Thesis

Last-mile delivery, where goods move from a distribution hub to their final destination, is one of the most complex and costly parts of the delivery process, accounting for 53% of overall delivery costs as of December 2021. Moreover, relying on combustion-engine vehicles such as trucks and vans for last-mile delivery contributes to traffic congestion and pollution. As consumer preferences increasingly tilt toward greener, more cost-effective, and quicker delivery solutions, the traditional model of distributing packages by hand may become outdated. Drones, or Unmanned Aerial Vehicles (UAVs), are a way of reducing both the high costs of last-mile delivery and the resultant congestion and pollution.

In the United States, 90% of packages delivered to homes weigh under eight and a half pounds, well within the payload capacity of most commercial drones. Additionally, most items from major retailers such as Walmart are already compatible with drone delivery, with 85% of Walmart’s products meeting the necessary criteria as of January 2023. Drones could reduce the average cost of delivery of goods, which was $5-$10 in 2021, to under $1. Drone delivery adoption is on the rise, with NASA forecasting up to 500 million drone deliveries per year by 2030. In 2022, last-mile delivery accounted for 85% of the drone delivery market, and the volume of deliveries by drones increased by more than 80% from 2021 to 2022, reaching almost 875K deliveries worldwide.

DroneUp is a drone delivery service provider that enables companies to enhance their operations with scalable last-mile drone delivery. The company offers custom solutions for retail businesses, as well as food delivery and medical delivery. Its technology facilitates the integration of drone delivery into existing company operations, intended to enhance the ease and efficiency of implementing autonomous last-mile delivery. For example, its drone “Hubs” allow for rapid deliveries in less than 30 minutes. Walmart has invested and has a significant partnership with DroneUp, which operates 34 Hubs for Walmart as of August 2023. As such, the company is positioned to capitalize on the growing trend of fast, efficient, and environmentally friendly last-mile delivery solutions in partnership with one of the US’s largest retailers.

Founding Story

DroneUp was founded in 2016 by Tom Walker (CEO), a former US Navy officer, and John Vernon (CTO). The pair met at Web Teks, a digital transformation company where Walker served as President, and Vernon held positions as COO and CTO. In 2021, DroneUp would go on to acquire Web Teks.

Walker had his first exposure to drone technology during his military career, though in a 2022 interview he said that “at the time, it was very early and the technology wasn’t nearly as robust as it is today.” Once out of the military, Walker joined Web Teks as president. It was during his time at Web Teks that Walker began to notice the rapid speed with which drone technology was advancing, and its potential to impact society. This realization led to him founding DroneUp in 2016 alongside Vernon.

Product

Drones

DroneUp uses quadcopter-style drones for its services, which it procures from an external vendor. It only uses drones made in the United States. These drones can carry a maximum of 10 pounds of goods. To meet legal guidelines, the total weight of the drone and the cargo doesn't exceed 55 pounds. The drones are equipped with features that allow them to steer clear of people and moving cars, plus sensors to detect individuals on the ground.

In 2022, a DroneUp delivery took 27 minutes on average, according to one third-party source. As of January 2024, DroneUp claimed all items purchased through their store are delivered in less than 30 minutes. While the drones used by DroneUp can fly up to a range of 3 miles, as of January 2024 Federal Aviation Administration (FAA) regulations limit their delivery radius to within visual line of sight of the drone operator.

Drone Hubs

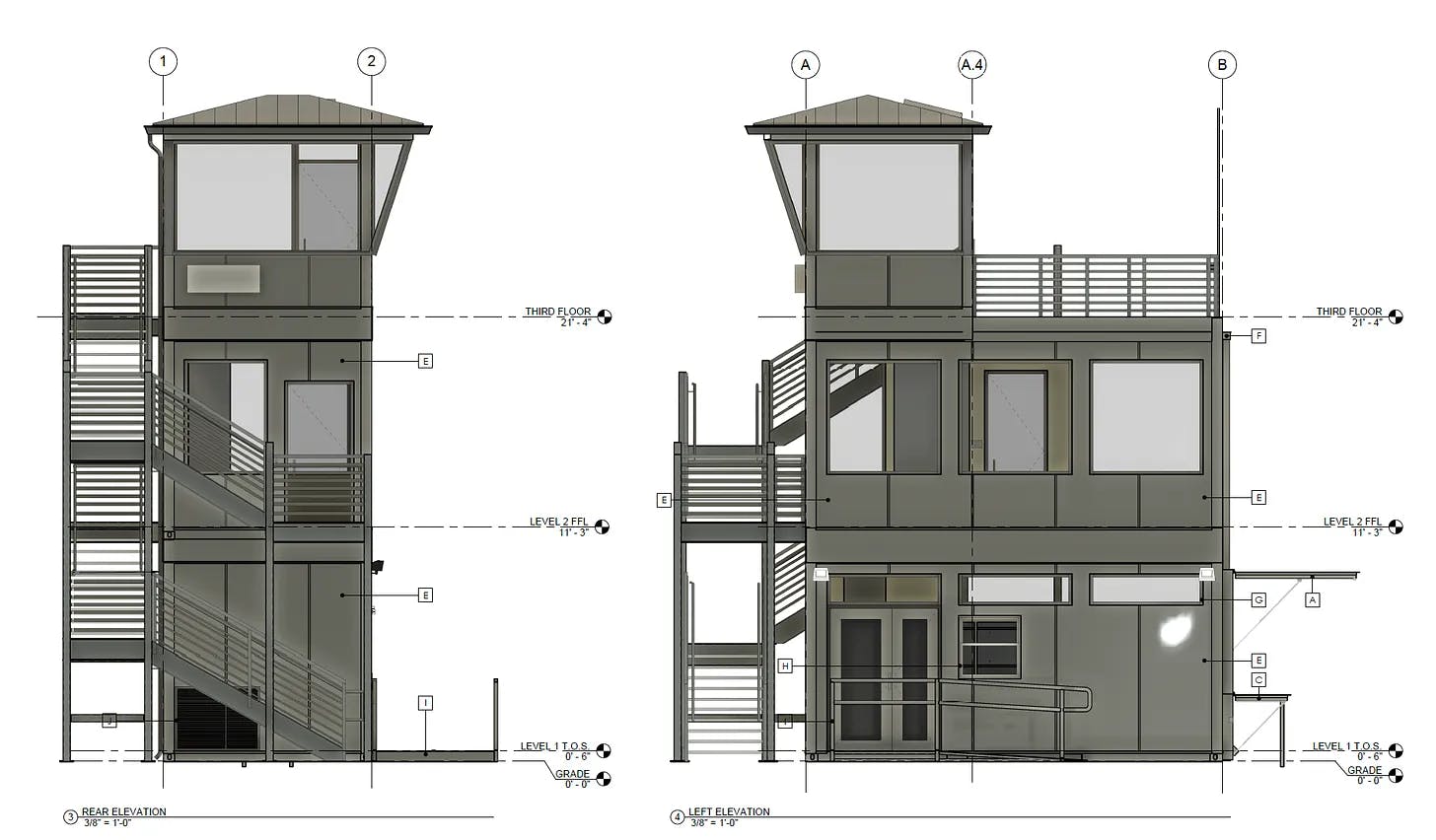

Source: Jason Garcia

The FAA mandates drones must operate within the visual line of sight of a human controller, though companies can apply for an exception. However, to avoid the process of obtaining exceptions, DroneUp built drone “Hubs” which are 30-foot control towers where FAA-certified flight engineers, whom the company “calls Hub Flight Engineers”, can perform drone deliveries up to 1.5 miles away. The first operational DroneUp Hubs were launched in 2021 in partnership with Walmart.

In May 2022, DroneUp and Walmart announced that by year-end the delivery network would expand to 34 sites across six states — Arizona, Arkansas, Florida, Texas, Utah, and Virginia. As of October 2023, all 34 sites were operational.

Retail Delivery

Customers who live within the delivery radius of a DroneUp Hub can order Walmart products straight from droneupdelivery.com, which as of January 2024 lists about 20K items. As of January 2024, delivery is free for all orders, and fulfilled in less than 30 minutes.

The platform first verifies whether the customer’s location is within a service area; if it is, customers can add items to their shopping cart totaling up to 10 pounds in weight. Once an order has been placed, DroneUp assesses the customer’s property to locate the safest delivery site. A DroneUp staff member then assembles the order and takes it to the delivery center, loads it onto a drone, and conducts a safety check.

While en route to its destination, the drone flies at an altitude between 160 and 300 feet. Upon arrival, the drone descends to 80 feet (considered a safe and quieter height for delivery), and a tether lowers the package to the ground. The drone then returns to the delivery center. A flight operator monitors the entire process to ensure it runs smoothly.

Food Delivery

DroneUp also offers custom drone-based food delivery services. Its packaging ensures food is protected and maintains the correct temperature, adhering to FDA standards. Partners can use DroneUp's Hubs to reduce costs and improve logistics. Food deliveries are completed within 30 minutes, with some as quick as 17 minutes from order placement.

Medical Delivery

DroneUp offers medical delivery solutions for a variety of healthcare entities, such as hospitals, clinical labs, and pharmaceutical companies. These aim to enhance patient access to care while addressing challenges in traditional road-based transportation by reducing human involvement in the delivery process and minimizing risks like traffic accidents and human error.

According to DroneUp, drone medical delivery not only enhances patient experience by reducing wait times and travel but also improves business outcomes through better adherence to medication schedules and more efficient lab sample transportation.

Brand Activation Services

DroneUp provides custom solutions for drone-facilitated brand activation and experiential marketing campaigns. Its services include planning, testing, and executing creative ideas, with a focus on maximizing campaign reach, with past initiatives having generated over 6 billion impressions for brands.

Commercial Flight Services

DroneUp’s autonomous commercial flight services include end-to-end solutions from order to delivery within three days, with capabilities such as aerial photography and videography, real estate marketing, progress monitoring, site inspections, façade and roof inspections, pavement analysis, digital twins and 3D modeling, topographic mapping, and thermal imaging.

DroneUp guides clients through the creation and execution of drone-based inspection and monitoring programs, ensuring compliance with FAA regulations. All flights are insured.

Market

Customer

DroneUp’s customer base includes large retailers, hospitals, clinics, and restaurant chains, as well as other types of enterprises and government bodies. For example, its clients include Brookfield Properties, Quest Diagnostics, and NATO Allied Command as of November 2022, as well as Riverside Health System Hospital and Carilion Clinic for medical delivery as of October 2023.

Its most notable partner and client is Walmart. As of October 2023, the company was “delivering to about 4 million households in the United States” according to DroneUp CEO Tom Walker. Here’s a timeline of the partnership:

2020: A small pilot program is launched where DroneUp delivers COVID-19 test kits to Walmart customers.

June 2021: Walmart makes a strategic investment in DroneUp and announces plans to initiate drone deliveries from its Bentonville, Arkansas, headquarters.

2022: DroneUp and Walmart expand to 34 delivery locations in six states including Virginia, Arizona, Utah, Florida, Arkansas, and Texas.

Commenting on the partnership, Walmart’s SVP David Guggina said:

“DroneUp has been a reliable partner as we’ve tested this solution and their capabilities will enable our business to scale with speed while maintaining a high caliber of safety and quality.”

The partnership’s success resulted in DroneUp’s pivot to fulfilling last-mile delivery, resulting in DroneUp laying off employees from its enterprise services unit in 2023. DroneUp CEO Tom Walker said in May 2023 regarding this pivot that:

“After tremendous consumer adoption of our drone delivery services, we have made the decision to shift our business model to align our company structure around the continued growth and success of drone delivery and other drone services out of our Hubs.”

Market Size

The global drone delivery market is set to grow from $2.8 billion in 2024 to $16.6 billion in 2029, growing at a CAGR of 42.7%. Within this market, the segment focused on payloads of less than two kilograms captured the highest revenue share in 2022, reflecting the frequent use of drones for small package deliveries. However, deliveries of payloads of more than five kilograms are expected to grow at the highest CAGR going forward, with projected growth of 48.4% from 2023 to 2030.

One key growth driver of the drone delivery market is the increasing willingness to adopt drone delivery. From 2021 to 2022, the number of packages delivered by drone rose by 80%, reaching 875K deliveries worldwide in 2022. During this period, the restaurant industry saw a 195% increase in drone deliveries, while the grocery and convenience industries saw a 100% increase in deliveries. From January to June 2023, drones made 500K commercial deliveries. As of October 2023, drones were projected to make more than 1 million commercial deliveries by the end of 2023.

The drone delivery market is limited to operate within visual line of sight per FAA regulation, barring waivers. However, recent regulatory developments suggest a movement towards a more adaptive approach in regulatory policies. For example, a bipartisan bill was introduced in the US Senate in February 2023, aimed at expediting and expanding the FAA approval process for BVLOS drone flights conducted by businesses and public agencies. In August 2023, the FAA issued its first-ever approval for commercial BVLOS operations. Since then, the FAA has issued further exceptions to companies like Flight Forward, uAvionix, PAU, and Zipline in September 2023, Alphabet's Wing in December 2023, and DroneUp in January 2024. These regulatory developments signal a positive shift for the drone delivery market potentially allowing for broader operational scope and increased adoption of drone-based logistics and services.

Competition

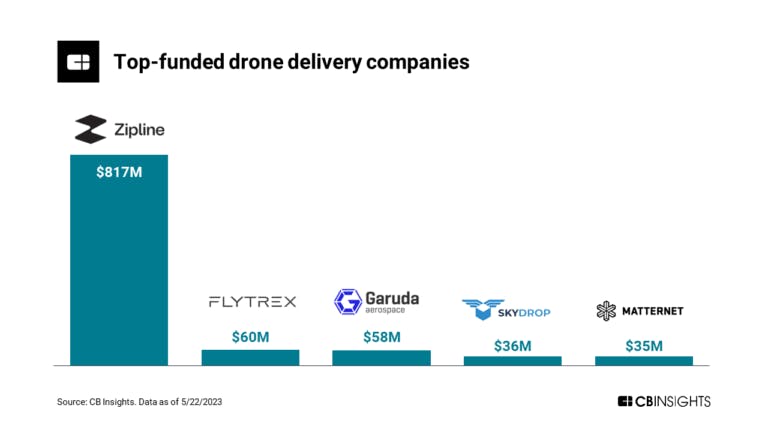

Source: CBInsights

Drone Delivery Companies

Zipline: Zipline is a drone logistics and delivery provider. Founded in 2016, it began with last-mile delivery of medical supplies in Rwanda. In March 2023, the company launched its P2 drones for instant delivery, enabling a 10-mile delivery within 10 minutes, seven times faster than traditional automobile delivery. In September 2023, Zipline was granted a license by the FAA to operate its drones beyond visual line of sight (BVLOS). Zipline is also the highest-funded startup in the drone industry, having raised $820 million since inception. This includes a Series E round in May 2023 in which it raised $330 million at a valuation of $4.2 billion.

Like DroneUp, Zipline is a partner for Walmart in its drone delivery operations. Unlike DroneUp, which procures drones from third parties, Zipline manufactures its drones. As of November 2023, Zipline has conducted over 800K deliveries.

Flytrex: Flytrex is a food and grocery drone delivery company. Founded in 2013, it initially made black boxes for consumer drone tracking, selling 20K units from 2013 to 2016. In 2016, the company pivoted to drone deliveries, focusing on the restaurant and grocery sectors, partnering with Brinker International and Unilever. The company made 21K deliveries across five locations in 2022. Flytrex's drones can cover about five miles roundtrip at 32 mph, delivering in five minutes with a capacity of up to 5.5 lbs.

Flytrex has raised $60.3 million in funding, including a $40 million Series C in 2021 at an undisclosed valuation. Flytrex is one of Walmart's three partners for drone deliveries, together with DroneUp and Zipline. As of November 2023, the company offers free delivery to all its customers.

SkyDrop: Skydrop (previously Flirtey) is a drone delivery provider focused on the food delivery market. Founded in 2013, the company conducted the first-ever FAA-approved drone delivery in the US in 2015. As of January 2024, Skydrop has made over 6K flights and holds 1K+ patent claims. In January 2022, Skydrop and Domino’s Pizza announced an agreement to launch a commercial delivery trail in New Zealand, due to begin in 2023. SkyDrop has raised an estimated $40 million in total funding as of June 2022.

Alphabet's Wing: Wing was developed in Google X, Alphabet's "moonshot factory," before being spun out in July 2018 as an independent company under the Alphabet umbrella. Wing established a partnership with Walmart in the Dallas-Fort Worth area in 2022, and as part of that partnership, the company services 60K homes of January 2024. Beyond its Walmart partnership, Wing has completed 350K across three continents. In December 2023, Wing was granted a license by the FAA to operate its drones beyond visual line of sight (BVLOS).

Adjacent Competitors

Prime Air: Amazon Prime Air is a service developed by Amazon to deliver packages to customers using drones, with the goal of expediting delivery of smaller packages. It was launched in 2016, making a notable first delivery in 13 minutes, but faced hurdles including workforce issues and crashes. Its drones, which have FAA approval as of August 2020, are capable of carrying packages up to five pounds, can travel at 50 mph for a 12-kilometer roundtrip, and fly at altitudes of 40 to 120 meters using sense-and-avoid technology to navigate around obstacles.

Amazon Prime Air has been making successful deliveries in College Station, Texas, since December 2022. By May 2023, however, it had managed only a hundred drone deliveries. A new drone model, MK30, will be launched in 2024, aiming for quieter, rain-resistant deliveries within 60 minutes. Amazon is said to have invested $2 billion into its drone delivery so far.

DoorDash: DroneUp and DoorDash* employ different delivery strategies (DoorDash uses human couriers, not drones) but share the goal of minimizing delivery times and enhancing efficiency. In Q3 2023, DoorDash reported a total of 543 million orders, a 24% increase from the same period the previous year. As of 2022, the marketplace had around 32 million users and 2 million delivery agents. In 2020, the company was catering to 45% of the overall food delivery orders in the US. DoorDash has also established partnerships with 450K merchants, extending its service to a vast number of areas.

However, the average delivery time of DoorDash was 42 minutes whereas DroneUp’s average delivery time was 27 minutes as of May 2022. In 2022 DoorDash started express grocery delivery of fresh groceries in under 30 minutes in more than 20 cities in the US. In addition, the company partnered with Google’s Wing in 2022 to pilot drone delivery in Australia, with the goal of delivering to customers in under 15 minutes.

Business Model

DroneUp operates a drones-as-a-service model, eliminating the need for clients to invest heavily in drone technology, infrastructure, and operational expertise. To this end, DroneUp has a network of 27K affiliated pilots as of November 2023. It has also developed a technology platform that matches supply with demand by locating, qualifying, and deploying single or multi-pilot crews according to client requirements.

A large portion of the operational expenses (OpEx) in drone service providers' business models is allocated to labor and batteries. In October 2023, DroneUp CEO Tom Walker highlighted that labor constitutes 70% of the company’s costs, while batteries comprise 20%. Meanwhile, a 2023 report estimated labor accounts for 95% of the overall operational costs of drone delivery. As of November 2022, there is a need for one drone operator for every six drones. Walker disclosed plans for autonomous drones requiring minimal personnel, along with better functioning batteries. These advancements are projected to cut operational overhead by 90%.

In 2022, DroneUp announced a partnership with Doosan Mobility Innovation (DMI) to test a new hydrogen fuel cell technology, which could extend flight times to two to five hours and lower carbon emissions to zero. It also partnered with Wonder Robotics in 2022 to improve precision landing and enable a single flight engineer to operate multiple drones simultaneously.

Previously, DroneUp had operated without obtaining FAA’s Part 135 waiver, which is required for flying drones beyond visual line of sight (BVLOS), requiring DroneUp to operate within a visual line of sight, restricting deliveries to a 1.5-mile radius. However, in January 2024, DroneUp received FAA approval to operate BVLOS flights at Riverside Health System facilities. The recent exception doesn't enable the company to operate all its deliveries BVLOS, but instead limits it to a small subset for now.

Traction

DroneUp initially focused on traditional drone services such as aerial data collection, roof inspection, and cell tower inspection. The company experienced its first growth boom during the COVID-19 pandemic. In the first two years of the pandemic, DroneUp’s business grew 10x the first year and 9x the second. During this period, organizations that previously relied on workers or manned aviation to conduct inspections, such as cell tower or roof inspections, suddenly weren’t able to do so — and were forced to turn to drones.

However, DroneUp’s focus shifted to drone delivery when Walmart contracted it to deliver COVID-19 test kits in 2020. The success of this initiative led to Walmart investing in and partnering with DroneUp to establish a permanent last-mile drone delivery program. Speaking on this shift, Walker said,

“Candidly, we had never done drone delivery, so we figured it out on the fly. We leveraged the experience we had from thousands of hours of flights in the traditional drone world, applied that, and our culture of safety.”

In November 2022, CEO Tom Walker mentioned that DroneUp conducted 150K operational flights. In October 2023, Walker claimed DroneUp was “delivering to about 4 million households in the United States.”

As of October 2023, DroneUp operates in 34 locations across six states with a network of over 27K pilots. It had begun implementing medical and pharmaceutical delivery, as well as food delivery. The company also has a Net Promoter Score (NPS) of 97 as of October 2023, reflecting high customer satisfaction.

Valuation

As of January 2024, DroneUp has raised a total of $7.5 million. The company raised a $2.3 million seed round in November 2016, followed by a $5 million venture round in November 2021. In July 2022, DroneUp received an additional $241.2K in investment. In November 2021, Walmart made an undisclosed investment in the company. DroneUp’s valuation is not publicly available.

Key Opportunities

Increasing Market Share of Commercial Drone Delivery

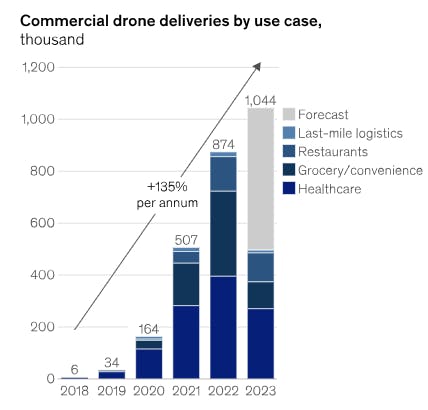

Source: McKinsey

Last-mile delivery is a crucial, yet cost-heavy, stage in the shipping process, accounting for 53% of overall delivery costs as of December 2021. This segment presents a significant opportunity for revenue generation, with US courier and local delivery services amassing yearly revenues upward of $100 billion as of December 2021.

Drones offer to bring down the costs of delivering small, time-sensitive items from the standard rates of $5-$10 in 2021 to potentially under $1. The delivery sector's willingness to adopt drone delivery is evident from the growth in the number of packages delivered via drone — up 80% from 2021 to 2022, approaching 875K deliveries globally in 2022, and was projected to exceed 1 million deliveries in 2023.

The restaurant industry saw a 195% increase in drone deliveries from 2021 to 2022, while the grocery and convenience industries saw a 100% increase in deliveries during the same period.

Market Adoption of Drones Beyond Defense

The drone market, once led by the military and defense sectors with a 61% market share in 2018, is now experiencing a shift towards commercial applications. A 2023 report projects that by 2027, the enterprise sector will claim approximately 41% market share, signaling a diversification in the use of drone technology. The global drone delivery market is set to grow from $2.8 billion in 2024 to $16.6 billion in 2029

This change aligns with a growing challenge in urban areas. In January 2022, major cities were projected to experience a 36% surge in traditional delivery traffic by 2030, which could result in an increase of CO2 emissions by 6 million tonnes and prolong daily commutes by an average of 21%, or an additional 11 minutes per trip. Metropolitan areas like Los Angeles and New York have already experienced up to a 35% increase in traffic congestion between 2010 and 2020.

Drones could be a key part of the solution by reducing last-mile delivery times while cutting down on traffic and pollution. By adopting drones for more deliveries, the logistics industry can move towards a faster and more environmentally friendly delivery system.

Partnerships & High Barrier to Entry

With 90% of the U.S. population living within 10 miles of a Walmart, DroneUp's partnership with the retailer is a significant asset. This is especially relevant as over 85% of items sold by Walmart Neighborhood Markets are compatible with drone delivery as of January 2023. DroneUp's management of 34 out of 36 Walmart drone delivery hubs as of August 2023, supported by Walmart's direct investment in the company, offers some advantage in the market. For example, DroneUp’s Medical and Food delivery services already take advantage of existing hubs built in Walmart locations, allowing partners to reduce operational costs and streamline logistics. However, it is important to note that both Zipline and Alphabet's Wing have similar Walmart partnerships.

Patents

DroneUp's portfolio of 10 patents that it holds as of 2022 could prove a differentiator in the drone industry. These patents cover a wide range of technologies, including drone navigation, payload delivery, and airspace management. For example, DroneUp's patented payload delivery system allows drones to deliver packages to precise locations without human intervention.

Another DroneUp patent, entitled “Multiplexed Communications for Coordination of Piloted Aerial Drones Enlisted to a Common Mission”, centralizes the process of managing drone pilots and assigning them missions through a web-based platform. The core concept involves using a mobile app that allows a central agency like DroneUp to input a job into a pilot network database. The system then identifies which pilots are suitable, available, and local to the mission, sending them a job offer via app. Once a pilot accepts the offer, additional details on the mission are sent to them directly. The advantages of this system include:

Efficiency: The automated system streamlines the entire process of finding and assigning pilots for drone missions, which makes operations more efficient.

Flexibility: The patented system can work for drone service providers or can be translated to large enterprise drone platforms.

Its patents allow DroneUp to license such systems to other service providers or keep it a unique feature to set itself apart in the market. Its existing patents could provide a competitive moat as the drone delivery market continues to mature.

Key Risks

Regulatory Risk

In the past, the Federal Aviation Administration (FAA) had been sluggish in updating regulations to accommodate the evolving capabilities of drone technology, particularly regarding beyond visual line of sight (BVLOS) operations. A May 2020 report found that more than 60% of potential use cases lie in BVLOS. However, recent developments indicate a shift towards a more responsive regulatory stance. A notable action is the introduction of a new bipartisan bill in the US Senate in February 2023 aimed at accelerating and broadening the FAA authorization process for BVLOS drone flights conducted by businesses and public agencies.

In August 2023, the FAA issued its first-ever approval for commercial BVLOS operations in response to requests from several companies. Since then, the FAA has issued further exceptions to companies like Flight Forward, uAvionix, PAU, and Zipline in September 2023, Alphabet's Wing in December 2023, and DroneUp in January 2024. Together, these actions depict a more proactive approach by the FAA in updating the regulatory framework to align with advancing drone technology and market demands, thereby helping unlock the potential BVLOS operations hold for various industry sectors.

However, the risk of regulatory overhang remains. If there are high profile failures, drone crashes, or privacy violations, the FAA or other federal or regulatory bodies could look to more aggressively limit the capabilities of drone operators, such as DroneUp.

Safety, Security, and Privacy

Drone delivery faces practical issues such as ensuring the safety of both the delivery items and people nearby, keeping items secure after delivery, reducing noise, preventing traffic jams in the sky, and improving delivery routes. Of these, safety is particularly relevant; a 2023 McKinsey survey highlighted safety as the primary concern for over 60% of participants.

Drones are also susceptible to getting hacked. Hackers can take control of the drones and intercept the data transmitted to the drone pilot, leading to direct losses and eroding consumer trust. For example, a single drone intrusion at Gatwick Airport led to a shutdown costing airlines approximately $64.5 million in 2019.

Under US Remote ID laws, drones must broadcast their location mid-flight, which allows third parties to track the drone's path from pickup to delivery points, potentially revealing customer purchases. This issue has raised concerns as it could lead to anything from unwanted ads to guesses about a person's health based on their deliveries.

A 2023 study published by a team from MIT indicates that to compete, drone delivery must emphasize privacy or outperform traditional methods in speed and affordability. Surveys show customers are four times more likely to choose ground delivery over drones when privacy isn't enhanced, even if the cost and delivery time are the same.

The use of camera-equipped drones has also faced public skepticism due to privacy concerns. Research conducted in April 2023 indicates that 88% of Americans prefer not to have their neighborhoods filmed during drone deliveries, and 54% are against allowing drones to fly near their homes. Public sentiment therefore remains an obstacle for the industry as a whole.

Summary

DroneUp, founded in 2016 by Tom Walker and John Vernon, initially focused on traditional drone services but experienced significant growth during the COVID-19 pandemic, particularly when Walmart contracted it to deliver COVID-19 test kits in 2020. This success led to Walmart investing in and partnering with DroneUp to establish a permanent last-mile drone delivery program. The company uses quadcopter-style drones sourced from US vendors, with a maximum payload of 10 pounds.

The company has built drone "Hubs" to comply with FAA regulations, enabling multiple simultaneous deliveries within a 1.5-mile radius. DroneUp operates in 34 locations across six states, offering retail, food, medical, brand activation, and commercial flight services. The market for drone delivery is rapidly growing, with the global drone delivery market expected to reach $16.6 billion by 2029. DroneUp's significant partnership with Walmart offers some advantage to the company as it seeks to capitalize on the growing demand for efficient and environmentally friendly last-mile delivery solutions.

*Contrary is an investor in DoorDash through one or more affiliates.