Thesis

US retail investors owned over $50 trillion worth of assets as of July 2021. Globally, retail investors owned ~50% of the estimated $275 trillion to $295 trillion global assets under management as of February 2023. The percentage of Americans who own stock directly increased significantly in recent years — going from 15% in 2019 to 21% in 2022, the largest increase on record, according to a Fed report. Meanwhile, a May 2023 survey found that 61% of Americans own stock in some form, up from 56% in 2021 and 55% in 2020; the highest rate of stock ownership since the great financial crisis in 2008.

However, a large minority of Americans still don’t own any stock, and the vast majority still don’t own stock directly in 2023. Owning stock is directly correlated with wealth creation, but stock ownership is highly concentrated amongst the wealthiest Americans; the top 1% of Americans by wealth owned 53% of stocks held by American retail investors as of August 2023. Ownership was also concentrated amongst older generations, with baby boomers holding 56% of stock. However, younger generations were starting to build their stock holdings; Gen Xers owned 26.3%, and Millennials and Gen Z owned 2.3% combined.

Public is a fintech company that seeks to capitalize on, and encourage, the expansion of retail investing. The company’s mission is “to make the public markets work for all people” via its commission-free investing platform that places a special focus on social investing, with features that encourage on-platform interaction between users. While lack of accessibility is one possible reason why many retail investors continue to refrain from actively participating in the markets, Public believes psychological and intellectual barriers to entry are also common obstacles. Public looks to solve this by expanding accessibility by providing the tools, education, and community for retail investors and other non-professionals to participate in the stock market and other forms of investing.

Founding Story

Public’s two co-founders, Leif Abraham (co-CEO) and Jannick Mailing (co-CEO) were successful entrepreneurs prior to launching Public in 2019. Mailing had two successful roles as an entrepreneur and operator. In 2008, he was a part of the founding team and product for CFH Group, a holding company for four separate entities that operated in the fintech space in prime brokerage, clearing, API, and cloud and education services. In 2012, Mailing became the co-founder of another fintech company within CFH Group called Tradable which was a unified API platform for fintech developers. Ultimately, CFH Group was sold to Playtech LTD in 2016.

Abraham also had two experiences as a co-founder prior to founding Public. In 2010, he started Pay with a Tweet, a referral marketing tool that he sold to Hanse Ventures in 2014. The company was later sold again to Aklaimo in 2017. In 2015, Abraham started And.Co, a software company for freelancers that he later sold to Fiverr in 2019.

With Mailing’s experiences in fintech, along with Leif’s marketing expertise, the pair decided to launch a company together which later became Public. Originally, Public operated under the name Matador; however, it always had the same mission of making a social investment platform.

Product

Public’s product is an investment platform. Its initial point of differentiation from other investment platforms was its focus on community-based, collaborative investing that made it easy for users to share their investment decisions, and the rationale behind those decisions, with others. It also distinguishes itself from competitors by not accepting payment for order flow as a source of revenue

Multi-Asset Investing

Source: Public

Public describes itself as being “one place” where users can go for all their investing needs, offering users the ability to “buy stocks, treasuries, ETFs, crypto, and alternative assets with deep fundamental data and custom analysis powered by AI”. Within the Public app, users can explore a variety of assets on a dedicated “explore” page, and they can use the “portfolio” page to see the status and performance of their investments.

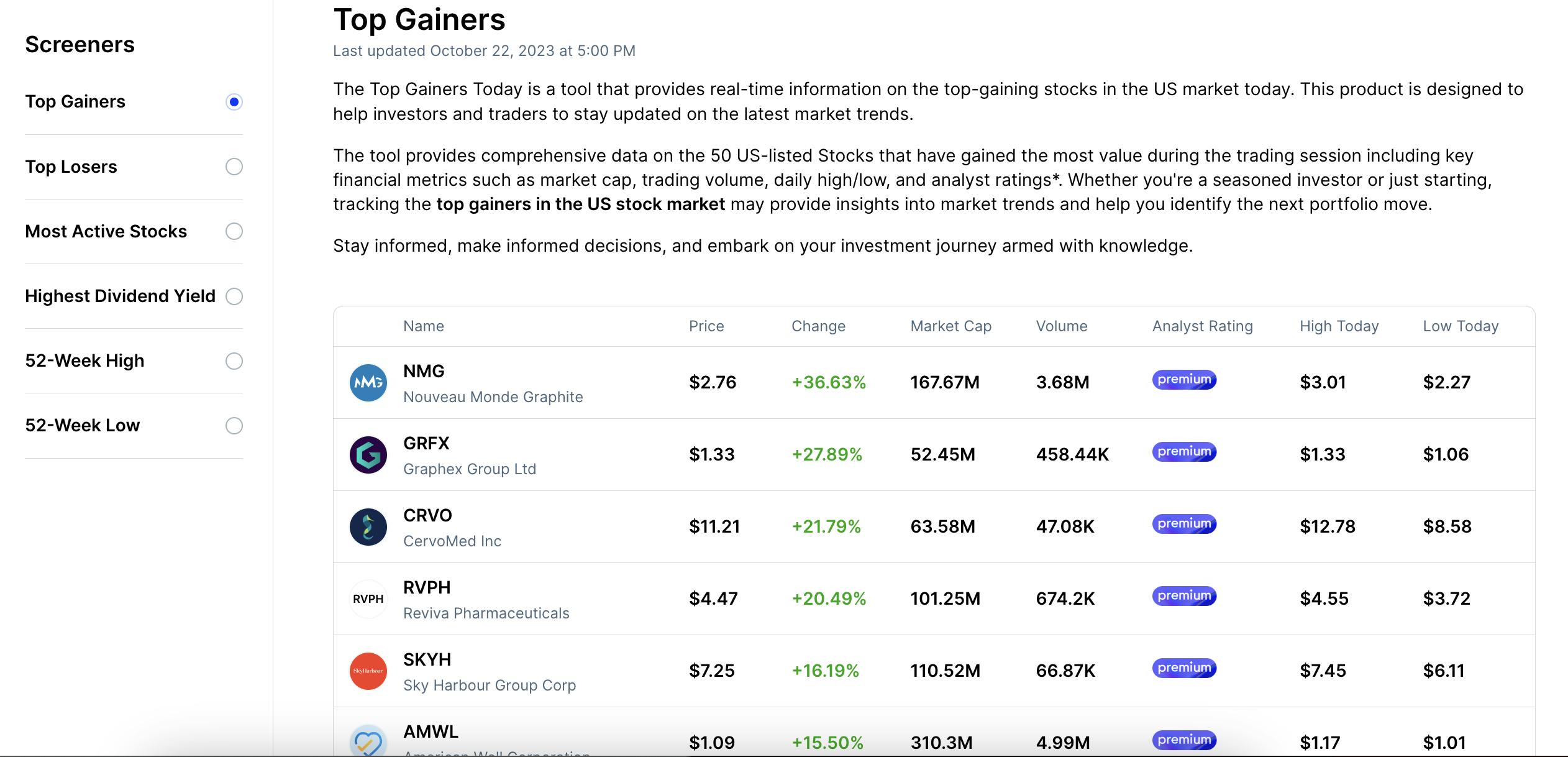

Explore

Source: Public

Public’s “explore” page allows users to browse top stock movers, popular crypto tokens, and stocks with upcoming earnings while also offering investors the ability to look at stocks under specific thematics like cannabis or streaming. In addition to its mobile app, Public also has a desktop version.

Within the Explore page, users can also buy fractional shares of alternative assets including NFTs and collectibles like a professional athlete’s game-worn shoe. Public began offering fractional ownership of such alternative assets after its March 2022 acquisition of Otis, an alternative asset company that described itself as “the stock market for culture”. Otis had over 100K users and 125 listed assets at the time of its acquisition by Public. In October 2023, Public also launched an offering allowing users to buy music royalties.

Portfolio

Public’s portfolio page allows users to view all of their holdings, deposit new cash, and make new investments. It also shows a report of the user's overall portfolio performance which can be viewed over a number of time windows. Users can organize their portfolios into subgroups with an “organize portfolio” feature and can view each asset and its performance individually. Users can also create and manage watchlists of assets they are interested in buying or want to follow.

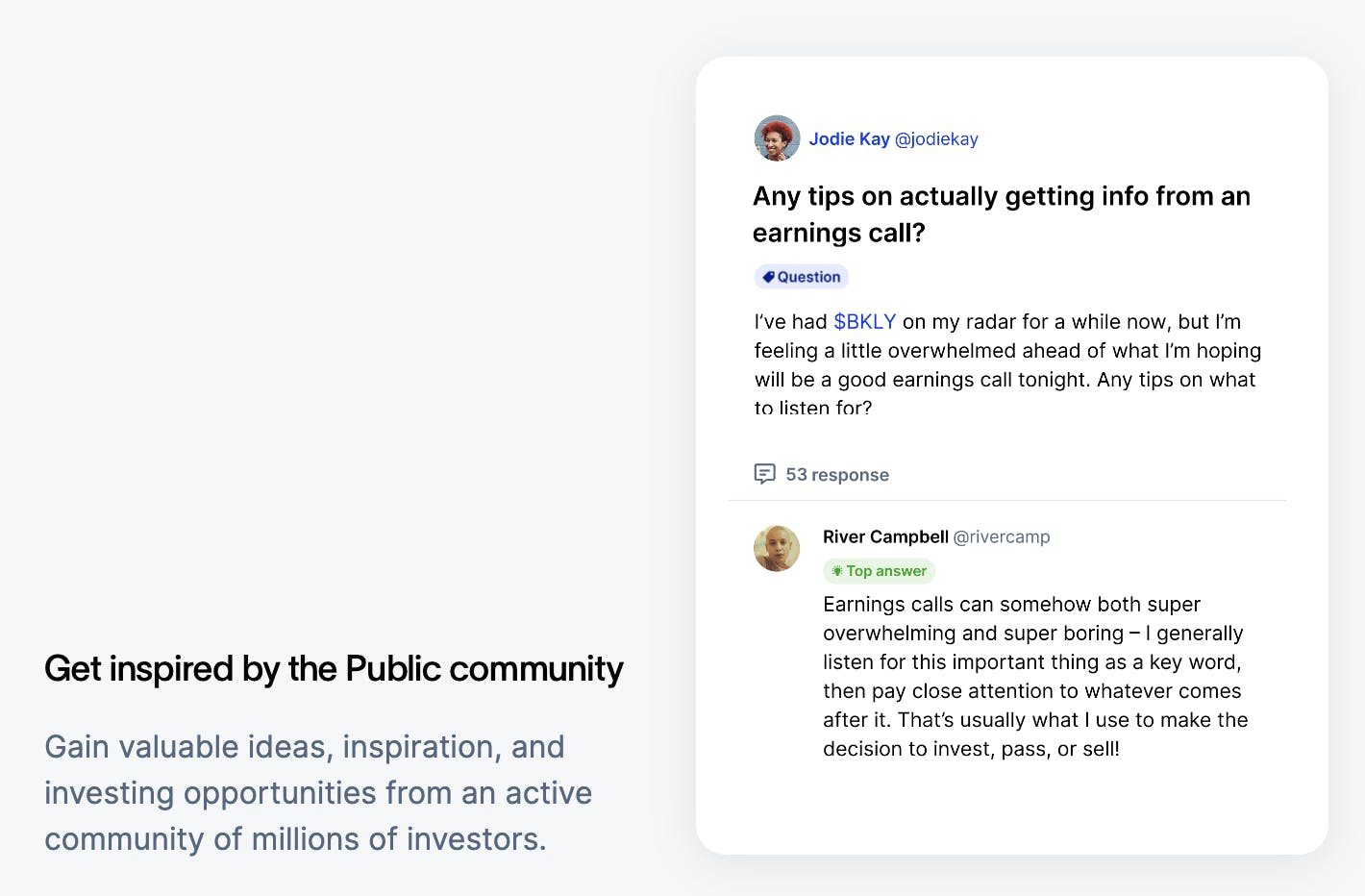

Community

Source: Public

Public’s community-oriented investing features were its initial point of differentiation from other investment platforms. Its “feed” interface is comparable to social media products like Twitter and enables community members to discuss prospective investment opportunities, follow famous investors, and see what investments friends or influencers are making and the thought processes behind those investments.

The feed allows for several different views as of October 2023, including “trending”, “following”, news”, Public Live, “learn”, “town hall”, and “saved.” Items in the “trending” and “following” sections feature common social media features like threaded comments, view counts, reactions, etc.

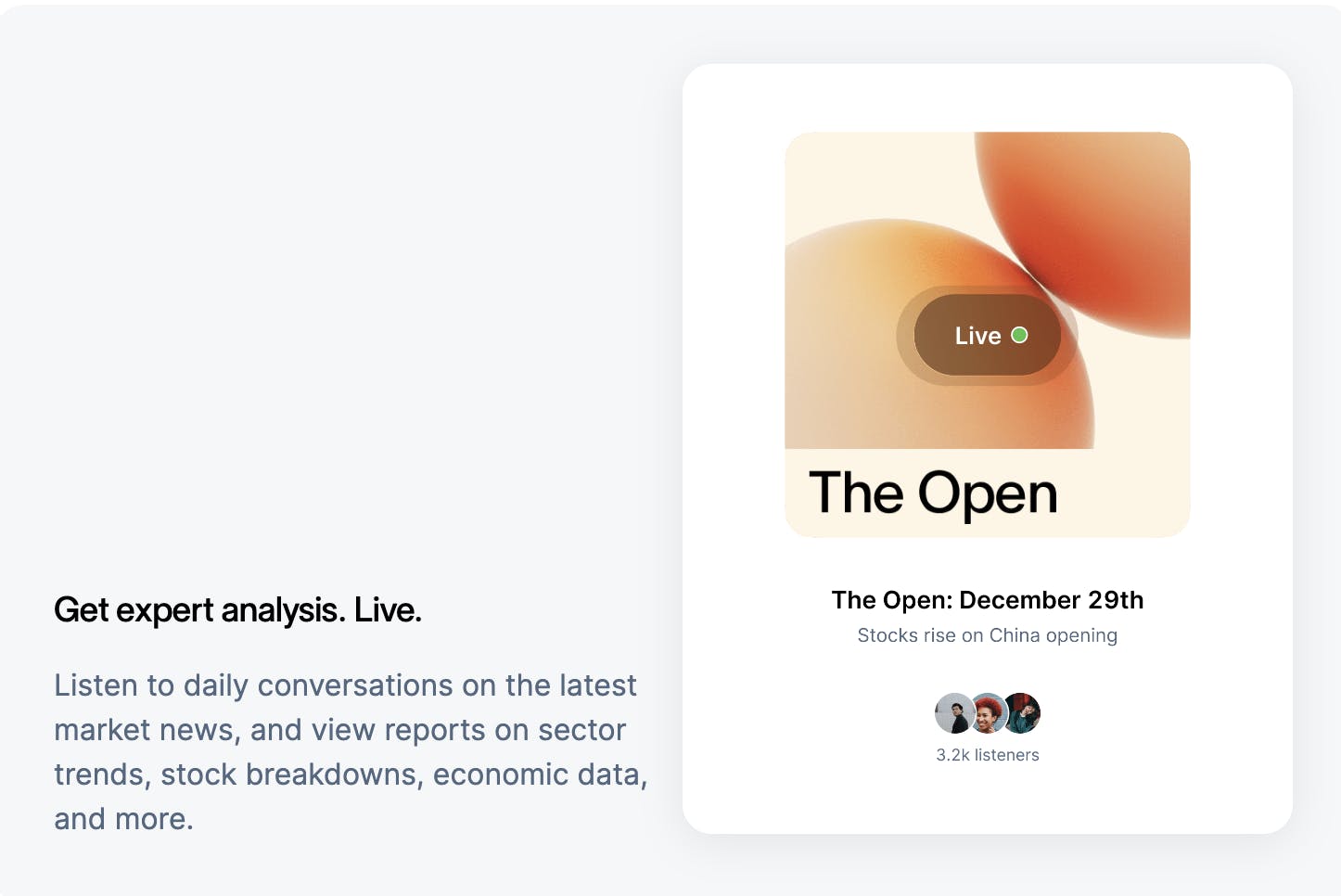

Public Live, Learn, and Town Hall

Source: Public

Public’s Live shows are 15-30 minute podcasts on recent happenings in the market. Investors can also find exclusive Public “Town Halls” with executives of Fortune 500 companies in their feeds. Finally, Public also has a “learn” tab that features educational content from financial influencers.

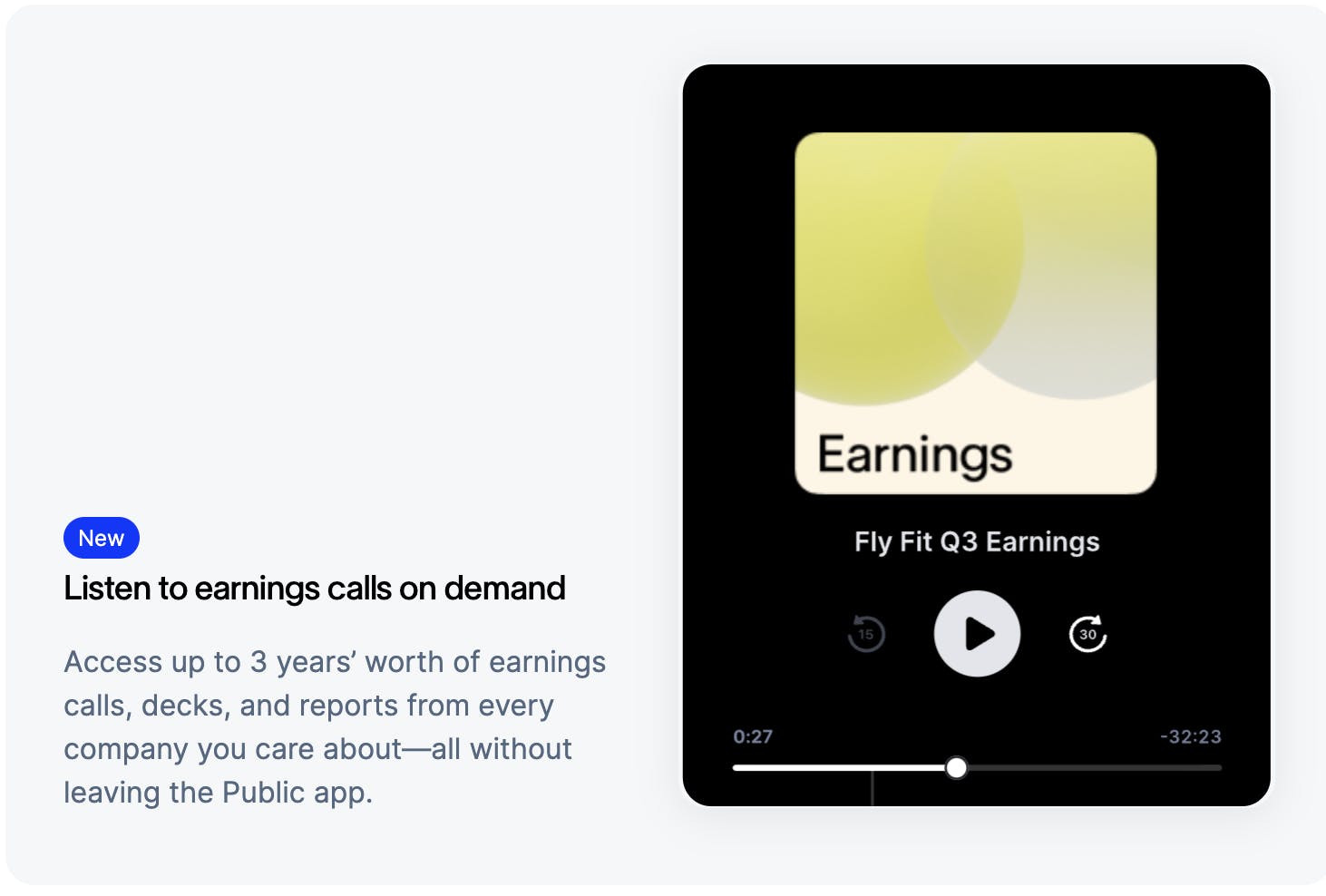

Earnings Calls on Demand

Source: Public

For investors looking for direct reports, Public also offers Earnings Calls on Demand. This feature provides users with access to up to three years' worth of earnings calls, decks, and reports from most major companies, which may be accessed via the Public app. The value of Earnings Calls on Demand lies in its ability to provide easy access to historical earnings through a low-effort format (audio) instead of having to read through complicated documents.

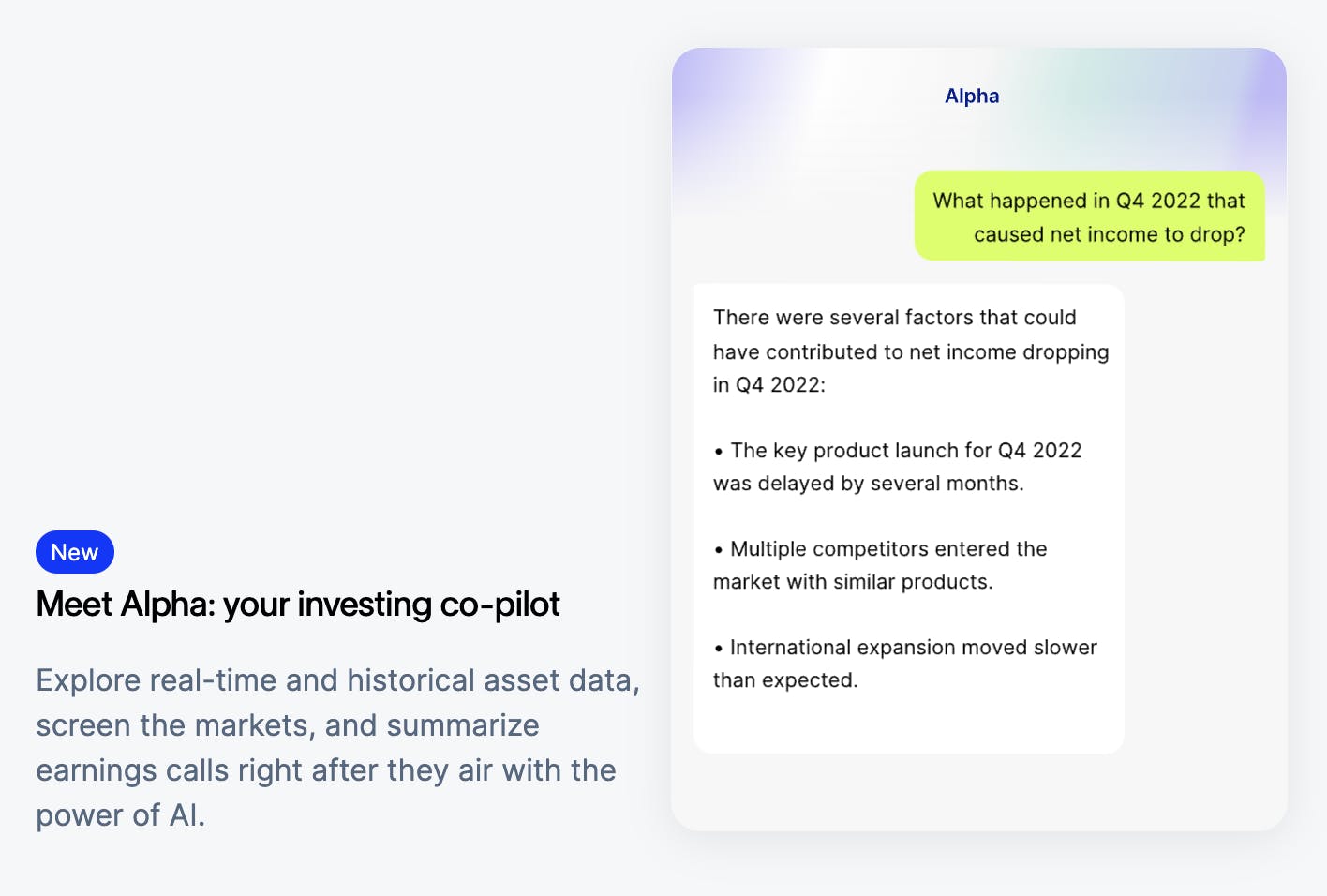

Alpha

Source: Public

In May 2023, Public introduced a product called Alpha, an AI investing assistant powered by OpenAI’s GPT-4. Public pitches its Alpha product as an AI assistant that “instantly delivers the insights you need to make informed investment decisions”. The product was intended to reduce the amount of time that users have to spend researching and tracking their investments. It allows users to ask questions to GPT-4 and receive contextualized answers with real-time market data.

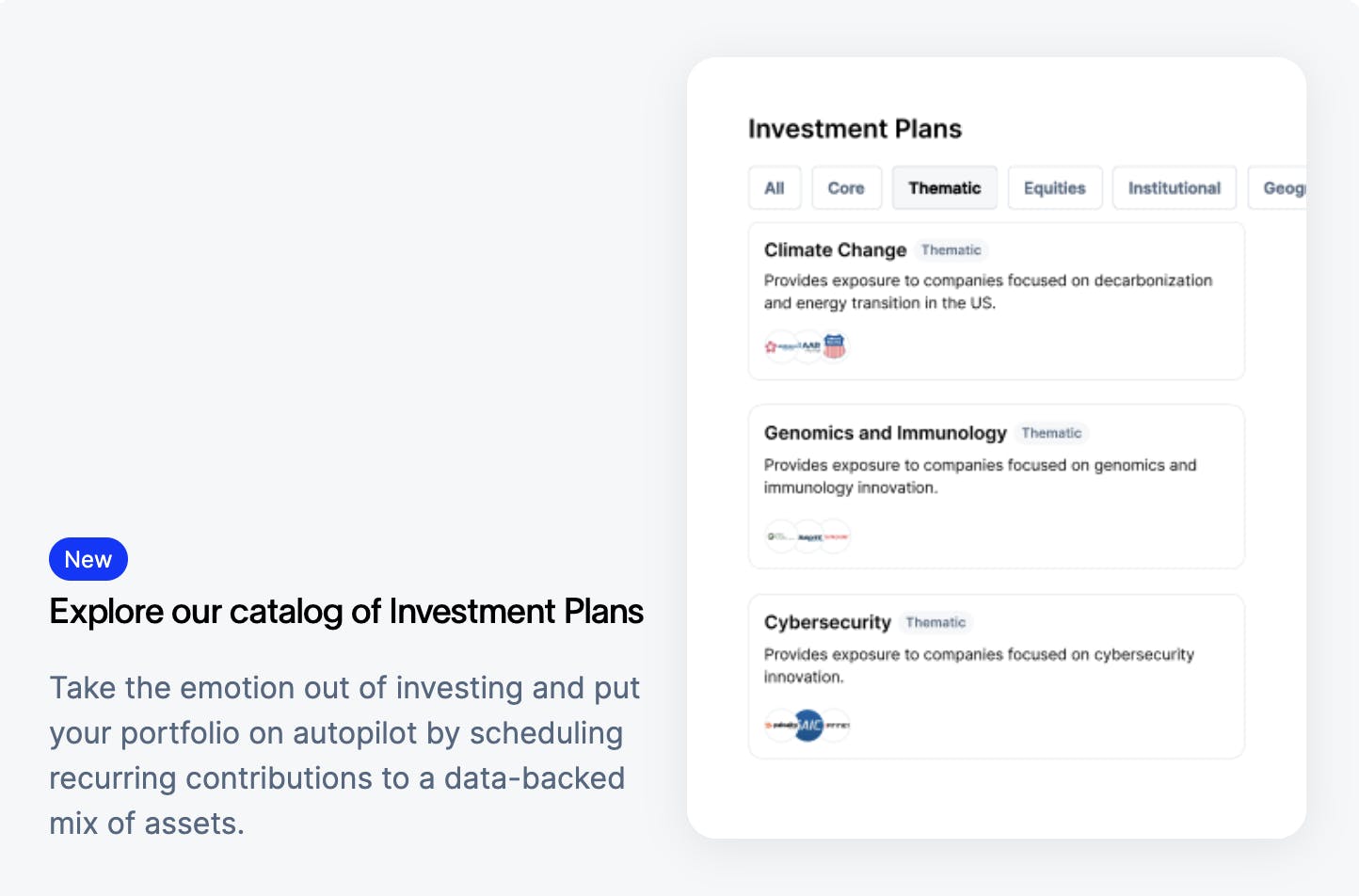

Investment Plans

Source: Public

Public’s investment plans let users automate their investments with recurring contributions or pre-arranged buckets of assets curated by Public itself. To set up an investment plan, users are asked to add up to 20 assets, set their investment frequency, and select a recurring deposit amount. Investment plans essentially allow users to pursue a dollar-cost-averaging (DCA) strategy and help remove some of the emotion out of investing, as well as the temptation to try and time the market.

Pulse

Public's Pulse feature is designed to connect public companies to their US retail investors. Pulse is the backend for Public’s consumer-facing “Public Live” center and gives companies an easy way to plan and host live earnings calls, and Q&As and distribute company news specifically to their retail investors on Public. Public describes Pulse as a way for companies to tell “the story behind their ticker”, by encouraging public companies to share their company mission, and competitive outlook, and address any concerns retail investors may have.

Art & Collectibles

Public allows users to buy fractional shares in artworks and collectibles, such as “rookie patch auto” (RPA) rookie sports cards. Such assets are illiquid and have higher risk than more traditional assets and equities, so Public requires users to acknowledge the risks before opting in to purchasing alternative assets. However, this capability allows Public users to diversify their portfolios further.

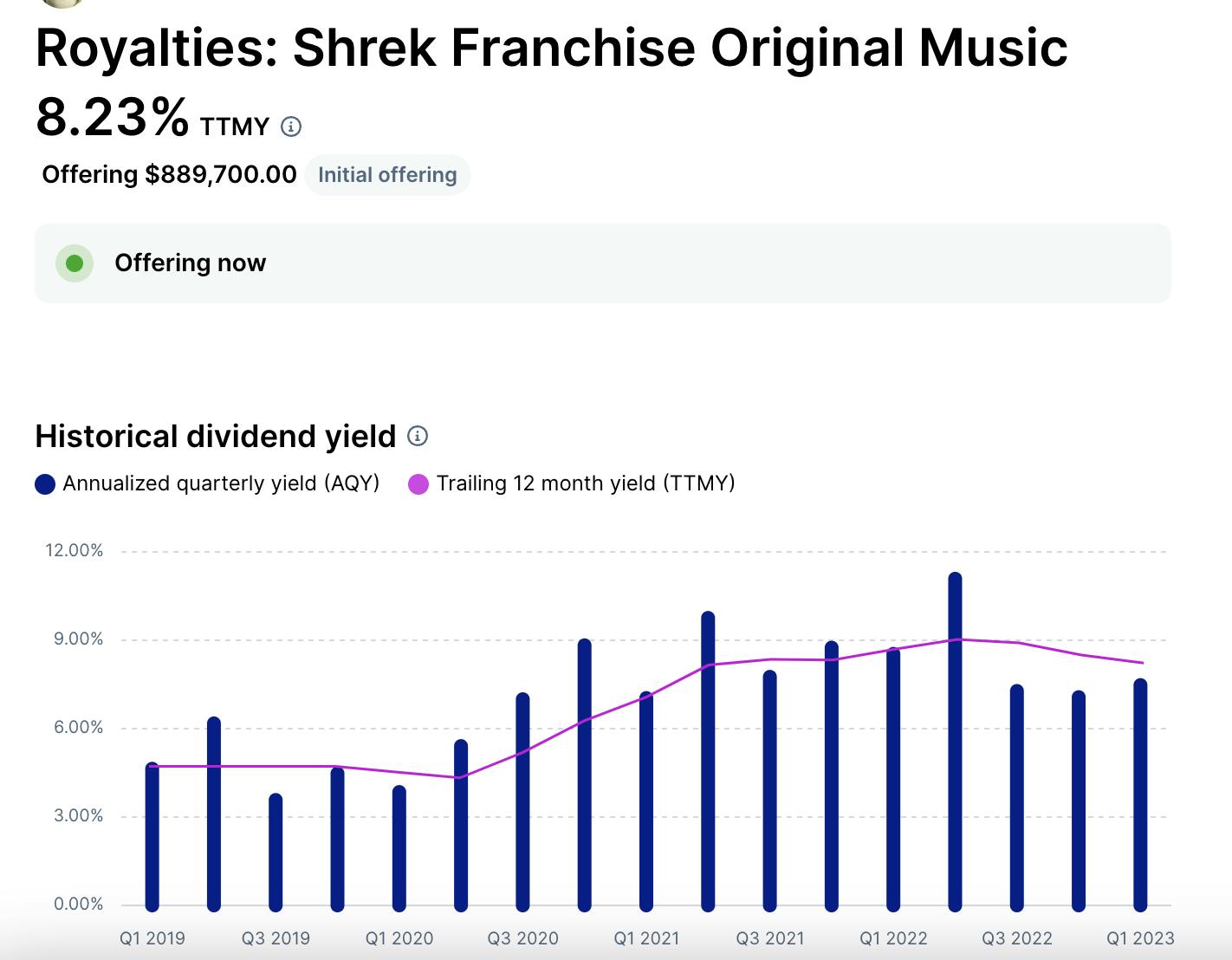

Music Royalties

Source: Public

In October 2023, Public launched the capability for users to buy music royalties. The initial music catalog included 768 tracks from the Shrek movie franchise, the second-highest-grossing animated movie franchise of all time. Since royalties have low correlations with stocks and bonds, this presents users with another opportunity to diversify their portfolios.

Market

Customer

Public’s ideal customer consists of young US retail investors who do not yet have their assets set up with older incumbents. Although younger investors tend to have the smallest share of assets (in the US, Millennials and Gen Z only owned 2.3% of stocks as of August 2023), younger customers are most likely to prefer community-oriented, easy-to-use investment platforms like Public.

As of 2020, 68% of 18-29 year-olds did not have any money invested in the markets. Since the majority of young Americans have not invested before, Public seeks to acquire users who may be newer to investing. It targets them by offering resources for learning about basic investment principles, its AI co-pilot feature, its feed and community features, and its range of asset options.

Market Size

In recent years, a significant increase in participation in the public markets by retail investors. In 2010, retail investors accounted for just under 10% of total trading volume, a number that had climbed to 52% in October 2022. The number of Americans who directly owned stocked has also increased quickly, going from 15% in 2019 to 21% in 2022, the largest increase on record. In addition, a May 2023 survey found that 61% of Americans own stock in some form, up from 56% in 2021 and 55% in 2020; the highest rate of stock ownership since the great financial crisis in 2008.

The trend of retail investors participating in equity markets in greater numbers is expected to continue. Increasingly, users expect every aspect of their lives to be digitally enabled, and financial services are no exception. Millennials, in particular, have those expectations, and they represent the largest generation in the US at 72 million members. Finally, there is an estimated $30 trillion in assets being passed from baby boomers to subsequent generations.

As of 2023, the total amount of money invested in the stock market globally was about $109 trillion. In 2021, digital platforms accounted for about 20% of wealth invested in equities, implying a TAM of about $22 trillion (which is likely to grow as both the percentage of wealth on digital platforms and the stock market itself grow). The market for serving these retail traders is estimated to be ~$13 billion by 2026, with meaningful successes in the space, as stock trading apps generated over $20 billion in revenue during 2021.

Competition

Public operates in a competitive space with a variety of different players ranging from well-established brokerages like eTrade and Charles Schwab to smaller companies focused on younger retail investors like Robinhood and eToro.

Robinhood

Robinhood, a public company, is Public’s largest direct competitor. Robinhood was founded in 2013 when it pioneered commission-free trading. It has seen significant traction and raised $5 billion in private funding prior to going public in a July 2021 IPO, where it raised over $2 billion at a $30 billion market cap. Its market cap as of October 2023 has fallen to $8.4 billion.

At the end of Q3 2022, Robinhood had 22.9 million net cumulative funded accounts, 12.2 million monthly active users (MAUs), and $65 billion in assets under custody (AUC). In the 3rd quarter of 2022, the company made over $361 million in revenue. Robinhood has experienced slow growth in the ensuing quarters. In its Q2 2023 report, its net cumulative funded accounts slightly increased to 23.2 million and its AUC increased to $89 million, while revenue increased to $486 million. However, MAUs had decreased to 10.8 million — likely driven by a continuation of the global stock drawdown from its peak in 2021.

On the other hand, Robinhood reported net profits of $25 million in Q2 2023, compared to a net loss of $511 million in the preceding quarter, and a $175 million net loss in Q3 2022. Unlike Public, Robinhood is focused on crypto and stocks exclusively. The company does not have alternative asset offerings or a location for community members to connect and interact like on Public. Additionally, Robinhood engages in PFOF generating around ~80% of its revenue through this revenue stream.

eToro

Another significant player in the online retail investing landscape is eToro. eToro was founded in 2007. eToro offers stock and crypto trading while also offering several interesting products like “Copy” where eToro consumers can copy the strategies and trades of popular investors. eToro also has an emphasis on education through eToro Academy where it offers guides, podcasts, and both in-person and online training courses. Some key differences between eToro and Public include the global scale at which eToro operates, and the fact that eToro engages in payment for order flow to monetize.

By December 2022, the company had more than 30 million users in more than 100 countries including the US, where it launched in early 2022. The company reported that its 2022 revenue was $631 million, having fallen significantly from its 2021 revenue of $972 million; shares of the company were reportedly being traded at a 35%-40% discount in August 2023, a month after a secondary deal in which $120 million worth of eToro shares were sold at an implied valuation of $2.5 billion.

Prior to this, in March 2021, eToro announced that it was planning on going public via SPAC with FinTech Acquisition Corp. V at a $10 billion valuation. In December of that year, however, eToro decided to cut the valuation of the SPAC by 15% to $9 billion. As the SPAC market continued to fall, in July 2022, eToro & FinTech Acquisition Corp. V mutually agreed to forgo the SPAC process keeping eToro a private entity. eToro has raised a total of $692.7 million in funding as of October 2023.

Acorns

Acorns was one of the earlier companies focused on the wealth management of the retail investor. The company was founded in 2012 and focused on the concept of “micro-investing”; the idea being that when a consumer buys something, the change from the purchase price would be invested into an ETF on a user’s behalf, effectively integrating the act of investing with the act of spending. Key differences between Acorns and Public include the fact that Acorns requires a monthly subscription, offers various banking features, and limits individual share purchases.

The company officially launched its app in 2014. Since its inception, the company has added several features including retirement accounts, checking accounts, and customized portfolios. The company had 6 million subscribers as of April 2023 (with subscription plans priced from $3-$9 per month). In May 2021, the company planned on going public via SPAC with Pioneer Merger Corp which would have netted the company $565 million. As the SPAC market collapsed, Acorns canceled its plans to go public in January 2022 and raised a $300 million Series F at just under a $2 billion valuation two months later, in March 2022. The round brought Acorns’s total funding to $510 million.

Adjacent Investing Platforms

There are several other notable competitors to Public including Stash (focused on beginner investors), WeBull (trading-focused retail investors), as well as Commonstock and FinTwit (investment communities driven by discussion and research). There are also centralized crypto trading platforms like Coinbase and Kraken, and decentralized protocols like Uniswap, that indirectly compete with Public for AUM.

Business Model

The standard method for stock trading apps to monetize comes from payment for order flow (PFOF). PFOF is the process of brokerage firms routing trade orders to specific market makers for execution and in return receiving compensation for forwarding the order to the market maker. PFOF is one of the key revenue sources for competitors like Robinhood and eToro, as well as larger brokerages like TD Ameritrade and E*trade. Specifically, Robinhood makes ~80% of its revenue from PFOF.

This practice is 100% legal, however, there is controversy surrounding it. On one hand, it allows brokerages to offer commission-free trading to its customers. On the other hand, the market makers make money on the spread between the price at which the investor submits their order, and the price the stock is actually sold at, creating perverse incentives. Therefore, in many instances, market makers are not inclined to execute trades at the best prices for the consumer placing the trade.

In February 2021, Public announced that it was officially PFOF-free to ensure its community members were getting the best prices on their transactions and not exposed to the risks associated with PFOF. It described Payment for Order Flow as a conflict of interest for investment services. Instead of PFOF, the company relies on eight key revenue streams:

Interest on cash balances: If investors have cash in their accounts that is not invested into the markets, Public earns interest on it.

Public Premium Subscription Fees: Public offers a premium subscription tier which gives community members access to research reports, advanced company data, and other unique features. This service costs $8/month.

Instant Withdrawal Fees: ACH transfers on Public do not have a cost associated with them, however, liquidated stocks can take up to 5-7 business days to become withdrawable funds. For an instant withdrawal, Public charges a 3.5% fee. For full balance transfers, Public takes a $25 domestic wire fee. Additionally, there are several other withdrawal options with fees associated with them varying from $25 – $115.

Pulse Partnerships: Public partners with publicly traded companies to share key information with Public community members. Public charges an undisclosed fee for Pulse partners.

Optional Tipping: Optional Tipping allows Public investors to support the fact that the company rejects PFOF as a commitment to their community. This is 100% optional.

Markups on Crypto Transactions: Public uses Apex Crypto to execute crypto transactions on the platform. Apex charges a 1% to 2% per transaction and Public receives a portion of the fee.

Alternative Asset Fees: During the Primary Offering of an Alt asset, a 0-10% fee goes to a Public subsidiary. For any trade in the Secondary Market, both the buyer and seller are charged a 2.5% fee. If an asset is sold, Public “may” take a 10% fee on profits.

Securities Lending: If Public members are enrolled in Apex Clearing Corporation’s (Public’s clearing firm) Lending Program, Apex can loan out their shares to other investors and institutions. Apex gives Public a percentage of the fee earned associated with lending the shares, usually for short selling. Public emphasizes that Public users can sell their shares at any time and

There are also several other miscellaneous fees that Public can generate revenue from including but not limited to, extended hours trading, restricted account fees, and account maintenance fees.

Traction

In February 2021, the company shared that it had reached over 1 million users in its first 18 months. As of March 2023, an unverified report listed its user base at 3 million, having increased 3x from less than 1 million at the end of 2020. It has additionally expanded overseas, having launched in the UK in July 2023.

Valuation

Public’s most recent funding round as of October 2023 was in February 2021, when the company raised a $220 million Series D at a $1.2 billion valuation. The round included investors like Accel, Greycroft, Lakestar, Intuition Capital, Tiger Global, as well as celebrity backers like the Chainsmokers and Will Smith, bringing the company’s total funds raised to $308.5 million.

For comparison, in Q2 2023, Robinhood did $486 million in quarterly revenue, implying ~$1.9 billion in annual revenue. The company had a $10 billion market cap at the end of Q2 2023, implying a ~5.3x revenue multiple.

Key Opportunities

Global Expansion

As of October 2023, Public is only available in the United States and the UK, where it initially launched in July 2023. Historically, retail investors are significantly more active in the US than in Europe. In the US, 25% of trading as of 2022 was driven by retail trading, while in Europe this figure was just 5-7%. However, Public could still expand its TAM by continuing to expand in Europe beyond the UK, and in other international markets from Asia to India to LatAm where it is not currently available.

Public Premium

Public offers Public Premium, a $8/month service that gives users additional features like expanded portfolio management tools, enhanced trading features, exclusive content, and improved customer service. Building up this offering over time and creating demand as well as pricing power could be a significant opportunity for Public to monetize its quickly-growing user base and increase its average revenue per user.

Key Risks

Payment for Order Flow

A significant amount of Public’s competitors' revenue comes from PFOF. Specifically, ~80% of Robinhood’s revenue came from PFOF as of August 2021. By forgoing that source of revenue because of the potential for perverse incentives, Public has placed a large bet on cultivating a trusted reputation among retail investors. However, in order for that bet to pay off, Public needs to find alternative ways to monetize to remain in competition with their competitors who don’t forego PFOF as a revenue source.

Retail Investor Interest

The volatility of the stock market is highly correlated with brokerage’s MAUs. Robinhood, for example, saw MAUs drop from 21.3 million in Q2 2021 to 12.2 million in Q3 2022. Over the long term, this means that Public’s user base and revenue will be somewhat at the mercy of market volatility, and it must achieve and maintain a state of funding that allows it to survive bouts of market downturn or volatility without losing ground to competitors.

Summary

Public is looking to become a significant player in the growing retail investor market. The company is focused on creating a community-driven, commission-free online investment platform. It believes that approachability, financial literacy, and understanding of the markets is the biggest hurdle for the average person to become an investor, and targets newer investors as part of its customer acquisition strategy. Competitive and market risks are significant, but Public’s strategy is to differentiate itself with its community-focused approach, building a trusted reputation, and offering a wide array of both traditional and alternative assets to its users.