Thesis

The demand for software is outpacing the supply of software developers, with some estimates expecting an 85 million shortfall by 2030. In addition, as of 2024, developers are spending the majority of their time on menial tasks such as connecting APIs, handling text coverage, and writing simple application logic. Based on surveys of over 250K developers, the median developer spent only 52 minutes per day actually writing code.

All of this plays perfectly to the increasing demand for AI-generated code. 63% of organizations are already piloting or deploying AI code assistants, and by 202,8 75% of enterprise software engineers are expected to be using AI to help them write code, up from only 10% in 2023. 44% of software engineers reported using AI tools in development workflows, and 26% reported planning on doing so soon. The role of these tools is often to help with code generation, completion, and quality improvements.

One 2023 study showed that generative AI can halve the time it takes developers to complete coding tasks. More specifically, new code can be written in half the time, existing code can be refactored in two-thirds the time, and code functionality can be documented in half the time. Developers using AI were 15-30% more likely to complete medium and hard tasks in the allotted time frame. Another study in February 2023 of the AI coding tool Copilot found that users with the tool completed tasks 55.8% faster than those without. The study concluded that if its results were to be extrapolated to the level of the US population, “the increase in productivity would imply a significant amount of cost savings in the economy and have a notable impact on GDP growth.”

Furthermore, there are notable examples of general-purpose LLMs failing in code assistance, giving rise to a demand for a tailored approach. General-purpose LLMs often hallucinate to produce syntactically correct code that does not actually fulfill the task requirements. LLMs can also struggle in real-world development environments with complexities like code repositories that have unique dependencies and documentation.

Poolside is building a generative AI foundation model, an API, and a coding assistant designed specifically for software engineers. By building a specialized model, Poolside competes by being tailored to the specific needs of the coding industry. Poolside can write and edit code snippets, respond to user questions, and give suggestions based on context from the developer’s workspace. Poolside also ensures that no data or code ever leaves the company’s security boundaries and excludes copyrighted material and personally identifiable information. Poolside’s training model differentiates via its use of synthetic training data at scale, allowing it to avoid data bottlenecks in training, as well as increasing the company’s ability to build more secure models.

Founding Story

Poolside was founded in 2023 by Jason Warner (CEO) and Eiso Kant (CTO).

From 2014 to 2017, Warner was the VP of Engineering at Heroku, a Platform-as-a-Service to run cloud applications, which is now owned by Salesforce. Following that, Warner was the CTO of GitHub until 2021. As CTO, he oversaw GitHub’s launch of Copilot, the most widely used AI development tool. In July 2021, he left to serve as a managing director at Redpoint Ventures until 2023, when he would go on to found Poolside.

At GitHub, Warner got exposure to almost every aspect of the business, including product engineering, design, security, data, infrastructure, marketing, HR, and corporate development. The only fields he did not touch were finance and sales. At the time he joined GitHub, the firm was a simple code hosting platform where people could enter code and collaborate. His vision, however, was to turn it into an end-to-end software development platform infused with intelligence. The products he helped build at GitHub included GitHub Actions and Packages, Security, Analytics, Code Spaces, Connect, and eventually Copilot after its acquisition by Microsoft.

Warner met Kant in 2017 when Warner tried to acquire Kant’s company to become the AI at the core of GitHub. Kant previously co-founded several developer-focused startups, including engineering analytics firm Athenian and code search, retrieval, and analysis tooling startup source{d}. Though the acquisition did not go through, the two became friends. Over the next six years, the pair plotted an AI-driven tool suite to assist developers, which became Poolside. Warner had a vision for using AI in domain-specific uses, specifically with software development being the area he believed would provide the most value.

Originally, Warner and Kant planned on naming their company Snowball. However, they had to scrap the name due to trademark issues with AWS Snowball. While having a potential funding meeting with an unnamed hyperscaler for their computing needs, the executive team at the hyperscaler asked the two for a “poolside” informal meeting. The name fit Warner’s requirement of a fun, short, two-syllable name. They also believed it would be a name worth remembering.

In April 2024, Poolside hired former GitHub Chief Revenue Officer Paul St. John (CRO) to lead its go-to-market plan in the enterprise landscape. Poolside’s team of researchers and engineers has been assembled from firms including Deepmind, Yandex, Amazon, and Uber.

Product

Poolside is a full stack solution for software development: at the base layer are its foundation models fine-tuned on code and developer interactions. On top of that is middleware, such as its APIs, that connect the models with applications. At the application layer, Poolside offers an assistant that utilizes natural language processing to converse with developers, complete code phrases, and review code.

According to one presentation, Poolside was built with three key convictions in mind.

First, general-purpose LLMs cannot bridge the gap from simple code assistance to actually playing the role of a junior developer who can think at a higher level. This is because general-purpose models are not trained specifically for software development, rather they are taught about code and not how to code. Poolside’s Reinforcement Learning via Code Execution Feedback (RLCEF) method trains models based on criteria such as if the code compiled, passed unit tests, was efficient, and is secure. Poolside uses RLCEF to teach models how to “think.” In other words, the models are able to arrive at output code based on the actual results of executing code. This is done by using code from over 500K open-source software repositories in the training process.

RLCEF allows Poolside to generate synthetic data at scale by exposing its models to realistic coding tasks from open-source code bases, providing feedback based on the actual results of code execution, and then employing reinforcement learning at scale. Reinforcement learning is a machine learning technique that uses a reward and punishment model such that models can learn from the feedback and outcome of each action.

Second, software development models and general-purpose LLMs as of December 2024 do not understand the customer’s business. Poolside’s models train based on its individual customers’ code, data, and user behavior. The goal is for all other apps to plug into Poolside, which will understand the entire software development lifecycle better than one lone human developer.

The third view is that the company deploys its intelligence to many vendors, creating a need for secure software development environments. For a development assistant to be integrated throughout the software lifecycle, firms will need to allow models access to their entire ecosystem. Therefore, Poolside is deployed within its customers’ security boundaries and never leaves. The use of RLCEF also means models can train on synthetic data without relying on any of their customers’ data.

Models

As of May 2025, Poolside provided two models: Malibu is its flagship model for deep reasoning via chat, and Point is its code completion model. Both models are built from the ground up and fine-tuned on each customer’s software environments. This means ingesting codebases, documentation, and knowledge bases. Both models are trained via RLCEF, which allows the models to understand how code is thought about and written. The models are deployed in customers’ secure environments, and no information leaves.

Malibu is useful for completing complex software engineering tasks, such as code generation, test writing, refactoring, and documentation. Malibu’s maximum token amount is over 1 million. Point is used for real-time code completion as a developer type and uses context awareness to predict the developer’s next steps. Point also offers suggestions for optimizing algorithms and design patterns. Point’s maximum token amount is 100K.

API

Poolside’s API allows for custom model fine-tuning on a company's specific codebases, libraries, and documentation, resulting in a proprietary model tailored to the organization's development practices. Poolside's stack can be deployed within a company's own infrastructure, ensuring that no data or code leaves the security boundary, which is particularly beneficial for industries with strict compliance requirements. Additionally, Poolside offers integrations with popular development environments such as VS Code and IntelliJ, as well as web browsers like Chrome, Safari, Firefox, and Arc, facilitating adoption by development teams.

Application

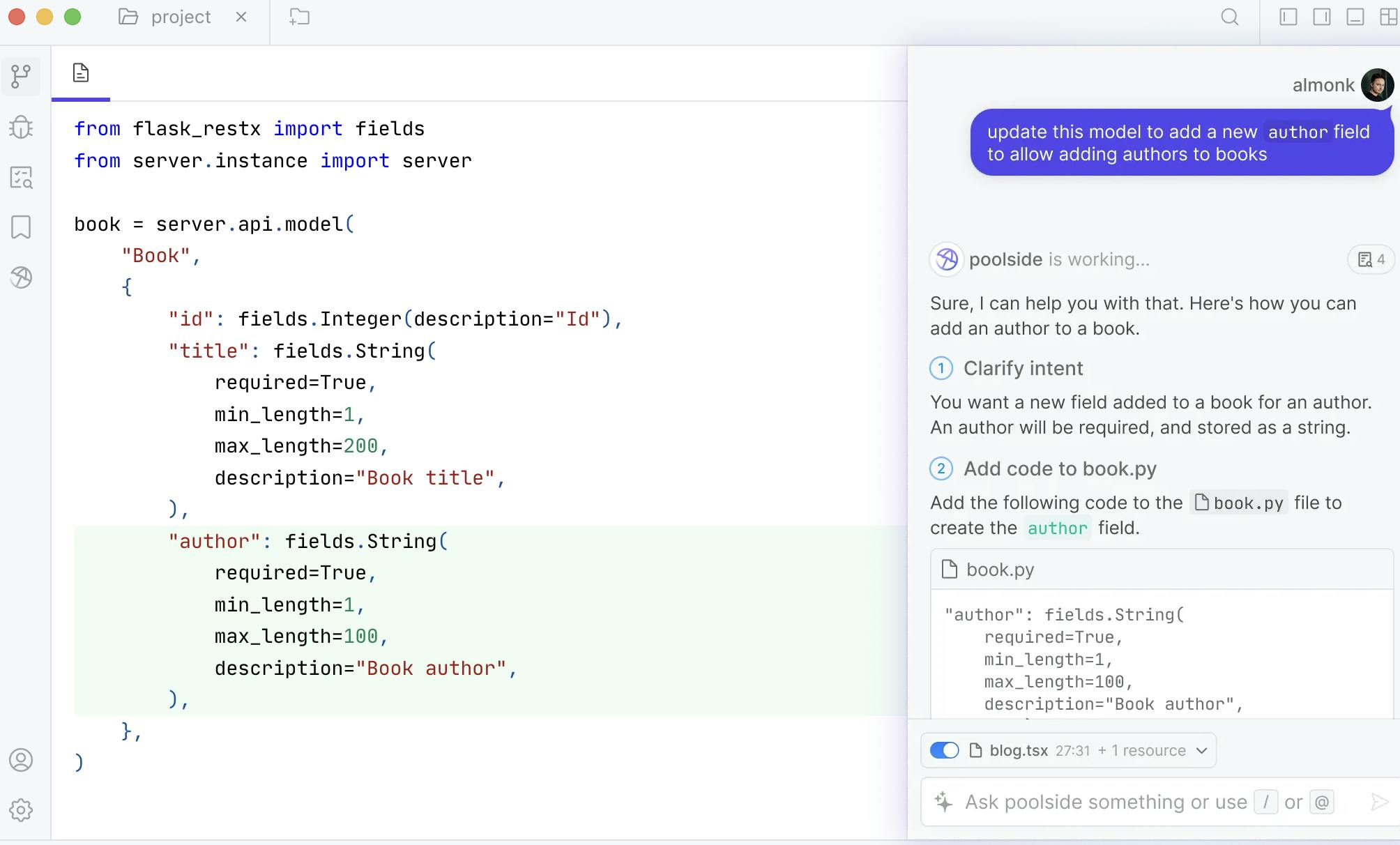

Malibu and Point feed into its application layer tool, Assistant, which can write and edit code snippets, respond to user questions, and give suggestions based on context from the developer’s workspace.

Source: Poolside

Despite launching applications, Poolside has repeatedly emphasized its focus on building high-quality models. In March 2025, Poolside CEO Jason Warner argued that most companies should focus on building AI applications rather than foundational models, unless they are committed to advancing intelligence as a core capability. He also emphasized that foundational models should not be standalone products but components of broader solutions, particularly as competition increases. Warner stated that Poolside is pursuing artificial general intelligence (AGI) through software and targeting complex environments such as defense and government.

Market

Customer

The product is not open to the public as of May 2025. Poolside has said it wants to sell to enterprise clients with software development teams. According to one early poolside customer, the company’s current go-to-market initiatives may be limited by the size of the team, GPU size, and the size of Poolside’s LLM architecture. Poolside customers include undisclosed Global 2000 companies and government agencies.

Market Size

The AI coding tools market is expected to grow from $5 billion in 2024 to $27 billion in 2032 at a 24% CAGR. The expected growth is driven by the rising demand for software developers and the growing requirement to help developers with challenging coding tasks. As mentioned, the shortfall of software developers is expected to reach 85 million by 2030.

Competition

Competitive Landscape

The software development tooling landscape is dominated by GitHub Copilot and OpenAI’s ChatGPT. 44% of developers recorded daily use with Copilot and 82% with ChatGPT. However, the landscape for these AI development tools has seen other players fill the space in 2024, including Anysphere’s Cursor, Magic, Windsurf (formerly known as Codeium), and Cognition AI. Similar to Poolside, these competitors are focusing on code completion and generation.

Poolside’s main points of differentiation are its use of domain-specific models and RLCEF. By building frontier models specialized in software development, the Poolside team believes they can dominate the AI coding vertical. Their method of training models, RLCEF, uses the deterministic nature of code execution to train models based on actual code output. RLCEF allows Poolside to create synthetic data, avoiding data bottlenecks and ensuring customer data privacy.

Competitors

Github Copilot: Github was founded in 2008 and acquired by Microsoft in 2018 for $7.5 billion. Copilot is GitHub’s AI code editor with customers including Shopify, EY, BMW, Infosys, Lyft, FedEx, and AT&T. As of 2024, 44% of developers reported using Copilot. This reflects over 100 million developers, up 26% from 2023. Users can choose from models including GPT-4o, Claude 3.5 Sonnet, and o1. As of October 2023, GitHub Copilot had over 1 million users across over 37k subscribed organizations.

The primary function of Copilot is code completion with real-time suggestions as developers type by understanding the context of the code. Copilot lacks broader software developer functionalities, such as automated testing or document generation, which Poolside can do. Copilot is also built off of general-purpose models, which Poolside believes will be less accurate and tailored compared to domain-specific frontier models. These general-purpose models only understand the input task and code output, which in software development is not as useful as understanding the steps to write the code, compile, execute, and iterate again.

However, because Copilot is just one GitHub product, the benefits it offers include being a more comprehensive suite that includes code collaboration, CI/CD, DevOps, and DevSecOps. Meanwhile, poolside focuses specifically on writing code.

Anysphere: Founded in 2022, Anysphere is the developer of AI coding assistant Cursor. In May 2025, the company raised a $900 million round of funding at a $9 billion valuation from Thrive Capital. Cursor is reported to be the AI coding tool with the most popularity, growing from $4 million in ARR as of April 2024 to $300 million ARR by May 2025. Customers include OpenAI, Midjourney, Perplexity, Replicate, Shopify, and Instacart.

Cursor is built on a mix of general-purpose and domain-specific models. Similar to Poolside, Cursor learns from customers’ existing codebase, but Poolside takes personalization one step further by analyzing messaging tools like Slack and project management ticketing tools like Jira. Cursor can suggest multiple edits at once, predict cursor position, automatically fix mistakes, and use NLP to chat with the developer. The tool can see a user’s current file and cursor position, which allows it to respond with context to questions like “Is there a bug here?”.

Magic: Magic is an AI software coding tool founded in 2022. The company raised a funding round of $320 million at a $1.6 billion valuation in August 2024 with investors including Sequoia. Magic’s tools help engineers write, review, debug, and plan code changes. It differentiates via its models’ extremely long context windows. A model’s context window refers to the amount of text an LLM can process. Longer context windows can prevent models from forgetting the content of recent inputs and from getting off-topic. Magic calls this architecture Long-term Memory Network or LTM.

In August 2024, Magic released LTM-2-mini, which has a 100 million-token context window, which is the equivalent of 10 million lines of code. This would make it the largest context window of any available commercial model, with the second being Google’s Gemini at 2 million tokens. Due to the ultra-long context window, the model was able to complete a complex development project with no human assistance.

Windsurf: Windsurf, previously known as Codeium, was founded in 2021 by two MIT grads to focus on GPU optimization. In 2022, the team pivoted to become a generative coding company. It raised a $150 million Series C at a $1.25 billion valuation in August 2024 with investors including Kleiner Perkins and Greenoaks. In May 2025, OpenAI announced it was acquiring Windsurf for $3 billion. Unlike Poolside, Windsurf has a free tier and sells to individuals. As of August 2024, the firm had over 700K users, including over 1K enterprises such as Anduril*, Zillow, and Dell. Similar to Poolside, Windsurf is accounting for fears about data privacy by offering a self-hosted installation option that can be deployed within an enterprise’s own boundaries.

Cognition: Founded in 2023, Cognition is the developer of AI coding assistant Devin. Cognition raised a $175 million funding round led by Founders Fund in April 2024 at a $2 billion valuation. Cognition claims Devin can act as an autonomous software developer capable of handling entire development projects, learning new concepts, building and deploying apps, and fixing bugs. Devin is the highest-performing model on the SWE-Bench benchmark, scoring a 13.86% accuracy in fixing issues without any intervention. This metric is used to evaluate AI models on software engineering tasks.

Augment: Augment is an AI-powered coding platform founded in 2022. Augment raised $252 million at a $977 million valuation in April 2024 from investors, including Lightspeed Venture Partners and Index Ventures. It had 50 employees as of April 2024 and is expected to double this count by EOY 2024. Augment’s model can chat with developers to offer suggestions and answer questions, make codebase-wide code suggestions, and complete lines of code.

Business Model

According to a customer of Poolside, the firm offers a custom price at pay-per-use pricing that is on a scale-out model, not a fixed price. This indicates customers are priced on their actual usage of Poolside’s services or resources. The scale-out portion refers to incentives and discounts as a company increases its usage of the product.

Pricing parameters include the volume of code translated, the kind of process, such as what type of GPU, post-sales support, and other services like performance testing, security testing, and core benchmarking.

Traction

Poolside is leveraging over $600 million in funding to scale its training clusters to 10K Nvidia GPUs to train future models and increase compute. Poolside’s two models are trained on over 500K open-source codebases.

In December 2024, Poolside announced a partnership with AWS to provide Poolside’s Assistant and foundational models via Amazon Bedrock. Bedrock allows users to access foundational models in a single API. The partnership will allow enterprise customers to access Poolside within the security boundaries of AWS.

Valuation

Poolside raised a $500 million funding round led by Bain Capital Ventures at a $2 billion valuation in October 2024. Other notable investors included eBay, Nvidia, Citi Ventures, Redpoint, and Adams Street.

Poolside previously raised a $126 million seed round in August 2023 at a $526 million valuation. The deal was led by Felicis, Redpoint Ventures, and Xavier Niel and included other investors such as Bain Capital Ventures, Air Street Capital, and Scribble Ventures.

Key Opportunities

Reinforcement Learning

Poolside stresses its advantage over competitors is its RLCEF training method. By identifying over 10K tasks within a code base and simulating that with its model, a customer can reinforce the model with good, mediocre, and bad responses such that the model learns ways to do something and ways not to do something. In addition, these repeated iterations of executing real code within their simulated environment are a way of producing large amounts of synthetic data.

When developing next-generation models, this synthetic data provides high-quality data in large volumes for the model to be trained on. With data being one of the major limitations to model advancement, Poolside’s early investment in RLCEF could pay major dividends against competition as the company scales.

Partnerships

According to customers of Poolside, a major drawback as of December 2024 with using the platform is the size of their team and post-sale support. Because Poolside differentiates by allowing customers to install the model within their private networks, having installation support and help is crucial. Especially at the scale of large organizations with complex software developments, poolside is unable to provide adequate support. However, through partnerships with major cloud providers such as AWS and AWS Bedrock, Poolside can be deployed easily into a virtual private cloud by using a single API. Thus, Poolside can be easily accessed without hands-on support itself.

Key Risks

Scale

One of the major factors in model training is compute. More compute allows models to process more data, make more complex calculations, and make better decisions. As Warner admits, Poolside will eventually need to build its own data centers to increase its computing capacity. The other major factor in model training is data quality, which Poolside believes it has an advantage in via RLCEF. From OpenAI to emerging platforms like Anysphere’s Cursor and Windsurf, the demand for generative code is exploding, and with it, the demand for compute. Poolside will have to continue to compete for access to the resources it will need.

Lack of Differentiation

As noted in the competition section, there are various startups similar to Poolside with various degrees of similarity in their offerings. To compete against Copilot and other platforms and win market share, Poolside will need to go beyond simple code assistance to control broader aspects of the software development workflow.

Warner mentions how the focus of AI tooling in development is currently on code assist as of December 2024, but the next few years will require an expansion into the entire lifecycle of software development. Poolside will need to integrate and improve every aspect of the software development lifecycle, not just writing code. For example, updating repositories with complex dependencies or learning from Slack messaging.

Summary

Reliance on AI tools for software development is increasing rapidly. Tools like Poolside are crucial for relieving developer shortfalls and easing the high workloads faced by existing developers. Poolside’s founding team, with experience from market-leading product Github Copilot, has the potential to challenge Copilot. The key going forward will be if the platform can move beyond basic code completion to understanding an organization’s entire software landscape. While there are many players offering coding tools, Poolside must differentiate by expanding its foundational models beyond editing and line completion.

*Contrary is an investor in Anduril through one or more affiliates.