Thesis

Business expense management is a large category with considerable room for expansion. There was a total of $149 trillion in global B2B payments in 2022. In 2021, only $1.5 trillion of the then $120 trillion in global B2B spend was spent on corporate cards. Instead, many businesses still use expensive, inefficient, and error-prone manual processes like paper receipts or spreadsheets to manage their expenses; one 2022 study, for example, found that 19% of expense reports contained errors and cost $58 on average to process.

How businesses deal with business spending is, however, starting to change. In 2020, the size of the global corporate card market was $32.3 billion, with a projected annual growth rate of 7.3% through 2026. This was driven by an increase in businesses using non-cash payments for better visibility and control over expenses. In 2022, the business spend management software market was valued at $17 billion and projected to grow at a CAGR of 11.1% to reach $39 billion in 2029, with increased usage of cloud solutions, and spend analytics, expected to drive growth.

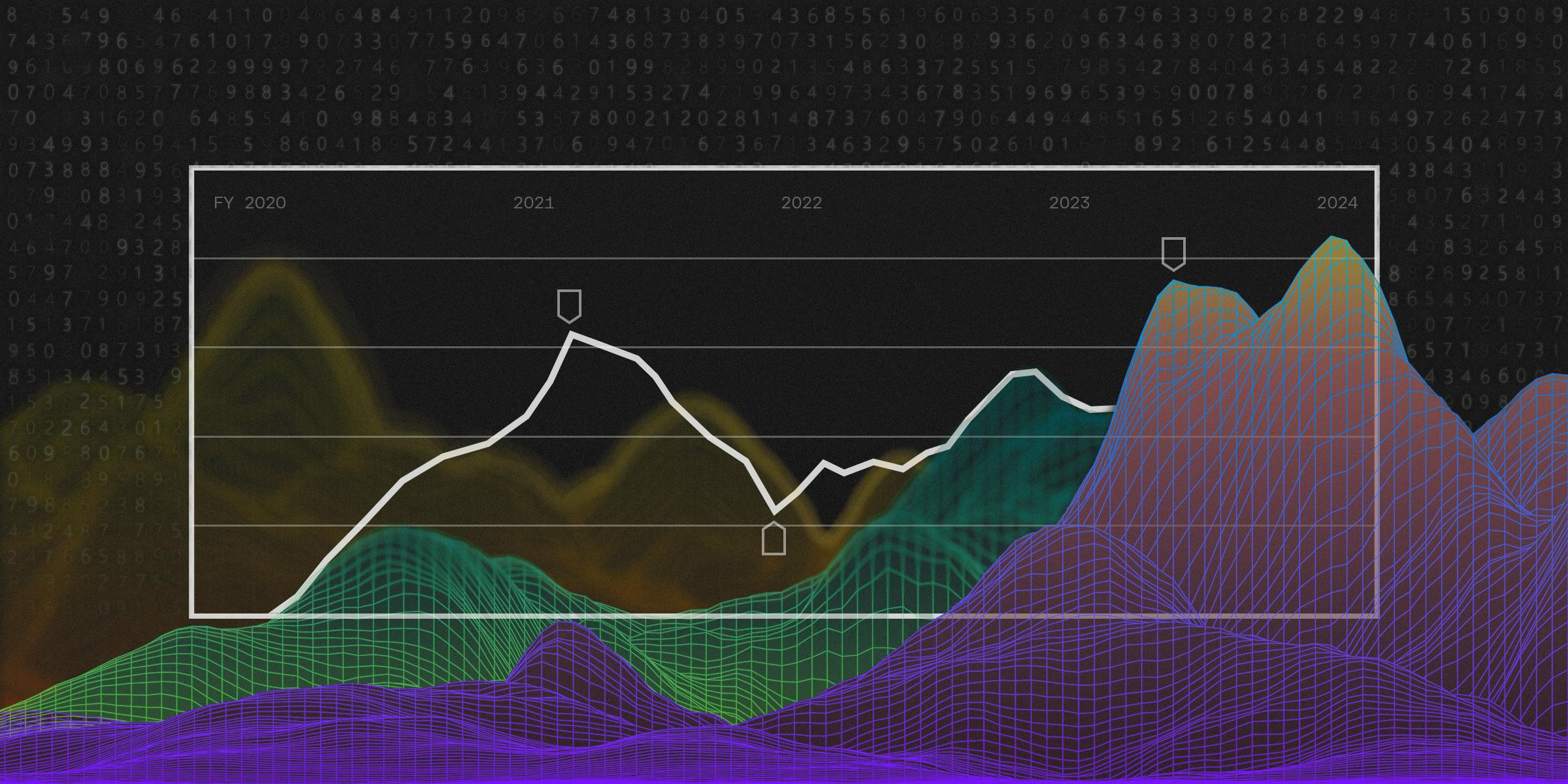

The scale of the opportunity has attracted a significant amount of new capital flow into corporate card and other expense management startups. From 2010 to 2020, less than $2 billion flowed into the space. But in 2021 alone almost $3 billion of venture capital poured into business expense management startups, especially digital-first corporate card startups like Brex and Ramp*.

Valued at $12.3 billion in 2022, Brex is a large player in the digital-first corporate expense management space. It entered the market by focusing on an underserved customer segment: startups. Unlike more established companies, until the rise of digital-first corporate cards, startups could not get corporate cards from traditional credit card companies like American Express due to a lack of established credit.

Since launching its corporate card in 2018 — when startups “literally couldn’t get a card,” according to co-CEO Pedro Franceschi — Brex has become a first mover in the market for startup corporate cards; Franceschi stated that one in three US startups used Brex as of 2024. Following the launch of its banking, expense management, and AI products, plus the Empower platform, Brex is positioning itself to both move upmarket to enterprise customers as well as capture more of customers' business spend on its platform.

Founding Story

Source: Techcrunch

Brex was founded in 2017 by Henrique Dubugras (co-CEO) and Pedro Franceschi (co-CEO).

The pair, both originally from Brazil, are self-taught coders who began coding as kids. Franceschi hacked an iPhone at eleven years old to get Siri to understand Portuguese. Dubugras began by building clones of games his parents wouldn’t buy in middle school; he generated “tens of thousands of dollars” from his version of a video game called “Ragnarok” before receiving a legal warning from the game’s Brazilian distributor.

Dubugras and Franceschi eventually met over social media when they were 16 years old. They decided to work on a company together and launched Pagar.me, a Brazilian equivalent to Stripe, in 2013. Pagar.me had 150 employees and was processing over $1.5 billion in transactions when the pair sold it in 2016 for “tens of millions” of dollars.

They were both admitted to Stanford but spent less than a year there before dropping out to join YC’s W2017 batch with an idea for a VR startup. After noticing early-stage startups’ difficulties in obtaining credit cards, they pivoted back to payments and launched Brex in January 2017. Brex started by serving startups and expanded to other verticals like ecommerce, life sciences, and mom-and-pop small businesses — although the company dropped those verticals to focus on startups and large enterprises.

As of February 2024, Dubugras and Franceschi remain co-CEOs of Brex. Franceschi focuses on internal functions like engineering, while Dubugras has an external focus on business-oriented functions sales, fundraising, and partnerships.

Product

Brex offers financial services and software for funded startups, mid-sized companies, and enterprises. As of February 2024, products include the Brex corporate card, Brex business account (alternative banking), expense management software, automated bill payments, and financial modeling software. Companies can also automate flows involving Brex using the company’s API and no-code templates. In March 2023, Brex announced that it was collaborating with OpenAI and Scale to launch a suite of AI tools. The first of these tools, “Brex Assistant”, was launched in September 2023.

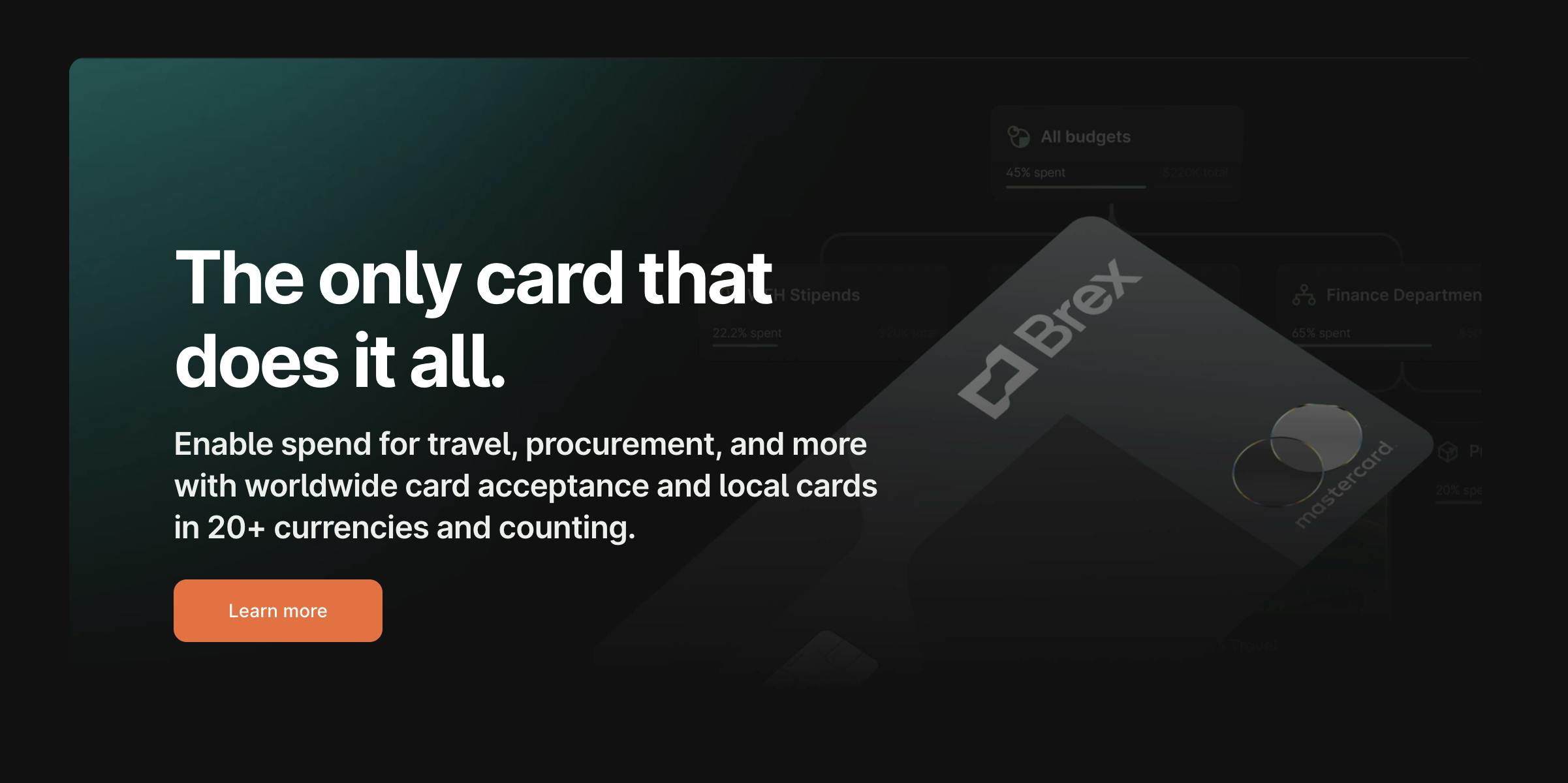

Corporate Card

Source: Brex

Brex offers corporate credit cards for startups and enterprises. As of February 2024, the Brex card doesn’t require collateral or security deposits from its customers. Card credit limit adjusts dynamically based on the company’s “financial factors such as revenue or dollars raised.” While card balances must typically be paid off daily, companies can build business credit through using them.

Brex’s corporate card offering is flexible, supporting multiple scenarios in which a card may be used, such as:

T&E cards: Businesses can issue spending limits for purchases while abroad, with specific policies for hotels, meals, and flights.

Vendor cards: Businesses can limit spending on designated vendors, with spend rules set to recur or expire on a given date.

Purchase cards: Businesses can issue cards with per-transaction limits in 40+ currencies with preset controls and limits.

Benefits cards: Businesses can issue recurring or one-time employee stipend cards, and only pay for what is used.

Additionally, Brex’s cards come with a points-based rewards program. Points can be redeemed for travel, gift cards, and cash-back. More niche redemption options include billboards, offsite planning, executive coaching, mental healthcare, and aid to Ukraine. Brex’s partnerships with companies like AWS, Apple, and QuickBooks provide discounts or extra points on purchases.

Although cash-back rewards systems (like Ramp’s* flat 1.5% cash-back rewards, available as of February 2024) can be more straightforward, customers can sometimes extract greater value through Brex’s points. Namely, the company claims customers can “earn up to 7x back” when using its cards. According to a 2022 analysis, Brex uses its scale to negotiate better deals for rewards like billboards and AWS cloud services.

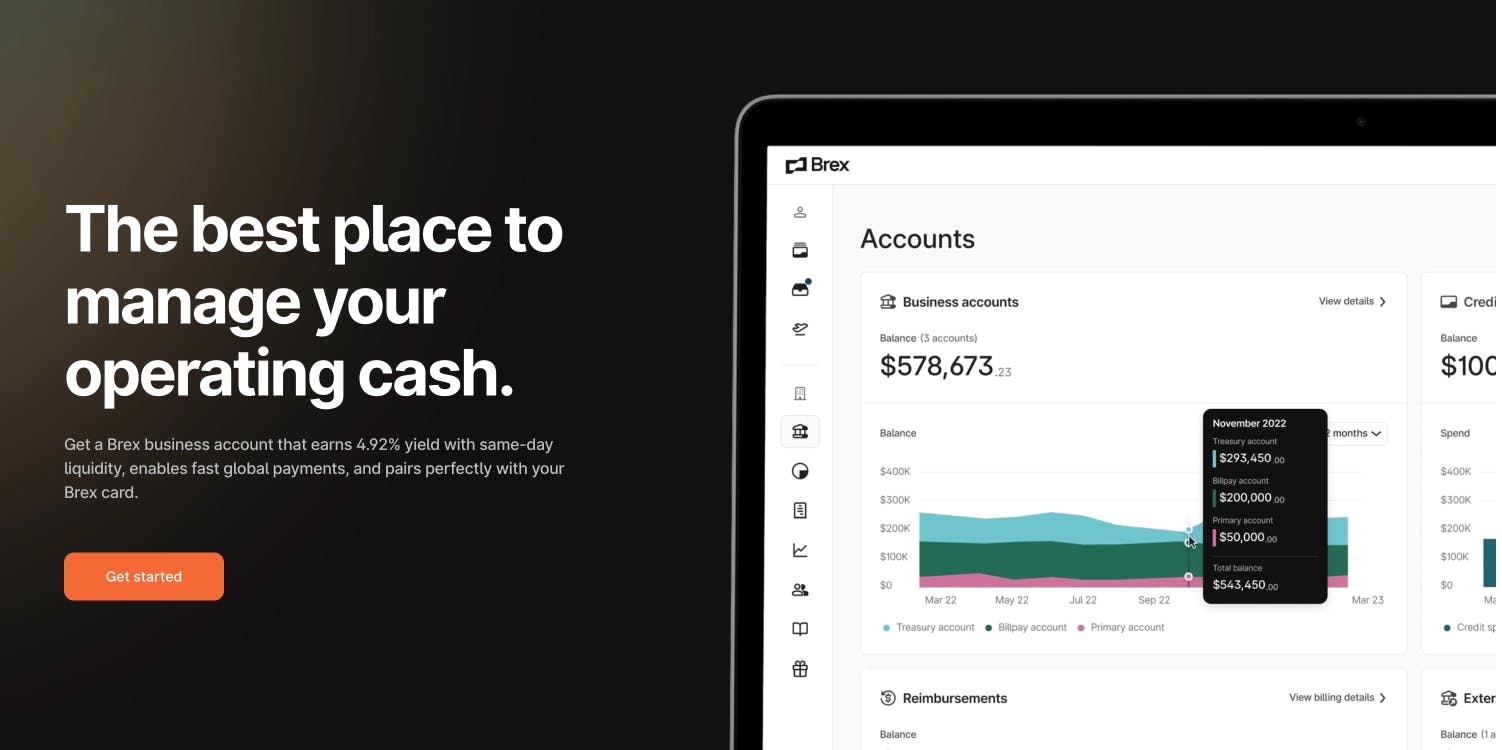

Business Account

Source: Brex

In October 2019, Brex launched Brex Cash, an alternative to a business bank account. The product was later renamed to “business account”. It allows companies to deposit and hold funds, make ACH and wire payments, and, as of February 2024, earn a 4.92% yield with same-day liquidity.

A Brex business account is not a business bank account but rather a cash management account. Cash management accounts are hybrids of checking, savings, and investment accounts enabling businesses to save, spend, and invest from a single place. Brex does not hold its customers’ funds on its balance sheet. Rather, funds are stored in either money-market funds or FDIC-insured accounts.

Business account users can choose their deposits to be spread between multiple partner banks. This extends FDIC insurance beyond the typical $250K limit up to $6 million in total. Brex lists 27 partner banks as of May 2023. Alternatively, businesses can invest their business account funds into a government money-market fund administered by the Bank of New York Mellon. This bank oversees more than $1.8 trillion in assets. Its money-market fund is AAA-rated and is designed to protect invested capital while ensuring daily liquidity; the fund is obligated to invest at least 99.5% of its assets in cash or in securities fully guaranteed by the U.S. Government.

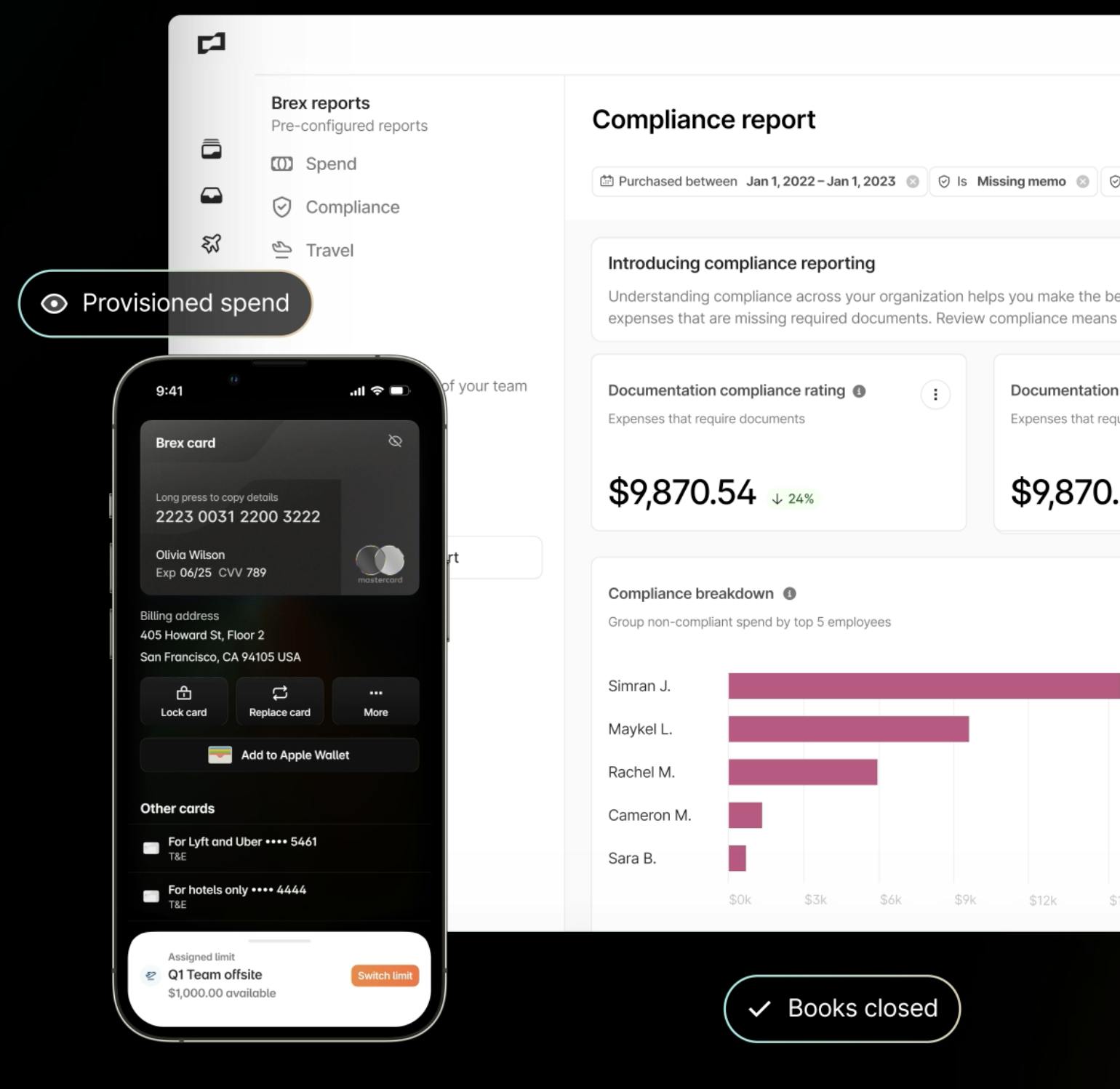

Expense Management

Source: Brex

Brex's expense management product offers are designed to help businesses manage their spending and reimbursements more efficiently.

For example, the company’s bill pay system integrates with its spend limits feature to simplify bill payments. This feature includes functionalities such as vendor self-service, matching purchase orders, and allowing payments from external bank accounts. The company employs large language models (LLMs) through Brex AI for automatic expense flagging to identify policy violations in receipts.

On the policy enforcement front, Brex automates the application of a company's spending policies across transactions, including cards and reimbursements. For expense reporting, Brex automates document collection and offers the Brex Assistant for any queries employees might have. This feature leverages AI to add IRS-compliant receipts, generate memos, populate fields, and automatically set up departments or projects. Additionally, Brex utilizes OCR technology to match receipts in any language.

Its Live Budgets feature allows for real-time monitoring of departmental budgets set by the customer. Department heads can then allocate spending to individuals or teams. Brex AI flags anomalous activity to ensure budgets are maintained. Finally, Brex integrates with companies’ existing HRIS and ERP software.

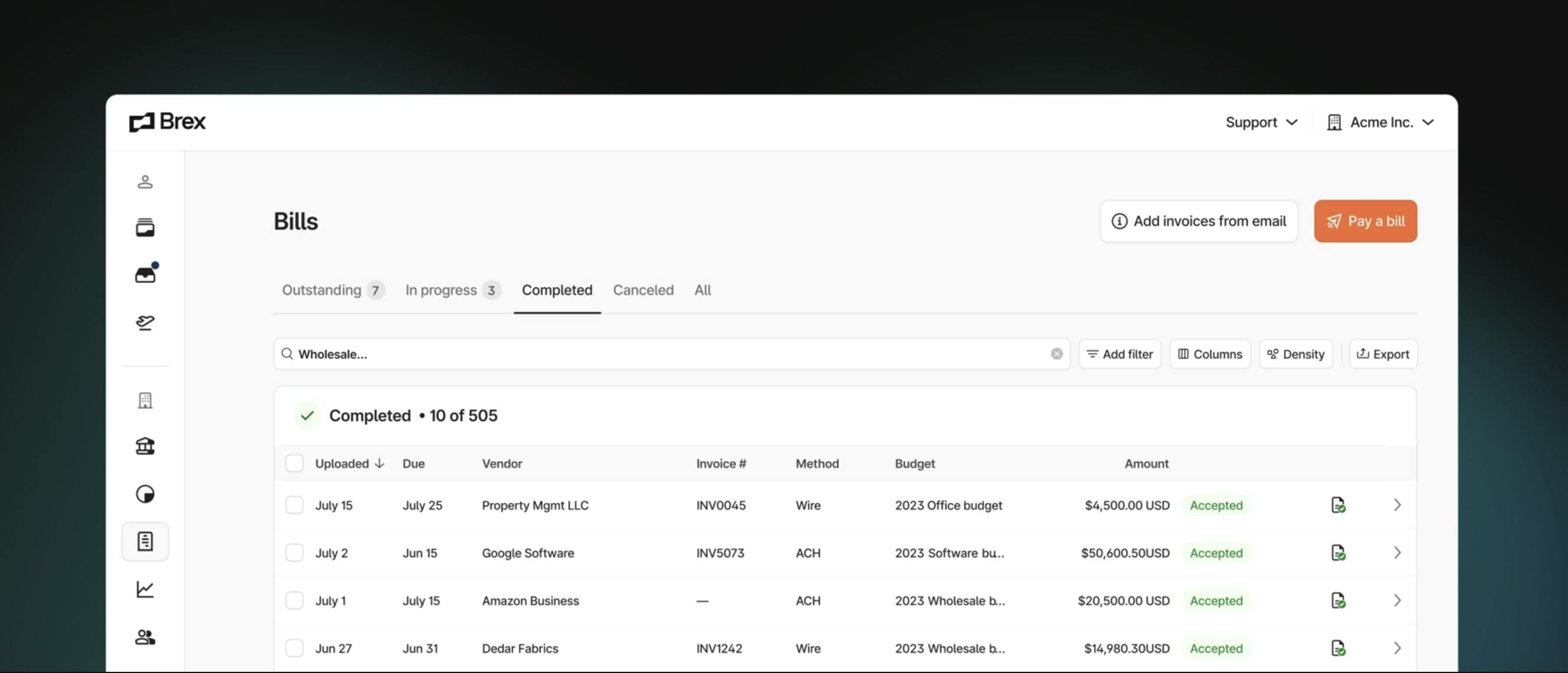

Bill Pay

Source: Brex

Bill Pay handles companies’ non-payroll, non-employee spending. Instead of manually processing invoices, customers can forward bills to Brex via email, upload, or drag and drop directly into the Brex platform. The company’s AI auto-captures the details. Customers can also input their vendors’ email addresses into Brex and the company will provide them with a secure link to upload their payment information.

Admins for the customer then receive notifications to review and finalize bill payment drafts. The payments are sent from the user’s business account via wire, ACH, or check, and they automatically sync with external accounting systems like Xero and Quickbooks.

Pry

Source: Brex

Brex acquired Pry Financials, a startup offering financial planning software, in April 2022. Instead of using spreadsheets, companies can use Pry to forecast financials, play out different scenarios, and create real-time KPI dashboards.

Travel

In March 2023, Brex launched a travel and expense management (T&E) system. This product helps customers with business travel booking, event management, travel-specific cards, expenses, and reimbursements. Travel combines several of Brex’s features into one platform. For example, customers using travel can:

Issue cards (virtual or physical) in 20+ currencies, with local and global reimbursement.

Avoid manual input of receipts with Brex’s expense management system.

As of February 2024, Brex describes its travel feature as “an open and transparent platform that never biases search results” related to flight, hotel, or car rental bookings.

Source: Brex

Brex AI

Brex AI leverages large language models (LLMs) and autonomous AI agents with the intent of improving the spend management experience for customers.

Launched in September 2023, Brex Assistant is the flagship product of Brex AI. This feature provides employees with a proactive expense management tool. It uses natural language processing and data from various sources like calendar entries and past expenses to automate expense documentation. For instance, it can automatically categorize a work-related travel expense by pulling information from an employee's calendar. This reduces manual entry, ensures compliance with company policies, and even answers common finance-related queries from employees.

As of February 2024, other key functionalities of Brex Assistant include:

High-Risk Expense Flagging: It can identify specific items like "vodka" on receipts, even if the broader category of "alcohol" isn't mentioned, enabling businesses to maintain compliance with their spending policies.

AI-Powered Commenting and Conversation: Brex AI can start discussions about expenses that may violate company policies, offering explanations and guidance on compliance issues.

Smart Filtering and Search: Users can make natural language queries about spending patterns or specific expenses, like asking for "marketing expenses over $200 without receipts last month," and receive filtered results.

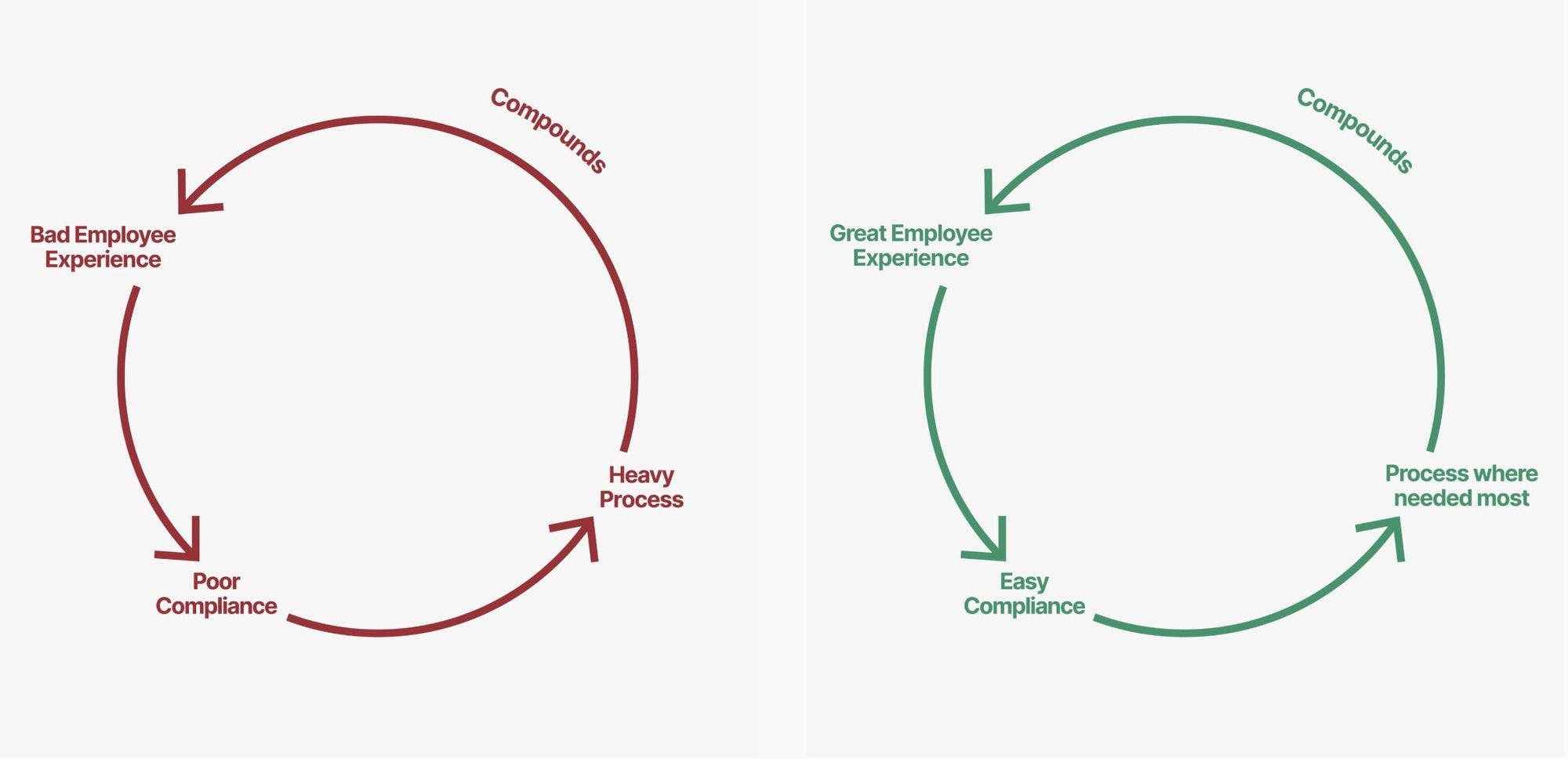

Empower

Customers also have the option to enable Brex Empower (instead of Brex Classic). This is a financial management platform that builds on the company's existing offerings by providing more advanced controls, visibility, and integration capabilities to help businesses manage their spending more effectively. It was originally launched as an expense management system in April 2023. As of February 2024, however, Empower combines features for expense management, corporate cards, and accounting integrations into a single platform.

The company’s philosophy behind this platform is to drive responsible spending by empowering customers’ employees to make the right decisions. One VP at DoorDash*, a Brex customer, phrased the benefits of Empower like this:

"Managers can stop feeling like the T&E police, and instead only review the few transactions that are actually out of policy."

Source: Brex

Vertically integrating the financial stack enables Brex to automate many processes, like accounting and receipt generation. As of February 2024, Empower offers “1,000s of software integrations and APIs to easily connect your business systems and automate any financial workflow.”

Market

Customer

2022 marked a major shift in terms of the type of businesses Brex targeted as customers. The move toward software and the launch of Brex Empower (its financial software bundle) in April 2022 was part of the company’s move upmarket to enterprise customers. In June 2022, Brex announced that it was dropping support for SMBs without professional investors, although it was careful to emphasize that funded startups remain a core customer for Brex.

Co-CEO Henrique Dubugras explained that the decision was necessary because “it became difficult to serve brick-and-mortar companies that had a ‘completely different set of needs.’” Brex’s revenue fell less than 2% after letting go of these customers, showing that they were not critical to its business while costing a lot in terms of support. In a January 2024 statement, co-CEO Pedro Frenceschi announced that “with our focus on financial software and high-quality growth, we grew gross profit by 75%+ last year.”

As of February 2024, prospective Brex customers must meet one of the following requirements:

Have received an equity investment of any amount (accelerator, angel, or VC) or plan to in the near future.

More than $1 million in yearly revenue.

50+ employees.

Tech startups who are on a path to meeting the criteria above, and are referred by an existing customer or partner.

Source: Brex

By August 2023, Brex had 200K+ small and medium-sized customers, plus 10K enterprise customers. As of February 2024, Brex had “tens of thousands” of customers. Notable examples include DoorDash*, SeatGeek, Coinbase, ScaleAI, Masterclass, Indeed, Allbirds, and Superhuman.

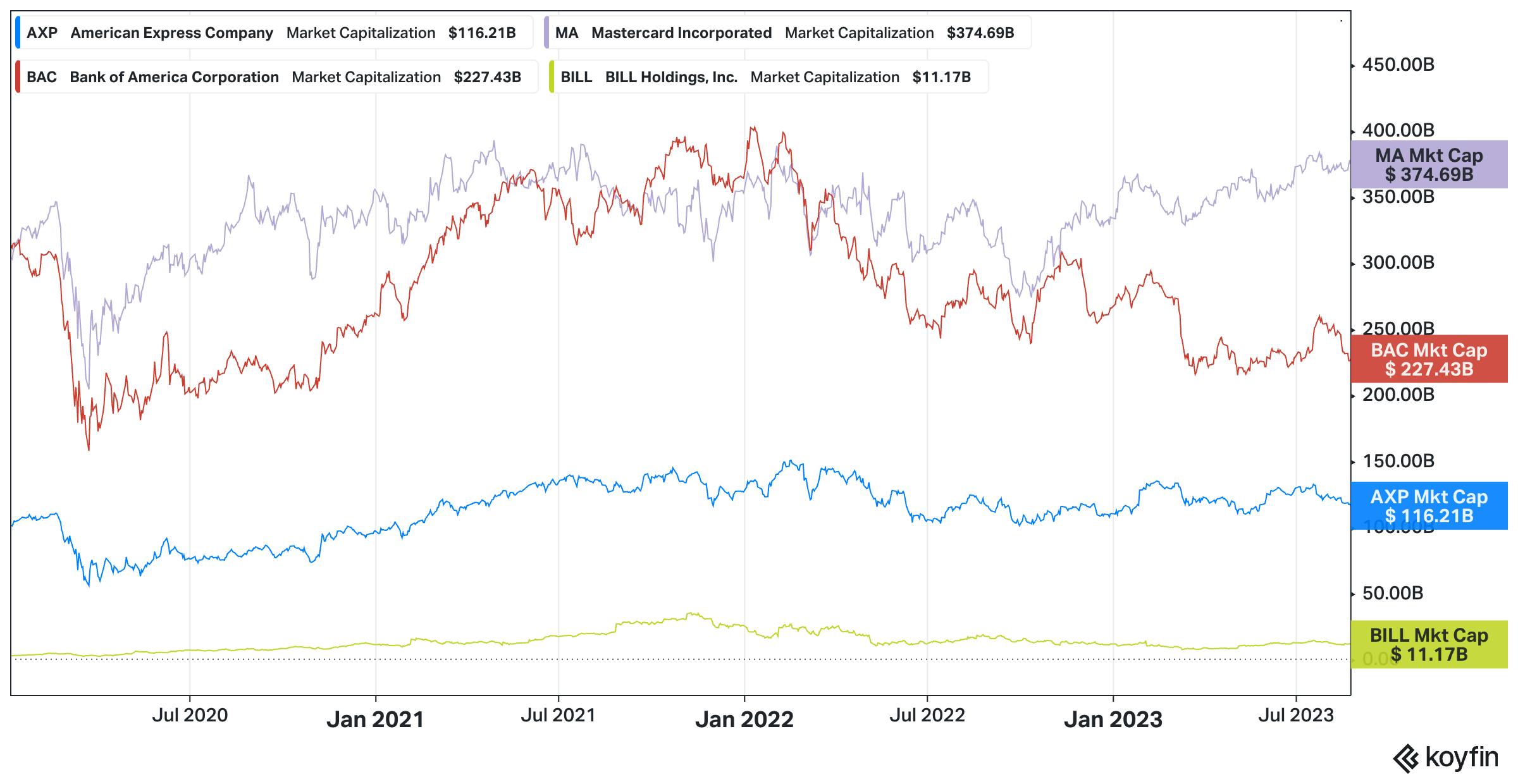

Market Size

Several of Brex’s public competitors, each addressing primarily just one of Brex’s product areas, have market valuations ranging from $8 billion to $430 billion as of February 2024. American Express, Mastercard, and Bank of America offer corporate cards and banking while Bill.com offers primarily bill pay (although its acquisition of Divvy broadened its offering into expense management). Concur, an expense management platform, was acquired by SAP for $8.3 billion in 2014.

These numbers may still fall short of Brex’s true addressable market. There was $149 trillion worth of B2B transactions in 2022. In 2021, only $1.5 trillion of the then $120 trillion in global B2B spend was spent on corporate cards — with 64% of B2B transaction volume in the US flowing non-digitally through cash and checks as of April 2024. By comparison, in 2021 only a third of B2C payments volume occurred through cash and checks. B2B is likely to catch up to this level of penetration as fintech companies like Brex make global, digital payments easier than ever.

Competition

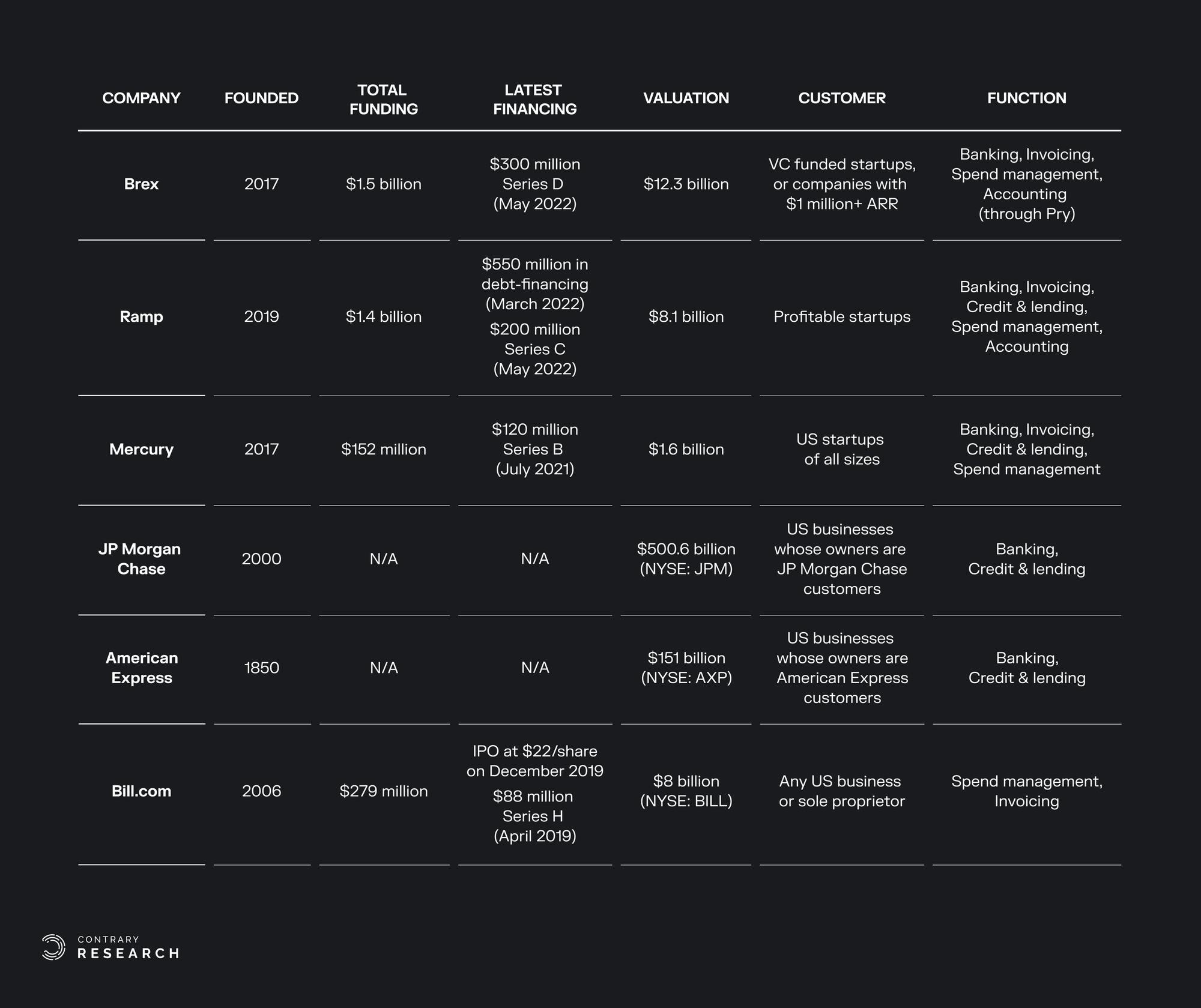

Brex faces competition on various fronts owing to its expanding product suite. It closely competes with startups like Ramp* and Mercury, as well as more established companies like Bill.com, and American Express, and banks like Chase. Below is a breakdown of key information about several of Brex’s competitors, followed by an analysis of the company’s competitive dynamics across its different features.

Sources: Crunchbase, TechCrunch, Brex, Protocol, Mercury, Chase, Nerdwallet, and Bill.com. Updated February 2024

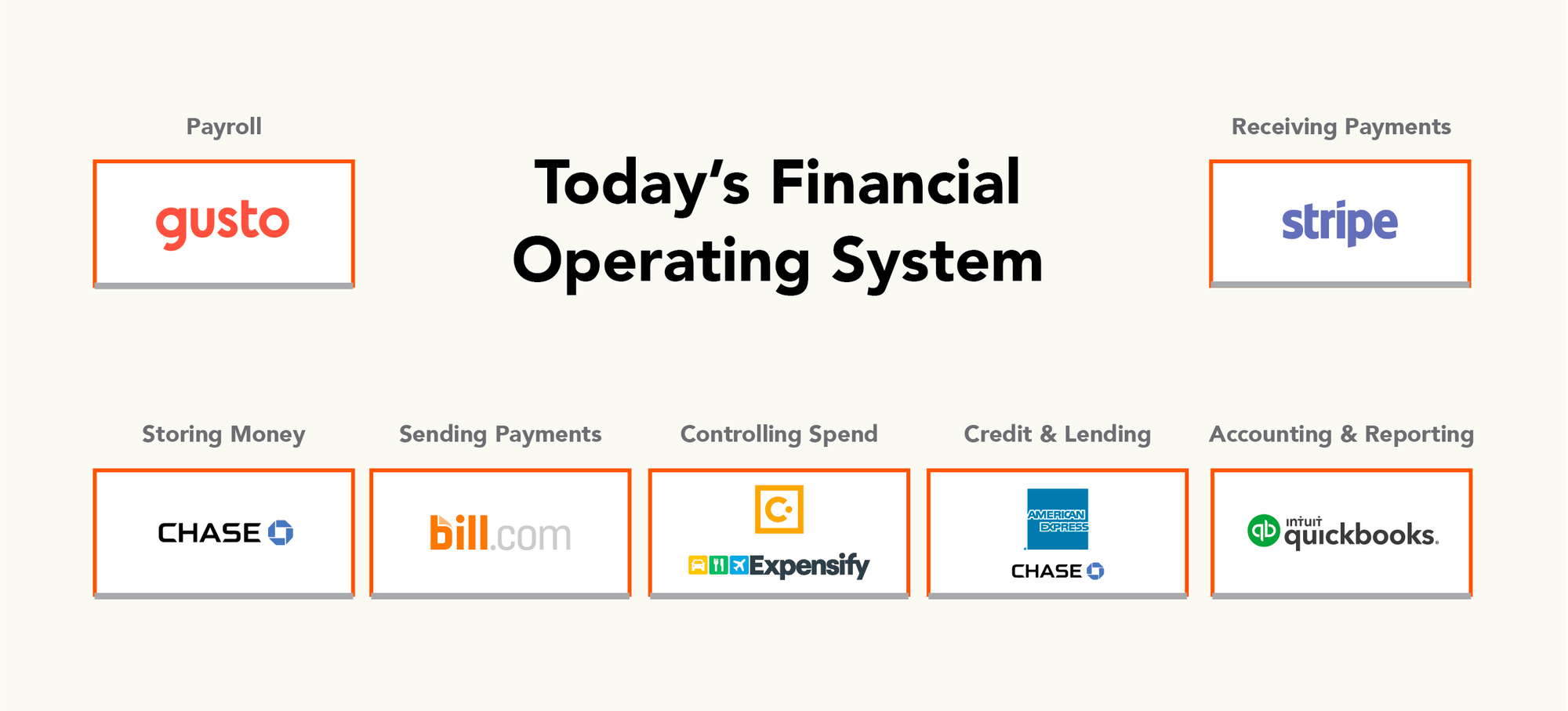

As shown in the graphic below, a Brex customer today could use Chase for their business bank account, Bill.com for bill pay, Expensify for expense management, American Express for cards, and Quickbooks for accounting.

Source: Y Combinator

However, Brex’s vision is to replace all of these with a vertically integrated product line. Namely, the company launched Empower in April 2022. As of February 2024, this feature combines several of Brex’s functionalities into a single platform, including expense management, corporate cards, and accounting integrations.

Other competitors are also broadening their product suites. For example, Bill.com acquired Divvy in May 2021; Airbase launched a standalone bill pay product in June 2021; Ramp* started with cards in 2019 and launched bill pay and invoice management in October 2021; and Rho added expense management software to its platform in August 2022. Additionally, American Express acquired Nipendo in January 2023, a B2B payments automation company. According to an Amex spokesperson, the acquisition “will make B2B payment processes much easier for our customers.” Despite this convergence, the massive volume of B2B payments, which totaled $149 trillion in 2022, suggests there is space for multiple winners.

Corporate Cards

Before Brex, the corporate card space was dominated by legacy providers like American Express and Chase. Compared to Brex and Ramp*, these companies have some disadvantages: they offer lower spending limits, require personal guarantees, have $100+ annual fees, and do not offer built-in expense management software. Ramp*’s cards come with 1.5% cash back while Brex offers point-based rewards.

Corporate cards are becoming commoditized as more and more companies are offering them, so differentiation will come through adjacent financial services and software like expense management and bill pay software.

Business Accounts

Brex competes against traditional banks and other fintech startups in offering business banking/cash management accounts. General-purpose banks include household names like Capital One, Wells Fargo, Bank of America, and Chase. Banks targeting startups include incumbents like Mercury, Rho, or the now-defunct Silicon Valley Bank (SVB). This multiplicity of competitors can signify a volatile market, where disruptions can swiftly redistribute market shares and consumer trust from established players to emerging competitors. Namely, following SVB’s failure in March 2023, Brex saw “billions of dollars pour in” and 4K+ new customers.

Pricing & Monetization

One important point of differentiation among these companies is their varying business models. For example, Ramp* monetizes primarily through interchange as of February 2024. On the other end of the spectrum is Airbase. Its CEO believes software subscriptions provide higher-quality and more durable revenue compared to card interchange, so Airbase focuses on software revenue. Brex initially monetized primarily through interchange but has shifted more of its revenue to a SaaS model over time.

Airbase launched a free offering in February 2022 that returned almost all interchange revenues to customers and had the highest cash-back on any corporate card at the time. The company would likely consider this move a success if competitors like Ramp* abandon interchange-only business models; this would stop a race to the bottom with interchange fees.

Bill Pay

Many competitors in the expense management space like Airbase, Brex, and Ramp* also have bill-pay products. Bill.com moved in the opposite direction when it extended from bill pay into expense management and cards with its acquisition of Divvy in May 2021. Other companies, such as Avidxchange, Libeo, and Stampli, give more exclusive attention to bill pay. Some products, such as Bill.com’s and Libeo’s, handle accounts receivable in addition to accounts payable.

Unlike with corporate cards, bill pay is subject to network effects. Each B2B bill payment involves two parties, the customer and the vendor. It’s easier for a vendor to manage all of their invoices through a single bill-pay provider who has all of their customers. Likewise, it’s easier for a customer to pay all of their invoices through a single bill-pay provider who has all of their vendors. As of February 2024, Bill.com handles both the accounts payable and the accounts receivable sides, in contrast with companies like Brex and Ramp* which are more focused on accounts payable. As of February 2024, Bill.com also has the advantage of 5.8 million companies in its network. However, competitors may be able to chip away at market share through superior products or integrations.

Business Model

Interchange → SaaS

In April 2022, Brex revealed that over half of its revenue comes through interchange fees on card transactions. Interchange fees are split between various financial entities, and Brex captures a cut of this. In the US, companies offering cards can keep as much as 1.5% to 2% of transaction value.

However, Brex has since shifted its focus to a SaaS revenue model, as hinted at by co-CEO Henrique Dubugras in an April 2022 interview. For example, the company announced Brex Premium, its original bundle of financial software that was aimed at SMBs, in April 2021 and charges $49 per month for a subscription. A year later, the company showed how serious its focus on software was when it replaced Brex Premium with Brex Empower. In the announcement, the company described Empower as ”the biggest change to Brex since we launched.” As of February 2024, Brex has four pricing tiers:

Essentials: free, for startups and growing companies.

Premium: $12 user/month, for mid-sized companies.

Enterprise: Custom pricing, for “global enterprises with custom needs.”

Smart purchasing card: free, for companies “that want to simplify procurement.”

Other sources of revenue include:

12b-1 fees from the money market mutual fund. These types of fees are legally capped at 0.75% and generally range from 0.25% to that upper limit.

Brex may also earn affiliate commissions for referring customers to other businesses through the card rewards program.

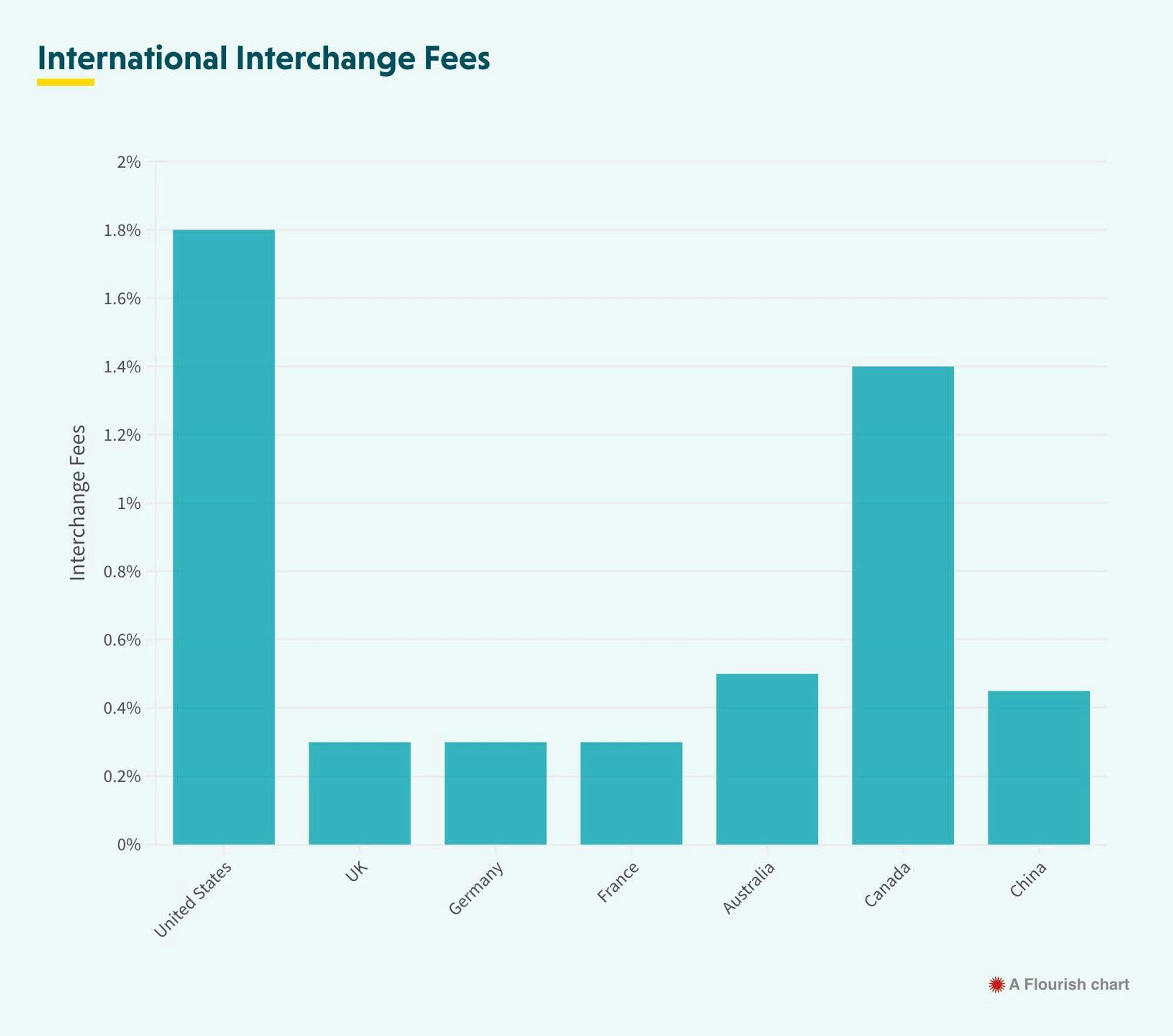

Diversifying revenue streams beyond interchange is especially important when serving global enterprise customers. The US has far higher interchange fees than most other countries, as illustrated by the 2022 chart below.

Source: CMSPI

As of August 2023, the average interchange rate in the US was 1.8%. This is substantially higher than the 0.96% average in Europe and the 0.99% average globally as of August 2023. This means that when non-US-based employees of global companies use credit cards, Brex likely captures less interchange revenue than with US-based employees.

Acquiring Startup and Enterprise Customers

Early on, Brex’s 2019 billboard campaigns successfully attracted startups in the Bay Area. Since Brex’s partnerships with startup accelerators have provided a stream of professionally-funded startups with the potential to become large customers. In July 2023, for example, Brex revealed that 80% of Y Combinator companies use Brex. The company also announced a similar partnership with TechStars in November 2022. Following the announcement, Dubugras explained the decision to partner with TechStars this way:

“If you look at Brex’s cost of acquisition to get a startup; if they fail at Series A, we lose money when looking at how much revenue is generated for us versus how much it cost to acquire the customer. If [the startup gets to] Series B or Series D, we make a lot of money.”

In 2022, Brex dropped non-funded SMBs to focus on funded startups and large businesses. The company was spending too much of its resources on this category. It got to the point where some of its biggest customers, like Scale AI, warned Brex that they would have to leave the platform if Brex didn’t build products and features tailored to them.

Traction

In 2021, Brex doubled both revenue and transaction volume. At the time, its revenue was estimated to be $192 million, having grown 100% year-over-year. In 2022, Brex had an estimated $215 million in annual revenue. The company announced that 40% of US-based startups used Brex when they launched Empower in April 2022.

Brex announced layoffs of 11% of its workforce in October 2022, leaving it with slightly more than 1K employees. By August 2023, Brex had 200K+ small and medium-sized customers, plus 10K enterprise customers including DoorDash, Airbnb, and Coinbase. In Q4 2023, the company’s annualized net revenue was $279 million, a 32% increase compared to the previous year. Brex also increased gross profit by 75% during this period. The majority of this growth took place in Q1 2023; following SVB’s failure in March 2023, Brex reported “billions of dollars” and 4K+ new customers entered the company.

Following reports of stalled growth in January 2024, Brex laid off 282 employees, about 20% of its staff. A January 2024 article reported the company had been spending $17 million a month in Q4 2024, and that it only had “enough cash to last through March 2026.” However, a Brex spokesperson described the data as “inaccurate” to TechCrunch, saying:

“Brex’s financial plan is to be well above cash flow positive with the current cash we have, which calls for around 4 years of runway. Plus, cherry picking certain months for financial burn is not the correct way to look at burn.”

Diving deeper into Brex’s particular products, a November 2023 survey showed that over one-fifth of startups used Brex Cash as their company account. The credit card market reveals even greater dominance. Brex poached customers from traditional startup credit card providers to grow from essentially zero market share in Q2 2018 to over 50% market share in Q2 2021. In January 2024, co-CEO Pedro Franceschi wrote that Brex served one in every three startups in the US.

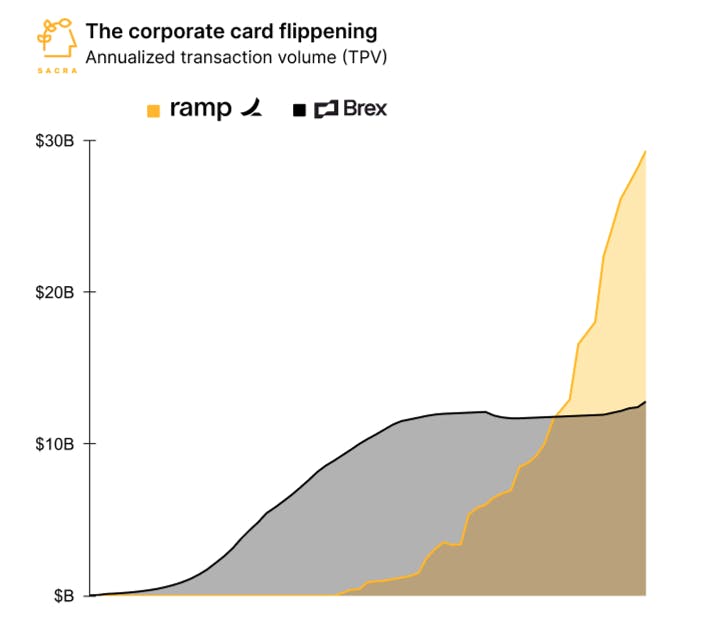

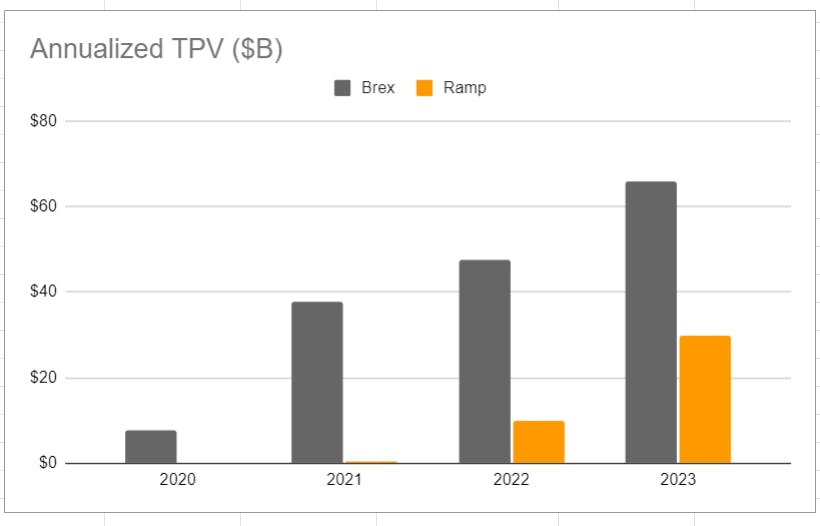

However, this trajectory may be difficult to continue amid the rise of younger competitors like Ramp*. A January 2024 analysis by an unverified source estimated that Ramp* had overtaken Brex in total payment volume (TPV). According to this unverified source, Ramp* reached an estimated $30 billion annualized TPV at the end of 2023, growing 209% year-over-year.

Source: Sacra

However, Brex ambassador Shai Goldman stated that the estimates in the chart above were not an apples-to-apples comparison of the total volume of money transacted using each respective competitor. Instead, he suggested that the correct comparison still showed Brex to be the lead as illustrated below.

Source: Shai Goldman via Twitter

Valuation

Brex has raised a total of $1.5 billion over 12 rounds of funding from investors including DST Global, Kleiner Perkins, Ribbit Capital, and Y Combinator. In October 2022, Brex raised $300 million at a $12.3 billion valuation in its second Series D round. Greenoaks and TCV co-led this round. This round came just six months after the company’s first Series D round led by Tiger Global, when it raised $425 million at a $7.4 billion valuation.

Assuming Brex’s revenue remains at the previously estimated $279 million at the end of 2023, its latest valuation would represent a 44x revenue multiple. This is comparable to earlier-stage competitors like Ramp*, which was valued at 80x revenue in March 2022. Public competitors trade at lower revenue multiples; As of February 2024, Bill.com and Expensify trade at approximately 6.64x and 0.94x revenue multiples respectively.

Source: Koyfin

Key Opportunities

Digitization of B2B Payments

$149 trillion worth of B2B spend is processed each year, according to a 2022 analysis. In 2022, about half of this volume occurred through paper checks. Brex stands to benefit as, per a 2023 report, an increasing proportion of B2B payments are processed digitally. Not only can Brex benefit from actually sending these payments via card, ACH, or wire transfer, but they can also automate these processes with bill pay and ensure internal expense policy compliance with expense management.

The digital transition in B2B payments shows signs of acceleration. A September 2020 survey found that nearly two in three companies in the US are moving to electronic invoices from physical invoices. By June 2021, over 90% of US companies with over $25 million in revenue were already “integrating digital technologies into their accounting operations.” More specifically, 61% of the companies were digitizing invoices, 51% were digitizing payment processing, and 48% were digitizing payment tracking. In a December 2023 article, Anu Somani, head of global payables & embedded payments at US Bank, said:

“All the innovation that’s happening in the consumer space will move into the B2B world.”

In the same article, Shawn Cunningham, managing vice president and head of Capital One Trade Credit at Capital One was quoted as saying:

“In general, business customers are no longer accepting of the clunky manual processes long associated with B2B accounts receivables.”

Companies stand to save significant money by digitizing payments-related workflows. Switching from electronic to paper invoices was estimated to save $4 - $8 per invoice in 2016. In 2014, a hypothetical switch for all US companies was estimated to save over $100 billion in total. In addition, automating invoice management was estimated in 2022 to cut processing costs by over 80% and processing time by 56%. Brex could deliver both to create more value for customers.

Growing with Startups

Brex is well established in the corporate card market for startups with an estimated 55% market share in Q2 2021. The company also has critical partnerships with two top accelerators: Y Combinator (80% of YC companies used Brex as of November 2022) and Techstars. These partnerships provide Brex with a flow of promising early-stage startups.

Brex built Empower so that it can scale with customers indefinitely. As these startups grow, they issue more cards to employees and integrate Brex more deeply with their accounting systems, so switching to a competitor becomes increasingly difficult. Further, assuming Brex serves their needs well, they are unlikely to want to switch in the first place. In fact, in January 2024, co-CEO Pedro Franceschi wrote that Brex served one of every three startups in the US. As of February 2024, YC’s companies have a combined valuation worth over $600 billion, highlighting the tremendous value of Brex’s unique positioning in the startup credit card market.

Key Risks

High Enterprise Switching Costs

With the launch of Empower, Brex pivoted to increasingly serving enterprise customers. The marketing and sales tactics that it has used for startups and SMBs, such as the Brex billboards campaign, will likely be less effective in acquiring enterprise customers. Instead, it will need to build out a new GTM strategy that overcomes the stickiness of incumbent products. In the bill pay space, network effects make it difficult to assail competitors like Bill.com. With expense management, larger customers anticipate switching providers to be so painful that they often delay the process even if they know it would save them money.

Competitive Landscape

Other startups like Ramp*, Airbase, Mercury, and Rho offer similarly broad financial platforms, and Bill.com acquired Divvy in May 2021 to expand beyond bill pay. In April 2022, some analysts expected further consolidation between players with a single financial product to form broader horizontal platforms themselves, which would further crowd the landscape. In 2022, multiple sources (Kruze, Workweek) expected competitors to achieve similar product functionality, raising the question of how they will differentiate themselves. In the first four months of 2022, corporate card startups raised $1.8 billion in VC funding. That includes Ramp*, which in March 2022 raised $200 million in equity and $550 million in debt.

Summary

Brex started with corporate cards for startups and has grown to be the leader in that segment. Its partnerships in the startup arena will help an ongoing stream of startups continue to become Brex customers. Brex can scale alongside these startups. In 2022, the company pivoted to financial software built on top of its corporate cards and aimed at enterprise customers. This strategy shift will require a new GTM and sales motion to convert customers of legacy companies in a traditionally sticky product area. Although the competitive landscape is crowded, the massive volume of B2B payments that could soon be digitized provides opportunities for multiple winners to emerge.

*Contrary is an investor in Ramp and DoorDash through one or more affiliates.