Thesis

Homeownership among households headed by adults ages 25-34 surged before the Great Recession (2007-2009) due to increased access to mortgages. After the subsequent economic downturn and housing market crash, lending became restricted and home prices rose, making it increasingly hard for young people to buy their first home. Between 2003-2007, homeownership of households headed by adults ages 25-34 peaked before falling to 41.3% by 2010 and bottoming out at 36.8% between 2014-2016. Although there has been a slight uptick since then, as of 2019 this figure was still below pre-recession levels.

Homes represent the single largest asset most people will own in their lifetimes. Homeowners have historically received a 600% 20-year ROI on levered home equity. The average net wealth of a homeowner is 75 times that of a renter. Despite the benefits of homeownership, it has become inaccessible for many Americans. A few things are responsible for this. First, the US lacks an affordable housing supply. The median home price has grown by 120% since 1997, which means home buyers have to save two times more for a down payment. At the same time, underwriting requirements have tightened. The pre-GFC average FICO score of homeownership, 690, has risen to 740, which excludes an additional 20% of US consumers. Younger home buyers also have more financial challenges than older generations did at the same age. For instance, 26% of students who came out of school had over $20K in student debt in 1995, compared to 48% in 2019.

Divvy is a tech-enabled real estate platform that facilitates rent-to-own home purchases. For consumers who want to own a home but can’t qualify for a mortgage, rent-to-own programs like that provided by Divvy are an option that provides them with the time to accumulate a solid credit history and the means of savings towards a downpayment. Divvy purchases homes on behalf of its customers and leases the properties to them such that a portion of rent goes towards customer equity in the home, with the goal of selling these properties to the customer at the end of a three-year lease. Even before they receive the deed, customers have access to many of the perks of being a homeowner, like higher-quality homes in better neighborhoods. With this approach to homeownership, Divvy aims to help a new generation of Americans become homeowners and start building wealth.

Founding Story

Source: TechCrunch

Adena Hefets (CEO), Brian Ma (Former CEO), Nick Clark (CTO), and Tiffany Li founded Divvy in 2016. Hefets started her career as a TMT investment banker at Bank of America, moved to large-cap real estate buyout at TPG, and then became a product manager at Square. At Square, she was part of the team that started Square Capital, Square’s merchant cash advance platform. Before starting Divvy, Hefets led DFJ’s early-stage fintech investing practice.

Brian Ma joined Zillow as an intern when it was 15 people and founded Decide.com, which was acquired by eBay. Later in his career, he became an Entrepreneur-in-Residence at HVF, Max Levchin’s startup studio that incubated Affirm, Yelp, and Glow. This is where he got together with Hefets and Clark to start Divvy. Clark had been CTO at DoubleDutch, a provider of mobile event apps, and a senior development engineer at Microsoft. Li was an investor at Anthos Capital and later worked at HVF. She joined Divvy's founding team and focused on sales.

Divvy began as a fractional vacation homeownership product, but progress stalled because the problem it was solving lacked urgency. Hefets led the pivot to primary residences, splitting off from Ma to target a wholly different set of customers. The idea for Divvy emerged from Hefets’ childhood experience; her parents immigrated from Israel to the United States. They found their dream home but could not secure a mortgage due to their lack of credit history and unknown earnings potential. The previous homeowner recognized the couple’s struggle and kindly offered them a seller financing agreement where they could pay her directly in installments rather than taking on a traditional mortgage. They happily moved into the house. Eventually, they could get a mortgage, take cash out of the house, and use it to pay for all four of their kids to go to college. From an early age, Hefets viewed homeownership as a way to build wealth and a symbol of security, family, and the American dream.

Hefets found her first customer through a Craigslist ad. After proving its rent-to-own model by closing 100 homes in its first year, the company looked to scale. While they secured a $20 million debt facility with Cross River Bank, Silicon Valley investors hesitated to write more checks because of the company’s customer profile. In Hefets’ words:

“Two years in… the feedback I got was: ‘Wait, we're giving loans to poor people?’ And I was shocked, because they have a track record, they’re performing, who cares what you define people by, you’re making a return off them! There was a whole stigma to get around in serving consumers who didn’t match Silicon Valley standards.”

Product

Divvy offers a rent-to-own program. Its customers choose any home on the market, and Divvy purchases it with cash and leases it back to them. The customer’s monthly rent payments contribute toward their equity in the home, which gradually builds to 10% after a three-year lease period. At the end of the program, the customer can choose to buy the home from Divvy with this 10% as a down payment or withdraw their savings. In more detail, the program works as follows:

Step 1: Application

Source: Divvy

The customer applies for prequalification and is evaluated based on employment status, income, and a soft credit check. Divvy requires its customers to have a minimum FICO score of 550, a minimum monthly household income of $2,500, and available employment history for the last 3 months.

Step 2: Home Search

Source: Divvy

Next, the customer shops for the home of their choice. Almost all homes in the 19 metropolitan areas across the 9 states Divvy serves are eligible, excluding manufactured homes and foreclosures. Divvy touts that a major benefit of their program is that homes for sale tend to be of a higher standard and better maintained than homes for rent. To close a deal, customers can use their own real estate agent or find one through Divvy’s network of over 36K agents. Divvy works with them to determine a competitive bid, and the agents receive a 100% commission for the purchase transaction.

For agents, Divvy aims to allow them to reach more customers and close more deals. They also benefit from the competitive advantage of an all-cash offer from Divvy. Divvy also provides agents with marketing resources and a Divvy Widget that they can embed in their webpage to facilitate applications. They also gain access to the Divvy Agent Portal, where they can refer new customers, check their clients’ budgets, and get real-time updates on deals.

Step 3: Home Purchase

Source: Divvy

Divvy then purchases the home with cash. The cash payment includes all fees, closing costs, taxes, and insurance. The customer makes an initial downpayment of 1-2%, representing the customer’s starting home equity. Divvy's initial contract includes an agreed-upon “future” price and reflects a three-year forward home price appreciation. Locking in a price three years in advance provides optionality to the customer at the end of their three-year lease. If the home's true value has increased more than expected, the customer retains all upside. If it falls short of the predetermined price, the customer can cash out their equity position and look for a new home.

Step 4: Customer Move-in and Rental Period

Source: Divvy

Next, the customer moves in and pays monthly rental payments. 70-75% of the payment represents the fair market value of rent, while the remaining 25-30% goes toward a synthetic equity account. The program is designed for customers to reach 10% home equity in 3 years. Divvy emphasizes that its aim is for customers to ”feel like homeowners.” Customers build their credit and save toward a down payment during their three-year lease. They are encouraged to make cosmetic home improvements to make their home their own. They also receive complimentary offers of homeownership counseling through the National Federation of Credit Counseling.

Divvy allows customers to test homeownership and get a sense of the space and the neighborhood before committing to a long-term mortgage. Because Divvy customers tend to treat their homes like they own them, Divvy sees lower vacancy, lower turnover, and lower maintenance costs per home than traditional rental companies. Divvy covers all maintenance and repair costs during the lease period, but the customer is responsible for all utility payments. At any point during their three-year lease, customers can buy the home from Divvy or cash out their savings.

Step 5: Final Purchase Decision

Source: Divvy

After three years, the customer can buy the home or walk away with their savings, minus a 2% re-listing fee. If the customer buys the home, the equity they’ve built goes towards their mortgage downpayment. If the customer moves out, their savings do not appreciate the home's value. As of July 2022, 51% of Divvy’s customers had exercised their purchase option at the end of their lease. This figure only reflects the outcomes of its first cohort of customers. The company has grown significantly since the first cohort, so the figure in 2023 is likely higher.

Market

Customer

Divvy serves individuals or families who want to own a home but cannot easily qualify for a traditional mortgage due to a low credit score, insufficient savings for a down payment, or a high debt-to-income ratio. Divvy accepts a minimum FICO credit score of 550, well below the typical score of 620 needed for most mortgages. Its built-in savings mechanism helps customers struggling to save up for a downpayment. These features benefit first-time homebuyers, low-income families, immigrants, and individuals with past credit issues. Many self-employed or recently employed individuals are also drawn to Divvy’s program because it considers non-traditional sources of income and looks at customers’ last three months of income when determining their home-shopping budget.

Divvy CEO Adena Hefets has said that the largest segment of Divvy’s customers is healthcare workers, who usually have large amounts of student debt. These are followed by educators who might not have the savings to afford a downpayment and logistics workers like truck drivers, Uber drivers, and Instacart shoppers who tend to have inconsistent income.

Divvy’s customer profile is unique because it lies at the intersection of renting and owning. Since Divvy’s 1-2% down payment requirement is two to four times the size of a security deposit on a rental, its customers are pre-selected to have some degree of savings. Customers are also given the opportunity to select the home they want and become a partner in its ownership, incentivizing them to take better care of the property through regular maintenance, landscaping, renovations, and other investments that a typical tenant may not make. Warren Buffet’s adage “No one pays to wash a rental car” has been a core part of Divvy’s thesis.

Market Size

In 2021, the US rent-to-own market was valued at $10.5 billion and will likely reach $15.5 billion by 2027, growing at a CAGR of 6.8%. Divvy’s addressable market includes Americans who do not already own homes and lack the credit score or savings to become homeowners. Over a third of Americans have a credit score that is considered subprime, 35% do not own their own homes, and 36% of people have more credit card debt than savings.

Competition

Invitation Homes: Invitation Homes, which went public in 2017, is the largest owner and operator of single-family rental homes in the United States, serving over 80K tenants. Blackstone founded the company in 2012 while home prices remained bottomed out following the Great Recession, building in-house capabilities of acquiring, renovating, leasing, maintaining, and managing single-family homes. Because it was so well-capitalized from the start, the company benefits from significant economies of scale. In 2022, they moved into the rent-to-own space via their lead investment in Pathway Homes, a rent-to-own startup.

Pathway Homes: Founded in 2021, Pathway Homes is a rent-to-own startup with two products: HomeStart and SavingsMatch. With HomeStart, Pathway Homes purchases the home of a customer’s choice and leases it to them a year at a time. It locks in rent for up to five years, and renters can buy the home at a pre-agreed price at any time, with no penalty if they move out. With SavingMatch, customers build home equity during the lease period by putting down a 2.5% deposit upfront that Pathway matches up to 100% when they’re ready to buy. This is distinct from the synthetic equity accounts that Divvy uses for the same purpose. Every Pathway Homes home also comes with smart-home technology. The company received $225 million in debt financing from Invitation Homes in 2022.

Home Partners of America: Home Partners of America (HPA) was founded in 2012 and offers a similar rent-to-own program as Divvy. HPA typically finances more expensive homes than Divvy, with an asking price range of $100K to $450K compared to Divvy’s $60K to $350K range. Renters can purchase a home at any time during their five-year lease at a price that increases annually at a predetermined rate to account for anticipated appreciation. There are no penalties for renters who decide not to purchase at the end of their lease, so it has a lower rent-to-own conversion rate than Divvy of 20%. HPA’s partnership with Century 21, a large real estate agent franchise company, gives it a distribution advantage against its competitors. The company operated in 41 markets and was acquired by Blackstone for $6 billion in 2021.

ZeroDown: ZeroDown is another rent-to-own startup founded in 2018 and provides customers in hot real-estate markets a path toward home ownership. Their program is geared toward people who want to try before they buy, rather than those struggling with credit or affording a down payment. It is available in all major Arizona, California, Colorado, Florida, Georgia, Texas, Virginia, and Washington metro areas. It raised a $100 million debt financing round in 2019, putting its total funding at $136 million. More recently, the company has pivoted to focus on building an advanced home search engine that allows users to complete the home buying process online, from start to finish. As of April 2023, ZeroDown’s rent-to-own program is on hold due to volatile housing market conditions.

Landis: Landis is a rent-to-own startup founded in 2018. A core differentiator of Landis’s program is its focus on delivering a personalized, tech-enabled coaching program that helps customers build credit and save for a down payment. Landis customers can rent their homes for up to two years, after which they are expected to become owners. The company partnered with Transcendent Investment Management, a major single-family rental landlord, to turn more renters into owners. As of April 2023, the company operates in Alabama, Georgia, Indiana, Kentucky, North and South Carolina, Maryland, Ohio, Pennsylvania, Tennessee, and West Virginia. It raised a $40 million Series B in 2022, putting its total funding at $222 million.

Verbhouse: Founded in 2016, Verbhouse is an alternative home finance platform that offers a rent-to-own program similar to Divvy’s. With Verbhouse, customers pay 5-10% up-front to lock in a monthly lease payment and future home purchase price for the next five years. In March 2020, it planned to roll out a pilot program for educators.

Dream America: Dream America is a rent-to-own program geared towards people with the savings to qualify for a mortgage but not the credit score. The program requires a minimum FICO score of 500 and a budget of $150K or higher. The customer rents the home for a year while receiving assistance to improve their credit and putting 10% of their monthly rent payments towards an eventual down payment. It is available in Florida, Georgia, and Texas metro areas.

Business Model

Source: Seeking Alpha

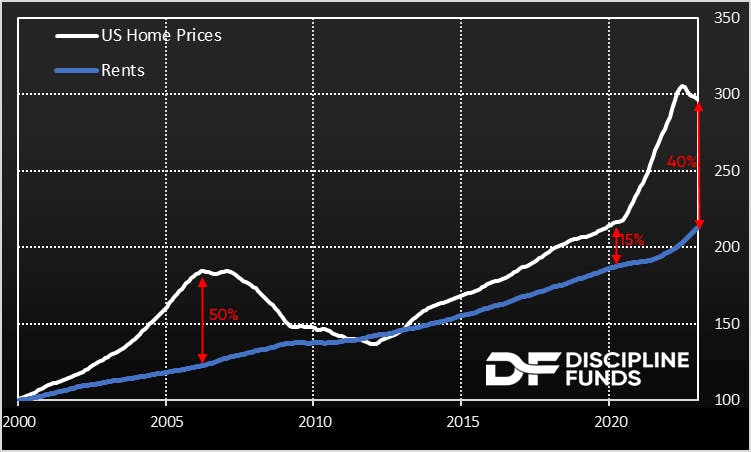

Divvy generates revenue from the monthly rental payments and the home’s appreciation over time. In 2022, Divvy charged tenants a monthly rent of ~$1.4K to $3.2K, depending on geography, and spent an average $1.2K per home on maintenance. Rather than taking on foreclosure risk like traditional mortgage lenders, Divvy evicts tenants in instances of payment delinquency and lease-breaking. Its built-in savings mechanism disincentivizes risk-inducing customer behavior by locking up customers’ savings in their homes. Divvy also profits by locking home appreciation rates at the lease’s start. Its main source of recurring revenue is rent, which has steadily increased since the 2000s and beyond. When Divvy was only operating in three markets, co-founder Tiffany Li stated, “Home prices in [our markets] would have to go down by 15% for us to not break even.” In other words, the more money Divvy charges in rent and the less it has to spend on maintenance, the better it does. Whether or not the tenant buys the home has a limited effect on the company’s bottom line.

Divvy is a highly capital-intensive business, having raised a total of $1.2 billion to date. Most of its capital comes from large debt facilities from lenders like Cross River Bank, Goldman Sachs, Moore Capital, and Libremax. Its access to debt has allowed them to lever their houses almost 95%.

Traction

By April 2023, Divvy had expanded to 19 metropolitan areas across nine states, partnering with over 36K real estate agents. It has had over 750K applicants since inception, and ZoomInfo estimates Divvy’s revenue at $307.4 million.

Divvy saw its business take off during the pandemic. During this time, underwriting standards tightened at the same time as a mass migration from multi-family and downtown areas increased demand for single-family homes. These tailwinds allowed Divvy to finance five times as many homes in 2020 as it had combined in all previous years of operation.

Valuation

In October 2021, Divvy raised $735 million in debt financing from Barclays, Goldman Sachs, Cross River Bank, LibreMax Capital, and Brigade Capital Management, just two months after Tiger Global and Caffeinated Capital led its $200 million Series D. These rounds put the company at $1.2 billion in total funding with a $2 billion valuation.

In May 2022, Crunchbase compiled a list of 20 companies that had raised in the past year involved in property buying and online mortgage services. The list included companies like Opendoor, the operator of a digital real estate marketplace; Roofstock, a marketplace for real estate investors; and Offerpad, a tech-enabled real estate broker. Collectively, these companies had raised $5.8 billion in funding since inception. However, the largest funding rounds for these companies took place during one of the sharpest ascents of home prices in American history. As home prices fall back to more reasonable levels, valuations have come down. After Zillow announced it was exiting its home-buying business, public companies Offerpad and Opendoor shed three-fourths of their market capitalizations from peaks in November 2021.

Key Opportunities

Product Expansion

Divvy is only available in nine states, leaving much room to expand geographically. Changes to Divvy’s product offering could also allow it to capture a larger TAM. For example, Hefets has stated that Divvy is working toward customizable programs where customers can tweak their initial down payment and time horizon. Additionally, Divvy currently uses third-party ancillary services for title, escrow, closing, and mortgages, but Hefets hopes to offer all these in-house eventually.

In the future, Divvy can expand its services to include additional options for renters like insurance, landscaping, moving, and internet/TV connection. If Divvy is able to integrate vertically, it can consolidate all of the customer acquisition costs that the various counterparties in a traditional real estate transaction bear. While other prop-tech companies interact with their customers once a decade, Divvy already does so every month. This gives it a built-in advantage to cross-sell the transaction stack from start to finish.

Remote Work

In January 2023, about 28% of all new job vacancies were advertised as remote. As a result of shifting labor preferences, homebuyers increasingly prefer larger homes in lower-cost geographies like Texas and Georgia, where Divvy is most active. By allowing customers to try out a home before buying, Divvy will likely benefit from the trends toward remote work.

Key Risks

Maintenance

Divvy claims responsibility for “ensuring the home is safe and that critical systems (e.g., roof, structure, HVAC, plumbing, and electrical) are operational.” but many Divvy customers complain about their failure to resolve maintenance requests. There have been instances involving pests, mold, gas leaks, water leaks, faulty wiring, and downed trees, where Divvy was slow to respond to urgent maintenance requests or when the contractors they sent worsened the issues. Other customers have questioned the thoroughness of Divvy’s diligence process after discovering problems with their homes’ foundations, roofs, and HVAC systems. This poses a long-term risk to trust in Divvy as a brand.

Rent-to-Own Skepticism

Previous iterations of Divvy’s rent-to-own model were notoriously predatory. Contracts for deeds, which gained popularity in the 1950s, often charged excessive rent and passed maintenance costs, taxes, and insurance onto the renter. They were also unregulated, meaning landlords got away with exploitative practices and structures that allowed them to profit if renters could not purchase their homes. Rent-to-own models reportedly stripped black families with no alternatives to homeownership of an estimated $3 billion to $4 billion from the 1950s to 1960s. Even in 2023, opponents of the model point out that rent-to-own businesses are prone to a fundamental conflict of interest: they sell people on the dream of homeownership but profit from keeping them as tenants. Catherine Brady, CEO of a nonprofit advocacy group TechEquity Collaborative, suggests that Divvy might be a case of Silicon Valley putting a “shiny veneer and flashier marketing around models that have existed before.” In 2019, the NAACP explicitly condemned rent-to-own models that exploit low-income homebuyers and consumers. This skepticism, if it becomes widespread, poses a risk to the continued growth of Divvy’s business.

Declining Home Prices

CoreLogic’s Case-Shiller U.S. National Home Price NSA Index reports that home prices fell for the seventh consecutive month since their peak in June 2022. As the Fed hikes rates to combat inflation in 2023, consumer demand for housing will continue to decrease. The macro environment of 2023 threatens Divvy’s operations because it makes it unfavorable for them to buy homes that they know will decrease in value. The company says, “A home not appraising is a lose-lose situation for our customer and us that we work hard to avoid.” In November 2022, Divvy adjusted its bidding strategy to account for the cooling housing market, offering 10-20% below the list price. In a February 2023 interview, Hefets stated that Divvy wasn’t buying homes. Nonetheless, Divvy believes the long-term outlook for the housing markets remains strong. It is actively monitoring the Fed, risk spreads, inventory, and affordability data to gauge whether the housing market has stabilized enough for the company to resume growth.

Summary

Divvy provides a much-needed service to Americans pursuing the goal of home ownership. The company is well capitalized and has become one the top-ten net acquirers of single-family homes in the United States, competing with legacy players in the space. The opportunity for Divvy to bundle up the entire homeownership stack is there, but some doubt whether its incentives truly align with customers because of the inherent properties of a rent-to-own business model. As it confronts an entirely new housing macro than the one it was founded in, it’s up to Divvy and its peers to prove they’re worth the hype they’ve garnered in recent years.