Thesis

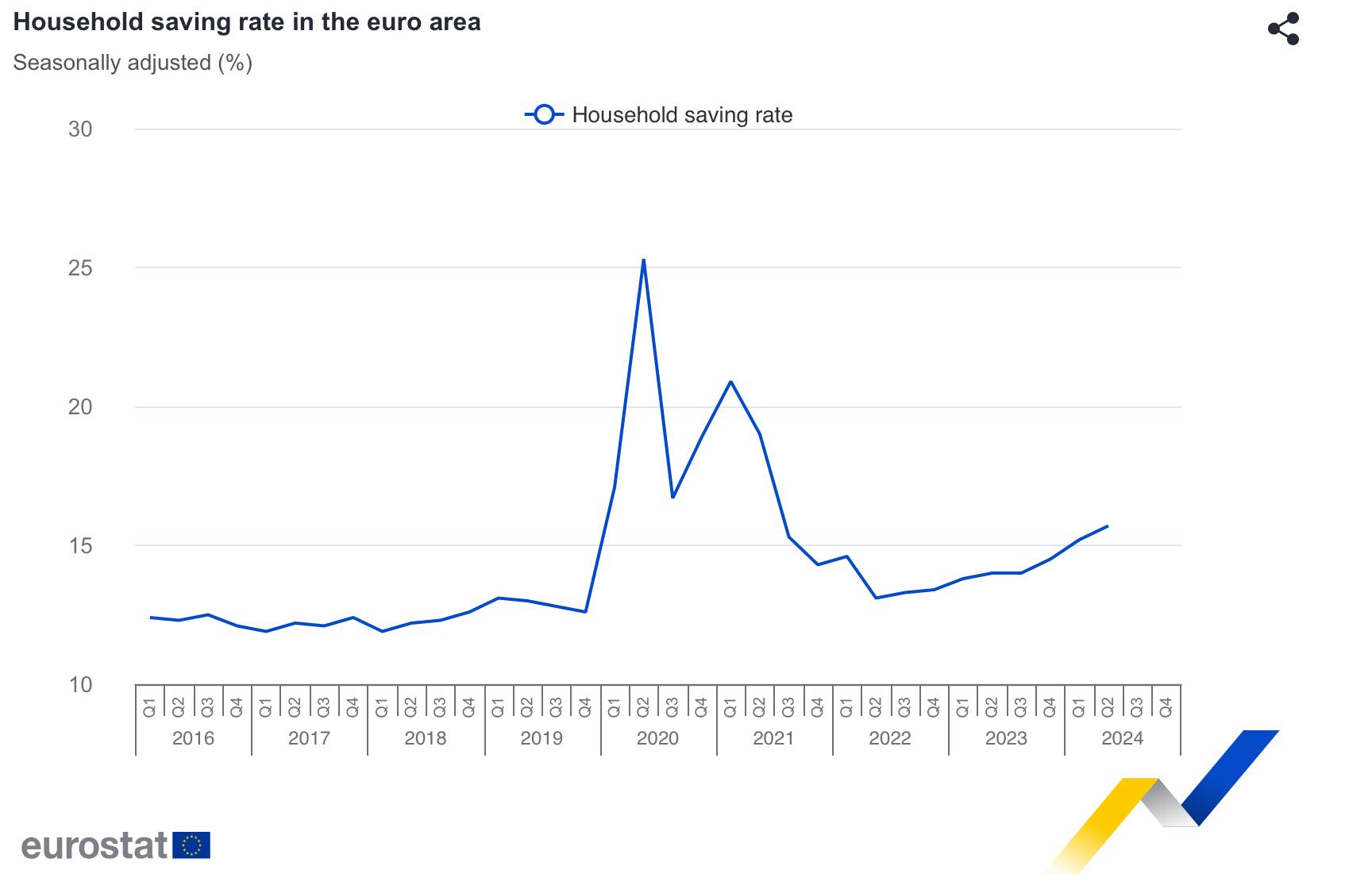

Europe has one of the highest individual savings rates in the world, with households from Eurozone Member States having set aside 15.7% of their gross disposable income in 2024 Q4. This was up from an average of 12.4% between 2013 and 2019. By comparison, the household savings rate in the US was 4.4% as of November 2024.

Source: Eurostat

Despite the high savings rate, retail market participation remains low in Europe. In 2021, only 17% of EU household assets were held in financial securities (listed shares, bonds, mutual funds, and financial derivatives). In the US, this was 43% in the same year. One of the key drivers of this difference is culture. Europeans invest in fewer stocks and put their money in bank accounts instead. This is reflected in how US companies rely much more on tradable stocks and bonds to finance themselves. It is also reflected in the culture around retirement: Europeans have established welfare systems with comprehensive healthcare, education, and retirement benefits that have precluded an urgency to individually invest in retirement.

However, this tradition to save rather than invest may be changing. Europe faces an aging population that could strain welfare systems. Such systems require a balance between the population ratio of working-age adults who can contribute to welfare funds and elderly adults who receive payouts from them. Making matters worse, in 2023, 40% of Europeans across 15 countries indicated that the economic climate, including high inflation, cost of living, and economic uncertainty, had eroded their ability to contribute to pensions.

In the future, it will be increasingly important for Europeans to save and invest in their retirement to ensure they can maintain a comfortable standard of living. This will require tools and resources that make investing accessible to those who have not invested before. In a October 2024 survey, 33% of European adults said they did not know how to invest or how to get started. Meanwhile, 56% of 18-34-year-olds who are not investing stated that lack of know-how was the primary hurdle to investing. Neobrokers, digital financial services that make trading and investing more accessible, could engage new investors across generations.

Trade Republic is a Berlin-based savings platform that allows individuals to invest in capital markets, as well as invest and trade in capital markets, commission-free. Trade Republic takes a mobile-first approach and intends to provide an intuitive user interface while placing an emphasis on financial literacy and accessibility for its users. It seeks to be the easiest, fastest, and cheapest tool to invest in capital markets and help people save recurrently and consistently.

Founding Story

Trade Republic was founded in 2015 by Christian Hecker, Thomas Pischke, and Marco Cancellieri in Munich under its original name, Neon Trading, as part of the accelerator program of Comdirect Bank.

Co-founders Christian Hecker and Thomas Pischke had known each other since 2011, when they were university students at Ludwig-Maximilians-Universität München in Germany. After university, Hecker worked in investment banking while Pischke worked at a fintech company. The two would meet up and have conversations on macroeconomics in banking and the future of pensions in Europe, which became the inception of Trade Republic.

Demographic change in Europe, where populations are skewing older and living longer, has meant that the proportion of workers to retirees is falling. This has strained pensions, which are retirement plans where retirees receive monthly incomes from a fund that current workers contribute to. Larger proportions of retirees relative to workers can increase payout demands; this is increasingly the case in Europe, making pensions unsustainable. Seeing this challenge and the need for individuals in Europe to save, Hecker and Pischke set out to build a platform to enable it. They were motivated by the thesis that there is a pension gap that would drive millions of Europeans to start investing.

The two began building a company around this thesis in early 2015. Traction was slow, and they were unsuccessful in finding an investor, so they tried different things. One of these things was participating in hackathons. They soon met Marco Cancellieri at a Munich hackathon, and he joined the team, bringing a background in mobile app design. The three then won Comdirect Bank’s hackathon in 2016 and were invited to join its accelerator program, Comdirect Startup Garage, in Hamburg. They spent a year in the program but were ultimately not selected for investment by investors.

After the program, the team moved to Berlin and bootstrapped from 2017 to 2019. They started small, developing a trading competition for university students through which they introduced their product and got their first customers. After that, they met with angel investors, one of whom was Sino AG, a German brokerage company. They raised €600K from Sino AG in 2017 under an agreement that it would own 75% of the company. Once the founders got a banking license and their first 10K paying customers in 2019, other VCs started to express interest. These investors managed to reduce Sino AG’s initial high stake in the company.

Product

Trade Republic offers an investment platform that allows customers to save, spend, and invest.

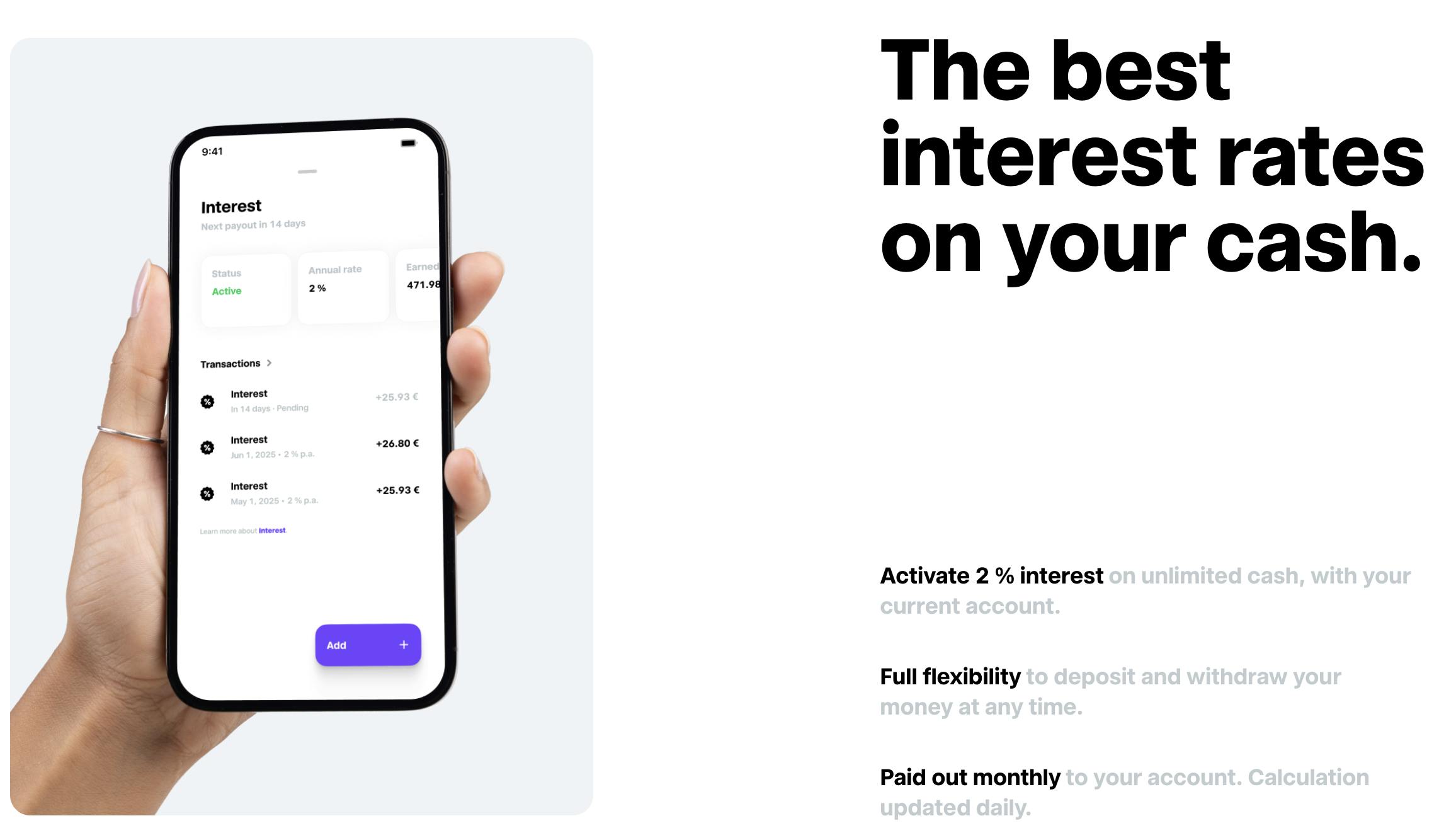

Save

Source: Trade Republic

Trade Republic’s current accounts are free to open, have unlimited cash balances, and pay a 2% rate of interest that is accrued daily and paid out monthly as of July 2025. Customers can set up a savings plan that automatically deposits select amounts at select intervals (e.g., weekly, monthly) into their accounts. Trade Republic is a full German bank supervised by the German Federal Financial Supervisory Authority, which means it offers the protections and functions of a full German bank. Cash deposited into Trade Republic accounts is distributed among partner banks, which include Deutsche Bank AG, J.P. Morgan SE, HSBC Continental Europe S.A., and Citibank Europe plc as of July 2025. Deposits into these partner banks are protected up to €100K.

Spend

Source: Trade Republic

Customers with a Trade Republic account can take advantage of several benefits. While customers pay a €1 fee for withdrawals under €100, they have free ATM withdrawals above this threshold. They can also order a Visa debit card that is linked to their account and can be used online, in stores, or at ATMs to withdraw cash or complete a transaction. There are three types of cards with different designs: a free virtual card, a €5 classic card, and a €50 mirror card. Benefits of the card include being subscription-free and offering a 1% Saveback benefit, which allows 1% of card payments to be invested into a savings plan of choice up to a limit of €15 per calendar month.

Invest

Source: Trade Republic

Trade Republic users can choose to invest in stocks, ETFs, bonds, derivatives, and cryptocurrencies. Trade Republic also offers fractional investing, which allows customers to invest based on a given amount of currency (e.g., €500) rather than investing in a certain quantity of shares, ETFs, or bonds. It also offers research tools and resources such as market news and company financials to enable customers to make informed investment decisions. For example, each instrument is listed with an “analyst view,” which shows the buy, hold, or sell rating of a particular stock.

All trades are commission-free, unlike traditional brokerage firms that typically charge fees for each trade. Trades are executed with LS Exchange, an electronic marketplace that is run by the Hamburg Stock Exchange. Stock prices are linked to the reference market XETRA when listed there.

Market

Customer

According to its website, as of July 2025, Trade Republic had 8 million customers and €100 billion assets under management across 17 countries. Any permanent resident above 18 years old in one of the 17 countries in which Trade Republic operates who has a European phone number, SEPA account, and smartphone is eligible to open a Trade Republic account. These restrictions apply because Trade Republic trades European securities. As of July 2025, US citizens or other taxable persons in the US are not eligible to open an account with Trade Republic.

Trade Republic is a neobroker, a digital financial platform that makes trading and investing more accessible to a broader consumer base. Users of neobrokers are predominantly young and first-time investors. In 2022, almost 70% of Trade Republic users were younger than 35 years old. Half of its users in 2022 were novice investors spanning across all income levels, with almost 30% belonging to the lower half of the income distribution.

Market Size

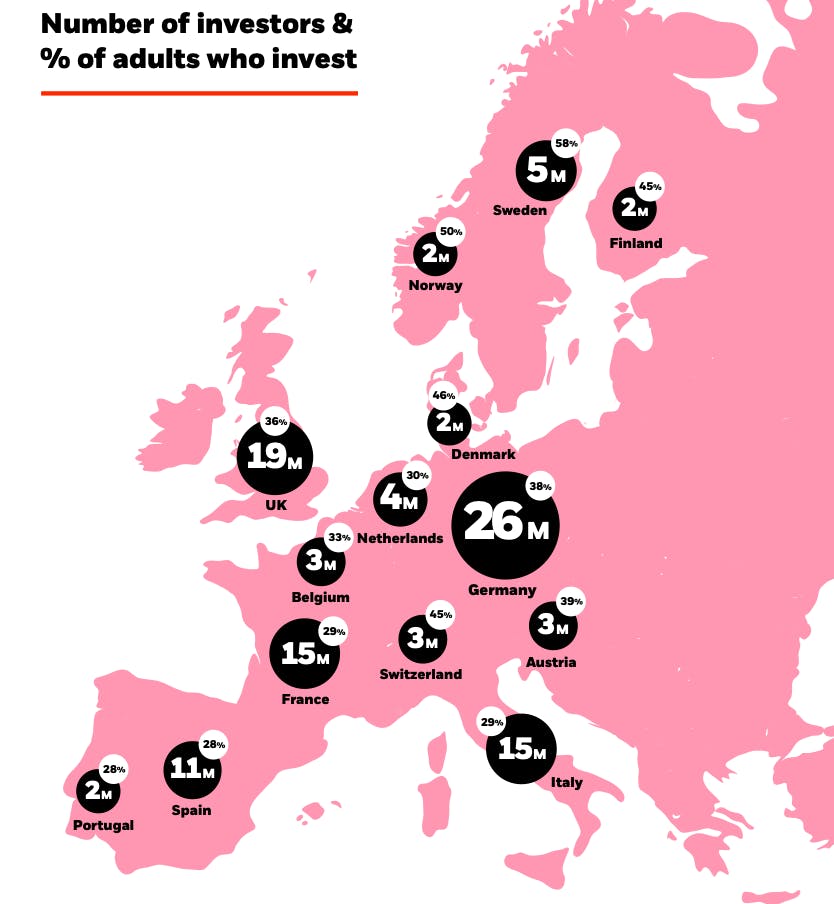

Source: BlackRock

As of October 2024, 113 million people in Europe, or 34% of all adults aged 18 and above, had invested in financial assets such as stocks, mutual funds, bonds, ETFs, cryptocurrencies, or another form of investment. Germany, where Trade Republic began, has the greatest number of investors, with 38% of adults, or 26 million people, owning some type of investment. Meanwhile, the proportions of investors in France, Italy, and Spain, where Trade Republic opened local branches in January 2025, were 29%, 29%, and 28% of their adult populations, respectively. These rates are much lower than the US, where 61% of Americans owned stocks as of May 2025.

Europe has an aging population, which may challenge the sustainability of pension funds that are maintained through contributions from employees. In January 2023, the total European population was estimated to be 488.8 million people. 63.8%, or approximately 312 million of European residents, were between the ages of 15 and 64, which is considered working age. In 2022, there was one elderly person for every three people of working age.

In 2100, it is projected that there will be nearly two elderly people for every person of working age in Europe. As the ratio of elderly non-working-age population to working-age population increases, Europeans may increasingly invest for their retirement due to worries that they will not get a fair share of pension payouts. In October 2024, there was an 11% increase, or 11 million additional people, in the share of European adults who invested compared to 2022. According to one survey, it is estimated that an additional 11 million European adults who do not hold investment products will start investing by 2025.

Competition

eToro: eToro is a global social investing platform founded in 2007 in Israel by Yoni Assia (CEO), Ronen Assia (Executive Director, former CPO), and David Ring (former CTO). It offers multiple asset types, including stocks, cryptocurrencies, ETFs, indices, commodities, currencies, and options. Its focus is to bring together experienced and beginner investors by offering the unique ability to copy the trades of successful investors and learn from their strategies. Similar to Trade Republic, it also allows fractional share trading. Unlike Trade Republic, it operates in various regions around the globe, with over 38 million registered users from 75 countries as of July 2025. The company went public in May 2025 and had a market cap of $4.8 billion as of July 2025.

DEGIRO: DEGIRO is a Dutch online brokerage platform that offers low-fee trading of stocks, ETFs, bonds, options, futures, and commodities. It was founded in 2013 and operates in 15 countries in Europe as of July 2025, with customers provided access to more than 45 global exchanges. The company had 3 million investors as of July 2025. It was acquired by flatex at a valuation of €250 million in December 2019.

Unlike Trade Republic, DEGIRO does not offer fractional shares or an automated savings plan. It also charges commission and handling fees of approximately €1-3 each, as well as connectivity fees of €2.50 per stock exchange each year. However, compared to Trade Republic, DEGIRO offers a wider range of investing resources as part of its Investor’s Academy, such as online lessons on the basics of investing concepts and strategies. These resources may be particularly appealing to new investors across the region.

Interactive Brokers: Interactive Brokers (IBKR), which was founded in 1977, is a public company that offers a securities trading platform that caters to both institutional and retail investors in 160 markets as of July 2025. It offers trading in forex, stocks, options, futures, fixed income, and funds. It also provides various educational resources and research tools to support customers and access to real-time market insights to make informed investment decisions.

While IBKR offers customers the opportunity to create an account for free in a similar fashion to Trade Republic, one difference is that it has two transaction fee systems that change based on the stock market that customers trade in. For example, in Germany, there is a fixed pricing model of 0.05% of each trade value, with a minimum of €3, for investments that are routed automatically by the platform. Under the tiered pricing model in Germany, customers pay a lower percentage than with fixed pricing depending on the size of the trade, but have to pay additional exchange, clearing, and regulatory fees.

Robinhood: Robinhood is a commission-free trading platform that was founded in 2013. Like Trade Republic, Robinhood took a mobile-first approach to its product and caters to a young demographic of investors. However, as of July 2025, Robinhood was only available to EU customers through Robinhood Europe, which only allowed for limited Robinhood services such as cryptocurrency trading; the company primarily operates in the United States and the UK. However, in July 2025, Robinhood launched tokenized shares, which were intended to give users exposure to private companies like SpaceX and OpenAI; as of July 2025, this feature was only available to EU-based Robinhood users. As of July 2025, Robinhood had a $91.1 billion market cap.

Business Model

Trade Republic generates revenue through payment for order flow (PFOF), transaction fees, and interest on cash balances. PFOF is when a broker receives compensation for directing orders to different parties for trade execution. Trade Republic profits from executions where there is a spread between the buy and sell price of each trade. Additionally, while Trade Republic offers commission-free trading, it does charge a small fee for certain transactions, such as a 1% deposit fee based on deposited amounts and a €1 fee for ATM withdrawals above €100. Finally, Trade Republic collects interest on cash balances held in customers’ trading accounts. As a licensed bank, it invests these cash balances in interest-bearing accounts and securities, accruing additional income.

Alongside these three revenue streams, Trade Republic may also generate revenue from additional services, such as the provision of Trade Republic cards, which are a one-time charge of €5 for a classic card and €50 for a mirror card, or from registration fees for annual shareholder meetings, which is €10 per participant who holds at least one company share. This diversified revenue model allows Trade Republic to maintain its commission-free trading structure and maintain better financial stability. In 2023, the company closed its financial and calendar year with an undisclosed net profit.

Traction

According to its website, as of July 2025, Trade Republic had 8 million customers and €100 billion assets under management across 17 countries. Notably, it claims that 65% of customers are first-time investors. As of January 2025, one third of its customers came from markets outside of Germany. Trade Republic aims to continue accelerating growth in 2025 by establishing local bank branches and offering localized banking and savings products. In January 2025, it opened national branches in France, Spain, and Italy, offering current accounts with a local IBAN and additional functions such as automated tax submissions to local authorities.

Valuation

In May 2021, Trade Republic raised a $900 million Series C at a valuation of $5.3 billion. Investors included Sequoia Capital, which led the round, as well as TCV, Thrive Capital, Accel, and Founders Fund. In June 2022, it raised an additional €250 million in a Series C extension led by Ontario Teachers’ Pension Plan. As of July 2025, the company has raised a total of $1.3 billion in funding.

Key Opportunities

Expanding Into International Markets

Trade Republic has announced plans in 2025 for customers across many EU markets to gain access to national current accounts with local IBANs and local payment methods, and to offer state-supported savings products in the largest European markets. In January 2025, it opened national branches in France, Spain, and Italy with the goal of further accelerating international growth.

As of January 2025, 1/3 of its customers come from markets outside of Germany. Next, Trade Republic could consider opening branches in Portugal, the Netherlands, or Austria, where there were 54%, 28%, and 28% respective increases in the number of predicted new ETF investors by 2025. At the same time, it could focus marketing to female investors since 48% of the next wave of first-wave investors in Europe is estimated to be female, up from the 39% of females who made up the total number of investors as of October 2024.

Supporting long-term investments

Trade Republic describes itself as “a savings platform” rather than just an investing platform and positions itself as a place where customers can make long-term investments. Its 2024 rollout of a debit card that enables customers to receive cash back on transactions, as well as a current account that offers customers the option to save according to an automated savings plan, indicates this emphasis.

The 2024 launch of the European Long-term Investment Fund (ELTIF), an initiative that seeks to incentivize private savings to flow into long-term investment funds like infrastructure, innovative small and medium companies, and private debt, provides opportunities for Trade Republic to double down on its positioning. The company could identify opportunities to support ELTIF rollout as well as opportunities to encourage long-term retirement savings, such as life-cycling strategies, as seen in US target date funds, to differentiate itself from competitors.

Key Risks

Regulatory Risks

Stricter financial regulations in Europe could increase compliance costs for Trade Republic. Cryptocurrency trading is especially subject to regulatory scrutiny. The EU established a comprehensive regulatory framework for crypto-assets through the Markets in Crypto-Assets Regulation (MiCA), which came into full effect in December 2024. MiCA aims to enhance consumer and investor protection and mitigate financial crime risks.

Also, in 2023, the EU agreed to ban payment for order flow (PFOF) - one of Trade Republic’s revenue sources - with the intention to fully phase it out by June 2026. In 2024, PFOF accounted for a third of Trade Republic’s revenue. While the company has been diversifying its products to reduce this share, it will be important to continue to adapt to new policies that may constrain company growth and financial sustainability.

Competitive Risks

Banks and legacy brokers are adapting to the rise of fintech in Europe by launching digital offerings, intensifying competition for Trade Republic. Interactive Brokers, which has existed since 1978, is an example of established brokerage firms that have expanded into web and mobile platforms to reach new customers. Meanwhile, since 2016, fintech has been growing at a rapid pace, with more than twice as many new fintech companies being established than in the first 15 years of the century.

This includes neobrokers competitive to Trade Republic who offer a mix of social trading opportunities, crypto investing, saving features, and education to cater to a variety of customers. Neobrokers have accelerating decades-long trends where customers have been moving from traditional branch-based financial services to online alternatives. The total value of neobroker client assets in Europe surpassed €100 billion in 2022 and €150 billion in 2023.

To maintain a competitive advantage in an increasingly saturated market, Trade Republic could focus on continuous product innovation to attract new customers and retain existing ones. It can also identify strategic partners with whom it could reach new customers through referrals.

Summary

Trade Republic is a German neobroker founded in 2015, offering commission-free trading on stocks, ETFs, derivatives, and cryptocurrencies. The company serves over 8 million customers across 17 European countries and has raised more than €1.2 billion in funding from top investors like Sequoia and Accel. Its mission is to democratize investing by providing easy and affordable access to financial markets through a mobile-first platform. Trade Republic aims to expand its product offerings, enhance financial education, and solidify its position as Europe’s leading digital investment platform. With a growing user base and strong venture backing, it is poised to shape the future of retail investing in Europe.