Thesis

In recent years, autonomous drones have been on the rise, providing a cost-effective and efficient solution for a wide range of applications. The global autonomous drone market was valued at $15.5 billion in 2022 and is expected to grow to $56.5 billion by 2030. Technological advancements in areas such as artificial intelligence, machine learning, and computer vision have significantly improved the capabilities of autonomous drones.

With the ability to perform complex tasks autonomously, drones are increasingly used in agriculture, construction, infrastructure inspection, national defense, and logistics to improve efficiency, avoid human injuries, and reduce costs. Moreover, governments worldwide are developing regulations that enable the safe and responsible use of drones, which has boosted the adoption of autonomous drone technology. For instance, the U.S. Federal Aviation Administration has established rules for the operation of drones. This has led to the widespread use of drones for commercial purposes.

Skydio manufactures drones used by consumers, enterprises, and government customers. It designs, assembles, and supports the use of its products in the US. Skydio also develops software for its drones in-house. It is the leading drone manufacturer in the US, and its customers include the U.S. Department of Defense, U.S. State Departments of Transportation, public safety agencies across states, and energy utilities.

Founding Story

Skydio was founded in 2014 by Adam Bry (CEO and co-founder), Abraham Bachrach (CTO and co-founder), and Matt Donahoe (co-founder). Prior to founding Skydio, Bry authored numerous papers and obtained technical patents. He was recognized on MIT’s list of 35 young innovators under 35. He sits on the FAA’s Drone Advisory Committee board, to which he was appointed in 2021. Bachrach has also co-authored numerous technical papers. Donahoe was the founding engineer of PocketGem’s story-based videogame, Episode Interactive.

Bry went to MIT for a master’s degree in computer science and artificial intelligence, aerospace, aeronautical and astronautical engineering. That's where he met fellow students and Skydio cofounders Bachrach and Donahoe. Bry and Bachrach worked in the robotics program at MIT. While researching self-flying planes without GPS, they created a fixed-wing drone with autonomous navigation via a laser range finder in a parking lot. Soon after, Adam and Abe joined the founding team of Google X's Project Wing in 2012, which worked on delivery drones that were tested in Australia. After 18 months, they departed Google X and joined forces with Matt Donahoe, whom they had met at MIT's Media Lab. Their goal was to build a system to autonomously control drones using the same affordable chips and sensors found in standard smartphones, and, as Bry said in 2015, thereby reduce the cost of drones from ~$5K to closer to $50.

Product

Drones

Skydio X2: Skydio X2 drones see in every direction using six 4k 200° navigation cameras, understand the world using onboard AI running on an Nvidia TX2, and make decisions to fly with 360° obstacle avoidance. The drones can return to their starting GPS location, which makes them easy to control. They also have robust obstacle-avoidance capabilities and can fly at night. Skydio X2 drones can connect to Skydio 3D Scan or Skydio Cloud, enabling data from the drones’ flights to be uploaded to the cloud.

Source: Skydio

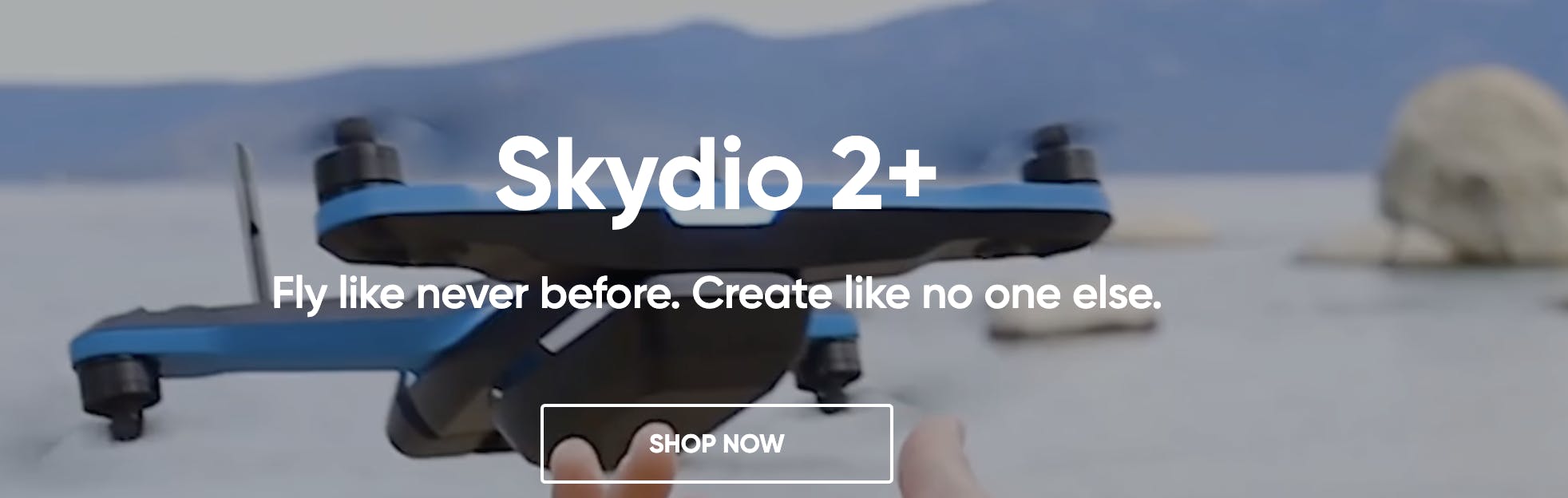

Skydio 2+ for Enterprise: Skydio 2+ drones can “see” their surroundings and interpret the information around them, allowing them to avoid obstacles. The 2+ drones have no blind spots. Instead, they’re equipped with enough cameras (at least six per drone) to allow 360-degree vision. Unlike the earlier Skydio R1 drones which came out in 2018, 2+ drones can see at night. The 2+ drones also have GPS tracking features. This enables them to fly over water without crashing or mistaking it for a landing surface (which was a problem with Skydio’s first product, the R1).

As of January 2023, Skydio 2 and 2+ Enterprise drones can take vertical, horizontal, and panoramic videos and photos. The Skydio Enterprise Controller is a controller for enterprise drone operations. It can boost the drone’s operational range and is built with military-grade components, an ergonomic design, and a 6.8” bright touchscreen. Skydio Care Enterprise complements the Skydio 2+ Enterprise hardware warranty with an extra layer of protection that covers the drone in cases of damage resulting from collisions and water damage.

Source: Skydio

Skydio 2+ Consumer: Skydio 2+ drones can also be used for consumer or hobbyist applications. Skydio’s KeyFrame capability allows human controllers to pre-program the drone to hit several “key frame” locations. The drone will then fly itself between these locations. Human controllers only need to adjust the speed.

Source: Skydio

Skydio Software

The consumer Skydio app is available to consumers, whereas the Skydio Enterprise app is only available for enterprises.

Skydio 3D Scan: Skydio’s 3D scan reads data from Skydio drones to create 3D digital twin models of physical locations. They can also be controlled beyond the visual line of sight. 3D scans of physical locations are used to create digital twins, which can help inspectors spot small errors or safety concerns such as hairline cracks in concrete. 3D reconstruction software can produce 3D models of structures, scenes, or assets

Skydio Scout: Skydio Scout is a 3D scanning software designed for military units. Skydio Scout enables drones flying above military convoys to transmit information to humans inside those convoys. Soldiers on the field can monitor the controllers who receive the Scout information; such controllers do not need to be expert pilots.

Skydio Autonomy: Skydio’s autonomy software enables its drones to recognize obstacles beyond what its cameras can detect. For example, if the cameras detect a line floating in mid-air, such as a power line, the autonomy software predicts that the line will extend in both directions, allowing the drone to avoid the obstacle. Skydio’s autonomy software also creates a 3D space map, allowing drones to “remember” where they are flying. Because it reduces the burden on human pilots, a single pilot can manage multiple Skydio drones.

Skydio Cloud: Skydio Cloud enables data from Skydio drones to be uploaded easily to the cloud rather than relying on third-party software. When connected to the Cloud, drones can live-stream their data to other users on the Cloud, enabling many people to see the flight path simultaneously. This simplifies the organization's fleet management, media sharing, and live streaming.

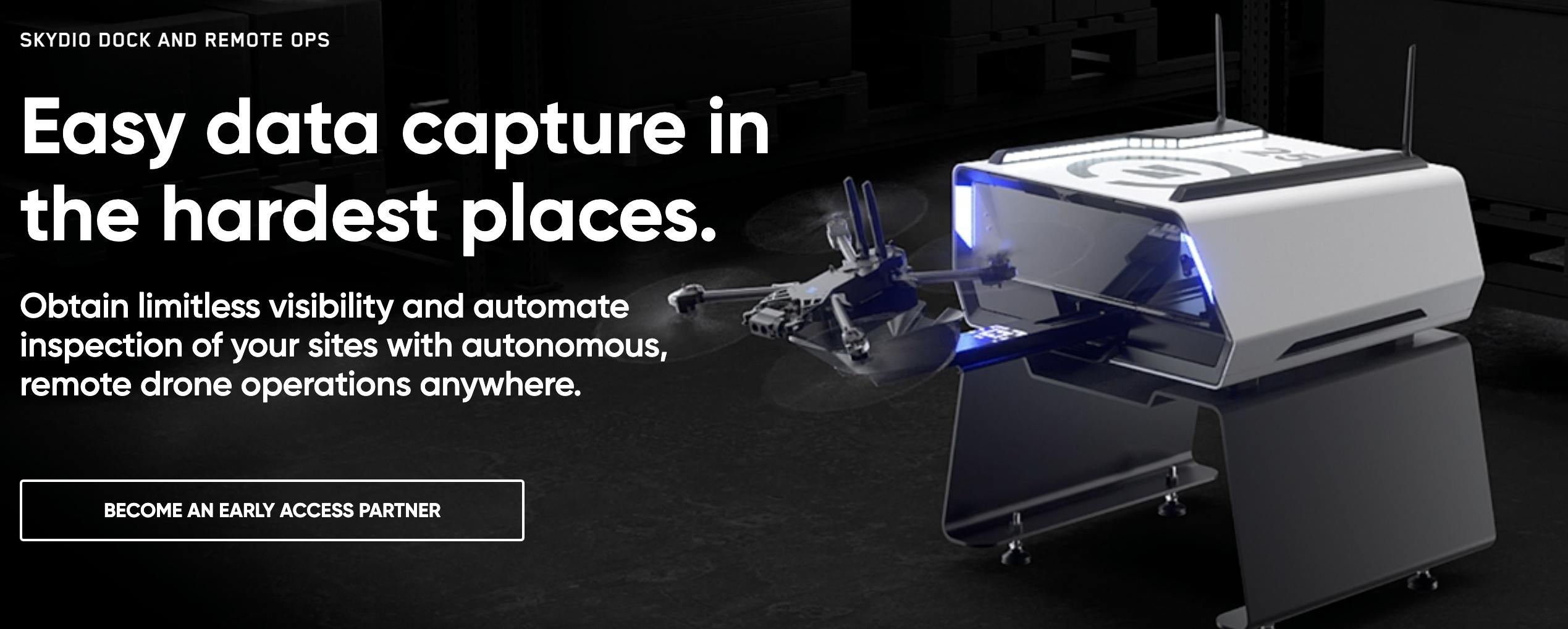

Skydio Dock

The Skydio Dock allows drones to take off, land, and charge their batteries without human intervention. The Dock communicates with drones via the Internet rather than through GPS. Because of its shape, the Dock is a type of “drone in a box” system containing a landing pad and charging station and can be controlled remotely, or can be partially autonomous. The Dock is mostly weatherproof, with a door to keep dust and debris from the charging dock. Its temperature regulation keeps the battery and drone in optimal temperature ranges.

The Skydio Dock enables flight much closer to level five autonomy than previous solutions: it does not need to be piloted in real-time by a human. Instead, humans can pre-program the drones to fly on specific missions and pre-schedule a time for the drones to launch. If humans wish to oversee the drones’ flight, they can; the Dock enables users to pilot drones remotely.

Source: Skydio

Skydio Regulatory Services

Skydio Regulatory Services simplify the waiver approval process for drones and helps organizations unlock the potential of autonomy-enabled operations. Skydio offers templates and guidance to grow drone programs for advanced operations.

Skydio Accessories

Skydio sells a variety of add-on products in addition to its core products. Accessories include beacons, batteries, and controllers for the drones.

Market

Customer

Skydio has three customer types: individual consumers, enterprises, and government organizations. The company began by targeting individual consumers, but once it received sufficient traction among consumers, it began selling to enterprises and then to the U.S. government.

Consumers use Skydio to fly drones as a hobby or for enjoyment; for example, they may purchase the drone to film themselves performing an extreme sport. Some purchase drones to film the surrounding landscape rather than themselves.

Enterprise applications of Skydio drones include inspection and monitoring of physical environments. For example, utility companies benefit from using Skydio drones to monitor and inspect power lines and the grid. Railway company BNSF began using Skydio’s autonomous drones to monitor its railways in 2021. Other enterprise customers include Aelius, Cyberhawk, Mosaic, and Ware.

Government applications of Skydio drones include military applications and law-enforcement applications. Autonomous drones can monitor crime scenes. Military drones can engage in missions without endangering humans. Public safety technology company Axon also partnered with Skydio to service 911 dispatchers, providing them with video footage from both cars and drones.

Market Size

As AI capabilities have advanced, enterprises, military organizations, and consumers are increasingly willing to pay for autonomous drones. Within the enterprise sector, key applications for this include construction, built-environment inspection, and agriculture. Military applications of drones extend to the Department of Defense and the FBI.

The global drone market was valued at $28.5 billion in 2021 and is expected to reach $260 billion by 2030, growing at a CAGR of 27%. Drivers of this growth will be increased demand for defense, enterprise, and consumer drones, followed by drones for public safety and logistics applications. The Department of Defense (DoD) was the largest single customer of autonomous drone solutions in the US in 2022. The global drone enterprise market is estimated to reach about $17 billion by 2025.

The 2022 budget for the U.S. Department of Defense (DOD) included $8.2 billion to support the research, development, testing, and procurement of unmanned systems. That represents an increase of $700 million for unmanned vehicles relative to the budget from FY2021.

Competition

Skydio faces competition from both drone hardware companies as well as software companies across consumer, enterprise, and military markets.

DJI: DJI, a Chinese private company founded in 2006, produces consumer and military drones. It is the world's largest drone manufacturer with more than 70% of the global drone market. DJI’s consumer drones were on the market before Skydio’s and are of comparable quality. Although the US government is concerned that DJI drones pose a safety concern, DJI drones are popular among US consumers. In 2020, DJI had 77% of the consumer drone market. Some industry reviews suggest DJI drones have superior flight capability, video quality, portability, and ease of use to Skydio’s. DJI’s drones have also been used in military applications, including by the Russian military during the invasion of Ukraine. Skydio’s competitive advantage over DJI is that it’s a US-based company; the US military refuses to use DJI products because of security concerns.

Autel Robotics: Autel Robotics, founded in 2014, also produces autonomous drones. Autel’s multi-drone (swarm drone) technology allows multiple drones to map an area simultaneously. Although Autel itself is an American company, the parent company is Chinese. Autel’s competitive advantages include a hot-swappable battery (which can be plugged in and out of the system without restarting the system) and interchangeable lens cameras. In January 2023, Autel launched the EVO Nest, comparable to Skydio’s Dock. Like the Dock, the EVO Nest facilitates drones in taking off, flying, landing, and charging without a human controlling such operations in real time. Like Skydio, Autel also offers drones with 360-degree obstacle detection and avoidance capabilities. Although Autel competes with Skydio for market share in enterprise solutions, Autel is not a US company so is unlikely to gain business from the US government.

Parrott Anafi USA: Parrott Anafi is a French company founded in 1994. Since 2017, the company has focused exclusively on manufacturing drones for enterprise applications. The Department of Defense trusts its US-based ANAFI USA operation. In the consumer sector, the Parrot Anafi drone is considered by some to be comparable to DJI’s Mavic or the Skydio 2 drones. Like Skydio, Anafi drones are being used for surveying and inspection applications and military and consumer needs. For example, Anafi’s 4G drones can survey land and create digital twins. Unlike Skydio, Parrot promotes the use of open-source software, so developers can embed their own code on the drones. This may give Parrot a competitive advantage, as it prevents developers and drone enthusiasts from being constrained to off-the-shelf solutions.

Northrup Grumman: Northup Grumman, founded in 1994, has a market cap of about $70 billion as of April 2023. The company manufactures a variety of aircraft, naval craft, and artillery pieces. Its wide suite of products includes some products potentially competitive to Skydio’s, including the remotely-piloted Global Hawk aircraft. Global Hawk, an aircraft significantly larger than any of Skydio’s drones, can fly for up to 30 hours over enemy territory while gathering images and data. The Department of Defense awarded Northrup Grumman a $4.8 billion contract in 2021 for Global Hawk delivery, development, and modernization. However, Northrup Grumman’s competition with Skydio is in the area of military drones, not consumer or enterprise drones.

Business Model

Skydio’s business model includes selling directly to end-users, in which end-users pay for products either individually or in packages.

For consumers, drone kits range from ~$1.1K to ~$2.4K. Drone kits for enterprises are more expensive than for consumers: the Skydio X2 kit costs around $5K for enterprises. Enterprises can pay a subscription fee to upgrade to add Skydio’s 3D Scan and Skydio Cloud services. Skydio benefits from receiving a lump-sum payment upfront for the purchase of its drone kits, as well as leveraging SaaS subscription model which generates recurring revenue.

Traction

As of April 2023, Skydio drones are used by 1.2K enterprise organizations, 200 public safety organizations, and 60 energy utilities, as well as by every branch of the US Department of Defense. Skydio has U.S. manufacturing facilities in Hayward, CA totaling over 36K square feet. In 2022, the US Army selected Skydio for its Short-Range Reconnaissance program, signing a contract with a base value of $20.2 million.

Skydio donated more than $300K in drones and training services to Ukraine in the wake of Russia's invasion. As of May 2023, Skydio is the largest drone manufacturer in the United States.

Skydio has also built partnerships with authorized re-sellers like Adorama Drones, ADS, Gresco, and RMUS. These partnerships presumably allow Skydio to increase its market reach. Skydio also has technology partners like Airdata, Qualcomm, Nvidia, and Bentley.

Source: Skydio

Valuation

Skydio announced a $230 million Series E round at a $2.2 billion valuation in February 2023. Linse Capital led the round and also included investors from Andreessen Horowitz, the Walton Family Foundation, and Nvidia, among others. It has raised a total of $570 million in funding. Assuming that revenue was $103 million in 2022, its $2.2 billion valuation implies a 21x revenue multiple.

As a point of comparison, public companies working on similar systems, such as Northrop Grumman and the Boeing Company, have revenue multiples of 2.2x and 2.5x, respectively. However, large public companies like Boeing and Northrop Grumman — which have existed far longer than Skydio and produce a wider variety of products — are not directly comparable. Skydio’s valuation may be more directly comparable to past valuations of similar startups. For example, in 2018, DJI’s valuation was 7.5x revenue.

Key Opportunities

Regulatory Changes

Regulatory changes are both an opportunity and a risk for Skydio. The opportunity exists in regulations that change to enable Skydio to reach larger markets. For example, regulatory changes in 2020 allowed Skydio’s autonomous drones to be used for beyond-visual-line-of-site inspections (BVLOS inspections), whereas drones were previously required to fly within a human’s visual line of sight. This regulatory change enabled Skydio to sell autonomous drones to more customers than they would have reached otherwise, expanding the market. Future regulatory changes could similarly benefit the company.

Market Expansion

Precision agriculture is another potential area of opportunity for Skydio. The market for drones for agriculture may reach $6 billion by 2030 — including drones that will spray crops, collect agricultural data, and predict crop growth. With some adjustment, Skydio’s drones could likely be engineered to deliver similar solutions to the farming industry.

Key Risks

Regulatory Risk

Increased regulation is a risk to the drone industry as a whole, and can both increase costs and shrink the market. For example, between 2021 and 2023, the FAA imposed Remote ID compliance regulations on a growing number of drones. In 2022, Skydio began manufacturing Remote ID-compliant drones to keep up with the government’s regulatory requirements. Remote ID enables drones to broadcast their GPS location, and anyone with a ‘receiver’ unit, such as law enforcement officials, can determine where the drone is located. Drones manufactured after September 2022 must have Remote ID signaling capability as part of the drones themselves. Drones manufactured before September 2022 can comply with the new regulation by affixing a broadcast module to the outside of the drone. Drones that do not comply will be limited to flying in areas deemed FAA-Recognized Areas.

Key Customer Risk

The Department of Defense is an important customer for Skydio. Skydio may struggle to bring in new contracts if it suffers budget cuts. In 12 out of the 13 years before 2022, the US military has operated under a continuing resolution, meaning that its budget was frozen at the beginning of the year. Although Skydio has managed to weather this challenge so far, budget cuts could be an issue in the future. Military and defense spending may be cut as the US government faces higher interest payments on the debt it owes.

Profitability

Although Skydio’s products are impressive, the company is still not profitable nearly ten years after its founding. As Skydio has not demonstrated its ability to be cash-flow positive, there is a risk that the company never becomes profitable. This may occur if R&D costs and the cost of goods sold are too high.

Summary

Skydio manufactures both drone hardware and software. Considered one of the top 5 players in the drone market, the company’s automated drone solutions such as Skydio Dock are some of the lightest and “smartest” on the market as of 2023. Skydio has gained significant market traction, including adoption by the US military, the US Department of Defense, and 1.2K enterprise companies. By continuing to develop hardware and software that more closely allows full autonomy, it seems likely that Skydio will remain on the cutting edge of autonomous drone development. However, it remains to be seen whether the company will ultimately be profitable enough to justify its current valuation.