Thesis

Managing mental wellness and mental health has become an increasingly important priority to many people today, with almost 30% of American adults experiencing symptoms of anxiety or depression in 2023. An estimated 1 in 5 adults in the US live with a mental illness, but 74% of Americans still found mental health services inaccessible as recently as 2018. Historically, mental health resources have been heavily restricted to clinical care, but with the growth of healthcare apps, this is starting to change.

Mental wellness has a tangible impact on businesses and employers, in addition to individual consumers or employees. The total cost of mental illness, accounting for its direct and indirect effects, amounts to more than 4% of global GDP. This figure is expected to reach $6 trillion annually by 2030. Employees also frequently leave their jobs because of issues relating to mental health. In 2021, 68% of millennials who left their jobs did so for mental health reasons (up from 50% in 2019). Similarly, 81% % of Gen Z who left their jobs were due to mental health reasons (up from 75% in 2019). Such costs create an incentive for businesses to invest in employee mental health, which is partially why the market size for mental health apps was valued at $5.2 billion in 2022.

Calm is a mental wellness platform offering users meditation, sleep, and relaxation resources. It also enables businesses to offer mental wellness resources or workshops to their employees. Calm’s curated content promotes mental fitness for users through a variety of audio and visual offerings via its app or website. Calm targets three pillars of mental wellness and healthcare — wellness for individuals, wellness for employees, and clinical care.

Founding Story

Calm was founded by Michael Acton Smith (former co-CEO, co-executive Chairman) and Alex Tew (former co-CEO, co-executive Chairman) in 2012. David Ko, formerly CEO of RippleHealth (acquired by Calm in 2022), became Calm’s CEO in 2022, succeeding the founders in this role.

Smith was a serial entrepreneur before helping found Calm. He founded his first company, Firebox.com, with Tom Boardman in 1998 when he was 24. By 2004, Firebox was one of the fastest-growing private businesses in the UK. In 2004, he launched Moshi Monsters. Moshi Monsters was a subscription-based virtual world aimed at kids, and it eventually achieved more than 80 million registered users and a $200 million valuation. After Moshi Monsters’s growth began to stall due to the mobile app trend overtaking desktop games, Smith found that he became burnt out and began to explore meditation alongside his friend Alex Tew.

In 2005, Alex Tew was well known for selling pixels on his “Million Dollar Homepage” to finance his way through university. After the Million Dollar HomePage ended up successfully raising over $1 million, Tew dropped out of university and began experimenting with other viral ideas like the “do nothing for two minutes” website. Tew moved to California with the goal of melding meditation and technology to help people, and Smith eventually stepped down as CEO of Mind Candy in 2014 to join Tew.

David Ko founded Ripple Health Group in 2019 to connect users with clinical healthcare options, due to his own experience with his mother’s healthcare. Ripple Health Group was acquired in 2022 by Calm. Shortly afterward, he succeeded Tew and Smith as Calm’s new CEO. Before joining Ripple, Ko had been the President and COO of Rally Health, which was acquired by UnitedHealth Group in 2017. David’s previous experiences included having been COO at Zynga, which he helped take public in December 2011, and 10 years at Yahoo in various senior executive roles, including SVP of Yahoo’s audience, mobile, and local businesses.

Product

Calm originally started with a meditation offering before branching out to providing other major features, most notably around sleep. Its Sleep Stories product offering came from an analysis of user behavior that indicated many users were using the Calm app right before bed.

Since then, the product has expanded across multiple features and pillars. Calm currently offers the Calm App, which includes other feature categories such as Wisdom or Movement. Meanwhile, the Calm Business offering caters to employers and employees. In late 2022, Calm also announced Calm Health, which is its first clinical health offering.

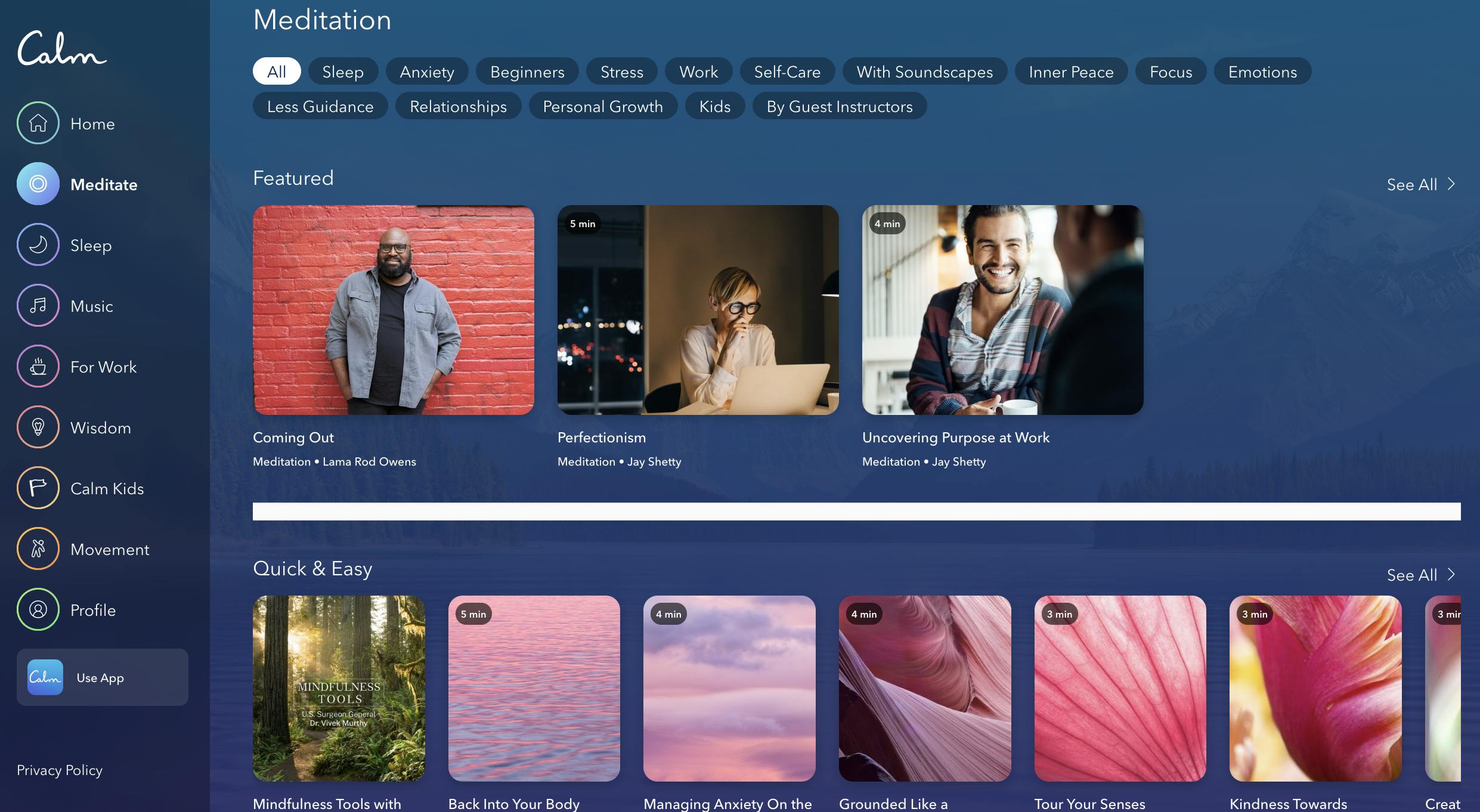

Meditate

The meditate section of the Calm app allows users to listen to speaker-guided meditation sessions that deliver mindfulness content. Meditation sessions are grouped into different categories, such as sleep, anxiety, beginners, stress, work, relationships, and more. Meditations can be accessed as stand-alone sessions, courses, or series, and range between 3 - 30 minutes in length.

Source: Calm

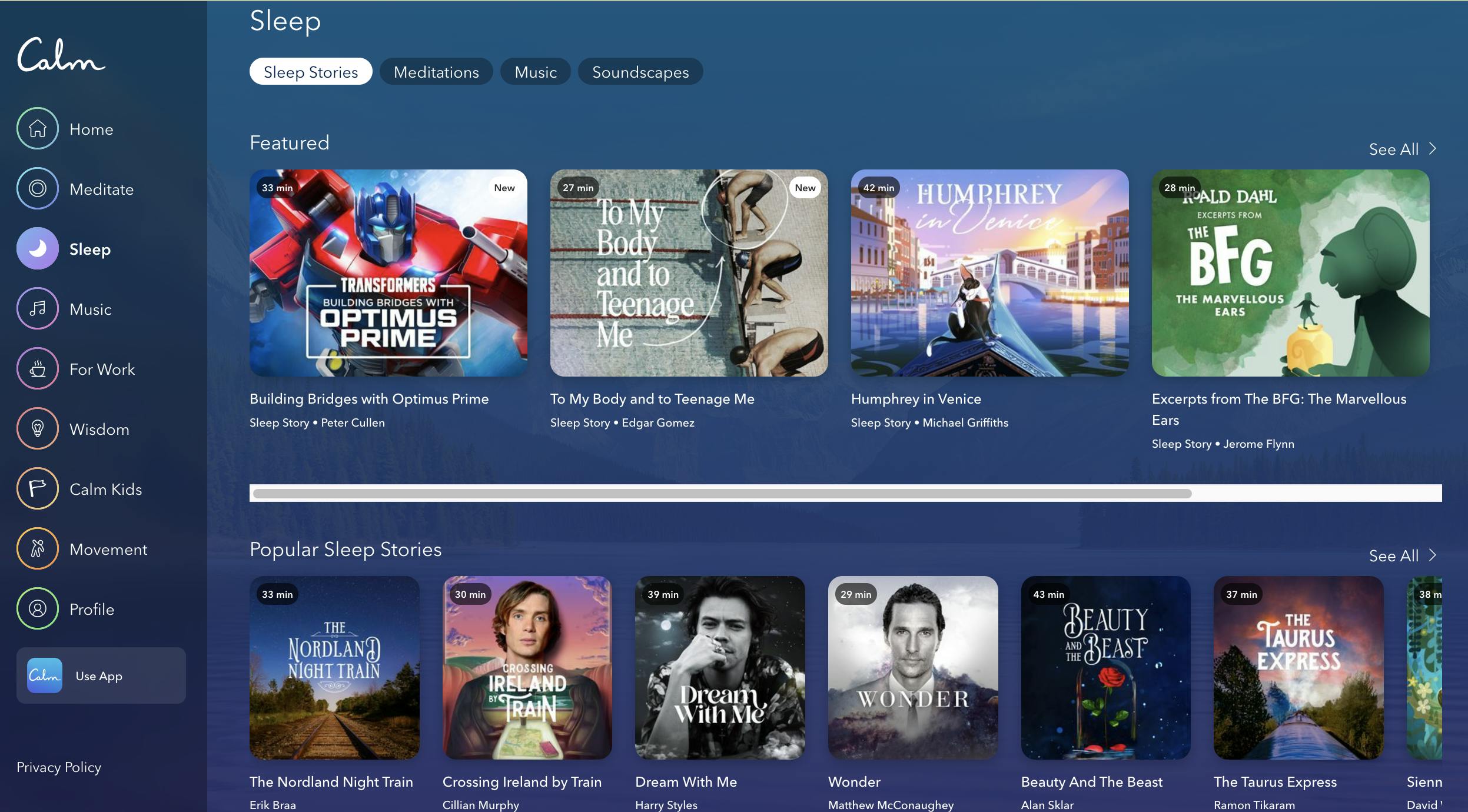

Sleep

The Calm sleep offering includes “sleep stories”, music, meditations, and soundscapes. Sleep stories are essentially bedtime stories for both kids and adults, intended to help the users fall asleep faster. Sleep story categories include fiction, nonfiction, naps, and more. Quite a few sleep stories feature celebrity voices, such as those of Harry Styles and Matthew McConaughey. Sleep meditations are meditations specifically suited for falling asleep, and the music section of the sleep offering includes various music calming choices such as acoustic or piano. Soundscapes are unique soundtracks that include sounds that resemble specific scenarios or settings.

Source: Calm

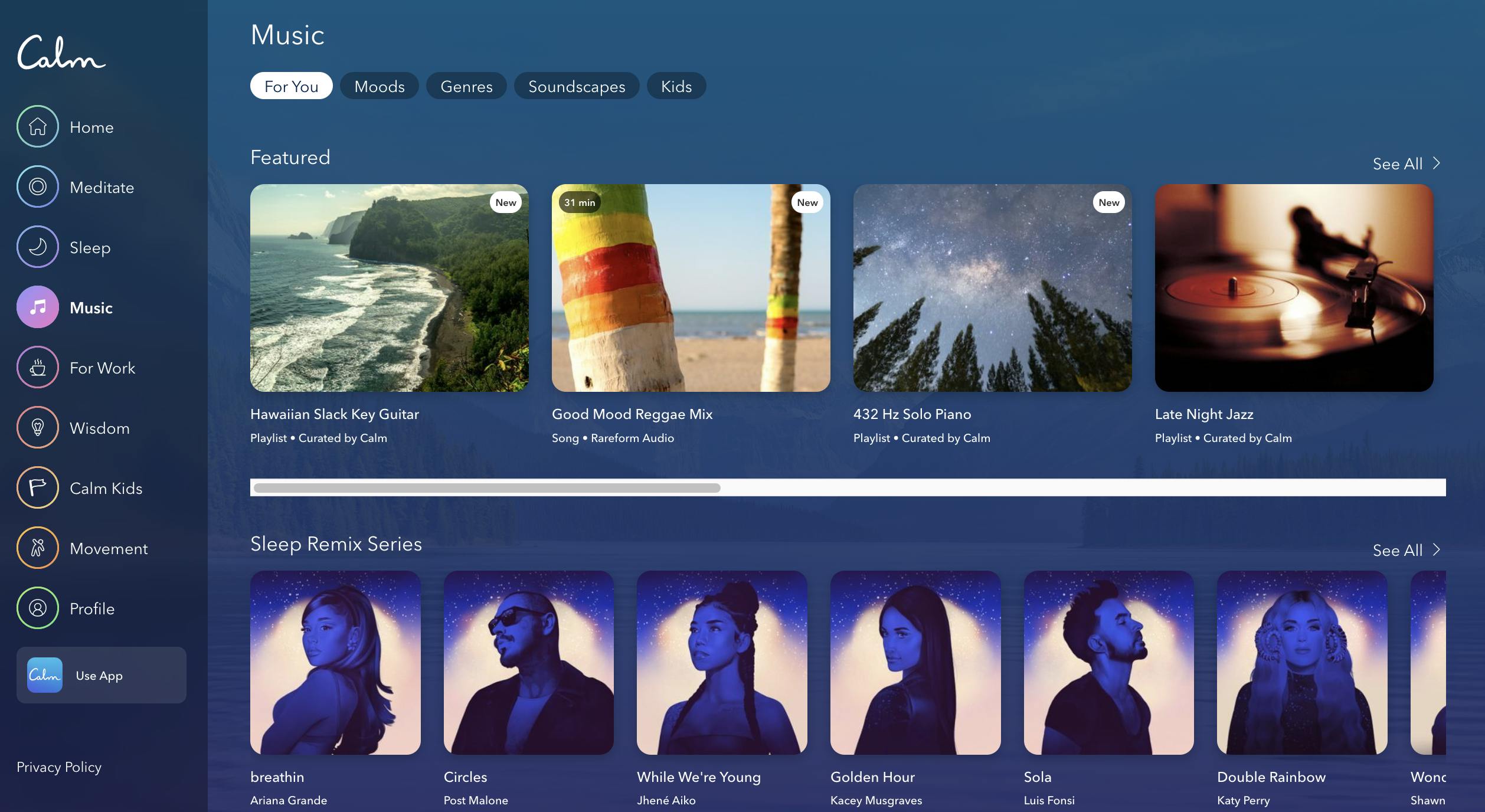

Music

The music section within the Calm app includes the option to categorize by mood, genre, soundscapes, and even choose music specifically for kids. It includes a sleep remix section that remixes popular artists, and some of the moods include “wind down”, “deep sleep”, “rise and shine”, and “yoga”, while some of the genres include piano, acoustic, and classical.

Source: Calm

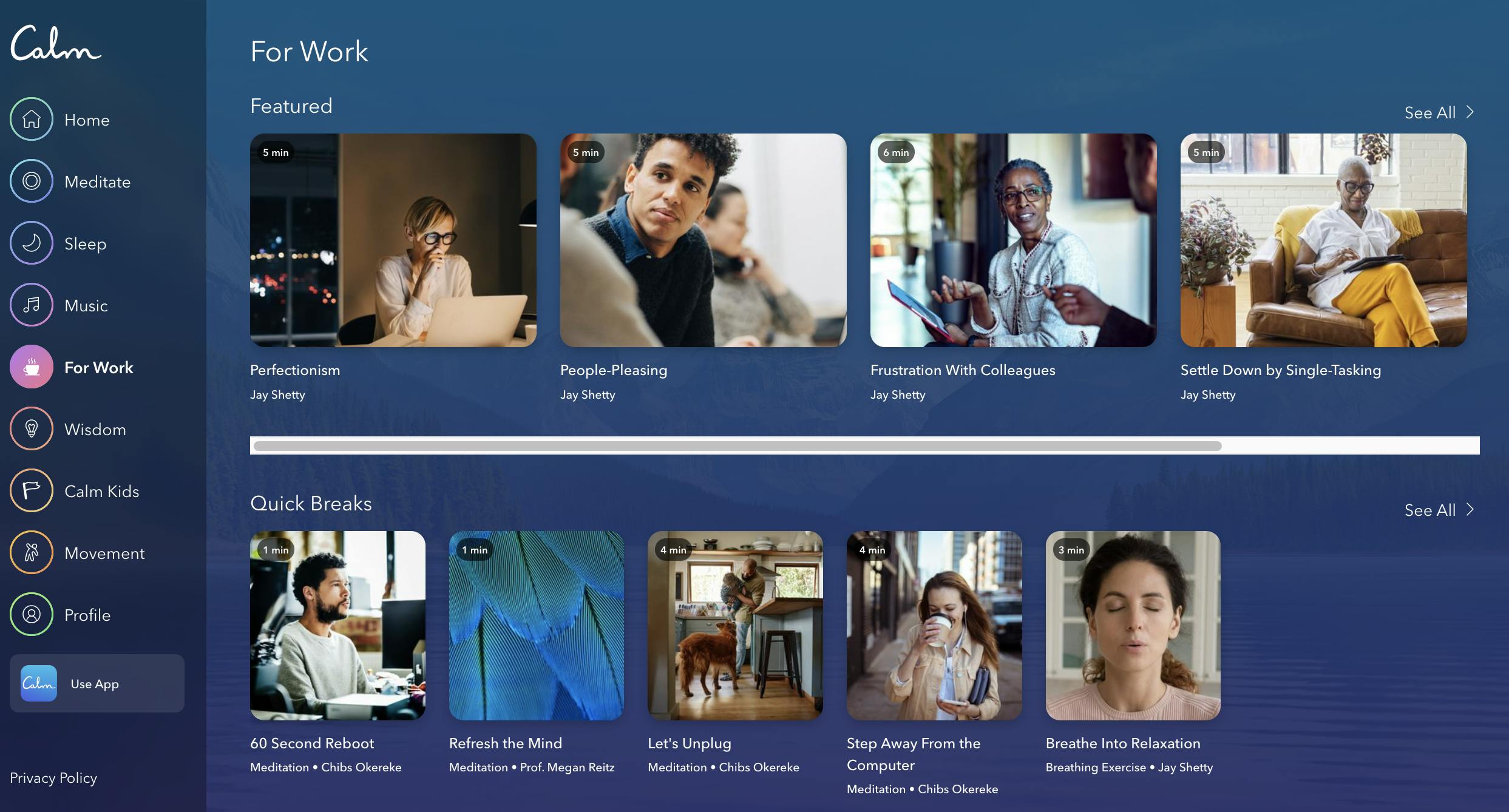

For Work

The “for work” section of the Calm app includes various features that aim to support employees. Featured sessions include suggestions and guidance from Jay Shetty, who joined Calm as “Chief Purpose Officer” and is a popular mindfulness teacher, coach, and author. Sessions center around topics like “perfectionism” or “people pleasing”, while other sections include other guided sessions to refresh and reboot. There are categories that aim to manage feeling overwhelmed, getting focused again, finding work life balance, becoming motivated, and professional growth.

Source: Calm

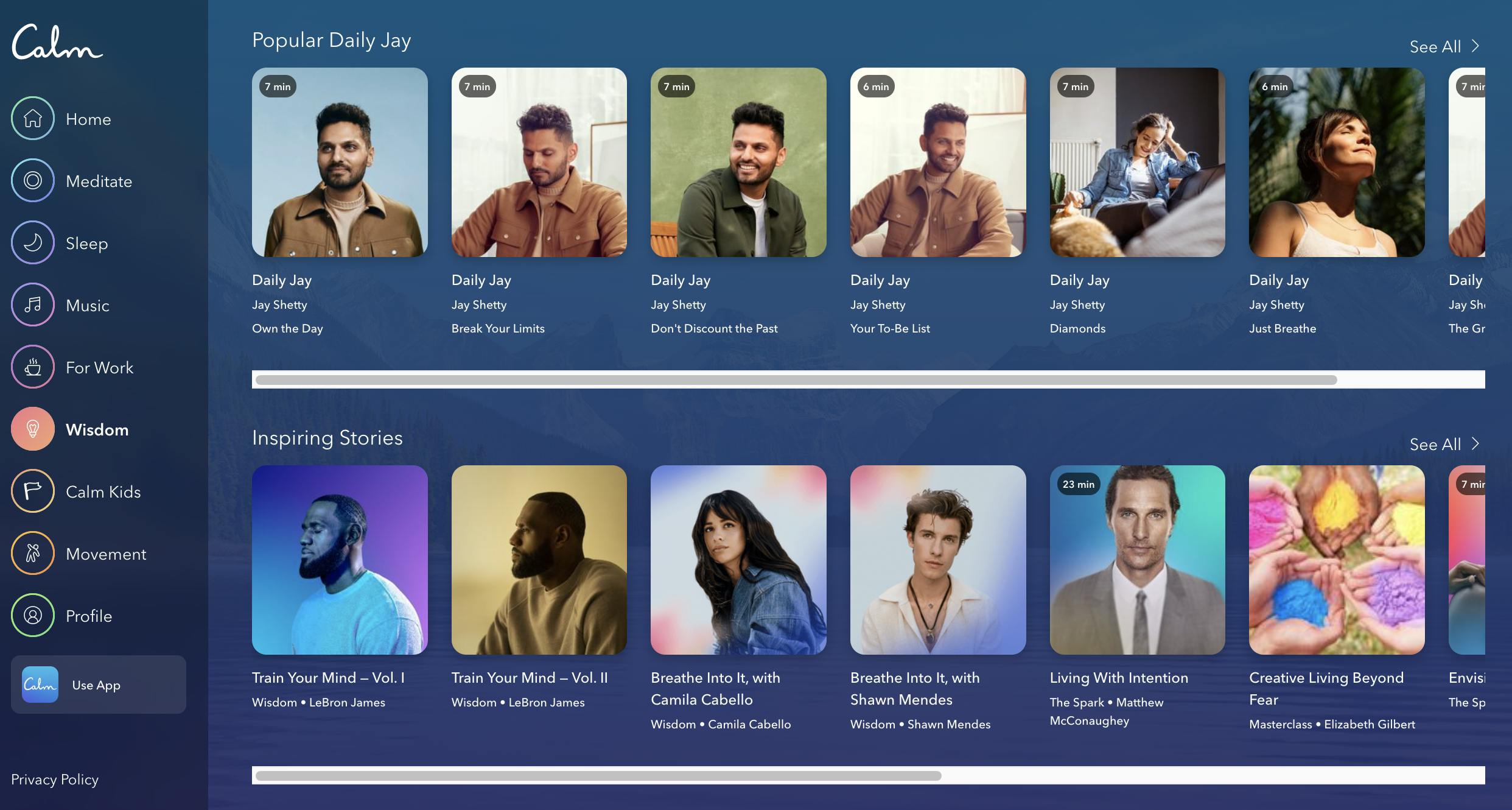

Wisdom

The wisdom section in the Calm app includes guided sessions, many of which come from Calm’s Chief Purpose Officer Jay Shetty. His show on Calm, The Daily Jay, covers a wide variety of topics and is meant to make meditation accessible for everyone. The section also includes inspiring stories from celebrities and public figures, as well as Masterclasses on issues like radical self-compassion, breaking bad habits, or “stoic wisdom for modern life” from figures like Ryan Holiday.

Source: Calm

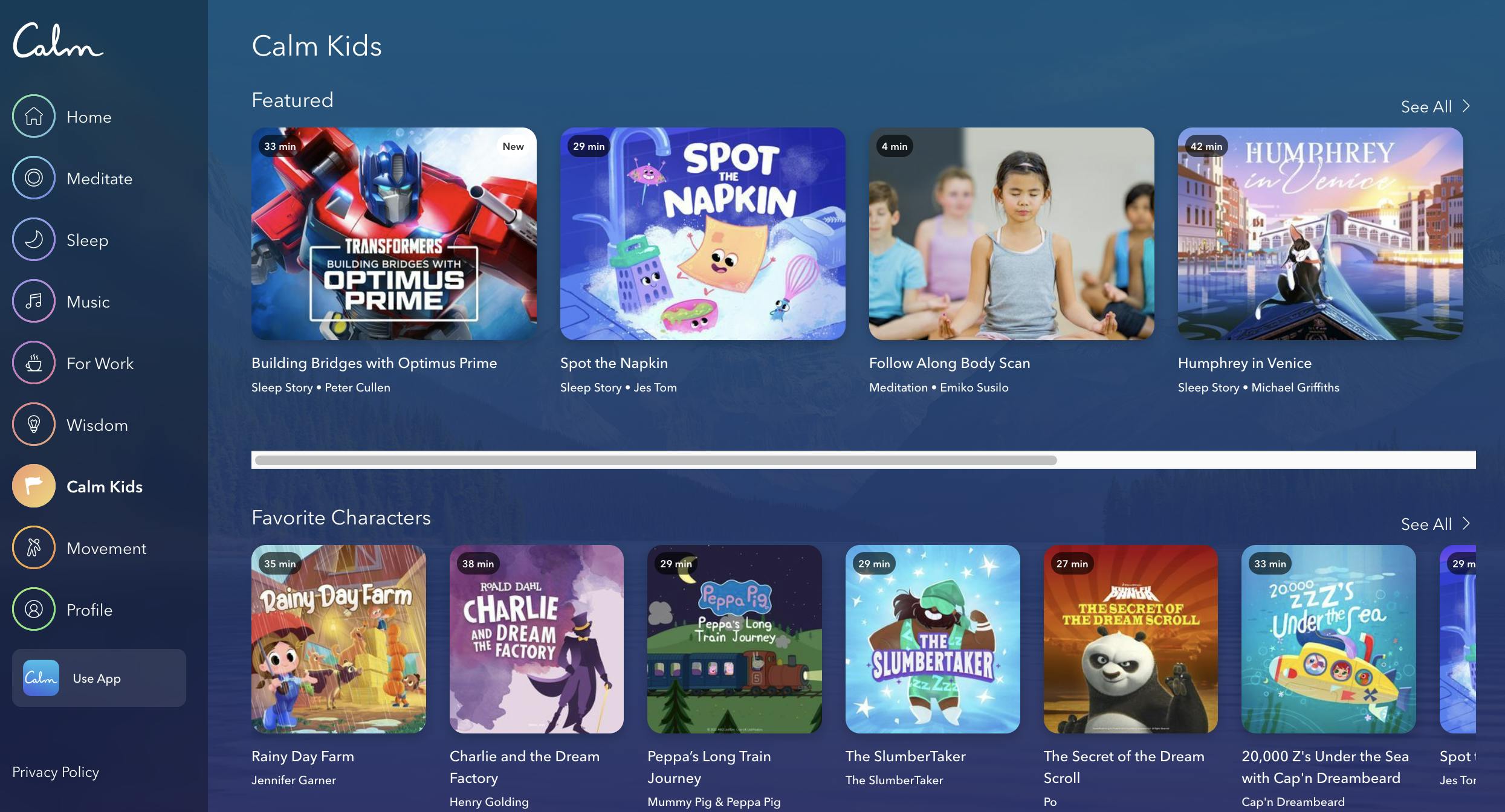

Calm Kids

The Calm app also includes a special section for kids, which includes stories that feature popular children’s characters Peppa Pig or Po from Kung Fu Panda, as well as classics like Peter Pan and Winnie the Pooh. There are also meditations, lullabies, and soundscapes specifically curated for kids.

Source: Calm App

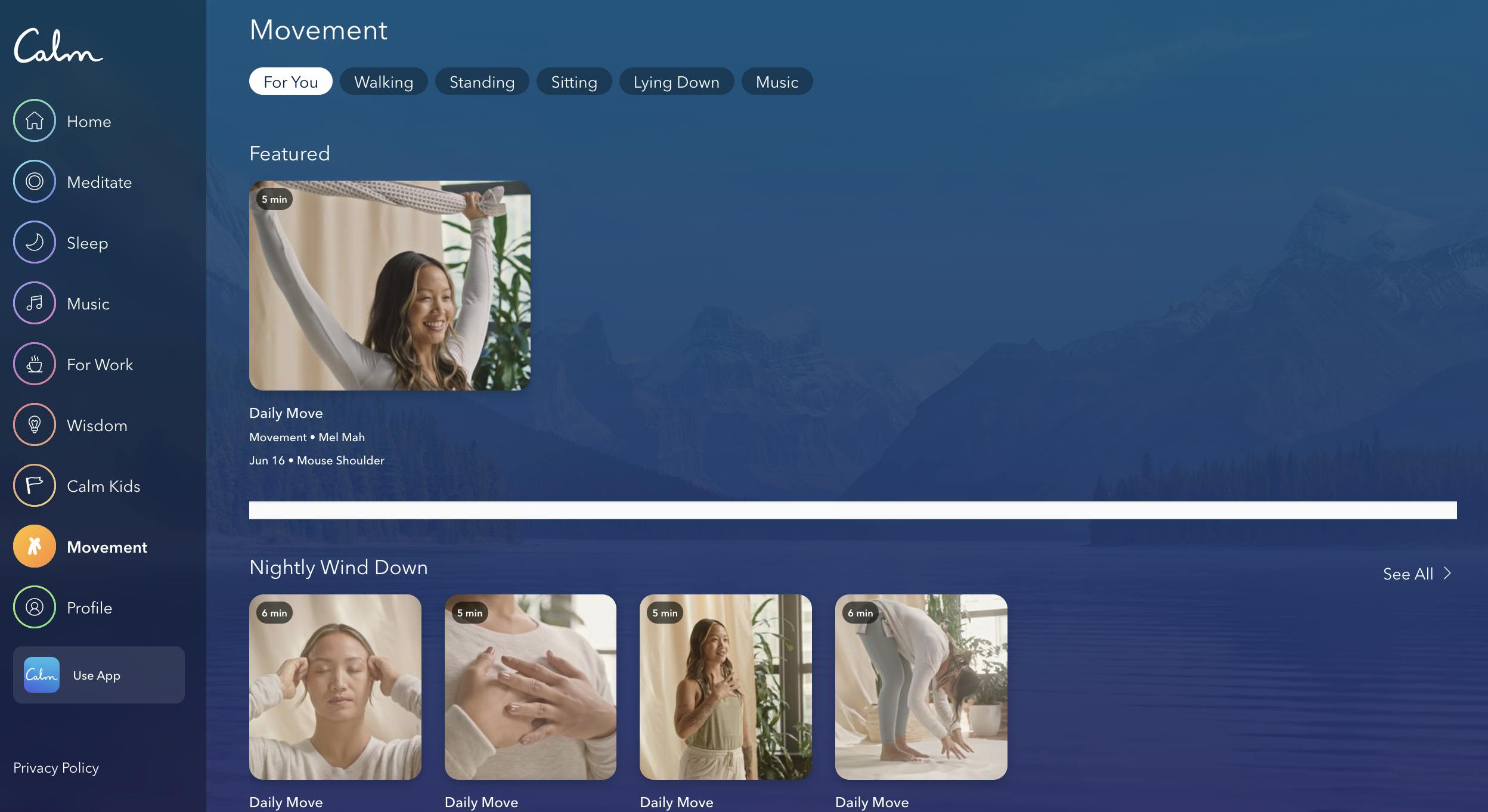

Movement

The last section within the Calm app is for movement, which is dedicated to physical wellness in addition to mental wellness. Calm recruited Mel Mah, a yoga instructor, to guide users through daily movement exercises, usually five-minute flows. These can be filtered down into specific categories like walking or lying down.

Source: Calm App

Calm Business

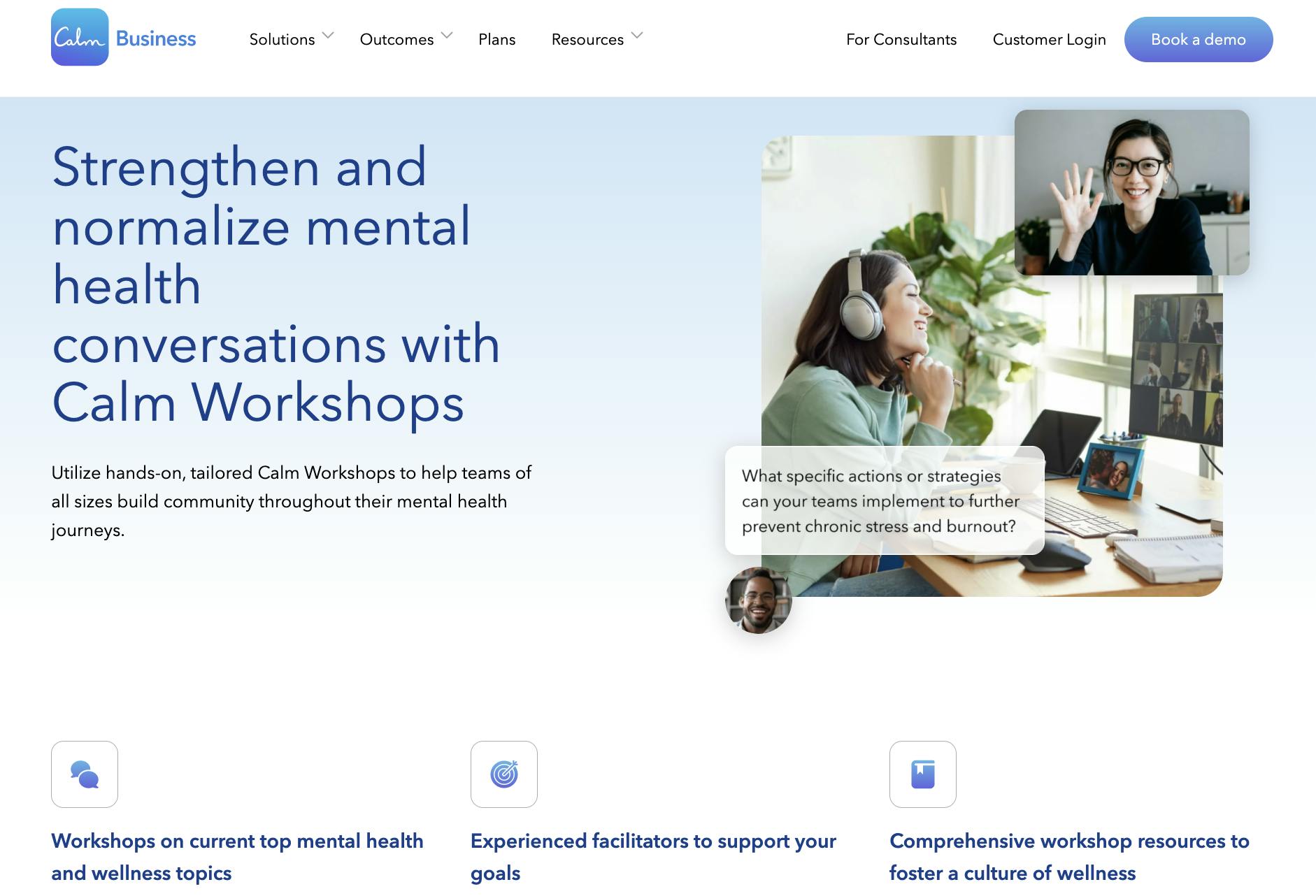

Calm’s Business offering includes various solutions for employers and gives employees access to premium content, Calm Workshops, and management resources.

Calm Workshops cover important mental health and wellness topics through interactive sessions that range from 15 to 90 minutes. Some examples include “The Power of Resilience” and “Building a Strengths-Based Culture”. These workshops are delivered through experienced facilitators who can be scheduled and oriented towards each organization’s goals, and the workshop includes a resource guide for employees to utilize in the future.

The health and wellness advisors who design and administer Calm Workshops include national board-certified health and wellness coaches, facilitators with professional diversity, equity, and inclusion certifications, and mindfulness–based stress reduction instructors.

Source: Calm

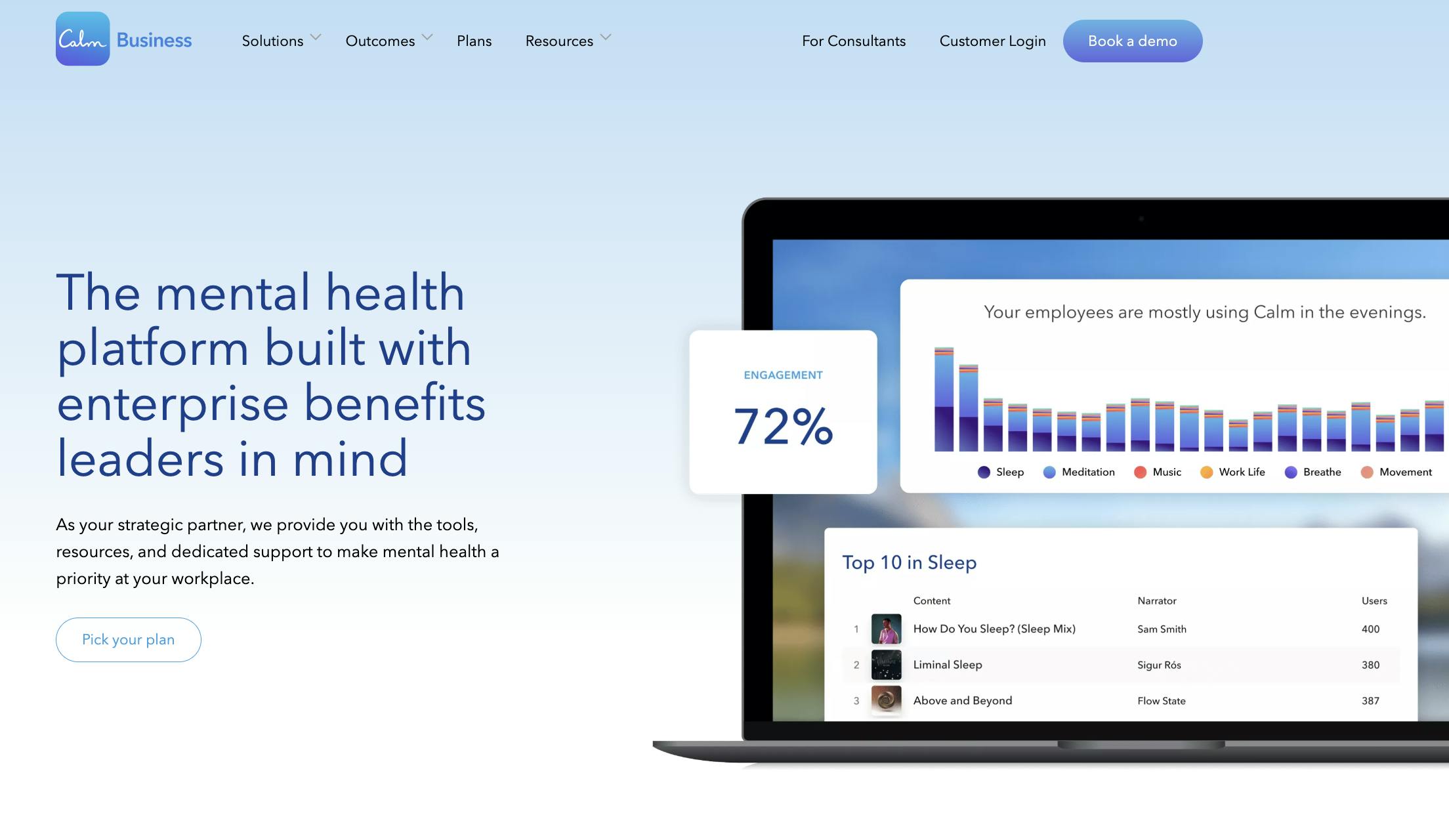

Calm Business also includes management resources which allow employers to track user engagement and relevant trends. The company-wide insights and analytics allows employers to view aggregated, de-identified data to understand engagement, while real-time anonymous feedback allows businesses to hear about employees’ experiences with Calm and how it is impacting their mental wellness. Employers can customize and filter on data on metrics such as team, location, function, and more to uncover unique trends.

Source: Calm

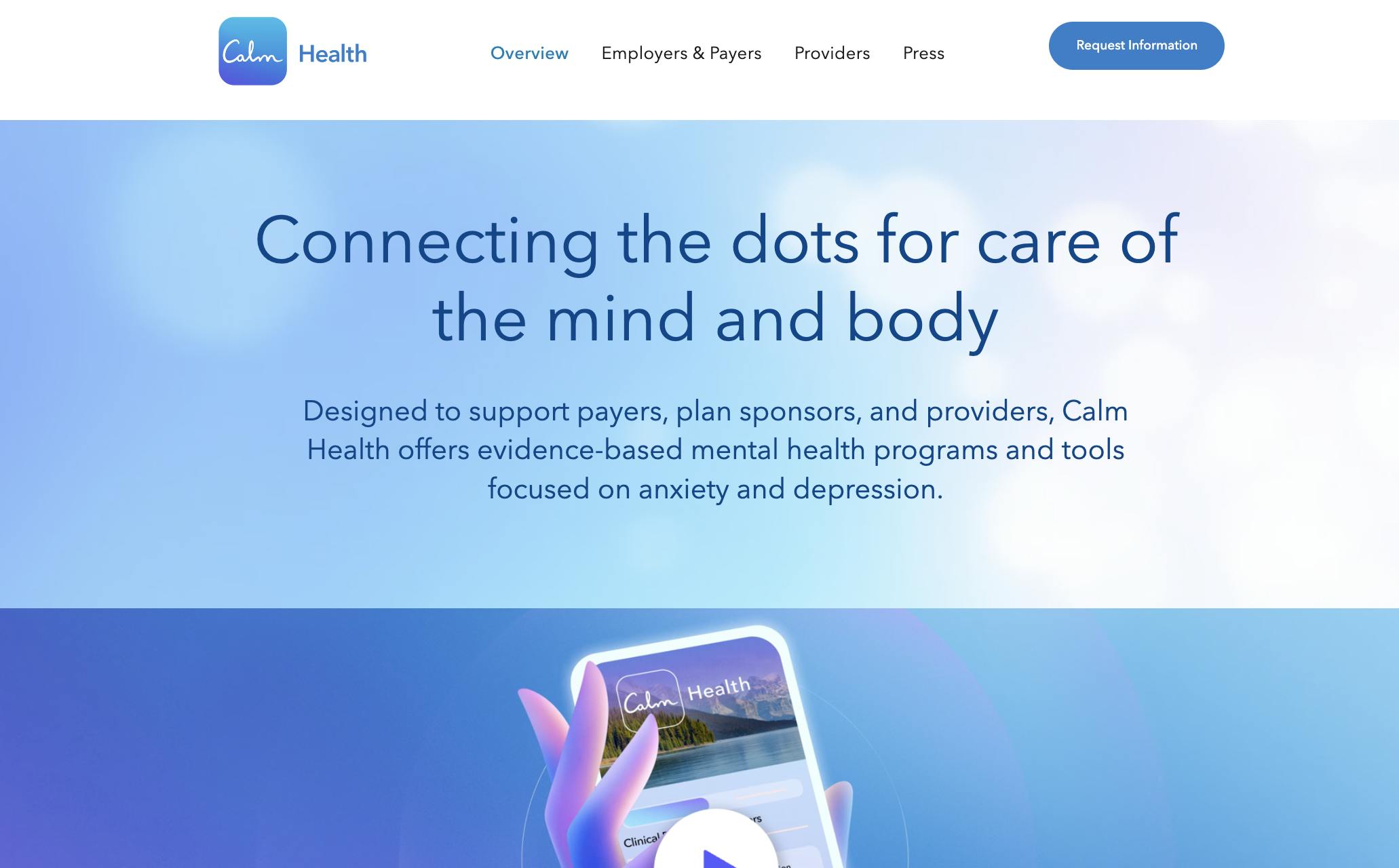

Calm Health

Calm Health is the newest pillar of Calm, announced in late 2022. This is Calm’s first foray beyond mental wellness and sleep into clinical healthcare. Offered through payers, providers, and self-insured employers, Calm Health includes condition-specific programs designed to “bridge the gap between mental and physical healthcare.” Calm acquired Ripple Health, a company dedicated to connecting users with proper healthcare options, in early 2022, with the intent of using its technology to offer support to patients by providing them with clinical healthcare options for problems like anxiety and depression.

Calm Health allows users to self screen for anxiety and depression via a dynamic assessment that uses GAD-7 and PHQ-9 question sets. Based on the severity of symptoms, Calm Health’s assessment either recommends the Calm app, Calm Health, or partner care. The app allows users to set goals, track medications and side effects, and easily share information with providers. The app also enables users to enter data to better track their wellbeing.

Source: Calm

Market

Customer

Calm’s ideal customer profile ranges from regular users looking for mental wellness support to employers and employees. Calm’s app offers content for both adults and children. Calm Business offers solutions for employers to analyze employee usage of Calm, as well as Premium content from the app for employees. Calm’s business clients include notable companies such as McDonalds, Time, and CapitalOne among more than 3K organizations. Lastly, Calm Health is a solution for payers, providers, and self-insured employers.

Market Size

The global mental health and wellness market was valued at $5.2 billion in 2022 and is projected to reach $17.5 billion by 2030. It is expected to expand at a CAGR of 16.5% from 2023 to 2030. In 2021, the mental health and wellness app market size was $1.6 billion. Mental health and wellness app market growth follows the trend of increased mental illness among global populations, with depressive symptoms growing globally by 28% during the COVID-19 pandemic.

Competition

Headspace

Headspace was founded in 2010. It is a digital health platform that provides guided meditation sessions and mindfulness training and has raised $215 million in funding. Headspace is Calm’s largest competitor. In 2017, Headspace had already achieved $70 million of funding to Calm’s $1.5 million at the time. However, Calm was the first to reach a valuation that exceeded $1 billion. Calm and Headspace held 70% of the mental wellness app market share as of 2020.

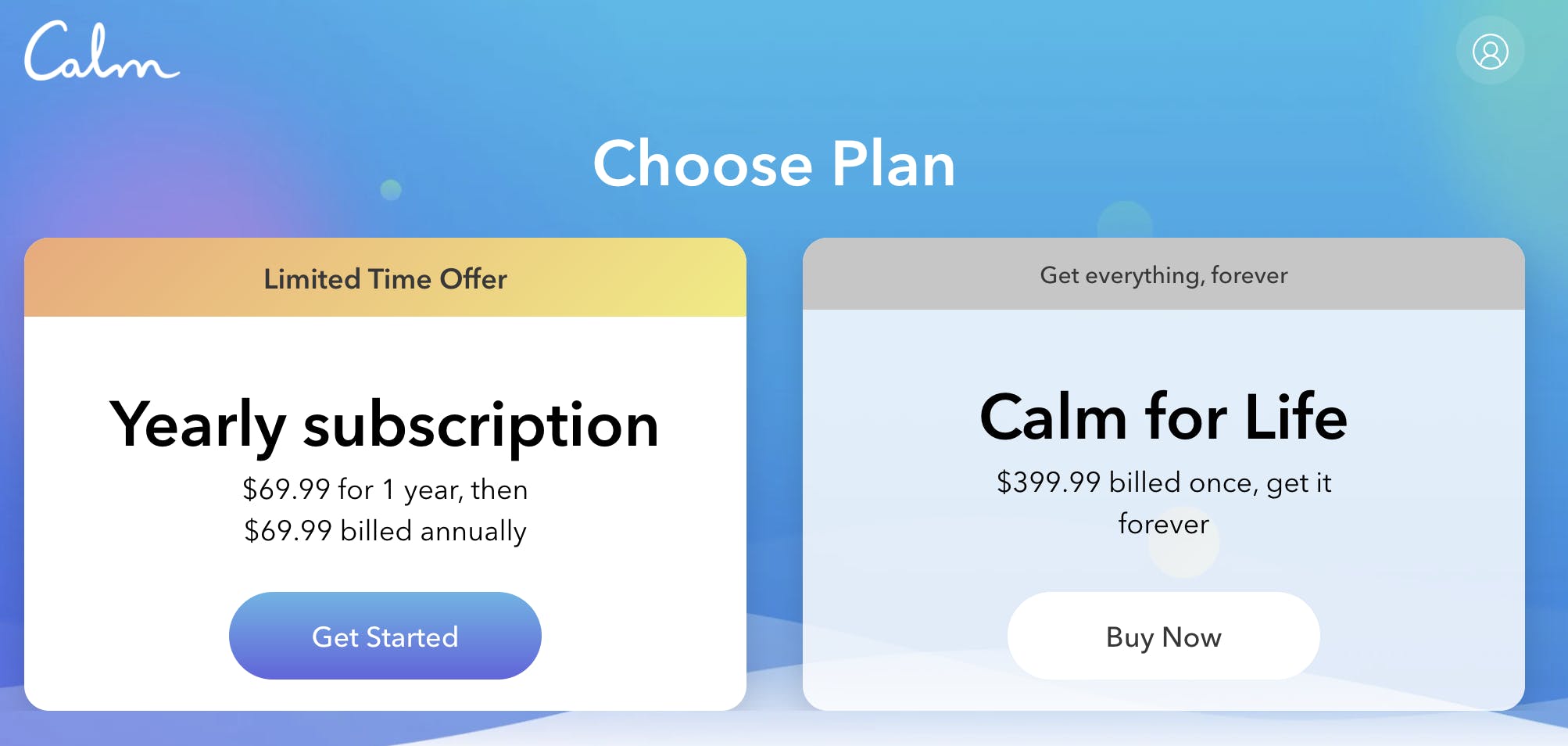

When it comes to pricing, Calm offers a yearly subscription of $69.99 or a lifetime subscription of $399.99 billed once. By comparison, Headspace offers a subscription at $69.99 per year with 14 days free, or a monthly billing of $12.99 per month with 7 days free. Headspace’s pricing is therefore slightly lower cost, and Headspace also offers a monthly option whereas Calm does not. Headspace, however, does not offer free content like Calm does. One assessment rates Headspace as slightly better when it comes to privacy and security compared to Calm.

Another assessment sees Headspace as better for beginners due to its simplicity. Headspace also has graphics and the ability to add friends. Both apps include parallel features, such as meditation, sleep, movement, and focus. Calm, however, has a few additional offerings, including its wisdom section that includes a Masterclass series with professional or in-depth guidance for users, as well as its music section with plenty of options and celebrity appearances. Headspace for Work parallels Calm Business with premium offerings for employees and engagement tools.

In 2021, Headspace merged with Ginger, an on-demand mental health service provider, to create Headspace Health. Headspace Health provides mental wellness resources as well as clinical care, similar to Calm Health. Headspace Health had a head start on Calm with its clinical offerings of one-on-one mental health coaching, therapy, psychiatry, and self-guided care, all rolled into one employee assistance program (EAP). Headspace also uses machine learning to analyze user behavior.

Overall, Calm has a larger range of product offerings when compared to Headspace and both companies have similar product suites. Calm is more robust and suited for users who want to access a larger amount of features and are more experienced. Headspace may be best for users who prefer a more structured approach.

Lyra Health

Lyra Health is a B2B mental health service that helps companies improve access to effective, high-quality mental health care for their employees. Since Calm has now expanded into the B2B mental health care space, companies like Lyra Health directly compete as EAPs or EAP alternatives. It was founded in 2015 and has raised $910 million in total funding.

More than 300 companies work with Lyra Health to offer mental health benefits to their employees, including Meta, Pinterest, and Starbucks, giving more than 13 million people access to care. Lyra supports in-person, virtual, and self-guided care, and Lyra Health focuses more on behavioral health or other forms of therapy, whereas Calm has historically focused on mental fitness and wellness. However, with Calm Health and its venture into clinical care, both of their products and approaches may converge.

Modern Health

Modern Health is a mental well-being platform enabling companies to offer therapy, coaching, and self-guided courses to employees. The platform combines a WHO well-being assessment to help triage users, self-service wellness kits, a network of certified coaches, and licensed therapists, and its digitized care offerings are meant to increase the accessibility of mental health services.

Modern Health was founded in 2017 and has raised $170 million in funding. Modern Health offers products like a workplace insights hub, one-on-one care, self-guided care, and “Circles” community care, which is something that sets Modern Health apart from Calm. Modern Health is more established in the B2B mental health care market than Calm Health, which is just getting established in 2023, but Calm also retains quite a bit of the market share for mental wellness apps, so it might be a more popular choice for employers and employees.

Talkspace

Talkspace is an online therapy platform that connects users to licensed therapists in their state via text, audio, and video messaging and live video chats. The company offers a variety of therapy services, including individual therapy, couples therapy, teen therapy, and psychiatry. It was founded in 2012 and went public via SPAC in June 2021 in a $1.4 billion deal, but its market cap as of August 2023 had declined to just $254.8 million.

Business Model

Calm operates on a freemium model, and pricing varies between its Calm App and Calm Business offerings. The Calm App offers a seven-day free trial, and then charges either $69.99 a year, or offers a $399.99 lifetime subscription. This includes all audio and visual features available through the app or website.

Source: Calm

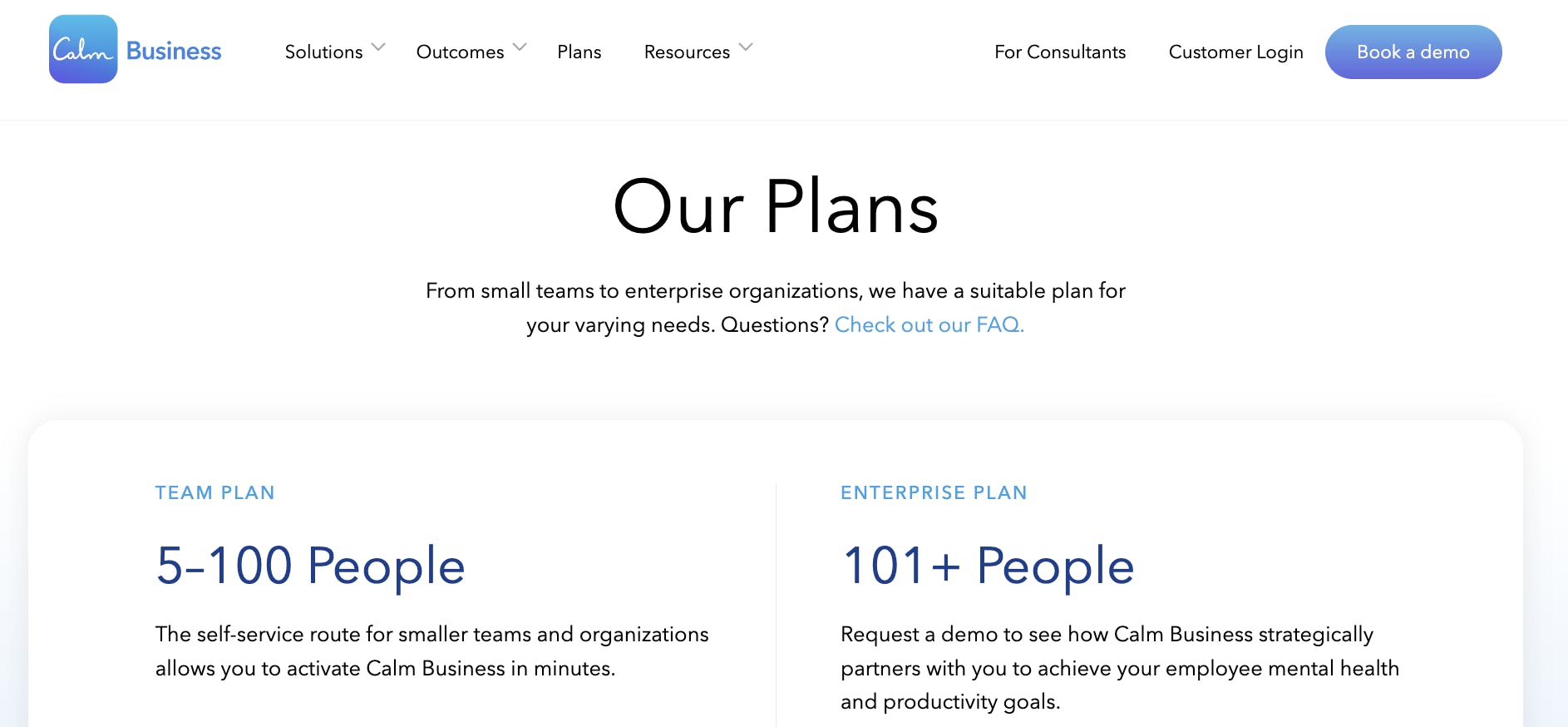

Calm Business has two plans for smaller teams of 5-100 employees or enterprises with over 100 employees. The team plan subscription per employee decreases with more employees, ranging from a rate of $57.80 per user in a five employee company (totaling $289 per year) to $30.80 per user in a 100 employee company (totaling $3k per year). The enterprise plan has pricing details available upon request.

Source: Calm

Traction

In 2019 Calm announced it had hit ~$150 million ARR, which grew to an estimated $500 million in 2021. As of 2022, Calm was seeing 66% year-over-year ARR growth. Calm surpassed 100 million downloads as of August 2021. As of 2022, Calm had 4 million paid subscribers, and as of 2023, Calm Business has over 3K customers and provides its services to 20 million workers.

In 2022, Calm laid off 20% of its staff due to the economic environment, with a large part of the layoffs affecting its marketing department. Despite this, Calm’s revenue was higher than ever in 2022. Although demand and downloads declined since their peak during the COVID-19 pandemic, revenue per download increased according to one estimate.

Valuation

Calm announced a $75 million Series C round led by Lightspeed Venture Partners in 2020, bringing its valuation to $2.2 billion and total funding to $218 million. This was following a $88 million Series B in 2019 which made Calm the first mental health startup to exceed $1 billion in valuation, raised at the same time that the company announced it was hitting ~$150 million ARR.

Key Opportunities

Clinical Mental Healthcare

Calm announced the launch of Calm Health in 2022, which is Calm’s first clinical mental health product. Calm Health builds off of Calm’s acquisition of Ripple Health Group and will use Ripple’s technology to connect users with different healthcare options, starting with support for patients suffering from anxiety or depression. Calm also plans to add mental health programs for people with physical conditions like hypertension, obesity, heart disease, and cancer. Choosing to explore clinical care could prove a unique differentiator in the mental health app market.

Celebrities & Partnerships

Throughout the course of its growth, Calm has focused on its marketing. Calm has mentioned that 50% of the time, it capitalizes upon current trends and viral hooks to capture attention and attract users. This includes examples like advertising Calm meditation on CNN during the 2020 presidential election, which allowed it to jump over 20 spots into first place on the app store. Calm has also enlisted the support of major celebrities like Kevin Hart and Harry Styles for different sessions. Utilizing celebrities for marketing is a popular trend for mental health apps, such as Michael Phelps being an ambassador for TalkSpace, but Calm has integrated them into its product offering which could continue to differentiate it from other offerings

Calm has also partnered with brands such as American Airlines, Uber, Apple, Fitbit, and Oculus to emphasize the vital role of mindfulness and self-care across industries. Through its partnership with Novotel hotels, Calm was introduced at 530 hotels across 60 countries. Bumble also partnered with Calm in 2020 to re-emphasize the role of mindfulness in relationships. Continuing to utilize such partnerships can help Calm cement its place in the market.

Artificial Intelligence

Calm already utilizes AI in certain parts of its business, such as using machine learning by feeding its user data, like behavioral and purchase data, directly a third-party ML system to analyze and run scenarios on. This impacts its user engagement and customer retention. Another way in which Calm is utilizing AI is through the creation of its Sleep Stories. ML also plays a role in user recommendations of features and categories, and Calm uses Amazon Personalize to do so. The recommendations generated from Amazon Personalize led to a 3.4% increase in daily mindfulness practice among Calm’s members. If Calm can continue to use AI through features or data analytics, it can remain on top of a potentially transformative technology shift.

Key Risks

Privacy and Security

An investigation from Mozilla studied 32 apps, including Calm, and found that mental health and prayer apps had the lowest security when it came to data privacy. While Calm does not sell data, it does collect information on actions, preferences, interests, browsing behavior, and more to target users with ads and personalized recommendations. While this sort of data collection isn’t specific to Calm and has become a larger issue to many consumers, it’s something that many users can find disagreeable due to the vulnerable nature of information shared on mental health and wellness apps. As the number of available mental health apps on the app store continues to increase, users will be looking for new differentiating factors between competing companies, and privacy can become a deciding factor if this isn’t something Calm makes changes on.

Pricing

Calm introduced a family plan in 2021, allowing multiple users to share a subscription but keep information separate across accounts. It had mentioned this was a highly requested feature, indicating that pricing can be a blocker to Calm’s usage for many users. Subscription fatigue is growing among users across industries, and if consumers decide to cut costs, monthly or annual subscriptions are usually the first to do so. Additionally, if other apps begin to lower their subscription prices and Calm is unable to do so, it may not be able to compete in the market since subscriptions contribute to the majority of its monetization.

Summary

Mental health and wellness impact individuals across all global markets and industries while playing an important role in company productivity across the board. There are now a plethora of mental wellness apps in existence. Calm offers a robust and forward-thinking product suite for individuals and businesses and has a clinical health tie-in for its existing wellness resources. Calm includes products like meditation, sleep stories, music, and more, and has supplemented this offering with the chance for employers to offer this to their employees directly. Going forward, Calm will need to continue to meet the basic needs of users while differentiating from other mental health companies in the oversaturated market in order to hold its current position.