Thesis

The IFC estimates that 40% of micro, small, and medium-sized enterprises in developing countries cannot meet their financing needs, and many of them are not able to access traditional banking services. In the years since the emergence of decentralized finance (DeFi), a range of decentralized financial services have been created to expand financial services to people and businesses that are otherwise unable to access traditional banking.

Of these, most crypto lending protocols only support over-collateralized loans which lend against existing assets, because this allows for easier risk management. However, borrowers with collateral tend to be margin traders or crypto holders who don’t want to sell their positions. Most borrowers seek to borrow money because they don’t have the capital they need. Borrowers who need access to credit the most, i.e. those who don’t already have assets to lend against, are therefore unable to benefit from most DeFi lenders.

Goldfinch is a decentralized credit platform that broadens the pool of potential lenders beyond just banks. It operates as an open marketplace for loans without collateral and employs a decentralized loan underwriting process. Goldfinch’s design is based on two beliefs: (1) in the 2020s decade, low real bond yields will drive investors to demand new investment opportunities and (2) global economic activity over this same period will increasingly move on chain, making every transaction programmable. By providing a way for borrowers to show creditworthiness based on the collective assessment of other participants, Goldfinch seeks to make borrowing more accessible, particularly to individuals and businesses in developing countries.

Founding Story

Goldfinch was founded by Mike Sall and Blake West in 2020. Both are graduates of the Wharton School of Business. West had been a software engineer and the first employee at Hint Health before joining Coinbase, while Sall had been Head of Data Science at Medium and Head of Product Analytics at Coinbase prior to founding Goldfinch.

Goldfinch was founded in July 2020 to make crypto borrowing more accessible to individuals and businesses in developing countries. For borrowers, it strives to make raising capital easier and faster by tapping into a decentralized network of underwriters and a new source of capital. For investors, it purports to offer higher yields that are uncorrelated with the markets. With Ethereum-enabled smart contracts, these loans can be made directly to borrowers and immediately underwritten with no collateral, secured on a public blockchain, and global.

Goldfinch launched in January 2021, following the publication of the Goldfinch Whitepaper 1.0 in July 2020. By the end of January 2021, the protocol had distributed its first $1 million in loans, displaying borrower interest and early investor traction in junior tranche opportunities for higher yields or senior tranche exposure opportunities optimized for ease and diversification.

Product

Goldfinch is a decentralized credit protocol that enables borrowing with off-chain collateral, rather than crypto collateral, to provide a solution to under-collateralization. The protocol's approach to creditworthiness relies on trust through consensus, where borrowers can demonstrate their creditworthiness based on the collective assessment of other participants instead of over-collateralizing their loans with crypto assets.

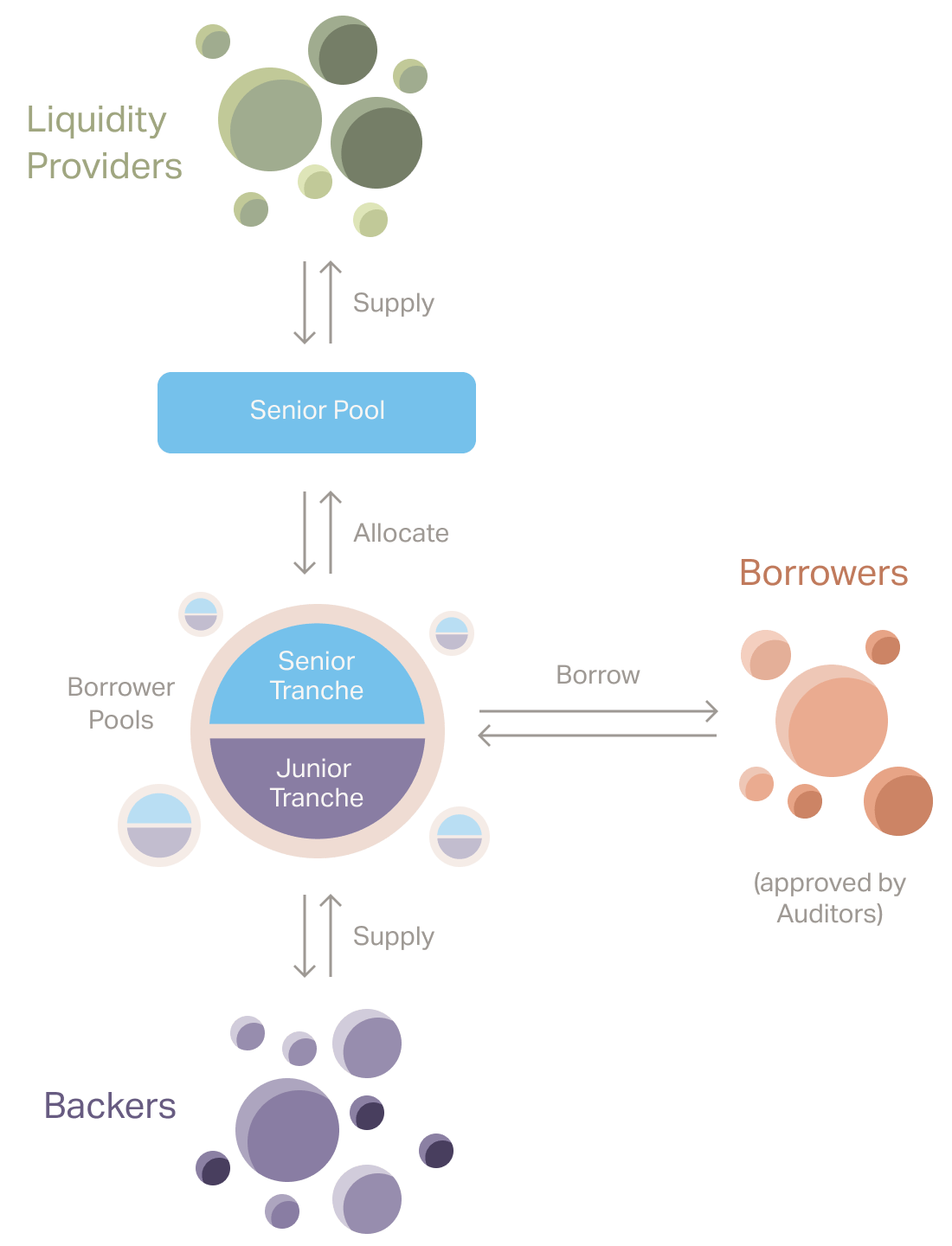

Borrowers propose deal terms for credit lines to the protocol. Investors in the Goldfinch community can then supply the capital to these credit lines, either directly to individual pools as backers or indirectly through the senior pool via liquidity providers. Borrowers then use their credit lines to draw down stablecoins, specifically USDC, from their pool. They exchange the USDC for fiat currency and deploy it on the ground to end-borrowers in their local markets. While the protocol doesn't trust any individual backer or auditor, it does trust the collective actions of many of them. Goldfinch provides liquidity providers with flexible and stable yields while diversifying their staked investments, creating a win-win situation for borrowers and liquidity providers.

There are two native tokens on Goldfinch: GFI (Ethereum token that governs Goldfinch) and FIDU (an ERC20 token representing a Liquidity Providers position in the Senior Pool). The protocol also utilizes stablecoins, currently only USDC (digital stablecoin pegged to the United States dollar), for investment and loans.

GFI is Goldfinch’s core native token. GFI is used for governance voting, auditor staking, auditor vote rewards, community grants, staking on backers, and protocol incentives, and can be deposited into a member vault to earn member rewards in exchange for helping to secure the protocol’s growth.

FIDU is a token that represents a liquidity provider’s deposit to the senior pool. When a liquidity provider supplies to the senior pool, they receive an equivalent amount of FIDU. FIDU can be redeemed for USDC in the Goldfinch decentralized app (dApp) at an exchange rate based on the net asset value of the senior pool minus a 0.5% withdrawal fee. The exchange rate for FIDU increases over time as interest payments are made back to the senior pool.

Source: Goldfinch

Market

Customer

Goldfinch's lending model relies on four core participants: borrowers, backers, liquidity providers, and auditors.

Goldfinch's ideal customer profile (ICP) includes borrowers in emerging markets or regions with high barriers to lending. These customers may face difficulty obtaining loans from traditional financial institutions due to a lack of credit history or collateral. Goldfinch aims to empower these individuals and help them achieve their financial goals by providing access to affordable loans without collateral requirements.

On the liquidity provider end, Goldfinch does not have a specific ICP, as it offers a diverse set of financial products. Anyone who holds DeFi assets and is interested in using their holdings to support positive societal impact can become a liquidity provider. Goldfinch allows liquidity providers to earn stable yields or back individual borrowers and projects based on their preferences.

Backers, meanwhile, are responsible for evaluating borrowers and supplying the first-loss capital to the borrower pools. Backers also achieve better returns when the senior pool leverages them with a senior tranche pool. Auditors are responsible for performing human-level checks on borrowers to confirm they are legitimate in order to secure the protocol against fraud further, and borrowers require the approval of auditors to borrow from borrower pools.

Market Size

The global microlending market was valued at $187 billion in 2021 and is projected to be worth $550 billion by 2030, representing a CAGR of 12.8%. The on-chain lending and borrowing industry is a part of the micro-loaning/micro-financing space and represents a segment in the broader lending space for small businesses and independent projects. This market targets startups, projects, and independent initiatives in emerging markets and areas with high financial barriers.

Competition

Masa Finance - Masa Finance is a hybrid credit protocol and a decentralized credit bureau. It has raised $3.5 million in funding and was founded in 2021. The company aims to leverage blockchain technology to provide a more transparent and fair system for assessing creditworthiness.

RociFi - RociFi is a decentralized zero and under-collateralized lending protocol. It was founded in 2021 and has raised $2.7 million in funding.

TrueFi - TrueFi is another decentralized protocol for uncollateralized on-chain lending. It was founded in 2020 and has raised $12.5 million in funding.

Atlendis - Atlendis is a capital-efficient DeFi lending protocol. It was founded in 2021. The company has raised $4.4 million in funding and wants to provide borrowers with more flexible and accessible lending options.

Porter Finance - Porter Finance enables creditworthy DAOs to obtain fixed-rate financing. Founded in May 2021, the company has raised $5 million. The company's focus on providing financing solutions for DAOs represents a unique niche in the DeFi lending space.

While each of these companies operates in the DeFi lending space, some have value propositions that differentiate them from Goldfinch. For example, Masa Finance's focus on credit scoring, Atlendis' emphasis on capital efficiency, and Porter Finance's focus on DAO financing all represent potential areas of differentiation for these companies. Goldfinch's focus on under-collateralized loans and infrastructure for emerging markets may help to differentiate it from competitors and attract a unique customer base.

Business Model

Goldfinch makes money through its tokenomics design, which involves holding its tokens and charging a small fee on issued loans. The company's major costs are platform costs on Ethereum and engineering costs for project upkeep. In order to maintain the trust-based consensus mechanism and ensure the security of the platform, there are ongoing development and maintenance costs that must be covered.

Additionally, as the platform expands and more borrowers and lenders use the service, the costs associated with managing the increased volume of loans and transactions will likely increase. However, Goldfinch's focus on under-collateralized loans and infrastructure for emerging markets also helps keep costs down by minimizing the risk of default and attracting borrowers with few other lending options.

Traction

Goldfinch currently has $101.3 million in active loans, with a reported default rate of 0%. It has repaid 11% of all loans and has closed 24 borrower pools. In February 2021, Goldfinch said it’s working with PayJoy in Mexico, Aspire in Southeast Asia, and QuickCheck in Nigeria, which has collectively drawn down $1 million from the Goldfinch protocol and deployed it to thousands of their end borrowers. In September 2022, it said it had issued $100 million in loans to help scale businesses in emerging markets.

Valuation

Goldfinch has raised $36.7 million to date, with their most recent round being $25 million, led by a16z crypto. Notable investors in the company include Coinbase Ventures, Varient Fund, and Divergence Ventures.

Key Opportunities

Product Differentiation

Goldfinch's ability to provide under-collateralized loans is a differentiator in the marketplace. Traditional banks and lenders often require collateral or other forms of security to issue loans, making it difficult for many people to access credit. Goldfinch's trust-based consensus mechanism, which involves lenders agreeing to provide capital for loans, allows the company to support otherwise impossible loans. This approach provides critical support to people who may not have access to credit through traditional channels, and it represents a significant opportunity for the company.

The company's focus on emerging markets and individuals that face high financial barriers is another key lever that makes it compelling. Many in these markets lack access to basic financial services like loans, credit cards, and bank accounts. Goldfinch's ability to provide critical financial services to these individuals could transform their lives, providing them with the means to start businesses, pursue education, and improve their overall financial stability.

Mainstream Adoption

If the broader market becomes more comfortable with cryptocurrency and decentralized finance, Goldfinch stands to benefit. By providing an easy interface with DeFi infrastructure on the backend, users will be able to choose among diverse financial products while supporting high-impact projects. Additionally, a shift towards more purposeful investments that drive growth in high-impact projects or inject liquidity into markets that need it the most could benefit Goldfinch. An abstraction layer is built on top of the barebones DeFi architecture could make interacting with DeFi more intuitive. This development could expand the market for DeFi products and make it easier for people to access the services provided by companies like Goldfinch.

Key Risks

Technology Risk

There is a risk associated with smart contracts, which are a critical component of blockchain platforms. Despite their potential advantages, smart contracts are not yet fully tested and proven entirely resistant to hacking attempts by malicious actors. A significant risk is associated with investing in cryptocurrency based on these technologies.

Scalability

Most blockchain platforms are not yet equipped to handle the high volume of transactions required for widespread adoption. This is particularly true for Ethereum, a popular blockchain network many cryptocurrencies use. As more users enter the market, the Ethereum network may struggle to keep up, resulting in delays and increased fees. This scalability issue is an area of concern for investors, as it can impact the speed and cost of transactions.

Summary

Goldfinch is a decentralized credit protocol that allows crypto borrowing without crypto collateral—with loans instead fully collateralized off-chain. Investors have the opportunity to deploy their capital in high-impact diverse investment options. At the same time, borrowers can leverage efficient transaction processes and low financial barriers to utilize their loans effectively. Goldfinch is already leading the charge in this market and has potential to become the market leader. A key question is if Goldfinch can continue to draw high-quality borrowers onto their platform while ensuring that their costs of running on the Ethereum network do not draw down their profit line.