Thesis

Customer service helps companies build relationships with customers, increase brand affinity, and drive top-line growth. In 2021, 45.9% of businesses said that customer service was a top priority in the next five years. In June 2022, 61% of businesses reported increased customer support call volumes over the previous two years, with 58% expecting call volumes to continue to grow. To meet this rising demand, companies are increasingly investing in customer experience (CX) management tools, with the CX management market estimated to grow from $19 billion in 2024 to $43.4 billion by 2029.

Customers expectations, however, are changing. In 2021, over 65% of customers said their customer service expectations had risen significantly compared to the previous year. According to a 2023 report, two-thirds of millennials expected real-time customer service, while 75% of all customers expected consistent cross-channel service. A 2024 report found that 25% of customers would churn after just one bad experience with an agent.

Artificial intelligence might help companies increase customer satisfaction and retention at scale. A 2024 report found that 70% of consumers believed “AI has become a modern part of customer service,” while 67% of customer experience leaders believed AI bots could build stronger emotional connections with customers than humans. This would explain why a 2024 survey found that 44% of leaders in organizations with 5K+ employees planned to “somewhat increase investment” into providing agents with Generative AI tools, while 30% planned to “greatly increase investment.”

Cresta delivers real-time intelligence for call centers and builds AI-powered products to help agents, managers, and leaders grow revenue and improve efficiency. Its suite of products — built on its Ocean-1 AI model — coaches agents in real time based on analysis from top performers. Its products also allow managers to track agent progression, and enable executives to make data-driven decisions. According to Cresta, as of February 2024, its customers saw, on average, increased customer satisfaction (CSAT) of 20%, 30% faster onboarding, 15% lower handle time, and 25% higher revenue per lead.

Founding Story

Cresta was founded by Zayd Enam (former CEO) and Tim Shi (CTO) in 2017. Enam and Shi first met at Stanford, where they were both PhD students from 2015-2017. The pair shared the philosophy that AI could enhance rather than replace humans, meaning humans should be included in the engineering feedback loop.

In June 2017, as part of his research, Enam gave a presentation outlining how AI could be used to empower people and make them more effective in their day-to-day work. Enam shadowed sales and support teams, observed blockers, and built tools to help automate basic workflows, including systems that helped agents resolve an inquiry or provided real-time prompts that guided agents through a conversation.

Within a few weeks, the first company that Enam worked with generated $100K in incremental sales per month. Enam’s work caught the eye of his PhD advisor Dr. Sebastian Thrun (creator of Google X). Recognizing the potential applications of this research, Thrun urged Enam to drop out of his PhD program and start his own company. A week later, Enam and Shi both dropped out and founded Cresta.

In the early days, Cresta had a slow start. The company needed to build its technology in-house versus competitors who were using off-the-shelf AI. Enterprises were also afraid to take a risk on a relatively untested product. After dozens of customer rejections, Enam accepted an internship with Intuit as an opportunity to test his product from the inside. Five months later, Intuit signed on as a customer, and Enam was able to take this newfound credibility to attract additional enterprise customers.

In May 2023, Enam stepped away as CEO into an advisory position. In his place, Ping Wu, a former Google AI executive, was appointed CEO. Wu remained CEO as of February 2024.

Product

Cresta provides generative AI solutions for improving contact center operations across sales, customer care, collections, and retention.

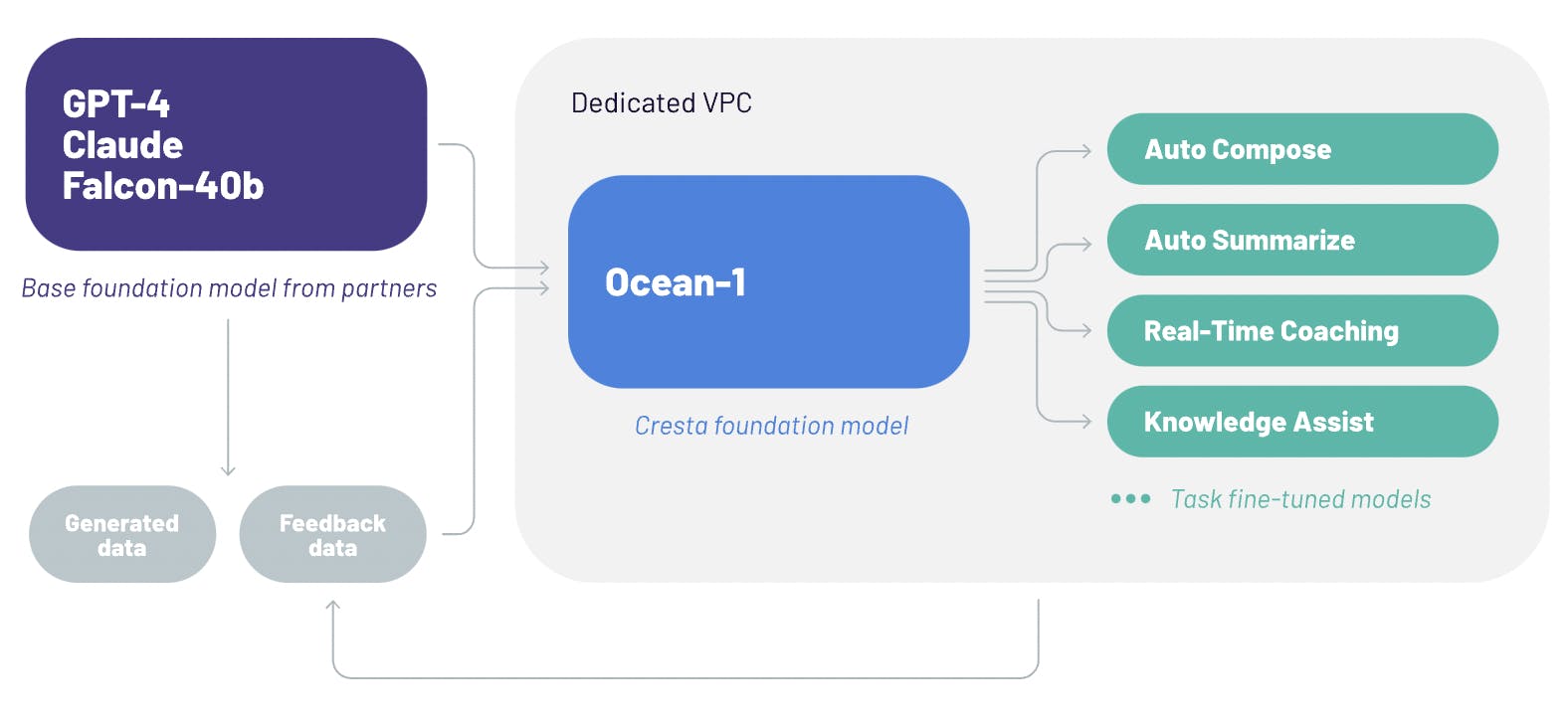

The company’s products run on Ocean-1, an AI model announced in June 2023, which Cresta dubs “a foundational model for the contact center.” This model utilizes LLMs such as Claude, Falcon-40b, and OpenAI’s GPT-4 as a base — and then leverages domain-specific data to enhance performance in contact center applications.

Ocean-1 integrates synthetic and customer-specific data for training and improves based on feedback. It is designed to achieve three goals:

Enhance base model capabilities for contact centers

Improve adherence to instructions through feedback learning

Optimize for lower latency and reduced operational costs.

Source: Cresta

Customers can interact with Ocean-1 through Cresta Opera, a no-code Generative AI platform. Opera provides ready-to-use AI models and allows users to customize models for their specific use cases.

As of February 2024, Cresta offers the following products:

Agent Assist: including Knowledge Assist, and Auto Summarization & Note-taking

Post-Call: including Cresta Insights and Cresta Director

Agent Assist

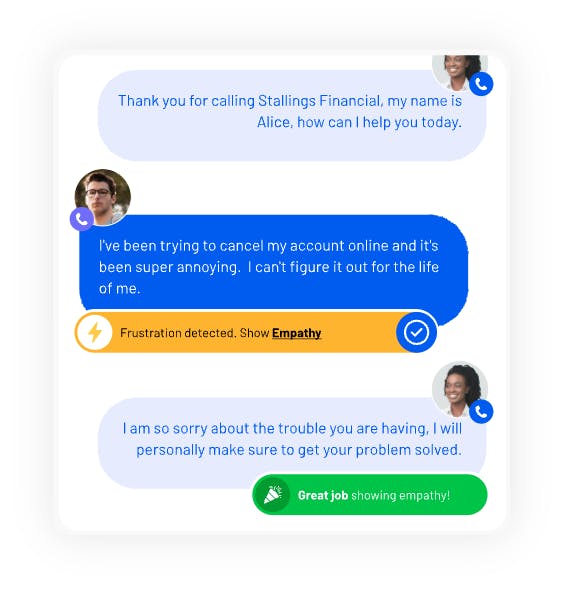

Agent Assist offers front-line assistance to both voice and chat customer service agents. It takes best practices from top performers and applies them across the rest of the team, guiding agents through customer conversations with real-time coaching, assistance, and automation. Its features include AI Coaching, Knowledge Assist, Auto Summarization & Note-taking, and Smart Compose & Suggestions.

Agent Assist serves two objectives:

Improve agent efficiency: By automating repetitive tasks through features such as Smart Compose, Cresta helps agents focus on higher-leverage issues that require human input. As of February 2024, Cresta claimed that features such as Smart Compose could save agents up to five hours of work per week.

Boost agent effectiveness: Cresta’s AI Coaching equips customer service agents with a personalized AI coach for every phone and chat interaction. This coach is designed to enhance agents’ soft skills and adherence to established best practices.

Source: Cresta

By providing agents with the tools they need to resolve customer issues, Cresta Agent Assist helps improve agent productivity and skill sets, while reducing new employee ramp-up time. For example, in a March 2022 testimonial video, Crissa Graham, Director of Marketing at Holiday Inn Club Vacations said:

“The real-time coaching has been a real game changer. [It] has allowed us to cut anywhere from two to five minutes off of our calls. We did see a bump on the metrics. We are basing our agents on what we call ‘bookings per day’, and we have seen an increase in that.”

Another customer, Michael Hopkins SVP of Sales & Service for Blue Nile, said in the video:

“For an agent that is working directly with a customer to have that real-time feedback, and have the suggestions and tips that they can use to create a better experience for the customer — that was a real game changer for us.”

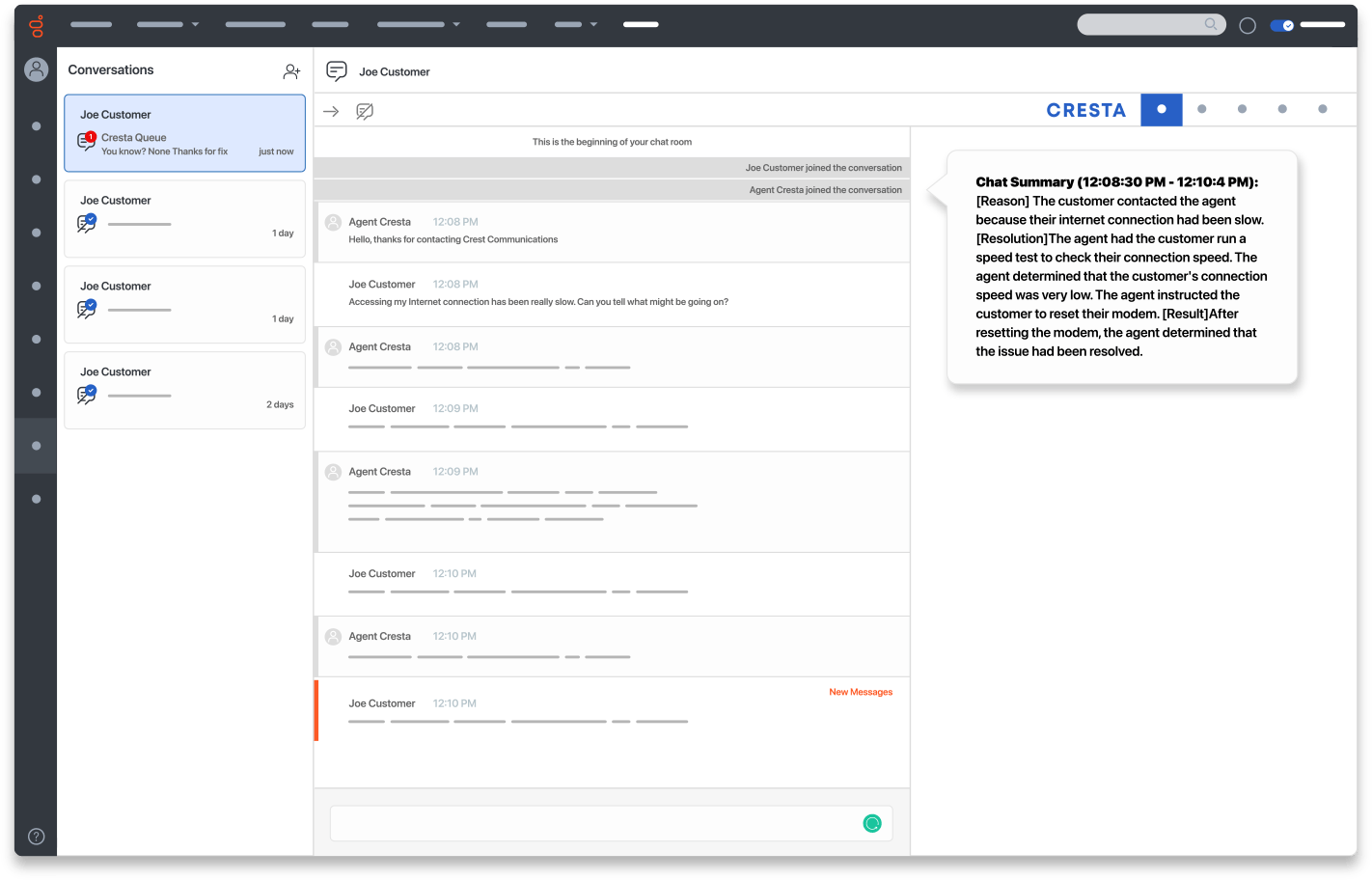

Post Call

Cresta’s Post Call offering has two components: Cresta Director and Cresta Insights.

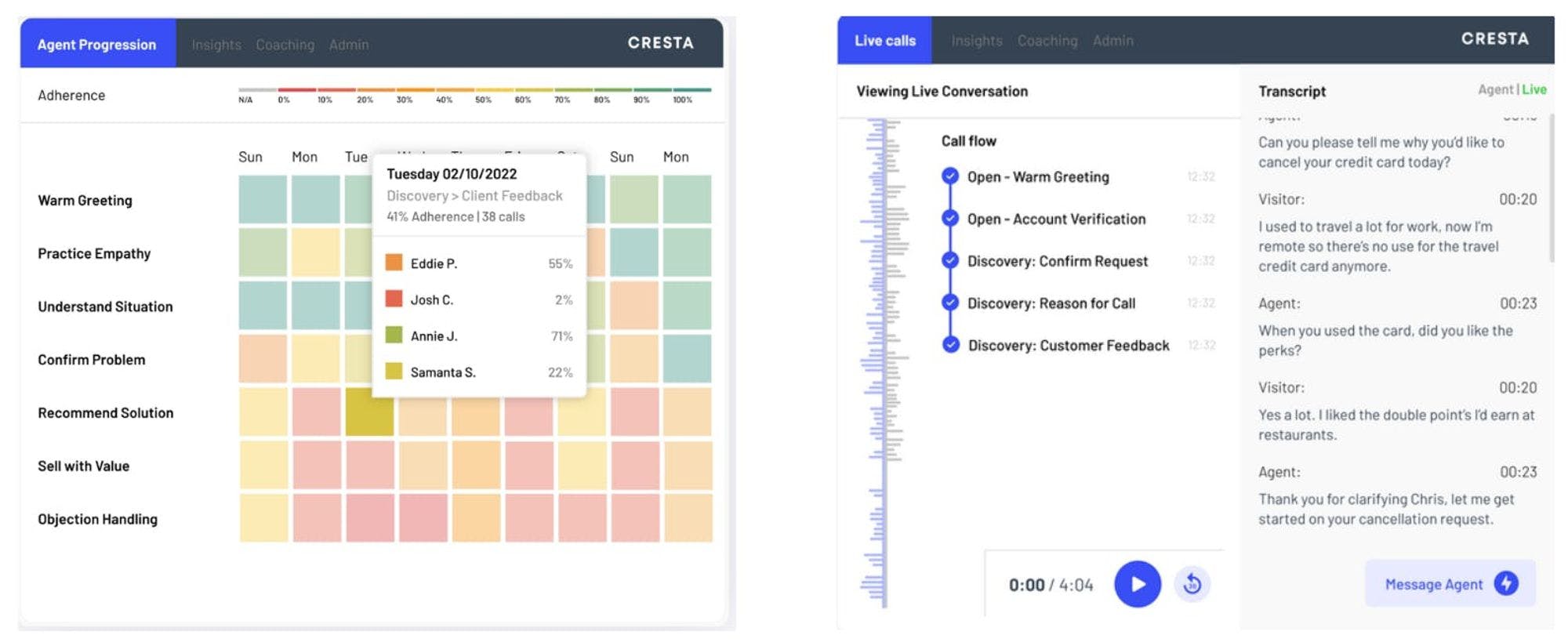

Cresta Director is a coaching, quality assurance (QA), and performance management tool for front-line managers in customer service teams. It enables managers to measure performance insights from every agent conversation and key metrics, including average handle time (AHT), conversation volume, and whether agents practice skills and behaviors.

Managers can use Cresta Director to evaluate individual team performance, identify coaching gaps, and develop personalized coaching plans within one interface. Managers can also save past customer service conversations and share them with agents to help with onboarding and performance improvement.

Source: Cresta

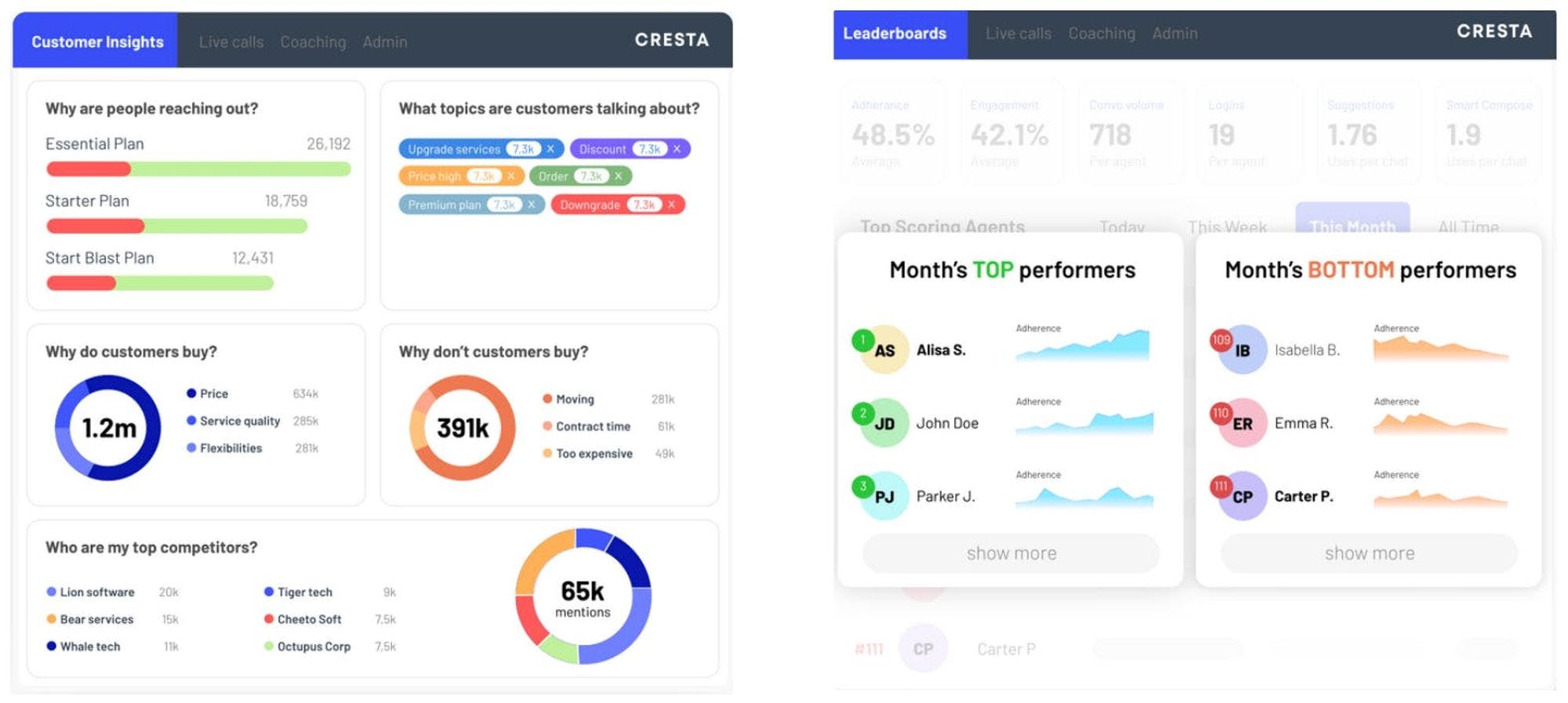

Cresta Insights is a call center analytics dashboard. It reports on customer’s behaviors, critical business questions, and key agent metrics such as who the top performers are, why they are doing well, and how to motivate agents. These data provide strategic information to executives about overall customer experience, what types of requests are most frequent, and which products are selling.

For example, users can use Cresta Insights to answer questions such as: “What are the top reasons my customers are calling in?”, “How is the new pricing and packaging strategy performing?” and “What are the top reasons customers are calling in?” Company leadership can use the answers to these questions to make data-driven decisions and inform business and contact center strategies.

Source: Cresta

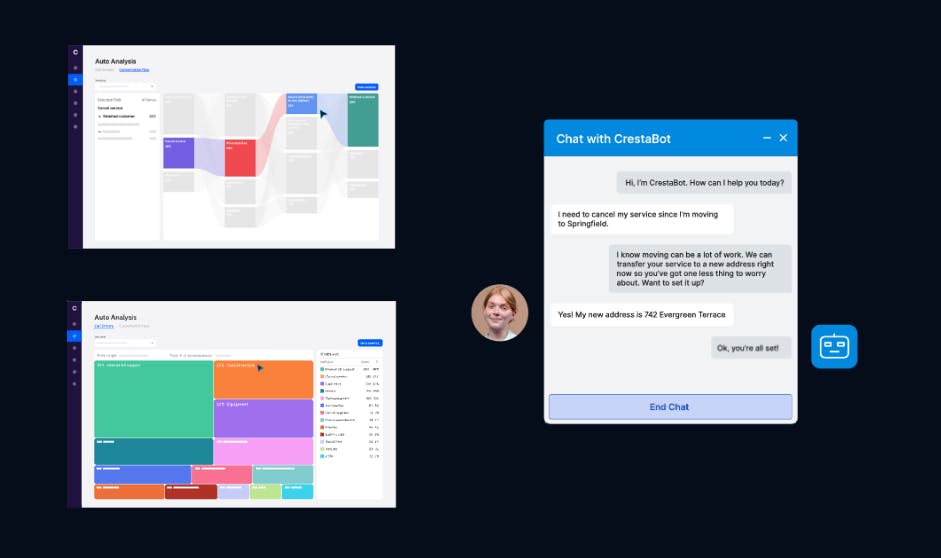

Virtual Agent

With Virtual Agent, users can build an AI-assisted chatbot tailored to their specific needs. These chatbots can understand conversation drivers and business outcomes such as solved care cases, purchases, upsells, or retentions.

After companies integrate their conversation data, Cresta’s Virtual Agent identifies and prioritizes use cases with the highest ROI. It then analyzes conversations, identifying and categorizing both agent and customer behaviors, including deviations from desired outcomes and strategies for realignment. Once deployed, these chatbots analyze customer inputs to guide conversations toward desired outcomes. When necessary, virtual agents facilitate transitions to live agents with detailed summaries for context.

Source: Cresta

As of February 2024, Cresta’s website detailed how an “internet service provider” had saved 27K hours of agent chat time in one quarter thanks to Virtual Agent; and how a “high-end retailer” had seen a 10X return on investment (ROI) after implementing the product.

Partners & Integrations

As of February 2024, Cresta integrated with “the best contact center technologies, business process outsourcing services and consulting services to accelerate time to value, maximize performance and optimize ROI for our customers.”

The company’s network of partners is made up of strategic partners, technology partners, and consulting & services partners. Strategic partners include Genesys, Five9, and Zoom — all investors in the company. Cresta’s partnership with Genesys allows customers to connect both services “with a turn-key, painless setup”. Customers can then use Cresta inside the Genesys platform, or side-by-side. Similarly, Cresta integrates with Five9 chat and VoiceStream.

Source: Cresta

Technology partners include Avaya, Cisco, Twilio, Liveperson, and Amazon Web Services (AWS). Cresta’s software solutions are hosted on AWS and can be purchased through the AWS marketplace. The company also partners with AWS Contact Center Intelligence (CCI) and AWS Connect “for complementary technologies that help our customers create competitive advantage through amazing customer experiences.”

As of February 2024, AdvisoryHub, Concentrix, and Neuraflash were consulting and services partners.

Market

Customer

As of February 2024, Cresta targets companies across the following industries: automotive, retail, telecommunications, airlines, travel & hospitality, finance, and insurance. Cresta’s ideal customer profile is an enterprise with a large team of contact center agents. At this scale, these companies have enough data points for Cresta’s AI technology to capture repetitive patterns across conversations that multiple agents have, glean insights, and derive best practices from it. In an April 2021 interview, former CEO Zayd Enam noted:

“It was clear that the biggest market by far was in the enterprise, because the enterprise had the largest customer-facing context and operations and it was the biggest place where you can just have a huge impact and huge value.”

As of February 2024, Cresta customers included Cox Communications (250 customer service agents), Holiday Inn Vacations (500 agents), Vivint (300 agents), as well as one “leading vacations provider” (50 agents), a “top telecommunications company” (1.5K agents), and a “leading cloud SaaS provider” (50 agents). Other customers featured on the company’s home page as of February 2024 include Hilton, Intuit, Porsche, and Carmax.

Source: Cresta

Cresta aims to provide executives with the ability to mitigate costs, train their employees more effectively, and improve customer relations. As of February 2024, Cresta highlighted that its customers saw, on average, an increased CSAT of 20%, 15% lower handle time, 30% faster onboarding, and 25% higher revenue per lead.

Market Size

The customer experience management market was estimated at $19 billion in 2024 and was expected to reach $43.4 billion by 2029, growing at a CAGR of 17.9% during the 2024-2029 forecast period. Key growth drivers include (1) a growing focus on providing highly personalized customer experience in companies (2) customers being increasingly accustomed to personalized, user-friendly relationships with companies, and (3) customers increasingly turning to self-service tools like chatbots.

According to a 2024 report, 59% of consumers “believe the way they interact with a company will completely change within two years”, while 70% believe “AI has become a modern part of customer service.” Another 2024 report found that 25% of customers would defect after just one bad experience with an agent. Customer care teams are responsible for not only building robust net new customer relationships but also maintaining existing customers to ensure brand loyalty. As a result, companies are looking for automation (e.g. bots) or intelligence tools, similar to Cresta, to reduce handle time, improve customer satisfaction rate, and utilize agent resources to resolve more intricate issues. Moreover, 67% of customer experience leaders believe bots can build stronger emotional connections with customers than humans.

Businesses have moved toward a digital-first contact approach to customer service. In 2024, 71% of businesses use digital channels — such as chatbots, messaging, and email — for first contact and voice for resolving more complex customer issues. Customers, however, expect seamless interactions between these channels according to a 2024 report. Cloud-based contact centers give businesses the capability to access real-time customer information and centralize their communication across multiple channels. They also allow agents to work from any part of the world, especially critical as the COVID-19 pandemic distributed workforces.

A 2024 survey found that 44% of leaders in organizations with 5K+ employees were planning to “somewhat increase investment” into providing customer service agents with Generative AI tools, while 30% planned to “greatly increase investment.”

Competition

There are two categories of competitors for Cresta: (1) AI-led players that, like Cresta, help maximize agent performance and pinpoint coaching opportunities; and (2) Cloud Contact Centers, some of which do not compete with Cresta directly, but could in the future; and others who have fully integrated Cresta-like AI into their offerings.

AI-Led Players

Balto: Founded in 2017, Balto is a generative AI platform that enhances contact center operations by providing real-time assistance, coaching, and analytics to improve agent performance and customer satisfaction. Balto focuses on voice-based teams, whereas Cresta is omni-channel across voice and chat. Balto has also raised less funding than Cresta, having raised a total of $52 million in funding as of February 2024. In June 2023, the company announced it had reached 200 million conversations “guided in real-time”, up 2x since January 2022. Notable customers include Rent-2-Own, AmTrust, and Health Plan One.

Observe AI: Founded in 2017, Observe AI also provides coaching, reporting, and analytics tools for contact centers. Like Cresta, which runs on Ocean-1, Observe is built on a proprietary “30 billion-parameter contact center LLM” as of February 2024. As of February 2024, it had raised over $214 million in total funding, having raised a $125 million Series C in April 2022. As of February 2024, Observe served 200+ companies and organizations.

Cogito: Founded in 2007, Cogito is an AI-driven platform providing real-time coaching and guidance for contact centers. Cogito is a spinout from the MIT Media Lab, and initially focused on assisting healthcare providers to detect mental health issues and PTSD in soldiers. Like Balto, Cogito’s platform is much more geared towards voice-based teams and particularly specializes in voice and behavior coaching for agents. Though Cresta’s AI service emphasizes coaching less than Cogito's, it still seeks to compete based on customer service agent tools and AI assistants. As of February 2024, Cogito had raised nearly $156 million in funding and counted five of the Fortune 25 companies among its clients, along with four of the “top 5 National Health Insurers” and two of the “top 5 US Cable Providers”.

Cloud Contact Centers

In the long term, larger players like Nice, Amazon Connect, Genesys, and Five9 may become competitors to Cresta as they build or acquire more robust automated Contact Center as a Service (CCaaS) solutions. CCaaS incumbents largely view AI-led automation players as partners rather than direct competition, as indicated by Zoom, Genesys, and Five9’s strategic investments in Balto and Cresta.

However, the line continues to blur. Nice, Amazon Connect, Genesys, and Five9 all featured their AI capabilities on their home pages as of February 2024. Talkdesk is one example where the line has blurred completely; in October 2023, the company announced it had layered generative AI across its entire contact center platform.

Nice: Founded in 1986, Nice is a customer experience (CX) platform. It offers solutions across customer experience, financial crime, compliance, and data analytics. Nice is a publicly traded company (NASDAQ: NICE) since 1996. As of February 2024, it had a market capitalization of $14.3 billion. While Nice offers a comprehensive suite of solutions that cater to a wide variety of industry needs, Cresta focuses more narrowly on optimizing customer service operations. As of February 2024, Nice had been used by over 1 million agents worldwide.

Amazon Connect: Amazon Connect is a cloud-based contact center solution designed for setting up and managing customer contact centers at any scale. Launched in 2017, it was born out of Amazon’s own need for a highly efficient customer service system. It allows organizations to set up and manage a customer contact center with ease, leveraging the power of AWS cloud infrastructure for reliability and scalability. Some of its features, such as the AI-powered assistant Amazon Q, and its analytics dashboard compete with Cresta’s products directly. As of February 2024, customers include CapitalOne Bank, the DC government, Intuit, and Adobe. Amazon Connect is part of Cresta’s partnership with AWS as of February 2024.

Genesys: Founded in 1990, Genesys is a legacy player in cloud customer experience and contact center solutions, offering software to manage customer interactions across voice, text, web chat, and social media. Genesys provides tools for AI-powered automation, analytics, and workforce engagement. It caters to businesses aiming to improve customer service and operational efficiency. Unlike Cresta which is a purely enterprise solution, Genesys targets businesses of all sizes. As of February 2024, Genesys says its customers experience up to a 400% increase in digital sales, a 25% increase in agent productivity, and 100% ROI in less than three months. Customers included BBVA, Quicken, Vivo, Singapore Airlines, and Vodafone as of February 2024. Genesys was acquired by private equity fund Permira in February 2012 for $1.5 billion. The company was an investor in Cresta’s Series C funding round.

Five9: Founded in 2001, Five9 is a cloud contact center provider offering solutions to manage customer interactions across voice, email, chat, social media, and video. Its platform leverages AI to enhance customer service through automation and data-driven insights, similar to how Cresta uses AI for real-time coaching of customer service agents. Like Genesys, Five9 was an investor in Cresta’s Series C round. Five9 has been a public company (NASDAQ: FIVN) since 2014. It had a market capitalization of $5.2 billion as of February 2024. As of February 2024, notable customers included Alaska Airlines, Estée Lauder, Teladoc Health, and Wyndham.

Talkdesk: Founded in 2011, Talkdesk offers a cloud-based contact center platform designed to improve customer interactions across voice, video, chat, and social media. In October 2023, the company announced “significant product updates that deepen the integration of generative AI (GenAI) within its flagship Talkdesk CX Cloud platform and Industry Experience Clouds.” Many of its features, such as Automatic Summary, Agent Assist, Virtual Agent, and AI Trainer compete directly with Cresta’s products. As of February 2024, Talkdesk had raised almost $500 million; it raised a $230 million Series D in August 2021.

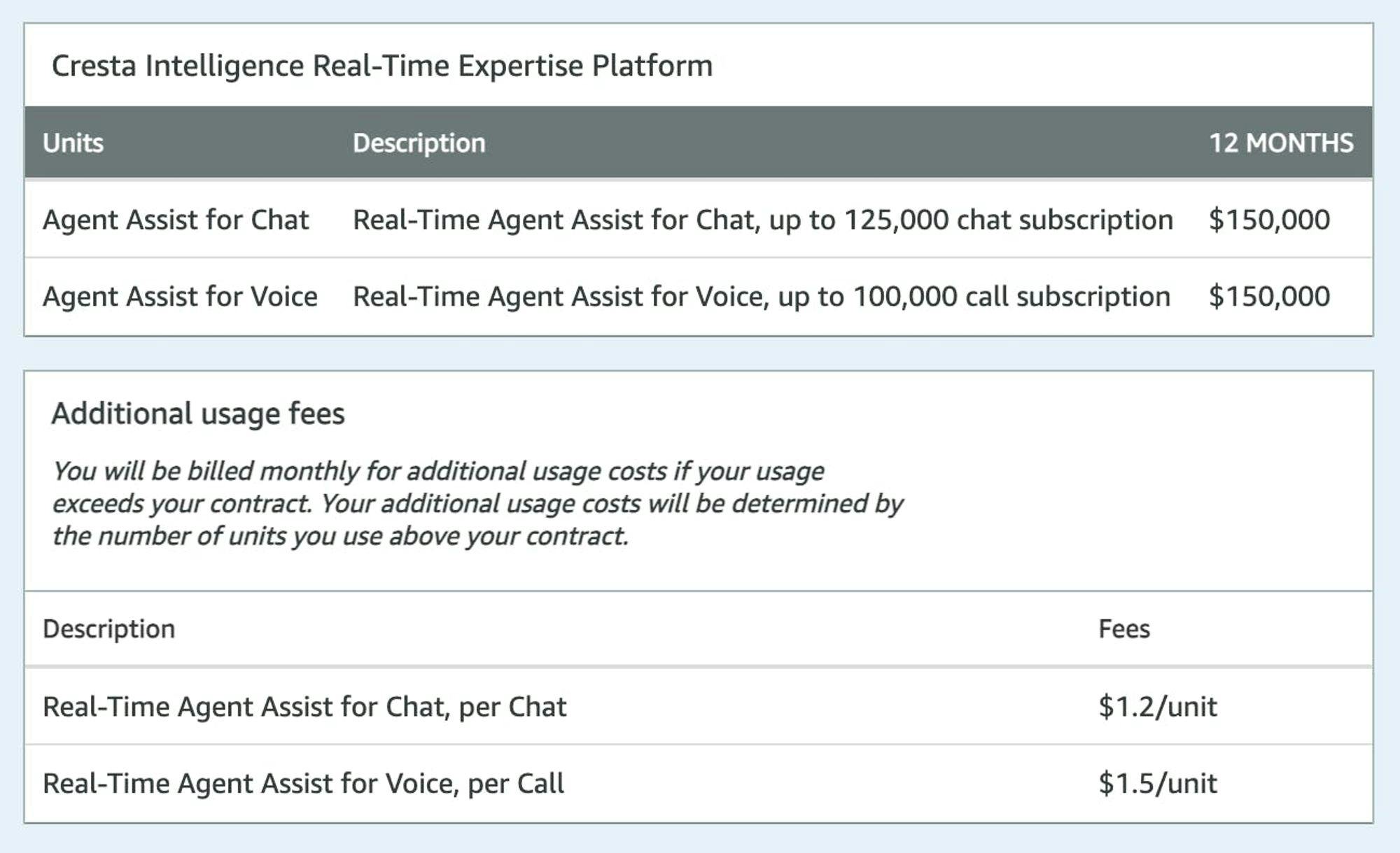

Business Model

As of February 2024, Cresta does not share its pricing publicly. The company offers a customized plan based on each customer’s needs and targets. However, in some instances — as is the case when customers purchase the company’s services via the AWS marketplace — Cresta bills per contact (i.e. number of chat and voice interactions). Terms can vary depending on contract length.

Source: AWS Marketplace

According to past customers, in 2021 Cresta often offered an attractive upfront rate for the pilot, which could convert to a more fully-fledged contract if certain ROI targets were met. By doing this, Cresta got a foot in the door with potential clients and earned the customer’s trust by delivering on specified outcomes. In March 2022, customers often started by signing five or six-digit deals to test Cresta’s software in a business unit before expanding usage to other teams.

Traction

Cresta had a slow start following its founding in 2017. At the time, enterprises — which Cresta targeted — were reluctant to sign up for a relatively untested product. The company faced dozens of customer rejections until former CEO Zayd Enam decided to intern with Intuit, seeing it as an opportunity to test the product from within a large enterprise. Five months later, Intuit signed up as a customer.

In 2020, Cresta quadrupled its revenue. The company then tripled its revenue in 2021 and reached tens of millions in revenue in 2022. At the time, Cresta was also approaching 100 customers, including large companies like Verizon, CarMax, and Porsche. In a 2022 interview, however, Enam noted that a big driver of Cresta’s revenue growth was not new customers but rather existing users, as demonstrated by Cresta’s Net Revenue Retention (NRR) of 210% in 2021.

In 2022, the company announced strategic partnerships with Zoom and Genesys (both investors in Cresta’s Series C raise), making Cresta’s technology more easily accessible to customers of both partners. As of February 2024, Cresta had processed over 100 million conversations and was growing 3X year over year with an NRR of 150%.

Valuation

Cresta had raised a total of $151 million across four funding rounds as of February 2024. In March 2022, Cresta raised an $80 million Series C round led by Tiger Global, with participation from key strategic investors, including Genesys, Five9, and Zoom. Previous investors Sequoia Capital, Greylock Partners, Andreessen Horowitz, and Porsche also participated. This round put Cresta’s valuation at $1.6 billion, quadrupling it in a year.

In 2022, Cresta’s revenue had reached double-digit millions. Since then, the company has grown 3X year over year as of February 2024. Assuming Cresta’s 2023 revenue was within a $30-$50 million ballpark, the latest valuation would imply a 32-54x revenue multiple.

As of February 2024, publicly traded contact center software companies like Five9 and Nice have seen their revenue multiples decline from a high of 30x and 10x in 2021 to current levels of 6x and 5.7x, respectively.

Source: Koyfin

Key Opportunities

Establishing a Data Moat

Customer service software is a relatively commoditized product, as evidenced by the number of players in the space like Balto, Cogito, and Observe. It is difficult for automation players to command strong pricing power unless their technology is sufficiently differentiated. Building a strong data moat can help prevent commoditization. Cresta’s models are largely trained on chat and voice history data. However, as Leigh-Marie Braswell from Founders Fund puts it:

“It’s important to note that a company’s competitive advantage isn’t just the private data used to train the model initially, but the additional data you get when customers interact with the model, telling it what is right, wrong, and sometimes what the answer should be instead.”

Cresta, however, has taken steps to address the above. In March 2023, Cresta expanded its generative AI solutions to allow managers to identify and prioritize key behaviors. In June 2023, the company launched Ocean-1, a proprietary AI model with a strong emphasis on user feedback. With these new features, Cresta can continue to strengthen its data moat while improving its own customer experience.

Category Expansion

Cresta launched as an agent coaching tool — arguably a point solution, not a platform yet. This left the company vulnerable to competition from larger platform players like Genesys if they decided to enter the coaching space. As of February 2024, however, Cresta had expanded its suite of products to become an “end-to-end AI platform”, with solutions across sales, customer care, collections, and retentions. By doing this, Cresta has broadened its value proposition and expanded its addressable market. If Cresta continues to execute well on this it stands to not only compete more effectively with platform giants like Genesys, but also encroach the territories of similar companies like Balto, and even cloud contact centers such as Talkdesk.

Key Risks

High Scaling Costs

Scaling an AI-driven customer engagement platform like Cresta involves significant challenges, including rising infrastructure costs, operational expenses, and the need for continuous innovation. For example, cloud spending is crucial for supporting AI operations, with AI-related cloud investments reaching as high as $200 billion globally by 2025 according to a 2024 report by Deloitte. Notably, Cresta’s AI software solutions were hosted on AWS as of February 2024. Continued innovation is also key to staying competitive and lowering scaling costs.

In recent years, Cresta reduced labeling costs significantly (over 10x in 2020) by decreasing the number of labeled samples required to train a classifier from a few thousand to a few hundred per customer. However, continuously fine-tuning a proprietary AI model such as Cresta’s Ocean-1 can be computationally and financially expensive. This is where talent acquisition, another key area, comes into play. While good AI engineers can lower the cost and amount of work necessary to fine-tune an LLM, they can also be costly. As of November 2023, AI specialists’ salaries often exceeded $100K annually. Efficiently managing these factors — infrastructure, innovation, and talent retention — is essential for sustainable growth.

Economic Volatility

Given the volatility of the market in 2023 that may extend into 2024, companies have been looking to consolidate vendors, potentially opting for larger, all-in-one platforms such as Genesys or NICE. Cresta also targets enterprises, which have long sales cycles. A potential slowdown in topline growth, combined with high development costs, would increase pressure on product and GTM execution. As customers increase scrutiny on vendor ROI, delivering on promised success metrics and professional services support will be crucial.

Summary

Customer support is becoming a high priority for companies. The quality of support can make a material difference in revenue growth and customer retention. Customers’ expectations, however, are changing: two-thirds of millennials expected real-time customer service, while 75% of all customers expected consistent cross-channel service as of 2023. Additionally, a 2024 report found that 25% of customers would defect after just one bad experience with an agent.

Cresta has seen success addressing this problem, with its users reporting on average an increased CSAT of 20%, 25% higher revenue per lead, 15% lower AHT, 30% faster onboarding, and as much as a five-hour reduction in repetitive tasks for agents every week. That said, whether Cresta can overcome scalability challenges and encroaching competition from larger platform players remains a question. By deepening its data moat and strengthening its position through continued category expansion, Cresta can prepare itself for these challenges.