Thesis

Business communications are undergoing a generational shift to the cloud. Previously, businesses used legacy on-premise private branch exchange (PBX) phone systems from companies like Avaya or Cisco to check voicemail or route customer support calls. The advent of the internet enabled VOIP (voice over IP), freeing voice calls from an analog phone line. Now, businesses are turning towards unified communications as a service (UCaaS), a cloud-delivered solution that combines a full suite of communications: telephony, meetings (audio, video, web), messaging, fax, and more.

UCaaS adoption is primed to grow from multiple secular trends accelerated by the COVID-19 pandemic: digital transformation efforts, the rise of hybrid work, and cloud adoption. The global UCaaS market was estimated at $91.7 billion in 2022. The shift to cloud-based phone systems is driving a shift among the heaviest phone users in most organizations: contact centers. Legacy call center software typically relied on “cubicle farms” for customer support calls. Today, driven by the need to meet rising standards of customer experience, businesses are adopting contact center as a service (CCaaS) to deliver omnichannel customer engagement across voice, text, video, social channels, email, and more. Typically, UCaaS and CCaaS are separate platforms, but businesses often face problems integrating the two systems, leading to siloed data sets, access, and employee processes.

Dialpad is a cloud-based business communication, collaboration, and contact center platform. It offers real-time transcription, automated note-taking, live sentiment, and voice analytics. Its products cover the full range of business communications needs across voice, video, group messaging, text, conferencing, screen sharing, and document-sharing services, enabling employees to collaborate in a single platform. Dialpad integrates UCaas and CCaaS. It brands this as TrueCaaS, a platform with the aim of giving users a “single pane of glass” for all business communications.

Founding Story

Dialpad was founded in 2011 by Craig Walker (CEO) and Brian Peterson (CTO). Walker started Dialpad Communications, an internet telephony service provider, in 2001. The venture was acquired by Yahoo in 2005, after which Walker stayed on at the acquired company for 6 months before co-founding GrandCentral, another telecommunication startup. He founded this company with Vincent Paquet, who had previously been the Director of Business Development at Yahoo. In 2007, Google purchased GrandCentral for $50 million. The product was launched in 2009 as Google Voice, a consumer phone service that let users make and receive calls from any web browser with a free number.

Walker then moved to Google Ventures as an entrepreneur in residence (EIR) in 2010 after Google’s focus shifted to Google+ and Facebook. While there, Walker eventually returned to his roots in business communication, drawing from his consumer experience at Google.

Along with Peterson, who had previously been a senior software engineer at Google and who worked on Google Voice, Walker started UberConference in 2011. It was launched at Techcrunch Disrupt NY in 2012, winning the event’s startup competition. Walker bought the Dialpad brand and domain from Yahoo in 2013 after Yahoo Voice was shut down and renamed UberConference to Dialpad.

Half of Dialpad’s first 30 hires came from Google. The thinking behind this was that Google hires knew how to build for scale; as Walker noted:

"If you launch a product at Google, particularly a consumer product, it has to theoretically scale to be able support 100 million users on Day One. And that made us build the Google Voice platform in a way that scaled like no other phone system before it or since could."

Dialpad’s Google roots also paid off unexpectedly with the hire of Dan O’Connell, Chief Strategy Officer and former CRO at Dialpad. O’Connell was the founder and CEO of TalkIQ, a voice AI startup. Dialpad partnered with TalkIQ and eventually acquired it in 2017, forming the foundation of Dialpad’s AI products. Petersen had been one of the early engineers that sat next to O’Connell at Google back in 2004.

Product

Business Communications

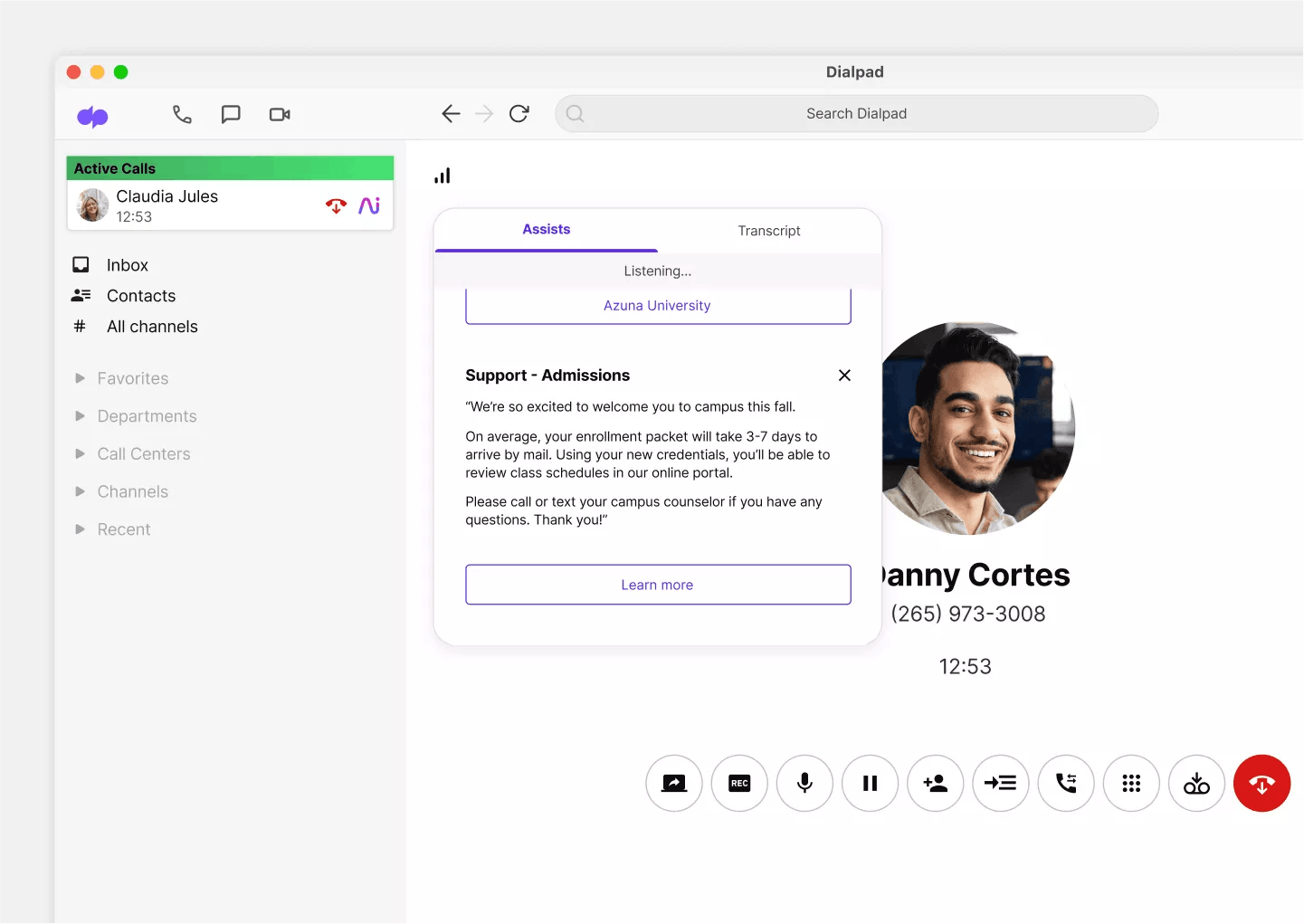

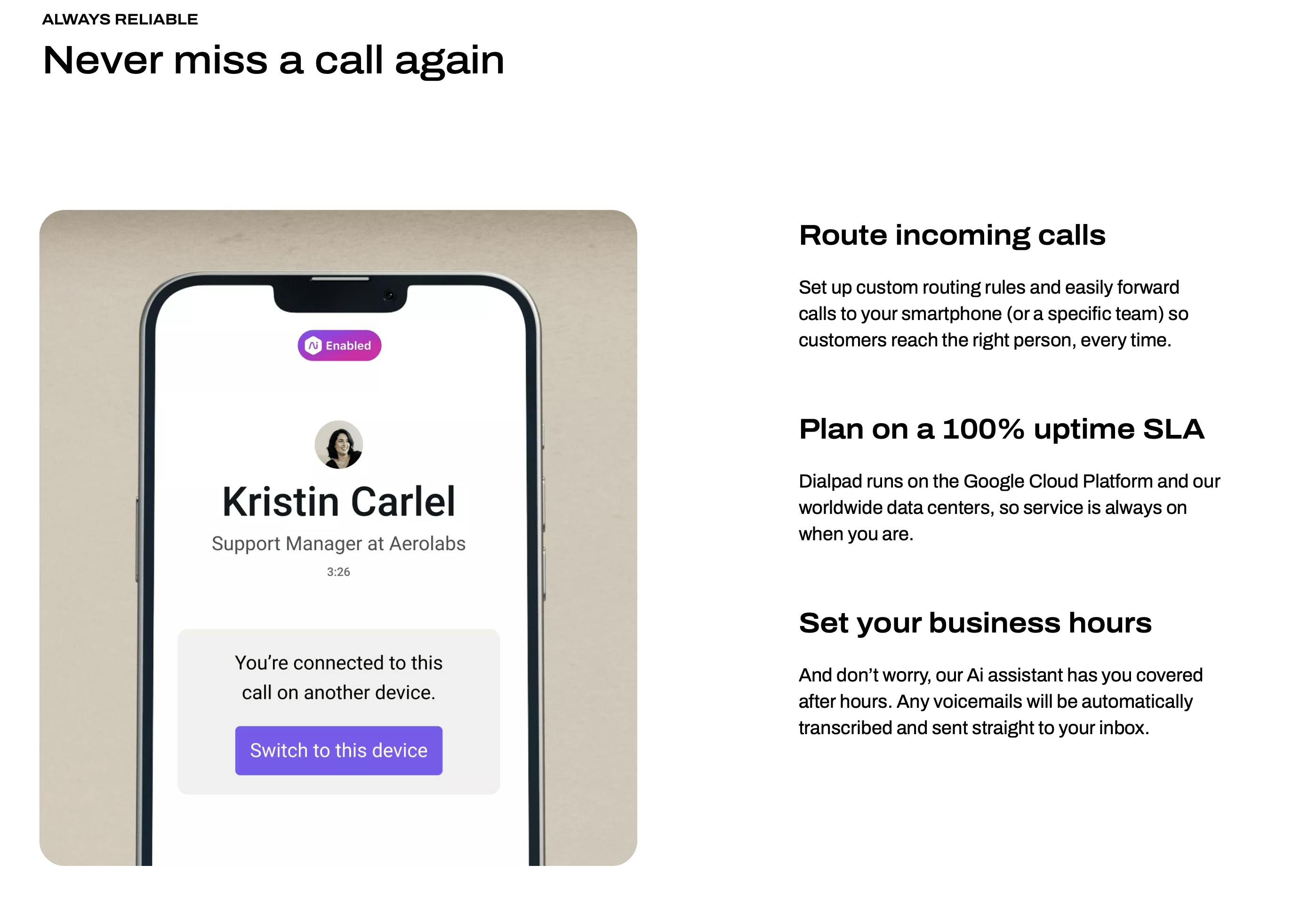

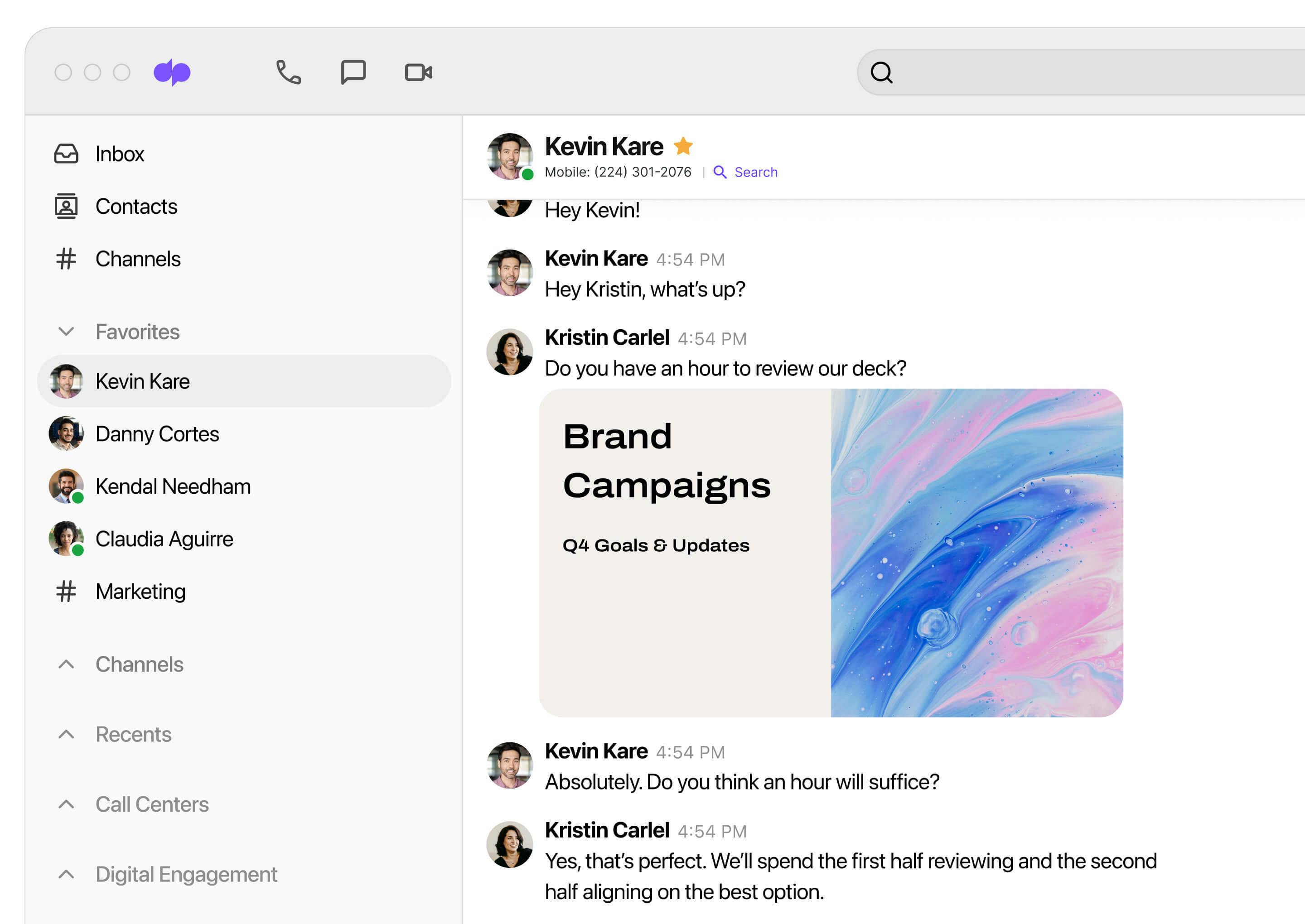

Dialpad combines calls, chats, and video conferencing in one platform. Dialpad transcribes calls, action items, snippets, and notes. It sorts incoming calls based on call routing rules so users can track and manage conversations.

Source: Dialpad

Users can also assign operators, set business hours, create a custom greeting, upload hold music, and transfer an incoming call to someone on their team.

Source: Dialpad

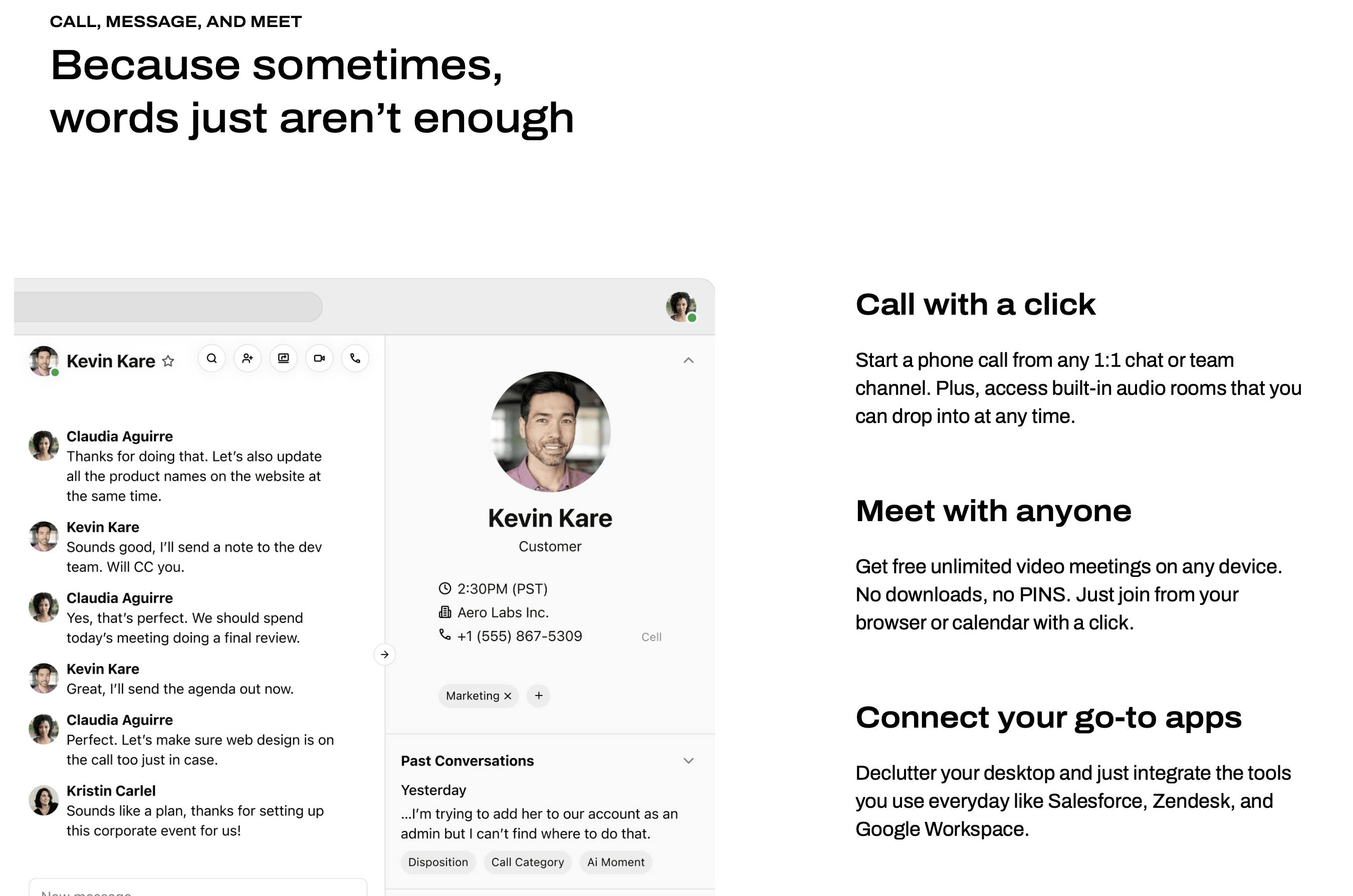

The Dialpad Business Communications offering includes Dialpad Ai Messaging and Dialpad Ai Meetings.

With Dialpad Ai Messaging, users can chat with their team or external partners in the same app and across devices, send files of all shapes and sizes, and connect tools like Google Drive so everything’s in one place. Users can start a phone call from any 1:1 chat or team channel and access audio rooms they can drop into anytime. Dialpad offers integrations with Salesforce, Zendesk, and Google Workspace.

Source: Dialpad

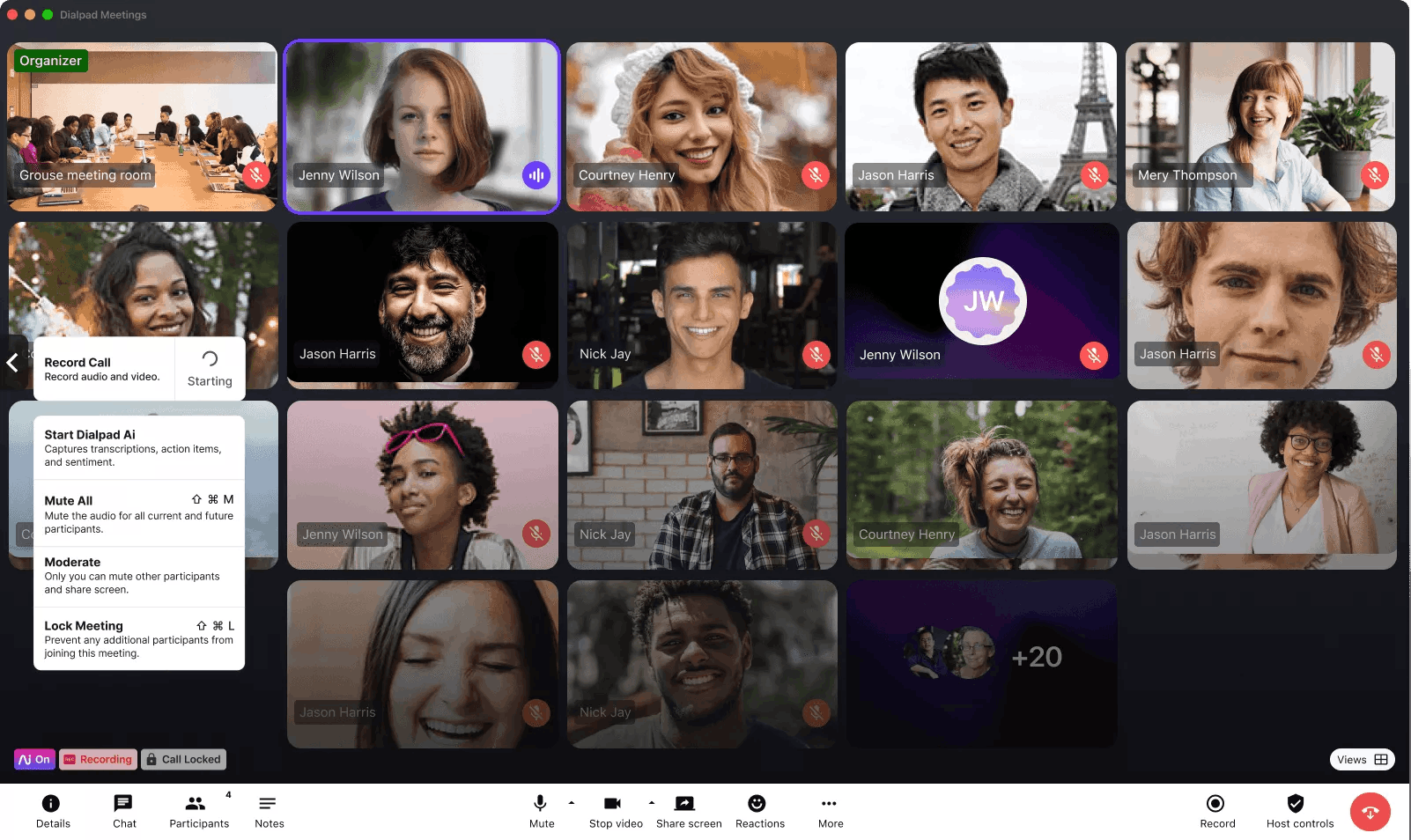

Dialpad Ai Meetings allow users to turn their turn video functionality on or off anytime. Users can also screen share from any device, and guests don't have to download the app. Dialpad lets users send an SMS with a link to the screen share which they can join from a web browser.

Source: Dialpad

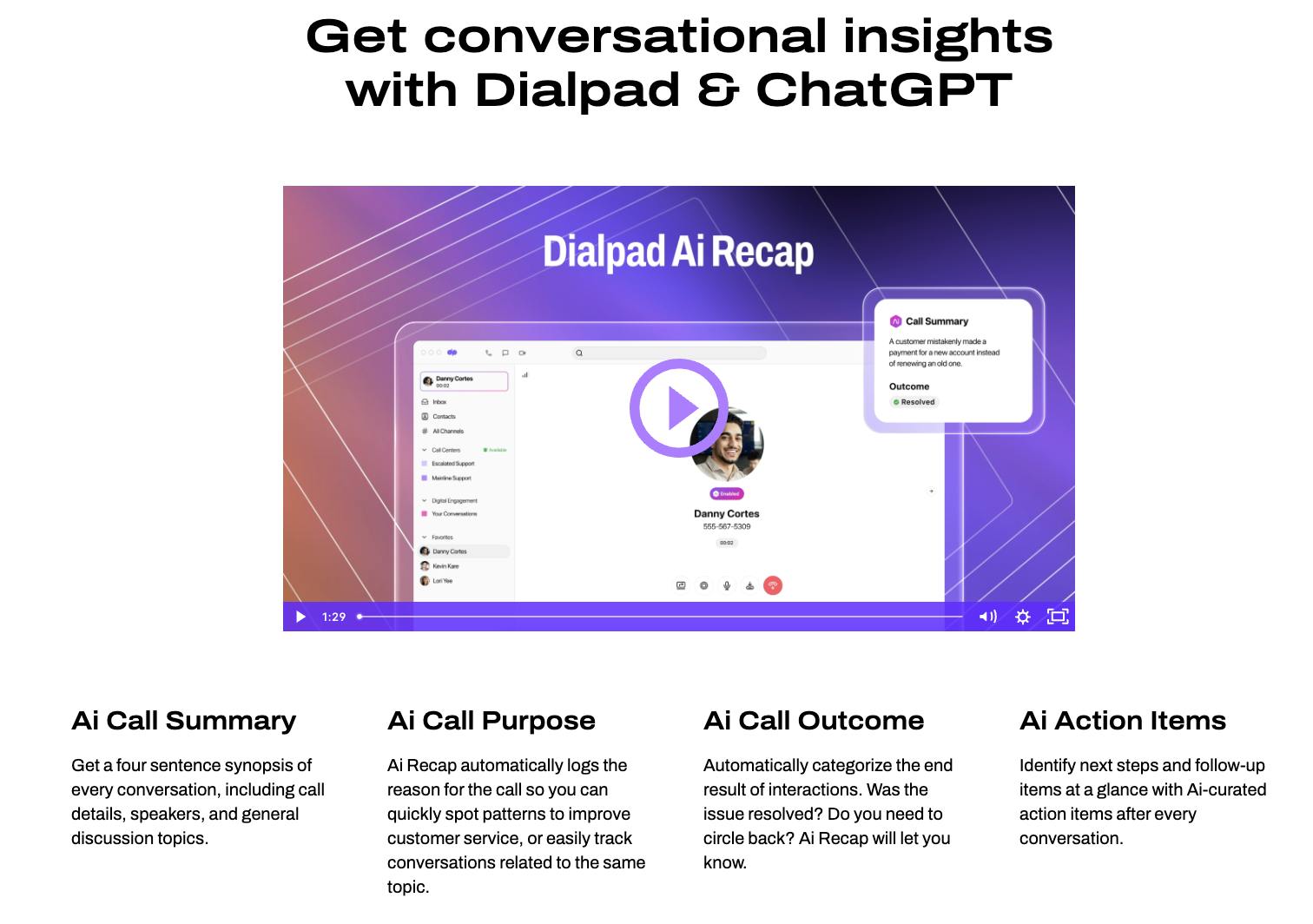

Furthermore, Dialpad’s conversational intelligence is powered by ChatGPT in a new feature called Ai Recap. Ai Recap uses Dialpad’s AI algorithms, proprietary models, and ChatGPT’s summarization and text generation capabilities. It creates a summary that captures a conversation's main ideas, topics, and follow-up items. Contact center leaders and supervisors can scan the Ai Recap for each agent in their contact centers or coaching teams and find commonalities.

Source: Dialpad

Customer Engagement

Dialpad’s Customer Engagement product comprises its Ai Contact Center, Ai Sales, Self-Service, and Ai CSAT offerings.

Dialpad’s Ai Contact Center aims to be an AI-powered contact center across channels, all available in the same app used for Dialpad business communications. Dialpad enables organizations to set up and administer a global contact center with local numbers.

Source: Dialpad

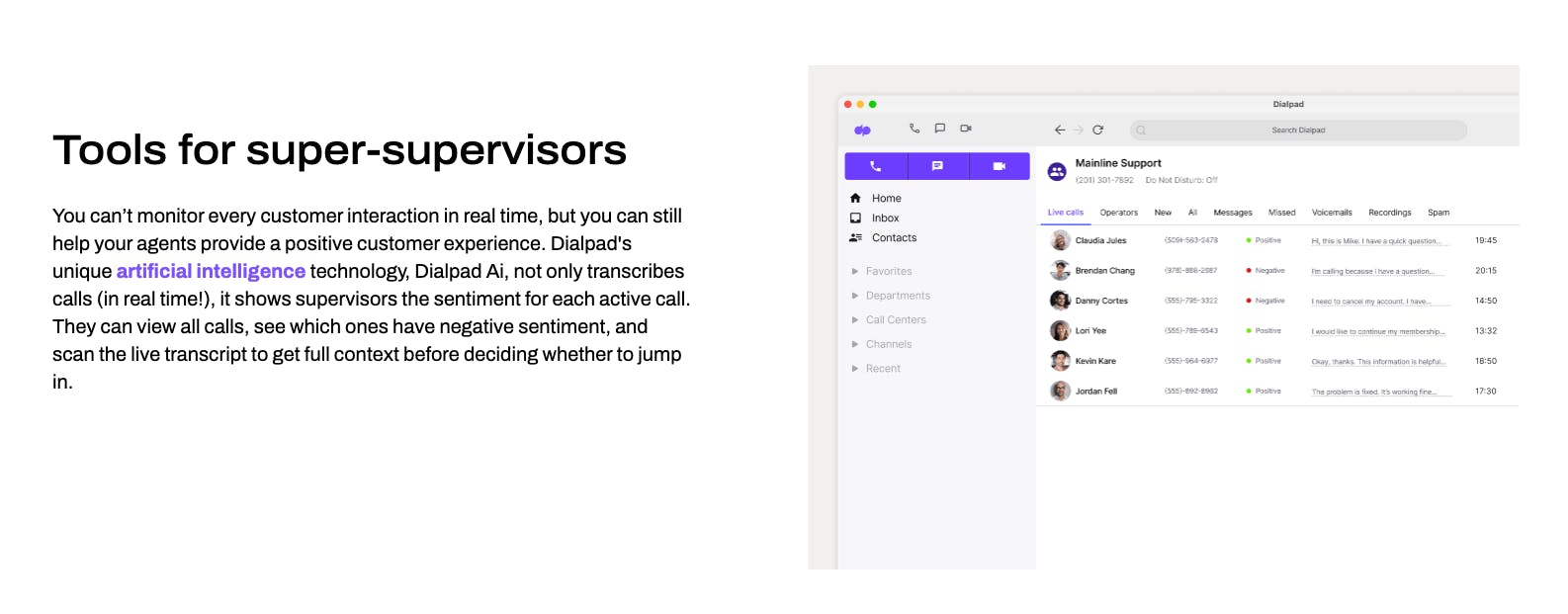

Dialpad aims to improve agent workflows with transcriptions, real-time coaching, and a unified interface for both voice and digital interactions. It automatically scrapes internal and external knowledge sources to surface answers for customers. Dialpad lets agents track customer conversations across channels like WhatsApp, Facebook Messenger, and Apple Business Chat in one workspace. The AI capabilities are meant to allow digital agents to solve requests faster by automating workflows and surfacing relevant suggestions. Dialpad Ai can also automatically pop up Real-time Assist cards when certain keywords are spoken on a call.

Dialpad Ai Sales enables outbound teams with tools like sentiment analysis, live Ai coaching, and real-time assists. Its Ai assistant connects sellers to the right information in real time and helps with objection handling, recommendations, and scripts. Dialpad enables companies to keep their salesforce on track with QA scorecards, sentiment analysis, and in-call modes like listen-in, barge-in, and takeover. It also auto-logs calls, transcripts, and notes in a customer’s CRM for them, and provides insights into sales performance with call volume tracking, leaderboards, and custom reporting.

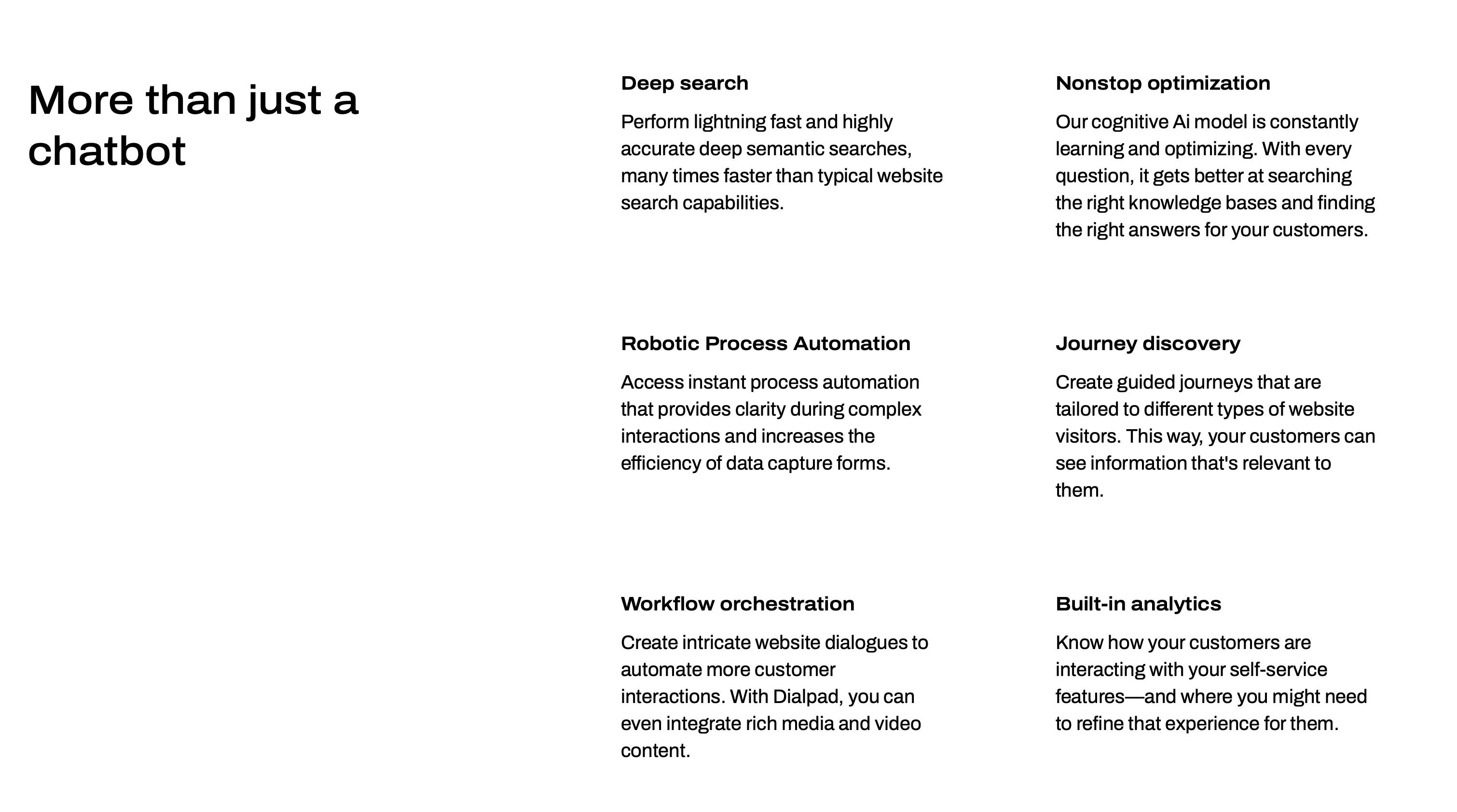

Dialpad’s Self Service solution it intended to make it easy to provide virtual customer assistance. Users can connect their knowledge sources like the website, CRM, and ticketing system to Dialpad with this solution. With Dialpad, users can build automation and workflows without coding.

Source: Dialpad

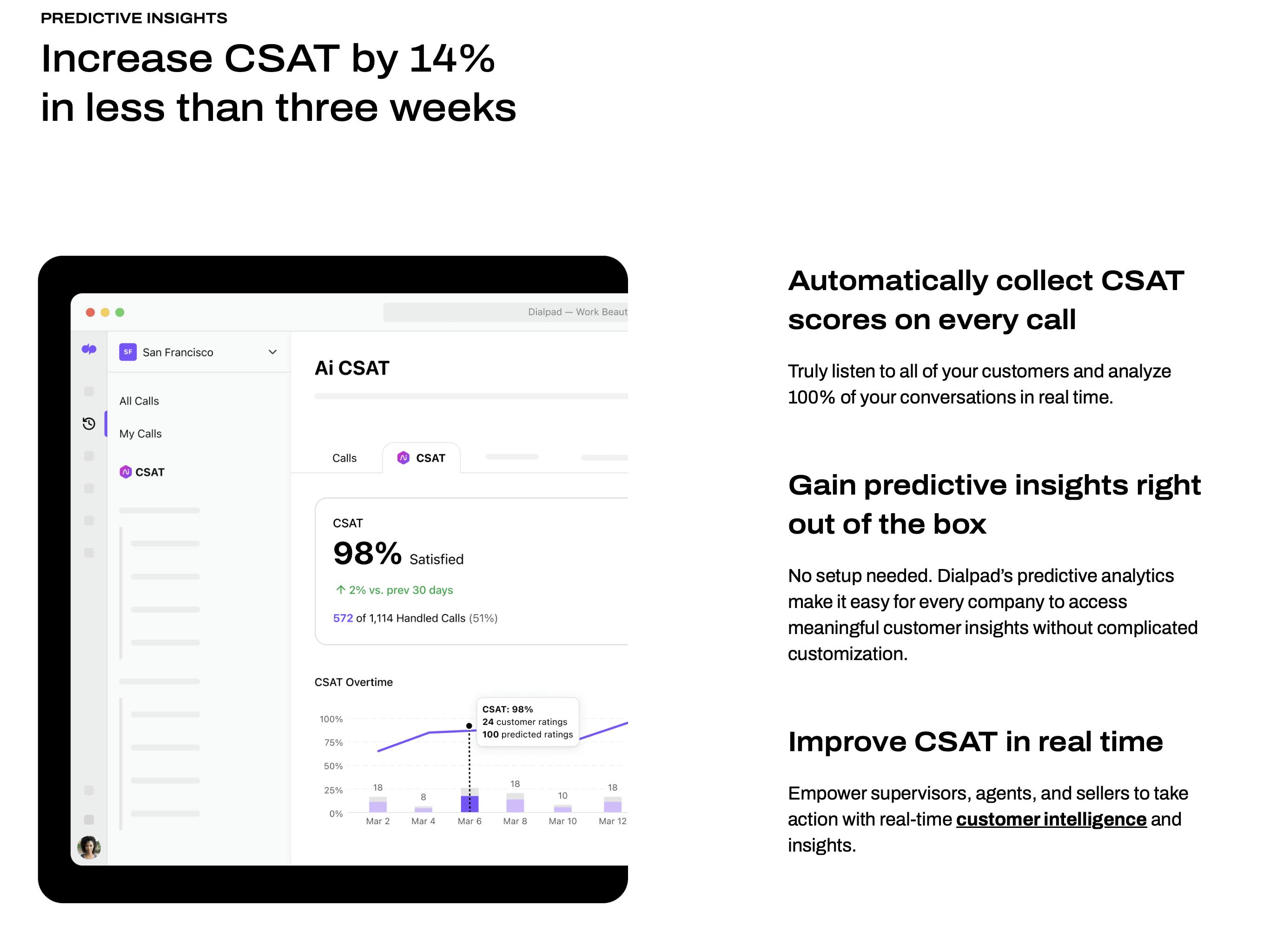

Finally, with its Ai CSAT offering, Dialpad provides an AI-powered CSAT (customer satisfaction score) automatically after every call. Dialpad has analyzed thousands of conversations to develop deep learning models that can infer customer satisfaction with 87% accuracy.

Source: Dialpad

Market

Customer

Dialpad segments its customer base into enterprise, mid-market, and SMBs. A former customer success leader at Dialpad has stated that a majority of Dialpad’s revenue came from enterprise. In April 2023, Dialpad announced that its enterprise customer segment grew fastest in 4Q 2022, driven by Dialpad Ai.

Dialpad has customers across the education, healthcare, real estate, technology, professional services, legal, retail, recruiting, and automotive industries. Notable customers include Stripe, Uber, Splunk, PagerDuty, Toast, Drizly, Quora, TED, and Crunchbase.

Dialpad relies heavily on channel sales to drive growth like other cloud communications providers. An example of a partner sale is T-Mobile allowing customers access to Dialpad within T-Mobile WFX Solutions. Dialpad announced its partner program in 2017 and features partners such as T-Mobile, Intercom, Playvox, and Google Cloud. In Q2 2021, channel sales brought in 60% of sales, up 40% from the previous quarter.

A former customer success leader at Dialpad noted that Dialpad targeted two distinct types of buyers: those migrating off of legacy PBX phone systems, and those already on VOIP.

Dialpad emphasizes global scalability, and its largest enterprise customers include:

WeWork: Dialpad powers business phones in 700+ WeWork buildings and 16K conference rooms

Xero: Xero has 1.4K employees distributed across 17 offices and decided to transition to a “work-from-anywhere” model.

RE/MAX: RE/MAX has over 140K real estate brokers and agents across 110 countries and territories. RE/MAX uses Dialpad’s business phones, contact center solutions, and integrations with Salesforce.

While Dialpad had an early enterprise win in signing Motorola, Dialpad struggled for a period after that with long sales cycles and skeptical enterprise customers. Dialpad refocused on mid-market companies in 2016, and CEO Craig Walker noted that this was how Dialpad found traction:

"If I had to do it over again, I would have focused on the mid-market more and longer. Enterprise sales forces are expensive, and the process is slow and long."

As Dialpad built out from its core business telephony product into a broader business communications and customer engagement platform, Dialpad has shifted from single-SKU to multi-SKU deals and cross-sells into its existing customer base. While Dialpad’s telephony product is typically sold to the CIO or IT, other products may need to be sold to sales and customer success departments.

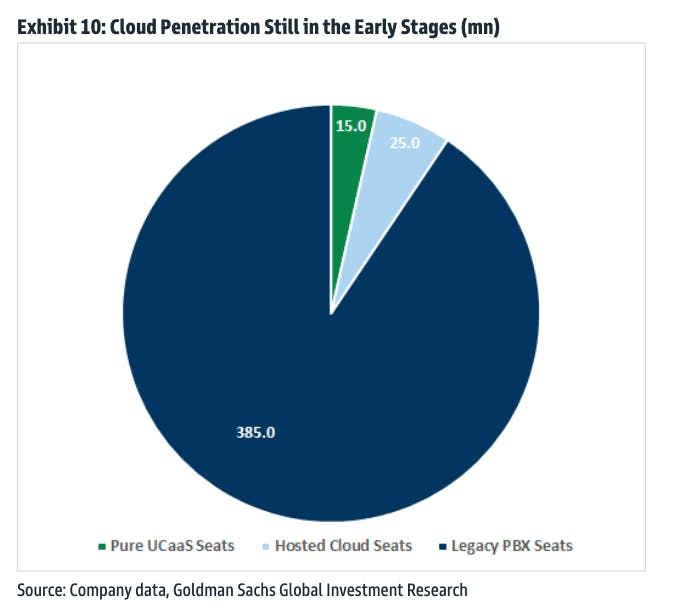

Market Size

Dialpad’s business communications product competes in the unified communications as a service (UCaaS) market. In the past, organizations would have on-premise PBX phone systems for business calls. Increasingly, organizations are turning towards UCaaS, a cloud-delivered solution that combines a full suite of communications: telephony, meetings (audio, video, web), messaging, fax, and more. UCaaS adoption is primed to grow from multiple secular trends accelerated by the COVID-19 pandemic: digital transformation efforts, the rise of hybrid work, and cloud adoption. In 2020, UCaaS was on track to capture 28% of the PBX market, with some estimates indicating that it would eventually capture 50% of the market. The global UCaaS market was estimated at $91.7 billion in 2022 and was projected to reach $381.2 billion by 2030.

Dialpad’s Customer Engagement product also competes in the CCaaS market. Call centers are now expected to handle both inbound, such as customer support, and outbound, such as sales and marketing. The global CCaaS (call/contact center as a service) market was valued at $4.7 billion in 2022 and was projected to reach $15.1 billion by 2028.

Source: Goldman Sachs (2021)

Competition

Legacy Providers

Dialpad competes as a replacement against legacy platforms. The challenge is that legacy platforms have a dominant install base that has already sunk high upfront costs and is cheaper to maintain than cloud solutions. Dialpad often waits for legacy contracts to expire to “rip and replace.” Dialpad has a new opportunity with one of the largest legacy players, Avaya, filing for their second bankruptcy in six years in February 2023.

Other legacy players in this space outside of Avaya include large providers such as NEC and Cisco, along with telecommunications providers like Vodafone, Verizon, AT&T, and more. None of these legacy providers have been able to build a cloud-native platform and, in fact, partner with providers such as RingCentral to provide an integrated communications platform. As Goldman Sachs notes:

…both legacy PBX vendors such as Avaya, Mitel, and Cisco, and legacy video conferencing solutions such as Cisco WebEx, BlueJeans, and LogMeIn/GoToMeeting, lack key features and integrations, have not innovated enough vs the next-gen vendors, and offer cap-ex heavy solutions, even as customers have shifted their consumption models to op-ex.

RingCentral

RingCentral, which was founded in 1999 and went public in 2013, is a leading player in the business communications and contact center solutions market. Its total revenue was ~$2 billion in 2022, with its CCaaS solution contributing $300 million of this. RingCentral's key products include RingCentral Office, a unified communications as a service (UCaaS) platform combining voice, video, team messaging, and collaboration. It also provides RingCentral Contact Center, a cloud-based contact center, and RingCentral Engage, a digital customer engagement platform.

RingCentral has a strong enterprise partnership base including Avaya, Atos, Alcatel Lucent, AT&T, Vodafone, Verizon, Mitel, BT, and AWS. Dialpad has fewer legacy provider partners than RingCentral and targets a cloud-friendly customer base. Dialpad also aims to offer end-users a better experience, with a customer success leader at Dialpad stating that at the enterprise level:

Ring[Central]… didn't have an app interface, whether that was a phone app or a desktop app. It just was hidden behind a desk phone. So, with the move to work from home, the frustration from enterprise customers really hit up where it was quickly had to move to a non-desk phone solution, and their app was just crappy. And they would see Dialpad and their jaws would fly [open].

Zoom

Zoom, founded in 2011 cross-sells its telephony product, Zoom Phone, as part of its overall business communications bundle, Zoom One. Zoom Phone has had record-breaking growth, hitting 5.5 million seats as of January 2023, 4 years after launch. Zoom also offers Contact Center and Rooms, a room audio-conferencing solution, aiming to become a full-featured Unified Communications and Contact Center solution. As a former customer success leader at Dialpad notes, Zoom Phone attempted to grow aggressively in the telephony business by bundling it free with Zoom Meeting. Dialpad has more expertise in telecommunications, with a stronger international presence. Dialpad retains an advantage with the enterprise but may lose out SMBs who are more price sensitive.

Point Solutions

Cloud-based phone system startups compete with Dialpad’s core business telephony product by offering a cheaper but smaller suite of products:

Aircall: Founded in 2014, Aircall is a cloud-based voice platform that integrates with productivity and helpdesk tools. It announced a $120 million series D in June 2021 at a $1 billion valuation, led by Goldman Sachs Asset Management. It has raised $225 million in total funding. Aircall is a French company with a more international customer base than Dialpad. As of June 2021, Aircall reportedly had 8.5K customers — 15% were based in France, 35% in the U.S., and 50% in other countries.

OpenPhone: Founded in 2018, OpenPhone announced a $40 million Series B led by Tiger Global in April 2022. San Francisco-based, OpenPhone targets US customers and SMBs with a sweet spot of “… between five and 500 employees.” As of April 2022, it handled 10 million calls and messages monthly for its customers.

Specialized Sales and Contact Center Solutions

As Dialpad sells its Sales and Contact Center solutions more aggressively, it’ll come up against specialized players in these spaces. The wedge Dialpad has here is its core competency in enterprise-grade, global phone systems – if an organization prizes a reliable phone system more than a specialized contact center, they may choose Dialpad. Players in Contact Centers include Five9.

Five9: Founded in 2001, Five9 is a public company that rejected Zoom's $14.7 billion acquisition offer in September 2021. It had a market cap of $4.1 billion as of May 2023.

Talkdesk: Founded in 2011, Talkdesk raised a $230 million series D at a $10 billion valuation. Talkdesk has raised $498 million since its inception and had 1.8K companies as customers, including IBM, Acxiom, Trivago, and Fujitsu, as of August 2021.

Business Model

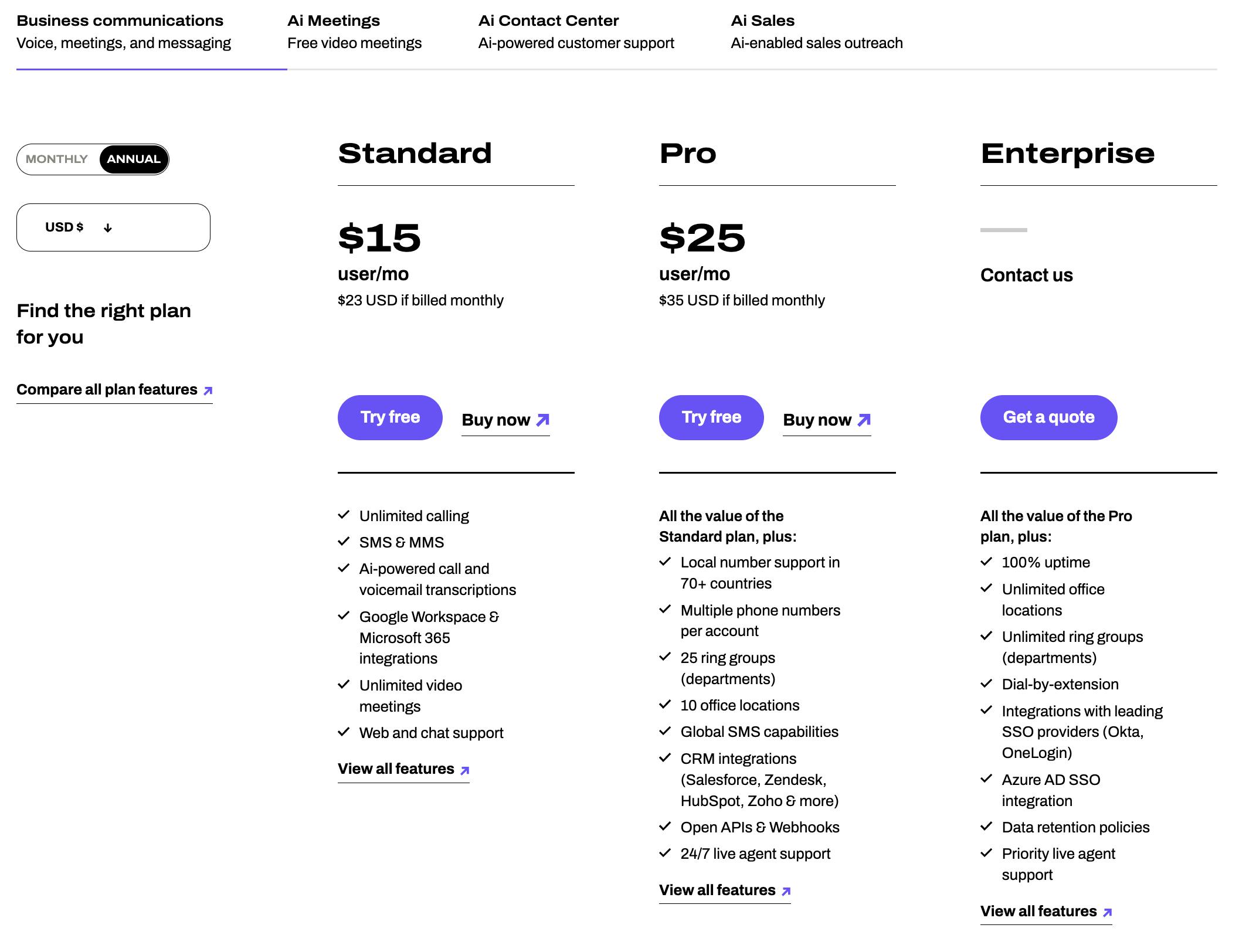

Dialpad offers a suite of four primary pricing plans for four offerings: Business Communications, Ai Meetings, Ai Contact Center, and Ai Sales. Its business communications offering has self-serve per-user pricing, with a free-to-try meeting product and enterprise pricing available upon request, whereas its Ai Sales and Ai Contact Center solutions are custom enterprise pricing.

Business Communications: This includes the core product bundle, voice, meetings, and messaging.

Source: Dialpad

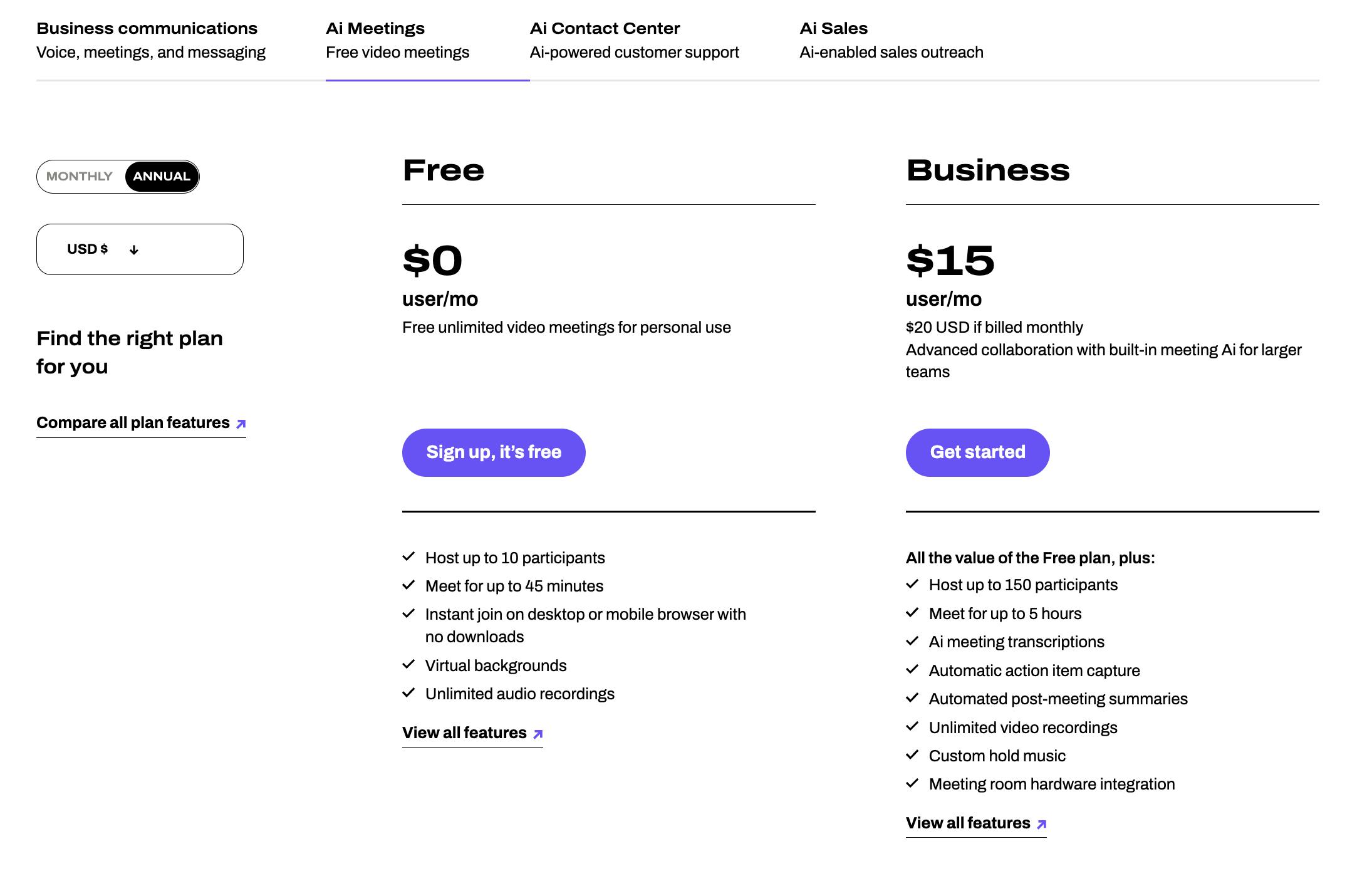

Ai Meetings

This product has two pricing tiers, a free tier ($0 per user per month) and a business tier ($15 per user per month).

Source: Dialpad

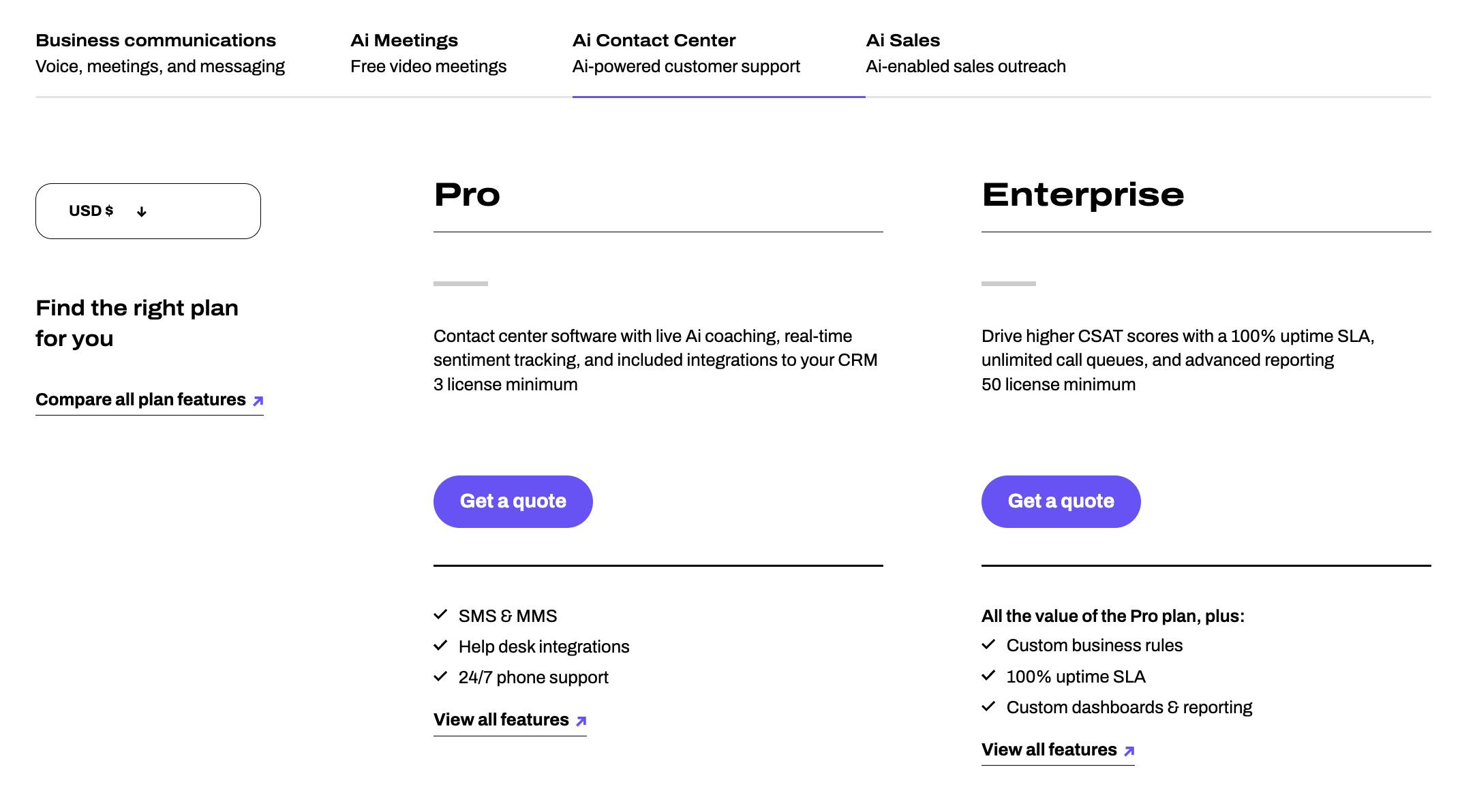

Ai Contact Center

This product's pricing is not listed publicly, with custom pricing for the enterprise.

Source: Dialpad

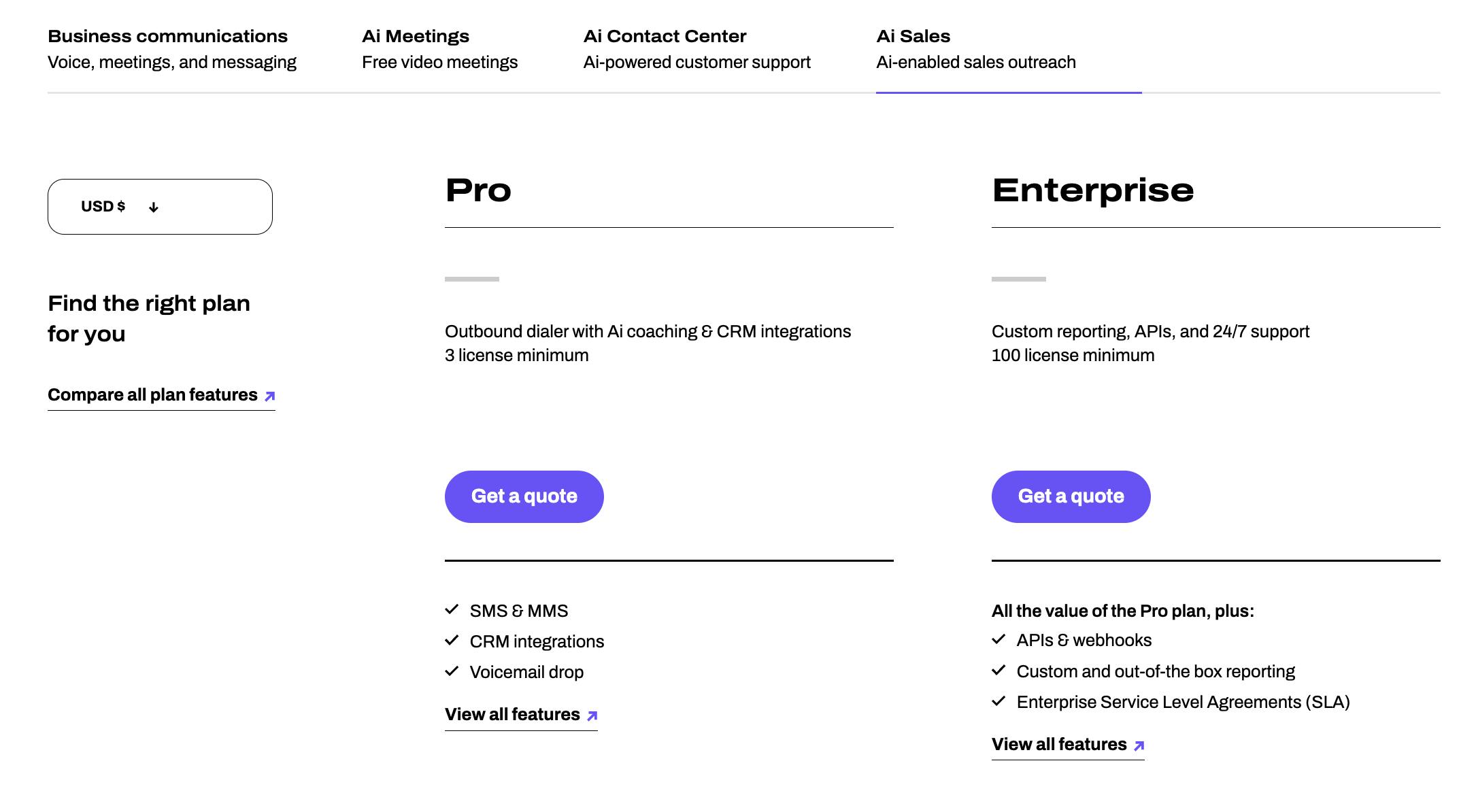

Ai Sales

This product's pricing is not listed publicly, with custom pricing for the enterprise.

Source: Dialpad

Traction

Dialpad announced $200 million in ARR in April 2023. It has more than 30K customers. Notable customers include Stripe, Uber, Splunk, PagerDuty, Toast, Drizly, Quora, TED, and Crunchbase.

Valuation

Dialpad announced a $170 million Series F at a $2.2 billion valuation in December 2021 led by ICONIQ Capital with participation from Amasia, GV, OMERS Growth Equity, Work-Bench, Section 32, and T-Mobile Ventures. It has raised $450 million in total funding as of May 2023.

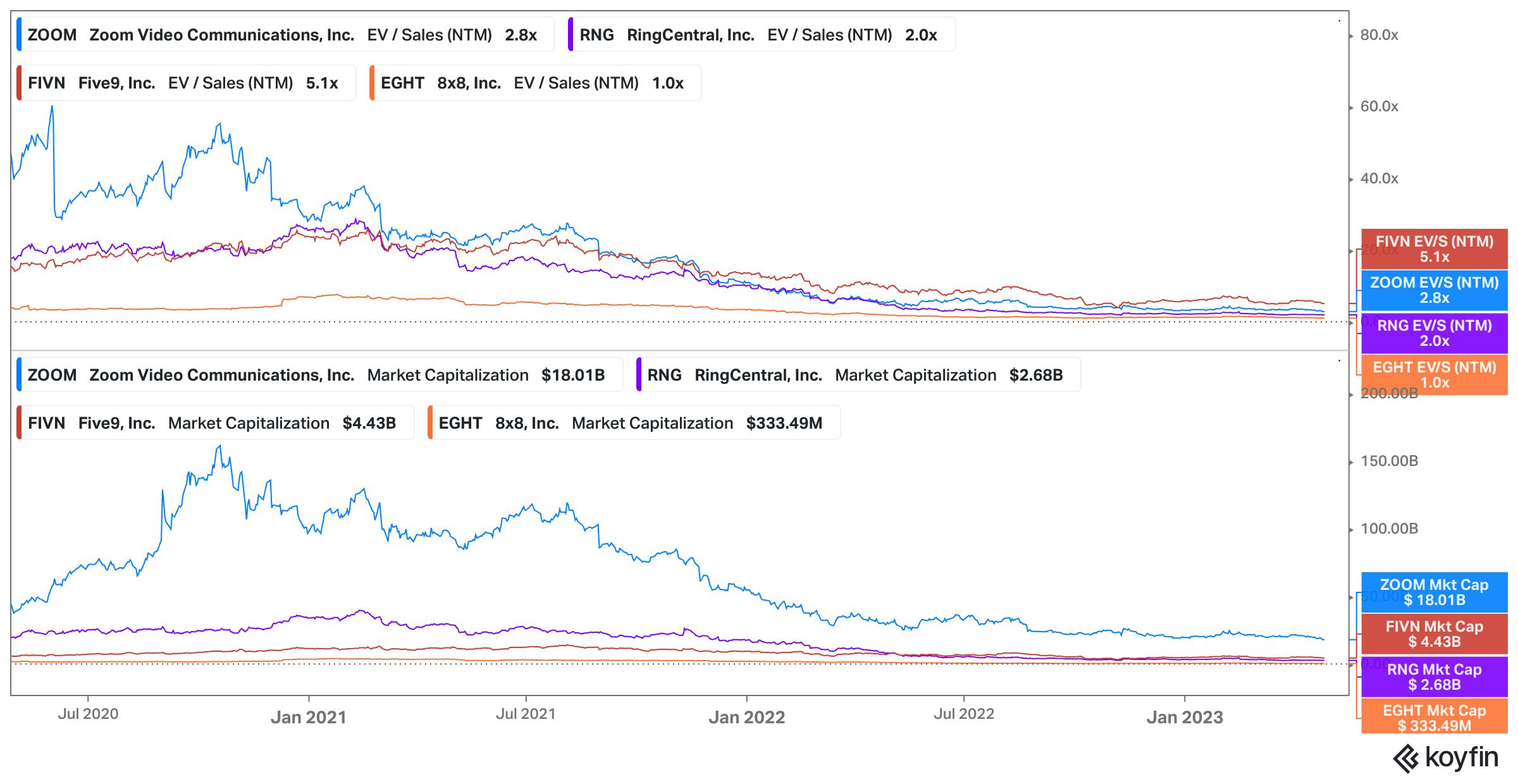

Dialpad’s closest competitors in the public markets are business communications players Zoom, RingCentral, and 8x8. Adjacent competitors include Five9, a contact center solution. Market caps for these companies range between $333.5 million (8x8) and $18 billion (Zoom), and revenue multiples range between 1x (8x8) and 5.1x (Five9).

Source: Koyfin

Key Opportunities

AI-led Product Innovation

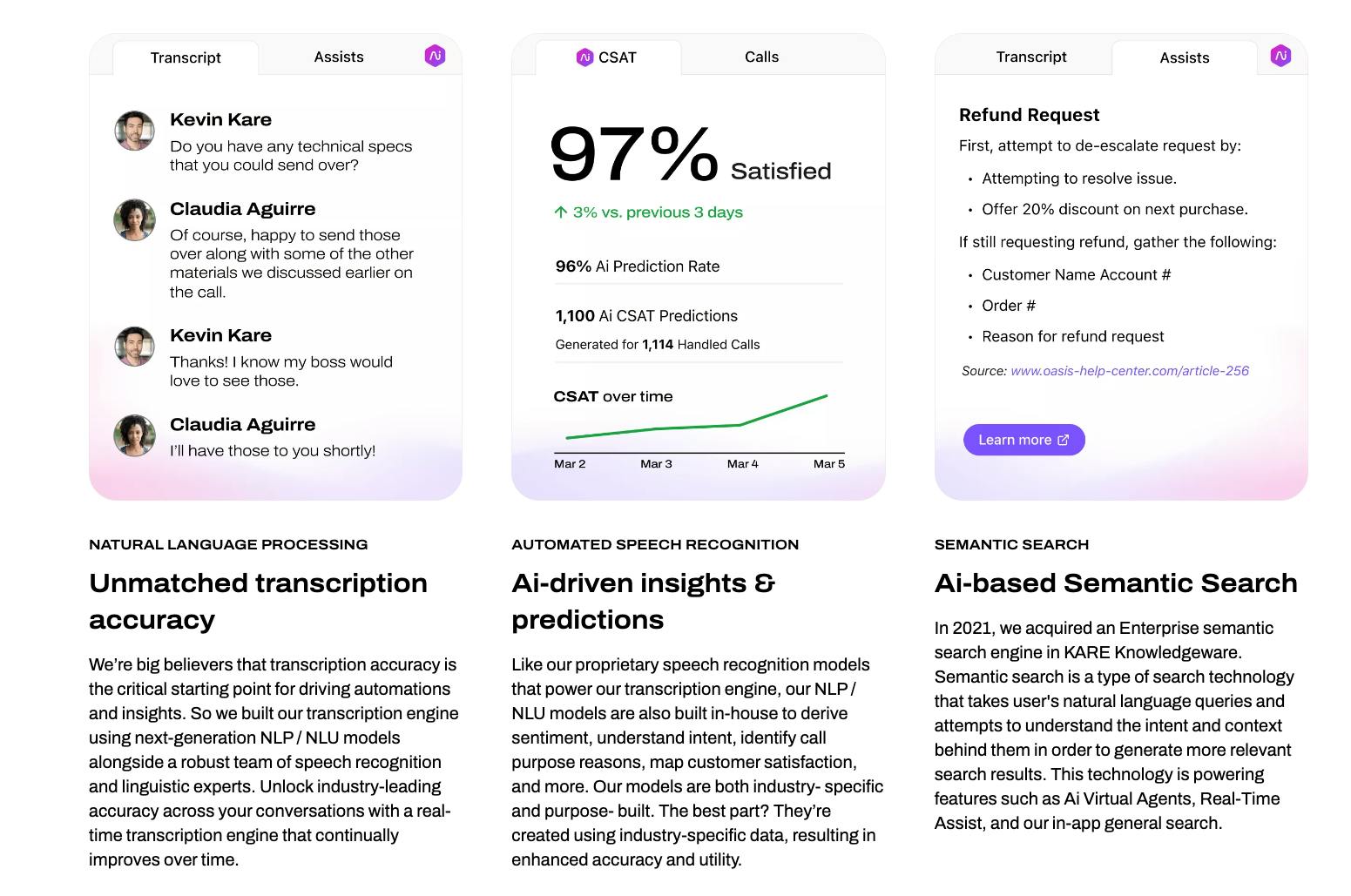

Dialpad is betting on AI as a differentiator and a major source of growth for the company, announcing over 4 billion minutes of meeting and voice data collected and a $50 million investment in the research and development of AI. In 2022, 9 research papers were published by Dialpad AI Engineers, with a large focus on NLP

Dialpad is leveraging generative AI for features such as Ai Recap to summarize meetings, Ai Scorecards to provide instructions to support agents, Coaching Hub, a real-time coaching platform, and Ai Playbooks, which provide real-time guidance and tracking against sales processes. In April 2023, Dialpad announced “access to Ai Scorecards in May, the Coaching Hub in June, and Ai Playbooks in July. All other updates are slated for later this year and early 2024.”

Source: Dialpad Ai Labs

Vendor Consolidation

Tighter budgets after the 2022 bear market made it harder for all software companies to land new deals and grow existing contracts. However, Dialpad can position itself as a cost-saving solution that provides business telephony, messaging, meetings, a contact center, and sales all in one. As Dialpad continues to drive innovation in its core wedge, business telephony, any business that views telephones as mission critical – whether real estate agents calling clients or WeWork office managers calling into headquarters – presents an opportunity for Dialpad to land and expand.

Key Risks

Channel Partnerships

A former customer success leader at Dialpad has noted that channel partners were critical for the company’s ability to land large enterprise deals.

While Dialpad has secured partnerships with T-Mobile and Google Cloud and an SVP of Global Channel Sales with a track record of success in the SaaS space, growing channel partnerships remains vital. RingCentral is a formidable competitor, with established partnerships with most legacy providers, major telcos, and cloud providers, including AWS, Avaya, Mitel, Atos, Alcatel-Lucent, Vodafone, Verizon, BT, and AT&T. It will be an uphill battle for Dialpad to establish a better market position against RingCentral.

Source: RingCentral

Pricing Pressure

Business communications is a large, attractive market with room for multiple players. New entrants may offer a cheaper, lower-quality service or bundle business telephony for free, exerting pricing pressure on Dialpad.

Zoom is an aggressive entrant into business telephony, scaling from 0 to 5.5 million seats on Zoom Phone 4 years after its launch. Players like Zoom have a strong wedge in the communications space. It can bundle telephony for free and subject Dialpad to pricing pressure.

Microsoft Teams is another giant in this space, offering a Teams Phone. Microsoft has not invested significantly to gain share here, with partnerships such as RingCentral for Microsoft Teams, but this could change and pose a similar risk to Dialpad as Zoom.

Summary

Dialpad, founded by Google Voice veterans, executed from a cloud-based phone system into a unified business communications platform, combining telephony, meetings, messaging, and more. With over 3K customers and $200 million in ARR, Dialpad has established a solid foothold but faces competition from players such as RingCentral and new entrants such as Zoom.

Dialpad aims to differentiate itself through its unified platform, combining data from all its channels into analytics and an integrated AI solution. Dialpad has collected over 4 billion minutes of proprietary voice and meeting data, powering features such as summarization and AI Coaching. Armed with omnichannel communications and higher-level AI features, Dialpad is expanding into external business communications by pushing into contact centers and sales, entering the territory of point solutions in these areas.