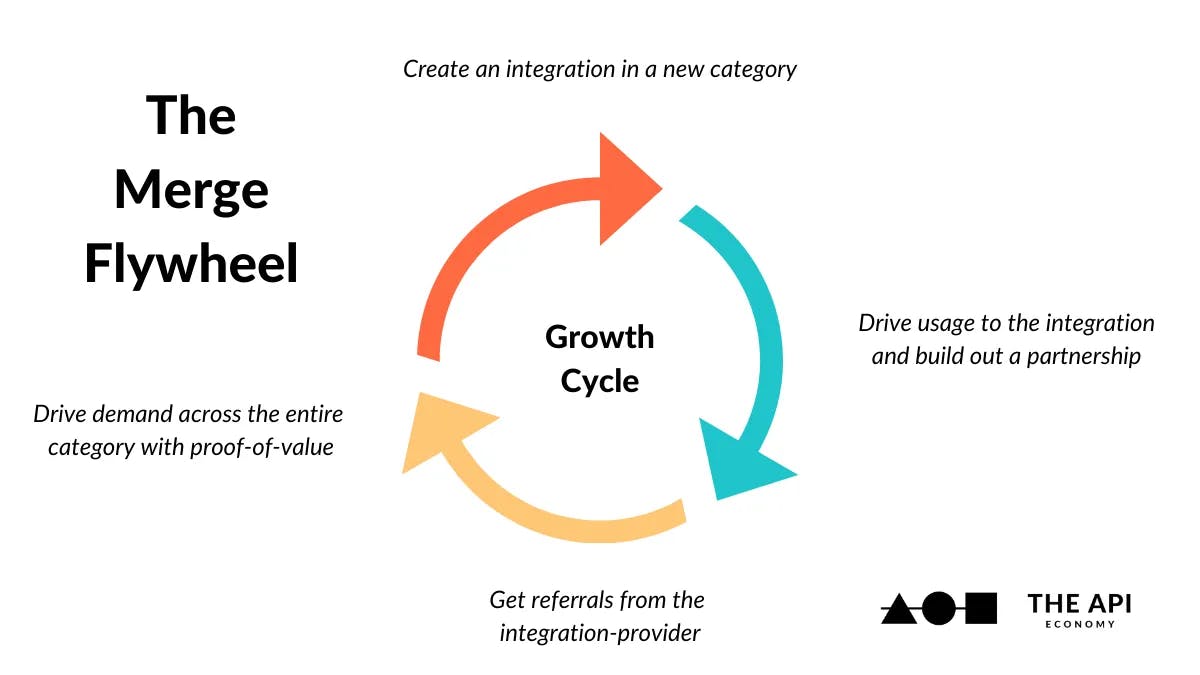

Continuing Its Flywheel

Merge can continue running on its flywheel. Every new successful integration it creates drives new usage to the platform across its entire customer base. The platforms it integrates with are benefiting from the increased activity driven by Merge and are incentivized to promote Merge and send more business Merge’s way through word of mouth or case studies. For instance, after Merge built an integration with HireBeat, the CEO of HireBeat began to promote Merge.

Source: The API Economy

Key Risks

Competition

Merge has to deal with competition coming from both its initial beachhead market of HR systems as well as competition from strong, well-capitalized “universal API” players that started in other categories but can expand into Merge’s current categories. Factors that could determine the eventual winners and losers of this competition include:

Developer experience

Quality and quantity of integrations

Customer support

Pricing

Summary

Merge is tackling a problem common to most enterprise software companies — the need to build integrations and maintain them easily. Merge allows companies to build integrations with dozens of platforms across the HRIS, ATS, Ticketing, Accounting, and CRM categories in weeks instead of months. It allows engineering teams to speed up product roadmaps, decreases the cost of experimentation for product teams, and improves the ability of sales teams to win new customers by removing integration-related blockers to deals. In this blue ocean market, it remains to be seen who will eventually emerge from a sea of competitors tackling the integration challenge.

*Contrary is an investor in Ramp, Rutter, and Pave through one or more affiliates.