Thesis

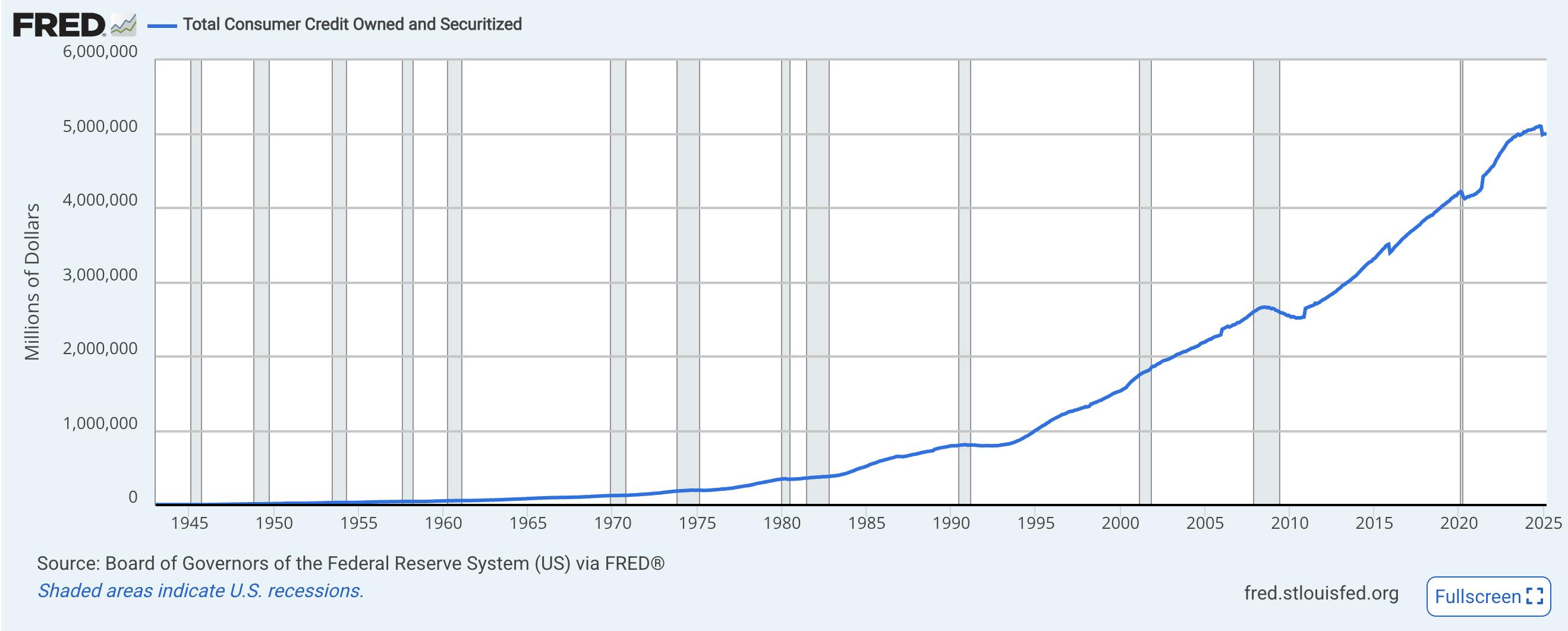

The invention of credit cards in the mid-20th century unlocked a new model of consumer finance. By allowing users to defer payments with minimal friction, cards became a cornerstone of post-WWII consumer culture — fueling everything from retail expansion to the rise of travel, dining, and entertainment as everyday behaviors. Over time, card networks embedded themselves into the backbone of the global economy, shaping how consumers transacted and how merchants accepted payment. By 2002, cardholders paid $3.2 trillion towards credit card debt.

Source: FRED

As commerce shifted online in the 1990s and 2000s, credit cards remained the dominant payment method. Ecommerce made spending easier, faster, and more impulsive — but the infrastructure remained largely unchanged. Despite digital frontends, the rails underneath were still expensive, opaque, and optimized for issuer profits rather than consumer clarity. Late fees, revolving balances, and complex terms became normalized, especially in the United States.

Many consumers, particularly younger ones, are increasingly skeptical of traditional credit. At the same time, alternative forms of payment like Buy Now, Pay Later (BNPL) have surged in popularity, offering clearer repayment terms, upfront pricing, and flexible installment plans that are often interest-free. BNPL is a type of financing similar to a personal loan, where a purchase is made upfront and partial payments are spread out over time in equal installments until the full value of the purchase is paid off. It is a loan offered to a customer at the point of sale to purchase merchandise on credit, but without having to use a credit card. The payment installments are interest-free as long as payments are made on time. BNPL functionally extends the window to pay back a purchase without incurring interest.

By 2022, BNPL had become very popular. Adoption surged in the second half of 2022 due to higher living costs and rising inflation. The gross merchandise value of BNPL was expected to increase from $178.6 billion in 2021 to $899 billion by 2028. Young consumers with limited incomes value the service as an alternative digital payment and a lending option with flexible installment plans, enabling them to purchase big-ticket items. In the first half of 2022, BNPL apps saw a new record of nearly 10 million installs on the App Store and Google Play.

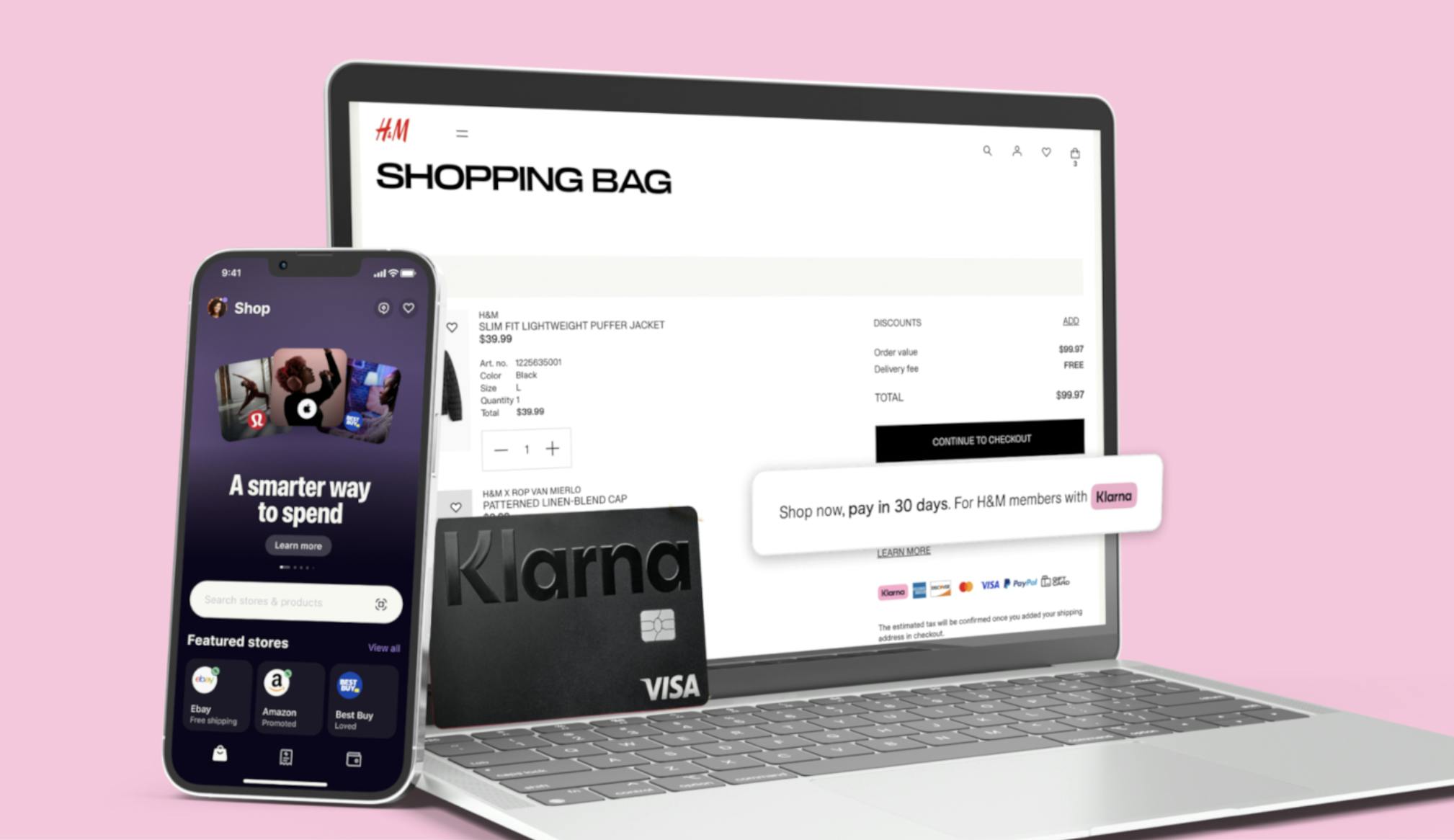

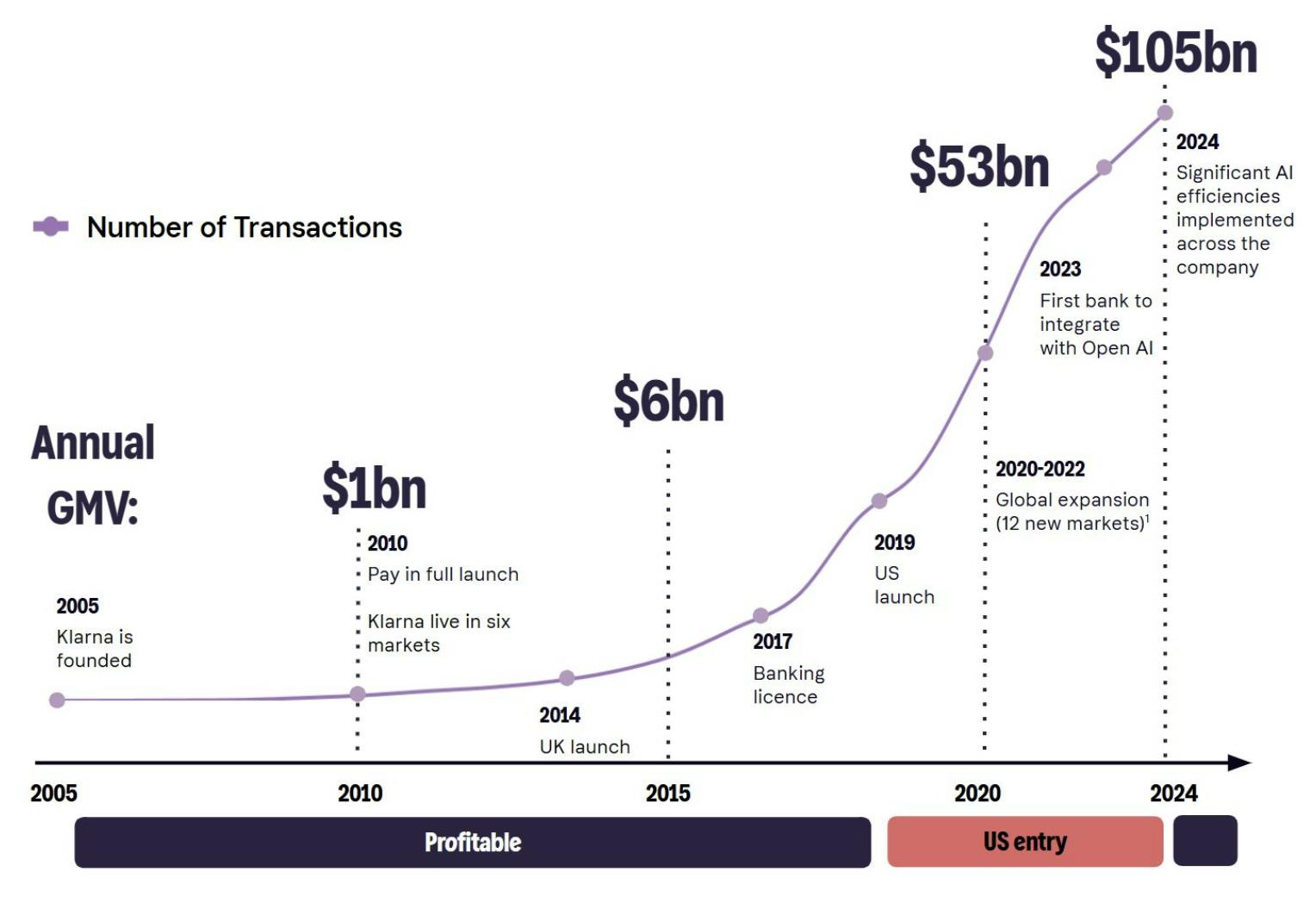

Klarna has emerged as a market leader in this shift. What started as a Swedish BNPL provider is now a global payments, commerce, and banking platform used by nearly 100 million people, powering $105 billion in GMV as of March 2025. For consumers, it offers flexible payment options, banking services, and its own marketplace. For merchants, it helps attract, convert, and retain customers with flexible payment options and a growing marketing suite.

Klarna has leaned into artificial intelligence more aggressively than its peers, deploying internal copilots, an AI-powered shopping assistant, and machine learning models for real-time underwriting. Klarna became the first bank to partner with OpenAI in 2023 and is now building toward a future of AI-native commerce, with ambitions to power every checkout and digital wallet.

Founding Story

Klarna (formerly Kreditor) was founded in Stockholm in 2005 by Sebastian Siemiatkowski (CEO), Niklas Adalberth (former deputy CEO), and Victor Jacobsson (former CFO), three students at the Stockholm School of Economics.

Siemiatkowski and Adalberth met while working together at Burger King. Siemiatkowski, who was living on welfare checks and food stamps, also worked as a salesperson for a factoring company. This company provided loans to small businesses that needed cash to pay their invoices. While working there, he noticed that merchants wanted customers to pay via debit card at checkout to guarantee payment. This gave him an idea: what if there was a middleman who could pay the seller at checkout and collect payment from the consumer upon delivery?

This would allow customers to pay only once they were satisfied with their order, similar to many mail-order transactions in Sweden, where trust was a large part of the culture. Credit card usage in Sweden was low, and debit cards didn’t offer the same protections. Siemiatkowski contemplated if a ‘buy now, pay later’ system could be applied to digital commerce. He pitched Kreditor to his superiors at the firm and a pitch competition, but was ultimately dismissed.

Siemiatkowski returned to school with the idea to bring BNPL into the digital era with Kreditor. He recruited Adalberth and Jacobsson to help him launch the company, initially relying on manual invoicing to let customers pay after delivery. Together, the founders decided to participate in a Shark Tank-style show in Sweden, judged by the country’s top financiers. Kreditor finished last in the competition, but one comment from a spectator stuck: “The banks will never do it.”

In February 2005, the team raised a €60K pre-seed round in exchange for a 10% stake in the company and an additional 37% stake for hiring a few software developers, who would build the first version of the platform. Kreditor began cold-calling merchants, offering direct payments, installment plans, and pay-after-delivery options. In April 2005, they processed their first transaction with a Stockholm bookstore, Pocketklubben.

In the following years, Kreditor expanded across the Nordics, but attracting top engineers to join the company required credibility, so Siemiatkowski set his sights on a marquee investor. In 2010, Sequoia Capital invested in Kreditor’s Series B round at a $100 million valuation, buying 25% of the company. That same year, Kreditor reached $54 million in annual revenue and rebranded as Klarna.

Source: TechCrunch

In February 2012, Siemiatkowski contacted PayPal’s co-founder Max Levchin to offer him to join Klarna as an advisor. Later in the year, Siemiatkowski learned that Levchin was launching Affirm, a direct competitor to Klarna in the US, with installment lending for ecommerce transactions and credit building as core features.

By 2014, Klarna was one of Europe’s fastest-growing companies. It acquired the German payments company SOFORT for $150 million in December 2014, resulting in a 10% market share of Europe’s ecommerce market. Klarna entered the US market in 2015, received a Swedish banking license in 2017, and pivoted from a pure BNPL provider into a broader financial platform. Jacobsson, who had served as CFO, left the company in 2012. Adalberth left in 2015 after selling most of his stake to focus on impact investing through his Norrsken Foundation.

Source: Klarna via SEC

When OpenAI released ChatGPT in November 2022, Siemiatkowski immediately took notice. He offered OpenAI to use Klarna and its customers as an experimentation platform, thus becoming the first fintech company in the world to launch a ChatGPT plugin. In only the first month after its debut in February 2024, Klarna’s OpenAI-powered AI Assistant had over 2.3 million conversations. These accounted for two-thirds of the company’s customer service chats, equivalent to the work of 700 full-time agents with similar quality. At the same time, ChatGPT Enterprise was rolled out at Klarna on a company-wide scale.

However, by May 2025, Siemiatkowski acknowledged that the company went “too far” in its customer service automation rollout and explained that Klarna will resume hiring for human customer service agents in 2025.

Klarna remained profitable for much of its early history but chose to sacrifice margin in 2019 to fuel growth in the US. By the end of 2024, Klarna had reached 93 million users, 675K merchants, and $2.8 billion in 2024 revenue on $105 billion in gross merchandise volume. It redomiciled to the UK and filed to list on the NYSE in March 2025, aiming for a $15 billion IPO. That plan was paused in April 2025 after newly announced US tariffs spooked the public markets.

Product

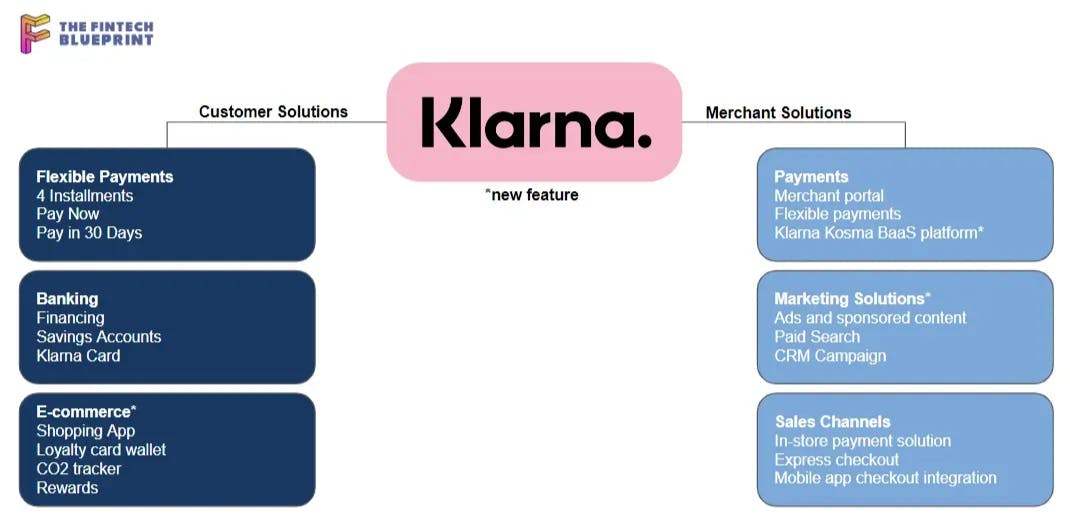

Klarna started out as a BNPL provider but has since expanded its footprint across the entire consumer shopping journey. First, by layering on discovery tools and marketplace features, and more recently by embedding core banking infrastructure. What ties this evolution together is Klarna’s role as a transaction middleman: stretching payments for shoppers while driving more sales for merchants. That wedge has allowed Klarna to extend both upmarket (into B2B checkout, marketing, and conversion tools) and downmarket (into deposits, cash-back, and debit-like functionality for consumers), resulting in its transition into a full retail bank.

Source: Fintech Blueprint

Klarna for Shoppers

Payments

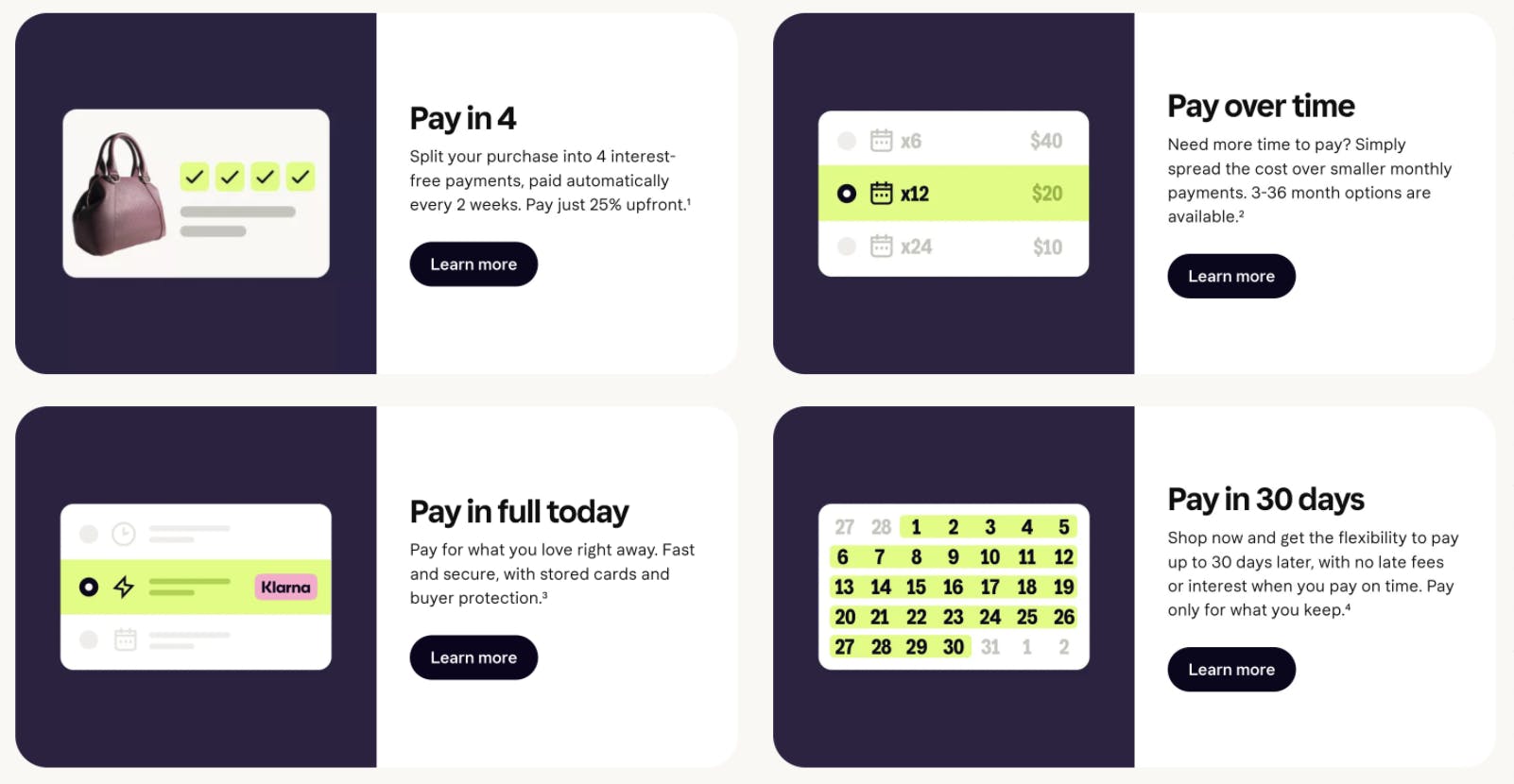

Klarna offers flexible, consumer-friendly payment options designed to make shopping easier and more affordable. Shoppers can choose from a variety of payment methods depending on their preferences and the size of the purchase:

Pay in 4: Split the cost into four interest-free installments, collected every two weeks. Klarna runs a soft credit check at sign-up and charges a late fee only if a scheduled payment is missed.

Pay Over Time: Finance purchases over 3 to 36 months with interest rates ranging from 0.00% to 35.99% APR, depending on credit and merchant terms.

Pay in 30 Days: Receive the item first and pay up to 30 days later, interest-free and with no late fees when paid on time.

Pay in Full: A streamlined experience with prefilled details and buyer protection. Used for everyday purchases, this option accounted for 16% of Klarna’s payment volume in 2024, down from 26% in 2022.

Source: Klarna

Klarna’s payment options are available at checkout with Klarna’s merchant partners, through its own platform, and as a browser extension. If Klarna isn’t shown at checkout, shoppers can still use Apple Pay, a virtual one-time card, or the Klarna card. Klarna can be used for most retail purchases, but there are restrictions, such as rent or utility bills, medical services, gambling, and alcohol or drug purchases. As of December 2024, Klarna supported over 2.9 million transactions per day.

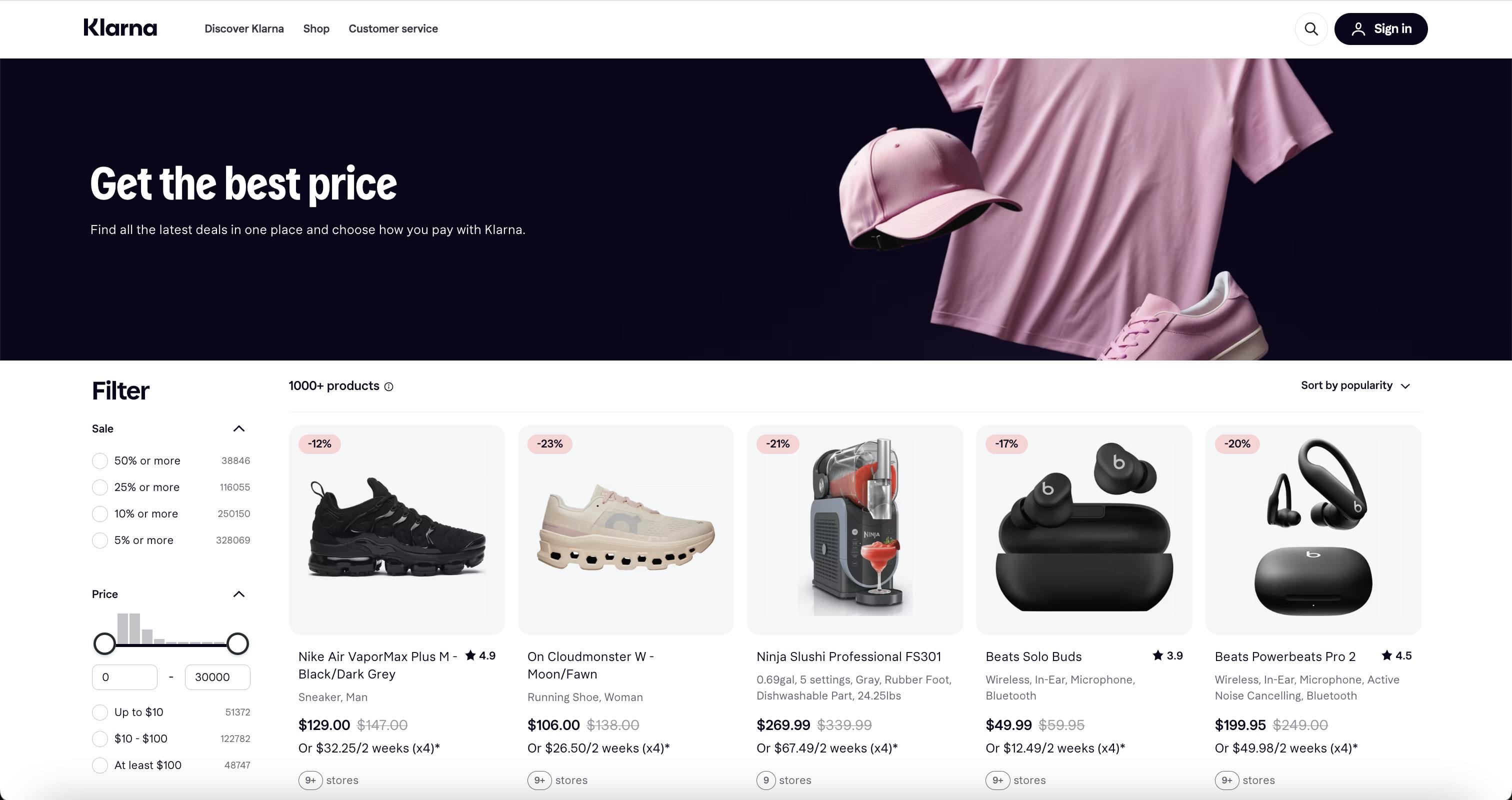

Shopping

Through the Klarna app, launched in 2018, users can browse and search products, track orders, manage returns, and receive price-drop alerts on saved items. The app also powers the company’s loyalty program, which rewards users with points for each dollar spent, redeemable for brand-specific perks. To support browser-based shopping, Klarna offers a browser extension that automatically finds and applies coupon codes at checkout. It also enables flexible Klarna payments on sites that don’t directly partner with Klarna, broadening the scope of where Klarna’s users can shop.

Source: Klarna

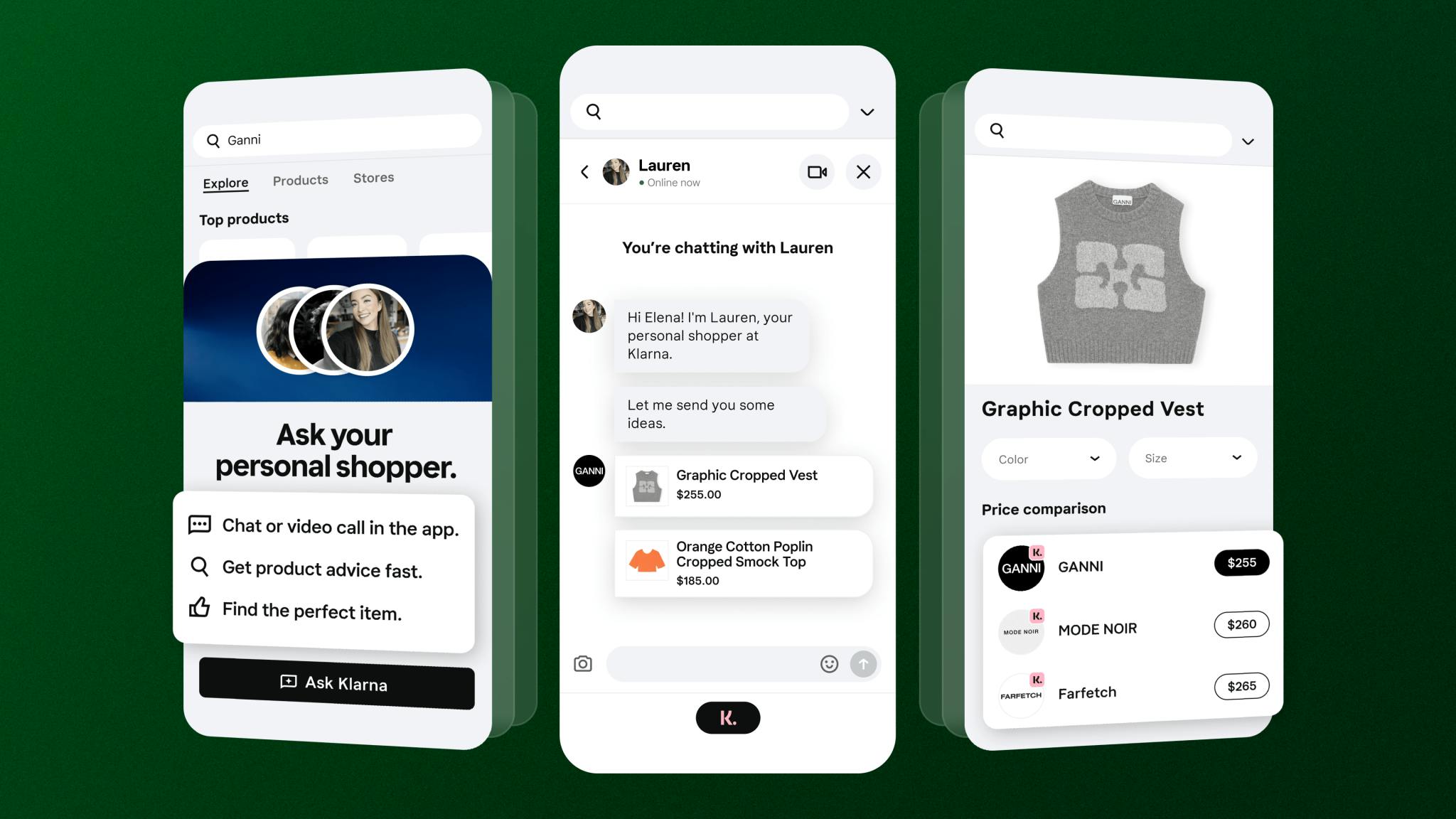

In April 2023, Klarna launched a virtual shopping experience through one-on-one video and chat consultations with in-store experts. Shoppers visiting a participating brand’s website can initiate a conversation to receive live product advice. This service, called Ask Klarna, was launched following the company’s acquisition of Hero in 2021 and is positioned as a way to replicate the in-store experience online.

Source: Klarna

In 2024, Klarna launched Klarna Plus, a $7.99/month subscription product for users in the US. The service waives fees for purchases made at non-partner merchants through the Klarna app and includes brand discounts, recurring credits, and early access to deals. Klarna Plus surpassed 100K subscribers by June 2024, with users saving an average of $18 in their first month alone.

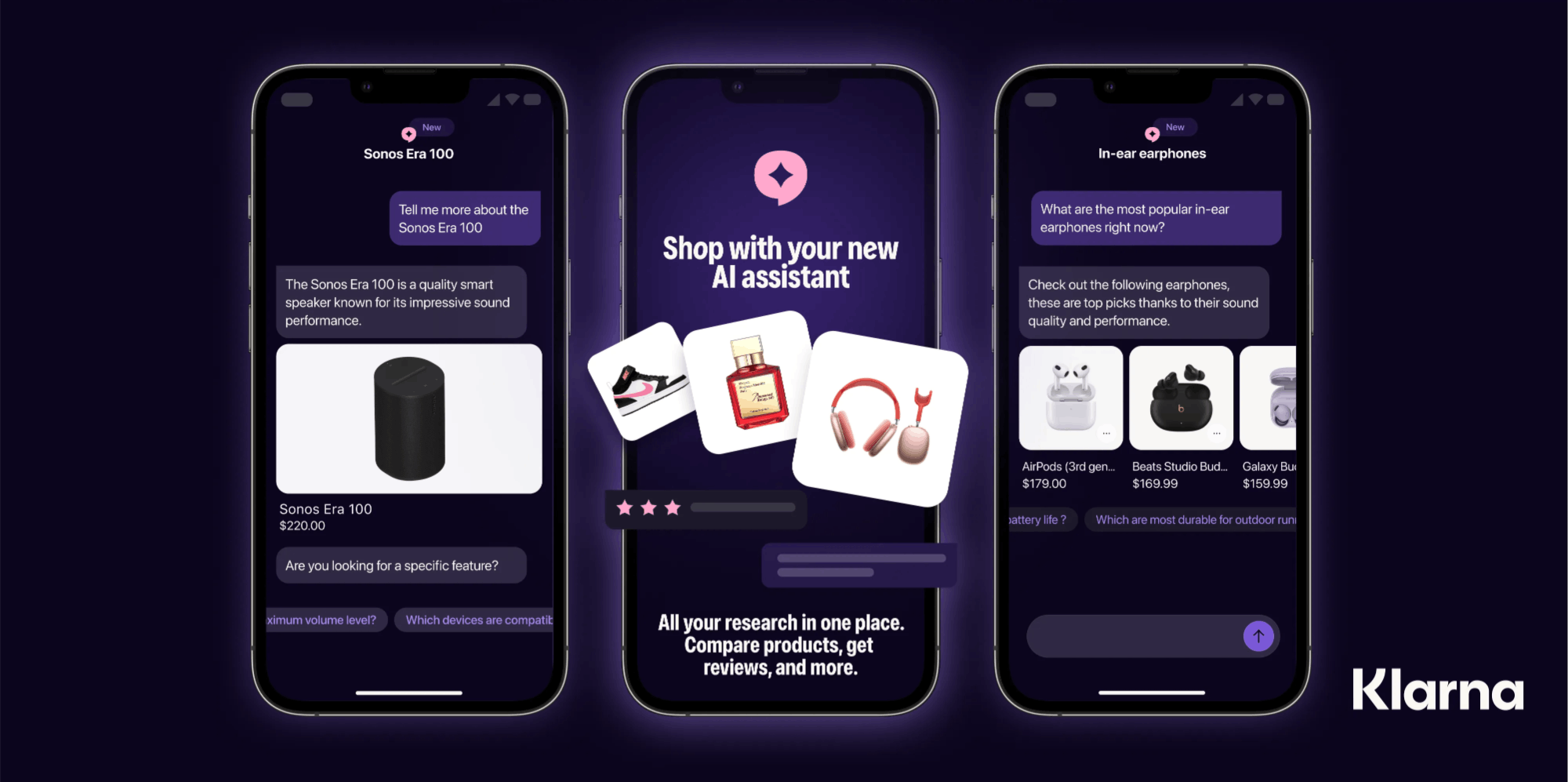

Klarna’s AI shopping assistant, developed in collaboration with OpenAI, enhances the user experience further by enabling conversational product discovery. Customers can ask questions in natural language, receive personalized recommendations, and get AI-generated summaries of product pros and cons. Once a product is selected, purchases can be completed in-app using Klarna’s payment options.

Source: Klarna

Banking

The Klarna Card was first launched in Sweden in 2019 and became available to US consumers in 2024 following a waitlist rollout. It operates as a charge card when used normally, requiring users to pay in full monthly to avoid interest, but also supports monthly installments at interest rates up to 29% APR when users opt into Klarna’s Pay Over Time plan. Cashback of up to 10% is available at select merchants when transactions are completed through the Klarna app.

Source: Klarna

The Klarna Balance account, launched in August 2024 in the US and 11 European countries, is Klarna’s closest step toward full-stack banking. Users can deposit funds from external bank accounts into their Klarna Balance and use that cash to pay in full or to fund BNPL purchases. In Europe, where Klarna operates under a full banking license, balances accrue interest up to 3.58%. In the US, Klarna partners with WebBank as of May 2025, and balances do not yield interest or carry FDIC protection, though the company has publicly stated its intent to expand features over time, including savings functionality.

Klarna Balance also serves as a hub for cashback rewards, refunds, and future financial services. As of December 2024, Klarna held over $9.5 billion in consumer deposits across its products. While its US offerings lag in interest-bearing functionality due to regulatory limitations, Klarna has signaled that more capabilities are coming.

Klarna for Business

Payments

Klarna gives merchants a flexible payment layer that drives conversion, lifts cart size, and improves repeat rates. Partners can offer Pay in 4, Pay in 30, and Financing at checkout, both online and in-store, while Klarna pays merchants upfront and handles risk. In 2024, Klarna’s average take rate was 2.7% across $105 billion in GMV, with merchants seeing a 23% increase in AOV, 20% higher conversion, and 46% greater purchase frequency from Klarna users.

Marketing

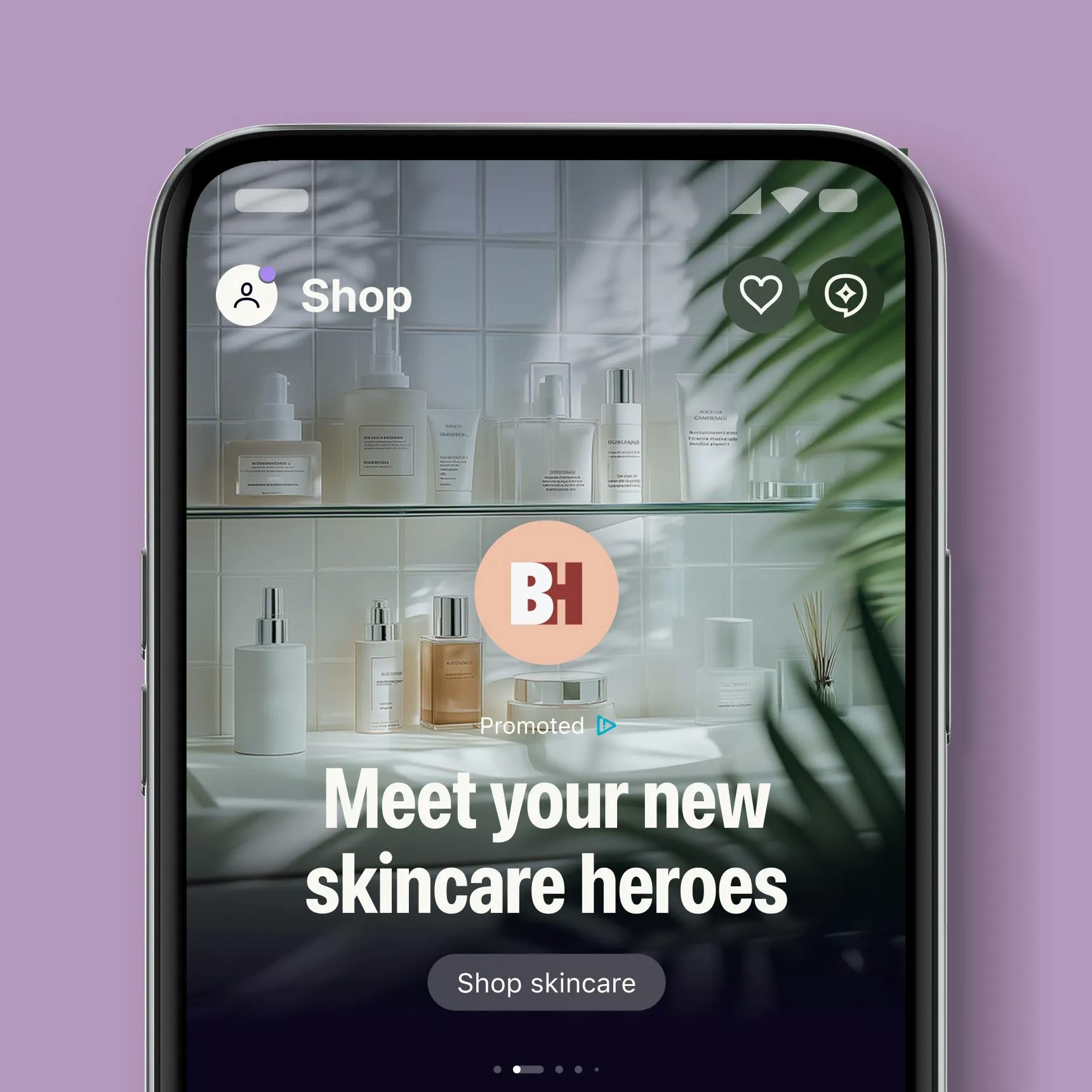

Klarna offers merchants a full-funnel marketing suite designed to convert high-intent shoppers across every stage of the buying journey. Through Klarna’s platform, businesses can run targeted campaigns across channels — search, programmatic ads, affiliate placements, cashback offers, and personalized in-app content, reaching over 24 million active shoppers. Klarna’s search and comparison tools allow merchants to showcase products directly to users with conversion rates of up to 10%.

Brands can also leverage Klarna’s creator network for influencer partnerships, run drive-to-store ads to acquire new customers, and deploy content across Klarna’s app, email, and push channels. Klarna centralizes campaign execution and performance tracking, making it easier for merchants to scale reach, increase AOV, and improve ad efficiency.

Source: Klarna

Checkout

With Klarna’s in-store solutions, merchants can offer its flexible payment options at the point of sale, boosting conversion, increasing average order value, and attracting new customers. According to Klarna, its shoppers spend 118% more than non-Klarna shoppers in-store. The Klarna app helps drive foot traffic by showing nearby Klarna-accepting retailers, and merchants can engage customers through in-app messaging and location-based visibility.

Klarna’s point-of-sale tools allow for seamless checkout experiences in-store, over the phone, or on the go, directly from Klarna’s Merchant Portal. Klarna also handles fraud and credit risk while offering a smooth post-purchase experience for shoppers, including flexible payments, order tracking, and 24/7 customer support.

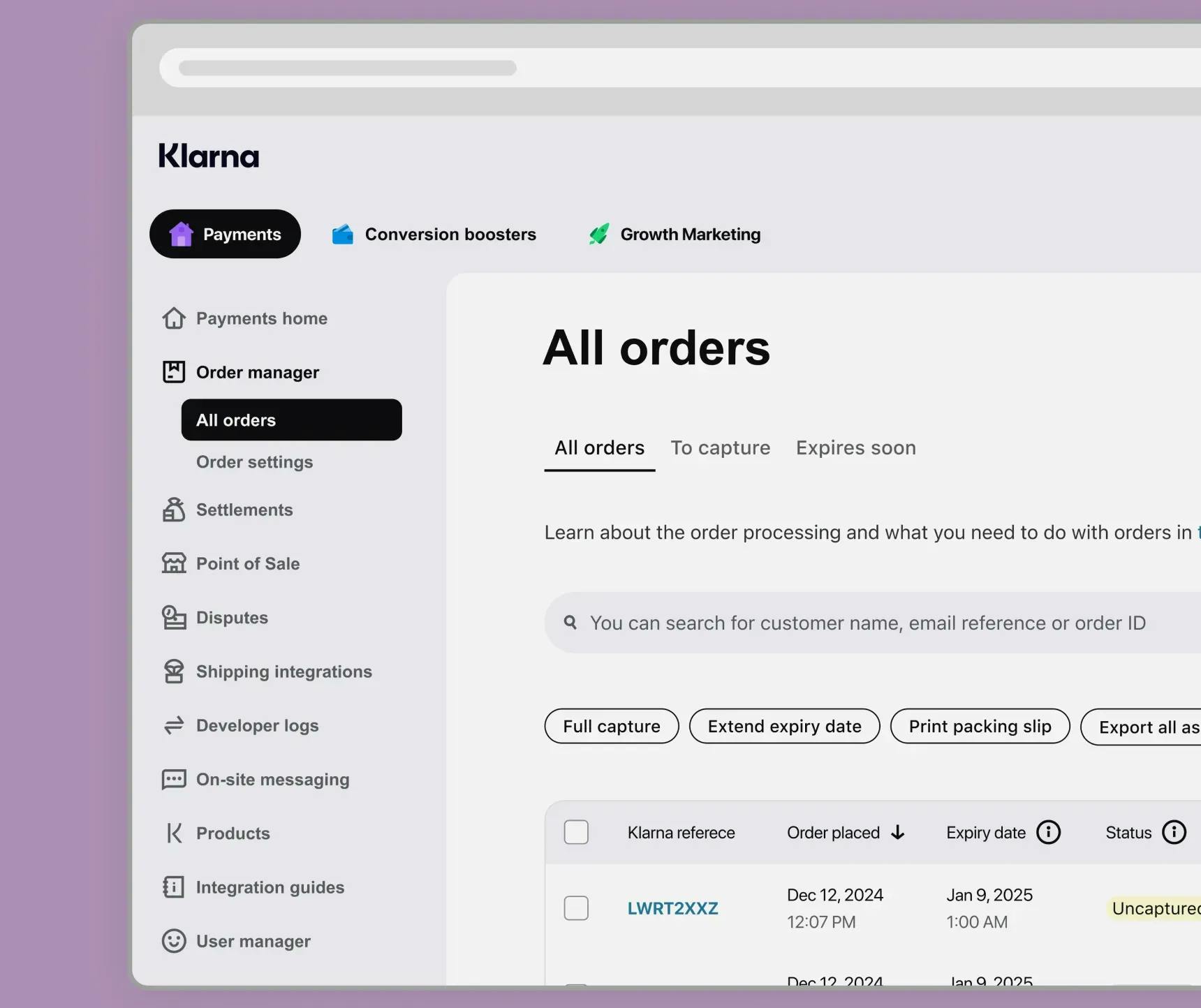

Merchant Portal

Klarna’s Merchant Portal is a centralized dashboard where businesses can manage payments, track sales, fulfill orders, and handle customer support across both online and in-store channels. Merchants can view daily sales, respond to disputes, customize settlement reports, and grant team-specific access to tools and data. The portal also consolidates order management and provides access to help resources, making it easier to run day-to-day operations without switching between systems.

Source: Klarna

Market

Customer

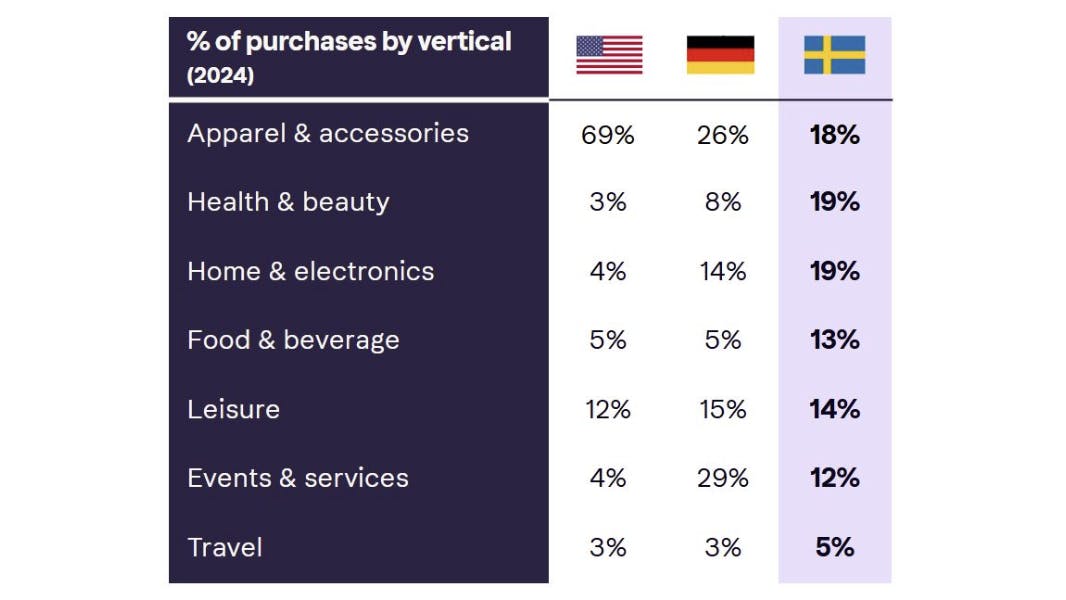

As of December 2024, Klarna serves 93 million active consumers globally, processing over 2.9 million transactions per day across 26 countries. Its user base is predominantly young and digitally native — 58% women, 42% men, and 40% students. A growing number of users is turning to Klarna instead of traditional credit products due to lower fees, more transparency, and perceived trustworthiness. In Sweden, Klarna’s most mature market, 82% of all adult shoppers have used Klarna in 2024.

Source: Klarna via SEC

Klarna’s appeal varies across verticals. In fashion, 49% of all checkouts in live markets in 2024 occurred via Klarna, with H&M seeing 60% of new customer orders in Sweden made using Klarna. In beauty, Klarna users at Sephora purchased 70% more frequently than the average customer and were twice as likely to be in Sephora’s top loyalty tiers. Klarna shoppers also drive gains in travel, with Expedia seeing significant growth in new customer acquisition and a 5% uplift in basket size. In food and beverage, Klarna consumers made 14% more purchases and account for 35% of all checkouts in Sweden with partners like Foodora.

Source: Klarna via SEC

Market Size

Klarna presents itself as a company at the intersection of two sectors: payments and digital advertising. In Klarna’s live markets, total annual consumer retail and travel spend reached $18 trillion in 2023, representing a $450 billion revenue opportunity based on Klarna’s average take rate of 2.7%. On a global basis (excluding China), the broader consumer retail and travel market reached $30 trillion, translating into a $750 billion payments revenue opportunity.

Klarna is also building a presence in digital advertising, a $475 billion global market (excluding China) as of 2023. Klarna discloses its particular interest in commerce media, the fastest-growing segment of digital advertising, projected to expand at 19% CAGR from 2023 through 2027.

The BNPL industry has experienced rapid growth in recent years, driven by evolving consumer preferences and increased adoption of alternative payment methods. GMV of BNPL is expected to increase from $178.6 billion in 2021 to $899 billion by 2028. The global BNPL market was valued at $90.7 billion in 2020 and is projected to reach $4 trillion by 2030, growing at a CAGR of 45.7% from 2021 to 2030.

Competition

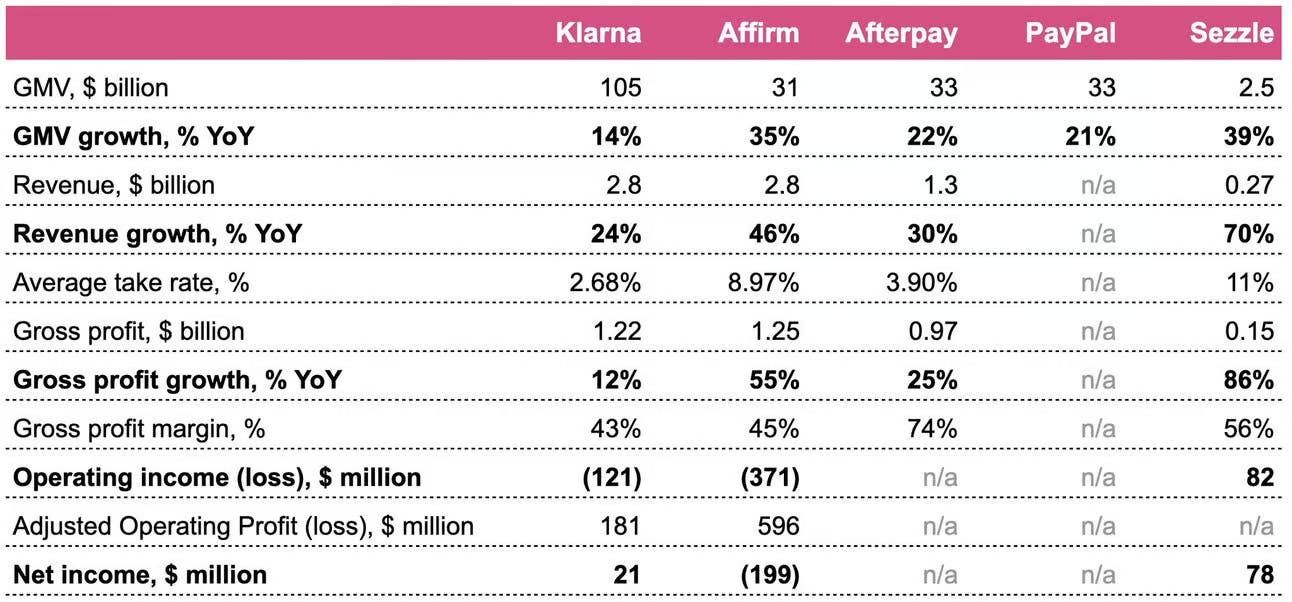

Klarna operates in a competitive landscape spanning payments, lending, advertising, and financial infrastructure. Its core BNPL offering competes directly with fintech lenders, while its broader ecosystem, spanning a shopping app, marketing network, and retail banking tools, positions it against a wider set of players, including credit card issuers, eccommerce platforms, and digital wallets.

Source: Fintech Brainfood

Direct Competitors

Affirm: Founded in 2012 by PayPal co-founder Max Levchin, Affirm offers an alternative to traditional credit cards by allowing customers to make purchases and pay for them in fixed monthly installments. Like Klarna, Affirm integrates with retailers, allowing shoppers to select the Affirm option at checkout and receive instant approval for a loan to cover their purchase. It offers installment plans, a card, a browser extension, and a shopping app. Affirm cut 19% of its workforce in February 2023. In December 2024, Affirm reported 21 million active consumers, $31 billion in GMV, and $2.8 billion in LTM revenue, on par with Klarna’s $2.8 billion in 2024 revenue.

However, Affirm operates with a slightly different business model. Its average take rate was 7.3% in 2024, significantly higher than Klarna’s 2.7%, due to the prevalence of interest-bearing loans. While 72% of Affirm’s loans carry interest, Klarna’s core products are typically 0% APR. Affirm focuses on higher-ticket financing (e.g., Peloton, Eight Sleep), whereas Klarna is better positioned for lower-ticket discretionary spend like fast fashion and beauty. In March 2025, Walmart announced it was leaving its exclusive partnership with Affirm in favor of Klarna, which resulted in an 8% decrease in Affirm’s stock price the following afternoon. As of May 2025, Affirm’s market cap was $16.5 billion.

AfterPay (Block): Based in Australia, AfterPay is another player in the BNPL market. Founded in 2014, AfterPay also allows customers to pay in installments while paying merchants upfront. AfterPay was acquired by Block in January 2022 for $29 billion. The acquisition extended AfterPay’s services to all merchants who use Square’s point-of-sale services, aiding in-person installment-based payments. As of November 2024, Afterpay was offered by over 348K merchants and used by over 24 million active customers, with a GMV of $33 billion. As of May 2025, Block’s market cap was $29.5 billion.

Zip: Founded in Australia in 2013, Zip offers digital financial services and point-of-sale credit. It operates in two main markets: the US and Australia, and New Zealand. Klarna currently operates in 26 countries. Zip offers a BNPL product similar to Klarna, but unlike Klarna, which excludes support for utility or rent bills, Zip can be used to pay the biller and offers repayment flexibility. It also offers banking solutions and a Zip Visa card. In 2024, Zip processed over $10 billion in transactions for 6 million active consumers and integrated with 79K merchants. Its revenue was AUD 868 million in 2024, a 30% increase from 2023. As of May 2025, Zip’s market cap was $1.5 billion.

Adjacent Competitors

PayPal: PayPal was founded in 1998 in Palo Alto, CA. As a pioneer of online payments, its core offering has been the ability to send and manage money online. PayPal offers Pay in 4 and Pay Monthly plans like Affirm and Klarna. Pay Monthly was introduced in June 2022 and gave consumers a more flexible way to pay by breaking down the total purchase cost into monthly payments over 6 to 24 months. This feature integrates seamlessly within the PayPal checkout process, and a decision is made in seconds as to whether or not a Pay Later option can be supported. In May 2023, PayPal said more than 32 million consumers had used its BNPL products and that over 3 million merchants offered the option. As of May 2025, PayPal’s market cap was $66.8 billion.

Credit Cards: Traditional credit card companies offer consumers the ability to make purchases and pay for them over time, similar to BNPL services. However, they usually involve interest charges and potentially other fees, making BNPL services like Klarna's more attractive to some consumers. Despite this, the widespread acceptance and familiarity of credit cards make them a significant competitor in the payment solutions market.

Business Model

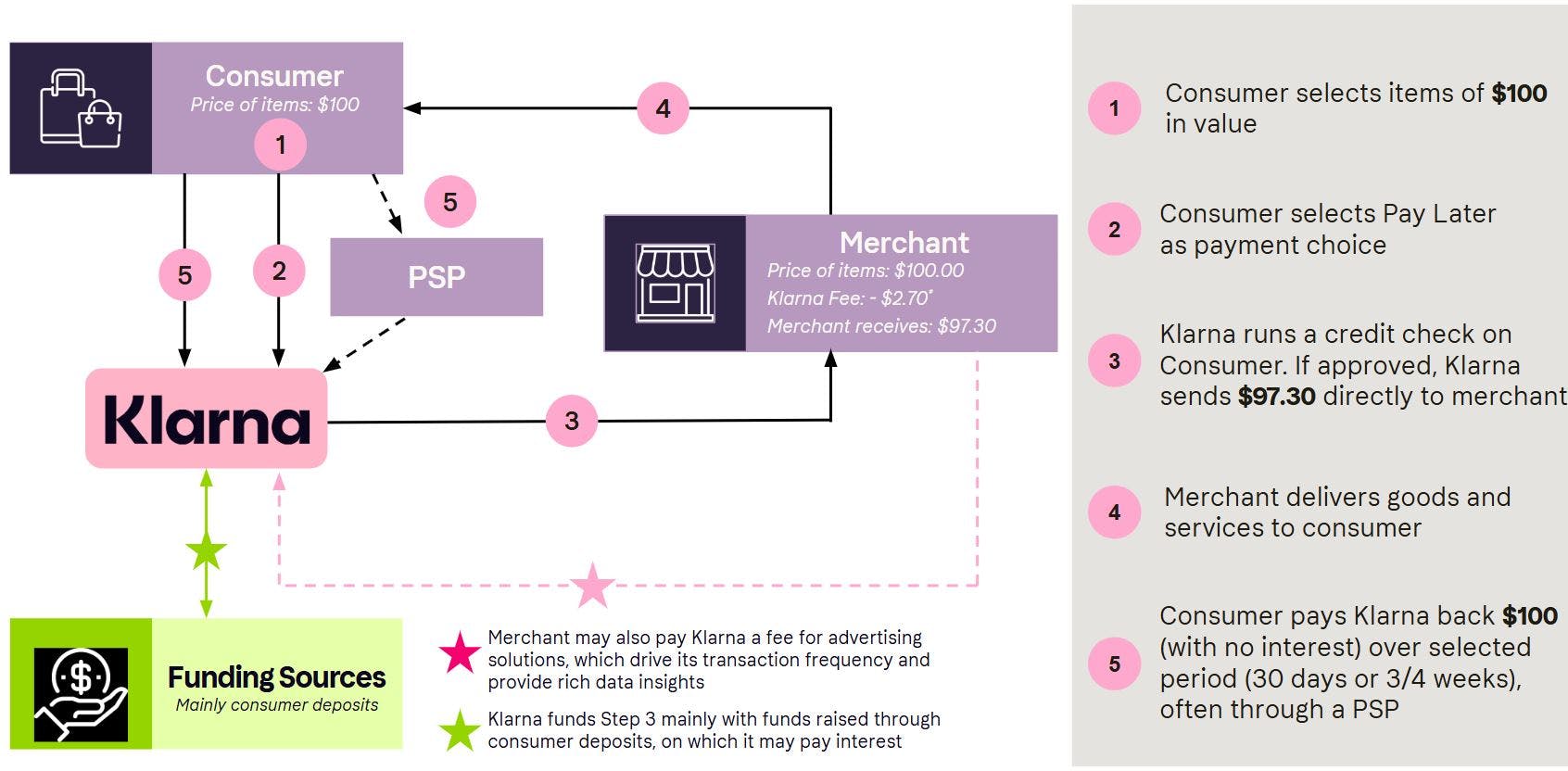

Klarna primarily generates revenue by charging merchants a fee for every transaction facilitated through its platform. In 2024, Klarna’s average merchant take rate was 2.7% across $105 billion in GMV. When a consumer selects $100 of goods and chooses Pay Later, Klarna runs a quick credit check and immediately pays the merchant $97.30, keeping a 2.7% fee. The merchant gets paid upfront with no credit risk, while the consumer repays Klarna in full over 30 days or four interest-free installments. Klarna funds the initial outlay primarily using consumer deposits from its banking operations. In addition to merchant fees, Klarna may generate revenue from advertising solutions that help merchants drive conversion and reach high-intent shoppers.

Source: Klarna via SEC

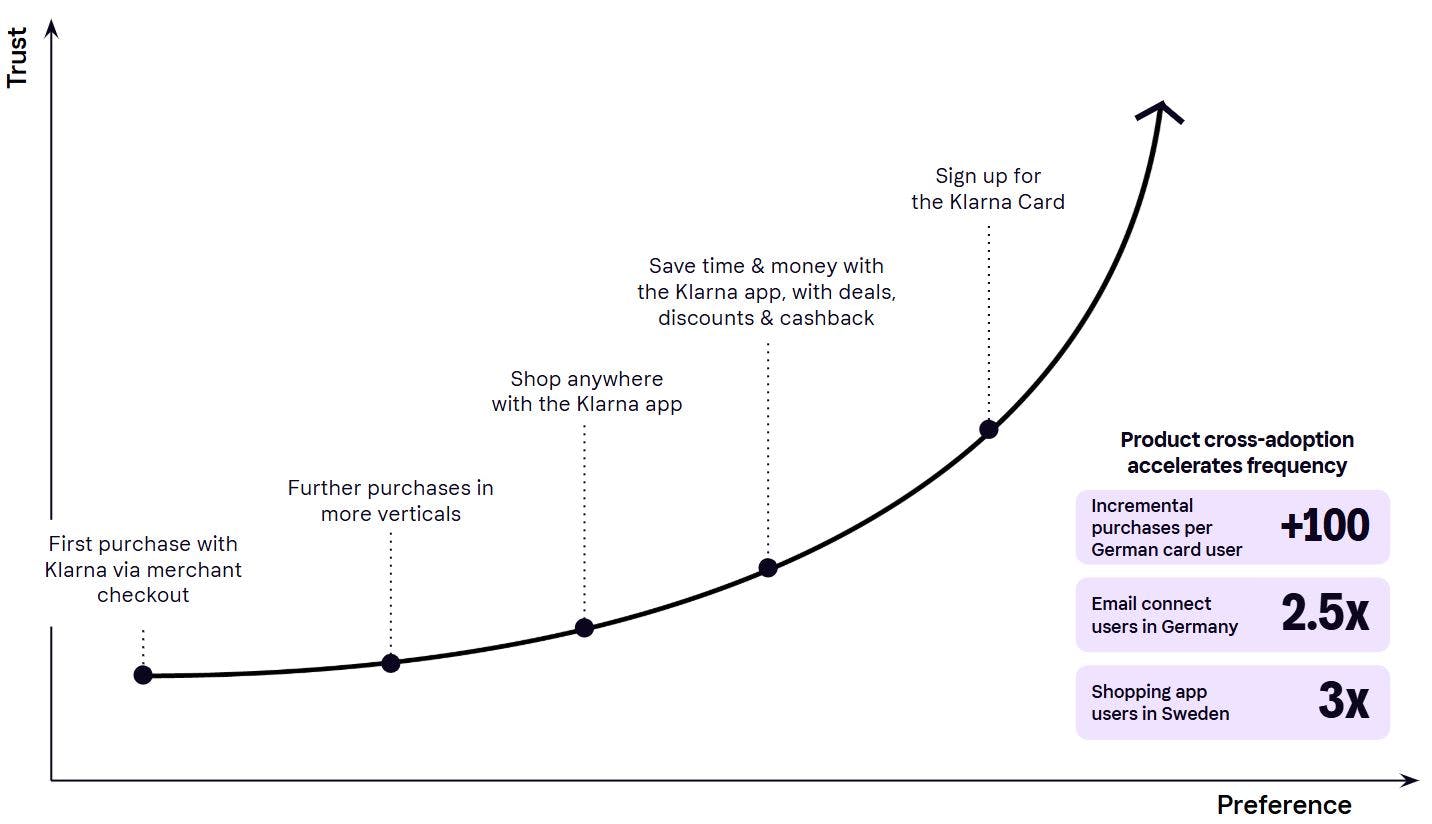

The core of Klarna’s model is a flywheel — consumers benefit from flexible payments and cashback, merchants benefit from higher conversion and order values, and Klarna benefits from growing volumes and increased product cross-adoption. For example, Klarna Card users in Germany made 100 more annual purchases than non-card users in 2024, and Klarna app users in Sweden transacted 3x more frequently than non-app users.

Source: Klarna via SEC

Klarna’s revenue streams fall into three categories:

Merchant revenue (75% of transaction/service revenue in 2024): Klarna earns value-based and fixed fees per transaction, adjusted by merchant vertical and geography.

Consumer service revenue (16% of transaction/service revenue in 2024): Primarily reminder fees for late payments, capped at low amounts to encourage repayment behavior without punitive interest.

Additionally, Klarna earns interest income on long-term financing products, though this represents less than 0.7% of GMV. Most short-term options, like Pay in 4 and Pay in 30 days, remain interest-free. Klarna funds these credit offerings primarily using consumer deposits, particularly in Europe, where it operates as a licensed bank. As of December 2024, Klarna held $9.5 billion in deposits.

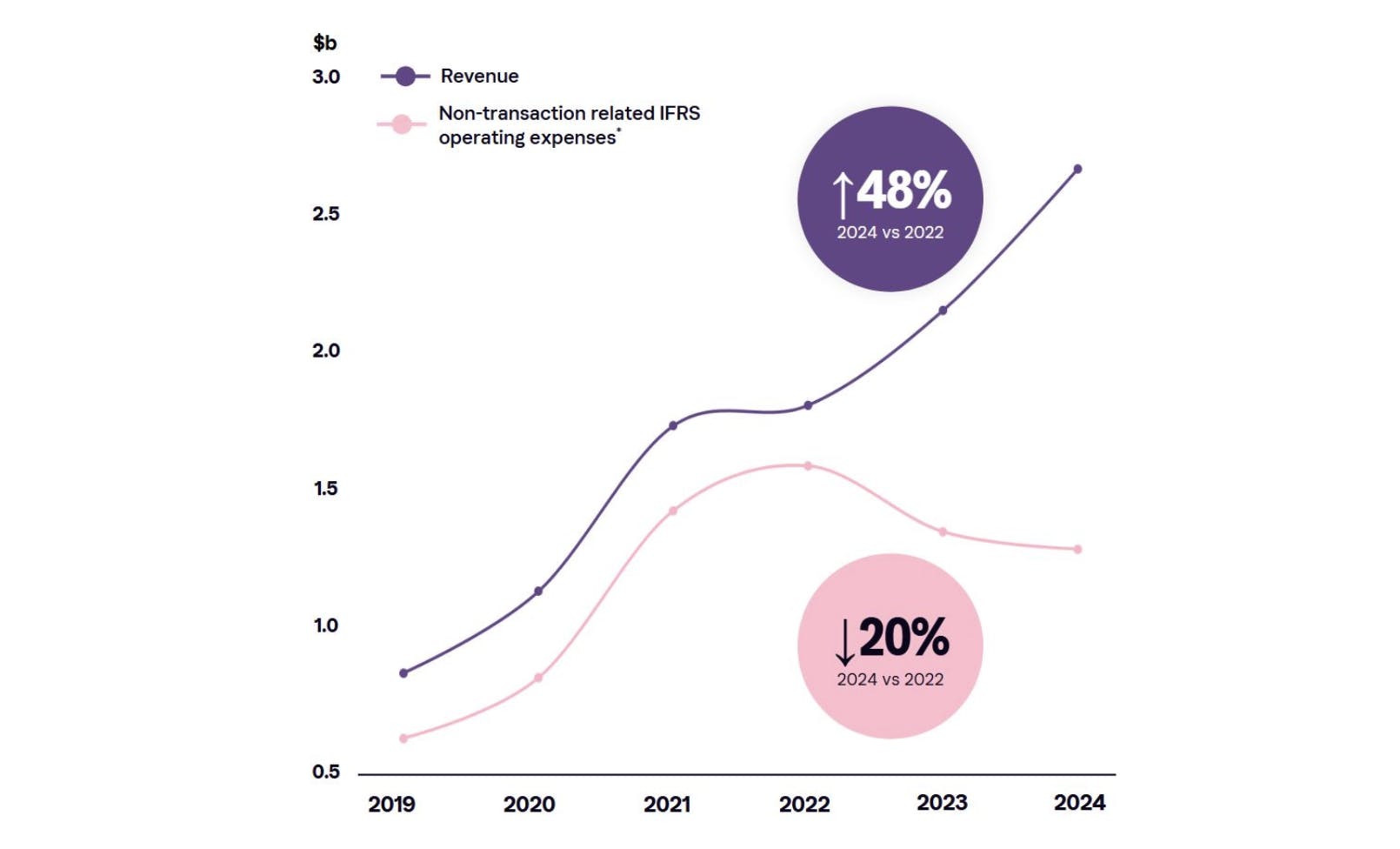

Klarna grew revenue 48% from 2022 to 2024 while reducing non-transactional operating expenses by 20%. Operating leverage was driven by AI efficiencies in customer service, lower credit losses, and reduced marketing spend as user acquisition shifted toward owned channels. CEO Sebastian Siemiatkowski attributed $40 million in improved profitability to AI in 2024.

Traction

As of March 2025, Klarna is the largest BNPL network by GMV globally. In 2024, Klarna’s GMV reached $105 billion, over 3x more than its nearest competitor, Affirm. Klarna ended 2024 with a return to profitability, reporting $2.8 billion in revenue, up 48% from 2022, and achieving $21 million in net income. This marked a turnaround from its losses in 2022, driven by 27% GMV growth and declining operating expenses. Klarna’s adjusted operating profit reached $181 million, compared to an adjusted loss of $726 million just two years prior. Improvements in technology, marketing efficiency, and AI-driven cost optimization helped reduce operating expenses by 20%, enabling stronger leverage even as the business scaled.

Source: Klarna via SEC

In 2019, only 5 of the top 100 ecommerce merchants in the US were partnered with Klarna, compared to 29 in March 2025, alongside 52 in Germany, 50 in the UK, and 64 in Sweden. Klarna partners with global brands like H&M, Sephora, Expedia, and McDonald’s across categories from apparel to travel, everyday payments, and electronics. Klarna’s checkout is also used by marketplaces and platforms like Doordash*, Shopify, Wix, and Booking.com. Swiss sneaker brand On grew Klarna’s share of checkout from 12% in 2020 to 32% in 2024, while GMV increased 5x and Klarna-driven revenue grew 9x in the same period. Klarna’s global NPS was 73 in September 2024, compared to 44 for the general finance industry.

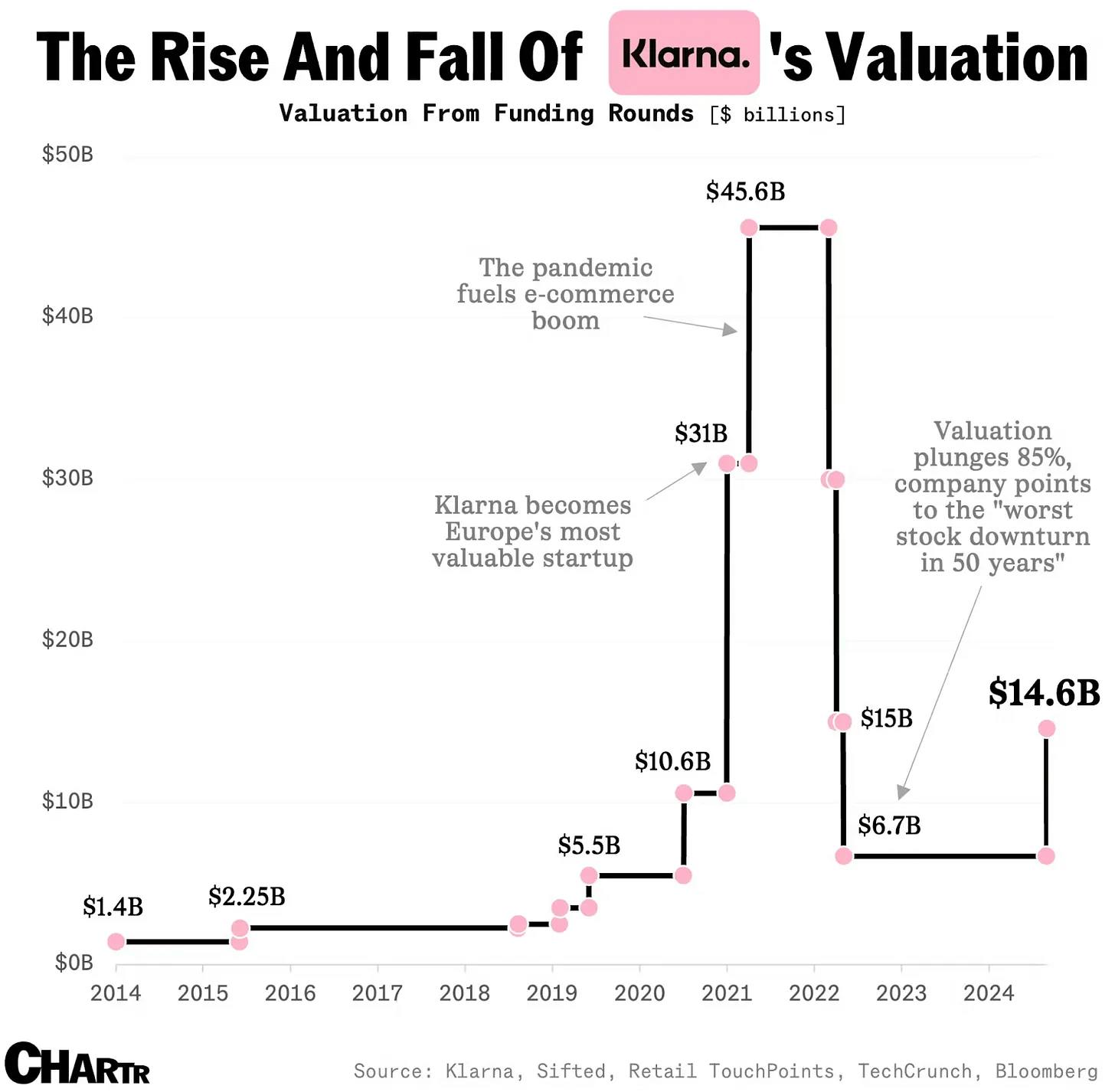

Valuation

Klarna’s most recent funding round came in July 2022, when it raised $800 million at a $6.7 billion post-money valuation. The round included participation from Sequoia, Silver Lake, the Commonwealth Bank of Australia, Mubadala Investment Company, and the Canada Pension Plan Investment Board.

Prior to this, in June 2021, Klarna raised $639 million at a $45.5 billion valuation, led by SoftBank. This deal took place at the height of the zero-interest-rate environment, when growth-stage technology companies commanded high revenue multiples. The $38.8 billion valuation collapse in just over a year marked one of the steepest markdowns among late-stage private tech companies, amongst the broader pullback that followed the ZIRP-fueled rally.

Source: Fintech Blueprint

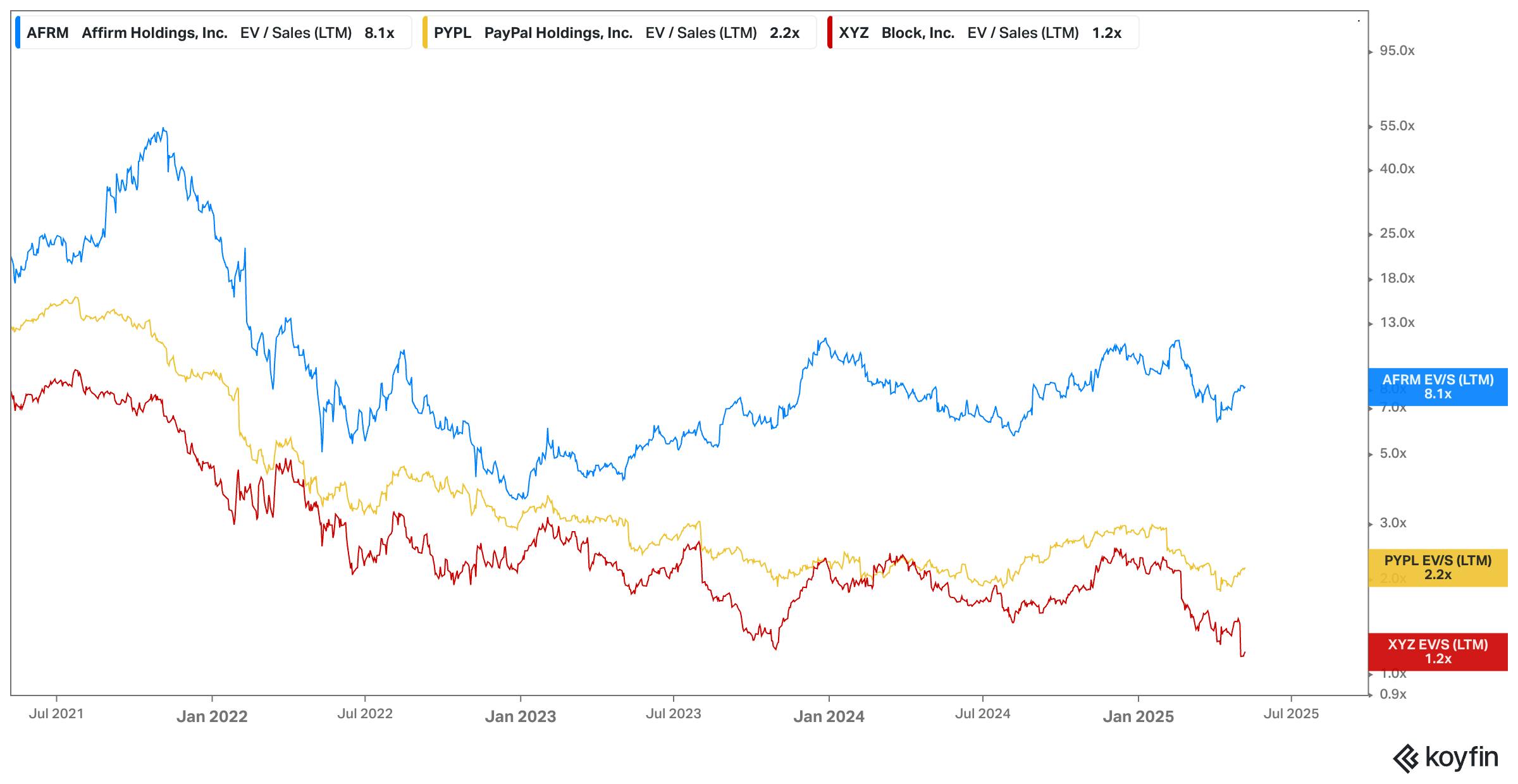

In March 2025, Klarna filed to go public on the NYSE at a $15 billion valuation. It ended 2024 with $2.8 billion in revenue, implying a 5.4x revenue multiple. Public market peers include Affirm, Block, and PayPal.

Source: Koyfin

Based on current EV/Sales multiples, Klarna’s target $15 billion IPO valuation at a 5.4x revenue multiple sits above mature fintech peers like PayPal’s 2.2x and Block’s 1.2x, but below Affirm’s at 8.1x. This premium relative to most incumbents reflects Klarna’s broad consumer network, diversified product suite, and improving profitability. As Klarna moves beyond pure BNPL into banking infrastructure and adtech, public comps may shift, but near-term revenue growth and margin expansion will likely remain the key valuation drivers.

Key Opportunities

Going Public

Klarna filed to go public on the NYSE in March 2025 at a proposed $15 billion valuation but has postponed the IPO in April 2025. The delay comes despite stronger financial performance, including $2.8 billion in 2024 revenue and a return to profitability. Going public would give Klarna access to permanent capital and provide liquidity for current shareholders, while also increasing transparency as it pushes deeper into banking and advertising. A listing could also help Klarna build credibility with large merchants and financial partners. In its prospectus, Klarna noted macroeconomic volatility as a risk factor, writing:

“A downturn in the general economic environment or a slower pace of economic growth, including as a result of changes in international trade policies, multilateral trade agreements or imposition of new tariffs, taxes and other restrictions on global trade, or changes to immigration policies or migration patterns, can lead to decreased consumer spending and adversely affect the financial condition of our merchants.”

Becoming an AI Leader in Consumer Finance

In an interview with Sequoia Capital in July 2024, Siemiatkowski envisioned a future in which a user wakes up in the morning, and their digital financial assistant informs them that they may save money by refinancing their mortgage from Bank A to Bank B — all that remains to be done is the user’s confirmation.

Klarna is positioning itself as one of the first major consumer finance companies to embrace AI at scale, both to personalize customer experiences and to improve internal efficiency. Nearly all Klarna employees now use generative AI in their daily work, and over 85% of engineers use an AI copilot to help write and review code. Klarna has also rolled out company-wide tools like Kiki, its internal knowledge assistant, and automated legal and customer support workflows to reduce costs and boost productivity.

On the consumer side, Klarna has integrated AI into its product discovery and customer service experience. In February 2024, Klarna launched an AI-powered shopping assistant in partnership with OpenAI. The assistant can handle customer service tasks like refunds and multilingual support, but also helps shoppers browse and receive dynamic product recommendations from Klarna’s extensive merchant network. Klarna’s AI-enhanced shopping feed and search tools are designed to increase merchant conversion and drive incremental revenue.

Klarna’s cloud-native architecture enables these initiatives to operate through a unified platform. The company’s machine learning models support real-time underwriting, helping it manage credit risk while still delivering high conversion rates. This combination of proprietary consumer data, integrated product surfaces, and AI-native operations allows Klarna to simultaneously improve its user experience, lower operational costs, and strengthen merchant outcomes.

International Expansion and Bank Licensing

Klarna's expansion into the US and other global markets presents a significant opportunity. With international bank licensing, Klarna can offer its services to a broader customer base and tap into new markets. Klarna has invested heavily in US marketing and brand awareness campaigns to support this growth. This includes collaborations with celebrities and influencers, and traditional and digital media advertising. Additionally, Klarna is committed to maintaining high regulatory compliance standards in all its markets, including the US. The company has a dedicated team to ensure compliance with all relevant laws and regulations.

Key Risks

Path to Profitability

After several years of losses, Klarna returned to profitability in 2024, reporting $21 million in net income and $181 million in adjusted operating profit. The rebound was driven by 27% GMV growth, improved gross margins, and a steep decline in operating expenses, falling from 151% of revenue in 2022 to 104% in 2024. Klarna credits this progress to increased operational efficiency, tighter cost control, and broad deployment of AI across engineering, legal, and customer service workflows. Nevertheless, Klarna is yet to prove that it can operate profitably in the long term.

Klarna’s path to sustained profitability remains sensitive to product mix, merchant verticals, and regional growth dynamics. As its US business expands faster than more mature markets, Klarna expects total transaction margin dollars to increase, but notes that overall transaction margin percentage may decline. Management cautions that short-term fluctuations in these metrics should not be interpreted as a clear signal of future financial performance. Profitability going forward will depend on maintaining credit quality, deepening consumer engagement, and scaling newer revenue streams such as advertising and banking services.

Internal Agility

As Klarna continues to grow and expand into new markets, it will need to maintain its internal agility to respond quickly to changes in the market and customer needs. In September 2022, Klarna joined the round of major tech layoffs with a 10% staff cut. Klarna attributed the layoffs to changing economic climates and different attitudes around scaling. Now, Klarna must continue to scale with fewer employees and successfully engage the remaining workforce.

Klarna has made a bet on AI to streamline operations and reduce headcount, particularly in customer service, where its AI assistant started handling the majority of customer inquiries in February 2024. However, in May 2025, Siemiatkowski acknowledged the company had “gone too far” in its AI ambitions, noting that cost savings had come at the expense of service quality. Due to this, Klarna will resume hiring human agents over the course of 2025 to ensure customers can always speak with a real person.

Even so, Klarna continues to explore where AI can improve efficiency across the business. As AI tools take on more core workflows, Klarna must ensure that remaining employees stay engaged, supported, and motivated. If not managed carefully, continued rollout of AI across teams could lead to attrition, especially among staff who feel their roles are being marginalized. Balancing automation with internal morale will be key to maintaining operational agility as the company grows.

Encroaching Competition

Klarna operates in a crowded space, facing pressure from both legacy incumbents and emerging challengers. Traditional players like PayPal continue to expand their BNPL offerings, while fintechs like Afterpay, Affirm, and Zip compete directly on flexible payment terms. At the same time, credit card issuers remain deeply entrenched, and tech platforms from Uber to Shopify are embedding financial services into their ecosystems. As the lines between payments, banking, and commerce continue to blur, Klarna must differentiate not just on product, but on distribution, trust, and data advantage.

Summary

Klarna is a global payments company and a dominant BNPL player, which has since expanded into banking, marketing, and commerce infrastructure. After years of high growth and international expansion, Klarna returned to profitability in 2024 with $2.8 billion in revenue and over $100 billion in GMV. The US is its largest market by revenue, fueled by products like the Klarna Card and AI-powered shopping tools.

Klarna is positioning itself as an AI-native consumer finance platform, using generative AI to boost customer engagement and internal capabilities. While competition from Affirm, PayPal, and Afterpay remains intense, Klarna’s banking license, proprietary data, and growing app ecosystem provide durable differentiation. The company filed to go public at a $15 billion valuation in March 2025, though the IPO has since been postponed in April 2025 due to economic uncertainty.

*Contrary is an investor in DoorDash through one or more affiliates.