Thesis

On average, sales representatives only spend one-third of their time selling, with the rest focused on researching and organizing leads. Several companies, like ZoomInfo and D&B Hoovers, have worked to provide access to additional data on leads. Unfortunately, most have unreliable data accuracy. As of August 2019, only 8% of sales and marketing professionals said their data was sufficiently accurate.

Historically, companies have used manual processes centered primarily on reviewing demographic, geographic, firmographic, and other types of profile data. Automation tools allow sales teams to use lead scoring to make their outreach efforts more efficient and accurate. With modern technology, sales professionals don't have to waste time on low-quality leads that will most likely end up rejecting them. Instead, they can focus on finding people in their target audience, and leverage data to reach out with the right message.

Apollo.io is a B2B sales intelligence and engagement platform that provides sales teams with access to contact data for over 220 million contacts and tools to engage with these contacts in one platform. By helping sales professionals find the most accurate contact information and automating the outreach process, Apollo.io streamlines customer engagement. The company’s community-based approach to crowdsourcing data gives users maximum coverage while ensuring data accuracy, and has positioned Apollo.io as an emerging competitor to legacy data platforms.

Founding Story

Tim Zheng studied computer science at MIT before starting BrainGenie, an edtech startup teaching K-12 students math and science online. After trying a wide range of sales prospecting tools and finding they weren’t effective, he decided to build his own in-house go-to-market platform. They built a database of teachers and principals, created targeted email campaigns, and grew their user base from 5K to 150K over six weeks.

After growing BrainGenie to 1 million+ users with other businesses wanting to use the product for their own sales prospecting, Zheng realized there was a significant unmet need in the market for prospecting data. In 2015, Zheng recruited Ray Li as CTO, who was previously a software engineer at Square, and Roy Chung as COO, who had previously worked at a YC company called Doblet. Shortly after, the team joined Y Combinator’s Winter 2016 batch.

Since its founding, the company has also attempted to bring in several additional members of the management team. In June 2019, former COO of ClearSlide Jim Benton was brought in as CEO while Zheng moved to COO, and Chung transitioned to Chief Business Officer. However, Benton only remained CEO for 10 months before leaving to become the CEO of Chorus.ai in March 2020, which was eventually acquired by ZoomInfo, a competitor to Apollo.io.

Zheng stepped back into the CEO role, and in April 2021, the company brought on Santosh Sharan as President and COO who had spent 5 years at ZoomInfo, and a similar data business called LeadGenius. However, at some point in 2022 Sharan left Apollo.io. In April 2022, Roy Chung stepped down as Chief Business Officer and became a strategic advisor to Apollo.io.

Product

Prospecting & Intelligence

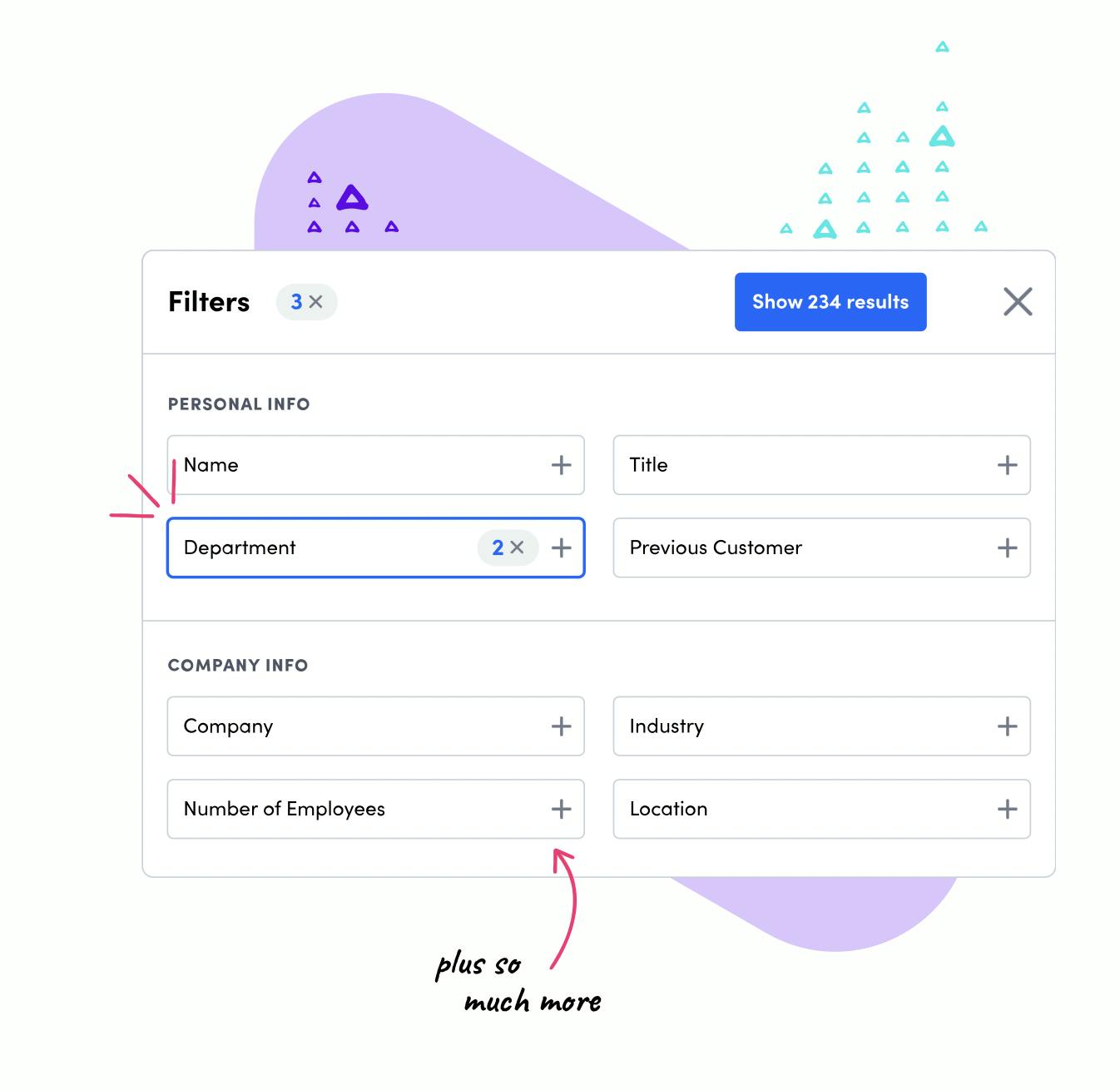

Apollo.io is a B2B contact database with email addresses, phone numbers, and direct dials for over 220 million global contacts across over 30 million companies. The platform tracks over 200 data attributes that customers can use to sort prospects, such as by title, revenue, location, number of employees, VC funding, and more. It collects data through a variety of sources, including scraping from hundreds of millions of websites, including LinkedIn, purchasing from third-party wholesalers, and its own proprietary network of over 500K users that contribute data through their email signatures and CRMs.

Source: Apollo.io

Enrichment & Job Change Alerts

Apollo.io helps correct, append, and update prospects’ data to ensure sales teams are working with reliable, accurate, and up-to-date information. Apollo Refresh is a feature designed to help capitalize on key contacts with whom its customers have a vested interest. They can receive alerts and notifications when designated contacts change jobs or get promoted.

Sales Engagement & Analytics

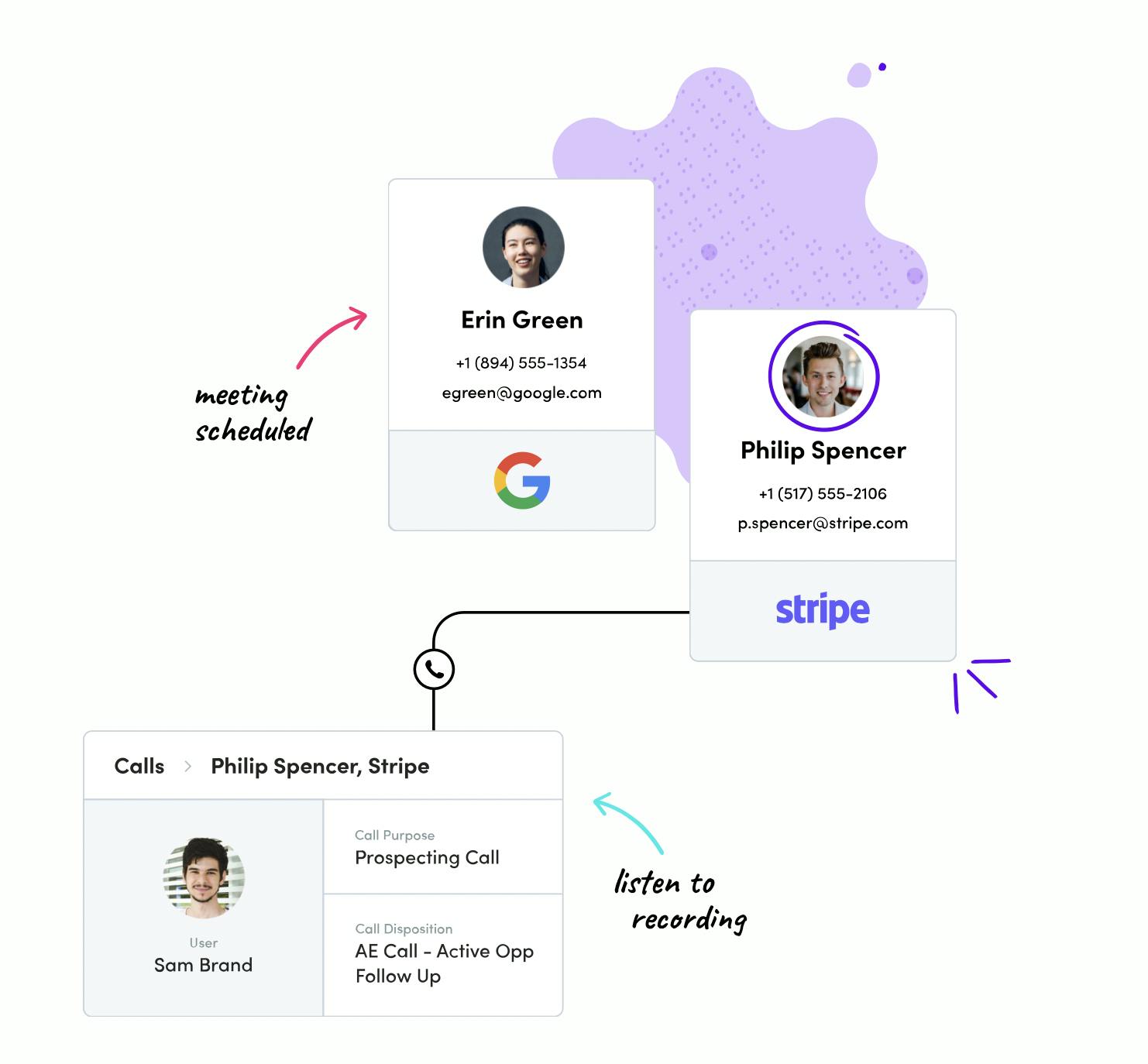

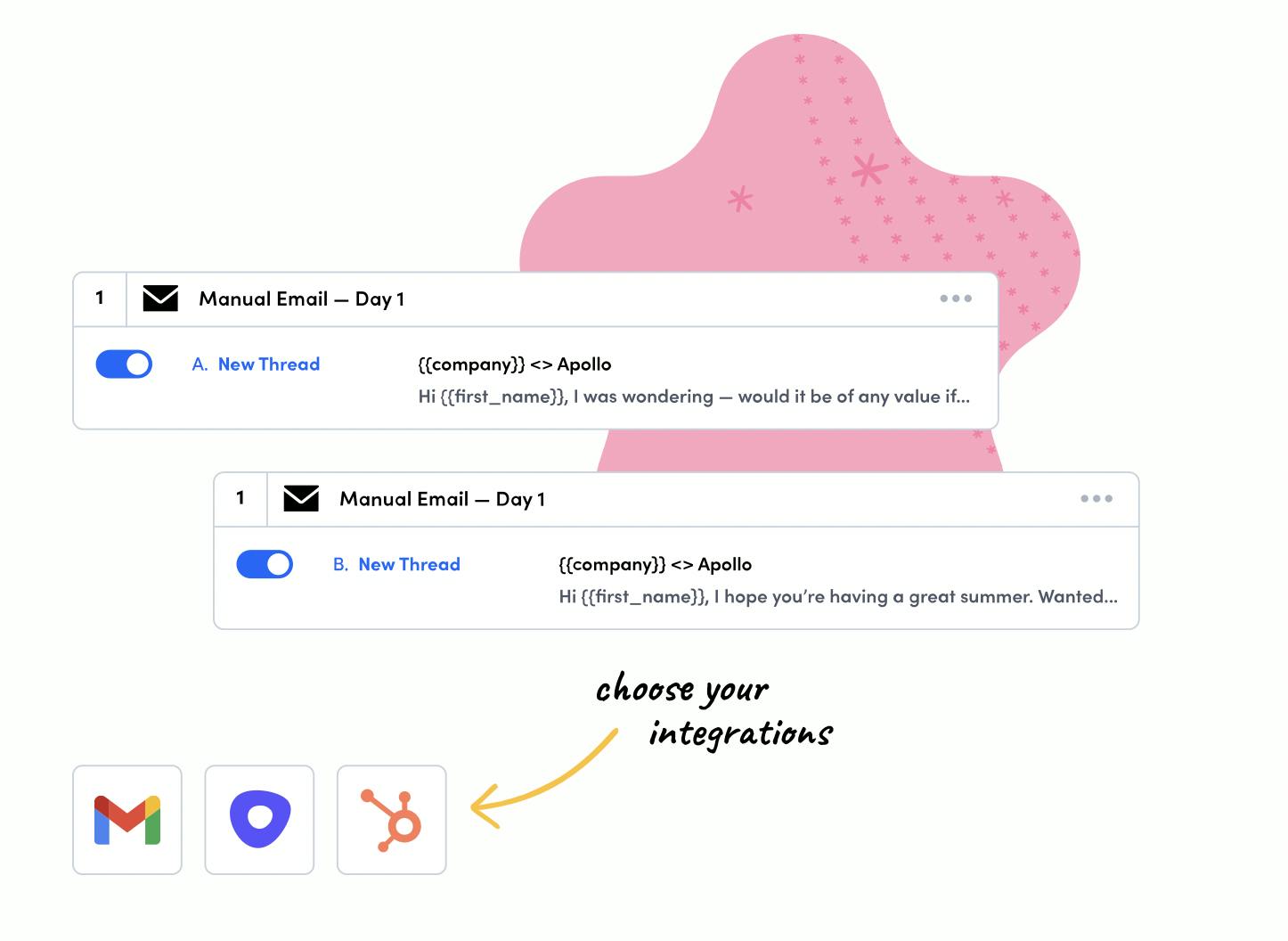

Apollo.io’s sales engagement features help sales teams reach the right people with the right message at the right time. It offers engagement tools to allow sales reps to most effectively leverage existing data to automate outreach. Reps can set up automatic calls and emails, A/B test different templates, and automate follow-ups. They can also call prospects directly from the platform, and Apollo.io will record and transcribe the call and log it in the user’s CRM.

Source: Apollo.io

API

Apollo.io’s REST API lets companies query for whatever data they want to enrich their system. Whether for people, organizations, opportunities, or more, the Apollo.io API enables a user to replicate any of the platforms features, but as integrated data feeds to other products. Apollo.io’s API can also be used to customize sales teams’ workflows. Users can update task priority, due date, custom fields, and more. Apollo.io’s API is charged based on consumption, and API calls are only counted when a request is made to their server.

Integrations

Sales teams can optimize their workflows through integrations with LinkedIn, Gmail, Salesforce, HubSpot, Outreach, SalesLoft, and more. Apollo.io’s integration with Sendgrid and Mailgun help with email communication across functions. For bulk email campaigns to subscribed users, the integration helps bypass built-in daily and hourly e-mail limits that are meant to safeguard against being marked as spam.

Source: Apollo.io

Market

Customer

Apollo.io’s customers are typically companies with 50-200 employees, indicating they focus on small to mid-sized companies. Some of their customers like Customer.io and Census fall near this range, with 248 and 180 employees respectively, as of March 2023. However, Apollo.io also lists larger customers like Autodesk, Rippling, Deel, Jasper, and Divvy.

Competitors like ZoomInfo also target the long tail of smaller customers, with 14K customers and an average contract size of $23K. However, ZoomInfo has also made meaningful progress with enterprise customers, with “580+ customers who pay them >$100k ACV, and 18 customers paying >$1 million ACV, including DocuSign, SAP and Zoom.”

Market Size

The global sales intelligence market is expected to grow from $2.7 billion in 2021 to $3.1 billion in 2022. However, ZoomInfo estimates the market opportunity to be much larger. ZoomInfo identified companies in several segments of size (e.g. 10 to 99 employees, 100 to 999, and 1K+) and then applied their typical annual contract value (ACV) for each segment. As a result of this exercise, ZoomInfo estimated the market opportunity for sales intelligence at $24 billion as of December 2019.

Competition

ZoomInfo: ZoomInfo provides access to more direct dials and email addresses than any other B2B contact provider. Verified professional and business profiles come fully loaded with detailed information about prospects, including web mentions, employment history, and direct access to colleagues. ZoomInfo uses its portfolio of technology, a community of 300K+ users, and third-party integrations to collect, organize, validate, and publish a comprehensive directory of business data in the marketplace. ZoomInfo aims to provide a 360-degree view of a user’s ideal customer, empowering each phase of their go-to-market strategy. It was founded founded in 2000 and went public in 2020. ZoomInfo is the largest competitor and leader in the space after DiscoverOrg acquired RainKing in 2017, and subsequently merged with ZoomInfo in 2019.

Linkedin: Sales Navigator is LinkedIn’s flagship product for sales teams. It enables sales reps, and managers to inform their processes by taking advantage of the full breadth of LinkedIn’s data, insight, and relationship-building tools. It helps identify and learn about people and companies, track key developments at target accounts, and connect with prospects while tapping into LinkedIn’s messaging and content-sharing capabilities. Users typically use LinkedIn along with ZoomInfo or Apollo.io as complementary platforms, where prospects would be identified using LinkedIn and then engaged through a platform like Apollo.io or ZoomInfo.

Lusha: Lusha offers B2B salespeople of every company size accurate and accessible data through its simple, self-service products. With Lusha, sales professionals can identify, engage, and close prospects through Lusha’s prospecting platform, web extension, and API. Lusha has expanded to over 670K sales professionals and 223K sales organizations, including Zendesk, Google, and Yotpo. Lusha has 60 million emails and 50 million phone numbers. The company was founded in 2016 and has raised $245 million in funding as of March 2023.

Apollo.io also competes directly and indirectly with a number of other companies across its various modules. On the sales intelligence side, companies like Cognism, Reply.io, HubSpot, and Seamless.ai are all competitors. In addition, Apollo.io’s ability to execute outreach campaigns to the leads its data informs puts them in competition with outreach platforms like Outreach.io and SalesLoft.

Business Model

Apollo.io sells primarily to sales teams with a bottom-up, freemium business model. By offering an expansive free tier, Apollo.io aims to maximize its reach to potential users and upsell additional functionalities.

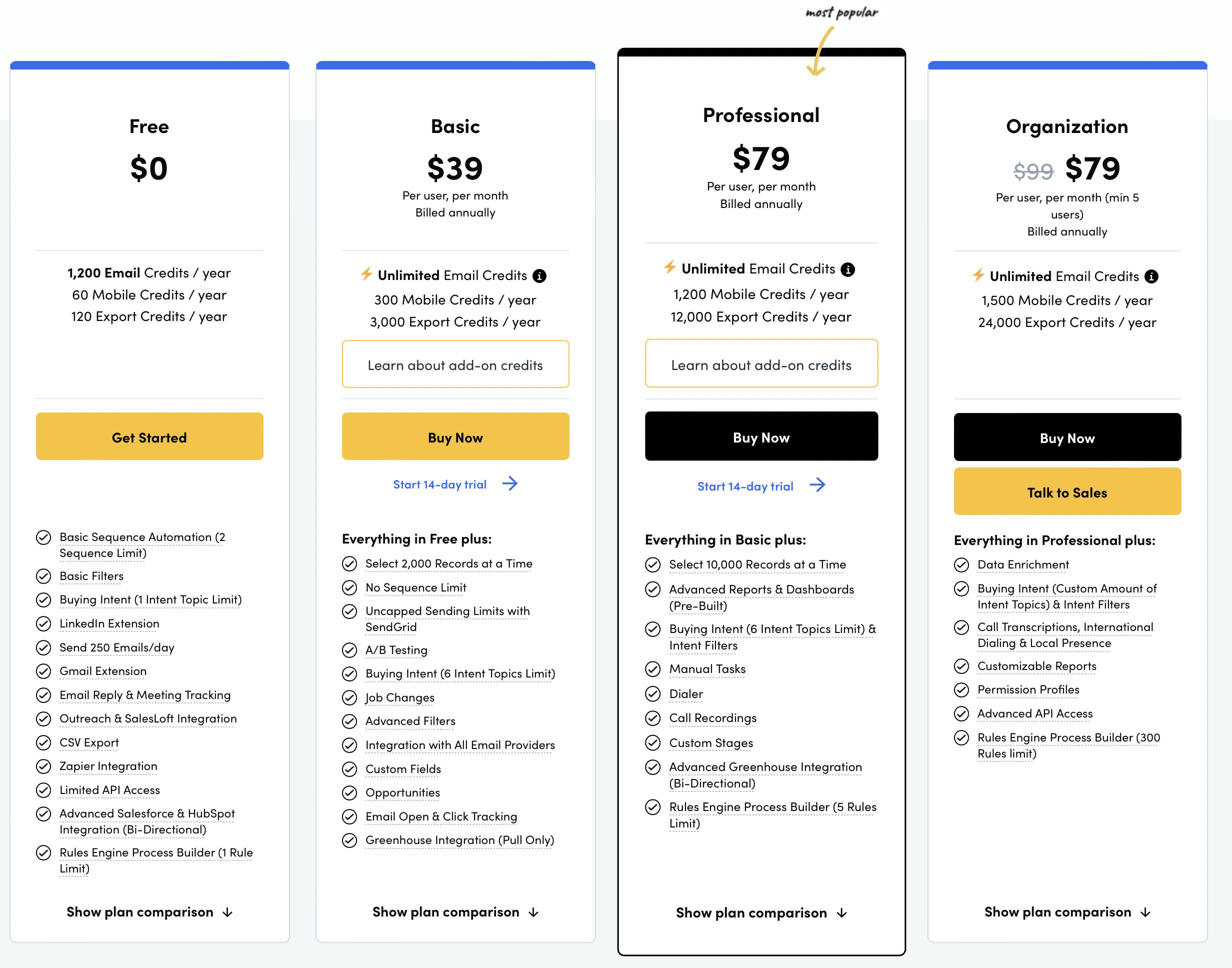

Apollo.io has four pricing tiers and charges on a monthly or annual basis. The various pricing tiers differ mainly on volume of emails and phone numbers a user is able to access. Although the free tier also includes intent data and basic engagement features, such as sequence automation and integration with LinkedIn, CRMs, and Outreach and SalesLoft, its basic plan expands on this by allowing users to select more intent topics, conduct A/B testing and remove the limit on sequences. Its professional plan further expands on this by including call recordings and allowing users to export more contact records at once. Finally, its organization tier includes call transcriptions and customizable reporting.

Source: Apollo.io

Traction

Since its founding in late 2015, Apollo.io has had ups and downs in its growth path. When the company was still known as ZenProspect, it grew from $0 to $1 million in ARR within the last 3 months of 2016. By June 2018, the company had grown to 500 customers. Unfortunately, in October 2018 Apollo.io announced that its prospecting database had suffered a security breach, exposing access to 125 million email addresses and 9 billion individual data points.

In January 2023, former employees managing Apollo.io’s go-to-market organization reflected back on the breach:

“[We] were, at $6 million, $7 million revenue and went down to $2.5 million, roughly. [We] were losing a lot of marquee accounts.”

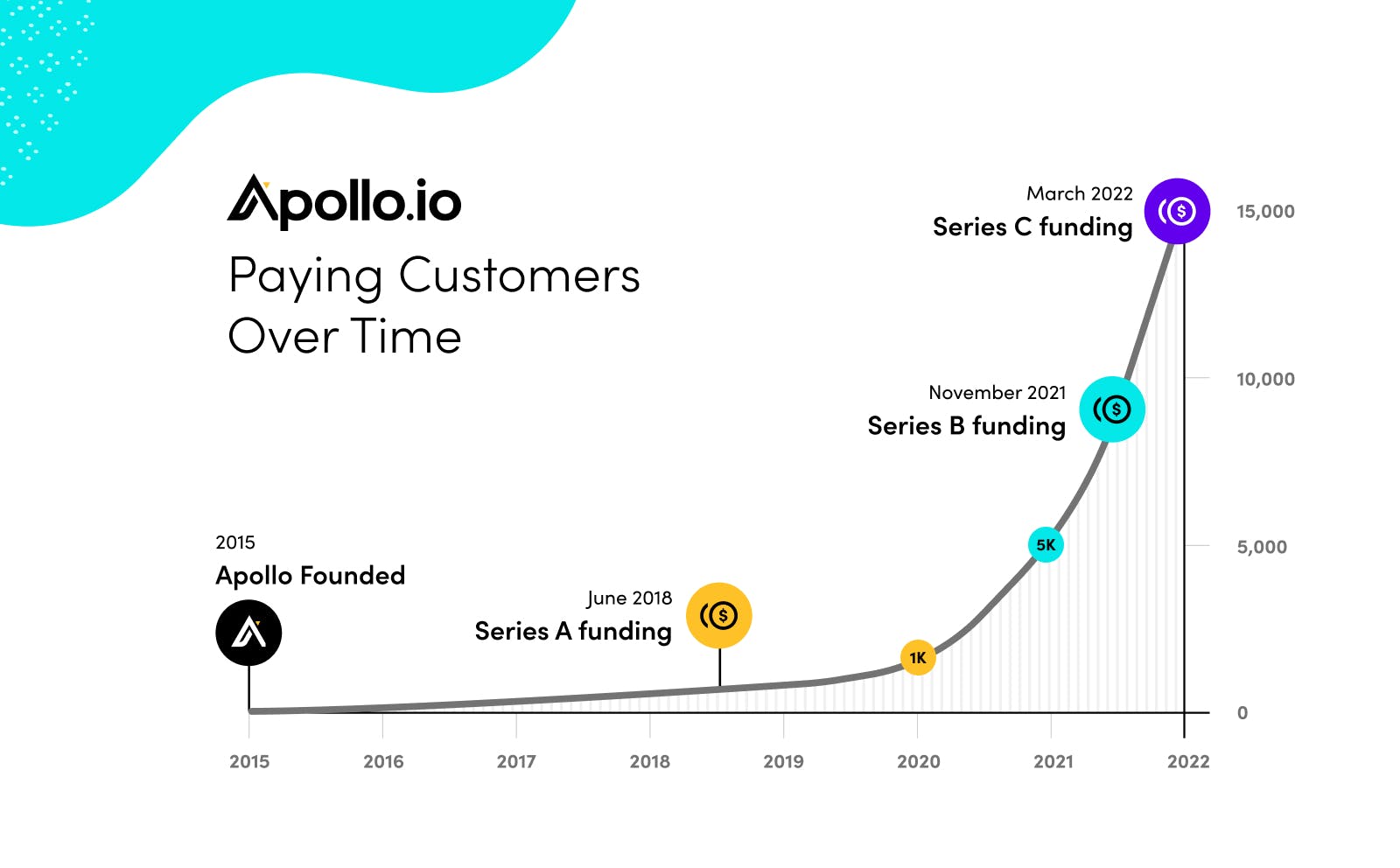

In June 2018, the company had ~50 employees, but by early 2019 had dropped to only ~12 employees. However, Apollo.io was able to recover from the negative experience by making security a priority. By March 2021, the company had reached 5K paying customers and a year later, in March 2022, the company announced it had grown to 160K customers across free and paid, with paying customers growing 60% in the first quarter of 2022 alone, from 9K to 15K.

Some sources estimate that Apollo.io’s revenue in 2022 was $22.8 million, having grown 288% year-over-year. By December 2022, the company had grown to 110 employees, and in early 2023, Apollo.io was listed by G2 as one of the fastest-growing products in terms of user reviews, alongside companies like Snyk, Miro, and Deel.

Valuation

Apollo.io has raised $151 million in funding across several rounds. The company raised a $7 million Series A in June 2018, a $32 million Series B in 2021 from Tribe Capital, and a $110 million Series C in March 2022 led by Sequoia Capital, which valued the company at $900 million. At an estimated revenue for 2022 at $22.8 million, the company’s Series C valuation represents a 39.5x revenue multiple.

Source: Apollo.io

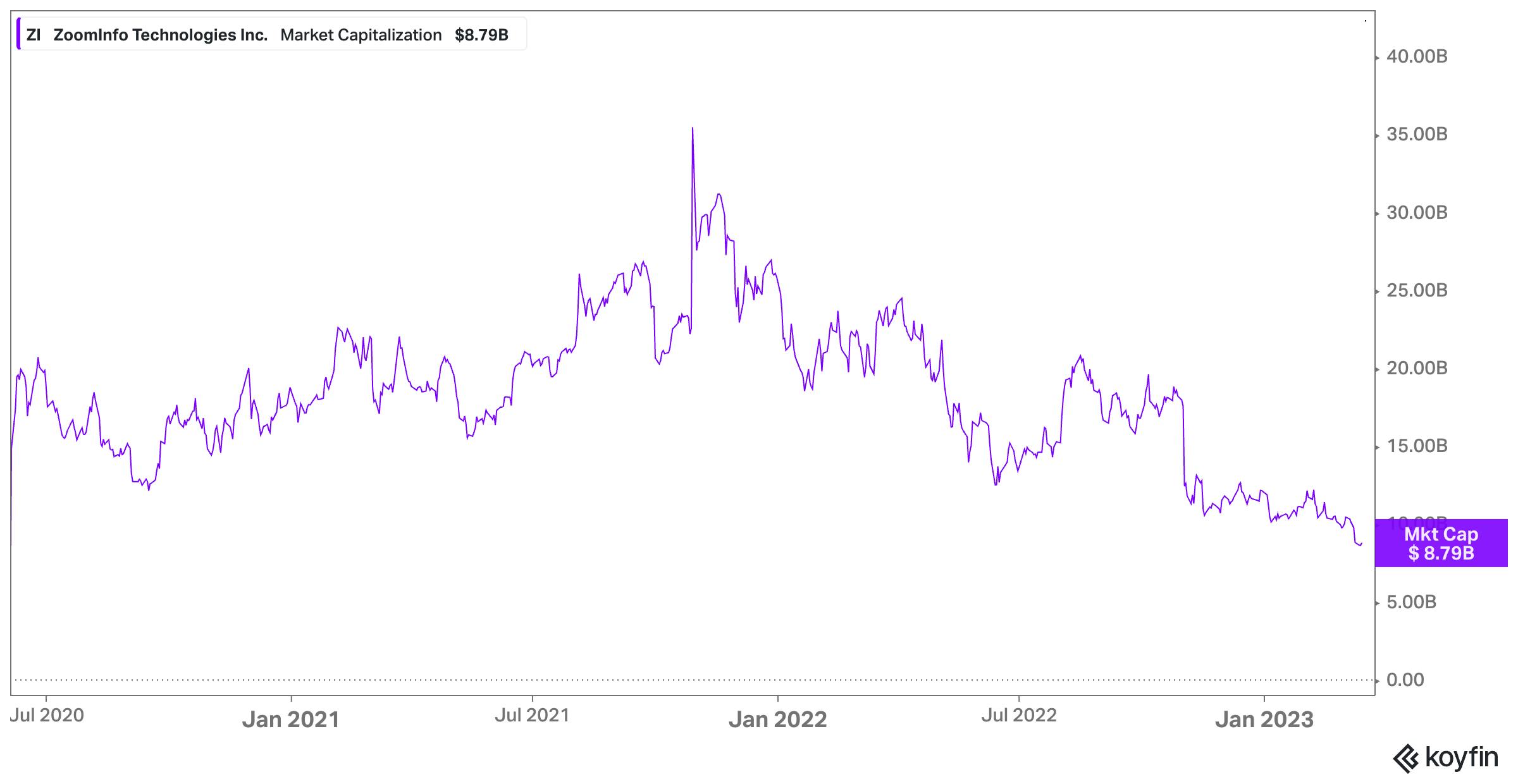

ZoomInfo is Apollo.io’s main public market comparable. As of March 2023, ZoomInfo was trading at ~8.6x LTM revenue with ~$1.1 billion of revenue in 2022, growing 47% year-over-year. Apollo.io also grew its paying customer base by 4x from January 2021 to July 2022, while ZoomInfo grew large customers over $100K ACV by 32% YoY from Q4 2021 to Q4 2022.

Source: Koyfin

Key Opportunities

Expanding Sales Engagement Tools

Building a holistic go-to-market platform is a natural opportunity for Apollo.io to cross-sell its existing customers and increase engagement. This could involve building tools similar to Regie.ai or Copyfactory.io that create email templates based on specific inputs or improve open rates.

Apollo.io could execute a similar playbook as ZoomInfo, who has also grown its product suite inorganically through acquisitions. For example, ZoomInfo acquired Comparably, a recruitment platform, to build out TalentOS, which allows recruiters to use ZoomInfo’s contact base to identify and engage with potential talent. As Apollo.io scales, it could acquire or merge with adjacent companies or competitors in order to build a more holistic platform.

Expanding Upmarket

Apollo.io competitor ZoomInfo has a more established presence among larger customers like Zoom and SAP. Apollo.io has a price advantage that could appeal to larger organizations as more companies look for cost-cutting opportunities.

Key Risks

Data Privacy Regulations

Regulations like GDPR and CCPA have primarily focused on parameters for the collection and utilization of personal data. While this hasn’t had as much impact on corporate data use cases, like sales intelligence, they could expand to do so. Data breaches continue to be a primary concern for data brokers such as Apollo.io. As of February 2023, a study found that 23 of 506 registered data brokers had experienced a data breach in the past, representing half a billion data records. As these breaches continue to occur this will likely attract additional regulatory pressure.

LinkedIn Restricting Access to Data

Apollo.io scrapes a significant amount of data from LinkedIn today. In the future, the platform may limit access to its products in order to drive more platform power for LinkedIn’s own tools. If other large data platforms follow suit, this could lead to lower data quality, especially as competitors like ZoomInfo do not rely as heavily on third-party sources.

ZoomInfo Moving Downmarket

ZoomInfo is the incumbent in the space, with more scale and resources than Apollo.io, allowing them to acquire point solutions and expand into additional modules like MarketingOS and TalentOS faster than Apollo.io could. If ZoomInfo were to make a larger push into the SMB market, it could affect Apollo.io’s win rates. ZoomInfo noted on their Q4 2022 earnings call that the company was seeing the highest win rates ever in SMB in January 2023.

Macroeconomic Environment

Apollo.io provides data for companies to increase their ability to rapidly sell products. As the broader macroeconomic environment proves more painful, companies will not only look for opportunities to cut spend for particular tools, but will also see sales cycles slow down, potentially making tools like Apollo.io make less sense. For example, ZoomInfo has seen a significant slowdown in revenue growth, guiding to 17% YoY growth in 2023 after growing 47% in 2022. Its net retention rate also fell from 116% in 2021 to 104% in 2022 and is expected to fall to the mid-90s for 2023 as customers pull back on seats and pause on upsells. Furthermore, Apollo.io has a much larger exposure to SMBs than ZoomInfo, which are more likely to be exposed to macro fluctuations than enterprises.

Summary

Apollo.io is a sales intelligence tool that enables B2B sellers to more efficiently identify and contact key decision-makers through its prospecting database. The company benefits from network effects by leveraging its freemium model to collect data from its users, allowing it to achieve higher accuracy and breadth than competitors. While Apollo.io faces formidable competition from ZoomInfo, it is gaining share due to its lower price and growing popularity among sellers. Apollo.io started as a B2B contact database but has the opportunity to build a holistic platform central to every company’s go-to-market efforts.