Thesis

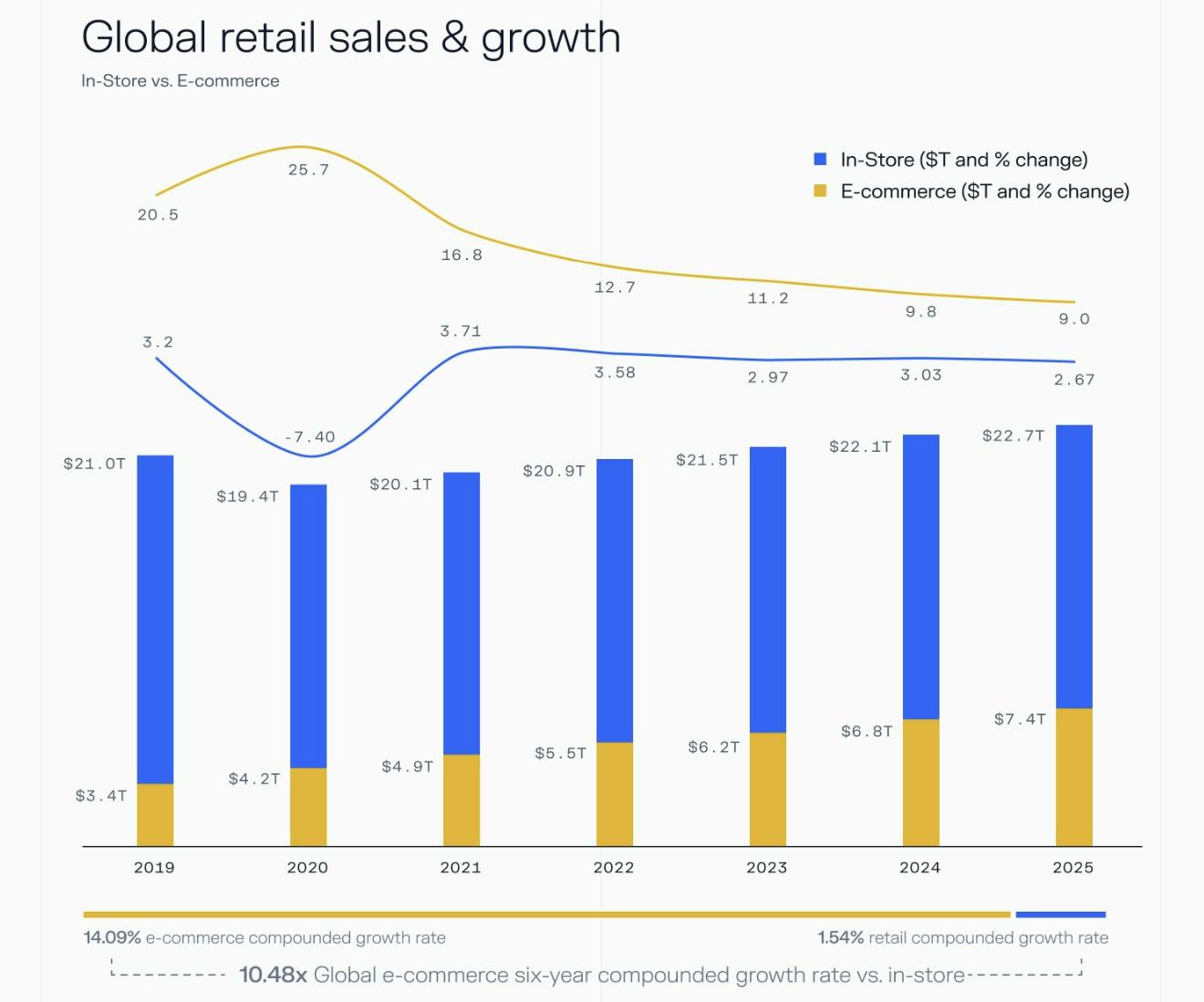

In an economy increasingly driven by digital transactions and commerce, demand for seamless, secure online payment solutions has become foundational to the global economy. Ecommerce has grown steadily since the first recorded online transaction in 1994, when a CD by the musical artist Sting was sold for $12.48 plus shipping. From 2013 to 2024, global ecommerce sales have jumped from $1.2 trillion to over $6.8 trillion, and have grown at a CAGR of 14.1% between 2019 and 2025, compared to a CAGR of 1.5% for in-store sales. The COVID-19 pandemic accelerated this growth, with lockdowns and social distancing measures leading consumers to embrace online shopping.

Source: Contrary

As the share of commerce taking place online increases, digital transactions are becoming the leading mode of value exchange, reshaping consumer expectations and forcing businesses to rearchitect their financial infrastructure to keep up. Spending habits are shifting alongside changes to this infrastructure. Consumers expect to pay in local currencies, using real-time and alternative payment methods. Businesses increasingly need to support subscription, usage-based, and outcome-based pricing. As global brands expand into new markets, a new generation of entrepreneurs, creators, and vertical SaaS platforms is embedding commerce into every experience.

The 2020s ushered in two platform shifts with far-reaching implications for commerce: artificial intelligence and stablecoins. AI is transforming how software is built, sold, and operated – compressing timelines, lowering startup costs, and enabling teams to build global businesses. Stablecoins, meanwhile, offer a programmable currency that settles instantly across borders with reduced friction, fees, and intermediaries. Together, these technologies are rewriting the infrastructure layer of the global economy.

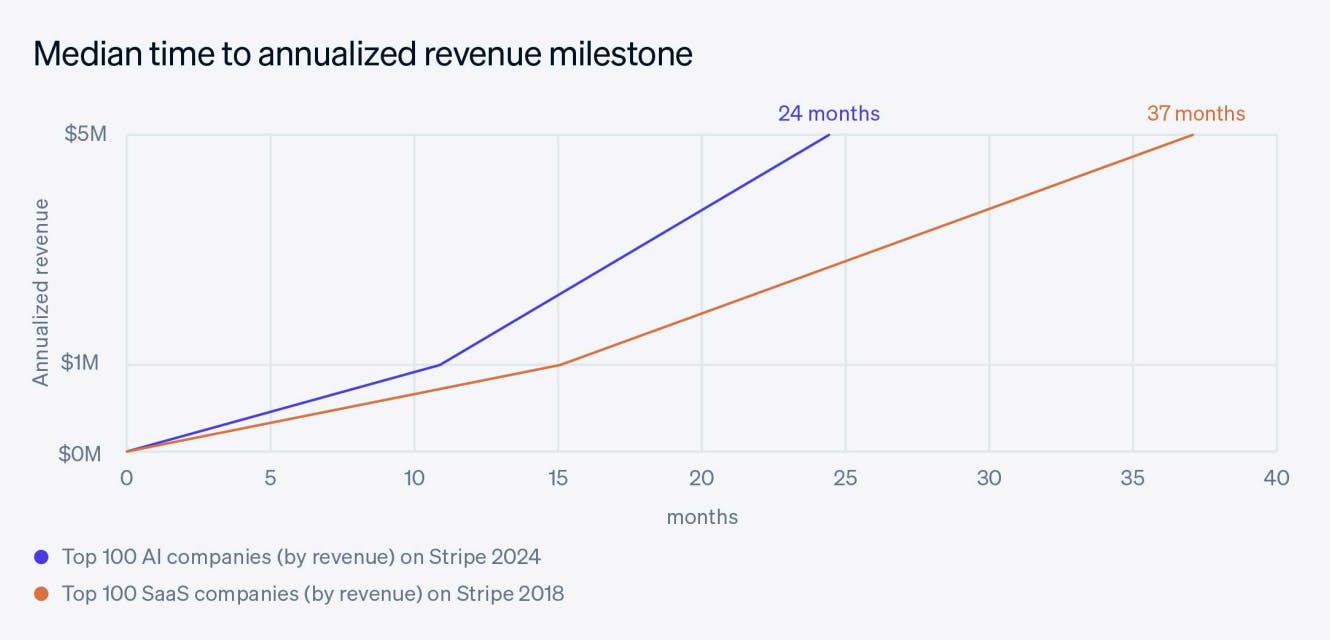

AI-native businesses are scaling at unprecedented speeds, with distributed customer bases and minimal headcount relative to traditional businesses. For example, Midjourney went from $0 to $500 million in ARR in under three years, reaching over 100K customers in more than 200 countries — all without raising outside capital. Cursor and OpenAI have followed similarly steep trajectories. These companies operate with new commercial models, such as metered billing, usage-based pricing, and autonomous agent transactions, which legacy payment system infrastructure was never designed to handle.

Source: Stripe

Stripe is a payments and financial infrastructure platform that enables businesses of all sizes to accept payments, manage money, and scale globally. As of August 2025, millions of companies from early-stage startups to Fortune 500 businesses utilize Stripe to power everything from one-time transactions to complex multi-party payment flows. Stripe aims to build and modernize online financial infrastructure in service of its stated mission to “increase the GDP of the internet.”

As startups scale faster, operate leaner, and serve global customers from day one, they need financial systems that are just as flexible and composable. As of August 2025, Stripe processes over 50K transactions every minute, and handled $1.4 trillion in total payment volume in 2024. Stripe powers companies, including the AI-native businesses Midjourney, Cursor, and OpenAI, enabling stablecoin acceptance, real-time localization, and seamless settlement across more than 200 countries. As software agents begin transacting on behalf of users and new commercial models take hold, Stripe is emerging as an important financial operating system for the AI economy.

Founding Story

Stripe was founded in 2010 by two brothers from Ireland, Patrick Collison (CEO) and John Collison (President). The pair came to the US in 2006, at ages 18 and 16, respectively. The prior year, Patrick had won a national Irish competition for young scientists with his project “Croma: a new dialect of LISP” (LISP is a programming language developed at MIT), leading an Irish newspaper at the time to dub him “the smartest redhead in Ireland”.

In the US, the brothers applied to Y Combinator with a startup idea for tracking software for eBay sellers. They ended up joining forces with another pair of brothers, Harj and Kulveer Taggar, who were already in the program with a similar idea. That startup, Auctomatic, was acquired for $5 million in 2008. In 2009, John enrolled at Harvard, near Patrick, who was at MIT. To finance their studies, they developed mobile apps.

Observing the difficulty of accepting payments over the Internet, the pair began working on Stripe during college, which was then known as /dev/payments. They grew increasingly focused on this project until, after almost a year, they both dropped out of college to work on the company full-time. The brothers raised their first round of funding in 2010 from Y Combinator, although they did not participate in the accelerator’s demo day.

At the time, there were few straightforward options for startups to process payments. Setting up with banks involved weeks of administrative work and often incurred substantial fees. PayPal, a popular alternative option, was also complicated to set up and came with its own issues, including taking up to 60 days to provide access to funds and lacking a white-label solution. /dev/payments, by contrast, was built to be a developer-friendly product that could be integrated with a simple seven-line code snippet, which was especially appealing to startups.

As a result, /dev/payments achieved product-market fit with other Y Combinator startups and quickly gained traction. However, the startup was forced to change its name because Delaware does not permit leading slashes in corporation names; The company name needed to appeal to more traditional bankers that the company had to work with. After considering various options, the team eventually settled on “Stripe.” The team grew to four people after a year, with the Collisons insisting on highly technical backgrounds for employees, including managers.

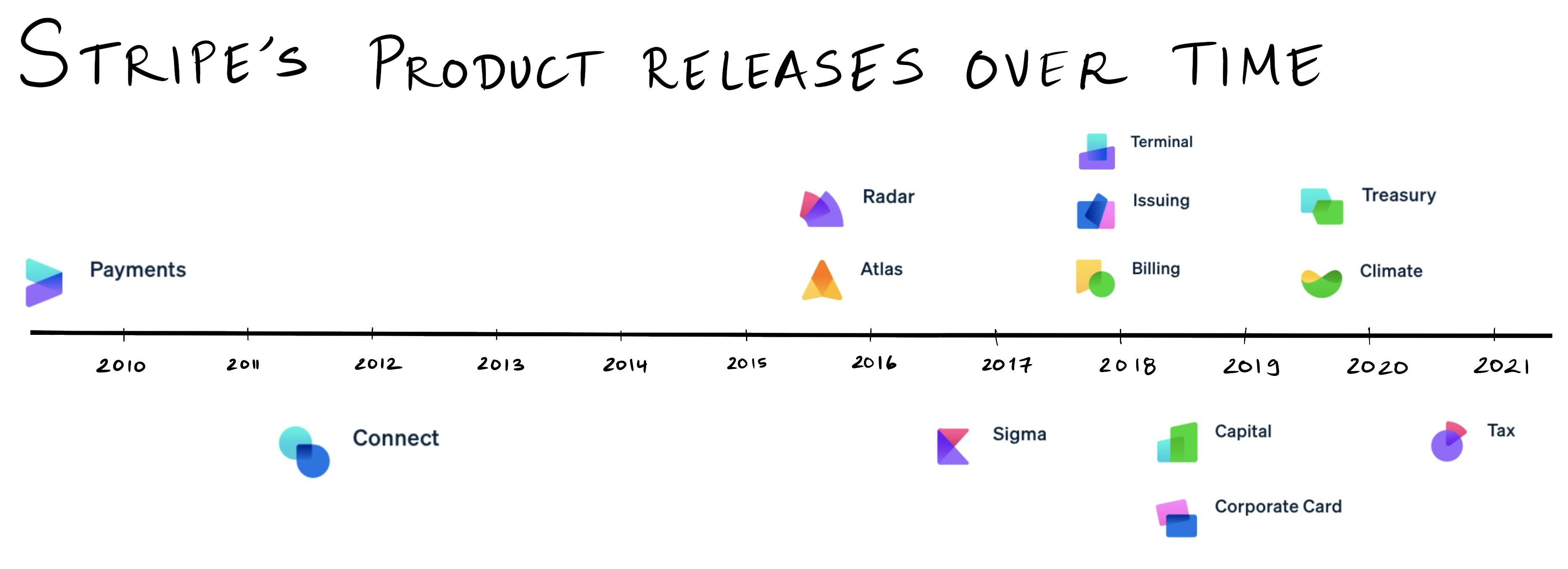

Source: Stripe

After launching its primary product, Payments, in 2010, Stripe’s first major product extension was Connect in 2012, enabling marketplaces like Lyft, Postmates, and Shopify to manage complex multi-party payment flows. In 2015, the company broadened its scope beyond payments into foundational services for online businesses, launching Radar for fraud detection and Atlas for company incorporation. By 2018, Stripe had entered financial analytics and in-person payments with Sigma, Terminal, and Issuing, while also addressing recurring revenue with Billing.

Between 2019 and 2021, the company released a suite of back-office and infrastructure tools—Capital, Corporate Card, Treasury, Climate, and Tax, moving Stripe deeper into financial services and compliance. These product releases marked Stripe’s shift from a payments API to a comprehensive financial operations stack for internet businesses. As of August 2025, the Collison brothers continue to lead Stripe, with Patrick serving as CEO and John as President.

Source: The Generalist

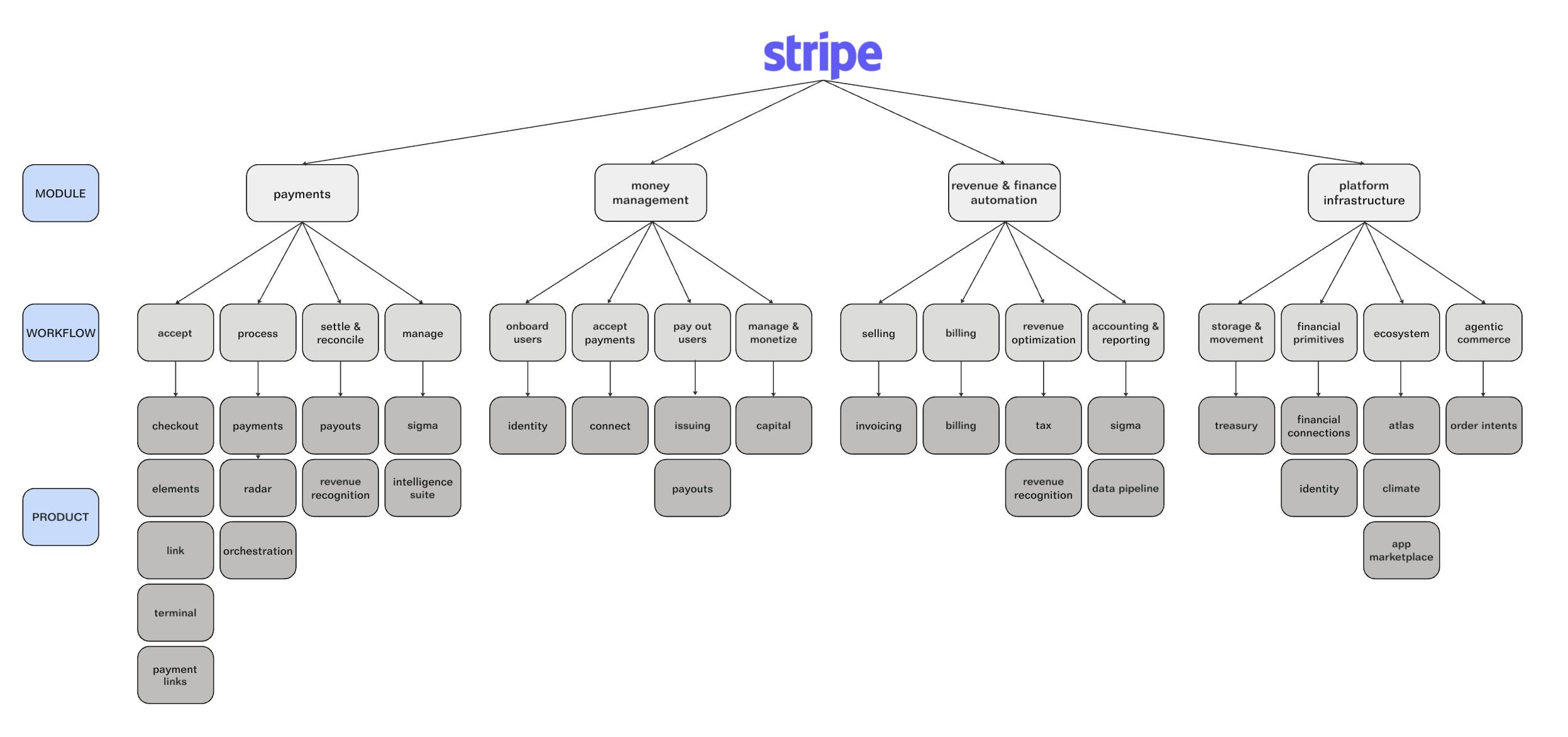

Product

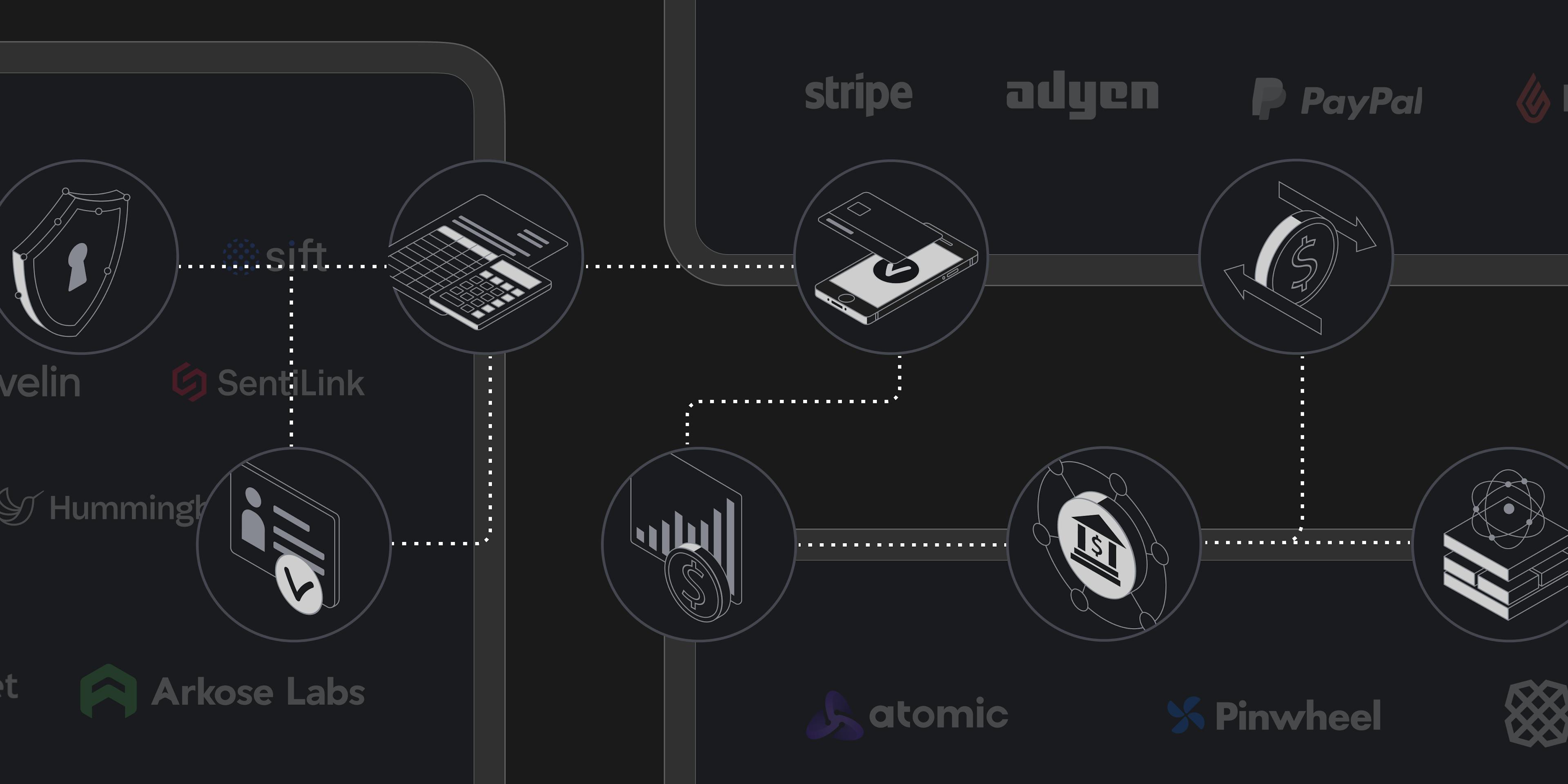

Stripe offers a fully integrated suite of financial and payments infrastructure, designed to support businesses across the entire lifecycle of commercial transactions — from onboarding and checkout to reconciliation, payouts, and reporting. As of May 2025, Stripe’s product ecosystem was structured into four core categories:

Payment services for accepting, routing, and optimizing transactions.

Money management and embedded finance tools to move, issue, and store funds.

Revenue and finance automation products.

Platform infrastructure and extensions.

Source: Contrary

Payments

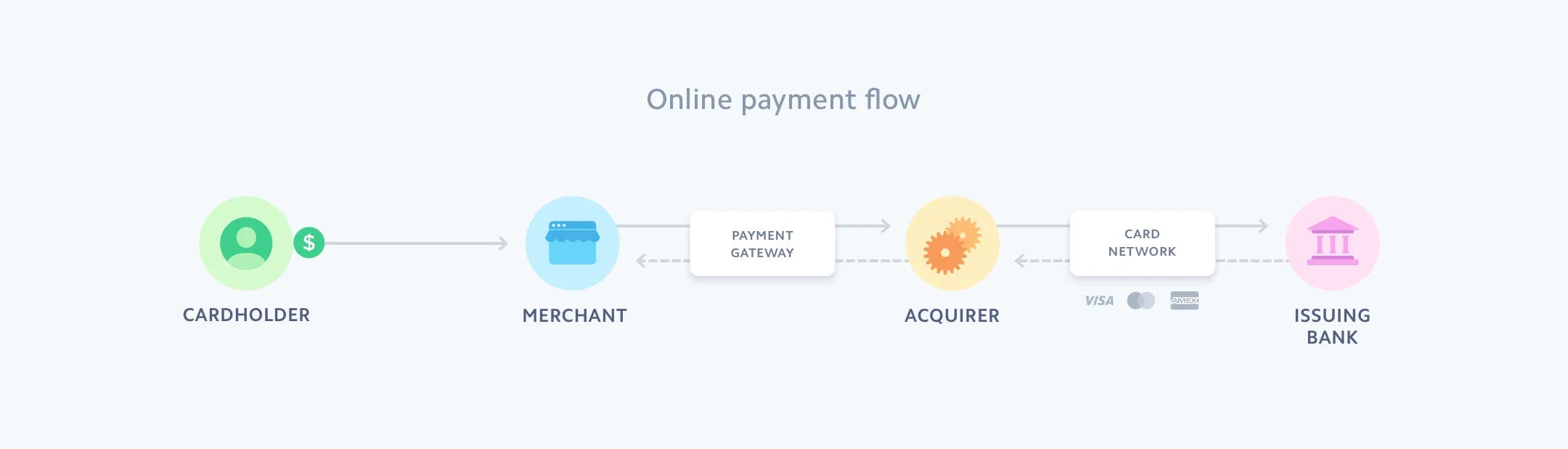

Payments is Stripe’s core product. It provides an API for businesses to accept online payments from customers around the world. In the US, the online payment flow works as follows as of August 2025:

The customer provides their card information to the business.

The business sends the payment information to the “acquiring bank” via a “payment gateway.” The acquiring bank is the bank receiving the payment. Payment gateways ensure that the information is sent securely and in compliance with PCI standards.

The acquiring bank communicates through a card network, such as Visa or Mastercard, to the “issuing bank.” The issuing bank is the bank sending the payment.

The issuing bank communicates its acceptance or rejection of the transaction back through the card network, acquiring bank, and payment gateway to the business.

The funds for the payment are placed on hold at the issuing bank and later sent to the merchant account. A “merchant account” is separate from the business’s usual bank account and is where the money is held for ~1-2 days before being moved to the usual bank account.

Source: Stripe

As of August 2025, Stripe Payments allows businesses in 46 countries to sign up for Stripe in order to link their bank account and use Stripe’s API to accept payments. Stripe handles payments in over 135 currencies and supports numerous payment methods like cards, digital wallets, crypto wallets, BNPL offerings, and bank transfers from 197 countries.

Payment Links

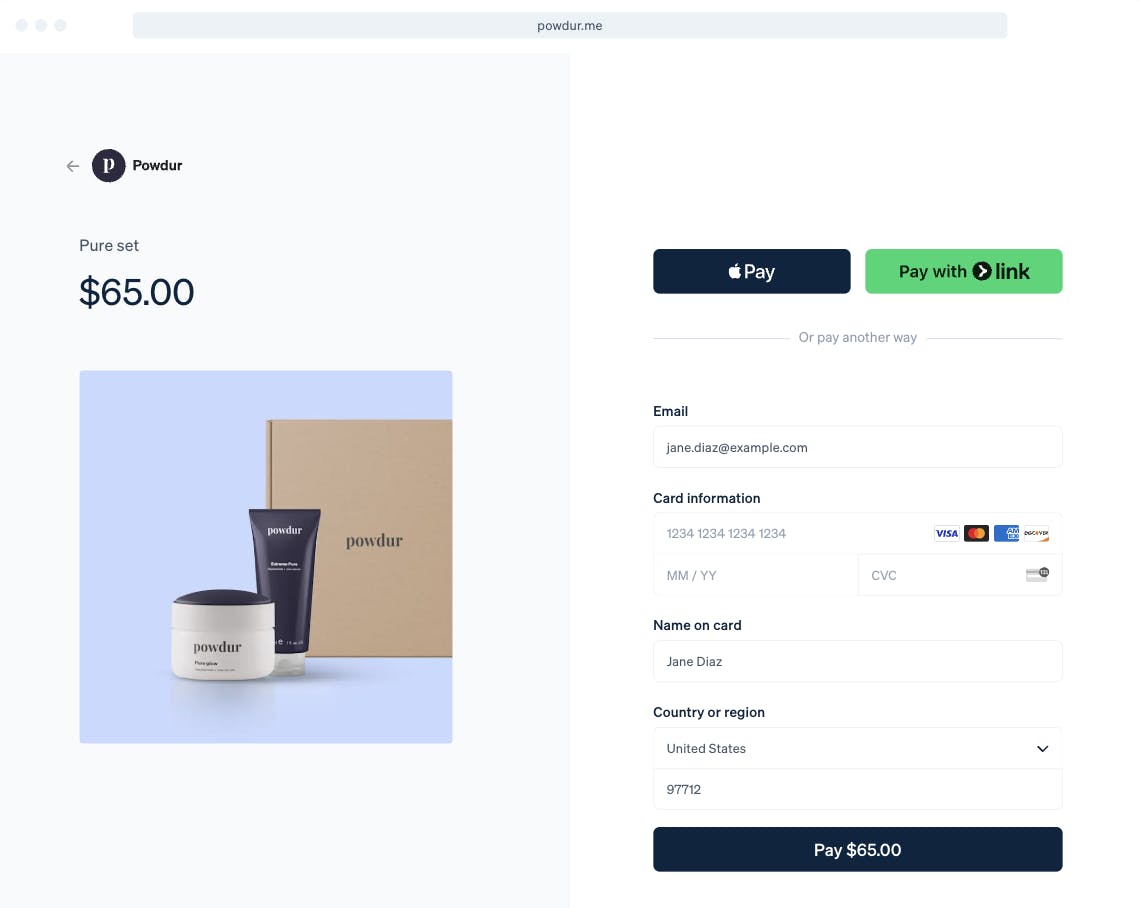

Stripe Payment Links allows businesses to share links that customers can use to pay. These links can be generated from the Stripe Dashboard or via the Stripe API and direct customers to a checkout page hosted by Stripe.

Source: Stripe

No-code dashboard creation of Payment Links reduces the difficulty of accepting payments online. Links can be shared via social media, text messages, or email; this flexibility can be useful to help creators or small businesses transact with customers. As of August 2025, Stripe Dashboard assistant allows users to create Payment Links entirely through natural language.

Checkout

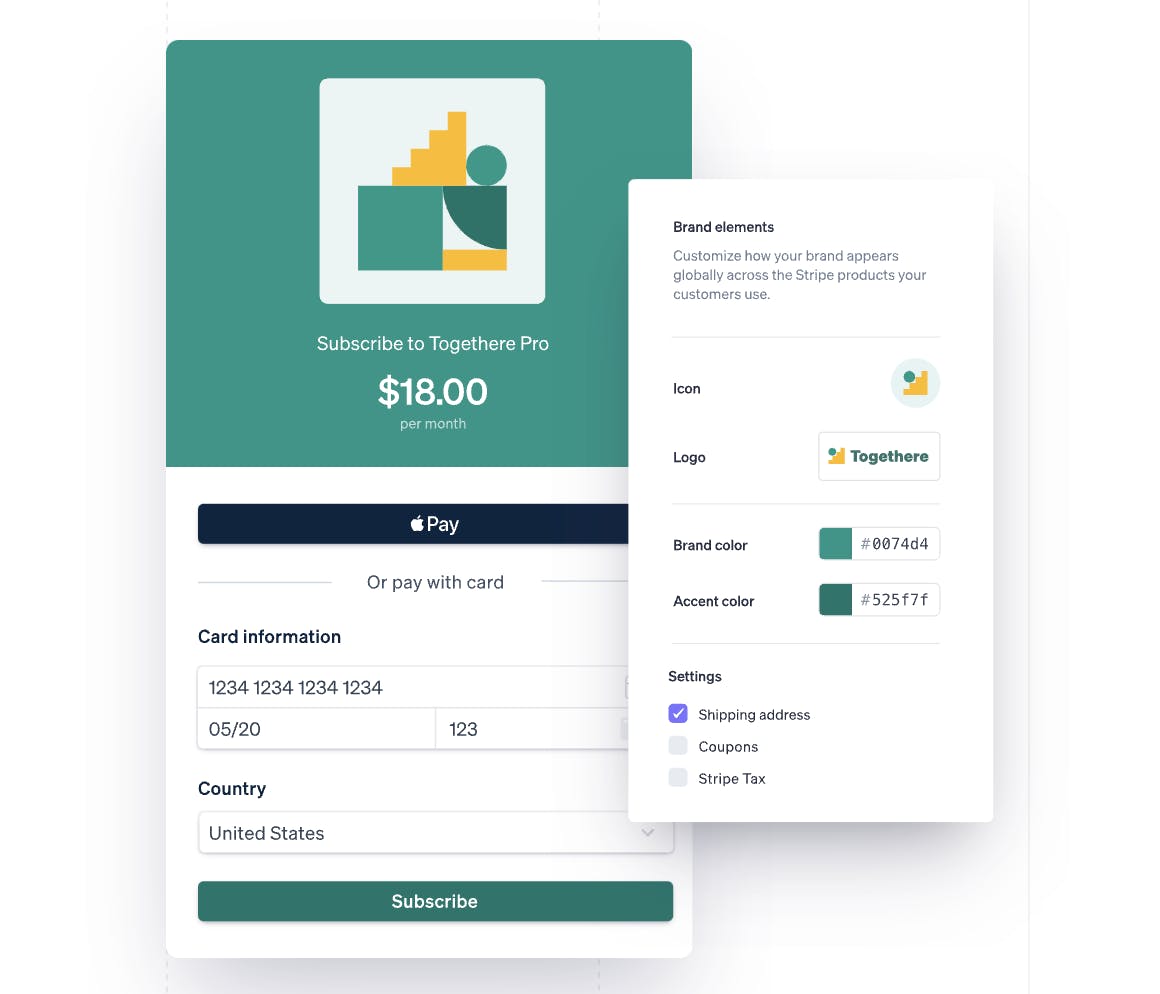

Stripe Checkout is a prebuilt payment page that allows businesses to start accepting payments online with minimal engineering effort. It supports one-time purchases, recurring subscriptions, and custom pricing models such as flat-rate, usage-based, and per-seat billing. Checkout is optimized for performance across both desktop and mobile devices and includes native support for over 125 payment methods. Businesses can modify the base Checkout template with custom colors, fonts, and shapes to align it with their branding.

In May 2025, Stripe rolled out its Optimized Checkout Suite, a set of intelligent upgrades powered by machine learning. These updates allow Stripe to personalize the checkout experience in real time based on over 100 user signals, determining which payment methods to display and which fields to prioritize to improve conversion rates. Stripe also introduced new capabilities like Adaptive Pricing, enabling businesses to localize prices without additional fees.

Checkout integrates with the rest of the Stripe ecosystem, including Billing for subscription management, Tax for global compliance, and Revenue Recognition for accounting. Developers can use the Checkout Sessions API to design an end-to-end checkout flow with just one line of code, significantly reducing implementation time.

Source: Stripe

Elements

Stripe Elements are customizable components for businesses that want more control over their payment page. Control goes down to the level of CSS for granular styling. A checkout page built with Elements is hosted on the business’s website rather than Stripe’s website. In contrast to Stripe Checkout’s fully hosted page, Elements enables a more integrated, brand-consistent experience, optimized to work smoothly across devices and screen sizes.

Terminal

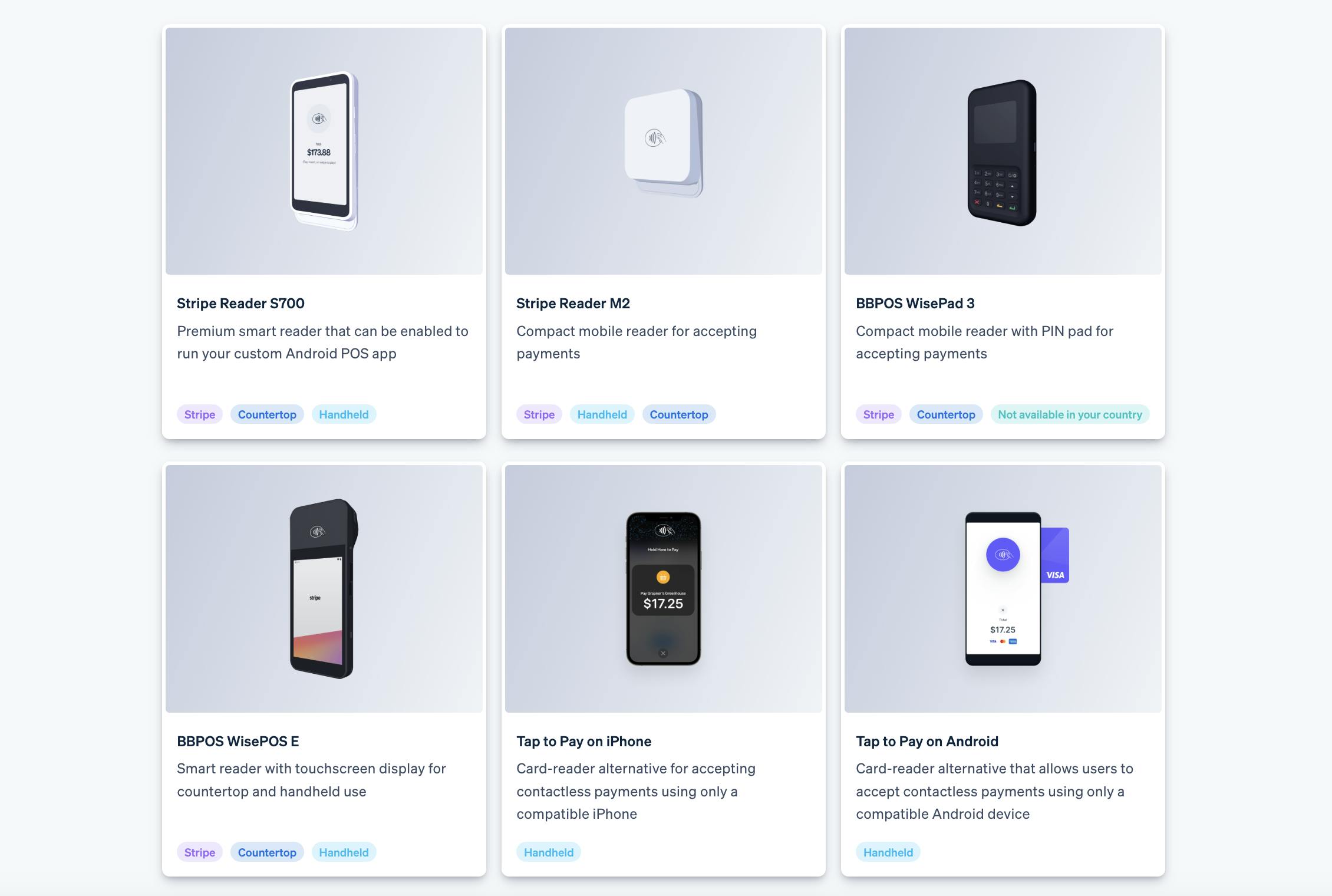

Stripe Terminal enables businesses to accept in-person payments. Companies can use Stripe’s pre-certified card readers, such as the Stripe Reader M2 or BBPOS WisePOS E, accept contactless payments through Tap to Pay on iPhone and Android devices, or through third-party devices such as Verifone. For no-code integration, businesses can use point-of-sale software from a Stripe partner, while the Terminal SDK allows for custom code integrations for businesses that need more control over the checkout experience.

Source: Stripe

Link

Stripe Link is a one-click checkout solution available on hundreds of thousands of websites. Customers new to Link can save their payment details and shipping information to enable faster checkout in the future. Link automatically detects if a customer is enrolled by using their email address, phone number, or browser cookies. The customer then receives a one-time passcode to authenticate their session. After authentication succeeds, Link loads the customer’s payment and shipping information, allowing the customer to pay with one click.

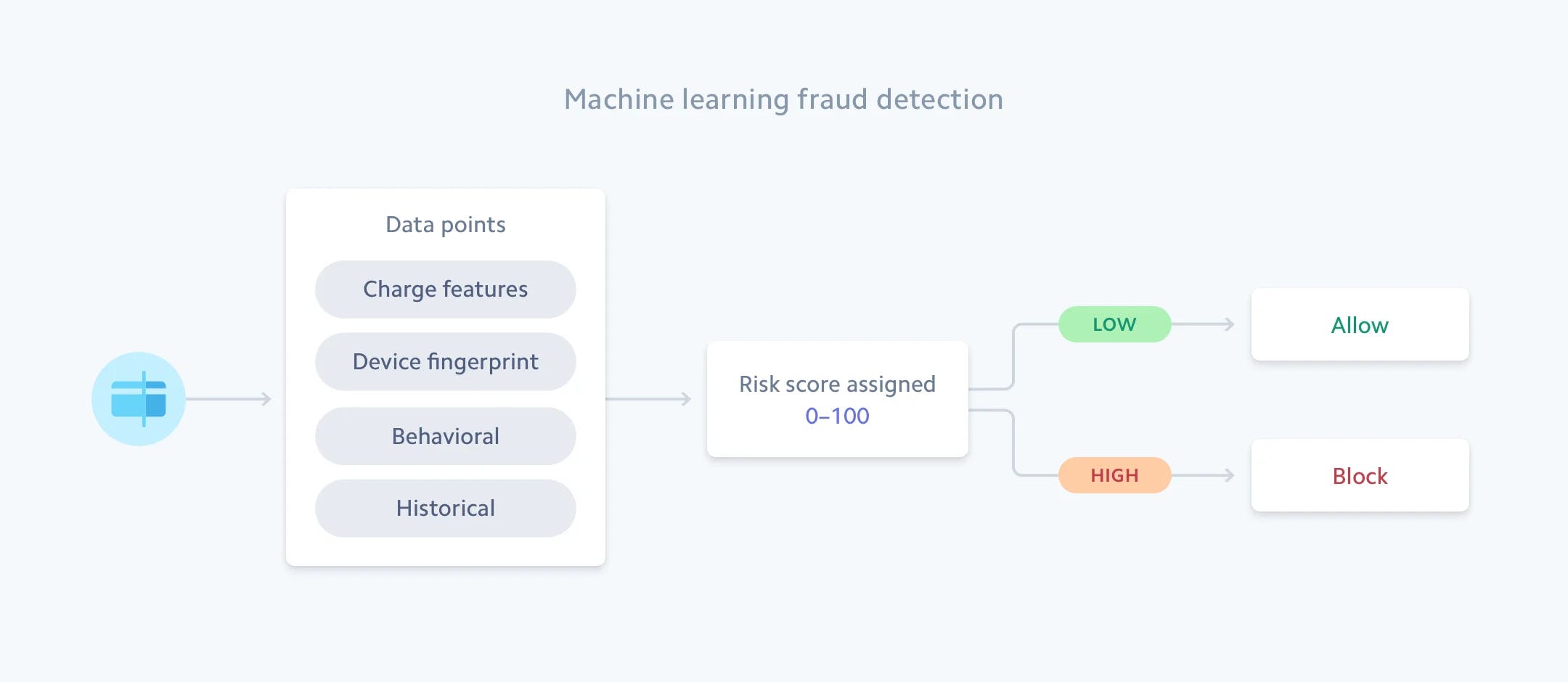

Radar

Stripe Radar uses machine learning to prevent fraudulent payments from being processed. Stripe trains and updates its ML models on the billions of payments it processes annually. Data points used for fraud detection include customer information, shipping and billing addresses, and IP addresses. When a fraudster uses a stolen credit card number to make an online purchase and the payment is processed successfully, the true cardholder can dispute this charge by filing a chargeback with their bank. With Chargeback Protection, merchants’ sales are protected against fraudulent disputes, helping prevent losses. Whether or not the dispute is legitimate, Stripe will reimburse the disputed amount and waive dispute fees. Businesses can also create custom rules with Radar. For example, they can automatically flag payments over a certain amount from any email within a specified list of email addresses.

Source: Stripe

For customizability, Stripe offers Radar for Fraud Teams. This allows businesses to tune their risk tolerance. Those with lower tolerance may prefer to block payments more aggressively at the cost of incorrectly blocking or flagging some valid payments. Radar for Fraud Teams enables better pattern recognition. It surfaces related payments in the manual review process and allows companies to integrate their data with Radar’s data through Stripe Data Pipeline.

In May 2025, Radar’s capabilities expanded as part of Stripe’s broader Payments Intelligence Suite. As of August 2025, businesses can pull Radar’s risk scores directly into their own fraud systems or multiprocessor environments via API, and Stripe has extended Radar’s protection to include ACH and SEPA payments in addition to cards. Dispute prevention has been enhanced with real-time signals from Ethoca and Verifi, enabling merchants to notify customers and resolve charge issues before they escalate to chargebacks. Stripe also introduced Smart Disputes, a feature that automatically responds to eligible disputes with tailored evidence, improving win rates and reducing operational overhead.

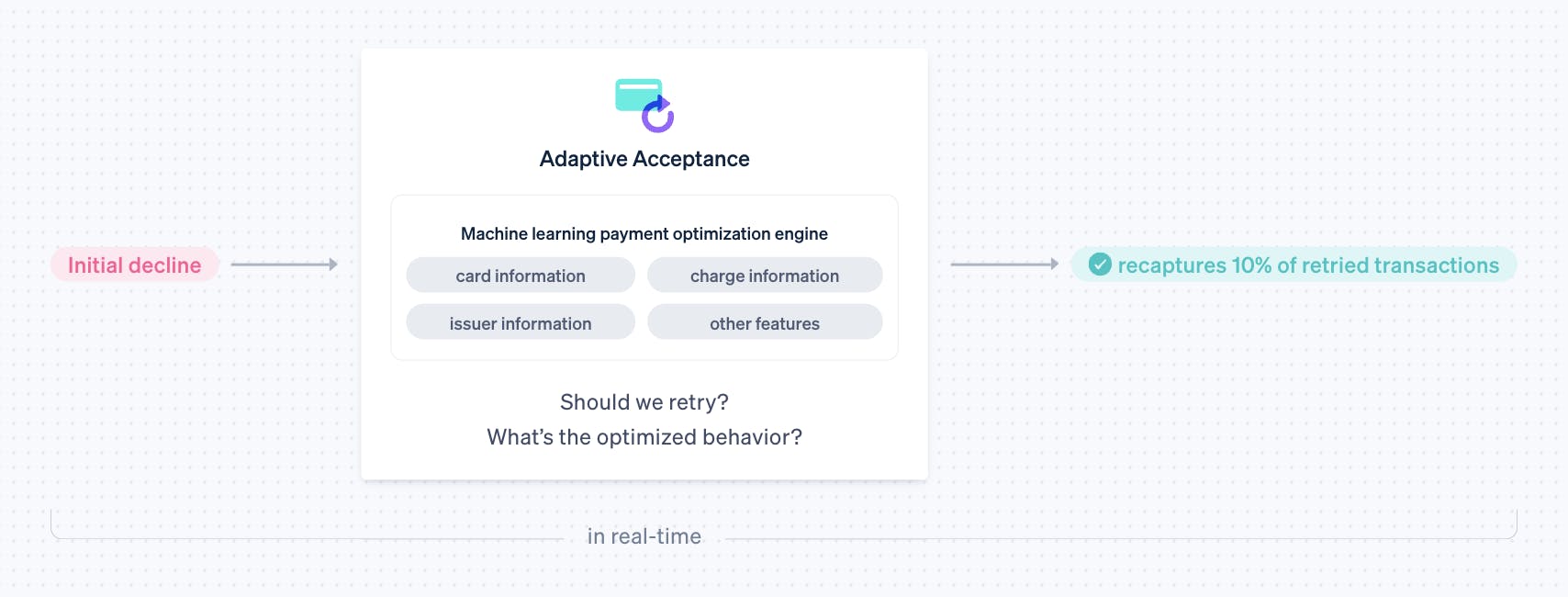

Authorization

Stripe helps businesses increase authorization rates and recover failed payments through a suite of optimizations. Adaptive Acceptance uses machine learning to tailor requests to each card issuer’s preferences, improving first-attempt success rates. When payments fail, Smart Retries determines the best time to try again, reducing declines for recurring charges by up to 30%. Stripe also keeps customer card details current to avoid churn from expired cards. These tools work together to reduce friction, retain customers, and drive incremental revenue.

Source: Stripe

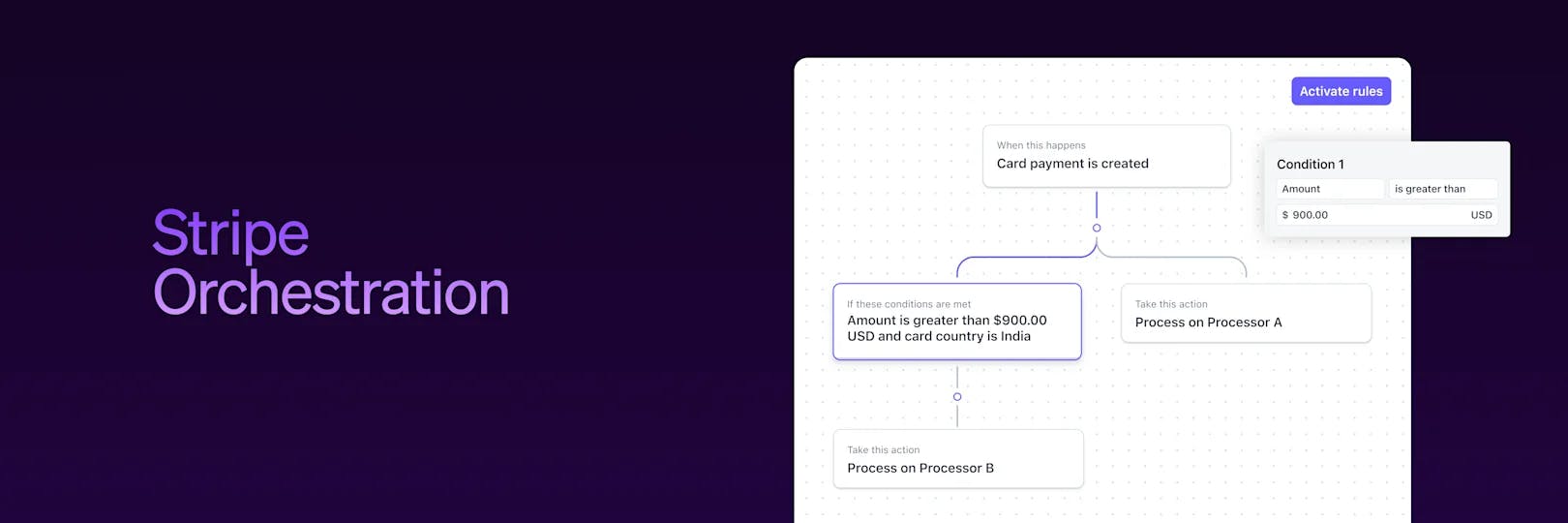

Orchestration

Announced in May 2025, Stripe Orchestration gives businesses the ability to route payments across multiple processors while maintaining a unified interface and consistent integration. Built for companies that rely on more than one payment provider, it enables control over how transactions are routed by geography, volume, or issuer. Businesses can create custom routing rules to optimize for cost, performance, and reliability. Payments can be dynamically sent to supported third-party processors without changes to existing integrations. While Stripe handles the orchestration layer, third-party processors are responsible for transaction processing, fees, and disputes for payments routed their way.

Source: Stripe

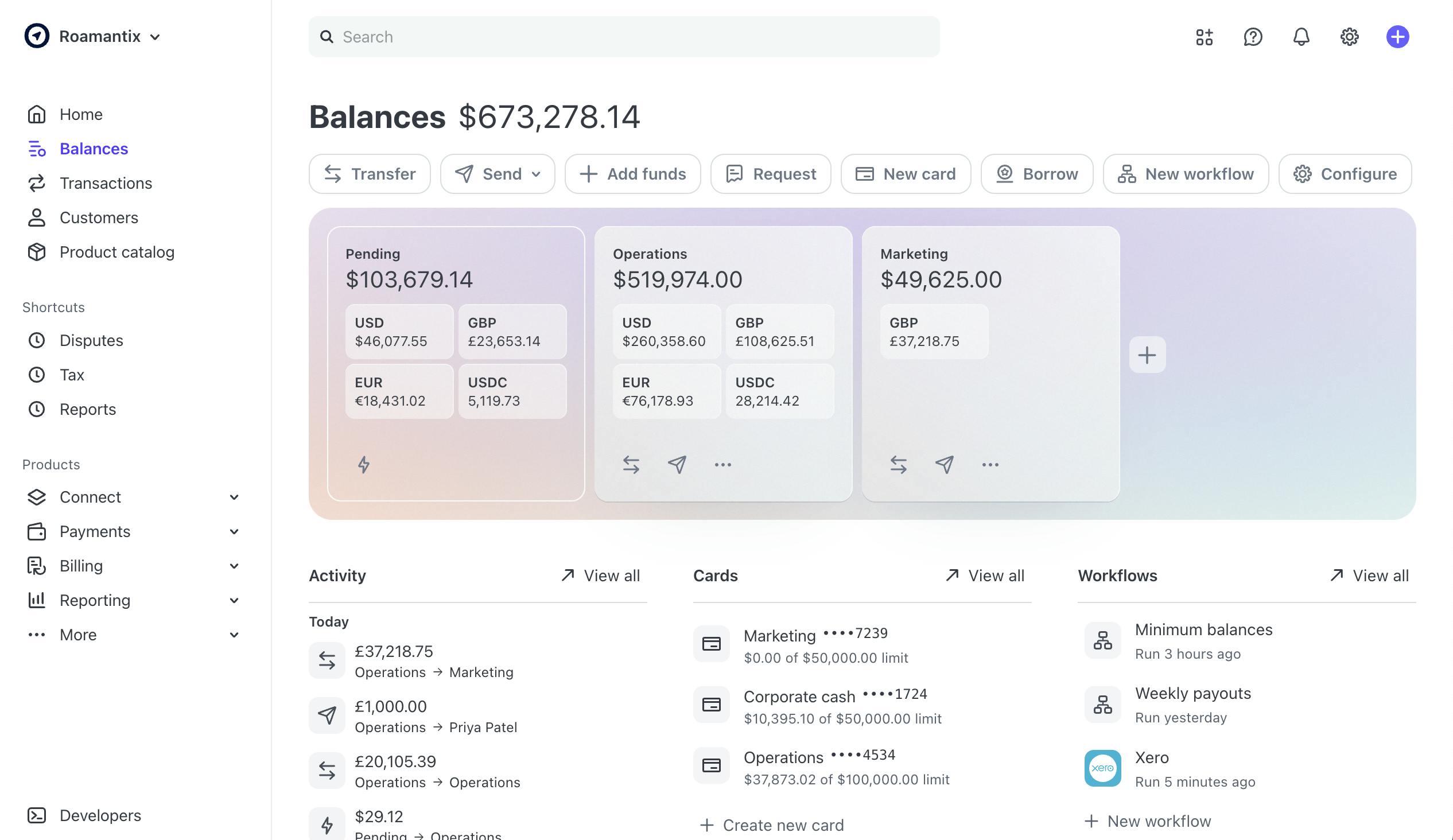

Money Management and Embedded Finance

Stripe’s money movement infrastructure powers platforms that need to hold, route, and disburse funds on behalf of their users. What began with Stripe Connect has grown into a broader suite that includes global payouts, card issuing, lending, and stored-value accounts. These tools enable businesses to embed financial services directly into their products, accelerating onboarding, creating new revenue streams, and delivering a unified user experience. In May 2025, Stripe previewed new money management capabilities, including a dashboard that allows users to store, send, receive, and convert money directly in the platform.

Source: Stripe

Connect

Stripe Connect handles payments for online marketplaces and platforms. These types of Stripe customers facilitate transactions between other parties, meaning that more parties are involved in each transaction than in a typical sale. For example, when a consumer orders food via an on-demand food delivery marketplace like DoorDash*, the funds are split between DoorDash, the delivery driver, and the restaurant. Similarly, when a consumer orders a product from a Shopify-powered e-commerce store, the funds are divided between Shopify and the store. Stripe must process the payment and then pay each of these parties their share of the transaction.

Source: Stripe

In addition to facilitating payments and payouts, Connect helps marketplaces onboard, verify, and screen users. This is done by leveraging the tech that powers Stripe Identity, which is important for compliance. Connect customers can earn revenue from transactions on their platforms through Stripe’s Revenue Share program or by imposing additional fees. The money would typically take at least one business day to reach the recipient, but can arrive in minutes with Stripe Instant Payouts. Businesses can also issue cards to their users with Stripe Issuing.

In May 2025, Stripe expanded Connect’s functionality with networked onboarding, allowing existing Stripe users to join new platforms with just three clicks. A redesigned dashboard now offers connected account growth metrics, performance summaries, and user support analytics. Platforms can also use a version of Radar built specifically for fraud detection across connected accounts, and model customer relationships more flexibly via the new Accounts v2 API.

Global Payouts

Stripe Global Payouts enables businesses to send funds to third parties around the world quickly and in local currencies. Stripe provides a unified API to support one-time or recurring disbursements across dozens of use cases, including insurance, contractor, rewards, and creator payouts. Companies can create recipient profiles, initiate payouts, and monitor delivery success, while Stripe handles currency conversion, compliance, and cross-border infrastructure.

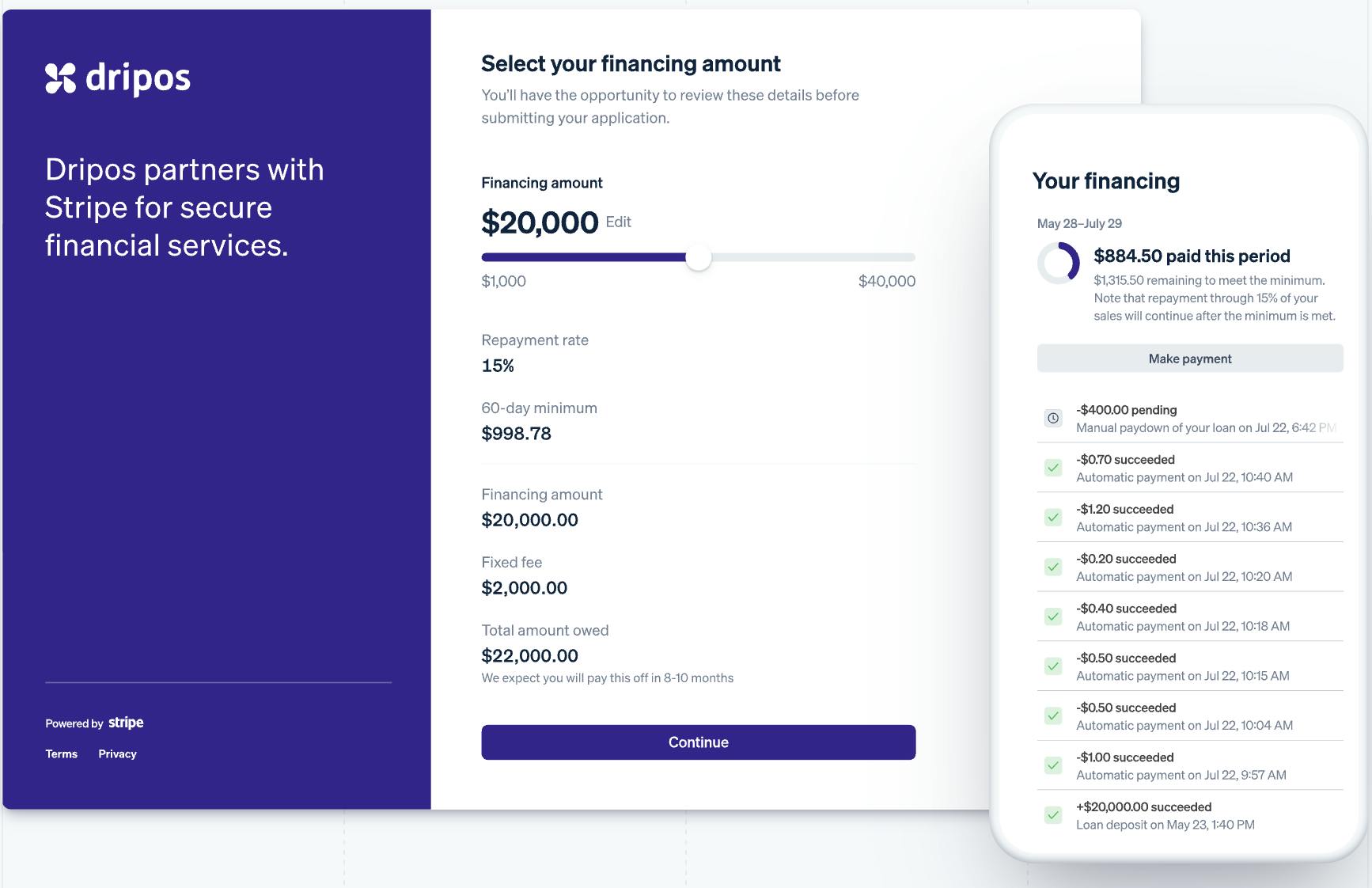

Capital

Stripe Capital offers financing to companies that use Stripe to process their payments. Stripe is able to use customers’ past payment data to gain insight into their businesses’ health. Customers who use this product pay a percentage of sales until the loan and loan fee are paid off. Stripe Capital also enables other platforms to provide loans to businesses. Stripe outsources the development of customer relationships with SMBs by partnering with platforms. Stripe Capital manages the underwriting and lending process and absorbs all credit losses. This way, platform partners face less financial risk and are also able to earn a revenue share from the loans.

Source: Stripe

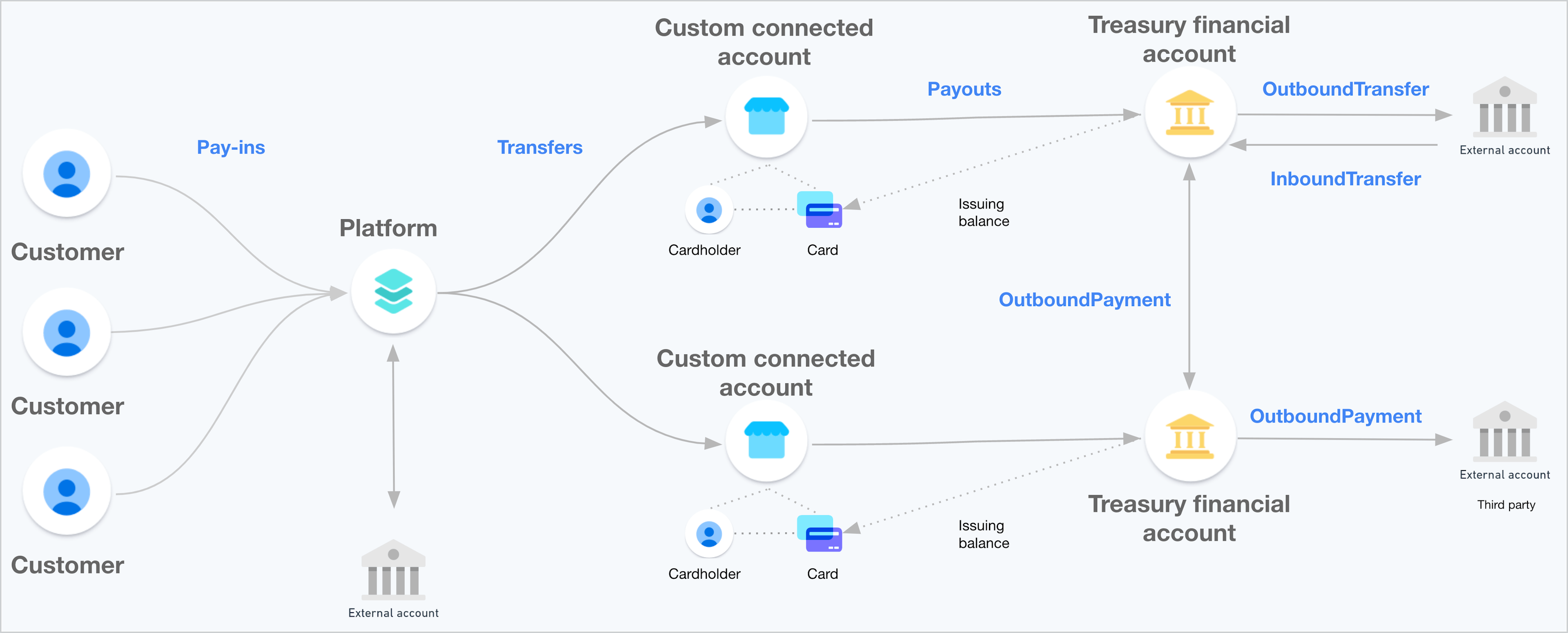

Issuing

Stripe Issuing lets companies issue and manage physical and virtual commercial cards. The cards can be programmed to control where and how much money is spent. Once they reach enough volume, businesses can capture a small percentage of each transaction as interchange revenue. Platforms using Stripe Connect can also issue cards to individuals associated with business entities on their platform. As of August 2025, cards are issued through Stripe’s banking partners Celtic Bank, Cross River Bank, Sutton Bank, and Evolve Bank & Trust under Visa and Mastercard licenses. The diagram below, where the connected account represents a business entity, helps visualize this use case:

Source: Stripe

In this example, the platform could be an expense management company (such as Ramp*), the connected account could be one of its SMB customers, and the cardholder could be an employee of the SMB.

In 2025, Stripe expanded Issuing to support consumer credit card programs, giving companies the flexibility to design turnkey offerings or retain control over licensing and bank relationships. A rules engine allows businesses to define complex authorization logic without engineering resources, and API-level fraud signals help optimize real-time decision-making during authorization. Stripe also began supporting card issuance for subsidiaries of multinational customers in over 40 countries, helping platforms scale card programs globally, including stablecoin-backed cards in partnership with Ramp*.

Treasury

Stripe Treasury is a banking-as-a-service API that enables platforms to embed financial services for businesses. They can create stored-value accounts (a bank account replacement), earn interest, and move money via wire transfers and ACH. Stripe’s Treasury offering was made available in the US in May 2025.

Platforms must be integrated with Stripe Connect to use Stripe Treasury. When using Stripe Connect, there is a “connected account” for each seller on the platform (e.g., for each digital store on the Shopify platform). With the correct configuration, this connected account can use Treasury. The overall architecture is illustrated in the diagram below:

Source: Stripe

As an example, Shopify Balance is built on top of Stripe Treasury. Balance provides financial services for Shopify store owners. They can bank and issue cards from within Shopify rather than relying on an external entity to manage their finances, while Stripe interfaces with the underlying financial infrastructure.

Source: Stratechery

Revenue and Finance Automation

Stripe’s revenue and finance automation suite provides a set of tools to manage the financial operations that follow a transaction. This includes capabilities for billing, invoicing, tax calculation and filing, revenue recognition, and financial reporting. Designed to integrate with Stripe’s core payments infrastructure, these products enable businesses to support a wide range of commercial models, such as subscriptions, usage-based pricing, and one-time purchases, while maintaining accuracy, compliance, and operational efficiency.

Billing

Stripe Billing is Stripe’s subscription management and recurring revenue product. It is designed to support a wide variety of commercial models — including flat-rate, per-seat, usage-based, and overage pricing. It enables businesses to bill customers globally, manage subscription lifecycles, and automate revenue collection across both self-serve and sales-led channels. Billing integrates with Stripe Payments, making it a unified system for acquiring customers, collecting payments, and managing revenue at scale. Billing also integrates with Revenue Recognition and Invoicing for accounting purposes. As of August 2025, Smart Retries recovers 57% of failed payment volume according to Stripe.

With the launch of Stripe Scripts in May 2025, teams can define and deploy custom business logic directly within the billing engine, such as adjusting charges based on user behavior or applying conditional discounts. The Workflows feature allows companies to build and execute multistep flows across Stripe products using APIs, logic branching, and real-time triggers.

Source: Stripe

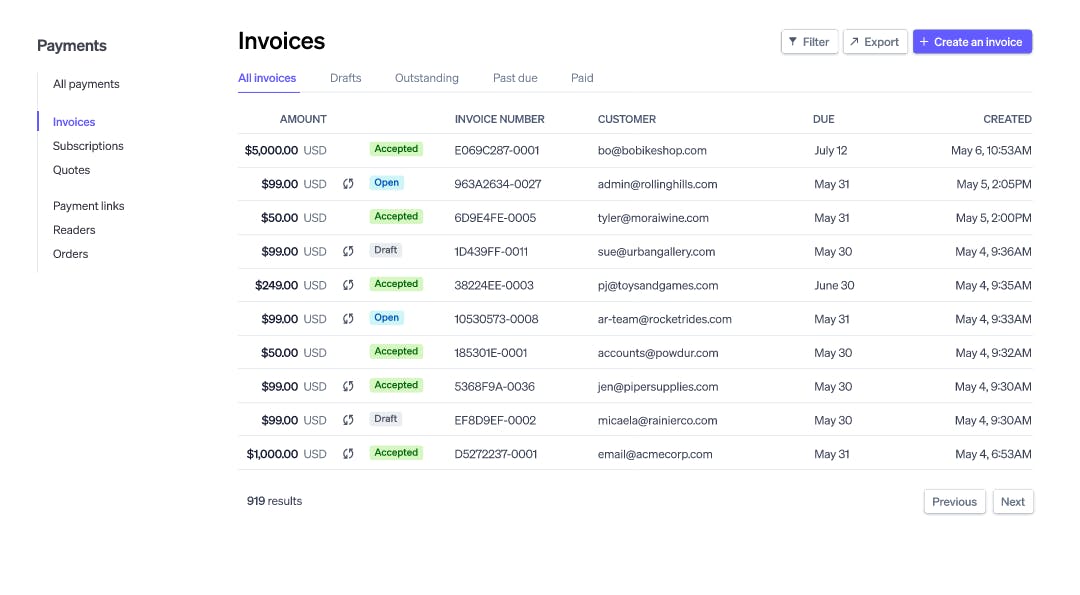

Invoicing

Stripe Invoicing lets businesses create, manage, and send invoices to their customers. It can be used for both one-off and recurring payments. Invoices can be created via the no-code dashboard or through Stripe’s API. Invoices can be generated directly through Stripe's dashboard or through an API for more advanced integration with existing systems. The platform offers features such as customizable templates, automatic payment reminders, and support for multiple payment methods, aimed at helping businesses get paid faster and manage their accounts receivable more effectively.

Source: Stripe

Tax

Stripe Tax automatically collects taxes on Stripe-powered purchases in over 100 countries, including sales tax, VAT, and GST. Designed to reduce the operational burden of tax compliance, it determines the appropriate tax amount by evaluating a customer’s precise location and the specific product or service being sold. This allows businesses to remain compliant with local tax laws without relying on manual calculations or external accounting systems.

Stripe integrates with third-party tax providers such as Anrok, Avalara, and Sphere, allowing businesses that use Stripe Billing or Checkout to layer in additional tax functionality if needed. As of August 2025, support for specialized verticals is underway, further extending the platform’s reach across industry-specific tax requirements.

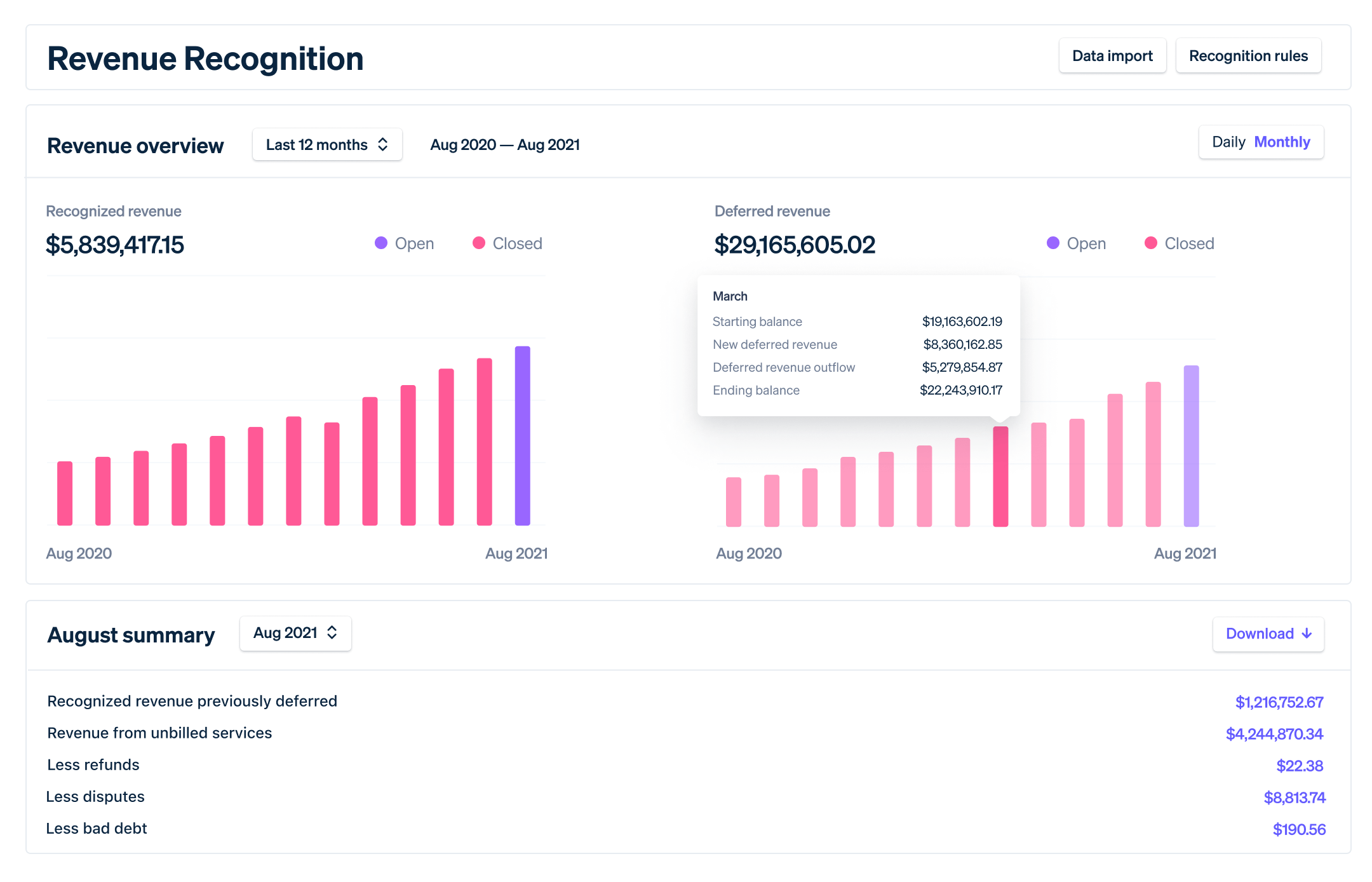

Revenue Recognition

Stripe Revenue Recognition helps companies comply with accrual accounting standards by recognizing booked revenue at the appropriate time. For example, revenue from an annual subscription should be spread out in increments over the course of the year rather than being entirely recognized at the time of purchase. Revenue Recognition works on Stripe data but also allows for importing external transactions, and lets businesses generate financial reports such as balance sheets and income statements. Revenue Recognition also enables companies to trace revenue to particular transactions, helping them remain audit-ready. It handles edge cases like refunds, upgrades, and disputes to maintain accuracy.

Source: Stripe

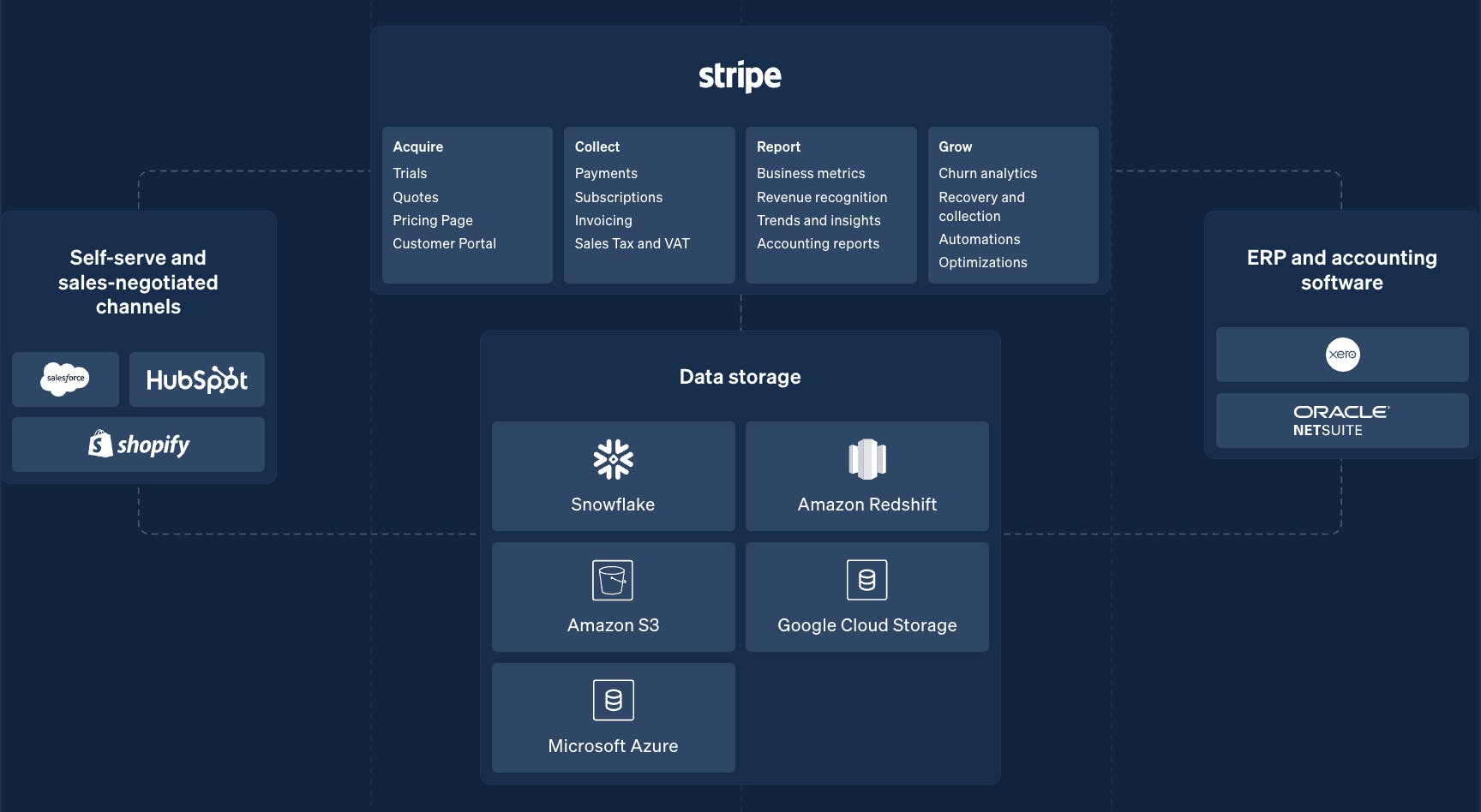

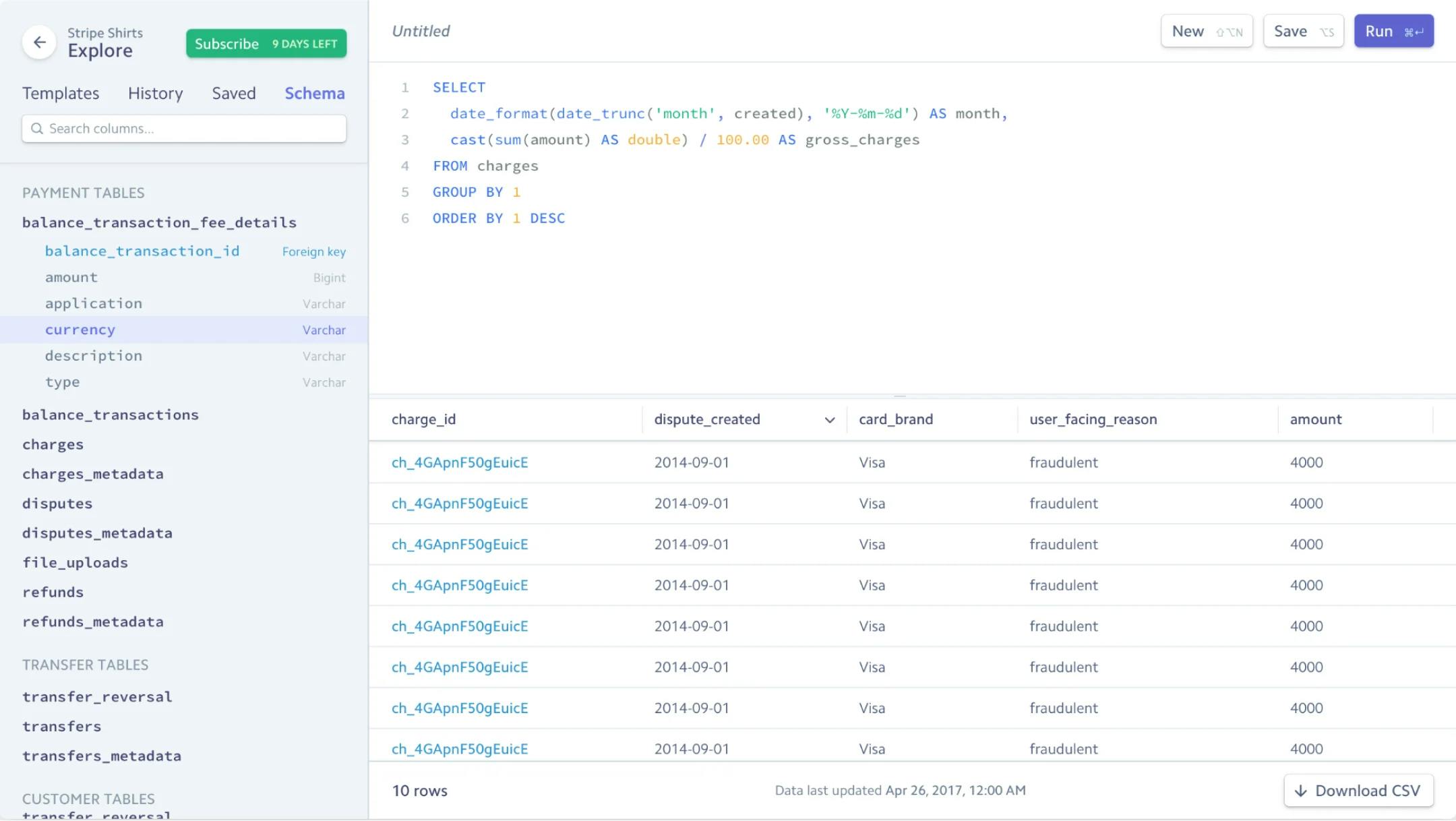

Sigma

Stripe Sigma allows companies to access and analyze their Stripe data from the Stripe Dashboard and the Sigma API. Using SQL queries, users can generate custom reports on various aspects of their operations, such as payments, subscriptions, customers, and payouts. Sigma offers prebuilt query templates for standard business metrics, including Average Revenue Per User (ARPU), which can then be customized to fit the specific needs of a report. Additionally, users can schedule queries to run automatically at set intervals — daily, weekly, or monthly — and have the results delivered via email, facilitating regular reporting and data-driven decision-making. In May 2023, Stripe introduced the Sigma Assistant, which allows users to query their data using natural language instead of SQL.

Source: Stripe

Data Pipeline

Stripe Data Pipeline lets Stripe customers export transaction-level data from Stripe to their Snowflake or Amazon Redshift data warehouse. They can combine their Stripe data with data from other sources to run more complete analyses of their businesses.

Platform Infrastructure and Extensions

Beyond payments and finance, Stripe offers a growing suite of infrastructure tools that serve as foundational building blocks for modern internet businesses. These products help companies onboard users, verify identities, connect financial accounts, incorporate new entities, and extend Stripe’s capabilities into new modalities like stablecoins and agentic commerce.

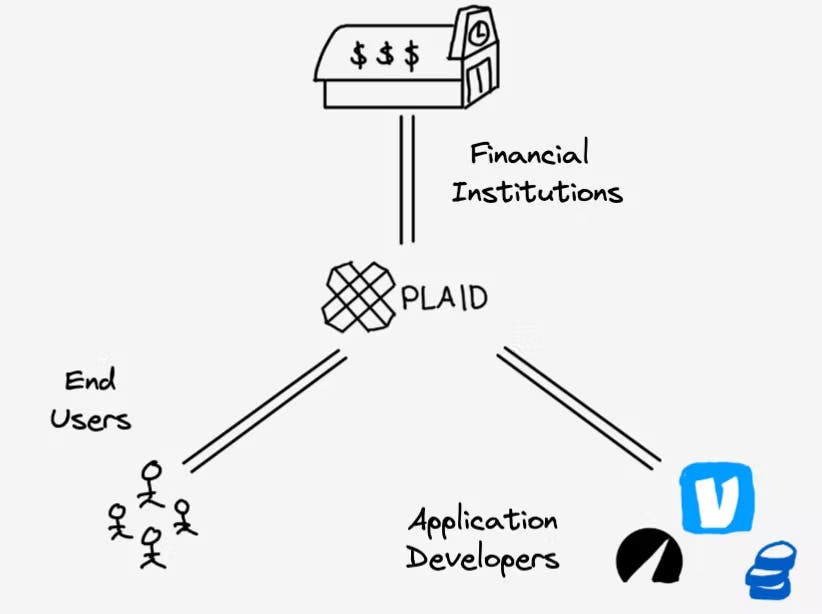

Financial Connections

Stripe Financial Connections enables businesses to securely access their customers’ financial data, facilitating account verification, balance checks, and transaction retrieval without the need for custom integrations with individual financial institutions. The product functions similarly to Plaid, which has caused some concern from Plaid itself, a longtime Stripe customer and partner. As of August 2025, Stripe claims that Financial Connections can help clients connect to 97% of US bank accounts.

Identity

Businesses use Stripe Identity to confirm users’ identities for use cases like onboarding users to a marketplace or linking financial accounts through Stripe Financial Connections. Additionally, KYC regulations in certain industries require identity verification. Verification requires striking a balance between preventing fraudsters from getting through and remaining as frictionless as possible for legitimate users. As such, Stripe Identity relies on both machine learning and manual reviews to improve accuracy and reduce friction.

Stripe validates the authenticity of identity documents and matches user selfies with the image on the identity document. It supports ID documents from over 100 countries. Stripe’s Identity product can also check to validate the information input by the user, such as name, date of birth, government ID number, and address. Stripe itself stores this data, so companies don’t have to worry about data security and compliance. Identity also provides users with control over their data by requiring explicit consent before data sharing and letting them view and delete their data.

Atlas

Stripe Atlas is a business incorporation service available in over 140 countries. It navigates the laws, paperwork, and fees necessary for starting a business. The company partners with the law firm Orrick to offer Atlas. Users can decide whether to incorporate as a C Corp or a limited liability company (LLC). Incorporation occurs in Delaware, a US state whose business-friendly policies attracted about 93% of 2021 US IPOs. Delaware requires companies to maintain a registered agent with an office address in the state, and Atlas handles this as well. Other perks of Atlas include access to the Stripe Atlas Community, help opening a US business bank account, free legal templates, and access to $100K in benefits through Atlas partners.

Climate

Stripe Climate lets companies automatically donate a percentage of their revenue to carbon removal efforts. This commitment is visible to customers at checkout and in receipts and invoices. The carbon removal is facilitated through Frontier, a public benefit LLC fully owned by Stripe. Frontier is a $925 million, nine-year advance market commitment (AMC) for permanent carbon removal with funding from Stripe, Shopify, Alphabet, Meta, McKinsey, and businesses using Stripe Climate. An AMC aims to stimulate the supply side of a market through demand-side commitments. In this case, Frontier aims to foster R&D on carbon removal tech. Its experts decide which carbon removal companies receive funds.

App Marketplace

Stripe’s App Marketplace launched in May 2022 to let companies integrate their Stripe information with third-party business applications. As of August 2025, 347 apps are available. Apps are reviewed by Stripe’s team before being published to the store. App use cases include accounting automation (Xero), analytics (Baremetrics), cloud-based file storage (Dropbox), and agreements (DocuSign).

Cryptocurrency Support

Stripe first started testing Bitcoin payments in March 2014, discontinuing in April 2018 due to volatility concerns. After several years of monitoring the space, Stripe launched USDC payout support for creators on Twitter (now xAI) in April 2022, and formally reintroduced crypto payments in 2024. In April 2024, Stripe launched support for accepting USDC stablecoin payments, integrated directly into its checkout and payments stack. As President John Collison noted:

“Transaction settlements are no longer comparable with Christopher Nolan films for length,” he said earlier Thursday. “And transaction costs are no longer comparable with Christopher Nolan films for budget. Stripe is bringing back crypto payments — this time with stablecoins, which are a way better experience.”

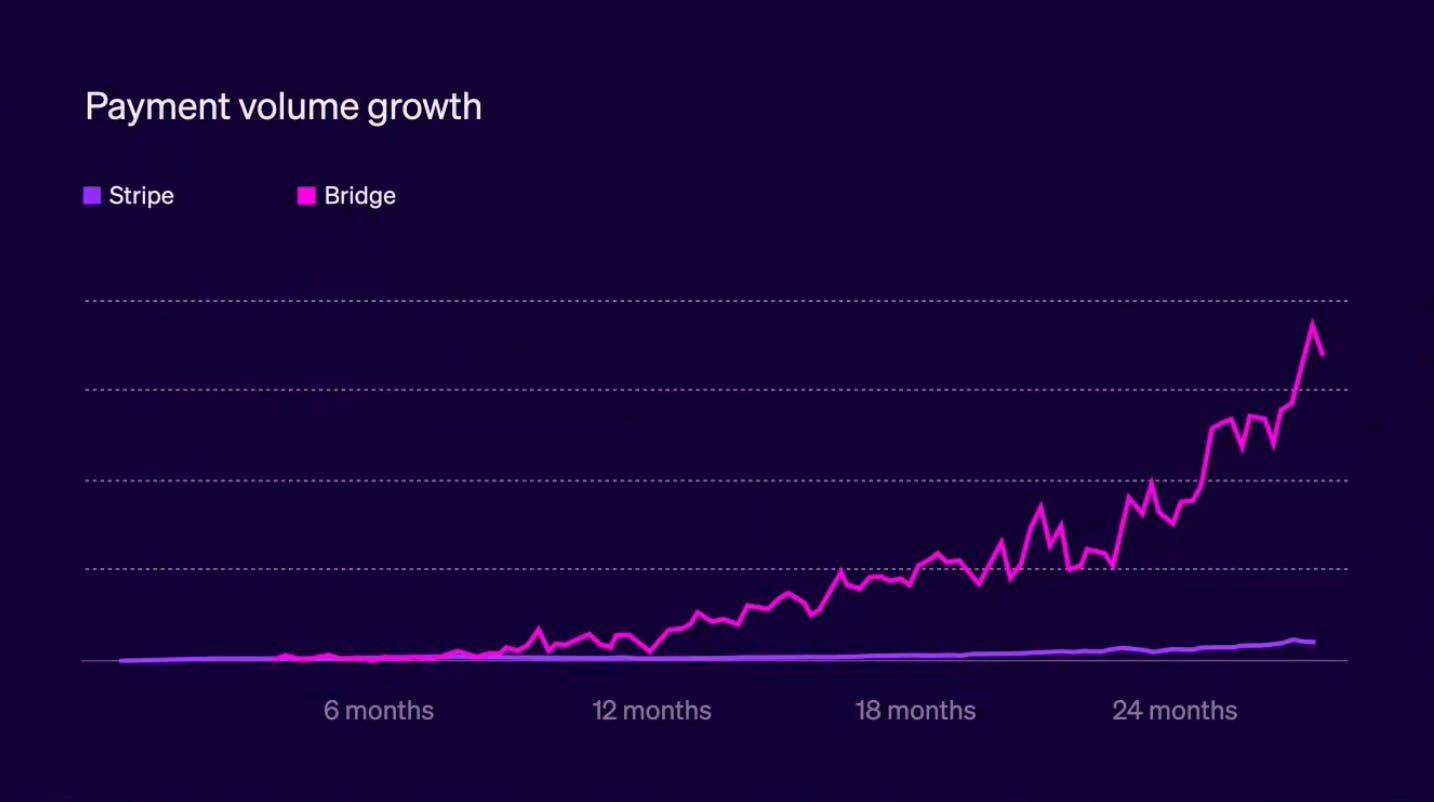

In February 2025, Stripe acquired stablecoin platform Bridge for $1.1 billion, a provider of infrastructure for stablecoin money movement, including APIs for storing, converting, and spending currency-tied stablecoins like USDC. This gave Stripe a full-stack stablecoin platform, allowing it to serve use cases ranging from cross-border payouts and global commerce to programmable agent-led transactions. The acquisition was fueled by the rising adoption of stablecoins as a payment method and store of value, which Stripe saw as one of the most important platform shifts of the 2020s.

Source: Stripe via YouTube

As of August 2025, Stripe’s crypto offerings span several products and partnerships that bring stablecoins into mainstream financial workflows. Businesses can accept stablecoin payments at checkout, with Stripe handling instant fiat settlement behind the scenes. Through the introduction of Stablecoin Financial Accounts, companies in over 100 countries will be able to store, send, and receive funds across both fiat and crypto rails, enabling programmable treasury operations and faster cross-border payouts.

Stripe is also preparing to launch a USDC-denominated corporate card, built on Stripe Issuing and powered by its Bridge acquisition. In May 2025, Ramp* announced it would partner with Stripe to introduce stablecoin-backed corporate cards aimed at simplifying international transactions. The product will launch in select Latin American markets before expanding to Europe, Africa, and Asia.

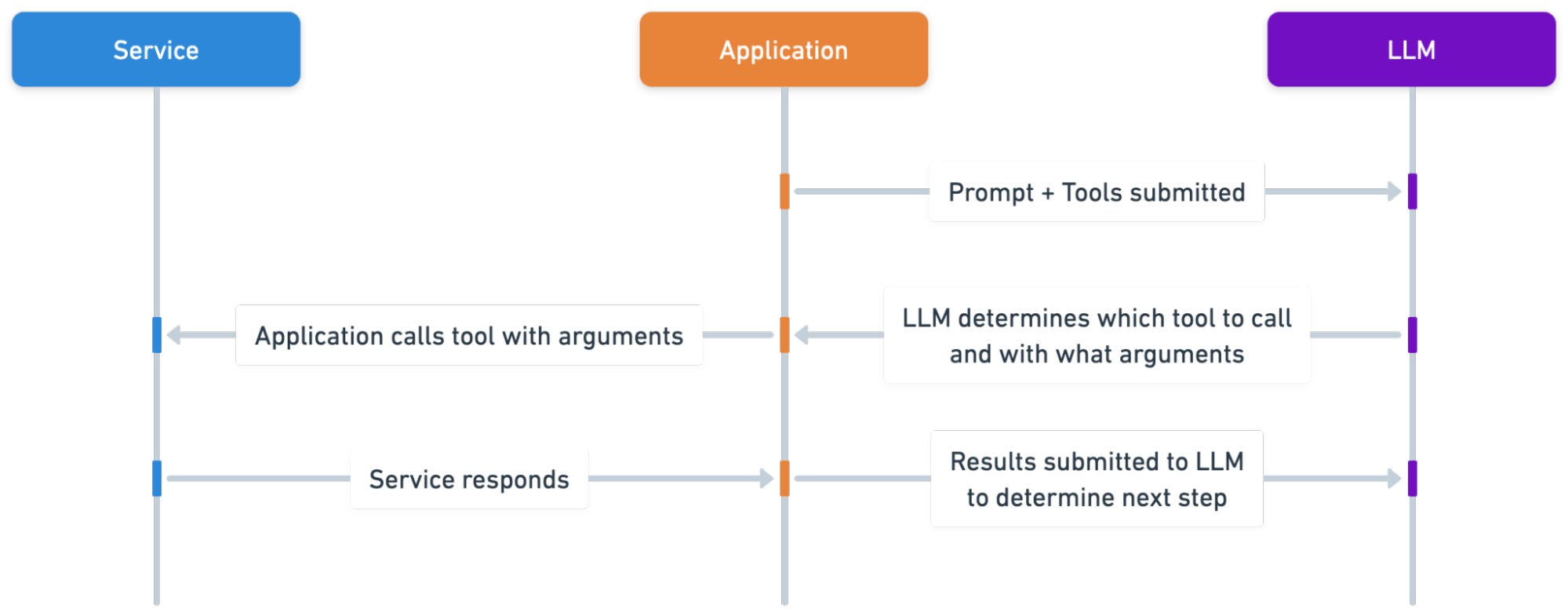

Agentic Commerce

Stripe is building infrastructure to support autonomous software agents that can initiate and complete transactions without human input. At the core of this effort is the Order Intents API, which allows developers to create agents that navigate websites, extract product details, apply discounts, and complete purchases using stored payment credentials. These agents can execute transactions across the public internet, directly from the command line or within applications.

Stripe also supports giving agents access to financial primitives such as stablecoin accounts and programmable cards, allowing them to store, spend, and manage funds. This infrastructure enables embedded purchases on third-party websites without redirecting users, making it useful for cases like affiliate monetization and automated procurement.

These capabilities are supported by Stripe’s Optimized Checkout Suite, which uses over 100 signals to select the appropriate payment method and format for each transaction in real time. Together, these tools position Stripe to support agent-initiated commerce as it becomes more common across applications.

Source: Stripe

Market

Customer

As of August 2025, more than 2 million businesses in the US actively use Stripe, representing 6% of all American businesses. This includes 50% of the Fortune 100, 80% of the Forbes Cloud 100, and 78% of the Forbes AI 50.

Stripe began with a focus on startups and SMB customers, providing a fast and easy way for developers to accept payments over the Internet. It grew with these companies over time, and the company eventually moved upmarket to serve enterprise customers.

Source: Stripe

The steady expansion of Stripe’s customer base has been reflected in the sequence of its product offering launches. Stripe launched Connect in 2012 to serve platforms and marketplaces like Shopify and Lyft that need multi-party payments. In 2018, it launched Billing to handle the needs of subscription-based SaaS companies such as Figma, Slack, and Zapier. Stripe supports invoices and introduced Financial Connections in 2022 to ease payments directly between bank accounts, which are important for B2B companies like Atlassian and Maersk.

The company also has deals with two of the world’s largest ecommerce platforms, Shopify and Amazon. Shopify Payments and Shopify Balance were built using Stripe’s infrastructure. Shopify Payments facilitates payments between customers and Shopify merchants, and Shopify Balance provides business accounts and spending cards for Shopify merchants.

Amazon and Stripe first partnered in 2017, and in January 2023, they announced the expansion of this partnership. Stripe will expand its usage of AWS as its cloud infrastructure provider. In exchange, Amazon will use Stripe to process payments in the US, Europe, and Canada for a significant portion of payment volume for offerings like Prime, Audible, Kindle, Amazon Pay, and Buy With Prime. Other notable Stripe customers include marketplaces like Lyft and Instacart and companies like Ford, Slack, Figma, and OpenAI.

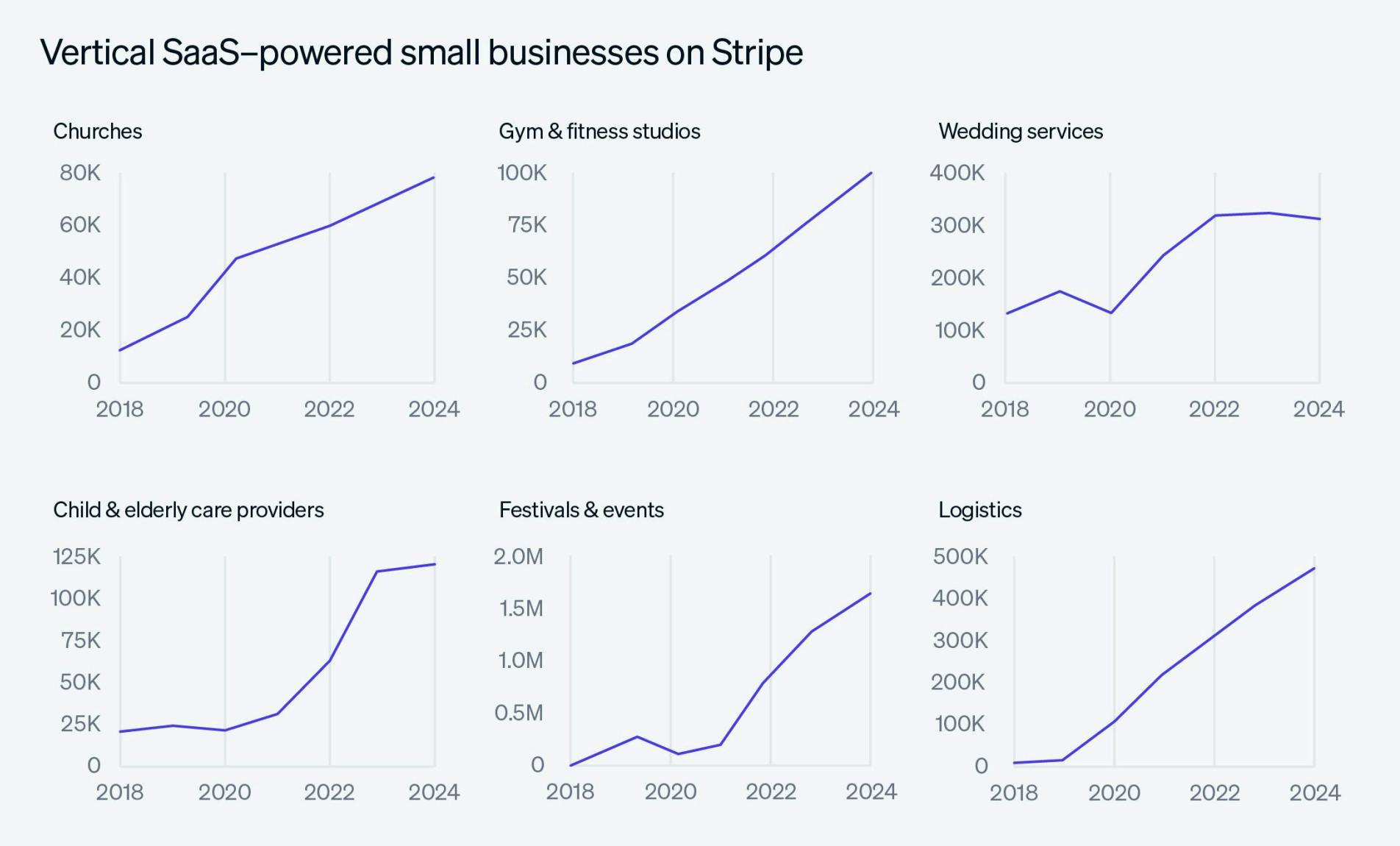

In Stripe’s 2025 keynote, the company highlighted AI companies, vertical SaaS platforms, and creator businesses as the fastest-growing customer categories on Stripe. With Stripe’s support, these companies can serve customers globally and adopt specialized commercial models, such as usage-based or outcome-based pricing. Vertical SaaS platforms like GlossGenius and Jobber are embedding Stripe to help small businesses automate workflows and offer integrated financial services. Legacy brands like Fender, a guitar manufacturer, are using Stripe to expand into new business models, such as connecting teachers and students through a global learning platform.

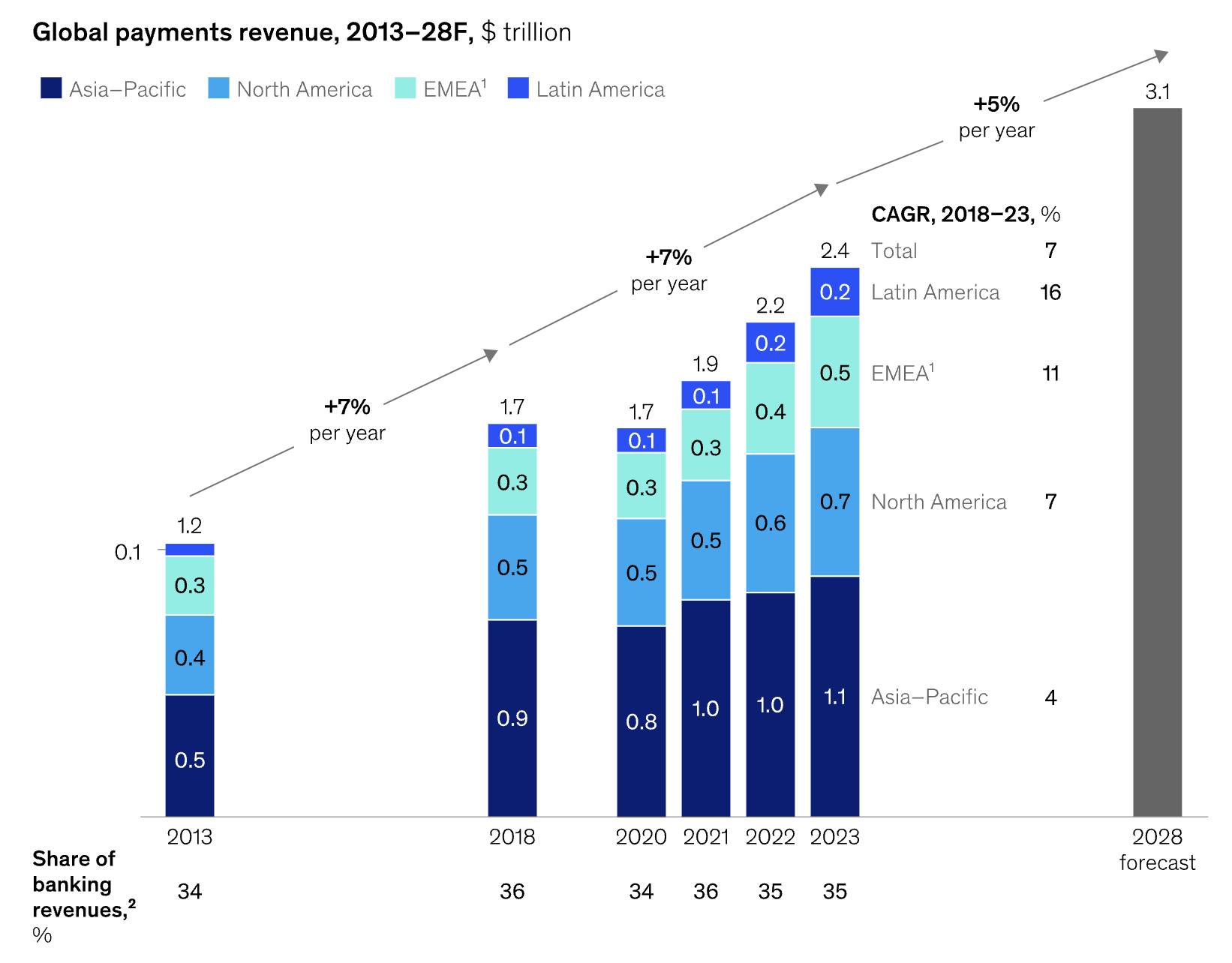

Market Size

In 2025, the global payments industry was valued at $2.5 trillion in revenue, and is projected to grow to $3 trillion by 2029. The global total payment volume (TPV) across P2P, C2B, B2C, and lower-value B2B payments was estimated at $162 trillion in 2023. 89% of US consumers use digital payments to some degree, compared to only two in three consumers worldwide.

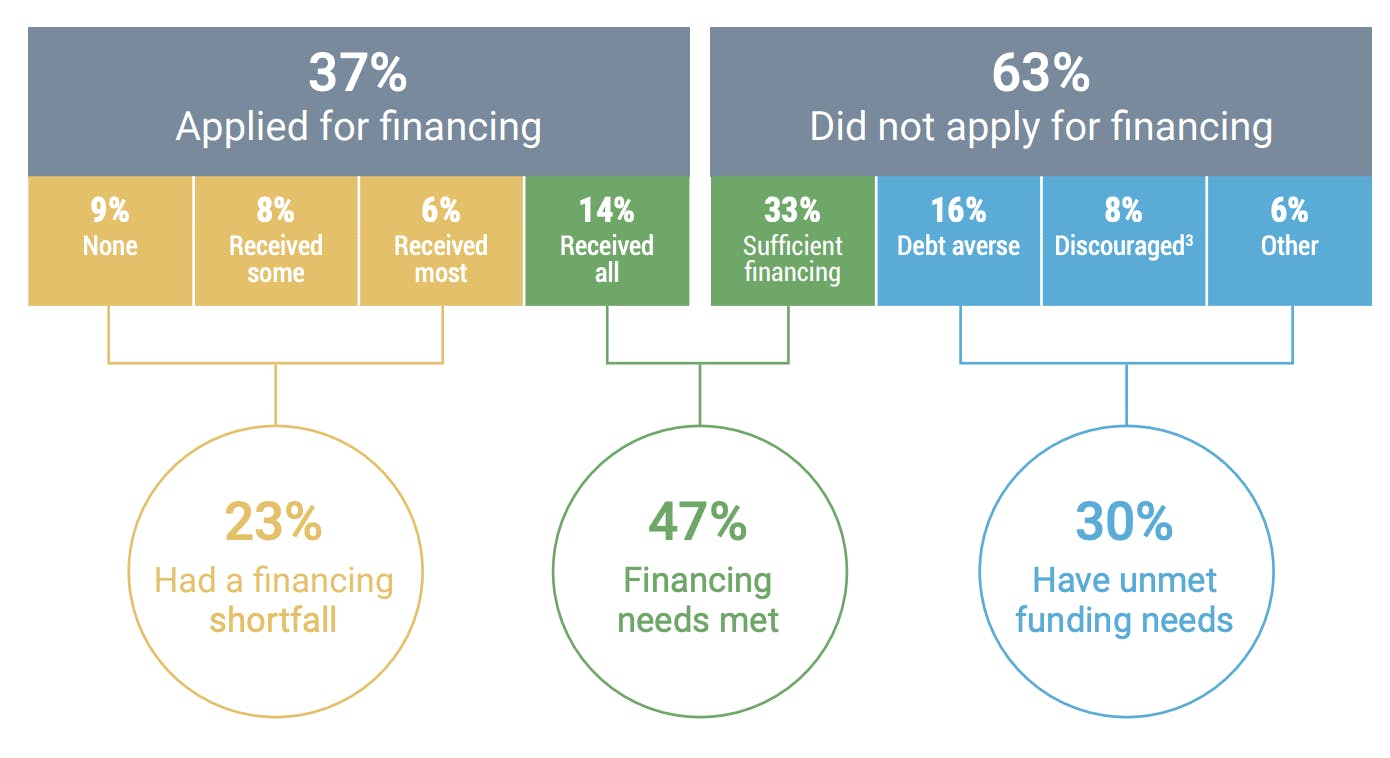

Source: McKinsey

Stripe’s product suite exposes it to markets beyond payment processing. Radar alone, for example, expands its addressable market significantly; As of 2022, businesses were expected to face $343 billion in losses to online payment fraud globally between 2023 and 2027. In addition, Stripe Capital provides loans to SMBs using Stripe or a Stripe-enabled platform, and SMBs are financially underserved. In developing countries, 40% of SMBs have unmet funding needs totaling $5.2 trillion annually. In the US, a 2021 survey found that less than half of US small businesses had their funding needs fully met, as shown in the graphic below.

Competition

Stripe offers a payment product with an integrated product ecosystem. Once a company uses Stripe for one aspect of their business, they are more likely to use Stripe for other products they need. In addition, the more integrated Stripe becomes into a customer’s operations and finances as that customer adopts more and more Stripe products, the higher the switching costs become.

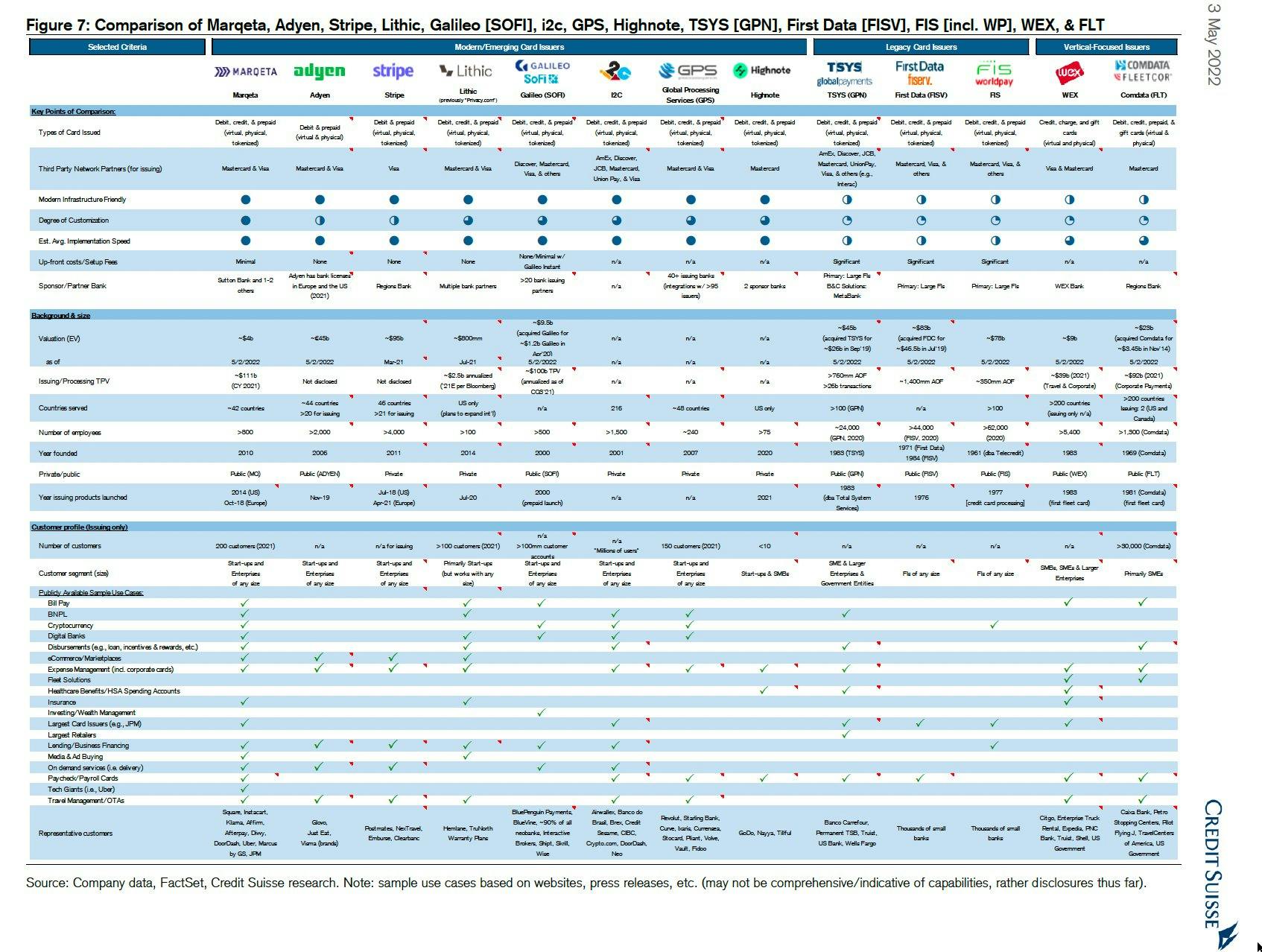

However, competitors focused on narrow slices of Stripe’s business still provide competition. For example, Marqeta issues cards with greater customizability than Issuing, and Plaid offers more bank integrations than Financial Connections. Here are some of Stripe’s competitors across various parts of its business, followed by deeper dives into the competition for Payments, Financial Connections, and Issuing:

Payments: Adyen, PayPal, Checkout.com

Financial Connections: Plaid, Finicity (Mastercard), Tink (Visa)

Issuing: Marqeta, Lithic, Highnote, Galileo

Treasury + Issuing + Capital: Unit, Bond, Treasury Prime

Capital: Pipe, Clearco, Square Loans

Billing: Chargebee, Recurly, Zuora

Radar: Sardine, Sift, Kount

Identity: Persona, Socure, Alloy

Tax: Avalara, Vertex, Sovos, Anrok

Link: Bolt, Apple Pay, Google Pay

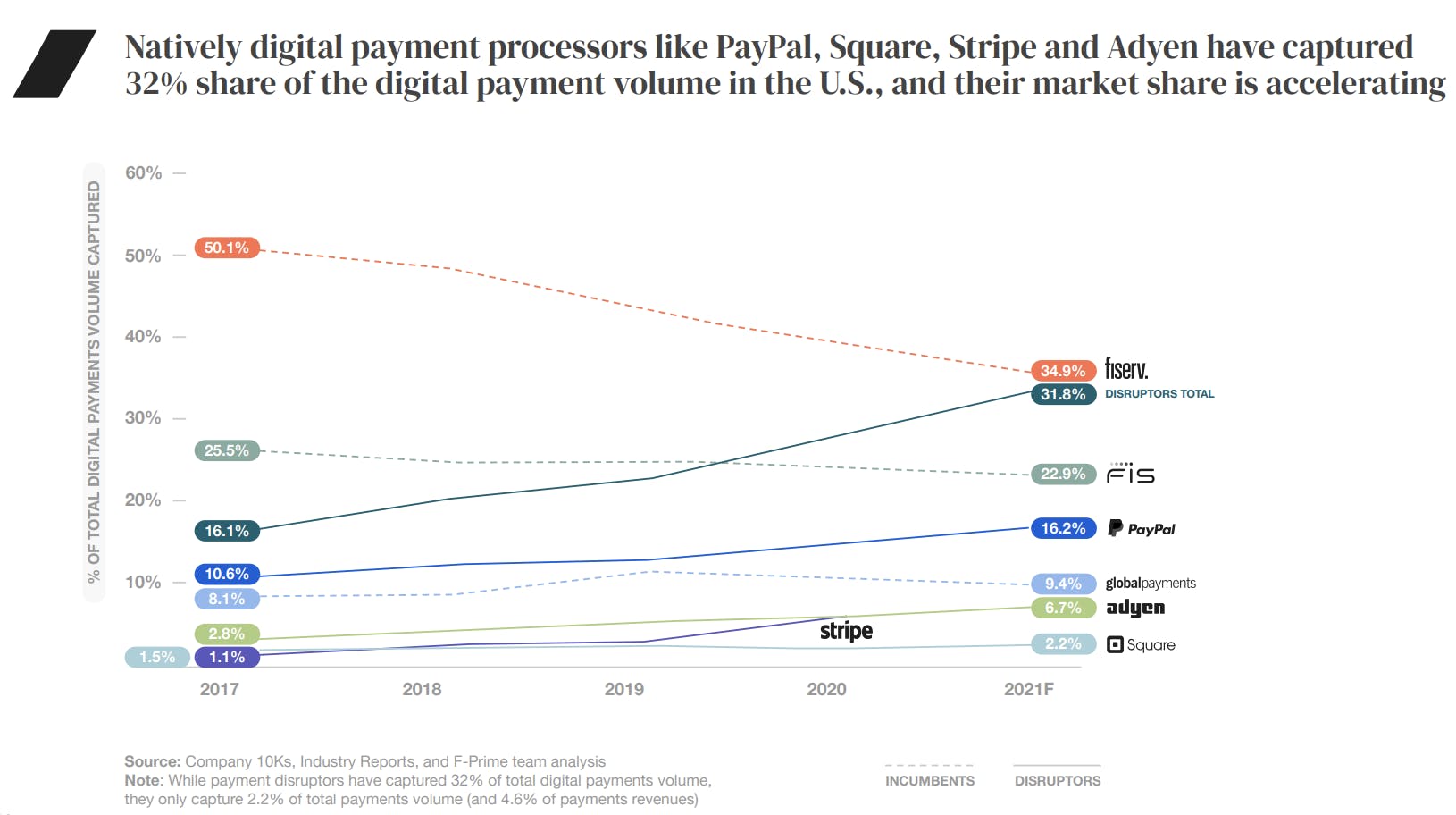

Competitors to Stripe Payments

Given its large addressable market, payment processing has capacity for multiple major players to win a significant customer base. Competitors to Stripe include PayPal (Braintree) and Square for SMBs and Adyen, PayPal, Checkout.com, and FIS for enterprises. However, tech-forward players like Stripe are gaining market share from legacy businesses, as shown below:

Source: F-Prime Capital

Internationally, Stripe has been more successful in countries with higher card penetration. An important component of Stripe’s competition is companies that act as “the Stripe for [country].” Razorpay in India and Xendit in Indonesia are two unicorns in this category.

Adyen

Founded in 2006, Adyen is Stripe’s main competitor in payments. As of August 2025, its market cap was $53.5 billion. From inception, Amsterdam-based Adyen focused on serving large, global enterprises. As of August 2025, a self-serve option for SMBs and startups is not available with Adyen; Stripe started out targeting SMBs and startups and is moving upmarket into Adyen’s territory. Stripe also reaches many more small businesses through platforms such as Shopify.

These strategic differences are reflected in the two companies’ respective customer counts and compositions. In 2023, Stripe had millions of customers, but only 110 with $1 billion or more in volume. Adyen, on the other hand, had just over 100K customers in 2025, comprised solely of enterprise and mid-market companies. Bigger customers have higher transaction volumes, but their greater negotiating power results in a lower take rate for Adyen.

Adyen’s offerings have been tailored to global enterprises’ needs. Stripe’s point-of-sale solution, Terminal, lags behind Adyen’s, although Stripe’s acquisition of BBPOS may help address this. This point-of-sale solution advantage helps Adyen win omnichannel deals with companies like Subway and McDonald’s, even as it attracts digital enterprises like Uber and Spotify. In addition, Adyen provides support for more countries and payment methods than Stripe. Adyen supports over 300 payment methods in nearly 100 countries, compared to fewer than 50 payment methods in 47 countries for Stripe. Nevertheless, Stripe ended 2024 with an estimated revenue of $5.1 billion – almost twice as much as Adyen at $2.2 billion.

Other differences include Stripe’s broader product suite versus Adyen’s, which contributes to Stripe’s higher take rate. Adyen does not have offerings to match financial software products like Stripe Tax and Revenue Recognition. Stripe also has greater traction among platforms such as Shopify since it has given more attention to serving ecommerce partners than Adyen. For example, Stripe launched Treasury and Capital ~2-3 years before Adyen launched competing offerings.

Despite Stripe’s higher take rate, Adyen has better margins. Stripe lost $500 million in 2022, although it expects to return to profitability in 2023. In contrast, Adyen generated over $650 million in free cash flow in 2022. A major contributing factor is that Stripe spends much more on its workforce. Adyen has fewer than 3K employees, whereas Stripe has 7K employees, even after laying off 14% of its workforce in 2022. Adyen also likely pays each employee less, given that most of Adyen’s employees are based in Amsterdam instead of the US. Stripe’s higher headcount was likely needed to build out its additional products and seems to be reflected in its financials.

Financial Connections

Open banking refers to the ability for users to share their financial data stored at one financial services provider with other financial services providers. Unlike the US, Europe has regulations that have driven the adoption of open banking.

Stripe Financial Connections is one of many offerings facilitating open banking through data aggregation in the US. Other players in the US include Plaid, MX, Yodlee, and Finicity, which was purchased by Mastercard in 2020. Tink, acquired by Visa in 2021, leads the European market. Plaid has also been expanding into Europe.

Plaid

Founded in 2012, Plaid is the most well-known company in this area. In its latest round, the company raised $575 million at a $6.1 billion valuation in April 2025. Like Financial Connections, Plaid offers APIs that allow application developers to retrieve end users’ account data from financial institutions. One customer described Financial Connections as very similar to Plaid, though the two products also differ in pricing transparency. As of August 2025, it’s difficult to find Plaid’s base pricing, while the pricing for Financial Connections is easily accessible.

Source: Stratechery

Stripe supports 5K financial institutions in the US, while Plaid supports over 12K in the US and Europe. Plaid has partnered with various financial companies to build a network for bank account payments. Bank account payments save merchants from having to pay credit card fees, hurting card networks like Visa. The Department of Justice focused on this aspect of Plaid’s business in its antitrust lawsuit to prevent Visa’s acquisition of Plaid. Companies that rely on the interchange for revenue could be negatively affected by the widespread adoption of bank account payments.

Issuing

Companies whose main focus is card issuance include FIS, Marqeta, Highnote, Galileo, and Lithic. One industry expert described Stripe as having effectively productized a low-cost, easy-to-implement solution at the expense of customizability.

Source: Credit Suisse

Marqeta

Marqeta is an enterprise-focused card issuing company. It was founded in 2010 and is trading at a market cap of $2.7 billion as of August 2025. Stripe Issuing is focused on commercial cards, but Marqeta issues both commercial and consumer cards (e.g., Cash App’s Cash Card). In addition, Marqeta’s card-issuing capabilities are more advanced than Stripe’s, according to several sources. Marqeta added banking capabilities to its platform in October 2022, expanding its competitive surface area with Stripe to include Treasury. However, Marqeta faces customer concentration risk. Block accounted for ~70% of Marqeta’s net revenue in 2020 and 2021, and its contract is set to expire in 2027. In 2024, Marqeta generated $507 million in revenue.

Business Model

Stripe started as a bottom-up company without traditional outbound sales. Its focus on the developer experience paid off because purchasing decisions, like picking a payment provider, were increasingly made by developers. One founder put it like this:

“Stripe caught on because it didn’t sell to companies. It sold to developers. That is, Stripe offered an alternative to PayPal and Authorize that was so much easier to implement that developers around the world were naturally inclined to use it.”

Another leg of the company’s grassroots approach is content. It launched Stripe Press in 2018 to publish technological and economic progress books. Stripe also publishes Increment, a magazine about software, owns Indie Hackers, and writes high-quality API documentation, accessible to developers on VS Code through an AI assistant as of March 2025.

As its customers grew, Stripe grew with them. For example, Shopify was an early customer of Connect and is a $183 billion company as of August 2025. After years of organic product-led growth, Stripe created a sales organization in 2016 to further bolster growth. It has moved upmarket over time, reaching 25 customers with over $1 billion in payment volumes in 2019 and 110 in 2022.

Even as Stripe moves upmarket, it still emphasizes serving startups to maintain its product quality. Smaller companies also provide higher margins, which help offset the lower pricing that large customers can negotiate. Stripe benefits from keeping these large customers away from competitors and collecting large volumes of payment data. These data open up cost-cutting and product-improvement opportunities. For example, they serve as training data for fraud detection ML models, help save Stripe customers over $2.5 billion by optimizing card network requests, and can inform underwriting for lending products like Stripe Capital.

Additionally, Stripe is increasingly embedded directly into third-party platforms and workflows, including vertical SaaS tools, POS systems, and AI agents. With the launch of Order Intents and support for agent-initiated transactions, Stripe can now be integrated into autonomous workflows that make purchases or manage funds without human input. This positions Stripe as infrastructure that is pre-integrated into the software and tools businesses already use.

Margins

Stripe Payments lies at the core of Stripe’s business and features usage-based pricing. The standard pricing for Payments in the US is $0.30 + 2.9% of the transaction value for each successful card charge and includes Radar for fraud detection. Pricing varies by country. Stripe increases its take rate with the products layered around Payments. Its take rate for 2025 was estimated to be 0.4%. Below are standard charges companies incur for other products, although Stripe products generally offer custom pricing for high volumes:

Radar: $0.05/transaction

Issuing: $0.10/virtual card and $3.50/physical card

Billing: $620/month or 0.7% of billing volume

Data Pipeline: $0.03/transaction

Revenue Recognition: 0.25%/transaction

Tax: $90/month or 0.5%/transaction

Connect: 0.25%/payout

Identity: $1.50/verification

Financial Connections: $0.10/Balances API call

Atlas: $500 one-time fee

Not only do the additional products increase the take rate Stripe is able to charge, but they also create a more complete ecosystem for business finance. Companies using multiple products may be less likely to switch away from Stripe once it is deeply embedded in their operations.

Stripe has also diversified its product suite with higher-margin BaaS (Banking-as-a-Service) offerings, including Treasury, Issuing, and Capital. Embedded finance (which refers to integrating financial products into non-financial platforms) helps platforms by opening up additional revenue streams while enabling contextual financial services. In 2022, 9% of Stripe’s revenue came from non-payment products. For Capital, Stripe charges loan fees, and platforms can earn a revenue share.

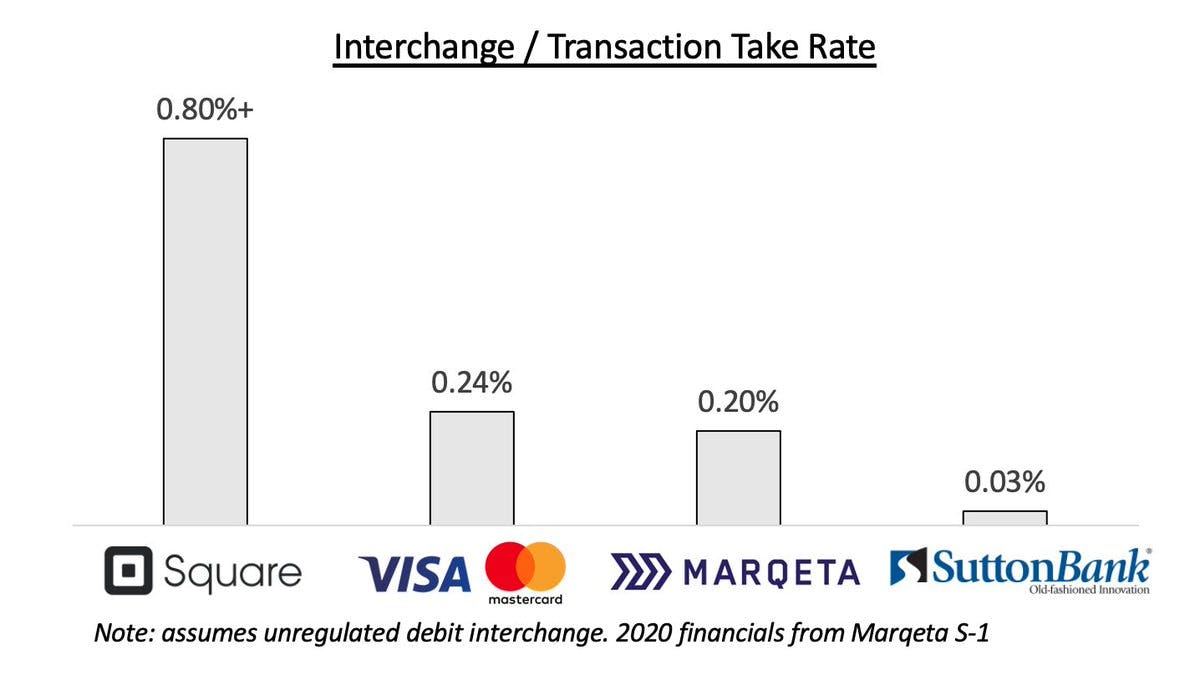

Treasury allows companies to store money using Stripe. When this money is spent on cards issued by Stripe Issuing, Stripe likely monetizes through interchange revenue, as other companies offering card issuing do. Interchange refers to the small fees associated with using payment cards. A portion of this interchange revenue can be shared with the platform. Here’s the breakdown of interchange fees for competitor Marqeta to provide an idea of what Stripe’s take rate could be:

Source: James Ho

Acquisitions

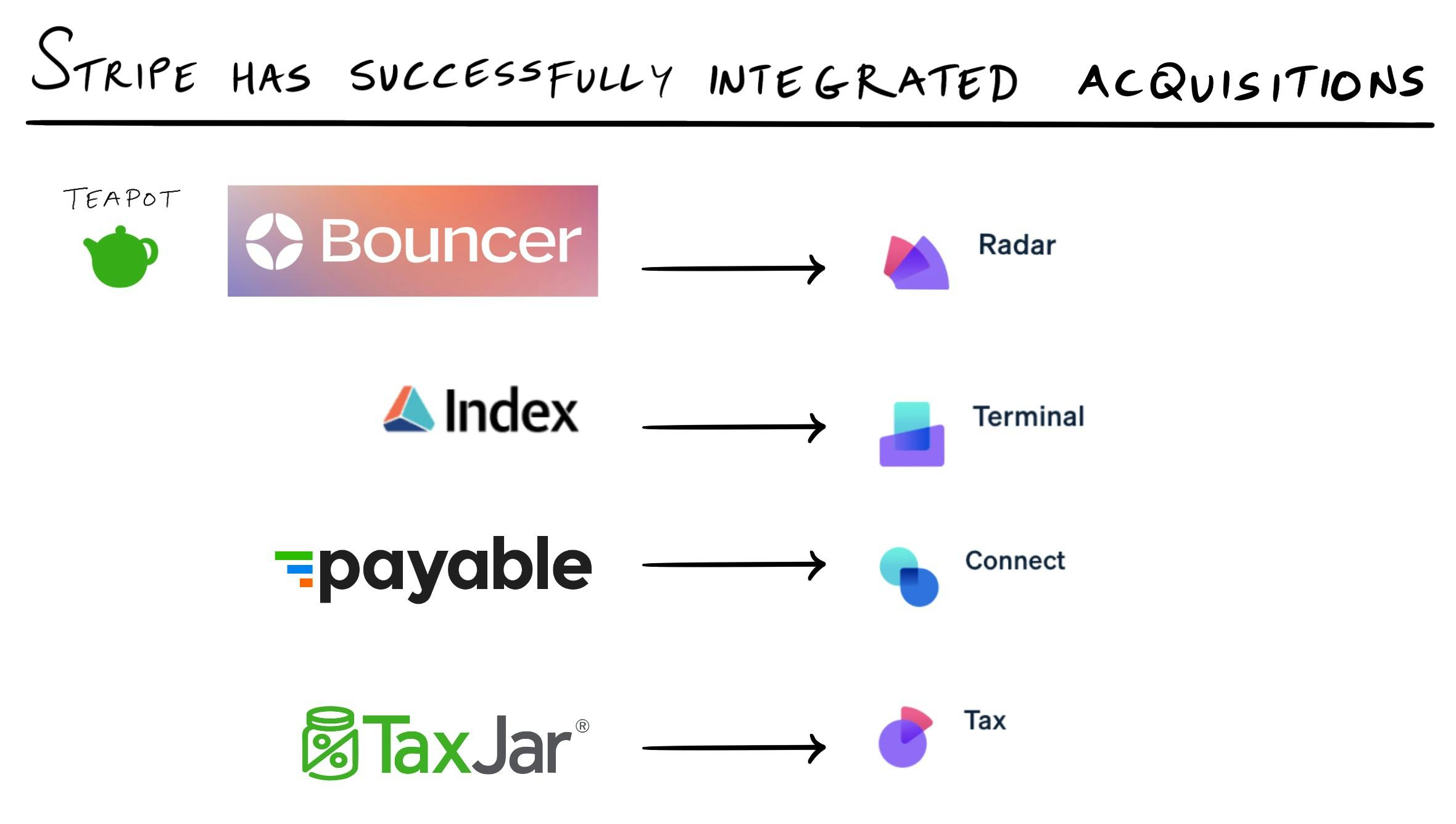

Stripe has acquired 18 companies as of August 2025. Some of Stripe's acquisitions contributed to product development, as in the graphic below. The company’s acquisition of OpenChannel, announced in December 2021, may have been helpful for launching the Stripe App Marketplace in May 2022. To improve its point-of-sale hardware capabilities, Stripe acquired BBPOS in early 2022. Other acquisitions, like those of PayStack (Africa) and Touchtech (Europe), helped Stripe expand globally.

In February 2025, Stripe acquired Bridge for $1.1 billion, its largest acquisition as of August 2025. Bridge provides APIs that enable businesses to store, transfer, and convert stablecoin balances, with a focus on USDC. The acquisition marked a step for Stripe into programmable money movement and cross-border financial services. Bridge now powers Stripe’s Stablecoin Financial Accounts, USDC-denominated corporate cards, and settlement infrastructure for agent-initiated transactions.

Source: The Generalist

Investments

Stripe has made dozens of investments through its venture capital arm. The company has two main investment criteria. First, the investment must drive forward Stripe’s mission to “grow the GDP of the Internet” and be in a space where Stripe has sufficient expertise. Second, the investment must represent what the company views as a sensible allocation of capital in a great business. As of August 2025, Stripe's venture capital arm led 34 of the 79 funding rounds it participated in.

Stripe has invested in payments companies in other countries, like Rapyd (UK), PayMongo (Philippines), and Safepay (Pakistan). Neobank investments include Monzo (UK), Step (US), and Cuenca (Mexico). A few of the highest-profile US startups Stripe has invested in are Ramp* (corporate card, spend management, bill pay), Check* (embedded payroll), and Pulley (cap table management).

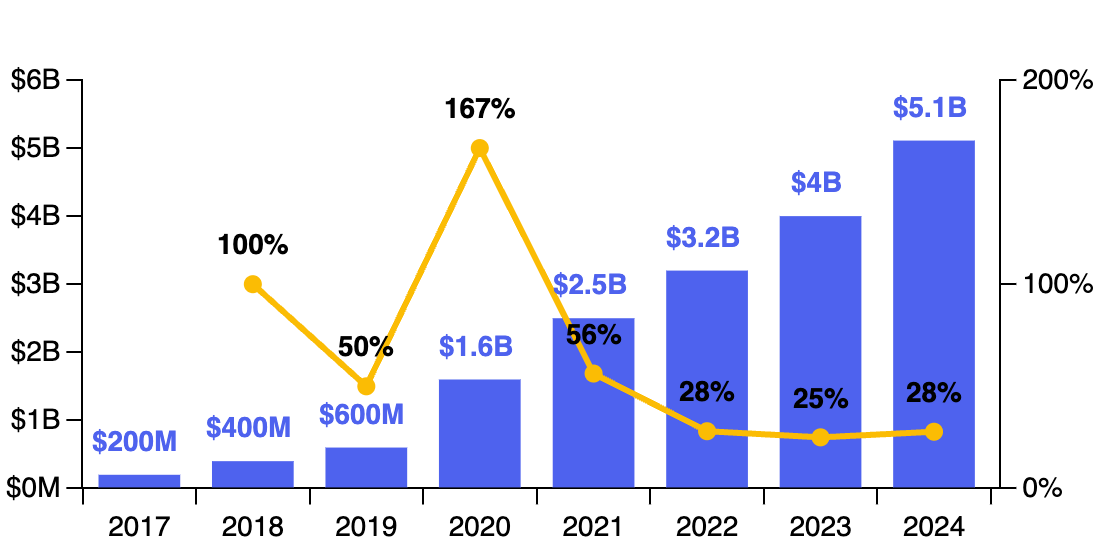

Traction

In February 2026, Stripe reported that it had reached $1.9 trillion in total volume, which represented an increase of 34% from 2024. This was the equivalent of about 1.6% of global GDP, according to Stripe. With an estimated 0.4% take rate, this would yield an estimated $7.6 billion in 2025 revenue from payments. Meanwhile, outside of payments, Stripe's Revenue suite, including its Billing, Invoicing, and Tax products were estimated to hit $1 billion in annual revenue in 2026 for a total estimated revenue of $8.6 billion.

Before this, in August 2025, Stripe was processing an estimated 50K transactions every minute for its customers. In 2024, Stripe processed a total of $1.4 trillion in payments, a 38% increase from 2023 and equivalent to 1.3% of global GDP. Shopify accounted for $292 billion of this volume.

Stripe’s net revenue grew 28% year-over-year to $5.1 billion in 2024, returning to profitability after prior cash burn in 2022. The company’s take rate remained around 0.4%, boosted by a growing share of revenue from higher-margin products such as Billing, which was used by over 300K companies in 2024 and brought in over $500 million in revenue run rate.

Source: Sacra

As of August 2025, Stripe’s customer base included over 2 million businesses in the US, representing 6% of all US businesses. Stripe serves 50% of the Fortune 100, 80% of the Forbes Cloud 100, and 78% of the Forbes AI 50, with continued upmarket momentum, growing the number of customers processing over $1 billion annually from 25 in 2019 to over 110 by 2022. Across the platform, Stripe-powered businesses are growing seven times faster than the S&P 500 on average.

Stripe attributes much of this growth to the proliferation of new AI-native businesses. Customers like OpenAI ($200 million in 2022 → $4.9 billion in 2024), Cursor ($0 in 2023 → $300 million in 2025), and Midjourney ($0 in 2022 → $500 million in 2025) are scaling faster than any previous cohort of startups. International expansion is another major driver. In 2024, one in six Delaware corporations incorporated via Stripe Atlas, and vertical SaaS adoption is growing rapidly in markets like Australia, the UK, France, Germany, and Singapore.

Source: Stripe

Valuation

In February 2026, Stripe's valuation rose to a high of $159 billion through an employee tender offer, with Thrive Capital, Coatue, a16z, and others participating in the round, with Stripe using some of its own funds to repurchase shares.

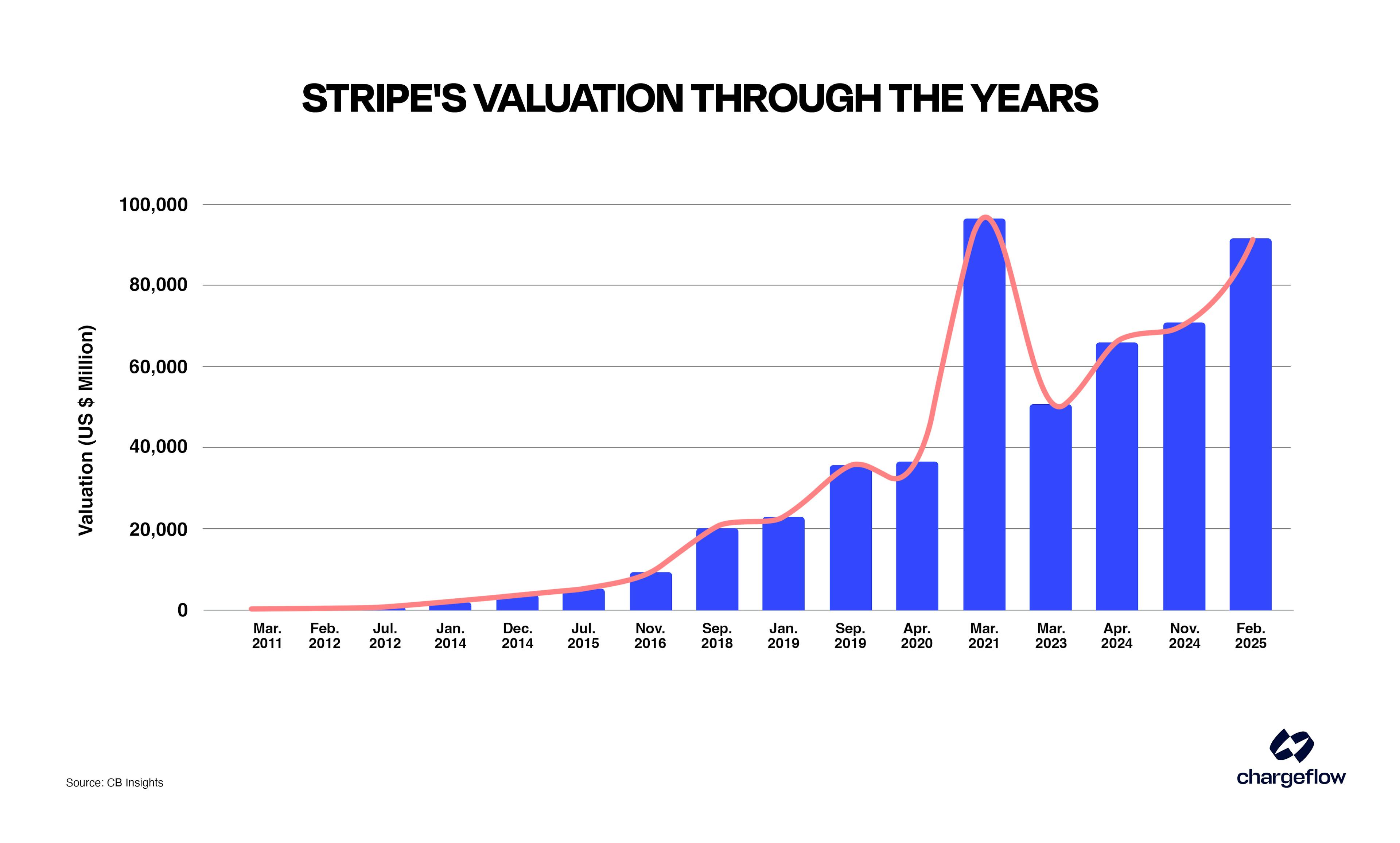

Prior to this, Stripe was one of the most valuable private companies in the world as of August 2025. After peaking at a $95 billion valuation in its March 2021 Series H, led by Fidelity, Sequoia, and NTMA, the company faced multiple markdowns amid a broader tech market correction. Internal valuations were revised to $74 billion in July 2022, then $63 billion in January 2023, coinciding with a 14% workforce reduction and a pivot toward profitability.

In March 2023, Stripe raised $6 billion at a $50 billion valuation, largely to address expiring Restricted Stock Units and facilitate a tender offer for employees and early investors. However, by February 2025, Stripe rebounded, conducting a secondary tender at a $91.5 billion valuation. As of August 2025, the company had raised over $9.4 billion in total funding and is trading on the secondary markets at an aggregate price of ~$34 per share.

Source: chargeflow

At a $91.5 billion valuation and $5.1 billion in 2024 net revenue, Stripe trades at an implied 17.9x multiple. This places it slightly below Adyen at 19.2x, and well above public fintech peers like FIS (7.1x), PayPal (2.8x), and Block (2.2x) as of May 2025. Adyen’s valuation multiple has been highly volatile, peaking at 97.7x in August 2021 before falling to 9.2x in October 2023.

Source: Koyfin

While Adyen remains the closest peer in terms of enterprise focus and technical capabilities, Stripe’s premium over other fintech companies reflects investor conviction in its ability to monetize new vectors like embedded finance, tax and compliance automation, and intelligent commerce infrastructure.

One way to contextualize Stripe’s valuation is by using competitor valuations as benchmarks. The valuations below reflect the public market cap or the last private funding round valuation in August 2025:

Payments: Adyen ($53.3 billion)

Financial Connections: Plaid ($6.1 billion)

Issuing: Marqeta ($2.7 billion)

Treasury + Issuing + Capital: Unit ($1.2 billion)

Capital: Clearco ($2 billion)

Billing: Chargebee ($3.5 billion)

Radar: Sift ($1 billion)

Identity: Socure ($4.5 billion)

Corporate Card: Brex ($12.3 billion)

Tax: Avalara ($8.4 billion)

Link: Bolt ($11 billion)

Key Opportunities

Agentic Commerce

AI-native commerce marks a shift in how transactions happen online, centered on autonomous AI agents acting on behalf of human users. Stripe has positioned itself early in this transition by launching a developer toolkit and new APIs that allow agents to browse, purchase, and pay across the internet. As of August 2025, these tools are already in use by thousands of developers weekly, with early adopters building AI agents that manage refunds, issue virtual cards, and automate subscription workflows.

Stripe’s Order Intents API enables agents to parse product pages, apply shipping logic, and complete purchases end-to-end without human input using Model Context Protocol (MCP). Combined with Stripe Issuing, developers can authorize spending rules for agents in real time, offering guardrails around what agents can and can’t do financially. More than 700 AI agent startups launched on Stripe in 2024, and the company expects that figure to accelerate as every AI tool becomes a potential commerce endpoint. As traditional web checkouts give way to agent-native flows, Stripe is building the infrastructure to support a future where machines drive demand on behalf of people. As President John Collison put it:

“This is an entirely new modality for commerce. The term you're going to start hearing way more of is MCP, which is a simple way to allow models to engage in tool use in the wider world, including making complex purchases on your behalf. There's tons of applications for this, which will create buying opportunities and patterns for growth for all sorts of companies – soon, every AI tool may become a sales channel for you.”

Stablecoins

Stripe sees stablecoins becoming a foundational layer for global financial infrastructure, offering programmable money that is faster, cheaper, and more interoperable than legacy systems, providing practical tools for real-world commerce and eliminating the friction and latency of traditional banking rails. According to Stripe, finance teams use stablecoins for treasury operations; platforms use them to serve customers in countries with limited card infrastructure; and individuals in unstable economies use them for remittances and savings.

Stripe’s acquisition of Bridge in February 2025 has accelerated this shift. Customers like SpaceX use the platform to move revenue from Starlink sales in markets like Argentina and Nigeria, while Mexican neobank DolarApp enables users to receive USD-denominated payments from employers like Deel. With the introduction of Stablecoin Financial Accounts, Stripe users in over 100 countries can store, send, and receive funds across fiat and crypto rails. Combined with products like Stripe’s USDC-denominated corporate card, the company is building toward a vision where stablecoins seamlessly integrate into everyday financial operations, unlocking borderless business models, faster liquidity, and new economic opportunities.

Growing with New Companies

Stripe started with a bottom-up, developer-first mentality that allowed it to piggyback on the growth of startups such as Shopify. The company intends to continue serving startups as it moves upmarket to the enterprise space. It can capitalize on the growth of the next generation of young companies. An important aspect of this strategy is Atlas, which provides a funnel of newly incorporated startups. Atlas has incorporated 20K young businesses for entrepreneurs in 140+ countries, and those companies may be more likely to turn to Stripe for other use cases in the future. Because Atlas is available in many more countries than other products like Payments, it establishes Stripe’s presence and reputation in those countries, acting as a beachhead for future rollouts.

There are a number of emerging startups that are vertical SaaS platforms. These platforms have increasingly been used as an operating system for small businesses, embedding software, services, and financial infrastructure in one place. Rather than build a tech stack from scratch, a towing company can spin up with Traxero, a pizzeria can use Slice, and a med spa can launch with Moxie in just under 30 days. Behind the scenes, many of these platforms are powered by Stripe.

Source: Stripe

International Expansion

Only 3% of the world’s companies transact outside their country’s borders as of November 2022. Zooming in on the US, Stripe’s home market, just 1% of SMBs export abroad as of 2017. This could change as technology eases the friction required for international operations. Stripe contributes to international commerce by supporting payments from 197 countries and a few dozen payment methods. Although this coverage trails some large competitors like Adyen, it leads smaller domestic players such as Razorpay and Xendit. These players lack support for relevant payment methods outside their home markets, including Apple Pay, Pix (Brazil), and iDEAL (Netherlands). In comparison to these more limited offerings focused on local markets, Stripe is better positioned for companies that want to sell globally. This is especially true for SMBs, which competitors like Adyen don’t cater to.

Becoming a Financial Center of Gravity

Jeff Bezos has said that the more important question for a business is not “What’s going to change in the next 10 years?” but rather “What’s not going to change in the next 10 years?” When that question is applied to a company’s finances, it becomes clear that companies will likely still need to accept payments from customers. They will also likely still need to pay consumption taxes on their sales, to track revenue in accordance with accounting standards, to reduce losses from fraudsters, and to spend money on business expenses. Stripe offers products to address all of these essential, enduring use cases on one integrated platform. That positions it to be the financial center of gravity for customers for a long period of time, providing a sticky base as the company explores additional sources of revenue like BaaS and Financial Connections.

Key Risks

Competition

Given that the functionality of payment processors is often similar, differentiation between providers generally occurs through price. As customers grow, they negotiate lower pricing, evident in Adyen’s decreasing take rate. As Stripe moves upmarket, it is likely to experience similar margin compression even as its processing volume increases.

The heavy competition in the space is likely to exacerbate downward pricing pressures. Open banking account-to-account payments threaten to change the payment landscape with lower fees than card payments. Stripe also must invest in keeping up with competitors. Adyen and Square provide more established offerings than Stripe for in-person payments. Some companies are creating integrated solutions for particular customer segments, like Paddle for SaaS businesses. In developing countries, startups such as Razorpay and Xendit have gained traction in their home countries by replicating the Stripe playbook.

Internal Products

At a certain scale, it can make sense for enterprises to build payments in-house for greater control and lower fees. Tech platforms may do this since they have the engineering talent to execute. In addition, platforms process higher volumes of transactions, with card fees eating into each one.

For example, as of March 2023, Toast is a $10 billion software platform for restaurants that handles payments for its customers, capturing $0.77 of every $100 transacted. And, with a market cap of $76.8 billion as of August 2025, Airbnb has hundreds of engineers working on its internal payments system.

This risk is especially relevant for Stripe, given that Shopify accounted for about 25% of Stripe’s transaction value in 2022. However, Shopify deepened its integration with Stripe through the launch of Shopify Balance and has not indicated that it would pursue internal payments processing.

Summary

Stripe has evolved from a developer-facing payments API aimed at SMBs into a full-stack financial infrastructure platform powering businesses of all sizes – from startups to Fortune 100s. Its core strength remains online payments, but its value proposition has expanded to include embedded finance, finance automation, data infrastructure, and crypto-based money movement. With over $1.4 trillion in annual TPV in 2024, Stripe now serves as the financial backbone for many of the world’s fastest-growing companies, including vertical SaaS platforms and AI-native startups. As commerce becomes more global, automated, and software-defined, Stripe’s opportunity grows, alongside the pressure to execute across an increasingly complex product surface and competitive landscape.

*Contrary is an investor in DoorDash, Ramp, and Check through one or more affiliates.