Thesis

An estimated $247 billion was spent globally on salon services in 2024. Much of this revenue goes to independent professionals and small studios, with a July 2020 report estimating that 29% of beauty professionals are self-employed. However, these small businesses and solo entrepreneurs have historically been underserved by technology, with many relying on pen-and-paper appointment books or generic payment apps, which have limited their ability to efficiently manage clients and grow revenue. Consumer expectations have also shifted. One 2019 analysis of a spa and salon software provider found that 46% of appointments are booked outside of opening hours, and the COVID-19 pandemic has only accelerated this digital shift.

Shifting consumer expectations and the pressures on independent business owners have led to increased demand for specialized software tailored to independent beauty professionals. This fits with the growing trend of vertical SaaS solutions supplanting more general horizontal software. Companies like Toast and Mindbody have found success in selling software specifically for restaurants and fitness studios, respectively, often supplanting more horizontal software targeted at many different industries.

GlossGenius operates within this market as a vertical software solution for small businesses in the personal care and services space, including owners of salons, spas, barbershops, and massage studios. Its platform offers scheduling, payment processing, client management, and marketing automation tools. Unlike general point-of-sale (POS) and scheduling systems, GlossGenius includes industry-specific functionalities designed to address the needs of its target customer. Having started with independent salon professionals, GlossGenius expanded to make a bet on capturing a bigger share of the growing beauty and wellness industry.

Founding Story

GlossGenius was officially co-founded in 2016 by Danielle Cohen-Shohet (CEO) and Karim Butt (CTO).

Cohen-Shohet, a Princeton University graduate, worked in finance at Goldman Sachs and is a full-stack mobile and web engineer. During her time at Princeton, she pursued freelance makeup artistry, which led her to recognize the need for better tools to manage business operations and client engagement. Butt, a freelance music DJ, experienced similar challenges in managing his business’ operations. The two had previously collaborated on several software projects. Their shared experiences with freelance work and their exposure to technology led them to develop an early version of what would become GlossGenius, aiming to address the pain points faced by independent beauty professionals.

With small funding from Princeton’s Alumni Entrepreneurs Fund, Cohen-Shohet and Butt developed the idea for GlossGenius, securing a place in Techstars’ NYC 2015 cohort. The program provided mentorship and early validation for the product. Upon completing Techstars, the two launched the first iteration of the GlossGenius platform. The early version of the platform aimed to streamline operations for beauty professionals by integrating scheduling, online presence, and client management in a single solution.

In October 2021, Butt departed from GlossGenius. In May 2021, Leah Cohen-Shohet, the sister of CEO Danielle Cohen-Shohet, joined GlossGenius as Chief Business Officer. Leah brought experience from previous roles in finance and strategy at Goldman Sachs and Symphony, and is responsible for marketing and growth as of July 2025.

Over time, GlossGenius further expanded its leadership team. Christopher Cunningham joined as CTO in February 2022 after previously working in senior engineering roles at Lyft, SoundCloud, and Huge. Jed Cullen joined as CFO in March 2022 and served until June 2025, when he left to become CFO of Loop. Before GlossGenius, he was an investor at Warburg Pincus and served in finance leadership positions at Juul and Cherry. Matthew Denman joined as Chief Revenue Officer in January 2025 after a 10-year run at Uber, where he was General Manager for Uber Eats ANZ and later Head of Commercial Operations.

Product

GlossGenius offers a software platform tailored for beauty and wellness professionals, encompassing various tools to manage client experiences, business operations, growth strategies, and brand development. The product suite is organized into four primary categories: Build a Client Experience, Run Your Business, Grow Your Business, and Build Your Brand.

Build a Client Experience

Source: GlossGenius

This category focuses on improving the client journey through automation and personalization.

Online Booking: GlossGenius provides a customizable online booking system accessible 24/7. Bookings can be accepted directly through Google Search/Maps, Instagram, Facebook, and Yelp. Business owners can auto-approve bookings, require a card on file, set custom cancellation policies, and create waitlists.

Client Management: The platform includes a CRM system tailored for beauty professionals. It maintains detailed client profile information like contact info, appointment history, and notes on preferences which help providers personalize the client experience.

Client Notifications: Automated SMS and email notifications are available for appointment confirmations and follow-ups. Business owners can send automated rebooking reminders or even birthday messages.

Run Your Business

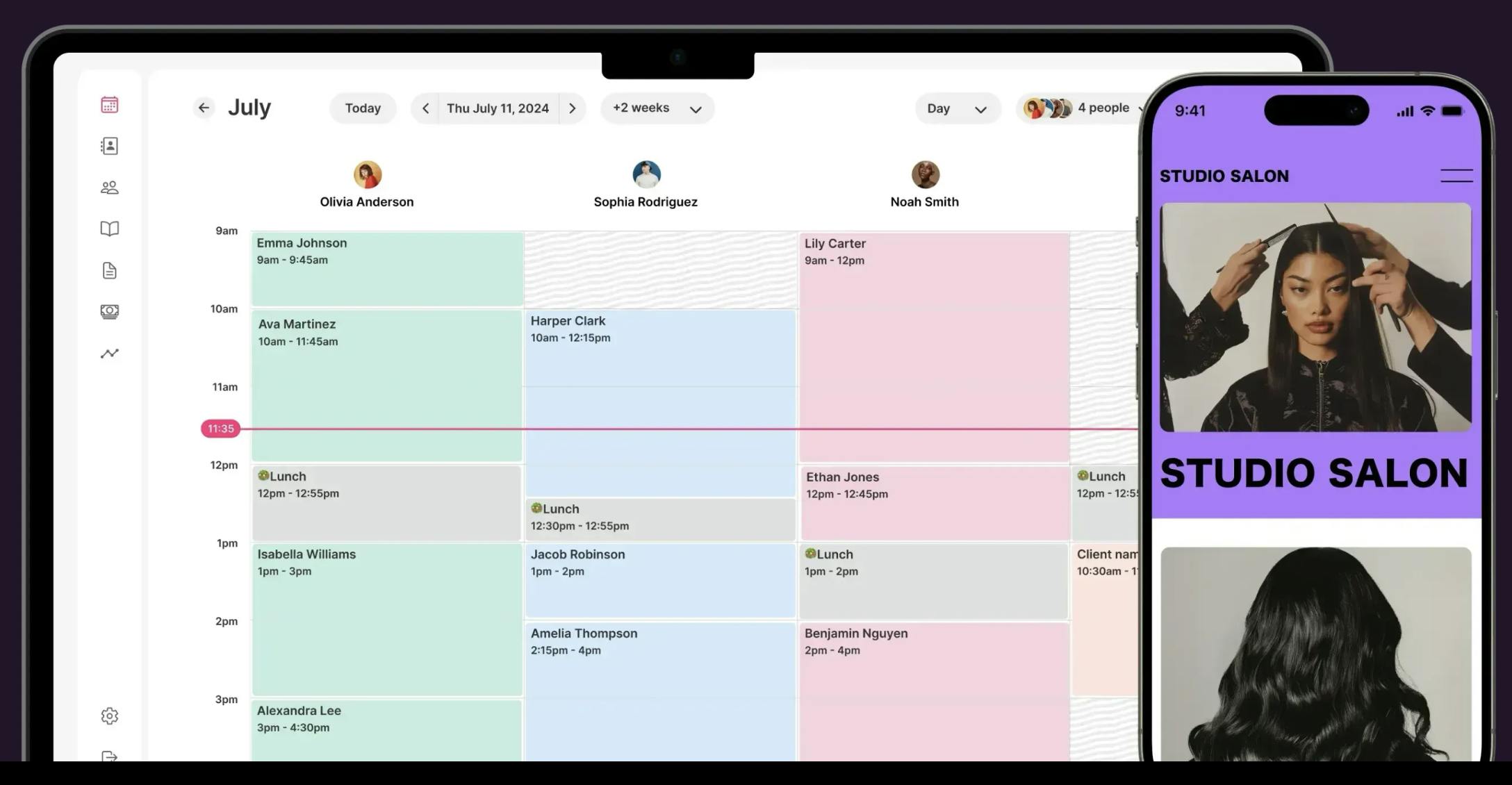

Source: GlossGenius

This suite is designed to simplify daily operations through scheduling, payments, analytics, and more.

Scheduling & Calendar: GlossGenius offers two-way calendar synchronization, integrating with Google Calendar and Apple Calendar for seamless updates. Business owners can customize their calendar settings, allowing for “gap time” between clients or double booking of clients for services that have client downtime.

Payments: The platform includes a POS system with built-in payment processing. It ensures secure transactions via encrypted payment gateways and offers instant payouts. The system supports various payment methods, including tap, swipe, or manual entry.

Reports & Analytics: An analytics dashboard is provided for tracking financial performance. The dashboard shows team performance metrics, live snapshots of intraday metrics, and automated tracking against goals.

Inventory Management: GlossGenius offers tools for managing product stock and inventory. Features include automated stock replenishment alerts and barcode scanning integration to simplify inventory updates.

Payroll: GlossGenius has an embedded payroll product that auto-pulls hours, tips, and commission totals from the booking and POS modules, so business owners can run W-2 and 1099 payroll in three clicks. It calculates and files federal, state, and local taxes in all 50 states, and supports multiple pay schedules and custom commission tiers.

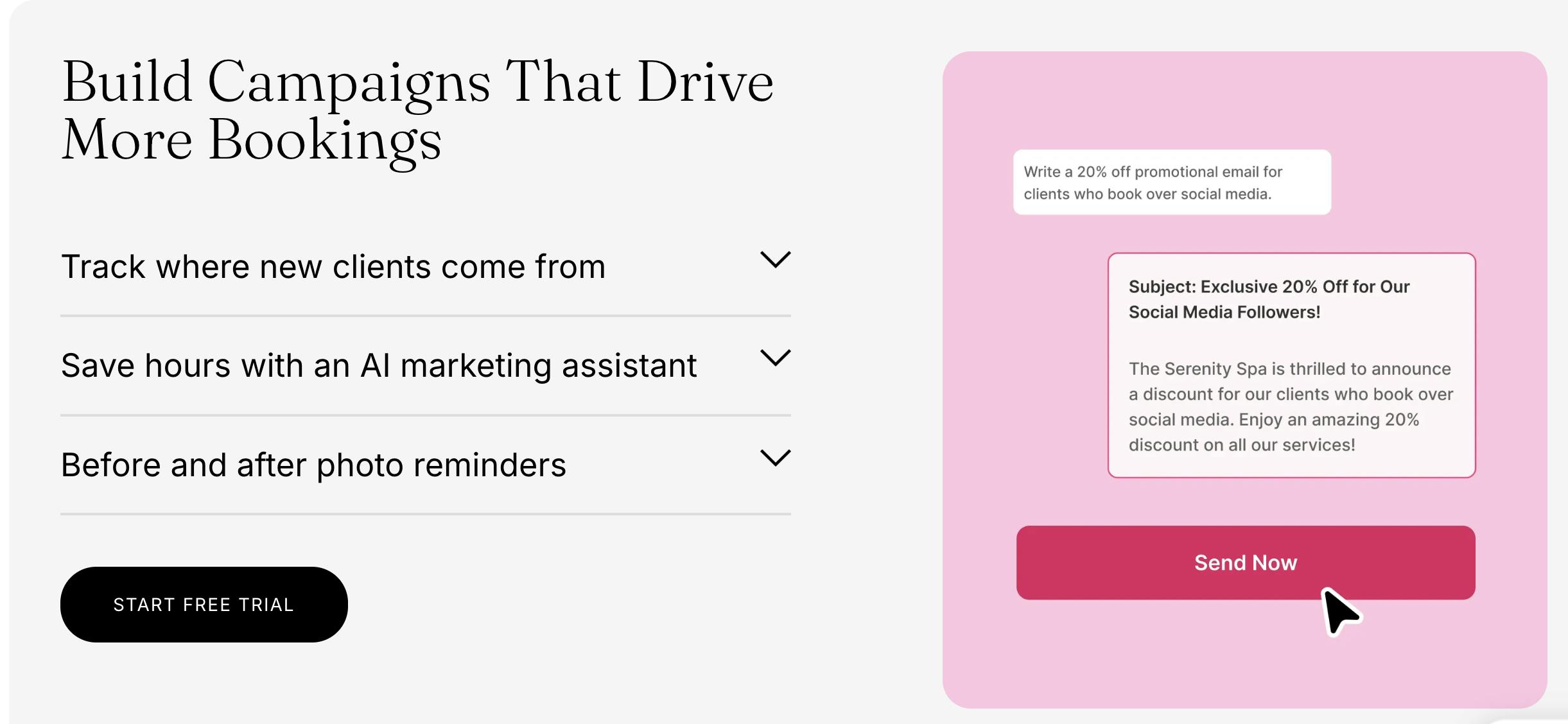

Grow Your Business

Source: GlossGenius

This category encompasses tools that leverage marketing automations and financial products to boost revenue and client retention.

Marketing: GlossGenius provides unlimited email campaigns and SMS Blasts that can be segmented by visit history, service type, or client spending. It includes pre-built campaign templates with drag-and-drop email builders and has an AI marketing assistant that helps business owners write personalized campaigns from AI prompts.

Buy Now Pay Later: Business owners can enable BNPL at checkout so clients pay through Affirm, Afterpay, or Klarna while the business receives the full amount upfront. GlossGenius charges 6% + 30¢ fee, higher than the normal 2.6% payment processing fee, and all fraud and repayment risk is handled by the provider.

Genius Loans: Eligible users see pre-qualified offers from $1K to $250K inside their dashboard and, once accepted, funds arrive as soon as two business days. Repayments are taken automatically as a fixed percentage of future GlossGenius sales via Stripe Capital, with no interest, collateral, or late fees.

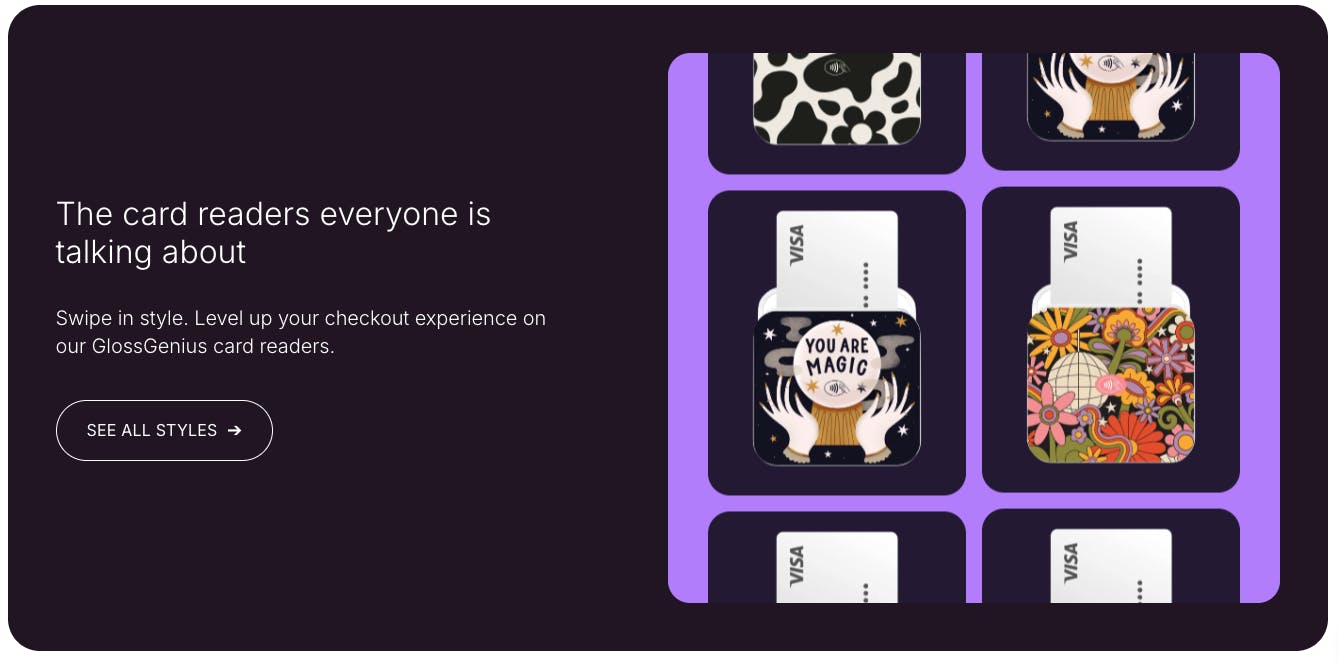

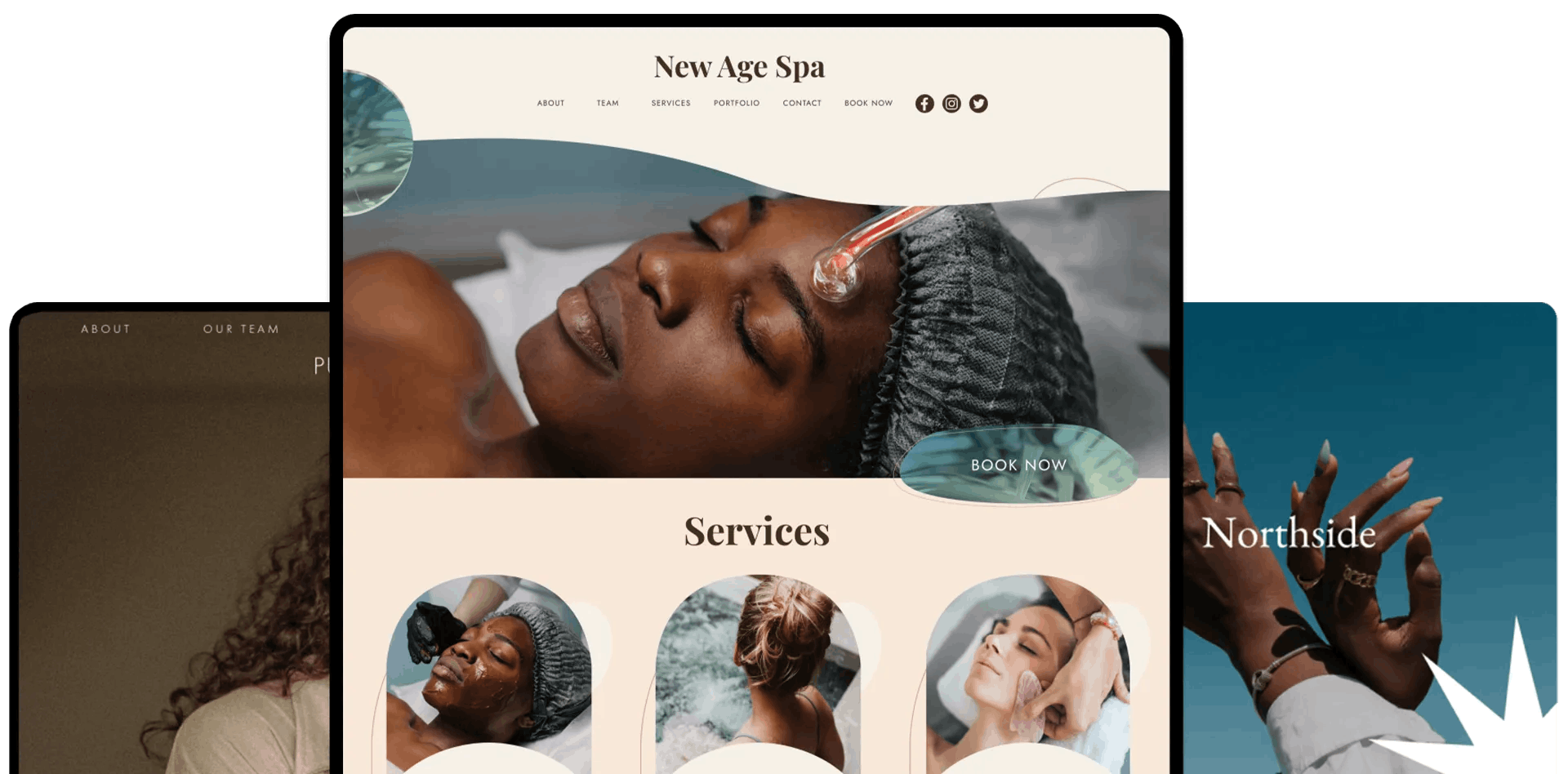

Build Your Brand

Source: GlossGenius

Tools in this category assist professionals in enhancing their business branding.

Custom Website Builder: Business owners can create branded websites. The platform features a drag-and-drop interface with pre-built modules for easier customization and includes SEO optimization tools to improve search engine rankings.

Client Reviews: After every checkout, GlossGenius automatically attaches a review prompt to the client’s receipt and lets the business decide whether the feedback is routed to its own site or directly to Google. The feature is integrated with the CRM, so owners can track sentiment in one place and boost local SEO by funneling verified 5-star reviews to their Google Business profile.

Market

Customer

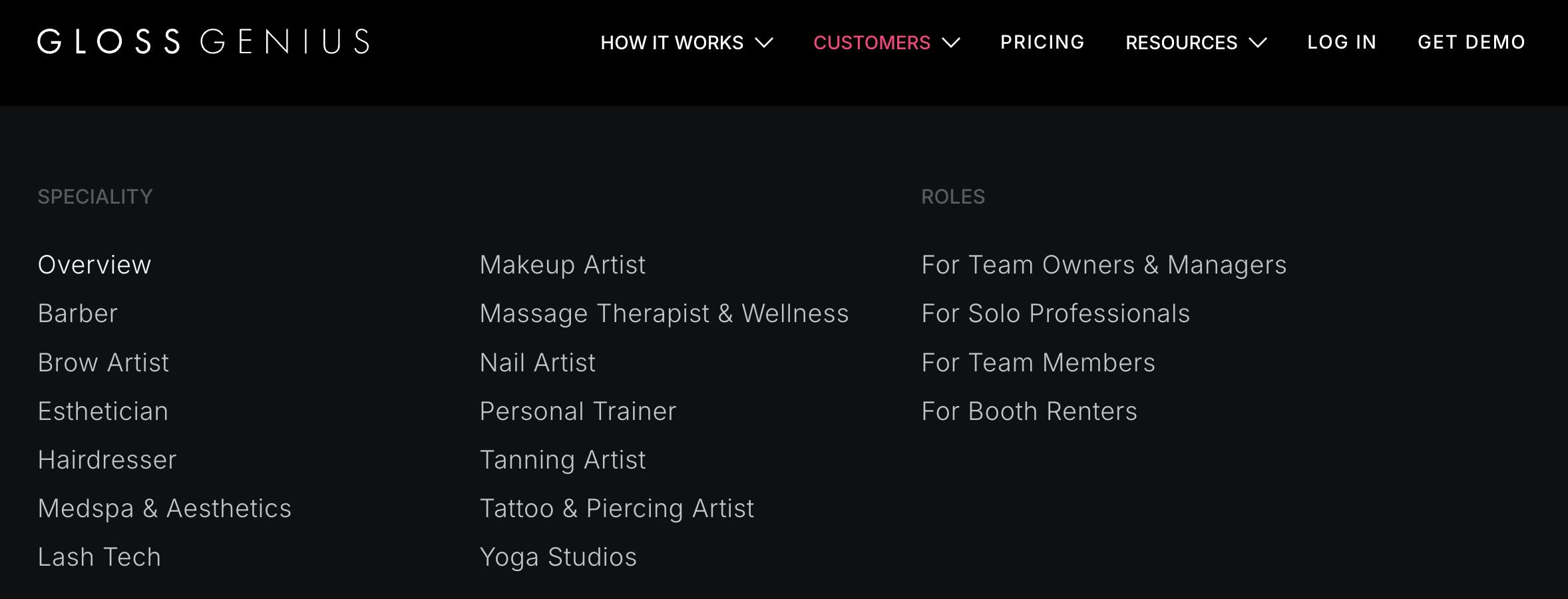

GlossGenius primarily serves small businesses in the personal care and services space, including owners of salons, spas, barbershops, and massage studios. GlossGenius’ target customer has expanded over time. When GlossGenius first started in 2015, it targeted independent professionals like makeup artists, hair stylists, and nail technicians. Many of these professionals operate as freelancers out of salon suites, where they rent a smaller private suite in a larger salon facility and run their own business.

Since then, GlossGenius has expanded its target customer to the broader wellness and beauty industry, targeting small businesses in addition to independent professionals. Its “customers” page as of July 2025 included medspa professionals, tanning artists, personal trainers, and massage therapists.

Source: GlossGenius

GlossGenius’s customer base is extremely fragmented, with over 444K licensed salons, spas, and barbershops in the US, according to one estimate from 2023. The industry also skews heavily female and diverse. CEO Cohen-Shohet notes that ownership in the salon and spa space comprises “more than two times the private sector average when it comes to women, African American and Asian business owners,” and 70% of GlossGenius’s customers as of September 2022 were women.

One example customer of GlossGenius is The Purple Chair Salon & Spa. It has 14 employees, located in Fort Worth, and switched to GlossGenius in 2022. One June 2025 report notes it has since seen a 478% increase in monthly revenue and has a 70% client rebooking rate, which it credits to GlossGenius’s CRM and automatic notifications.

Market Size

GlossGenius is targeting a large and growing market at the intersection of beauty/wellness services and software. The global salon services market was estimated to be $247 billion in 2024 and is expected to rise to $447.8 billion in 2032. The market for software for these businesses is smaller. One estimate put the global spa and salon software market at $1 billion in 2025 and projected it to reach $1.7 billion in 2030. Another estimate put it at $1 billion in 2024 and estimated it to rise to $3.2 billion in 2033.

However, these estimates may be an underestimation of the revenue opportunity for GlossGenius, given that they focus on application software revenue and don’t include estimates of the payments or financial revenue GlossGenius has access to as well. Companies like Toast illustrate how large that upside can be. Toast breaks down its ARR (”Annualized Recurring Run-Rate”) into subscription fees and its payments’ gross profit. At the end of 2024, 49% of Toast’s ARR came from payments, and this component is growing even faster than its subscription revenue.

Competition

Competitive Landscape

Within appointment-based beauty-and-wellness software for small businesses, companies cluster into three strategic models:

Vertical SaaS solutions like Boulevard charge recurring subscriptions for workflow depth.

Across these different models, providers compete on several levers, including price, depth of beauty-specific workflows, embedded fintech products, and the ability to drive incremental bookings through marketing tools and consumer marketplaces.

Competitors

Mindbody: Founded in 2001, Mindbody is an incumbent software provider for the fitness, wellness, and beauty industries. Originating as a yoga studio scheduling system, Mindbody grew into a broad platform used by gyms, spas, and salons worldwide. It went public in June 2015, then was taken private by Vista Equity Partners in 2019 in a $1.9 billion acquisition. Mindbody’s relevance in the salon space comes mainly from its 2018 acquisition of Booker, a salon and spa software provider.

Compared to GlossGenius, Mindbody caters to mid-size and enterprise multi-location businesses and has traditionally focused more on fitness and wellness vs its beauty business. Many independent stylists also find Mindbody overly complicated or expensive and prefer simpler apps like GlossGenius.

Vagaro: Founded in 2009, Vagaro offers scheduling, payment processing, and marketing automation tools tailored for salons, spas, and fitness businesses. The company raised an undisclosed amount in a Series C funding in November 2021, led by FTV Capital, valuing the company at $1 billion. As of July 2025, it served over 90K businesses and 232K “service providers.” Pricing begins at $25 per month for a single user, scales $10 for each extra calendar, and payment processing costs 2.2%-2.6% per transaction.

Compared with GlossGenius, Vagaro serves a wider mix of verticals, including fitness studios, and leans on its consumer marketplace for client acquisition, whereas GlossGenius has traditionally focused on independent beauty professionals with a simpler pricing model.

Boulevard: Founded in 2016, Boulevard provides business management software for salons and spas, focusing on scheduling, payment processing, and marketing automation. The company raised $70 million in Series C funding in August 2022, led by Point72 Private Investments, at an undisclosed valuation.

Boulevard has a similar product suite to GlossGenius but focuses more on premium clientele and larger, multi-location beauty businesses, whereas GlossGenius emphasizes independent professionals and smaller teams. This is reflected in Boulevard’s pricing, which ranges from $158-$369 per month, whereas GlossGenius’s pricing ranges from $24-$148 per month.

Fresha: Founded in 2015, Fresha operates as a global salon and spa booking platform, offering POS systems, payments, and customer management tools. In December 2021, the company raised $52.5 million at a valuation of $640 million in a Series C extension, with the round co-led by Michael Lahyani and BECO Capital. In August 2024, Fresha secured a $31 million venture debt facility from J.P. Morgan. As of February 2025, Fresha had over 130K merchants and had a presence in 120 countries.

Unlike GlossGenius, which operates on a subscription-based model, Fresha offers a free-tier service, monetizing primarily through payment processing fees. Additionally, Fresha has a more significant global presence, while GlossGenius is primarily focused on the US market.

Booksy: Founded in 2014, Booksy is a Poland and US-based beauty appointment booking app that has achieved significant scale, especially among barbershops, salons, and nail studios. It raised a $70 million Series C in January 2021, led by Cat Rock Capital, at an undisclosed valuation. Booksy claims 390K “pros” use its software around the world.

Compared to GlossGenius, Booksy is more consumer-facing and has a booking marketplace for customers to find businesses. Both companies aim to be the default platform for appointment-based beauty services, but Booksy’s strategy leans more on network effects from its marketplace.

Square: Founded in 2009, Square powered commerce for over 4 million sellers worldwide as of July 2025. Square is a product of the company Block (formerly known as Square), which went public in 2015 and had a market cap of $42.6 billion as of July 2025. Square doesn’t break out revenue for its spa and salon segment, but it recorded revenue of $1.9 billion overall and $339.2 million from subscriptions and services in Q1 2025.

While Square has a rich set of features and financial solutions, it lacks industry-specific features tailored for beauty professionals.

Business Model

GlossGenius operates on a subscription-based revenue model supplemented by payment processing fees. The platform offers three monthly subscription tiers designed to cater to the needs of beauty and wellness professionals at different stages of their business. The Standard Plan, starting at $24 per month, provides a range of essential tools like online booking and payment processing. For larger teams or businesses seeking more advanced features like premium website designs and auto-generated SMS & email marketing, the Gold Plan is available at $48 per month. The Platinum Plan, priced at $148 per month, is designed for teams of 10 or more and offers features like premium customer support and Google marketing tracking and analytics.

In addition to subscription fees, GlossGenius generates revenue through payment processing fees, charging 2.6% per card transaction. This dual revenue model enables the company to collect recurring subscription revenue while capitalizing on the transaction volume processed through its integrated payment system. The company also offers payroll services as an add-on, priced at $40 per month plus $6 per employee per month.

The company incurs costs related to payment processing, product development, customer support, and marketing. Since GlossGenius facilitates transactions, a portion of the collected payment revenue is allocated to card networks and to interchange fees to the card-issuing bank.

Traction

GlossGenius served over 70K spa and salon businesses as of July 2025. That is up from the 60K in July 2023 and 40K in September 2022. The only revenue figures disclosed came in April 2024 when CEO Cohen-Shohet said the business hit close to $100 million in revenue in the previous 12 months. As of July 2023, Cohen-Shohet said GlossGenius was powering "billions of dollars of annual transaction activity.”

Valuation

In its Series C funding in July 2023, GlossGenius raised $28 million at a $510 million valuation, with L Catterton leading the round and participation from Bessemer Venture Partners and Imaginary Ventures. GlossGenius raised a $25 million Series B in September 2022, led by Imaginary Ventures and Bessemer Venture Partners, with participation from Left Lane Capital. In November 2021, GlossGenius raised a $16.4 million Series A led by Bessemer Venture Partners. Before its Series A round, GlossGenius raised $2.8 million in funding from Techstars and angel investors.

Key Opportunities

Expansion into the Wellness Industry

GlossGenius can move into the broader wellness sector, including massage studios, yoga teachers, holistic therapy centers, fitness trainers, etc. These businesses operate on the same “book-pay-rebook” workflow that GlossGenius already powers for salons, and remain lightly digitized. In the US alone, massage services generate about $21.6 billion in annual revenue across 267K businesses, while the global wellness economy is projected to approach $9 trillion by 2028. GlossGenius is already testing a move into this sector, with its customer page listing "Massage Therapist and Wellness”, “Personal Trainer”, and “Yoga Studios” as options as of July 2025.

Expanding Fintech & Financial Services

Fintech offers a clear next step for GlossGenius beyond card processing and in-house card readers. The platform already sees "billions” of dollars in annual transaction volume and, in January 2024, GlossGenius launched “Genius Loans,” using first-party sales and booking data to pre-qualify beauty professionals for advances and working-capital loans.

Leveraging the same data stack, GlossGenius could next introduce business bank accounts, credit cards, insurance, and more. This is a playbook that other vertical SaaS companies have followed, including Toast and Housecall Pro.

Leveraging AI for Personalized Customer Experiences

AI-driven personalization is becoming an essential tool for businesses looking to enhance customer experiences. GlossGenius already uses AI to help business owners create marketing campaign copy, but there are other areas it can add to. For example, GlossGenius could enable AI-based recommendations to business owners on scheduling changes or new services to offer. Additionally, AI could enable dynamic pricing models or suggest upselling opportunities based on real-time customer data. Implementing these enhancements would align with broader industry trends and provide additional value to beauty professionals seeking to optimize client engagement.

Build a Consumer-Facing Marketplace

Adding a consumer-facing booking marketplace would give GlossGenius an additional channel for driving demand to its merchants and a performance-based revenue stream. Vagaro claims a network of more than 20 million consumers and promotes the listing as a no-fee benefit to attract new business customers. Fresha supports its free software model by taking a one-time 20% commission, with a $6 minimum, on bookings from first-time clients who discover a venue through its marketplace. Similarly, Booksy’s optional Boost feature increases visibility for businesses in its marketplace, and Booksy charges a 30% commission on new client bookings when it's enabled.

These examples indicate that a marketplace could help GlossGenius fill idle appointment slots for professionals who want more traffic, diversify revenue beyond subscriptions and payment processing, and increase its value proposition to its customers. And with GlossGenius’s large existing customer base, it is likely in a position to launch a marketplace that has enough liquidity to be competitive.

Key Risks

Competitive Pressures From Larger Platforms

GlossGenius operates in a highly competitive market with established incumbents like Square and Mindbody, and well-funded beauty software competitors like Vagaro and Fresha. Most of these competitors have similar product suites to GlossGenius and are competing for the same customers.

One challenge for GlossGenius is that some rivals offer free or heavily subsidized pricing, like Fresha’s free software model or Square’s free scheduling tool. Vagaro and Booksy also offer consumer-facing marketplaces, helping these companies build more brand awareness and pitch businesses on their ability to drive more demand than just a software solution.

Challenges in Selling to SMBs

Serving small and midsized businesses (SMB) means GlossGenius is inherently exposed to higher churn and lower LTV, which could put pressure on GlossGenius’s unit economics.

Independent salons and stylists operate on thin margins, with one estimate putting salon profit margins at 8.2%. They also see high churn, as salon booth renters, or stylists who rent space in a salon to operate, have seen failure rates rise from 10% to 30% from 2013 to 2023. If a customer goes out of business, GlossGenius loses both the subscription and the associated transaction revenue.

As of July 2025, GlossGenius hadn’t highlighted high churn or low LTV as a meaningful problem. But as long as they maintain their focus on small businesses and don’t move upmarket, this will remain a risk.

Summary

GlossGenius operates in the beauty and wellness software market, offering business management tools tailored to independent beauty professionals and small salons. The company has positioned itself as a specialized platform in a competitive landscape that includes both established players like Square and Mindbody and well-funded beauty software competitors like Vagaro and Fresha. The market continues to grow, driven by increased customer demand for online booking portals and beauty professionals’ demand for better software to run their business and increase bookings.

GlossGenius has opportunities for expansion, including expanding into new categories, expanding deeper into financial services for its users, using AI to improve the value of its software, and building a consumer-facing marketplace. However, its long-term success will hinge on its ability to win in a market with steep competition and overcome challenges inherent in selling to its current target customer of small businesses and independent professionals.