Thesis

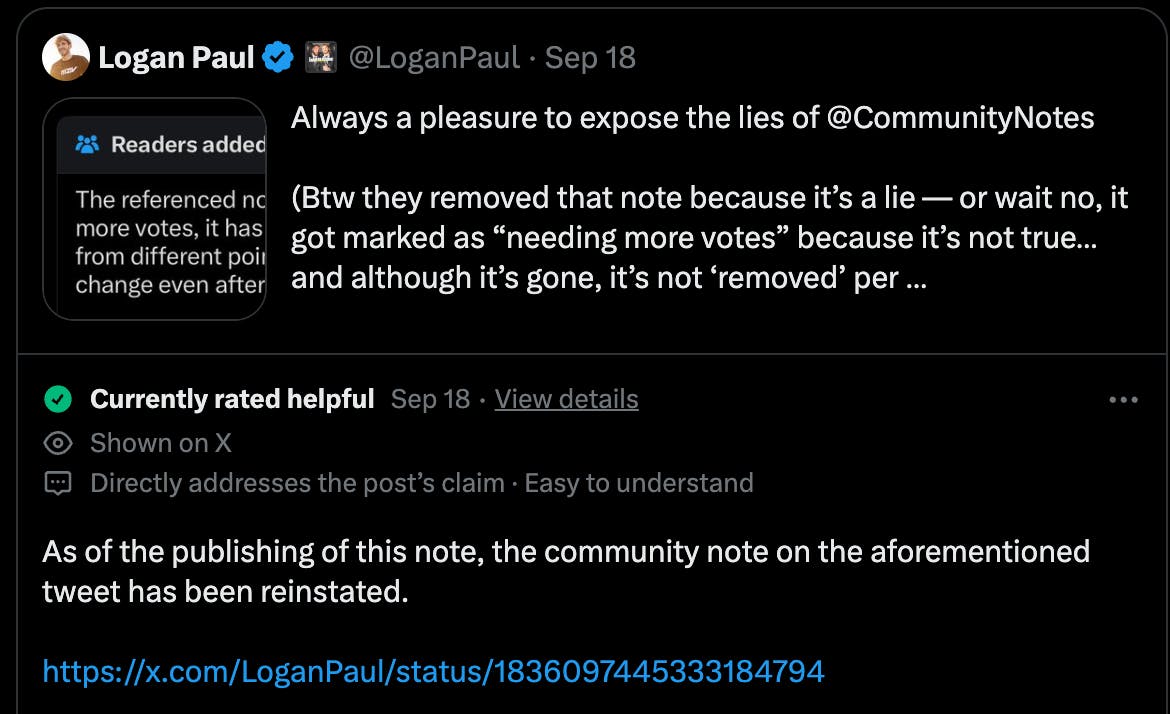

The digital landscape is increasingly crowded, with social media platforms like Instagram, Facebook, TikTok, Tinder, and Snapchat offering seemingly endless options for connection. The average amount of time spent on social media has risen significantly too as users shift more of their activities to digital spaces. In 2024, users averaged 143 minutes on social media compared to an average of 90 minutes in 2012. As competition for user attention intensifies, platforms continue to evolve, aiming to centralize entertainment and services to become users’ “everything app.”

As users spend longer online and plugged into social media, the global social networking market continues to grow rapidly, projected to reach $940 billion by 2026 at a 25.4% CAGR. In parallel, the creator economy is growing, fueled by advances in generative AI and the increasing accessibility of digital tools. By 2027, the creator economy is expected to nearly double in size, and to grow from $250 billion in 2023 to $480 billion. More creators are looking to monetize their content and audience, emphasizing the need for platforms to offer robust tools for content creation and direct monetization.

With 568 million MAUs as of 2024, X has evolved from a microblogging platform into a comprehensive social ecosystem, aiming to capitalize on the shift toward digital social spaces. X is the premier platform for real-time public discourse and has built a wide array of personal and community-based interactions, encompassing AI-powered tools, community building, and online commerce. From xAI’s Grok as a X-based AI personal assistant to X Spaces and X Shopping, X aims to become the centerpiece of real-time digital communities and commerce in the 21st century.

When Elon Musk bought Twitter in April 2022 and changed its name to X in July 2023, he did so with the intent to create a super app such as WeChat in China. Musk stated that “buying Twitter is an accelerant to creating X, the everything app,” laying out his vision for X to integrate financial transactions, community features, and a broad suite of social functions. US tech giants have achieved limited success in integrating entertainment, communities, and financial transactions into a single consumer platform, and WeChat remains the only extant super app in existence. Musk aims to build from 0 to 1 in the United States by building X into an analogous super app, expanding interaction features, and providing a platform user experience that could redefine how Americans interact, transact, and access information in a unified digital ecosystem.

Company History

Founding Story

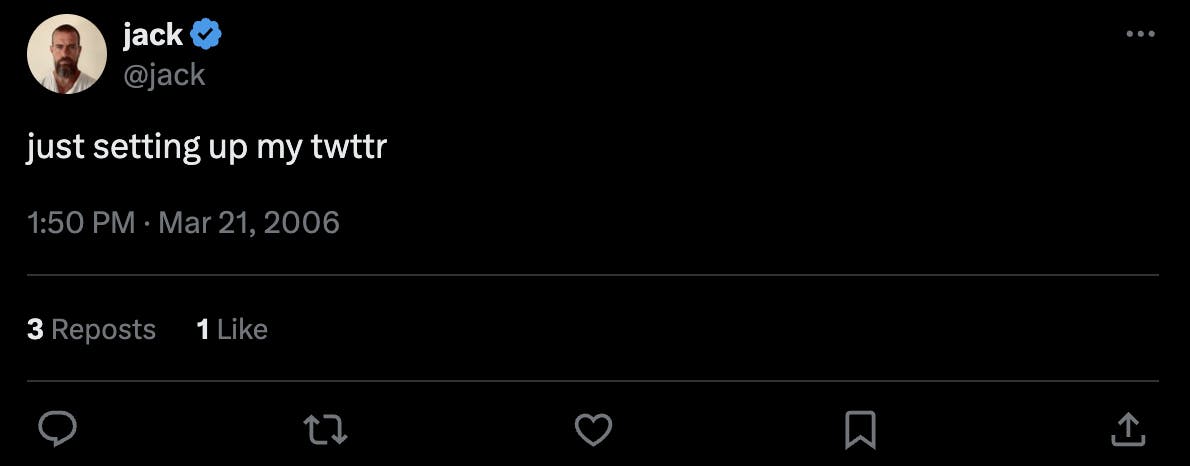

X, originally launched as Twitter in 2006, was co-founded by Jack Dorsey, Noah Glass, Biz Stone, and Evan Williams. The platform was born out of Dorsey’s vision for an SMS-based tool allowing people to share real-time updates. Dorsey’s background in dispatch software, where rapid, succinct communication was essential, inspired the concept. Twitter’s original model, which limited posts to 140 characters, was designed to mimic the brevity of SMS messages, making it easy for users to share thoughts and updates quickly. In October 2008, Dorsey stepped down as Twitter CEO to become chairman of the board and founded Square (now Block), with Williams taking over as CEO.

Source: X

Twitter rapidly gained traction as a platform for real-time communication, particularly during significant global geopolitical and news events such as the 2010 NBA Finals, Michael Jackson’s death, and the Arab Spring. The platform became a critical tool for news dissemination and activism, giving everyday users, journalists, and public figures a direct line to global audiences. As Twitter became the go-to platform for fast public discourse, it facilitated global conversations around movements, politics, and trends.

Twitter went public in 2013 at $26 a share, valuing the company at $18.1 billion. As a public company, Twitter faced pressure to scale revenues and demonstrate profitability. To meet these expectations, the company developed new advertising models such as promoted tweets and trending topics aimed at integrating ads seamlessly into users' feeds without overwhelming them. Twitter also pursued data licensing, leveraging the vast amounts of real-time data generated on its platform to sell directly to marketers and research institutions.

Over the years, Twitter expanded its capabilities, introducing features like live streaming, Explore, and a doubled character limit to 280 in 2017, adapting to the evolving digital landscape. Despite these innovations, Twitter struggled to balance growth, profitability, and content moderation. By 2022, estimates revealed that Twitter had not recorded an annual profit since 2019 and had posted losses in eight years of the previous decade.

Twitter & The COVID-19 Pandemic (2020 - 2022)

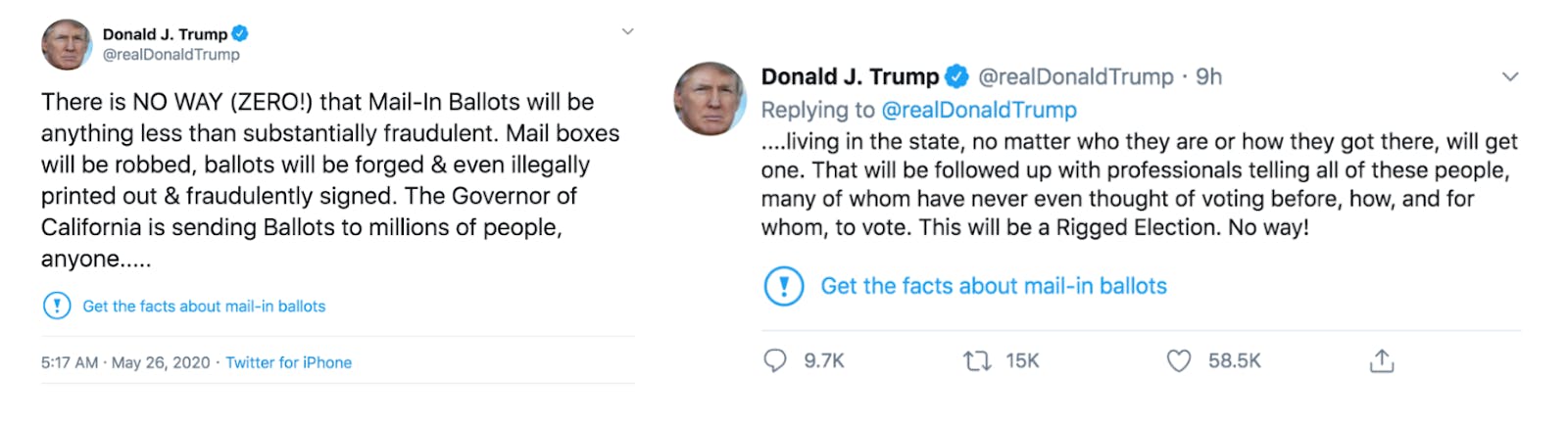

With the advent of the COVID-19 pandemic, Twitter found itself simultaneously growing (182 million DAU in Q2 2020, up 34% YoY) and at the center of debates surrounding free speech and misinformation, forcing the company to refine its policies and implement new tools like fact-checking and user safety features. From March to May 2020, Twitter put into place a “strike-based” system designed to label, fact-check, and add context to “misleading” information. However, the system occasionally marked factual information as misinformation.

In May 2020, Twitter moderators flagged two tweets from then-US President Donald Trump during the 2020 Presidential Election as “potentially misleading” and linked them to fact-checks.

Source: X

In response, President Trump signed an executive order aimed at weakening Section 230 of the Communications Decency Act, which shields social media platforms from liability over content moderation decisions. Twitter also received criticism from American government officials such as Senator Marco Rubio for moving into an “editorial role” instead of maintaining an open forum of public discussion.

Dorsey, who returned as CEO in 2015 after Dick Costolo’s resignation, responded to these criticisms of Twitter overstepping its original mission with the following tweet:

“This does not make us an 'arbiter of truth.' Our intention is to connect the dots of conflicting statements and show the information in dispute so people can judge for themselves. More transparency from us is critical so folks can clearly see the why behind our actions.”

On January 2021, two days after the January 6 attack on the United States Capitol, Twitter permanently banned President Trump, claiming that it did so to avert the risk of “further incitement of violence.” As Twitter had historically provided open platforms to world leaders, the move ignited backlash, with figures such as Angela Merkel and Matt Gaetz criticizing the ban as an infringement on free speech.

In the backdrop of these escalating challenges, Twitter faced internal leadership changes. In November 2021, Dorsey stepped down once again, handing the reins to CTO Parag Agrawal as the company struggled to find stable ground amid increasing political scrutiny, profitability concerns, and competition from emerging social platforms.

Elon Musk’s Acquisition of Twitter (2022 - 2023)

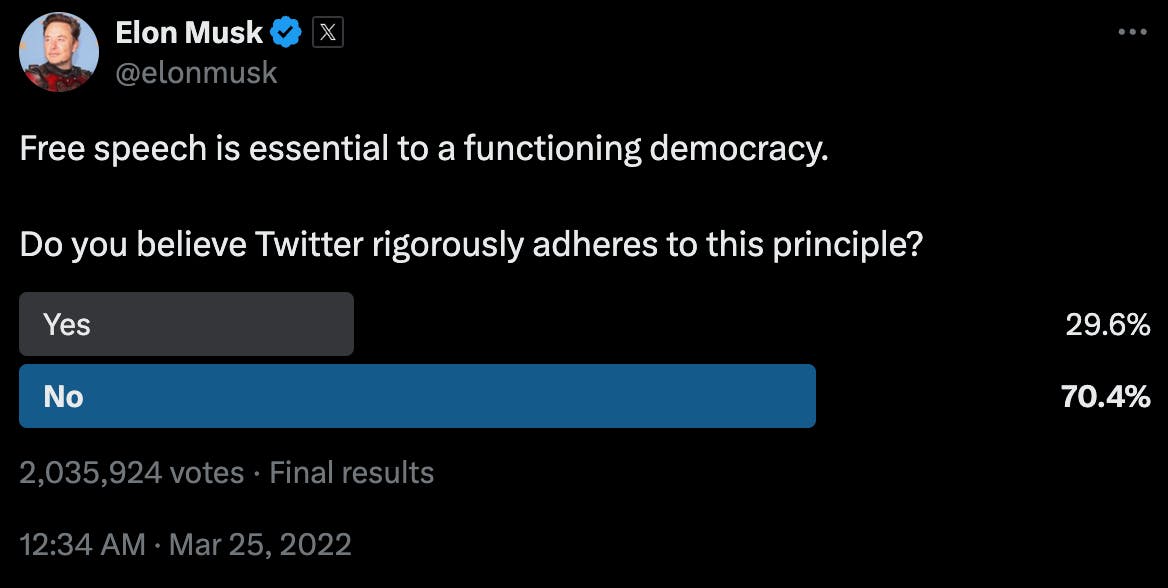

Elon Musk has been one of the most influential voices on Twitter, joining the platform as a user in 2010 and accumulating a follower count of 80 million by April 2022. In March 2023, Musk openly criticized Twitter to his followers, questioning its commitment to free speech. Among other statements, he asserted that "free speech is essential to a functioning democracy." He further asked, "do you believe Twitter rigorously adheres to this principle?”

Source: X

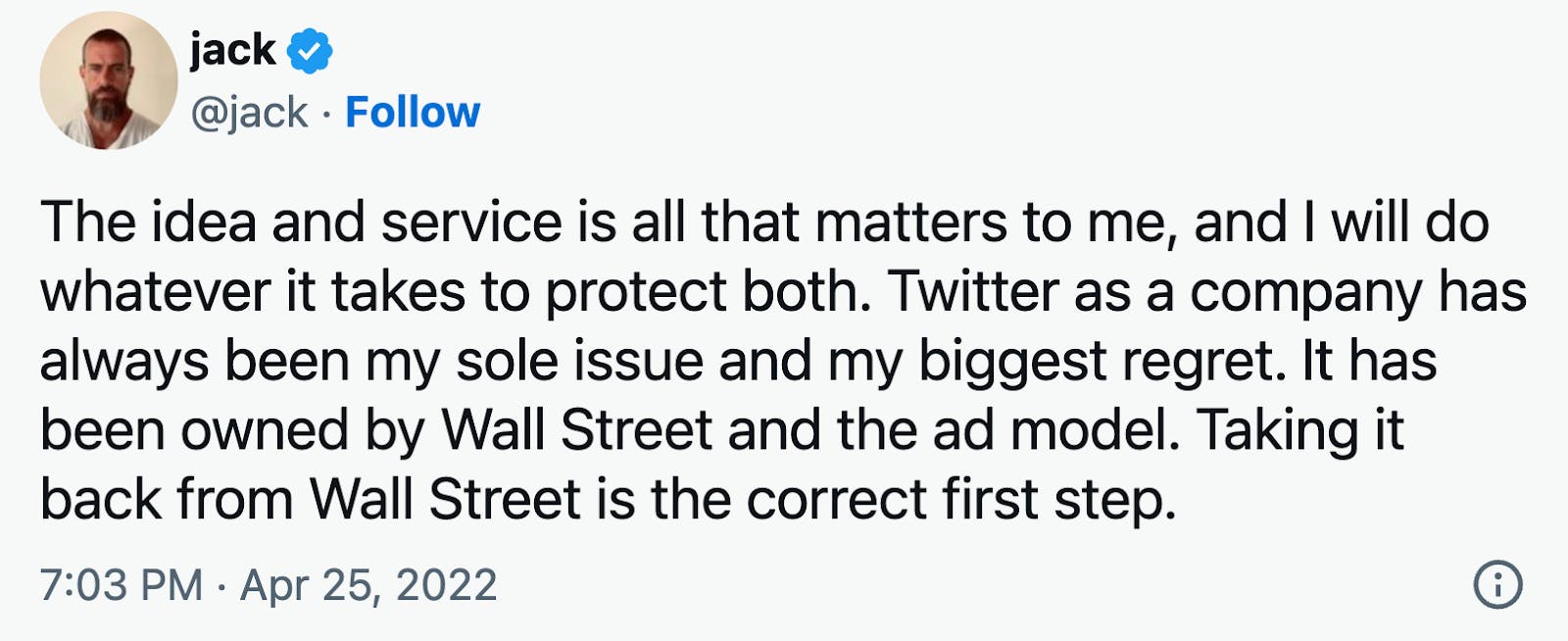

In the same month, Dorsey texted Musk expressing his reservations on Twitter’s direction, explaining that he believes Twitter should be an “open-source protocol” and needed to move away from its existing advertising model — something that needed to happen not as “a company” but as a “new platform.” Dorsey had previously pushed to add Musk to the Twitter board of directors but had been rejected, resulting in Dorsey deciding to step down in 2021 as CEO, explaining that “I needed…to leave, as hard as it was for me.”

Source: X

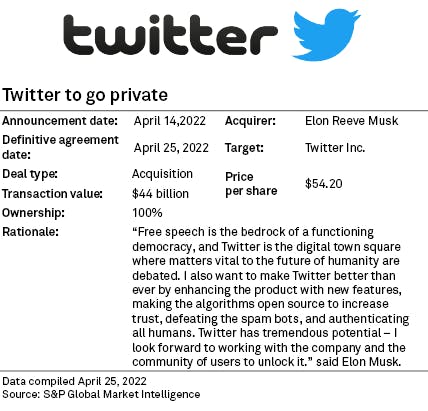

In April 2022, it was made public that Musk had been building an ownership stake in Twitter since January 2022. Musk declined offers by Twitter to join the board, instead opting to make a buyout offer of $43 billion on April 14th, 2022. In texts to then-Twitter chairman Bret Taylor, Musk argued that restructuring Twitter and changing the platform “should be done as a private company.” After a protracted series of legal trials, attempted terminations, and deal syndications to major lenders, Musk acquired Twitter for $44 billion on October 27th, 2022.

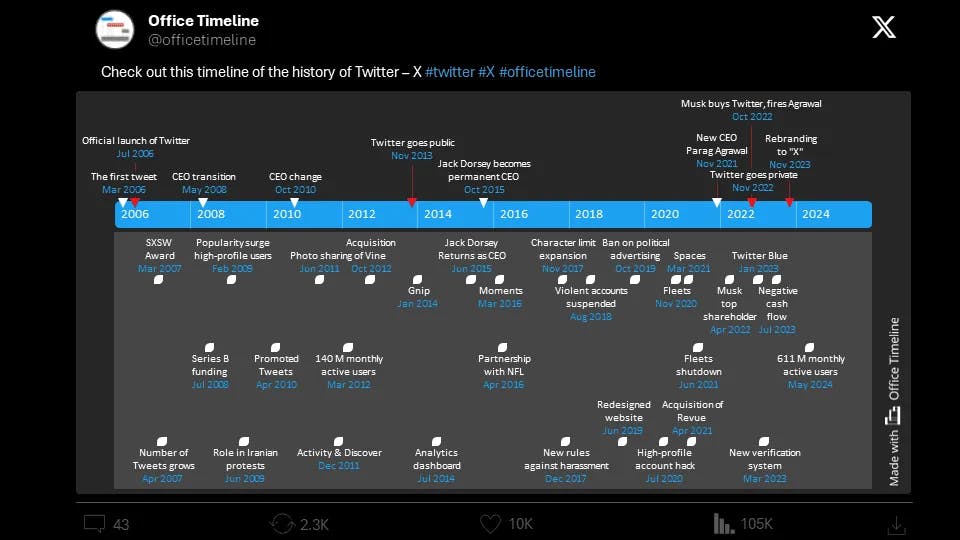

Twitter Acquisition Timeline

January-April 2022: Musk began acquiring Twitter shares, becoming its largest shareholder with a 9.2% stake by April. Twitter invited Musk to join its board, but he declined, opting to make an unsolicited buyout offer of $44 billion on April 14.

October 2022: Musk reversed course and agreed to complete the acquisition. On October 27, Musk finalized the $44 billion purchase and became CEO.

Post-acquisition: Musk implemented several changes, including laying off half the workforce and relaxing content moderation. In July 2023, Twitter was rebranded as “X” and merged into X Corp.

Source: Office Timeline

Twitter’s Rebrand into X (2023 - Present)

In October 2022, Musk purchased Twitter for $44 billion to transform the platform into X, an “everything app” that can handle a wide array of social, financial, and media functions. Musk’s vision for X aims to extend the company beyond simple social media, aspiring to create a platform that combines messaging, payments, and other services to become indispensable to everyday life.

Under Musk, X has launched new features like integration with xAI's Grok and X Premium (formerly Twitter Blue), allowing users to pay for advanced features, enhanced customization, and an ad-free experience. The rebranding of Twitter to X marked a pivotal moment in the company’s history, signaling the platform’s ambition beyond its original purpose. Musk's long-term goal for X is to create an ecosystem that allows users to communicate, transact, consume media, and build communities all within a single digital space.

Source: X

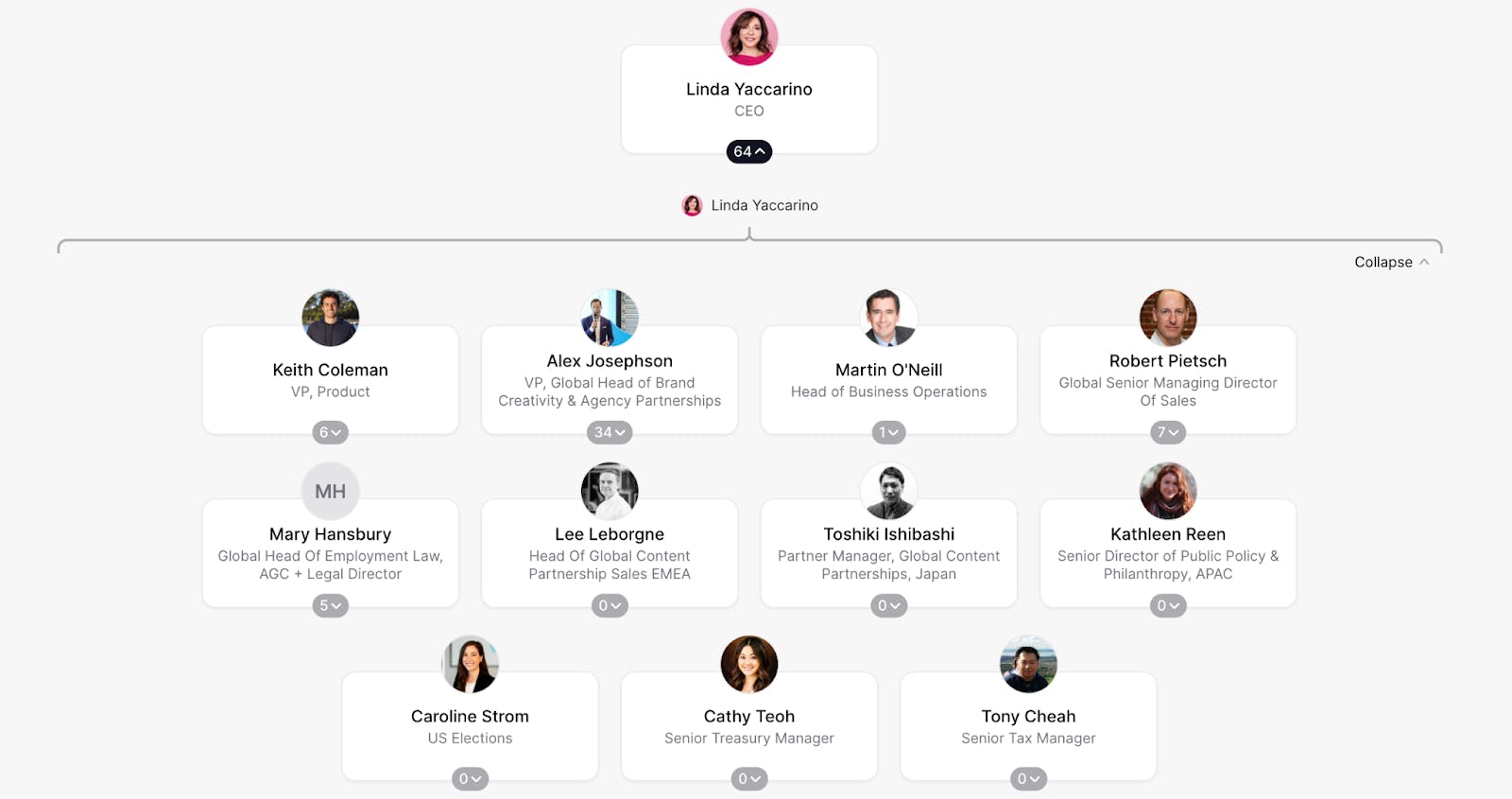

Immediately after the acquisition of Twitter and rebranding to X was completed, Musk reshuffled the leadership team and laid off 80% of the existing team, bringing the total number of employees from just under 8K to 1.5K. Musk argued that the drastic actions were necessary, warning that X was “going to go bankrupt if we do not cut costs immediately” and that there were a “lot of people doing things…[without] a lot of value,” resulting in multiple rounds of layoffs and restructuring of organization incentives around productivity.

Musk removed a number of key executives after his acquisition of Twitter, including then-CEO Parag Agrawal, CFO Ned Segal, policy head Vijaya Gadde, and general counsel Sean Edgett. Other key leadership departures included head of trust and safety Yoel Roth, chief information security officer Lea Kissner, and chief compliance officer Marianne Fogarty.

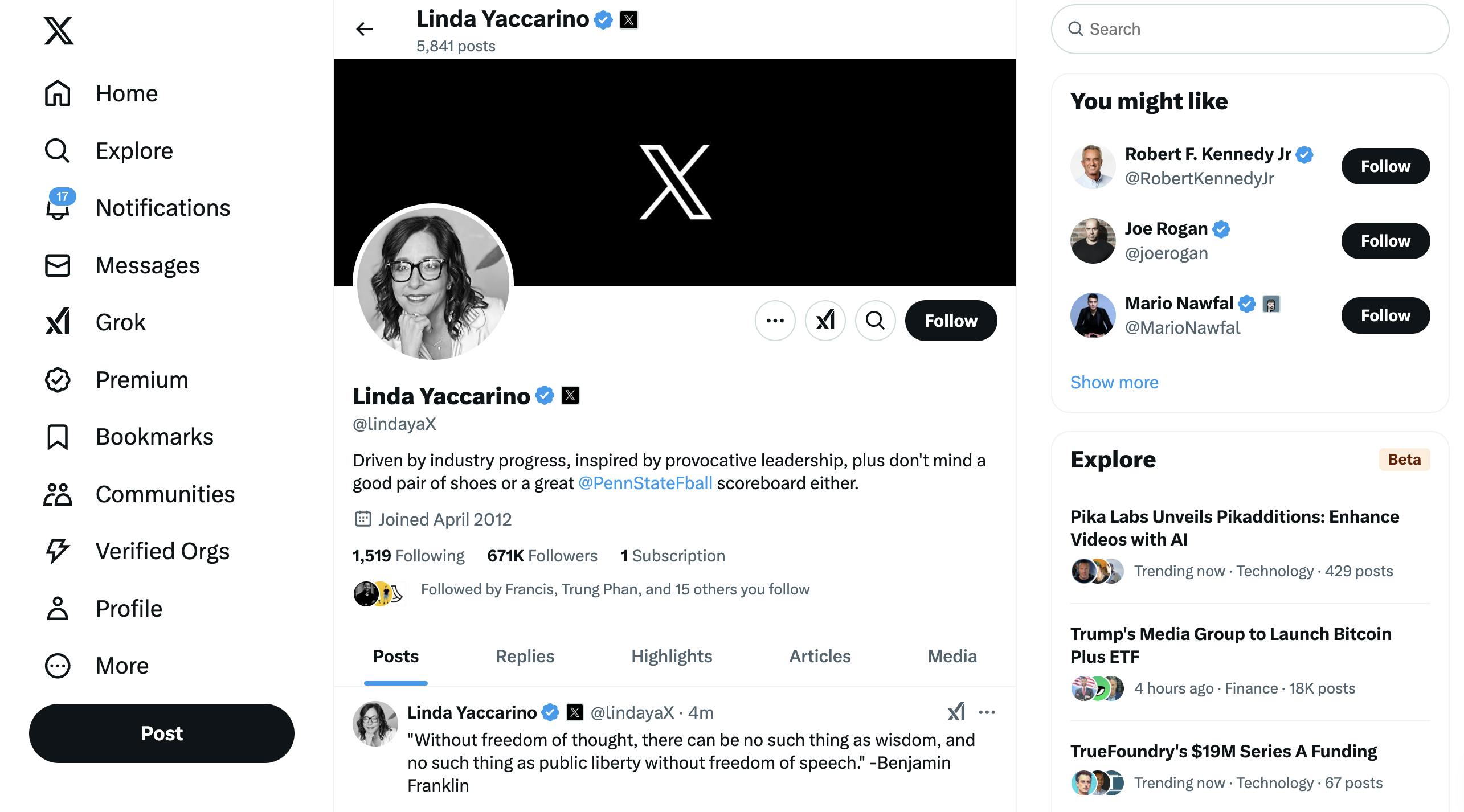

Simultaneously, Musk made several strategic hires to lead X into its next phase. Linda Yaccarino, the former chairman of global advertising and partnerships at NBCUniversal, was appointed as CEO in June 2023. Angela Zepeda, the former CMO of Hyundai, was named X’s global head of marketing in September 2024, while Yale Cohen, a former executive at Publicis Media, took on the role of head of brand safety and advertising solutions in April 2024.

The layoffs at X led to a significant migration of former Twitter employees to other tech giants. TikTok absorbed the biggest portion (16%) of ex-Twitter employees. Reddit, which went public in March 2024, attracted 13%. Google took in 12%, while Meta, with its launch of Threads - a direct competitor to X - hired 11% of ex-Twitter staff. Spotify attracted 10%. Other notable destinations for ex-Twitter employees included Snap (9%), Pinterest (9%), Uber (7%), Netflix (7%), and Apple (6%).

Source: The Org

Product

Product Evolution

Since its inception, X has undergone several significant iterations that reflect its evolving goals and the changing landscape of social media:

Twitter 1.0 (2006 - 2010): The platform focused on microblogging with a strict 140-character limit, introducing foundational features like hashtags, retweets, and replies. These innovations facilitated real-time conversations and allowed users to engage in succinct, immediate communication on a global scale.

Twitter 2.0 (2010 - 2022): During this period, Twitter expanded its features by increasing the character limit to 280, introducing Twitter Lists and Moments, and supporting multimedia content such as photos and videos. The platform aimed to improve user engagement and retention by offering more ways to share and consume content, keeping pace with competitors that were emphasizing visual media.

Post-Acquisition X (2022 - Present): Under Musk's leadership, X aims to become an all-encompassing platform that integrates various services beyond traditional social media. This includes payments, enhanced multimedia capabilities, live audio and video features, and advanced AI integration. The goal is to create an "everything app" that serves as a central hub for communication, commerce, and entertainment.

Source: X

Key Features

Posts (formerly known as Tweets)

The core functionality of the platform allows users to post short messages, originally limited to 140 characters and expanded to 280 in 2017, with the limit removed entirely for X Premium subscribers. Posts support short and long-form text, images, videos, polls, and other interactive elements, enabling users to share a wide range of content. Users can interact with and follow other users’ posts by using the integrated reply, reposting, liking, bookmarking, or sharing functions under each post.

Source: X

Users can also share others' posts with their followers, adding their commentary through quotes and Reposts. Alongside replies, these are the primary methods X users can share, comment, and note other user posts on the platform.

Source: X

This promotes content virality and encourages community engagement by allowing users to amplify messages and contribute to ongoing conversations as they happen.

Source: X

Posts are publicly visible by default but users can block accounts they do not want to interact with directly. As of September 2024, blocks on X will allow users to still see posts from users who have blocked them. Musk has voiced his dislike of the block feature and this recent move is another step in the removal direction:

“Last year, [Musk] said the feature “makes no sense” and that “it needs to be deprecated in favor of a stronger form of mute.” He also threatened to stop letting users block people on the platform completely, except for direct messages.”

Hashtags & Mentions

These features facilitate topic grouping and direct response on X, aiming to produce and identify trends and key topics. Hashtags allow users to participate in broader discussions on specific topics and take the form of a hashtag “#” and a phrase the user picks.

Mentions enable direct communication between users and notify the other user that they’ve been “mentioned.” These take the form of a “@” and the username of the other user.

Source: X

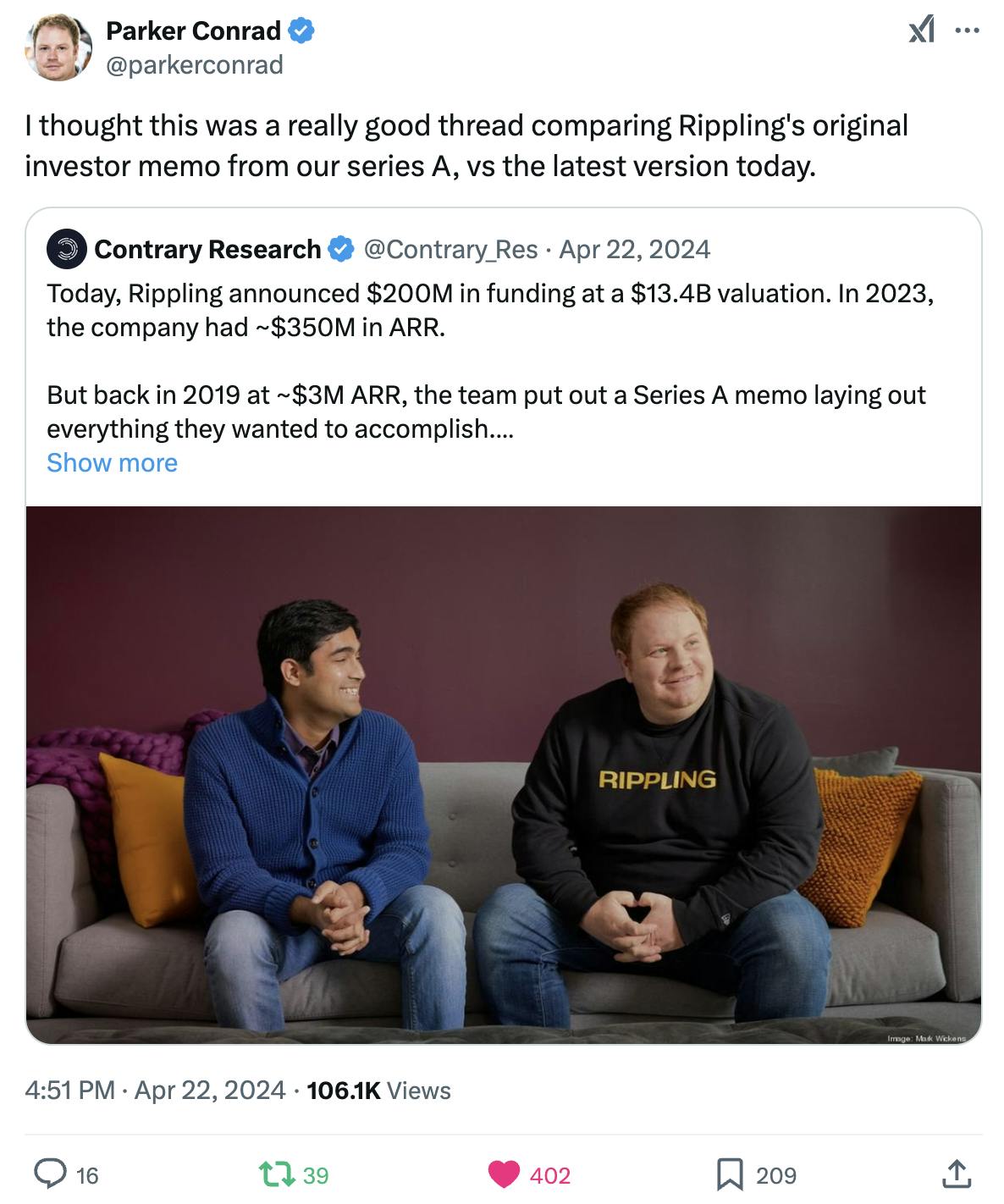

Community Notes

Formerly known as Birdwatch, Community Notes is a community-driven content moderation tool that allows users to add context to posts. Designed to combat misinformation, it enables users to collaboratively provide additional information or corrections, enhancing the quality of information on the platform. The Community Notes algorithm is open-source and designed to allow users from diverse perspectives to judge the quality of each note: if enough users agree a note is helpful, it will automatically appear on an X post.

Source: X

Launched in 2021, Birdwatch became especially relevant during the 2022 Russian Invasion of Ukraine and the COVID-19 pandemic as misinformation on the platform increased during these events. It was rebranded to Community Notes in November 2023, with approximately 133K community contributors working to counter misinformation.

Source: X

User Profiles

Source: X

User profiles are self-curated and personalized pages on X. Users can integrate websites, contact information, and personal details into their profile page. Outside users can follow a user by selecting the “follow” and “notification” options as well as view a user’s past posts, replies, highlights, and media uploads.

Home Page

X’s home page is an aggregated feed of posts from users one has followed and from auto-recommended sources. Users are also able to create their own posts from the home page. Steven Johnson, an American science writer, described the mechanics of X (then Twitter) in 2009 this way:

“As a social network, Twitter revolves around the principle of followers. When you choose to follow another Twitter user, that user's tweets appear in reverse chronological order on your main Twitter page. If you follow 20 people, you'll see a mix of tweets scrolling down the page: breakfast-cereal updates, interesting new links, music recommendations, even musings on the future of education.”

Source: X

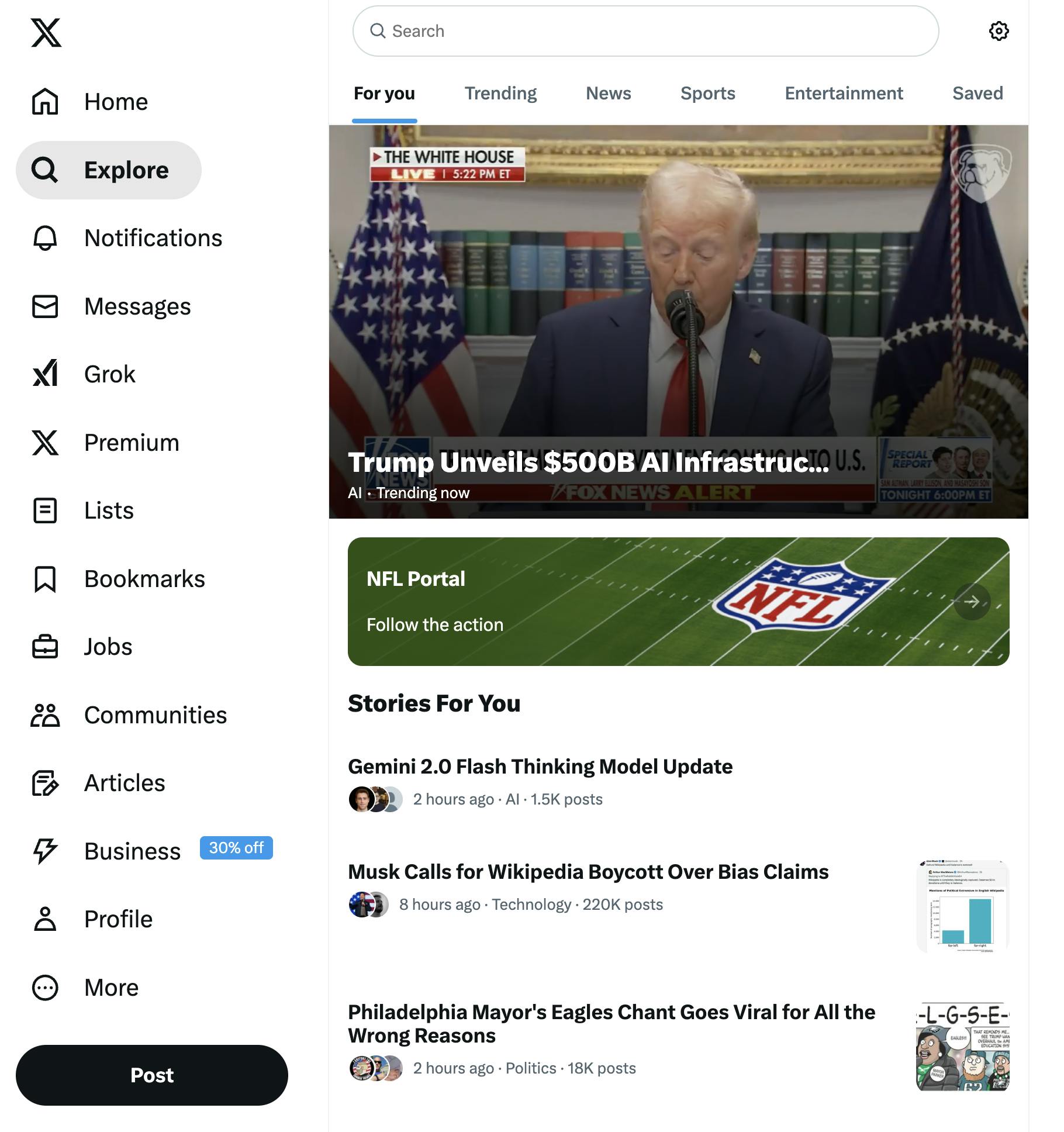

Explore Page

The explore page retains a similar functionality to the home page but aims to produce a wider scope of topics, content, and interests that may be relevant to users. Key topics integrated into the page include topics curated for the user, trending topics, news, sports, and entertainment.

Source: X

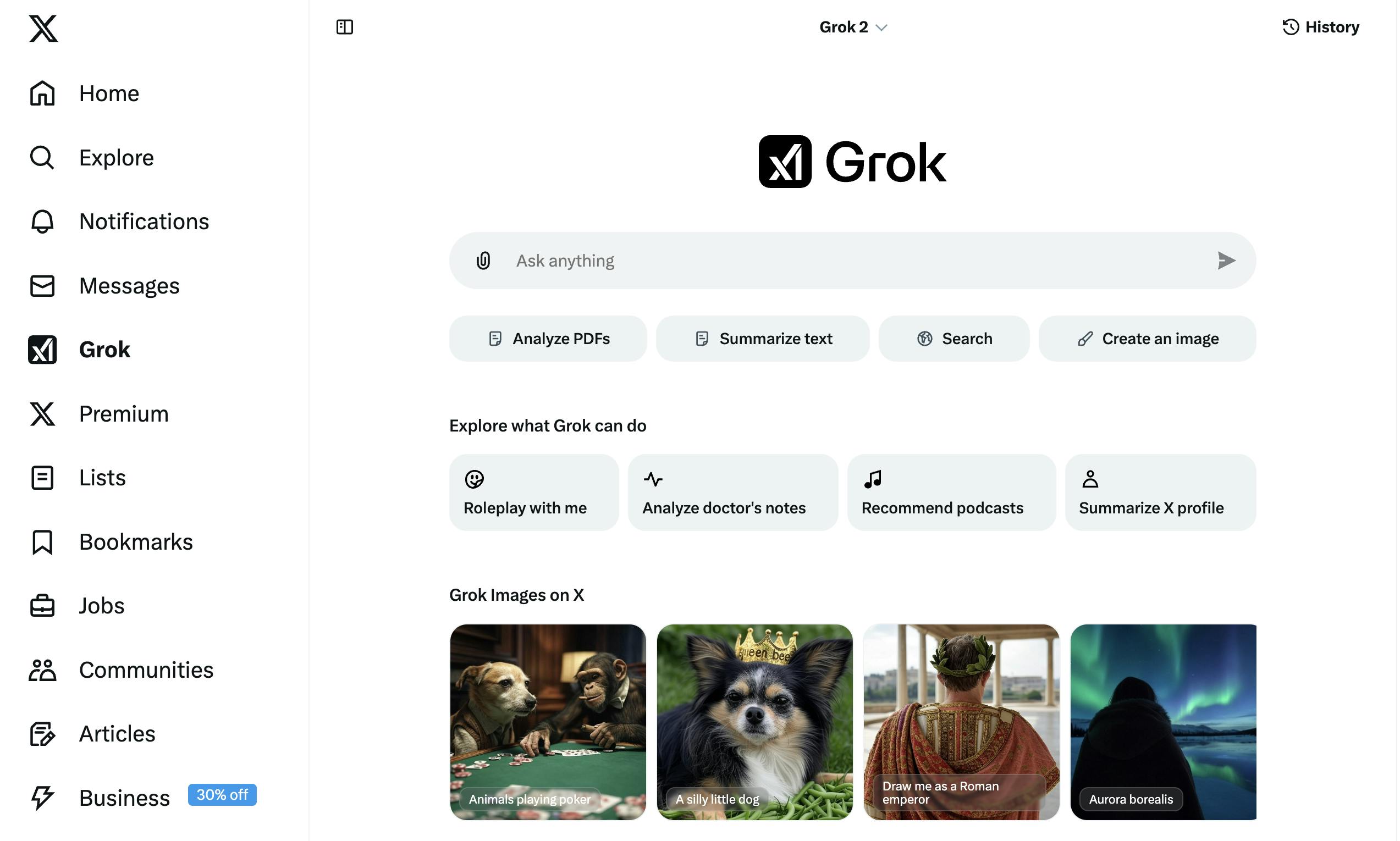

Integration with xAI’s Grok

Grok is an enhanced integration available to X Premium subscribers powered by xAI’s large language model Grok 2. Founded by Musk in 2023, xAI is a foundational model company that aims to develop an open-source alternative to OpenAI’s closed model development. In return for xAI’s access to X’s user-generated content and computer cluster, X owns a 25% stake in xAI as of February 2025.

Grok is able to search X public posts and conduct a real-time web search on the Internet to function as an advanced search tool with up-to-date information on X. As a multimodal LLM, Grok is also capable of text, image, and code generation.

Source: X

Communities

Communities are smaller, self-curated, and self-moderated communities on X on specific topics, interests, and niches similar to Reddit’s subreddits. As of September 2024, only X Premium subscribers have access to Communities, categorized into broad topics such as sports, technology, art, entertainment, gaming, and politics. Posts in Communities can be seen by anyone on X, but only others within the Community itself can engage and participate in the discussion.

Source: X

Spaces

Introduced as live audio conversations with unlimited listeners, Spaces supports interactive discussions similar to platforms such as Clubhouse. Users can host or participate in real-time audio sessions on various topics with up to 13 people (including the host and 2 co-hosts) speaking in a Space at any given time.

Source: X

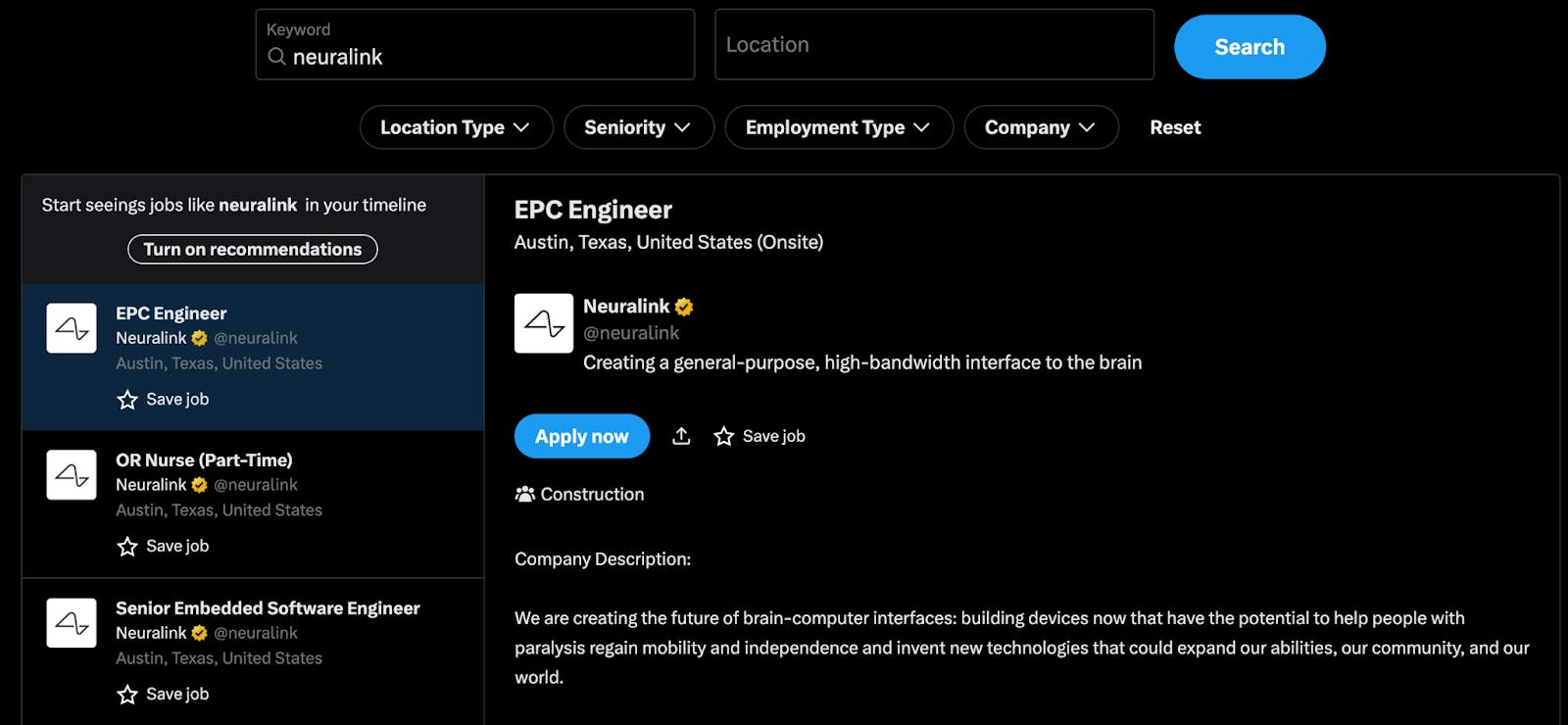

X Hiring

X Hiring is an X feature designed to curate, list, and push job listings to X users on the platform. The feature is only available to verified organizations on X, but all individual users on X can access and apply for jobs on the platform. Musk launched this X feature as a direct competitor to LinkedIn, stating that:

“People send me LinkedIn links sometimes, but the cringe level is so high that I just can’t bring myself to use it, so I ask for the resume or bio to be emailed. We will make sure that the X competitor to LinkedIn is cool.”

Source: X

X Hiring was, in part, driven by the acquisition of Laskie in May 2023. Laskie was previously a tech hiring platform that “helped match tech job seekers with employers based on details from their profile and an employer’s requirements, circumventing the traditional job posting and application process.” X Hiring was later announced in August 2023.

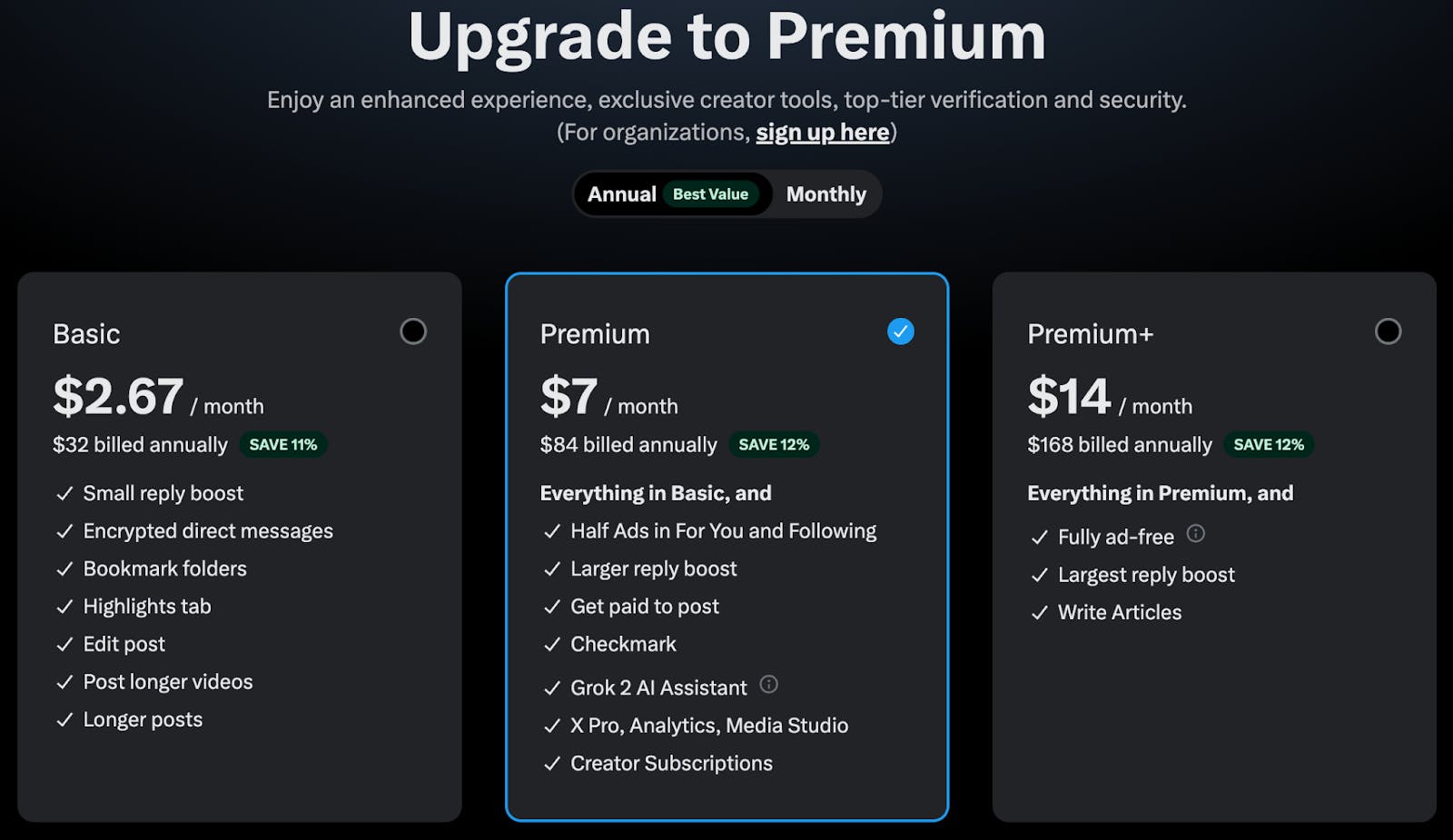

X Premium

X Premium (formerly Twitter Blue) is a tiered subscription service offering enhanced features such as post-editing, custom app icons, ad-free experiences, and algorithmic prioritization. Depending on the subscription tier, subscribers can receive a blue verification badge, access to exclusive features (including long-form posts and Grok), and unlock monetization pathways, providing an incentive for users to support the platform financially.

Source: X

X Creator Monetization Features

Accessible to users with X Premium subscriptions, X has rolled out a plethora of tools to give creators on the platform a way of monetizing their audience.

Source: X

Creator Subscriptions: This feature allows creators to monetize their content by offering exclusive material to subscribers who pay a monthly fee. It aims to support content creators financially, incentivize high-quality content production, and deepen engagement between creators and their audiences.

Ads Revenue Sharing: X’s ad revenue-sharing program for X Premium subscribers allows creators who meet certain engagement thresholds to earn a portion of the platform’s advertising revenue. Currently, revenue splits are estimated at $8.5 per million verified impressions.

Tip Jar: Users can send monetary tips to creators, fostering direct support and engagement. This feature supports various payment methods including Venmo and popular cryptocurrencies, and is part of X's efforts to build a sustainable creator economy on the platform.

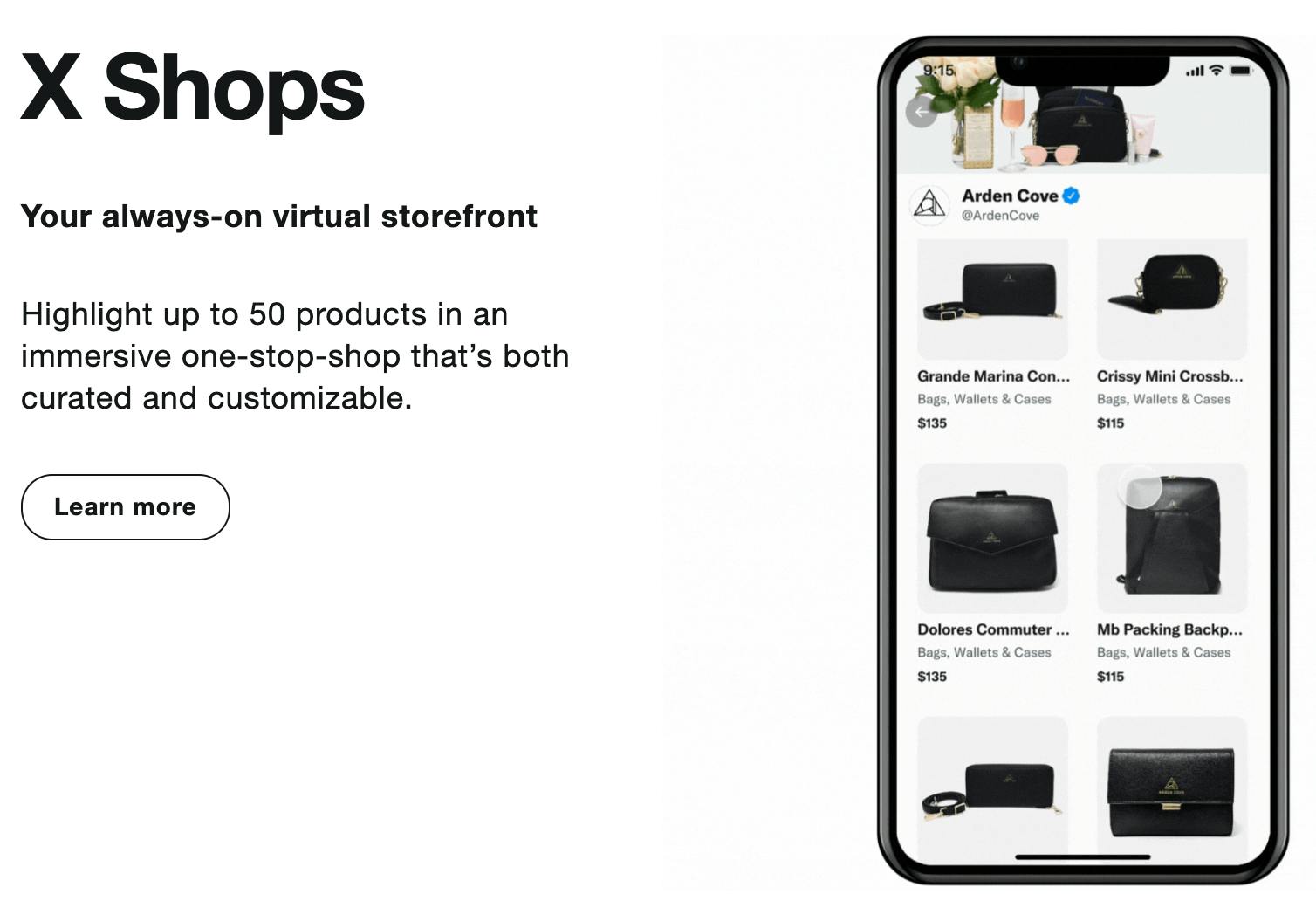

X Shopping

X Shopping is a direct-to-user X-based storefront that currently allows users with professional accounts to sell up to 50 products, as of February 2025, in a curated one-stop shop, enabling users to browse and purchase items without leaving the app. The feature also enables retailers to stream products and interact with consumers in real time, combining entertainment with live e-commerce.

As of 2024, X did not take a cut of any sales and was offering X shopping tools for free. X is exploring also global expansion alongside more 3rd party integrations into digital storefronts, targeting a launch by 2025.

Source: X

X Money

In January 2024, X set up a user account for X Money, and indicated that a corresponding X money product would launch in 2025. In January 2025, X CEO, Linda Yaccarino, announced that Visa had become X’s first partner for X Money. According to Yaccarino, the account would include “secure and instant funding to your X Wallet via Visa Direct,” as well as connections to debit cards for P2P payments and the ability to instantly transfer funds from X Money back into your bank account.

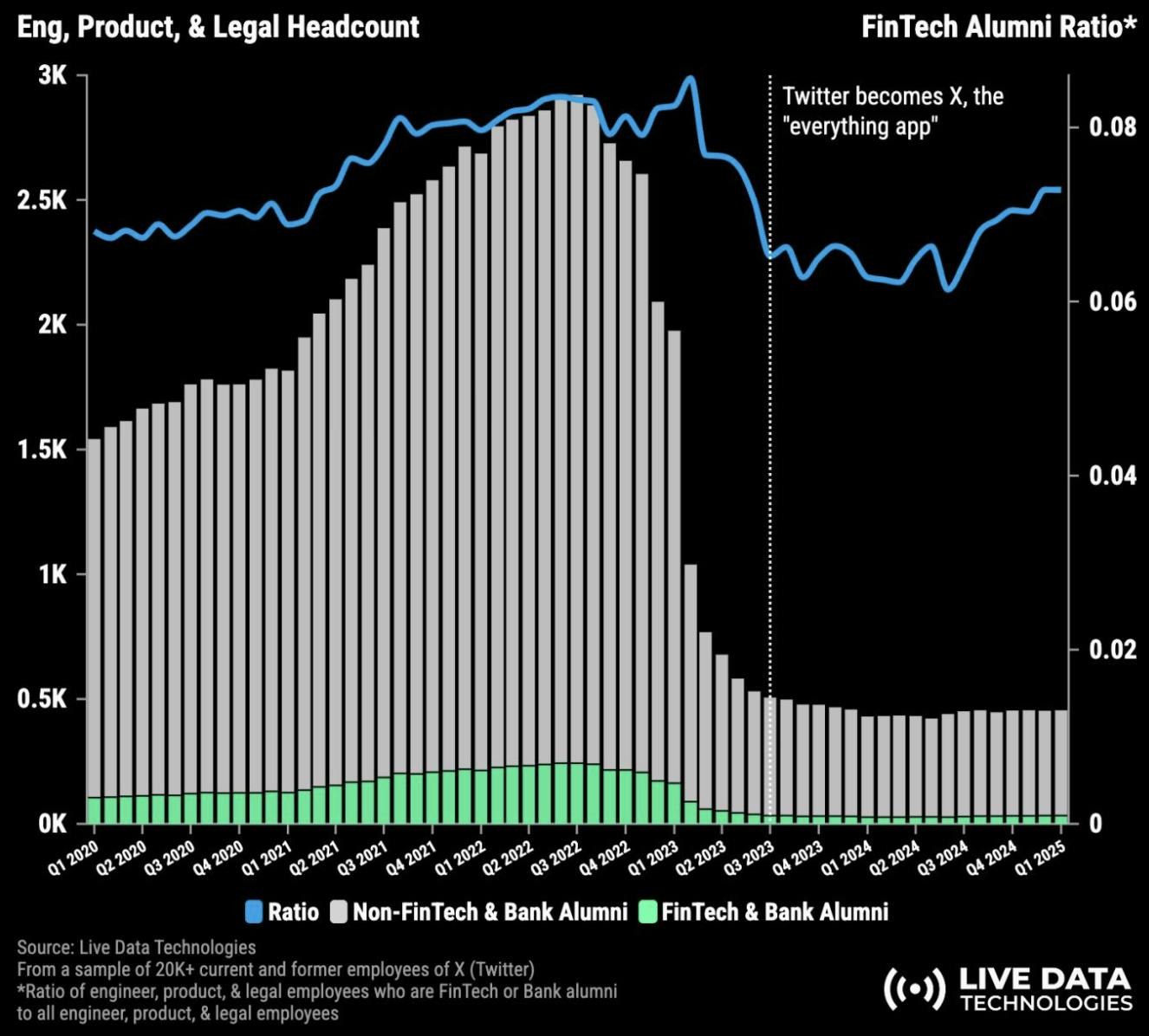

According to one analysis, the ratio of fintech to non-fintech employees at Twitter started to rise in Q2 2024, with the company hiring former employees of fintech and bank employers. This could indicate a growing body of employees at the company focused on building out the necessary fintech capabilities to execute on X Money.

Source: Live Data Technologies

Market

Customer

X Users

As of 2024, X was estimated to have 640 million MAUs, with a diverse user base including politicians, celebrities, influencers, journalists, activists, and everyday people. While X’s core features have historically centered around short-form, text-based communication, it has gradually diversified into long-form content, video, and live audio, attracting new demographics of creators and audiences.

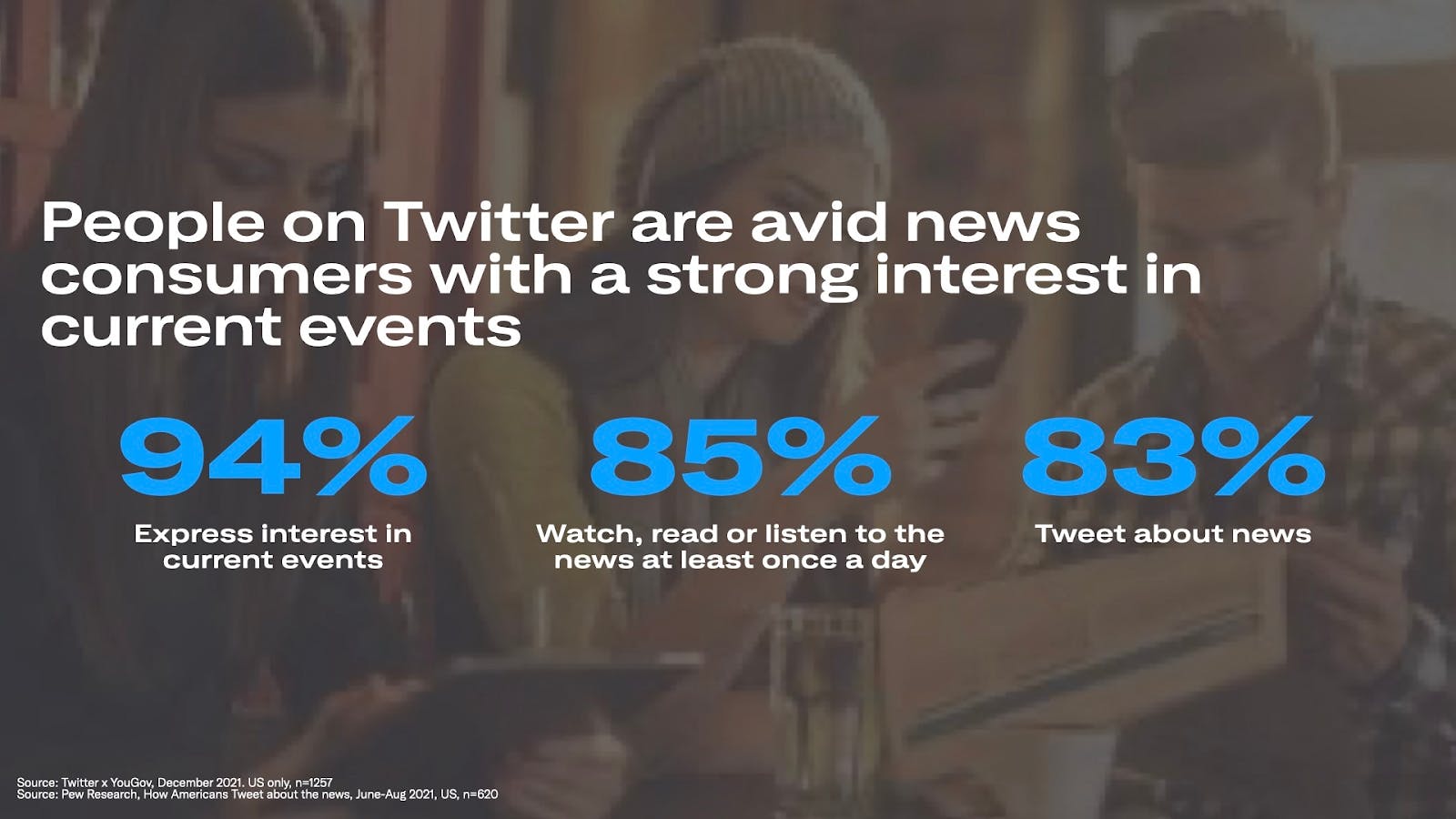

X’s users span multiple interests, from breaking news and political discussions to entertainment and cultural commentary. The platform is particularly influential in the realm of real-time discourse, making it the go-to platform for users seeking immediate updates and engagement on global events. However, X’s new push toward multimedia content and subscription-based features has also broadened its appeal to creators looking to monetize their presence and content.

Source: X

X Advertisers

Advertisers who spend money on X to get access to the company’s user base are the core revenue-driving customers on X. Prior to Musk’s acquisition, Twitter saw 89% of its revenue come from advertising. Since then, that number has come down to 75% of X’s revenue as of January 2025.

Since rebranding Twitter into X, Musk has had a fairly adverse relationship with advertisers, which was part of his drive for X to pivot away from a primarily ad-base model to a multi-source revenue model. In September 2023, Musk confirmed that US ad revenue was down 60% and, as of February 2024, 75 out of the top 100 US advertisers on X from October 2022 had ceased ad spending on the platform. However, towards the end of 2024 and beginning of 2025 several major advertisers have returned to spending money on X, including Comcast, Disney, and IBM.

X Creators

X has launched a suite of creator tools, including subscriptions, tipping, and enhanced monetization options for long-form content and Spaces, aiming to attract influencers, independent journalists, content creators, and digital artists. To qualify for this program, creators must have an X Premium subscription or be a Verified Organization, generate at least 15 million impressions over the past three months, and have at least 500 followers.

As of March 2024, X reports having over 150K creators on the platform and has distributed more than $45 million in payments. A new revenue-sharing program, which rewards creators with a portion of ad revenue from their posts, has been introduced as part of X's broader mission to help users earn a living directly on the platform.

As of August 2023, the number of creators using X’s monetization features was relatively low with less than 0.5% of all X users being signed up for X Premium. However, the platform's focus on empowering creators suggests this segment will continue to grow, especially as more tools are introduced to support content creation, promotion, and direct monetization. As X moves away from an advertiser model and seeks to retain creators on the platform, X’s revenue sharing seeks to compete directly with other platforms such as Instagram, Snapchat, Youtube, and TikTok.

AI Training Data

Increasingly, AI companies have become more and more dependent on access to data. For example, in February 2024, Reddit announced a $60 million deal with Google to provide training data for the company’s AI models. In July 2023, after Musk introduced usage limits on processing Twitter data pre-rebrand, he pointed to the need to prevent AI companies from scraping Twitter data for training purposes. Since then, X has started monetizing access to its data. For example, one report indicated that xAI has paid X “hundreds of millions of dollars” to X for access to training data. This could open up other possibilities for monetizing access to that data from other AI companies.

Market Size

In 2024, the global social networking market is expected to grow at a CAGR of 25.4%, reaching $940 billion by 2026. X’s role in this market is unique due to its focus on real-time interaction and public discourse. As more people move their social interactions, news consumption, and personal branding online, X is well-positioned to capture a larger share of this growing market. Though X is a major player within the global social media landscape, the company trails behind giants like Facebook, Instagram, and TikTok in total user base. However, X stands out in public influence and real-time “fast” engagement, areas where platforms like Facebook and Instagram are not as reactive.

Ad revenue continues to be a major percentage of X’s revenue intake despite continuous efforts by Musk to shift the platform to a user subscription-based service. PwC estimates that global internet advertising revenue will expand at 9.1% CAGR to reach $720 billion in 2026, driven by increased consumer time spent in digital spaces, diversified markets, and ever-advancing advertising technologies.

As X continues to grow its creator tools and incentives, X is positioning itself to take a greater share of the creator economy market, which Goldman Sachs estimates to roughly double in size to $480 billion by 2027 from $250 billion. Powered by lowered costs to create from generative AI and an increasingly digital world, Goldman Sachs expects the 2023 estimate of 50 million global creators to grow at a 10-20% CAGR until 2028.

In terms of the fintech and ecommerce spaces, X’s potential market opportunity is significant if it succeeds in achieving its vision of becoming an “everything app.” By integrating payments, shopping, and financial services into its core social platform, X could tap into the rapidly expanding global digital payments market, which is projected to reach $16.6 trillion in transaction volume by 2028, as well as the growing global e-commerce market, which is expected to hit $7.6 trillion in transaction volume by 2024.

Competition

X competes with several major social platforms, each of which offers overlapping features and attracts similar demographics. In X’s ambition to become the “everything” platform, it faces competition from incumbent social media, live-streaming & video, payment & e-commerce, hiring, and creator economy platforms.

Social Media Platforms

Meta Platforms (Facebook, Instagram, WhatsApp, Threads): Founded in 2004 and headquartered in Menlo Park, California, Meta owns several of the largest social networking apps globally. Facebook offers extensive social networking features, including groups, events, and marketplace functionalities. Instagram focuses on visual content through photos, stories, and Reels, appealing to a younger demographic. WhatsApp is a global leader in messaging, offering end-to-end encrypted communication, and competes indirectly with X. Threads, launched in 2023, is a microblogging app that directly competes with X's text-based communication features and, as of October 2024, had reached 275 million monthly active users. With over 3 billion combined users across its platforms, Meta is a dominant player in the social media space.

Snapchat: Founded in 2011 and headquartered in Santa Monica, California, Snapchat is known for ephemeral messaging and augmented reality features. Snapchat competes with X indirectly on multimedia sharing and direct messaging functions in the social media space. With 800 million MAUs, Snapchat is primarily known for innovations around AR filters and personalized content creation.

Reddit: Reddit, founded in 2005 and based in San Francisco, is a social news aggregation and discussion platform. It distinguishes itself with a large pseudonymous user base, where most participants interact without revealing their offline identities. While users can choose to be anonymous on X, the majority of users use their real identities, creating a platform where pseudonymous and real-name users coexist. Reddit has become a go-to destination for breaking news and event discussions, including sports, politics, and pop culture, much like Twitter’s role in real-time updates and conversations. However, Reddit's strength lies in its explicit division into interest-based communities known as subreddits. These allow for highly targeted and topic-specific interactions, creating formal spaces for niche discussions compared to X’s more informal community niches.

Live-streaming & Video Platforms

Prior to Elon Musk’s acquisition and the rebrand to X, Twitter had already made some segues into video. In 2012, Twitter acquired Vine, a social platform with three founders that had yet to launch, for $30 million. Vine officially launched in 2013 and grew to 13 million users in its first six months. After the launch of video on Instagram in June 2013, Vine fell behind and was costing $10 million per month to operate, so Twitter shut Vine down in October 2016.

Since the rebrand to X, the company has intensified its focus on leveraging its reputation as a hub for live events and breaking news to expand into live streaming and audio-based interactions, such as Spaces. Historically known as the go-to platform for real-time updates on news and events, X is now using this brand identity as a strategic wedge to compete with live-video platforms such as YouTube, Twitch, Instagram Reels / Facebook Live, and TikTok. By enhancing its multimedia offerings, X aims to attract video creators and build a more comprehensive content ecosystem.

YouTube: Founded in 2005 and owned by Alphabet, YouTube is the dominant global platform for long-form video content and live-streaming, with over 2.5 billion users. YouTube's live-streaming functionality and monetization tools for creators directly compete with X's efforts to attract video creators and expand its multimedia offerings, with YouTube paying out over $70 billion to creators from 2021 to 2024.

Twitch: Founded in 2011 and acquired by Amazon in 2014, Twitch is a leading live-streaming platform with a focus on gaming and creative content. With 240 million MAUs, Twitch is a competitor in live video streaming and real-time interaction between creators and viewers. X’s push into live-streaming via Spaces and live video shares similar goals with Twitch, although X’s focus extends beyond gaming.

Instagram (Reels) / Facebook Live: Instagram Reels and Facebook Live, both part of the Meta ecosystem, allow users to share short-form videos and live streams to a massive user base. Reels, in particular, rivals X’s multimedia posting capabilities, while Facebook Live competes with X’s live video efforts. Instagram Reels' focus on creator monetization, advertising revenue, and viral video trends puts pressure on X to innovate within the video-sharing space.

TikTok: Founded in 2016 by ByteDance and based in Beijing, TikTok has rapidly grown to over 1 billion users. Known for short-form video content and an algorithm that drives high user engagement, TikTok appeals to creators and users with its video-first approach. Its focus on real-time content sharing, live streaming, and e-commerce overlaps with X’s multimedia posting and planned e-commerce features, making TikTok a strong competitor in user engagement and creator monetization.

Payment Platforms

PayPal: Founded in 1998 and headquartered in San Jose, California, PayPal is one of the largest digital payment platforms globally. Musk was actually a co-founder of a PayPal competitor, also called X, which merged with PayPal's parent company, Confinity, in 2000. Musk’s vision for PayPal was originally to expand into a full-fledged financial services technology platform. PayPal’s integration with social media platforms like Instagram and its Venmo app, which allows peer-to-peer payments, directly competes with X's plans to expand into financial services.

Block (formerly Square): Founded in 2009 and based in San Francisco, Block offers a range of payment processing services, including peer-to-peer payment app Cash App. Founded by Dorsey after leaving Twitter (now X), Square maintains a strong presence in the creator economy and small businesses. Square's product suite challenges X’s ambitions to become a multi-functional platform that includes payment solutions.

Stripe: Founded in 2010 and headquartered in San Francisco, Stripe is a financial infrastructure platform that powers payments for online businesses. With deep integrations into e-commerce platforms and a growing presence in creator tools, Stripe’s API-first approach is a competitor to X’s plans for payment and transaction services for creators and businesses alike, especially in the e-commerce space.

Creator Economy Platforms

Patreon: Founded in 2013 and based in San Francisco, California, Patreon is a platform that allows creators to earn recurring revenue through subscriptions and direct support from their audiences. As X focuses on creator monetization through features like subscriptions and tipping, Patreon represents a direct competitor for creators looking to generate income.

Substack: Founded in 2017 and based in San Francisco, California, Substack is a newsletter platform that allows writers and creators to monetize their content through subscriptions. Substack’s user-friendly interface and built-in monetization tools challenge X’s efforts to expand its newsletter offerings, including the integration of long-form content on its platform.

In April 2023, tensions arose between X and Substack after X blocked users from liking, sharing, or embedding posts with Substack links. This followed the announcement of Substack's new feature, Notes, a short-form content platform seen as a potential rival to X’s microblogging format. Musk, as X CEO at the time, denied intentionally blocking Substack, but users and content creators reported significant disruptions, including Substack links being flagged as "unsafe." Though X reversed the Substack link ban, the incident highlighted the increasing competition between social media platforms and content monetization services.

Business Model

X operates on a freemium model, combining ad revenue, premium subscriptions, and new monetization strategies for creators and businesses. Under Musk’s leadership, the platform has pivoted away from a pure ad-based revenue model and instead focused on increasing direct monetization from users. X Premium provides a tiered paid experience, where users pay for enhanced features such as access to Grok, post-editing, verified status, increased character limits, and algorithmic prioritization. These subscriptions range from $3 to $16 per month depending on the subscription tier.

Source: X

Beyond paid premium users, X’s business model is heavily dependent on advertising revenue.

Advertising on X

X's advertising revenue has traditionally been a key part of its business model but has seen notable shifts under Musk’s leadership. The platform has focused on reducing the volume of ads while aiming to make them more relevant and "meaningful" to users. Musk has suggested that future advertisements on X will prioritize quality, with potential integrations into features like trending topics and live Spaces events. Despite a new focus on monetization through premium subscriptions and creator-driven revenue models, ads remain a significant revenue stream, accounting for up to 75% of revenue as of January 2025.

Since rebranding Twitter into X, Musk has maintained a contentious, back-and-forth relationship with advertisers. Before and after the rebrand, Musk has maintained that X must pivot from a purely ad-base model to a subscription model. In September 2023, Musk confirmed that US ad revenue was down 60% and, as of February 2024, 75 out of the top 100 US advertisers on X from October 2022 had ceased ad spending on the platform.

In November 2023, Musk disbanded the “Influence Council”, a select group of top advertisers on the platform. In the same month, Musk doubled down on his aversion to advertisers in a live interview at the New York Times Dealbook Summit after concerns over Musk’s controversial posts on X:

“I hope [advertisers] stop. Don’t advertise […] if someone’s going to try to blackmail me with advertising, with money, go f**k yourself. Go f**k yourself. Is that clear? I hope it is. Those advertisers [will] kill the company.”

Key new hires, including Yaccarino, Zepeda, and Cohen, respectively former heads of marketing at NBC, Hyundai, and Publicis, have looked to smooth relationships with advertising, emphasizing content safety and lowering reputational risk. Steps undertaken have included looking to revive the client council of advertisers, the expansion of X’s revenue-sharing program, and content moderation. In June 2024, Musk revealed a more conciliatory tone towards advertisers at the Cannes Lions International Festival of Creativity:

“First of all, it wasn’t all advertisers as a whole. It was with respect to freedom of speech. It’s important to have a global free speech platform where people with a wide range of opinions can voice their views. In some cases, there were advertisers who were insisting on censorship. [Advertising on X] is worth trying out and I am interested in critical feedback. X is focused on showing ads to people who will find them interesting. We have made progress and will make more. Every third-party reviewer has given us an A-plus on brand safety.”

Even as Musk looks to woo advertisers back to the platform, he remains critical of advertiser groups and boycotts. In August 2024, X brought a lawsuit against the Global Alliance for Responsible Media (GARM), which includes companies such as Mars and CVS Health. The lawsuit alleged that GARM “conspired…to collectively withhold billions of dollars in advertising revenue [from X] by collectively act[ing] to enforce [X]’s adherence to [certain brand safety] standards.” In the same month, GARM was discontinued, citing “significant” drains on its “resources and finances.”

Some estimates indicate X’s 2024 ad revenue came in at ~$2 billion, down from $4.5 billion the year Musk acquired Twitter. In addition, ad revenue for 2024 was expected to still represent 70-75% of X’s total revenue, a significant difference from Musk’s hope for “subscription revenue to make up half of the company’s total business.” To bolster existing revenues and make up losses from larger advertisers, X has also moved to targeting small and medium-sized businesses for the platform alongside increased X feature incentives to monetize existing users.

However, despite these past conflicts with advertisers, X has begun to see significant advertisers return to the platform to the platform. For example, in January 2025, Amazon announced it was raising its ad spending on X, with some saying that Amazon CEO, Andy Jassy, was directly involved in the decision. This followed announcements in November 2024 from companies like Comcast, Disney, and IBM who had returned to spending advertising dollars on X.

Creator Monetization on X

X’s ad revenue-sharing program for X Premium subscribers allows creators who meet certain engagement thresholds to earn a portion of the platform’s advertising revenue. Currently, revenue splits are estimated at $8.5 per million verified impressions. The platform also enables creators to earn through features like subscriptions (where followers pay for exclusive content) and tipping (where users can donate directly to their favorite creators). For creators monetizing through subscriptions, X allows creators to keep 97% of revenue until a lifetime cap of $50K, at which point revenue share drops to a maximum of 90%. If more creators leverage X, this could become an increasingly significant revenue stream, encouraging higher engagement and direct monetization from the user base.

X Shopping

X has also introduced X Shopping, a direct-to-user X-based storefront that currently allows users with professional accounts to sell up to 50 products in a curated one-stop shop. As of 2024, X does not take a cut of any sales and offers X Shopping tools for free. X is also exploring global expansion alongside more 3rd party integrations into digital storefronts, targeting a launch by 2025. If successful, this could position X as a competitor in the fintech space, creating a new revenue stream through transaction or subscription fees and moving X one step forward to Musk’s vision of the everything app.

Traction

Startup Growth & Scaling (2006 - 2013)

During its early years, Twitter grew rapidly, gaining prominence as a platform for real-time communication. However, despite its initial appeal, Twitter struggled with scalability, monetization, and user retention. While the platform attracted millions of users and became a key player in digital communications, it was unable to compete with the exponential growth of rivals like Facebook and Instagram. Twitter's advertising solutions also lagged behind those of its competitors, failing to generate the same returns. By 2012, Twitter’s sixth year in business, the platform would boast 200 million monthly active users (MAU). Meanwhile, Facebook reached 608 million MAUs by 2010, its sixth year, and by 2012 had grown to over 1 billion MAUs.

IPO to Post-Pandemic (2013 - 2022)

Although Twitter went public in 2013, the company continued to face challenges in scaling its user base and monetizing the platform. The platform retained criticism of being too niche, with 330 million MAUs in 2017, in comparison to Facebook and Instagram each of which had billions of global users. Despite efforts to improve the user experience and refine its advertising products, Twitter continued to struggle with advertiser retention and attracting new users.

Over the course of the COVID-19 pandemic, the platform gained visibility during major news events, but its unique open format often enabled the spread of misinformation and abusive content. Controversies over spam, bot accounts, misinformation, and the freedom of speech led to leadership shuffles and advertisers also expressed concerns, leading to inconsistent advertising revenues.

Rebranding to X

Since Musk’s acquisition of Twitter and its subsequent rebranding, X has seen mixed but notable traction. Though some high-profile users have left the platform due to Musk’s leadership style and changes in content moderation, the platform has continued to grow, driven by new features and Musk’s public persona. As of January 2025, X has 611 million MAUs, up from 368 million when Musk acquired Twitter in 2022, ranking it 12th among all global social media applications.

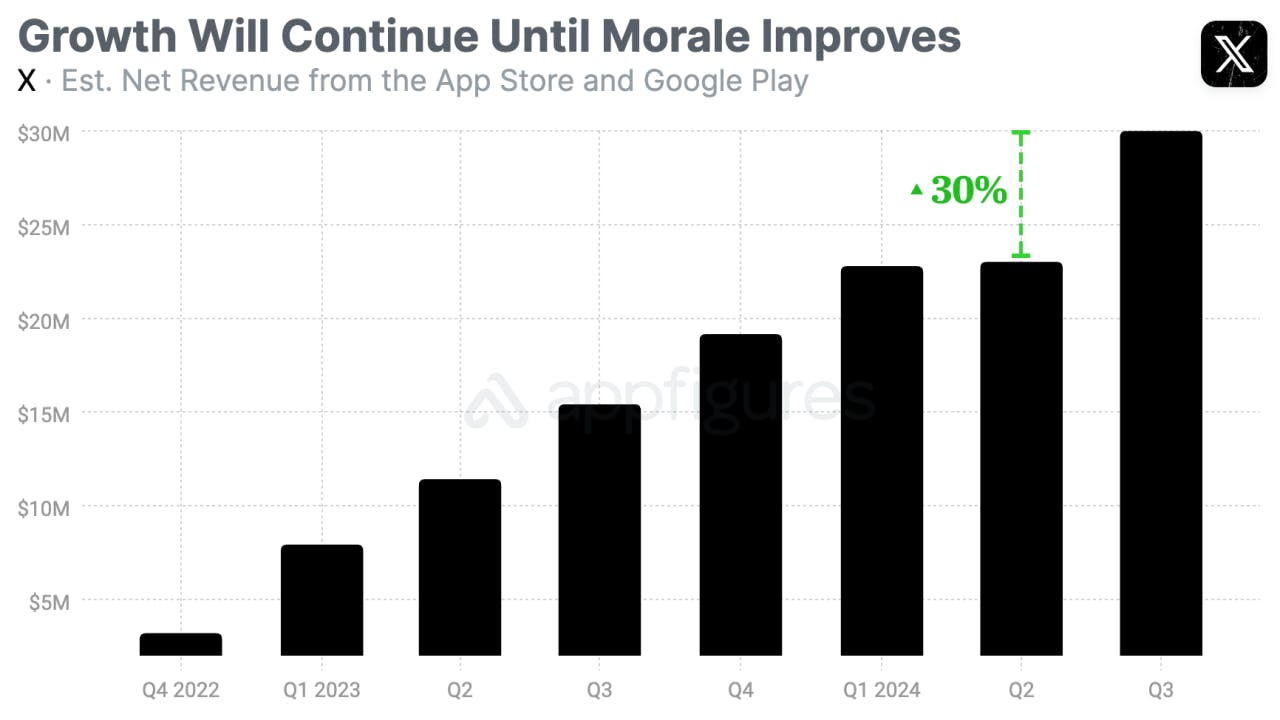

One key area of traction has been with X Premium, which has attracted a growing number of subscribers despite initial skepticism. In September 2024, X Premium was estimated to have added 1.4 million subscribers and generated $14.7 million through in-app purchases, including subscriptions. Overall, subscription revenue for Q3 2024 was estimated at ~$30 million, up 30% from the prior quarter.

Source: TechCrunch

The X Premium subscription service, combined with monetization tools for creators, has led to a notable rise in user-generated revenue, even as traditional ad revenue faces challenges. The introduction of long-form content has also been a pivotal moment for the platform, allowing for deeper engagement and creating a space for newsletters, blog-style posts, and more substantial media-sharing capabilities.

The addition of Spaces, X’s live audio feature, and ongoing investments in video capabilities have contributed to this traction, with more creators and influencers using the platform to host real-time conversations, podcasts, and live shows. Combined with its effort to incorporate creators and businesses into its ecosystem, X’s product pipeline aims to further monetize its user base through increased features.

In terms of engagement, X has positioned itself as a leader in real-time conversations, particularly around breaking news, political events, and global movements. The platform’s popularity during major news cycles, elections, and global crises has kept it in the public consciousness, maintaining its role as a central player in shaping discourse. This live, real-time engagement remains a key differentiator from competitors like TikTok, Instagram, and Facebook.

Valuation

At the time of Musk's acquisition in October 2022, Twitter was valued at $44 billion, representing a significant premium over its publicly traded market value of $31.5 billion at the time. This valuation was driven in part by Musk’s ambition to turn the platform into a broader “everything app” and his belief in its potential for massive revenue growth through subscriptions, creator monetization, and fintech integration.

Source: S&P Global

As a private company, current valuations for X have not been publicly released but estimates derived from employee stock rewards and aggregated public filings from mutual funds such as Ark Invest, Fidelity, and Baron Capital, with each mutual fund marking their X investment at different values. Those estimates indicated X’s valuation as of October 2023 at ~$19 billion, down 56% from the original acquisition price. X’s valuation fell, at least in part, in response to ad revenues declining from $5.1 billion in 2021 to an estimated $3 billion in 2023, driven by the advertiser exodus that took place after Musk’s acquisition.

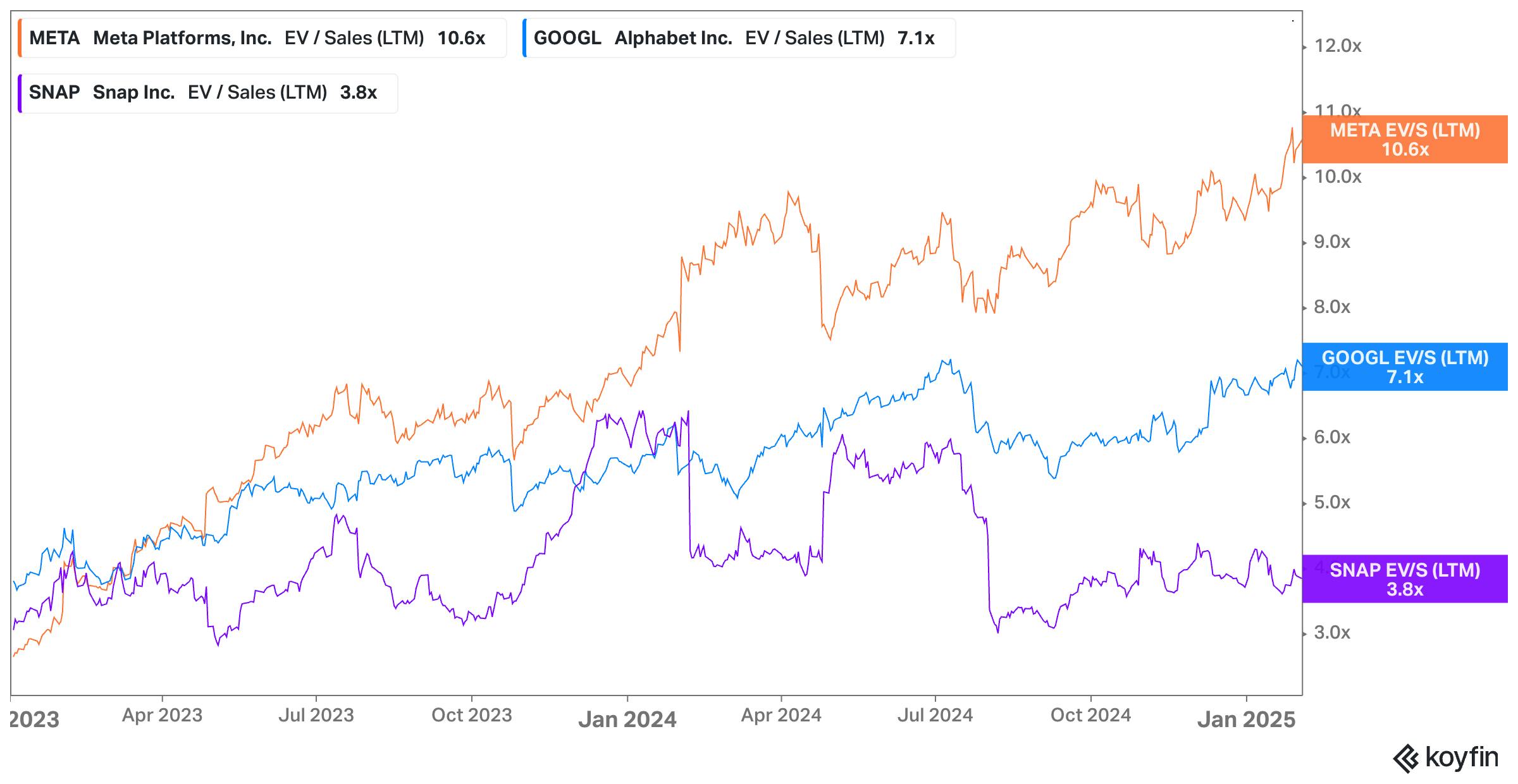

In November 2024, another of Elon Musk’s companies, xAI, which is a competitor to OpenAI and the creator of Grok, announced as part of a $5 billion funding round that investors who supported Musk’s Twitter buyout would receive a 25% stake in the AI company valued at $50 billion. In Q4 2024, X’s valuation mark across various mutual funds had risen to a range between $21 billion and $25 billion. Based on an estimated revenue of $2 billion in 2024, that would represent a 10.5-12.5x LTM revenue multiple.

In terms of comparable companies, Meta, Alphabet, and Snap are consumer technology companies that are publicly traded. As of February 2025, these companies were trading at an LTM revenue multiple range of 3.8x to 10.6x. Other comparable companies, like Reddit, are outliers, trading at 30.1x LTM revenue.

Source: Koyfin

Early efforts to ramp up subscription revenue through X Premium and creator monetization are gaining traction, but advertising, which has historically been a core revenue stream and currently accounts for 70-75% of revenue, is under pressure. Musk’s efforts to diversify revenue streams will play a crucial role in determining the platform’s valuation trajectory. As X explores the integration of payments and commerce, it could open new avenues for growth that might support a higher future valuation. However, if these initiatives do not take off as planned, the gap between the platform’s revenue and valuation multiples may become a greater concern for investors.

Finally, as a private company, X is relatively insulated from public shareholder pressures to alter its current path forward under Musk. In the email revealing his buyout offer to then-Twitter chairman Bret Taylor, Musk commented on this dynamic, stating that:

“I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy. However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.”

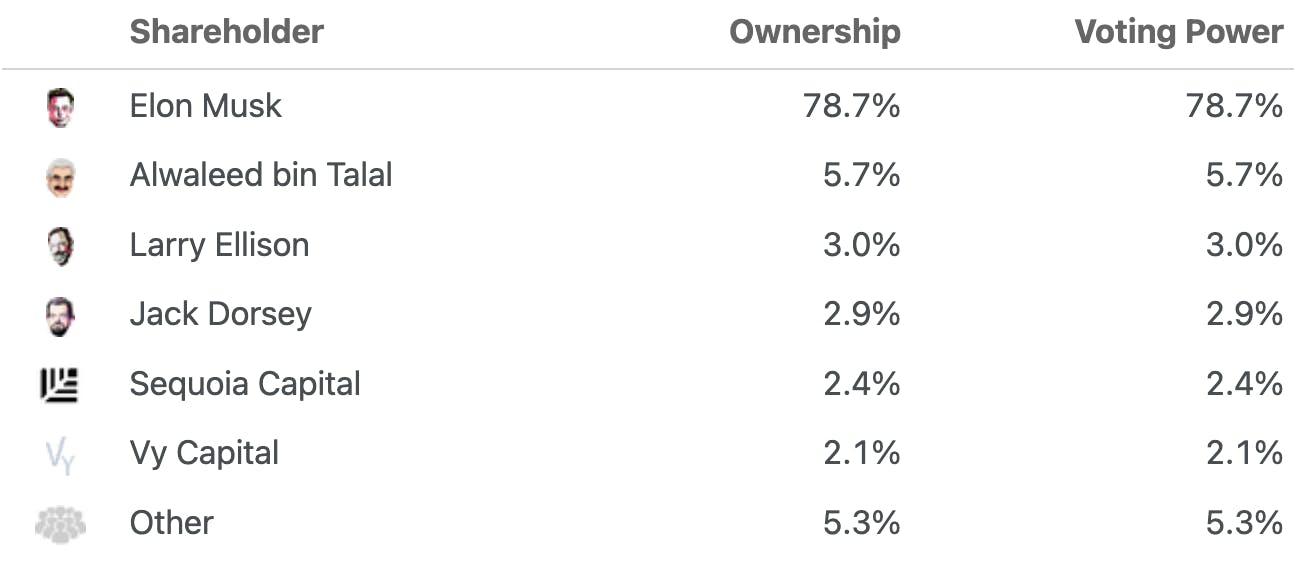

As of October 2022, Musk maintained a ~79% share ownership and voting power in X post-acquisition. Granted, that stake is supported by $13 billion of debt secured against Musk’s ownership in Tesla stock. In addition, as of August 2024, the investment banks that helped underwrite that debt have been unable to resell the debt, marking the longest the debt for a leveraged buyout has sat on a bank’s balance sheet since the Lehman Brothers bankruptcy.

Source: Kamil Franek

In January 2025, banks such as Morgan Stanley went out to market to sell $3 billion of the $13 billion in debt that was used to support Elon Musk’s buyout of Twitter. The banks hoped to sell the debt for “90-95 cents on the dollar.” While some have considered this debt to be some of the worst financed by banks since the 2008 financial crisis, the relatively low discount on the debt is a vote of confidence for the company overall.

In February 2025, X’s lenders exceeded their expectations and were able to sell $5.5 billion worth of the debt at 95 cents on the dollar. In part, this was driven by X’s improved financial position, despite declining revenue. Prior to Musk’s acquisition, Twitter had generated $5 billion in revenue and $682 million in EBITDA in 2021. Since, the company has seen revenue decline to $2.7 billion in 2024, but generated $1.3 billion in EBITDA, nearly 2x the profit.

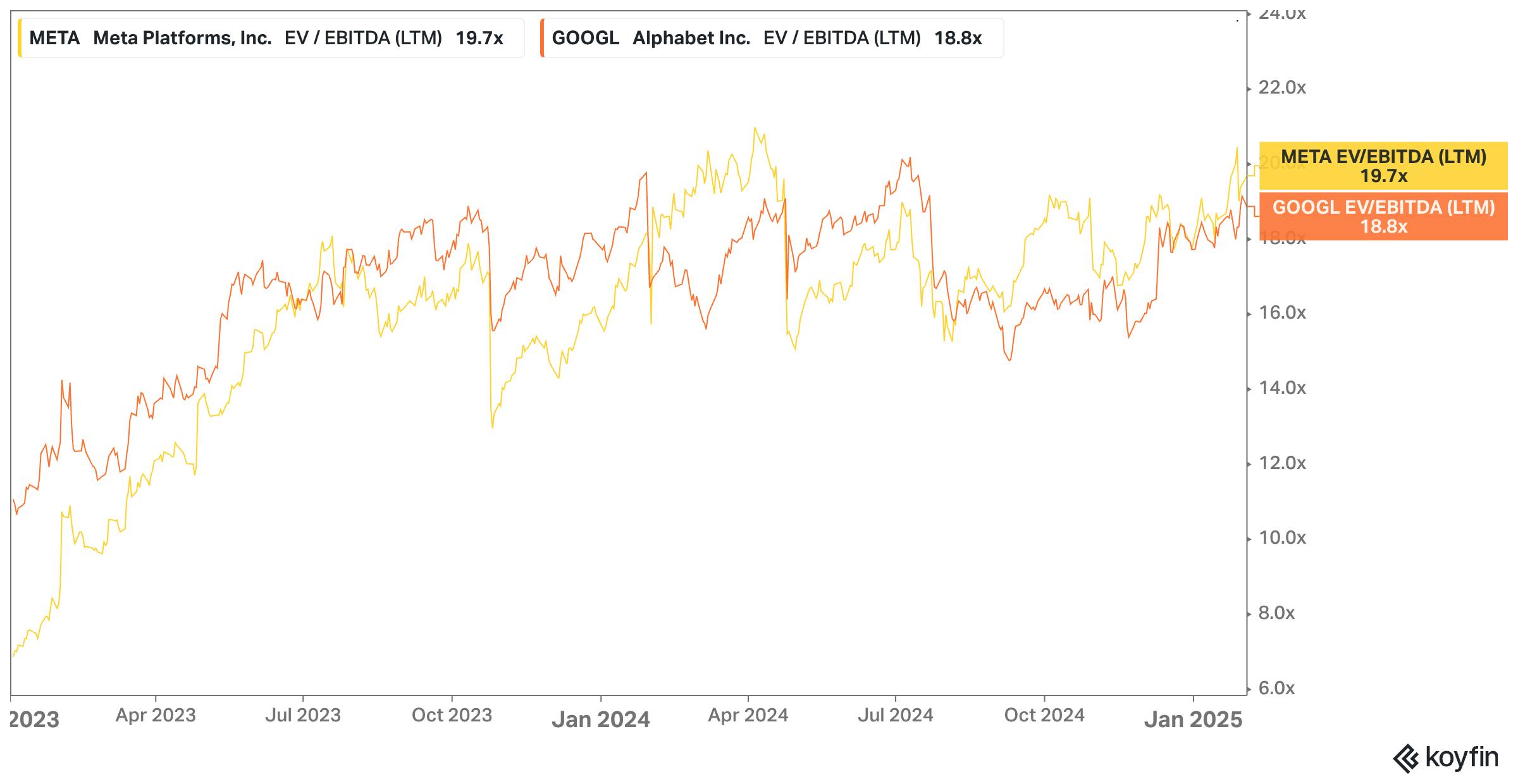

On a profit basis, comparable social companies like Meta and Alphabet trade at ~18-19x LTM EBITDA. Applying those comparable data points to X’s $1.3 billion in EBITDA would give an implied valuation of $23.4 billion to $24.7 billion. That is in line with the variety of mutual funds valuation marks that range between $21 billion and $25 billion.

Source: Koyfin

Key Opportunities

The “Everything App”

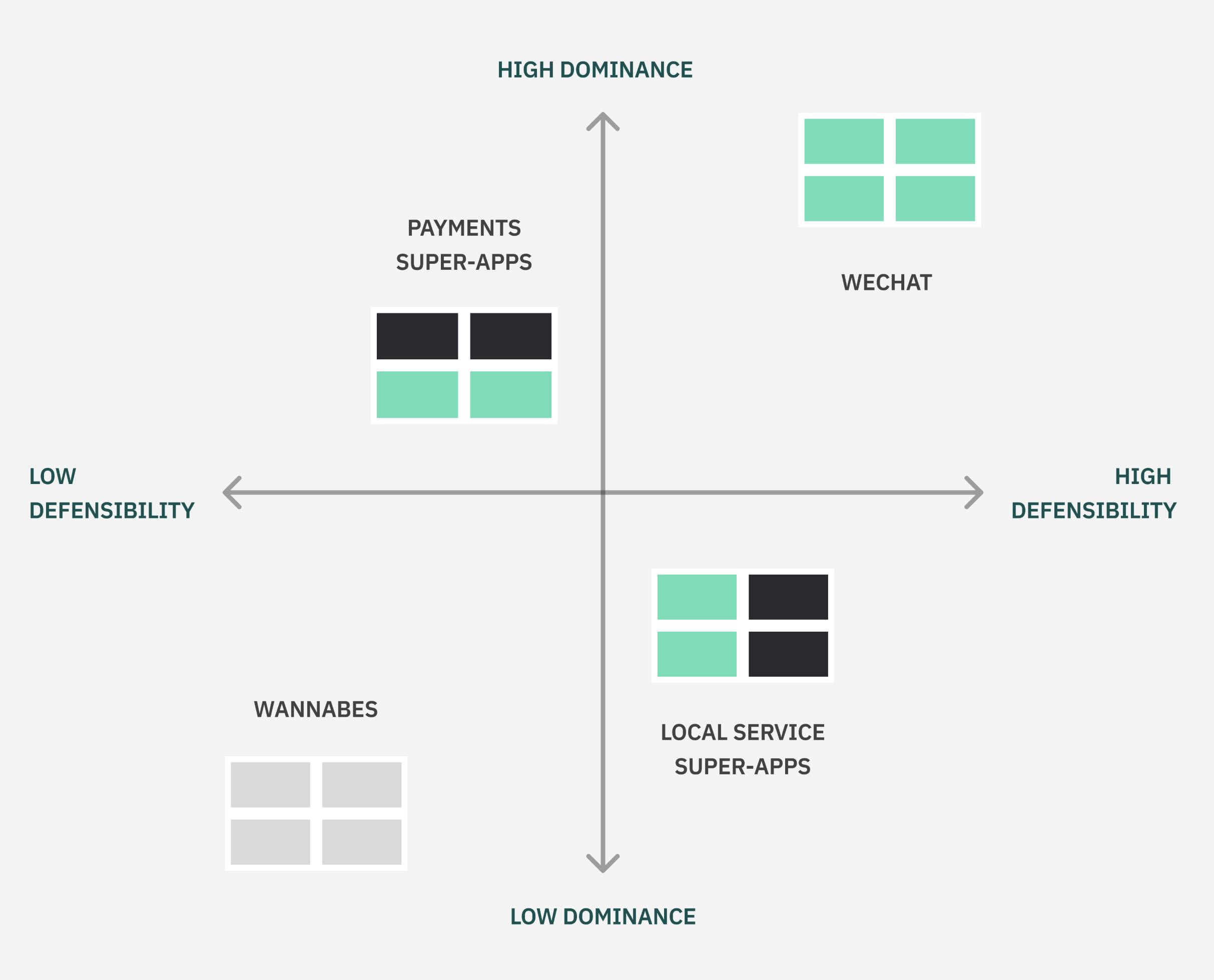

Elon Musk’s grand vision for X is to transform it into an “everything app,” similar to China’s WeChat, which combines social media, messaging, payments, and e-commerce. From the very beginning of his career, Musk has aimed to create a fully online bank, capable of easy payments. In fact, PayPal was formed from the merger of Musk’s X.com (the domain name was sold back to Musk in 2017) and Peter Thiel’s Confinity. Post-2020, Musk has frequently spoken about his desire to integrate payments and financial services into X, stating “We’re rapidly transforming the company from what it was, Twitter 1.0, to the everything app.” WeChat, for example, has achieved meaningful success, growing to 1.3 billion active users, by incorporating payments, ride-hailing, shopping, and e-commerce features into one super app.

To replicate this success, X would need to integrate a vast range of services in addition to existing communication networks, such as creator economies, peer-to-peer payments, e-commerce, and decentralized finance. The lack of a super app in Western markets, despite numerous attempts by major companies like Meta and Google, has often been due to regulatory barriers, market fragmentation, and the distinct behaviors of Western consumers, all of which may prevent X from succeeding.

One approach to the super app that Elon Musk has pitched is what he calls “the Muskonomy.” In the past, Musk has used this concept to explain shared benefits for his companies, like his The Boring Company digging tunnels as part of Tesla’s Texas Gigafactory to transport Cybertrucks. In the context of X, Musk has articulated how the connection between X as a source of training data and access to xAI’s Grok products are symbiotic for users. Over time, X’s super app prospects could be tied to other advantages provided by other companies in the Muskonomy.

For example, one financial benefit for X has become payments from xAI for access to data for training. One report indicated that xAI had paid X “hundreds of millions of dollars” for training data.

Creator Monetization

Platforms like YouTube, TikTok, and Patreon have been fairly dominant in the creator economy, enabling individuals to earn substantial income by monetizing their content. YouTube, for example, has generated over $70 billion in payouts to creators from 2021 to 2024 through ad revenue and partnerships. With X introducing features such as subscription, tipping, and enhanced monetization tools, the platform could provide creators with more diversified revenue streams. However, these tools are still developing, and adoption may be slow if the incentives don’t align with what creators already benefit from on more established platforms, like Patreon, where fan-based subscriptions have become the norm.

Long-Form & Multimedia Content

X has made public commitments and spearheaded features aimed at shifting X towards supporting long-form content, which would allow the platform to directly compete with Substack and Medium. Both Medium and Substack have seen surges in popularity versus Twitter as writers, journalists, and content creators seek a platform that offers independence, fewer restrictions, and strong monetization options through subscriptions. Both platforms have also weathered controversies. Medium’s monetization and “content mill” have created some stigma towards the platform while Substack has faced criticism and some creator departures for content moderation decisions.

By allowing creators to post newsletters, images, and videos, X can recapture a large portion of creators and audiences that had churned to Medium and Substack. This approach positions X to become a comprehensive content platform rather than just a microblogging site. However, the platform must develop high-quality content discovery tools and possibly expand content moderation to ensure creators can grow their audience - a problem Substack and Medium have struggled to solve. Without these, creators may hesitate to move over from more established long-form platforms.

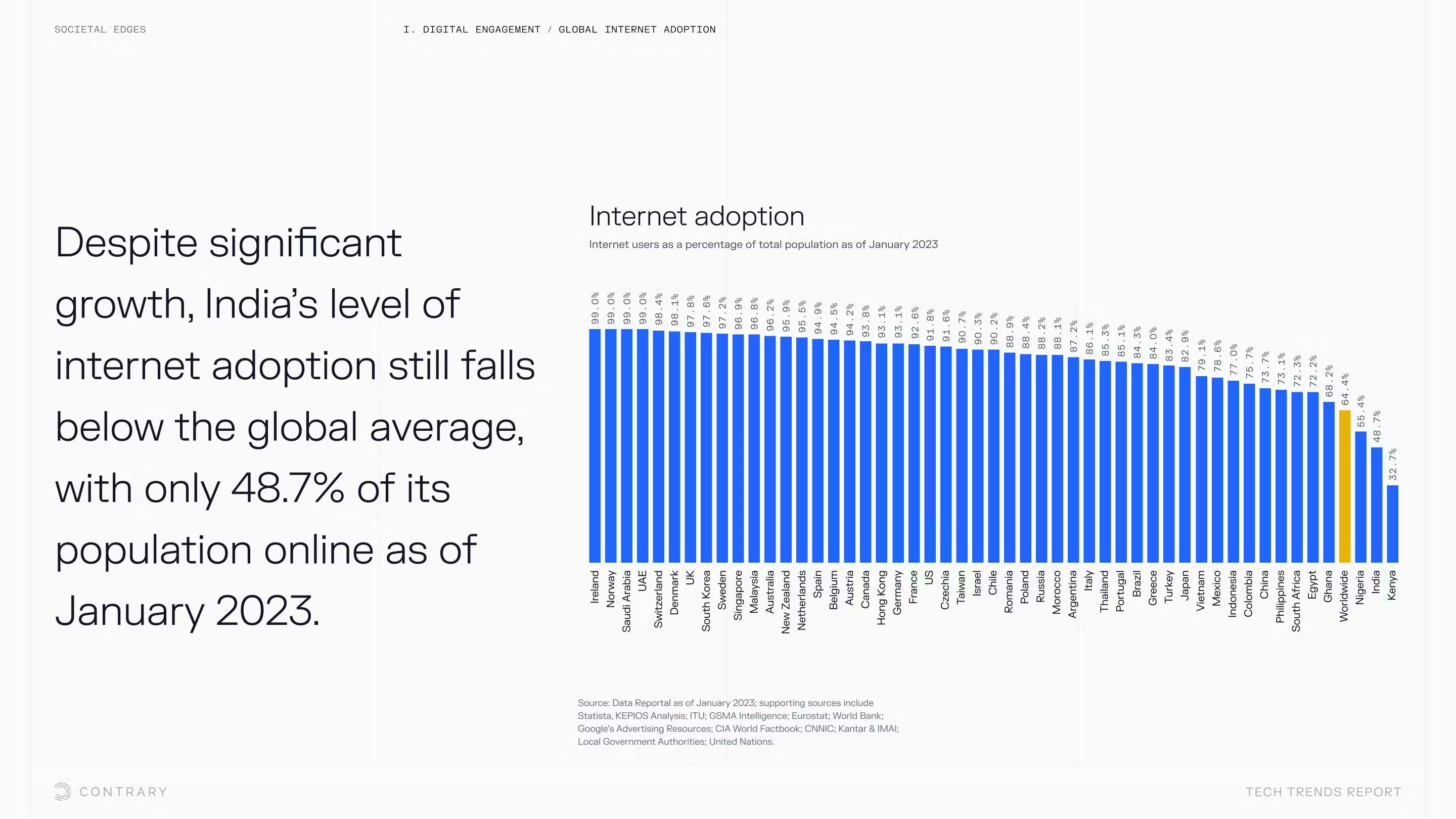

Global User Base Expansion

X has a global user base, but there remains massive potential in emerging markets like Southeast Asia, India, and Africa. These regions are experiencing rapid growth in internet access, and social platforms are in high demand. For instance, internet penetration in India is expected to reach 900 million users by 2025. Expanding X’s presence in these areas could unlock millions of new users who seek real-time communication and digital communities.

Source: Contrary

Platforms like WhatsApp and WeChat have captured these markets through localized features and payment integration. X would need to adapt similarly, ensuring that the platform remains relevant to diverse cultures and addresses infrastructure challenges like unreliable internet speeds or lower-end mobile devices. For X, integrating creator tools and monetization features could be key to unlocking value in these regions, allowing users to not only engage but also earn money via the platform.

Web3 & Blockchain Integration

X could benefit by tapping into the rapidly growing Web3 ecosystem. Blockchain technology offers decentralized applications, crypto payments, and permanent records of transactions, all of which align with Musk’s public enthusiasm for decentralized finance and crypto. Musk has been an outspoken advocate of cryptocurrencies like Bitcoin and Ethereum, and integrating blockchain technology would open new revenue streams for X, making it a hub for crypto enthusiasts.

Crypto payments for creators, or tokenizing certain aspects of X’s economy, could create a stronger link with the Web3 creator economy, where decentralized ownership and revenue sharing are foundational principles. Blockchain remains in its early stages, and widespread adoption of blockchain technology within social media remains elusive. Regulatory issues, scalability, and user education would all need to be addressed before Web3 could become a mainstream part of X.

Key Risks

Execution of the “Everything App” Vision

Elon Musk’s vision to transform X into a Western equivalent of WeChat, a super app offering social media, payments, and commerce, faces significant execution risks. Integrating multiple services like payments, peer-to-peer transactions, e-commerce, and decentralized finance is complex, and many companies have tried and failed in the West. For example, Meta attempted to integrate e-commerce and payments into Instagram through Instagram Shopping but faced resistance from users who weren’t ready for a super app ecosystem. Western consumers are accustomed to using specialized apps for distinct functions, making it harder to change behaviors. Keith Rabois, who previously worked at PayPal with Elon Musk, articulated the reasons a super app doesn’t exist in the US this way:

“The reasons why [a super app] works in China are very specific. For example, internet download times in most of China are not good. So you don't want to download 10 apps when it's really painful. You want to go through the pain once. Secondly, most people do not have credit cards in China. Their first access to credit was digitally… Apps on your iPhone are the remote controls for the real world. You want a button for food. You want a button for your Uber. You don’t want one button and then you have to keep sub-dividing.”

Many of the features Musk envisions are either still in development or largely untested in Western markets. A super app requires an immense ecosystem of partners, regulatory approval, and user trust. For instance, integrating cryptocurrency payments across X would likely face pushback from regulatory authorities concerned about transparency and fraud. The transformation of X from a social platform to a fintech or e-commerce app could also alienate its core user base if executed poorly, as users might feel overwhelmed by feature bloat.

While Musk’s ambitious plans for X could present significant growth opportunities, much of the potential remains in development. It will require careful balancing of innovation with usability and regulatory considerations to reach the scale and success that arguably only WeChat has achieved.

Source: Platform Revolution

Content Moderation & Regulatory Scrutiny

Content moderation has remained a persistent challenge for X, even before its rebranding from Twitter. Striking a balance between free speech and limiting harmful or offensive content is a tightrope walk that can have significant repercussions. If X fails to address these issues effectively, it risks further alienating users, advertisers, and brands, which has already led to reputational damage and loss of revenue.

Historically, platforms like Facebook, YouTube, and Twitter have drawn fire from both sides of the political spectrum on content moderation - critics who accuse them of either censorship or lax enforcement. However, the platform needs to walk the line carefully to avoid becoming a breeding ground for hate speech, misinformation, or other harmful behaviors. Regulatory bodies, especially in the European Union, have already taken issue with X’s content moderation policies, which could expose X to legal action and fines. In addition, emerging markets like Brazil have threatened to ban X due to concerns over fake news and inadequate content moderation.

Moreover, X will inevitably attract more regulatory scrutiny as it expands into areas like payments and financial services globally. The European Union has already shown its willingness to penalize tech giants such as Apple and Microsoft for breaching its stringent data privacy and content moderation laws under the Digital Services Act. Beyond content moderation, entering the financial space will require X to adhere to strict anti-money laundering (AML) and know-your-customer (KYC) rules. Any missteps in these areas could damage user trust, limit adoption, and invite regulatory bans and fines, which would delay or hinder X’s expansion into financial services.

One note in X’s favor is that other platforms, like Meta, have chosen to adopt similar content moderation strategies. In January 2025, Meta announced plans to remove its third-party fact-checking efforts and, instead, adopt an X-like Community Notes platform.

Spam Bots & Fake Accounts

One of the longest-standing issues with X (and Twitter) has been the proliferation of spam bots and fake accounts. Musk himself stated in June 2022 that the amount of bot accounts was one of X’s main issues. While X has introduced measures to limit the number of fake accounts, the platform continues to struggle. In the years after the X rebrand, X implemented features including “Not a Bot” and X Premium to reduce bots, but its effectiveness remained questionable as of April 2024 at least. If X fails to resolve this issue, the platform may suffer from reduced user trust, lower engagement, and a tarnished reputation among advertisers, who depend on genuine human engagement for their marketing efforts.

Monetization Challenges

X’s pivot to monetization via subscriptions is another area of potential risk. While X Premium and creator monetization tools offer potential new revenue streams, the platform's ability to convert a meaningful portion of its user base into paying customers is unproven. Subscription fatigue is a growing concern across digital platforms, with users increasingly reluctant to commit to multiple recurring payments. X risks being seen as just another platform asking for a slice of users' monthly income, without offering a differentiated value proposition. Competitors like TikTok, YouTube, and LinkedIn have built fairly robust creator ecosystems, where users can earn income through more established monetization tools. X will need to innovate around its premium offerings and justify the subscription costs to avoid losing momentum in this space.

Advertising Revenue Decline

Historically, advertising has been the lifeblood of X’s business model. However, with Musk’s intent to reduce ad clutter and pivot toward a subscription model alongside reduced content moderation, the platform is currently experiencing a major drop in advertising revenue. As advertisers stay wary of associating with a platform with inconsistent content moderation policies, X could struggle with advertisers leaving the platform. Platforms like Facebook, Instagram, and TikTok have optimized their advertising algorithms, offering advanced targeting and user insights that X may struggle to compete with. If X doesn’t innovate around its advertising solutions or create new revenue streams to replace ad dollars, it may struggle to remain financially viable.

Summary

Originally launched as a microblogging platform for real-time public conversations, X (formerly Twitter) is now aiming to transform into a multifaceted "everything app" under Elon Musk's ownership. Musk envisions X as more than just a social media platform - expanding into payments, e-commerce, and other digital services in a bid to emulate the success of super apps like China’s WeChat. While maintaining its core functionality of real-time communication, X is introducing monetization strategies such as X Premium subscriptions, ad-revenue sharing with creators, e-commerce, and digital payments. These initiatives are intended to reduce reliance on traditional advertising revenue and sustain growth, although challenges around content moderation, user willingness to adopt, and regulatory scrutiny remain significant hurdles as the platform evolves.