Thesis

In 2024, the cost of medical care benefits in the US was expected to rise by 8.9%, up from 8.2% in 2023. Medical costs associated with employer-sponsored plans also increased, growing between 6.8% and 7.3% on average in 2024. As of January 2024, these increases outpaced general inflation and placed financial strain on both employers and employees, driven by overuse of care, poor health habits, and new medical technologies.

The rising costs of prescription drugs, with a projected median increase of 4.5% from 2024 to 2025 — particularly specialty medications and GLP-1 drugs for weight loss — are contributing to projected increases in medical costs. As of April 2023, employer healthcare costs were forecasted to grow by 9-10% through 2026, potentially impacting profitability across industries.

In response to these challenges, employers are adopting strategies to not only manage costs but also improve health outcomes and employee satisfaction. Between 2010 and 2023, the percentage of small employers offering at least one self-insured plan rose from 13% to 16%, while medium-sized firms saw an increase from 27% to 32%. This growth is partly attributed to the introduction of level-funded arrangements, a funding option that combines self-funding with extensive stop-loss coverage. In 2023, 38% of covered workers in small firms were enrolled in level-funded plans.

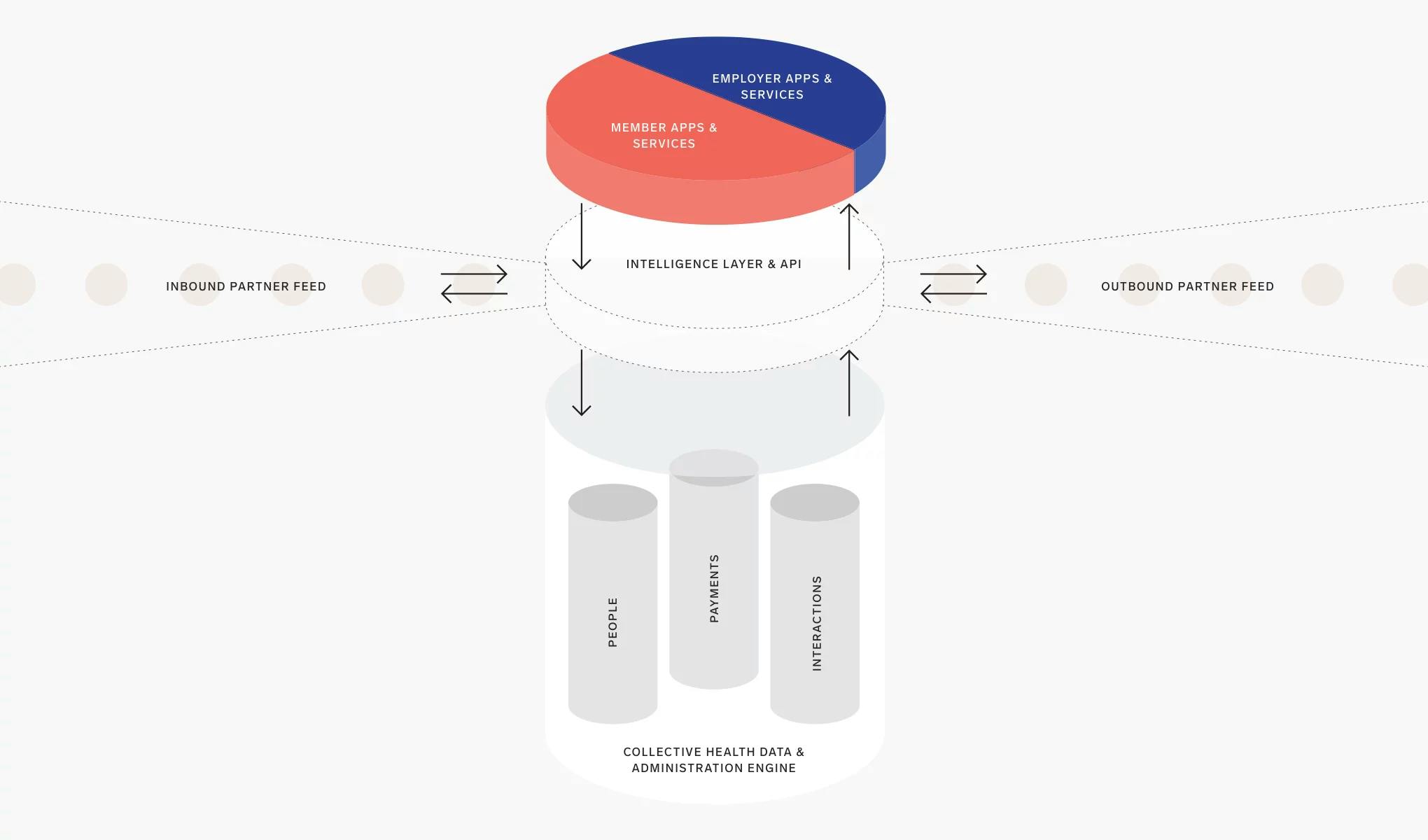

To meet the needs of employers navigating this evolving landscape, Collective Health offers an integrated health benefits solution for businesses with self-funded insurance plans. Collective Health’s platform is designed to simplify and improve the management of employee healthcare by offering an integrated member interface that consolidates medical, dental, vision, pharmacy, and program partners. The platform is designed to reduce the administrative burden for self-funded employers while providing employees while providing a mobile-first experience. Collective Health handles plan administration, claims adjudication, and member advocacy while integrating third-party wellness programs and analytics to help self-funded employers optimize health benefits, improve employee outcomes, and control costs.

Founding Story

Source: Collective Health

Collective Health was founded in 2013 by Ali Diab (CEO) and Dr. Rajaie Batniji (former Chief Health Officer).

In 2013, Diab faced a life-threatening medical emergency when his intestines twisted, cutting off blood supply and requiring emergency abdominal surgery. As he recovered, he was thrust into a confusing and frustrating battle with his health insurer. Despite having what he considered good coverage, Diab received unexpected bills and vague explanations, with some charges deemed “experimental” or attributed to physician error. Seeking clarity, he turned to his friend, Batniji, who was working as a resident physician in internal medicine at Stanford University. Batniji explained that such experiences were common in a system plagued by misaligned incentives and a lack of transparency. Their conversations, often during early-morning coffees or long bike rides, led to a shared realization: the healthcare system needed fundamental change.

Later that year, Diab and Batniji co-founded Collective Health with the goal of transforming how Americans pay for and interact with healthcare. They envisioned a transparent and user-friendly health benefits platform to replace traditional employer health insurance, using technology to simplify costs, claims, and coverage. The founding team expanded two months after the company’s inception, with Preston Tollinger joining as Chief Technology Officer and Kent Keirsey joining as Chief Legal Officer in December 2013. Tollinger had experience developing mobile marketing software and scalable systems at NASA, and Keirsey had previously worked in corporate transactions as an attorney at Gunderson Dettmer following his completion of dual JD and MBA degrees from Stanford University in 2012.

In January 2014, the company signed Datasafe as its first client. That same month, the company raised $6 million in Series A funding led by Founders Fund, which allowed it to build a scalable platform and assemble a team of engineers, designers, and healthcare professionals dedicated to challenging the status quo. In August 2014, Collective Health officially came out of stealth mode, revealing its platform designed for self-insured employers seeking more control over their healthcare spending. By the end of 2015, the company had expanded its membership from 150 to 30K+ members and released its Member Portal and mobile application for employees.

Around 2021, Batniji left his role as Chief Health Officer at Collective Health to co-found Waymark, a company focused on enhancing access and outcomes for Medicaid beneficiaries through technology-enabled care. As of March 2025, Diab remains CEO and has been joined by Scott Murray (COO), who brought 17 years of leadership experience from eBay when he joined in 2018, and Ari Hoffman (SVP of Product and Chief Clinical Officer), a former associate professor of clinical medicine at the University of California, San Francisco.

Product

Collective Health offers an integrated health benefits solution for businesses with self-funded insurance plans. Benefits administration is the process of managing employee health and wellness benefits, including enrollment, eligibility verification, claims processing, compliance with regulations, and coordination with insurers and healthcare providers. It ensures employees can access their benefits smoothly while helping employers control costs and adhere to legal requirements.

Collective Health’s core offerings include plan administration, member experience, care navigation, financial management, and integrated analytics. Collective Health’s Plan Administration and Data Engine processes claims across medical, dental, vision, and pharmacy benefits and manages eligibility and payments. The Member Experience is improved by digital tools and support from Member Advocates. Care Navigation provides support for members with complex health needs, while the Financial Management and Payments service handles adjudication of medical claims and provides reporting to help employers optimize their healthcare strategy.

Collective Health's platform also features a partner ecosystem, with 140+ integrated partners across 30+ clinical categories, as of March 2025, allowing employers to customize their benefits offerings. The company's analytics capabilities, including the Collective Compass employer dashboard, provide reporting and performance analytics to help fine-tune healthcare strategies.

Plan Administration and Data Engine

Collective Health’s Plan Administration and Data Engine offering uses a cloud-based software platform to manage health plan administration for employers with self-funded insurance plans. Self-funded plans are those where the employer assumes the financial risk for providing health care benefits to employees, rather than purchasing a fully insured plan from an insurance carrier.

The platform processes medical insurance coverage for doctor visits, hospital stays, and other medical services, dental insurance coverage for dental procedures and check-ups, vision insurance coverage for eye exams and vision correction, and pharmacy benefits for prescription medications.

The engine can process and analyze data from eligibility files, claims data, and program utilization statistics. Employers gain insights into workforce engagement with health benefits, enabling informed decision-making and strategy adjustments. The system also supports cost allocation and accounting, allowing large organizations to track health benefit costs across multiple business units or cost centers. The engine includes auditing and reconciliation tools to ensure financial accuracy and compliance with plan documents describing the terms of health coverage.

With a cloud-based architecture, the engine offers scalability, faster updates, and improved security compared to legacy, on-premise solutions. It integrates with other digital health solutions and supports real-time eligibility updates and claims adjudication, which is the process of determining how much of a claim the plan will pay and how much is the member's responsibility. Data protection measures are implemented to safeguard sensitive health information and ensure compliance with regulations like HIPAA (Health Insurance Portability and Accountability Act).

Collective Health's engine helps coordinate between various stakeholders in the healthcare system, including providers (doctors, hospitals), and pharmacies. The system supports different plan design features including value-based care arrangements. Value-based care arrangements are where providers are paid based on the quality of care rather than the quantity of services.

Source: Collective Health

Member Experience

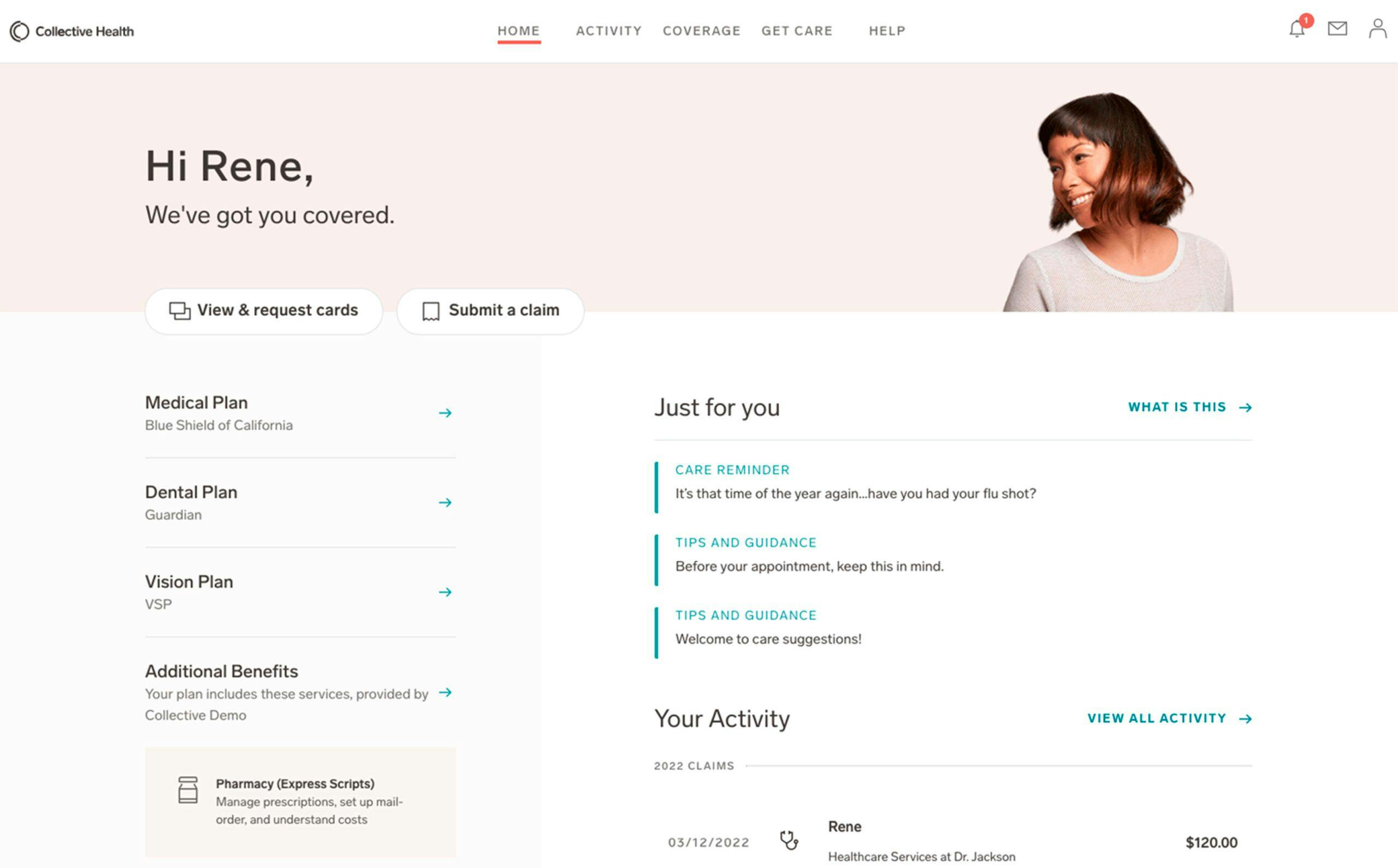

Collective Health provides a user-friendly approach to health benefits management for employees. The My Collective application is a central hub where members can access and manage their health benefits. Through a single login, users can view plan details, find in-network providers, track claims, and access their member ID card. The application's interface is designed for ease of use, featuring benefit grouping, clear language, and centralized communication to help members better understand and utilize their benefits.

The offering is supported by a team of Member Advocates who provide guidance via phone, email, and online chat. Advocates assist members with understanding benefits, finding providers, and navigating the healthcare system. Collective Health emphasizes accessibility, and as of July 2022, claims a response time of 30 seconds, far below the industry average of 40 minutes. Using advanced data analysis, the system identifies care gaps and sends personalized reminders for routine screenings and preventive care, helping close 40% of care gaps and improving health outcomes. Its metrics and quality assurance focus on solving members' issues rather than minimizing call times. To ensure consistent service excellence, quality coaches review member advocate interactions and provide ongoing training for the delivery of high-quality support and care.

Source: Collective Health

Care Navigation

Collective Health's Care Navigation is a care management program designed to support members with complex health needs. It focuses on the 10% of members who account for approximately 75% of healthcare spending. The program assembles a multidisciplinary team of healthcare professionals—including pharmacists, social workers, nurses, and dietitians—to provide holistic support for members dealing with chronic or serious illnesses.

Using its proprietary machine learning engine, CH Cortex, Collective Health analyzes data, such as medical claims, to also identify members who could benefit from the program. This technology-driven approach is paired with the expertise of the Care Navigation team, who deliver real-time, human support. The program is disease-agnostic, capable of addressing any condition rather than limiting itself to the most common ones. It also allows for early intervention by not requiring a specific cost threshold for members to qualify.

Recognizing that complex health issues often stem from socioeconomic factors, such as geographic location and access to food or transportation, Care Navigation adopts a holistic approach. This enables the team to address not only medical needs but also broader determinants of health. Upon engagement, a full assessment of the member’s needs, including a depression screening, is conducted to ensure comprehensive care.

As of October 2020, pharmacist interventions within Care Navigation, including medication management and prescription drug optimization, have led to health cost savings of approximately $10 per employee per month (PEPM) across the entire program, yielding a 2:1 return on investment for clients. Members directly exposed to pharmacist interventions achieved net total savings of $346 PEPM. Additionally, the program achieved a 35% engagement rate among complex care members, a rate considered high compared to traditional carrier-led care management programs.

Financial Management and Payments

Collective Health’s Financial Management and Payments (FMP) offering is a suite of services designed to simplify the financial aspects of self-funded health plans. The service aims to streamline operations for employers, reducing the administrative burdens of managing self-funded health plans. Through its FMP offering, Collective Health administers health plan payments for claims, administrative fees, and premiums on behalf of clients. During the implementation process, Collective Health completes a Partner Payment Matrix to outline the health plan partners and vendors that will be paid on the client's behalf.

One feature of the FMP offering is the ability to self-bill administrative fees and premiums. This enables Collective Health to manage eligibility and calculate the necessary fees without waiting for invoices from clients' benefit partners. Collective Health can also manage the initial billing integration and setup, including the collection of vendor W-9s and payment information.

The FMP offering also includes a range of regular financial management services, such as weekly and monthly payments, bank account maintenance, monthly self-billing, and reconciliation of headcount-based admin fees and premiums. Clients also receive weekly and monthly financial reporting to provide insights into their health plan’s financial performance. Additionally, Collective Health helps identify and prevent vendor overpayment, offering cost savings by centralizing and closely managing payments.

The FMP offering further improves cash management capabilities, giving clients better visibility into the timing and amount of payments, which supports more effective management of cash resources. Collective Health offers reporting for clients’ finance and accounting teams, allowing for better financial oversight and planning. The service also includes issuing reimbursements to members for out-of-network medical claims.

Integrated Analytics

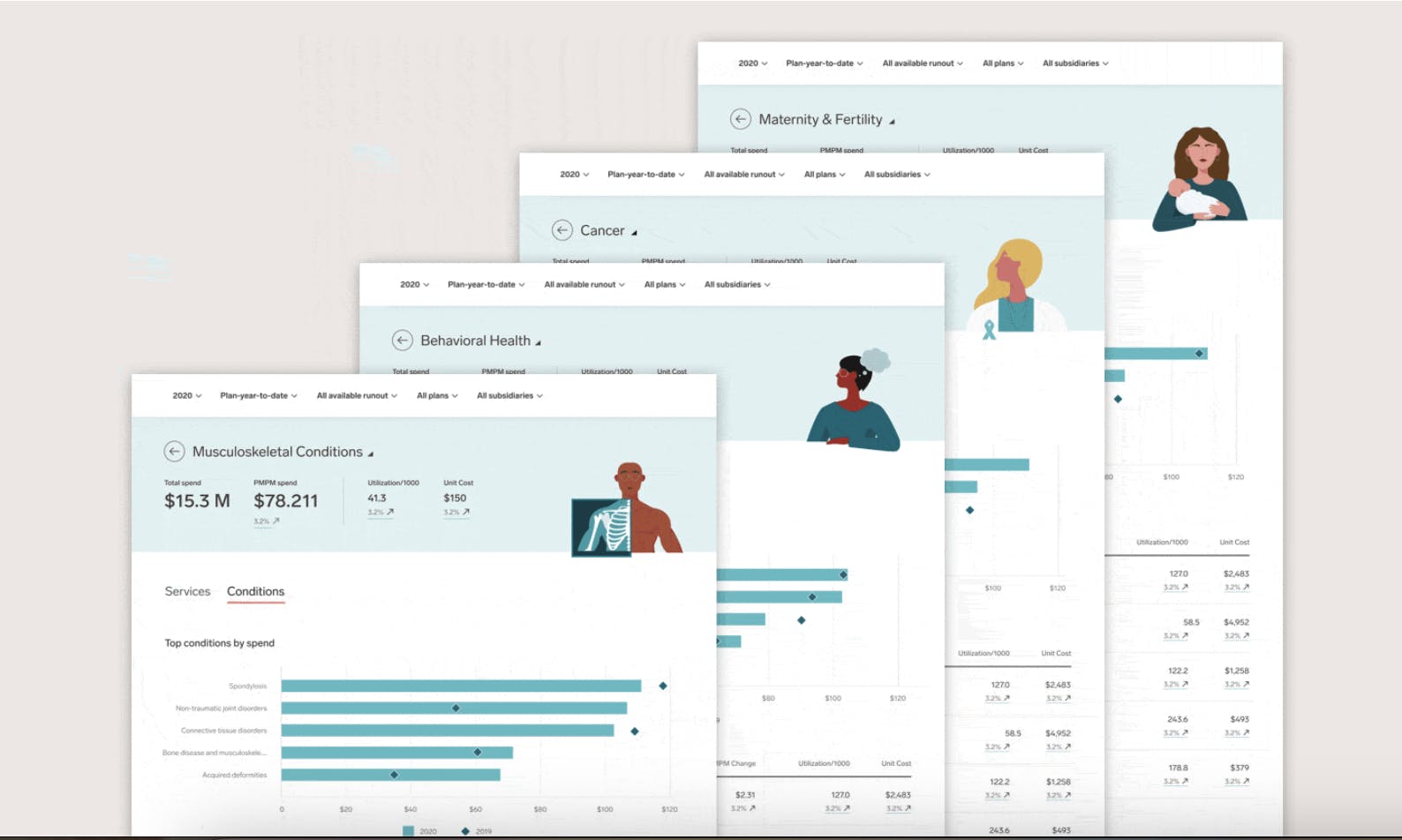

Collective Health provides tools and services to equip employers with in-depth insights into their health benefits programs. Central to this offering is Collective Compass, a platform that allows employers and consultants to manage their healthcare strategy from a unified interface. Collective Compass features advanced claims analytics tools, enabling benefits leaders to evaluate their benefits strategy with clear visualizations and year-over-year comparisons.

Benefits teams are also able to explore cost and care across 18 clinical categories, as of January 2021, providing them with a deeper understanding of member populations and the associated impact on spend and utilization. The clinical category detail pages provide data view options, improving visibility across different plans and member populations. To make the data more accessible, Collective Health has incorporated tooltips that offer simple descriptions of clinical conditions and examples, helping benefits teams focus on important insights without needing medical expertise.

Source: Collective Health

The Partner Collective

The Partner Collective is designed to improve the benefits plan design process for employers. The digital health hub provides benefits leaders, brokers, and consultants with a platform to evaluate and compare a wide range of digital health solutions. The Partner Collective aims to help benefits professionals identify high-value solutions for employer-sponsored plans by providing detailed information on Collective Health’s partner ecosystem, including insights into clinical models and integration depth.

The platform encourages competition among digital health providers by showcasing financial and clinical results. The platform's advanced integrations help manage partner payments, drive member engagement, and facilitate claims administration and contracting. These integrations allow for the delivery of performance statistics, claims costs analysis, and management of member medical and prescription drug expenses. By simplifying the selection process, the Partner Collective makes it easier for brokers and benefits leaders to choose solutions that align with organizational goals. The company has expanded its ecosystem to include over 140 partners as of March 2025.

Within the Partner Collective, Collective Health further expanded its approach to digital health partnerships through its Premier Partner Program — a curated selection of high-impact solutions that undergo deeper integration and deliver proven value across member experience, cost management, and health outcomes.

Collective Health's Premier Partner Program is designed to simplify the process of selecting, integrating, and evaluating digital health partners for employers. Launched in July 2021, the Premier Partner Program features a select group of digital health partners determined by Collective Health to have a track record of delivering impact across member experience, cost management, and health outcomes. The program initially launched with 10 leading digital health solutions across six of the most in-demand clinical categories: virtual primary care, telemedicine, behavioral health, cancer care, diabetes management, musculoskeletal care, and family building services.

Some of the first partners to join the program included 98point6, AccessHope, Carrot Fertility, Ginger, Hinge Health, Lyra Health, Modern Health, Progyny, and Teladoc Health (including Livongo). By December 2023, new partners like Galileo and Tria Health were added, expanding offerings in telehealth and chronic care management.

Source: Collective Health

Market

Customer

Collective Health serves employers with self-funded insurance plans looking to streamline their health benefits administration and improve employee healthcare experiences. These companies seek integrated solutions to manage healthcare costs while providing comprehensive coverage to their workforce. In May 2024, Collective Health served 70+ enterprise clients, collaborated with 130+ health partners, and supported 500K members in the United States.

Collective Health's customers span various industries, including technology, financial services, aerospace, consumer packaged goods, energy, real estate, retail, automotive, provider services, security, and manufacturing. Notable clients include Zendesk, Pinterest, and Activision Blizzard.

Market Size

Collective Health operates in the benefits administration software market, specifically focusing on digital health benefits planning and administration solutions for self-funded employers. The global benefits administration software market was valued at $1.3 billion in 2024 and is projected to reach $3.8 billion by 2033, growing at a CAGR of 10.7% from 2025 to 2033. Because it offers an integrated health benefits platform, Collective Health also operates in the digital health market. The global digital health market was valued at $217 billion in 2022 and was estimated to achieve a market size of $1.6 trillion by 2032, projected to grow at a CAGR of 25.3% from 2023 to 2032, as of October 2023.

The increasing complexity of employee benefits programs and the need for streamlined management solutions have driven the benefits administration software market, as organizations seek to reduce administrative burdens, ensure compliance with evolving regulations, and improve employee engagement through user-friendly platforms. In the digital health sector, widespread adoption of mobile devices and wearable technology, coupled with growing demand for personalized healthcare services, is fueling innovation in telemedicine and AI-powered diagnostics. The COVID-19 pandemic accelerated digital health adoption, and continued government initiatives promoting healthcare digitization and increased investments in healthcare IT infrastructure contribute to both markets' growth.

Competition

Competitive Landscape

Collective Health operates within the digital health and benefits management market, a sector that bridges healthcare and technology to streamline employer-sponsored benefits. This market includes well-established players like Accolade and startup platforms like Transcarent, League, and Take Command Health. These companies compete to provide solutions for employers and employees, ranging from benefits administration to personalized healthcare support.

Collective Health provides an integrated benefits management platform that consolidates benefits data for self-funded employers and offers plan administration, claims adjudication, and member advocacy. In contrast, competitors like Transcarent and Accolade supplement benefits solutions for self-funded employers with clinical support and medical services. Other companies like League provide digital infrastructure to build consumer healthcare software solutions, while Take Command Health manages health reimbursements instead of benefits for self-funded employers.

Competitors

Transcarent: Transcarent, founded in 2020, is a health and care experience company that operates within the healthcare sector. In May 2024, the company raised $126 million in Series D funding led by General Catalyst and 7wireVentures, bringing its total funding to $450 million and valuation to $2.2 billion as of May 2024. Transcarent has raised funds from investors like Founders Fund, NEA, and SoftBank Vision Fund. The company offers a platform that simplifies access to healthcare services through a personalized app and an on-demand care team. The company serves self-insured employers and their employees, offering a healthcare solution that integrates with existing benefits programs. Transcarent offers direct access to medical services, such as virtual care and specialist consultations, whereas Collective Health specializes in plan administration and benefits navigation. Additionally, Transcarent partners with health systems to increase their direct contracting and provide employers with access to national networks for their employees.

Take Command Health: Take Command Health, established in 2014, offers a platform specializing in health reimbursement arrangements (HRAs) and health benefits solutions. As of March 2025, the company raised a total of $39 million in funding, including a $25 million growth investment led by Edison Partners in September 2023. Take Command Health offers an Individual Coverage HRA (ICHRA) administrative platform, which provides employers with a tax-free stipend solution for employees to select their own health insurance plans from an individual health marketplace. Take Command Health serves employers of all sizes, from small businesses offering health benefits for the first time to large corporations seeking to mitigate annual renewals and improve participation rates. Unlike Collective Health's focus on self-funded employers and plan administration, Take Command Health helps manage health reimbursement arrangements as an alternative to traditional group health insurance plans.

Accolade: Accolade, founded in 2007, is a healthcare and benefits company that aims to improve the healthcare experience for employees and their families. In March 2018, the company raised $50 million in Series F funding led by Andreessen Horowitz, Carrick Capital Partners, and others. Accolade went public in July 2020, raising $220 million in its IPO. Accolade’s platform combines personalized service with clinical support and consumer engagement technologies. Accolade utilizes health assistants, clinicians, and data analytics to help employees navigate the healthcare system, understand their medical benefits, and connect with appropriate providers for care. Although Accolade and Collective Health both try to simplify health benefits navigation for employees, Collective Health focuses more on benefits administration while Accolade provides clinical support.

Yuzu Health: Yuzu Health is a third-party administrator founded in 2022. In October 2023, it raised a $5 million seed funding round from Lacey Groom with participation from Neo, Day One Ventures, and Altman Capital. Yuzu Health manages claims, payments, eligibility, and benefits for self-funded insurers using AI and machine learning. As of November 2023, Yuzu Health offered 10 plans for thousands of members. Historically, Yuzu Health focused on serving small businesses and startups, while Collective Health serves self-funded employers of any size.

Business Model

Collective Health operates as a third-party administrator for employer health benefits. Its customers are self-funded employers looking to streamline their health benefits administration and improve employee healthcare experiences. Collective Health's platform processes claims across pharmacy, medical, dental, and vision benefits. As of November 2022, they had processed over 23.6 million claims, resulting in more than $11 billion in total claims processed. The company emphasizes cost savings for employers, citing a 50% reduction in healthcare cost trends over a five-year period for their clients.

The company generates revenue by providing an integrated platform for plan administration, navigation, and advocacy services to these employers. While specific pricing details are not provided, Collective Health may charge fees based on the number of employees covered or the complexity of services provided. As of March 2025, Collective Health’s partnership ecosystem had over 140 ecosystem partners, allowing employers to integrate various health benefit providers and services into a single platform. Costs for the company may include technology development and maintenance, customer support, and the infrastructure required to process and manage large volumes of healthcare data securely.

Traction

In 2015, Collective Health reported having one client with 100 members. In 2016, the company expanded to serving six clients with a collective 26K members. In 2017, Collective Health had 15 clients with 77K total members served, and the company also added 41 new network, program, benefits administration, COBRA, and health funds partners in the same year and experienced a 0.1% increase in medical costs, compared to the industry average of 5%. Members adjusted their care utilization patterns, with emergency room visits decreasing by 5%, urgent care visits increasing by 4%, utilization of behavioral health services increasing by 13%, and specialist visits and advanced imaging declining by 8% and 12%, respectively. Clients also saved an average of $500 per family on medical costs in 2017, and those who had been with Collective Health for at least two years realized a -0.3% medical trend and a -0.8% medical trend among members who engaged with a Member Advocate, compared to the industry average increase of 6%.

At the beginning of 2018, the company had 30 enterprise clients and 120K members across the United States. Collective Health also had an NPS of 76, relative to the industry average of eight. By the end of 2018, Collective Health had 45 enterprise clients with 200K members served, maintaining a 100% client renewal rate. That same year, the company expanded to over 140 health partnerships and enabled more than 600 total integrations in conjunction with their customers. Collective Health maintained an NPS of 70+ throughout 2018, and it also announced it would open a total of two new offices in Chicago, IL, and Lehi, UT.

In May 2021, Collective Health had 55+ enterprise clients and served a collective 300K members in the United States. In November 2022, the company processed over 23.6 million claims since its founding, resulting in over $11 billion in processed claims. As of November 2022, Collective Health had a customer satisfaction score of 90% and a 75+ transactional NPS, outperforming the health insurance industry average NPS of nine. The company closed 40% of care gaps, including cancer screenings and chronic disease management, and achieved 25% lower ER utilization compared to the national benchmark, saving $110K annually per 1K employees. Additionally, 80% of customers reported reduced administrative burden, 70% of claims were preceded by engagement within 60 days, and preventive visit rates were 15% higher than the national average.

In April 2023, Collective Health announced its solution halved the five-year healthcare cost trend to 7.2% compared to 14.9% in a matched control group. Over five years, customers saved $261 per member, with costs for members managing two chronic conditions improving from $57 above the control group to $1.1K below. In May 2024, Collective Health served 70+ enterprise clients, collaborated with 130+ health partners, and supported 500K members in the United States. Collective Health also opened a new office in Plano, TX that same month.

Valuation

Collective Health raised $280 million in Series F funding in May 2021, bringing the company’s valuation to approximately $1.5 billion and bringing its total funding to $719 million as of March 2025. Notable investors of Collective Health include Founders Fund, NEA, G Squared, Softbank, and Maverick Ventures.

Key Opportunities

Increasing Adoption of Self-Funded Health Plans

Self-funded insurance plans increased from 55% of the market in 2015 to 60% in 2021, with growth observed particularly with small and medium-sized firms. Self-funded plans offer employers greater flexibility, potential cost savings, and exemption from certain state insurance regulations. For instance, self-insured health plans established by private employers are exempt from most state insurance laws under ERISA, including reserve requirements, mandated benefits, premium taxes, and many consumer protection regulations.

Collective Health could benefit from this expanding opportunity for self-funded employers. Its integrated platform and third-party administrator capabilities, combined with its partnerships with national networks, enable it to offer its services to self-funded employers across 14+ expanded states, as of June 2024. Additionally, their Financial Management and Payments solution addresses the administrative challenges associated with self-funded plans by streamlining operations, potentially reducing costs by preventing vendor overpayment.

Improved Employee Health Outcomes

Preventive care and better management of chronic conditions can lead to significant cost reductions for employers. As of 2021, efforts to lower or eliminate cost sharing for primary care or medications for chronic illnesses were shown to be some of the most effective interventions in employer-led health benefit strategies. For instance, as of 2021, participation in an asthma intervention program decreased monthly medical costs by $59 per participant, with increased medication adherence offsetting higher pharmacy costs. Similarly, another program targeting asthma, hypertension, and diabetes led to 9.4% higher adherence to cardiovascular medications.

Costs are also rising for employees with employee-sponsored insurance plans. From 2015 to 2019, average annual healthcare spending among those with employer-sponsored insurance plans rose 22% to just over $6K per person. To retain talent, companies must find ways to reduce costs while maintaining the quality of care, which presents Collective Health with an opportunity to expand amongst self-funded employers. Collective Health’s solution has been shown to cut the healthcare cost trend by 50% over a five-year period for studied customers, with savings being greatest for members with two chronic conditions. Collective Health's approach includes high engagement rates with care advocacy and guidance, fewer emergency room visits, and increased use of preventative care.

Sentiment Favoring Employee Health Benefits

In 2024, 56% of U.S. adults with employer-sponsored health benefits considered the quality of their coverage a major factor in staying at their job. Additionally, 46% cited health insurance as a reason for choosing their current employer. That same year, 92% of employees reported valuing health insurance benefits, and 80% preferred benefits or perks over a pay raise.

Businesses that offered generous health coverage as part of their employee benefits package in 2024 saw 27% lower turnover rates than companies with no health plan or minimal offerings. Also, in 2024, some industries, such as professional services, saw turnover rates reach as high as 63%. In 2022, 78% of employees reported being more likely to stay with their employer due to their benefit program. Health benefits play a significant role in retaining a stable workforce, particularly in a labor market where 80% of employers saw talent competition as a major factor influencing their benefits strategy in 2024.

Collective Health’s platform allowing employers to manage various health programs aligns with the growing demand for personalized, accessible benefits to cater to employee healthcare needs. Collective Health's technology-integrated third-party administrator capabilities and partnerships with national networks enable it to serve self-funded employers across multiple states, including markets like Ohio, New York, Virginia, and Georgia. The company highlights its NPS of 75+ concerning solutions for its member experience.

Key Risks

Sensitivity to Macroeconomic Environment

During periods of economic stress, employers may be forced to reduce their workforce, leading to a decrease in the number of individuals covered by employer-sponsored health insurance. Between 1988 and 2019, the average cumulative lost earnings from rising health insurance premiums were over $125K per family or nearly 5% of total earnings over the 32-year period. As economic pressures mount, employers may struggle to absorb rising healthcare costs, potentially leading to reduced benefits or shifting more costs onto employees.

Further, economic downturns can strain healthcare providers and payers, with the impact of inflation on the broader economy being able to drive input costs in healthcare. In 2022, it was projected that by 2027, there could be an additional $90 billion in labor costs and $110 billion in non-labor costs in the healthcare system. This inflationary pressure could lead to a sharp decline in operating margins for healthcare organizations, with payer and provider executives expecting a drop in margins of between 25-75%.

Such financial pressures could result in reduced healthcare spending by both employers and individuals, potentially impacting companies like Collective Health that rely on employer-sponsored health plans. As a company that serves self-funded employers, Collective Health's business model is tied to the financial health of its client companies. During economic downturns, employers may be more likely to cut back on health benefits or switch to less comprehensive plans to reduce costs. This could lead to reduced revenue for Collective Health or pressure to lower its fees. Additionally, if unemployment rises and fewer people are covered by employer-sponsored health plans, Collective Health's potential market could shrink.

Regulatory Compliance

In 2017, health systems, hospitals, and post-acute care providers spent nearly $39 billion annually on administrative activities related to regulatory compliance across nine domains. For an average-sized community hospital with 161 beds, this equates to approximately $7.6 million annually. The financial burden is worsened by the volume of regulations: healthcare organizations had to comply with over 600 discrete requirements as of 2017.

Clinical staff, including doctors and nurses, also have spent increasing amounts of time on compliance tasks, detracting from patient care. For example, in 2017, an average community hospital dedicated 4.6 full-time equivalents to quality reporting, costing approximately $709K annually. The burden extends to areas like implementing and maintaining electronic health records to meet Meaningful Use requirements, costing an average-sized hospital nearly $760K annually for administrative requirements and an additional $411K for system upgrades.

As a company handling sensitive health data, Collective Health must maintain strict data security and privacy standards to comply with regulations like HIPAA. While the company has achieved HITRUST certification for its in-scope systems, maintaining compliance requires ongoing investment. As Collective Health expands partnerships with national networks and serves self-funded employers across multiple states, it must manage rising compliance costs and navigate a complex regulatory landscape, including state-specific laws.

Scalability and Adoption Challenges

As health insurance systems grow, traditional systems often struggle to handle the influx of patient records, policy data, and other healthcare information, leading to delays in data retrieval and processing that can impact service efficiency. Additionally, interoperability issues arise from the lack of standardized communication protocols, which hinders the flow of information between insurers, healthcare providers, and regulatory bodies. This fragmentation can make it difficult for companies to expand their services across diverse healthcare ecosystems efficiently.

Employer adoption of reference-based pricing (RBP) to improve healthcare value faces obstacles. These obstacles include the complexity of RBP benefit design, concerns about employees incurring catastrophic out-of-pocket costs, the lack of a clear business case for implementation, and fears that RBP could hurt the employer's competitiveness in the labor market. The geographic distribution of employees and concerns over potential employee reactions to changes in provider options can further complicate adoption.

Any limitations in Collective Health’s scaling of data processing capabilities or integrating with various healthcare entities could hinder its ability to serve larger employers or a broader range of markets. Additionally, the adoption barriers for reference-based pricing could negatively influence Collective Health's approach to health benefits. Employers may be hesitant to adopt new models of health benefits management due to concerns about complexity, employee satisfaction, or potential disruption to its existing benefits strategies.

Summary

With rising healthcare costs, the growing prevalence of chronic conditions, and the increasing importance of employee healthcare, digital health and benefits administration platforms are gaining traction in helping self-funded employers manage their health benefits. Collective Health is a health benefits platform designed to simplify the healthcare experience for employers and their employees. The company offers an integrated solution combining plan administration, claims adjudication, and member advocacy. Collective Health will face new challenges in scaling its existing solutions to new markets and adapting to changing regulations in healthcare. As competition from established players and new entrants in digital health grows, the company can look to maintain its growth among self-funded employer health plans and continue improving cost efficiencies across chronic conditions.