Thesis

Internet connectivity has become a fundamental part of life on Earth. Increasing access to the internet, both for individuals and businesses, represents a sizable opportunity. As of November 2025, 2.2 billion people, primarily in low- and middle-income countries, lacked internet access, representing a $3.5 trillion economic opportunity through 2030. For businesses, maintaining and building internet connectivity has become increasingly complicated because of new digital threats and the rapid growth of communications technology. Downtime alone can cost corporations $400 billion annually. And the increasing relevance of threats like satellite jamming only makes that risk more material.

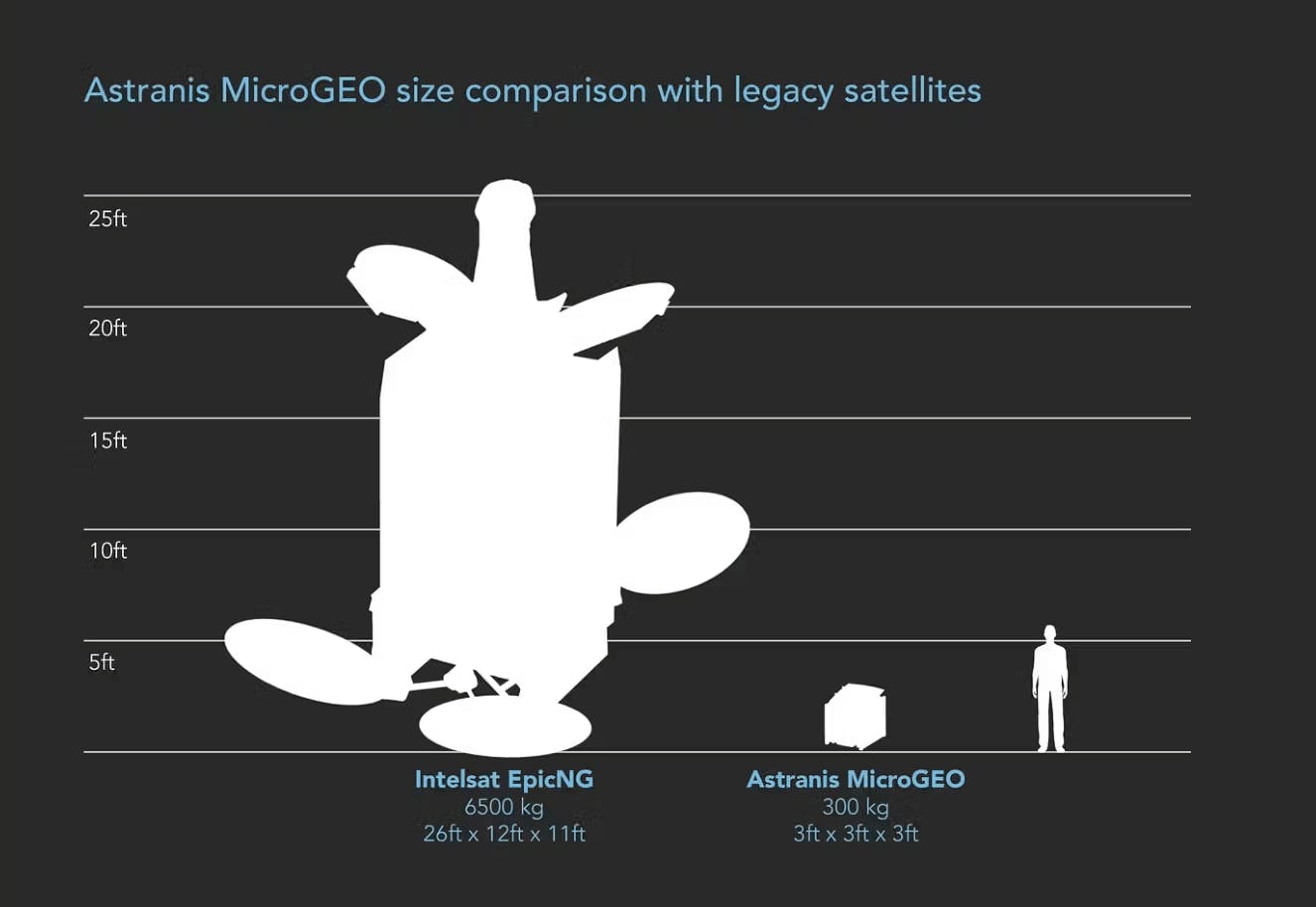

As of November 2025, satellite networks support approximately 1% of global internet traffic, while the remaining 95%+ is primarily routed through undersea fiber optic cables. As regional conflicts (Ukraine-Russia, Israel-Hamas) intensify and increase in number, the threat to undersea cables has increased substantially, leading many organizations to look for alternatives. However, traditional satellite internet infrastructure in areas without internet connection has historically been limited by high manufacturing and launch costs, bandwidth constraints, and reliance on geostationary satellites. Satellites that provide this infrastructure, located in a fixed, geosynchronous equatorial orbit (GEO) 36K km above Earth, cover large “wide-beam” areas but provide limited bandwidth per user, and cost between $100 million and $400 million to manufacture and deploy in 2021.

The satellite industry is rapidly evolving with ongoing technological advancements. Miniaturization, software-defined radio technology (SDR), and decreasing launch costs (from $65K per kg to $1.5K per kg) have changed cost structures and operational capabilities. While the GEO satellite market was projected in June 2023 to grow to $69.4 billion from 2023 to 2030, traditional GEO satellite orders have been declining, with fiber, streaming, and Low Earth Orbit (LEO) satellites taking their place, largely due to size, cost, and assumed economic advantages.

That’s where Astranis comes in. Astranis Space Technologies is an internet connectivity enablement company using GEO microsatellites with unique characteristics to unlock the potential of GEO satellites. Its satellites are approximately 400 kg, 1/20th the size of traditional GEO satellites, heavily reducing manufacturing and launch costs. Instead of wide-beam coverage, Astranis satellites focus on geographic regions where laying fiber isn’t practical. The company uses software-defined payloads to adjust coverage and bandwidth distribution as needed. In particular, Astranis’s approach to leveraging a more optimized size for GEO satellites makes its satellites an ideal solution for clients that require superior security and uptime of connectivity relative to consumer solutions like Starlink that can provide less consistent service at a lower price.

Source: Astranis

Founding Story

Astranis was founded in 2015 by John Gedmark (CEO) and Ryan McLinko (CTO) to build small geostationary satellites to provide cost-effective broadband internet access. Originally from Kentucky, Gedmark saw connectivity issues both in rural areas in the US and globally. As Gedmark explained:

“We want people to have access to information about healthcare, agriculture, and human rights. We want them to be masters of their own destiny. There is a shared store of human knowledge that we take for granted. And part of the world that is online is missing out, too. Everyone that's not online isn't as able to apply their brainpower and smarts to solve problems.”

Before founding Astranis, Gedmark co-founded and led the Commercial Spaceflight Federation, where he played a role in advancing private-sector space initiatives during the Obama administration. McLinko brought engineering expertise from multiple spacecraft programs after leading teams at Planet, where he helped design over 100 small satellites.

Astranis was built on the premise that traditional satellite internet infrastructure had become increasingly large and complex, a phenomenon in the space industry referred to as the Battlestar Galactica approach: “one massive ship to do it all.” Astranis believed this complexity of infrastructure limited accessibility as satellites became correspondingly expensive. Unlike the trend of deploying thousands of Low Earth Orbit (LEO) satellites, requiring continuous handoffs, Astranis focused on smaller, more affordable GEO satellites that remain fixed over specific regions, providing uninterrupted connectivity. The company's approach allows for market entry with a single satellite while using standardized designs for manufacturing efficiency at scale.

The company was part of Y Combinator’s Winter 2016 cohort and launched its first prototype in 2018. By the fourth quarter of 2018, Astranis completed its first commercial satellite, set to launch on a SpaceX rocket. The company has since attracted senior talent from SpaceX, Skybox, SSL, and Orbital, including Dan Berkenstock, founding CEO of Skybox, who serves as a board observer. Astranis has continued to attract senior talent to fill key C-suite positions, with Mark Messler, formerly CFO of Archer, joining as CFO in July 2025. Astranis’s technical capabilities include proprietary software-defined radios, on-board propulsion systems, radiation-hardened electronics, and advanced manufacturing techniques.

Product

As of November 2025, Astranis produces several GEO satellites for internet communications. These satellites differ in both purpose and connectivity capabilities, and support a variety of customers in different parts of the world.

Astranis Prime

Source: Astranis

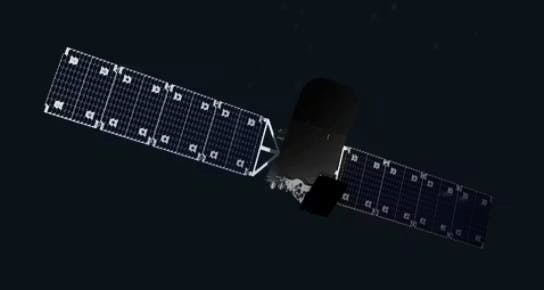

In 2023, Astranis introduced the world's first MicroGEO satellite, Arcturus, as part of the Astranis Prime program. Weighing approximately 300 kg, Arcturus utilizes electric propulsion to maintain its geostationary orbit and communicates using Ka-band frequencies. Its high-throughput payload delivers 7.5 Gbps of capacity and employs spot beam technology to enhance bandwidth efficiency and data rates.

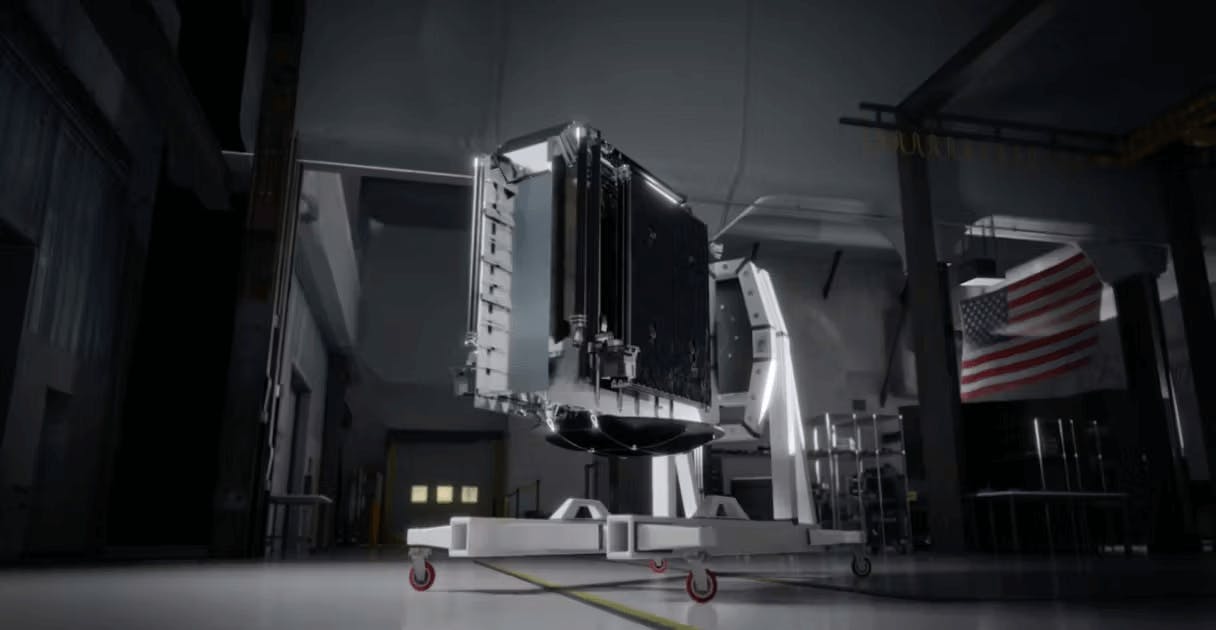

Astranis UtilitySat

Source: Astranis

Launched in 2024, the UtilitySat is recognized as the world's first multi-mission GEO satellite. Dubbed the "Swiss Army Knife of Satellites," it offers broadband connectivity across Ka, Ku, and Q/V band frequencies. Ka-Band (26.5–40 GHz) offers high data throughput and smaller antenna sizes, making it ideal for broadband internet. However, it is more susceptible to rain fade (signal loss due to precipitation). In contrast, the Ku-Band (12–18 GHz) is a well-established band for satellite communications, balancing bandwidth and weather resistance. This frequency band is commonly used for television broadcasting and enterprise networks. The Q/V-Band (33–75 GHz) represents the frontier of satellite communications, enabling even higher data rates but requiring advanced technology to mitigate atmospheric attenuation. By supporting all three frequency bands, Astranis satellites can flexibly allocate spectrum across diverse geographies and applications.

Equipped with Astranis's proprietary ultra-wideband software-defined radio (SDR) technology, UtilitySat can adaptively fine-tune frequencies. Unlike traditional radios, which rely on fixed hardware for signal processing, SDRs use software running on digital signal processors (DSPs) to modulate and demodulate communications. This architecture enables reconfigurability, scalability, and resilience by allowing satellites to adapt post-launch to new frequency bands, protocols, or customer needs. This equipment can receive software updates, support high-throughput MIMO operations, and quickly switch frequencies or modulation schemes to counter interference or jamming.

UtilitySat’s dual-propulsion system combines chemical monopropellant and electric ion thrusters, enabling extensive maneuverability and reconfigurability and allowing it to serve multiple missions throughout its operational life. Astranis can move each UtilitySat around the geostationary belt more than 30 times over its useful life, representing a significant move away from legacy GEO satellites with long lifespans and single-mission profiles that are predetermined well before launch.

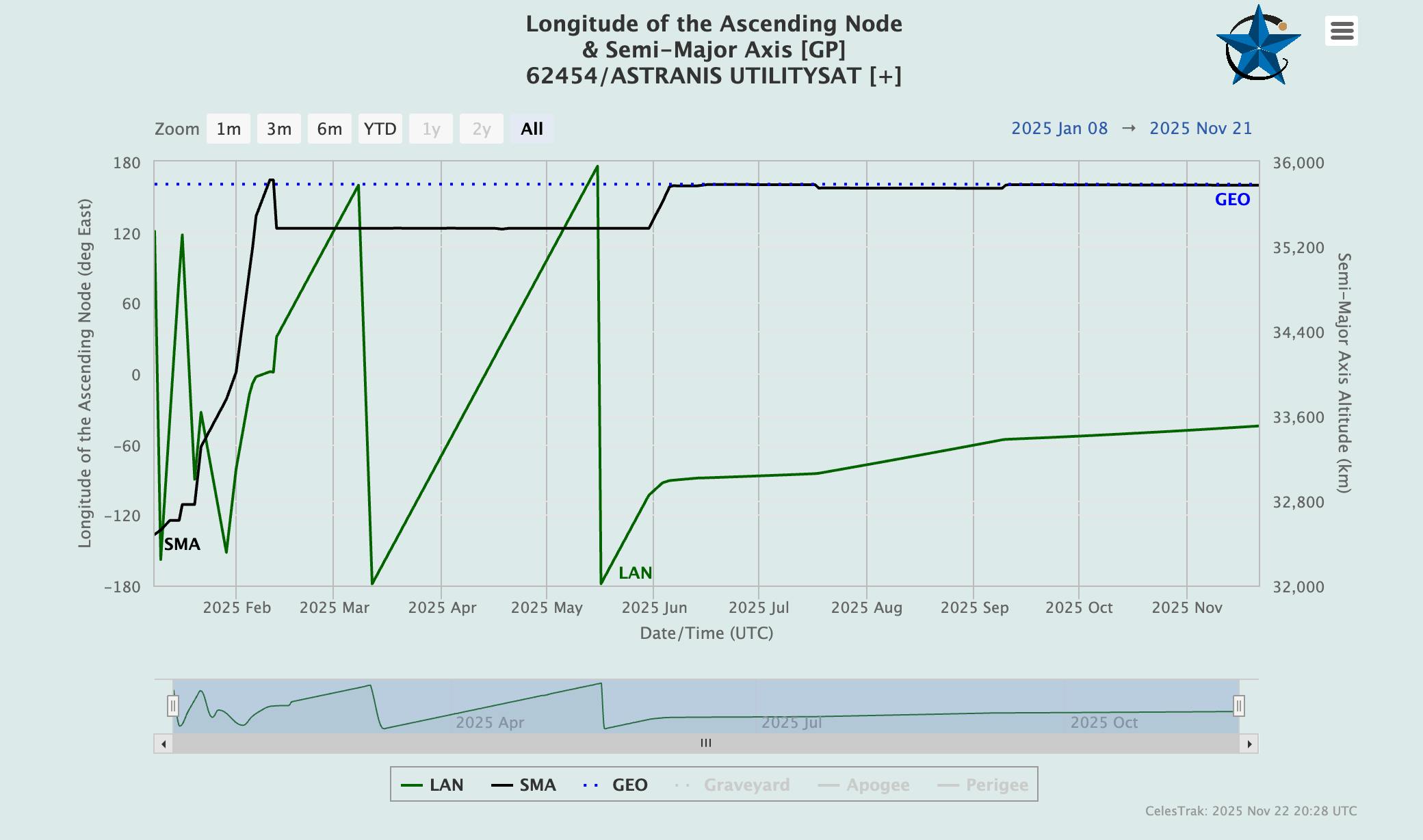

In April 2025, industry reports found that a launched UtilitySat had failed during orbit-raising and become stranded in supersynchronous transfer orbit, likely constituting a total loss. According to the report, the satellite, launched in December 2024 aboard a Falcon 9 alongside three sister MicroGEOs, stopped changing orbit in early February after its electric propulsion system failed. Tracking data from Celestrak showed the spacecraft was marooned in orbit.

Source: Celestrak

Insurance sources expect a claim of roughly $30 million, a modest amount relative to recent high-value GEO losses, still significant in terms of the spacecraft’s importance in backfilling coverage service lost when Astranis’s earlier Arcturus satellite suffered a power failure in August 2023.

Astranis Omega

Source: Astranis

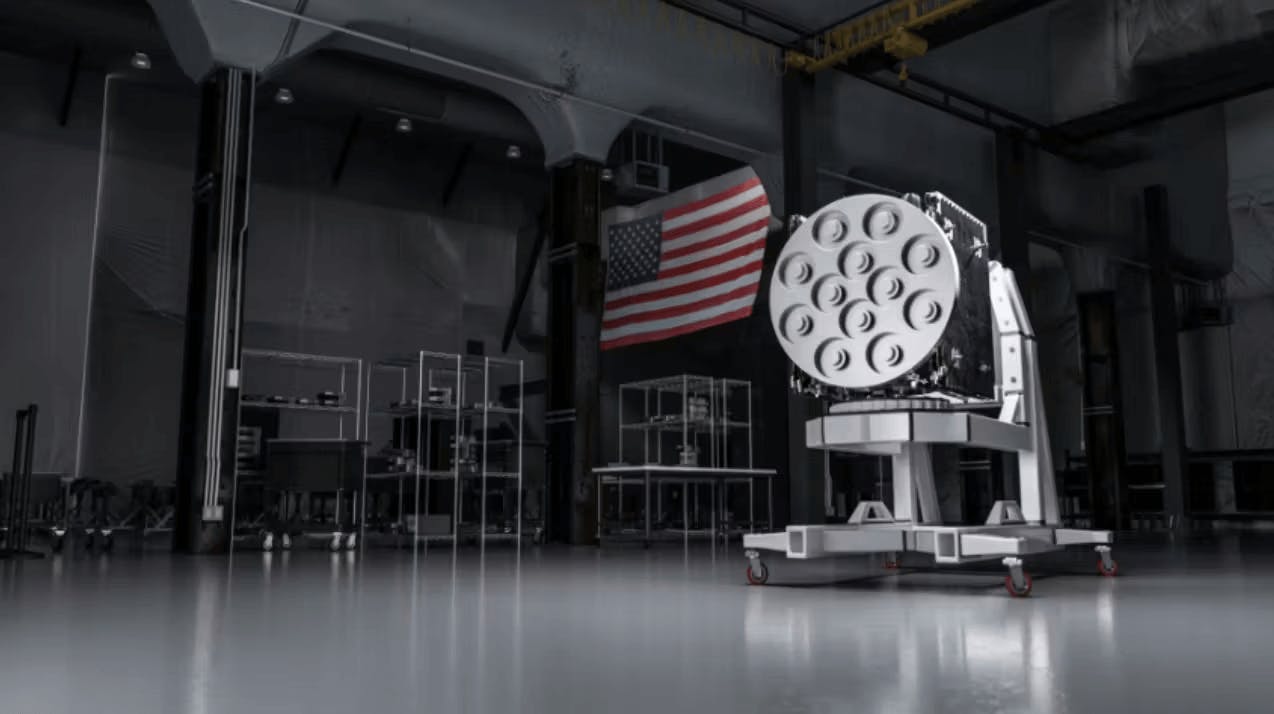

As of November 2025, the Omega program is set to launch its first satellites in 2026. This satellite platform produces over 50 Gbps of bandwidth across both civilian and military Ka-band frequencies, achieving five times the power output of Astranis’ first-generation satellites. The satellite design includes a deployable reflector that unfolds to boxing ring dimensions once in orbit. The manufacturing process for these satellites maintains 70% in-house component production. The system incorporates Protected Tactical Waveform (PTW) compatibility for operation in contested environments, while all-electric propulsion enables station-keeping and orbital maneuvers throughout its 10+ year operational lifespan.

For government and defense customers, Astranis incorporates compatibility with the PTW, the US military’s jam-resistant, secure communications protocol. PTW enables satellites to maintain a secure, high data-rate connection even in contested or denied environments.

As of April 2024, the Astranis Omega deployment strategy was expected to begin with six satellites in 2026, followed by potential expansion to 24 units annually. Through its "satellite as a service" model, customers can lease complete or partial satellite capacity using either upfront or monthly payment structures.

Astranis Nexus

Source: Astranis

Planned for deployment in 2028, the Nexus satellite aims to enhance the resilience of America's GPS constellations. In collaboration with the US Space Force's $2 billion Resilient Global Positioning System (R-GPS) program, Nexus is designed to serve as a backup for the current US GPS satellite system. It will incorporate modernized GPS signals, including the military protocol M-Code, to make America’s GPS constellations more resilient to jamming, spoofing, and kinetic attacks. As of November 2024, Astranis plans to use the existing MicroGEO satellite design with PNT algorithms from Xona Space Systems, which will be implemented into the Astranis Octane SDR hardware. In October 2024, Astranis received an $8 million contract from the US Space Force for concept development, and plans to build and launch a fleet of more than 20 small GPS satellites as part of this program. In March 2025, Astranis completed a key demonstration for the US Space Force’s Resilient GPS program, transmitting core GPS waveforms using Astranis’ software-defined radio hardware, with Astranis’ Nexus concept positioned as a candidate GEO component in the emerging R-GPS architecture.

Astranis Vanguard

Source: Astranis

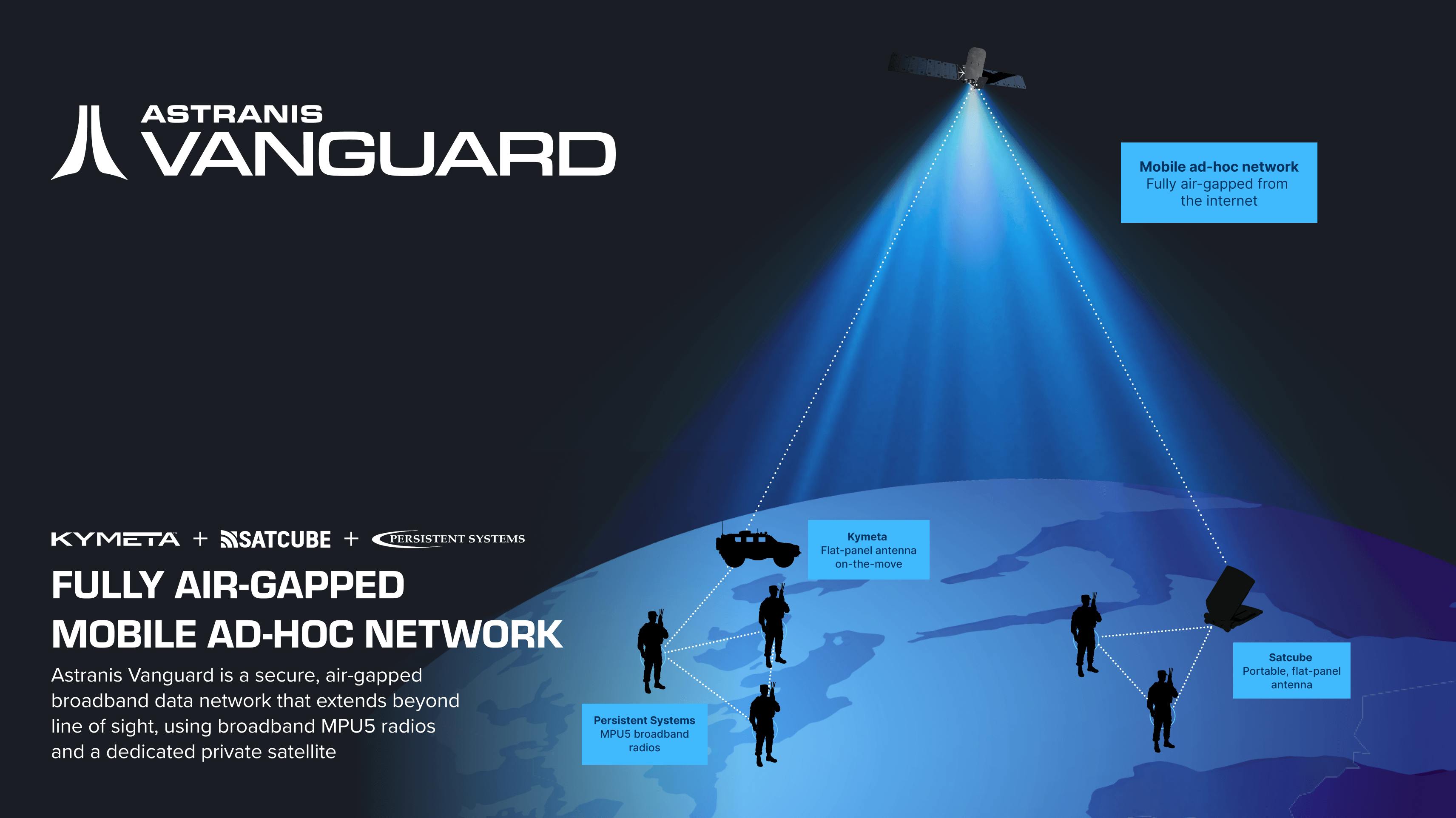

Announced in November 2025, Astranis Vanguard is a satellite-enabled Mobile Ad-Hoc Network (MANET) capability that creates a fully air-gapped, rapidly deployable communications network using a dedicated Astranis GEO satellite. Developed with partners Persistent Systems, Kymeta, and Satcube, Vanguard integrates MPU5 MANET radios with Astranis’s onboard Software-defined radio (SDR) and flat-panel user terminals to deliver resilient voice, video, and broadband data beyond line-of-sight.

This system enables warfighters to maintain command-and-control and situational awareness in contested or infrastructure-denied environments, while first responders and commercial users can reestablish connectivity within minutes after disasters or in remote industrial operations. Vanguard demonstrates Astranis’ move towards providing tailored solutions to the US defense and intelligence community, especially in high-conflict, low-infrastructure regions.

Market

Customer

Astranis primarily serves telecommunications companies (telcos), internet service providers (ISPs), and mobility service providers seeking dedicated satellite bandwidth to expand their coverage areas.

Selling to commercial entities like telcos and ISPs can be challenging, given existing infrastructure investments and long sales and commitment cycles. Many service providers currently lease fractional capacity from existing large satellite operators, which can be costly and limit their ability to expand services. Commercial customers include Thaicom and Apco Networks. In September 2023, Apco Networks collaborated with Astranis to launch two satellites dedicated to Mexico, aiming to connect up to five million people to affordable broadband internet.

In March 2024, Thaicom partnered with Astranis to build and operate the THAICOM-9 satellite, enhancing connectivity over Asia. In August 2025, Astranis brought online two satellites that provide broadband coverage over the United States for in-flight connectivity partner Anuvu, described as the first private customer-dedicated GEO satellite network in operation globally. In September 2025, Astranis and Impulse Space signed a partnership for a 2027 mission, aiming to deliver Astranis MicroGEO satellites from LEO to GEO without the use of a Heavy-class rocket.

Astranis also serves government agencies requiring secure and resilient satellite communications for defense and scientific missions. As of 2025, many government agencies still relied on aging satellite infrastructure that did not meet modern security and resilience requirements. Though government contracts often involve rigorous procurement processes, Astranis's track record of performance, dual-use technology, and offering of satellites on demand make it a viable candidate for such partnerships. Astranis also works with the US Space Force, which selected Astranis as a prime contractor for the Resilient GPS (R-GPS) program, focusing on developing next-generation positioning, navigation, and timing satellites. In July 2025, Astranis was also selected by the Space Force to design and demonstrate anti-jamming Protected Tactical SATCOM-Global capabilities (PTS-G).

Market Size

By 2025, satellite launches had reached historic highs, with over 1.2K satellites launched between January and April of 2025, 50% more than during the corresponding period in 2024. This surge has been driven by advancements in automation and technology, leading to reduced launch costs and heightened demand for compact satellites. In 2024, space-related startups secured over $8.6 billion in funding, with analysts speculating that intensifying US-China competition in space technology will drive further investment in the space.

The small satellite (smallsat) sector was estimated to have a market size of $7.9 billion in 2025 and is expected to reach approximately $110.5 billion by 2032. Growth is expected to be driven by global constellation replenishments and increasing demand for complex single satellite missions, especially from government entities. The smallsat market has further benefitted from the introduction of ride-sharing launch programs to optimize deployment efficiency. For instance, in January 2021, SpaceX's Falcon 9 rocket carried 143 small satellites into orbit, exemplifying the benefits of shared launches.

Competition

Competitive Landscape

Satellite operators primarily differ by orbital regime, including Low Earth Orbit (LEO), Medium Earth Orbit (MEO), or Geostationary Orbit (GEO), and by the applications they target. LEO constellations (e.g., Starlink, Amazon Leo, OneWeb) deliver much lower latency than legacy GEO broadband; Starlink reports US median peak-hour latency in the low-30-ms range, comparable to many terrestrial links. Because LEO satellites move relative to the ground, connections must be handed off between satellites frequently (measurements show primary-link switches on Starlink on the order of seconds). This can introduce brief interruptions that operators may need custom infrastructure to minimize. By contrast, a GEO satellite appears fixed over a region, providing continuous coverage without satellite handoffs, which is useful in regions where predictable and fixed service levels matter.

Business models map to these architectures. Starlink pursues mass-market broadband; Amazon Leo is building a LEO network with phased-array user terminals and optical inter-satellite links, and is explicitly integrating private connectivity into AWS for enterprise and government users. OneWeb (now part of Eutelsat Group) has emphasized telco and government backhaul, while Eutelsat adds a large GEO footprint to the combined, multi-orbit offering. SES operates both GEO and its MEO O3b mPOWER system to serve mobility, enterprise, and government requirements that value managed performance and lower latency than GEO. Omnispace is developing a hybrid satellite-terrestrial, direct-to-device model geared to mobile and IoT, positioning it differently from fixed broadband providers.

Astranis combines GEO’s “always-on” regional coverage with a microsatellite form factor. Its MicroGEO satellites are designed to be dedicated to a specific ISP or region, with commercial options that include “your own satellite” and flexible ownership or capacity-lease structures, letting smaller operators stand up targeted GEO capacity without deploying a large multi-tenant GEO platform. Because these are GEO spacecraft, they avoid LEO handoffs and provide continuous service within their footprints. Examples include capacity programs in Alaska and Peru structured around dedicated MicroGEO assets.

Astranis operates in a competitive landscape defined by three distinct groups: direct competitors, who also operate GEO communications satellites; defense contractors, who manufacture satellites but do not operate commercial networks; and adjacent players, whose LEO or hybrid architectures target broader consumer or mobility markets. Astranis’ differentiation lies in deploying small, dedicated GEO satellites that give individual telecoms and ISPs control over their own capacity, rather than relying on multi-tenant or consumer-focused models. In addition, Astranis’ specific differentiation comes from its focus on enterprise-grade service, including SLAs, uptime, and security.

Direct Competitors

Astranis’ direct competitors are operators of geostationary communications satellites (GEO) that provide broadband capacity to telecoms, ISPs, and governments. These companies compete for the same connectivity contracts Astranis is targeting, though their models focus on large-scale, multi-tenant satellites rather than Astranis’s smaller, dedicated approach.

SES Satellites: Founded in 1985 in Luxembourg, SES is one of the largest satellite operators, with both GEO and Medium Earth Orbit (MEO) assets. It serves enterprise and government customers with large-scale, multi-tenant capacity. Astranis differentiates itself by enabling smaller ISPs and telecom providers to own and operate their own GEO satellites.

Intelsat: Founded in 1964 as the International Telecommunications Satellite Organization, Intelsat is headquartered in Luxembourg and operates one of the world’s largest GEO fleets. It provides broadband, media, and enterprise services globally under a shared-capacity model. In May 2025, Intelsat secured regulatory approval in India for direct broadcast services. In July 2025, it was acquired by SES in a $3.1 billion deal, creating a consolidated GEO/MEO operator.

Viasat: Founded in 1986 in California, Viasat operates high-throughput GEO satellites serving residential broadband, in-flight connectivity, maritime, and defense. Its ViaSat-3 constellation aims to expand global coverage with terabit-class capacity. Unlike Astranis’ dedicated-satellite model, Viasat focuses on massive, shared-capacity systems targeting broad consumer and enterprise markets.

Eutelsat: Established in 1977 and headquartered in France, Eutelsat operates a fleet of 35 GEO satellites. Following its 2023 merger with OneWeb, the company started to combine GEO coverage with access to more than 600 LEO satellites. Eutelsat’s GEO business overlaps with Astranis in broadcast and broadband markets, but its focus remains on large-scale, multi-tenant services. In June 2025, the French government doubled its stake in Eutelsat to nearly 30% via a €717m investment in a larger capital raise, explicitly to shore up finances and maintain a European alternative to Starlink.

Maxar Technologies (Defunct): Founded in 2017, Maxar was best known for geospatial imagery and defense, but also manufactures and operates GEO communications satellites. While Maxar’s brand is tied to imagery, its GEO communications business partially overlaps with Astranis. The company was publicly traded until March 2023, when private equity firm Advent International acquired it for $6.4 billion. Advent has since split Maxar Technologies’ satellite operations and manufacturing into two new companies, Vantor and Lanteris Space Systems.

Vantor (formerly Maxar Intelligence): Founded in 2025 as a carve-out from Maxar Technologies, Vantor focuses on remote sensing, geospatial analytics, and AI-enabled multi-sensor fusion. It continues to operate Maxar’s legacy WorldView satellites and its newer WorldView Legion constellation, and remains a major provider of imagery and analysis to the US Intelligence Community. Vantor’s strategy centers on redefining the former Maxar Intelligence business as a broader “spatial intelligence” company, underpinned by its Tensorglobe platform, which fuses data from space, air, and ground sensors into a unified, continuously updated intelligence picture.

Lanteris Space Systems (formerly Maxar Space Systems): Founded in 2025 as a carve-out from Maxar Technologies, Lanteris encompasses the satellite manufacturing arm, including the Lantaris (formerly Maxar) 1300-series GEO communications bus. As of November 2025, more than 95 Lanteris 1300-series satellites were in orbit, spanning both communications and earth observation. Lanteris positions itself as a next-generation defense and space-technology company, producing missile-tracking satellites, secure communications platforms, and high-power spacecraft buses for national security, commercial connectivity, and deep-space exploration. The company retains legacy Maxar production capabilities in Palo Alto and continues to serve both US government and commercial customers.

Defense Contractors

While Astranis’ direct competitors are operators, defense contractors like Boeing and Northrop Grumman play a different role: they manufacture satellites but do not operate commercial broadband networks. This makes them suppliers in the value chain rather than head-to-head competitors.

Boeing: Boeing has a long history of building communications satellites, including the Boeing 702 series, for government and defense clients. Its role is as a manufacturer under contract rather than as a service provider. In October 2024, one of its GEO satellites exploded in orbit, highlighting risks in the supply chain. For Astranis, Boeing represents a potential partner for spacecraft manufacturing but not a competitor for customers.

Northrop Grumman: Northrop Grumman is another legacy defense prime with deep experience in GEO satellites. It has built spacecraft for national security missions and developed on-orbit servicing technologies, but it does not operate broadband networks. Like Boeing, it is more relevant to Astranis as a supplier than a rival.

Adjacent Players

Because Astranis deploys dedicated GEO satellites that provide fixed, continuous coverage to specific regions, its architecture avoids the handoffs required in LEO constellations and delivers always-on connectivity within its coverage area. This makes Astranis better suited for applications where reliability and uptime are critical. In contrast, adjacent players target consumer, mobility, or IoT markets, meaning they overlap broadly on connectivity but not on Astranis’ core enterprise and government deals.

SpaceX Starlink: Founded in 2018, Starlink operates the world’s largest LEO satellite constellation, delivering broadband internet with global reach and low latency, often achieving median latencies as low as 33ms during peak hours. This architecture enables Starlink to serve mobile users and remote locations where terrestrial infrastructure is unavailable. However, the physics governing LEO systems result in satellites moving continually relative to fixed positions on Earth, requiring frequent handoffs between satellites to maintain connectivity. As of October 2025, SpaceX has launched over 10K Starlink satellites, with roughly 8.6K still in orbit and ~7.4K in operational planes, widening its lead in sheer deployed capacity.

While Starlink’s multilayer network design aims to optimize coverage and handover, users (especially those relying on a single terminal) can experience brief but frequent connectivity dropouts, sometimes every 60 to 120 seconds, which can disrupt large data transfers or critical enterprise applications. Starlink’s cost per bit, a common metric used for satellite connectivity pricing, is often more affordable than legacy satellite providers, but this metric does not account for intermittent connectivity or the lack of contractual service guarantees that enterprise and government customers often require. For these users, even short disruptions can be problematic, as they may impact operational continuity, data integrity, or mission-critical communications.

Amazon Leo: Announced in 2019, Amazon Leo (rebranded from Project Kuiper in November 2025) is a $10 billion Amazon initiative aiming to deploy a constellation of 3.2K LEO satellites for the delivery of fast, affordable broadband to underserved and remote communities worldwide. Amazon’s goal is to integrate satellite internet with its existing ecosystem, potentially bundling services with Prime subscriptions, Alexa devices, and Amazon Web Services (AWS). Technology like phased-array antennas and inter-satellite laser links enables directing signals and transmitting data between satellites at high speeds without physical connections. Leo and other LEO megaconstellations, like SpaceX’s Starlink, have largely overlapping markets. The first 78 LEO satellites were launched in collaboration with SpaceX over three launches in 2025, with 150+ total satellites in orbit as of November 2025. Amazon Leo is betting on global scale, rapid deployment, and integration with Amazon’s digital platforms to capture a share of the broadband market, especially in areas where terrestrial infrastructure is lacking.

OneWeb: Founded in 2012 and acquired by Eutelsat in 2023, OneWeb operates a global LEO constellation delivering broadband “backhaul” for telcos and governments. Backhaul is a term for the infrastructure that links a local network, like a home Wifi system, to a backbone or core network. OneWeb’s approach differs from Astranis’ in that it provides global connectivity using LEO satellites, whereas Astranis focuses on regional coverage with dedicated GEO satellites. While both companies compete for telecom and government contracts, their infrastructure models serve different use cases, with LEO favoring global, low-latency applications and GEO providing more stable, targeted coverage.

Omnispace: Founded in 2012, Omnispace had raised $140 million from Columbia Capital, TDF Ventures, and Greenspring Associates as of November 2025. It is developing a hybrid satellite-terrestrial network using Medium Earth Orbit (MEO) and LEO satellites for direct-to-device (D2D) mobile connectivity, bypassing traditional land-based cell towers. Omnispace’s strategy is centered on the future of mobile and IoT applications, whereas Astranis is focused on expanding fixed broadband access in underserved regions. As of November 2025, Omnispace agreed to merge with Lynk Global, creating a combined direct-to-device operator with SES as a major strategic shareholder. The merged company aims to offer global 5G NTN and legacy handset coverage, sharpening competitive pressure in the D2D segment.

Business Model

Astranis operates a bandwidth-as-a-service model, designing, building, and operating small, high-capacity GEO satellites to provide turnkey connectivity solutions to its customers. By owning and managing its satellites, Astranis offers adjustable frequency and coverage, maximizing spectrum utilization and delivering up to 10 Gbps of bandwidth per satellite. This approach enables the company to serve underserved markets, including small to medium-sized nations and remote regions often overlooked by larger providers.

The company constructs and launches satellites within 12 to 18 months, allowing it to respond more quickly to market demands, reducing the typical timeline of traditional satellite operators. Astranis's revenue model centers on leasing satellite capacity to internet service providers, mobile network operators, and governments, who then offer internet services to end-users. This strategy provides a steadier income stream compared to satellite sales.

Traction

Satellite and space companies like Astranis rely on long-term partnerships with customers for the funding and runway to conduct development and testing of their products. Astranis partnered with Pacific Dataport for the Arcturus satellite serving Alaska in June 2019, Apco Networks for two satellites aiming to connect up to five million people in Mexico in September 2023, and Orbits Corp to provide satellite internet services to two million people in the Philippines in November 2023. In September 2024, Astranis secured a $13.2 million contract from the US Space Force's Space Systems Command to integrate military Ka-band frequency compatibility into its Omega satellites.

As of November 2025, Astranis’ satellite deployments have been fulfilled via the company’s partnership with SpaceX. In April 2022, Astranis signed a contract with SpaceX for a dedicated Falcon 9 launch to deploy four MicroGEO satellites. This collaboration continued with a successful launch in December 2024 from Cape Canaveral Space Force Station. In January 2025, Astranis secured another Falcon 9 launch to deploy five additional MicroGEO satellites later this year. In September 2025, Astranis and Impulse Space signed a partnership for a 2027 mission, aiming to deliver Astranis MicroGEO satellites from LEO to GEO without the use of a Heavy-class rocket.

Valuation

In July 2024, Astranis raised a $200 million Series D funding round led by Andreessen Horowitz and BAM Elevate, at an undisclosed valuation. Other notable investors in Astranis include Refactor and Y Combinator, which have backed the company in previous rounds. In 2023, the company also raised $200 million and was valued at $1.6 billion at the time. As of November 2025, the company had raised a total of $753.5 million.

Key Opportunities

Regional & Disaster-Resilient Connectivity

Telecommunications providers and national governments are increasingly turning to dedicated satellites to enhance network resilience, particularly in regions vulnerable to natural disasters or submarine cable disruptions. Astranis’ partnership with Chunghwa Telecom in April 2025 to launch Taiwan’s first dedicated geostationary satellite is one example of this shift. The dedicated satellite is expected to serve as a digital backbone for cellular, maritime, and government communications, and as a backup during crises.

Government & Enterprise Markets

As of November 2025, the government and enterprise segments of the internet connectivity market have both faced increasing requirements for secure, resilient, and sovereign communications. As of 2025, industry analysts continually identify government end-customers as the largest potential customer of satellite services, with ongoing geopolitical complexities and focus on data security accelerating adoption. Astranis is betting on dedicated, regionally focused bandwidth with contractual service guarantees to capture a larger share of this expanding market.

Astranis’ recent leadership team hires and product announcements reveal the company’s ambitions in providing satellite communication solutions to the US defense and intelligence community. As regional and global conflicts intensify, the US SIGINT market is a key opportunity, where Astranis’ secure, persistent, and regionally tailored GEO products can provide a competitive advantage against existing incumbents.

Terrestrial Networks & Direct-to-Device Growth

As of February 2025, there is increasing demand for the integration of satellite and terrestrial networks for use cases including mobile, IoT, and automotive applications. The expansion of direct-to-device (D2D) satellite connectivity is projected to reach 130 million users by 2032, making satellite-based communication more accessible and driving increased demand for flexible, reliable space-based infrastructure. As of November 2025, Astranis still does not offer its own end-user ground devices or direct-to-device service; instead, it provides satellite capacity and managed networks to operators and enterprises.

Key Risks

Technological Challenges

Astranis's ability to deliver reliable broadband service depends on the performance of its satellite components. In July 2023, the company’s first commercial satellite, Arcturus, suffered a malfunction in its solar array drive assembly, preventing it from delivering broadband service to Alaska. This incident highlighted the risk of component failures affecting future deployments, a hardware risk that all satellite companies face. Additionally, geostationary satellites are exposed to high levels of radiation, which can degrade electronic components over time.

The April 2025 UtilitySat failure further demonstrates the challenges involved with deploying and operating high-performance GEO satellites. Industry reports found that the spacecraft’s electric propulsion system failed during orbit-raising, leaving UtilitySat stranded in supersynchronous transfer orbit and likely constituting a total loss. Because this UtilitySat was intended to backfill service lost when Arcturus malfunctioned, these incidents illustrate that propulsion reliability, power-system robustness, and radiation tolerance remain key execution risks for Astranis as it scales its fleet to deliver permanent and geosynchronous connectivity uptime globally.

Significant Market Competition

Astranis operates in a highly competitive landscape, facing pressure from both emerging and established players. The LEO satellite networks, including SpaceX’s Starlink and Amazon’s Project Kuiper, pose a notable threat. As of November 2025, these networks are rapidly expanding and offer lower latency and higher data throughput than GEO systems. Legacy satellite operators, including Eutelsat and SES, are consolidating to create hybrid GEO-LEO networks, making it harder for GEO-only companies to compete.

Regulatory & Spectrum Allocation Risks

Astranis's business is highly dependent on access to radio frequency electromagnetic transmission channels, which are increasingly contested. The industry has seen growing disputes over spectrum allocations, with companies like SpaceX advocating for regulatory changes that would impact spectrum and transmission power rights for all service providers. Astranis also relies on securing approvals from national and international regulatory bodies for satellite deployment and operations. Delays or denials in these approvals could slow expansion efforts and disrupt business operations.

Summary

The global satellite internet market is expanding rapidly, projected to grow from $4 billion in 2023 to $17.1 billion by 2028, reflecting a 33.7% CAGR. As of November 2025, Astranis produces and operates micro-geostationary communications satellites designed to deliver high-speed internet to underserved regions. The company has secured contracts for a dozen satellites globally, representing more than $1 billion in satellite services sold. As competitors like SpaceX’s Starlink and Amazon Leo continue deploying LEO constellations, the long-term viability of Astranis’ geostationary approach will depend on its ability to compete on latency, coverage, and cost.