Thesis

The US construction sector is expected to reach $1.3 trillion in 2024. Despite challenges with rising costs and labor shortages since COVID-19 in 2020, the industry is poised for steady growth as of 2024, with a projected CAGR of 5% during 2024-2028.

Two factors are driving this growth. First, as of 2024, the US economy was still recovering from lingering COVID-19-related economic effects, particularly in the construction industry. COVID-19 resulted in commodity pricing surges, supply chain disruptions, and high inflation, which stymied construction demand. The Federal Reserve’s half-point interest rate cut in September 2024 — the first in more than four years — was expected to lower borrowing costs for homebuyers and businesses, increasing demand for construction projects.

Second, government policies incentivize investments in construction. The Bipartisan Infrastructure Law passed in 2021 is the largest long-term investment in infrastructure in US history, injecting $550 billion over 2022-2026 for new infrastructure projects including roads, mass transit, and energy. As of November 2023, 40K projects had been funded and over 670K jobs have been added in the construction sector, exceeding pre-Great Recession highs in construction employment for the first time.

However, fully realizing this growth requires overcoming a core challenge in the construction sector: fragmentation. The industry is highly fragmented because there are many specializations within the sector, collaboration happens on a project-by-project basis, and regulations vary by project location. This complex and fragmented ecosystem has meant that cost and schedule overruns are often the norm.

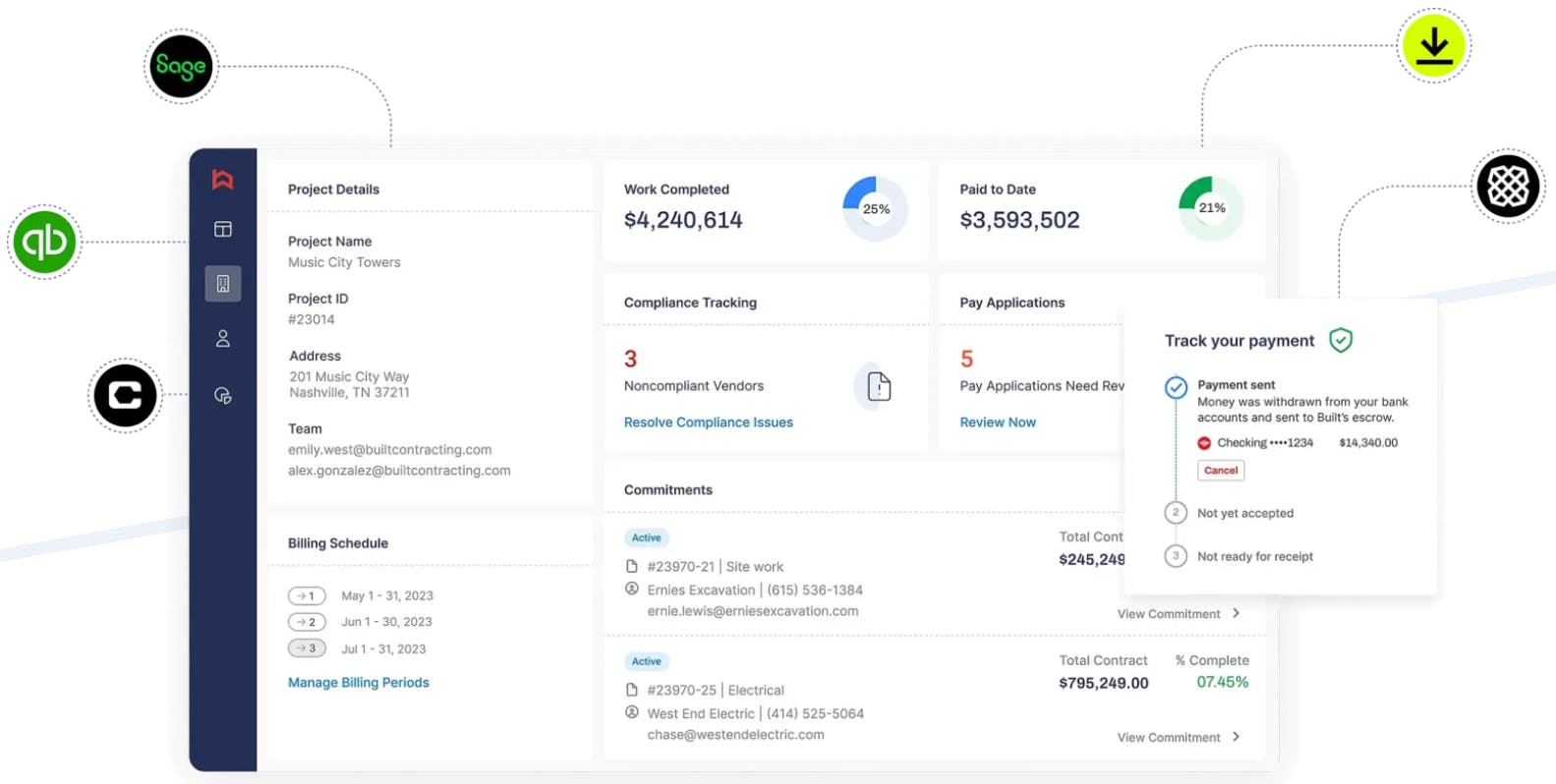

Built is a construction lending software company that seeks to respond to this fragmentation problem. By providing a platform for collaboration that targets pain points in the construction process through increased transparency and efficiency, Built’s goal is to help reduce construction loan risk and increase loan profitability, serving as a partner to those across the construction value chain.

Founding Story

Build was founded in 2014 by Chase Gilbert (CEO), Andrew Sohr, and Scott Sohr.

Andrew Sohr’s experiences in real estate inspired the founding of Built. Prior to co-founding Built, he was the owner of Taziki’s Mediterranean Cafe from 2011 to 2013 and was overseeing multiple construction projects. For the construction projects, he had to deal with multiple lenders and grew frustrated by each lender’s individual application process and application form. He was also annoyed by the long process it took to receive construction loans. These were common challenges since lenders tend to hold money back and pay in a piecemeal approach rather than fund the borrower. The slow pace can be problematic for construction project managers, who need to work with subcontractors who often prioritize projects based on how quickly they can get paid.

Andrew Sohr shared these frustrations with Chase Gilbert, who was an investor in Taziki’s. Chase Gilbert, along with Scott Sohr, a serial entrepreneur and one of his mentors, discussed Andrew Sohr’s belief that there had to be a better way to manage construction project workflows with technology. The three brainstormed a better management process and spoke to lenders, project owners, inspectors, contractors, subcontractors, and any others involved in a project to test ideas. Their goal was to create a centralized platform that ensures smooth cash flow and information exchange in the whole construction and real estate ecosystem. As Chase Gilbert explained:

“We were very much trying to improve money flow from the lender to the owner of the project, from the owner to the contractors, and even the suppliers all the way downstream.”

Their efforts were timely. The technology necessary to create Built — mapping technology for construction sites, cloud computing, and smartphones — was only introduced a few years prior to the company being formed in 2014. Also, the fact that construction lending was a small share of all lending activity in 2014 meant that they were working on a novel idea; many entrepreneurs are unlikely to have thought about building a company that caters to the needs of what was then a comparatively small consumer base.

Built was launched in May 2015 with banks as its first three customers. In 2016, Built acquired 10 more banks as clients. By 2018, Built’s client list had grown to include 40 banks that used the company’s product for their construction loans. It was strategic to focus on banks as the first customers because 80-85% of construction projects have some sort of debt in their capital stack. By working with banks, Built got exposure to all types of borrowers: project developers and owners, contractors, and homebuyers. The company then set out to build products for both lenders and borrowers.

In January 2023, Built appointed James Chen as CTO. He had previously held leadership roles across marketplace, logistics, and B2B technology at Flexport, Amazon, and Rakuten. Before Built, he worked as CTO of Flexport, where his team steered B2B global logistics to streamline global trading for buyers, sellers, and their logistics partners. Chen only remained as Built’s CTO until March 2024. In 2023, the company appointed Sam Kemp as CFO. He previously served as the Chief Strategy Officer at GoDaddy, focusing on aligning strategy, business models, operational drivers, and financials to achieve profitable growth. Pat Poels, former CTO of Eventbrite, joined as Senior Vice President of Engineering in March 2024 and then was promoted to CTO in February 2025.

Product

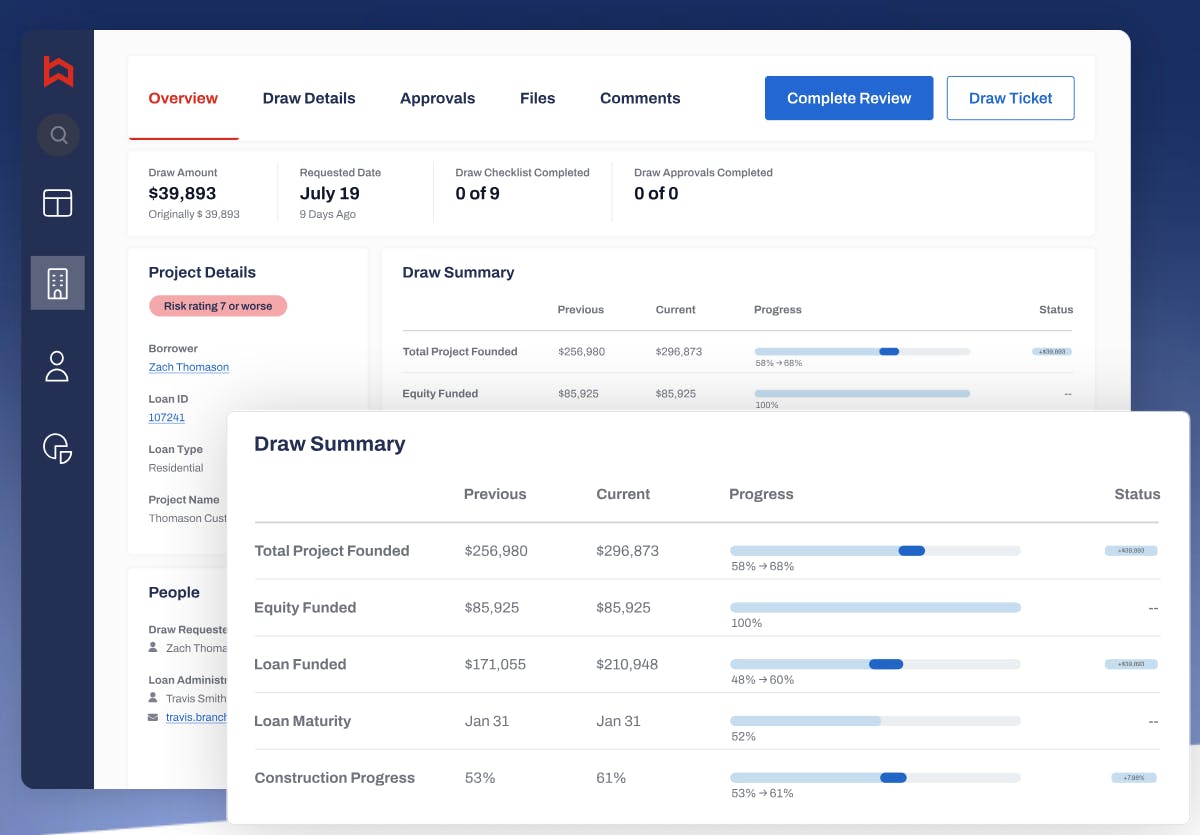

Construction Loan Administration

Source: Built

Built’s loan administration platform streamlines the construction loan process by providing real-time portfolio visibility, simplified loan administration, and accelerated capital flows. It has three key functions: improve draw and budget management processes to enable lenders to service more loans; help manage portfolio risk by aggregating loan information in a single platform and automating contractor due diligence and lien tracking; offer construction project inspections by trained professionals, ensuring compliance and project completion according to terms.

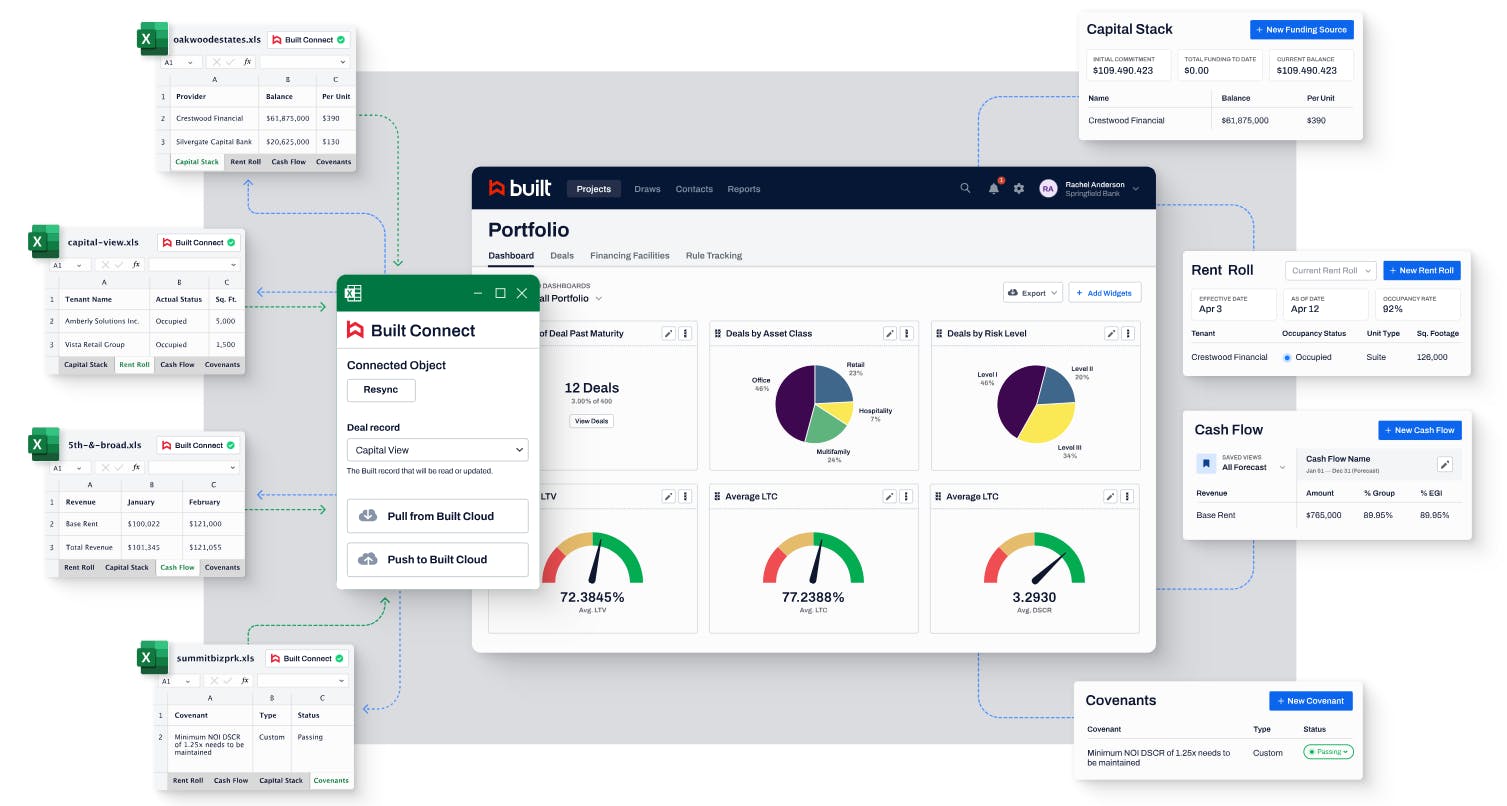

Deal Management

Source: Built

This system centralizes deal data at the portfolio and asset levels to mitigate and manage risk in commercial real estate investments. It helps construction lenders to streamline underwriting through an Excel integration that synthesizes data in one platform and runs customizable earnings and investment reports to inform lending decisions. By making it easier to get portfolio insights, the system improves project pipeline analysis and deal origination speed.

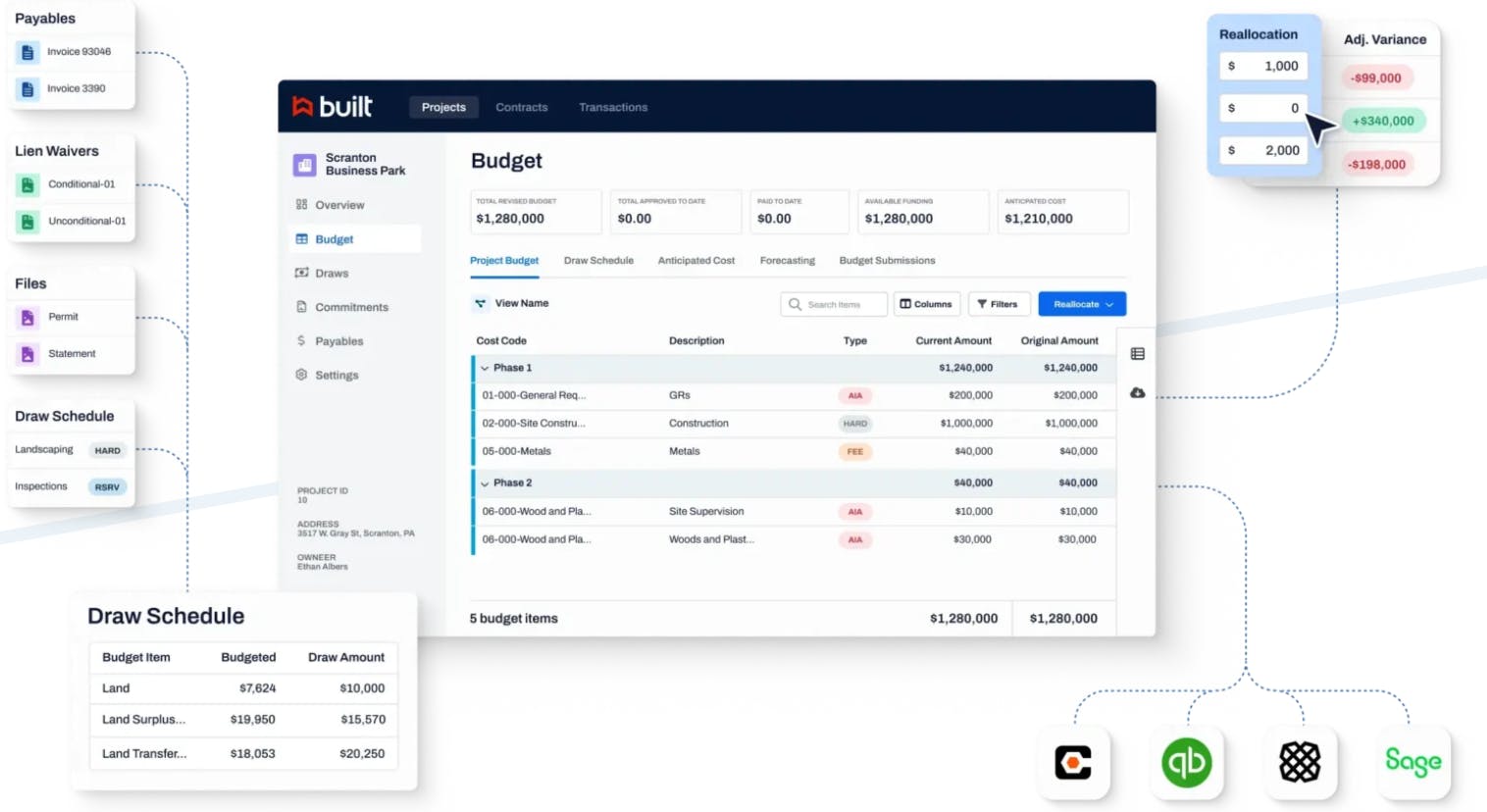

Project Financials

Source: Built

This product aims to facilitate smarter financial decisions in construction projects by enabling customers to manage and automate invoice management, draws, and accounts payables in one place. The product provides one platform to track project cash flow so that projects are kept on schedule. In addition, the module enables lenders to manage compliance documents (e.g., certificates of insurance, safety documents, notices), and manage end-to-end lien waiver processes (i.e., creating a lien waiver, requesting signatures, and issuing payments to project partners).

A lien is a claim for payment made against a property by contractors or subcontractors who have provided labor or materials to a construction project but who have not been paid yet. Unpaid parties can file a lien claim form to enforce payment when it is delayed unless they agree to sign a waiver. The platform also connects to ACH payment solutions to streamline the construction billing process. Given the broad set of functionalities, the product could serve construction lenders, developers, and contractors.

Payment Management

Source: Built

This product centralizes construction billing and payment processes. It facilitates invoice management so that subcontractor and contractor payables are efficiently managed and paid on time. It supports compliance tracking by streamlining compliance document requests across all projects. It supports the creation, tracking, and sending of lien waivers, which protect property owners or contractors from potential claims from subcontractors or suppliers. Finally, it manages payments through an integrated ACH solution. This product’s broad applicability makes it relevant to construction lenders, developers, and contractors.

Market

Customer

While the majority of Built’s clients use the platform to service construction loans, Built also helps track construction payments and spending. By creating end-to-end visibility in construction finance, Built serves customers across the construction ecosystem. Broadly, its customers fall into four categories.

First are lenders and asset managers who service construction loans. Built supports them to manage construction portfolios and de-risk the construction loan process. For example, Sachem Capital is a lender that provides short-term financing solutions for real estate investors. Prior to using Built, the Sachem Capital team utilized several applications to perform tasks, including the Microsoft Office suite for document management and Truepic for inspections. This scattered approach took up excessive time and effort. It was also cumbersome for the borrower, who had to use multiple applications to submit a single draw request. With Built’s Construction Loan Administration platform, Sachem Capital was able to streamline its workflow and make the draw process more efficient and transparent for borrowers.

Second are project developers who require detailed job cost reports to track project expenses and profitability. For example, RWC, a vertically integrated real estate investment management and development company investing across all real estate asset classes, needed a software solution that would support its complex portfolio without forcing a complete overhaul of its existing processes. Many of the software solutions the company explored required it to abandon Excel—an integral tool in its workflow. Built’s Deal Management software solved this challenge since it was able to capture and report on RWC’s Excel data, analyzing the data to make decisions throughout the life cycle of a loan without requiring a migration away from Excel.

Third are contractors who are seeking a better payment experience. For example, Rod Heisler Construction (RHC), which manages complex projects from residential buildings to office spaces, approached Built as its portfolio grew. The RHC team knew it needed a more efficient way to pay trade partners. The company used Built’s Payment Management product to streamline payment processes, such as processing invoice submissions from subcontractors, collecting unconditional waivers, and securely sending funds.

Fourth are home builders who are seeking a better borrower experience. For example, The John Kraemer & Sons team, which builds luxury homes and remodels residences in Minnesota and Wisconsin, had been dealing with a cumbersome manual lien waiver management process for years. The team turned to Built’s Payment Management product to more easily and systematically collect lien waivers at the time of payment.

Market Size

The construction loan management software market was valued at $900 million in 2023 and is expected to reach $2 billion by 2032 at a CARG of 9.8%.

This growth is in part driven by the expectation that the market would ride the wave of the expected increase in construction spending, which was $2.1 trillion as of August 2024. Of this spend, residential construction contributed approximately $911 billion, increasing by 2.7% from August 2023. Residential construction is likely to see a continuous modest increase in spending due to increased demand for single-family houses as mortgage borrowing costs decrease.

Meanwhile, non-residential construction contributed approximately $1.2 trillion, increasing by 5.2% from August 2023. The increase in nonresidential construction spending has thus far been driven by data centers and manufacturing projects due to uncertainties around commercial construction amid high inflation and shifts in the locations and types of demand for commercial construction projects (e.g., offices, lodging, retail).

The outlook for commercial construction is positive. The US commercial construction market was estimated to be worth $171 billion in 2024 and is expected to grow to $203.5 billion by 2029 at a CAGR of 3.5%. However, this could be hampered by the economic impacts of things like tariffs, announced in March 2025, that are expected to drive the prices of lumber, aluminum, copper, and steel. For example, steel prices rose 20% in March 2025 alone.

As inflation reduction and government incentives improve conditions for construction projects, there could be an increase in revenues and transaction activity that boosts the construction loan management software market. Many commercial real estate owners and investors who have seen stagnant revenues and pullbacks in spending are optimistic, sharing that financing will likely be less expensive and easier to obtain in 2025. Since Built’s products serve lenders in various industries from commercial real estate to residential projects, it is well-positioned to take advantage of expected market growth.

Competition

Procore

While the construction loan management software market is still young, there is one notable incumbent. Founded in 2002, Procore is a public company that provides a cloud-based construction management platform. This platform consists of 13 products across four categories: pre-construction, project management, resource management, and financial management. It promotes efficiency and accuracy for each process by providing a real-time consolidated view of an entire construction project on a single platform. Procore had a market cap of $10.5 billion as of March 2025 and generated $1.2 billion in revenue in 2024.

Land Gorilla

Since 2010, Land Gorilla has offered a cloud-based construction loan solution that the company claims makes lending faster, safer, and more efficient. Its Construction Loan Manager platform enables lenders to upload and manage loan documents, manage risk, generate reports manage disbursement, and track project processes — similar to Built. A key difference with Built is that Land Gorilla’s target audience consists of construction lenders only. Built, meanwhile, serves a wider audience of lenders, developers, contractors, subcontractors, and homebuyers. Though public information is limited, Land Gorilla is expected to have raised a total of $785K in a single conventional debt round in April 2020.

Rabbet

Founded in 2014, Rabbet enables real estate developers and construction lenders to manage their entire portfolios on one platform using real-time data workflows. The platform helps developers manage project risks by accessing snapshots of project and portfolio data. It also helps lenders increase efficiency and lower operational costs by simplifying document handling, tracking project requirements, and facilitating communication with borrowers. In 2023, the company launched Rabbet Vantage, which uses machine learning to allow customers to query their construction finance data on the platform for much faster decision-making and risk detection of their portfolios. As of March 2025, Rabbet had raised $9.9 million in total funding from investors such as Goldman Sachs and QED.

Handle

Handle offers two products to help contractors get paid on time. First, it offers a suite of software tools to automate routine tasks associated with receiving payments, such as lien management, deadline tracking, and online lien filing. These tasks are typically still done manually, leading to errors and lengthy processes, which means contractors aren’t paid on time. Second, it provides a group of financing options such as purchase order financing and invoice factoring to make credit more accessible. It uses business intelligence gathered from its software capabilities to securitize credit offered to customers.

The combined software and financing offering allows Handle to help contractors get paid faster and with more transparency. While its focus on streamlining lien management and payment processes is similar to Built, Handle does not offer as full of a suite of products as Built does. Founded in 2019, the San Francisco-based startup raised a $10 million Series A led by Energize Ventures in 2022 and secured a $5 million investment from Amex Ventures and Suffolk Technologies in 2024, bringing the company’s total funding amount to $19.7 million as of March 2025.

Business Model

Built operates a subscription-based model, though details on pricing are not public. One external source suggests that pricing for contractors is based on project revenue volume managed on Built’s platform while for subcontracts it is based on contract value. Built is also likely to generate revenue from implementation and customization services for clients requiring specific software setup support. It also may charge extra fees for integrations with third-party software providers such as Quickbooks and DocuSign, which the company partners with.

Traction

Source: Built

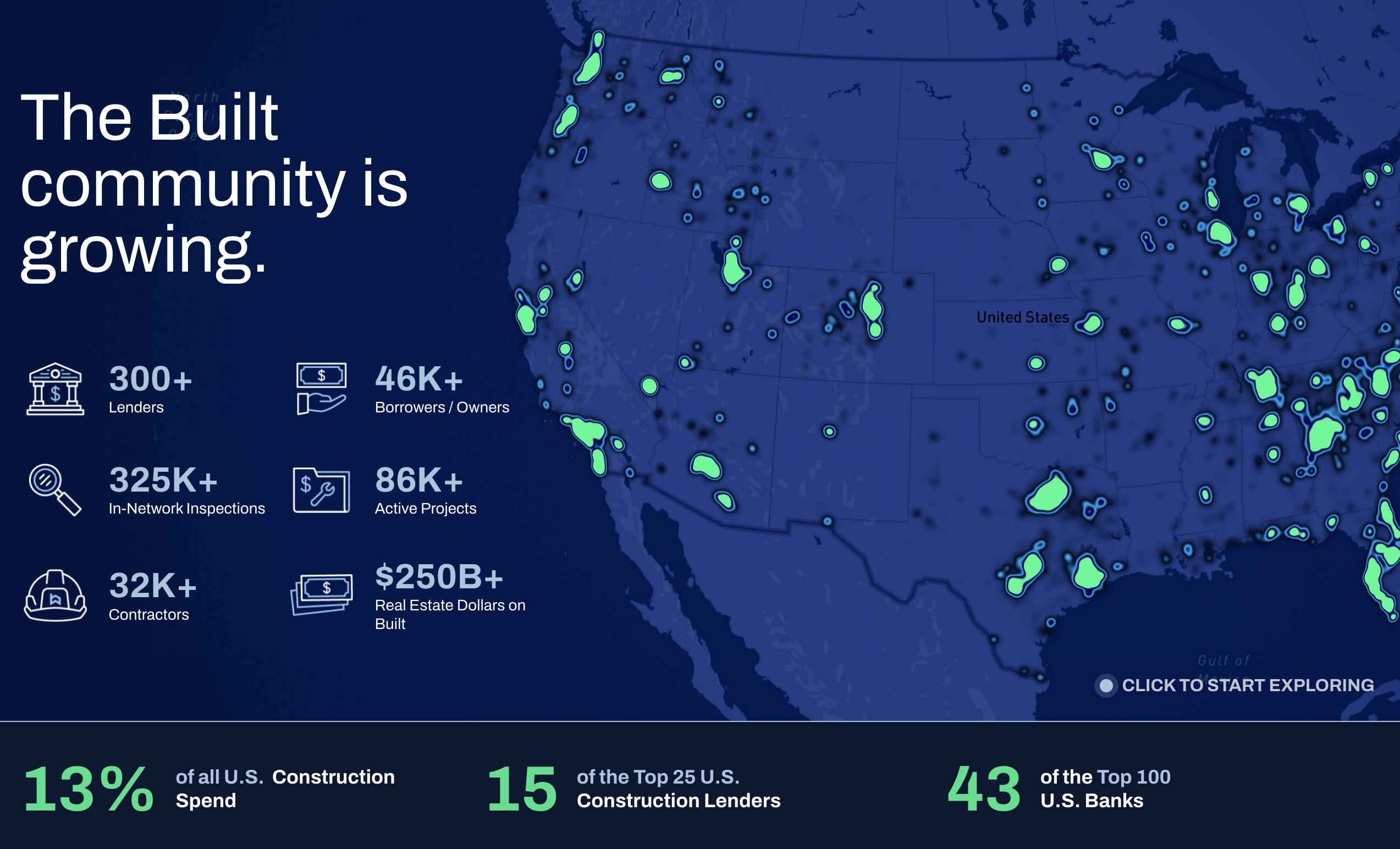

As of March 2024, Built had a quarter of a trillion dollars in real estate being actively managed on its platform, representing approximately 13% of all U.S. construction spend. It has managed over 200K projects at a value of $135 billion, serving more than 46K borrowers, over 32K contractors, and over 300 lenders as of March 2025.

Additionally, Built has partnerships with accounting firms, ERP companies, financial institutions, consulting and advisory firms and independent software vendors including DocuSign, Black Knight, and Procore. Partners participate in a referral program to support Built to expand its reach and in turn receive access to Built’s 1K+ customers across the construction ecosystem, including financial institutions, vendors, and subcontractors.

One unverified estimate of Built’s annual revenue for 2024 was $83 million, up from $14.8 million in 2021.

Valuation

In September 2021, Built raised a $125 million Series D at a $1.5 billion valuation. Since then, the company raised ~$25 million in strategic funding from smaller groups as well as large banks, like Citi, over the course of 2022 and 2023. These strategic investments were aimed at allowing Built to gain traction in commercial real estate asset management. As of March 2025, the company had raised $312.7 million in total funding.

Key Opportunities

Customer Expansion

The half percentage point interest rate cut in September 2024 was expected to increase construction and lending activity. As of January 2025, construction spending had grown 3.3% year-over-year. If construction spend continues to grow, it may create demand for Built’s products. Any continued rate cuts could increase construction lending activity in two ways. First, lower interest rates could lead to lower project financing costs, which may free up bank financing and increase lending to market-rate housing and commercial building projects. Second, lower interest rates typically result in lower mortgage rates, which is expected to stabilize around the 30-year average of five to six percent. This could incentivize more borrowers to enter the market due to pent-up demand for housing.

There are early signs of increased activity in the US construction industry. New apartment construction is expected to hit a 50-year record high, with the construction of 600K units by 2025, above the annual average of 250K units between 2000 and 2022. Also, nonresidential construction planning activity increased in August 2024 in anticipation of the interest rate cut announcement. Commercial planning, such as industrial and hotel projects, as well as institutional planning, such as education and healthcare projects, all saw an increase in planning activity. In the first quarter of 2025, those trends continued with expected growth being driven by data center expansion as well.

Built is positioning itself to benefit from increases in construction lending activity because it has had meaningful adoption among banks, construction lenders, and borrowers. It works with 43 of the top 100 US banks, 15 of the top 25 construction lenders, and over 46K borrowers. Built could encourage its existing customers to purchase more of its products as their needs expand and change with increased lending activity.

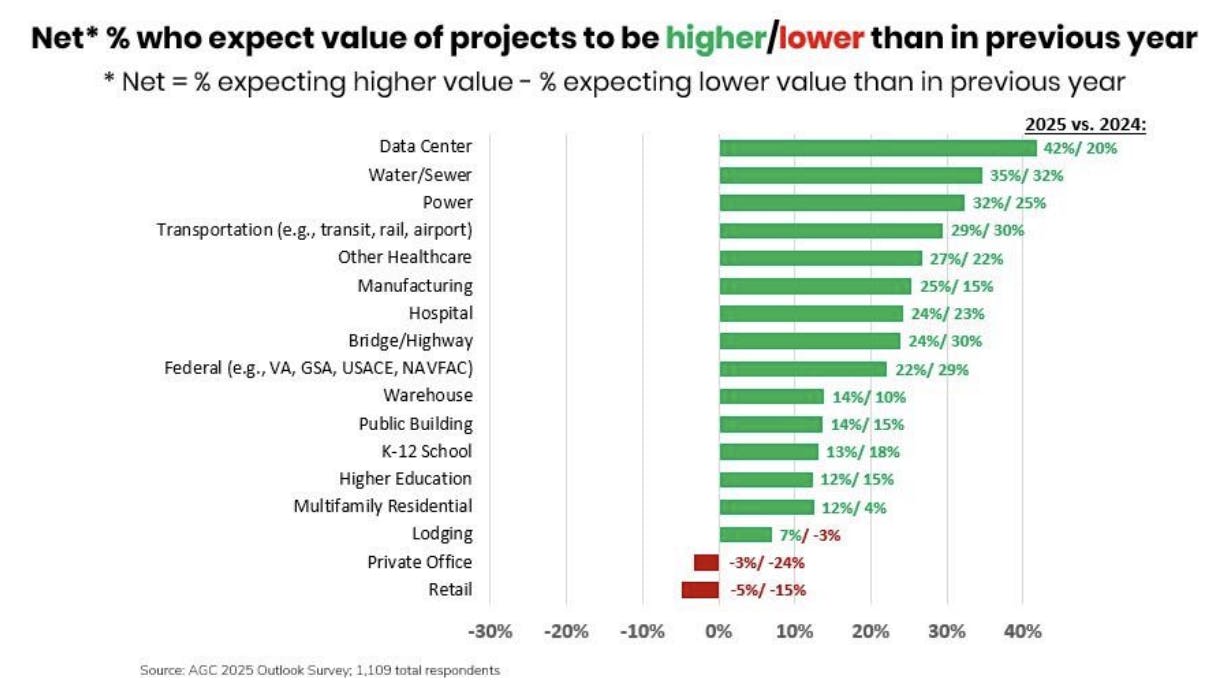

New Customer Acquisition

Over the course of 2025, residential construction is expected to grow 12%, while nonresidential construction is expected to grow 8%. Within nonresidential segments, there are clear breakouts in terms of sectors that are expected to drive larger projects in 2025 compared to 2024, such as data centers, water/sewer, and power.

Source: AGC

These trends are likely to continue. The increase in data center construction spending is a direct result of the increased uptake of artificial intelligence and advanced computing across industries, which is only expected to grow. The increase in power construction spending is a result of government investments such as the Bipartisan Infrastructure Law, which will invest a total of $973 billion into infrastructure projects through 2026.

These trends suggest an opportunity for Built to continue its efforts to broaden its reach to contractors. In 2020, Built rolled out its lien waver management product to support contractors with payment process management. It has since served companies such as Rod Heisler Construction, which works on various projects from residential buildings to education facilities, and John Kraemer & Sons, a local construction company building homes in Wisconsin and Minnesota. Built could offer new products and services that meet the needs of contractors working in various sectors including data centers, manufacturing, and power to leverage increased construction spending in these areas.

Digital Adoption in Construction

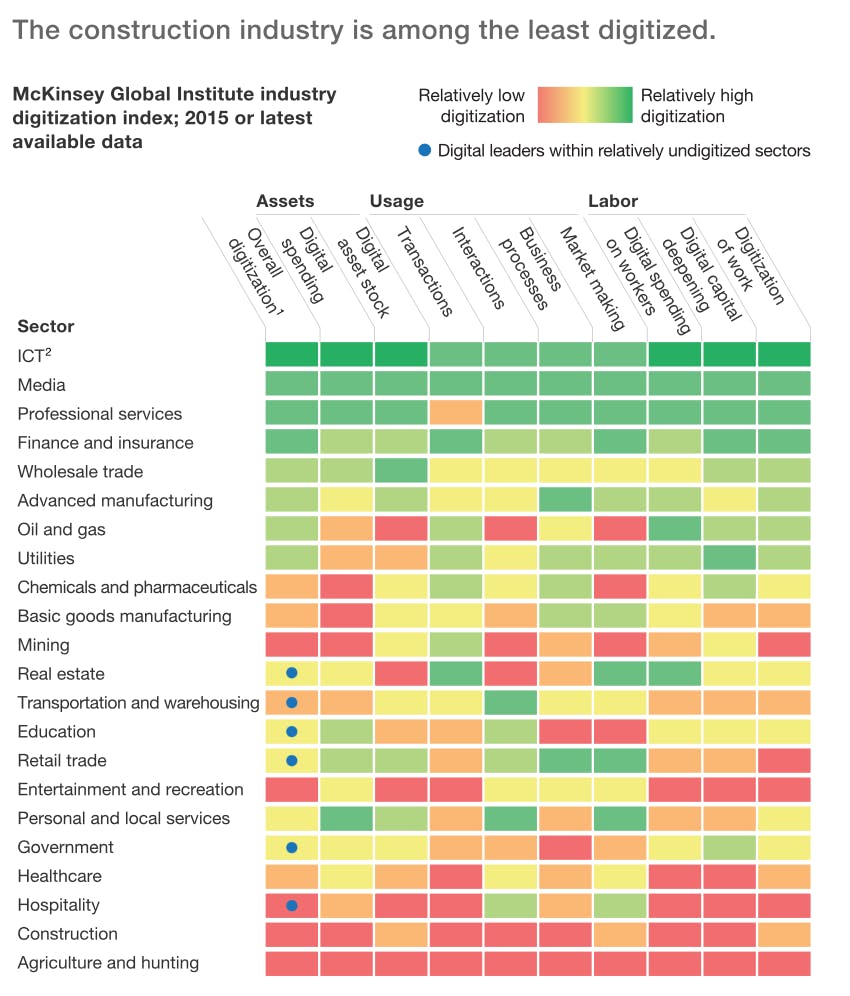

Construction has historically been slow to turn to digital solutions because of continued reliance on manual processes. In 2016, construction was the second least digitized industry after agriculture.

Source: McKinsey

The industry is increasingly changing its mindset. In one survey in 2022, 74% of construction professionals indicated that they were planning to implement new technologies to improve productivity, achieve greater competitiveness, reduce costs, and lower construction times.

The industry has already seen an increasing number of innovations, such as Building Information Modeling (BIM) tools that create a centralized system to plan and design construction projects and construction project management enterprise resource planning (ERP) software that deploy artificial intelligence for project scheduling and resource management. Built has created a niche for itself as a construction lending software company and could ride this wave of increased interest and adoption of construction technologies.

Key Risks

High Upfront Costs

Cost concerns among lenders and contractors may inhibit uptake of Built software. Nearly $500 billion in commercial mortgages is set to mature in 2025. Lenders may be concerned about elevated costs of capital as they face this wall of loan maturities and borrowers may be unable to pay.

More broadly, construction is a notoriously low-margin business. The average net profit margin for construction companies is usually between 2-10%. Companies typically operate on slim margins because of stretched labor markets and tight project schedules for which there are no easy improvements. There continues to be a talent shortage in the construction sector, with an estimated gap of 500K workers as of May 2024. Also, scheduling challenges can arise for many reasons such as coordination challenges among numerous contractors, weather delays, and changes in construction specifications.

These sensitivities to cost may disincentivize investments in new technologies, particularly because construction historically has not invested in digitization.

Increased Competition

The digital lending market is expected to grow by $34.6 billion from 2023 to 2028 at a CAGR of 26.6%. The lending market has increasingly turned to automation and digitization to verify and analyze customer data, reduce operating costs, optimize risk management, and make lending decisions. Digital lending startups in the real estate industry such as Better Mortgage and Builders Patch offer online mortgages and underwriting tools that serve borrowers and lenders. While these companies are not in direct competition with Built since their core service is lending rather than loan management, their ability to streamline loan processes could make Built’s services duplicative.

Banks are also developing their own digital platforms, which may reduce demand for Built’s software. Banks face an ever-growing list of new technologies that improve their ability to offer personalized lending solutions, protect against credit risk, and manage approval processes. They may opt to launch their own digital products as a way to retain oversight over security measures, maintain control over their entire technology stack, and keep costs low.

Summary

Built provides a construction lending software platform designed to mitigate risk and simplify construction loan management. The company's platform offers real-time visibility into construction portfolios and simplifies complex loan administration processes to accelerate the movement of money into projects. It eliminates siloed systems and manual processes in existing loan management processes, supporting various actors in the construction value chain to reduce loan risk, increase loan profitability, and ensure compliance.

Built actively manages approximately 13% of US construction spend as of March 2025, and is expanding its reach to new lenders and borrowers in the commercial real estate space. Going forward, Built has the opportunity to take advantage of continued growth in construction spending, while also having to fend off competition from incumbent and in-house solutions.