Thesis

Junior financial research analysts spend up to 40% of their day gathering data. With over 325K financial and investment analysts in the US alone, this inefficiency affects a large workforce. While other areas in finance like trading have seen operational efficiencies from new technologies, financial research has largely remained untouched. With the exception of the introduction of Excel in 1985, which transformed financial modeling practices, the act of finding the correct inputs for those models remains a largely manual process.

This inefficiency persists due to the fragmented and unstructured nature of financial data. Analysts must manually consolidate information from diverse sources such as financial statements, earnings calls, management meetings, and news stories, each often in different formats and platforms. While search engines like Google have improved information retrieval for general online content, they fall short when dealing with proprietary financial data, which is often locked in PDFs or behind paywalls, leaving analysts to gather and synthesize this information.

This drag on productivity has been detrimental to the industry. While research quality has improved over time, regulatory changes such as MiFID II, an oversupply of research firms, and an influx of alternative research sources have put pressure on the profitability of equity research. Increasing the productivity of junior research analysts would help buck this trend. But while the problem of data gathering is most acute in financial services, all large corporations must grapple with it. Whether getting competitor intel or scoping out new acquisition targets, the data required for these tasks is often difficult to retrieve.

AlphaSense is an AI-powered market intelligence platform that consolidates and analyzes financial data from various sources, including company filings, earnings calls, and expert interviews. It serves financial services firms and corporations, providing tools for efficient research, competitive intelligence, and market trend analysis. The platform's key features include advanced search capabilities, AI-driven summaries, and real-time monitoring of market trends. As of October 2024, AlphaSense has over 4K corporate customers, including 85% of the S&P 100.

Founding Story

AlphaSense was founded in 2008 by Jack Kokko (CEO) and Raj Neervannan (CTO). The company officially launched in 2011.

Kokko began his career in investment banking as an analyst at Morgan Stanley in 1997. While there, he convinced Morgan Stanley to move from London to Silicon Valley with the intention of meeting a cofounder after his banking stint. He would later state in an interview that he “quickly realized how challenging it was to find key insights and data at the speed and reliability that the [investment banking] job required.”

Kokko left Morgan Stanley in 2000 and spent the next eight years building a semiconductor company called Silecs, which was eventually acquired in 2014, with a friend from undergrad. In 2006, while still at Silecs, he began an MBA program at Wharton. While working on a business case study with Neervannan, who was a classmate at the time, he was reminded of the same research challenges he encountered back at Morgan Stanley. As he later recalled:

“This problem still was there, that it was still incredibly hard to find information. It was very manual. All of these search technologies and other machine learning, AI, [and] other technologies that had come about for many consumer applications, you had consumer web search engines and other things making things incredibly easy to find information on the web, but none of this really applied in the business world for finding business information.”

Neervannan, who went on to co-found AlphaSense with Kokko, echoed the same point: they noticed the shortfalls of using Google for their research, specifically as it related to answering business-related questions. There were limitations with relying on Google for research stemming from keyword searches, uncertainty on missing information, non-reactivity to new information, and limitations on searching through PDF documents.

Upon graduating from Wharton in 2008, Kokko and Neervannan agreed to partner on a venture together. They spent three years validating the idea for AlphaSense while building out the technology. In 2011, they launched the MVP, at the time called Information Discovery Engine, which targeted portfolio managers and investment analysts.

Product

AlphaSense is a market intelligence and search platform that is intended to allow users to expedite research and diligence. It uses AI and natural language processing (NLP) to analyze a wide range of data from various sources including SEC filings, annual reports, industry research reports, transcripts from corporate earnings calls, and more.

AlphaSense’s platform allows users to search across all of these sources to find trends, risks, opportunities, and competitive insights. It's intended for use by financial analysts, researchers, corporate strategists, and anyone looking to track markets, industries, or companies. In addition, AlphaSense's AI capabilities are designed to make it easier to find critical data and analyze large datasets efficiently. Its platform provides users with several content categories and features, as described below.

Content

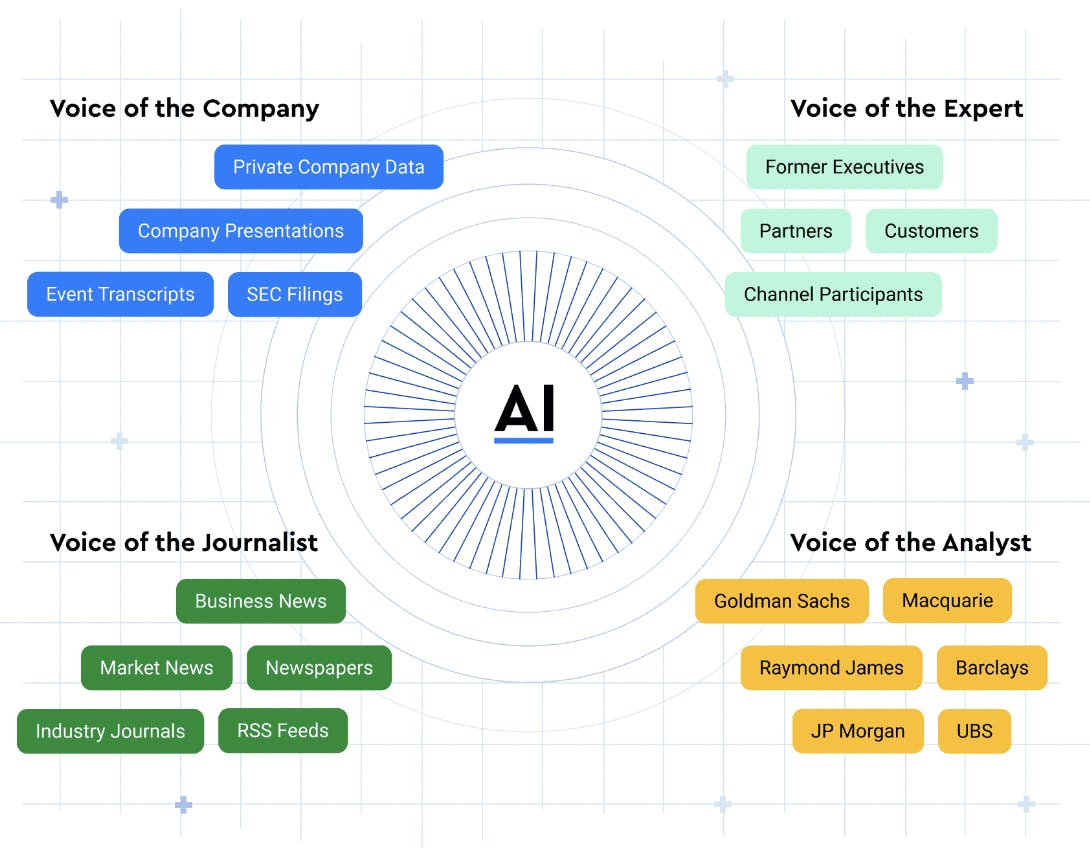

Source: AlphaSense

Broker & Independent Research: AlphaSense provides equity research covering global sector themes, industries, and companies from over 1K sell-side and independent firms through its platform called Wall Street Insights. It includes research from banks like Morgan Stanley, Barclays, Citi, and Goldman Sachs.

Expert Transcript Library: AlphaSense provides a collection of over 45K transcripts through its Expert Transcript Library. This library includes interviews with previous executives, customers, and partners. Each interview is conducted by an analyst. AlphaSense also provides the ability for a user to schedule one-on-one calls with an AlphaSense expert to ask their own questions. This transcript library is intended to benefit users like hedge funds, VC firms, and asset management firms.

Company Documents: AlphaSense supplies regulatory filings from over 68K companies worldwide. This includes SEC and global filings, earnings calls, investor conference transcripts, investor relations documents, and press releases. AlphaSense also provides valuation data for over 200K private companies, as well as company tear sheets for over 1 million private companies.

News: AlphaSense delivers news from newspapers, trade journals, and other media sources across industries including health care, real estate, technology, aerospace, industrials, defense, transportation, and energy.

Regulatory: AlphaSense provides updates from global health and energy organizations through its regulatory site. Some sources it draws from include the FDA, CDC, Federal Reserve Bank, and EU Clinical Trials Register.

Internal Content: AlphaSense’s internal content tool allows users to upload and search their own proprietary content including internal research, meeting and conference notes, industry reports, and newsletters. It also powers AlphaSense Enterprise Intelligence, enabling secure searches, summaries, and follow-up questions across a user’s internal data.

Features

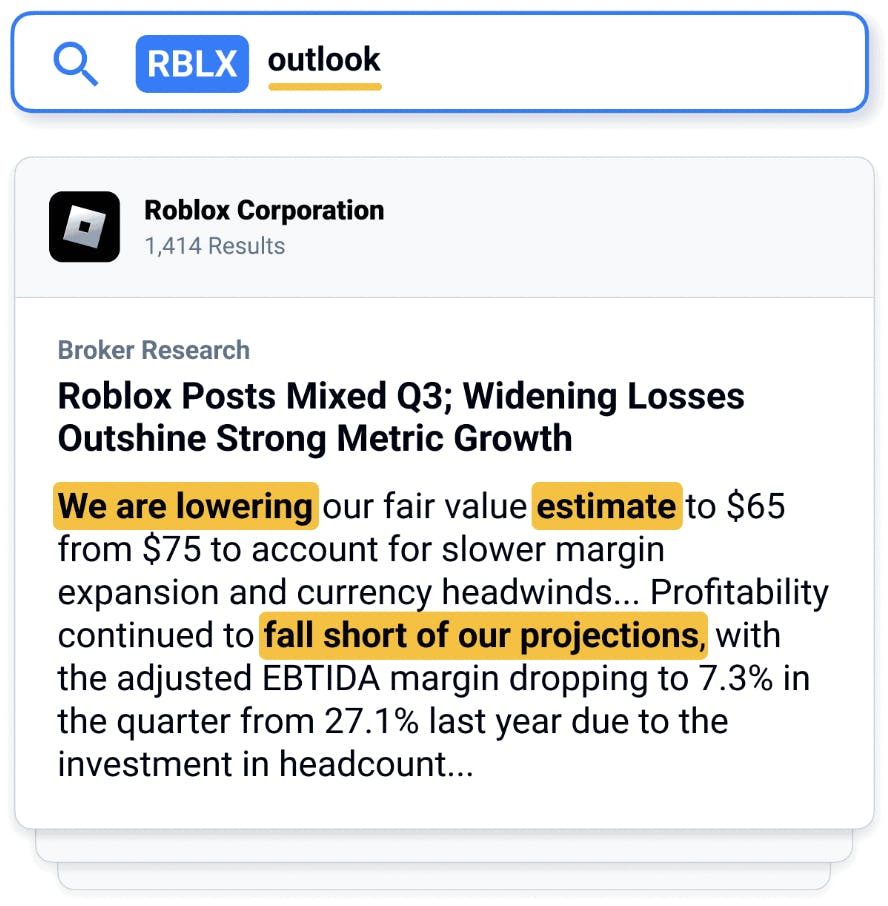

Search, Analyze, & Discover: Alphasense’s Search feature is a patented search technology that allows users to analyze AlphaSense’s content library and identify relevant pieces of information. Users can search by ticker, company keywords, or industry.

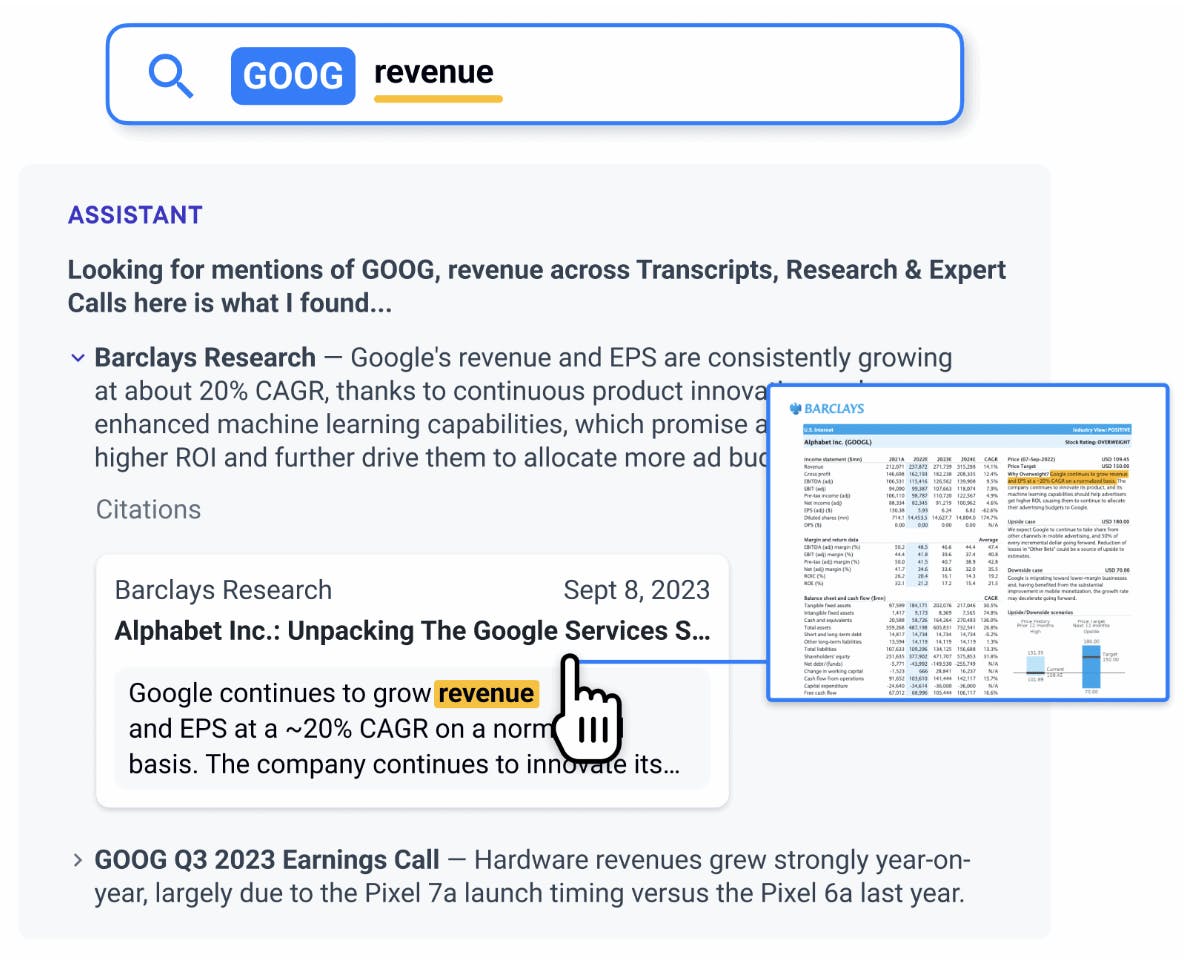

The feature also includes Assistant, an AI-powered chatbot designed to summarize “billions of data points” into a simple answer. Assistant is a proprietary LLM that was trained and fine-tuned on AlphaSense’s company document library. It synthesizes data from over 10K content sources and provides in-line citations to make each answer verifiable.

Source: AlphaSense

The Search tool also automatically includes all synonyms and excludes irrelevant results to ensure complete coverage of a topic, a feature AlphaSense coined Smart Synonyms. This AI-powered feature enables users to discover relevant information by identifying alternate phrasing, industry-specific jargon, and contextual equivalents within documents and data. For example, if a user searches for "revenue," Smart Synonym may also surface results with terms like "sales," "turnover," or "income" depending on the context.

Source: AlphaSense

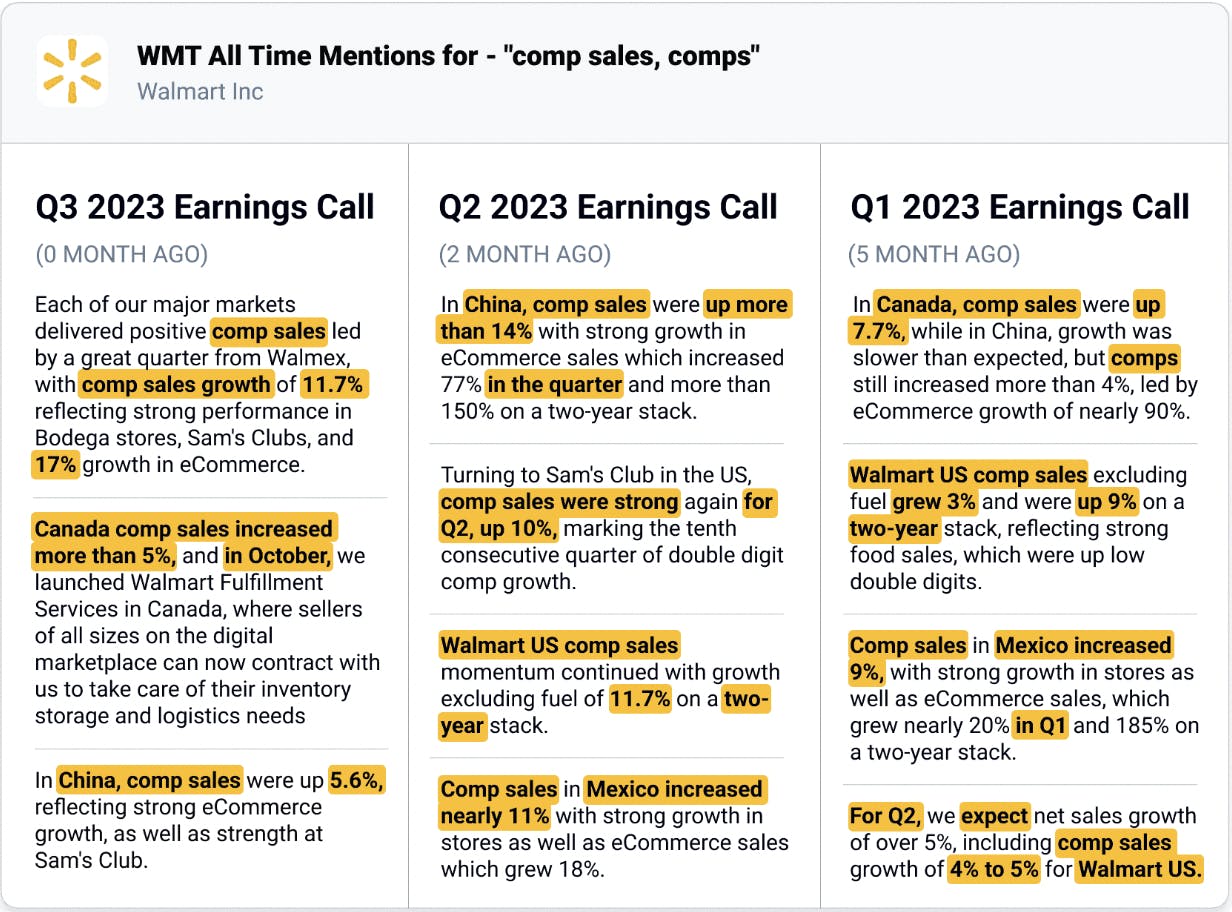

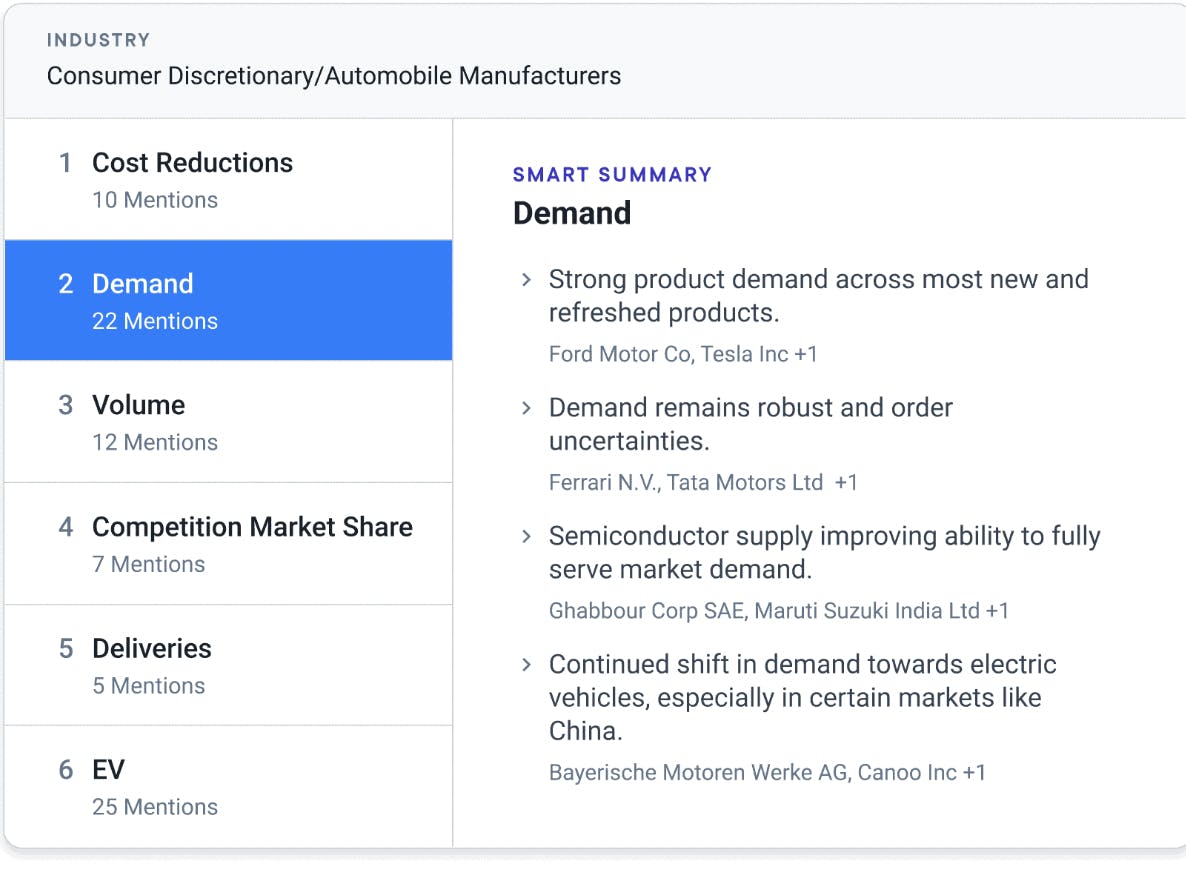

Through another tool called Smart Summary, AlphaSense can provide condensed analysis of company information, like an earnings call. In this case, Smart Summary would highlight positive and negative data points, along with questions discussed throughout the call. Additionally, if a user is reviewing an analyst report on a company, AlphaSense's Smart Summary can extract and highlight insights, including a SWOT analysis, competitive analysis, and stock upgrades or downgrades.

Source: AlphaSense

AlphaSense also offers Smart Summary to analyze and distill insights on an entire industry. These summaries provide an overview of industry concerns, strategic priorities, and earnings performance, allowing users to understand market trends and challenges without diving into multiple reports.

Source: AlphaSense

If a user wants to quickly retrieve information on a public or private company, AlphaSense can provide search results that include company tear sheets. Tear sheets present company figures like valuation, number of employees, and market cap. If the user wants more depth on the company, AlphaSense also created Company Entity Pages, which provide earnings call sentiment scores, company financials and estimates, competition, and historical search analytics.

Source: AlphaSense

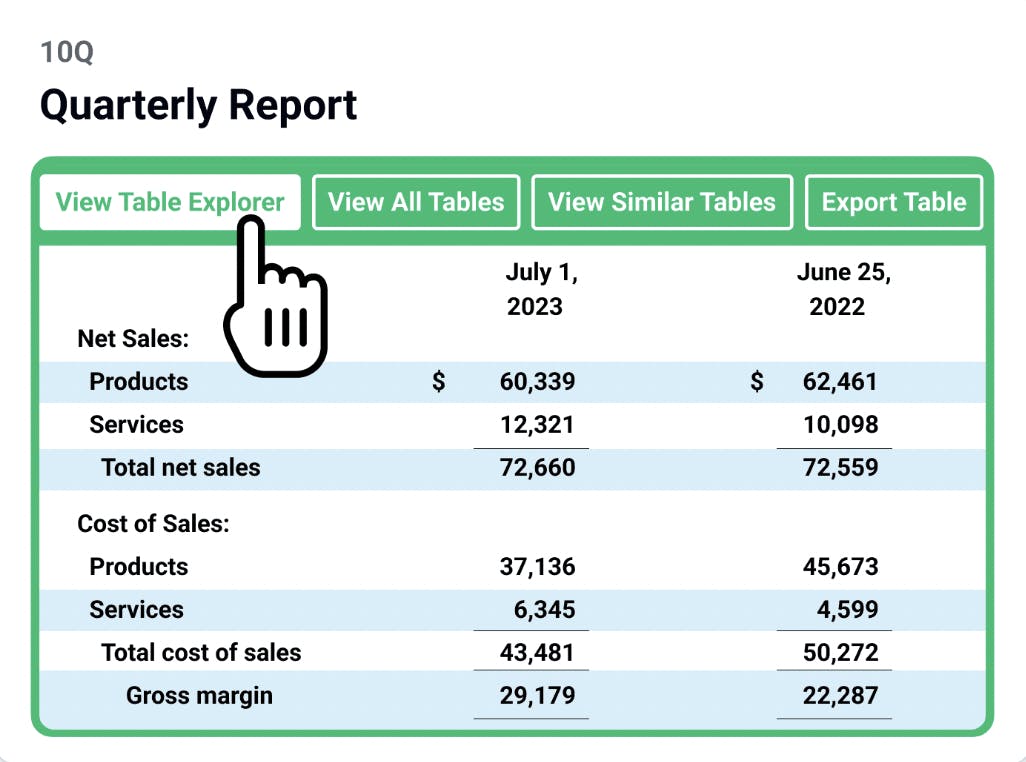

AlphaSense searches can also include charts, tables, and images from company presentations and reports. Its Table Explorer tool allows users to automatically edit and calculate financial metrics from these searches and export directly to Excel.

Source: AlphaSense

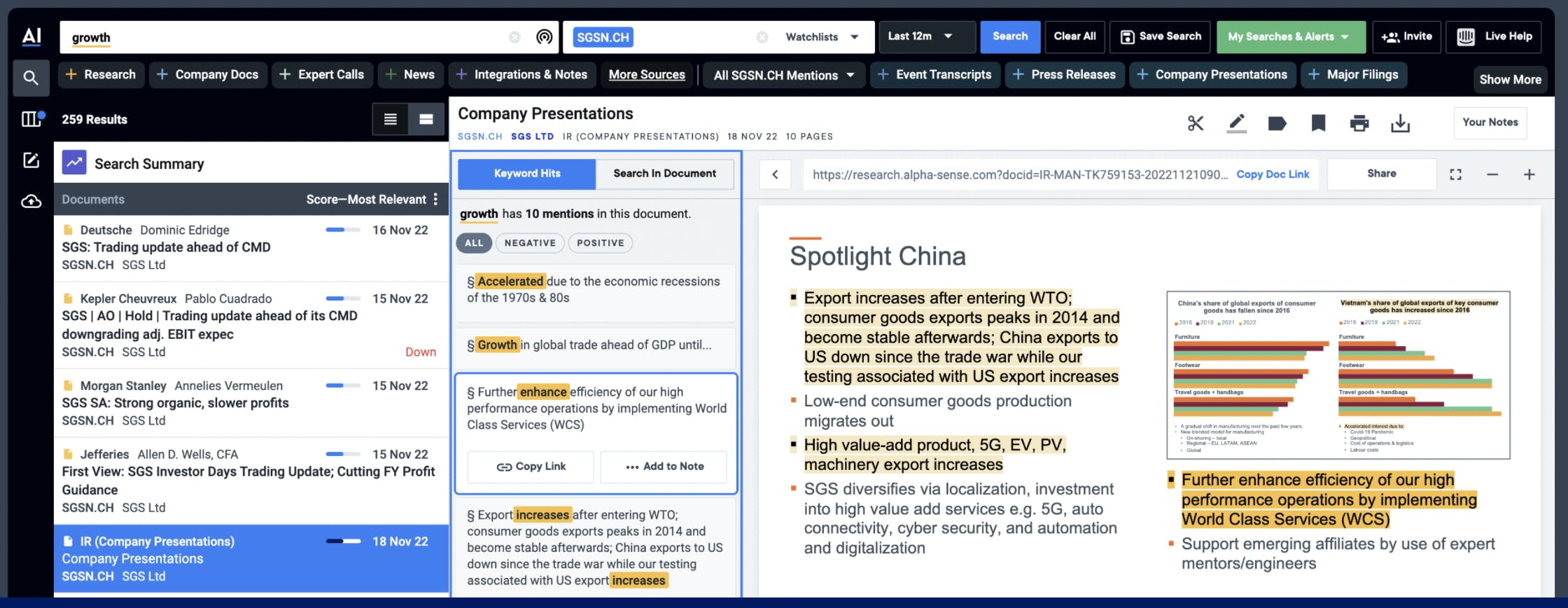

Platform Interface: AlphaSense’s interface gives users a three-pane view to browse different layers of content: a list of relevant documents, document keyword mentions, and the document itself. This interface is patented and was designed to reduce the number of clicks users spend on synthesizing search results.

Source: AlphaSense

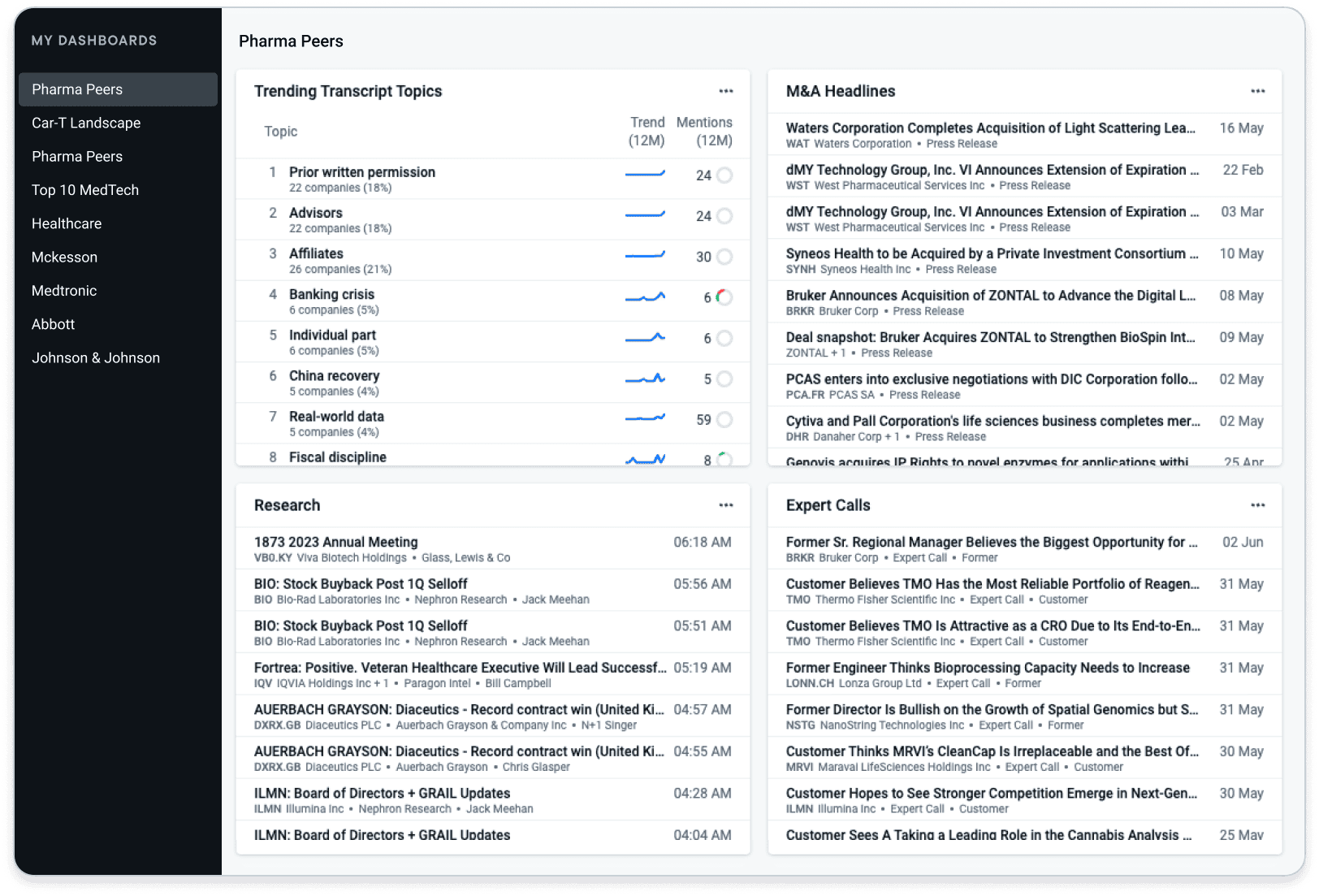

Monitor: AlphaSense’s monitor dashboard is designed to keep users up-to-date on market trends, competitors, and macro trends. These monitors can be customized to the user’s specific interests, and are updated in real-time. A user can also choose to get periodic updates covering recent trends, as well as a list of relevant documents to read.

Source: AlphaSense

Collaborate & Integrate: While exploring AlphaSense's content library, users can highlight, tag, and annotate material, saving notes automatically to their personal Notebook tool. The Notebook can be shared securely within an organization through Box, SharePoint, and OneNote. Additionally, its enterprise integration tool enables companies to incorporate its internal data into the platform.

Market

Customer

AlphaSense divides its customer base into two segments: financial service customers and corporate clients. Within financial services, it serves asset managers, hedge funds, private equity investors, investment banks, and sell-side researchers. When it was founded, AlphaSense focused solely on serving customers in the financial service category because Kokko knew the problem of data gathering was well-defined since he experienced it himself. Customers in this category leverage AlphaSense to accelerate investment due diligence, generate new investment ideas and themes, stay informed on emerging market trends, and complete pitch decks faster.

AlphaSense CEO Jack Kokko initially expected the second customer base, corporate clients, to be smaller in size but stated in a May 2022 interview that he had been “positively surprised” by the demand from that category for AlphaSense. Use cases of AlphaSense from corporations include competitive intelligence, corporate strategy, corporate development, and investor relations. Kokko claimed that “any company with a degree of scale and complexity” that merits a detailed understanding of its competitor landscape and emerging trends would benefit from a product like AlphaSense.

Market Size

The global market intelligence market, defined as products that provide information on industries, competitors, and trends to help inform business decisions, was valued at approximately $84 billion in 2023. It’s expected to grow at a CAGR of 3.3%, reaching $94.5 billion by 2027. In the US, the market research industry was valued at $33.5 billion in 2023. More specifically, the global financial analytics market was valued at $8.8 billion in 2023 and is expected to grow at a CAGR of 11.5% reaching $23 billion by 2032.

Competition

FactSet: Founded in 1978, FactSet is a software company that provides financial data and analysis tools for financial professionals. As of October 2024, FactSet had a market cap of $17.3 billion, served 216K users throughout 8K client institutions, and retained 95% of its annual subscription value. FactSet offers different quantitive data than AlphaSense, like real-time market data for example. A customer of both products claimed that AlphaSense holds an edge in providing a more intuitive interface and search functionality against FactSet. Nonetheless, FactSet's long-standing presence in the market intelligence sector has enabled it to command higher prices and establish an international presence as a research tool for enterprises.

S&P Capital IQ: Founded in 1999 and acquired by McGraw-Hill Financial in 2004 for more than $200 million, S&P Capital IQ, also known as Capital IQ, is the research arm of S&P Global. It provides investment professionals with data feeds, covering 62K public and 4.4 million private companies. Like FactSet, Capital IQ offers quantitative data covering real-time market information. However, it doesn’t offer the search capabilities and depth of research offerings that AlphaSense provides.

Factiva: Factiva was founded in 1999 as a joint venture between Reuters and Dow Jones & Company. In 2006, Reuters sold its stake in the company to Dow Jones for $178 million. Factiva aggregates content from 33K news, data, and information sources across 200 countries in 32 languages. It offers corporate profiles along with research tools to analyze media coverage. While the company does not disclose its pricing, it was reported to cost approximately $5K per year as of 2019. Customers reported using Factiva primarily as a news and publications aggregator.

Business Model

As of October 2024, AlphaSense does not publicly disclose its pricing structure. However, an executive at a former AlphaSense client stated that the company paid $8K per license for AlphaSense. Depending on whether a customer wants access to full enterprise integration or its transcript library, a subscription can cost up to $20K annually. While interviews have indicated that AlphaSense costs less than FactSet, its Wall Street Insights product, which launched in 2020, gave the company a foothold to increase its prices.

Traction

AlphaSense reached $200 million in ARR in April 2024, a 2x revenue increase in under two years. As of April 2024, AlphaSense had over 4K enterprise customers, which included over 85% of the S&P 100. As of August 2024, AlphaSense said that it served 80% of the top consultancies, 86% of the top healthcare companies, 80% of the top asset management firms, the top 15 sell-side research firms, and 75% of “the world’s top hedge funds”. AlphaSense is also a top-ranked financial research software on G2, with an average rating of 4.7 stars as of August 2024.

Acquisitions

In October 2021, AlphaSense acquired Stream, an expert interview platform that contained over 8.5K transcripts at the time of acquisition, for an undisclosed amount. This acquisition helped kickstart AlphaSense’s transcript library platform. In May 2022, it acquired Sentieo, a financial intelligence platform designed for asset managers, for an undisclosed amount. This acquisition, in addition to adding 1K new customers, introduced new product features for AlphaSense like the Table Explorer.

In June 2024, AlphaSense acquired Tegus, an expert network and financial intelligence platform, for $930 million. Tegus, valued at over $3 billion in 2021, was a major competitor to AlphaSense. AlphaSense filed a patent lawsuit against Tegus in September 2023. By the time it was acquired, Tegus reached over $100 million in ARR and served over 3K businesses. Tegus also made two acquisitions of its own. In October 2021, it acquired BamSEC, a platform to access and analyze SEC filings and earnings transcripts, for an undisclosed amount. In August 2022, Tegus acquired Canalyst, a platform that provided financial models for over 4K publicly traded companies, for approximately $300 million.

Tegus’s most important asset, however, is its transcript library, which surpassed 100K transcripts in April 2024. With its acquisition of Tegus, AlphaSense significantly expanded its proprietary data and research capabilities, strengthening its position in the market intelligence market. Moreover, the acquisition signaled AlphaSense’s intention to pursue an IPO, rather than becoming an acquisition target itself.

Valuation

AlphaSense raised a $650 million Series F round in June 2024 at a $4 billion valuation, bringing its total funding to $1.4 billion as of October 2024. Its investors include Goldman Sachs, Viking Global, CapitalG, Soros Fund Management, and Innovation Endeavors.

Key Opportunities

Strategic Acquisitions

AlphaSense's past acquisitive strategies represent a potential opportunity for continued market leadership and growth. By acquiring companies like Tegus, AlphaSense expanded its proprietary data assets and customer base as it covered more than 35K public and private companies. This approach allowed AlphaSense to enter new market segments and eliminate potential competitors. If AlphaSense continues to make similar strategic acquisitions, it can cement its place within its market.

Potential Data Network Effect

AlphaSense's growing proprietary content library serves as a key differentiator. Its data library can be used to enhance its AI models, improving its search platform's performance. The resulting superior user experience increases customer retention and raises switching costs. As this flywheel reinforces itself, AlphaSense strengthens its market position, creating a sustainable competitive advantage.

International Expansion

Global expansion presents a growth opportunity for AlphaSense. While the complete geographic breakdown of AlphaSense's customer base is uncertain, one customer interview indicated that its users primarily reside in North America. By extending its reach to international markets, particularly in the APAC region since it received funding from a Singaporean investor, AlphaSense can potentially tap into underserved customer segments. This expansion may allow AlphaSense to diversify its revenue streams, reduce dependence on a single market, and magnify its serviceable addressable market.

Key Risks

Competitive AI Advancements

If AlphaSense’s competitors develop comparable AI-powered search capabilities, AlphaSense could lose its competitive edge. One corporate customer mentioned in an interview that if FactSet or CapitalQ released their own AI-powered search product, the company wouldn’t need its AlphaSense license. An additional threat is the advancement of general-purpose LLMs like OpenAI’s ChatGPT. As of October 2024, the LLM is accessible for free and could offer a substitute for some of AlphaSense's functionalities. Kokko addressed the risk in a September 2023 interview, saying that ChatGPT gives “somewhat random results that don’t understand the business or commercial standpoint” of questions being asked.

Incomplete Product Offering

AlphaSense has been unable to substitute incumbent financial data providers like FactSet and Capital IQ. Despite its content and search capabilities, AlphaSense lacks features like live stock quotes, which could be necessary for its customers in financial services and investor relations. As a result, these users must maintain subscriptions to multiple platforms, potentially viewing AlphaSense as a supplementary tool rather than a primary resource. This can put the company at a disadvantage in the event that these customers decide to consolidate their tool and vendor set.

Third-Party Data Dependency

AlphaSense faces risks from its reliance on third-party data sources. While the company has proprietary assets like its transcript library, it also depends on external providers for its sell-side research content and SEC filings. If these third-party providers were to change their terms, increase prices significantly, or terminate their agreements, it could disrupt AlphaSense's functionality and customer experience.

Summary

AlphaSense is an AI-driven market intelligence platform that consolidates and analyzes financial data for corporations. It integrates sources like company filings, earnings calls, and expert interviews. With its AI-powered search and analytics tools, businesses can enhance their financial research and streamline decision-making processes. AlphaSense has seen growth through strategic acquisitions and an expanding proprietary content library, which strengthens its competitive position. Although it faces challenges from technological competition and potential product limitations, AlphaSense demonstrates potential through its growing customer base, consistent revenue growth, and valuable proprietary data assets.