Thesis

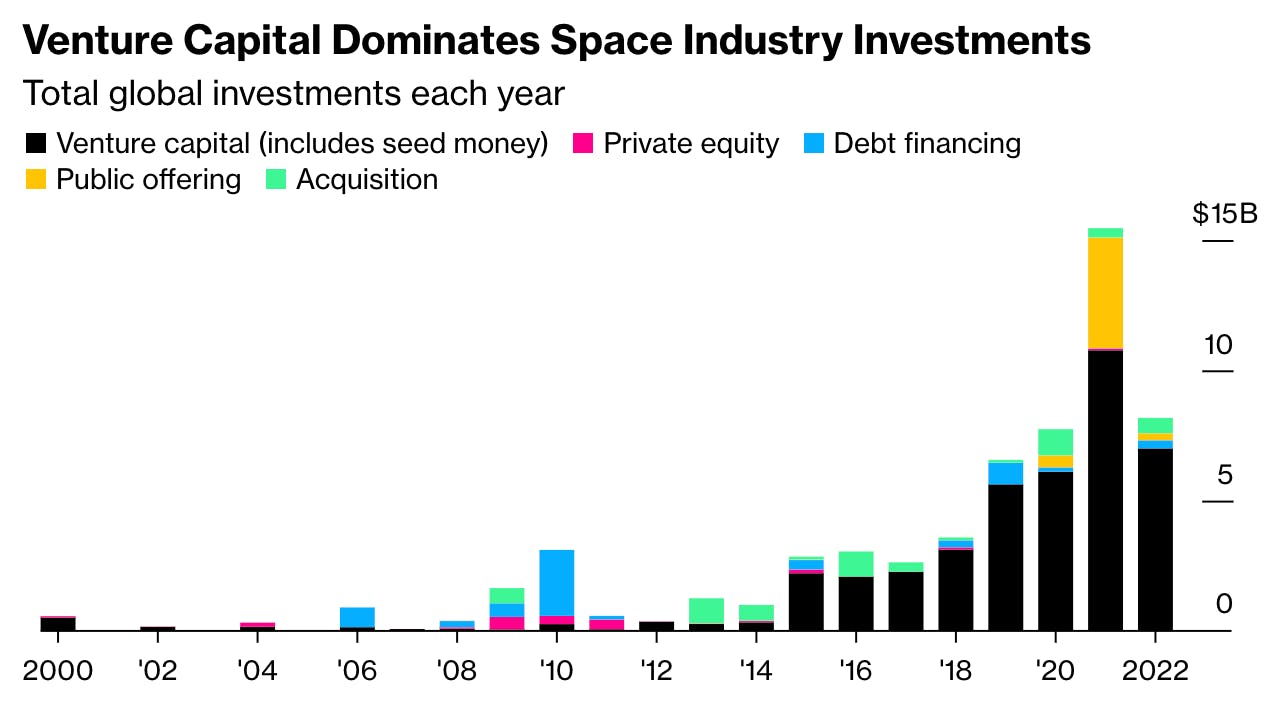

In 2002, total global investment in space startups was just $168 million. By 2021, this figure had reached $15 billion, catalyzed by a new wave of commercial space entrants. Declining space launch costs, technological advances, and private capital inflows have transformed a market once dominated by the government into an increasingly commercial sector.

Source: Bloomberg

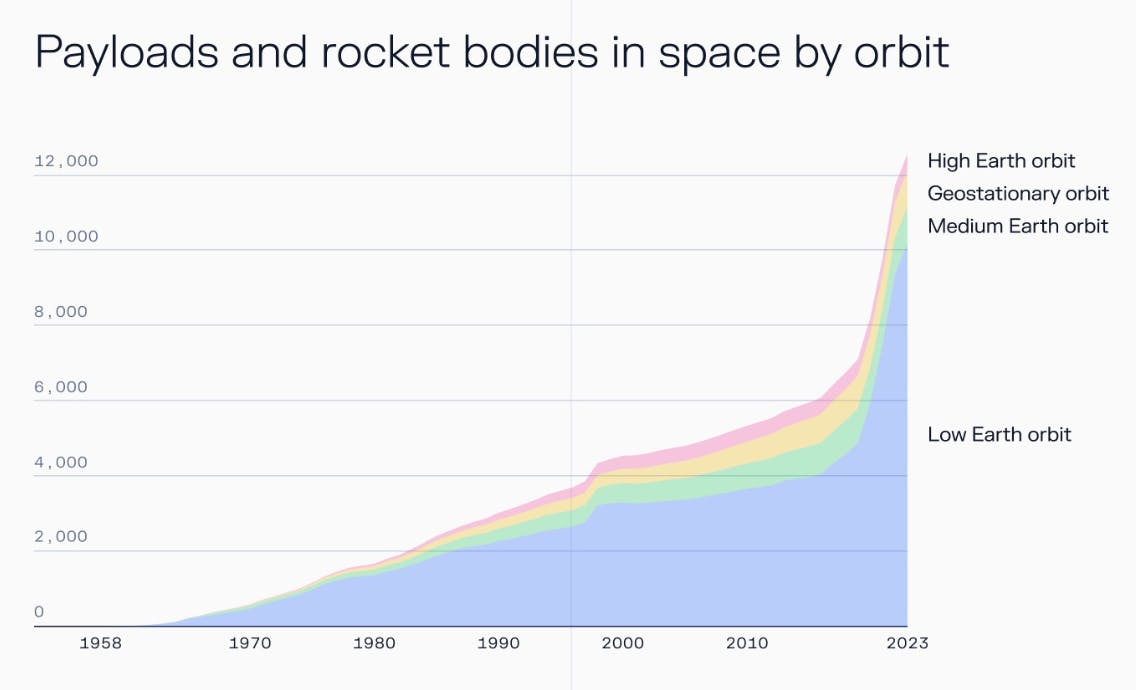

The turning point came with the rise of SpaceX and the operational success of reusable rockets, which significantly decreased the cost of launch per kilogram. From 2015 to 2024, the number of satellites launched annually increased by more than 8x, led by the US. The effect is visible in the Earth’s orbit itself. As of October 2025, there are over 13K active satellites in orbit, up from just a few thousand in 2015, with projections indicating that over 80K satellites could be deployed by 2030.

Source: Contrary

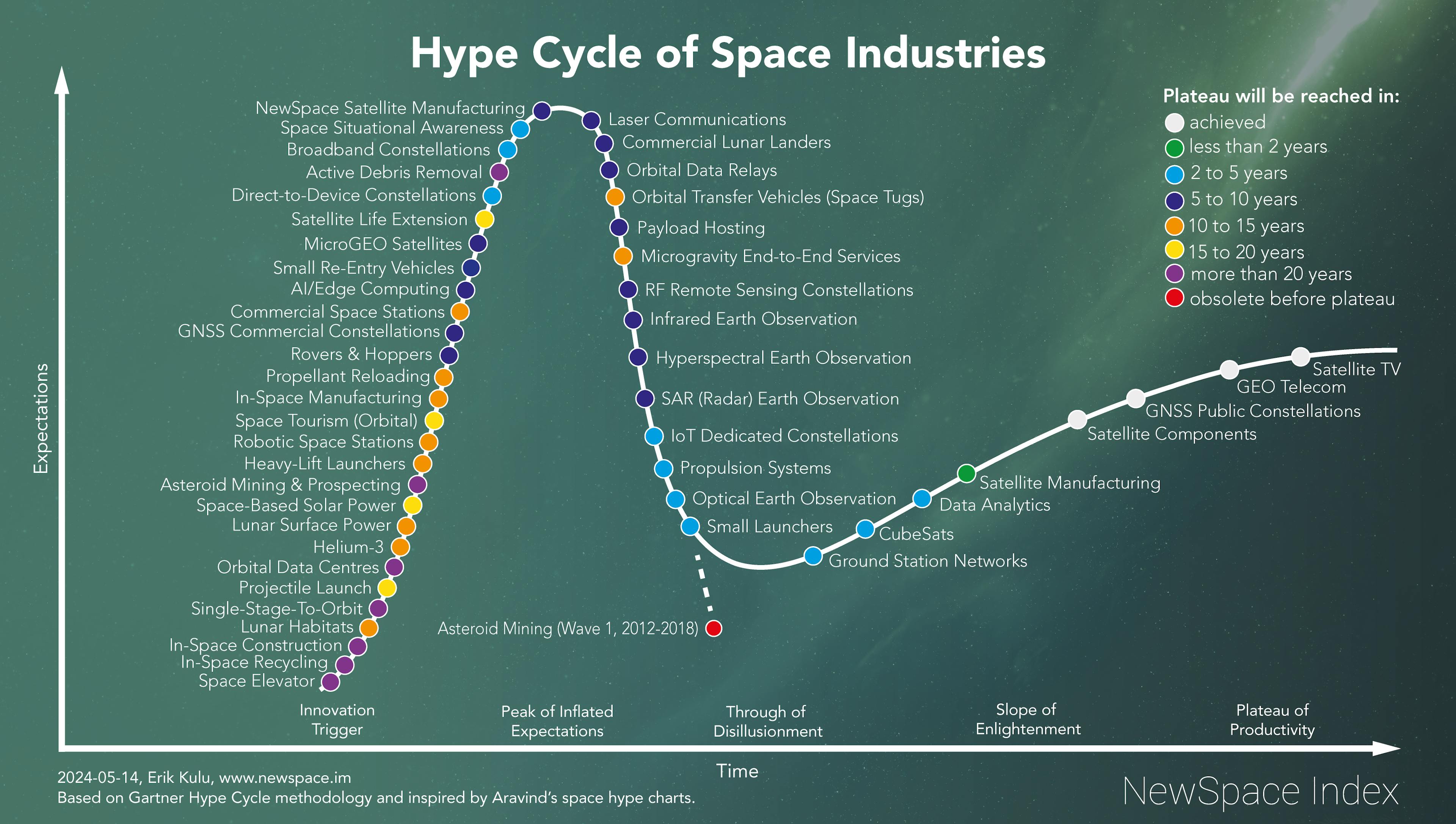

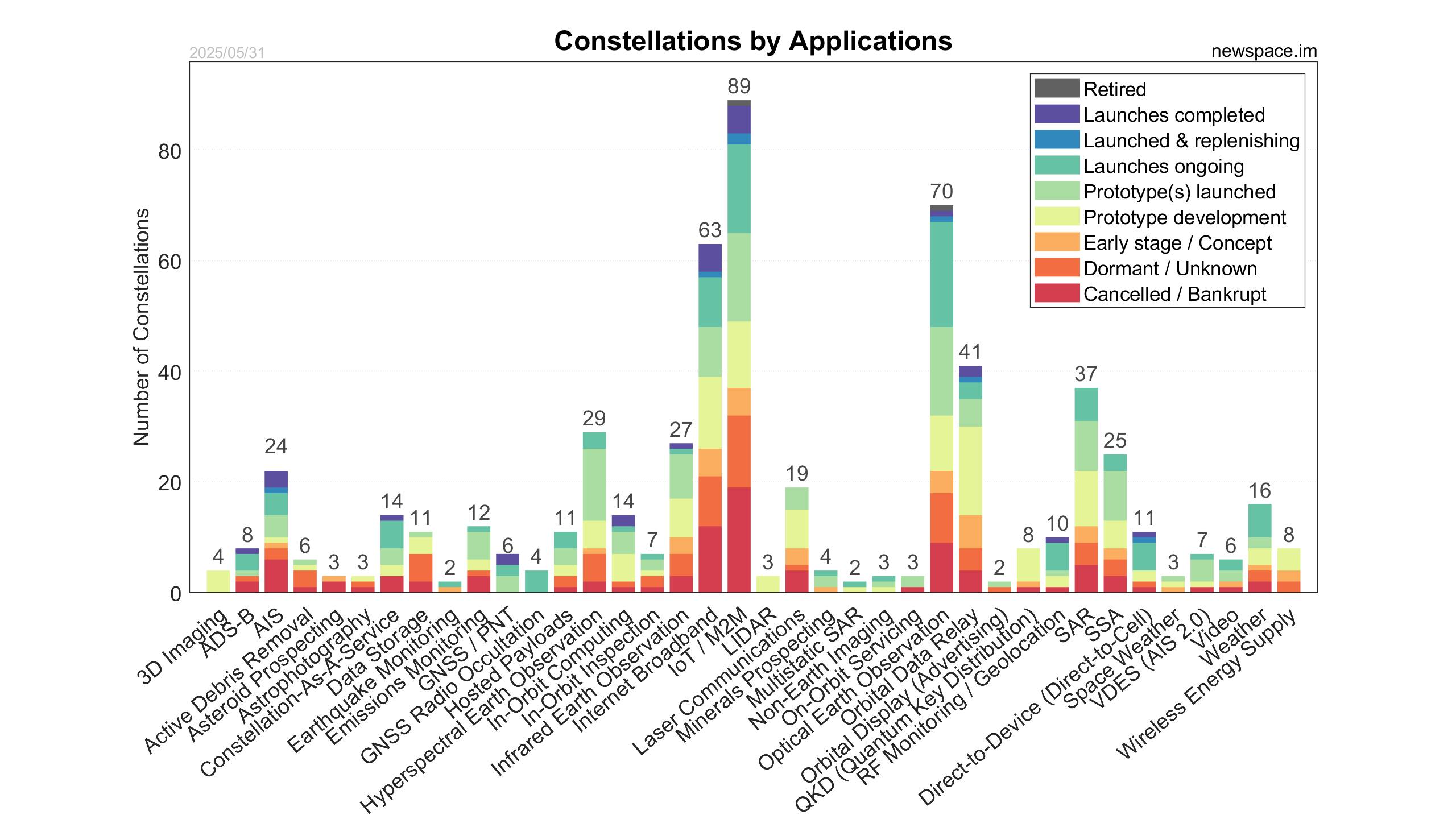

This shift has redefined space as not only a communications or observation layer, but increasingly as a compute and infrastructure environment, where software applications can be executed directly aboard satellites. New applications are emerging in edge analytics, sovereign sensing, autonomous defense operations, and space-based AI inference. However, deploying those applications still requires navigating vendors, satellite integration timelines, and regulatory bottlenecks, creating friction that limits access for all but the largest or most technically capable organizations.

Source: NewSpace

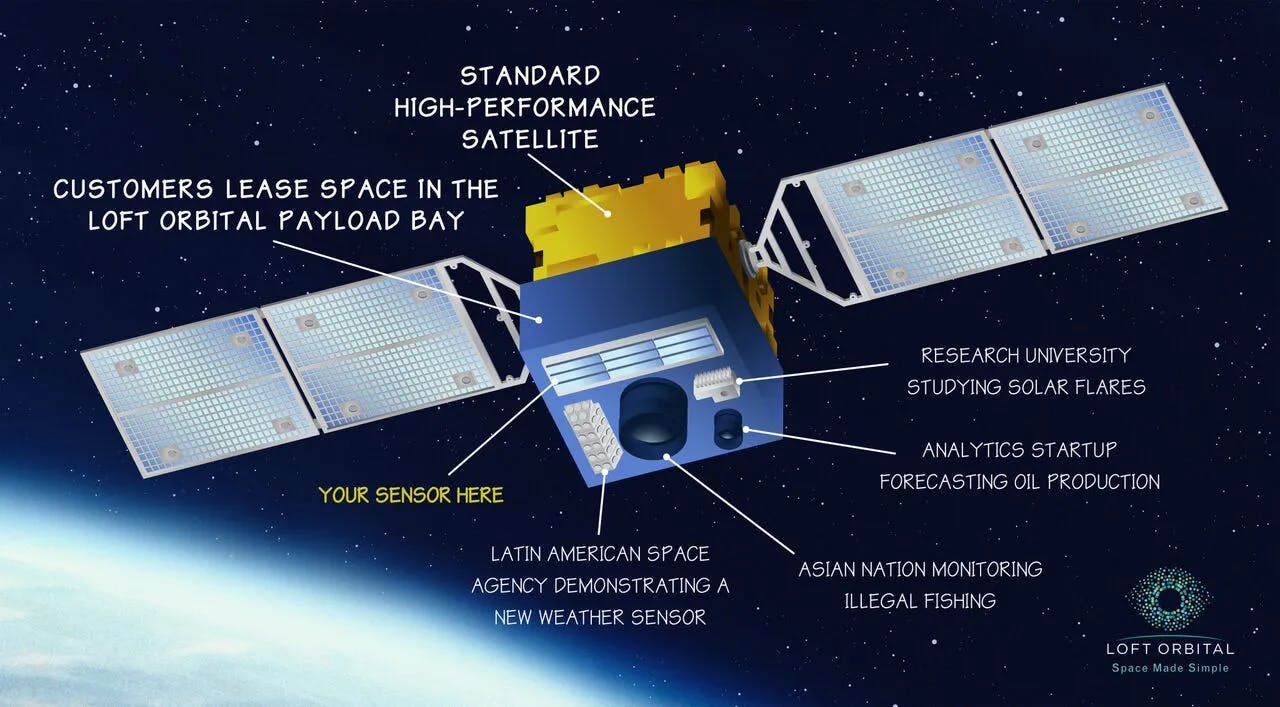

Loft Orbital was founded to solve this problem. By abstracting away the hardware, integration, and operations, Loft offers a modular platform that allows customers to deploy payloads or applications to orbit without needing to own or operate satellites. Just like AWS enabled developers to launch applications without setting up their own servers, Loft aims to let users deploy space missions without owning or operating their own spacecraft. If successful, it could unlock a new era of software-defined space missions, enabling both governments and startups to deploy and operate space-based applications as easily as they do cloud-based ones.

Founding Story

Loft Orbital was founded in 2017 by Pierre-Damien Vaujour (CEO), Alex Greenberg (COO), and Antoine de Chassy (President), who met while working together at Spire Global, a satellite data company. The trio, with backgrounds spanning engineering, business, and satellite operations, identified a persistent bottleneck in the space industry – deploying new missions required custom satellite builds, leading to high costs, long lead times of up to five years, and significant technical complexity for customers.

Source: SpaceNews

Vaujour, originally from France, had previously earned a master’s degree in aerospace engineering at the University of Michigan and worked in both the European and American space sectors. Greenberg, with experience in satellite operations and systems engineering, brought operational rigor to the founding team. De Chassy contributed commercial acumen, having held leadership roles in aerospace and telecommunications.

The founders observed that while the CubeSat (cube satellite) Revolution had opened low-cost access to space for small, simple missions, organizations with more demanding requirements had to work with traditional aerospace primes, often resulting in multi-year projects and budgets out of reach for most. They also noticed that each new mission was essentially a ground-up engineering effort, reminiscent of the early days of computing before the rise of cloud infrastructure.

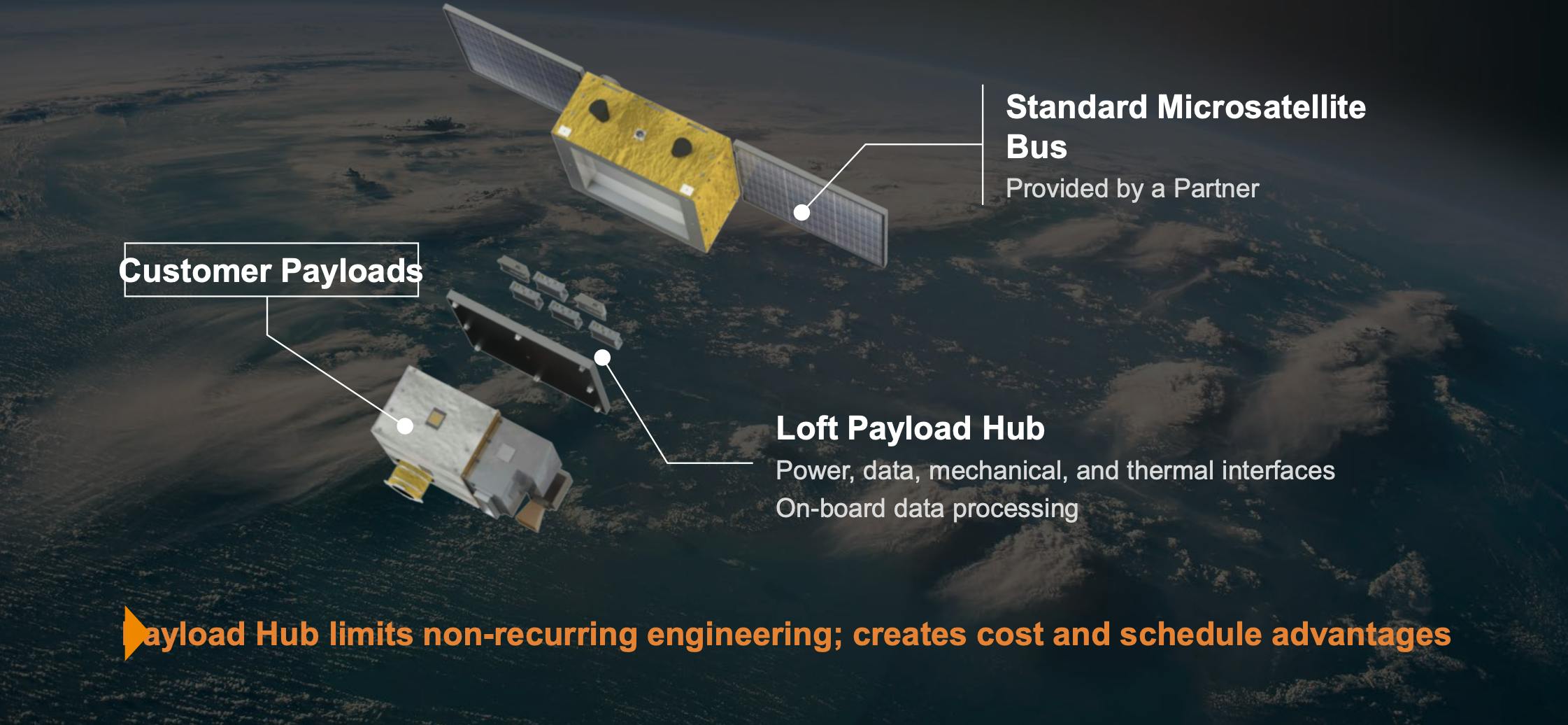

Inspired by the cloud computing model, the team set out to build “space infrastructure as a service,” aiming to make deploying missions in space as easy as deploying an application to the cloud. Rather than building satellites themselves, the company began sourcing standardized satellite buses from third-party manufacturers, including LeoStella and Blue Canyon Technologies, and focused on developing proprietary technology to simplify payload integration. Loft’s central technology was the Payload Hub, a universal adapter that allowed any payload, whether hardware or software, to be quickly integrated onto a standard satellite bus.

By 2019, Loft Orbital had begun booking launches and receiving deposits from a diverse range of customers, from startups and commercial enterprises to government agencies and international space programs, which was an uncommon milestone for a space startup at its stage. In parallel, Loft was developing Cockpit, a software platform streamlining satellite operations, enabling customers to interact with and control their payloads as simply as using a web application.

The company’s first satellites, YAM-2 and YAM-3 (“Yet Another Mission”), launched in 2021, each carrying a mix of government, defense, and commercial payloads. This milestone validated Loft’s approach and demonstrated that customers could “buy a ticket” to space rather than investing in a dedicated satellite. As the company scaled, it expanded its supplier relationships, including bulk orders of Airbus One Web satellites to support larger constellations. In January 2022, Loft Orbital was selected by EarthDaily to build, launch, and operate a $150 million constellation of Earth observation satellites.

Product

Loft Orbital’s platform is designed to reduce the complexity of space missions, as it is intended to enable customers to seamlessly deploy and operate payloads or software applications in orbit. By combining third-party satellite hardware, a universal payload adapter (Hub), and a mission control interface (Cockpit), Loft delivers space as a service, supporting physical, virtual, and on-demand missions. Customers can access proven in-orbit resources, integrate custom hardware, or deploy software applications, all without needing deep expertise in satellite engineering or operations.

Source: Loft Orbital

Missions

Loft Orbital’s platform supports three mission types: Physical, Virtual, and On-Demand. Each mission has different levels of customer involvement and urgency.

Physical Missions

Loft Orbital enables customers to deploy physical payloads such as sensors, instruments, or complete multi-satellite constellations, on standardized satellite platforms without owning or managing any infrastructure themselves. Through combining a universal payload adapter with shelf-ready satellites and pre-booked launch capacity, Loft offers a simplified, accelerated path to orbit that minimizes risk and engineering burden.

Each physical mission follows a structured five-step lifecycle. The process begins with a mission definition phase, during which Loft evaluates payload requirements, confirms feasibility, and aligns on pricing and service-level agreements. Once approved, Loft configures the mission using its Hub, the company’s universal payload adapter that abstracts satellite bus complexity and provides standardized interfaces for power, compute, communications, and control.

Customers then validate their hardware and software interfaces using a provided HubKit, which ensures compatibility before final integration. Once validated, the payload is sent to Loft for integration and full environmental testing. Loft manages the entire launch campaign, from licensing to vehicle integration, leveraging launch capacity booked years in advance. After deployment, Loft commissions the satellite and operates the mission on behalf of the customer, who can access and task their payload in real time via the Cockpit interface.

Loft supports three physical mission formats, each tailored to different customer needs. Dedicated missions provide customers with full access to a Longbow satellite configured specifically for their use case. Rideshare missions allow smaller payloads to share satellite real estate and only pay for the resources they consume. For customers seeking global coverage or high revisit rates, Loft can deploy dedicated constellations across multiple satellites using the same streamlined architecture and operational framework.

Source: Loft Orbital

In 2023, EarthDaily selected Loft to host its 10-satellite Earth observation constellation, delivering high-resolution, daily revisit imagery without the burden of developing or operating its own spacecraft. Esper, a hyperspectral sensing company, partnered with Loft in December 2024 to deploy its Four Leaf Clover sensors across multiple upcoming missions in 2026, unlocking new insights for mining, climate monitoring, and national security. Helsing, a German defense AI company, chose Loft to host a multi-sensor constellation designed to deliver real-time situational awareness using onboard AI inference, planned for launch in 2026.

Virtual Missions

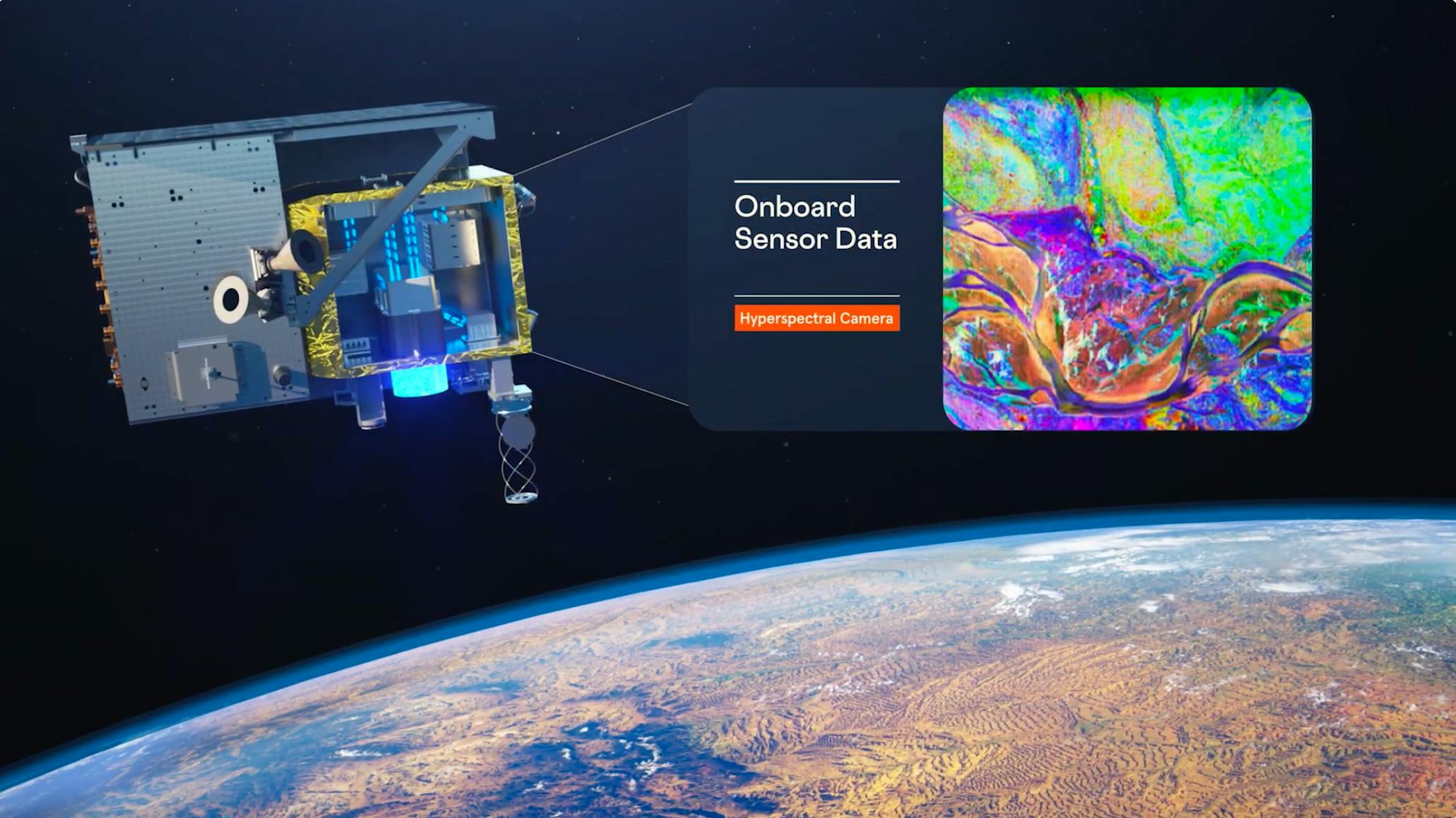

Loft Orbital’s virtual missions platform enables customers to deploy software applications in space without ever launching a physical payload. By leveraging Loft’s in-orbit infrastructure, customers can run AI and data processing workloads as hosted applications, bypassing the complexity of satellite hardware development entirely.

The process begins with mission definition, where Loft collaborates with customers to determine the appropriate on-orbit resources, such as specific sensors, compute hardware, and communications capabilities for the task at hand. Customers then build and test their applications in Ultimate Edge, Loft’s cloud-based development environment accessed through Microsoft Azure.

Once validated on a virtual test bench, Loft deploys the application directly to one or more satellites in its fleet. From there, customers can operate their applications using Cockpit, Loft’s mission control platform. Loft’s satellites carry a mix of sensors, software-defined radios, CPUs, GPUs, and communications links, including global ground station coverage and inter-satellite relays, allowing virtual missions to run with low latency and real-time responsiveness.

Source: Loft Orbital via YouTube

These capabilities are being put to use across national security, environmental monitoring, and commercial analytics. Little Place Labs partnered with Loft in August 2024 to deploy a low-latency maritime domain awareness application to YAM-6, processing sensor data on-orbit and transmitting actionable insights with minimal delay. In March 2024, SkyServe has partnered with Loft to host its STORM edge computing platform, which supports on-demand predictions for applications such as wildfire tracking, irrigation optimization, and mining logistics by processing sensor data directly onboard. Scientific Systems Company demonstrated onboard target recognition and data fusion for the Space Development Agency using Loft’s YAM-3 platform, prototyping the sensor-to-shooter workflows needed for modern defense operations.

On-Demand Missions

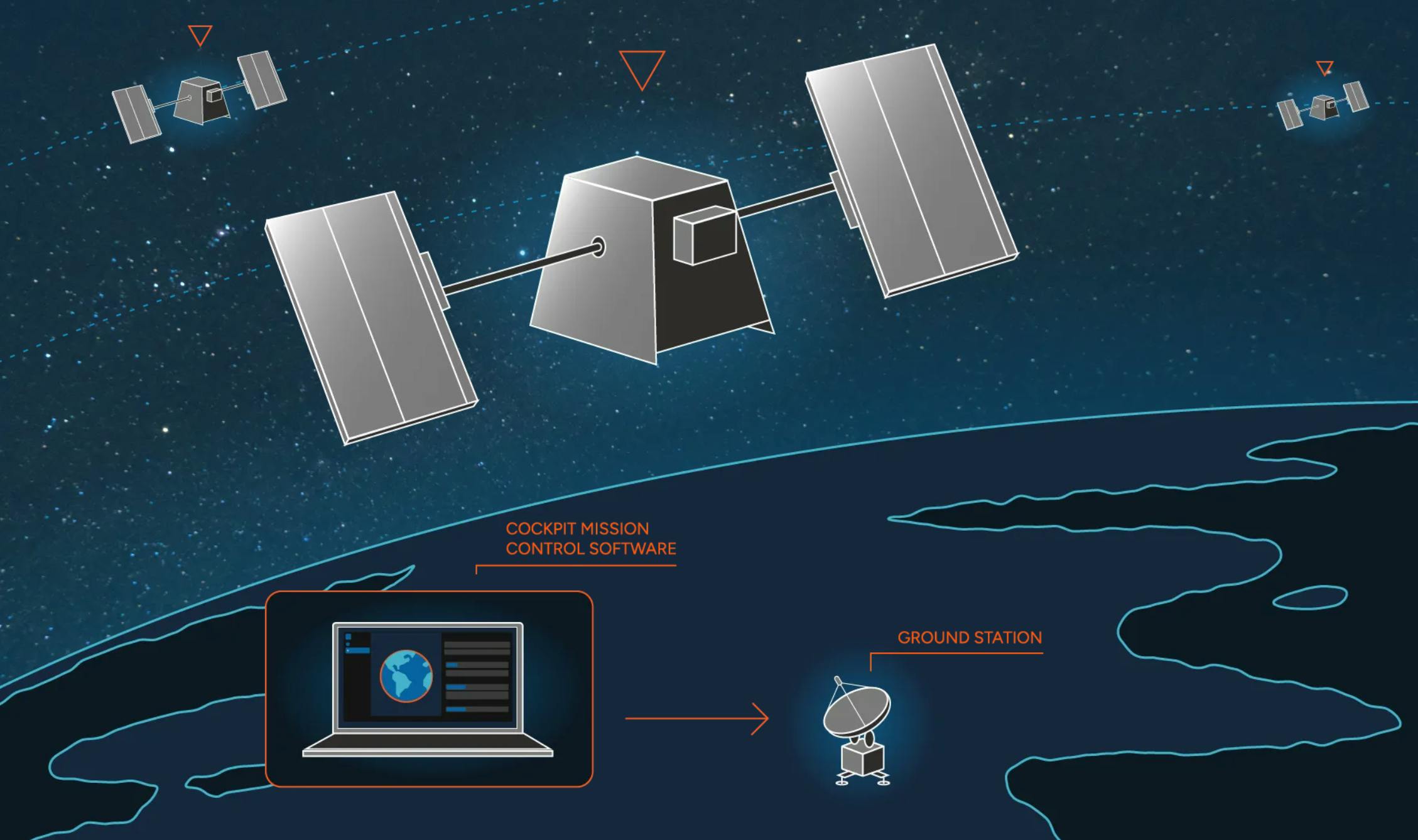

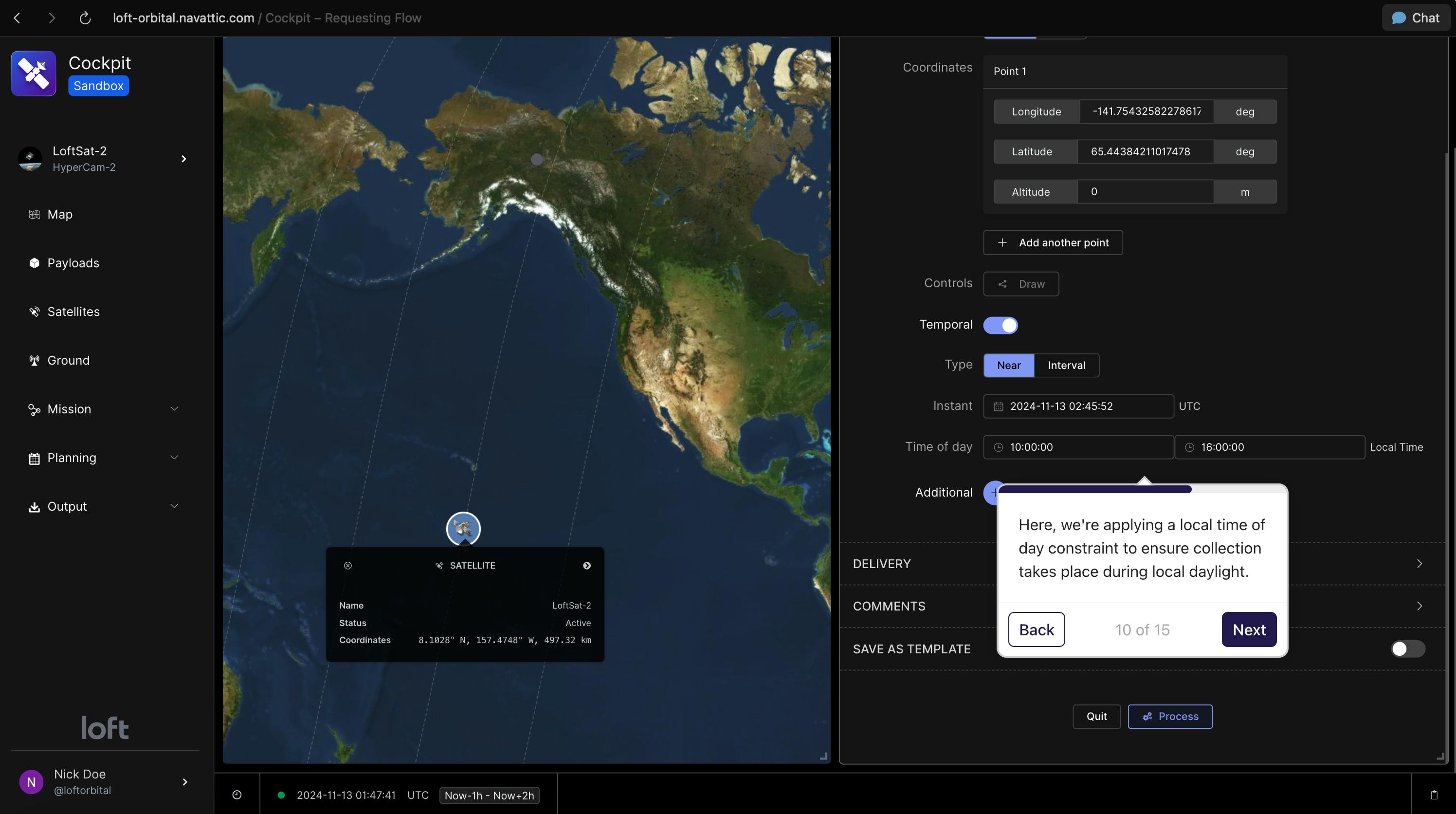

Loft Orbital’s on-demand missions offer the fastest way for customers to access space-based sensing and data collection without launching any hardware or deploying custom applications. Using Loft’s Cockpit mission control software, customers can directly task a diverse network of active sensors across a fleet of operational satellites to collect targeted datasets within days.

On-demand customers first define the mission’s data requirements and whether it involves imagery, RF collection, or other forms of sensing. Loft then works with each customer to identify which on-orbit resources are best suited to meet those needs. Once tasking begins, data is collected by Loft’s satellites and delivered back to the customer through Loft’s ground station network or inter-satellite communications links, depending on latency requirements.

In 2023, Wyvern partnered with Loft to expand its Dragonette hyperspectral imaging constellation. By accessing Loft’s sensor-equipped satellites on demand, Wyvern can increase its revisit rates and data volume without launching additional hardware. This allows the company to better serve customers in agriculture, environmental monitoring, mining, and defense, while focusing entirely on data quality and analytics. Loft handles infrastructure and operations, letting partners like Wyvern operate as data providers.

Platform

At the core of Loft Orbital’s offering is a modular platform architecture that abstracts the technical complexity of space systems, enabling payloads and applications to run seamlessly across a shared infrastructure. The platform is anchored by two key components: Payload Hub, which standardizes payload integration, and Cockpit, which provides intuitive mission control for all types of missions.

Payload Hub

Source: Loft Orbital

The Payload Hub is Loft’s universal adapter that bridges customer payloads, whether hardware or software, with any satellite bus. It removes the variability of different satellite platforms by providing a common interface for power, compute, command and control, and data handling. For physical missions, the Hub enables plug-and-play integration of sensors or instruments with no need for custom electrical or mechanical design work. For virtual missions, it provides the software runtime environment through Microsoft Azure, known as Ultimate Edge, that allows customers to validate, deploy, and execute applications directly on Loft’s satellites.

The Hub is what makes Loft’s “any payload on any bus” model possible. It decouples payload engineering from bus engineering, significantly reducing mission timelines, risk, and non-recurring engineering costs. It also allows Loft to reuse the same satellite bus across missions, even when hosting entirely different payloads or applications.

Cockpit

Source: Loft Orbital

Cockpit is Loft Orbital’s mission control interface that enables customers to task payloads, monitor performance, and downlink data in real time, without needing prior experience in satellite operations. Through an intuitive GUI or API integration, customers can plan, schedule, and execute missions across Loft’s fleet, whether they are flying a physical payload or a virtual application.

For physical missions, Cockpit provides visibility into satellite health and telemetry, along with controls for payload tasking and data delivery. For virtual missions, it allows users to operate their software in orbit, make configuration changes, and trigger data processing workflows. In on-demand missions, customers can use Cockpit to directly schedule data collection from Loft’s existing sensors. Across all mission types, Cockpit simplifies the traditionally opaque and technical process of satellite operations, bringing it closer to a modern cloud-based developer experience.

Market

Customer

Loft Orbital serves a diverse customer base spanning government agencies, commercial enterprises, and international institutions seeking access to orbital infrastructure. Customers engage with Loft through one of three mission types, depending on their data needs, timelines, and technical maturity. Loft enables these organizations to deploy space missions without becoming space companies themselves. In January 2025, COO Alex Greenberg explained that customers use Loft Orbital to achieve three fundamental goals: (1) connectivity and data; (2) national security and sovereignty; and (3) understanding our climate.

Source: NewSpace

Government agencies are a cornerstone of Loft Orbital’s customer base, particularly in defense and national security. The company operates a dedicated subsidiary based in Colorado, Loft Federal, which supports classified US government programs and has secured contracts with the Department of Defense and the US Space Force. Civil agencies like NASA have also partnered with Loft for space missions, leveraging Loft’s rapid deployment model for research payloads. In Europe, Loft works with institutions such as the European Space Agency (ESA) and maintains a dedicated office in Toulouse, France, to support defense and civil contracts with the French government.

On the commercial side, Loft supports customers across Earth observation, climate analytics, defense technology, and hyperspectral sensing. EarthDaily partnered with Loft to deploy a 10-satellite constellation delivering daily revisit Earth imagery. Esper selected Loft to integrate its hyperspectral sensors as part of its Four Leaf Clover constellation for applications including sustainable mining and methane leak detection. Helsing chose Loft to host its multi-sensor constellation, enabling real-time situational awareness via AI inference. Additional commercial users include SkyServe, which deployed its STORM edge computing platform onboard Loft satellites to deliver insights in wildfire tracking and carbon monitoring; Little Place Labs, which partnered with Loft on a maritime domain awareness application; and Wyvern, which accesses hyperspectral imagery on demand via Loft’s shared infrastructure.

Loft is also expanding into international and emerging markets. Many of these customers, particularly national governments, seek sovereign access to satellite-derived data but lack a domestic space industrial base. In August 2024, Loft formed a joint venture with UAE-based Marlan Space to launch Orbitworks, the Middle East’s first private space infrastructure company. Backed by over $100 million in initial investment, Orbitworks aims to produce up to 50 commercial satellites per year and will serve a range of national missions across Earth observation, telecommunications, and research. The venture will also support the UAE’s growing AI ecosystem by enabling local companies and research institutions to deploy applications to orbit without building their own satellites.

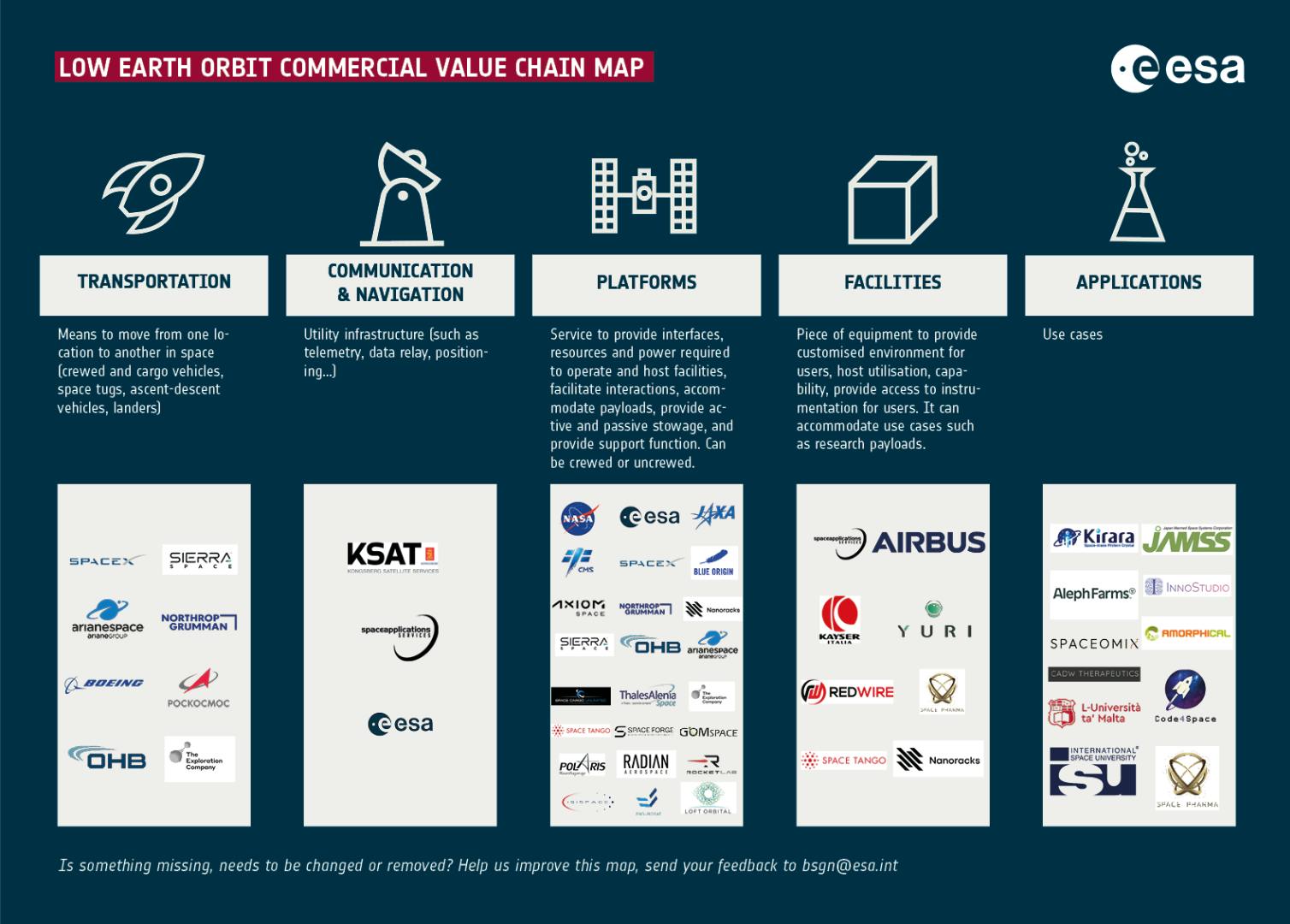

Market Size

Loft Orbital operates within the platform layer of the low Earth orbit (LEO) commercial value chain. This layer sits between launch (transportation) and end-use applications, and provides the interfaces, power, and integration infrastructure needed to host and operate payloads in space. Unlike traditional manufacturers or vertically integrated space companies, Loft abstracts this complexity for its customers, offering space infrastructure-as-a-service through standardized satellite buses, universal adapters, and a software-defined operations layer.

Source: BSGN

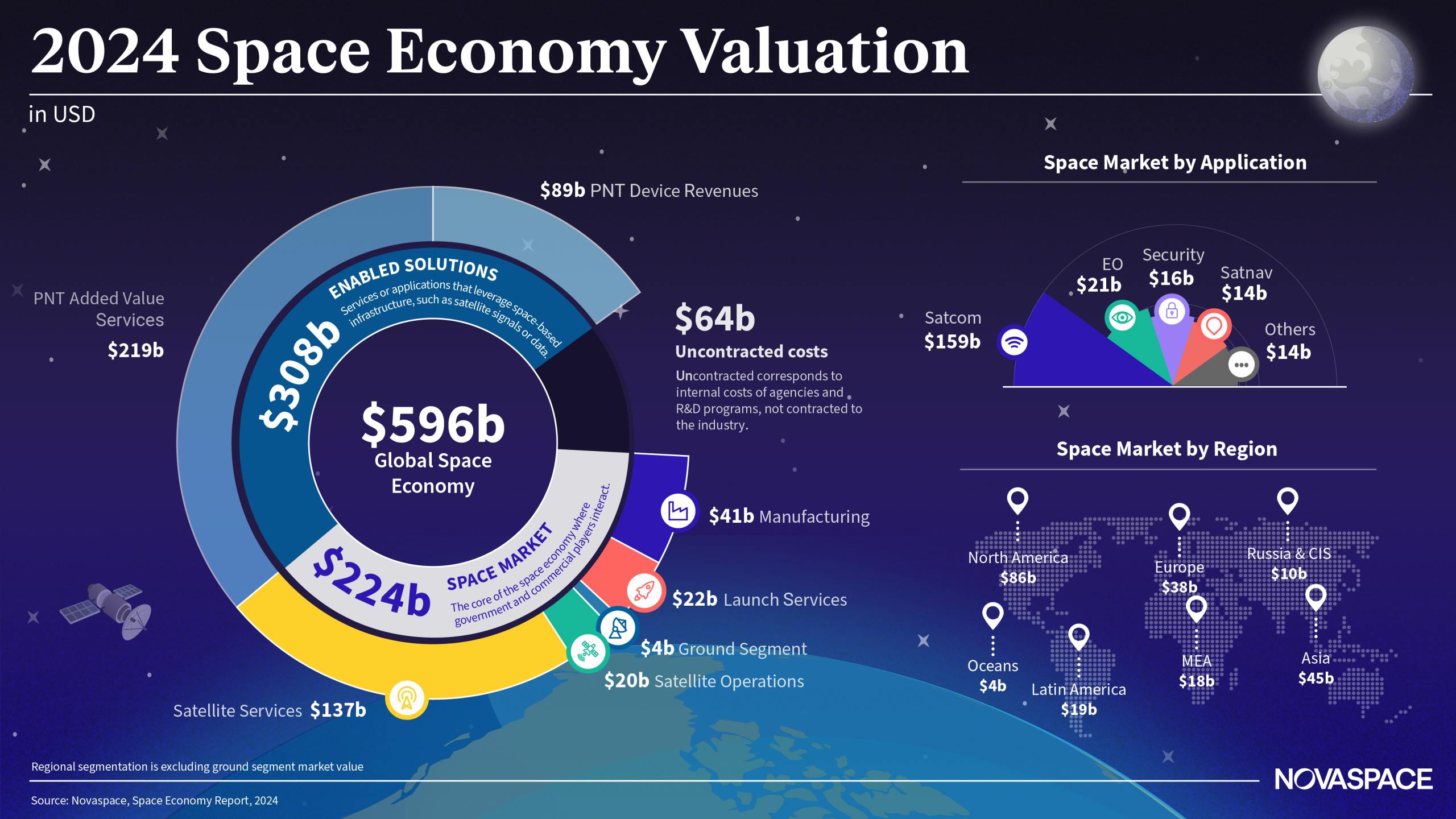

The global space economy was valued at $596 billion in 2024. Of that, $224 billion is attributed to the core space market, the part driven by spacecraft, launch, ground, and satellite operations, while $308 billion represents the broader market for services and applications that depend on space-based infrastructure. Loft operates at the intersection of both, contributing to the satellite services market while enabling downstream value creation in Earth observation, defense, climate analytics, and communications.

Source: NovaSpace

Within this, Loft more specifically targets the $137 billion satellite services segment, with particular focus on hosting, operations, and mission enablement. As of October 2025, there are over 13K active satellites in orbit, a number expected to grow by 70K until 2030, as commercial and government actors expand sensing, connectivity, and edge computing capabilities in space. This growth is driven by falling launch costs, increasing demand for low-latency data, and rising interest in space infrastructure.

Competition

Competitive Landscape

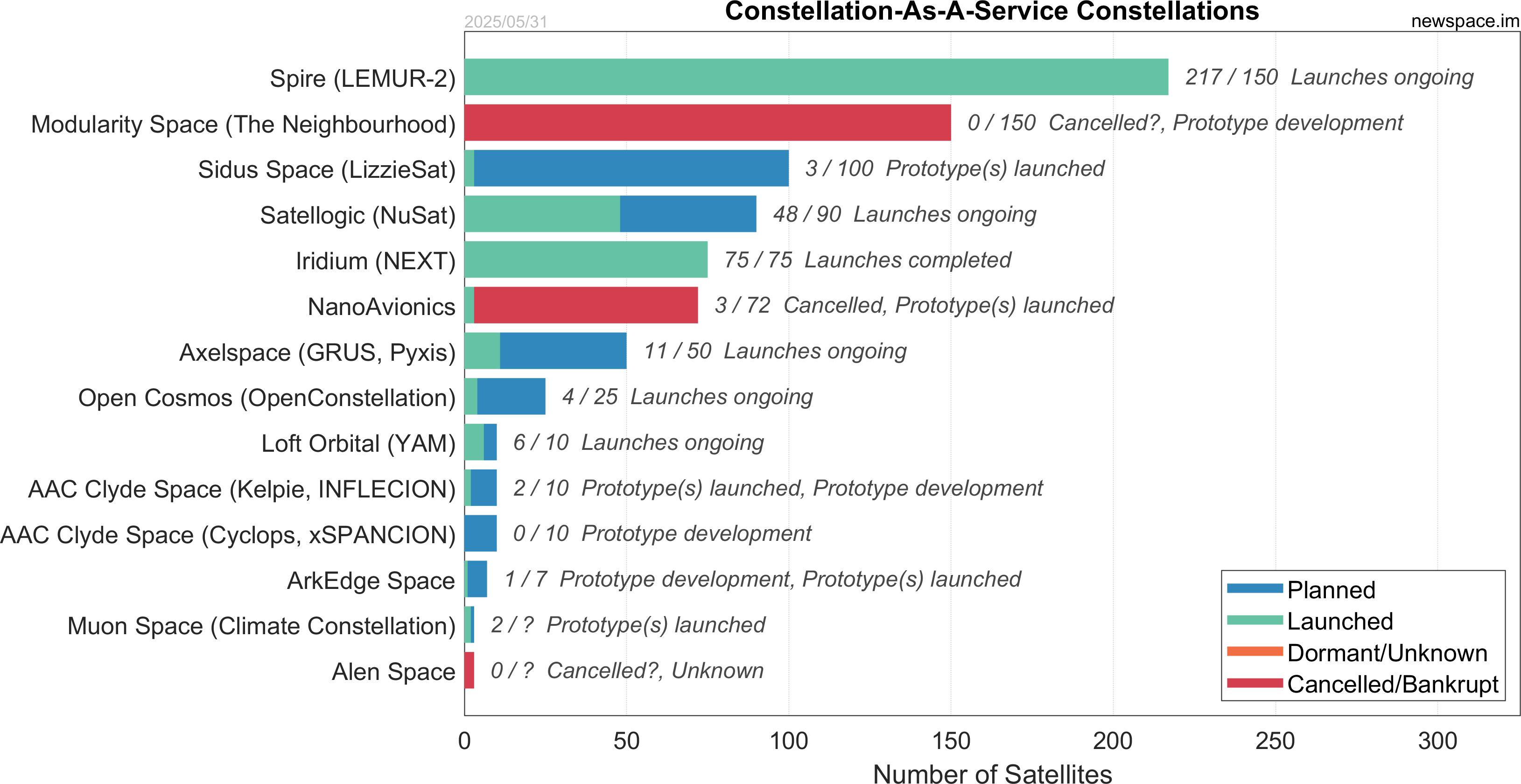

Loft Orbital operates in the emerging constellation-as-a-service category, where companies aim to offer standardized, scalable access to space for commercial and government customers. As of October 2025, Loft has launched six satellites in its YAM series, making it one of the few companies in this space to demonstrate meaningful operational execution. While players like Spire and Satellogic have achieved scale, they are vertically integrated and focused on their own constellations, rather than offering infrastructure as a service to third parties.

Source: NewSpace

Direct Competitors

York Space Systems: Founded in 2012 and headquartered in Denver, Colorado, York Space Systems manufactures standardized satellite buses and provides end-to-end mission services, including integration, launch, and operations. The company has emerged as a key defense contractor, winning large-scale constellation contracts with the US Space Force and other federal agencies. York operates with a vertically integrated model that enables rapid production of its platforms and supports constellation-scale deployments for customers that require high volume and operational control. While York’s model directly overlaps with Loft’s in offering turnkey satellite access, it is more tightly coupled to defense contracting and lacks Loft’s software layer that decouples payloads from hardware.

Blue Canyon Technologies: Acquired by Raytheon Technologies in 2020, Blue Canyon Technologies is a provider of small satellite platforms and components for government, civil, and commercial space missions. The company offers a range of spacecraft and has supported over 50 unique missions by 2022, with strong traction in the defense sector. Blue Canyon specializes in high-performance, often custom-tailored satellite platforms, with tight integration between payload and bus. While the company competes for similar payload hosting and satellite delivery contracts, it does not offer a generalized, modular infrastructure layer like Loft’s Hub and Cockpit, which support rapid configuration across a wider range of missions.

NanoAvionics: Founded in 2014 and acquired by Kongsberg Gruppen in 2022, NanoAvionics is a smallsat integrator that provides modular bus platforms in CubeSat and microsatellite classes. The company has launched over 45 satellites and offers mission integration, launch brokerage, and operations as part of its services. NanoAvionics targets commercial customers and academic institutions seeking low-cost access to LEO for narrowband communications, IoT, and Earth observation use cases. While it competes in hosted payloads and turnkey bus delivery, NanoAvionics operates more as a hardware vendor and lacks Loft’s infrastructure-as-a-service model that supports shared satellite platforms and virtualized payload deployment.

Adjacent Competitors

Spire Global: Founded in 2012, Spire Global operates one of the world’s largest multipurpose small satellite constellations, with over 100 LEMUR-class satellites in orbit. The company provides vertically integrated space-based data services across maritime, aviation, and weather sectors and offers a “Space-as-a-Service” model, allowing customers to host payloads or run applications on Spire’s satellites.

In 2021, Spire went public via SPAC, which valued the company at $1.6 billion. Spire reported $110 million in revenue in 2024 and serves a mix of commercial and government clients. As of October 2025, Spire’s market cap was $410 million. While Spire competes with Loft on hosted payload opportunities, its model is more vertically integrated and data-centric, with limited platform modularity or infrastructure-sharing. Customers who want to bring their own software or payloads and maintain operational independence may prefer to work with Loft.

Momentus: Founded in 2017, Momentus focuses on in-space transportation and hosted payload services through its Vigoride orbital service vehicle. The company aims to provide last-mile satellite delivery and on-orbit servicing, with early commercial missions launched in partnership with SpaceX rideshare programs. Momentus has experienced delays and financial challenges, with limited revenue as of 2025, but remains an active player in the modular space logistics segment. While Momentus overlaps with Loft in enabling hosted payloads and modular access to orbit, its focus is on transport and mobility.

OrbitsEdge: Founded in 2018, OrbitsEdge is focused on deploying edge computing infrastructure in space. The company is developing data centers and compute modules designed to host AI/ML models in orbit, reducing reliance on ground-based processing and enabling low-latency insights. OrbitsEdge is a conceptual competitor to Loft’s virtual missions offering, especially in use cases requiring high-throughput orbital compute. However, unlike Loft, OrbitsEdge does not own or operate its own satellites and must rely on partnerships for launch, hosting, and tasking, limiting its control of the full stack and making it a complementary or downstream player rather than a direct threat.

Business Model

Loft Orbital operates as an infrastructure-as-a-service provider, offering customers access to orbit without requiring them to build, own, or operate their own spacecraft. Through its modular architecture, the company enables rapid deployment of both physical payloads and software applications. Customers pay to deploy missions, not to own satellites, making Loft’s offering more akin to AWS for space than a traditional aerospace vendor.

Rather than manufacturing its own satellites, Loft procures flight-proven satellite buses from established aerospace partners. Key suppliers include Airbus, which provides the OneWeb-based Longbow bus, LeoStella, and Space Systems Loral. These standardized platforms allow Loft to host a broad range of payloads without bespoke hardware development.

For launch, Loft works with a variety of providers depending on payload requirements, destination orbit, and schedule. Partners include SpaceX, Rocket Lab, Firefly Aerospace, Vector Launch, and ECM Launch Services. Loft pre-books launch slots to ensure availability for customer missions, removing a major bottleneck from traditional satellite timelines. Once procured and integrated, Loft owns and operates its infrastructure, allowing customers to focus solely on mission data and outcomes.

Loft generates revenue through mission-based contracts that align with its three service models. This structure suggests Loft can amortize satellite and launch costs across multiple customers and mission types, improving capital efficiency:

Physical Missions: Customers pay to integrate hardware payloads onto Loft’s satellites, typically via dedicated or rideshare slots.

Virtual Missions: Software developers and analytics companies pay to deploy code to Loft’s in-orbit compute infrastructure, enabled by Loft’s Hub and Ultimate Edge runtime.

On-Demand Missions: Customers directly task existing sensors on Loft’s satellites via Cockpit.

Source: SpaceNews

From 2021 to 2025, Loft Orbital has signed more than $500 million in contracts with customers including NASA, the US Space Force, Microsoft, and the European Space Agency, with a reported waitlist of approximately 30 satellites awaiting launch.

In 2017, co-founder and President Antoine de Chassy noted that Loft targets a dual-structured market. For large institutional clients or constellation operators, Loft offers full-satellite services akin to how Airbus or Boeing sell aircraft. For smaller, more fragmented users like startups or research labs, the company offers contracts in the $1–2 million per year range. This suggests that Loft’s rideshare model could accommodate 10-20 customers per satellite.

Traction

Loft Orbital has demonstrated traction across both government and commercial segments, translating early infrastructure investment into substantial contract momentum. The company reported $5.5 million in revenue in 2020 and has grown revenue at a rate of over 100% year-over-year in both 2022 and 2023, though exact figures remain undisclosed. By January 2025, Loft had secured over $500 million in cumulative bookings on just $160 million of capital raised, demonstrating strong capital efficiency and customer demand.

Government contracts, particularly in national security, have emerged as a core growth engine. In January 2025, Loft surpassed $100 million in signed US defense contracts, including a notable role in the Space Development Agency’s $176 million NExT program, where its Loft Federal subsidiary is supplying 10 Longbow satellite buses to Ball Aerospace for launches in 2024 and 2025. Loft was also one of 12 companies selected for the US Space Force’s $237 million, 10-year small satellite procurement vehicle announced in May 2025. In September 2025, NASA awarded Loft with a task order to deliver mission support for their five-year $45 million RadPC project.

On the international front, Loft entered a $100 million joint venture with Abu Dhabi-based Marlan Space to form Orbitworks, the Middle East’s first private space infrastructure provider. Orbitworks is currently constructing a 50K square foot integration and test facility in the UAE and is expected to support the manufacturing and deployment of up to 50 commercial satellites per year, marking a step in localizing satellite infrastructure for sovereign markets.

Valuation

As of October 2025, Loft Orbital has raised over $326 million in total funding and is trading on the secondary markets at an average price of ~$14 per share. Its latest round came in January 2025, when the company raised a $170 million Series C at a valuation of $1 billion, from investors including Bpifrance, Temasek Holdings, AXIAL Partners, and Tikehau Capital.

Prior to this, Loft Orbital raised a $140 million Series B in November 2021, led by BlackRock. With its Series C round, the company plans to scale its launch frequency from a couple of satellites annually to 10+ per year. Loft also plans to increase investment in its virtual mission capabilities and AI application partnerships.

Key Opportunities

Owning the Infrastructure Layer for In-Orbit Compute

As the demand for real-time sensing, analytics, and autonomy accelerates across defense, climate, and commercial applications, compute is shifting from centralized ground systems to edge environments in orbit. Loft Orbital is uniquely positioned to become the default execution layer for AI workloads in space, analogous to how AWS Lambda became the standard for deploying code to the cloud.

As CEO Pierre-Damien Vaujour explained: “We’re co-developing a CI/CD pipeline with Microsoft so that any Azure developer can deploy code to space.” If successful, this would mark a shift in how space-based compute is accessed, lowering the barrier to orbital deployment and embedding Loft into the cloud developer ecosystem. This not only creates defensibility but also opens the door to scalable, usage-based monetization models over time.

Scaling Deployment of Virtual Missions

Loft Orbital’s virtual missions unlock a new model for accessing space through software-only deployment. Instead of building, integrating, and launching hardware, customers can upload applications to Loft’s in-orbit compute environment. These apps run directly on satellites equipped with GPUs, SDRs, and onboard connectivity, processing data in real-time and delivering insights without the latency or cost of full ground-based pipelines.

This shift mirrors a broader technological trend toward edge compute and containerized software environments, but applied to space. As more customers adopt virtual missions, Loft can evolve from an asset-heavy, contract-based business into a scalable, usage-based platform with cloud-like unit economics. Pricing models may eventually resemble AWS Lambda or Azure Functions.

International Partnerships

Loft Orbital is well-positioned to capitalize on growing international demand for sovereign space capacity, particularly in regions where governments seek greater control over satellite data for defense, intelligence, and national infrastructure, but lack the industrial base to build and operate their own systems. These customers want access to space-based ISR (intelligence, surveillance, and reconnaissance) capabilities without taking on the complexity, risk, or time required to stand up domestic space programs from scratch. With Loft, governments can deploy sensors or applications onto Loft-managed satellites or directly task existing assets on demand. This makes it possible to achieve near-term space capability, critical for environmental monitoring, maritime domain awareness, and national security.

A key example is Loft’s $100 million joint venture with UAE-based Marlan Space, which created Orbitworks, the Middle East’s first commercial space infrastructure company. Through this partnership, Loft is localizing satellite integration, operations, and talent development in Abu Dhabi, while supplying the technical backbone and flight-proven platform. The Orbitworks model could be replicated in other space-ambitious nations across Asia, Africa, and Latin America.

Key Risks

High Execution Complexity

While Loft Orbital’s platform model has been validated through commercial traction and customer adoption, the next phase of scale introduces significant execution risk. Coordinating a global supply chain of bus manufacturers, launch providers, compute hardware, and ground stations requires tight orchestration and fault-tolerant systems. As Loft moves to launch and operate over 30 satellites across physical, virtual, and on-demand missions, it must also scale its internal capabilities.

Unlike pure software businesses, Loft’s success depends on consistent delivery across both physical and digital infrastructure, with minimal tolerance for error. The company still requires hands-on coordination to validate customer software and ensure that applications don’t interfere with satellite operations. As Loft continues to productize its virtual mission stack, the challenge will be balancing flexibility for developers with the reliability and predictability demanded by satellite systems. The broader market has shown how difficult this execution model can be. Spire, a comparable company offering hosted payloads and application access, has struggled with profitability despite operating one of the largest smallsat constellations.

Dependence on Third-Party Hardware

Loft Orbital’s platform is built on a strategy of hardware abstraction rather than vertical integration. While this approach has enabled rapid iteration and capital efficiency, it also creates structural reliance on third-party hardware providers, most notably Airbus, LeoStella, and Space Systems Loral, for satellite buses. If these suppliers face production delays, capacity constraints, or changes in pricing terms, Loft’s delivery schedules and margin structure could be negatively impacted.

As Loft scales up to dozens of satellites per year, its ability to maintain predictable costs and timelines depends heavily on the availability, pricing stability, and long-term alignment of its hardware partners. Airbus, in particular, plays a central role through the Longbow platform, which serves many of Loft’s current and upcoming missions. Any upward pressure on bus pricing or prioritization of Airbus’s internal customers could squeeze Loft’s gross margins or introduce program delays.

While Loft mitigates some of this risk through multi-vendor sourcing and long-term supplier relationships, the company’s dependence on third-party hardware means it lacks full control over one of the most critical inputs to its platform. As the business matures, it may need to explore co-production, deeper integration partnerships, or limited in-house capabilities to protect cost structure and delivery reliability.

Summary

Loft Orbital is building a modular space infrastructure platform that abstracts the complexity of satellite missions through standardized hardware, a universal payload interface, and a cloud-like software layer. Unlike vertically integrated space operators, Loft enables customers to deploy physical payloads, software applications, or on-demand data tasks without owning or managing any spacecraft. The company has demonstrated strong commercial traction, is scaling satellite deployments, and is positioning its virtual missions offering as the default compute runtime for space-based AI. Key challenges include scaling integration and operations, maintaining supplier reliability, and transitioning from contract-based revenues to usage-based monetization. If successful, Loft could become the foundational layer for software-defined space infrastructure globally.