Thesis

The software industry faces an escalating developer talent shortage, with demand for software engineers projected to grow by 17% from 2023 to 2033 — far outpacing the 4% average across all occupations in the same period. Enterprises have increasingly turned to outsourcing to meet this demand through third-party development firms. As of 2025, the global IT outsourcing market was expected to reach $591 billion. By 2029, the market is expected to grow to $812 billion. Yet, as of 2024, outsourcing software development had major drawbacks, such as limited control, inconsistent quality, and mounting costs. As a result, 70% of companies from a survey insourced portions of their previously outsourced functions from 2019 to 2024, primarily to strengthen internal capabilities, improve service quality, regain control, and eliminate vendor markups.

A new wave of AI-assisted coding tools has emerged to enhance developer productivity without the need to outsource personnel. In particular, products like GitHub Copilot have demonstrated value, boosting task completion speeds by 55% and raising project completion rates by 8% in 2024. AI adoption in software development has also surged, with Copilot reaching 400K subscribers in its first month of public launch and 76% of developers using or planning to use AI in their workflows as of 2024. Despite these advances, tools like Copilot remain assistants — they suggest snippets but don’t execute full workflows. Thus, $8.2 billion was invested in 2024 in companies to develop autonomous end-to-end software development solutions.

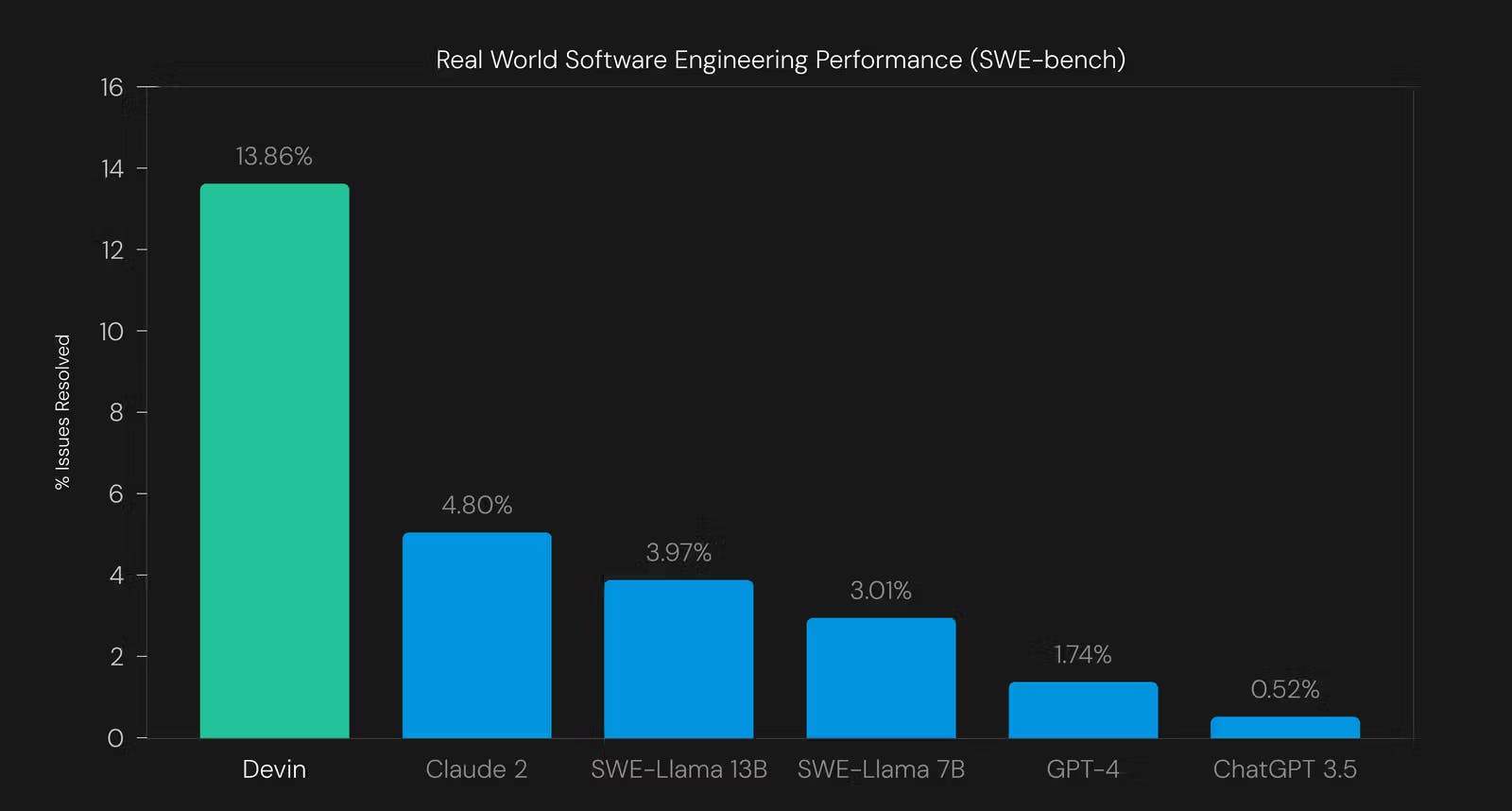

Devin, developed by Cognition, is claimed to be the first fully autonomous AI software engineer. Unlike copilots that assist human programmers, Devin executes entire software projects and resolves 13.9% of real-world GitHub issues end-to-end on SWE-bench — far outperforming GPT-4’s 1.7% and Claude 2’s 4.8% as of March 2024. Overall, Cognition’s vision is to offer a scalable alternative to human engineers through autonomous AI coding agents.

Founding Story

Cognition, also known as Cognition Labs, was founded in November 2023 by Scott Wu (CEO), Steven Hao (CTO), and Walden Yan (CPO). The founding team brought strong competitive programming and software engineering backgrounds.

Wu, a Harvard graduate, is a three-time gold medalist at the International Olympiad in Informatics (IOI), a 2011 Mathcounts national champion, and later the co-founder and CTO of Lunchclub from 2017 to 2022, an AI networking platform backed by Lightspeed and Coatue. He also placed third at Google Code Jam in 2021 and was named to Forbes 30 Under 30 in 2020. Hao studied computer science and math at MIT from 2014 to 2018 and became a top engineer at Scale AI after he joined the company in 2018. Before working at Scale AI, Hao had interned at firms like D.E. Shaw and Dropbox and won a gold medal at IOI 2014, placing 6th globally. Yan, who dropped out of Harvard in 2023 to co-found Cognition, previously worked on Cursor at Anysphere from June to August 2023 and was a cofounder of DeepReason, a web3 security startup, from 2022 to 2023. He also served as managing partner at Inverted, a media consultancy that was acquired in 2021. In 2020, he earned a gold medal at IOI, placing 19th out of nearly 400 participants from over 100 countries.

The founders likely knew each other through IOI and their time at Harvard and MIT, initially exploring cryptocurrency projects before pivoting to generative AI in late 2022 as interest in models like ChatGPT accelerated across Silicon Valley. Wu said the task of building an AI to code is “deeply algorithmic” and well-suited to their background. Collectively, the team had won 10 IOI gold medals — a fact that shaped the company’s early identity and seemed to give it an edge in the field of AI programming.

The concept for Devin emerged from the team’s desire to turn the logic and process behind competitive coding into an AI system. The breakthrough came in late 2023 when the team realized that large language models like GPT-4, combined with reinforcement learning, could be trained to reason through complex, multi-step software tasks. In a pivotal moment before Christmas Day in 2023, after hours of struggling with a server issue, the team gave Devin a chance to solve it. Devin identified and deleted a faulty system file they had overlooked, successfully configuring the server. It was the first time Devin had autonomously handled a real-world task, which affirmed the company’s vision.

Cognition operated in stealth until March 2024, when it launched Devin to the public. A demo video showing Devin autonomously fixing a bug in an open-source library gained over 30 million views on X as of May 2025. The company also claimed that Devin had passed real-world engineering interviews and performed complex coding tasks without human input. In the same month, Cognition announced a $21 million Series A investment led by Founders Fund.

Source: X

Product

As of May 2025, Cognition’s flagship and only product was Devin, an AI coding agent designed to autonomously complete software engineering tasks when prompted by a user. Unlike traditional code assistants, Devin operates within an integrated development environment equipped with its own Linux shell, code editor, browser, and other standard developer tools inside a cloud-based sandbox. When given a task, whether via chat, the web platform, or a Slack command, Devin formulates a step-by-step plan, executes code, runs tests, debugs, and updates its plan as needed. Throughout the generative process, it streams updates and accepts user corrections, maintaining an interactive feedback loop.

Devin is built to handle a wide range of tasks across the software development lifecycle. It can independently build full-stack applications, find and fix bugs, learn and apply new libraries, and even train or fine-tune machine learning models. In public demos, Devin has created a dynamic web app from scratch (the Game of Life) and autonomously patched a bug in the Sympy math library. Cognition describes Devin as a “tireless, skilled teammate” that can either pair-program or complete full tasks for later review.

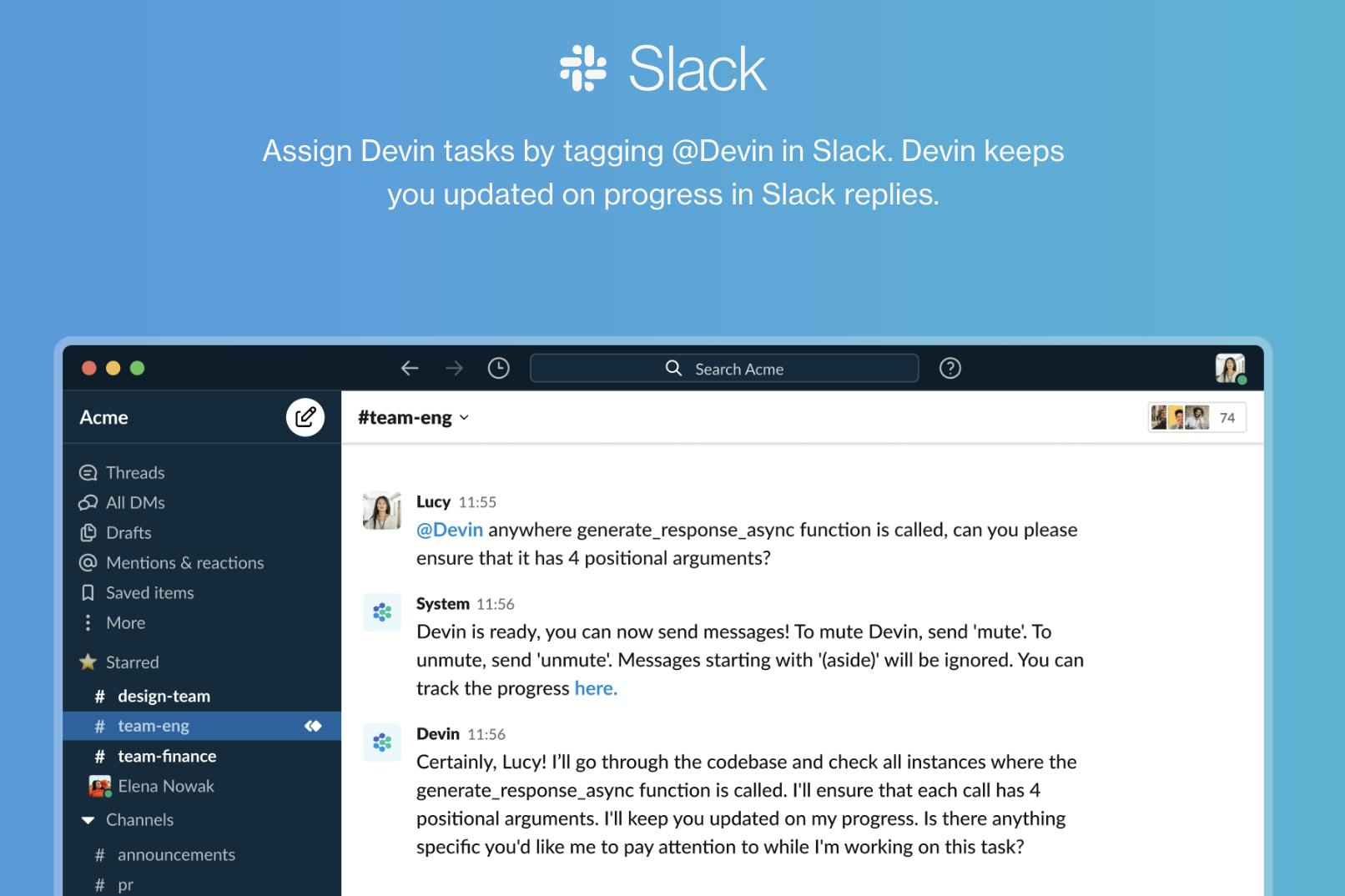

At its core, Devin uses large language models like GPT-4 Turbo, augmented with custom planning algorithms, long-term memory, and adaptive reasoning. Devin is capable of retaining context across thousands of steps and making thousands of micro-decisions toward a goal. When asked to clean up a codebase, for example, it can devise and execute a multi-part plan involving linting, refactoring, and API updates. When faced with errors, it searches documentation or forums, and if tests fail, its built-in self-reflection loop allows it to adjust strategy and retry. New features include voice command input and enhanced repository context for working with large codebases. Devin is available as a web app, Slack bot, or VS Code extension and integrates with tools like GitHub to act as a junior developer on a team.

Source: Cognition

In terms of coding performance, Devin leads the field on SWE-bench, a benchmark of real GitHub issues, solving about 13.8% of tasks end-to-end, compared to just ~2% by GPT-4 and Claude 2 as of May 2024. In production, companies like Nubank have used Devin to automate large-scale refactoring of monolithic codebases, resulting in an 8× improvement in engineering efficiency and 20× cost savings as of May 2025.

Source: Cognition

At the enterprise level, Cognition offers advanced capabilities through MultiDevin, a version of Devin designed for large-scale, parallelized task execution. MultiDevin consists of one “manager” Devin that coordinates up to ten “worker” Devins, each assigned a small, isolated subtask. Worker Devins run in parallel, and their successful outputs are automatically merged into a single codebase. This setup is particularly effective for workloads that involve a high volume of repetitive subtasks, subtasks of junior engineer-level difficulty, and those that are isolated, incremental, and objectively verifiable. This may include tasks such as linting, refactoring, or updating API calls across a large monolithic codebase. Devin is best suited for projects with minimal interdependencies, where each component of the work can be completed and validated independently.

In April 2025, Cognition released Devin 2.0, which introduced several enterprise-grade enhancements aimed at improving transparency and collaboration in complex workflows. Devin 2.0 can perform proactive codebase exploration and generate a detailed execution plan that users can edit or approve before task execution begins, a feature which Cognition calls interactive planning. The update also introduced Devin Search, which allows users to query their codebase directly and receive responses backed by cited code, improving visibility and codebase comprehension. Additionally, Devin Wiki was added to automatically index repositories every few hours, producing browsable documentation and architecture diagrams that link directly to relevant parts of the code.

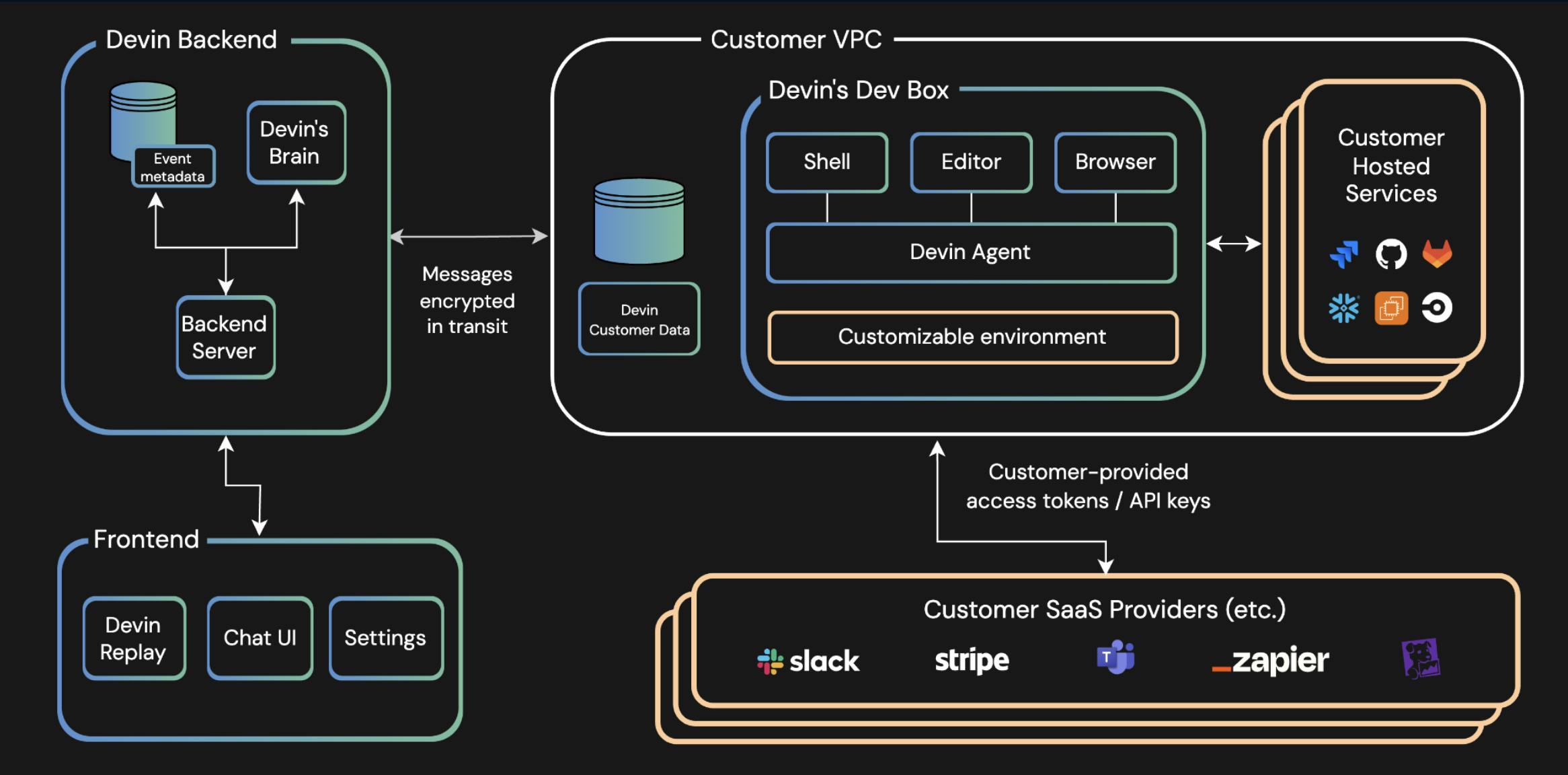

To support secure deployment at scale, Cognition offers a Virtual Private Cloud (VPC) deployment model. The architecture of the VPC system separates the Devin Backend, composed of Devin’s Brain, event metadata, and backend servers, from the Customer VPC, which hosts Devin’s Dev Box. The Dev Box contains a Linux shell, code editor, browser, and the Devin Agent itself, all operating inside a customizable environment. Customer data resides fully within their VPC, and communication between systems is encrypted in transit. Devin integrates with developer ecosystems, including GitHub, GitLab, and Snowflake, as well as customer-provided SaaS tools like Slack, Stripe, Teams, and Zapier, through secure API tokens. This infrastructure enables Devin to act as a safe, embedded AI teammate, capable of scaling engineering workflows while maintaining full enterprise compliance and control.

Source: Cognition

Market

Customer

As of May 2025, Cognition’s customers included OpenSea, Ramp, Nubank, Lumos, Microsoft, and Curai Health. These early customers have primarily been engineering-centric, growth-focused, mid to large tech companies, many of which maintain substantial codebases and developer teams. They demonstrate a clear emphasis on developer productivity and willingness to experiment with emerging technologies like AI coding agents.

Several industry verticals stand out for Cognition’s ideal customer. In fintech, companies like Ramp and Nubank are adopting Devin to modernize legacy systems, where technical debt often grows faster than it can be resolved. In these environments, Devin’s ability to automate refactors, migrate APIs, and run verification loops provides meaningful leverage. Technology startups such as Lumos, which tend to operate with lean engineering teams, are another natural fit, as they leverage AI tools like Devin to accelerate development cycles and focus human engineers on higher-order logic. Cognition’s other customers reflect a cross-industry interest in Devin’s capabilities, such as OpenSea in Web3 and Curai Health in healthcare — sectors where software quality and iteration speed can be key differentiators.

Since Devin remains a relatively new product, early customers appear to function as beta partners. For instance, Cognition emphasizes that Devin works best when users provide detailed requirements, test its outputs, and offer feedback to improve its performance. This approach aligns with the idea of early users shaping the product through their interactions and feedback. As the product matures, Cognition will likely target larger enterprises, like Fortune 500 companies, that have the scale and technical infrastructure to benefit from automating parts of their software development life cycle.

Market Size

Cognition operates within the emerging generative AI coding assistants market, which was valued at $25.9 million in 2024 and is expected to grow to $97.9 million by 2030, reflecting a CAGR of 25.5% from 2024 to 2030. While current market size figures are relatively small, the genAI coding assistants market is only beginning to monetize and is positioned for growth in the future as large enterprises increasingly adopt agents to automate repetitive, tedious software engineering tasks.

The market may be segmented into three layers: code autocompletion tools (e.g., Copilot), AI code review and optimization tools, and a new third category — fully autonomous coding agents. Cognition targets this last segment, which is both the most nascent and potentially the most disruptive. Its total addressable market is effectively the global software engineering industry. As of 2024, there were approximately 28 million software developers worldwide — a number expected to reach 45 million by 2030. As more of their workflows become automatable, Cognition’s positioning within this market allows it to capture value well beyond the current coding assistant segment.

Competition

The competitive landscape for AI coding assistants can be divided between established incumbents and a wave of well-funded startups in a few forms, including AI code assistants, AI code agents, and foundation models for software engineering.

Incumbents

GitHub Copilot: GitHub Copilot, launched in June 2021, offers AI-powered code suggestions and in-IDE autocompletions through its integration with editors like VS Code and JetBrains. Now part of the broader Copilot X platform, Copilot supports chat-based code explanation and has over 1.3 million paid developers and 50K business team subscribers. Backed by Microsoft and OpenAI, who together have raised nearly $18 billion, Copilot remains widely adopted. However, its functionality is limited to code suggestions and completions; it does not independently manage full software tasks as Devin does.

Amazon Q: Amazon’s Q Developer, launched in November 2023, offers a more comprehensive feature set, including code completions, chat-based assistance, security scans, and refactoring. Integrated directly into the AWS ecosystem, it claims to improve coding speeds by 80% and boost productivity by 40%, with an acceptance rate of 37%. While Q Developer shares more workflow automation overlap with Devin than Copilot, Devin still surpasses it in long-term planning, recovery from failure, and execution of complex, multi-step engineering goals.

Claude Code: Claude Code, launched in February 2025 by Anthropic, is an agentic coding tool embedded directly in the terminal. It enables developers to edit files, run and fix tests, resolve merge conflicts, and query architectural logic via natural language. In benchmark testing, Claude Code achieved a 70.3% score on SWE-bench Verified and has been shown to save over 45 minutes per task in enterprise workflows, reducing test run time by 95%. As of April 2025, it is used by teams at top technology firms like Cursor, Replit, and GitHub. However, Claude Code remains in beta and operates without Devin’s dedicated development environment, making it less autonomous than Devin.

GPT-4: Finally, GPT-4, accessed through ChatGPT or API integrations, is often used in coding contexts via custom tools like Auto-GPT or SWE-agent. While GPT-4 ranks high on coding benchmarks like HumanEval, it lacks structured memory and planning and typically requires significant orchestration to complete multi-step development tasks. In one study, GPT-4 scored only ~1% on SWE-bench when deployed without fine-tuning. Devin, by contrast, is purpose-built with long-term memory, a structured planning loop, and a sandboxed development environment, enabling it to reliably complete tasks that general-purpose models like GPT-4 cannot handle alone.

AI Code Editors

Anysphere (Cursor): Among AI-native code editors, Cursor (owned by Anysphere) has emerged as a leading competitor to Devin. Released in May 2023 by Anysphere, Cursor is built from the ground up as an AI-first IDE. It supports natural language commands, smart autocompletion, chat-based assistance, and multi-file edits powered by a custom-trained model. Anysphere, founded by MIT alumni in December 2022, has attracted massive investor interest, raising a $60 million Series A in August 2024 at a $400 million valuation, followed by a $100 million Series B at $2.6 billion. As of April 2025, Cursor is used by over 40K developers and has surpassed $100 million in ARR. While Cursor excels at improving developer efficiency inside the IDE, Devin differentiates itself by being an autonomous agent, able to plan and execute full engineering workflows across repositories without constant human input.

Windsurf (formerly Codeium): Windsurf is another fast-growing player, offering AI-assisted coding via plug-ins and its own IDE. Founded by several MIT alumni in 2021, Windsurf supports dozens of programming languages, providing autocomplete, chat-based editing, and natural language code search. It runs on a freemium model and has reported usage by over 1K companies by summer 2024. In terms of funding, Windsurf raised a $150 million Series C in August 2024 at a ~$1.3 billion valuation. It was reported to be seeking more funding at a valuation of ~$2.9 billion as of February 2025. In May 2025, it was announced that OpenAI had agreed to buy Windsurf for $3 billion to complement ChatGPT’s coding abilities.

Though powerful, Windsurf’s capabilities are bounded by the editor and user prompting while Devin operates independently within a cloud-hosted development environment to carry out work across systems.

Augment Code: A newer entrant is Augment Code, which launched from stealth in April 2024 with $252 million in Series B funding at a $977 million valuation. Founded by ex-Google and Microsoft engineers Igor Ostrovsky and Guy Gur-Ari in 2022, Augment is focused on helping engineering teams automate backlog reduction and improve software quality at scale. Its product is designed to turn structured inputs like Jira tickets into complete merge requests, with initial usage across “hundreds” of developers in early access, including payment startup Keeta, according to Ostrovsky in April 2024. While Devin has focused on arbitrary user-prompted tasks and full-cycle development, Augment leans into workflow automation and quality assurance across enterprise codebases — suggesting a complementary, though distinct, strategic focus.

Foundation Models for SWE

Poolside AI: Poolside AI, founded in 2023 by Jason Warner (former CTO of GitHub) and Eiso Kant, is developing foundation models from the ground up for code-related applications such as autocomplete, intelligent code search, and codebase navigation. In October 2024, the company raised a $500 million Series B round from investors, including eBay and NVIDIA, bringing its total funding to $626 million and valuing the company at $3 billion. The funding enabled the company to bring 10K NVIDIA GPUs online for training in October 2024.

As of May 2025, Poolside had not released its product publicly. The company has stated it intends to serve Global 2000 enterprises and public-sector agencies, particularly those with large proprietary codebases. Poolside focuses on building powerful foundation models, while Cognition takes a system-level approach, combining existing models into an interactive, agent-like system.

Magic AI: Magic AI is also building proprietary foundation models for software development. Founded in March 2022, the company secured a $320 million investment in August 2024 from investors like Eric Schmidt and Atlassian at a valuation of approximately $1.5 billion, bringing its total funding to $465 million as of May 2025. Magic partnered with Google Cloud to build dedicated AI infrastructure, including systems equipped with 8K NVIDIA H100 GPUs and upcoming Blackwell chips. The company has stated that its long-term objective is to scale compute to 160 exaflops for training.

Technically, Magic has introduced a long-context architecture called Long-Term Memory (LTM), which reportedly supports 100 million token windows — significantly larger than the 2 million supported by other models such as Gemini as of May 2024. This capability could allow Magic’s models to process and reason over entire enterprise-scale codebases without needing to break problems into smaller parts. While Devin focuses on orchestration, planning, and execution using existing model backends, Magic is pursuing scale and context size as differentiators in its model architecture. Both approaches address different components of the software development stack and may converge over time.

AI Code Agents

Factory AI: Founded in 2023, Factory AI offers an agentic development platform built around autonomous “AI droids” that assist throughout the software engineering lifecycle. These agents integrate with version control systems and issue trackers to pick up tasks, implement code changes, open pull requests, and handle feedback during code review. The company has raised a total of just over $20 million as of May 2025, including a $15 million Series A led by Sequoia Capital in June 2024, which valued the startup at $120 million. Factory emphasizes fast iteration, working closely with the LangChain ecosystem to refine prompting strategies and response quality.

Factory’s agents have shown early signs of effectiveness. In pilot deployments, as of July 2024, users reported a ~20% reduction in open-to-merge time and a 3X drop in code churn within 90 days. On the SWE-Bench benchmark, in June 2024, Factory’s droid solved approximately 19% of tasks — higher than many baseline models but lower than Devin’s reported scores. Compared to Devin, Factory appears more focused on team augmentation rather than full autonomy, which may appeal to organizations that prefer keeping engineers in the loop.

Genie: Genie, developed by Cosine (YC W23) in 2023, is another autonomous coding agent that has gained attention primarily through performance benchmarks. Despite raising only a $2.5 million seed round in August 2024 led by Soma and Uphonest Capital, Genie achieved 30% task completion on SWE-Bench — the highest reported by any agent, as of August 2024. This marks a 57% relative improvement over Factory’s 19% and significantly exceeds other published results. Cosine attributes this to its approach of encoding human-like reasoning patterns into the model, aiming to emulate how experienced engineers structure and solve problems. Genie is built on top of OpenAI’s long-context model, with additional fine-tuning and behavior-layer techniques developed in-house.

While Genie has demonstrated strong test-time reasoning capabilities, its product maturity and real-world integration features appear less developed than Devin’s, which includes sandboxed execution, multi-agent coordination, and enterprise deployment infrastructure. That said, Genie’s benchmark results suggest that model-level reasoning, particularly when enhanced by agent-specific fine-tuning, can yield high task accuracy even with relatively low funding.

Business Model

As of April 2025, Cognition offers Devin to customers with a SaaS business model, offering subscription-based access to its AI coding agent. After an invite-only beta period, the company launched its official pricing in December 2024 when Devin became generally available. The pricing is split into two main tiers: a Team Plan at $500 per month and a customizable Enterprise Plan.

The $500 per month Team Plan includes full access for an entire engineering team, with no per-seat limit. This plan provides use of the standard version of Devin, allowing for autonomous task execution, collaboration via natural language, and learning from historical interaction patterns. The pricing is based on compute usage, or “ACUs,” rather than the number of users. If usage exceeds the included compute quota, teams can opt into usage-based billing on top of the base subscription.

The Enterprise Plan offers access to Devin Enterprise, which includes more advanced capabilities such as Custom Devins (fine-tuned versions for specific workflows) and MultiDevin, which allows parallel task execution using a group of AI agents. Additional enterprise features include virtual private cloud (VPC) deployment, a dedicated account team, and custom legal and security terms.

By offering a flat-rate base price for teams and usage-based scalability, Cognition lowers the barrier to initial adoption while creating a path to monetize increased usage. As the product matures, the company may expand revenue by targeting larger enterprises with complex engineering environments that require higher capacity, customization, and secure deployment options.

Traction

Devin has generated interest within the developer and broader tech community since its public debut. The initial demo, published by Cognition in March 2024, received over 30 million views shortly after its release. While Cognition has not released official user numbers, the product has likely reached hundreds or thousands of developers across its customer base within the first few months of launch, given the size of its early enterprise customers. Independent developer forums discussing Devin’s technical capabilities have emerged, and open-source projects such as OpenHands have begun replicating its architecture, indicating early influence on the engineering community.

Devin has already contributed measurable engineering output to customer deployments. As of February 2025, at Linktree, Devin authored approximately 300 pull requests over one month, of which about 100 were successfully merged. These contributions included bug fixes, small features, and initial implementations of more complex functionality. One example was the integration of newer social platforms, such as RedNote and Lemon8, which Devin handled end-to-end, modifying backend systems, updating URL handling, and adjusting UI components. This helped Linktree streamline internal processes that traditionally required extensive planning and developer coordination.

Devin has also received attention from prominent figures in the tech ecosystem. Eric Glyman, co-founder and CEO of Ramp, described Devin’s demonstration as the “single most impressive demo” he had seen in the past decade. Aravind Srinivas, CEO of Perplexity, commented that Devin was the first AI agent he had seen “that seems to cross the threshold of what is human level and works reliably.”

Valuation

Cognition has raised substantial venture funding since launching Devin. In March 2024, the company secured a $21 million Series A round led by Founders Fund at a valuation of $350 million. The following month, in April 2024, Founders Fund led a significantly larger round of $175 million, increasing Cognition’s valuation to approximately $2 billion. Other participating investors include 8VC, Elad Gil, Conviction Partners, and Khosla Ventures.

As of early 2025, Cognition was not generating meaningful revenue relative to its valuation. Monetization began following the general availability of Devin in December 2024. Based on its public pricing of $500 per month for team plans and a visible customer count of at least 12 companies on its website as of April 2025, a minimum monthly recurring revenue (MRR) of ~$6K can be inferred. Assuming a broader adoption base of a few dozen companies by Q1 2025, Cognition could be generating between $15K and $30K in MRR, or $180K–$360K in annual recurring revenue (ARR). These estimates remain speculative and do not include potential usage-based enterprise fees.

The company has not disclosed total user counts. However, given the team-based licensing model (no per-seat limits) and several customers with large engineering teams, it is likely that hundreds of developers have used Devin directly as of April 2025. This number may increase if a portion of the current waitlist converts. At this stage, Cognition appears to be prioritizing product development and adoption growth over near-term monetization.

Key Opportunities

Expand Key Partnerships

Cognition has the opportunity to expand through a combination of strategic partnerships, investor tailwinds, and early-mover advantage in the autonomous AI agent space. A key milestone was its partnership with Microsoft, announced in May 2024. The collaboration integrated Devin into Microsoft’s developer ecosystem, with a focus on increasing productivity in areas such as code migration and modernization. This relationship increased Cognition’s exposure among enterprise software teams and developers using tools like Visual Studio Code and GitHub while also enhancing credibility with potential customers and investors.

Industry and Investor Tailwinds

The broader market environment has also been favorable. In 2024, venture capital interest in AI developer tools accelerated. Large funding rounds included $10 billion raised by Databricks and $260 million raised by Glean Technologies, reflecting sustained demand for enterprise AI solutions. Overall, AI represented more than 60% of all venture funding in Q4 2024. If this momentum continues through 2025 and beyond, Cognition may have opportunities to secure further capital, form strategic partnerships, or pursue acquisitions to enhance Devin’s capabilities.

Early-Mover Advantage

Cognition benefits from being among the first to market with an autonomous software engineering agent. Investment in AI companies rose by over 80% year-over-year, from $55.6 billion in 2023 to over $100 billion in 2024. TechCrunch further reported that total AI startup funding reached $110 billion in 2024 — a 62% increase despite broader declines in venture funding. As of May 2025, in the segment Devin operates in, the global market for generative AI coding assistants is projected to grow from $25.9 million in 2024 to $97.9 million by 2030, representing a 24.8% CAGR from 2024 to 2030. Investor interest in “fully autonomous agents” is increasing, which aligns with Cognition’s positioning.

Key Risks

Exaggerated Capabilities

Cognition has marketed Devin as a breakthrough in autonomous software engineering, but the company has faced scrutiny regarding the accuracy of its product demonstrations. One example involved a detailed review in April 2024 by the YouTube channel “Internet of Bugs,” which analyzed an Upwork task featured in a demo. The video alleges that Devin may have operated on pre-configured files with known bugs, calling into question the authenticity of its problem-solving process. These concerns have gained traction in online communities such as Reddit, where users have expressed skepticism about the agent’s capabilities and the framing of its performance.

Additional independent testing has further highlighted gaps between demonstration and real-world functionality. An evaluation by Answer.AI found that out of 20 tasks assigned to Devin, only three were successful, while 14 failed and three were inconclusive — suggesting a 15% success rate. The report also noted that Devin sometimes took days to complete tasks that typically take human engineers a few hours. Although Cognition has responded to some of these criticisms, maintaining transparency about limitations and performance will be important for preserving trust within the developer community.

Intense Competition

The autonomous coding space is attracting attention from well-capitalized incumbents and startups alike. Large technology companies such as Microsoft (via GitHub Copilot), Amazon (AWS Q), and Anthropic (Claude Code) are building or expanding competing solutions. Some, such as Magic AI and Poolside AI, are developing software-specific foundation models with significant funding and infrastructure. If a competitor integrates a more advanced model with strong planning and memory into a full-stack coding agent, it could reduce Cognition’s differentiation and capture market share.

Given Cognition’s relatively small team and limited operational history, it may face challenges defending its position if larger players offer comparable autonomous capabilities as part of broader developer ecosystems.

Scaling Challenges

Devin’s architecture involves long-context inference, multi-step planning, and sandboxed development environments — all of which can be compute-intensive. While the $500 per month team plan makes Devin accessible to smaller organizations, it may not fully cover usage costs for teams running high-volume or enterprise-scale workloads. Without careful cost control, heavy usage could compress margins or lead to higher-than-expected operational expenses.

If revenue growth lags behind infrastructure costs, Cognition may be forced to raise additional capital under less favorable terms or limit access to high-compute functionality — both of which could slow product adoption. Scalability and pricing optimization will be key as the company transitions from early-stage adoption to broader enterprise deployment.

Summary

Cognition is the maker of Devin, an AI coding agent capable of planning and executing complex engineering tasks end-to-end in a sandboxed environment. Devin can write code, debug, deploy applications, and even learn new tools independently, functioning as a versatile teammate across the software lifecycle. Despite intense competition from both incumbent players and specialized startups, Devin’s technical breadth, enterprise traction, and strategic partnerships position the company to maintain an early lead in the rapidly expanding AI coding market.