Thesis

Many believe that the US was able to help win World War II largely because it was able to turn a massive industrial manufacturing base towards the war effort, producing more than half of the world's wartime industrial output. That industrial base enabled the US to become responsible for 40% of global manufacturing by the 1950s, a figure that had dropped to 16% by 2021.

At the same time as manufacturing in the United States has shrunk, the global aerospace and defense industries have grown. These industries represented a $875.3 billion market in 2025, reflecting a 6.7% year-over-year growth from 2024. The space industry alone is estimated to exceed $1 trillion in annual revenues by 2040, up from $427.6 billion in 2022. Each of these industries is dependent on high-precision manufacturing, a market expected to reach $71 billion by 2026.

As critical as precision manufacturing is to aerospace and defense, the market has a number of weaknesses. The US defense industrial base is dependent on thousands of “mom and pop” machine shops, with no single player owning more than 1% market share. Roughly 90% of machine shops have fewer than 20 employees and less than $7 million in revenue. In addition, the average machine shop operator is 63 years old. Some estimates indicate that by 2030, the progressive retirement of these operators could result in a collapse of America’s industrial base.

The collective capacity of these machine shops represents more than $60 billion of annual spend, most of which is built on fairly manual processes developed in the 1960s. Across rockets, satellites, or drones, the average part takes 8-12 weeks to be delivered, with 40% of orders late or having quality issues. As an emerging generation of defense and aerospace companies has begun to grow, this exacerbates the capacity problems for the industrial base. Funding for space startups in 2024 was $8.6 billion, with the space economy reaching a record size of $613 billion in 2024. There were over 5K space companies in the US as of 2021, representing 50%+ of all space companies globally. With companies like SpaceX spending billions on manufacturing, there is a need for a modernized supply chain to support American manufacturing.

That’s where Hadrian comes in. Hadrian is a manufacturing company that has built vertically integrated technology for high-precision manufacturing, with modules including quoting, programming, machining, and inspection. Hadrian’s goal is to build factories to accelerate the pace of American manufacturing by delivering parts in ”less time, on time.” Hadrian manufactures precision components for aerospace and defense technology companies using semi-autonomous, software-powered precision factories that, according to the company, can help its customers make their products 10x faster and “>40% more efficiently.”

Founding Story

Hadrian was founded by Chris Power in November 2020. Power’s early career included a number of experiences that led him to new-age manufacturing.

Early Career

One of Power’s first roles was as a general manager for an Australian ecommerce business called Retail Splash. While there, Power helped the business grow from $3 million to $10 million in revenue over the course of two years. Because Amazon didn’t launch in Australia until 2017, Power’s company had to operate its own warehouses.

After this role, Power spent several years at a workforce planning software company called Ento that helped organizations schedule blue-collar labor. While engaging with these clients, Power learned a valuable lesson about getting software to work with industrial customers. He explained his experience as:

“The product incentives of building software for Industrials companies is wrong. The buyer is the CFO, so you always want to build more software to sell so that you end up with a bunch of pretty dashboards, but you get no operating efficiency. You get about 20% of the automation as a software vendor into the actual business. You really need to be running the operation, hiring and firing people, and restructuring it in parallel with what the software can do.”

Machine Shop Roll Ups

In September 2018, Power relocated to the US and set out to build better technology for industrial companies. He spent 4-5 weeks living at a hostel in Dallas, cold-calling hundreds of plant managers and visiting their facilities. That’s when he came across the dynamics in the aerospace industry: a highly technical industry with a fragmented customer experience run by operators who are, on average, over 60 years old.

He also saw that, to succeed, these manufacturing operations typically started in precision manufacturing because it has higher margins. However, building a precision manufacturing operation takes time. Rather than spending the typical eight years building a manufacturing operation with meaningful contracts, Power decided the best course was to acquire these businesses.

After literally googling “what is a private equity fund,” Power launched a private equity firm called ADSC in September 2019 with the intention of rolling up precision manufacturing facilities in aerospace and defense. Ideally, this would provide the scale required to both reap the benefits of automation and garner larger customer contracts. But as Power spent more time engaging with these manufacturing operations, he became less convinced he could build a better solution on existing machine shops. He described his experience this way:

“When you've been into a factory that looks like a garage out of the Fast and the Furious, and you ask the guy ‘what's that shiny piece of metal under the cardboard box’ and they go ‘oh, that goes on this rocket or this fighter jet,’ and then you know in movies from the '90s where someone realizes something and then it zooms out to the Earth, and then it comes back in? I had one of those moments and I was like, ‘oh God this is how the whole thing works.’”

New Age Factory

Instead of buying machine shops and retrofitting technology on top, Power saw the need to build a more fully integrated solution. He had already seen the weakness of selling software to industrial customers, having grown “really frustrated at Ento selling $500K a year SaaS contracts, when optimizing these companies that would save $20 million a year.”

Power considered his background to be “really important for getting very good at going into real-world companies that are operationally complex and figuring out where to build software and where not to build software.” Power also realized that the structural issues with the incumbent supply chain would be challenging, if not impossible, to fix through scale or vertical software alone. This informed his decision to build new factories from the ground up. As Power said in May 2022, “I realized that the right way to bring technology to the industrial space is not to sell software to these companies, it’s to build an industrial business from scratch with software.”

In particular, Power was motivated to build Hadrian because he wanted to help enable the US to rebuild its industrial manufacturing base. He originally outlined the thesis as needing to focus on a large market, explaining how the decision felt like it was between China and the US, but he opted for the latter because he saw the Chinese Communist Party (CCP) as “pure evil.” As Power put it, “the literal choice I made was based on ‘what do I have to believe to believe that America can maintain Pax Americana?’”

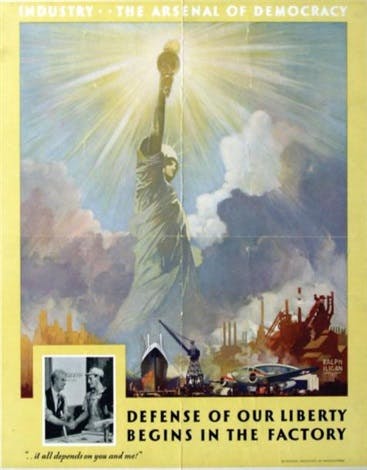

In one interview, he pointed to a World War II poster by Ralph Iligan as his favorite poster. The message of the poster? “Defense of our liberty begins in the factory.”

Source: artnet

As Power explained:

“I'm a firm believer that democracy needs a sword. The reason why we won World War II wasn't because we had the fanciest fighter jet. It was because we had this insane industrial base where we could crank out everything that we needed to support the war effort. It's the same thing for getting to space, or building robots on-shore, or medical devices. Everything you can imagine, from building the Jetson's flying car future to national security, starts with production. What we’re supporting isn’t trivial. It’s not a joke. It’s quite serious. Without domestic production capacity, everything else doesn't work. That's why our mission is important to the future of the country.”

Power further emphasized his ethos in an April 2025 hearing before the House Oversight and Accountability Committee. He cited data from the Congressional Research Service showing the US defense manufacturing workforce declined from 3 million in the mid-1980s to 1.1 million by 2021.

As of October 2025, Hadrian employs approximately 130 staff members across North America, Africa, and Europe. Since its founding, Hadrian has added a number of employees from companies such as Tesla, Anduril, Raytheon, Palantir, Stripe, and Meta, as well as nearly a dozen former SpaceX employees, including Chris Baker, who led the production of SpaceX’s passenger-capable spacecraft, Dragon. In March 2023, Ben Braverman, the former CRO of Flexport, announced he was joining the company as Chief Business Officer. In June 2023, Braverman shared he had closed a partnership with Anduril. Sometime after July 2023, Braverman left the company without a public explanation.

In October 2024, Hadrian appointed West Owens as CFO, replacing Ben Braverman. Owens had previously served as CFO of TerraWatt Infrastructure and VP of Finance at SolarCity. His capital markets experience supports Hadrian’s strategy of financing capital-intensive factories.

Product

Vertical Integration

Source: Twitter

For Hadrian, the factory is the product. Hadrian is building vertically integrated factories for the advanced and precision manufacturing industries. The company has built a manufacturing facility where it leverages software to extract efficiencies throughout the production value chain. Hadrian’s California factory runs with roughly 10 robots per human operator and produces 10K unique parts per month for drones, rockets, satellites, and naval systems. This allows its machinists to produce high-quality precision parts with low lead times and high tolerance levels, explained by Power as:

“It's very hard to upgrade brownfield operations. You cannot automate manufacturing unless you simultaneously standardize the hardware. By simplifying the physical world you can usually make the algorithms easier. If you walk into a factory and there's 40 machines, but there's N of 1 of each of them, they all have different code running on them. The non-standardization creates a massive explosion in software complexity so it's just impossible.”

Some software for the manufacturing industry will try and automate “the process of taking a computer-aided design (CAD) file from a customer and generating G-code, which tells the machines how to cut the metal.” But, as Power explains, “To do that, you need context on what cutting tools you’ve got. You need to know how the machine performs. As a standalone software company, you never have enough data or context about what’s going on in the physical world to be able to actually close a loop on all the data and solve the right problem.”

In response to this challenge, Hadrian set out to “build five software companies and a robotics company internally.” In describing the process for doing this, Power explains that Hadrian couldn’t just build one full piece of software after another. Instead, Hadrian built full-stack automation at “roughly the same automation rate” in order to identify what to build. That process required a close-knit relationship between the engineering and manufacturing teams. As Matt McLaughlin, a principal software engineer at Hadrian, put it, “Our philosophy is we pair software engineers with people who really know what they're doing. That’s where the magic happens. We actually run a factory so there's not much room for bullshit software.”

Chris Power further explained how universally critical this closeness is, not just for vertically integrated manufacturing operations like Hadrian, but across technology more broadly:

“Philosophically the greatest companies in the world get their software engineers closest to the customer problem as soon as possible. [Companies like] Rippling and Ramp have this great thing where engineers do the customer support tickets for as long as possible. How can you push the people that can solve the problem, like software engineers and manufacturing engineers, as close the problem as humanly possible? You want to remove product management as much as possible so that the person writing the code has seen the whole picture. The easiest way to do that is write code as close as possible to the problem that you're trying to solve.”

This principle is reminiscent of a standard set by Kelly Johnson, the original founder of Lockheed’s famous R&D lab, Skunk Works. In building airplanes made famous for their contributions during the Cold War, Johnson maintained the standard for his engineers: "Engineers shall always work within a stone's throw of the airplane being built.”

By keeping software engineers as close as possible to manufacturing operators, it enables Hadrian to, ideally, build a more iterative process. Being vertically integrated gives the company a “closed loop system of data.” Most systems are built in silos, with an army of software engineers being separated from the operations by product managers. Often, this will result in months of product building only to find out that the software team has built the wrong product for the operations team. Meanwhile, Power believes one of Hadrian’s strengths is this iterative ability to prioritize “change management, because [the company is] continually upgrading operations and changing processes to get better and better.”

Human-in-the-Loop Automation

Source: CNBC

In the process of building a vertically integrated factory, Hadrian has made the decision not to automate every aspect of its operations. One guiding principle is seeing “what [processes] can be a spreadsheet the longest.” Instead of full automation, the company works to get between 70% and 80% of the factory automated and “leave the last 20%.” Those unautomated processes get software built around them to “make it simple, [but] it’s a workflow tool” for people to use instead. As Chris Power explains, “to go 100% on every single part of the factory would take a decade.”

One key piece of building this automation is working with expert machinists and providing context to the team's software engineers to incrementally take aspects of the process out of an expert's head and put them into software. In an August 2024 interview with Contrary Research, Chris Power explained it this way:

“With everything we build, we start with software engineers and experts. And what we build first is not automation, it’s simplification. The goal of the first product is not to take something from 60 hours to five minutes. It's to simplify it so you could train anybody to do that in 30 days. Starting with an expert and trying to automate their job never gets you to a product that a non-expert can use. The starting position is taking 5-6 experts, lots of context-heavy software engineers, and the goal is that none of the experts are doing thinking anymore. At first, it might take the same amount of time but the process is consistent, they’re using our software. And then it's very easy to take chunks out to automate.”

Leaving a portion of the factory’s operations unautomated means that there will still be a human element required, though labor shortages in manufacturing are particularly pronounced. In 2023, there were 615K manufacturing jobs unfilled; the equivalent of 45% of all manufacturing jobs. Contributing to this shortage is a high rate of churn; each year, roughly 10% of machinists leave the industry. Hadrian’s factories require a multifaceted selection of skillsets, from machining to welding, casting, and forging. Hadrian addresses this labor shortage through software that is much more accessible to a typical worker. The goal of Hadrian’s software is not only to “take a 20-hour task down to two hours,” but to also make “that two hours way simpler.”

According to Hadrian, the company can take “former baristas and copywriters” as well as “former bus drivers, nurses, UPS drivers, or Home Depot workers,” and enable them to learn how to operate manufacturing machinery within 30 days; a capability that would typically require “years of training.” In fact, the company claims that “less than 10% of [its] manufacturing team actually stepped foot in a machine shop before their Hadrian interview.” In an August 2024 interview with Contrary Research, Chris Power describes the company’s workforce development approach to ensure quality from this newly established labor force:

“What we’re doing is massively, but not completely, deskilling the thing so that you can learn it in 30 days, not a decade. The other trick is we have a well staffed workforce and training team whose entire job is to take people, mold them, shape them culturally, discipline-wise, and [teach them] how to use our software. We’re at the point where [for] 100% of our factory roles, no more is there an expert apart from operations leadership or when something goes wrong and an expert needs to intervene. But it took a long time to get there.”

While that iterative process of removing experts from the workflow enables more scale for Hadrian’s automation, it also requires a lot of technology literacy and comfort from Hadrian’s operations team. In that same interview with Contrary Research, Chris Power explained why this approach is critical:

“You need a new workforce that is technology-first. They can deal with our software engineers making changes to their workflow every second day, which is no joke. Our operations team is incredible because half the tools don’t exist and half of them are [constantly] changing.”

As of February 2024, Hadrian also claimed to be capable of operating at a 1:5 or 1:6 human-to-machine ratio. While that is already much higher than the industry standard human-to-machine ratio of 2:1, Hadrian’s goal is to “double the efficiency even from where it is [as of February 2024].” Hadrian also claims its equipment uptime is “close to automotive levels”, which can be 80-90%, compared to “usual aerospace manufacturing at 30% equipment uptime.” In an August 2024 interview with Contrary Research, Power confirmed that Hadrian consistently sees equipment uptime of 75-80% or so. In April 2025, Power testified before Congress that Hadrian’s factories operate 10× more effectively than traditional U.S. shops, a consequence of what Power cited as AI-driven uptime optimization.

In addition, Hadrian’s primary machining fleet is, reportedly, able to operate largely autonomously for several hours. As Chris Power explains:

“Everyone leaves at 5 or 5:30 and the machines all run themselves overnight. Whether they make one part or 100 parts, everything's set up the same way. That's a real trick of the automation is making sure that the physical tasks are really simple. 90% of the effort is being done by the machines, so the only job that people do manually is basically put the block of metal on and press go.”

According to Chris Power’s April 2025 congressional testimony, Hadrian’s factories run 10× more effectively than traditional US shops by optimizing robotics and AI for sustained uptime.

Full Stack Factory

The result of Hadrian’s vertically integrated factory and human-in-the-loop automation is what Chris Power refers to as “full stack automation.” The focus of Hadrian's factories is to leverage software to extract efficiencies throughout the production value chain. This setup allows Hadrian’s machinists to produce high-quality precision parts with reportedly lower lead times and higher tolerance levels. Hadrian claims that it now covers the advanced manufacturing stack from raw materials to finished products, meaning that the company can deliver complete mission-critical systems as opposed to just individual parts. In July 2025, Hadrian announced Factory 3 (F3), a 270K sq ft automated site in Mesa, AZ, and rolled out Factories-as-a-Service for primes in tandem with a Hadrian Maritime division focused on shipbuilding components.

Hadrian’s first factory was a 20K square foot R&D facility that could also service customers and was located in Hawthorne, CA. According to Hadrian, it could produce space and defense parts 10x faster and more efficiently than alternatives. The company’s second factory is 5x the size of its first and is located in Torrance, CA. The Mesa facility represents $200 million in investment, targets 350 new jobs, and is on the road to opening in early 2026.

Source: Boring Business Nerd

Hadrian's vision is to modernize America's industrial supply base by creating a manufacturing platform that removes any prototyping or production bottlenecks from slowing or deterring innovation across the aerospace and defense industries. Katherine Boyle, a general partner at Andreessen Horowitz and investor in Hadrian, described the company’s approach this way:

“Chris’s realization after talking with hundreds of machine shops and even more machinists is the hard truth we can’t ignore: financial engineering doesn’t solve the core problem of making aerospace and defense parts faster and cheaper… you need to build automation and solve a complex engineering problem in the physical world to truly shore up the aerospace and defense supply chain.”

Hadrian is building manufacturing facilities integrated with software in an attempt to improve the way its customers manufacture components that go into products like rockets, satellites, jets, and hypersonics. The company has built software workflows that complement the workflows of machinists operating precision manufacturing equipment, which allows the company to extract efficiencies both externally and internally. Hadrian wants to cut lead times from 20 weeks to three weeks by using software to streamline communications with customers and by automating manual tasks in the manufacturing process without compromising product quality.

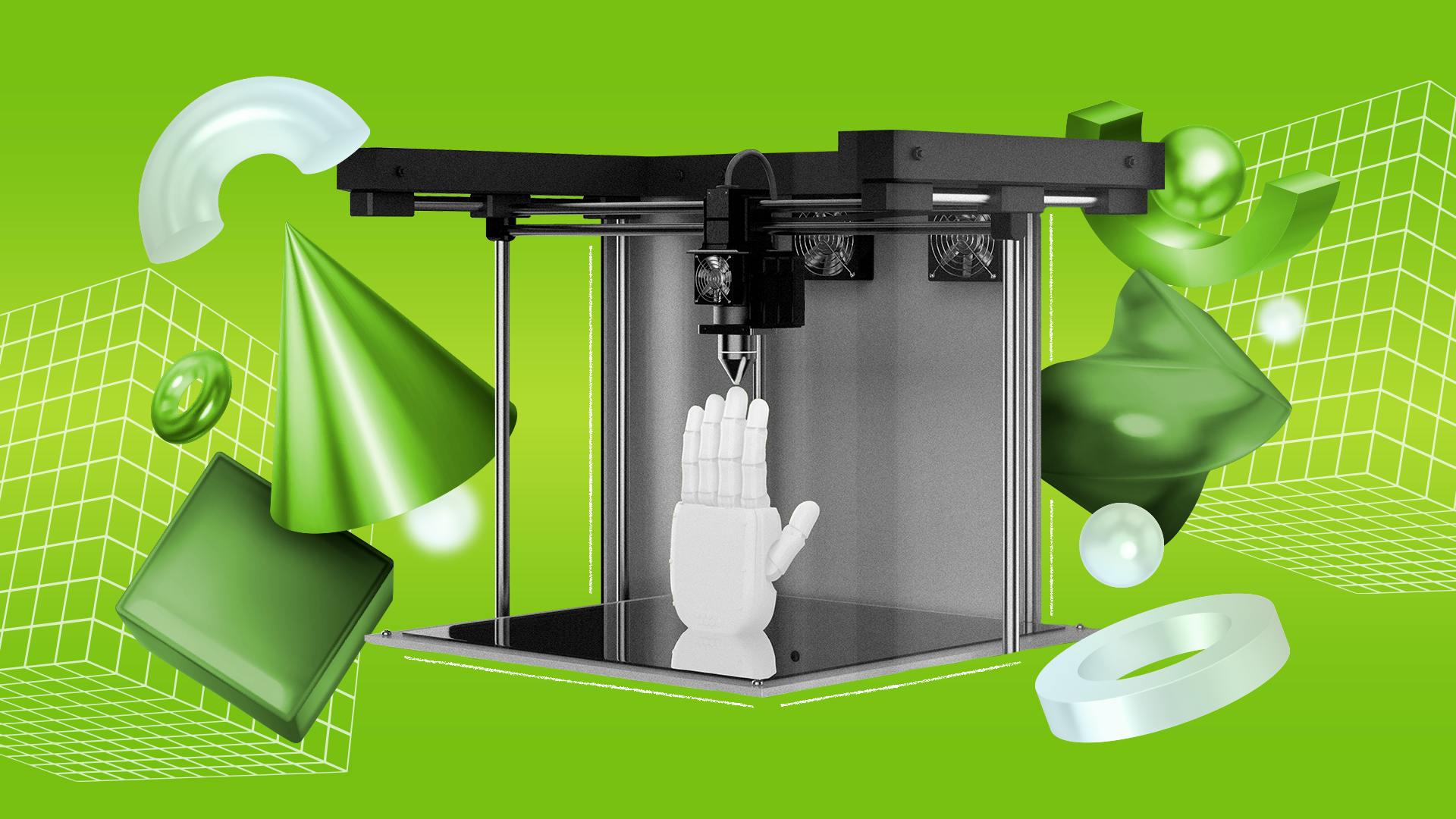

Hadrian had to build “five software companies and a robotics company internally.” The combination of a vertically integrated operation with engineers close to the problems and human-in-the-loop automation resulted in a number of different software and hardware modules being built. Hadrian’s software includes products like Designed for Manufacturing (DFM), CAM automation, Hadrian’s own ERP, Flow, and quality control modules. On the hardware side, Hadrian utilizes machines such as computer numerical control (CNC) machines and an inventory loading system, some Hadrian employees refer to as “the big parking lot.”

Designed For Manufacturing (DFM)

One of the first modules in Hadrian’s value chain is referred to as Designed For Manufacturing (DFM). The DFM module is software that can review customer requests. As of February 2024, Hadrian had four deployed manufacturing engineers leveraging the software to review “drawings and CAD files” from customers. After this review, the software provides a price, quote, scheduled lead time, and a proposal for whether or not the order should be filled. In other words, the software answers the question of “can Hadrian make the part?”, “Should Hadrian make the part?”, and “How much is it going to cost?” In July 2025, Hadrian confirmed that its DFM and quoting modules are integrated into its “Factories‑as‑a‑Service” offering. This arrangement allows for defense primes to deploy Hadrian’s automation and quoting capability directly inside their own production environments. As Chris Power explains:

“The way we manufacture stuff is largely defined by the customer requirements, so we don't get to say, ‘hey customer X, you're doing this a slightly wrong.’ They say, ‘make this thing.’ And the industry has been making these things really well for a long period of time. It's extremely efficient. You don't want to take a bad supply chain process and then write software on it. You want a genius operations person to make a stupidly simple operations process and input software in it.”

CAM Automation

The inputs going through the DFM system are typically 3D or CAD files, or even just PDFs with product sketches and instructions. Hadrian’s computer-aided manufacturing (CAM) automation software can take those inputs once a job has been approved and use them to create G-code, which is effectively “assembly instructions for [Hadrian’s] machines.” From there, a customer order is placed into Hadrian’s production line-up.

The G-code tells Hadrian’s CNC machines how to cut a particular part. The way this is typically done in production requires skilled machine operators to program a machine for each customer order, often multiple times throughout the production process. With Hadrian, programming the machine takes a couple of hours, and the machine can then typically run autonomously overnight.

Flow

Hadrian’s manufacturing operating system (OS) is called Flow, an internal enterprise resource planning (ERP) software that serves multiple functions. Internally, Flow streamlines the operational aspects of Hadrian’s production process from order entry through to fulfillment. This saves the company time by automating manual tasks, accelerating production times, and optimizing resource allocation. In addition, Flow directs operations on the factory floor to synthesize workflows into step-by-step instructions for on-floor machinists.

Externally, Flow also serves as an end-to-end management tool that streamlines processes and communication between customers and Hadrian from bid to ship. This provides visibility into the production process so that, ideally, customers can understand what stage of production a product is in. Flow aims to drive greater human resource efficiency, limit downtime, and reduce errors during the process, all of which produce shorter lead times for Hadrian and its customers. This is in contrast to the incumbent supplier base, which still relies on workflow processes from the 1960s, with many orders being placed over the phone, fax, or email.

According to the company, Hadrian's software cuts manual work by 80% for customers. The company streamlines the entire post-production process: everything from engraving serial numbers, purchase order paperwork, print revisions, keeping records of depth and load balancing details, and more. Small machine shops use PDFs to keep track of these details, which can cause major delays, increase cycle times, and make it more difficult to prototype new parts.

Quality Control

Once customer orders have been reviewed, processed, and machined there is still the need to review the product outputs for quality. While CNC machines are used to cut raw materials into finished products, Hadrian is able to use coordinate measuring machines (CMM) to judge product quality at micron-level accuracy. As Chris Power explains:

“One micron is 170th of a human hair. Every unique part we make for customers needs 40 to 200 unique cutting tools. Let's say this tool can last a thousand minutes before it wears out. What a brilliant machinist will usually do as you're cutting 100 parts is eyeball the tool and look at how it's wearing down, and then adjust on the machine. ‘We think this is 5 microns shorter on the top. Now we have to tell the machine in software that it's 5 microns shorter.’ Times that by 100 tools, times that by a number of parts. It's really hard data to manage, so we scan everything so that it's got a perfect representation in code of the geometry of the tool. When it's in the machine we laser scan it every time it changes tools so we can basically tell how far it's worn down.”

Quality control and finishing processes on an end product can often represent up to 90% of the lead time. As a result, any operational improvements to the process for quality control can have significant improvements in preventing issues further down the road on a customer order.

Computer Numerical Control (CNC)

Source: Hermle

Hadrian utilizes CNC machines, which operate using pre-programmed software and codes that tell each machine the exact movements and tasks to complete. Rather than creating these machines from scratch, Hadrian uses machines produced by Hermle. These machines are used for cutting raw materials into specific outputs based on the code provided.

Other Robotics

In addition to CNC machines for cutting, Hadrian leverages a variety of robotic arms to hold materials during some cutting processes, as well as moving raw materials from one place to another. In particular, when production is being automated these arms are necessary to transport materials around the machine floor.

“The Big Parking Lot”

Source: Common Cents

Hadrian’s machines are capable of “running themselves overnight.” In order to do this without running out of raw materials, Hadrian has built what Chris Baker, Hadrian’s VP of Operations, refers to as “the big parking lot.” As he explains:

“That's where our raw materials are stored and where finished parts are stored that finish up through the night when we don't have anyone here to unload them. It's really the big work queue for the fleet of CNC machines we're putting here, as well as storage when we're waiting to take something off and take it over to quality.”

The AWS of Machining

One key aspiration for Hadrian’s full stack factory is to enable a faster feedback loop in manufacturing that hasn’t existed historically due to longer lead times and less transparent supply chains. Faster feedback loops not only enable faster delivery times but also the potential for more product iterations. Most businesses with manufacturing operations don’t have the luxury of “rapid iteration” like a software company would. If a company invests heavily in a manufacturing operation it may have spent 18 months and $15 million; that’s a difficult ship to turn on a dime. As Chris Power explains, software founders often “think in iterations, not in first principles.” Hadrian’s intention is to lower the burden of speed and iteration for manufacturing operations. Chris Power draws a parallel to AWS in saying:

“One of the reasons why we have so many great software companies is because the fundamental infrastructure is in place to make creating software very cheap and scalable. You don’t have to spend 50% of your backend software engineering resources standing up servers, notifications, or payments, you can just turn on AWS, Twilio, or Stripe. That makes the cost of starting new companies much lower and the velocity in existing companies much faster. To build the futuristic industrial future we want across defense and space requires this advanced manufacturing subcomponent infrastructure layer. Hopefully in five years time what we’ve got is 10-15 factories across the country in each of these large manufacturing hubs that are serving space, defense, semiconductors, energy. And what we’ve managed to do is the same impact that Stripe or AWS had on software where someone can spin up a successful EV company at the touch of a button because they’re just spooling up half a Hadrian factory, not having to figure out an entire ridiculous supply chain just to get a part on time.”

In particular, as newer entrants to the manufacturing world, like SpaceX, become larger and larger they’re bringing with them more agile operations. As a result, Chris Power explains that “we need to have a supply chain as agile as the customer.” Even beyond newer entrants, large primes who have become reliant on legacy machine shops have very limited excess capacity. Most of these shops are operating at or near their manufacturing capacity. If the US were to try to increase, for example, the number of F-16s even by 30% it would be nearly impossible given the incredibly inelastic manufacturing capacity. The goal of Hadrian is to increase that capacity and make it much more flexible as demands for particular parts fluctuate up and down.

Market

Customer

Hadrian’s stated mission is to “automate American manufacturing starting with high precision machining.” As of March 2022, Hadrian was serving SpaceX, Rocket Lab, and Astra, three of the largest space companies, and expected to add a number of companies in commercial aerospace and new defense as well. According to Chris Power, Hadrian started meaningfully going to market in early 2023. As he explains it: “We thought that it would take until the end of 2024 to do a good enough job with startup customers to be able to have the opportunity to serve the large primes. [But] around August [2023], we saw this huge acceleration where a lot of tier ones and primes wanted to work with us way earlier than we expected.”

When asked in an August 2024 interview with Contrary Research what might be motivating that eagerness from established primes to work with Hadrian, Power responded by saying: “I think a lot of them are patriots. They [know] this is going to change, [and that] this is terrible. It’s obvious when someone tells it to you. So we’ve seen massive acceleration on the production contract side. And usually that takes multiple years.”

Despite the surge in interest, Hadrian has been very deliberate about which customers it brought on to ensure the relationships were onboarded properly because, according to Power, “you really get one shot to prove yourself.” As of March 2024, Power said that Hadrian’s customers include “new primes, startups, and then mega primes, which are massive companies.” Hadrian has more difficulty working with smaller startups given how rapidly they iterate. To address that limitation, in August 2024 Hadrian acquired Datum Source, a company that “uses AI to help hardware companies find manufacturing partners.” This step allowed Hadrian to better support smaller firms such as Astranis in satellites and Shield AI in defense autonomy until they scale into higher-volume production.

Hadrian is protective of specific customer names, though some partnerships have been announced, such as a strategic partnership between Anduril and Hadrian announced in June 2023. According to Chris Baker, Hadrian’s VP of Operations, some of these customers work on putting astronauts on the ISS, getting a satellite into orbit, building satellites, or commercial aircraft. One common characteristic of many of Hadrian’s customers is the creation of products that “are flying in some manner, whether manned or unmanned, in this world, or out of this world.” Hadrian’s factories produce components for ISS modules, satellite constellations, commercial aircraft programs, and missile defense prototypes. Its Torrance, CA facility now runs at a ratio of roughly ten robots per human, producing about 10K unique parts per month across drones, rockets, satellites, and naval systems.

Customers use the Hadrian platform because, according to the company, it is more capital-efficient than building products in-house and more reliable than using third-party machine shops. The company's approach is rooted in automation built on top of existing machinery, cutting 80% of the manual work required while being 40% more efficient than existing suppliers for equivalent parts. For context, in a typical machine shop lead times to turnaround a part for a customer can take 4-16 weeks, whereas Hadrian claims to deliver in 1-3 weeks. By mid-2025, Hadrian had broadened its addressable market with a maritime division for shipbuilding and new production lines for missile systems and unmanned aircraft, moves that align Hadrian with high-priority US defense programs. In July 2025, Hadrian raised $260 million in Series C funding to scale its AI-powered factories, open a new 270K sq ft site in Mesa, AZ, and formally launch Hadrian Maritime to deliver parts for naval shipbuilding programs.

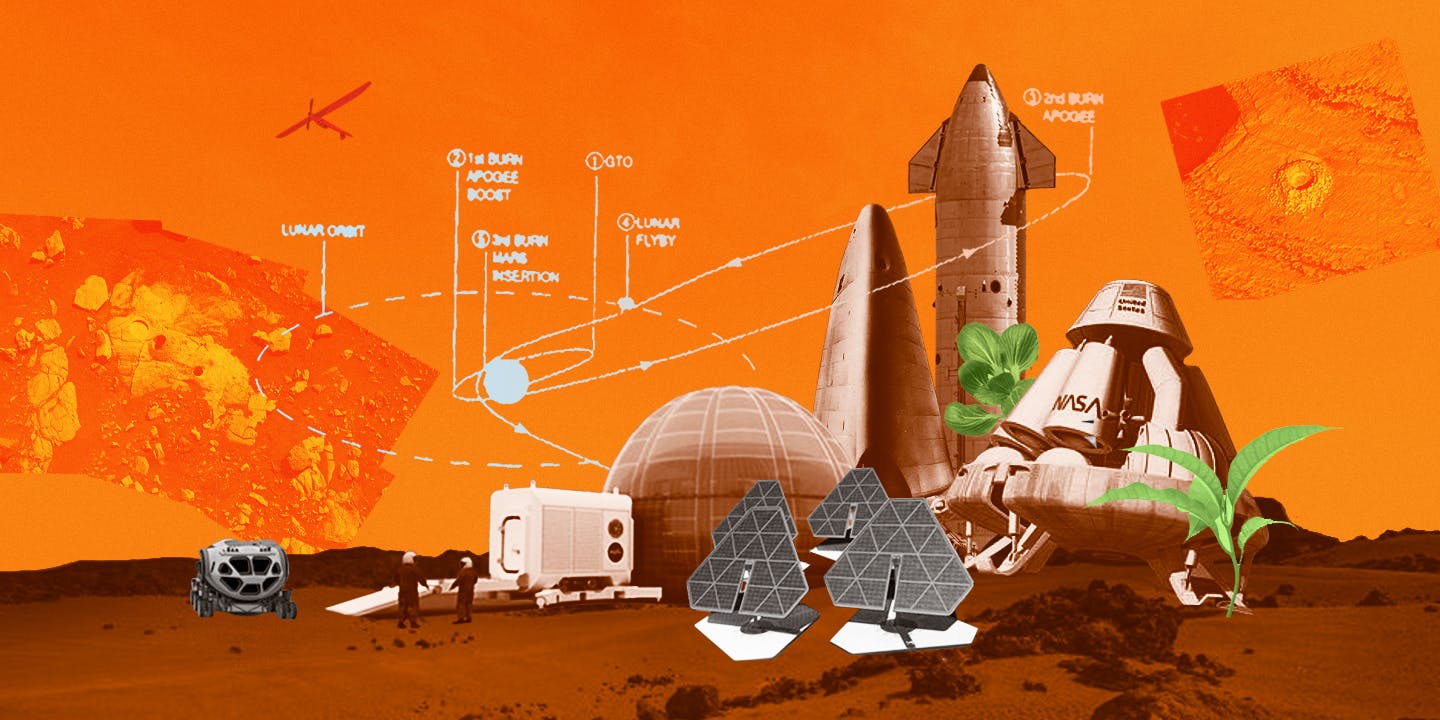

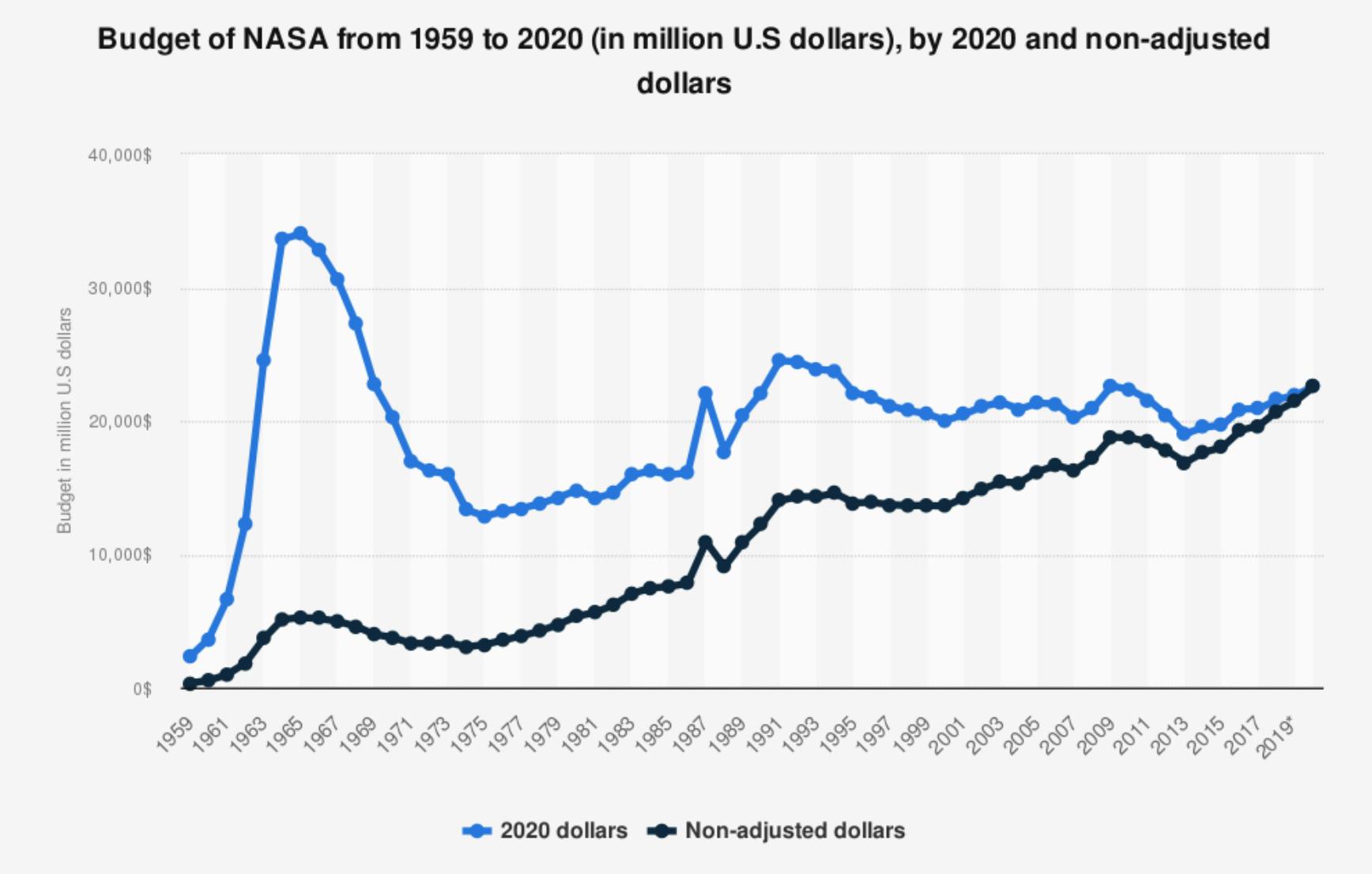

Market Size

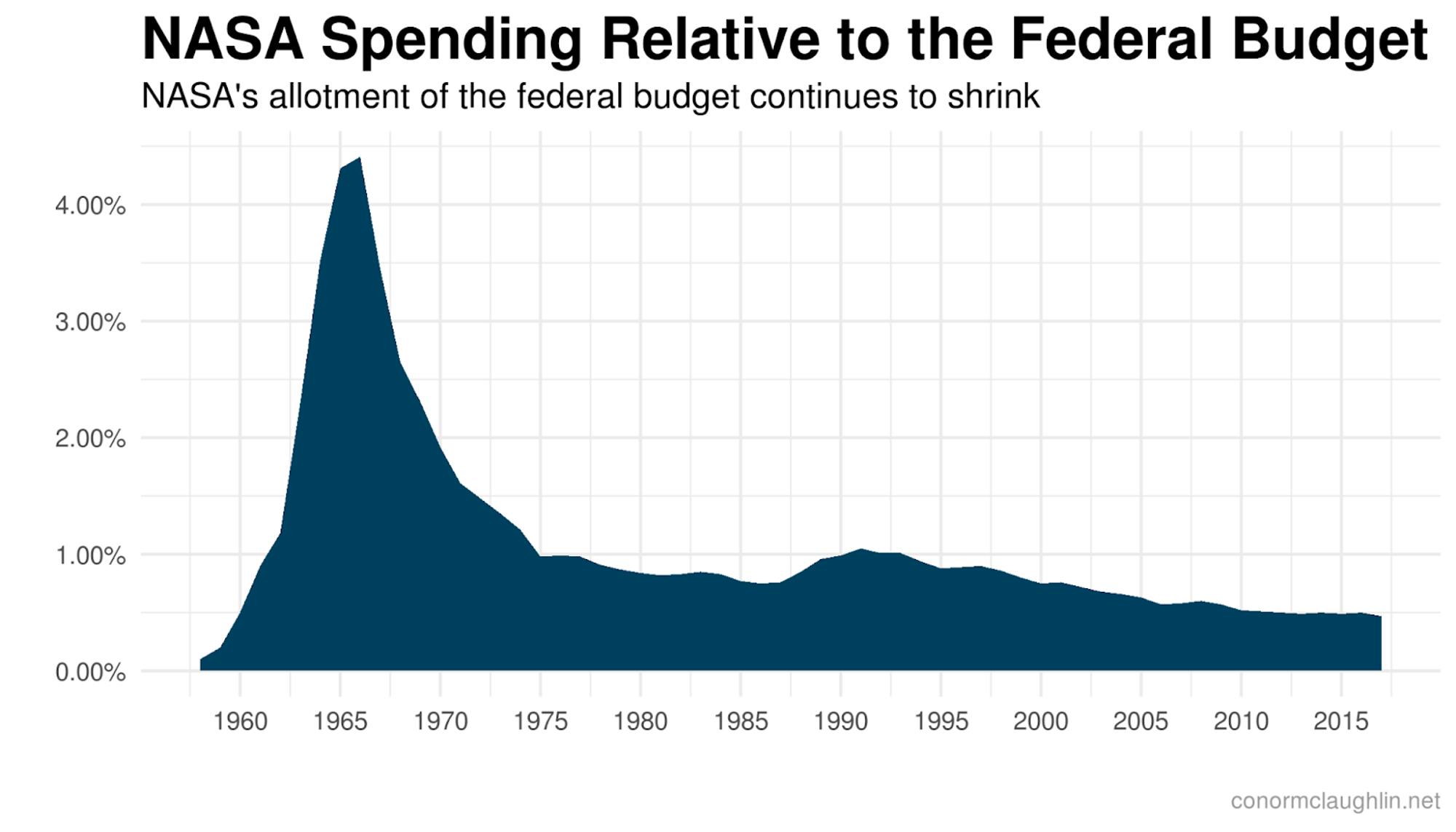

The US officially entered the space race in 1958 with the formation of NASA. In July 1969, Neil Armstrong and Buzz Aldrin became the first humans to set foot on the moon, which established the US as an early victor in the pursuit of space supremacy. This movement saw a rapidly increasing NASA budget, which grew to a peak of $50 billion in 1966 (adjusted for inflation), representing 4.4% of the Federal budget.

Source: CSIS

The US space industry supply chain traces its origins to the emergence of the aviation industry during World War II, where “prime contractors” like Boeing, Lockheed, and others were established to build aircraft for military use. The US space supply chain emerged immediately after World War II, built on this same network of primes where NASA had established intentional processes for contracting from the private sector.

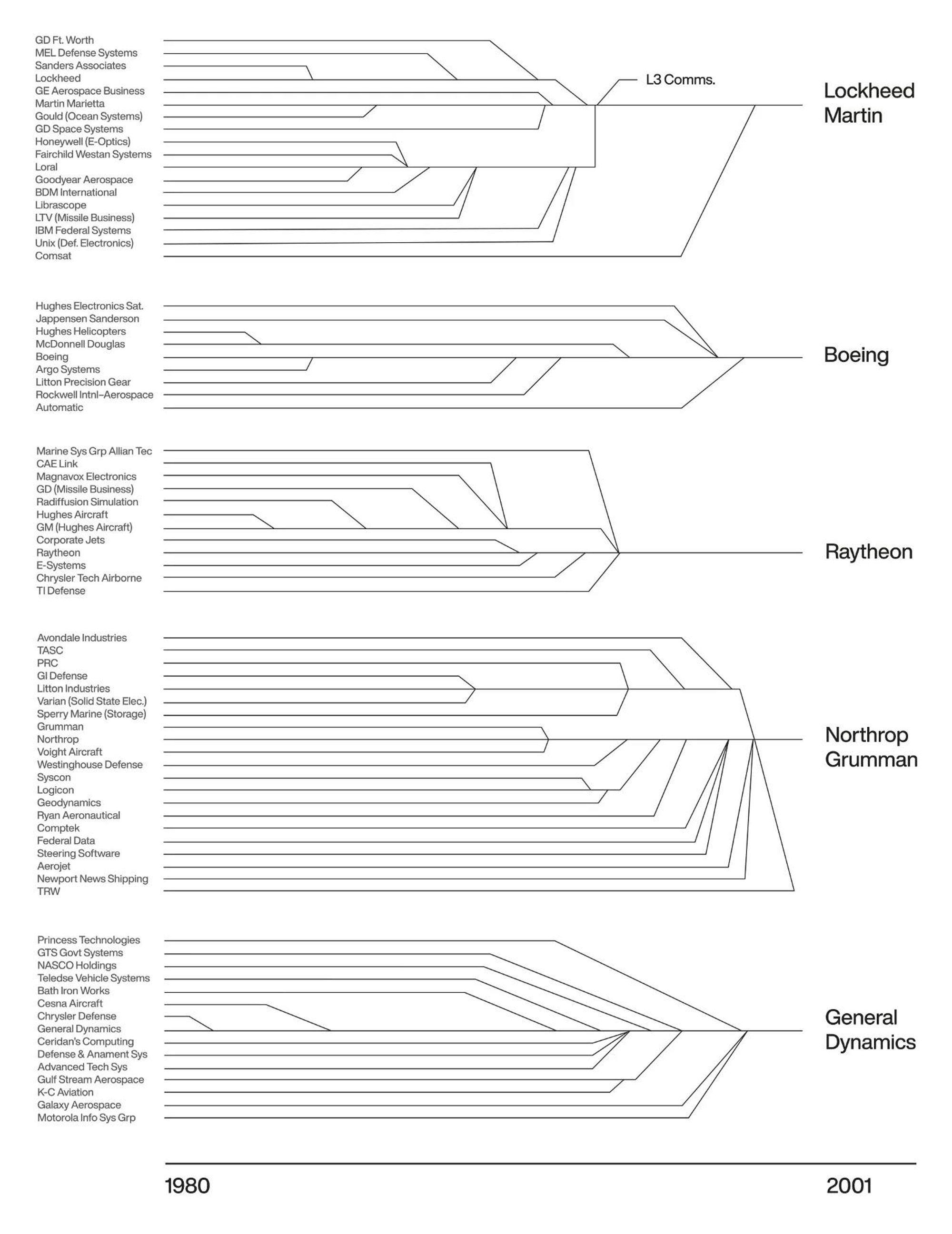

There were two significant waves of consolidation among prime contractors initially in the 1940s and '50s as military contracts declined following World War II, and then again in the 1990s as Bill Perry, the US Deputy Secretary of Defense, informed the major defense firms that “substantial cuts to the defense budget were coming and that many of their companies would not be able to survive.”

Source: Anduril

Beginning around 1980, large aerospace companies started to outsource the manufacturing of less critical components, which led to a growing network of companies providing a broader range of products, including subsystems, assemblies, parts, hardware, and materials. This demand-side pull from NASA and the US government, coupled with the supply-side outsourcing of manufacturing by the primes, is what led to the creation of the US space industrial base as it stands in 2024.

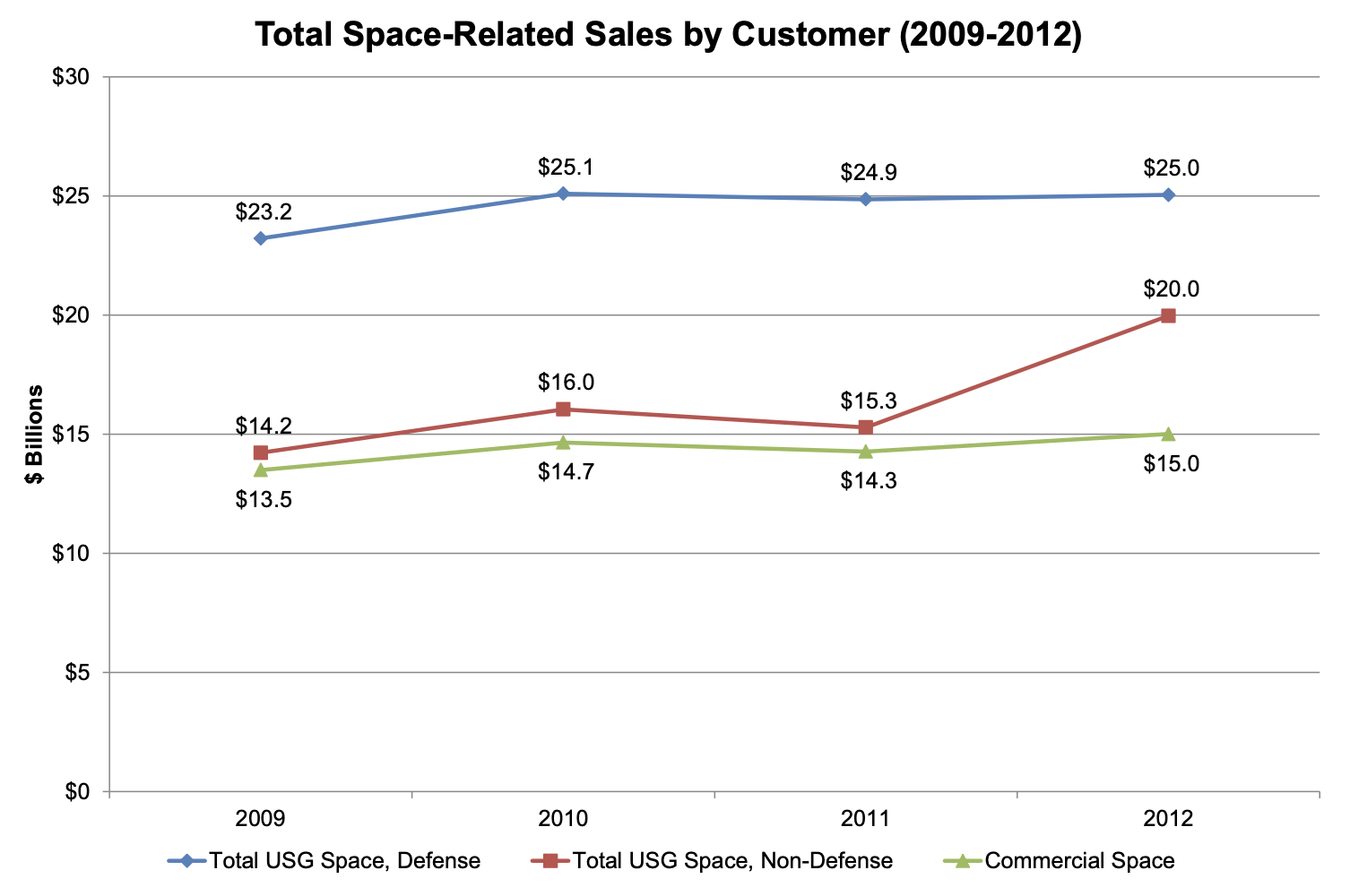

The Department of Commerce conducted a significant review of the space industry in 2012. That report found that the industrial base of US suppliers servicing the global space industry generated more than $60 billion in 2012, of which $56 billion (93%) was generated by US customers. The US Government collectively is the dominant customer in the industry, accounting for 75% of total spend in 2012, split between defense ($25 billion, 42% of total spend) and non-defense ($20 billion, 33% of total spend), with commercial space rounding out the remainder.

Source: US Department of Commerce

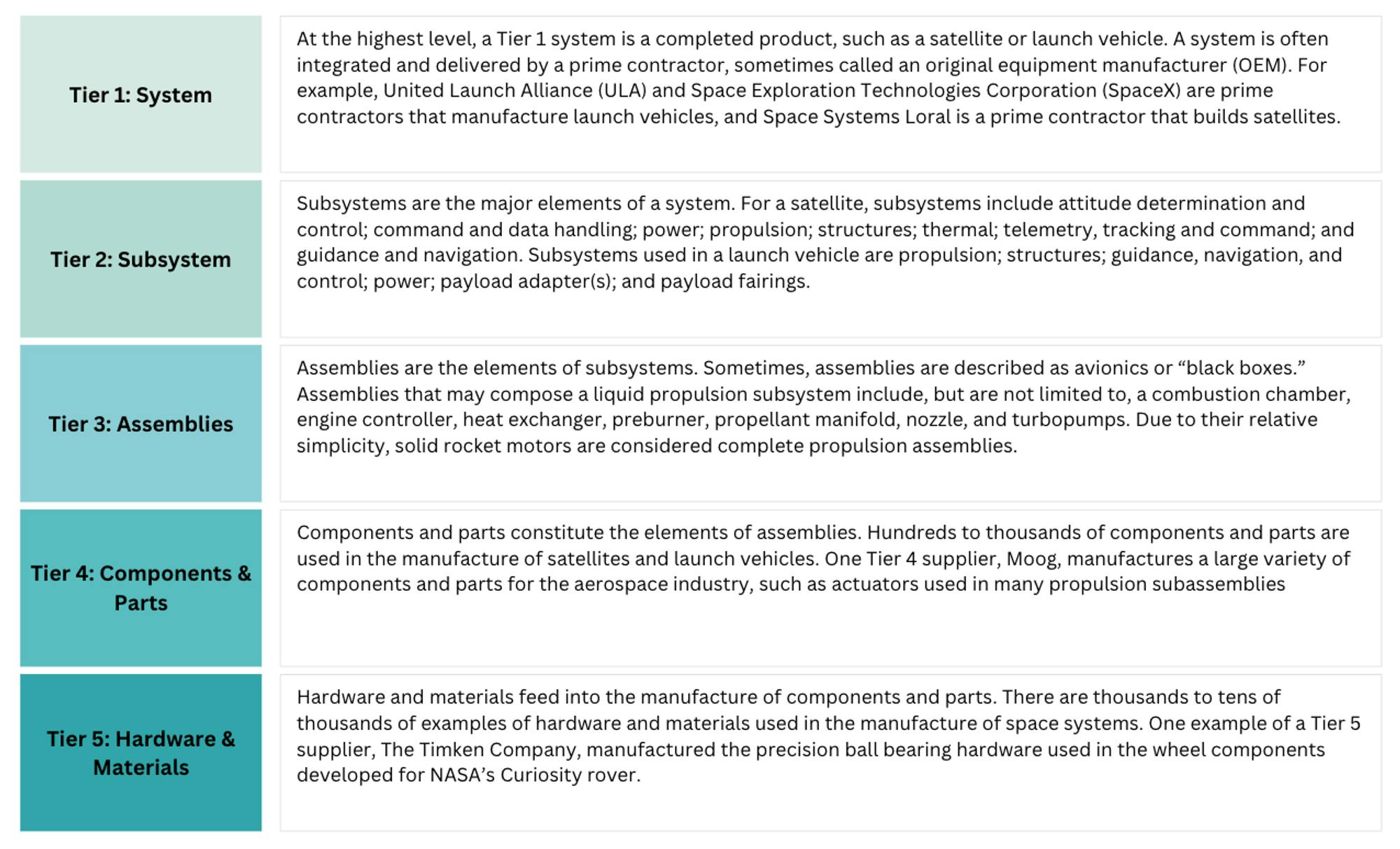

US aerospace and defense suppliers and manufacturers are often categorized by tiers describing the relative complexity of products, rather than describing manufacturers. While suppliers are often identified by a particular tier, it is common for suppliers to operate across multiple tiers of the supply chain.

Source: NASA

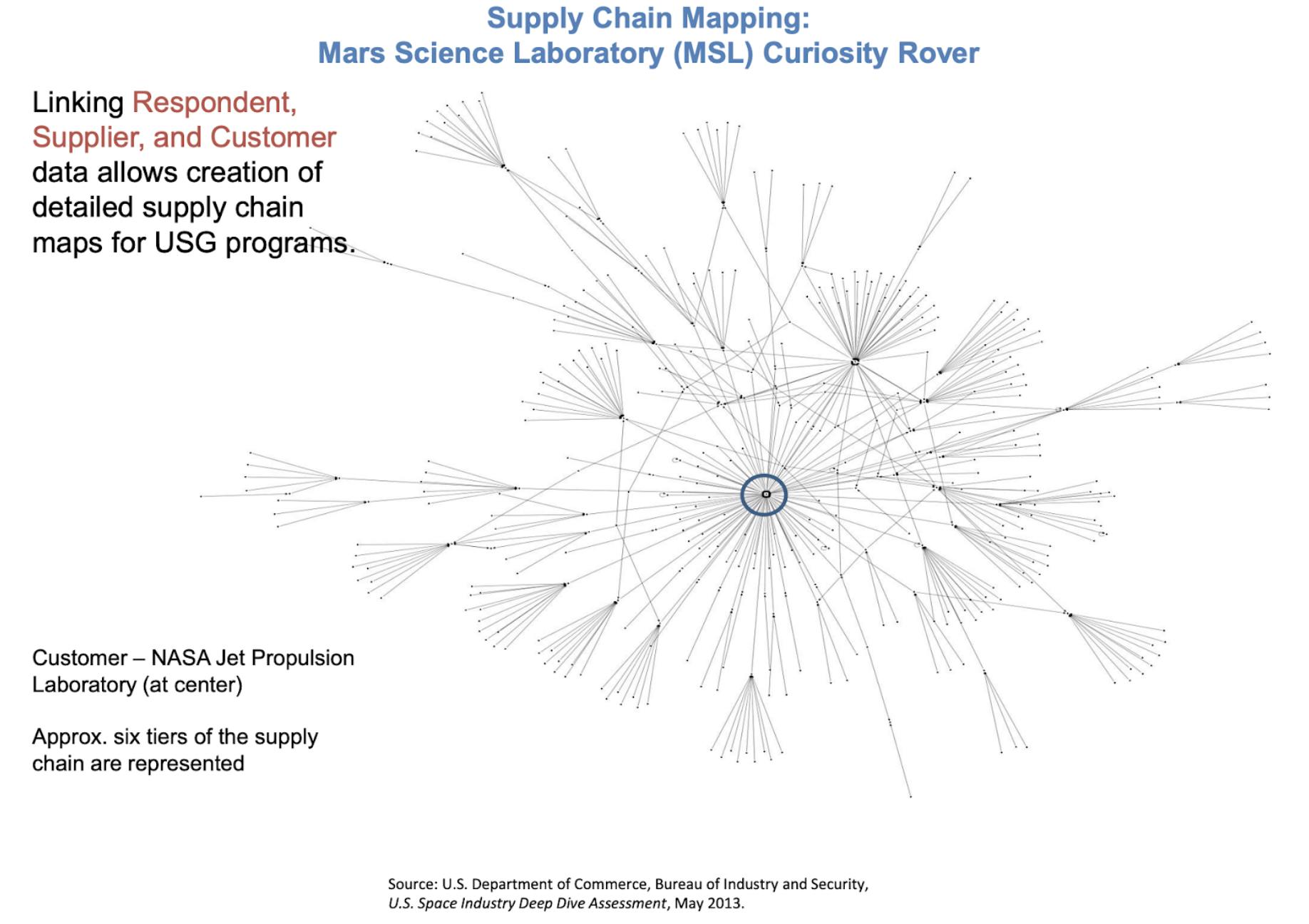

Over time, NASA's projects were outsourced to the primes, who in turn outsourced manufacturing responsibilities to this fragmented network of suppliers around the country. This resulted in thousands of suppliers working on any particular project, introducing uncertainties around costs, schedules, and quality throughout the manufacturing process. The number of suppliers involved was also difficult to manage, since projects can only move as fast as their slowest supplier, resulting in frequent production delays and project overruns.

Source: US Department of Commerce

The complexity of this model was already causing issues by the 1980s and has continued to cause problems. Some of the key obstacles inherent in this model include:

Low competition with a small number of large primes, leading to inflated costs

Fragmentation, adding to the already complex processes and increased lead times

Outdated workflows built in the 1960s

An aging workforce in individual machine shops

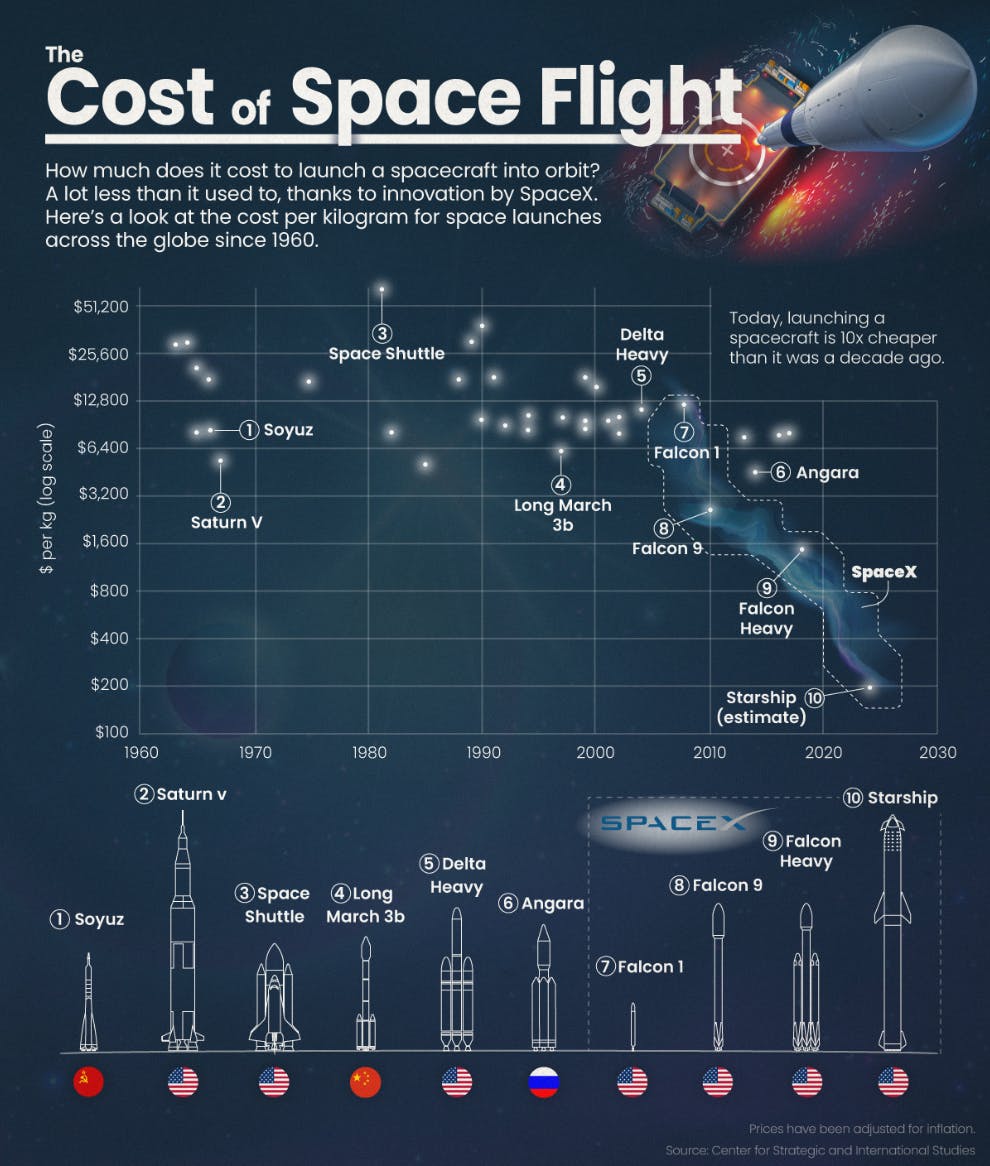

These issues were also present in the Space Shuttle program, with the program’s lifecycle costs totaling about $209 billion (in 2011 dollars), or roughly $1.5 billion per flight. With a maximum payload capacity of about 27.5K kg, the Shuttle’s average launch cost of $1.5 billion translated to roughly $54.5K for every kilogram of cargo it carried into orbit. In addition, the program missed half of its planned annual flights. NASA's budget declined as a percent of the federal budget from the 1990s onwards, and ultimately led to a policy in 2004 that concluded: "NASA's role must be limited to only those areas where there is irrefutable demonstration that only government can perform the proposed activity." This ultimately led to the termination of the Shuttle program in 2011.

Source: Conor McLaughlin

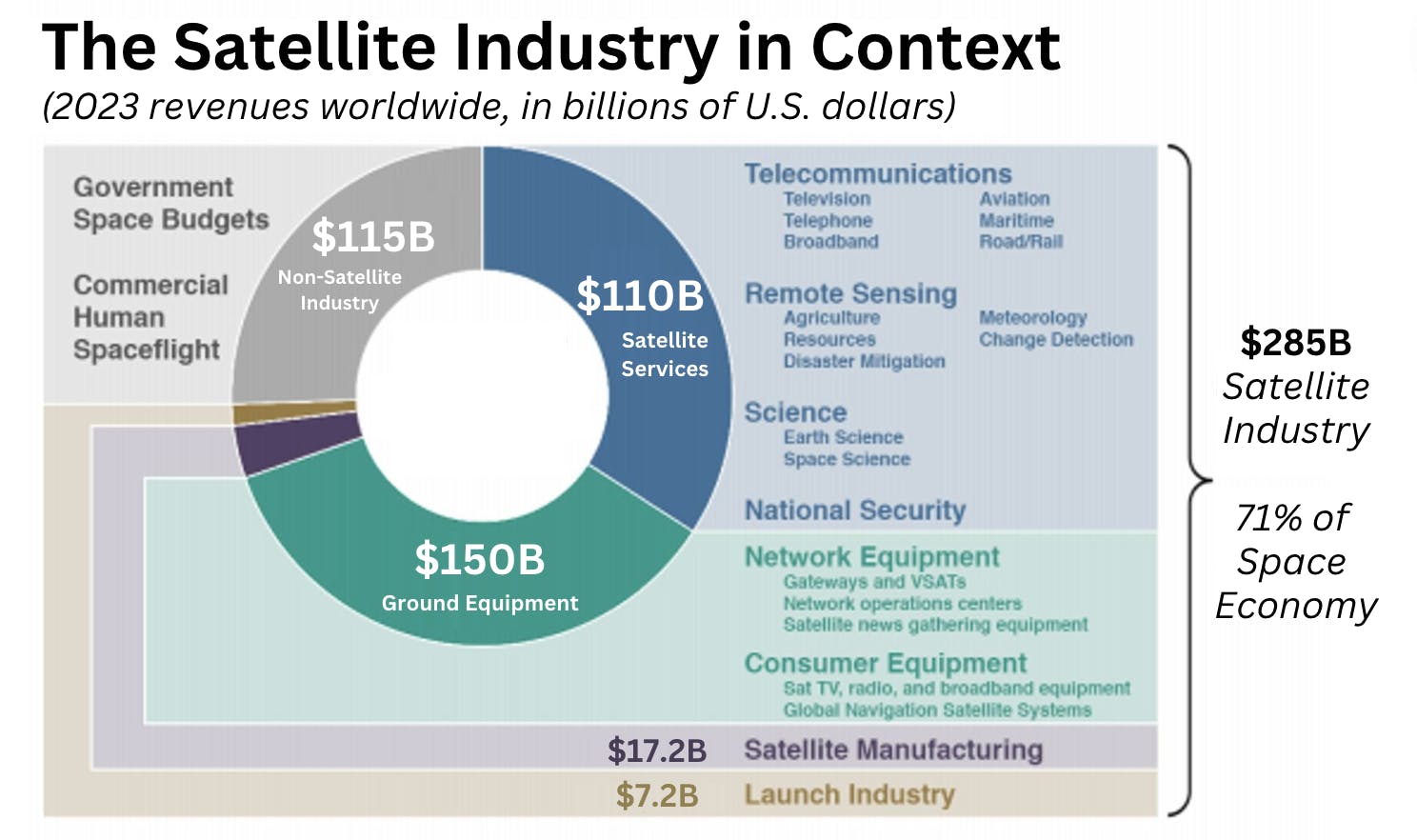

With the government directly engaging less and less, the already fragmented supplier base in defense and aerospace was further privatized. As a result, the global space economy reached a record $613 billion in 2024, with the commercial sector driving 78% of that growth. The satellite industry represents the significant majority of these revenues, at 71% as of 2023.

Source: Satellite Industry Association

Between 1970 and 2000, the cost to launch a kilogram into space remained fairly steady, with an average cost being $18.5K per kilogram. With the Falcon 9 and Falcon Heavy, SpaceX demonstrated that reusability can cut launch costs by nearly an order of magnitude. Analysts now estimate that Starship could reduce payload launch costs to $10–$100 per kilogram, representing up to an 80× reduction versus legacy rockets.

Source: Visual Capitalist

These declining launch costs are unlocking a wave of innovation from the private sector. Lower costs of launching products into orbit (and returning them to Earth) have changed the financial return profile of a range of new space initiatives beyond rockets and satellites, including in-space manufacturing, mining, and defense. Funding for space startups in 2024 was $8.4 billion, an order-of-magnitude increase from $300 million in 2012.

This growth is only expected to accelerate as industry forecasts predict the space industry to exceed $1 trillion in annual revenues by 2040. That continued investment has opened the floodgates in demand for space-capable products. Companies like Hadrian are positioned to take advantage of that trend by providing a more seamlessly integrated manufacturing process.

Competition

The competitive landscape for Hadrian is fragmented and complex. One individual Boeing 747 consists of 6 million individual parts provided by 20K different suppliers and partners. Each part represents a complex web of regulatory and performance requirements, geographic specifications, and raw material requirements.

Within precision manufacturing, there are also subsets of relevant products in aluminum, steel, titanium, and Inconel that require different machining capabilities and further segment the addressable market for each player. As a result, it’s difficult to identify specific relevant competitors to Hadrian. Instead, below is a landscape of relevant vendors that can address various aspects of the precision manufacturing market.

Traditional Machine Shops

In the US, there are an estimated 13K machine shops that generate over $60 billion in annual revenue. Machine shops broadly address a wide variety of product types, including airplane fuel pumps, oil & gas components, energy storage, hydraulics, launch platforms, and much more. These machine shops can have hundreds of employees and generate hundreds of millions in revenue, or have fewer than 20 employees and single-digit millions in revenue. According to the North American Industry Classification System (NAICS), there are around 1K operations that constitute a precision-turned product manufacturing operation. As of June 2025, most of the 13K US machine shops produce general industrial parts, but only a speculative 3K are capable of true aerospace-grade precision machining. This smaller subset is where Hadrian competes directly.

Here are just a few examples of precision machine shops that Hadrian could ultimately compete with for aerospace and defense contracts:

Kaman Aerospace: Founded in 1945, and based in Bloomfield, CT, Kaman is a manufacturing operation with subsidiaries like EXTEX Engineered Products and Kaman Aerospace. The company generated $775 million in 2023 revenue with major customers including the US military, Lockheed Martin, Raytheon, and Boeing, who accounted for 10% of the company’s revenue. In October 2024, Arcline Investment Management completed its $1.8 billion acquisition of Kaman, taking the company private.

Melling Tool Company: Founded in 1956, and based in Jackson, MI, Melling is a manufacturing operation with subsidiaries like Melling Products North and MellingMedical. The company generated $231 million in annual revenue and, while most of Melling’s customers are in the automotive industry, the business does have contracts with the Department of Defense, and can address assemblies for Tier 1 and Tier 2 suppliers.

Consolidated Precision Products (CPP): Founded in 1991 and based in Cleveland, OH, CPP manufactures titanium, aluminum, and steel castings for the aerospace and defense sectors. The company operates 19 facilities globally and supplies components for programs such as the F-35 Joint Strike Fighter as well as engines from Pratt & Whitney and GE Aerospace. CPP generates around $500 million in annual revenue as of October 2025. It entered into a recapitalization with Berkshire Partners and Warburg Pincus in June 2019.

Sorenson Engineering: Founded in 1956, and based in Yucaipa, CA, Sorenson Engineering is a manufacturing operation with 500 employees and $34.1 million in annual revenue as of October 2025. The company provides a variety of machining services and operates in industries such as aerospace, military defense, space, and satellites.

These types of machine shops present a fundamental risk to the industrial supply base in the US. The majority of these firms are owned and operated by people who are, on average, in their 60s. In February 2023, Chris Power predicted that within five to seven years there could be a total collapse of the defense industrial supply base due to the massive wave of retiring owners in these types of firms.

Manufacturing Conglomerates

Larger multi-faceted manufacturing operations can operate across two different segments of the market: (1) original equipment manufacturing (OEM), and (2) aftermarket parts. OEM parts are originally produced for an end product (e.g. the fasteners that go into a plane as it’s being built) whereas aftermarket parts are produced for an end product after the fact (e.g. a plane that needs a replacement valve).

TransDigm: Based in Cleveland, OH, TransDigm was created as the result of a leveraged buyout in 1993 that combined four companies; Adel Fasteners, Aero Products Component Services, Controlex Corporation, and Wiggins Connectors. Initially, the company focused on manufacturing aircraft components like batteries and fuel pumps. As of 2017, TransDigm had acquired 88 additional companies to expand its manufacturing coverage.

TransDigm went public in 2006, and as of October 2025 had a market cap of $74.5 billion and a TTM revenue of $8.6 billion, up 12.8% YoY. About 25% of TransDigm’s revenue comes from defense contracts, with the rest coming from commercial aerospace customers. In addition, as of 2016, about 50% of the company’s revenue came from OEM parts, while the rest came from aftermarket parts. In 2019, the company was criticized for generating a 9,400% profit margin on products like metal pins by price gouging the Defense Department.

Teledyne Technologies: Founded in 1960, and based in Thousand Oaks, CA, Teledyne is an industrial conglomerate that operates 100 companies, with at least 32 that were acquired. Teledyne’s operations spread across industries like aerospace and defense, factory automation, electronics engineering, and more. As of October 2025, the company had a market cap of $25.2 billion and generated $5.9 billion in TTM revenue.

HEICO: Founded in 1975, and based in Hollywood, FL, HEICO is a manufacturing conglomerate with two primary divisions: (1) the Flight Support group, and (2) the Electronic Technologies group. In aviation, according to the company, HEICO is “the world’s largest independent provider of FAA-approved aircraft replacement parts.” As of October 2025, HEICO had a market cap of $37.3 billion plus a TTM revenue of $4.3 billion.

AMETEK: Founded in 1930, and based in Berwyn, PA, AMETEK is a manufacturing conglomerate with two primary segments: (1) Electronic Instruments (EIG) and (2) Electromechanical (EMG). Across these two segments, the company represents over 100 brands of products. As of October 2025, AMETEK had a market cap of $43.5 billion and a TTM revenue of $7.0 billion.

Alternative Manufacturing Operations

A common alternative approach to satisfying demand for precision manufacturing is to build a network of suppliers. The fragmented landscape of 21K machine shops creates what many companies see as an opportunity to aggregate that manufacturing capacity and offer it as a collective production capability to end customers. One difficulty with this type of network is a lack of control over on-time delivery and product quality, given that the manufacturing operations are standalone companies with limited oversight by the network provider.

Xometry: Founded in 2013, and based in North Bethesda, MD, Xometry is an on-demand marketplace for industrial parts. The company claims to have a network of 10K manufacturers that can address a variety of precision manufacturing needs across aerospace, defense, automotive, medical equipment, and more. In December 2021, Xometry announced the acquisition of Thomas, a product-sourcing platform that expanded Xometry’s reach to a total of 500K suppliers. At the end of Q3 2021, Xometry claimed to have 26.1K active buyers (including 30% of the Fortune 500), while Thomas’ platform has 1.3 million registered users (including 93% of Fortune 1000 companies). As of October 2025, Xometry had a market cap of $2.4 billion and a TTM revenue of $604 million. In Q2 2025 the company posted record revenue of $162.6 million (up 23% YoY) and turned profitable, driving its stock up 166% since April 2025.

Fictiv: Founded in 2013, Fictiv was an operating software for a network of manufacturing operations. Fictiv was acquired in April 2025 by Japanese industrial supplier MISUMI Group for $350 million. That network consists of 250+ vetted partners that together make up 150K monthly machining hours. Customers that Fictiv has worked with include Honeywell, Facebook EdMod, and Gecko Robotics. The company has raised a total of $192 million in funding from investors like Accel and Bill Gates.

Proto Labs: Founded in 1999, and based in Maple Plain, MN, Proto Labs is a manufacturing operation focused on prototyping and low-volume production runs which are meant to be either test batches or non-recurring rush jobs. The company manages a network of 200+ suppliers that produce 4.6 million manufactured parts per month. As of October 2025, the company had market cap of $1.3 billion and a TTM revenue of $509 million.

Aerospace & Defense Companies

Instead of being competitors, large aerospace companies and defense primes are the primary customers for Hadrian and competitive machining operations. However, in some cases, these large companies attempt to manage some of their manufacturing operations in-house. For example, Northrop Grumman’s Advanced Manufacturing Technology & Innovation group is attempting to build additional research and development capabilities similar to Hadrian.

Business Model

Hadrian doesn’t publicly provide any information on how its products are priced or sold. Instead, there are some general principles of precision manufacturing that can be learned from comparable businesses, like TransDigm or Teledyne, that may be instructive. One important distinction is that precision manufacturing can operate in other (1) original equipment manufacturing (OEM), or (2) aftermarket parts. Hadrian is likely primarily focused on OEM for specific components used in a broader operation (e.g., creating one valve for a rocket, etc.,) but that focus isn’t something the company has discussed publicly.

Precision manufacturing operations in general often focus on developing and supplying highly engineered components with long product life cycles. These operations typically generate a significant portion of their revenue from aftermarket sales, providing replacement parts for maintenance, repair, and overhaul (MRO) activities. Aftermarket sales generally offer higher profit margins compared to OEM sales. Additionally, these businesses may employ value-based pricing strategies, setting prices based on the value their products offer to customers rather than solely on production costs, thus achieving higher margins.

Such companies frequently pursue an aggressive customer acquisition strategy, targeting businesses that possess proprietary products with significant aftermarket potential. This approach allows them to expand their product portfolios and market presence. Emphasizing operational efficiency, these companies may implement lean manufacturing practices and strategic sourcing to maximize profitability. Maintaining strong relationships with major OEMs and end-users ensures a steady demand for their products, while a global presence helps mitigate risks associated with regional economic fluctuations. By integrating these elements, precision manufacturing operations can create a robust business model that has the potential to generate stable, recurring revenue with high profit margins.

Traction

Efficiency

In February 2024, Hadrian claimed to already be “three to four times more efficient than industry standard.” At the time, the company claimed to be capable of operating at a 1:5 or 1:6 human-to-machine ratio. That is already much higher than the industry standard human-to-machine ratio of 2:1. In mid-2025, Hadrian pushed the ratio further, with about 10 machines per operator. Hadrian also claims its equipment uptime is “close to automotive levels”, which can be 80-90%, compared to “usual aerospace manufacturing at 30% equipment uptime.” In an August 2024 interview with Contrary Research, Chris Power confirmed that Hadrian “consistently” sees uptime at around 75-80%. Despite those efficiency gains, Hadrian believes it can “get to 10 times more efficient.”

In specific aspects of the manufacturing lifecycle, like increasing the speed from bid to ship, Hadrian’s process has led to 10x faster lead times and 40% efficiency gains, with a clear path to 70% efficiency gains over the next 1-2 years of R&D. In June 2023, Hadrian announced a strategic partnership with defense startup Anduril. The goal of the partnership is to reduce manufacturing lead time on national security solutions by up to 50%.

In July 2025, Hadrian secured $260 million in Series C funding to scale its AI-powered factories and expand its “factories-as-a-service” offering, allowing defense primes to deploy its automation model inside their own production lines. With this raise, Hadrian now has the latitude to build a third, 270K sq ft factory in Mesa, AZ, set to launch by early 2026 with four times the throughput of its current Torrance facility and plans for 350 new jobs.

Revenue

Hadrian considers its first year of selling to customers to be 2023 when it reached $3 million in revenue. In a February 2024 interview, Chris Power claimed the company had scaled revenue in its first year of operations “faster than most software companies.” As of August 2024, Hadrian estimated it would reach $30 million in revenue by the end of the year. In a March 2024 interview, Chris Power laid out his plans for scaling going forward:

“Our job is basically two very simple things: (1) 10x revenue like a software company, and (2) automate enough that operations has the support they need so that we don't break along the way. [We want to] go from where we are today to a position where we are so efficient that we can compete with Taiwan in America. We are the most efficient American manufacturer now but the goal is to be globally competitive, which means leveraging software innovation to be globally competitive.”

In July 2025, Power confirmed that Hadrian had achieved its 10x year-over-year revenue target, a benchmark that validated the company's software-style growth model.

Factory Footprint

When Hadrian began with Factory 1, the company had a 20K square foot facility with “cracked floors and linoleum everywhere” to get started making parts. Hadrian quickly attracted more demand than it could service, which led the company to start building Factory 2 in November 2021 after its Series A. In a February 2024 interview, Chris Power said that “if we keep going at the pace we're going, Factory 2 will be full at the end of 2024 or early 2025, which means that we need to start construction on Factory 3.”

In July 2025, Hadrian announced plans to build Factory 3, a 270K sq ft AI-powered manufacturing and software hub in Mesa, Arizona. The $200 million investment will generate 350 new jobs, and the facility is on the track to full operation by early 2026. Hadrian also revealed plans to expand its Torrance corporate and R&D headquarters to 400K sq ft, supporting the rapid hiring of more employees.

As of an August 2024 interview with Contrary Research, Power shared the Factory 3 timeline and process: “We’ll have to break ground in Q1 or Q2 of 2025, and it will come online late 2025. In terms of states, we’re down to eight or so that we like. We’ll run a formal site selection process in Q4 2024, which will have all sorts of incentives and [identifying] where is the best labor pool for us to recruit from.”

Copy-Pasting a Factory

In a June 2024 interview, Chris Power laid out his hope that “in five years time [Hadrian has] 10-15 factories across the country in each of these large manufacturing hubs that are serving space, defense, semiconductors, [and] energy.” While Factory 1 was a proof-of-concept, Factory 2 was Hadrian’s first testing ground for a vertically integrated factory. Over time, Power believes each factory could be entirely filled with manufacturing machines and inspection machines that are “fully robotized and just ripping out parts 24/7 for customers.” But in February 2024, Chris Power explained how different the process for Factory 3 would be from building Factory 2:

“The next phase is ‘can we then start copy-pasting facilities to run the exact same way across the country as fast as possible?’ That's where you really get the scaling vector. Being able to take the factory in the box and clone it and have all the software, training, and automation work so well together. We think [Factory 2] will [eventually] run perfectly. We will copy-paste the second one [with Factory 3], and we will realize that 30% of what was working no longer works because the product was missing something that someone else was doing manually, and when you put in a new place it will take three months of shaking that out.”

The ability to copy-paste a factory is intended to enable Hadrian to “scale up like AWS scales up data centers or Amazon Logistics scales up logistics facilities.” In August 2024, Power explained Hadrian’s long term vision this way: “[We will] do everything for everybody in core manufacturing for the US. Every 6 months we roll out one of those new product lines to customers to expand the capability of what we can do. Ultimately, we will have 50+ very large facilities specialized in each of those areas, so customers can tap into any one of those services depending on what they're making.”

Valuation

Funding

As of October 2025, Hadrian has raised $476.5 million in total funding. In December 2023, Hadrian raised a $117 million Series B at an estimated valuation of $500 million. The round was led by existing investor Construct Capital and included new investors such as Caffeinated Capital, RTX Ventures, the venture arm of the defense prime RTX, formerly known as Raytheon, and WCM Investment Management. Hadrian’s Series B also included existing investors such as Lux Capital and Andreessen Horowitz, who co-led a $90 million Series A in March 2022, and Founders Fund which co-led Hadrian’s seed round in April 2021 with Lux Capital. The company's latest equity round, a $110 million Series C closed in July 2025, included returning investors Founders Fund and Lux Capital at the helm while also bringing in new investors like Altimeter Capital and 1789 Capital.

Around the same time as the Series C round, Morgan Stanley had offered Hadrian a loan of $150 million to help finance its $200 million Factory 3 in Mesa, AZ. The company had previously raised $25 million in “debt financing for equipment and expansion,” with the December 2023 Series B including a “mix of equity and debt.” This mix of debt and equity financing reflects Hadrian’s strategy to scale rapidly while minimizing dilution. In March 2024, Chris Power specifically reinforced the idea that the company prefers to utilize debt for capital expenditures, such as factory equipment. In particular, Power sees debt as a key pillar that the company will have to continue to build out over time. In an August 2024 interview with Contrary Research, Power explained:

“50% of our value creation over the next ten years is going to be financial engineering. Because what you’re talking about here is billions in CapEx that have to be privately financed somehow where IRRs of CapEx by itself don’t work for venture returns. So I hope to have a big announcement on this in the next 2-3 months. One of the things we have to get extremely good at is non-dilutive sources of funding to buy and operate billions of dollars of CapEx. That’s a huge focus for us next year.”

Trading Comps

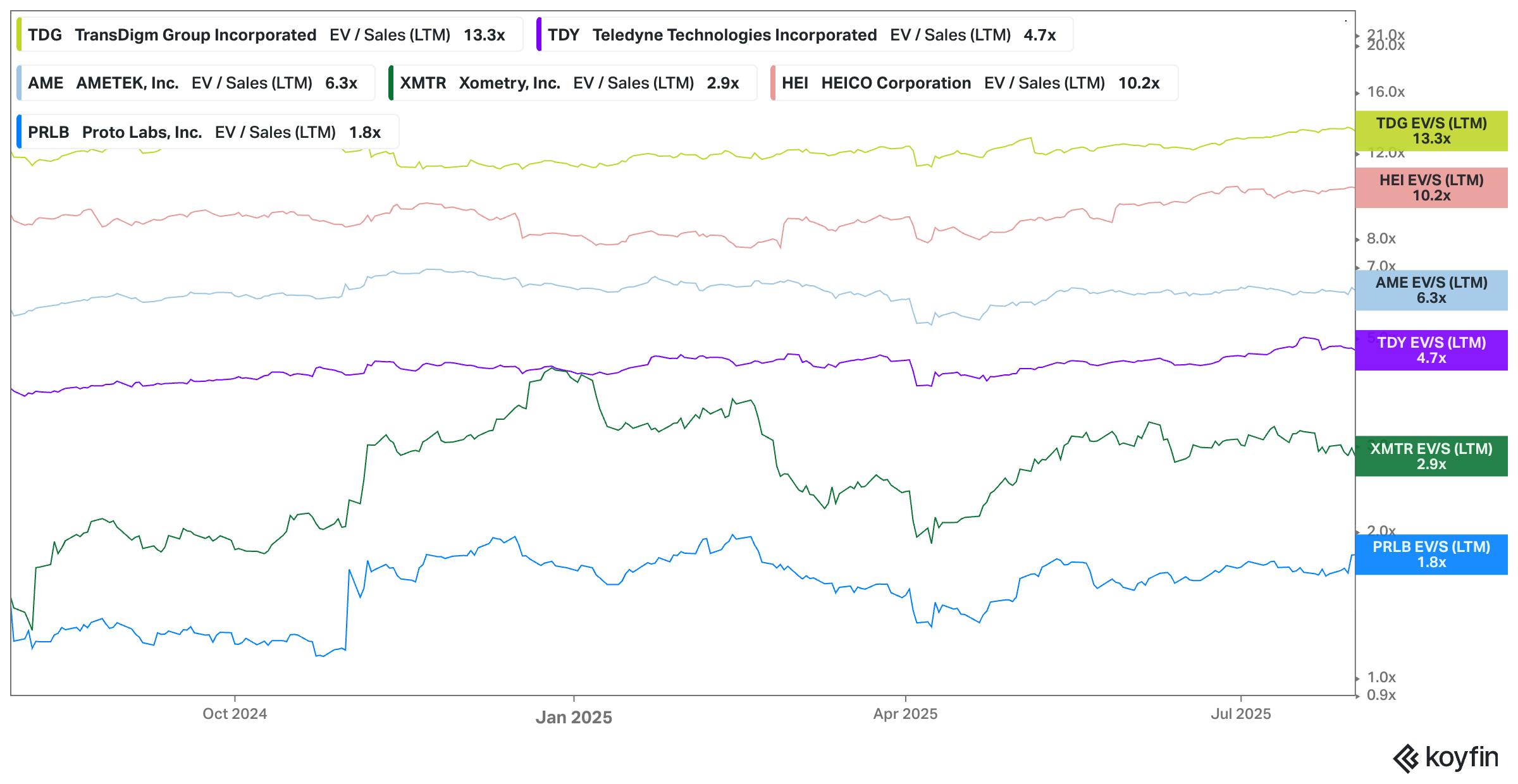

There are a number of public companies operating in the precision manufacturing space that can shed light on how a company like Hadrian may trade in the future.

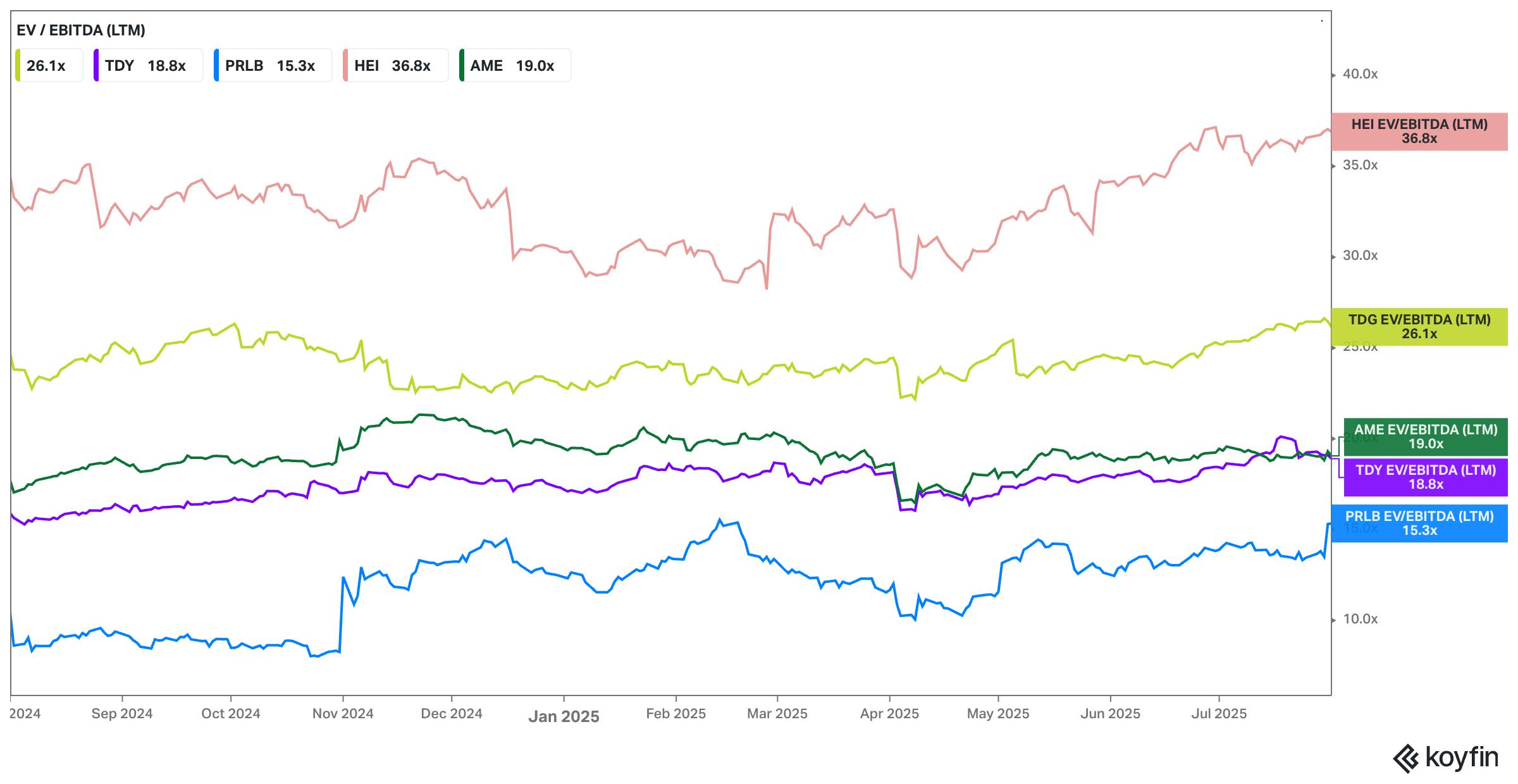

Source: Koyfin

As of mid‑2025, publicly traded peers like TransDigm and HEICO are trading at roughly 10–12× EV/Revenue, while smaller peers such as Proto Labs trade closer to 2x revenue. Growth is one aspect of this discrepancy. Companies with high revenue multiples, like TransDigm or HEICO, are growing 20-23% year-over-year. Alternatively, companies with low revenue multiples, like Proto Labs, are growing revenue at 3% year-over-year. Xometry, for instance, reported Q2 2025 revenue of $162.6 million, growing 23% year‑over‑year. One additional data point is Kaman; in April 2024, it was announced that Kaman would be acquired by private equity firm Arcline Investment Management for $1.8 billion, representing a 2.3x multiple on the company’s 2023 revenue.

Source: Koyfin

Looking at these companies on a profit multiple basis provides an additional perspective. Trailing‑twelve‑month EV/EBITDA multiples range from approximately 19× at Proto Labs to 23× at TransDigm. One big driver in how these types of companies are valued is based on the level of profitability they can achieve. Companies with high EBITDA multiples, like HEICO, TransDigm, and AMETEK, generate EBITDA margins of 24-46%. Meanwhile, companies with low EBITDA multiples, like Proto Labs, generate 4-12% EBITDA margins. Returning to the example of Xometry, while its revenue growth is 22%, its EBITDA margin is around -6%.

As Hadrian continues to grow, the company will likely be valued based on a combination of revenue growth and overall profitability. The average machine shop reports profit margins of 8-12%, which would generate an EBITDA margin on the lower end of the public set of comparable companies above. Hadrian will not only have to deliver a higher quality experience for customers but also do it at a much higher margin than a typical machine shop.

Eventual IPO

In terms of eventual outcomes, Chris Power doesn’t see a lot of middle ground. In a March 2024 interview, he explained the fairly binary outcomes for businesses like Hadrian:

“Large vertically integrated companies have two options. One is you do the whole thing and you win. Then you're TSMC or Tesla-big. Or, you die getting there. There's no halfway mark. But if you can run like hell for four or five years and get past that tipping point then no one's crazy enough to catch up. With vertically integrated deep tech businesses there are those two options. You get it right and you're Tesla or you get it wrong and everyone calls you Elizabeth Holmes.”

In other words, Power sees the eventual outcome for Hadrian as fairly all or nothing. As a result, an IPO is likely on the horizon for the company as the team seeks to build towards a large enough outcome.

Key Opportunities

American Urgency

One of the most significant tailwinds for Hadrian is the fact that people in the US have started to wake up to the threat of having a hollowed-out industrial base. For example, in January 2024, Anduril pointed out a clear issue that “America’s defense industrial base has served the nation well for decades, but [is] unable to meet the demands of 21st century warfare. Chris Power echoes that sentiment. In his keynote speech to the Reindustrialize Conference in June 2024, Power laid out where his sense of urgency comes from:

“It's this decade that the world is going to decide whether the West remains or declines. In this decade, the world will decide whether the West has the driver seat on AI, settling the solar system, and navigating the largest economic reset in the last century. And it's up to us to decide whether we cede moral and economic leadership to a Communist regime or maintain Pax Americana forever. And make no mistake; that chess board is set and we have three short years to figure this out. Not ten. And the key to all of this is reindustrialization fast and regaining that hard economic power that made this country a world leader in the first place.”

In another June 2024 interview, Power explained further the urgency over the next few decades in winning a global industrial race. Given the rapid advances in issues like AI, rising climate change, and increasing global conflict, Power believes the world is coming to a tipping point. In terms of the new space race, for example, “the moon is the tipping point for everything else. If we lose this one, the time window is such that you probably lose the solar system and then the Communists win space.”

As more companies, government agencies, and concerned citizens grow more vocal about the need to reclaim manufacturing dominance and rebuild the industrial base of the US, the more demand there is for Hadrian’s capabilities in precision manufacturing.

Product Expansion

Hadrian has historically focused on aluminum-based products with plans to then move to harder alloys, such as steel and titanium, that come with even greater production complexities and stricter tolerance levels. In a February 2024 interview, Chris Power indicated that Hadrian hoped to roll out steel options to customers by the end of Q1 2024. In addition, during that same February 2024 interview, Power reinforced Hadrian’s intentions to eventually offer other component materials, “like titanium or plastics.”

In an August 2024 interview with Contrary Research, Power confirmed that Hadrian had expanded into two additional metals beyond aluminum: titanium and steel. The company’s ability to execute on that expansion will open it up to a broader addressable universe of products to sell. When asked about other potential areas of expansion, Power indicated that the company was “so over-constrained” that it would be unlikely to see any additional expansions in the near term.

In addition to expanding the types of materials Hadrian offers, there are also alternative business models the company could pursue. In a February 2024 interview, Power indicated some of those alternatives: “Some customers expressed interest in alternate models, like having Hadrian build a dedicated facility to ensure committed factory capacity. The company is also considering setting up some factories under a joint venture with the customer; these would be focused on specific production areas, so the customer can essentially use Hadrian’s technology and systems to accelerate their own production in a focused area.”

In an August 2024 interview with Contrary Research, Chris Power elaborated on this approach to building dedicated facilities with specific customers:

“We built [an automated machining cell] because we could halve the CapEx cost of standing up our own robotics and going far more full stack than we initially though. In terms of taking a product… and standing up a facility just dedicated to that one thing, you just don’t have to deal with the variability. You can just discreetly automate things that you know are going to spit out the result versus building a system that can handle whatever the day throws at you... We’re working on some projects with the DoD and a couple customers where we are building automated production lines for a specific product. You can get to full lights out, 24/7. And we’re probably the only company in the US that can do that.”

In 2025, Hadrian introduced a factories-as-a-service model, deploying its hardware and Opus software to run production for defense primes and other clients.

Industry Expansion

While aerospace and defense are Hadrian’s primary focus markets as of October 2025, there is a significant amount of overlap in other industries that require precision manufacturing machine shops. For example, Melling is a manufacturing operation with $189 million in 2022 revenue. While the company does have defense contracts, a large portion of its revenue is in the automotive industry, with customers like GM and partnerships with Advance Auto Parts. In addition, Chris Power has pointed to other industries like semiconductors and energy as potential areas for future expansion. As Hadrian matures its manufacturing operations, there is an opportunity to address these adjacent markets that also have meaningful demand for precision manufacturing. In mid-2025, Hadrian launched Hadrian Maritime, a division applying its autonomous factory model to shipbuilding and naval defense, and announced upcoming divisions for munitions, missile systems, unmanned aircraft, and the like.

Full Autonomy

Hadrian’s approach to human-in-the-loop automation has been to get between 70% and 80% of the factory automated and “leave the last 20%.” While this creates opportunities to avoid unnecessary effort to automate steps that are easily done manually, there are always incremental ways to automate aspects of the factory operations. In a February 2024 interview, Chris Power mentioned that Hadrian “could get much higher throughput rates, and much lower costs of production, if we ended up building our own autonomous machining cell.” Later in February 2024, Power indicated that Hadrian was in “fully autonomous production with the new version of [its] production cell.”

Examples of this are already occurring in other corners of manufacturing. For example, in July 2024, Xiaomi announced a new 800K square foot factory in China that it claims is “100% autonomous” and can run 24/7 as a “dark factory” making over 10 million phones per year. Hadrian’s ability to automate more and more of the manufacturing process will only lift the operational leverage of its factories as long as quality is maintained.

In regards to the difference between automating larger batches of a small number of SKUs between precision manufacturing of a wide variety of parts, Chris Power described his perspective in an August 2024 interview with Contrary Research: “There’s a huge difference between the complexity of what we’re doing, which is making anything a customer throws at you, versus setting up an autonomous factory for a [single] product. The latter part of that is 100x easier than what we’re doing.”

Key Risks

A Mismatch of Narrative & Reality

In a June 2024 interview, Chris Power explained how large ambitious projects are often at risk of being stuck as small businesses or ending up like Theranos:

“Here's my thesis on what makes the difference between a small business and Theranos. There are two curves; one is narrative and [the other] is reality. If you [stay anchored to narrative], you're Theranos. If you [stay anchored to reality], you're a small business. What I think Elon Musk is probably the best at is where you [fluctuate between] narrative, reality, narrative, reality, and they converge and diverge over time. The important thing there is that you are competent enough to actually pull it off, because if you're not competent enough to pull it off then you become Theranos.”

This ebb and flow between painting a compelling narrative and then delivering that narrative into reality is something every ambitious, technical endeavor requires. To Power’s point, the biggest risk to these types of operations is either failing to push the boundaries of reality and grow or pushing the boundaries of narrative too far and being unable to deliver on them.

For Hadrian, the ambition is large. In July 2025, Power emphasized that “[Hadrian is] building the factories that will secure American leadership in advanced manufacturing." The biggest risk to the business is that it is unable to execute against the sizable narrative picture that it has painted. Hadrian’s ability to deliver on this narrative is being tested as it builds its third factory in Mesa, AZ, scheduled to open in early 2026 with 270K sq ft of capacity and four times the throughput of the company’s Torrance site. Hadrian has committed to hiring over 350 employees to support this expansion, and investors expect measurable revenue growth as the new facility comes online.

Vertically Integrated Primes

SpaceX was so frustrated by the poor experience offered by the space supply chain that it felt compelled to take up to 80% of its production in-house. Similarly, Northrop Grumman’s Advanced Manufacturing Technology & Innovation group is attempting to build additional research and development capabilities to reduce its dependence on a lower-quality supply chain. Over time, other large primes could see value in vertically integrating certain aspects of their supply chains.

In addition, in August 2024, Anduril announced plans to open Arsenal-1, a “software-defined manufacturing platform that is optimized for the mass production of autonomous systems and weapons.” In the announcement, Anduril also explained that the facility’s 4K workers can develop and manufacture “nearly 90 percent of Anduril’s products … at hyperscale using commercially available components and materials.” In January 2025, Anduril confirmed its plans for Arsenal-1. The company has started construction of the 5 million sq ft factory in Pickaway County, Ohio, and expects to begin production there by July 2026.

While this could limit Hadrian’s addressable market, it’s unlikely to ever take up a majority of the precision manufacturing market, given the high cost of capital for each of these initiatives. There’s a reason these large companies have leveraged a fragmented supply chain for 70+ years, and building a complex and multi-faceted internal manufacturing operation is not something most companies do overnight.

In particular, regarding things like Anduril’s Arsenal-1 factory, Power described how that factory is less of a threat to Hadrian and more of a potential destination for inputs coming out of Hadrian’s factories in an August 2024 interview with Contrary Research:

“What Anduril is building is like Tesla’s gigafactory for their scaled production products, the vast majority of which is going to be assembly lines for [their] products."

High Cost of Capital

Top-of-the-line machine shops average 13.5% net margins, while the broader industry achieves closer to 8%. In addition to operating a complex and expensive machining operation, Hadrian is also spending significant capital to build several technology products to augment that operation. As of mid-2025, Hadrian employs over 200 people and is actively hiring to staff new facilities. If the cost of that technology fails to enable Hadrian to achieve a higher profit margin on its machining operation, then scaling that operation could grow increasingly complex and costly.

High Switching Costs

In an October 2023 interview with Contrary Research, one Lockheed Martin executive shared that the supply chain of an F-35 was established 15 years ago and, for the most part, hasn’t changed since. While it’s true some suppliers are aging out of the market and being replaced, there are still significant costs each time a prime has to switch to a new supplier for any particular component. In addition, there are very few new products launched each year. For instance, Raytheon’s parent company RTX generated over $80 billion in 2024 revenue. However, most of RTX’s major 2024 awards, such as a $2 billion U.S. Army contract for missile defense systems and a $1.2 billion U.S. Air Force contract for radar upgrades, extended long-standing programs rather than establishing new supply chains. And while RTX and other primes do secure some new program starts (such as the Army’s LTAMDS radar and the Navy’s AIM-9X missile awards in 2025), anomaly funding data shows that only a handful of new-start requests get to the mat each year, while continuing resolutions outright prohibit new-start awards.

In an August 2024 interview with Contrary Research, Power confirmed the difficulty in replacing revenue from long-established vendors: “I would not discount how sticky these businesses are. I would not discount how painful it is to move a dollar of revenue away from someone who has been working with you for 30 years. Even if they’re doing a terrible job.”

Cybersecurity & Espionage

In 2012, General Keith Alexander, then Director of the National Security Agency (NSA) and Commander of US Cyber Command, testified that cyber theft cost US companies about $250 billion annually. He referred to the theft as the "greatest transfer of wealth in history." Subsequent stateside investigations reported that Chinese state-linked groups gained back-channel access to sensitive defense programs, including F-35 fighter jet’s design data. Because Hadrian works primarily in defense and aerospace, its primary customers are critical to national security. That makes it a target of potential cyber-attacks and corporate espionage. In a June 2024 interview, Chris Power explained the risk Hadrian faces in this regard: