Thesis

In an economy where the nominal value of wages has been declining since 1970, more households than ever are feeling the squeeze. Nearly half of Americans feel they are living paycheck to paycheck, according to a 2024 report from the Bank of America Institute, while banking data indicates that about a quarter of households were truly reliant on their next payday to meet financial obligations. Another report from 2023 indicated that 61% of US consumers felt they were living paycheck to paycheck. Perhaps surprisingly, even among households with annual incomes greater than $150K, approximately 20% appeared to be living paycheck to paycheck as of October 2024.

Prior to the emergence of Earned Wage Access (EWA) services, people who were unable to meet financial obligations were often forced to turn to high-cost financial solutions such as credit card debt, credit card cash advances, payday loans, pawnshops, overdraft protection services, borrowing from friends or family, or even skipping essential payments altogether. These options frequently came with significant financial and emotional costs, including exorbitant interest rates, fees, strained personal relationships, and potential damage to credit scores.

The traditional biweekly pay schedule — a relic of the 1940s, when it was enacted in order to accommodate income-tax withholding policies and limited computing capabilities on the part of companies — no longer aligns with the financial realities of today’s workforce. This outdated system places significant financial strain on the most economically vulnerable workers, who often face unexpected expenses, such as emergency medical bills or car repairs, without the option of waiting for payday. While approximately 73% of Americans received a paycheck twenty-six times or less annually as of August 2023, most workers want to be paid daily — a return to the true meaning of “a day’s wages.”

The rise of earned wage access (EWA) companies like EarnIn signals a broader shift toward modern pay practices. By providing employees access to the wages they’ve already earned when they need them most, EarnIn bridges the gap between work and pay. This approach not only alleviates the financial strain caused by the outdated pay cycle but also challenges predatory financial solutions, driving the adoption of more flexible, employee-centric compensation practices.

Founding Story

Earnin was founded in 2012 by Ram Palaniappan (CEO). While leading his first company in Cincinnati, Ohio, Palaniappan noticed employees struggling with payday loans and overdraft fees. When one employee couldn’t wait for her paycheck, he paid her directly and deducted the amount from her next paycheck. This experience sparked the idea for EarnIn, his first company. EarnIn began under the name Activehours Inc., and is headquartered in Palo Alto, California. It appears to have rebranded to EarnIn after its November 2017 Series A.

Sean Delehanty (CFO) became Earnin’s CFO in 2019 after serving as SVP of finance at Symantec, which followed his more than 13 years of experience as director of Silver Lakes, a global tech investment firm. Brittanie Williams (CMO) was brought on as the CMO in 2021 after working at Uber. Yair Rivlin (CPO) became CPO in 2022 after directing product at Amazon since 2014. Ofer Shaked (CTO) became CTO in 2021 after his role as VP of engineering at Intuit. EarnIn’s executive team also includes former leaders from Capital One, Even, Google, RAND, Robinhood, and Twitter (X).

Product

EarnIn offers a suite of six products, all designed to complement each other in promoting the financial well-being of its users. At the core of this suite is EarnIn's flagship product, Cash Out, which allows users to access earned wages before payday. Alongside Cash Out, the other products work together to provide a set of tools that support financial flexibility, budgeting, credit management, and savings.

Source: EarnIn

Cash Out

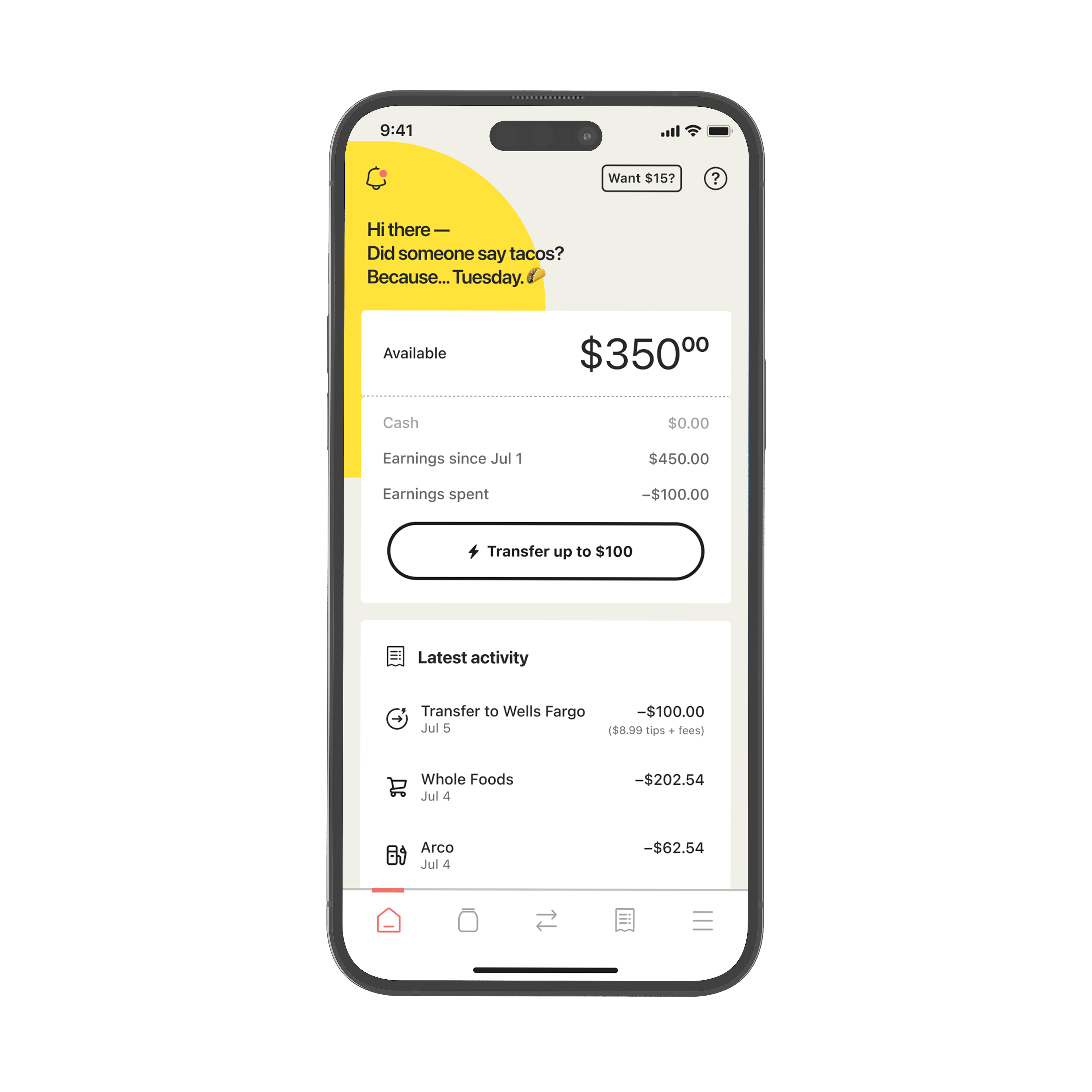

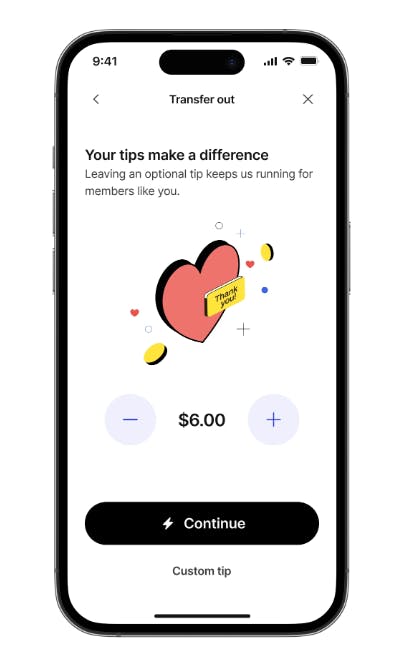

Earnin’s Cash Out product offering allows users to access up to $750 of earned wages per pay period prior to payday, with transfers of up to $150 per day to a linked bank account. There is no need to be a full-time employee—just a consistent pay schedule and at least $320 per pay period. The service has no interest charges, mandatory fees, or credit checks, and users can choose to tip an amount they feel is fair.

All transfers, including tips, are automatically repaid from the next paycheck. If a user is unable to repay, EarnIn assumes the risk and absorbs the loss, with no impact on the user other than not being able to withdraw additional wages until reimbursement is made. Pay period limits vary based on financial habits, providing flexibility tailored to each user. Cash Out is available to individuals whose primary residence is in the US.

Source: EarnIn

Early Pay

With Early Pay, paychecks are first deposited into users’ Evolve Deposit Account, provided by partner bank Evolve Bank & Trust, before being transferred to the linked bank account. Expedited transfers cost $2.99 per transaction as of February 2025, a fee charged by Evolve Bank & Trust, while a no-cost option ensures funds are available by the scheduled payday. Funds may be accessible as soon as the employer processes payroll, up to two days early. However, early access to funds is not guaranteed and depends on the timing of the employer’s payroll processing. Early Pay integrates seamlessly with existing bank accounts, requiring no changes.

Balance Shield

Balance Shield allows users to set a bank balance threshold between $0 and $500, and receive real-time notifications when their balance falls below that threshold. If desired, $100 can be automatically transferred from on-demand pay to protect the balance in case of overdraft. Expedited auto-transfers cost $3.99, with funds landing in the account within minutes. Alternatively, a no-cost standard transfer option is available, which deposits funds within 1-2 business days.

Tip Yourself

Tip Yourself, an automated savings product, was added to EarnIn’s suite of products in 2020 following an acquisition of a company by the same name. Tip Yourself allows users to create up to five Tip Jars to save with, with daily transfers ranging from $1-$100. Savings progress can be tracked in the app, and funds can be transferred back to the bank account at no cost, with FDIC insurance for security. The combined total across all Tip Jars is capped at $2K. Money can be transferred out of the Tip Jars at any time, for any reason.

Credit Monitoring

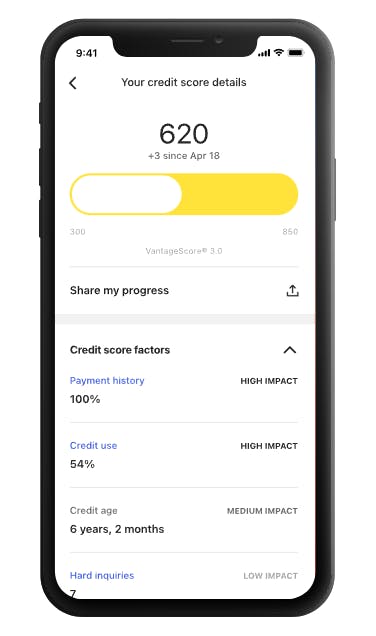

Credit Monitoring offers instant access to the VantageScore 3.0 by Experian, allowing users to view credit usage, open accounts, and payment history. It also provides alerts to help detect fraud and prevent surprises. The service does not involve any hard or soft credit pulls, ensuring there is no impact on the credit score or credit limit.

Source: EarnIn

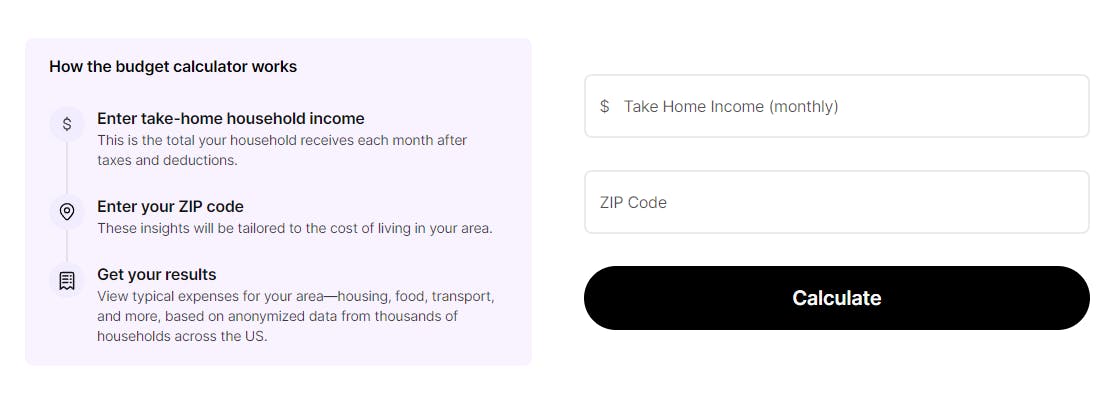

Financial Calculators

Financial Calculators provide tools to help users improve their monthly budget, compare costs, and plan for the future. These calculators cover a range of financial needs, including budgeting, rent, personal loans, credit card payoff, student loans, auto loans, and mortgage loans.

Source: EarnIn

Market

Customer

EarnIn’s customers are both US-based employers (indirectly) and employees (directly). Their pitch to employers is a zero-cost and zero-touch program for employees that boosts performance and retention. Through these partnerships, EarnIn gains access to its broader customer base. For example, EarnIn partnered with Sears Holdings and Uber in 2016 to give shift and gig workers more frequent paydays.

EarnIn’s paying customers are US-based wage earners who need access to cash quicker than payroll permits, typically in industries such as retail and gig workers, but also nurses and teachers. An internal survey published by EarnIn in 2021 shed light on the self-reported demographics of its customers: nearly seven in ten customers were under the age of 45, while over three-quarters earned $75K or less annually. Women made up a significant majority, accounting for 70% of the customer base.

Market Size

The projected size of the workforce in the US in 2025 is estimated to be 151.7 million people, and reports in 2023 and 2024 indicate that somewhere between ~50%-60% of Americans feel like they are living paycheck to paycheck. Given that EarnIn’s customers are wage earners either living paycheck to paycheck (or at least perceiving themselves to be), we can estimate a potential market size of approximately 75.9 - 92.5 million people. If EarnIn were to expand to the global market, that number could climb into the billions.

The EWA software market in particular is estimated to experience significant growth in the coming years. It was valued at $12.3 billion in 2022 according to one estimate and was expected to reach $121.9 billion by 2032, with a CAGR of 25.8% from 2024 to 2032. In contrast, another estimate placed the market size at $22.5 billion in 2022, with a slower growth trajectory, predicting it will reach $26.7 billion by 2030. This projection suggests a more modest CAGR of 2.2% between 2023 and 2030.

The payday loans market that EWA is disrupting was valued at $35 billion in 2023 and estimated to reach $52.3 billion by 2033. The credit card cash advance market was valued at $13.4 billion in 2023, and is projected to reach $25.7 billion by 2033.

Competition

Competitive Landscape

The mass proliferation of EWA providers stems from low technical barriers to entry — the core technology simply requires payroll integration and/or income verification, made increasingly accessible through banking APIs and fintech infrastructure providers like Plaid. This ease of entry, combined with an attractive business model where providers can generate revenue as middlemen while marketing themselves as ethical alternatives to payday loans, has led to a crowded marketplace.

The competitive landscape is particularly complex because companies like Earnin aren't just competing with pure-play EWA providers, but in the broader arena of short-term liquidity solutions. This includes traditional payroll companies adding EWA features, broader fintech platforms offering EWA as part of their suite, and various alternative lending products like buy-now-pay-later services, credit builder loans, and cash advance apps. All these services ultimately address the same core customer need: access to short-term funds between paychecks.

This multi-dimensional competition requires EWA providers to differentiate themselves not just on their core wage access offering, but also through additional features, user experience, pricing models, and employer partnerships, piecing together a mosaic of financial products to see what lures away and captivates new customers. The result is an increasingly sophisticated market where the lines between different types of short-term liquidity providers continue to blur.

According to a 2019 study of customer preferences when choosing an EWA provider, the top five criteria are, in order: security, cost, speed, convenience, and ease. Whichever provider can market these successfully will have a good chance at gaining traction.

Direct Competitors

PayActiv: PayActiv, founded in 2012 (the same year as EarnIn), was an early player in the employer-integrated EWA space. The company gained significant market prominence through its 2017 partnership with Walmart, becoming the retail giant's official EWA provider and reaching potentially millions of Walmart employees. PayActiv's platform differs from EarnIn by focusing on B2B partnerships and offering a broader suite of financial services including bill pay, savings tools, and prescription discounts alongside its core EWA product.

PayActiv makes it’s money from the interchange rate on the PayActiv Visa Card and small fees on real-time transfers. PayActiv raised $100 million in an August 2020 Series C led by Eldridge Industries and had an estimated $291.9 million valuation as of August 2020 after raising $133.7 million over six rounds from investors such as Generation Partners, Ziegler, and Softbank.

DailyPay: DailyPay, founded in 2015, also focuses on partnerships with employers through integration with 180+ existing HCM and payroll providers, such as ADP, Workday, and Oracle. Unlike EarnIn, it does not offer direct-to-consumer early wage access. An estimated one in six Americans have early access to wages through DailyPay, and one in ten RTP (real-time) payments allegedly occur through their platform. In 2022, Chime offered to buy DailyPay for $2 billion, but the offer was declined as DailyPay aimed for a higher bid or even a potential IPO in 2025. DailyPay raised $75 million in a Series in January of 2024 at an estimated $1.8 billion valuation.

Others: There are many copycat companies in the B2B-focused space that DailyPay and PayActiv occupy, such as ZayZoon, Instant, FlexWage, Juice Financial, Immediate, FlexEarn, Clair, Rain, Tapcheck, Branch, OrbisPay, Hastee, Fuego, SalaryCredits, AnyDay, One@Work and Wagely. Companies such as Clockout and PayKey are specifically posturing as solutions for banks to gain more loyal customers by giving early wage access.

Adjacent Competitors

Payroll & HCM Providers: Established payroll and HCM service providers such as ADP, Paychex, Ceridian, Asure, Inova, Paycom, Proliant, Edenred Benefits, UKG have integrated EWA capabilities into their existing platforms, leveraging their deep employer relationships and payroll infrastructure to offer on-demand pay features.

Cash Advance Apps: A proliferation of so-called cash advance apps have appeared offering instant cash advances of up to $1K with no credit check or interest. They make their money in a variety of ways such as tips, transfer fees, or monthly subscriptions. Some examples include Empower, Varo, MoneyLion, Cleo, Dave, Brigit, Klover, and Beem.

Neobanks: Current and Chime are neobanks with in-house EWA offerings. Other ambitious all-in-one money platforms such as SoFi, Albert, and Cash App offer two-day early paycheck deposits, and are likely not far off from an EWA offering.

Business Model

EarnIn operates on a freemium model, generating revenue through two primary sources: “Lightning Speed” transaction fees and voluntary tips. Lightning Speed allows users to receive their funds within minutes for a fee ranging from $2.99-$5.99, while standard-speed transfers (1-2 business days) are free. Tips are optional contributions that users can choose to provide, ranging from $0-$13.

According to EarnIn, the average tip is less than the average out-of-network ATM fee of $4.68. Moreover, 57% of earnings transferred out included a tip, 43% did not. Since neither tipping nor paying for Lightning Speed is mandatory, EarnIn users have full control over their cost of use. As mentioned earlier, while EarnIn’s business model is both DTC and B2B, they charge no fees to employers in exchange for de facto access to a customer base.

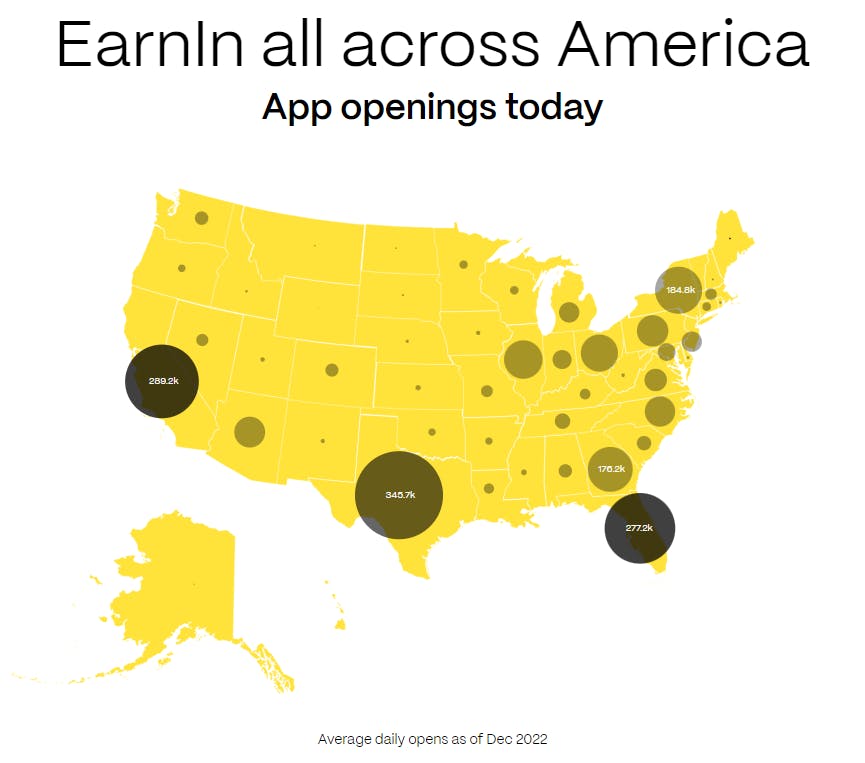

Traction

As one of the first players in the EWA space, EarnIn has particularly strong standing in the direct-to-consumer segment of an increasingly fragmented competitive landscape. To date, the company is used by 3.8 million+ employees accessing over $15 billion in earnings, with 1.3 million active users who rely on Cash Out for their early wage access needs. EarnIn has, moreover, spared its users from over $1 billion in avoided overdraft fees and helped them save over $36 million. Since Earnin’s founding, its 3.8 million customers as of October 2024 had given it over 460K+ 5-star reviews on over 19 million app downloads and counting as of February 2025.

Source: EarnIn

Valuation

EarnIn raised $125 million in its Series C round in December 2018, led by Andreessen Horowitz, DST Global, and Spark Capital. Key investors across Earnin’s funding rounds include Andreessen Horowitz, Matrix Partners, Felicis Ventures, DST Global, and Spark Capital, with a total funding amount of $190.1 million as of February 2025. EarnIn had an estimated valuation of $527 million as of 2020 according to Caplight.

Key Opportunities

Market Expansion

Earnin has the opportunity to expand its EWA offering into markets like the UK, Canada, Australia, and New Zealand, who conduct business in a shared language and with similar common law legal systems. The company can leverage its existing English-language platform, customer support infrastructure, and compliance expertise with minimal adaptation. These markets also share similar workforce challenges around paycheck timing and short-term liquidity needs, plus they have robust digital banking infrastructure and high smartphone penetration—key requirements for Earnin's model.

EWA is also gaining steam abroad beyond English-speaking countries, indicated by the appearance of localized companies such as PayWatch (Asia), Paymenow (Africa), Salary Hero (Thailand), Refyne (India/Asia), Jify (India), Minu (Mexico), Sprout Solutions (Philippines), GIMO (Vietnam), and Gajiku (Indonesia). It would be substantially more difficult to expand into these markets, but given that these geographies contain the majority of the world’s population, it may be worth it.

Acquisition by Neobank or IPO

A key strategic opportunity for Earnin lies in potential acquisition by a major neobank, as demonstrated by Chime's reported bid to acquire DailyPay. This signals neobanks' growing recognition of EWA as a critical feature for engaging paycheck-to-paycheck consumers. Acquisition interest from neobanks makes strategic sense — they can leverage their large user bases and banking infrastructure while adding a sticky, revenue-generating feature that drives user engagement.

Similar dynamics played out with Block (formerly Square) acquiring AfterPay, demonstrating the broader trend of larger fintech and retail players looking to own the short-term liquidity space. For neobanks specifically, adding EWA through acquisition provides an established solution with employer relationships and compliance frameworks, rather than building from scratch. If a suitable bid for EarnIn does not materialize, the company may also consider pursuing an IPO, similar to DailyPay.

Revenue Stream Diversification

There are three main revenue models in the EWA space: percentage of the interchange, per user per month, and one-off fees. Earnin could significantly expand its revenue streams by launching its own debit card, capitalizing on interchange fees (typically 1-3%) generated when customers make purchases. This would transform their model from just earning revenue on wage advances to participating in their users' everyday banking transactions.

The strategy aligns with how many fintech companies monetize — for example, Cash App generates substantial revenue through its Cash Card and Chime earns interchange fees on its debit card transactions. For Earnin, a debit card would be particularly strategic since they could seamlessly deposit advanced wages onto the card. This would create a more compelling value proposition by providing truly instant access to earned wages while potentially reducing risk through better visibility into fund flows. The card could also serve as a foundation for building out broader banking services to help users better manage their finances.

Key Risks

Regulatory Risk

The evolving regulatory landscape poses a significant threat to EarnIn's business model. Increased scrutiny from the CFPB (Consumer Financial Protection Bureau) and state regulators raises the likelihood of EWA products being classified as lending, requiring licensing and imposing substantial compliance burdens. EarnIn’s reliance on voluntary "tips" as a revenue model is under threat, as tips could be redefined as mandatory interest under lending regulations. Other risks include retroactive enforcement actions, fee structure pressures, and potential state-level licensing mandates. Future regulations based on the Truth in Lending Act could enforce interest rate caps, increase compliance costs, and necessitate operational restructuring, impacting revenue, valuation, and funding prospects. Adapting to these changes may demand significant investment in compliance and modifications to core offerings.

The Office of the Attorney General of DC recently sued EarnIn for “deceptively marketing and providing illegal high-interest loans” to DC consumers, alleging that the Lightning Speed fee amounts to the equivalent of a 300% annual interest loan. This kind of attention will likely continue until regulational clarity is reached. A bill called “Earned Wage Access Consumer Protection Act” was introduced to US Congress in 2024 seeking to provide that clarity.

Crowded Market

The EWA market faces growing competition that could challenge EarnIn's position. Traditional banks and payroll providers are launching native solutions, while fintech giants like PayPal and Square leverage their resources and customer bases to enter the space. Employer-sponsored free EWA programs threaten the fee-based model, and emerging technologies like real-time payments, blockchain, and open banking could diminish demand for EWA services. These pressures may lead to margin compression, higher customer acquisition costs, and reduced differentiation.

Obsolescence

Despite its current success, Earnin faces an existential threat from the evolving payroll landscape. As CEO Ram Palaniappan himself acknowledged in a June 2024 interview:

"I believe payroll will eventually move from batch processing to continuous processing. Meaning, you'll eventually see the money you've earned in your bank account in real-time, rather than waiting for a bi-weekly or monthly payday. The technology for this already exists; it's just a matter of changing the systems we use."

This shift toward real-time pay could render Earnin's core EWA offering obsolete, as the fundamental problem they solve — the timing mismatch between earning and accessing wages — would disappear. Major payroll providers are already exploring real-time payment capabilities, and the rise of instant payment infrastructures like FedNow could accelerate this transition, potentially leaving EWA providers searching for new ways to remain relevant.

Summary

EarnIn stands at the intersection of two major fintech battlegrounds: the competition between neobanks and vertical fintechs to control next-generation consumer wallets, and the evolution of next-generation credit lending. As an early player in the EWA space, EarnIn has built significant traction with 3.8 million+ users and $20 billion+ in accessed earnings by addressing the fundamental mismatch between biweekly payroll schedules and unexpected expenses.

However, the company faces multiple strategic challenges: regulatory scrutiny over its "tipping" model, the threat of obsolescence as real-time payroll processing becomes feasible, and intense competition not just from pure-play EWA providers but also from neobanks, traditional payroll companies, and various other short-term liquidity providers. While expansion opportunities exist in international markets, EarnIn's long-term success may depend on evolving beyond its core EWA offering to build deeper financial relationships with its paycheck-to-paycheck customer base.