Thesis

In 2017, 10.7% of people worldwide were living with a mental health disorder. In the United States, reportedly 1 in 5 adults deal with mental illness every year. With high reported rates of mental illness has come increased focus and awareness around mental health, but there is still a large gap in treatment; 28% of US adults afflicted by mental illness reported they were unable to receive the treatment they needed in 2023. The COVID-19 pandemic further intensified the mental health crisis, with nearly 40% of American adults reporting anxiety or depression symptoms in 2021 — a stark increase from just 10% in 2019.

As mental health awareness surged, so did the demand for accessible care. However, access to affordable care for mental health has been limited: 1 in 4 people struggled to find a therapist in their health plan’s network according to a 2015 survey. Many therapists decline to accept insurance due to low reimbursement rates. This results in therapists being drastically underpaid for the service they provide. Moreover, solo mental health practitioners find it time-consuming and complicated to process insurance claims. Without insurance coverage, people may have to pay thousands of dollars yearly for weekly therapy sessions. Scheduling can be a barrier to therapy, even when insurance or personal funds are available. Most therapists are only available during work hours; if an individual's job doesn't allow for regular appointments, therapy may not be possible.

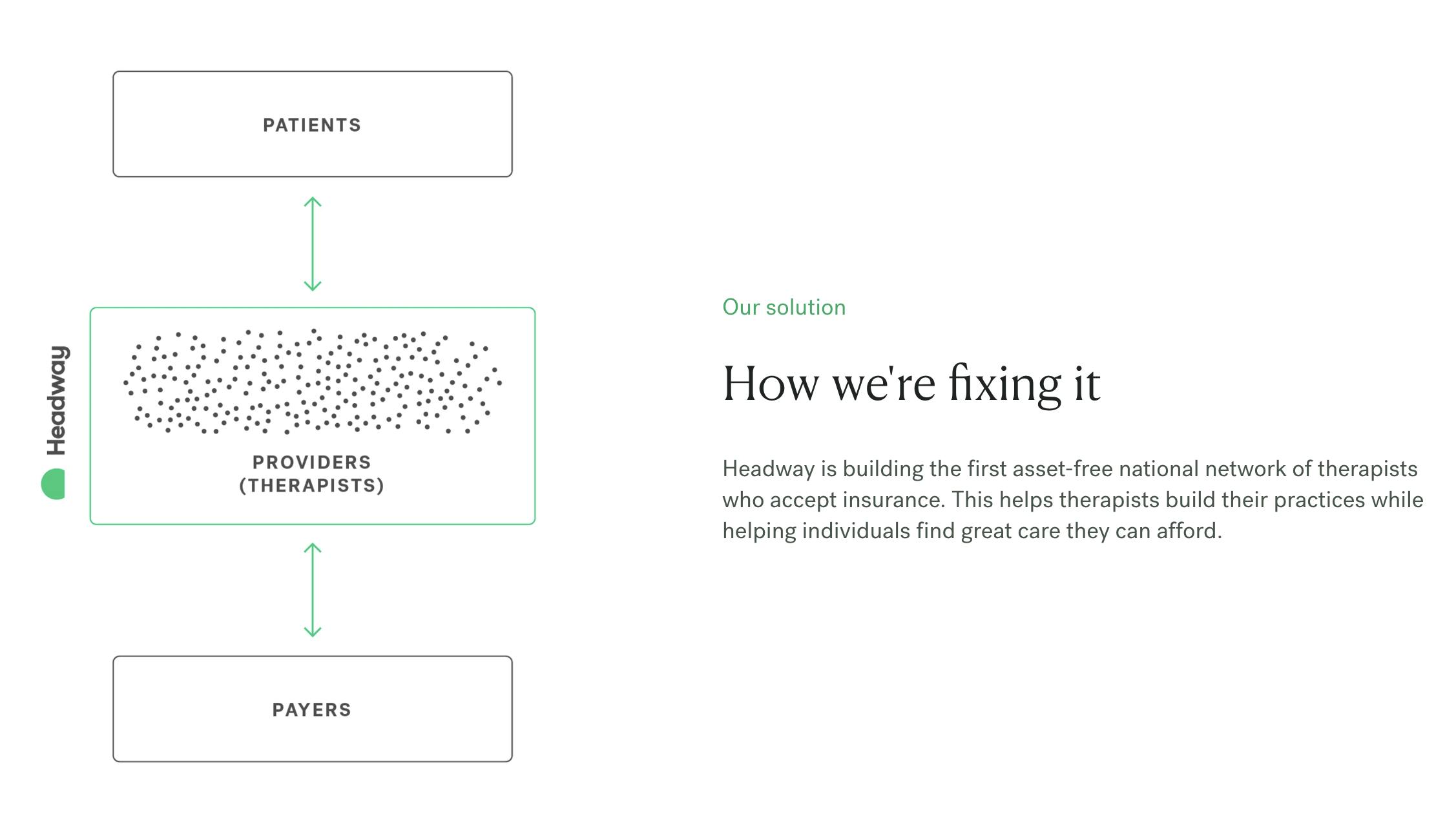

Headway has created a platform that connects patients, therapists, and insurance companies in the mental health ecosystem. Headway enables therapists to accept insurance coverage by offering claims management administrative support, payments, and scheduling. Headway improves the patient experience by allowing patients to search for therapists who best fit their needs, book appointments directly online, and get visibility into the costs they will be responsible for as part of their treatment. Insurance companies partner with Headway to increase access and quality for their health plan networks.

Founding Story

Headway was founded in April 2019 by Andrew Adams (co-founder/CEO), Jake Sussman (co-founder; left in 2022 to become an elementary school teacher), Dan Ross (Head of Ops; left in 2021 to join Benepass) and Kevin Chan (co-founder and Head of Engineering; left in 2021 to start Mayfair, a fintech company).

When Andrew Adams first moved to New York City from California in 2015, he struggled to find a therapist who would accept his insurance. Soon he realized he was not alone in this struggle. Frustrated by the process, he set out to build a platform that connects those seeking therapy with licensed therapists who would accept their insurance, with the mission of building a new mental healthcare system focusing on access and affordability.

Product

Headway is a marketplace connecting three stakeholders: patients, providers, and payers.

Source: Headway

Patients

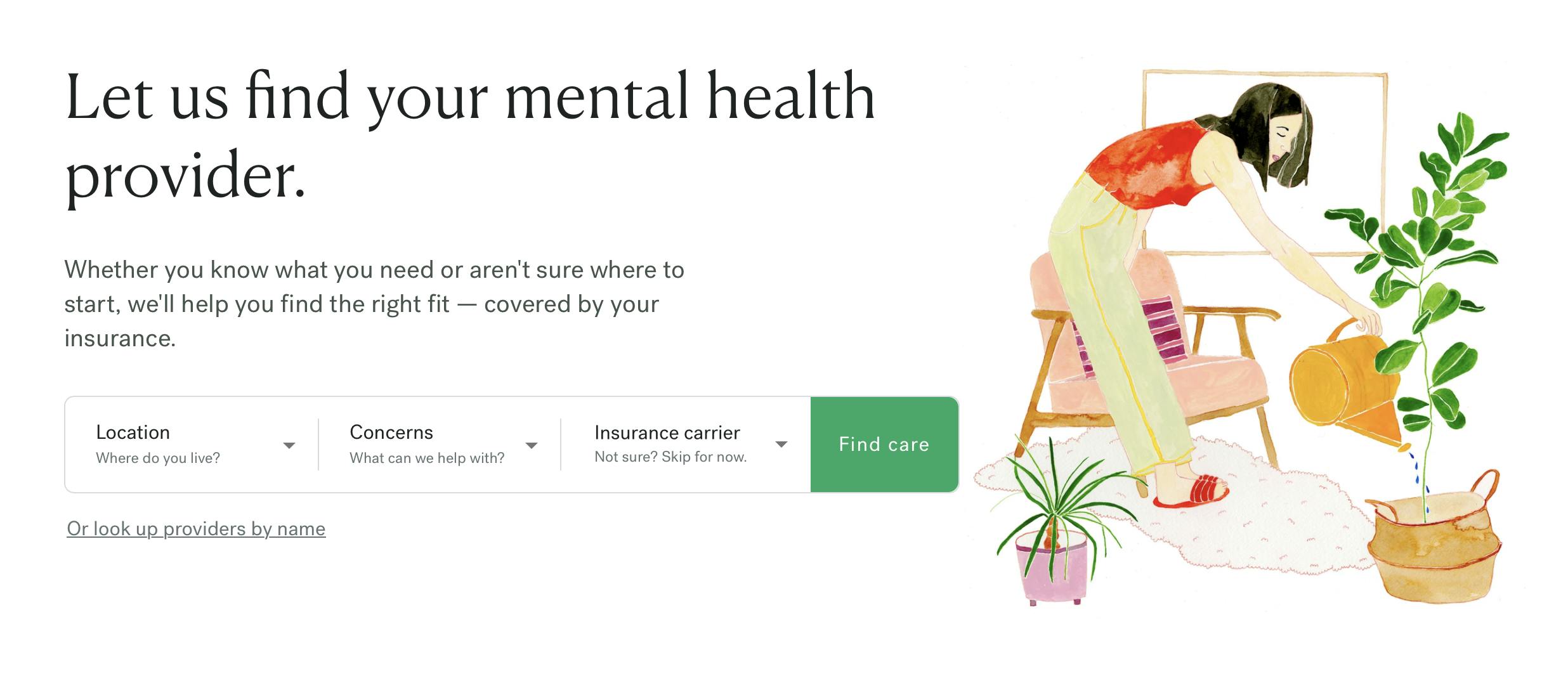

Patients can use the platform to book appointments with mental health professionals who accept their insurance and can offer care at a low cost to the patients. When potential patients seeking care for their mental health land on Headway’s website, it is a streamlined experience for them to make their first appointment.

Patients can select their location, specific concerns, and insurance carrier. They can see a list of providers who practice in their area and accept their insurance and their earliest availability for a virtual or in-person appointment. The list of providers can be filtered by specialty, location, gender, language, and ethnicity. Scheduling and payment are handled at this stage, with a transparent copay upfront, usually less than $30, compared to the out-of-pocket cost, often greater than $200 without insurance coverage.

Users can check the relevant coverage information from their insurance on the website before scheduling with a provider. Users do not pay a fee to use the platform and only pay the copay. Since Headway also handles scheduling, the time from a patient seeking care to their first appointment can be as little as 48 hours for those who need imminent care, with an average of fewer than six days after online booking. Headway offers access to a wide range of mental health professionals, such as psychiatrists, psychologists, therapists, counselors, and social workers, providing services from specialized therapy addressing specific conditions like ADHD to prescription medications.

Source: Headway

Providers

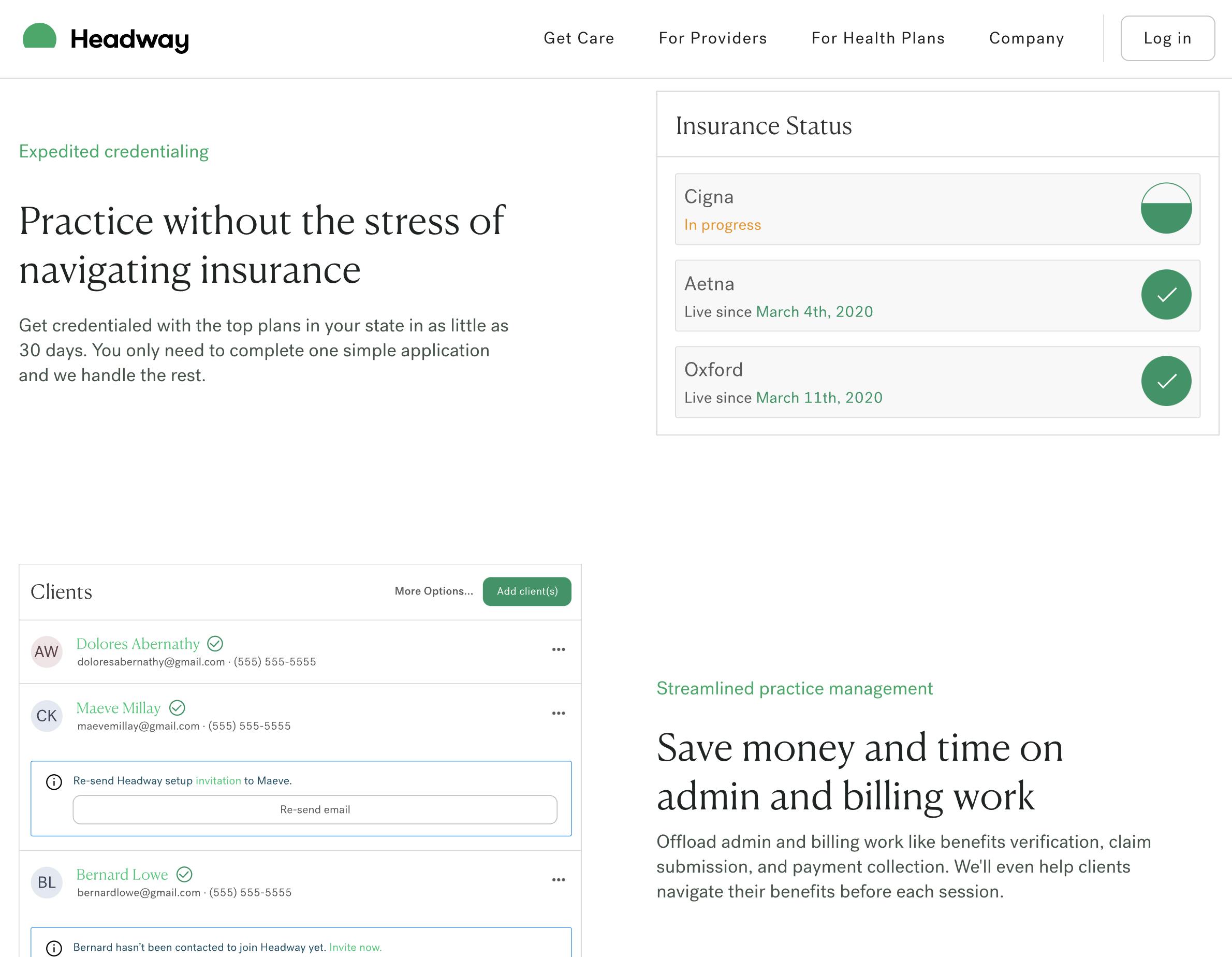

Headway takes care of the administrative burden of working with insurance companies so mental health providers can focus on helping their patients and growing their practices. Headway handles credentialing, claim submission, payments, benefits verification, client communications, and more on healthcare providers’ behalf.

Providers get guaranteed biweekly payments from Headway. Headway enables them to get credentialed with the top plans in their state in as little as 30 days. To apply to work with Headway, providers have to speak with one of their Practice Consultants to see if their practice is a good fit for Headway and complete an online form. Within 4-8 weeks, providers can start to use Headway to accept insurance clients. Headway also helps providers grow their practice. Features like SMS reminders help providers stay on top of their schedules, leading to a 50% decrease in missed appointments. Headway has partnered with organizations like Violet to empower providers to build expertise in specialty fields, such as catering to the LGBTQ population.

Source: Headway

Insurance companies

Headway works with insurance companies like Aetna, Anthem Blue Cross and Blue Shield, Cigna, United Healthcare, Oxford, and Oscar. Headway allows previously out-of-network providers to open in-network availability. This makes it easier for insurance companies to expand their coverage and increase access to mental healthcare.

Market

Customer

Headway serves patients, providers, and payers in the mental health ecosystem. Headway helps patients find mental health services that match their insurance plans and requirements. It also helps mental health providers process insurance claims easily and grow their practices. Finally, it helps insurance companies expand their coverage and increase access.

Market Size

The US behavioral health market was valued at $76.4 billion in 2021 and is projected to grow to $105.1 billion by 2029 at a CAGR of 4%. The COVID-19 pandemic further intensified the mental health crisis, with nearly 40% of American adults reporting anxiety or depression symptoms in 2021 — a stark increase from just 10% in 2019. The normalization of virtual interactions during the pandemic opened up the possibilities for telehealth services, which expanded the market's geographical access to the previously unavailable rural areas.

Competition

Alma: Founded in 2015, Alma began as an in-person co-working space for providers. It has since shifted to providing subscription-based services that help providers grow their private practices. By signing up for Alma, providers gain access to various benefits, including credentialing to accept insurance, billing and scheduling tools, marketing support, and a community of providers for support. This contrasts with Headway, which offers overhead management services, especially those related to insurance claims, to its providers for free. The subscription model allows Alma to accept cash-pay clients and out-of-network patients, giving them the flexibility to serve a broader client base. Alma is available in 20 US states with limited availability in the remaining states and has 8K providers on its platform as of August 2022. Alma raised a $130 million Series D round in August 2022, led by Thoma Bravo, which values the company at about $800 million with $220.5 million in total funding.

Sondermind: Founded in 2014, like Headway, Sondermind is a three-way marketplace of patients, providers, and payors. Unlike Headway, it supports the payment of services through both insurance and EAP (Employee Assistance Program). An EAP is a program offered by an employer that provides employees with confidential, short-term counseling services for personal or work-related issues. EAPs often offer a limited number of free counseling sessions and can provide referrals to mental health providers outside the EAP network if additional services are needed, which increases the top of the funnel of customer acquisition for Sondermind. In addition to the support of EAP, Sondermind differentiates itself with its focus on personalized care. This manifests as patient-provider matching based on a questionnaire at the beginning of a patient’s journey, backed by the acquisition of companies like Total Brain, a neuroscience company with the largest standardized brain database, and Qntfy, a machine learning company that aims to gather and analyze biometric data. It has raised $183 million in total funding, with its $150 million Series C round having been led by Drive Capital and Premji Invest in July 2021.

Modern Health: Modern Health is a mental well-being platform enabling companies to offer therapy, coaching, and self-guided courses to employees. The platform combines a WHO well-being assessment to help triage users, self-service wellness kits, a network of certified coaches, and licensed therapists — all available in 50+ languages. Modern Health's most recent funding round was a $74 million Series D round that closed in September 2021. The round was led by Founders Fund with participation from Lachy Groom. This latest raise brought Modern Health’s total funding to more than $170 million and its valuation to $1.2 billion.

Lyra Health: Lyra Health helps companies improve access to effective, high-quality mental health care for their employees. It was founded in 2015 and has raised $910 million in funding. More than 300 companies work with Lyra Health to offer mental health benefits to their employees, including Meta, Pinterest, and Starbucks, giving more than 13 million people access to care. Like Modern Health, it supports in-person, virtual, and self-guided care. in January 2022, Lyra Health acquired ICAS World, a global employee assistance program, to expand its business globally.

Ginger: Ginger is an on-demand mental health platform providing individuals and organizations with virtual therapy, coaching, and psychiatry services. The company was founded in 2011 and has raised over $220 million in funding. Ginger offers a comprehensive mental health platform that is strictly virtual, unlike Headway which supports in-person appointments. Ginger merged with direct-to-consumer mental health provider Headspace in 2021. The merge led to the creation of Headspace Health, which combines Headspace's meditation and mindfulness offerings with Ginger's text-based coaching, therapy, and psychiatry services and streamlines the administrative process for employers

Business Model

Headway doesn’t charge patients for its search service, nor does it charge therapists. In Headway’s words, “Headway is paid by insurance companies, so it’s free for you to use.” It takes a commission from insurance providers, which pay it to enable wider access to more therapists for their policies. For each appointment, Headway pays providers upfront and takes a cut of the reimbursements made by insurance companies. The exact terms of the revenue share between Headway and providers depend on the contracts specific to the insurance companies and the geography, and these terms are not publicly available.

Traction

With a nationwide increase in attention to mental health issues during the COVID-19 pandemic, Headway’s revenue grew ninefold in 2020. As of May 2021, It had over 2K patients joining the platform each month and had helped facilitate 300K appointments so far in that year, with an average of 30K appointments each month.

In 2022, it brought on 13K new mental health providers, achieving a total of 22K providers on-platform. In 2022, it also signed 7 new partnerships with health insurance plans and various startups, such as Zocdoc, the Blue Shield of North Carolina, and CareFirst to expand its network of payors. It ended 2022 with 300K monthly appointments held, up from 70K in January 2022. In 2022, Headway providers delivered more than 1.8 million hours of care. Headway said patients have an 85% second appointment retention rate with their chosen provider in 2022. Headway is available in 16 states and the District of Columbia, including California, Texas, Florida, and New York.

Valuation

As of February 2023, Headway was reportedly in talks to raise about a $100 million funding round from Spark Capital, Thrive Capital, Andreessen Horowitz and Accel at a valuation of over $1 billion. The company announced $70 million in a Series B funding round led by Andreessen Horowitz in May 2021.

Key Opportunities

Provider-focused Approach

Headway’s strategic focus on increasing the supply of providers has proven successful, leading to 22K providers on its platform, compared to 8K on its other provider-focused competitor like Alma. Providers are incentivized to move to and stay on Headway because the startup handles overhead management and insurance reimbursement on their behalf for free, in contrast with having to pay for subscriptions for similar services. This model leads to better provider rates than negotiated individually and potentially higher payments when patients are covered by insurance rather than paying cash.

By focusing on the needs of providers, Headway can attract more professionals to its platform, expanding the supply of available mental health services, which is crucial as long as the lack of providers remains the bottleneck of the ecosystem. Moreover, providers can expand their private practices with Headway rather than depending on temporary contracts for an EAP (employee assistance program). While an EAP may be a convenient short-term benefit offering for employers, it does not necessarily facilitate a sustainable patient-provider relationship that strengthens patient care compared to insurance-based solutions. Including insurance companies in Headway’s model allows patients and providers to decide how long they need care. Headway’s investments in providers’ growth of expertise and the flexibility in care terms is intended to boost their practice and put patients and providers first. Continuing to do so could help Headway to stand out to its core customers.

Expanding Access to Underserved Populations

A sizable population of Americans with health insurance have employers whose most imminent considerations do not include robust mental health services for their employees, such as gig economy workers and those covered by Medicare and Medicaid. Headway has a significant opportunity to attract a broader customer base by extending its services to individuals who often face hurdles in accessing mental health care.

Access to care for these underserved populations can result in considerable health benefits for the individuals and potential cost savings for the healthcare system, because providing mental health services to these individuals can help prevent more serious mental health conditions down the line, reduce emergency care usage, and enhance overall well-being and productivity. By addressing these mental health care coverage gaps, Headway can differentiate itself in the competitive mental health market. By demonstrating a commitment to inclusivity and accessibility, the company can potentially attract new customers and build up its brand through acquiring a positive reputation.

Key Risks

Crowded Geographical Market

As a relatively late entrant in the market, Headway faces strong competition from established players like Lyra Health and Ginger, which already have national coverage. Furthermore, without non-compete contracts, many mental health care providers currently work for multiple platforms in addition to Headway, such as SonderMind, Betterhelp, and Alma, while maintaining private cash-based practices. Competing for the same pool of therapists and navigating the relationship-based nature of the industry can be challenging as Headway looks to grow its geographic coverage. Meanwhile, multi-tenanting by providers is another source of key risk that most marketplaces have to deal with.

Insufficient Product Differentiation

The mental health care startup space is crowded geographically. It is also crowded at a higher level, with several existing players and entrants from both the employer-based angle and the D2C angle. There are several reasons why this is the case. First, the idea of widening access to mental health care through insurance coverage is noble but relatively easy to encounter for anyone who has had personal experience looking for a therapist with little barrier to entry. The added difficulty to differentiation is inadequate methodology for measuring the quality of service. How does a user know which service provider to choose when they all advertise low copay and satisfied patients? Without a standard procedure to quantify the quality of mental health care, it is difficult for a user to compare the services except for broader business metrics like the number of providers available on the platform and positive NPS scores.

Employer partnership-based competitors may be better positioned to address such issues since they shift the burden of choice to the employers with a clear evaluation goal: business impact. Competitors like Lyra Health have been able to focus on gathering data about the impact of their mental health care on the employees’ productivity and overall healthcare claims cost, which makes it easier to onboard the employers and thus broaden the reach of these companies at the top of the customer acquisition funnel. Furthermore, there is high activation energy needed for the potential users because many individuals might not realize they could benefit from therapy until it becomes more accessible as a benefit included in their employment. Headway doesn't solve the problem of individuals being unable to self-diagnose their need for therapy, while employer-based competitors have a higher chance of reaching them, leading to a higher customer acquisition cost for Headway.

Summary

Headway, a mental health care startup founded in 2019, aims to bridge the gap between mental health providers and insured patients by acting as a three-way marketplace for patients, providers, and payors. Currently available in 16 states and the District of Columbia, Headway supports a network of 22K providers and has facilitated nearly 1.9 million hours of care by the end of 2022. The US Behavioral Health Market is expected to grow from $76.4 billion in 2021 to $105.1 billion by 2029. Headway competes with companies like Lyra Health, Ginger, Alma, and Sondermind, which offer mental health services through employer-based programs or similar three-way marketplaces.

Despite strong competition, Headway's unique approach to reimbursement, with a focus on the needs of providers, offers a potential competitive advantage. However, the company faces challenges in differentiating itself meaningfully in a crowded market and navigating geographic expansion. In February 2023, Headway was reportedly seeking $100 million in funding at a valuation of over $1 billion, less than two years after raising $70 million in a Series B round led by Andreessen Horowitz in May 2021. With the growing market for mental health services and the opportunity to expand its reach, Headway's future success will depend on its ability to reach those unable to access care through employers.