Thesis

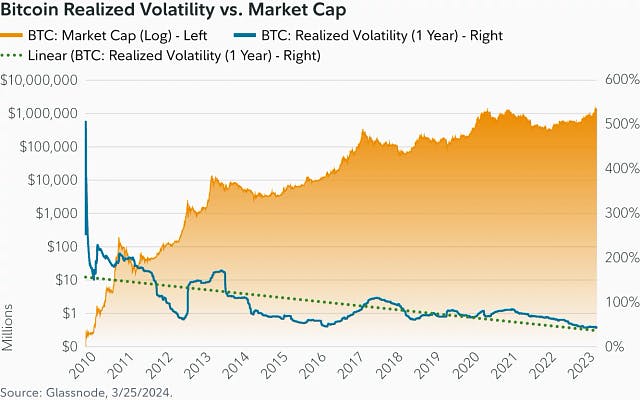

In March 2013, fewer than one million people globally held a cryptocurrency wallet. By the end of 2024, that figure had grown to 659 million, including an estimated 65 million users in the United States alone. Despite ongoing price swings, crypto adoption has consistently expanded. Ethereum network activity reflects this trend, with cumulative addresses rising from 66 million in 2019 to 335 million by October 2025, following a relatively linear trend of growth. Even during volatile market periods, such as Bitcoin’s price movements from $16K in late 2022 to $104K in late 2024 before falling to $75K in early 2025, user growth has remained steady. Bitcoin’s long-term volatility has also declined as its market cap has grown, suggesting that future price swings may become less extreme, reinforcing the trend of continued and broader adoption over time.

As cryptocurrency adoption has expanded, companies have increasingly focused on bridging traditional finance and crypto to make on-chain activity more accessible to users. Centralized exchanges act as key entry points, with friendly user interfaces that allow users to convert fiat into crypto. A growing number of companies are also integrating crypto into familiar financial products. Payment firms like Stripe reintroduced crypto payments in 2024 after a multi-year hiatus, while Square enabled merchants to convert a portion of their daily sales into Bitcoin. Large financial institutions have also embraced blockchain for cross-border transactions; JPMorgan’s Onyx platform has conducted blockchain-based payments and DeFi-based settlements using tokenized assets. Additionally, peer-to-peer payment apps, such as Cash App and PayPal, have incorporated crypto features alongside fiat payments, further blurring the lines between traditional and digital financial systems.

Kraken is a centralized cryptocurrency exchange and trading platform that serves both individual and institutional investors. The company offers advanced trading tools with low fees for high-volume transactions, targeting active cryptocurrency traders. Its product offerings have expanded beyond trading to include staking, decentralized finance (DeFi) services, a layer 2 blockchain, peer-to-peer payments, and stock trading through its main app. These additional services are designed to attract a broader user base and increase engagement within the Kraken ecosystem by providing more ways for users to hold, transact, and invest through the platform. By the end of 2024, Kraken reported $665 billion in annual trading volume, 2.5 million funded accounts, and $42.8 billion in assets held on the platform.

Founding Story

Jesse Powell (Chairman of the Board, former CEO) and Thanh Luu co-founded Kraken in 2011.

Powell began developing an interest in digital currencies in 2001 when he founded a company to help online gamers with account management and in-game currencies. In 2010, Powell’s interest in Bitcoin and blockchain grew. When Mt. Gox collapsed as a result of security breaches and poor operations in 2010, Mark Karpelès brought Powell in to help recover funds from the Mt. Gox hack. Studying the aftermath of Mt. Gox, Powell decided to launch a more secure and well-run exchange. He launched Kraken in July 2011 with the goal of creating an exchange, in his own words, on the “bleeding edge” of offerings supported by blockchain.

Since its founding, Kraken’s leadership team has expanded. Dave Ripley joined Kraken in 2016 as Chief Operating Officer after serving as a principal at Boston Consulting Group and as co-founder and CEO of Glidera, a blockchain company that participated in Techstars and was acquired by Kraken in 2016. In 2020, Kraken hired Marco Santori as Chief Legal Officer. Santori had previously been a partner at Cooley, where he founded and led the fintech practice in 2016. He was brought on to help expand Kraken’s legal capabilities and assist with acquisitions. Santori left in January 2025 to join Pantera Capital as a general partner and was replaced by Ben Gray, who had previous experience at Paxos, Block, and Square.

Powell led the company as CEO until April 2023. Ripley, then COO, became CEO in April 2023. In October 2024, Arjun Sethi joined as Co-CEO. Sethi had served on Kraken’s board since 2021 and was also the co-founder and chairman of Tribe Capital as of July 2025. He has a background in early-stage venture investing, with investments in companies such as xAI, Rippling, Slack, Gusto, Swarm, and Carta.

Product

Kraken's core product is its cryptocurrency trading and subscription trading platform. It also offers services like staking, infrastructure projects, and banking to help customers create additional value using their assets. In October 2024, it branched out into decentralized finance, and in June 2025, it launched its peer-to-peer transactions system.

Cryptocurrency Trading

Source: Kraken

As of October 2025, Kraken’s core business was its cryptocurrency exchange, which supported trading for 531 digital assets and seven fiat currencies. As of October 2025, the platform served more than 15 million clients across more than 190 countries. Users can buy and sell crypto using bank transfers, credit or debit cards, Apple Pay, Google Pay, or PayPal. From May 2025 onwards, international clients were also able to use Kraken to invest in over 11K US stocks and ETFs through its app.

Kraken offers features such as recurring purchases, custom orders, crypto conversions, staking, margin trading, futures trading, OTC services, API trading, and a built-in wallet. Kraken’s trading platform is structured around multiple service tiers that cater to different types of clients, from individual investors to institutional users.

Kraken Plus: Kraken Plus is a paid subscription service that offers zero trading fees on up to $20K in monthly trading volume, up to 4% APR on USDG holdings, and access to exclusive airdrops and other member-only perks. The service costs $4.99/month or $49.99/year in each major currency (USD, GBP, CAD, AUD, and EUR), with pricing based on location and app store. Kraken Plus is designed for frequent traders and investors seeking lower fees and additional rewards.

Kraken Pro: Kraken Pro is Kraken’s advanced trading platform for high-volume and experienced traders, available on both web and mobile. As of October 2025, it supported over 400 digital assets and provided total access to over 300 cryptocurrency markets. As of October 2025, Kraken Pro reported over 9 million verified users and over $267 billion in annual trading volume. Users can trade spot, margin, and derivatives products, including fixed-maturity and perpetual futures. Fees are charged per trade and vary based on trading volume over the past 30 days, with discounts applied automatically.

In August 2025, Kraken announced the acquisition of Capitalise.ai, an Israel-based company founded in 2015 that developed a natural-language, no-code platform for designing, testing, and automating trading strategies across equities, crypto, FX, futures, and options. The integration of Capitalise.ai’s technology into Kraken Pro was presented as allowing users to create and execute complex trading strategies using everyday language, eliminating the need for coding or advanced technical skills.

In September 2025, Kraken acquired Breakout, a proprietary trading platform founded in 2023 that funds traders based on verified performance. Breakout’s evaluation model around testing risk discipline, drawdown management, and strategy consistency was integrated into Kraken Pro, enabling qualified users to access up to $200K in notional capital and retain up to 90% of profits. According to Sethi, the acquisition underscores the company’s focus on merit-based capital allocation.

Kraken Prime: Kraken Prime provides institutional clients with integrated trading, financing, and custody services for digital assets. Clients can borrow against custodied assets for leverage or shorting, access financing solutions, and trade across 20+ liquidity venues with smart order routing and advanced analytics. Assets pledged as collateral can continue to earn yield. Custody services are fully segregated, regulated through Kraken Financial, and accessible directly from the trading platform.

Kraken Wallet

Source: Kraken

In April 2024, Kraken launched its self-custodial wallet, Kraken Wallet. The wallet is available to all users, regardless of whether they use Kraken’s exchange. It supports custody for both tokens and NFTs, with multichain compatibility across Bitcoin, Ethereum, Solana, Optimism, Base, Arbitrum, Polygon, and Dogecoin. As of October 2025, Kraken Wallet supported more than 2K digital assets.

Kraken Desktop

In October 2024, Kraken launched Kraken Desktop, a trading application built for active crypto traders. The platform provides full access to Kraken’s spot and futures markets through a customizable desktop interface. Inspired by Kraken’s legacy product Cryptowatch, Kraken Desktop introduces proprietary charting and technical analysis tools, including ladder trading and advanced order placement features.

It is built on a Rust-native tech stack, offering low-latency performance, high responsiveness, and efficient resource usage. The application supports multi-window layouts and is available on Windows, macOS, Linux, and Raspberry Pi, serving as a companion to Kraken’s existing web and mobile platforms.

Staking

Staking is a process in which cryptocurrency holders lock up their assets to help validate transactions on certain blockchains that use a system called Proof of Stake. In return, participants earn rewards, typically paid in the same cryptocurrency, making staking a way to both support network security and generate income.

Kraken discontinued its original US staking service in February 2023 after an SEC enforcement action, which alleged that Kraken had not properly registered its staking-as-a-service platform as a securities offering. At the time, the platform served more than 135K US users, with over $2.7 billion in assets staked as of April 2022. Kraken paid $30 million in penalties as part of the settlement.

In January 2025, Kraken launched a new staking offering for clients in 37 US states and two territories. Through Kraken Pro, eligible users can stake supported tokens using a bonded staking model, which requires locking assets for a set period. Kraken delegates these assets to validators, and rewards earned by validators are distributed back to users, net of fees. As of January 2025, Kraken planned to expand access as regulations allow. As of July 2025, Kraken offered staking services in all US states except for California, Maryland, New Jersey, and Wisconsin.

Kraken Financial

Kraken was the first US cryptocurrency exchange to obtain a Special Purpose Depository Institution (SPDI) charter, issued by the Wyoming Division of Banking. This charter allows Kraken Financial to operate as a state-regulated bank, offering direct access to banking infrastructure and reducing reliance on third-party banks for payment processing. Although the SPDI designation enables Kraken to hold both digital and fiat assets and develop integrated financial products, it does not make Kraken an FDIC-insured institution.

Kraken Financial maintains full-reserve backing for client funds, meaning client cash is not lent out. The institution operates under regulatory oversight and adheres to strict standards for security, data protection, and custodial practices.

Kraken also provides qualified digital asset custody services designed for institutional and high-net-worth clients. Assets are stored using secure infrastructure, including multi-party computation (MPC) and hardware security modules (HSM), and are fully segregated with on-chain transparency and auditability. Kraken has received SOC 2 Type 1 and Type 2 certifications for its custody operations.

The custody platform integrates directly with Kraken Prime, Kraken’s institutional trade offering, allowing institutional clients to trade and finance assets without leaving custody, minimizing transfer delays and counterparty risk. Additional features include customizable access controls, secure vault configurations, and 24/7 access to Kraken’s OTC and exchange liquidity.

Ink

In October 2024, Kraken launched Ink, a Layer 2 (L2) blockchain built using Optimism’s OP Stack and designed to integrate into the Superchain, a network of interoperable L2s sharing Ethereum’s security and governance standards. Ink is Kraken’s first proprietary blockchain and represents a strategic effort to bridge the gap between centralized exchanges and the decentralized finance (DeFi) ecosystem.

Ink was designed to be a user-friendly gateway to DeFi, particularly for those unfamiliar with on-chain environments. Ink allows users to move between custodial and non-custodial systems with less friction. From a technical standpoint, Ink inherits Ethereum's security guarantees while benefiting from Optimism's scalability. The blockchain supported one-second block times at launch, with the aim to reduce latency further, and utilized Kraken’s established compliance and security practices to address user concerns around DeFi risk. As of October 2025, Ink had 66 dApps on its mainnet.

Ink also serves as an institutional and developer platform. Developers are provided with technical documentation, support, and community resources. The chain allows direct integration with Kraken’s custody and liquidity products with direct access to capital, execution, and settlement for on-chain applications. Kraken operates the Ink sequencer, giving it control over transaction ordering and enabling a potential long-term revenue stream similar to Coinbase’s Base chain.

In June 2025, it was reported that activity on the Ink platform rose sharply with Ink’s announcement of its INK token with a fixed supply of 1 billion. Daily transactions surpassed 500K and active contracts nearly doubled since May 2025 to a peak of 6K in June 2025.

In July 2025, Kraken announced plans to integrate the $INK token and Ink Layer 2 protocol into its core products, aiming to create unified onchain and offchain infrastructure for trading and payments. The $INK token, issued by a subsidiary of the independent Ink Foundation, will serve as the native asset of the Ink Layer 2 ecosystem and will be distributed through a future airdrop to eligible Kraken users via the Kraken Drops program. Kraken co-CEO Arjun Sethi said the initiative will enable high-throughput, low-latency, EVM-compatible onchain systems across the company’s products, while the Ink Foundation described the integration as a step toward merging centralized and decentralized finance into a single, accessible capital market.

In October 2025, Kraken announced that it would support USDC deposits and withdrawals on the Ink Layer 2 network. USDC, a dollar-backed stablecoin issued by Circle, can now be transferred to Kraken accounts using Ink as the selected deposit network, with users advised to ensure deposits are made only through supported networks.

Krak

Source: Kraken

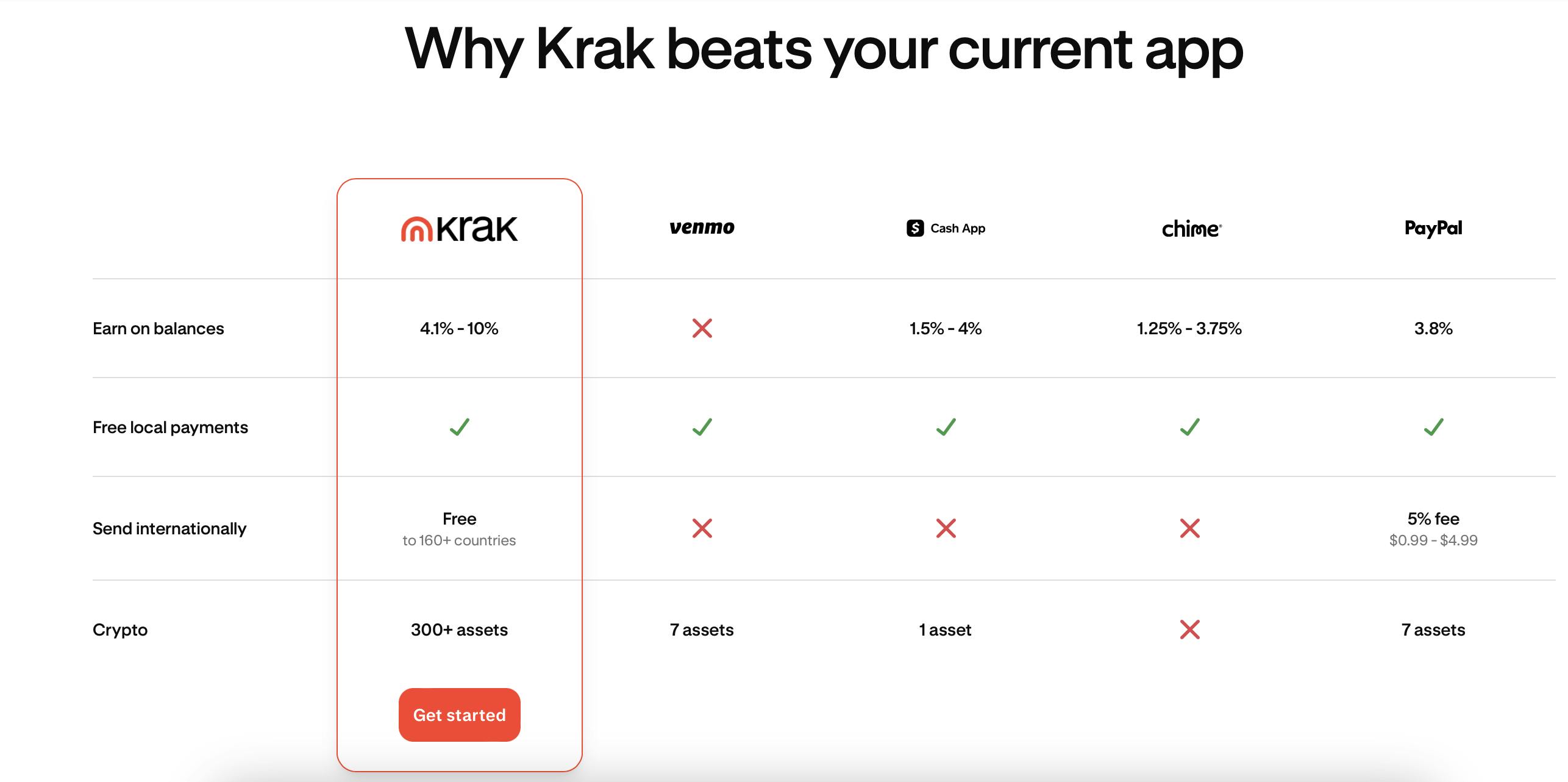

In June 2025, Kraken launched Krak, a peer-to-peer payments app designed for sending and receiving both fiat currencies and cryptocurrencies globally. As of June 2025, the app supported over 300 assets, including stablecoins, and allowed users to send funds to other Krak users across 160 countries. Users can make payments using “Kraktags,” which function as personalized payment IDs, removing the need for bank account numbers or wallet addresses. Krak is built on public blockchain infrastructure, aiming to offer faster settlement and low-cost cross-border transactions.

At launch, Krak offered spend-and-earn accounts, allowing eligible users to earn up to 4.1% on USDG stablecoin balances and up to 10% on other digital assets, with no lockups or minimums. The app does not lend against customer assets and uses fully backed stablecoins. As of July 2025, the app had geographic restrictions: UK clients could not make fiat transfers, and certain states had limits on crypto and cash transfers.

Future features include physical and virtual debit cards for in-store and online payments, as well as collateral-based lending and credit services. Krak is part of Kraken’s broader strategy to expand beyond cryptocurrency trading into consumer financial services and acquire users who don’t already trade cryptocurrency.

Market

Customer

Kraken initially focused on individual crypto traders and investors seeking low fees, strong security, and advanced trading tools. Over time, the company expanded its focus to institutional clients. Kraken later began serving a range of institutional customers, including trading firms, investment funds, banks, brokers, asset managers, private clients, and investment advisors, offering services such as institutional trading, banking, and custody solutions. As of October 2025, Kraken served customers internationally and across most US states, though services remained restricted in New York and Maine.

Kraken has further broadened its target audience. With the launch of Ink in October 2024, Kraken is expanding its focus to developers and crypto users seeking decentralized applications. Through Krak, its peer-to-peer payments app launched in June 2025, Kraken began targeting retail users who may not yet trade crypto, positioning the product as a way to grow its customer base. CEO Arjun Sethi has described Krak as a strategy to attract new users by offering free services and monetizing through other parts of the Kraken ecosystem.

Market Size

Cryptocurrency Exchange Market: The global cryptocurrency market size was estimated at $5.7 billion in 2024 and was projected to reach $11.7 billion by 2030, growing at a CAGR of 13.1% from 2025 to 2030. The increasing adoption of distributed ledger technology is anticipated to propel the cryptocurrency industry's growth during the forecast period.

The market size of centralized cryptocurrency exchanges is primarily determined by transaction volume, calculated as the number of trades multiplied by the asset price. Revenue is typically derived from fees charged on these transactions. For example, Coinbase reported $1.2 trillion in trading volume in 2024 and $467 billion in 2023, generating $4.0 billion and $1.5 billion in transaction revenue, respectively. This implies an average transaction fee of 0.32%-0.33%. In 2024, the ten largest centralized perpetual exchanges collectively recorded around $58.5 trillion in trading volume, representing an estimated $190.1 billion in potential global revenue based on comparable fee structures.

Transactions: As of October 2024, the global peer-to-peer (P2P) payments market was valued at $3.0 trillion in 2023 and was projected to reach $13.5 trillion by 2032, reflecting a compound annual growth rate (CAGR) of 17.8%. This growth is driven by increasing consumer adoption and advances in payment technologies.

Competition

Competitive Landscape

Kraken has both expanded its crypto offerings and entered the traditional finance market. It has historically competed with large, incumbent centralized exchanges that provide a range of services, including trading, monitoring, and custody.

It has further expanded its presence in the cryptocurrency market by launching Ink, a Layer 2 blockchain aimed at competing with other L2 networks for developer talent and crypto users interested in DeFi, helping to drive further engagement within the Kraken ecosystem. In addition, it expanded into traditional finance in 2025 ahead of its plans to go public. More specifically, it is directly competing with PayPal, Venmo, and Cash App through its transaction service, Krak, launched in June 2025, which allows users to send both cryptocurrency and fiat currency with no transaction fees.

Centralized Exchanges

Binance: Binance, founded in 2017, was the largest cryptocurrency exchange by trading volume globally as of July 2025, handling over 38% of global spot market volume between October 2024 and April 2025. As of October 2025, the platform offered 590 tokens and supported 89 fiat currencies, compared to Kraken’s 612 tokens and six fiat currencies. In March 2025, Binance raised $2 billion from Abu Dhabi’s state-owned investment firm, MGX.

Binance offers spot trading, derivatives, lending, custody, and research tools for both retail and institutional clients. Its institutional services include custody and advanced trading tools, similar to Kraken Prime. In addition to these services, Binance offers community-driven features, such as tools for discovering new token launches, completing quests for airdrop rewards, mining, and engaging with NFTs. As of May 2025, Binance had over 275 million registered users, significantly more than Kraken’s 2.5 million funded accounts at the end of 2024.

Like Kraken, Binance operates a Layer 2 scaling solution called opBNB. Launched in testnet in June 2023, opBNB uses the Optimism OP Stack and optimistic rollup technology, which enables low transaction fees, around $0.005, and high throughput of up to 4K transactions per second, focusing primarily on gaming, DeFi, and high-frequency trading applications.

Binance also offers a peer-to-peer (P2P) crypto trading platform, launched in October 2019, that enables users to buy and sell cryptocurrencies directly with each other. Unlike Kraken’s Krak app, as of October 2025, Binance P2P did not support fiat-to-fiat money transfers between users. The platform supports over 100 fiat currencies and 800 payment methods, with an escrow system to secure transactions.

Coinbase: Coinbase is a US-based cryptocurrency exchange founded in 2012. It went public in April 2021, reaching a market capitalization of over $100 billion on its first day of trading, and had a market cap of $86.4 billion as of October 2025. As of October 2025, Coinbase was the third-largest crypto exchange by trading volume, behind Binance and Bybit. In 2023, it reported 7 million monthly trading users and $3.1 billion in annual revenue.

Compared to Kraken, Coinbase supported fewer tokens (336 versus Kraken’s 612) but more fiat currencies (64 versus Kraken’s six) as of October 2025. Coinbase offers a range of products for both institutional and retail clients. Institutional services include brokerage, custody, and payment solutions. Individual users have access to spot and derivatives trading, custodial and non-custodial wallets, a crypto rewards debit card, and tax services. Coinbase also provides a membership program with lower fees and advanced trading tools, supporting over 550 spot pairs.

In addition to its exchange services, Coinbase operates Base, a Layer 2 blockchain built on the Ethereum network. Base is designed to provide lower transaction costs and a developer-friendly environment for building decentralized applications. Since its launch, Base has become one of the most active Layer 2 networks. Coinbase has also invested in peer-to-peer payments. In April 2025, Coinbase Ventures invested $2 million in P2P.me, a platform designed to facilitate direct digital payments between users. This investment expands Coinbase’s presence in the payments space, although it does not operate its own P2P app like Kraken’s Krak.

Crypto.com: Founded in 2016, Crypto.com is a payment and cryptocurrency exchange platform based in Singapore. As of January 2025, Crypto.com’s exchange was the 11th largest by trading volume. Crypto.com has raised an undisclosed amount of funding through a seed round led by Bit.co in January 2018. Since 2019, through its venture arm, it has made 26 seed and Series A stage investments to help grow its Web3 ecosystem.

Crypto.com offers products for individuals and institutions. For institutions, it offers OTC trading, payment services, and an affiliate program. For individuals, it offers services both related and unrelated to crypto. Crypto.com’s crypto solutions include trading, a crypto debit card, derivatives trading, and DeFi access. Crypto.com’s unrelated services include stock trading and regulated sports trading.

L2 Blockchains

Base: Launched in August 2023 by Coinbase, Base is a Layer 2 blockchain built on the Optimism OP Stack. It is fully compatible with the Ethereum Virtual Machine (EVM) and is integrated with Coinbase products. The network is designed to lower transaction costs and improve scalability for decentralized applications.

Since launch, Base has seen high levels of network activity. As of October 2024, it processed 8.8 million daily transactions, more than competing networks such as Arbitrum and Optimism, and recorded 9.7 million active wallet addresses as of May 2025. In October 2024, weekly transaction volume reached 65.9 million, nearly seven times higher than Ethereum during the same period.

As of July 2025, Base supported 409 decentralized applications, including Uniswap, Aave, and Sushiswap. Its total value locked (TVL) reached $4.7 billion in 2024, with cumulative transaction volume across Base-based protocols exceeding $360 billion. Engagement and increased activity have been driven in part by the growth of AI-focused projects such as Virtuals Protocol, which enables the deployment and monetization of AI agents in gaming, media, and social platforms.

Arbitrum: Developed by Offchain Labs, Arbitrum is a Layer 2 Ethereum scaling solution launched on the mainnet in August 2021. Offchain Labs, founded in 2018, had raised over $120 million in funding as of October 2025, including a $120 million Series B round in 2021. As of October 2025, Arbitrum’s ecosystem included several products: Arbitrum One (a general-purpose optimistic rollup), Arbitrum Nova (optimized for gaming and social applications), Arbitrum Nitro (the current tech stack for increased throughput and lower fees), Arbitrum Orbit (for launching custom chains), and Arbitrum Stylus (a tool for writing contracts in languages like Rust, currently in testing).

In 2023, Arbitrum launched the ARB token and shifted governance from Offchain Labs to the Arbitrum DAO. The DAO is a decentralized organization governed by community members through smart contracts on the blockchain. In April 2024, it had 1.4 million monthly active addresses, trailing Base, but still maintained a lead in 30-day active usage. As of October 2025, Arbitrum supported over 400 decentralized applications and was the second-largest Layer 2 network by total value locked, behind Base. The network has also experienced adoption from well-known DeFi protocols such as Uniswap, Aave, and Curve.

Peer-to-Peer Payments

Source: Kraken

PayPal: Founded in 1998, PayPal is a publicly traded financial technology company that offers digital payment and commerce solutions. As of October 2025, it had a market cap of $64.9 billion and was the most widely used online payment processor in the US, used by 40% of US adults for purchases as of December 2024. The company reported 434 million active accounts, $1.7 trillion in total payment volume (TPV), and 26 billion transactions in 2024, with 90.8% of revenue generated from transaction-based activity.

PayPal offers a broad suite of services, including peer-to-peer transfers, merchant payments, savings accounts (3.8% APY), buy-now-pay-later options, credit cards, and a cashback Mastercard. It supports crypto trading and transfers for assets including Bitcoin, Ethereum, Litecoin, and its own stablecoin, PayPal USD (PYUSD), launched in 2023. In 2024, PayPal introduced AI-powered vendor personalization tools and agent-based features for commerce automation. The company has expanded its ecosystem through acquisitions, including Venmo, Braintree, Honey, Xoom, and iZettle, supporting its global reach and product diversification. From 2018 to 2024, PayPal's TPV grew by 165% (19.5% CAGR), with the average transaction reaching $63.8 in 2024.

Venmo: Founded in 2009, Venmo is a US-based peer-to-peer payment platform that enables users to send money, split bills, and make purchases. The company raised $100K in debt financing in 2009, a $1.2 million seed round in 2010, and a Series A of undisclosed size in 2011. It was acquired by Braintree in 2012 for $26.2 million, and subsequently became part of PayPal through its $800 million acquisition of Braintree in 2013.

Venmo supports both peer-to-peer and customer-to-business transactions, and was accepted by more than 2 million US merchants as of July 2025. Users can spend their balance directly via a Venmo debit card, which offers up to 15% cashback at participating brands, and the platform also supports direct deposit. Venmo has also expanded its offerings to include a credit card, teen debit card, and crypto transfers between Venmo accounts, PayPal, and external wallets.

As of December 2024, 19% of US adults reported using Venmo for purchases, and the platform has served over 60 million users since its launch. As of October 2025, Venmo was limited to domestic use and did not support international transfers. As of December 2024, the platform did not charge fees for standard transactions between individuals, but it monetizes through interchange fees, credit card transaction fees (3%), check cashing, crypto services, affiliate commissions from cashback offers, and Pay With Venmo merchant services.

Cash App: Launched in 2013 by Block (formerly Square), Cash App is a peer-to-peer payment platform and nonbank financial services provider. The platform allows users to send and receive money instantly, access direct deposit, and manage funds without monthly fees or minimum balance requirements. Users can also order a customizable debit card used for purchases and ATM withdrawals, including cashback offers.

Cash App has expanded into adjacent financial services, including commission-free stock trading, Bitcoin trading, savings accounts with up to 4% interest, teen debit cards, and free tax filing. It also supports customer-to-business payments and integrates with Afterpay for interest-free installment plans. As of January 2025, the platform had over 56 million accounts and generated approximately $4 billion in gross profit for Block in 2023, making it one of the company’s largest business units.

In 2024, the Consumer Financial Protection Bureau (CFPB) ordered Block to provide up to $120 million in redress to CashApp users for issues related to unauthorized transfers, account lockouts, and delayed investigations, indicating that the platform may suffer from security-related challenges.

Business Model

Trading Platform

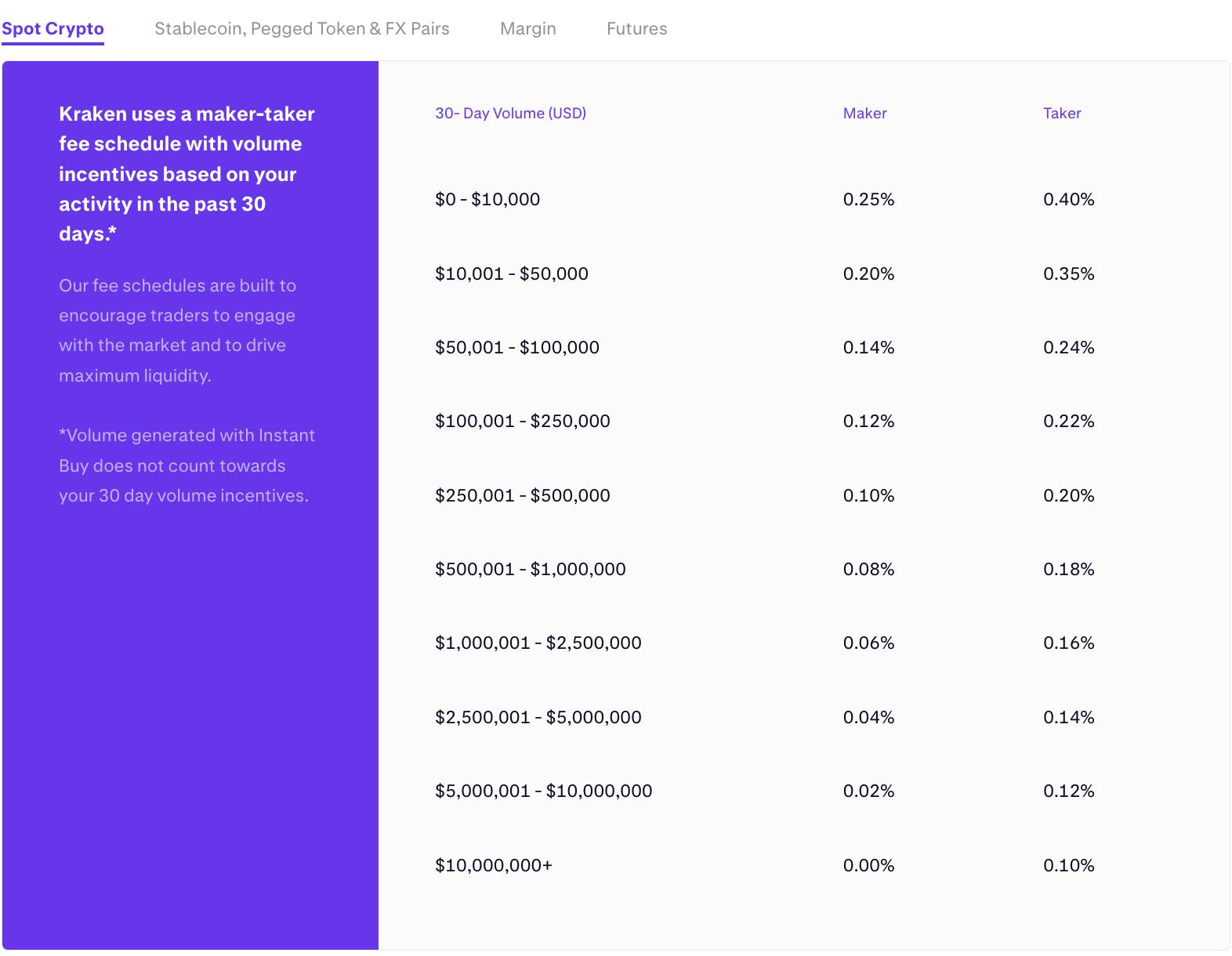

Source: Kraken

Kraken’s trading revenue comes from transaction fees, which vary based on volume incentives over a 30-day period. Its fee schedules vary across spot trading vs. margin or futures trading and by volume. As of October 2025, Kraken’s spot trading fees ranged from 0% on the low end to 0.4% on the high end.

Financial Services

Kraken has not disclosed its business model for institutional trading, custody, or financial products, but competitor data provides a useful reference. For comparison, Coinbase’s institutional platform, Coinbase Prime, reportedly charges a $10K setup fee and a 0.5% annual custody fee on assets under custody, with a minimum balance of $1 million as of May 2025. Other institutional custody providers, such as Fireblocks, appear to charge annual fees based on outbound transfer volume.

Layer-2 Blockchain

Layer 2 (L2) blockchains typically earn revenue by selling access to block space. Ethereum-based L2 blockchains bundle user transactions and post them to Ethereum in batches, charging users fees that cover both execution on the L2 and data publishing on Ethereum. These fees help cover operating costs, compensate validators, and prevent spam.

Ink, Kraken’s L2 network built on the Optimism OP Stack, follows a sequencer-based model. Kraken operates as Ink’s sole sequencer, arranging transactions and earning fees for this service. Coinbase, which uses a similar model for its Base network, generated $53 million in sequencer revenue in Q2 2024. Kraken intends to generate revenue through similar mechanisms as activity on Ink grows.

Transactions

Krak’s competitors, Venmo and Cash App, generate revenue by charging fees on transactions and related services. Venmo earns money primarily through a 1.9% + $0.10 fee charged to businesses when customers make payments, and a 3% fee on credit card transactions. Cash App monetizes through instant transfer fees, credit card payments, subscription-based financial products, and Bitcoin sales by applying a service fee and capturing the spread between buy and sell prices.

Kraken’s payments app, Krak, follows a different approach. As of October 2025, Krak did not charge transaction fees or lend against customer assets. Instead, Kraken positions the product as a way to acquire new users, particularly those not yet engaged in crypto trading. Co-CEO Arjun Sethi compared the model to YouTube’s early strategy of offering free access while monetizing elsewhere in the ecosystem. While this model supports growth, Kraken has not necessarily ruled out introducing transaction fees or other monetization strategies in the future.

Traction

Growth

Kraken reported approximately 4 million users in February 2019, growing to around 6 million by June 2021 and 9 million by May 2022. According to Kraken’s website as of October 2025, its user base had grown to over 13 million people.

Much of this growth took place during the COVID-19 pandemic and the 2021 crypto bull market. Kraken recorded $56 billion in trading volume in January 2021 alone, exceeding its entire 2019 volume. However, the industry as a whole encountered significant challenges when the bull market ended in 2022. In November 2022, Kraken laid off 1.1K people, or 30% of its workforce, due to market conditions. At this time, Kraken also shut down its operations in Japan and Abu Dhabi.

In October 2023, the company acquired Coin Meester B.V. (BCM), a Dutch crypto broker, to support regulated operations in the Netherlands, France, and Poland. By May 2024, Kraken’s 24-hour spot trading volume had reached approximately $600 billion. In October 2024, the company laid off 400 employees, or roughly 15% of its workforce, following the appointment of board member Sethi as co-CEO.

Kraken reported $1.5 billion in revenue for the 2024 fiscal year, representing a 128% year-over-year increase, along with $424 million in adjusted EBITDA. The company disclosed in April 2025 that it had laid off additional staff across multiple departments over the preceding months as part of ongoing efforts to streamline operations ahead of a potential public offering. In May 2025, Kraken reported $472 million in gross revenue and $187 million in adjusted EBITDA for the first quarter of the year, reflecting a 19% year-over-year revenue increase despite a decline in trading activity compared to the previous quarter.

In June 2025, Kraken announced that it had secured a license under the European Union’s Markets in Crypto-Assets Regulation from the Central Bank of Ireland, allowing it to offer regulated services and engage with clients across all 30 EEA member states.

Product Changes

Kraken has expanded its platform through a series of product launches, acquisitions, and adjustments aimed at broadening its footprint across crypto and traditional financial services.

To expand into staking, Kraken acquired Staked, a non-custodial staking infrastructure provider, in December 2021. The company later shut down its US staking service in February 2023 following an SEC enforcement action concerning the registration of its staking-as-a-service offering. A new compliant staking product was launched in January 2025 for US users via Kraken Pro.

In the NFT space, Kraken introduced a marketplace in June 2023 that enabled zero gas fee trading and access to collections such as Bored Apes and CryptoPunks. However, the platform was shut down in November 2024, with Kraken transitioning it to withdrawal-only mode and completing a full wind-down over a three-month period. The closure reflected a reallocation of resources toward other business areas.

In October 2024, Kraken launched Kraken Desktop, a downloadable trading application aimed at active users. The platform provides access to Kraken’s spot and futures markets and is built on a Rust-native tech stack for improved speed and resource efficiency. Also in October 2024, Kraken introduced Ink, a Layer 2 blockchain built on Optimism’s OP Stack. Ink was designed to simplify user access to decentralized applications and accelerate the migration of assets and activity on-chain.

In April 2025, Kraken began a phased rollout of commission-free trading for over 11K US-listed stocks and exchange-traded funds (ETFs), marking its entry into traditional equities. The move followed broader regulatory signals in the US supporting digital asset innovation and helped Kraken compete with platforms offering both crypto and stock trading. In May 2025, Kraken completed its $1.5 billion acquisition of NinjaTrader, a US-based retail futures trading platform. The integration is intended to enable cross-access between traditional derivatives and crypto markets under a unified trading interface.

In June 2025, Kraken launched Krak, a peer-to-peer payments app that supports over 300 assets and allows users to send and receive fiat and cryptocurrency across more than 160 countries. The app includes spend-and-earn accounts, with no lockups or minimums, and offers yields on stablecoins and other digital assets. Krak also plans to expand into physical and virtual debit cards and collateralized lending.

Regulatory

In February 2023, the SEC charged Kraken with offering unregistered securities through its staking-as-a-service program. The SEC alleged Kraken pooled customer assets to offer returns of up to 21% without disclosing material risks or financial details. Kraken settled without admitting wrongdoing, agreeing to pay a $30 million fine and to cease staking services for US customers.

In November 2023, the SEC filed a separate lawsuit alleging that Kraken operated as an unregistered securities exchange, broker, dealer, and clearing agency, and that it had commingled customer and corporate funds. Kraken chose to contest the charges. In March 2025, the SEC dropped the lawsuit with prejudice, resulting in no admission of wrongdoing, no penalties, and no required changes to Kraken’s business operations.

In June 2025, Kraken announced the relocation of its global headquarters to Cheyenne, Wyoming, citing the state’s regulatory environment and long-standing support for digital asset businesses.

Valuation

Kraken raised a Series D funding round of an undisclosed size in 2021. In addition to its equity funding, Kraken raised $100 million in 2019 from a group of its largest customers to acquire the London-based company Crypto Facilities. In June 2024, it was reported that Kraken was trying to raise a $100 million pre-IPO funding round.

In March 2025, it was reported that Kraken was reportedly working with Goldman Sachs and JPMorgan to raise between $200 million and $1 billion in debt financing, alongside a potential equity raise. The company indicated that the proceeds would be used to support growth initiatives.

By May 2025, Kraken had resumed discussions around a potential initial public offering. In May 2021, Kraken’s leadership had planned for Kraken to go public in 2022. By February 2023, its plans to go public were halted by a reportedly challenging public market and increasing regulatory scrutiny. In May 2025, Co-CEO Arjun Sethi stated that regulatory clarity around digital assets continues to be a determining factor in the timing of any IPO.

As of May 2025, a listing in late 2025 or early 2026 was cited as a plausible timeline, with PwC reportedly providing auditing services in preparation. Market analysts have pointed to Circle and Coinbase as key valuation comparables. In September 2025, Kraken raised a $500 million round of funding at a $15 billion valuation. Sethi continued to reiterate the company’s plans to go public.

Key Opportunities

Bridging Trad Fri & Crypto

Kraken’s expansion into traditional financial services may reflect a broader effort to diversify its business and reduce reliance on the cyclical nature of crypto markets. By offering stock and ETF trading, tokenized equities through xStocks, and futures trading via its acquisition of NinjaTrader, Kraken has expanded its ability to serve users interested in both traditional and digital assets. This approach allows the company to attract a wider customer base, including those who may not be engaged in crypto trading but are active in equities or derivatives. In parallel, the company’s peer-to-peer payments app, Krak, supports both fiat and crypto transfers, enabling users to move between asset types within a single ecosystem.

These offerings may also provide operational advantages. By allowing users to trade across multiple asset classes without leaving the platform, Kraken can drive higher user engagement, cross-sell products, and generate more consistent transaction activity, even during periods of low crypto trading volumes. Additionally, integrating traditional and crypto financial products could help Kraken build stronger relationships with regulators and institutional clients, particularly as US policymakers consider frameworks for digital assets and stablecoins.

Going Public

As of May 2025, Kraken was exploring the opportunity to pursue a public offering. An IPO would give the company access to a broader pool of capital to continue its expansion into new products, and continue investing in existing expansions like stock trading, payments, and its Layer 2 blockchain. A public listing could also enhance Kraken’s transparency and credibility with regulators, institutional clients, and partners, which could be important as Kraken expands further into traditional financial services. Additionally, an IPO could also allow Kraken to use its stock for future acquisitions.

Crypto Adoption Tailwinds

Despite short-term price and trade volatility, there is potential for sizable, steady user growth long-term for Kraken as a result of continued growth in crypto adoption. In June 2025, the number of new Ethereum addresses created each week was between 800K and 1 million. In July 2025, Ethereum had 327.5 million cumulative addresses, which was up from 271 million in May 2024 and 66 million in May 2019. This indicates that there is a growing pool of crypto users that has consistently grown even through periods of cyclical volatility in the crypto market. Almost 70% of US millennials believed cryptocurrencies would be part of their lives and continue to accrue value as of March 2022.

Favorable Short-Term Regulatory Environment

In 2025, the regulatory environment presented a near-term opportunity for crypto companies like Kraken. Following President Trump’s return to office, the administration signaled a more permissive stance toward the crypto industry, including an executive order aimed at encouraging US leadership in blockchain and digital assets. In January 2025, the SEC established a new “Crypto 2.0” task force tasked with clarifying regulations and creating more transparent paths to compliance. Unlike its prior focus on enforcement, the task force is designed to work across SEC divisions and with the public to clarify registration processes, disclosure standards, and enforcement priorities.

This shift has already resulted in the dismissal of enforcement actions, including the SEC’s May 2025 decision to drop its lawsuit against Binance following the company’s settlement with multiple federal agencies. Public statements from both Binance and US officials have framed this change as a pivot away from “regulation by enforcement” toward more predictable oversight. While this creates a more favorable climate in the near term, companies like Kraken may still face ongoing state-level regulatory complexities.

Key Risks

Margin Compression

Kraken faces a risk of margin compression as trading fees decline, especially in a competitive market with many centralized and decentralized exchanges. As trading becomes increasingly commoditized, exchanges may lower fees to attract users, reducing revenue from transactions. Larger exchanges with greater scale, such as Binance, may have more flexibility to cut fees. Binance, for example, eliminated Bitcoin trading fees in mid-2022, which led to a sharp increase in its market share before ending the program in March 2023.

Market Volatility

Cryptocurrency market volatility remains a core risk for centralized exchanges like Kraken, as trading volumes and, therefore, revenues, tend to move in line with crypto asset prices. For example, Bitcoin’s price climbed from $16K in November 2022 to $104K in December 2024 before falling to $75K by April 2025, with global crypto market capitalization shifting from $850 billion to $3.7 trillion over the same period.

While this volatility poses near-term risks, Bitcoin’s long-term volatility has gradually declined as its market matures and its market cap grows, reducing the impact of new capital inflows. Historical comparisons to gold suggest that as Bitcoin becomes more established, volatility may decrease over time. However, unexpected external events can still cause sharp market swings. Although future volatility may moderate, Kraken remains exposed to market cycles that can affect user activity and revenue.

Source: Fidelity Digital Assets

Summary

Kraken is a cryptocurrency exchange that offers a range of trading, decentralized finance, and financial services products for both individual and institutional clients. The company has expanded beyond crypto trading into traditional finance, allowing users to buy US stocks through its app and launching a peer-to-peer payments platform, Krak. Kraken raised an undisclosed Series D funding round and, as of May 2025, had resumed discussions around a potential initial public offering, which remains contingent on regulatory clarity. The company’s growth opportunities include expanding its position as a bridge between traditional finance and crypto, benefiting from increased crypto adoption, and operating in a more favorable short-term regulatory environment. However, risks remain, including low conversion rates among newly acquired users, margin compression, and ongoing volatility in crypto markets.