Thesis

The US military and its large defense budget following World War II and throughout the Cold War became a prime catalyst for Silicon Valley's growth. Backed by massive contracts and government funding, companies began to develop technologies capable of eventually guiding missiles, launching satellites, and keeping the US military ahead of its competition. The Pentagon’s partnership with Silicon Valley likely led to some of the most groundbreaking technological innovations during the mid-to-late 20th century.

In the 1990s, a declining military budget coupled with an explosion in the adoption of the internet resulted in a shift for Silicon Valley. Largely distancing themselves from war efforts, tech companies began to focus on producing consumer goods. This left the DoD to rely on a few traditional defense contractors who lack the talent and agility to facilitate high-tech defenses for the quickly evolving methods of 21st-century war. As a result, the days of technological dominance in the United States military were believed by some to be numbered. Entrepreneur and defense-tech enthusiast, Elad Gil, speaks to this point of view in stating that:

“Both sides [Republicans and Democrats] agree that the days of America’s military having the best technology may be coming to a close, and that ‘business as usual’ won’t save us.”

As a result, the Pentagon began to increasingly consider partnerships with a new generation of Silicon Valley-style defense providers capable of moving faster, smarter, and more aligned with the future of warfare. These partners could replace the long-established and minimally innovative traditional defense contractors. Overall, the period of America’s military dominance following WWII was powered by a strong partnership with Silicon Valley tech companies. As the rift between both parties grew following the turn of the century and the tech boom, the military was left to rely on slow-paced defense contractors whose methods are rarely conducive to innovation. In a world where national security and warfare are heading in the direction of autonomous systems, more innovative defense vendors will be necessary for the US military to keep up with that shift.

Anduril* is a defense company looking to transform the US and allied military capabilities with advanced technology and a unique approach to defense contracting. Centered around autonomous systems capable of monitoring all realms of war including air, space, land, and sea, Anduril is leveraging technologies such as AI and computer vision-powered operating systems to connect intelligent devices and hardware assets. Anduril aims to build innovative, cost-effective technology which outperforms what legacy providers are capable of developing. Unlike traditional defense contractors, Anduril deploys its own capital into R&D and production rather than relying on government funding and cost-plus contracting. Only selling to the military when an actual product is ready, Anduril saves the government money while also providing superior technology to keep the United States ahead of its adversaries.

Founding Story

Anduril’s existence is largely attributed to the perseverance of venture capitalist, Trae Stephens, who now serves as Anduril’s executive chairman. In 2014, Stephens made a career change and joined a venture capital firm named Founders Fund. While at the firm, Stephens developed an interesting thesis on the broken state of the government’s approach to defense contracting and made it his mission to back the next great defense tech startup. Unfortunately, venture-backed startups rarely had success in disrupting the long-established patterns of the military. Although Stephens did not find a defense startup to invest in, he did meet arguably the only person capable of starting the company Stephens was looking for: Palmer Luckey.

Prior to starting Anduril, Luckey was known for his invention of Oculus VR, which Facebook acquired in 2014. Stephens met Luckey around this time and quickly discovered Palmer’s shared interest in national security. The relationship was sidelined until 2017 when Palmer was fired by Facebook, a move he claims was instigated by a $10K donation he made to a pro-Trump organization. Following Luckey’s firing, Stephens pitched his idea for a modern defense contractor. Palmer was immediately interested. The two began to build Anduril Industries, but more executive talent would be needed to round out the early team.

Outside of Luckey and Stephens, Anduril’s management team has accelerated the company’s ability to bring the mission to life. Palmer and Stephens first brought on software developer and ex-director of engineering at Palantir, Brian Schimpf. To round out the founding team, Joseph Chen, a former paratrooper and Oculus employee, was added to the engineering team. Finally, Matt Grimm joined as COO. Grimm was described by Stephens as the most effective person to scale a startup seeking exponential growth.

The first five members of the management team played a massive role in propelling Anduril's journey to disrupt an inefficient market characterized by extreme consolidation and minimal innovation.

Product

Anduril’s product offerings are comprised of defense capabilities using advanced technology. Anduril is a family of autonomous systems, powered by Lattice OS, providing integrated, persistent awareness and security across land, sea, and air. Trae Stephens, Anduril’s executive chairman, likens the company’s product strategy to a Trojan Horse, stating:

“We found that selling software was incredibly difficult. There’s almost a moral aversion to paying software margins inside of the DoD. Our focus was putting the thing we know DoD really needed, which was the software system/autonomy capability, and wrapping it in metal because it is significantly easier for the customer to buy metal than it is to buy the software. We use that as a Trojan horse to get software in the front door.”

Lattice OS

Lattice is at the center of Anduril’s product. The software system operates as a general command hub. It uses AI and computer vision to depict a view of the battlefield which can be interacted with using a computer, tablet, or VR headset. Lattice streamlines decision-making and offers potential next moves for men and women in uniform to understand, decide, and act. Think about it as an operating system for war.

Real-Time Understanding: One aspect of Lattice is its ability to streamline understanding. Using technologies such as sensor fusion, computer vision, edge computing, machine learning, and artificial intelligence, Lattice can detect, track, and classify every relevant object in the vicinity to help the operator understand the battlespace.

Automated Decision Advantage: In the dynamic environment of war, decisions must be made quickly and accurately. Lattice takes a complex decision-making process and streamlines it by offering recommended points of action to support the operator.

Integrated Command and Action: Finally, Lattice takes the decision aspect one step further by turning a recommendation into action. Within seconds, orders are routed to various hardware assets to complete the desired action. Lattice’s real-time command allows a single operator to control separate teams of assets and simplifies coordination across multi-domain operations.

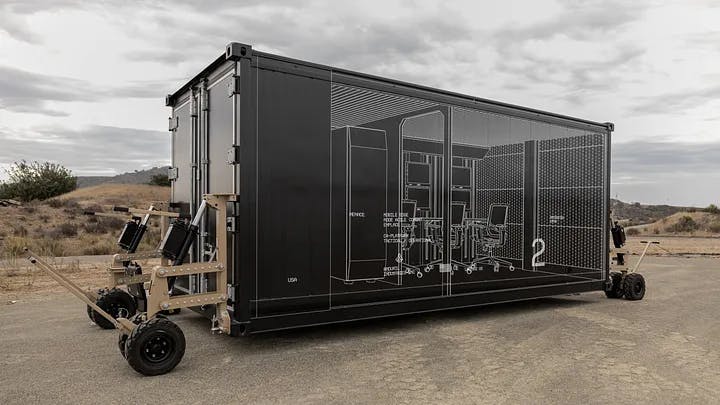

All of this technology is now supported by Anduril Menace, an integrated, expeditionary, secure, command, control, communications, and computing (C4) platform. Menace was built to provide redundant and resilient communications and can be operated in contested, degraded, and operationally limited environments. Because of its modular, open systems architecture and the software-agnostic nature of Menace, it is built to continually improve over time. With Menace, armed forces can execute plans while troops are dispersed in remote locations.

Source: Anduril

An example of the three components of Lattice in action is as follows: an Anduril field sensor may identify an enemy drone within a given air space. Because Lattice is a command hub connecting hardware assets, the data from the field sensor will depict an enemy drone on the Lattice display helping the operator understand the threat.

Then, Lattice will provide a recommendation for the operator to intercept the drone or perform an action to neutralize the threat. The operator can decide on the desired course of action at the push of a button.

Finally, within seconds, the decision of the operator will be routed to an asset - perhaps an Anduril drone - and the enemy drone will be intercepted autonomously.

Force Protection

Anduril’s first product was a sentry tower placed on the US-Mexico border in 2017 to monitor illegal border crossings. Since then, Anduril has advanced its sentry towers to be applicable in different environments and scenarios. Leveraging AI-enabled edge processing, Sentry can autonomously detect relevant objects and bring heightened safety to borders, military bases, oil and gas pipelines, airports, nuclear power facilities, and other critical infrastructure.

Anduril offers four different sentry towers including a standard range tower, a long-range tower, a cold weather tower with internal lens heaters to prevent frost, and a maritime sentry tower built with radar specifically designed to detect waterborne objects.

Source: Anduril

If detecting threats is the first step of force protection, Anvil is the second. Specifically built for CounterUAS, Anvil navigates autonomously to detect and destroy aerial drone threats. Permission must be granted for Anvil to take action, but once granted it will use kinetic energy sensors to locate and zero in on threats. Powered by Lattice, Anvil navigates autonomously to intercept and destroys enemy drones. To avoid collateral damage, Anvil’s critical parts are positioned away from the point of impact.

To supplement its sentry towers, Anduril offers sensors that are more portable and versatile in nature. One sensor asset offered by Anduril is called Dust. Dust is a ground sensor designed for military expeditions. The sensor uses radar, imagery, and edge computing to detect and classify targets of interest. Dust is intended to be portable and has a battery life of more than two months.

The WISP device is another sensor part of Anduril’s product offering. WISP stands for Wide-Area Infrared System for Persistent Surveillance. The sensor offers 360-degree wide-area imaging to aid in threat detection. WISP can be placed on ships, sentry towers, tactical vehicles, or on the ground to improve situational awareness.

Unmanned Aerial Systems

Covering the domain of air, Anduril’s fleet of unmanned aerial systems consists of two products: Ghost and Altius.

Ghost is a drone bringing real-time intelligence, surveillance, and multi-mission reconnaissance capabilities. Ghost is easily assembled and is nearly silent, making it perfect for covert surveillance.

Source: Anduril

ALTIUS is an unmanned aerial system that stands for an Agile-Launched, Tactically-Integrated Unmanned System. ALTIUS is designed to extend the reach and impact of operations. There are four different models of ALTIUS, with the furthest-ranging model capable of flying for more than 15 hours.

Underwater Vehicles

Finally, Anduril rounds out its defense coverage in the sea with autonomous underwater vehicles. Dive-LD is capable of both defense applications and commercial applications. Given its flexible and unique architecture, Dive-LD is ideal for missions including underwater battlespace intelligence, surveillance, mine countering, anti-submarine warfare, and more. On the commercial side, Dive-LD’s long endurance is perfect for deep-water surveys and inspections. Dive-LD can launch from a pier and return to the same pier, thus eliminating the need for high-cost offshore launch hubs.

Source: Anduril

In only five years, Anduril has managed to develop a wide range of innovative software and hardware assets in a market historically known for shipping products at a snail's pace with minimal innovation.

Market

Customer

Anduril’s main customer is the US government and its various branches, including the Department of Defense and the Department of Homeland Security. In 2017, US Customs and Border Protection, Anduril’s first customer, awarded the company its first contract to provide surveillance towers. As Anduril continues to broaden its product offering to incorporate autonomous warfare systems such as drones, the company’s main customer is the Department of Defense.

Sticking to the realm of warfare and autonomous battle, Anduril also serves the militaries of US allies. For instance, Anduril secured a $100 million contract with the Australian Ministry of Defense to provide its underwater autonomous vehicle, Dive-LD. This deal was done by Anduril Australia, an expansion and independent entity created in 2022 for national security. Additionally, Anduril also serves the UK Ministry of Defense with TALOS, a program focused on accelerating integrated command and control across all defense operations.

Most recently, Anduril Industries secured a 10-year-long contract with the US Special Operations Command (SOCOM) worth $967.6 million after beating out 11 competitors all vying for the contract. The contract includes various products from its family of systems such as its Sentry Tower, Anvil interceptor UAS, Pulsar, and Foxhound systems.

Although Anduril primarily serves the US military and its allies, the technology Anduril offers has many use cases outside of war efforts. Anduril serves commercial customers within industries such as oil and gas pipelines, and nuclear power facilities. Private sites with critical processes such as energy pipelines can leverage Anduril’s monitoring technology to ensure safety and protection. An example of an instance where Anduril’s technology would have been useful to a non-military customer was in September 2019, when drones attacked two major Saudi oil refineries.

Market Size

Anduril operates in an enormous and growing market. In 2020, the US spent $778 billion on defense and the Department of Defense contract obligations reached $448.7 billion. Bloomberg Government forecasts the 2024 DoD contract obligation to be around $452 billion. In reality, the entire $452 billion will not go towards defense contractors because part of the contract obligations for the DoD goes towards non-military categories such as food or clothing and footwear. Within the contracted portions of the DoD budget, there are hundreds of billions of dollars for Anduril to go after in the US alone. Taking into consideration the contracting budgets of US allies as well as the non-commercial customers Anduril serves, that market only gets larger.

Given Anduril’s unique outlook on the future of war and an accelerating shift towards software, new opportunities are presenting themselves and increasing the company’s market size. A prime example of this is the U.S. government’s program called Joint All Domain Command and Control, or JADC2. JADC2 encapsulates the Pentagon’s desire to “knit together all its surveillance and weapons systems to create a unified view of the battlefield and orchestrate them from afar.” Anduril’s operating system, Lattice, allows operators to autonomously conduct missions by bringing together information from thousands of sensors and data sources. As the U.S. military continues its shift to software and autonomous warfare, Anduril is well-positioned to compete for billions in new government spending.

Competition

The defense industry has never suffered a negative ten-year period since 1963. Large defense contractors are not known to build exceptional products on quick timelines, so what contributes to this consistent market growth? Defense companies have continually gotten away with underperformance because low competition paired with a highly consolidated market has forced the military to be dependent on a select few companies.

The largest defense contractors are staffed with patriots who don't possess the expertise required to develop software capable of powering tomorrow’s weapons. The end result is an outdated, top-heavy defense industry with very few entrants even attempting to chase incumbents. To illustrate the lack of fair competition in the defense industry, two-thirds of major Department of Defense weapons contracts had just one bidder. Of the contracts that actually receive some competition, less than 10% have three or more offers. Although Anduril is building defense technology suited for the future, the company still competes with antiquated defense contractors. Firms like Lockheed Martin and Raytheon have been around for decades and possess long-standing relationships and powerful lobbyist arms allowing them to win contracts despite not having the best technologies. At the end of the day, Anduril is competing for the same customer as traditional players: the US government.

Outside of the major defense contractors, Anduril faces competition from a handful of defense startups with a similar outlook on the future of war. Rebellion Defense is a defense company focusing on building software to provide battlefield awareness and autonomous mission execution. Rebellion only offers a software product rather than Anduril’s holistic offering that includes hardware. Shield AI is another defense company offering similar product capabilities to Anduril, namely through its AI Pilot called Hivemind. Hivemind is a software that enables autonomous piloting of various aircraft. Similar to Anduril, Shield AI also offers unmanned aerial systems autonomously controlled by Hivemind.

Although Anduril faces competition from defense startups with a similar mission, it is a very healthy and beneficial type of competition. When multiple startups have a unified goal to shake up the defense industry, the US government will have no choice but to pay attention and act accordingly to ensure its military dominance. Thus, the competition from like-minded startups accelerates the shift to software and autonomy in the defense industry, ultimately benefiting Anduril’s prospects in the long run.

Business Model

The standard business model in the defense industry is broken. By issuing contracts with a set of detailed and rigid specifications, the military is constricting innovation and incentivizing slow timelines. Anduril is challenging this inefficient practice by adopting a business model common to almost every other industry: develop the product first, then get appropriately rewarded for the value the technology will provide.

Anduril’s business model is unique in the defense contracting industry as the company is ”building to the mission, not to spec”. Product innovation stems from having a distinct vision of the overall mission and how its future would be shaped by a new product or technology. This is precisely what Anduril is attempting to do by adopting an innovation-friendly business model.

Traction

The level of traction Anduril has seen over its first 5 years would be deemed as strong for a startup in any industry, but particularly notable in the defense industry where venture-backed startups often fail to disrupt long-established incumbents and deeply entrenched procurement processes prevail. In the first twenty months after being founded, Anduril hit $10 million in revenue. Within four years, Anduril eclipsed $100 million in revenue. In 2021, the company was rumored to generate $150 million in revenue. The company’s revenue growth is largely attributed to the founding team’s ability to bring together “deep sectoral experience with the wisdom of Silicon Valley.” As a result, the team grow from 700 to 1.1K employees over the course of 2022.

Anduril’s traction can also be viewed from the perspective of winning government contracts. Within the first two years of operation, Anduril’s fast-paced shipment of complex products earned them roughly a dozen contracts with the Department of Defense and the Department of Homeland Security in 2019. In 2020, Customs and Border Control awarded Anduril a contract worth $250 million. Anduril already has 176 sentry towers installed and monitoring the US-Mexican border. Anduril’s biggest contract came in January 2022. The company was selected to lead the US Special Operations Command's counter-drone systems integration. The contract is worth up to $1 billion over 10 years over which Anduril will deliver, advance, and sustain unmanned counter systems for special operations forces.

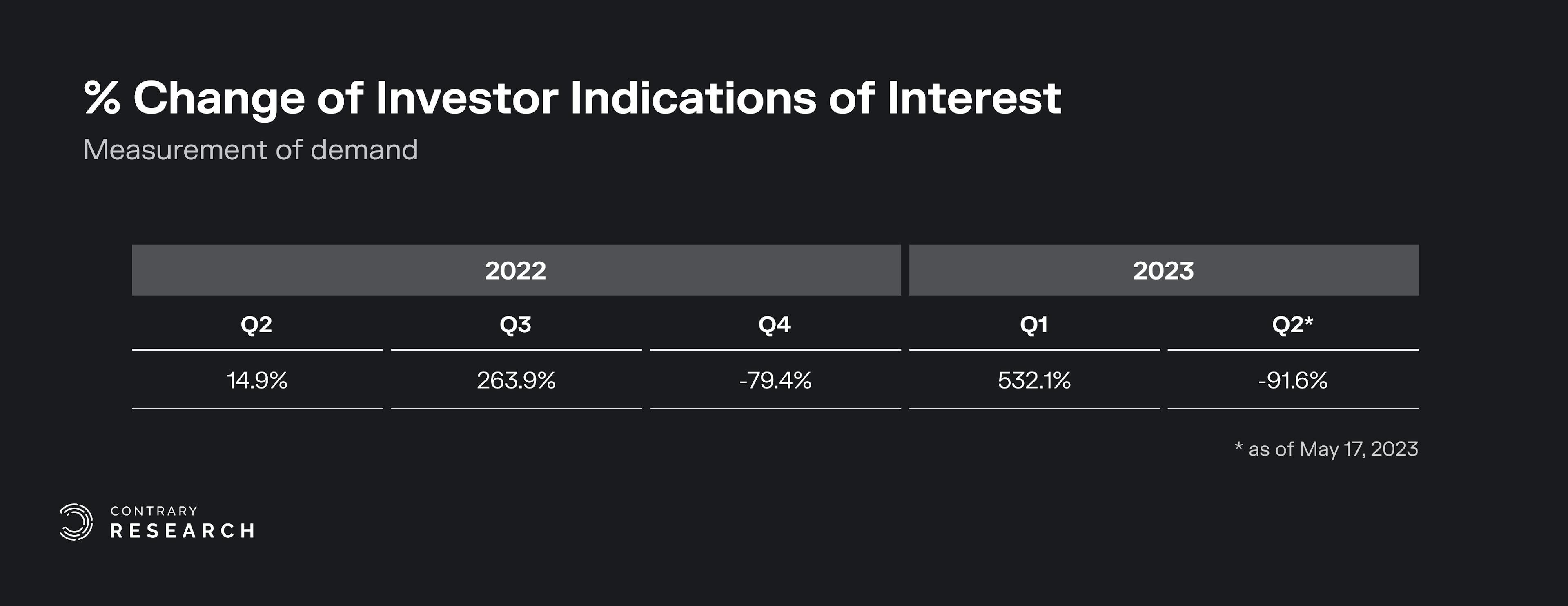

According to EquityZen, the leading pre-IPO secondary platform, investor interest in Anduril has varied considerably from Q2 2022 - Q2 2023, with considerable spikes in interest in Q3 2022 and Q1 2023.

Source: EquityZen

Valuation

After Anduril began working on its first product in June 2017, the company raised a seed round led by Founders Fund in August 2017. Anduril raised $17.5 million dollars, most of which would be invested into R&D. After a year of gaining traction, Anduril raised a $41 million Series A at a post-money valuation of $250 million in June 2018. Once again, Founders Fund led the round and other investors such as SV Angel and Human Capital joined.

By mid-2019, Anduril had managed to land contracts with approximately a dozen agencies of the Department of Defense and the Department of Homeland Security. As a result, Anduril’s valuation broke the $1 billion threshold during its series B round in late 2019. The round was led by Founders Fund alongside firms such as Andreessen Horowitz.

In September 2019, a drone attack on Saudi oil refineries brought more attention to the concern of small, cheap drones evading traditional U.S. military defense systems. As one of the few companies focused on autonomous warfare, Anduril once again received attention from deep-pocketed VC firms. In July 2020, Anduril raised $200 million at a $1.9 billion post-money valuation. The funding was used to expand Anduril’s development capabilities as the company attempts to bring a fast-paced Silicon Valley approach to a stale defense contracting industry.

Following a year of office expansions, key acquisitions, and new product launches, Anduril doubled its valuation during its Series D round in June 2021. The company raised $450 million at a $4.6 billion post-money valuation. CEO Brian Schimpf spoke about the significance of the series D round, stating:

“This new round of funding reflects our confidence that the Department of Defense sees the same problems we do, and is serious about deploying emerging technologies at scale across land, sea, air, and space domains.”

After signing its nearly billion dollar deal with SOCOM, Anduril Industries raised a Series E round just 18 months after their Series D. This $1.5 billion round which was led by Valor Equity Partners would bring their post-money valuation to $8.5 billion. As one of the largest fund raises in 2022, only SpaceX and Epic Games raised more money during the same 12-month period.

Key Opportunities

Future of Autonomous Warfare

Although Anduril’s products have proven to be useful in modern-day conflicts, they also align with the future of war. Palmer Luckey alludes to the future of warfare, stating:

“For years there's been this science fiction trope of conflict in the future being defined by large numbers of swarming drones or autonomous systems. But it's not just a sci-fi trope. This is also what a lot of war planners and a lot of people looking at the military believe is going to be the future.”

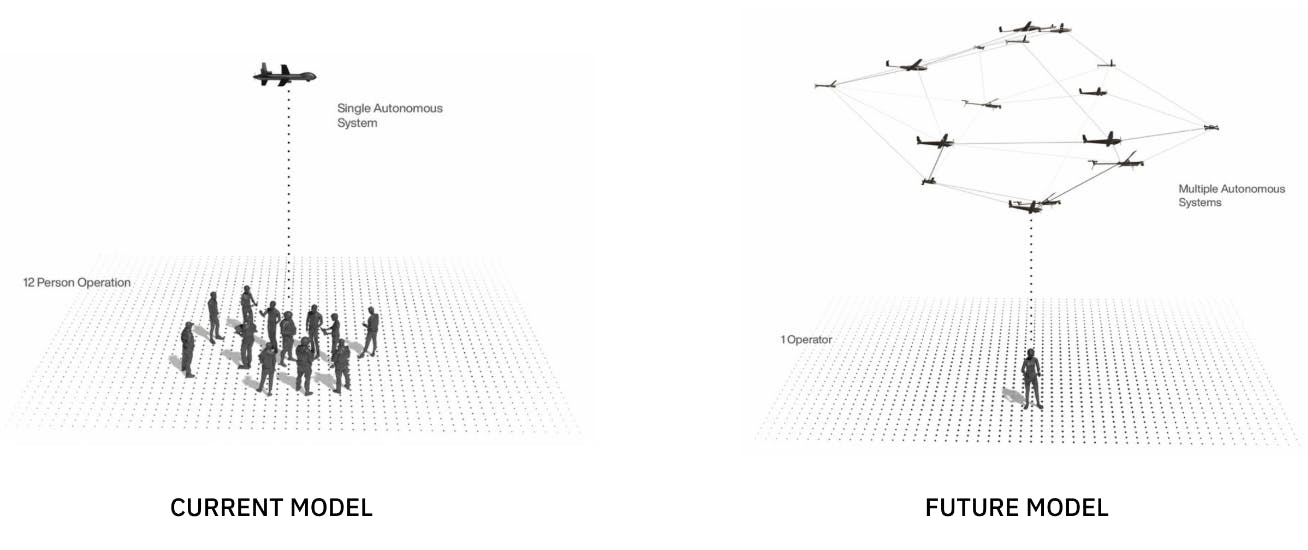

Anduril is one of the few companies in the defense space positioned to realize the vision of autonomous warfare for the US military. Anduril’s software, Lattice, is integral to this vision because the coordination of autonomous vehicles like drones becomes impossible to manage without an AI engine.

Source: Anduril

Becoming the Default Defense Company

To get a sense of the state of the defense industry, the Department of Defense’s nuclear arsenal was only upgraded from relying on 1970s-era floppy disks in 2019. A heavily consolidated competitive market with high prices and minimal innovation has led to scenarios of that nature, and ultimately a dwindling state of military superiority for the United States.

In an industry where traditional contractors ship products slowly and invest little in innovation, the traction of a company like Anduril is less surprising. Yet, Anduril still has plenty of room and opportunity to rise to the top of the defense industry. Palmer Luckey’s vision for Anduril is to become the next major contractor, stating:

“We want to be the company that when the DoD needs something, we're the first people they think of.”

Expansion Through Acquisition

Companies like Anduril are very rare in an otherwise consolidated and stale defense contracting industry, but they do exist. From April 2021 to February 2022, Anduril acquired three defense startups: Area-I, Copious Imaging, and Dive Technologies. Each respective startup combined forces with Anduril to produce various products including their underwater autonomous submarine. Given its existing relations with different governments, Anduril maximizes the potential for relatively unknown companies. For example, Dive Technologies generated less than $1 million in revenue, until Anduril secured a $100 million contract with the Australian Ministry of Defense.

Source: Anduril

Trae Stephens speaks to Anduril’s approach regarding its acquisitions, stating:

“We don’t want to just acquire your company and shut it down. We want to take the best ideas and technologies and use our business development strategy and pour jet fuel on it.”

Moving forward, Anduril’s acquisition opportunity is expected to increase as the company looks to deploy billions in funding and expand its product offering. One potential target is a startup dealing specifically with space-related surveillance systems, perhaps a modern satellite manufacturer. Given Anduril’s reputation and funding, it has a significant opportunity to acquire innovative defense startups that possess a similar mission to disrupt the stagnant defense industry.

Key Risks

Well-Established Competitive Landscape

On one hand, the state of the defense industry provides a great opportunity for Anduril to act as a disruptor and become a major player. On the other hand, a consolidated market with long-established primes can also pose a risk to Anduril. Palmer Luckey is well aware that the odds are stacked against Anduril and the reality of defense contracting, stating:

“People want to believe that if you build the best thing, then you’ll win. That’s not the way that the real world works.”

Luckey is referring to the antiquated procurement practices of the Pentagon and the biases they may have when selecting a contractor. One former Senior Program Manager at the Department of Defense confirms this idea:

”[Anduril’s] ALTIUS system and their dome system is fantastic, but I don't know about their marketing strategy where they're competing against some of the long-established people in the market… The government was used to working with certain contractors and they wanted to stick with them despite there might be a better solution out there.”

Continuing Resolution

For American contractors in the defense industry, the US military is the main customer. If military spending is impacted in any way, the revenue possibility will be diminished. One occurrence impacting the spending is a continuing resolution, a maneuver that keeps the government open but freezes spending at the previous year’s level. The Department of Defense has started 12 of the last 13 fiscal years under a continuing resolution. This affects the military’s ability to accomplish key objectives and dish out large contracts to defense companies. Undersecretary of Defense, Mike McCord, speaks to the impact of a continuing resolution on being competitive, stating:

"First, if you want us to be more competitive with our adversaries, it's going to make us less so. If you want us to be more agile, a continuing resolution has the opposite effect”

A continuing resolution is especially worrying for Anduril because of its unique approach to contracting. By investing its own money into R&D and production, Anduril’s ability to stay afloat is reliant on the government buying its products. Palmer Luckey understands that a company like Anduril suffers most from a continuing resolution:

“The real people who get screwed by this type of situation are the smaller defense companies, the startups, the people coming up with innovative things in a lab that are relying on that money being able to come through.”

Summary

Anduril is a defense company with a mission to reinvent the future arsenal of the US military and its allies. By positioning itself at the center of the shift to software and autonomous warfare, Anduril is exposed to new opportunities and billions in potential spending. Anduril, and other Silicon Valley defense tech startups, will likely play a massive role in maintaining the superiority of the U.S. military moving forward.

Anduril’s existence is a unique company; they are a defense contractor but operate with the speed of a startup, and sell software masked by a Trojan horse of selling hardware to provide war-focused technology with the hopes of bringing about more peace.

*Contrary is an investor in Anduril Industries through one or more affiliates.