Thesis

According to an estimate from April 2023, US millennials were anticipated to inherit over $68 trillion from baby boomers by 2030 in what has been called “the greatest wealth transfer in history”. This will happen concurrently with a notable shift in US retail investing: from 2010 to 2020, the US saw retail investing double its share of trading volume from 10% to 20%. This surge extends globally, with retail investors now accounting for nearly half of all global wealth. Factors such as easy access to investment information via mobile apps and lower barriers to entry enabled by fractional shares have fueled this expansion.

However, a significant portion of millennials remain disengaged from the stock market. Only 30% of millennials were investing in the stock market as of July 2023, compared to 51% of baby boomers. Among millennials who do invest in stocks, a third started investing before age 21, often influenced by family or employer-sponsored retirement plans. This leaves a significant gap in financial engagement for those without exposure to investing or corporate retirement benefits, highlighting a market segment yet to be tapped effectively. Even when new retail investors do open an account, the hardest part remains knowing what to invest in and when.

eToro is a global social investing app that aims to bridge this gap. It is a social trading platform offering multiple asset types including stocks, cryptocurrencies, ETFs, indices, commodities, currencies, and options. Its focus is to bring together experienced and beginner investors by offering the unique ability to copy the trades of successful investors and learn from their strategies. Like other popular investment platforms such as Robinhood, eToro also allows fractional share trading.

Founding Story

Source: eToro

eToro was founded in 2007 in Israel by Yoni Assia (CEO), Ronen Assia (Executive Director, former CPO), and David Ring (former CTO).

Yoni Assia’s father, David Assia, was the co-founder and CEO of Magic Software. When Assia was young, his father would often stop the car outside their local bank to see the end-of-day stock market quotes in the window and discuss them with his son. Assia’s growing passion for capital markets continued throughout his childhood, and his father gifted him shares for his bar mitzvah. When Assia was drafted into the Israeli army in March 2000, he witnessed the formerly successful technology stocks in his portfolio collapse amid the dot-com crash. He credited the experience with providing him with a hard lesson on booms, bubbles, and investment risk.

After he finished his military service in 2003, Assia co-founded WiTech Communications, a company that developed and installed video systems for amusement park rides. He served as its development manager for two years. However, he maintained his interest in investing throughout the 2000s and came to realize that existing investing platforms were not designed for the average person. Overwhelmed and frustrated by the complex processes and long wait times required to open a brokerage account, Assia started work on eToro in 2006 with a vision of making trading and investing simpler and more accessible.

Meanwhile, before co-founding eToro as CTO, Ring had spent seven years building 888.com, an online casino and poker website. Yonin Assia's brother, Ronen Assia, became eToro's VP of Product Management in 2007, later leading Product Marketing and finishing his tenure as eToro's Chief Product Officer, where he remained until 2020. He now serves as the company’s Executive Director.

eToro launched to the public in September 2007 with its Visual FX trading platform, which was focused on the foreign exchange market and trading currency pairs. Users could access the platform from a web browser and fund their account with a credit card — although as of December 2023, FINRA has issued guidance to brokerage firms disallowing the use of credit cards to fund trading accounts to prevent fraud. In 2007, eToro made key early hires across regulation, compliance, and liquidity operations by recruiting Avi Sela (COO Regulation) and Jonathan Dayan (Chief Revenue Officer).

In 2008, the early eToro team faced the global financial crisis. They were surprised to discover that the platform’s growth increased during this period, with Assia realizing that crises lead to more attention and interest in financial markets — not less. The company launched WebTrader in 2009, a platform where users could trade financial assets like stocks, commodities, and indices. In 2010 eToro entered the nascent world of social investing with OpenBook, its first platform integrating social networking features. This allowed users to automatically replicate the trades of other traders in real time.

Having witnessed the instability in traditional markets during the 2007-2008 financial crisis, Assia was intrigued by Bitcoin and other cryptocurrencies. He published an article in 2012 about the need for digital currencies and transparent monetary systems. By 2013, eToro offered Bitcoin on its WebTrader platform, and 90% of eToro users were trading crypto by 2017. Looking to offer more services for retail investors in the US, eToro hired Lulu Demmissie as US CEO in 2021. Following that hire, eToro launched stock and options trading in the US in 2022.

Product

eToro is a social trading and multi-asset brokerage platform that allows users in 74 countries as of December 2023 to trade various financial instruments, such as stocks, cryptocurrencies, and commodities.

Trading

Source: eToro

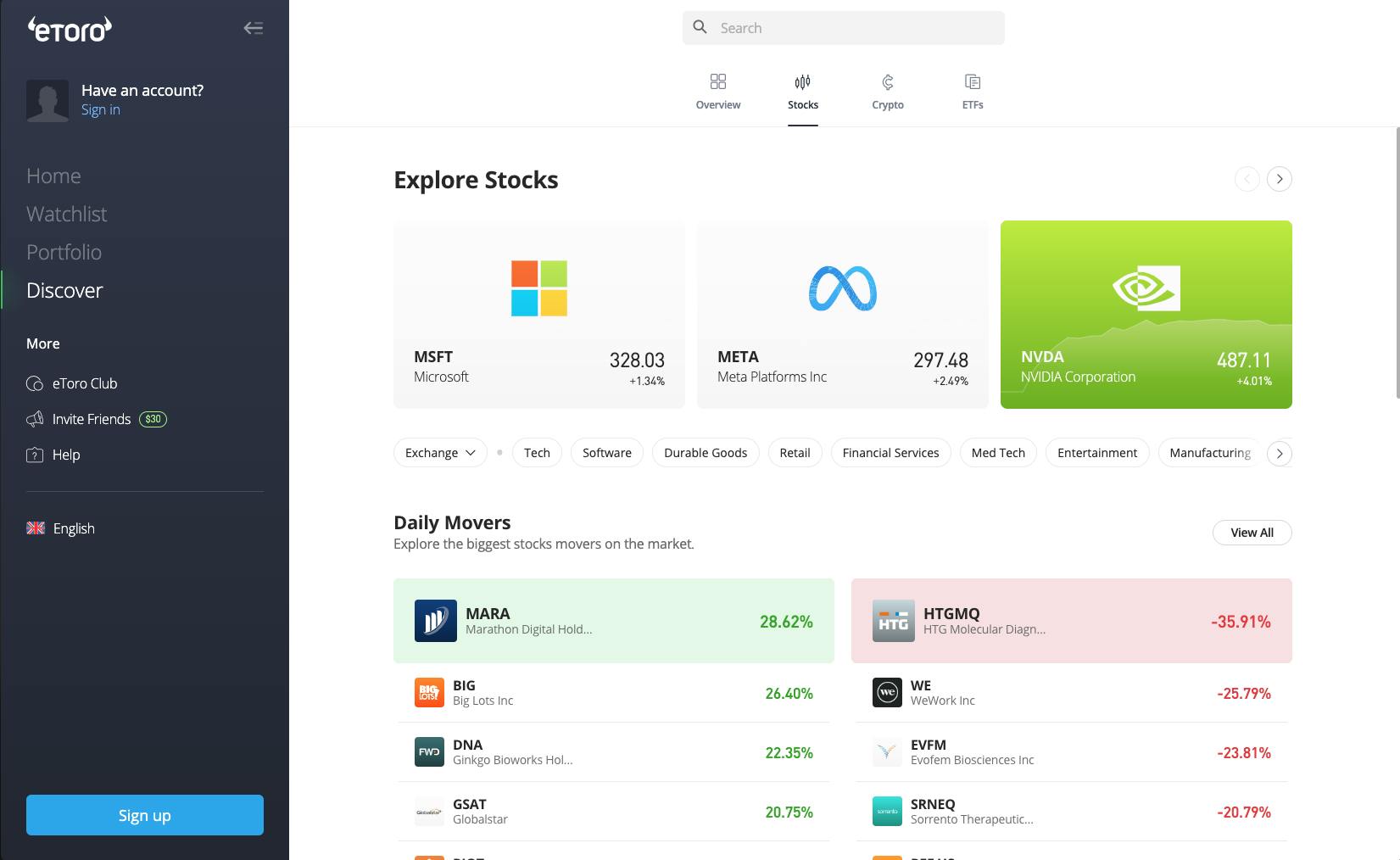

eToro's web trader and mobile app provide access to a variety of investment options, including cryptocurrencies, stocks, ETFs, commodities, and currencies. Central to eToro's platform is its social investing feature, which is integrated throughout the investing experience to capitalize on copy trading and community engagement.

While eToro's mobile app primarily functions as an embedded version of its responsive website, the company's increasing emphasis on retail stock investing signifies the growing importance of the mobile app. This is especially relevant for US investors, who gained access to eToro's primary trading services in January 2022 when eToro launched stock investments in the US. The following sections detail eToro's mobile and web onboarding experience for new investors in the US as of December 2023.

Mobile Onboarding

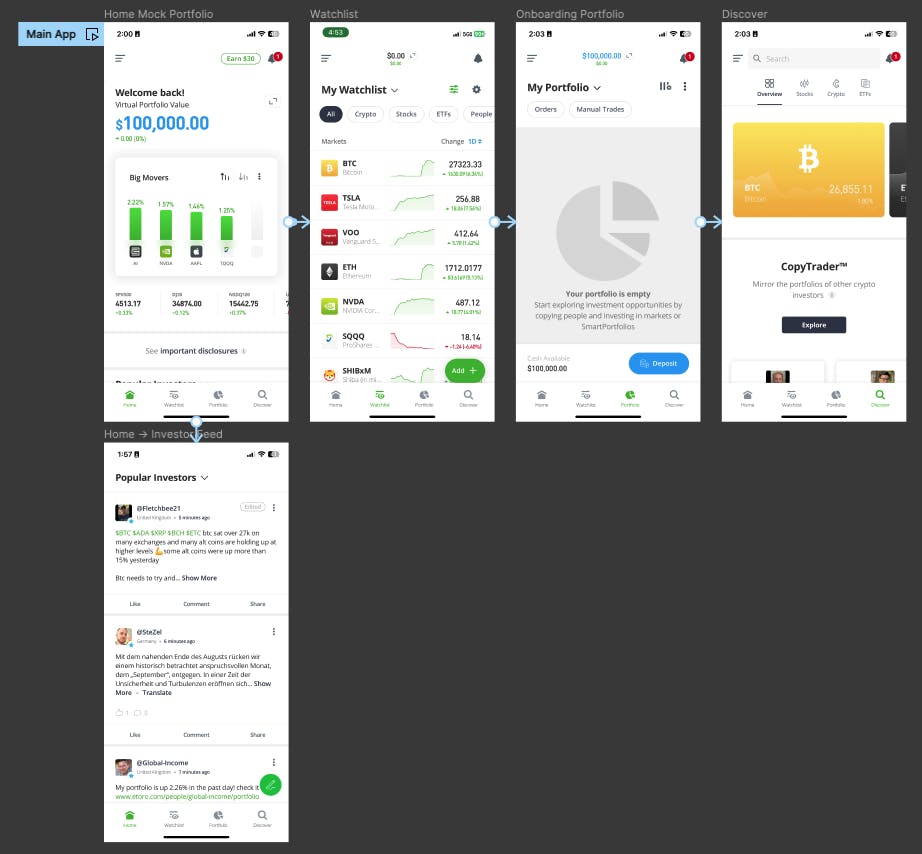

Source: eToro, Contrary Research

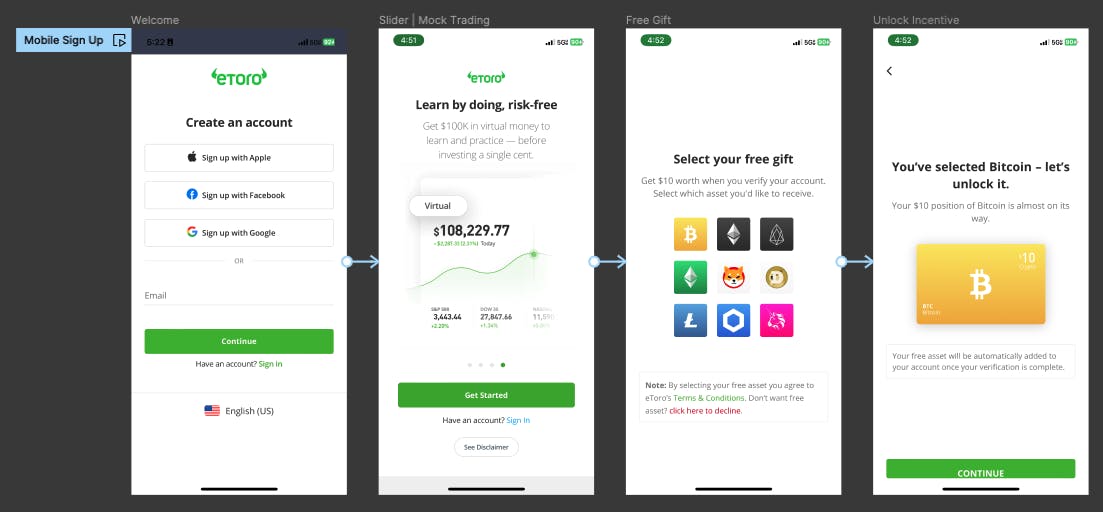

Upon opening the eToro mobile app, which effectively embeds the responsive website, users are greeted with a welcome screen. This screen introduces the platform's trading capabilities, social features, and a complimentary mock portfolio equipped with $100K in practice funds. New users are prompted to choose a $10 asset, either in stocks or crypto, as a reward for completing their account setup. The onboarding process is tailored to the user's selected reward.

After providing a phone number and choosing a username, users are directed to the home screen. Here, eToro displays various indices, necessary disclosures, and the social investing feed. This feed offers a toggle between popular investors and the latest news, allowing users to immerse themselves in the social aspects of investing right from the start.

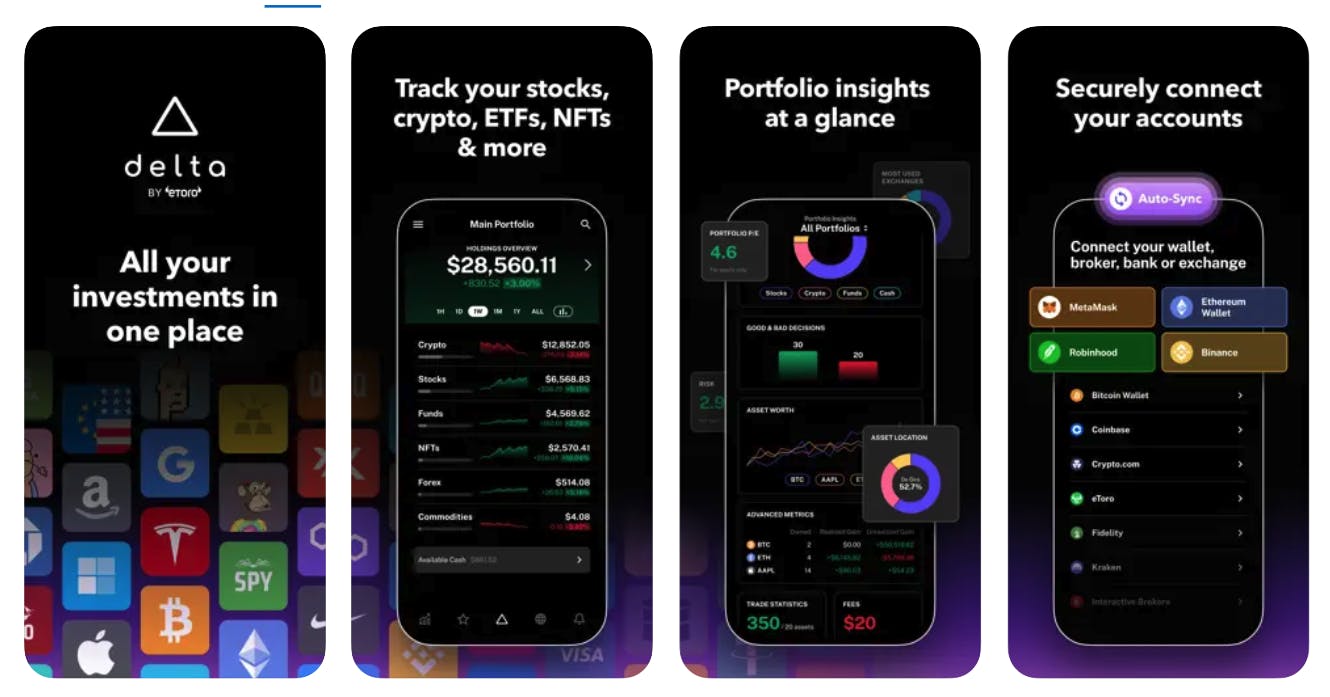

KYC → Initial Deposit

Source: eToro, Contrary Research

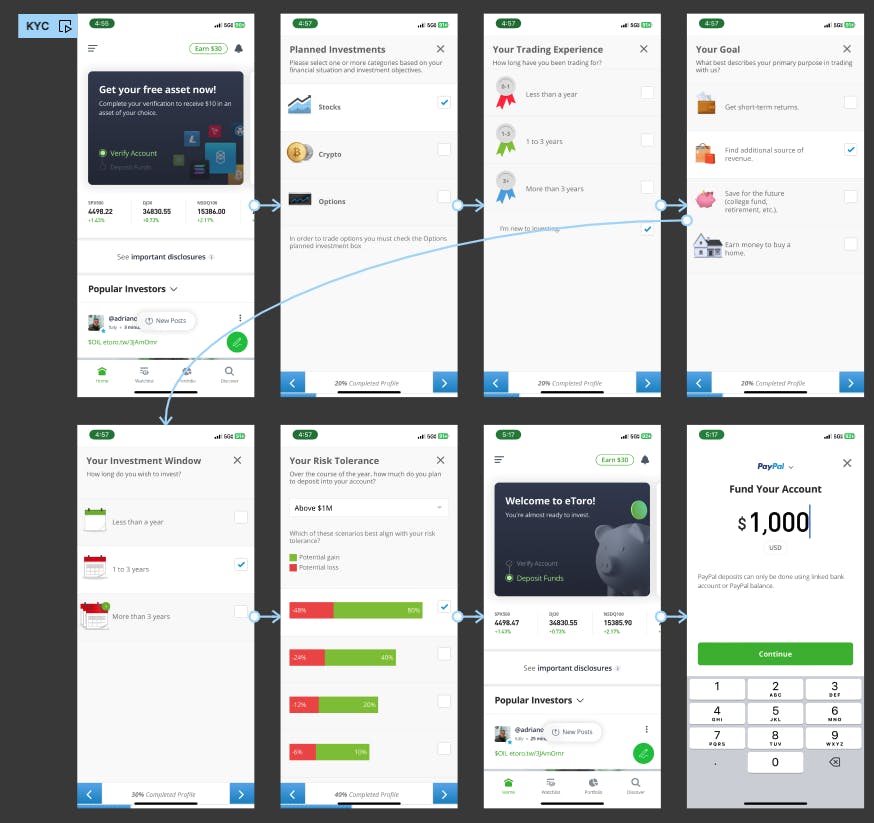

When a user engages with the “free stock” CTA card on eToro's platform, the app initiates a Know Your Customer (KYC) or identity verification process. This is a standard procedure across investing apps, but eToro differentiates itself by incorporating more visual elements and specifically highlighting risk tolerance graphs.

Once the KYC form is completed, eToro prompts the user to make a deposit. The app sets a default deposit amount of $1K, with PayPal as the suggested payment method. Unlike many investment providers that typically restrict funding to official bank accounts or debit cards, eToro offers more flexibility. It allows users to fund their investment accounts using partial payment services like PayPal and even borrowed funds, such as those from credit cards. This feature of eToro is intended to broaden the accessibility of its platform, catering to a diverse range of users with varying financial capabilities and preferences.

Mobile Exploration

Source: eToro, Contrary Research

When a user’s account is under review, the user can switch to a virtual portfolio or view the main home page, which includes a CTA to deposit funds. Users can explore a prefilled watchlist, empty portfolio, and robust discovery page.

Home: In the virtual portfolio mode, users are greeted with preselected big market movers and standard market indices. While there is no direct option to deposit funds or purchase stocks from the home screen, selecting any of the big movers prompts the user to deposit funds. Scrolling down, users can view eToro’s disclosures and subsequently, a feed of investors. This setup allows users to familiarize themselves with market trends and eToro's community while their account is pending approval.

Home → Community Feed: As of December 2023, the investing feed on eToro features recent posts that range from one to seven minutes old. eToro highlights its community features as a way to gauge investor sentiment and stay informed about global investing trends.

Watchlist: The default watchlist on eToro leans heavily towards cryptocurrencies, with Bitcoin prominently listed, followed by high-growth tech stocks like Tesla and Nvidia. The beginner watchlist includes one long-term ETF.

Portfolio: In contrast to some stock investing apps that display a free stock or crypto reward during onboarding, eToro’s portfolio page starts empty. The app encourages users to deposit funds, using the $100K of virtual funds as a starting point for exploration. Real trading with paper trading funds is not enabled unless actual funds are deposited.

Discover: The Discover page on eToro prioritizes cryptocurrency, followed by copy trading and popular investors. These popular investors are influencers with public portfolios available for copying, with eToro displaying their two-year return along with other information in the investor’s profile, which resembles a social media profile. For example, eToro features investor Jorden Boer, who posted a long description of his portfolio trading strategy.

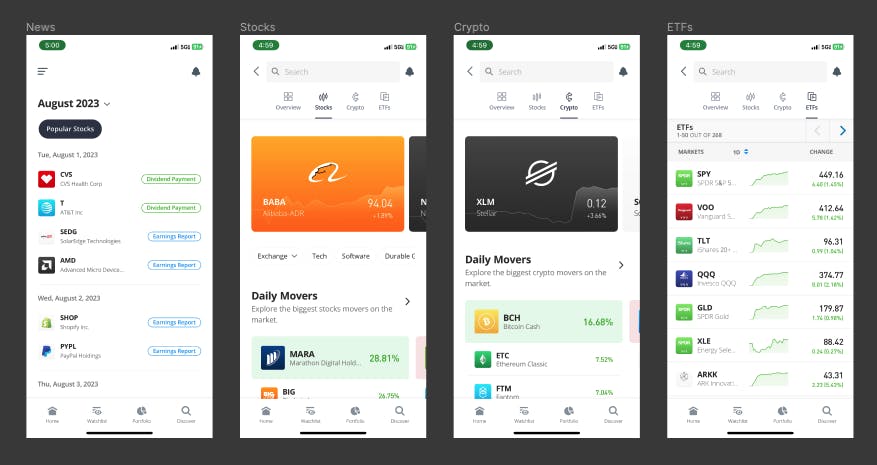

Discover: Assets

Source: eToro, Contrary Research

On eToro, the stock and crypto pages are curated to showcase trending investments, daily movers, and the most popular assets, along with community investor insights. However, the ETFs page lacks this curation, simply listing hundreds of ETFs. The mobile interface of eToro, featuring traditional table selectors and manual pagination, is more complex compared to the streamlined, user-friendly designs of apps like Robinhood and Public. This approach offers detailed information but can be less intuitive for users, especially those familiar with more modern interfaces that dynamically load content.

Individual Stock Page

Source: eToro, Contrary Research

The individual stock page is divided into three main tabs: overview, chart, and analysis.

Overview: This tab provides standard stock information. Unlike most investing services, there isn't a direct "Buy" or "Trade" button. Instead, users must click on the CTA button in the bottom right-hand corner to access options like buying, selling, adding the asset to their watchlist, or writing a post. The inclusion of the watchlist feature in this section may initially seem redundant, given the standard list icon in the upper right-hand corner. However, this design choice aligns with eToro’s aim to encourage users to familiarize themselves with investing by exploring personal lists or observing others’ stock choices before actively participating.

Chart: The chart tab features a Trading View candlestick chart, catering to more advanced investors. It allows for the addition of various charts, indicators, and asset comparisons, as well as customization of candlestick colors. Users also have the option to share their charts with others.

Analysis: Access to the analysis tab requires users to have funds deposited in their eToro account. This section provides comprehensive resources, including in-depth analyst reports, intrinsic value calculators, and other advanced investing tools. The analysis tab is geared towards providing users with detailed research and insights for stocks, cryptocurrencies, and ETFs.

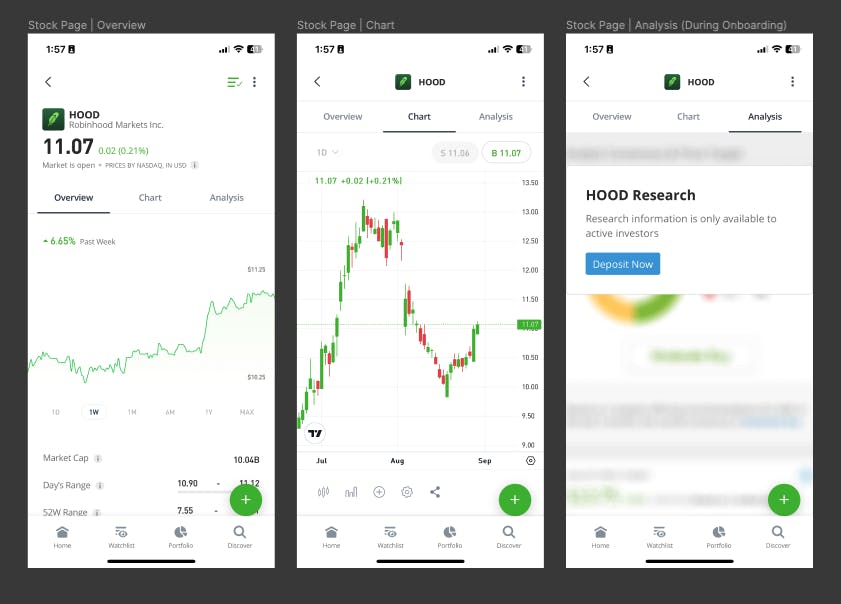

Delta

Source: Delta

In 2019, eToro expanded its offerings to cater to a broader range of retail investors, including those who do not actively invest through its platform, by acquiring Delta, an investment tracking app. Delta operates independently from brokerage services, allowing investors to consolidate and track their investments from various accounts. The app supports connections to several prominent platforms, protocols, and wallets, including MetaMask, Ethereum, Robinhood, Binance, and eToro.

Delta provides a unified view of an investor's entire portfolio, along with combined portfolio analysis. This feature assists investors in gaining a comprehensive understanding of how their funds are distributed across different investment platforms.

CFD Trading

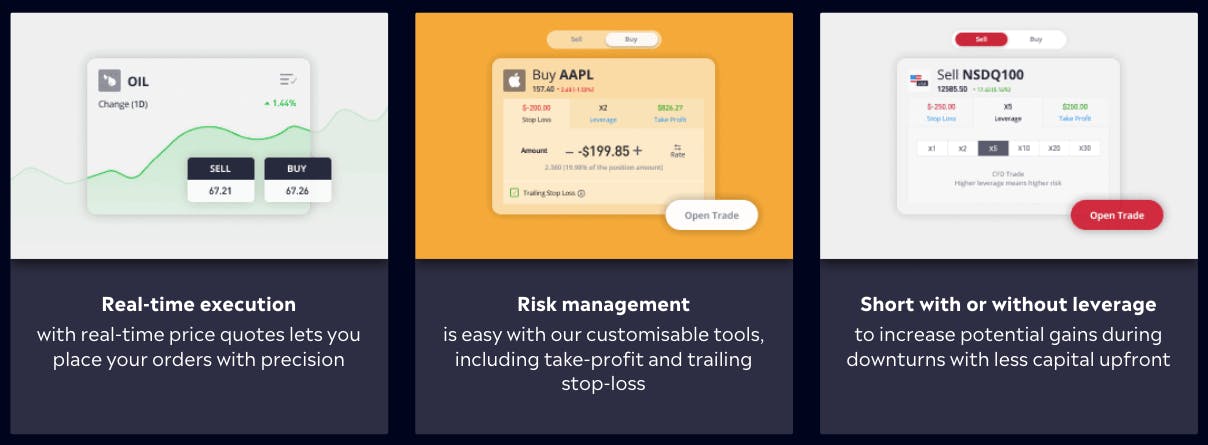

Source: eToro

For non-US investors, eToro offers the option of CFD (Contract for Difference) trading, a method that allows individuals to speculate on the value of an asset without owning the asset itself. This form of trading enables eToro to have more lenient KYC (Know Your Customer) requirements and allows the funding of accounts via credit cards.

The interface for CFD trading on eToro is similar to its US stock and crypto trading interfaces but with a notable difference in the asset ordering modal. Unlike typical market buy or sell orders or standard limit orders, eToro's default window for CFD trading emphasizes purchasing based on leverage amounts. Following this, users are prompted to set stop-loss and take-profit levels for their trades. eToro advertises real-time execution for CFD trades, along with features for risk management and the ability to short-sell.

CFD trading is known for its high-risk nature due to the leverage involved and the fact that it bypasses some traditional KYC requirements. As a result, it is illegal in the US. However, the flexibility of CFD trading in terms of regulatory compliance — as it doesn't involve actual securities trading — is what enables eToro to operate in numerous countries worldwide.

Copy Trading

Popular Investors

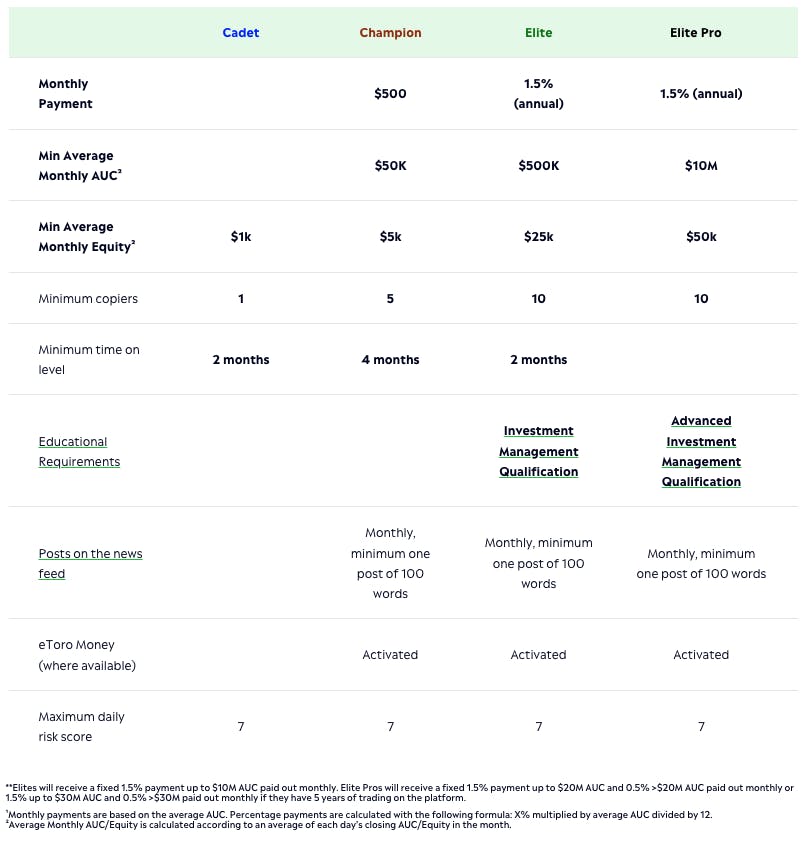

eToro introduced copy trading in 2010 as a strategy to boost beginner investor confidence and promote regular trading on its platform. The platform showcases popular investors, highlighting their two-year returns. eToro doesn't charge extra fees for automated copy trades, but users need a minimum of $200 to participate in copying an investor's trades.

Popular investors are a central feature of eToro's platform, prominently displayed on the home screen and stock overview sections. Their primary role is to provide copy trading opportunities to other eToro users. When an investor is copy traded, they earn a monthly payment equating to 1.5% of the assets copied annually. To qualify as a popular investor on eToro, there are various requirements, depending on the subscription plan. These requirements include minimum equity, time commitment, and even investment certifications.

As of December 2023, US users may only copy trades from other US users.

Source: eToro

Smart Portfolios

While eToro is known for its tools for short-term trading, it also caters to non-US investors interested in long-term investment options through "smart portfolios". These portfolios are curated investment funds managed by eToro's team of analysts. Users have the option to choose from a diverse range of smart portfolios, which cover areas such as traditional utilities, specific AI-driven technology sectors, regional economies, or targeted market objectives like the “OutSmartNSDQ” portfolio.

Each smart portfolio on eToro provides insights into its two-year return and the distribution of investments within the portfolio. To invest in these smart portfolios, users are required to commit a minimum of $500 for the initial investment. While eToro does not explicitly define ideal investment timeframes for these portfolios, it offers features like automatic dividend reinvestment, allowing users to effortlessly rebalance their portfolios over time.

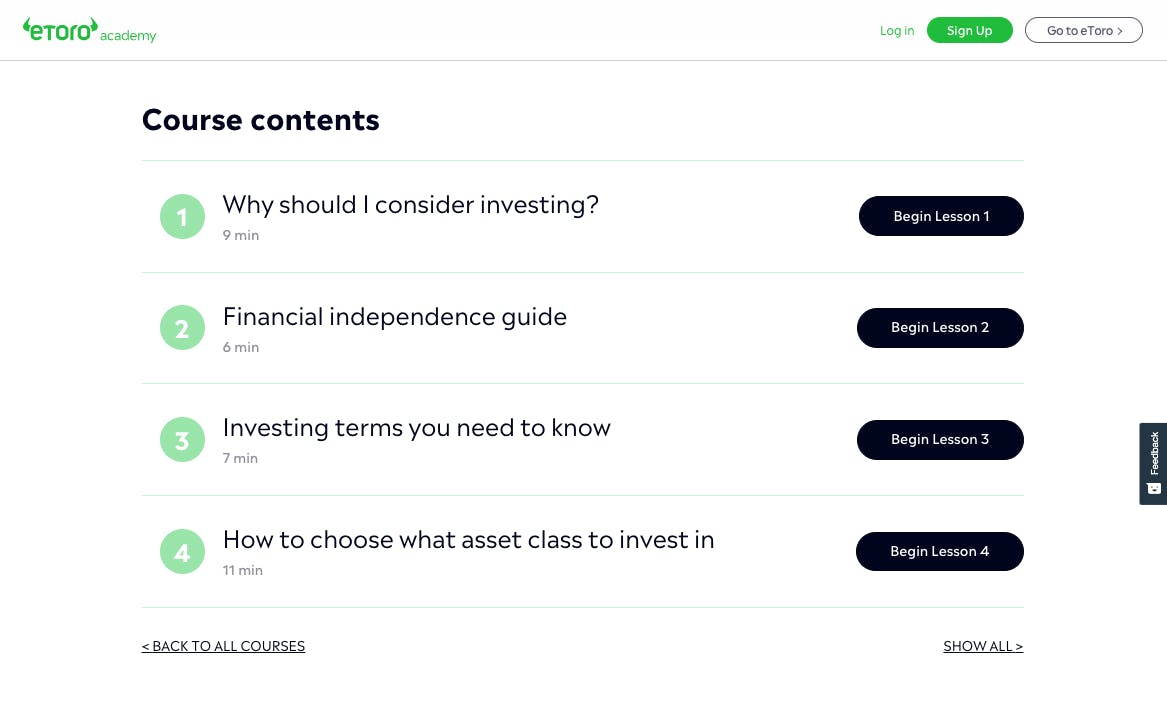

Education

Source: eToro

eToro features an investing academy, offering a guided blog that covers the basics of investing, alongside a media center hosting podcasts and discussions with popular investors. Additionally, eToro's News and Analysis section, grouped under its educational offerings, provides market news and introductory articles on financial concepts like yield signs, following a similar blog format for easy understanding.

Market

Customer

eToro’s ideal target customer is a beginning investor who is interested in trading multiple assets, using advanced trading tools, and using other investors to help shape their strategies. Professional or influencer investors who are looking to monetize their investments may also find eToro’s Popular Investor and copy trading features attractive.

In 2020, the median eToro investor was 34 years old, and 62% of users traded more than one asset type. However, it's worth noting that eToro's most profitable and reliable customers, from both a trading and assets under management (AUM) perspective, are the 45-year-old “Diamond” investors from Generation X. eToro segments its users based on average account deposits, ranging from as low as $968 in the Bronze category to as high as an average of $478K in the diamond category.

In 2021, funded accounts had the following distribution: 69% in Europe, 18% in Asia Pacific, 8% Americas, and 5% in the Middle East & Africa. These international customers are often less interested in long-term investing and ETFs, and more interested in CFD trading, perhaps unable to pass traditional KYC and alternative investments. eToro offers detailed analysis on its asset pages by default, making the trading platform useful for any retail investor who wants specific stock information.

Market Size

In 2010, retail investors accounted for only 10% of US trading volume. By 2020, the participation of retail investors in the US had doubled to 20%, and there was a noticeable increase globally. For instance, Brazil's B3, Istanbul's BIST, and Thailand's SET saw their retail participation rise respectively to 23%, 80% with a 5x increase in volume, and 50% with a 2x increase in volume. In September 2022, 18 out of 37 exchanges attributed an observed growth in retail investing to “improved access to data and analysis.” However, only a few exchanges observed a preference among retail investors for diversified exposures or reduced-risk investments.

eToro, leveraging this trend, provides beginner investors with access to earnings reports, advanced charting, and equity analysis, along with offering multiple high-risk assets. Yet, its primary profit center, spread on CFD trading, is not permitted in the US. To tap into the U.S. market's high-risk trading appetite, eToro introduced options trading in November 2022.

Targeting the 1.8 billion global millennials, eToro is eyeing a significant potential market, especially considering that US millennials are set to inherit an estimated $68 trillion from baby boomers by 2030. As of 2023, the total amount of money invested in the stock market globally was about $109 trillion. In 2021, digital platforms accounted for about 20% of wealth invested in equities, implying a TAM of about $22 trillion (which is likely to grow as both the percentage of wealth on digital platforms and the stock market itself grow). The market for retail traders is estimated to be ~$13 billion by 2026, and stock trading apps generated over $20 billion in revenue in 2021.

Competition

Robinhood: Founded in 2013, Robinhood offers stock trading through a mobile app. Robinhood also lets investors access higher-risk trading, including options, stock lending, and margin trading. Unlike eToro, which profits from the spread, Robinhood profits from Payment for Order Flow (PFOF), where a broker receives compensation for directing orders to different parties for trade execution. Robinhood serves the US retail investing market, largely focused on stocks, while eToro only entered the US market in 2021.

Robinhood served 23 million customers in the US alone in 2022. Robinhood’s smaller but concentrated user base generated $1.4 billion in revenue in 2022. eToro has a greater minimum deposit requirement of $10 but grants users a larger $10 asset gift and offers mock portfolios with $100K in test balance. Robinhood does not feature the same onboarding perks or public portfolios but features what might be seen as a cleaner user interface. Robinhood went public in 2021 and had a market cap of $11.3 billion as of December 2023.

Coinbase: Founded in 2012, Coinbase is one of the most popular onramps to the crypto ecosystem. It is exclusively focused on crypto and NFTs, while eToro is multi-asset. Instead of leaning on social investing and community features, Coinbase onboards young investors by granting them crypto tokens as a reward for engaging in educational activities about cryptocurrencies and crypto markets. As of 2022, Coinbase had 108 million users. Coinbase generated $3.1 billion of revenue in 2022. Coinbase went public in 2021 after raising a total of $498 million from investors including Andreessen Horowitz, Union Square Ventures, Ribbit Capital, and Tiger Global. As of December 2023, Coinbase had a market cap of $38.5 billion.

FOREX.com: Founded in 2001, FOREX.com helps retail investors trade currencies, commodities, equities and options. FOREX.com is web-first – much like eToro – but also offers a mobile app. Both FOREX.com and eToro started with currency trading and have since branched out to crypto, CFDs, stocks, options, and ETFs. FOREX.com is available in 180 countries but does not offer its CFD trading services to US customers as of December 2023. FOREX.com targets professional investors, highlighting specific technical features for professional retail trading. FOREX.com is a subsidiary of publicly traded company StoneX Group Inc., which traded at a market cap of $2.2 billion in December 2023.

Public: Founded in 2019, Public offers public, community-oriented investing portfolios, traditional equity trading, and other assets, including art and T-bills. Both eToro and Public emphasize their multi-asset portfolios, and Public offers lower-risk, long-term investments such as treasury bills. Despite offering public portfolio viewing and its emphasis on social investing, the Public does not feature copy trading like eToro. Public reportedly had 3 million users as of March 2023. Public raised a $220 million Series D in 2021 in February 2021 at a $1.2 billion valuation, bringing its total funds raised to $308 million. Public’s investors include Greycroft, Accel, Tiger Global, and Inspired Capital.

Business Model

eToro generates revenue primarily through fees on various asset trades and payment for order flow in stock investments. As of March 2023, the composition of eToro's commissions was predominantly in equities, with a distribution of 48% in equities, 27% in commodities, 19% in crypto assets, and 6% in currencies. The company earns 87% of its total revenue from the spread, which is the difference between the bid and asking prices of a user's order. Consequently, eToro has a financial incentive to promote frequent trading among its customers.

eToro's fee structure for each asset class is as follows:

CFDs: Fees are charged based on Pip (”point in percentage”) units, which represent the smallest price movement in currencies and commodities. Currency conversion fees range from 1 to 3 Pips. For example, converting $10K into euros at 1 Pip would cost $1. Commodity conversions start at 2 Pips, with higher rates for popular commodities like Copper (4 Pips) and up to 130K Pips for palladium.

Stocks & ETFs: eToro does not charge management, rollover, ticket, or overnight fees. However, foreign exchange fees may apply for non-USD withdrawals and deposits.

eToro Money: Users in supported countries, including the US but except certain states like New York, can avoid individual transaction fees by using an eToro Money account. These accounts incur a 1% transaction fee after the first $2K spent monthly. Fees for converting crypto tokens and currencies vary between 0.25% and 0.55%.

Other fees: eToro charges for after-market orders on CFDs, a $5 withdrawal fee, and a $10 monthly inactivity fee if an account is dormant for 12 months. Example fees for CFD orders with about $1K buying power range from $3 to $20.

To balance active trading with long-term customer use, eToro’s Money product generates anywhere from $556 to an estimated $1.1K in additional monthly revenue from interest on its user cohorts by year, with monthly churn rates ranging from 2.8% to 1.5%.

Referrals: eToro offers a $30 referral reward for any invited user who funds their account. Investing in influencers on eToro also attracts their followers to eToro’s public portfolio, which any registered user can view, which may encourage users to start trading to copy trade from their favorite influencer.

Traction

In August 2023, eToro reported having 32 million registered users on its platform and offered trading in 70 countries, with additional access to community and news features in 100 countries. In the five months between March 2023, when it had 31.4 million accounts, and August 2023, eToro added 600K accounts, averaging 120K new accounts per month.

eToro reported an EBITDA profit of $114 million in 2017 and $193 million in 2018, as revealed in a 2021 SPAC presentation. However, the company did not go public at a $10 billion SPAC valuation as planned and instead laid off 100 employees in July 2022.

Source: eToro

By comparison, Robinhood, which went public in July 2021, reported an annual EBITDA of -$1.6 billion and annual revenue of $1.8 billion. eToro's 2021 revenue was $1.2 billion, but its EBITDA was not disclosed. In March 2023, CEO Assia reported eToro as EBITDA profitable, having generated over $400 million in profit over the preceding five years. This suggests that from 2019 to 2022, the company's EBITDA was approximately $93 million, given the $114 million and $193 million figures for 2017 and 2018, respectively.

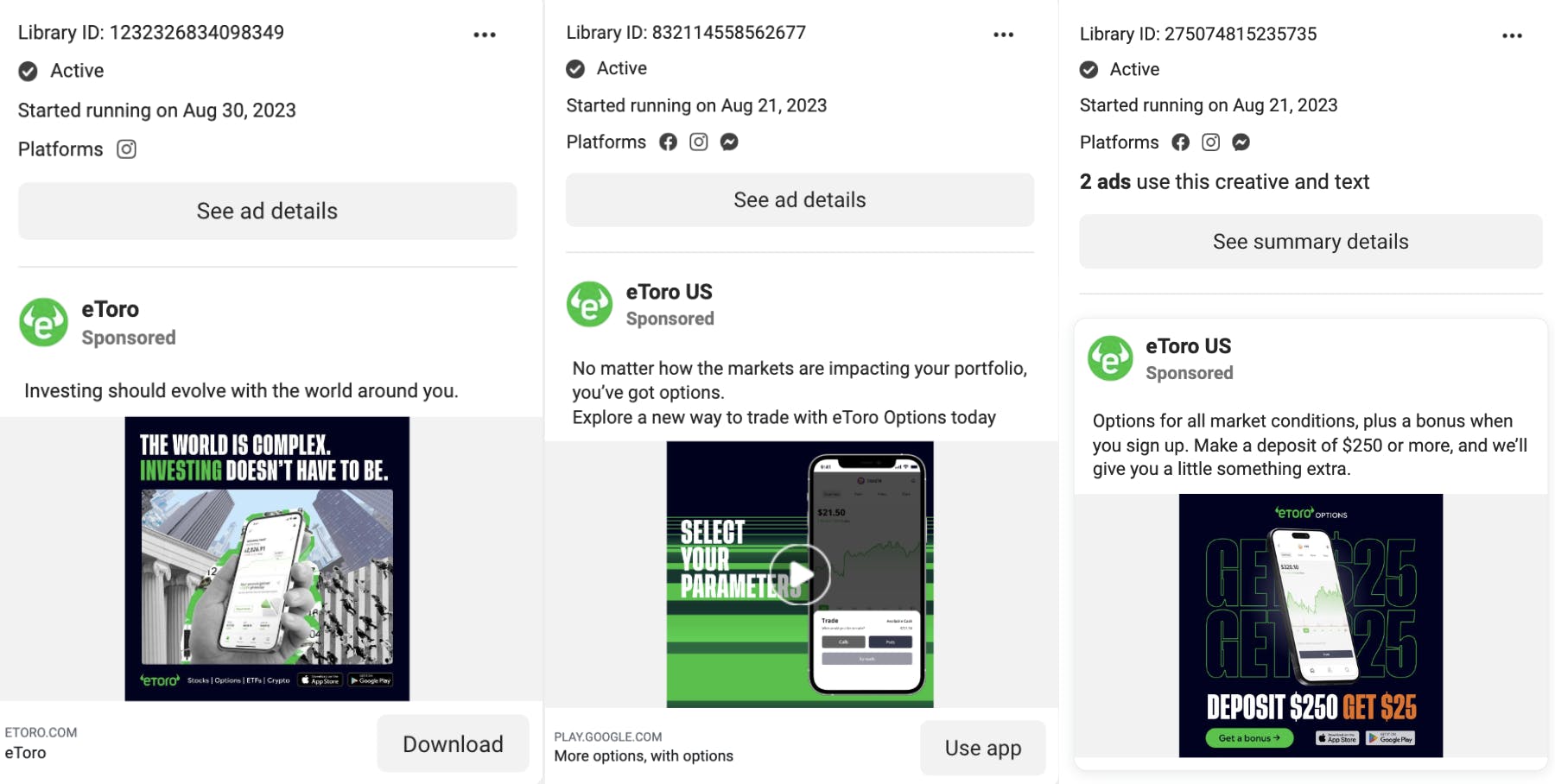

The peak of eToro's EBITDA coincided with the 2017 crypto rally, leading to significant growth and revenue carryover into 2018. However, a market correction in 2019 resulted in a 34% decrease in revenue. In anticipation of the SPAC — and to recover from 2019 — eToro nearly doubled its ad spend from $120 million to $229 million in 2020.

Customer Acquisition: In 2021, eToro reported a $31 average CAC for a new registered account. In 2021, eToro had 18.7 million users and 1.2 million funded accounts, revealing a 6.4% registered user-to-funding rate. In 2020, eToro spent $221 million with a five-month payback period and projected an estimated $998 million in cumulative revenue over the next six years.

Source: Facebook

Platform Partnerships: In August 2023, Twitter (now X.com) announced a trading integration with eToro, allowing users to buy and sell stocks on Twitter while using eToro’s trading platform on the backend. The integration expands on Twitter’s existing cash tags, which had 420 million searches between January 2023 and August 2023, by adding eToro’s asset information and trading accounts to Twitter’s existing chart data from TradingView. eToro’s partnership with Twitter allows it to capitalize on “Fintwit” the use of Twitter for financial news, which averages 4.7 million searches a day.

Valuation

In March 2023, eToro raised $250 million in funding at a valuation of $3.5 billion through an advanced investment agreement. This brought the total funds raised by eToro to $693 million as of December 2023. This latest round represented a significant decrease from the planned 2022 SPAC IPO valuation of $10.4 billion, which ultimately did not materialize. The most recent formal fundraising before this was eToro’s $100 million Series E in 2018, which valued the company at $800 million. That round was led by China Minsheng Financial and saw participation from other global investors including SBI Group, Korea Investment Partners, and The World-Wide Investment Company.

Key Opportunities

Expanding Into US Options Market

In 2022, eToro introduced options trading, positioning itself as a direct competitor to platforms like Robinhood and Webull. With options trading being a key revenue generator for these platforms, eToro's simpler interface for options and high-risk trading strategies could attract less experienced traders. This move could significantly impact eToro's growth, especially considering options trading is a major revenue source for Robinhood. Capturing even a small percentage of the US options market could be a substantial boost for eToro, complementing its existing revenue from spreads on US stocks and cryptocurrencies.

The Growth of Influencer Investing

The growing influence of financial influencers, particularly in the United States, offers a unique opportunity for eToro. Unlike its US competitors, eToro provides copy trading capabilities. In 2022, there were 68K American financial influencers on Instagram, who saw an 8% median growth rate and posted more than double the number of videos compared to influencers in other sectors. eToro's Popular Investor program, which allows influencers to monetize their portfolios with even a single copier, could increase the platform’s appeal in tandem with the growth of financial influencers.

Longer-Term Investment Solutions

eToro's Money product offers a sustainable, long-term revenue source by rewarding users for keeping funds in their eToro accounts. eToro's segmentation of customers based on average account balance reveals that older clients, especially those in the "diamond" club, tend to stay with the platform for extended periods, ensuring a steady revenue stream. Additionally, eToro charges a $10 monthly fee to users who haven't logged in for over a year, allowing the company to earn interest on these funds while also collecting fees. Following the industry trend, eToro might introduce longer-term investment solutions like official Roth IRAs, providing another avenue to earn interest on assets under management.

Key Risks

Declining Revenue

A significant risk facing eToro is a decline in revenue. In 2022, eToro earned $631 million from commissions, a 49%decrease from 2021 and only a slight 5% increase from the $605 million in 2020. This trend points to potential challenges in eToro's revenue model. Additionally, with a two-quarter payback period, eToro faces financial risks if customers churn or fail to convert to funded accounts within this timeframe. The platform's low conversion rate, with only 6.4% of customers funding their accounts in 2021, may contribute to its issues with revenue.

Late, Regulated US Entry

eToro's entry into the US market in 2022 was both late and heavily regulated, setting it up in a competitive environment dominated by platforms like Robinhood which had been around longer in the US. Both eToro and Robinhood primarily serve a similar demographic, with an average user age of 31 years. Robinhood's profitable customer base, particularly those using options services, is likely to remain loyal, posing a challenge for eToro. Despite its global success, eToro faces the task of appealing to US investors who might be overwhelmed by its advanced trading services. To facilitate its US operations, eToro appointed a US CEO in 2021, which may have helped with regulatory approvals. Nevertheless, obtaining full approval for stocks, crypto, and options trading took the entirety of 2022, even with strategic acquisitions.

Potential Market Volatility

eToro's financial performance is highly susceptible to market conditions. Between 2018 and 2019, the company's EBITDA plummeted from $193 million to $11 million, highlighting its vulnerability to market volatility. While all investment platforms face market-related risks, eToro's focus on CFD and crypto trading, which are higher risk compared to stocks and ETFs, exacerbates its exposure. Adverse global or regional economic conditions could lead to decreased trading volumes and, subsequently, reduced revenues.

Summary

eToro, an early player in the global social investing arena, offers unique features like copy trading from influencer investors. The platform, which entered the US market in 2022, offers multi-asset investing and is geared towards young investors across 74 countries. While eToro primarily earns through spread fees, especially from CFD trading – which is not permitted in the US – it distinguishes itself from other investing apps that are moving towards long-term, low-risk investment options like ETFs and retirement-focused services. eToro's strategy involves assisting beginners to navigate advanced trading tools with its simplified, community-centric interface. As of March 2023, the company has achieved EBITDA profitability. However, it continues to face challenges related to market volatility as it strives to expand its US customer base and strengthen ties with international investors.