Thesis

In the 1980s and 1990s, HR software consisted of various programs serving back-office functions such as payroll, HR, and IT. These systems began moving to the cloud in the mid-2000s, with employee-facing functionalities. The HR technology stack soon expanded to encompass a wider variety of work-related tasks, such as goals, feedback, hiring, and more. As a result, HR SaaS tools saw rapid proliferation.

According to a 2024 survey, the average company used 112 SaaS applications in total in 2023, up from just eight in 2015. Another 2022 report found that the average large company had 80 applications within the HR technology category alone. The proliferation of such tools has led to demand for consolidation, as businesses look for ways to simplify their stack and decrease spending. As a result, the next generation of HR technology is consolidating functions, with legacy players in the space partnering with ecosystems to integrate and simplify their HR tooling.

Rippling was built to consolidate functions by creating a comprehensive platform for HR, IT, and payroll processes at a global scale. It has been described as “the ambitious solution to the nation’s sprawling administrative crisis”, offering its users an alternative to the cost and complexity of tens or hundreds of narrowly-focused point solutions. The company’s stated mission is to “free smart people to work on hard problems” by helping “automate and eliminate the administrative work of running a company.”

Founding Story

Parker Conrad (CEO) and Prasanna Sankar (former CTO) founded Rippling in 2016 in San Francisco. Before becoming the founder and CEO of Rippling, in high school, Conrad studied neurological development in sea slugs to identify how their learning and memory was unrolling. After submitting his research, Conrad earned third place at the Intel Science Talent Research, which granted him a scholarship to support his studies at Harvard. In college, Conrad devoted 70 hours per week to the daily student newspaper which surveyed and critiqued campus life, eventually failing out of school.

Source: Business Insider

In 2013, Conrad founded Zenefits, his first company. Zenefits was a SaaS business that helped companies manage their human resource needs, such as payroll and health insurance. Within two years, the company grew to over $100 million in ARR across 10K customers. More than 90% of the company’s revenue came from the sale of health insurance.

In April 2014, Zenefits capitalized on its momentum by raising a $500 million funding round at a $4.5 billion valuation backed by Fidelity, Comcast Ventures, TPG, and Andreessen Horowitz, among other notable firms. Zenefits came under scrutiny in November 2015 when Buzzfeed News released a piece on Zenefits accusing the company of allowing unlicensed brokers to sell health insurance. Buzzfeed claimed the company had numerous salespeople act as insurance brokers in at least seven states.

In February 2016, due to the controversy, Conrad resigned as CEO and was replaced by COO David Sacks. Sacks detailed in a press release that there were “inadequate” efforts around compliance and that they made decisions that were “just plain wrong.” In October 2017, the SEC fined Parker Conrad and Zenefits $1 million over charges that they misled investors and lied about compliance. Zenefits paid $450K and Conrad paid $533K in the settlement.

Conrad lost no time after his resignation to get to work on his next company, and he founded Rippling in 2016 with Sankar, who had previously been the director of engineering at Zenefits. In 2017, the pair joined Y Combinator’s winter batch. Rippling raised a $7 million seed round in March 2017, and opened its first offices in San Francisco and Bengaluru, India. According to Rippling, the San Francisco office was positioned closely to the company’s customers, while the Bengaluru office was where its products were being built.

In 2018, Rippling went live with customers. Sankar left Rippling in 2021 to start another company, a “decentralized social network for the crypto natives” called 0xPPL. He was replaced by Albert Strasheim who joined Rippling as CTO in August 2022.

Product

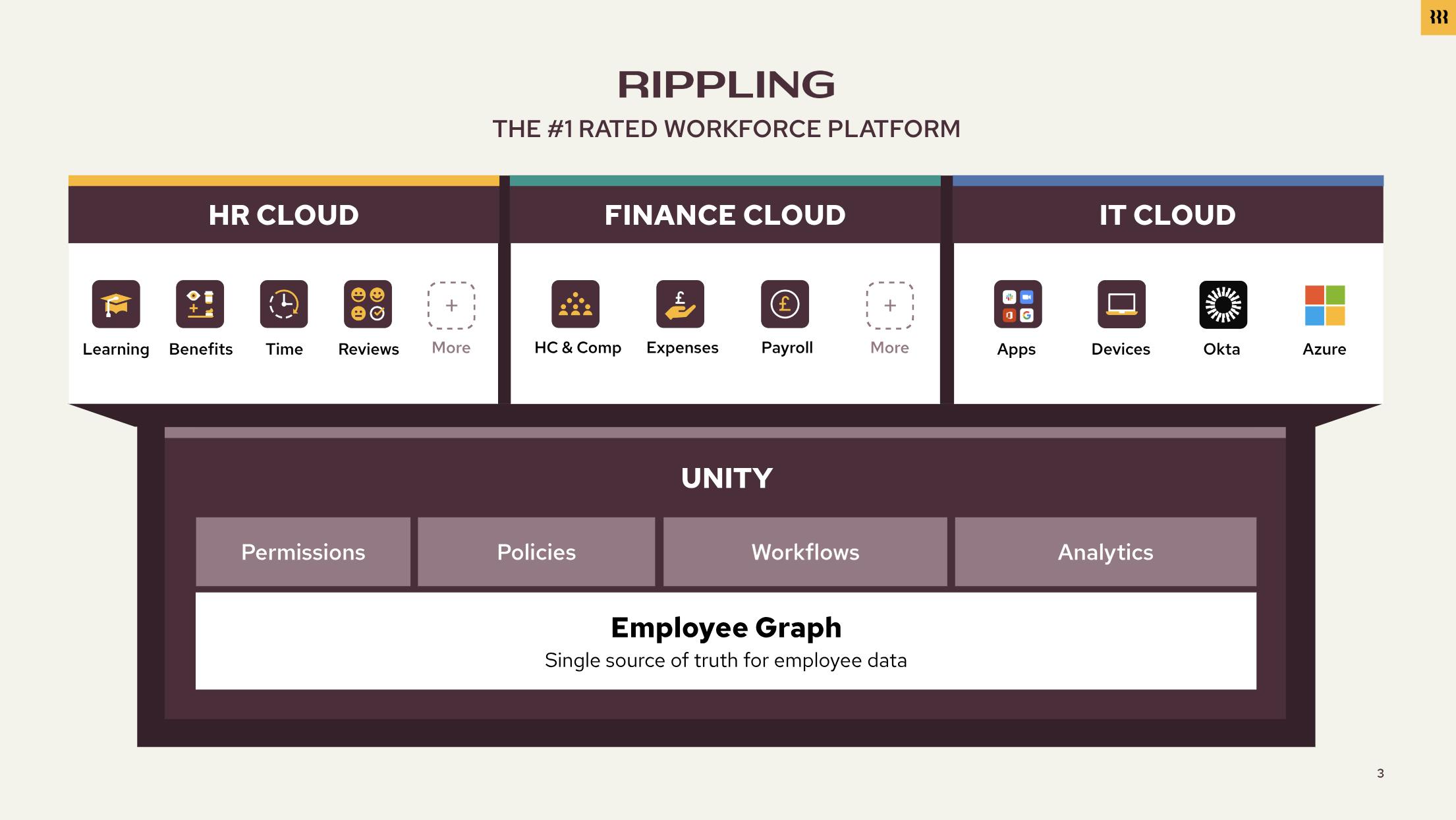

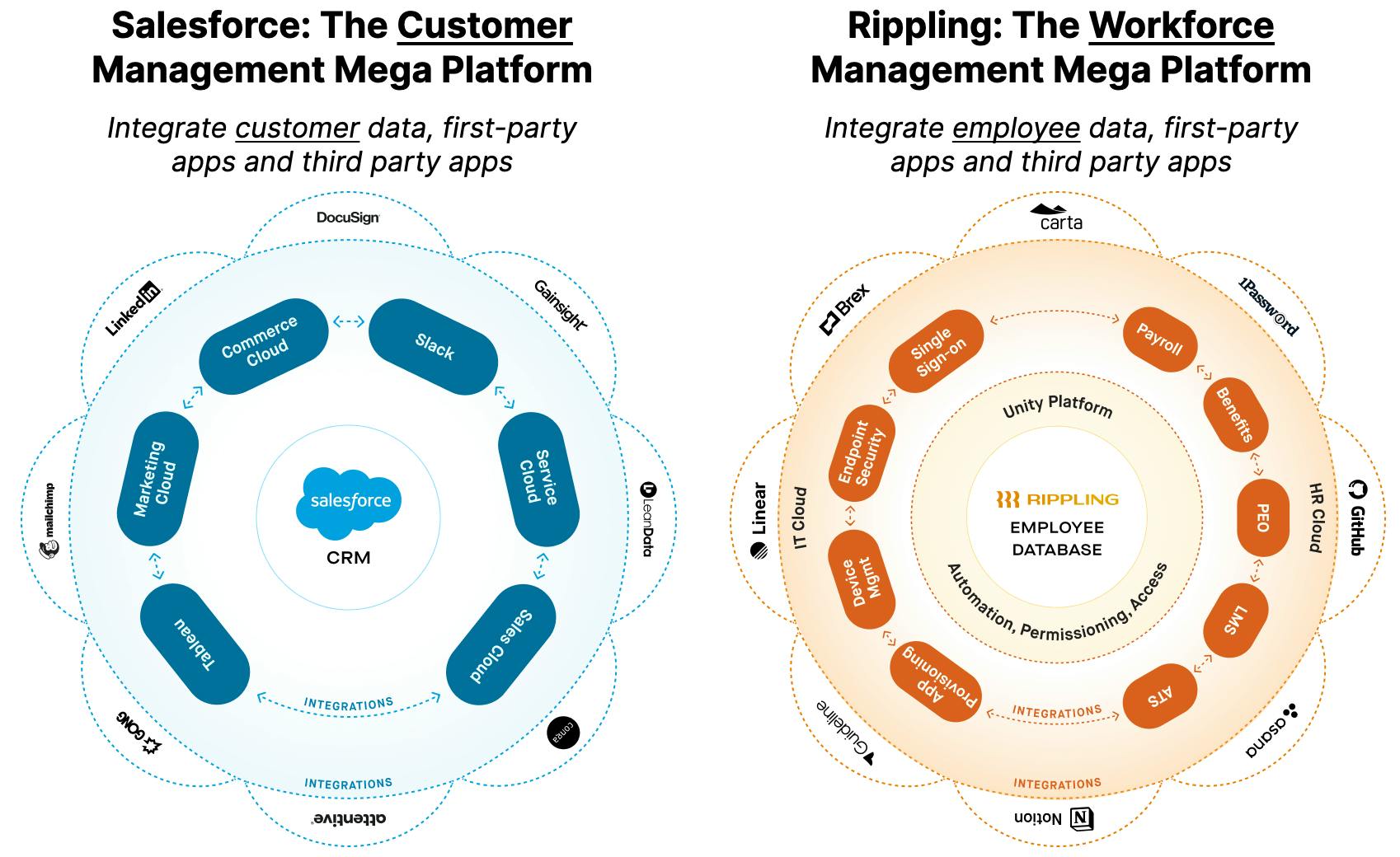

As CEO Parker Conrad put it regarding Rippling’s aspirational value proposition: “Rippling makes your company more operationally excellent.” Most businesses use several SaaS products, i.e. narrowly focused point solutions that separately focus on functions like payroll, IT, etc., to run their employee systems. However, an issue that arises with this is the lack of communication between the different products being used. If a key piece of information regarding an employee changes in one system, often it will have to be manually updated in other products.

Rippling offers a platform that is centered (source) around employee data and builds applications on top of that foundation. Rippling calls this central employee data “middleware.” When a key data point regarding an employee is changed, it is instantly updated across every product — from payroll and compliance to workflow automation.

Source: Rippling

Rippling’s product entry point is placed at employee onboarding. Throughout the onboarding journey, Rippling gets access to a customer’s key employee information including social security numbers, location, salary, and manager information, enabling them to create that initial employee data middleware. To enable its ability to continue expanding the surface area of its product, Rippling leverages a “compound product” approach focused on introducing a suite of tools vs. individual point solutions.

Rippling Unity

Source: Bedrock

Rippling’s platform enables companies to manage all their HR, IT, and finance processes from the cloud in a centralized location. Some of the capabilities include (1) automating workflows across multiple systems with zero code, (2) creating powerful analytical reports sorting by fields like hire date, department, and location and (3) automating and streamlining all company policies and permissions. Administrators can also quickly onboard or offboard employees or contractors in as little as 90 seconds according to the company.

HR Cloud

As of March 2024, Rippling offers twelve core HR products or “modules” including global payroll, benefits, recruiting, performance management, time and attendance, learning management, talent management, PEO (professional employer organization) services, global employment, surveys, headcount planning, and compensation bands.

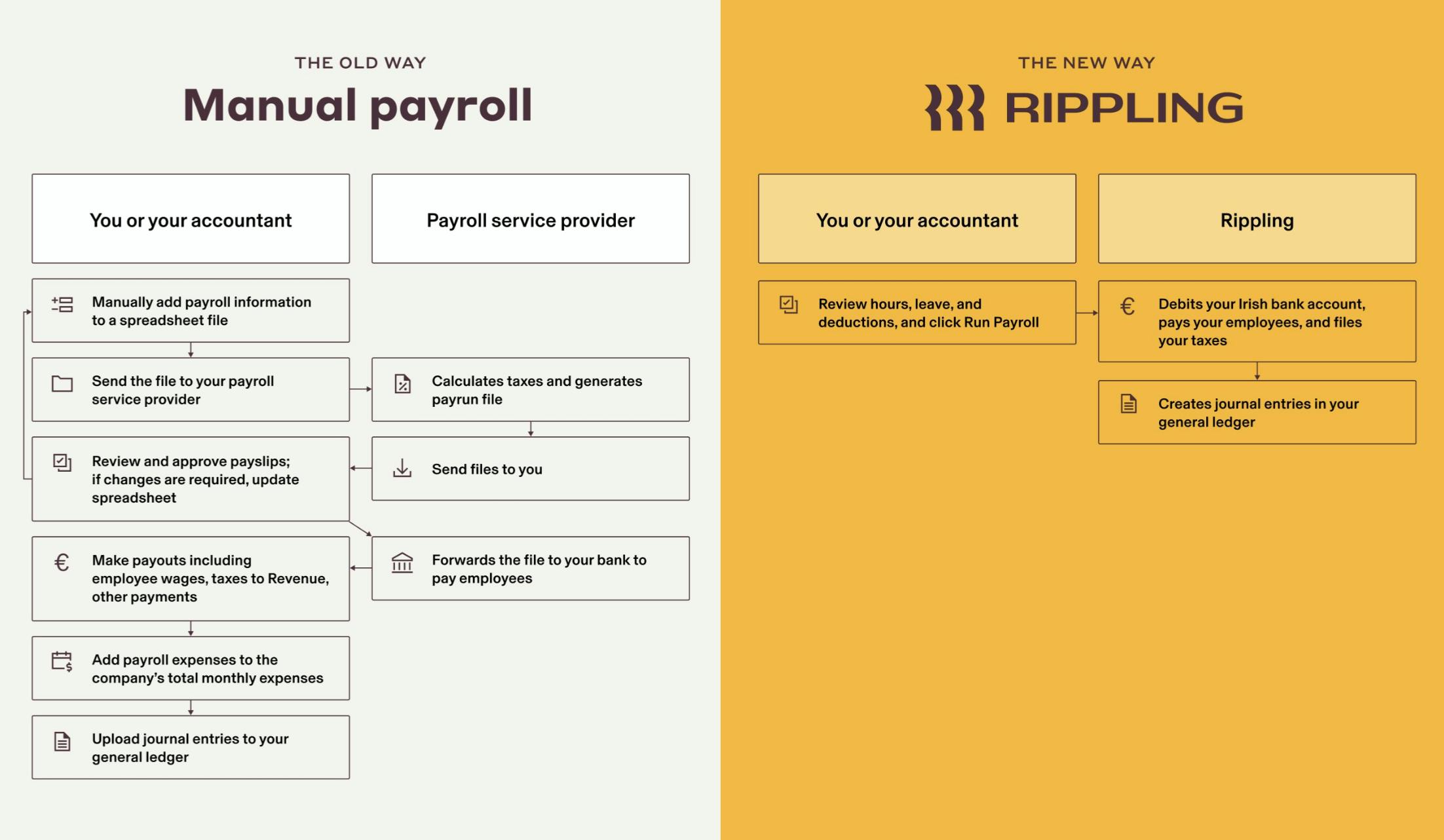

Part of building a “compound product” is ensuring that each individual module is, itself, a multi-function tool. For its workflow services, like payroll, Rippling combines existing data points, like employee hours or transactions, into one platform or offers heavily templated resources for content-based systems, like compliance, and employee learning.

Since employees track hours through Rippling, managers simply review hours, PTO requests, and deductions on the Rippling dashboard. Banking information is synced on Rippling, along with each employee’s payment cycle, allowing a manager to simply click “Run” to process payments, file texts, and generate journal entries for bookkeeping.

Source: Rippling

Rippling’s learning management tool has pre-built compliance courses, and the ability to upload courses, track progress, and create alerts with the ability to automate learning management requirements during onboarding.

Other tools include modules like Pulse, a tool that enables employers to survey employees, even among global teams. Using Pulse, administrators can send surveys automatically, control who can run surveys and see results, share feedback and comment chains, and use either custom or existing survey templates.

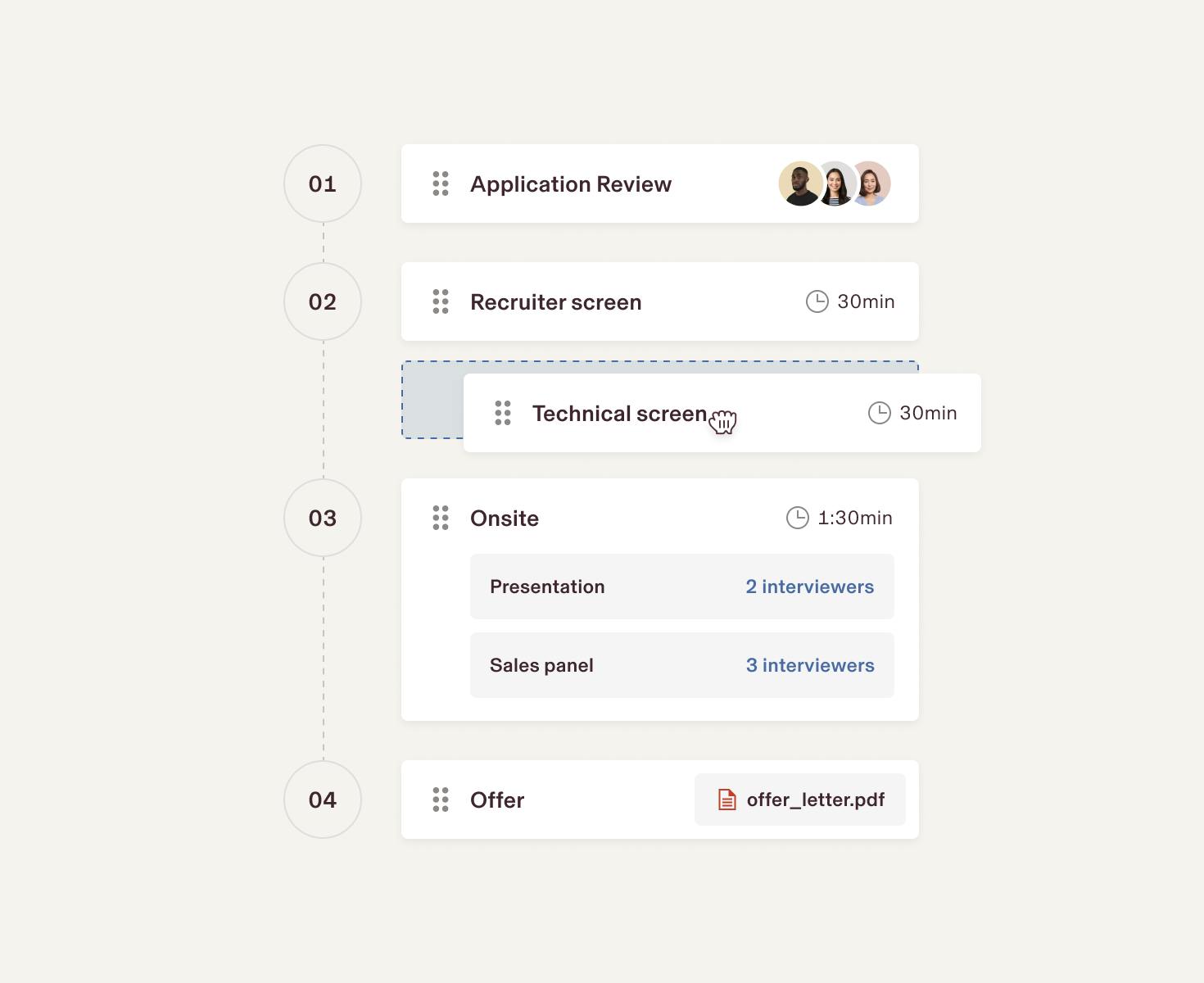

Rippling Recruiting

Recruiting candidates requires interaction with many data sources such as LinkedIn or email. It also requires updated tracking to share employee information, interview notes, and payment forms with HR team members. In August 2023, Rippling launched Rippling Recruiting, an applicant tracking system to help employers sync the full journey of an employee, from offer letters to exit surveys.

Source: Rippling

For this product, Rippling reused features from its internal form fields to let recruiters build their own applicant portals and automation. Once an applicant submits the initial form, the recruiter can indicate a review stage, screening stages, final onsite interviews, and then an offer letter. At every stage, the recruiter can add additional information to each applicant, allowing the HR team to quickly draft a completed offer letter.

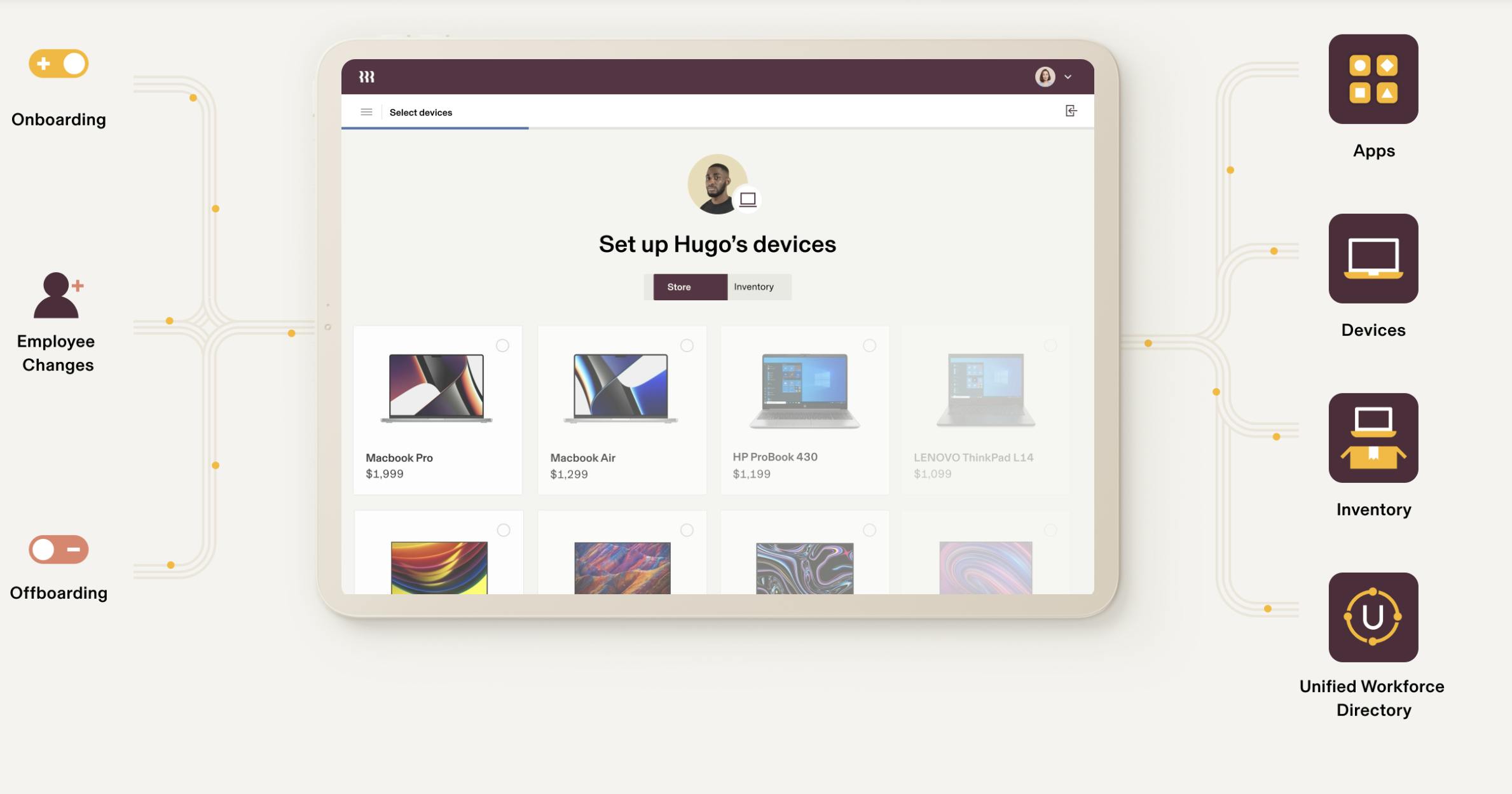

IT Cloud

Source: Rippling

Rippling offers a number of IT product offerings that allow administrators to manage applications, identities, devices, and inventory.

Application management allows administrators to set up and manage employee applications in one place. Using this tool, employers can audit logs and create activity reports, set role-based access policies, and team password management.

With Rippling’s device and inventory management tools, employers can set up and deploy computers in “90 seconds”, automatically enroll and de-provision devices, and purchase, update, track, lock, and wipe devices. They can also remotely store and ship inventory and enforce customer security rules with this IT offering.

These IT tools are intended to allow administrators to have Rippling take care of logistics associated with devices including remote software updates, security and compliance reporting, and device assessment. Specifically, Rippling offers services where employers can have “zero touch” on products like laptops.

For example, if an employer lets go of a remote employee, Rippling will send the employee a box with a shipping label addressed to a Rippling warehouse where the laptop is scrubbed and stored until a new employee is hired. When a company does hire a new employee, all the employer needs to do is assign a laptop to the employee and Rippling will take care of the fulfillment.

Finance Cloud

Source: Rippling

As of March 2024, Rippling’s Finance Cloud includes four key offerings: corporate cards, expense management, bill pay, and payroll management. Each of these is detailed below.

Corporate Card

Source: Rippling

Rippling’s corporate card allows companies to manage and issue both branded physical cards and virtual credit cards, track card cycle automation, and establish a cash reward program.

Users can also control employee spend with “hyper-custom” policies based on employee data from the Rippling platform, which is intended to allow administrators to automatically block “far more spend than other systems” in less time. Rippling also allows users to control access and visibility over spend based on role; for example, managers can view spend for their direct reports and no one else.

Expense Management

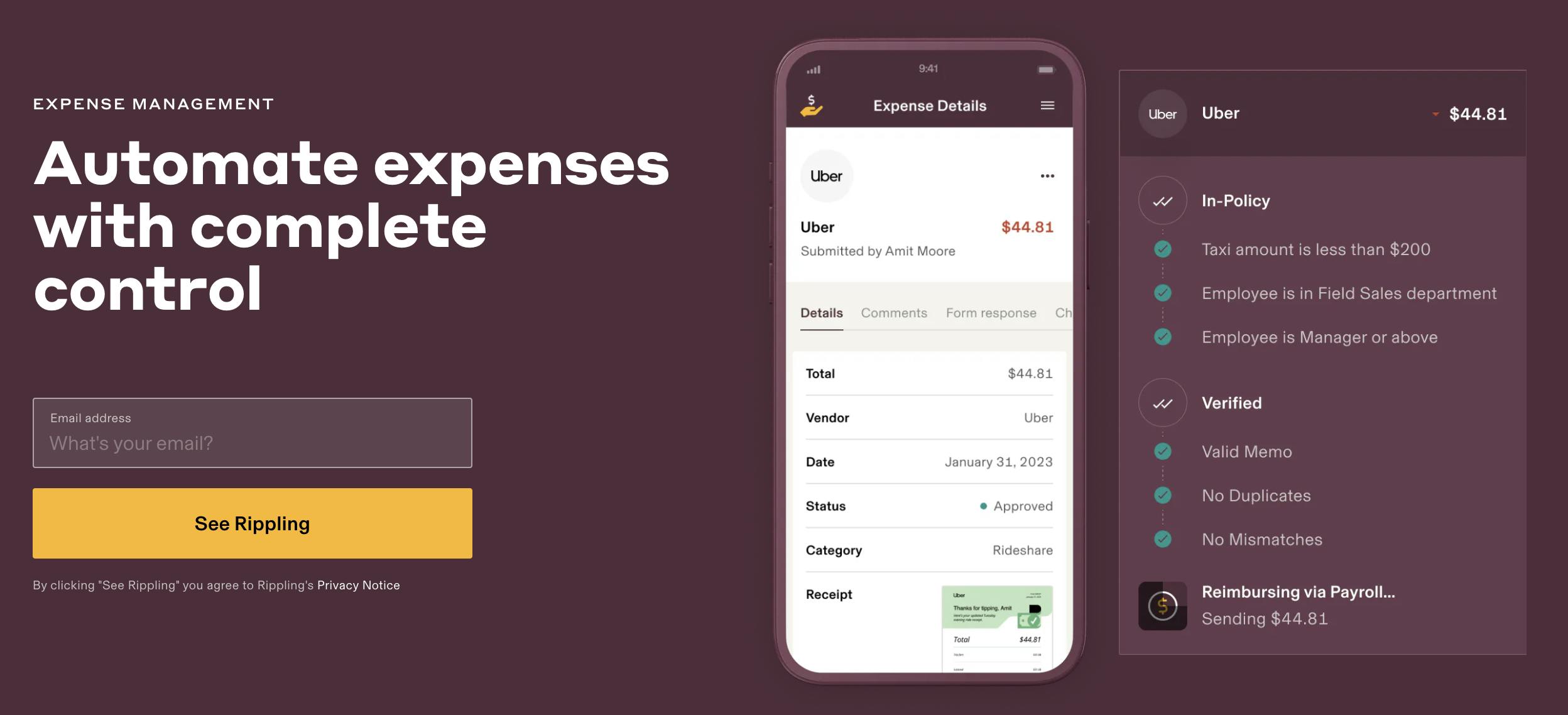

Source: Rippling

Rippling’s expense management platform enables companies to pay out employee reimbursements, create custom policies and approvals, and includes capabilities in over 100 countries as of March 2024. Reimbursements are made through the payroll tool and can be issued in any currency.

Bill Pay

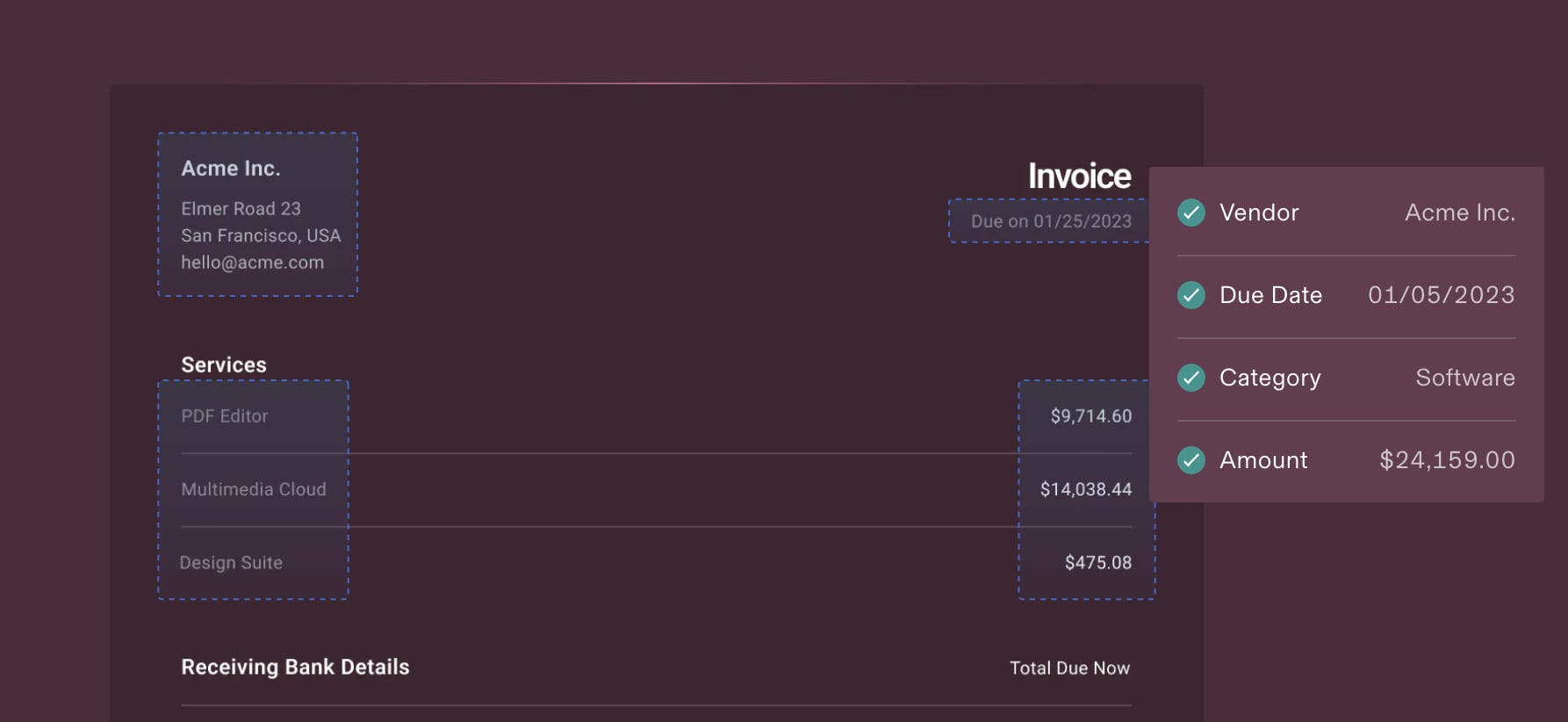

Source: Rippling

Rippling’s billing product, which launched in March 2024, allows users to route, review, and approve bills. With Rippling, users can automatically create bills by uploading or forwarding their invoices, and create custom approval rules that automatically send bills to whoever needs to approve it within an organization based on factors such as employee attributes, vendors, invoice amount, and others. It also allows users to control who can see and approve bills based on department, level, or invoice data. It also provides a comment threading function for quicker collaboration.

Market

Customer

By October 2021, Rippling’s customers ranged from small businesses of just two people to large companies with more than 1K employees. Over time, Rippling can continue to move up-market by rolling out new functionalities. In March 2023, Rippling revealed the following statistics about its customers’ employees: the average Rippling employee makes roughly $55K per year, 80% work outside of California, and 65% work outside of tech.

As of April 2025, Rippling has over 20K customers. Some examples include Five Guys, Taskrabbit, Anthropic, Barry’s, Clay, Blank Street Coffee, Superhuman, Chess.com, Highnoon, Double Good, Compass Coffee, Millennial Restaurant Group, and Qualio. Rippling customers have reported various instances where Rippling conferred benefits such as increasing the speed of technology onboarding by 10x, helping decrease HR and IT tasks by 96%, removing 15 hours of admin work a month, and saving $50K in software costs.

Market Size

In 2021, the global HR technology industry was $24 billion and is expected to grow to over $35 billion by 2028 representing 6% annual growth. In North America, the market was valued at ~$12 billion and is expected to grow to $17 billion by 2028. A catalyst of this growth has been the rise of remote work, with 80% of employees expecting to work from home at least three days a week as of 2023. This has created a rising need for employers to rely on software to help manage their workforce.

Although Rippling is mostly focused on the US market, it has products that allow the company to serve international companies such as global payroll, which it launched in October 2022, reimbursement in any currency, and PEO services. Conrad called the launch of Rippling’s global payroll product the “biggest launch of his career”, hinting that the company sees international expansion as a critical part of increasing its market size.

Competition

Within Rippling’s initial core market of HR software, there are a number of competitors. As Rippling has expanded its product suite, it also exposes itself to competitive threats from IT and finance providers. The company considers its key competitors as companies that have comprehensive HR, payroll, and benefits systems. Some relevant competitors to Rippling include HR vendors like Deel, Gusto, ADP, Bamboo HR, Paylocity, Paycom, Paychex, Quickbooks, Justworks, Trinet, and Zenefits, as well as adjacent tools like Ramp*, Brex, and Bill.com in finance, or IT vendors like ServiceNow or Ivanti.

Deel

Deel was founded in San Francisco in 2019. The company’s initial focus has been the facilitation of payments for international workers through a global contractor platform. Over the years, Deel’s product suite expanded to include HR, IT, and other embedded services within its platform — closely resembling Rippling’s offering and putting the two companies into direct competition. Deel has over 35K customers across 100 countries worldwide, including Shopify, Nike, Lego, and Revolut. As of April 2025, Deel raised a total of $979 million, and was valued at $12 billion in February 2025. Deel has announced that it was preparing for an IPO in 2026, having hit an annual revenue run rate of $800 million in 2024.

In March 2025, Rippling filed a lawsuit against Deel, accusing its leadership of orchestrating a corporate espionage scheme. The suit centers on allegations that Deel paid a Rippling employee, Keith O’Brien, to spy on the company while still employed there. According to an affidavit released by Rippling, O’Brien shared sensitive internal information with Deel over a four-month period, including customer lists, product roadmaps, and internal communications. Deel has denied any wrongdoing and stated that the claims are an attempt by Rippling to deflect from its own legal issues.

Gusto

Gusto was founded in 2011 in San Francisco. Rippling has primarily established itself in the HR management space, which has meant that companies like Gusto are its most relevant competitors. In early 2020, Rippling paid for billboards and bus ads in San Francisco targeted at Gusto customers, one of which said "Outgrowing Gusto? Presto Change-o.” The ad played on a common criticism of Gusto that it was primarily best suited for small businesses. Gusto filed a cease-and-desist order against Rippling. At the time, Gusto claimed it served more than 100K businesses of various sizes. Rippling eventually took the ads down.

As Rippling has expanded into global workforce management and adjacent offerings like spend management, it has moved into less direct competition with Gusto. While customers might consider both in their selection of an HR vendor, customers choosing Rippling will likely be those looking for a more all-inclusive platform vs. simply an HR solution. According to Rippling as of April 2025, there are four main reasons why users prefer Rippling to Gusto across 11K reviews: (1) Rippling meets scaling business needs better than Gusto, (2) Rippling offers more advanced reporting, (3) Rippling provides higher-quality support, and (4) Rippling can handle the complexity of all types of benefits. As of April 2025, Gusto raised a total of $746 million in funding and was valued at $9.5 billion in August 2021.

ADP

ADP, which was founded in 1949, is a longstanding player in the HR software space, with a $120 billion market cap as of April 2025. According to Rippling, as of 2019, ADP controlled 15-20% of the market and had taken limited steps to move into other areas within the employee management ecosystem. In 2024, ADP served 1.1 million companies across 140 countries, with over 42 million workers paid through its platform.

Rippling feels that the market leader in HR will capture 60% of the market share, the number two player 30%, and other companies will fight for the final 10%. Rippling argues there are three main reasons why its service is a better alternative to ADP’s is that (1) ADP lacks modern capabilities, given the platform was built decades ago, (2) Rippling offers a simpler and more transparent fee structure, and (3) Rippling offers international payroll capabilities, unlike ADP.

Workday

Workday, which was founded in 2005, provides HR and financial SaaS tools for enterprises. As of April 2025, it had a market cap of $62 billion. In contrast to Rippling, Workday is focused on large enterprise customers. According to a study commissioned by Rippling and conducted by an independent research firm called Benenson Strategy Group in June 2022, companies using Workday had to maintain almost twice as many employees in HR, IT, and finance as companies using Rippling.

Zenefits

Zenefits is Parker Conrad’s former company which was founded in 2013. It offers an HR platform with a specific focus on healthcare benefits. Rippling also argues that there are three main reasons why Rippling’s product is a better option than Zenefits’: (1) Zenefits’ limited capabilities as companies scale, (2) comparative lack of deep reporting and analytical tools, and (3) Rippling’s ability to easily integrate with third-party apps. Zenefits has raised a total of $584 million as of April 2025.

Single Sign On (SSO) & Device Management Tools

Rippling also considers companies in the identity management, password protection, and security space as competitors. Some of these companies include Okta, 1Password, and OneLogin. Rippling feels that key HR data at the center is the right approach for managing passwords, secure authentication, and permissions, not IT teams.

Global Workforce Management Tools

Historically, HR systems have avoided global availability. For example, Gusto is only available in the US. When Rippling launched its global workforce management solution, it put itself in further direct competition with global payroll providers like ADP (available in over 140 countries as of March 2024), as well as niche global workforce tools like Deel, Papaya Global, and Remote.

Corporate Cards and Expense Management

Another adjacent category for potential competition is in Rippling’s financial suite. In launching corporate cards and expense management software, it positioned itself to compete against vendors like Expensify, Concur, AmEx, Ramp*, and Brex — among others.

Business Model

Modular SaaS Fees

Rippling charges a core platform fee of $35 a month with an additional monthly fee for each user, defined as an employee on the platform, starting at $8 per month. The company, however, provides custom pricing for users based on the number of Rippling products that the employer is using. From the company’s early days, instead of focusing on a single workflow and charging $10-15 per user per month like most SaaS providers, Conrad aimed to consolidate multiple workflows into one platform — allowing Rippling to command higher pricing. He argues that the proliferation of SaaS tools has made sales and marketing significantly harder. In May 2022, Rippling reported a net dollar retention of 200% with an annual churn rate of 0%.

A core pillar of Rippling’s business model is cross-selling its various product modules, and focusing on growing the number of products that a customer uses. Given the number of products Rippling offers, it has a uniquely in-depth collection of employee data which enables customers to add additional products more easily. Rippling also has the advantage of being plugged into the customer onboarding process because it can know when a customer may be looking for additional modules. For example, companies may look for expense management around the time when they reach their 20th employee.

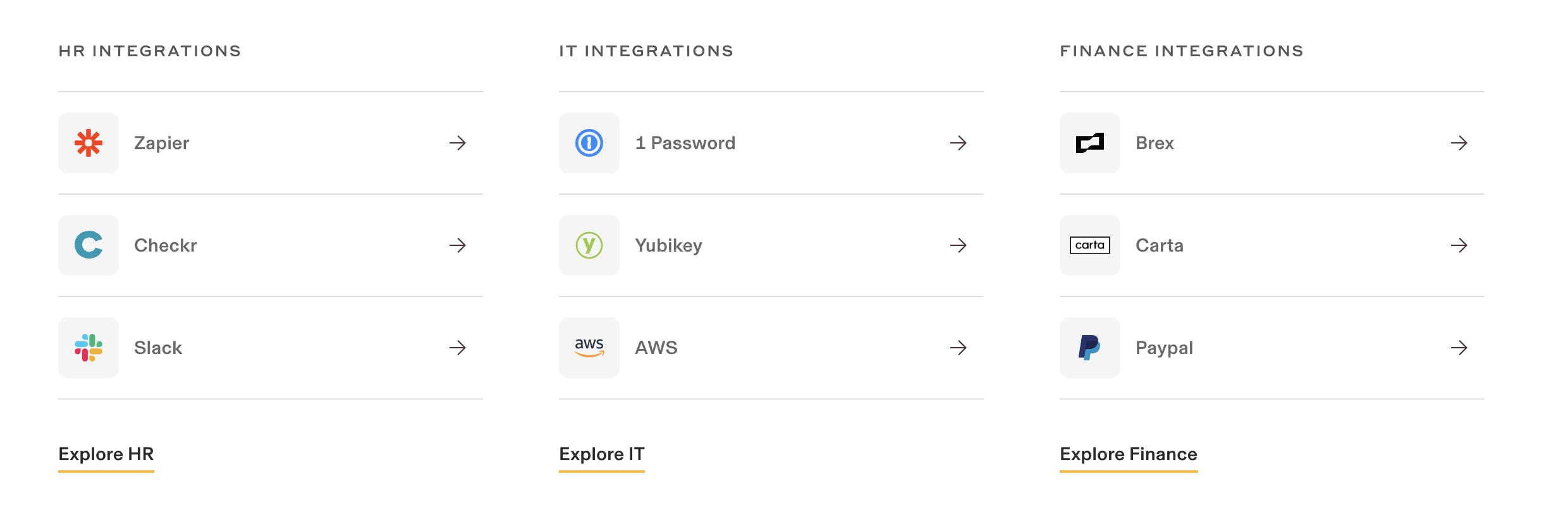

Rippling also has integrations with third-party SaaS applications with which Rippling makes money through revenue-sharing agreements. The fact that Rippling can monetize these third-party application suggestions makes it easier for Rippling to promote those products when a customer’s needs may be better fit by those third-party applications than by Rippling’s proprietary products.

The Cost of Growth

As a B2B startup, Rippling’s greatest costs are its sales and support functions, in addition to the cost of engineering talent to continue to expand the product. As of April 2025, out of 5.2K employees on LinkedIn, 1.3K were in sales or customer support — constituting roughly 25% of Rippling’s workforce. In comparison, the equivalent proportion for other companies was 15% for Deel and 14% for Gusto. Rippling spends more on sales when compared to larger enterprise competitors, which have more referrals and brand presence, but also similar-stage startups that are aggressively pursuing growth as well.

Traction

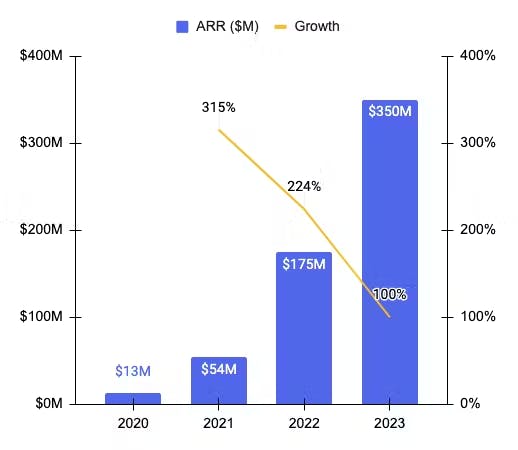

For the eight months after January 2018, Rippling was averaging 20% month-over-month ARR growth. That growth rate then accelerated in the last four months of 2018 to 25%, before achieving a 29% monthly growth rate in January 2019.

In January 2019, Rippling’s net promoter score (NPS) was ~70, implying customer approval and a willingness to recommend the company. The company had around 60 employees at the time.

By August 2020, Rippling had grown to over 250 employees and had “thousands” of customers, 40% of which were startups. In May 2022, Rippling reached ~$100 million in ARR. The company had more than doubled its ARR from six months prior and had a net dollar retention (NDR) of 200%. This retention rate is significantly higher than is typical. The average public software company had a net retention rate of ~120%, with best-in-class companies like Snowflake at ~165%.

In March 2023, following the closure of Silicon Valley Bank, Rippling raised an emergency financing round to support its customers’ employees. Rippling revealed that over 55K employees were set to be paid that Friday through Rippling’s Payroll platform, amounting to $130 million that cycle and total payroll-designated funds amounting to $545 million. According to LinkedIn, Rippling has 5.2K employees as of April 2025 which represents a 290% increase in headcount from the 1.8K in March 2023.

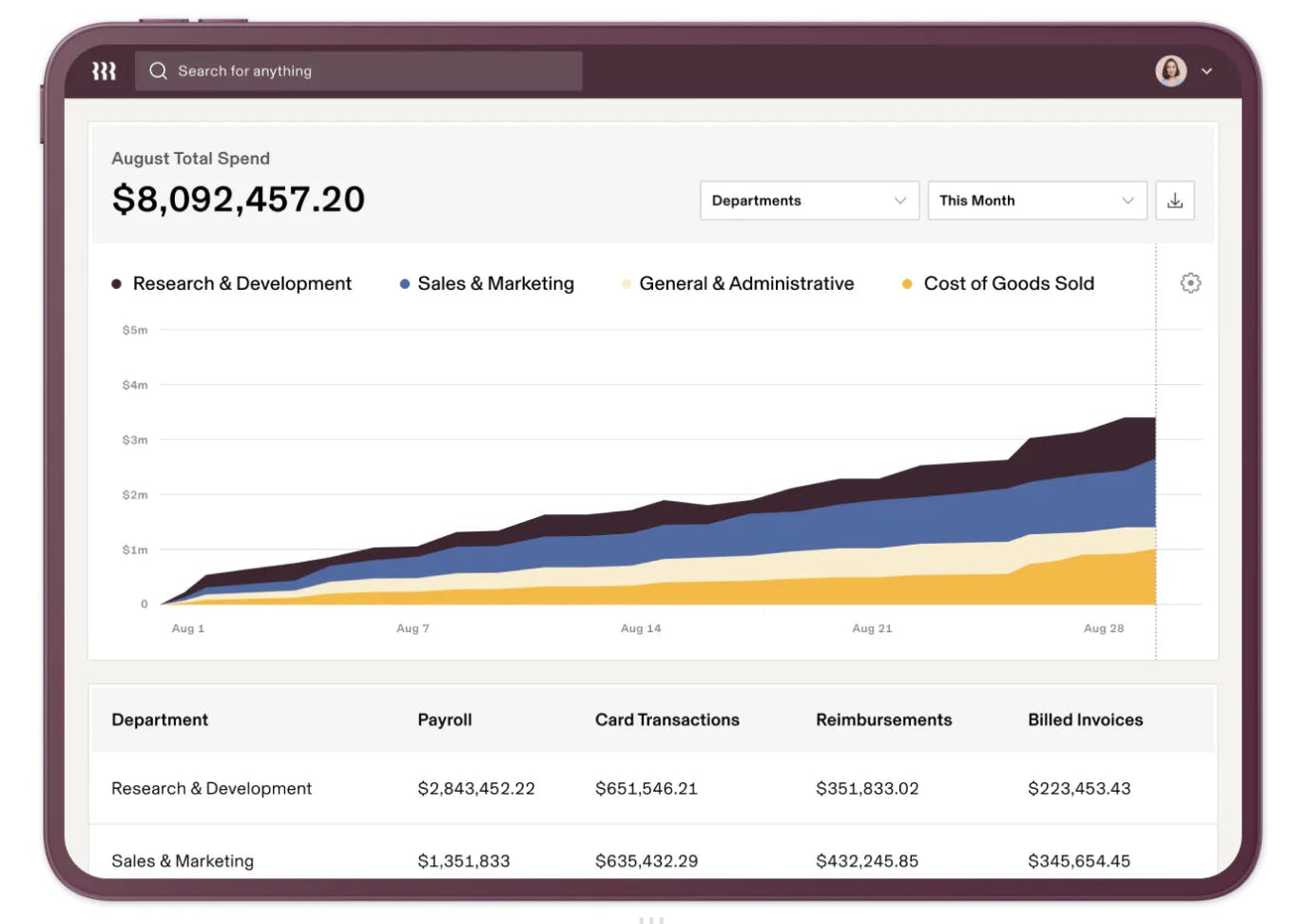

Source: Sacra

In January 2024, Rippling CEO Parker Conrad claimed that companies that don’t use Rippling had twice as many employees in HR, IT, and finance than those that did. In March 2024, it was reported that Rippling had doubled its annual recurring revenue to more than $350 million by the end of 2023 compared to the prior year. However, the company was reported to be burning about $100 million per year at that time. By comparison, Deel was reported to have reached $500 million ARR in February 2023.

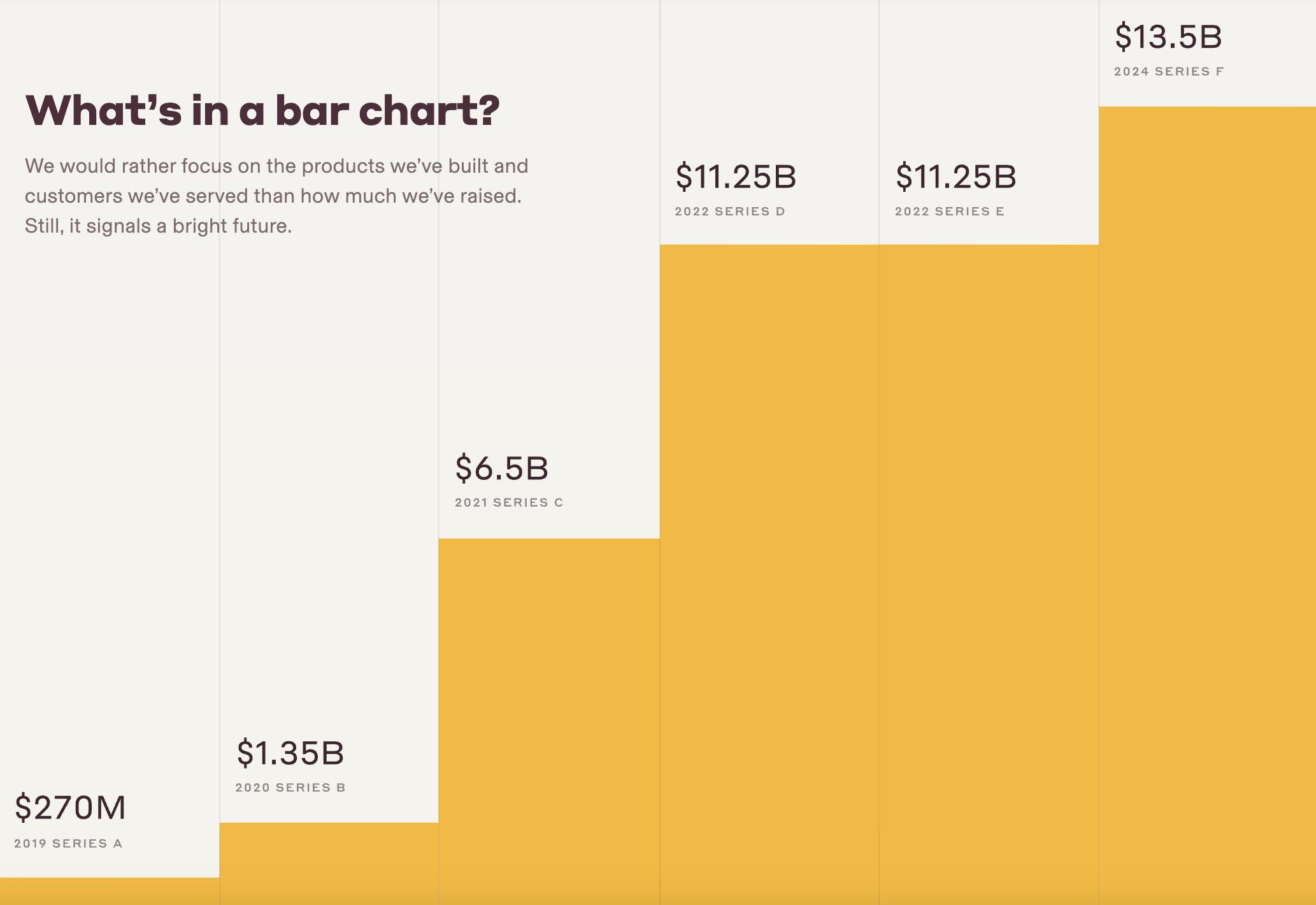

Valuation

In April 2024, Rippling raised a $200 million Series F at a $13.5 billion valuation led by Coatue, which brought the company’s total funding to $2 billion. In March 2023, following the freezing and later closure of Silicon Valley Bank, Rippling pulled together its $500 million Series E round in just 12 hours, as Conrad rushed to ensure its customers’ payroll would go out smoothly. Since the raise was designed to aid customers, the Series E matched the previous Series D valuation.

Prior to this, Rippling’s last planned fundraising round was a $250 million Series D at a $11.3 billion valuation co-led by Bedrock and Kleiner Perkins with participation from Y Combinator, Sequoia, and others. The Series D raise represents a ~75% increase in valuation from the company’s $250 million Series C at a $6.5 billion valuation in October 2021.

Source: Rippling

At the time of the Series D raise, Rippling had $100 million in ARR, while when it raised its Series C, just six months before the Series D, Rippling had “more than doubled” its ARR, implying that Rippling’s ARR grew from ~$50M to ~$100M in six months and that its valuation multiple decreased slightly, from 130x in October 2021 to 113x in May 2022. Rippling’s latest Series F round in April 2024 was conducted shortly after the announcement of its $350 million revenue figures in 2023, implying an EV/Sales multiple of 38.5x.

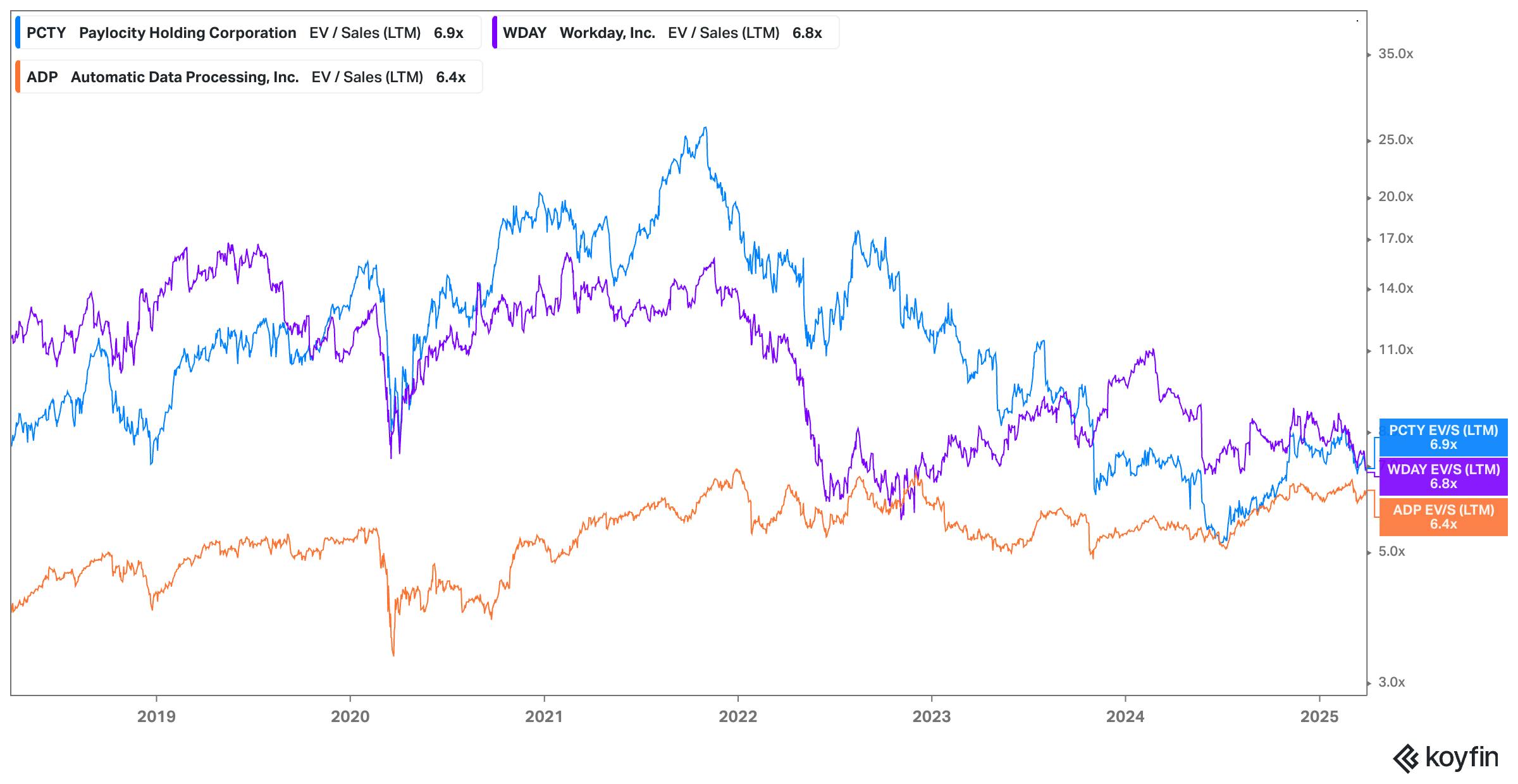

By comparison, ADP was valued at ~$118 billion in December 2024 and the company had generated ~$18.2 billion in revenue during 2024, growing ~5.6% YoY, representing a ~6.5x revenue multiple. ADP also generated $3.6 billion in free cash flow in 2024, while other public competitors like Paylocity generated ~$306 million, growing 42% YoY. Public comparable companies were trading at ~6.4-6.9x LTM revenue as of April 2025.

Source: Koyfin

In the private markets, Gusto raised a $175 million Series E in August 2021 at a ~$10 billion valuation. The company then raised a Series E extension in May 2022 at the same valuation. Gusto hasn’t shared its revenue figures. However, it shared that in 2021 it had several hundred million dollars in ARR and was growing 50% year-over-year. One unverified source estimates that Gusto’s revenue’s ARR was around $290 million in 2022. If the revenue figure is correct, Gusto would have been valued at ~34x ARR at the time of its Series E.

Ultimately, Rippling’s ability to live up to its valuation will be a function of maintaining best-in-class revenue growth, and net retention, as well as continuing to expand its platform.

Key Opportunities

Additional Products

Source: Spencer Peterson

Rippling’s focus on offering as many modules as possible enables it to collect a broader set of employee data, which allows it to leverage this data in expanding to additional products. That product expansion is one of the drivers behind Rippling’s net retention. As Rippling continues to build out additional products over time, it will push its flywheel further in adding new customers, new upsell opportunities, and more employee data.

App Store

Source: Rippling

Rippling’s goal is to provide one platform to service all HR, Payroll, and IT operations. One way Rippling enables this is by allowing for an expanding ecosystem of third-party applications. As this ecosystem expands, it will constitute a growing revenue opportunity. For comparison, in 2021, Apple generated between $13-26 billion in profit from its app store commissions. Rippling’s ecosystem represents a small fraction of that, but the ability to leverage Rippling’s own install base as a similar method of distribution for B2B applications could be meaningful for the business.

Key Risks

Competitive Landscape

Rippling operates in a competitive field with both incumbents like Workday and ADP and high-traction startups like Gusto, Zenefits, and others. Several of the companies that operate in this space generate significant profit, which makes them less reliant on external funding. That independence can be particularly powerful in withstanding periods of macroeconomic volatility and the consequent funding doubts. Additionally, the fact that giants in this space generate significant cash flow, bigger companies like ADP could acquire some of Rippling’s competitors, and demonstrate a more significant threat.

Regulatory Pressure

In the past, companies in Rippling’s position have encountered regulatory hurdles when dealing with things like health benefits. The surface area of Rippling’s product exposes it to a variety of potential sources of regulatory risk including payroll, employee agreements, global workforce management, and financial management. As pressure increases to appropriately handle these business operations, Rippling could face increasing scrutiny on its products.

Summary

Rippling is building an employee-centric operations platform that extends across HR, finance, and IT. Rippling is positioning itself to consolidate the various systems that touch employee data. While the landscape is competitive, Rippling is among the first companies to attempt to unify the data from these various silos. The company’s ability to integrate these solutions, and offer adjacent third-party applications could help it create an employee-data system of record.

*Contrary is an investor in Ramp through one or more affiliates.