Thesis

There were ~100 million knowledge workers in the US as of April 2023, which accounted for 76% of all full-time workers in the country. Knowledge workers are people who have jobs that require them to think for a living, including writers, salespeople, and engineers. An issue plaguing the modern knowledge worker is SaaS sprawl, which refers to the excessive use of SaaS applications within an organization. The average enterprise used 112 software applications as of 2023. This vast array of apps has led employees to spend an average of three hours per day searching for information, with 47% of digital workers reporting difficulty in finding the information needed to perform their jobs effectively per a 2022 survey.

The ability to efficiently locate information is particularly important within professional services fields such as financial services, law, and consulting, as employees are often required to perform due diligence processes that often require manual analysis of numerous dense documents. For example, private equity professionals often spend extended hours in data rooms, spaces for storing and sharing confidential information, due to the complex nature of due diligence, which includes reviewing and categorizing hundreds of documents such as financial statements, legal agreements, and corporate records. Research shows that while virtual data rooms can reduce time by up to 40%, inefficiencies persist in areas like document review and real-time collaboration. Additionally, lawyers also face inefficiencies in due diligence due to time-consuming manual document reviews, scattered processes across multiple platforms, and limited visibility over deal stages. These issues delay closings and increase the risk of errors or missed information.

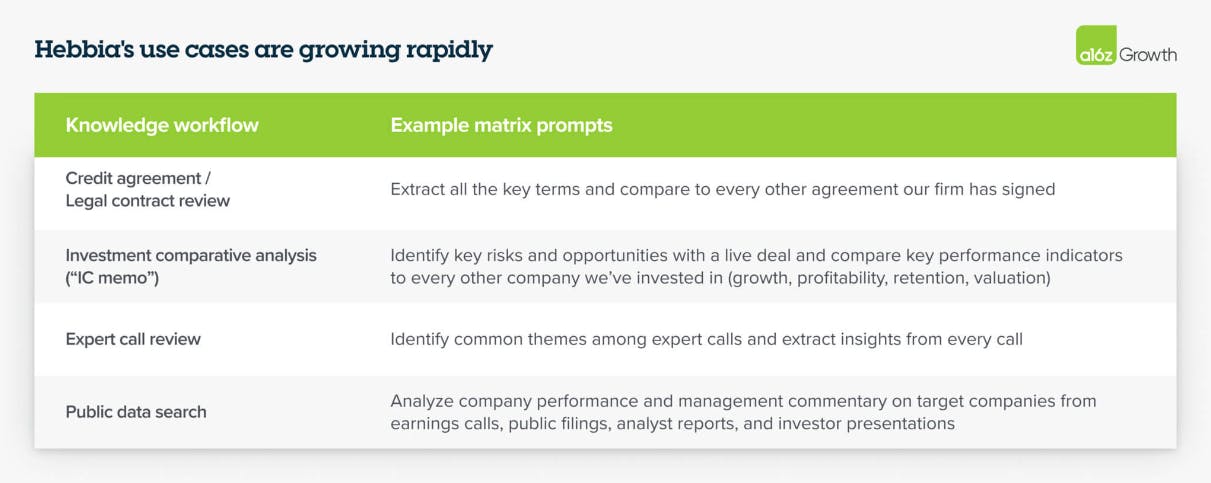

This is where Hebbia comes in. Hebbia was founded to provide neural search functionality for investment banking and private equity analysts so they could solve queries that were complicated and ambiguous. Its core product, Matrix, enables users to upload any type of document, including PDFs, presentations, emails, and images, to specify questions they’d like answered across each document and instantly provides detailed insights in a tabular format similar to Microsoft Excel. The company began in financial services and was being used by 30% of the top 50 asset managers by AUM as of July 2024. It seeks to become an enterprise search solution for knowledge workers in highly regulated industries in which decision-making speed and accuracy are crucial.

Founding Story

Source: George Sivulka

Hebbia was founded in August 2020 by George Sivulka (CEO). Sivulka had been an innovator from a young age. When Sivulka was 12 years old, he was building lasers that could light fires. By 16 he had an internship with NASA, working at its Goddard Institute for Space Studies from 2014 to 2016. He enrolled at Stanford for undergrad in 2016 and graduated in three years with a bachelor’s in mathematics and a master’s in applied physics. After undergrad, we almost entered a fully-funded PhD program in electrical engineering but didn’t end up going through with it.

Sivulka’s colleagues in a Stanford computational neuroscience lab where he worked introduced him to early transformer models, and he became intrigued by their potential to mimic human memory retrieval. During undergrad, he also noticed many friends moving into finance roles at firms like Morgan Stanley and Goldman Sachs, and when they reconnected, they often seemed unhappy and like they "hadn't smiled in months."

To explore this interest in neural search while attempting to create something useful for his friends, since he was taught to solve problems for people who face challenges, he created an early version of a neural information retrieval model in a Jupyter notebook. Unlike traditional text pattern matching in CTRL-F searches, his model was designed to enable the computer to grasp the user's intent and identify the most relevant text within a document. The initial prototype was trained on a single document type, DEFM 14-A, a 400+ page regulatory filing that investment bankers traditionally review manually — highlighting the potential for automating complex, document-heavy tasks.

Sivulka initially shared a rough draft of his model with a few bankers at Morgan Stanley's Menlo Park office. As the tool began circulating among others he hadn’t directly interacted with, he recognized the broader potential it held. This realization led him to take a leave of absence from his PhD studies to focus on solving this problem full-time, ultimately founding Hebbia.

Product

Hebbia is building an enterprise search specifically designed for knowledge workers. Hebbia CEO George Sivulka noted in July 2024 that thousands of companies are building chatbots or search engines that are great for simple user queries, but none can handle the complex, multi-step questions that knowledge workers in industries such as financial services, law, and consulting are tasked with solving daily.

CTRL-F Chrome Plugin

The Jupyter program that Sivulka built during his PhD program became the basis for Hebbia’s first product which was released in October 2020 — a Google Chrome plugin. This product moved beyond text pattern recognition to enable a computer to intelligently understand what information the user was seeking. Its neural search functionality enabled it to highlight the most contextually relevant words within the page for the user instead of merely returning the exact phrase the user specified in the search bar.

Soon after its release, the product garnered interest from law students, financial analysts, and Sivulka’s peers in Stanford research labs. They all saw the value in single-page neural searches but wanted the same functionality applied to their entire knowledge base.

Matrix

Source: Andreessen Horowitz

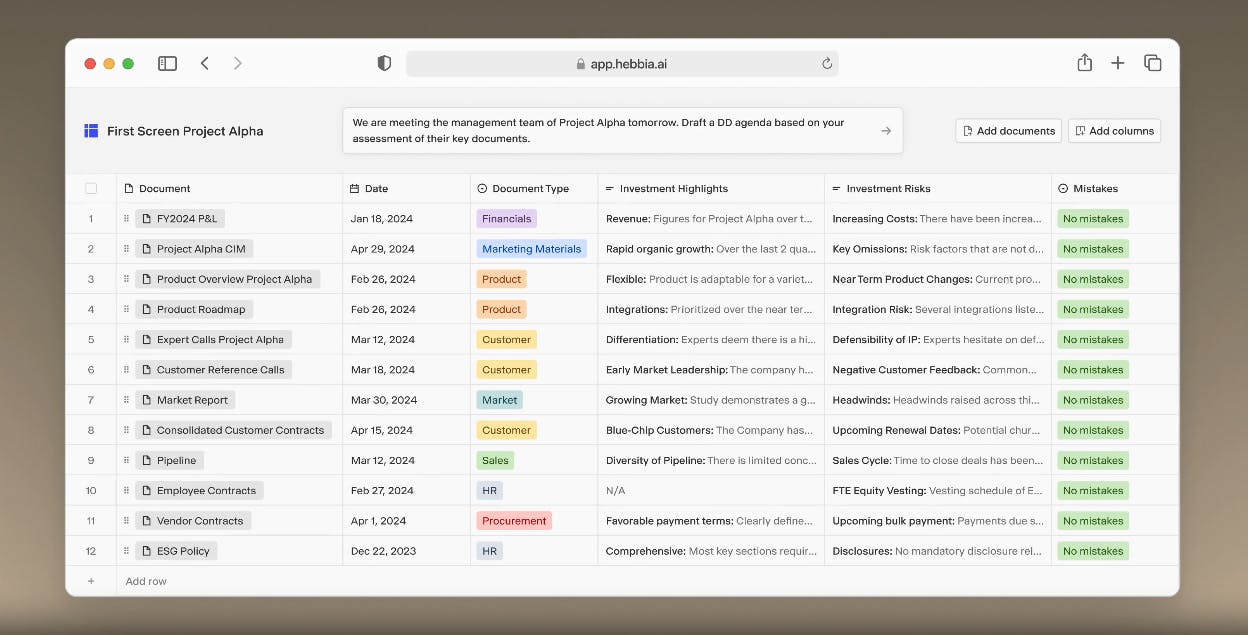

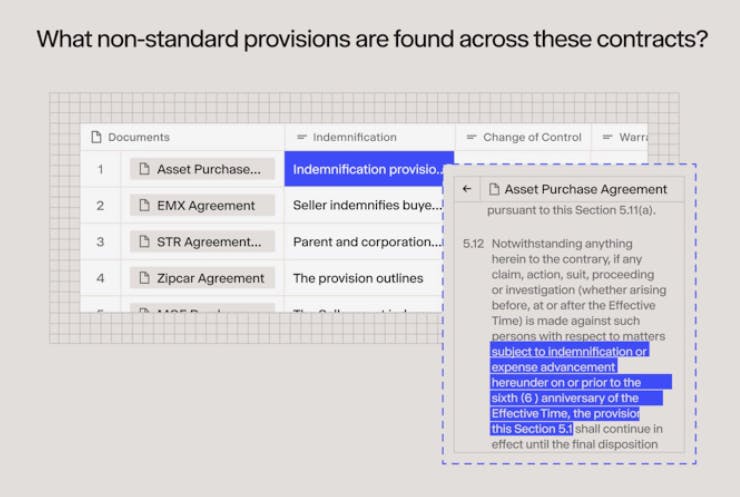

Matrix, Hebbia’s core product, was released in March 2024. It was specifically designed to complete highly complex, end-to-end tasks in a tabular format similar to that of Microsoft Excel. A user can upload any medium of structured or unstructured private document including PDFs, presentations, call transcripts, emails, or spreadsheets. Examples of complex questions that Matrix is designed to handle include “What’s our portfolio’s exposure to Silicon Valley Bank?”, or “What are the fastest growing revenue segments of the top ecommerce companies?”.

Each document uploaded by the user is placed in a row in the table. The user then specifies the questions it would like Matrix to answer across each of the documents that are shown as columns in the table. For each document, Matrix populates the pulled information for each question. For example in the above image, Matrix identified investment highlights and risks from each of the 12 documents uploaded by the user.

Source: Andreessen Horowitz

A former analyst at a large financial services firm indicated that going through a company’s data room and synthesizing it into a single page for a manager previously took about 10 hours, but with Matrix, the same task took about two hours. He highlighted that finding specific financial details, such as a company’s margin in a particular year or the reasons behind a decrease in margin, is typically challenging because it's difficult to locate these insights through simple keyword searches. Matrix simplifies this process by offering direct answers along with detailed sources, making it a valuable tool for saving time and effort.

Users can also click on a cell in the table to see exactly where in the document an answer was sourced from, along with a step-by-step breakdown of how the answer was derived.

Source: Hebbia

Market

Customer

Hebbia’s core product was designed for professionals in industries in which “decision-making speed and accuracy are paramount.” Hebbia’s primary vertical is financial services, which includes asset management firms, investment banks, private equity firms, hedge funds, and other types of financial institutions. Hebbia CEO George Sivulka has noted that Hebbia “started in private equity, but has since gone to market with many of the largest asset managers in North America and Europe.”

Within financial services, Hebbia specializes in diligence and research processes. Traditionally, when performing diligence on a prospective investment opportunity, analysts manually read through a high volume of dense company-provided documents in a data room along with publicly available materials. As Sivulka put it, “it’s your job as a private equity analyst to fill out a 400-question-long tracker with all these questions about a business.” Hebbia streamlines this process by immediately providing insights on analysts’ questions across all of these documents.

As of July 2024, Hebbia began broadening its focus beyond the financial services sector to pursue opportunities in the legal industry. This expansion was supported by a newly established sales team specifically targeting law firms. According to Hebbia’s head of legal, Ryan Samii, legal professionals encounter similar challenges to those in financial services, particularly with inefficient workflows and time-consuming processes that limit productivity and focus on high-value tasks. These inefficiencies, such as document review, contract analysis, and case management, create demands on time and resources within legal practices. By leveraging Hebbia’s technology to address these issues, it could empower law firms to optimize operations, streamline their workflows, and ultimately enhance the overall client experience.

Market Size

The global enterprise search market was valued at $5 billion in 2022 and is projected to reach $12.2 billion by 2032, reflecting a 9.6% CAGR between 2022 to 2032. Enterprise search refers to the process of pulling digital content from disparate data sources via a single search bar. The primary value of enterprise search tools is that users are provided the most contextually relevant information in a comparably short time frame.

Tools within this market enable enterprise employees to search for information across the wide variety of business apps they use. This includes CRMs like Salesforce, file management platforms like Dropbox, and internal messaging tools like Slack.

A predominant growth driver of this market is SaaS sprawl. As of March 2024, the SaaS market was growing nearly 18% annually. In 2022, the average number of software apps used by companies reached 130. “The problem with SaaS applications is they don’t talk to each other or they don’t integrate. It’s often these silos [that need] to be integrated”, said Greg Beltzer, head of technology at Royal Bank of Canada. As of November 2022, this increase in the digital surface area that knowledge workers use caused 47% of workers to struggle to find the information they need to perform their jobs effectively.

On a macro level, the global IT services industry spending was projected to reach $2 trillion by 2028. Furthermore, 10 of the largest IT services companies saw 44% of their revenues come from financial services, manufacturing, and energy. A 2023 survey of 847 IT leaders also indicated that increasing employee productivity was a top 15 enterprise need, which could be a positive proxy for enterprise search spend.

Specifically in the banking and investment services market, global IT spending in 2023 was estimated to be $685.7 billion and is expected to grow at an 8.5% CAGR to reach $957.6 billion by 2027.

Competition

Incumbents

IBM: Founded in 1911, IBM has a market cap of $190 billion as of November 2024. It offers a portfolio of technology products including software, infrastructure hardware, cloud solutions, and consulting services to enterprises, SMBs, and consumers. It is recognized as a leader in innovation, holding the record for the most patents received annually by a US company for 29 years in a row.

One of its key products, Watson Discovery, released in January 2020, is an AI-powered platform designed for intelligent document understanding and content analysis. While Watson Discovery supports various industries such as financial services, legal research, education, sports, and maintenance, it was not specifically designed to handle highly complex, multi-step, ambiguous queries like Hebbia was though Watson Discovery has well-documented use cases within the financial services and legal sectors. Additionally, Watson Discovery is an API product, while Hebbia offers Matrix as a standalone software.

Microsoft: Founded in April 1975, Microsoft is known for producing a wide array of technology products that serve enterprises, SMBs, and consumers across multiple industries. Its product offerings include the Windows operating system, the Microsoft 365 app suite, Azure for cloud computing, the Xbox gaming console, and the Microsoft Edge search engine. One of its offerings, Azure AI Search, provides secure information retrieval at scale over user-owned content. However, Azure AI Search is an API product, while Matrix is a standalone software. Additionally, Azure and AI Search are used by a wider variety of industries compared to Hebbia.

Direct Competitors

Glean: Glean was founded in 2019, with its core product being an enterprise search platform that integrates knowledge from various software applications used by a company. The platform ingests, indexes, and delivers personalized answers to employee queries. As of November 2024, Glean has raised a total of $618.2 million after securing a $260 million Series E raise in September 2024 at a $4.6 billion valuation led by DST Global and Altimeter. Glean’s customer base extends beyond financial services, in contrast to Hebbia, whose product is more suited to highly complex queries found in financial due diligence. Both Glean and Hebbia are model-agnostic, offering flexibility in their deployment across various industries.

Harvey: Harvey was founded in 2022 and its core product is an AI-powered tool featuring legal domain-specific models designed specifically for the legal industry. It assists lawyers with tasks such as document review, legal research, and contract analysis. By leveraging natural language processing, Harvey can understand and analyze legal documents, providing relevant insights and streamlining workflows to enhance efficiency and accuracy in legal practices.

As of November 2024, Harvey has raised $206 million including a $100 million Series C round in July 2024 which valued the company at $1.5 billion. The round was led by GV with participation from OpenAI, Kleiner Perkins, Sequoia Capital, and Elad Gil. While Harvey focuses on the legal industry, Hebbia concentrates on financial due diligence — though Hebbia has begun expanding into the legal vertical as of July 2024. Both platforms allow users to easily drag and drop files into the user interface for seamless integration into their workflows.

Algolia: Founded in 2012, Algolia offers a core product centered around a semantic search API which allows companies to integrate a more precise search experience into their platforms for end users. As of November 2024, it raised a total of $335.8 million including a $150 million Series D round led by Lone Pine Capital in July 2023, which valued Algolia at $2.3 billion. Other key investors included Accel, Glynn Capital, and Salesforce Ventures. While Algolia’s focus is on providing an API for customers to embed into their products, Hebbia offers a direct, end-to-end search platform intended for use by customers themselves rather than for integration into other products.

Vectara: Founded in 2020, Vectara is a company specializing in neural search technology. In June 2024, it raised a $25 million Series A round led by Race Capital and FPV Ventures, achieving a $225 million valuation. Other notable investors included Databricks Ventures, Samsung NEXT Ventures, and Proximity. Vectara’s core product is an API-based solution that allows developers to integrate neural search capabilities into various software applications for end customers. This contrasts with Hebbia, which provides an end-to-end search platform used directly by customers rather than for downstream customer use.

Business Model

Hebbia does not publicly disclose its pricing model. However, a senior director at SkyKick, a customer of Hebbia, noted that the product costs about $15K per license per year. However, this particular customer had 10 licenses that cumulatively cost $100K per year. Based on this, it can be inferred that Hebbia offers an annual per-user licensing model with discounts as user headcount increases.

Traction

In April 2024, Hebbia was named to the Forbes AI 50 list and was one of two companies on the list within the professional services industry. Harvey, a direct competitor, was the other listed company. Hebbia increased revenue by 15x in the 18 months before July 2024 and reportedly had an ARR of $13 million. It was profitable while pitching investors on its July 2024 Series B raise.

Hebbia was being used by 30% of the top 50 asset managers by AUM as of July 2024. Cumulatively, its customer base manages $14 trillion AUM. Notable customers within the financial services vertical include Charlesbank, American Industrial Partners, Towerbrook, and Crestline. The list of customers also includes three of the world’s largest consulting firms and the US Air Force.

Hebbia began ramping up its legal vertical GTM motion and hired Ryan Samii as head of legal in May 2024. The legal customer area as of November 2024 includes Fisher Phillips. Hebbia has expanded its team from 15 employees in September 2022 to 95 employees as of November 2024.

Valuation

In July 2024, Hebbia was valued at $710 million after raising $130 million in a Series B round led by Andreessen Horowitz with participation from GV, Index Ventures, and Peter Thiel. Its Series B $580 million pre-money valuation reflected a ~4.6x increase from its Series A which was raised in July 2022.

As of November 2024, Hebbia has raised a total of $161.1 million. Other notable investors from prior rounds include Naval Ravikant, Floodgate, Human Capital, and Jerry Yang. Given its reported $13 million ARR at the time of its Series B raise, Hebbia achieved a valuation multiple of ~54x. This slightly trailed direct competitors including Glean at 67x and Harvey at 54x.

Key Opportunities

Expansion into Legal Vertical

The legal industry is the next market Hebbia seeks to expand to as of 2024. 79% of law firm respondents anticipated that AI would have a transformational impact on their work within the next five years, a 10% increase over the prior year, according to a 2024 survey. Ryan Samii who was previously an M&A corporate lawyer at Paul Hastings and founder of Standard Draft (an AI startup for contract drafting and negotiation), joined Hebbia as head of legal in May 2024. The company has also expanded its sales team to more than 15 people as of November 2024 which could provide the workhorse needed to scale within the legal space.

Lawyers have many of the same pain points as analysts in the financial services industry, specifically with document review and due diligence. They often comb through numerous pages of dense material and read through thousands of contracts to prepare for depositions or court. Matrix’s ability to “precisely analyze vast amounts of data helps legal professionals manage complex queries, conduct thorough due diligence, and gain a strategic advantage in negotiations” could enable legal professionals to streamline the document analysis process.

Pertaining to AI in the legal industry, Professor David Wilkins from Harvard Law School believes this emerging technology can transform how law is practiced, noting that “the industry is moving from non-specialized AI to AI trained on legal materials, designed to tackle specific, complex legal problems.”

Document Drafting Functionality

Within investment banking, private equity, and law, preparing documents or investment memos takes up a majority of people’s time. For example, it’s common for an attorney to spend 20 to 40 hours on a single case brief. Harvey, a direct competitor of Hebbia, offers product functionality that enables users to retrieve insights from dense documents and automatically draft new documents, integrating these insights with industry-specific best practices. Expanding Hebbia’s Matrix to include this level of functionality could enable users to expedite their end-to-end workflow. Because Matrix is already effective in generating insights into complex questions, it could be a strategic next step to introduce a document drafting product or sub-feature.

Key Risks

Data Security Apprehension

A survey from January 2024 revealed that 85% of over 1.4K executives planned to invest in generative AI, yet organizations face an array of stumbling blocks. According to a 2023 study by IBM, 61% of CEOs are concerned by data lineage or provenance, 57% are concerned about the security of data, and 53% are restrained by regulation & compliance.

This concern is especially pronounced in highly regulated industries. It was noted that implementation of AI will be slow in sectors with high stakes and high regulation and that “AI may be used to look for problems in the due diligence stage and in the final contract, but nobody will rest assured until humans have reviewed the information.” A key risk for Hebbia is the challenge of gaining adoption in highly regulated industries, where concerns about data security, provenance, and regulatory compliance can slow AI implementation and increase the need for human oversight.

Pertinent to the legal vertical, 93% of legal professionals surveyed in a July 2024 report articulated a lack of trust in the accuracy of AI as a top concern. To combat this apprehension, Hebbia provides SOC2 I and II compliance as well as encryption on in-transit and at-rest data.

Lack of Established Big Tech Partnerships

Hebbia faces competition from established players like IBM Watson Discovery, Microsoft Azure AI Search, and Amazon Kendra, each backed by extensive customer bases, specialized search capabilities, and well-developed partner networks. These tools are designed to serve the existing customers of each company's broader cloud platform, allowing these tech giants to cross-sell enterprise searches within their comprehensive product portfolios.

In the private market, Glean has secured strategic partnerships, such as its alliance with Amazon Bedrock, which provides a foundation for AI applications on AWS and gives Glean access to AWS’s extensive customer base by being listed on the AWS Marketplace. Glean has also forged a similar partnership with Google Cloud, securing a listing on its marketplace. By comparison, Hebbia has yet to establish these types of alliances, which could accelerate its go-to-market strategy and revenue growth as it expands beyond financial services.

Summary

Hebbia is developing AI specifically designed for knowledge workers. Its goal is to simplify complex, open-ended questions that take numerous hours to answer manually. With its core product, Matrix, Hebbia has become a preferred enterprise search platform for due diligence and document analysis within the financial services industry. The company serves 30% of the top 50 asset managers by AUM and has scaled revenue 15x to $13 million within 18 months leading up to July 2024. Having secured $130 million in capital in a July 2024 Series B raise, Hebbia seeks to expand its market penetration within financial services, while diversifying its reach into the legal sector. The key question is whether Hebbia can continue its revenue growth as it attempts to replicate its success within the legal market.