Thesis

In the early days of ecommerce in the 1990s, purchasing an item online was a fragmented process. It took days for transactions to be approved and for funds to be transferred. Yet, in 2023, payment infrastructure has evolved so that the process is nearly seamless. When a user buys an item, numerous processes interact in milliseconds to make a transaction possible. These innovations, powered by companies like Stripe and Checkout.com, have laid the groundwork for online payment infrastructure in the evolution of the digital payment market which was worth $6.8 trillion in 2021. To support the growing digital payment market, payment infrastructure has evolved to support multiple parties (acquirers, issuers, banks) communicating with each other in real-time to facilitate transactions between customers and merchants.

Although payment stacks have improved since the 1990s, most transactions are not yet digital; Stripe estimated that only 3% of total commerce occurred online in 2020. Despite the technological advancement of digital payment infrastructure, it remains difficult for merchants to integrate and connect with each layer of the payment stack. Consequently, processing payments remains a complicated task for small merchants. Not only do merchants have to interact and develop relationships with banks, but they also have to work with APIs, ensure compliance with PCI standards, and have in-house expertise to authorize a transaction. These complications have played a part in hindering the growth of online transactions and have contributed to $123 trillion being transacted via alternative methods each year.

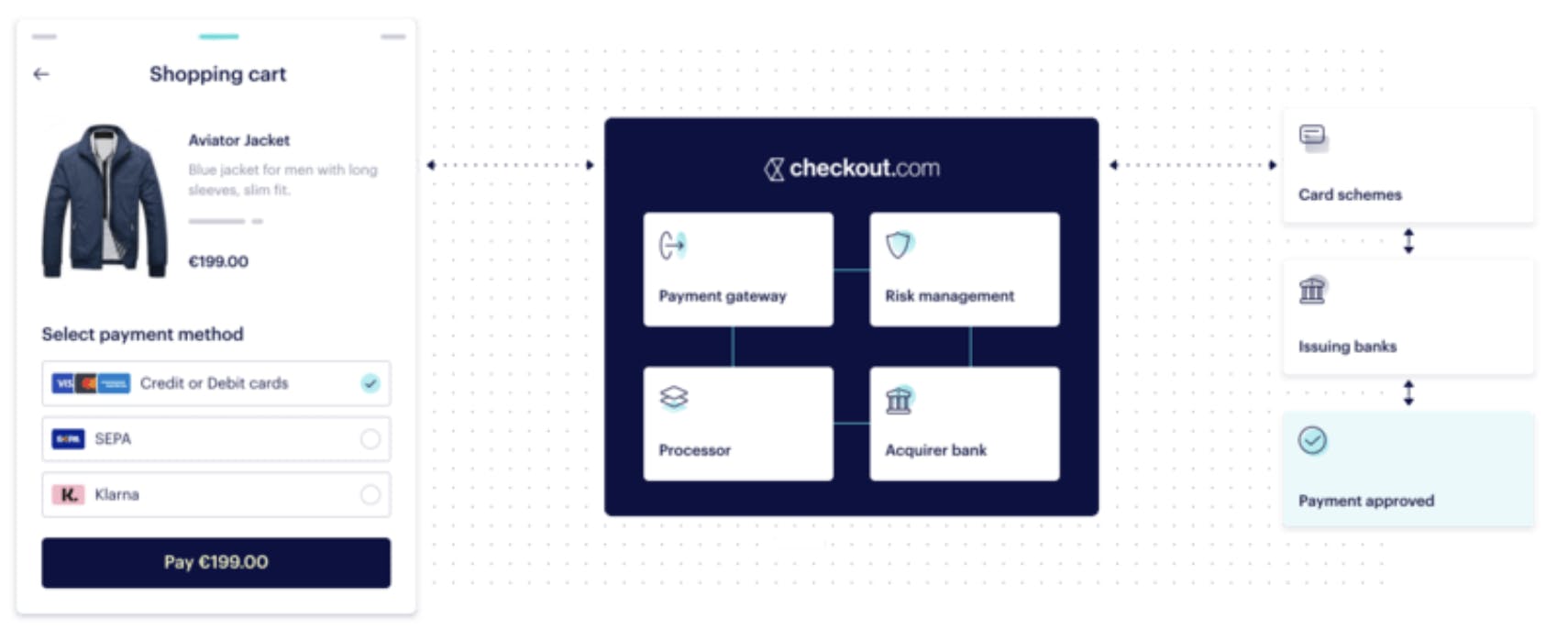

Companies such as Checkout.com aim to simplify the process of accepting digital payments through an end-to-end solution that handles identity verification, payment processing, risk management, card issuing, and payment routing. In short, Checkout.com helps merchants manage the acquiring and issuing segments of the payment stack. As a result, instead of having to independently develop banking relationships, merchants can integrate Checkout.com’s APIs into their products and accept payments immediately, from customers worldwide. This simplification can enable more merchants to accept digital payments, increasing the ratio of online transactions to alternative methods.

Founding Story

Checkout.com was founded by Guillaume Pousaz (CEO) in 2012. After dropping out of college in 2005, Pousaz moved to California to pursue his passion for surfing. After running out of money, Pousaz began working at International Payments Consultants (IPC). IPC was Pousaz’s first role in the payments sector, and it was there that he realized that ecommerce would transform the retail and consumer experience.

Pousaz’s role at IPC inspired an interest in the payment industry that prompted him to build his first startup, NetMerchant, in 2007. The company’s premise was to help American firms conduct business in foreign currencies, enabling them to benefit from the expansion of global transactions. The startup operated until 2009 when Pousaz decided to acquire SMS Pay for $300K. Shortly after, Pousaz founded Opus Payments, a Singapore-based startup, that allowed businesses operating in Hong Kong to accept global payments.

During Pousaz’s startup years, he developed a niche skill in payments. Additionally, he came to understand the power of the internet and the impact that it could have on commerce. He identified a key issue: processing payments on a global scale was difficult for both buyers and sellers. To solve the issue, he founded Checkout.com with the goal of simplifying the online payment process for global ecommerce companies.

Pousaz bootstrapped Checkout.com until 2019. Instead of pursuing a growth-at-all-costs strategy, Pousaz aimed to increase revenue by 50% per year. This strategy enabled the company to operate for seven years without any funding. The company’s first round of funding, a Series A in February 2020, was Europe’s largest-ever funding round for an early-stage fintech company, raising $230 million at a $1 billion valuation.

As of September 2023, Guillaume Pousaz remains CEO of Checkout.com. In addition to Pousaz, the company has made several senior hires, including Chief Commercial Officer Bradley Riss, Chief Product Officer Meron Colbeci, and President and Chief Operations Officer Céline Dufétel.

Product

Checkout.com is a digital payments fintech company that provides businesses with solutions in both the acquiring and issuing segments of the payment stack. In the acquiring segment, it acts as an online payment gateway, an acquiring processor, and a risk engine. In March 2023, Checkout.com announced its card-issuing business, where it acts as a card issuer, issuer processor, and card program manager. The company provides the underlying technology that enables merchants to receive and process payments for their products while also allowing merchants to issue cards to their customers to earn additional interchange revenue.

Source: Checkout.com

Payments

Checkout.com offers three payment-related products: payment processing, payouts, and card issuing. “Payment processing” enables businesses to accept debit and credit card purchases. “Payouts” enables businesses to send credits to bank accounts or to cards. “Card issuing” enables businesses to issue single-use or reloadable debit cards to their customers.

Payment Processing: Checkout.com’s payment processing product provides international coverage to allow companies to process payments in nearly 50 countries, over 150 currencies, and over 20 settlement currencies. Additionally, the company emphasizes local expertise to provide local payment methods and acquiring hubs to lower customer costs. Fraud detection is included within the payment processing solution to protect businesses without the need for additional integrations. Alongside these options, Checkout.com offers customers e-commerce integrations with partners including Shopify, PrestaShop, and WooCommerce.

Checkout.com offers two primary choices to integrate payment processing: frames and hosted payments. The primary difference between the two options is that frames is an iFrame gateway hosted by the client, whereas hosted payments are hosted by Checkout.com and the client sends a link to their customer to complete payment. This means that the frames integration puts the PCI-compliance responsibility on the client, whereas hosted payments puts the responsibility on Checkout.com. Both options offer software development kits (SDKs) to enable mobile payments.

Payouts: Checkout.com’s payouts solution enables businesses to send credits to bank accounts and cards. The company offers card payouts to clients in the UK, EU, and Singapore and bank payouts to clients in the UK and EU. Payouts can be sent to over 170 countries in over 100 currencies. To improve transparency, the payouts solution provides real-time transaction data and notifications of receipt. All payouts initiated by clients are screened against global sanctions and anti-money laundering regulation, ensuring compliance.

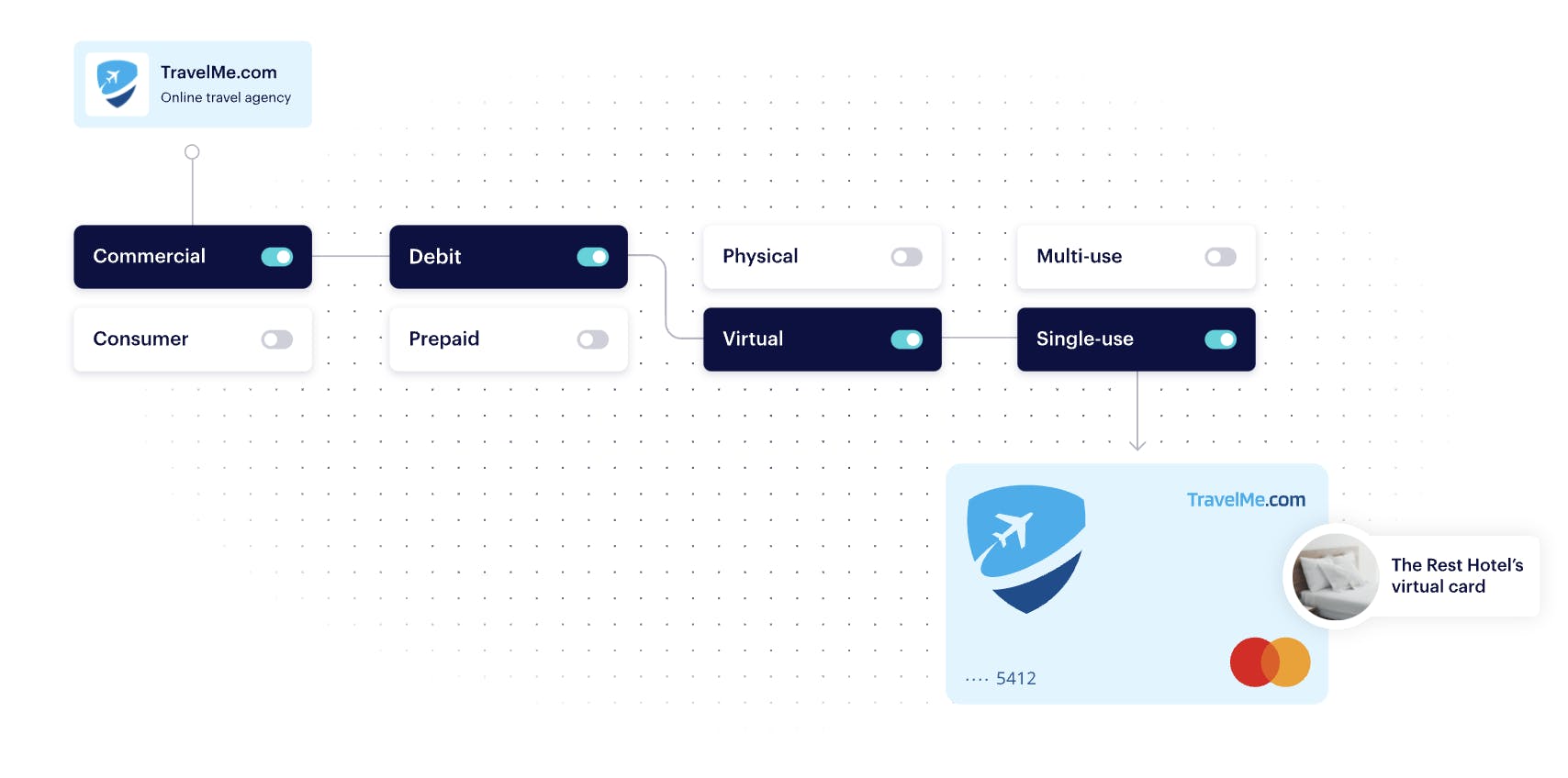

Card Issuing: Checkout.com’s card issuing solution, introduced in 2023, enables businesses to launch virtual or physical card programs. The solution supports single and multi-use virtual cards for online, offline, or in-app payments. All issued cards are compatible with digital wallets including Apple Pay and Google Pay. Further, companies can add personal branding to the issued cards. For physical card issuing, Checkout.com handles production, shipping, and fulfillment.

Source: Checkout.com

The card issuing API allows companies to utilize a real-time decision-making engine to approve and reject transactions upon request. Companies can choose to use a combination of Checkout.com’s card checks and spend controls to automate the management of authorization decisions, or they can manually approve them by receiving API requests. With predefined card checks and spending controls, companies can limit where the card is used.

Source: Checkout.com

Value-Added Services

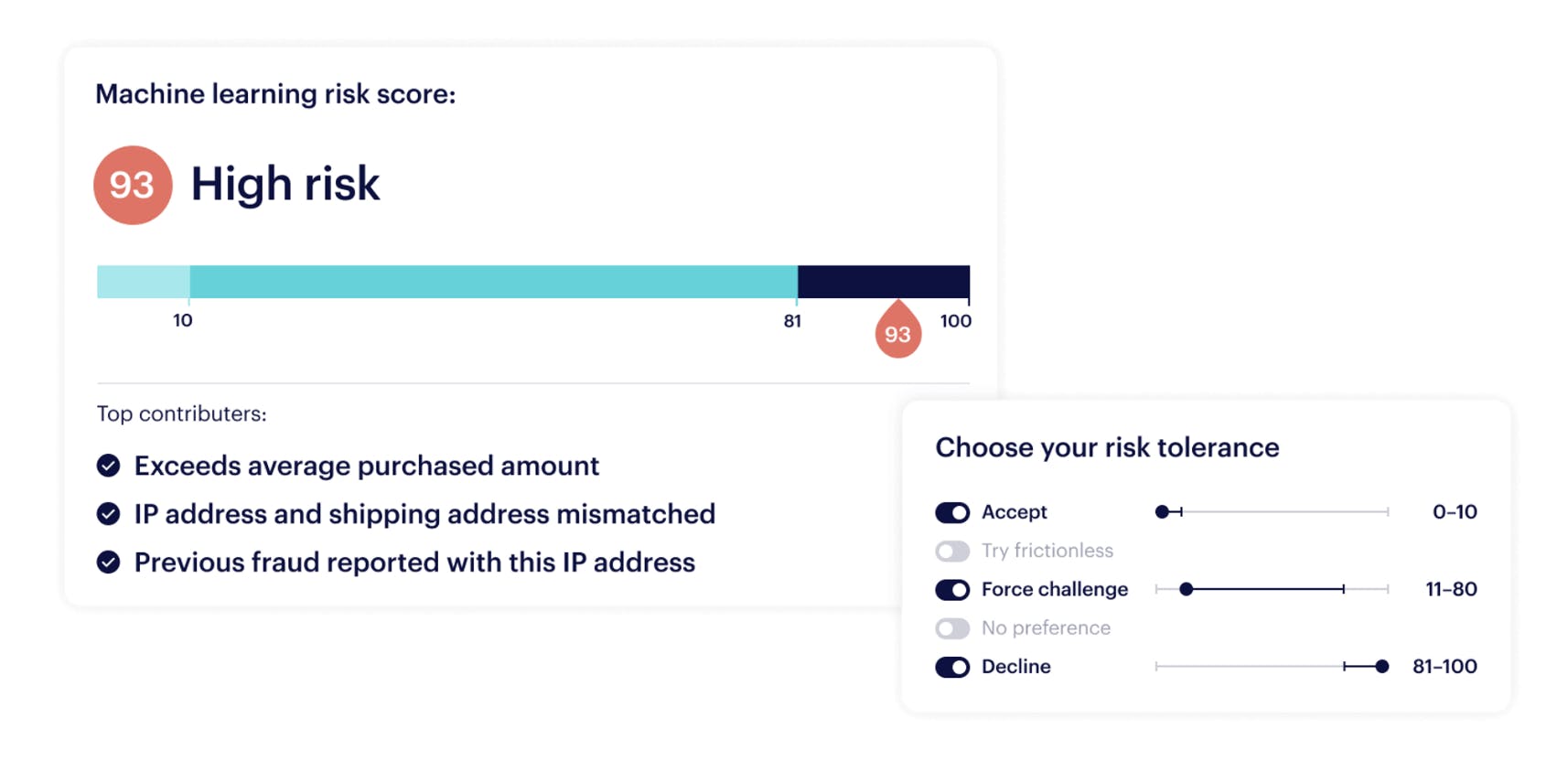

To accompany its payment solutions, Checkout.com offers additional services to help merchants integrate payments into their applications. The four key services Checkout.com provides are Fraud Detection, Authentication, Intelligent Acceptance, and Identity Verification.

Fraud Detection: Checkout.com’s fraud detection service enables customers to produce risk-scoring results by leveraging machine learning algorithms. These algorithms are trained on “billions of transactions from the biggest brands in the world.” With each algorithm that is deployed, companies can create custom rules to produce a weighted behavioral score. Alongside this, Checkout.com allows companies to add additional authentication to high-risk transactions using its integrated 3D Secure 2 Solution.

Source: Checkout.com

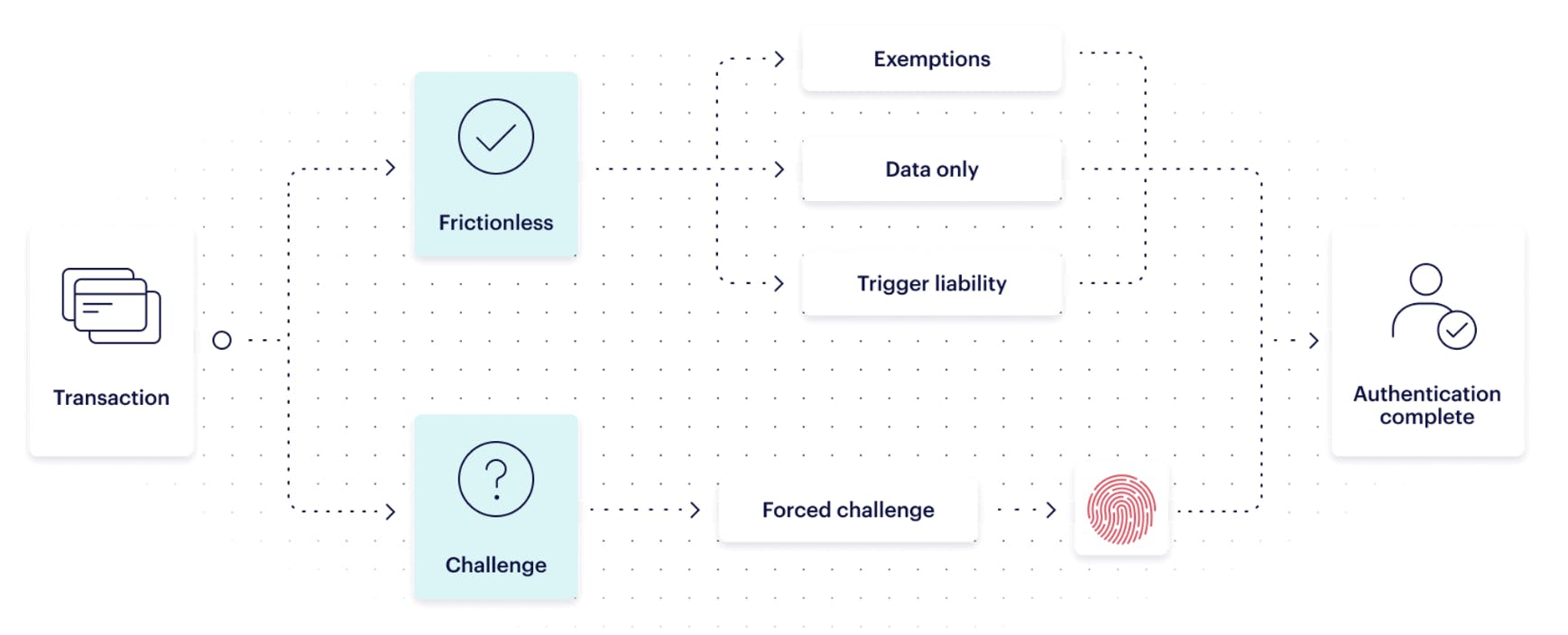

Authentication: Checkout.com offers two modes of authentication. The first option is a standalone product, while the second option is integrated within the Checkout.com platform. With the standalone product, authentication and authorization are handled separately, and companies can manage their own authentication needs across multiple acquirers. Companies also have the option of either a hosted or non-hosted presentation, and if they choose the latter, they have control over the authentication experience, including device fingerprinting, payment flow, and customization of the front end.

Further, the standalone product enables browser-based authentication on the web and mobile, as well as native mobile authentication via a mobile software development kit (SDK). With both the standalone and integrated product offering, Checkout.com leverages 3D Secure Authentication and supports PAN, Tokens, and Network Tokens.

Source: Checkout.com

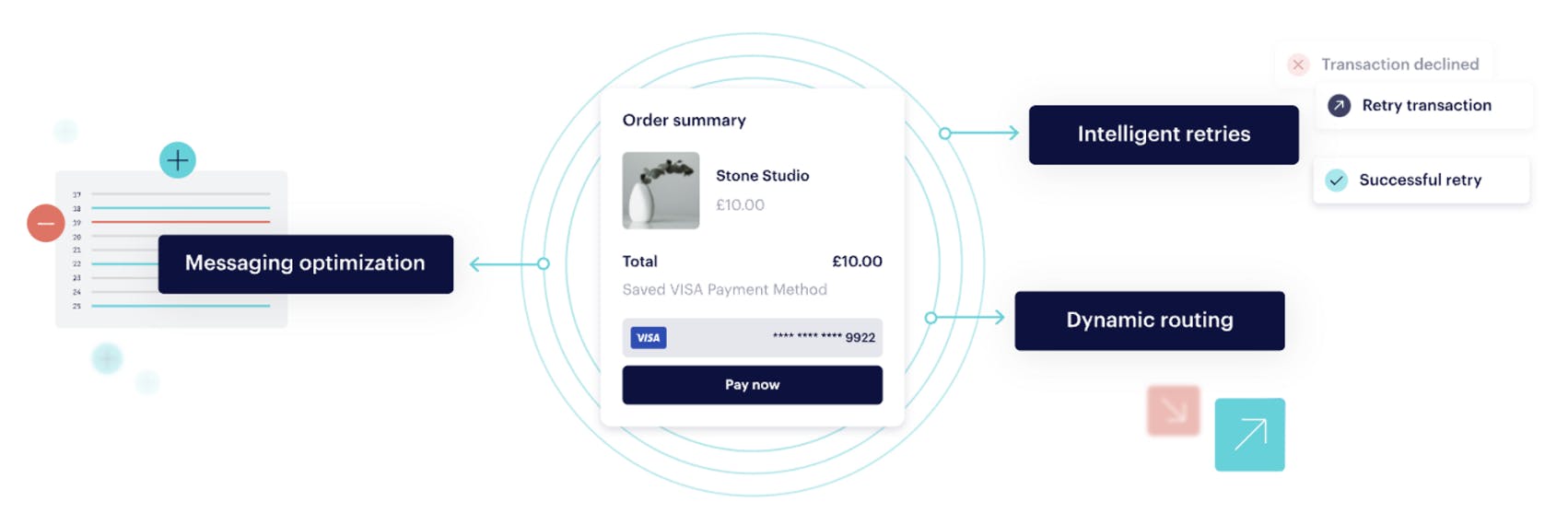

Intelligent Acceptance: Checkout.com’s intelligent acceptance solution utilizes AI and global network data to help merchants increase conversion rates. To date, the service has generated up to a 9.5% uplift in results while recording $741 million in revenue and leveraging over 20 billion data points for AI training. The service can identify when to use network tokens to unlock cost efficiencies with issuers using that method of credential-sharing method. Additionally, intelligent acceptance can determine whether strong customer authentication (SCA) is needed.

Source: Checkout.com

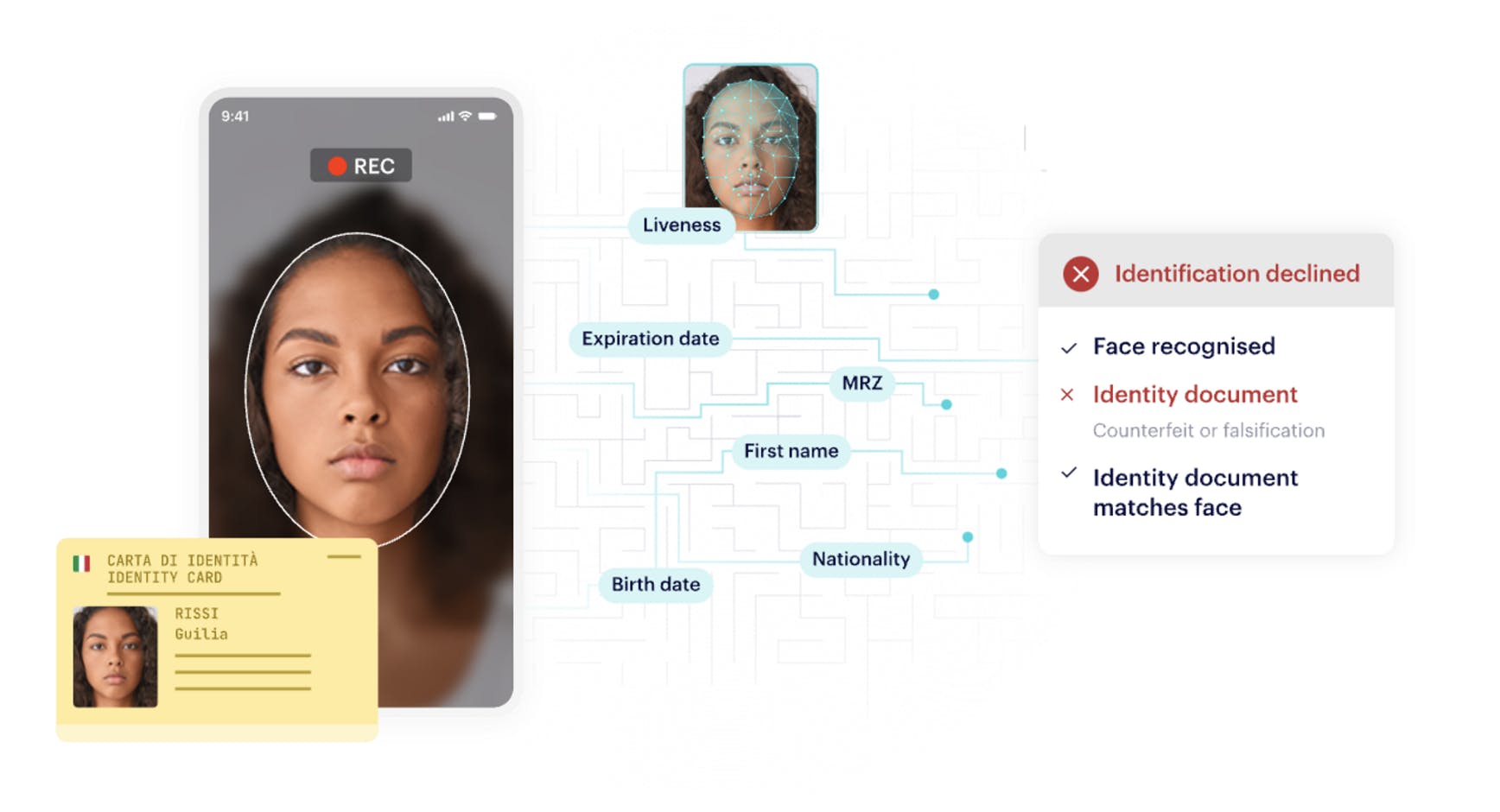

Identity Verification: Checkout.com offers various solutions to support identity verification. The service supports ID video streaming for 3K government-issued ID types across 195 countries. When a user records their ID, Checkout.com’s AI analyzes movement and tilting via video and checks holographic elements presented on authentic documents. Further, the AI can match a user’s face to their ID using facial recognition. To accompany the verification system, Checkout.com provides configurable user flows and journeys to personalize the user verification process.

Source: Checkout.com

Market

Customer

Checkout.com targets medium to large enterprises with high transaction volume. The company has a variety of customers within this demographic, including Shein and Patreon. It also plays a key role in the payment stack of “several fintech unicorns such as Klarna, Qonto, Revolut, and WorldRemit”. Checkout.com has also expanded into crypto, enabling companies to settle transactions using stablecoins. In 2022, Checkout.com’s crypto customers, including Coinbase, represented nearly 80% of global crypto trading volume.

Given Checkout.com’s focus on mid to large enterprise clients, its customer base is significantly smaller than competitors like Stripe. As CEO Guillaume Pousaz said in a September 2020 interview:

“We only do enterprise. We really only work with the big merchants. There are a few exceptions here and there but it’s mostly enterprise-only and it’s purely online. I once met [Stripe CEO] Patrick Collison and I joked with him. I said you might have a million merchants, I have [1.2K] merchants but I know every single one by name and they all process tens of millions every year. So I think it’s just a different business”.

Market Size

In 2021, the market for payment processing solutions is estimated at approximately $74.4 billion. The market is forecast to grow at a CAGR of 10% from 2022 to 2030, reaching a market size of $192.6 billion. The growth projection is primarily attributed to the increasing global penetration of the internet and smartphones, driving the adoption of digital payment processing.

Approximately $5.8 trillion dollars are spent on digital global commerce each year and the market size for global digital payments was valued at $6.8 trillion in 2021. The market is estimated to grow at a CAGR of 10.9% during 2021-2027, reaching a value of $12.6 trillion.

Checkout.com’s products are focused on growing that market size by simplifying each step of the payment process, from the acquiring segment to the issuing segment. Given its business model and target customer, Checkout.com is comparable to the likes of Stripe and Ayden, both of which were valued at ~$25-50 billion as of August 2023.

Despite a wave of innovation over the last decade, the digital payments industry is still in its infancy, leaving significant room for market growth. Stripe estimates that only 3% of total commerce occurs online. Given this low penetration of digital payment technology, the digital payment processing market size could potentially grow as internet and smartphone adoption increases.

Competition

Adyen: Adyen is a public company that provides end-to-end payment processing services. Like Checkout.com, Adyen supports card issuing and payouts and is used by 4.5K companies, including eight of the ten largest US internet companies. The customer demographics of Adyen in comparison to Checkout.com overlap each year, with Adyen increasingly adopting mid-market clients and Checkout.com moving upstream. Adyen is a less flexible or customizable solution than Checkout.com, which is likely to reduce long-term complexity. Unlike Checkout.com, Adyen pursues a “no M&A - ever” strategy. In 2018, Adyen went public with a market cap of $8.3 billion and is valued at ~$25 billion as of August 2023.

Stripe: Stripe is a payment processing and card issuing company that enables merchants to accept payments online. In 2021, Stripe was used by 1.1 million websites across 47 countries to process transactions. Unlike Checkout.com and Adyen, which focus on mid-to-large-market enterprises, Stripe focuses on SMBs with lower total transaction volume. Stripe offers a more diverse range of products than Checkout.com, with its products ranging from banking-as-a-service tools for embedded financial products to revenue automation tools for tax teams. In March 2023, Stripe raised a Series I round of $6.5 billion at a post-money valuation of $50 billion. The round included Andreessen Horowitz, Founders Fund, and General Catalyst.

Block (Formerly Square): Block enables business owners to accept credit card payments in-person, online, or both. At its core, Block provides payment processing services, yet unlike Stripe, Adyen, and Checkout.com, it has not evolved its offerings to include tools for the issuing segment of the payment stack. Further, one key difference between Block and Checkout.com is that Block is known for its hardware processing terminals for in-person transactions, while Checkout.com solely focuses on online digital payments. Block is built primarily for brick-and-mortar businesses whereas other competitors target digital-first businesses. To date, Block has raised $601 million and went public in 2015 at a $2.3 billion valuation. As of August 2023, Block’s market cap is approximately $34.9 billion.

PayPal: PayPal was founded in 1998 and went public in February 2002 before being acquired by eBay in July 2002 and being spun out in 2015. Like Checkout.com, PayPal helps merchants accept and process online transactions. Unlike the majority of competitors, PayPal isn’t exclusively focused on B2B payments; the company enables everyday consumers to set up their own accounts and transfer money across the world. As of 2023, PayPal has over 435 million active accounts, and in 2022, it processed nearly $1.4 trillion in payments. PayPal’s fees are dependent on the location of the merchant and the location of the customer. PayPal’s standard fee is 3.49% + a fixed fee per domestic transaction. To date, PayPal has raised $5.2 billion and its market cap as of August 2023 is approximately $67.7 billion.

Braintree (a subsidiary of PayPal): Braintree is a payment gateway that provides merchants with the ability to accept online and mobile payments. The company was acquired by PayPal in 2013 for $800 million. Unlike Checkout.com, which operates independently, Braintree is integrated within the PayPal ecosystem, enabling merchants to leverage PayPal's network of users. Braintree is known for its developer-friendly approach, offering customizable payment solutions, making it popular among startups and small to medium-sized businesses. It supports various payment methods and over 130 currencies, giving merchants the flexibility to cater to a global customer base. While Braintree and Checkout.com have some overlapping services, their integration within different payment ecosystems differentiates them.

Worldpay (FIS Worldpay): Worldpay is a global payment processor that provides end-to-end payment solutions to businesses ranging from early-stage startups to Fortune 500 companies. The company’s product line includes payment processing, fraud detection, risk management, point-of-sale solutions, and more. In 2019, Worldpay was acquired by Fidelity National Information Services (FIS) for $43 billion to form FIS Worldpay. While Checkout.com focuses on mid-market and enterprise customers, Worldpay caters to a broad spectrum of clients, including small businesses, enterprises, and global corporations. Worldpay operates in 140+ countries, making it a strong global competitor. In terms of size, Worldpay processes over 40 billion transactions and $1.7 trillion of payment volume annually.

Business Model

Checkout.com’s net take rate and pricing are not publicly available. In general, Checkout.com charges a flat rate based on a business’s risk category and business profile. Additionally, Checkout.com charges processor and interchange fees for each transaction it handles. It is unclear how these rates differ between clients given Checkout.com’s focus on a small number of clients with high transaction volumes.

In 2021, Checkout.com’s UK-filed report stated that its gross profit was $76.7 million. Further, it listed the cost of sales at $182 million. These costs of sales represent the value paid by Checkout.com to card networks and to cardholders’ banks for the acceptance of card-based transactions. It is important to note that these financial statements are only applicable to Checkout.com’s UK business. Since its founding in 2012, Checkout.com has also been focused on profitability, stating in 2022 that the company “has been profitable for several years.”

Traction

In 2021, Checkout.com processed hundreds of billions of dollars, tripling its transaction volume for a third consecutive year. In 2020, the founder noted that the company had 1.2K customers. Checkout.com has grown to 1.9K employees across 21 global offices while maintaining profitability.

Despite Checkout.com's growth, the company is not immune to the economic downturn occurring in 2022 and 2023. At the beginning of 2023, Checkout.com was reported to be laying off executive employees in stealth. In 2022, the company reduced its workforce by 5% (approximately 100 employees).

In December 2022, Checkout.com lowered its internal valuation from $40 billion to $11 billion. According to Checkout.com’s founder and CEO, Guillaume Pousaz, the company’s decision to reduce its internal valuation wasn’t due to performance difficulties. Rather, it was a decision made to provide existing employees with more potential upside on their stock options:

“We took advantage of the current conditions to update the tax valuation of the company. We decided to do that for our employees so that we can re-strike all the options that have been handed out recently and therefore create more upside potential for them — they will have to pay less for those options.”

Valuation

In January 2022, Checkout.com raised a $1 billion Series D at a $40 billion post-money valuation. Investors in the round included Insight Partners, Tiger Global, and Altimeter, bringing its total funding to $1.8 billion. In December 2022, the company reduced its internal valuation from $40 billion to $11 billion, citing more upside potential for its employees. Despite the internal valuation reduction, Checkout.com’s Founder and CEO stated that the company has significant runway:

“We don’t need to raise money and there are no plans in that respect. To be honest, we don’t have to raise again. Never say never, but unlike many fintech companies, we have a proven business model.”

In 2021, Checkout.com earned $259.6 million in revenue per its latest filings. These revenue figures are only inclusive of Checkout.com’s UK corporation, thus it doesn’t include its international or crypto segments. In 2022, the company stated that crypto and financial technology transactions accounted for over half of the company's revenue, suggesting that its revenue was, at least $521.8 million in 2021.

To derive an estimate of Checkout.com’s transaction volume, an estimate of its net take rate can be created by taking an average of Stripe’s 0.34% and Adyen’s 0.17% net take rate. Given this, Checkout.com’s transaction volume in 2021 can be estimated at around $237.2 billion (with 0.255% representing Checkout.com’s revenue of $521.8 million). This estimate is in line with Checkout.com’s funding announcement in 2021, where it stated that it processed “hundreds of billions in payments in 2021 alone”.

Though it is difficult to extrapolate Checkout.com’s transaction volume in 2023, using a baseline growth rate of 1.5x (half of Checkout.com’s 3x growth rate from 2019-2021), it is possible to estimate that it’s processing somewhere in the region of $533.7 billion.

Key Opportunities

Expansion into Crypto

Following its $1 billion Series D, Checkout.com announced its expansion into crypto. The opportunity lies in enabling merchants to accept crypto payments, ensuring that the end-user experience is as simple as paying with a credit card via a one-time payment link. In 2023, Checkout.com was being used by crypto exchanges which together represented 80% of crypto trading volume in 2022. Although Checkout.com has had success in crypto expansion, the opportunity will rely on cryptocurrency trading volumes, which have declined in 2023. Despite this, Checkout.com sees an opportunity to process payments in cryptocurrency. According to Bradley Riss, Chief Commercial Officer at Checkout.com:

“We see the adoption of cryptocurrencies and NFTs driving global ecommerce to grow faster than traditional commerce. As consumers increase the share of wealth locked in cryptocurrencies, merchants start experimenting with offerings for these early adopters. Our role is to make those connections and offer a broader range of options”.

US Expansion

To date, Checkout.com has primarily focused on the APAC and EMEA regions and has not yet claimed significant US market share. Given this, the company stated in March 2023 that it was making a push in the US, the world’s second-largest e-commerce market. Although the payment processing market features players with high market share like Stripe and Block. Checkout.com President, Céline Dufétel, noted that the company is bullish regarding the US expansion opportunity, explaining that many of the company’s international clients are “keen for our support in the US.”

Key Risks

Crypto Volatility

While crypto presents an opportunity for Checkout.com to support digital transactions, it could also lead to a key risk where Checkout.com's portfolio is extremely volatile. At the moment, over 50% of Checkout.com’s revenue comes from crypto trading transactions, and this portfolio included clients such as FTX which infamously collapsed. As a result, given the early nature of the industry, its vulnerability to regulatory changes, and overall uncertainty, Checkout.com's success is partially dependent on the trajectory of crypto and the adoption of cryptocurrencies. Despite this, Checkout.com’s President, Céline Dufétel, stated:

“We’ve always believed in serving innovative businesses, starting with fintechs, since our inception, and more recently, serving innovators in the crypto/web3 space in 2019. While this is an exciting sector, it represents a modest part of our business. We, of course, acknowledge the severity of the current situation in contrast to other past events, but remain committed to supporting our merchants with the best payment solutions possible”.

High Levels of Competition

Although Checkout.com has grown significantly since its first funding round, it still remains a competitor to established companies including Stripe, Adyen, and Block. These core competitors have captured significant market share. As Checkout.com expands into the US market, it will need to find a way to differentiate from existing alternatives that have a larger presence. In the current macro environment where global financial activity is slowing, it may be difficult for Checkout.com to establish itself against these competitors in the US. Further, it is already evident that price competition is inevitable in payment processing. With the presence of multiple established competitors, customers are able to negotiate rates down.

Summary

Checkout.com is a London-based fintech company specializing in payments. It has been able to scale effectively from a bootstrapped company focused on profitability to a fast-growing profitable unicorn. While its business model and products have proven successful in the APAC and EMEA regions, Checkout.com’s largest challenge lies in its expansion into the US market given the presence of competitors like Stripe, Adyen, and Block. Further, given macroeconomic uncertainty Checkout.com will have to overcome key challenges in terms of transaction volume growth. Despite these challenges, Checkout.com is well-positioned to take advantage of the forecasted growth in the payment processing market.