Thesis

Digital transformation is redefining the restaurant industry. In the wake of the COVID-19 pandemic, online ordering and marketing have become essential for restaurants’ success. One 2024 report found that 85% of diners always or usually look up a restaurant’s menu before dining. As of April 2025, an estimated 75% of all restaurant orders are takeout, delivery, or drive-thru.

Major chains have capitalized on this shift. For example, Domino’s and Starbucks have invested heavily in mobile apps, loyalty programs, and smooth online experiences, helping drive a substantial share of their sales. Domino’s generated more than 85% of its 2024 US sales through digital orders, almost entirely from first-party channels as opposed to third-party marketplaces. At US company-owned Starbucks stores in Q1 2025, 60% of sales came from Starbucks Rewards members, and 31% of transactions came from mobile ordering.

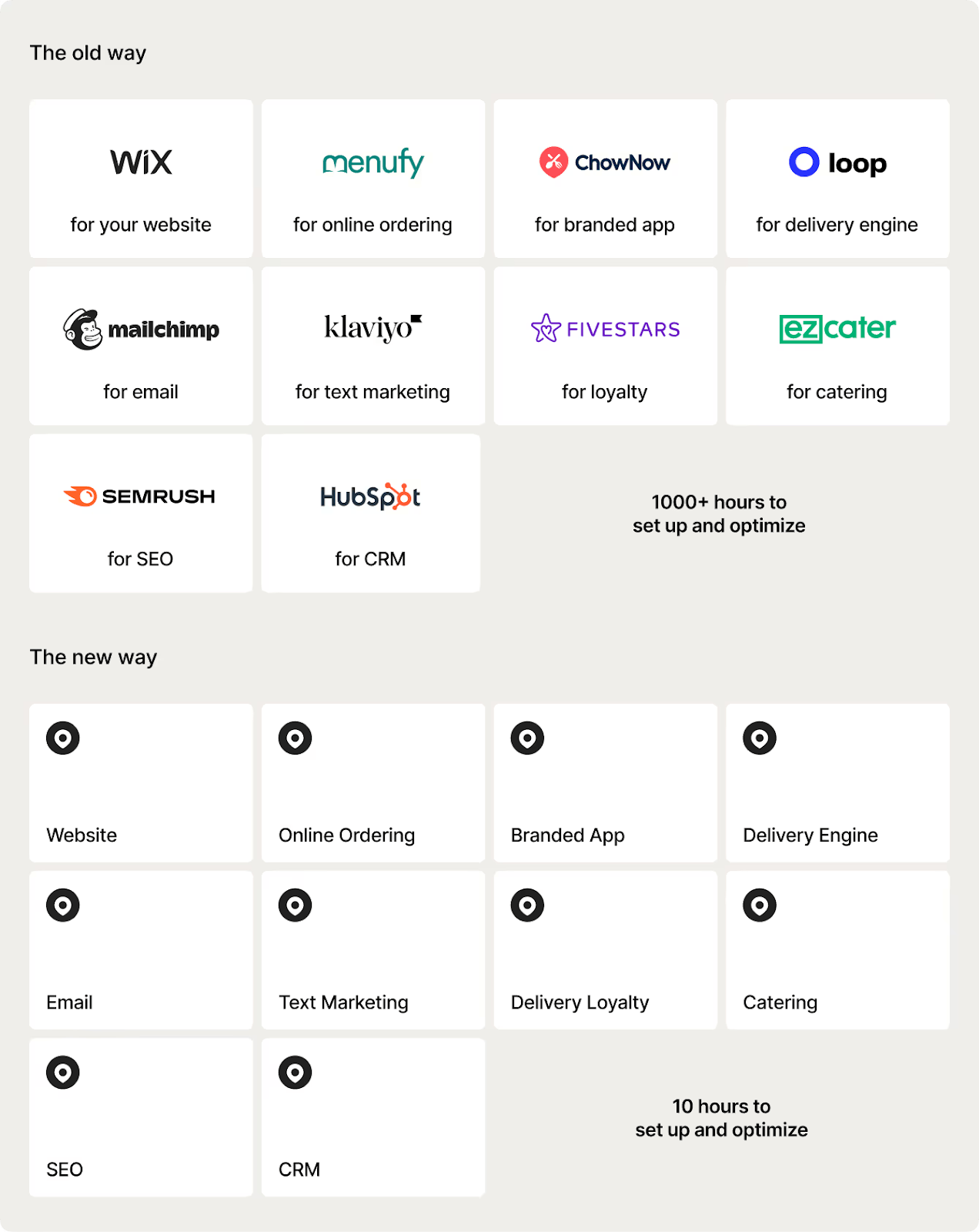

Independent restaurant operators, however, face structural disadvantages. Unlike the large chains, they don’t have the budgets to invest in building out their own technology and rely heavily on third-party marketplaces. For delivery, independent operators often pay high commission rates to platforms like DoorDash and Uber Eats, which also keep control of the customer relationship. To manage everything else, independent operators often rely on a variety of separate software systems to handle their website, CRM, marketing, app, menu, and more. Building the type of brand loyalty these tools enable is one reason why chain restaurants have been so successful, with the top 500 restaurant chains accounting for over 60% of all US restaurant sales in 2024.

Owner.com addresses this complex web of tools with a platform that bundles commission-free online ordering, white-label delivery, website hosting, automated marketing, and loyalty features under a single subscription. Owner helps restaurants pull order traffic off third-party marketplaces into a direct channel it controls, boosting margins and helping restaurants capture first-party customer data to drive retention. Unlike many of its competitors, Owner’s software is focused less on customizability and more on performance, applying conversion and retention best practices through standardized website and marketing templates that it iterates on centrally. Owner’s long-term goal is to take this playbook beyond restaurants and be the “Shopify for local business owners”, empowering independent operators across many service verticals to take on the large chains in their markets.

Founding Story

Owner was founded in 2018 as “Placepull” by Adam Guild (CEO). In January 2021, when the company rebranded to Owner, Dean Bloembergen joined as co-founder and CTO.

Before working on Owner, Guild spent his early teens running a Minecraft multiplayer server, which he launched at age 12. By continuously adding game modifications and promoting the community on social channels, he expanded the network to millions of registered players and hundreds of thousands of dollars in profit by the time he was 16. Halfway through 10th grade, Guild dropped out of high school to focus on scaling up his Minecraft server and building independent games for that community.

After several years of operating the Minecraft server, Guild found that running virtual economies felt increasingly detached from real-world needs:

“What I started to hate about it and hate about my life as I thought about my future was I felt when I looked forward 3, 5, 10 years of what my life would become focused in gaming, that it was basically scaling what I viewed as this negative impact because I was obsessed over how to get millions more players to ultimately waste time on my games so that I can make money.”

Looking for a more tangible problem to solve, he turned to his mother’s dog-grooming shop, which was struggling to attract and retain customers. Applying tactics he had learned running Minecraft servers, Guild first tried social media and direct-mail promotions, but the impressions came from users who lived far outside the salon’s five-mile service radius and showed little intent to buy.

Switching to search-engine optimization and basic conversion-rate tweaks, he targeted long-tail queries such as “best dog grooming in West Hollywood,” where competition was low but purchase intent was high. The strategy was successful, and Guild then began selling the same product to other small businesses under the name Placepull. By 2018, he noticed that independent restaurants were the most receptive customers, so he narrowed the product to serve that segment exclusively.

Over the next two years, Guild built a specialized website builder to help drive dine-in and reservations, and optimized it for both search engine and conversion rate optimization. Guild bootstrapped the business and sought profitability, leading him to choose a premium pricing strategy because it was “the only way to be profitable.” Guild priced the product at $2K per month, 20x more expensive than website builders from Squarespace or Wix at the time, pitching restaurant owners on increased sales that would more than pay for the high price. Guild found success and headed into 2020 with “hundreds of thousands of dollars in profitable revenue” and restaurants like PF Chang’s signing up.

However, given Placepull’s focus on dine-in and reservations, the COVID-19 pandemic led to it losing almost all its revenue and letting go of all of its employees but one. The company had only four months of cash left, and Guild pivoted the business to a new product focused on commission-free ordering in May 2020. In the next 10 months, the company went from zero customers and revenue to thousands of customers and over $1 million in revenue. The company changed its name to ProfitBoss in Oct 2020, and then, in June 2021, ProfitBoss rebranded to Owner.com.

After the rebrand, Bloembergen joined the company in January 2021 as co-founder and CTO. He previously founded Marble Technologies, a self-ordering kiosk startup for quick-service restaurants, and had been friends with Guild for years before joining the company. In the years since, Owner has hired several experienced executives to its team.

Kyle Norton joined in June 2022 as SVP Sales & Partnerships and was promoted to Chief Revenue Officer in January 2024. Norton was previously Director of Revenue and Merchant Success for Canada at Shopify. Guild identified early on that one of the biggest risks to Owner was its ability to make its “go to market motion extremely cost effective and efficient”, and he said he looked to hire Norton because of Shopify’s success in selling to small businesses.

Rob Lehman joined as President and COO in 2024 after a decade at Compass, where he was most recently Chief Business Officer. Will Hauser joined as CFO in April 2025, having previously held senior finance positions at The Production Board, NorQuin, and DoorDash. Lastly, Quenton Cook joined as Chief Product Officer in September 2024 after spending nearly nine years at Remind, where he joined as SVP of Product and led the company to a sale to ParentSquare as CEO in November 2023.

Product

Owner offers a software platform for restaurants that gives restaurants the tools to manage all aspects of their online presence: a website builder, online ordering system, delivery fulfillment, automated marketing, a loyalty program, and custom-branded mobile apps. Owner’s platform is tightly integrated and replaces a number of other software tools that restaurants today often cobble together.

Source: Owner

One unique aspect of Owner’s product is that, as the company explains is that it's “extremely opinionated.” Owner’s products do not allow for a lot of customization, but Owner argues this is a benefit to its end customers:

“All small business software before Owner was built to be maximally customizable. But Owner is optimizing for giving customers performance, not customizability. For example, restaurant owners can upload their logos and brand colors into the Owner website generator. But they can’t change the placement of CTA buttons, information hierarchy, or order conversion flow. They can’t change the things that dictate performance. The universal, standardized web templates allow Owner to run thousands of split-tests every single day. It’s impossible to run split-tests on sites you don’t control. But since Owner controls the websites, Owner can rapidly iterate to improve everyone’s websites.”

Owner does not replace a restaurant’s point-of-sale (POS) system and instead connects to the systems that many restaurants already use. The platform offers integrations with major POS systems like Clover and Square, allowing online orders placed through an Owner-powered site or app to appear automatically in the POS system and print to kitchen stations.

Website Builder

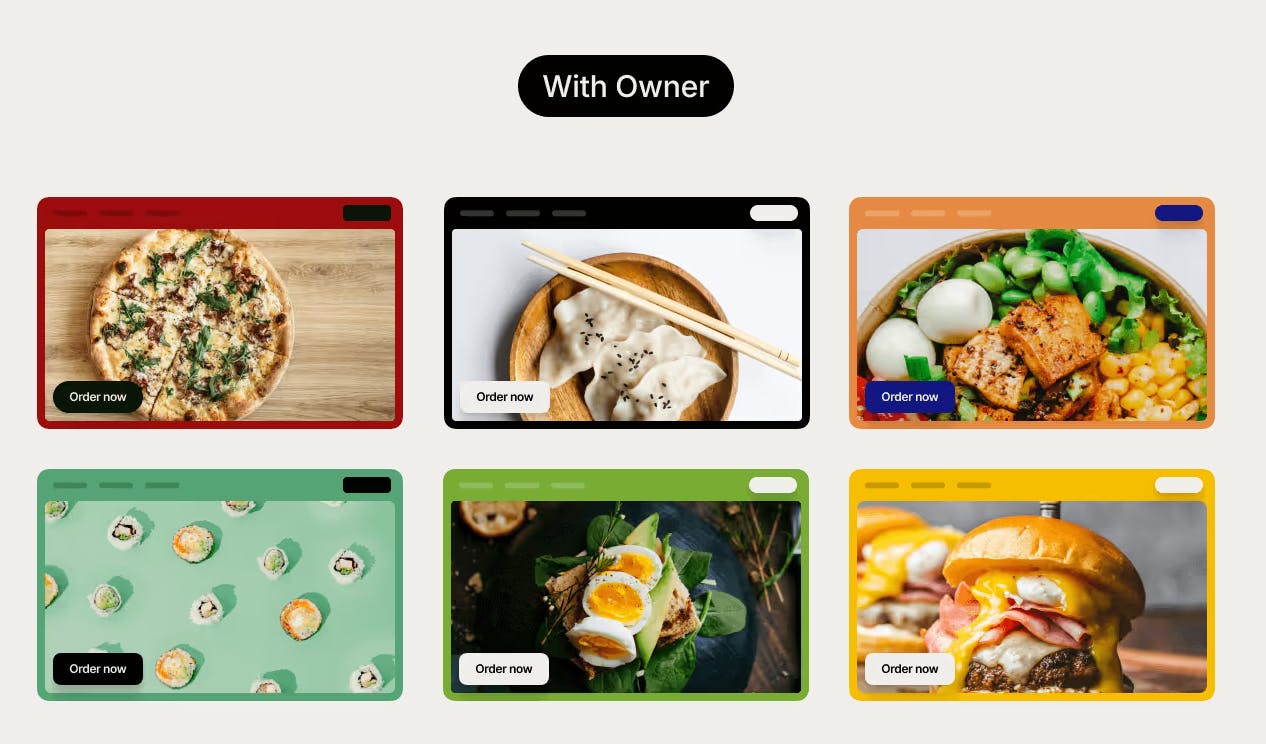

Source: Owner

Owner creates the restaurant’s website using data-driven templates that are optimized for search engine visibility and conversion. It automatically generates pages for relevant, high-volume, high-intent food searches, and its standardized templates rank high on Google for local food searches. As mentioned, Owner doesn’t allow very much customizability for restaurant owners and instead uses templates that it constantly experiments with. Owner claims that “restaurants on the Owner platform grow their traffic by 30% on average within 28 days,” and that “Owner’s websites convert 100% more visitors into customers, on average.”

Owner’s standard templates are meant to be simple and emphasize online ordering, with buttons on the top right and in the center.

Integrated Online Ordering & Zero-Commission Delivery

Every Owner-powered website comes with a built-in ordering system so customers can place pickup or delivery orders directly, without leaving the site. Owner charges zero commission to restaurants for deliveries and instead charges the customer a 5% “online platform fee” on all orders.

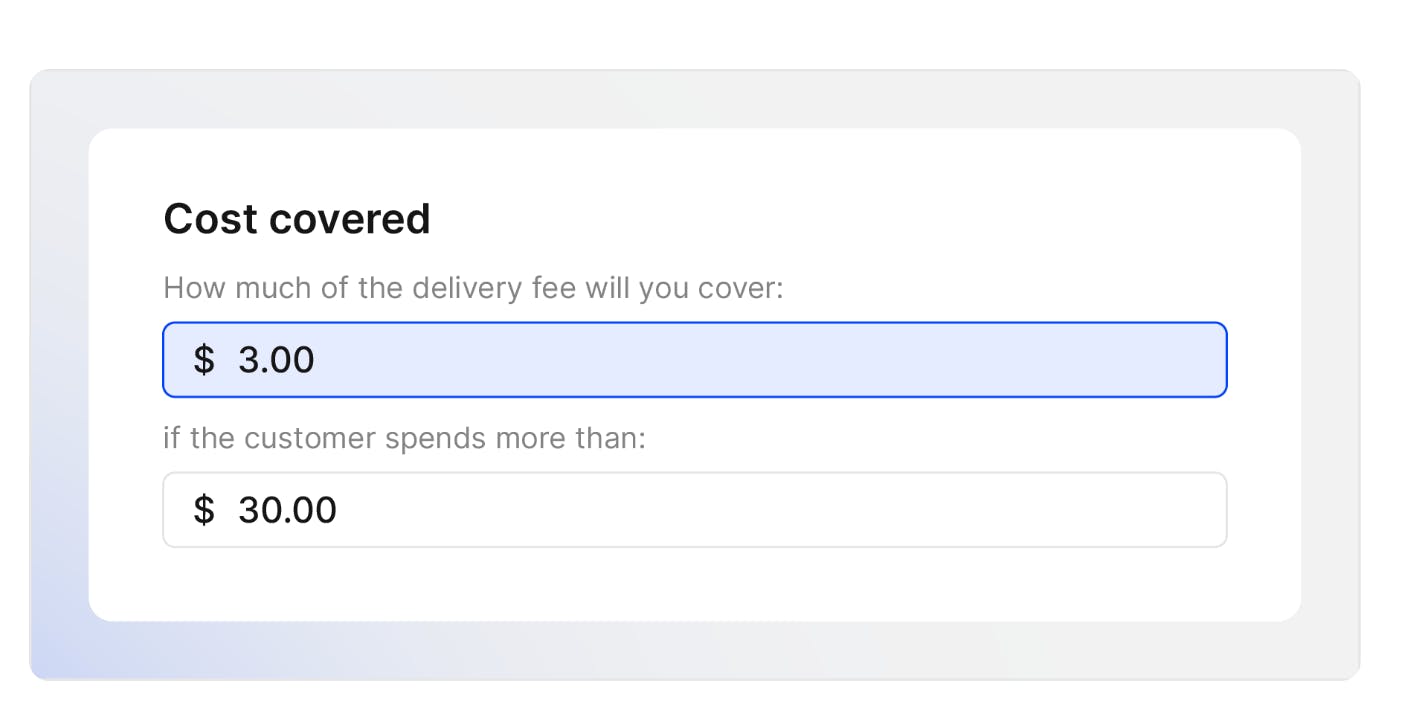

For delivery, Owner doesn’t operate its own courier fleet but partners with white-label third-party delivery networks like DoorDash Drive or Uber Direct. These third parties charge a flat rate for delivery, usually around $7. Owner’s default pricing passes this along to the customer for orders under $30 and has restaurants cover three dollars of the fee on orders above $30. It argues this is the best pricing from its conversion rate testing, but it lets restaurants toggle this if needed. Even if restaurants cover part of the delivery fee, Owner argues that using their software will help restaurants save money overall because it's less than the typical 15-30% commission third-party marketplaces charge restaurants.

Source: Owner

Owner also only uses drivers rated 4.5 and above, allows restaurants to call customers directly, and covers refunds for any delivery issues.

Automated Marketing & Loyalty

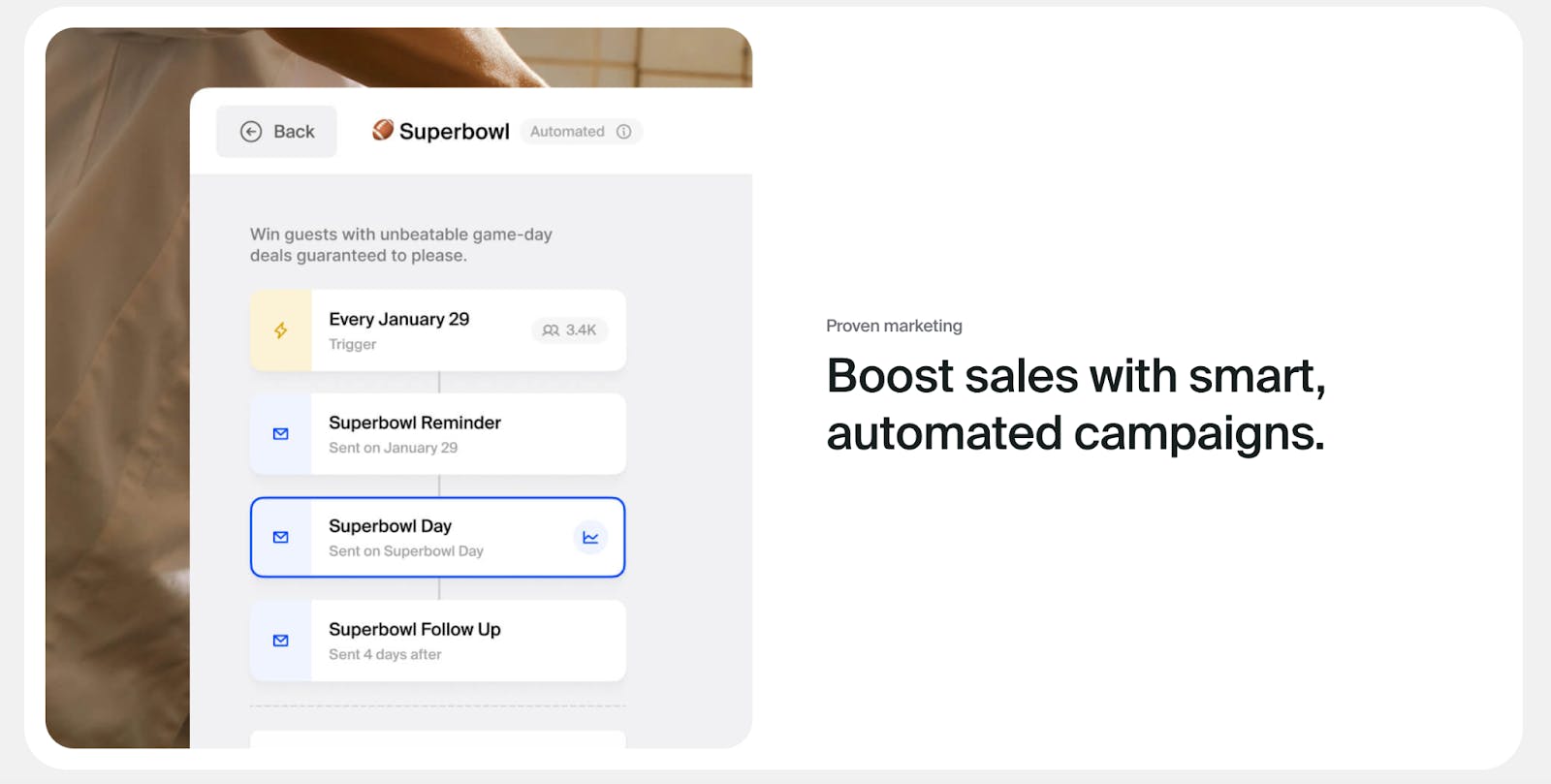

Owner’s platform includes a CRM and marketing automation engine to drive orders. It captures customer data from every order and uses it to automate campaigns, such as automated email/SMS campaigns for abandoned carts or holiday offers.

Restaurants can also build their marketing campaigns from scratch and use Owner’s AI-powered writing assistant. For example, a restaurant owner can simply type a prompt (e.g., “Promote my new spicy tuna roll”) and auto-generate a polished marketing email in the restaurant’s voice.

Source: Owner

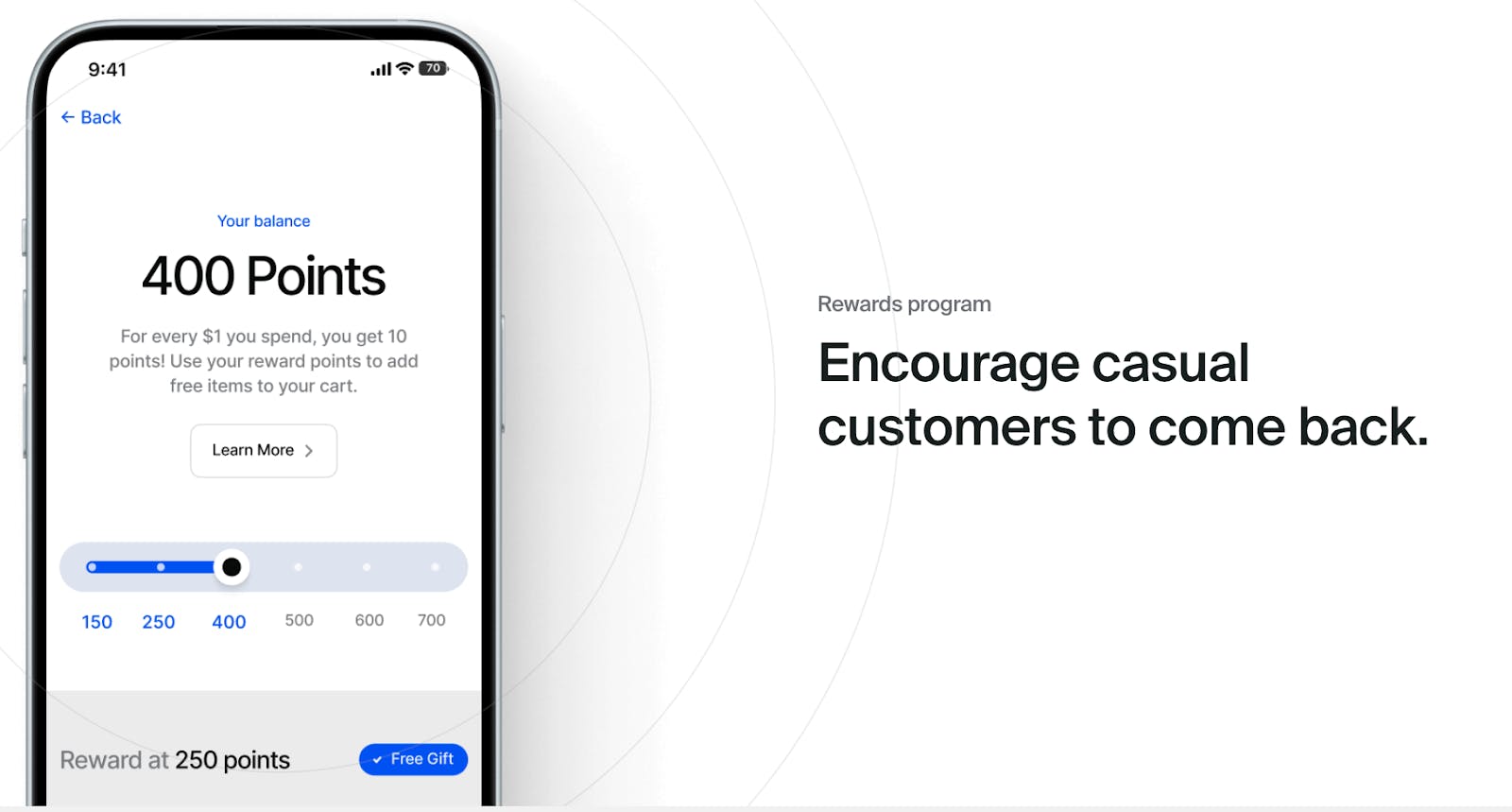

Owner also provides a built-in loyalty rewards program akin to large chains, allowing restaurants to offer points and deals to encourage frequent ordering. Customers receive ten points per dollar spent, and restaurants can adjust the point values for menu items.

Source: Owner

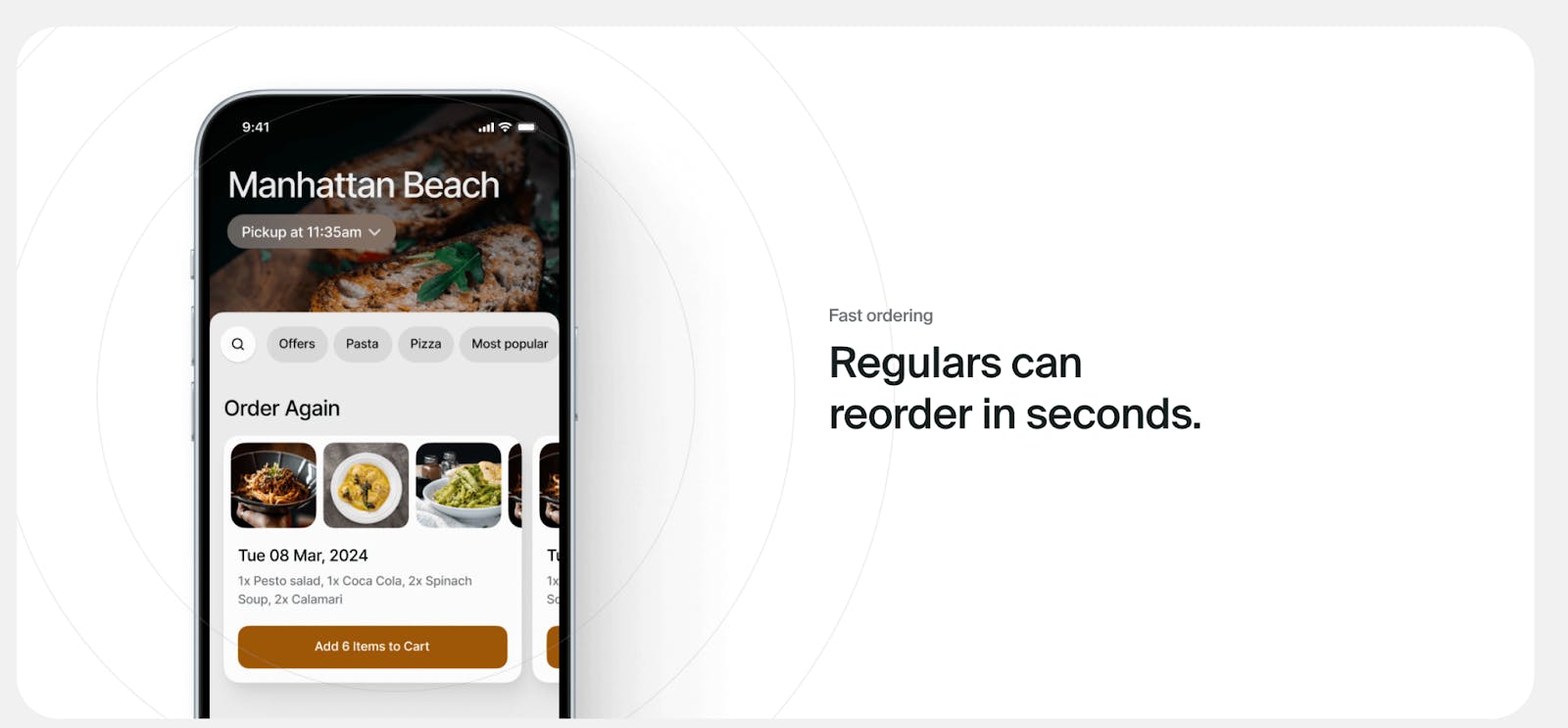

Mobile App Generator

For no extra cost, Owner produces a branded mobile app for each restaurant (iOS and Android). Similar to other products, Owner allows for some brand personalization but uses a standardized experience based on what it says works. Owner reports that having a branded app doubles the reorder rate of a restaurant’s customers on average.

Source: Owner

Market

Customer

Owner’s customers are independent restaurant owners, typically operators of single-location or small-chain eateries that lack the resources of national brands. Their pain points are often low online visibility, high fees on delivery orders, low repeat order rates, and no unified way to manage it all.

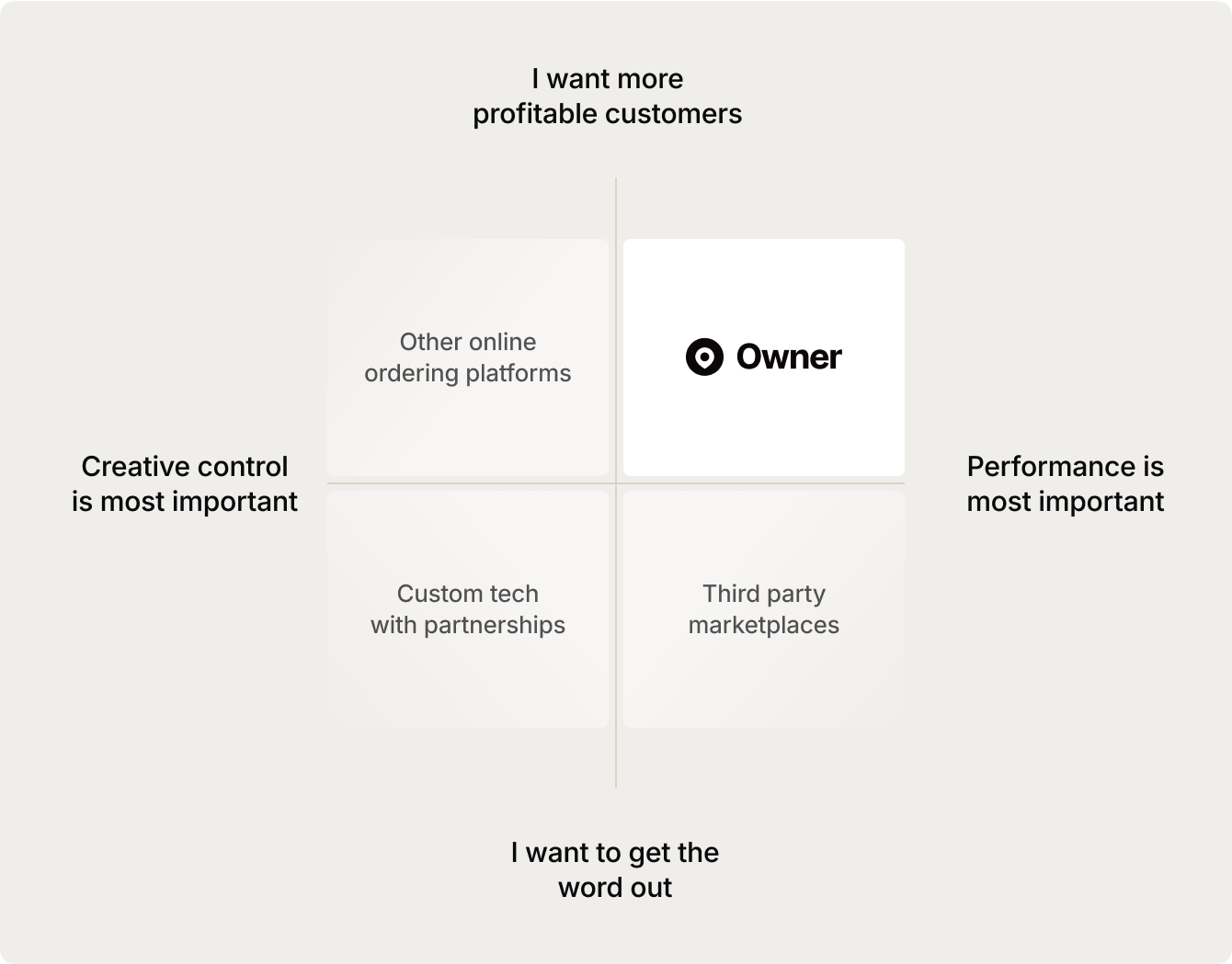

Owner typically focuses on customers with delivery or takeout-heavy offerings that already have online orders coming in but want more profitable customers. Owner says it's a “not so great” fit for fine-dining restaurants or restaurants that “mostly get one-time customers (like in a touristy area).”

Source: Owner

As of June 2025, Owner’s website features case studies with businesses like Talkin’ Tacos, a Mexican restaurant with over 10 locations in Florida. Before Owner, Talkin’ Tacos did minimal online orders ($4K per month) and had no branded mobile app. With Owner, it was able to generate $120K in online orders per month, reach 10K app installs, and attract tens of thousands of loyalty members.

Market Size

Owner considers its addressable market to be tech and marketing spend from independent restaurant owners in the US. According to Owner, there are 600K independent restaurants in the US, each spending $35K per year on technology and marketing, making it a $21 billion annual revenue opportunity. This assumes Owner captures a growing share of each restaurant’s tech and marketing spend over time, as its current pricing of $6K annually would imply a market size of only $3.6 billion.

Toast, the restaurant POS provider, estimated in 2021 that total technology spend among restaurants would grow to ~$55 billion by 2024. Meanwhile, other third-party estimates for the current size of the market are smaller. One report estimates the restaurant delivery and takeout software market in 2023 to be $12.5 billion globally and $4.5 billion in North America. Globally, the market is forecasted to grow by 9.4% annually, reaching $28.3 billion by 2032.

Restaurants are Owner’s initial target market, but its long-term vision is to go beyond restaurants and become the “Shopify for local business owners”:

“The vision involves championing 15+ other types of local businesses. Those will include hair salons, independent grocers, gyms, dog groomers, spas, and auto shops. They all need the same solution that Owner is building for restaurants today. So the Owner team has been building with transferability in mind.”

Competition

Competitive landscape

Independent restaurants have to weigh a diverse set of competitors that span bundled SaaS solutions, POS incumbents, third-party marketplaces, and stand-alone software solutions. On the SaaS side, platforms like ChowNow, Popmenu, and BentoBox offer a similar product to Owner and focus on website building, commission-free ordering, and marketing for a monthly subscription. Each started with a particular focus, but all have moved broadly into similar platforms to Owner that compete directly for small restaurant operators' business.

On the POS side, Toast, Square, and Clover have all added online ordering and are attempting to offer full-service solutions for restaurants across online and in-person orders. Third-party marketplaces like DoorDash have also been moving into the restaurant software space and are competing more directly with POS companies and Owner.

Owner also competes directly with a large number of software companies that handle individual parts of the restaurant technology stack. Instead of using bundled software, restaurants can use Wix for their website, Mailchimp for email, ezCater for catering, etc.

Against these competitors, Owner positions itself as a more expensive, “premium” option, where the cost is outweighed by the conversion benefits from using its more opinionated software. As Guild notes on Owner’s competition page:

“Owner is more expensive than many of our competitors. That’s why I recommend signing up for Owner only when you have online orders coming in. One reason we’re more expensive is that we’re constantly spending time and money to test what works best, so you don’t have to. Just this year, we improved conversion rates to Owner’s online ordering and checkout by over 14%. Most restaurants earned an extra $524 in sales per month thanks to that upgrade—which is more than the cost of an Owner subscription!”

Owner also says it frequently competes with marketing consultants, who many restaurants pay to manage their complicated software. Consultants like these can cost $1K per month, which is more expensive than Owner, and may lack access to a large pool of data to iterate on specific performance capabilities.

Competitors

ChowNow: Founded in 2011, ChowNow offers restaurant software to 22K restaurants. Its product is similar to Owner’s and has commission-free online ordering, websites, branded mobile apps, automated email marketing, and a loyalty program. It also offers a commission-free marketplace for customers to order from, which features restaurants that use its software. Its plans range from $119 to $298 per month, plus a 7.5% “Support Local” fee on marketplace orders.

As of June 2025, the company’s last publicly announced round was its $21 million Series C in May 2019 from private equity firms 3L Capital and Catalyst Investors. In March 2024, CEO Chris Webb said ChowNow is a profitable company. Owner and ChowNow have similar product features, and Owner’s main differentiation is its premium price and more opinionated, less customizable product offering.

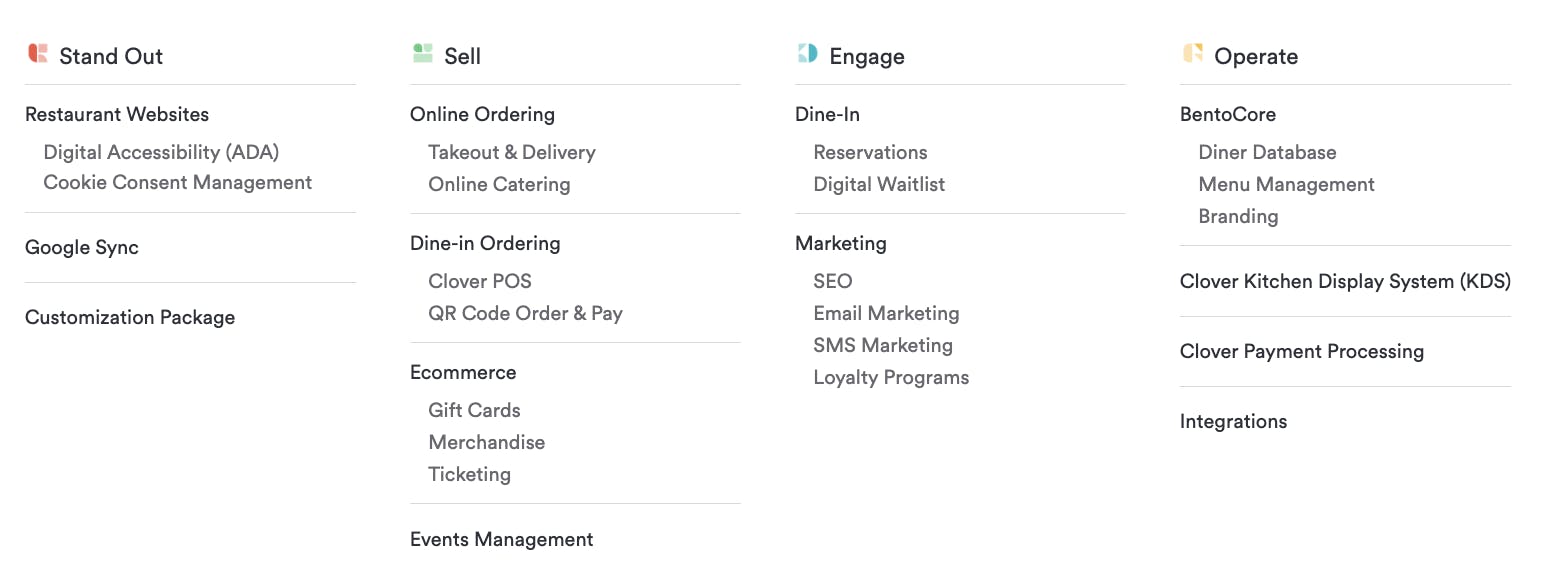

BentoBox: Founded in 2013, BentoBox provides a marketing and commerce platform for restaurants, including websites, online ordering, event ticketing, gift-card sales, reservations, and marketing tools. As of December 2022, it served over 14K restaurant locations worldwide. The company raised $28.8 million in a Series C funding round in October 2020, before being acquired by Fiserv, the parent company of the POS company Clover, in November 2021. BentoBox’s main differentiation is its part of the broader Clover platform. Fiserv integrates BentoBox directly with Clover, offering a platform that covers online and offline ordering.

Popmenu: Founded in 2016, Popmenu is a digital marketing and ordering SaaS platform serving over 10K restaurant locations worldwide as of June 2025. It offers a similar product suite to Owner’s, including websites, interactive menus, online ordering, no-commission delivery, AI-powered email marketing, and more. Pricing ranges from $149 to $499 per month. In June 2021, Popmenu raised a $65 million Series C, led by Tiger Global.

Popmenu sued Owner in April 2025, alleging that Owner’s “Restaurant Website Grader” gives inaccurate and misleading results that have hurt Popmenu’s business. It argued that the grader gives artificially low grades to mislead prospective customers and that Popmenu’s websites score well on neutral website graders.

Toast: Founded in 2011, Toast started as a POS system tailored for restaurants and has since grown into a broader restaurant management platform covering POS, payments, operations, digital ordering and delivery, marketing, loyalty, team management, and more. Toast went public in September 2021, and its market cap is $25.9 billion as of June 2025.

Toast is a market leader for POS and restaurant software. In Q1 2025, it had 140K active restaurant locations, far more than any of the SaaS software competitors (ChowNow is next largest at 22K). In Q1 2025, it had an annualized recurring revenue run-rate of $1.7 billion, which includes its software revenue and its share of payment revenue net of fees.

Toast’s core product is its POS system, but it has been adding features that more closely compete with Owner’s product in handling all restaurants’ needs for online and offline ordering. Toast launched its Digital Storefront and Marketing Suites in May 2024, adding SEO-optimized websites, integrated online ordering, and automated email / SMS campaigns to its core POS platform. It also launched loyalty for online ordering in January 2024 and launched branded mobile apps in October 2024.

On its competition page, Owner says Toast is “affordable and keeps things simple, which can work well if you’re not looking to do much beyond that.” But Owner argues it's own product is a better fit for restaurants trying to grow online orders significantly.

Square: Founded in 2009, Square powers commerce for over 4 million sellers worldwide and over 100K restaurants in the US as of June 2025. Square is a product of the company Block (formerly known as Square), which went public in 2015 and has a market cap of $40.3 billion as of June 2025. Square doesn’t break out revenue for restaurants, but it recorded revenue of $1.9 billion overall and $339.2 million from subscriptions and services in Q1 2025.

Square has a Food and Beverage product line, but it largely repurposes its more general-purpose platform for this vertical. In addition to its core POS system, Square’s product includes commission-free online ordering and branded websites via Square Online, automated marketing campaigns through Square Marketing, customer loyalty programs via Square Loyalty, payroll and team management tools, and even financial services such as business banking and loans.

DoorDash: Founded in 2013 in Palo Alto, DoorDash is the largest on-demand delivery marketplace in the US, holding roughly 60% market share at the end of 2024. DoorDash went public in December 2020 and has a market cap of $100.1 billion as of June 2025. In Q1 2025, DoorDash reported $3 billion in revenue on $23.1 billion gross order value across 732 million orders. DoorDash services over 500K total stores on its marketplace as of June 2025.

DoorDash’s restaurant software and marketing platforms have historically been limited compared to Owner’s, but DoorDash has been increasingly adding features. It launched the “DoorDash Commerce Platform” in October 2024, which offers commission-free online ordering, tableside ordering, and customer support solutions. At the same time, it announced branded mobile apps and, in June 2025, it acquired SevenRooms for $1.2 billion to add CRM, reservation management, and guest-experience tools directly into the Commerce Platform.

Business Model

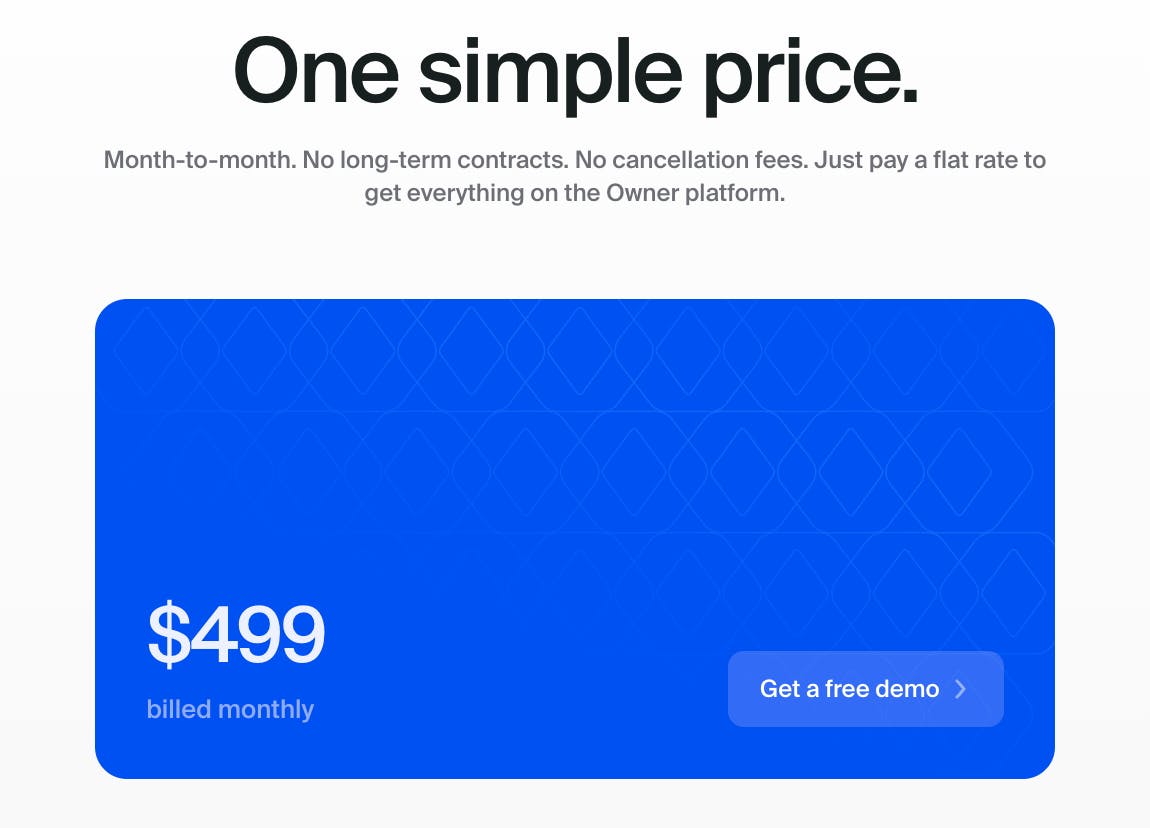

Owner sells its platform on a SaaS model where restaurants pay a flat $499 per month per restaurant for the full feature set, with no contracts, tiers, or feature-based upsells. The lack of any tiers or pricing options sets it apart from its competitors. For example, ChowNow offers three tiers, Bentobox offers five options and a “build your own” plan, and Popmenu offers three tiers. Owner also exclusively does month-to-month pricing, not annual contracts, and says it believes in “earning [customers’] business every month.”

Source: Owner

Owner does not charge restaurants any per-order commission and instead charges the customer who orders the feed a 5% service fee, which is added to their order total. For deliveries, Owner passes along the roughly $7 cost it incurs via its DoorDash Drive or Uber Direct partnerships to the customer, but lets restaurants decide how much of it to cover.

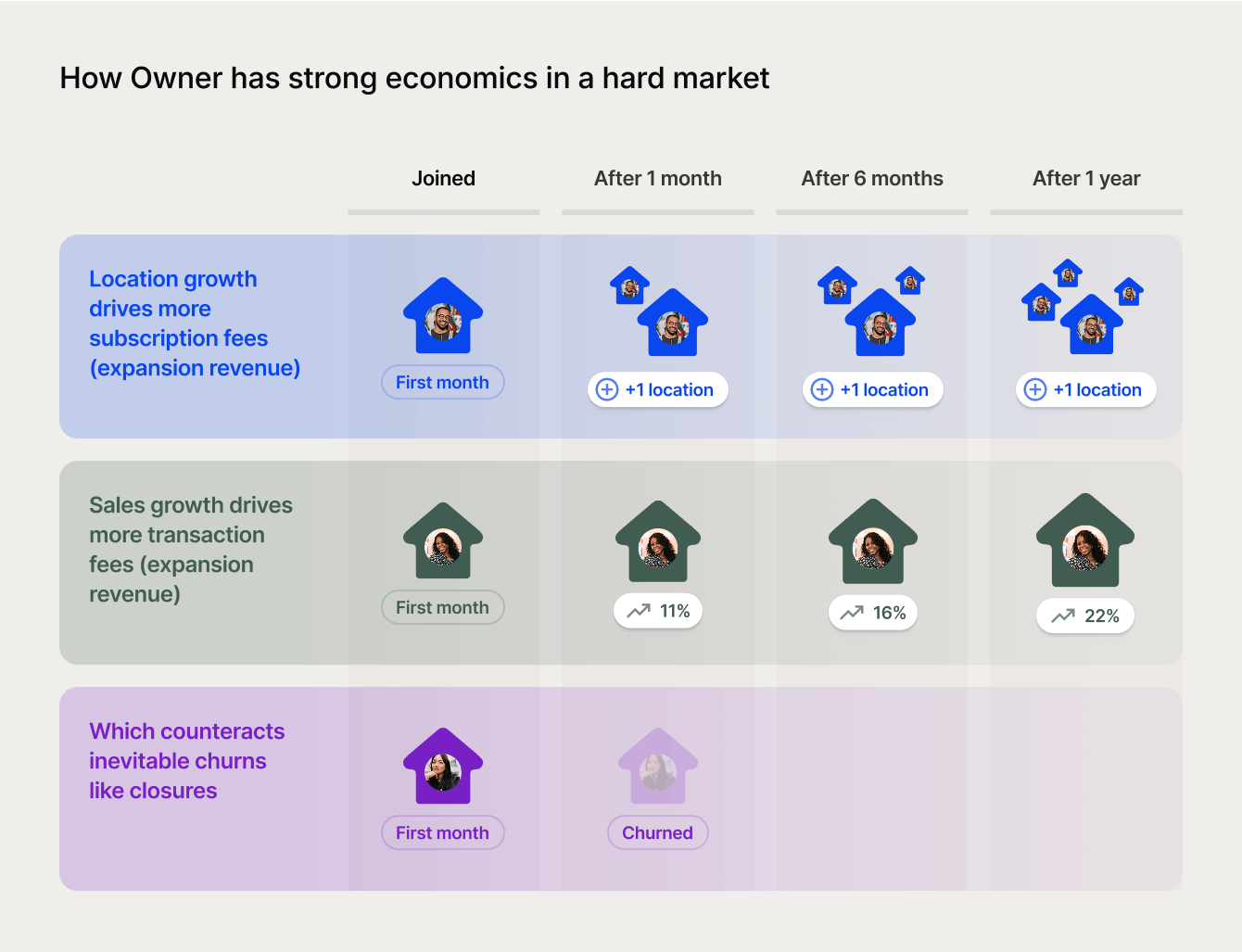

Owner charges a flat rate to customers for its software per location, but its goal is to grow its overall revenue per customer over time. Because Owner charges per location and per order, it makes more money as its customers add locations and grow their online business.

Source: Owner

There is limited data published about Owner’s costs, but one of its largest costs is sales. As of November 2024, Chief Revenue Officer Kyle Norton said the sales team was “close to 50 people.” Owner said it scaled overall headcount to 200 emplo in 2024, so that suggests the sales team was around 25% of the total employee count. Owner also has costs to maintain its 24/7, US-based restaurant support as well as its policy of covering all refunds for its orders.

Traction

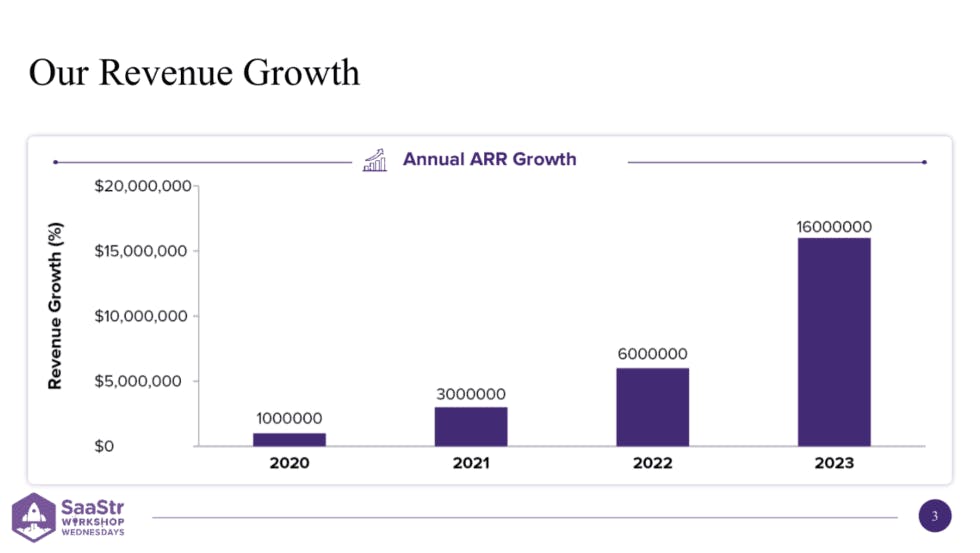

According to a presentation from Chief Revenue Officer Kyle Norton, Owner generated $1 million ARR in 2020, $3 million in 2021, $6 million in 2022, and $16 million in 2023. In April 2024, Norton said Owner had recently reached $21 million ARR. As of June 2025, one unverified estimate of Owner’s 2024 ARR was $34 million.

Source: SaaStr

Owner doubled its headcount in 2024 from 100 to 200 employees. As of June 2025, the company said it serves over 10K restaurants nationwide, up from 2K restaurants as of January 2024. Owner also touts that it’s the #1 rated restaurant tech software on G2 and Capterra as of May 2025.

In terms of growth strategies, Guild has pointed to the company’s inbound marketing engine, including a YouTube channel with over 30K subscribers as of June 2025. Guild has said Owner has become known as the “Moneyball” of the restaurant community:

“We've got a very popular YouTube channel in the restaurant community and Instagram page in the restaurant community that basically does the same thing of sharing what is working best for the most successful independent restaurant owners and the most successful large restaurant corporations. In a very tangible and actionable way with the rest of the restaurant community, we've become the Moneyball of a restaurant where we're constantly keeping a pulse on what is working and then sharing that with the community. And this content has driven us millions of views over time and has developed a cult-like following, which I say in the most positive connotation of that word.”

As a result, Kyle Norton said that 60-70% of Owner’s sales came from inbound channels as of November 2024.

Valuation

Owner has raised a total of $182.2 million as of June 2025. The company raised a $120 million Series C in May 2025, co-led by Meritech Capital and Headline Partners, at a $1 billion valuation.

Prior to that, Owner raised a $33 million Series B in January 2024, co-led by Redpoint Ventures and Altman Capital, at a $200 million valuation. The company’s $15 million Series A in March 2022 was led by Altman Capital with participation from Redpoint Ventures, SaaStr Fund, Day One Ventures, and Browder Capital. Its $10.7 million seed round, announced in August 2021, was led by SaaStr Fund.

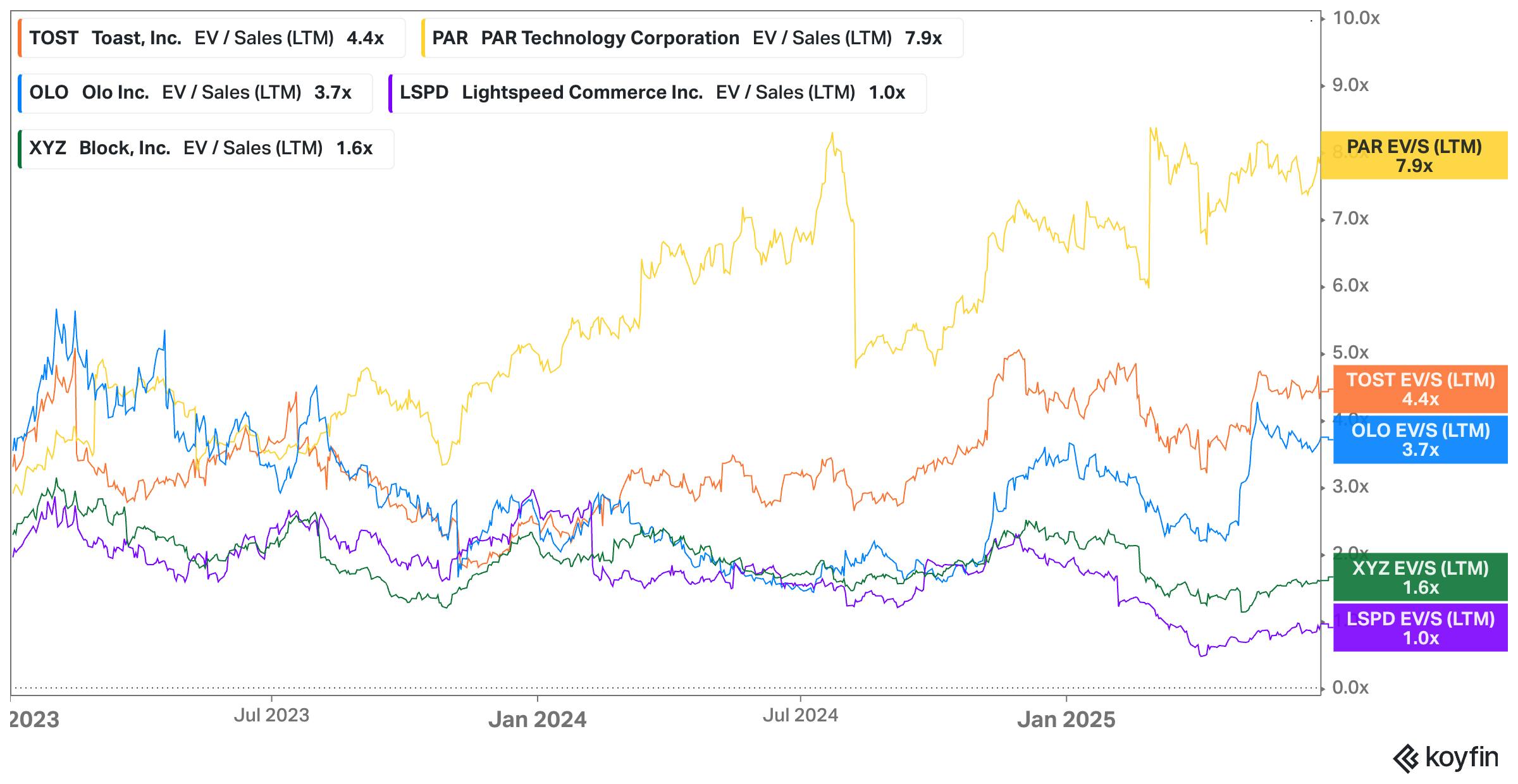

In terms of publicly traded companies that provide technology for restaurants, they trade at a range of EV / LTM revenue from 1-7.9x as of June 2025. These companies differ in notable ways where Block and Lightspeed serve the broader retail market in addition to restaurants, whereas Toast and Olo are focused on restaurants.

Source: Koyfin

Key Opportunities

AI Agents

Owner has highlighted AI agents as a key part of its product vision. By embedding “AI Executives” into its platform, Owner aims to automate the execution of its “battle plan” for profitable growth. Owner mentions three examples of “AI Executives” it plans to launch in 2025: AI CMO, AI CFO, AI CTO.

Owner envisions these agents being proactive, reportive, and reactive. Examples for the CMO include suggesting Memorial Day marketing campaigns (proactive), notifying restaurant owners of growth metrics (reportive), and disabling avocado items on the menu in response to a message from the restaurant owner (reactive). Owner is planning on having a text chat as the interface to start, and eventually expanding to allow restaurant owners to call AI agents on the phone. Owner argues it has a unique data advantage in building AI agents compared to its competitors:

“Owner has already collected and organized a massive amount of data. Owner's data spans thousands of restaurants, millions of menu items, cuisine specifics, SEO performance, ordering patterns, transaction patterns, and tens of millions of people using the product. Also, Owner’s data has already been structured into a highly prescriptive battle plan for local restaurants. Owner knows the single best way to grow restaurant sales. The battle plan includes the correct answers for many variables.”

Unbundling Delivery From Marketplaces

Third-party marketplaces, like DoorDash and Uber Eats, bundle order-taking, payment processing, delivery logistics, and customer acquisition into a single service, charging restaurants commission fees that typically range from 15-30% per order. Historically, this meant restaurants often paid high fees for customers who ordered through third-party delivery marketplaces, even if they came directly to the restaurant first.

Now these platforms are being unbundled. DoorDash Drive and Uber Eats’ Uber Direct both offer white-label delivery service options that let any company embed delivery alone for a flat fee. Owner charges ~$7. This unbundling is allowing companies like Owner to offer delivery as one part of their bundle without having to go through the challenges of building their own delivery marketplace. This is a long-term tailwind for Owner as many restaurants are frustrated by the high fees they pay to third-party marketplaces and are eager to find ways to reduce them.

Owner could also go even further and build its own commission-free delivery marketplace while still relying on white-label delivery services. ChowNow has this today, allowing customers to order from restaurants that use its software on ChowNow’s app and website. ChowNow’s CEO said in December 2022 that its commission-free delivery marketplace was its “winning formula” going forward.

Expansion Beyond Restaurants

Owner’s long-term vision is to expand beyond restaurants. Its platform’s core capabilities around websites, ordering flows, marketing automation, loyalty, and mobile apps extend naturally into other local service verticals. Owner calls out over 15 additional local service verticals it envisions selling to, including hair salons, independent grocers, gyms, dog groomers, spas, and auto repair shops. Many of these businesses face the same challenges as restaurants: low online visibility, fragmented technology stacks, and dependence on third-party marketplaces. Owner hasn’t given a timeline on when it plans to service these verticals, but it said in May 2025 that it “is already seeing strong signals of demand” from them and that Owner will “pursue them sequentially based on market pull.”

Key Risks

Competition From Incumbents

Owner faces a large number of competitors, both directly and as larger platforms extend from other parts of the restaurant software market, moving to compete with Owner’s core platform, especially given these competitors have much bigger distribution than Owner today.

Toast has expanded into many of the products that make up Owner’s platform, including marketing automations, SEO-optimized websites, integrated online ordering, loyalty, and branded mobile apps. These rollouts illustrate how Toast has moved beyond payments, POS, and in-store operations into the full digital-ordering and retention stack that Owner also offers. Toast also has the distribution advantage of upselling to a large existing base of customers, with 140K restaurant locations as of Q1 2025.

Other POS competitors are also adding similar features. Fiserv, the parent company of the POS company Clover, acquired the restaurant website and marketing platform BentoBox in November 2021 to bolster Clover’s digital ordering and marketing capabilities. The deal integrated BentoBox’s website builder, online ordering, and marketing tools into Clover’s POS and restaurant operations platform.

Source: BentoBox

Even third-party marketplaces are also adding features to compete with Owner. DoorDash’s launch of its Commerce Platform in October 2024 and its purchase of SevenRooms in June 2025 show it’s serious about competing with Toast and participating in the broader restaurant software market. Because Owner relies on DoorDash and other third-party marketplaces for white-label delivery, there is a long-term risk to Owner’s business if DoorDash decides to cut off Owner’s white-label delivery for competitive reasons.

SMB Churn & Poor Unit Economics

Guild identified early on that one of the biggest risks to Owner is the challenging unit economics of selling to single-location and small chain restaurants. These customers have smaller LTVs and higher churn rates than larger enterprise accounts, an issue faced by startups selling to small businesses in other industries, too. For example, Brex exited the SMB segment in June 2022, which some speculated was in part because the LTV and revenue per account for these businesses could not justify the customer acquisition costs (CAC) and support costs.

Owner noted in May 2025 that it had higher churn than an “enterprise SaaS company that serves large corporations,” but argues that it counteracts its logo churn with expansion revenue from its customers growing their business with it. Given the more challenging unit economics for small businesses, it will be important for Owner to keep its CAC low and maintain a high LTV / CAC. Owner hasn’t released any data on LTV / CAC recently, but one investor said their LTV/CAC in 2023 was high at 4.5x, compared to average LTV / CAC ratios of 3-4x.

Summary

There are over 600K independent restaurants in the US, and many are searching for ways to cut third-party delivery fees, consolidate fragmented tools, and compete with major chains. Owner has positioned itself as a premium bundle offering opinionated restaurant software that increases conversion, reduces delivery fees, and gives small restaurants tools to run their businesses more effectively. The company has grown to 10K locations and raised a $120 million Series C in May 2025 at a $1 billion valuation.

Owner’s long-term ambitions are to move beyond restaurants and be the “Shopify for local business owners.” But it still faces steep competition in its existing market. Owner's long-term success will depend on sustaining attractive unit economics while selling to independent restaurant operators and differentiating its product to fend off POS incumbents, restaurant SaaS peers, and delivery marketplaces that are rolling out comparable direct-ordering bundles.