Thesis

Commercial supersonic flights — which enabled trips between New York and London in less than three hours — ended after the Concorde made its final flight in November 2003, after almost thirty years in operation. The Concorde program began in 1976, when the Concorde began the world's first supersonic passenger service, with British Airways flights from London to Bahrain and Air France flights from Paris to Rio de Janeiro.

The Concorde was a remarkable feat of engineering that lasted for decades, but there were drawbacks that ended up leading to its retirement. The supersonic aircraft was noisy and extremely expensive, restricting flight availability, and the high operating costs led to fare pricing that was prohibitively high for many consumers. As a result, after an Air France Concorde’s engine failure in 2000 and subsequent crash, Concorde was finally retired for good in 2003.

In the decades since, demand for air travel has continued to grow, with the number of global airplane passengers increasing from 1.7 billion in 2003 to 4.3 billion in 2023. Passenger traffic has grown in tandem with the number of individual passengers, with global passenger traffic having hit 8.7 billion in 2023, a 95% increase from 2019, prior to the COVID-19 pandemic.

International business travel has expanded, too. In 2023, although its recovery from the COVID-19 pandemic had been slower than general air travel, business travel reached 83% of the levels it saw before the pandemic. By 2024, it had fully recovered, with global business travel spending reaching $1.5 trillion, representing a 6.2% increase over pre-pandemic levels.

Boom Supersonic is an airplane manufacturer that is developing supersonic airliners. It aims to kickstart a “supersonic revival”, and its mission is to allow this return of commercial supersonic aviation via the launch of its Overture aircraft, which is still in development. In January 2025, a successful test of its XB-1 demonstrator aircraft, which went supersonic, represented “the first time an independently developed jet has broken the sound barrier”. The flight also successfully demonstrated another technological breakthrough of the company, Boomless Cruise, which will allow supersonic flights to take place over land with no audible sonic boom.

Founding Story

Source: Boom

Blake Scholl (CEO) founded Boom Supersonic in September 2014. Scholl had been a plane enthusiast since he was a child when his parents took him to watch turboprop Cessnas taking off near their home in Cincinnati, Ohio. Scholl was inspired after seeing Concorde in a museum and became obsessed with figuring out how to enable a supersonic renaissance. In an October 2020 interview, he said that he had “set a goal in my mid-twenties that I wanted to go Mach 2” and that he had “put a Google Alert on ‘supersonic jet’ so I could be first to know when I could buy a ticket.”

Scholl began his career as a software engineer at Amazon in 2001. After four years at Amazon, he went on to become the first employee and Director of Product Development at Pelago. Although Scholl started his career in software, his interest in aviation persisted and he earned a private pilot license in 2008. In 2010, he cofounded Kima Labs, which created mobile ecommerce apps. Kima Labs was acquired by Groupon in 2012.

After a two-year stint as a Senior Director at Groupon, he decided to found Boom. First, he conducted several weeks of research, after which he concluded that supersonic travel was possible, and went about hiring aerospace engineers to help turn his vision into reality. The first people he hired were paid with money he had made from selling Kima Labs. Boom Supersonic then became part of Y Combinator’s W16 batch.

Since its early days, Boom has made several key hires of aerospace experts. Troy Follak joined Boom as VP of Engineering in 2020 and was promoted to CTO in September 2023. Follak had previously held the role of Chief Engineer at Gulfstream, which makes some of the fastest commercial jets available on the market. However, Follak left Boom in May 2024 after serving just nine months in the role.

Boom has hired several other senior leaders who led various engineering functions at Gulfstream. After Boom announced its own engine development program, Symphony, in December 2022, Scott Powell, who spent over 20 years at Boeing as an engineering leader, joined the company as Senior VP of Overture & Symphony in August 2023.

Product

Overture

Boom’s yet-to-be-built flagship product is its Overture aircraft. Overture will be a 201-foot-long supersonic commercial airplane capable of flying on 100% sustainable aviation fuel (SAF) and will carry 64-80 passengers. Overture is designed to cruise at Mach 1.7 and fly 4.3K nautical miles at a maximum altitude of 61K feet. This range allows Overture to fly nonstop on routes like Atlanta to London or Seattle to Tokyo, with about 600 viable routes. For longer routes, Overture may require a refueling stop. Commenting on this in a February 2024 interview, Scholl stated that:

“Everyone is going to wish that it flew continuously, of course. But when I talk to operators, I remind them that stopping for refueling is going to be like a pitstop at the Indy 500. You won't have to get out of your seat and it's probably going to be 25-30 minutes on the ground in total, maybe less if we optimize it really well. Compared to another six hours on the airplane, most passengers would prefer that.”

Overture’s contoured fuselage is designed to optimize airflow to reduce drag and increase fuel efficiency, while its gull wings are meant to reduce supersonic noise and minimize engine stress.

Source: Boom

At the 2023 Paris Air Show, Boom announced that it secured a number of key suppliers for manufacturing its flagship Overture aircraft. ADI will design a digital twin software to be used for Overture’s development. Boom will also use ADI's ADEPT edge computing software for simulation. Spanish company Aernnova will design and develop the gull wing structure for the Overture. Aernnova has experience with wing design for a number of efficient airliners like the Embraer ERJ and E families, as well as the Airbus A220. Leonardo, an Italian aerostructure provider that has designed and built airframes for leading wide-body airliners like the Boeing 787, will lead engineering for and manufacture major fuselage structure components. Spanish company Aciturri, which works with both Airbus and Boeing, will design and develop the empennage (tail).

In November 2023, Boom announced that Latecoere would design and build the complete electrical wiring interconnection system (EWIS) architecture for both the Overture and the Symphony engine. Latecoere designs and maintains wiring systems for both Airbus and Boeing, as well as a number of airlines like Lufthansa and Air France. In 2023, Boom also selected Honeywell to install the Anthem Integrated cockpit suite, the most advanced avionics system available on the market, in the Overture flight deck.

As of March 2024, the Overture airliner was targeting its first flight in 2030; Scholl stated that getting to this milestone could also cost upward of $8 billion (the company had raised a total of just over $700 million as of November 2023).

XB-1

Boom is testing the technology to be used in the Overture with its XB-1 “Baby Boom” prototype, a one-third-scale demonstrator aircraft. Boom says that this prototype is intended to “serve as a flying data collector; a massive data acquisition system is integrated into the airplane.”

Similar to the Overture designs, the XB-1 uses a carbon composite titanium fuselage and an ogive wing. It’s powered by three General Electric J85 turbojet engines since Boom’s own Symphony engine program is still in early development. This is not unusual, as airplane airframes and engines are usually developed separately. The XB-1 is targeting a top speed of around Mach 1.7, the planned cruise speed for the Overture.

Source: Boom

Originally rolled out in October 2020, the XB-1 was first planned to take flight in 2021. On March 22, 2024, the XB-1 completed its first successful flight at the Mojave Air and Space Port. This follows a completed Flight Readiness Review (FRR) in November 2023, a series of successful ground tests, and an experimental airworthiness certificate from the FAA.

As US regulations prohibit supersonic flight of civilian aircraft, Boom needs a “special flight authorization” from the FAA to begin testing the XB-1 at supersonic speed. Boom received FAA authorization for the XB-1 to exceed Mach 1 for further test flights in May 2024, paving the way for its first supersonic flight in the Black Mountain Supersonic Corridor. As an XB-1 test pilot stated:

“Right now, the plan is multiple supersonic flights. We plan to do Mach 1.1, 1.2, and 1.3 on the first three. The reason for that is each one of those points takes so much airspace that you only have time to do one of them, so we will be on condition for several minutes, we’ll get a flying qualities and handling qualities block, and have to come back home.”

In January 2025, the XB-1, flown by Boom Chief Test Pilot Tristan Brandenburg, successfully went supersonic, reaching an altitude of 35.3K feet and accelerating to Mach 1.1 (750 mph). Following the successful test, the company called the XB-1 “the first supersonic jet built from airliner technology” and said that its successful test represented “the first time an independently developed jet has broken the sound barrier.”

Symphony

Source: Boom

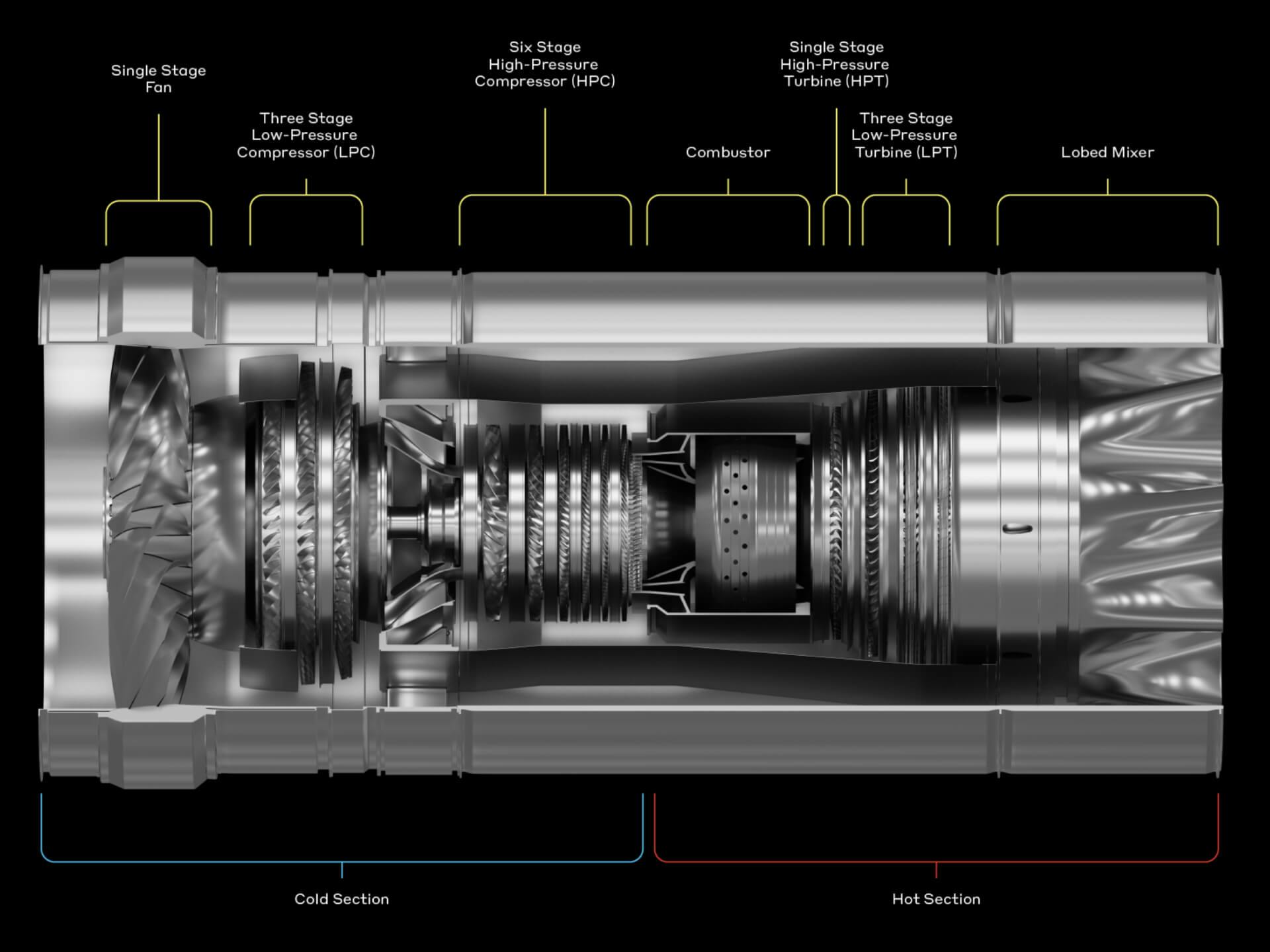

Symphony is the Boom-developed engine for Overture, which the company describes as a “purpose-built turbofan optimized for supersonic flight.” The Symphony will be a two-spool, medium-bypass turbofan engine with no afterburner.

In December 2022, following a setback in Boom’s Symphony engine development when Rolls-Royce pulled out of a partnership with the company, Boom Supersonic announced a deal with Florida Turbine Technologies (FTT) to design its own engine, the Symphony.

FTT, a unit of Kratos Defense & Security Solutions, has previously worked on supersonic engines for fighter jets like the F-22 and the F-35. Boom also secured collaborations with GE Additive for additive technology design consulting, and StandardAero for maintenance of the engines, key for airline customers as airframes and engines are maintained separately.

At the 2023 Paris Air Show, Boom announced the core engine architecture and key specs for the Symphony. The development program aims for 35K pounds of thrust with a single-stage 72-inch fan, 10 percent lower operating costs, and 25 percent more time on wing compared to derivatives of existing engines.

The Symphony is designed to meet all applicable noise and emission standards, including FAA and EASA existing engine certification requirements and Chapter 14 noise levels for quiet operation. It’s also optimized for 100% sustainable aviation fuel (SAF). In November 2023, Boom completed the Conceptual Design Review (CoDR) for the Symphony.

In July 2024, the company announced that it was “making rapid progress on its Symphony engine, with hardware testing underway and the first full-scale engine core to be operational in just 18 months.” It also said that the first 3D-printed parts for the engine had been produced, which included fuel nozzles and turbine center frame. In addition, it said that was expanding the aforementioned partnership with StandAero as follows:

“Boom also expanded its existing MRO partnership with StandardAero to include the production of Symphony. StandardAero will assemble and test Symphony engines at its facility in San Antonio, Texas. The Symphony assembly line will scale to produce 330 engines annually within a footprint projected to total over 100,000 square feet of production space.”

Boomless Cruise

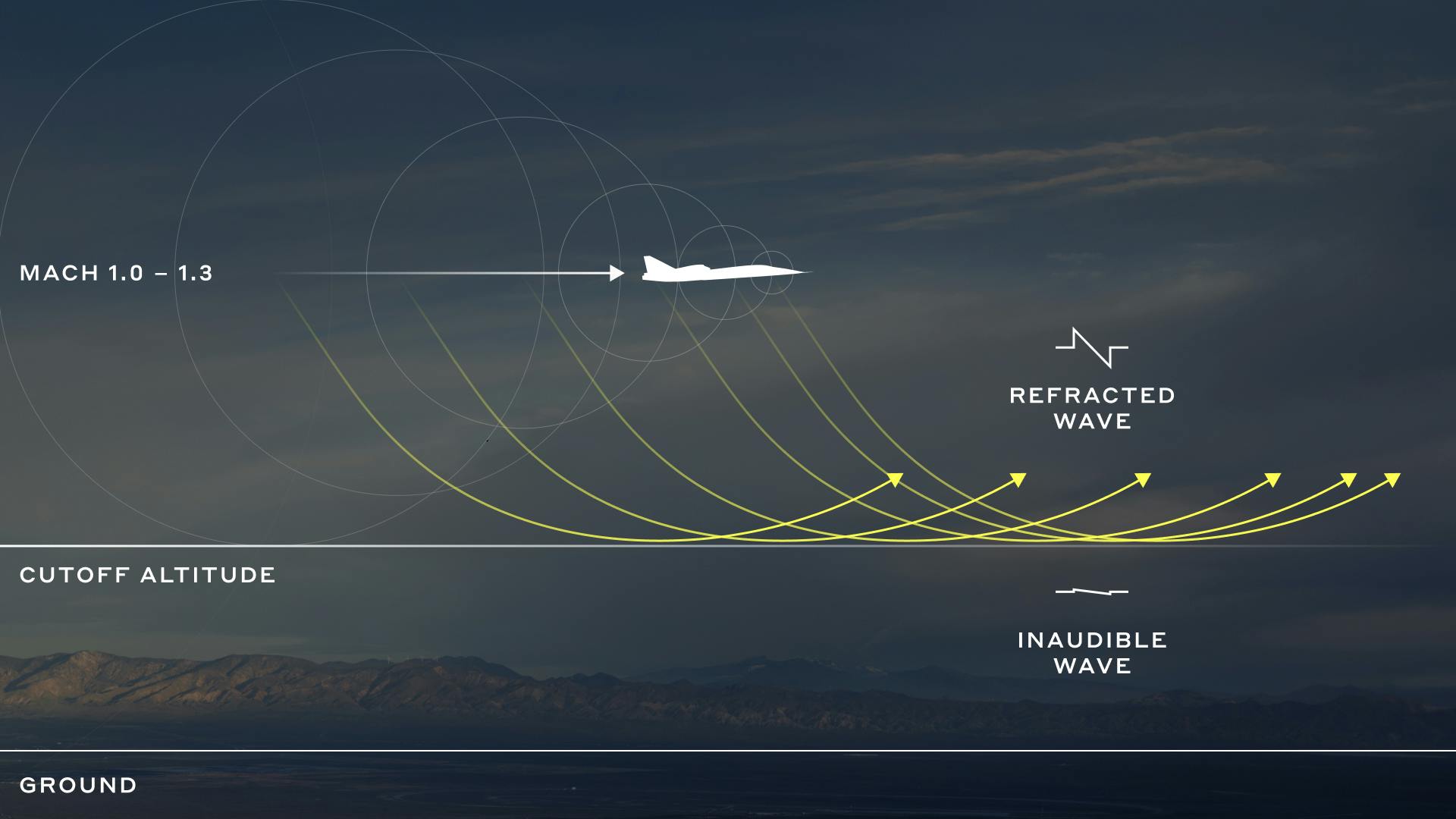

Source: Pennsylvania State University

In February 2025, a month after the XB-1’s first successful supersonic flight test, Boom CEO Blake Scholl announced that the company was introducing Boomless Cruise, which he described as “supersonic flights up to 50% faster with no audible boom.” According to Scholl, the technology for this was demonstrated “quietly” three times on XB-1’s supersonic test flight.

The company was able to achieve this using a physics principle known as Mach Cutoff, a supersonic flight technique that uses atmospheric conditions to prevent sonic booms from reaching the ground. As Scholl described it:

“When an aircraft breaks the sound barrier at a sufficiently high altitude, the boom refracts in the atmosphere and curls upward without reaching the ground. It makes a U-turn before anyone can hear it.”

Executing this technology, however, is technologically challenging. As Scholl further described:

“Boomless Cruise requires engines powerful enough to break the sound barrier at an altitude high enough that the boom has enough altitude to U- turn. And realtime weather and powerful algorithms to predict the boom propagation precisely. Boomless Cruise on Overture would not be possible without Symphony engines—which we're designing with enhanced transonic performance, allowing Overture to break the sound barrier at a high enough altitude for Boomless Cruise.”

Ultimately, Boomless Cruise will allow for flight speeds 40-50% faster than conventional airliners, even over land (where supersonic booms are an obstacle to supersonic flight). This would allow for an over-land flight from New York to LA, for example, to be up to 90 minutes shorter, while also creating incremental time savings for hybrid routes such as Chicago to Frankfurt.

According to Scholl, “Overture's autopilot will have a ‘boomless"’mode that automatically selects the fastest quiet speed while advising pilots on the fastest on most efficient altitude, based on predictions informed by realtime weather.” The top speed for Boomless Cruise will range from Mach 1.1 (844 mph) to Mach 1.3 (997mph), depending on the weather.

As Scholl has noted, US regulations as of February 2025 prohibit supersonic flight over land; however, Boom is planning to work with regulators to change this regulation in light of Boomless Cruise. On the day that Boomless Cruise was announced, Scholl posted that his "least favorite regulation is 14CFR 91.81, which prohibits supersonic flight regardless of noise profile. But it's easy to fix to allow boomless supersonic flight." Elon Musk responded to this, saying "This administration will get rid of all regulations that make no sense, like this one", to which Scholl replied by thanking Musk and telling him he looked forward to working with the administration to make it happen.

Superfactory

Source: Boom Supersonic

In January 2023, Boom Supersonic began constructing its Overture Superfactory in Greensboro, North Carolina. The factory is on a 62-acre campus at the Piedmont Triad International Airport. The structure of the Superfactory was completed ahead of schedule in September 2023, and the company announced that the factory’s construction was fully complete in June 2024, after which it planned to begin “procuring and installing tooling into the Superfactory, beginning with an advanced test cell unit” which would be used to “develop manufacturing processes, optimize the flow of the assembly line, and prepare staff for Overture production. “

The factory will produce 33 Overture supersonic aircraft annually, with plans to double capacity to 66 aircraft with the introduction of a second assembly line. The factory will serve as the final assembly, testing, and customer delivery center. It is estimated to contribute $32.3 billion to the state’s economy over 20 years and create 2,400+ jobs. The LEED-certified facility is expected to be 40% more energy efficient than similar manufacturing sites.

Commercial Service

Airlines will set final ticket prices, but Boom is designing Overture to allow airlines to offer fares comparable to business class fares in standard commercial flights. Overture will be compatible with existing ground support equipment, gates, and runways, and will operate out of all major international airports without any modifications to the terminal design or runway length. Overture is on track to commence production in 2026, take flight in 2027, achieve type certification, and enter commercial service in 2029.

Market

Customer

Source: Boom

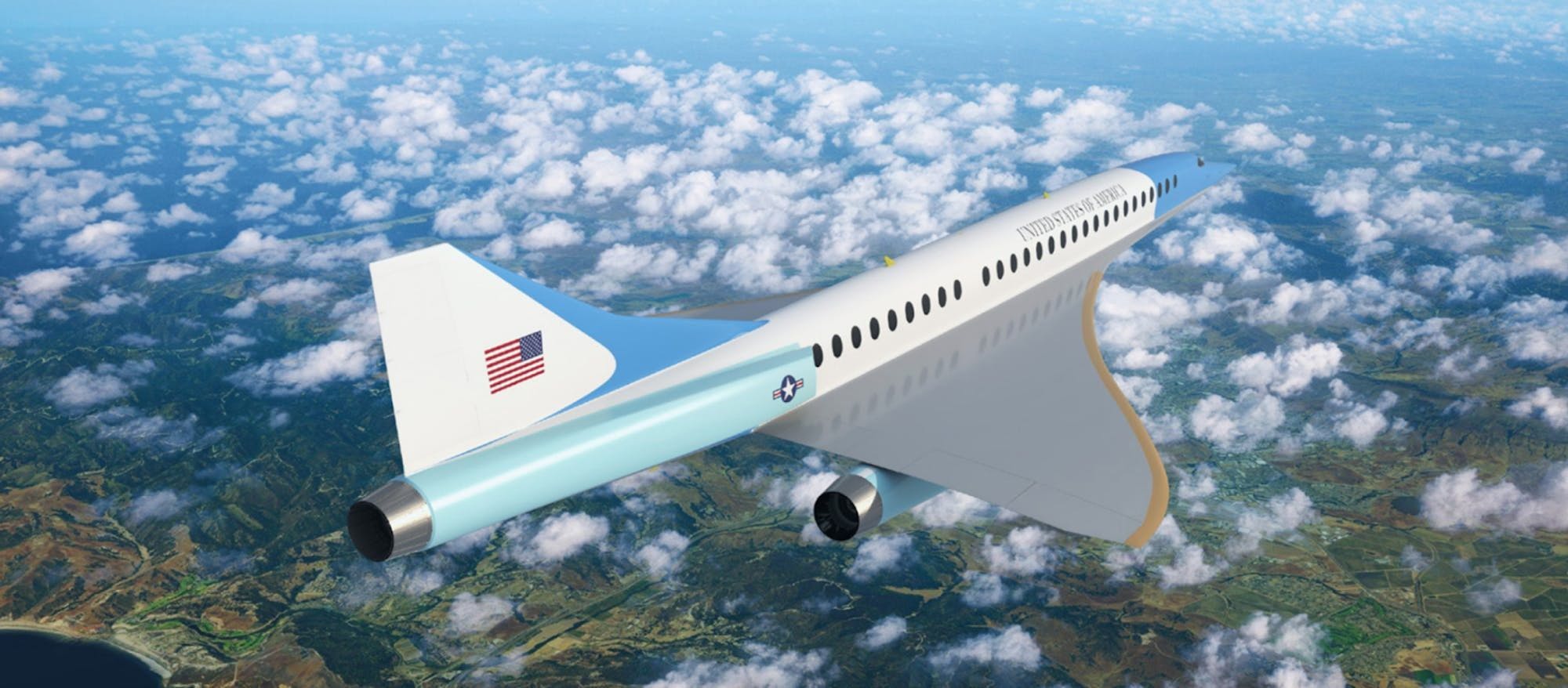

Boom’s target customers include commercial passenger airlines around the world, and also the US government and US military. Notable pre-order airline customers of Boom as of May 2024 include American Airlines, Japan Airlines, and United. In 2020, Boom Supersonic announced a partnership with the US Air Force to explore Overture modifications for government executive transport. Boom is also working with Northrop Grunman to adopt Overture for government and military missions.

Because of the high operating cost of supersonic flights, flights on Boom Supersonic aircraft will first target high-end, business class-level passengers with an all-business cabin setting. The 60-80 seating capacity of the Overture is comparable to the size of business cabins in most long-haul airliners currently in use.

Source: Boom

For Boom’s airline customers, the initial importance Boom is placing on business class passengers can be difficult to navigate. The profitability of airlines’ non-supersonic flights are heavily reliant on the high-margin business-class revenues, and they will likely have to weigh the possibility of cannibalizing returns from those flights by offering business-class flyers a supersonic option.

Market Size

In its 2022 commercial outlook, Boeing forecasted that, through 2041, airlines would need 41K+ new airplanes — including 2K+ regional jets and 30K+ single-aisle planes — representing a market value of $7.2 trillion. Boeing also estimates that by 2041, Revenue Passenger Kilometers (RPKs) — which measure the demand for air transport — will increase to 20.1 trillion, up from 8.4 trillion in 2023.

An analysis from Boom Supersonic competitor Spike Aerospace found premium passengers represented 11.2% of long-haul, non-stop international flights in 2017. According to Boom’s research, 91% of business class passengers would opt for supersonic flights if available. The global market for airlines, estimated at $332.6 billion in 2020, is projected to reach a revised size of $744 billion by 2026. Business travelers make up 12% of airline passengers, but they pay higher rates than other customers and are typically twice as lucrative, accounting for as much as 75% of profits.

Competition

Spike Aerospace: Spike Aerospace is developing its S-512 Supersonic Jet program, announced in 2013, in semi-stealth mode, with funding information not publicly available. Spike’s S-512 Supersonic Jet is a business jet designed to carry 12-18 passengers targeted at the private aviation market. In 2023, the company announced it was accepting reservations for the jet, which will be capable of flying from NYC to London within three hours, for a $100 million price tag. It had not, however, announced a timeline for delivery.

Source: Spike

Hermeus: Hermeus is a hypersonic aircraft startup founded in 2018. It raised a $100 million Series B led by Sam Altman in March 2022 and has raised a total of $216 million in funding as of February 2025. The company is testing its Chimera engine and has won a contract with the US Air Force to test its remotely piloted Quarterhorse demonstrator aircraft.

In January 2024, the company completed testing of its Quarterhorse Prototype, the “MK 0”, and in March 2024 it unveiled its MK 1 aircraft, which the company was planning to use for its first test flight in summer 2024. However, as of February 2025, the planned test flight had not occurred, having only conducted a ground test in December 2024. At the time of this test, the company said it was still “finalizing the administration efforts to obtain flight approval.”

Following the Quarterhorse, Hermeus plans to work on Darkhorse, an uncrewed hypersonic aircraft designed for defense and intelligence customers. The company will then begin the development of its Halcyon commercial passenger aircraft.

Source: Hermeus

Exosonic: Exosonic is a supersonic aircraft startup founded in 2019. It has raised $4.2 million in funding as of February 2025 and more than $2 million in contracts with the US Air Force. Exosonic’s work with the US Air Force includes developing a supersonic UAV to serve as a mock adversary in live flight training exercises. In May 2022, Exosonic said that its near-term priorities include developing an uncrewed supersonic demonstrator aircraft with a first flight in 2025. Its quarter-scale Trident prototype completed ground testing in May 2023, and the company announced a successful first flight of the unmanned Trident in April 2024.

Source: Exosonic

Business Model

Boom Supersonic’s business model primarily involves selling Overture aircraft to airlines. Each Overture aircraft will reportedly cost around $200 million. Since no Overture aircraft have been built, Boom Supersonic is taking modest down payments from airline customers for orders of an initial number of aircraft, with the option to buy more contingent on Boom Supersonic meeting industry-standard operating, safety, and performance requirements.

Traction

Airlines

As of February 2025, Boom had received orders from three airline partners: United Airlines, American Airlines, and Japan Airlines. It has a total of 206 orders, with 35 non-refundable deposits, and 171 pre-order purchase options. This began in December 2017, when Japan Airlines and Boom Supersonic announced a strategic partnership that included a $10 million investment in Boom Supersonic and an option for Japan Airlines to purchase 20 Boom Supersonic aircraft.

In June 2021, Boom Supersonic and United Airlines announced a commercial agreement to purchase 15 Overture aircraft with the option to purchase an additional 35. Mike Leskinen, CFO of United Airlines as of May 2024, said the company plans to use Overture on routes from Newark to London by 2030 and that ticket prices would be roughly $5K-$10K round-trip.

Source: Boom

In August 2022, Boom announced a contract it secured with American Airlines, where American put down a deposit to purchase 20 Overture aircraft with the option to purchase an additional 40. In February 2024, Scholl noted that Boom signed one additional airline customer that has not been announced yet. Over the 2020-2023 period, Boom has signed one airline customer per year and Scholl expects that trend to continue.

In August 2023, the Virgin Group withdrew from an option for 10 aircraft it had secured in a 2016 agreement.

Military

In January 2022, Boom Supersonic announced a three-year strategic partnership with the US Air Force valued at up to $60 million. In July 2022, Boom Supersonic announced a partnership with Northrop Grumman to offer the US government and allies a supersonic special-mission aircraft. Boom believes the aircraft can be adapted for executive airlifts, rapid mobility airlifts for personnel and cargo, and medical evacuations. In September 2023, Boom announced that it’s assembling a Defense Advisory Group of top military and defense experts to further consult on military use cases of the Overture.

Production Milestones

In December 2022, following a setback in Boom’s Symphony engine development when Rolls-Royce pulled out of a partnership with the company, Boom Supersonic announced a deal with Florida Turbine Technologies (FTT), a unit of Kratos Defense & Security Solutions, to design the engine.

In January 2023, Boom Supersonic began constructing its Overture Superfactory in Greensboro, North Carolina. The factory is on a 62-acre campus at the Piedmont Triad International Airport. The structure of the Superfactory was completed ahead of schedule in September 2023, and the company announced that the factory’s construction was fully complete in June 2024, after which it planned to begin “procuring and installing tooling into the Superfactory, beginning with an advanced test cell unit” which would be used to “develop manufacturing processes, optimize the flow of the assembly line, and prepare staff for Overture production. “

Source: Boom

In January 2025, the XB-1, flown by Boom Chief Test Pilot Tristan Brandenburg, successfully went supersonic, reaching an altitude of 35.3K feet and accelerating to Mach 1.1 (750 mph). Following the successful test, the company called the XB-1 “the first supersonic jet built from airliner technology” and said that its successful test represented “the first time an independently developed jet has broken the sound barrier.”

Regulatory Certification

In October 2023 Boom began the certification process for the Overture, in anticipation of its plans to achieve FAA-type certification by 2029. As the first stage of the certification, Boom received its G-1 stage 1 issue paper from the FAA. The G-1 stage 1 paper specifies the airworthiness and environmental standards required to gain full FAA Type Certification.

At the second stage of the process, which was underway as of May 2024, the FAA will explain its view on the specific certification basis for the Overture, including special conditions. Describing the regulatory challenges faced by Boom, Scholl highlighted that:

“It’s a very complex process, but in contrast with electric aircraft or vertical takeoff and landing aircraft, we don’t need an entirely new set of regulations in order to be certified … This is another airliner. It just flies at a different speed. But from a regulatory perspective, it’s the same safety standards, the same rules that are already written — we just have to follow them and prove that we follow them.”

Valuation

As of May 2024, Boom Supersonic had raised a total of $700 million. In October 2023, Boom raised an undisclosed amount from the Neom Investment Fund (NIF). NIF is the investment arm of NEOM, a sustainable city development project in Saudi Arabia. Following the investment, Boom and NIF planned to collaborate on supersonic opportunities in the Gulf Region. While the details of the round have not been disclosed, Boom shared that the round brought the company’s total funding to over $700 million.

Prior to this, in January 2019, Boom Supersonic raised a $100 million Series B round led by Emerson Collective, with involvement from Y Combinator Continuity, Caffeinated Capital, and SV Angel. In 2020, Boom Supersonic raised an additional $50 million funding round, bringing its valuation to more than $1 billion. Notable individual investors in Boom Supersonic include Sam Altman, Paul Graham, Ron Conway, Michael Marks, and Greg McAdoo.

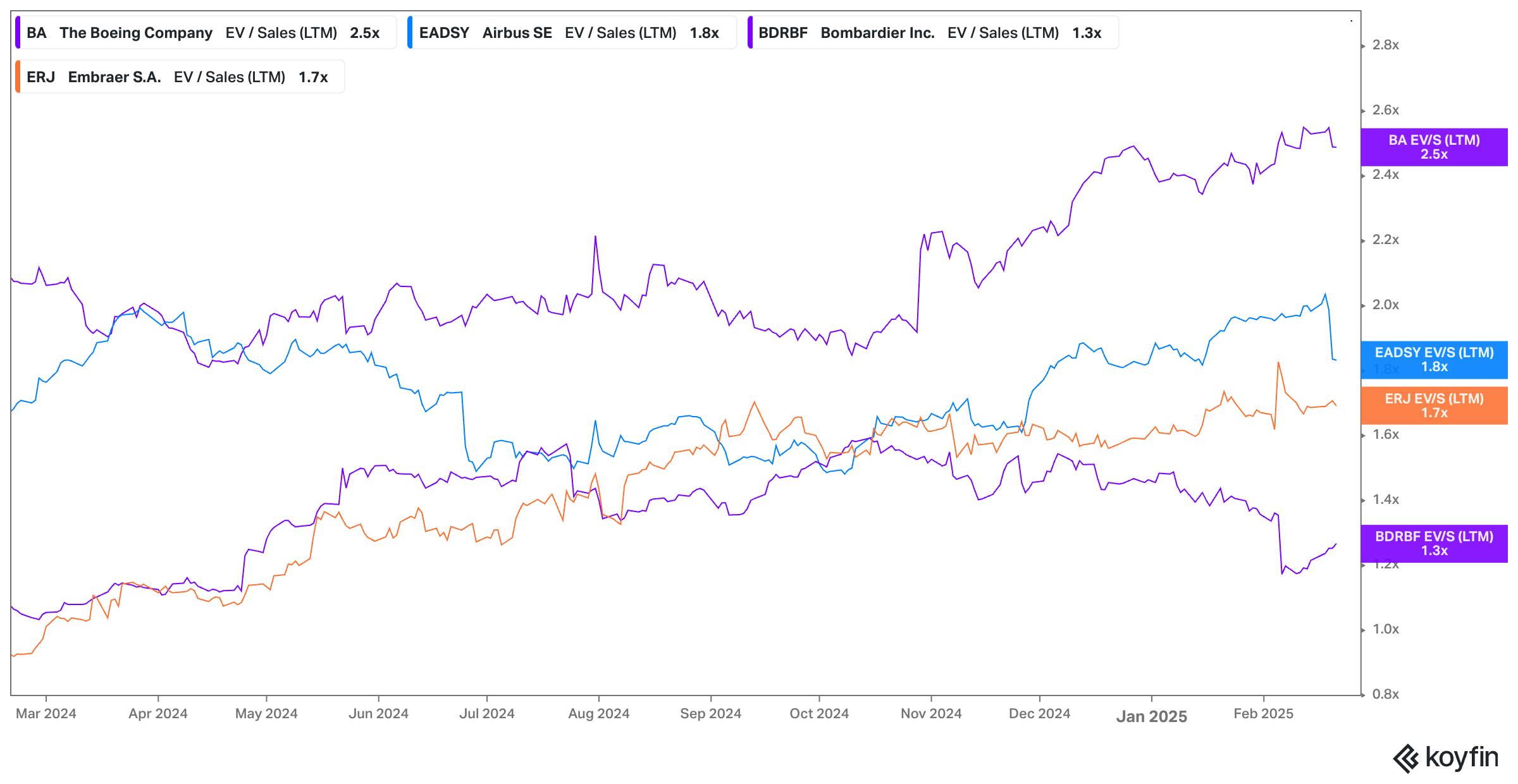

For comparison, large publicly-traded airplane manufacturers like Boeing and Airbus were trading at a 1.8x-2.5x revenue multiple as of February 2025, while smaller publicly-traded manufacturers like Bombardier and Embraer were trading at 1.7x-1.8x revenue.

Source: Koyfin

Key Opportunities

Continued Investment in Airplanes

Demand for new airplanes and air travel is projected to grow substantially over the next two decades. In line with Boeing’s estimates, Airbus forecasts demand for ~39.5K new aircraft deliveries through 2041 and an annual growth rate of 3.6% for passenger demand between 2019 and 2041.

The demand for aircraft in the Southeast Asian aviation market is growing particularly fast. During the Paris Air Show in June 2023, India’s low-cost carrier IndiGo announced an order for 500 new Airbus narrow-body jets, the largest single aircraft order in the history of aviation. A day later, Air India announced its order of 470 new aircraft from Airbus and Boeing. Scholl also believes that Asia-Pacific routes will have the most potential for Boom, including Dubai-Bangkok, Dubai-Hong Kong, New Zealand to Japan, and Hong Kong to Taiwan.

As airlines look to drive incremental value for customers with their fleets, a faster, supersonic option could be a competitive advantage in attracting the lucrative business traveler segment. Once one major airline invests heavily in this space, it is possible others could follow suit to remain competitive.

Fuel Innovation

The sustainable aviation fuel (SAF) industry must rapidly scale if Boom, and the rest of the airplane industry, hope to decarbonize aviation in the 2030-2045 timeframe. Scaling SAF production is also critical for Boom’s business as it looks to achieve attractive unit economics.

Boom Supersonic believes in the rapid scaling of SAF production to satisfy demand in the 2035-2040 timeframe by aligning public and private initiatives. Boom Supersonic holds that in order to do this, the industry would require early adoption, government incentives, sustained research and development funding, and long-term policymaking, pointing to the solar and wind industries as successful examples.

In February 2023, United Airlines announced that it was leading a $100 million investment fund aimed at supporting startups focused on the reduction of carbon emissions in aviation through sustainable aviation fuel research, technology, and production. Air Canada, Boeing, GE Aerospace, JPMorgan Chase, and Honeywell are partnering with United in that effort.

Regulatory Changes

For now, Boom’s addressable market is determined by the routes in which it can fly predominantly over water. Opening its business to predominantly land-based routes would significantly expand the company’s addressable market. The FAA has started to loosen the regulatory restrictions on supersonic flights over land, including a 2021 allowance for supersonic aircraft to be tested over land.

NASA is also planning to deliver the results of its Quesst mission to regulators to consider new rules based not on the speed of the aircraft but the actual noise it creates. NASA describes the mission as follows:

“Quesst is NASA's mission to demonstrate how the X-59 can fly supersonic without generating loud sonic booms and then survey what people hear when it flies overhead. Reaction to the quieter sonic 'thumps' will be shared with regulators who will then consider writing new sound-based rules to lift the ban on faster-than-sound flight over land.”

With Boom's test in January 2025, the company was able to successfully demonstrate such a technology, with its XB-1 test flight achieving supersonic speeds without producing a sonic boom. This led the company to add its "Boomless Cruise" product offering, which allows for supersonic over-land travel without a sonic boom. Scholl appears to have secured influence with the Trump administration that may allow for regulatory changes, having been told by Elon Musk that the regulation that banned supersonic flight over land would be changed on the day that Boomless Cruise was announced. Five days later, Scholl posted a picture with President Trump holding a model supersonic aircraft, commenting that "this administration is supersonic."

Key Risks

Fuel Costs

While Boom Supersonic is optimistic about the potential for the sustainable aviation fuel (SAF) industry to scale production meaningfully in the 2030-2045 timeframe, others are less so. Research has found that supersonic transport aircraft are expected to burn 7 to 9 times more fuel per seat-km flown than their subsonic counterparts, resulting in a 25-fold increase in their relative cost of fuel. This is a particular issue for Boom, since the Overture is significantly smaller than most airliners, making its footprint per passenger even higher compared to conventional airliners. Dan Rutherford, aviation program director at the International Council on Clean Transportation, said that Boom’s SAF analysis “completely ignores actual SAF growth trajectories.”

Even if the SAF infrastructure is sufficient, supersonic flights will still take much more fuel per passenger than conventional airliners, diverting SAF from being used more efficiently. Consequently, many question how supersonic travel will fit into the aviation industry’s general decarbonization strategy. This could dissuade airlines from purchasing Overture aircraft. “Until we’re confident that we can actually generate a reliable return from the aircraft, that’s not where we’re investing,” Delta chief executive Ed Bastian told Fox Business in August 2022.

Industry insiders note that the ultimate success of the Overture will rest on whether it will be flown as much as conventional long-haul airliners. The Overture will require an estimated 4K to 5K hours of flying time per year for the unit economics to be manageable for airlines. The Concorde, the last supersonic jet, did not get close to these utilization levels, with an average of around 1K hours of flying time per year. This was largely caused by the limited routes on which the Concorde could fly due to bans on supersonic flights over land. Boom will need to overcome similar challenges.

Pilot Shortages

Consulting firm Oliver Wyman estimates the global aviation industry will be short ~80K pilots by 2032. It forecasts North America will face a shortage of nearly 30K pilots by 2032. Even if Boom Supersonic manages to bring Overture to market economically, the question remains whether there will be enough pilots to work the planes depending on how airlines introduce new supersonic fleets.

This will likely affect Boom more than established manufacturers as the Overture will be an entirely new aircraft type with extensive pilot training requirements. Since comprehensive training will leave pilots out of service for longer than upgrading to different Airbus or Boeing models, it might make airliners more hesitant to purchase the Overture.

High Upfront Costs

Boom Supersonic has raised over $700 million as of February 2025. However, the company’s costs could reach over $10 billion to $15 billion to develop its plane. Boom Supersonic, however, estimates that the total cost to bring its product to market would be roughly half of that and that the operating cost of Overture will be 75% less than that of Concorde.

Nevertheless, Boom is working on a very ambitious timeline to commercialize the Overture. Some industry insiders are questioning the viability of certifying the Overture by 2029. Boom aims to achieve full type certification in about six years, while the certification of the latest long-haul airliner - the Boeing 777-9, a variant of an existing aircraft - has taken about 12 years. Boom is also developing and will need to certify its own engine for the Overture, the Symphony. Managing both these processes concurrently would be a significant challenge even for large manufacturers like Boeing or Airbus. Therefore, any regulatory delays will pose a major risk of the company running out of funds to commercialize the aircraft.

Summary

The demand for air travel is forecasted to increase significantly through at least the next couple of decades. Boom Supersonic has seen traction in building out its supersonic aircraft, manufacturing capacity, and engine designs and has also seen multiple early commercial wins. If Boom manages to roll out the first sustainable commercial supersonic jet, the company could benefit from a “gold rush” in which airlines compete for supersonic market share. The advent of faster commercial flight could also mean more people fly more often.

However, Boom Supersonic faces a chicken-and-egg problem in that it is difficult for Boom’s airline customers, development partners, and investors to measure the economic viability of a yet-to-be-built supersonic fleet at this time. To produce Overture, pass regulatory hurdles, complete manufacturing facilities, and benefit from cost-reduction in sustainable fuel, Boom Supersonic will likely have to secure billions more in financing and manage for quite a while. Lastly, like Concorde, an accident involving human life could set back the company, and the industry, for decades to come.