Thesis

As of 2023, there were an estimated 420 million cryptocurrency users globally, up from 300 million in 2022. In other words, roughly 5% of the global population either used or owned cryptocurrencies as of 2023. A report from July 2022 estimated that 0.3% of all individual wealth was invested in crypto, in contrast to 25% held in equities. A survey of Americans who had never owned crypto revealed that 51% would consider buying crypto if they could store it in their primary bank.

One of the biggest obstacles to mainstream crypto adoption is the friction involved in converting from fiat currency, like the US Dollar or Brazilian Real, to digital assets. Global regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which are intended to protect users from fraud, are complex, dynamic, and often ambiguous. Even as crypto adoption increases, people expect the same level of comfort and trust in whichever institution handles their finances.

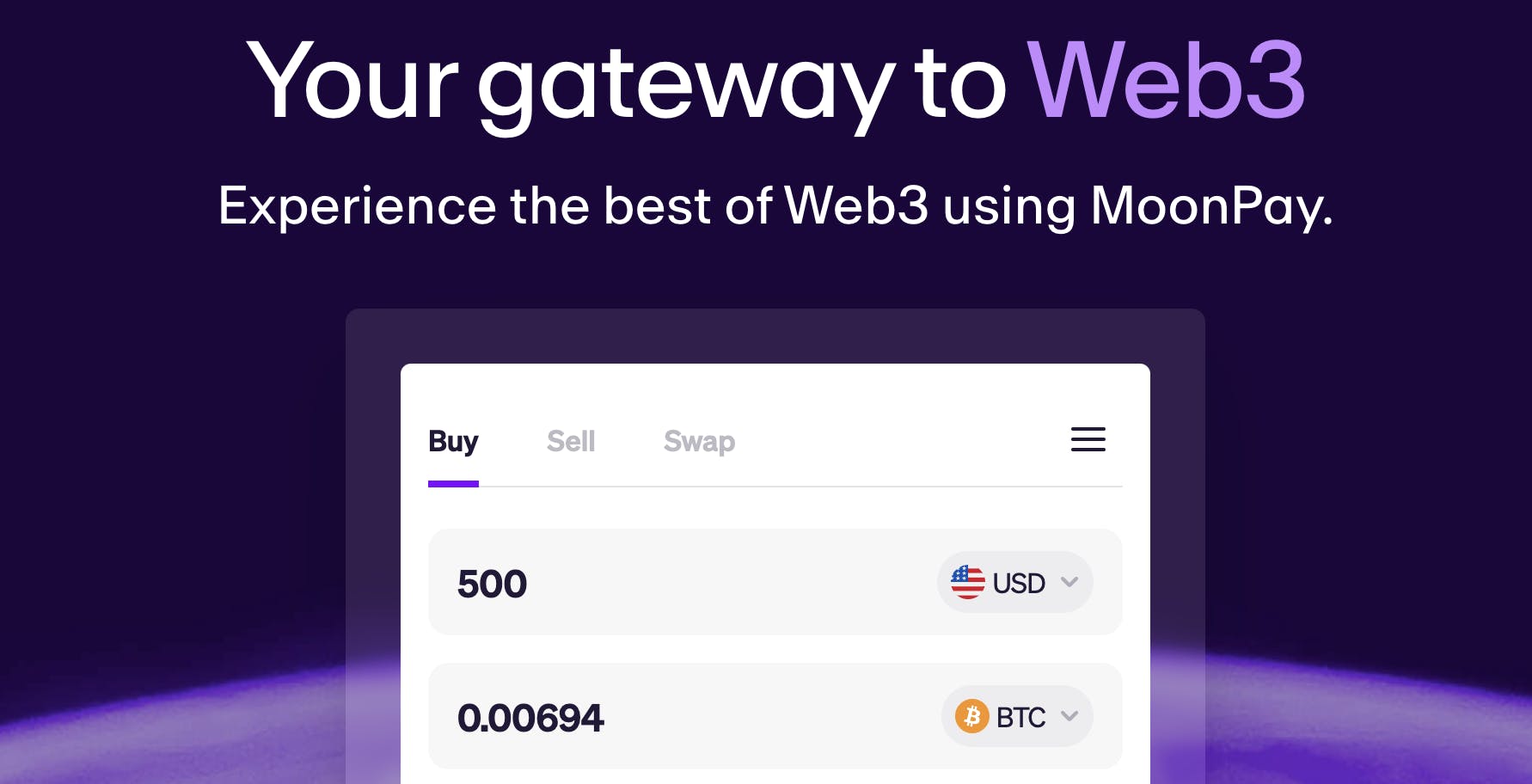

MoonPay describes itself as a “gateway to Web3” that functions as “the express checkout for the crypto world”. It enables individual users to buy crypto and sell crypto in exchange for fiat currency and also to swap different types of cryptocurrencies for one another. For businesses, it provides a crypto on-ramp with what the company describes as “global coverage, seamless revenue sharing, and zero risk of fraud or chargebacks” that can be embedded in a website or app with a snippet of code. Moonpay, which has described itself as “PayPal for crypto”, supported more than 80 crypto assets and had delivered over $2 billion of crypto as of April 2024.

Founding Story

MoonPay, based in Miami, was founded in 2019 by Ivan Soto-Wright (CEO) and Victor Faramond (Chief Engineer, formerly CTO). Soto-Wright started his career in institutional finance before founding an AI fintech company called Saveable in 2015, which was an AI assistant intended to help users grow their wealth. Soto-Wright and Faramond first connected during a joint stint at Hodl.vc where the former was the founder a general partner and the latter was head of engineering.

Soto-Wright first came up with the idea for MoonPay in 2018 after going on the App Store and realizing that for crypto mobile wallets at the time, there was no way to directly buy or sell cryptocurrencies without using an exchange as an intermediary, creating a lot of friction. Recognizing this as an opportunity, Soto-Wright and Faramond contacted Bitcoin.com, which enabled users to buy Bitcoin directly on its website. Soto-Wright and Faramond began building an API for BItcoin.com before realizing that every web3 wallet would need the same in-app functionality.

From there, Soto-Wright and Faramond set out to create a simple and secure software solution that would enable people to frictionlessly onboard into the crypto ecosystem. They started by reaching out to early-stage founders and pitching a plug-and-play widget to purchase crypto with fiat currency and send that crypto straight to their customer’s wallets.

Product

MoonPay began as an easy way to exchange fiat for crypto. It continued to expand its offering from there, launching a similar product for purchasing NFTs with fiat currencies, and then launching a no-code platform for creators and brands to spin up their own NFT projects.

MoonPay also handles the necessary KYC checks to verify customer identity via partnerships with vendors to ensure compliance with local regulations. Companies using MoonPay therefore don’t have to worry about the potential time or financial costs of chargebacks or fraudulent crypto transactions. Moonpay’s two core product offerings are a buy, sell, and exchange product for individual users and an on-ramp product for businesses. It also offers an NFT checkout product and a self-service minting product, as well as a white-glove concierge service for high-profile customers.

Personal

Source: MoonPay

MoonPay offers individual users the ability to buy or sell cryptocurrencies in exchange for fiat currencies. This functionality is ISO 27001-certified, which is an information security management certification. MoonPay also encrypts user data for additional security. MoonPay’s “express checkout” product is accessible via the company’s website, the MoonPay app, and via a number of prominent crypto wallets and exchanges that have partnered with MoonPay including Metamask, Bitcoin.com, OpenSea, and Sorare.

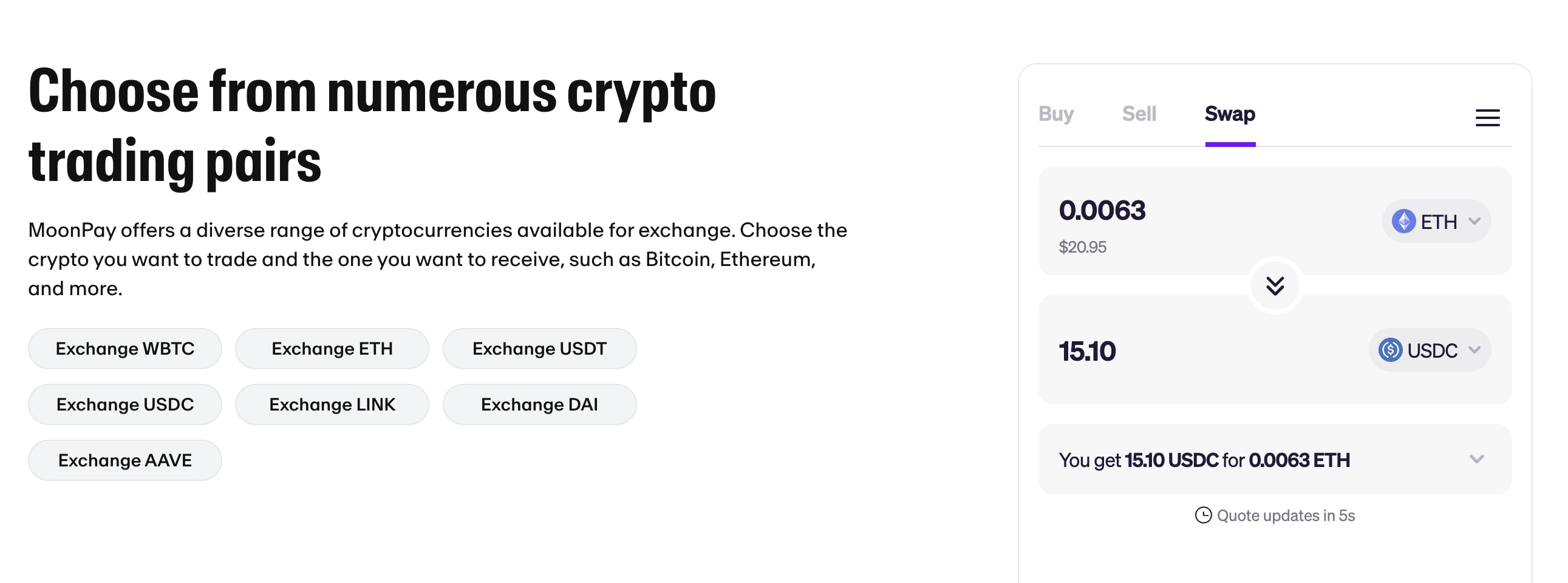

Source: MoonPay

MoonPay also provides a secure non-custodial crypto swap platform that enables users to exchange different cryptocurrencies for one another with no processing fees and security measures that are intended to protect users. Users can conduct cross-chain swaps by connecting with MoonPay via their preferred crypto wallet; as of April 2024, MoonPay supported popular wallets such as Trust Wallet, Ledger, MetaMask, Rainbow, Uniswap, and Exodus.

Business

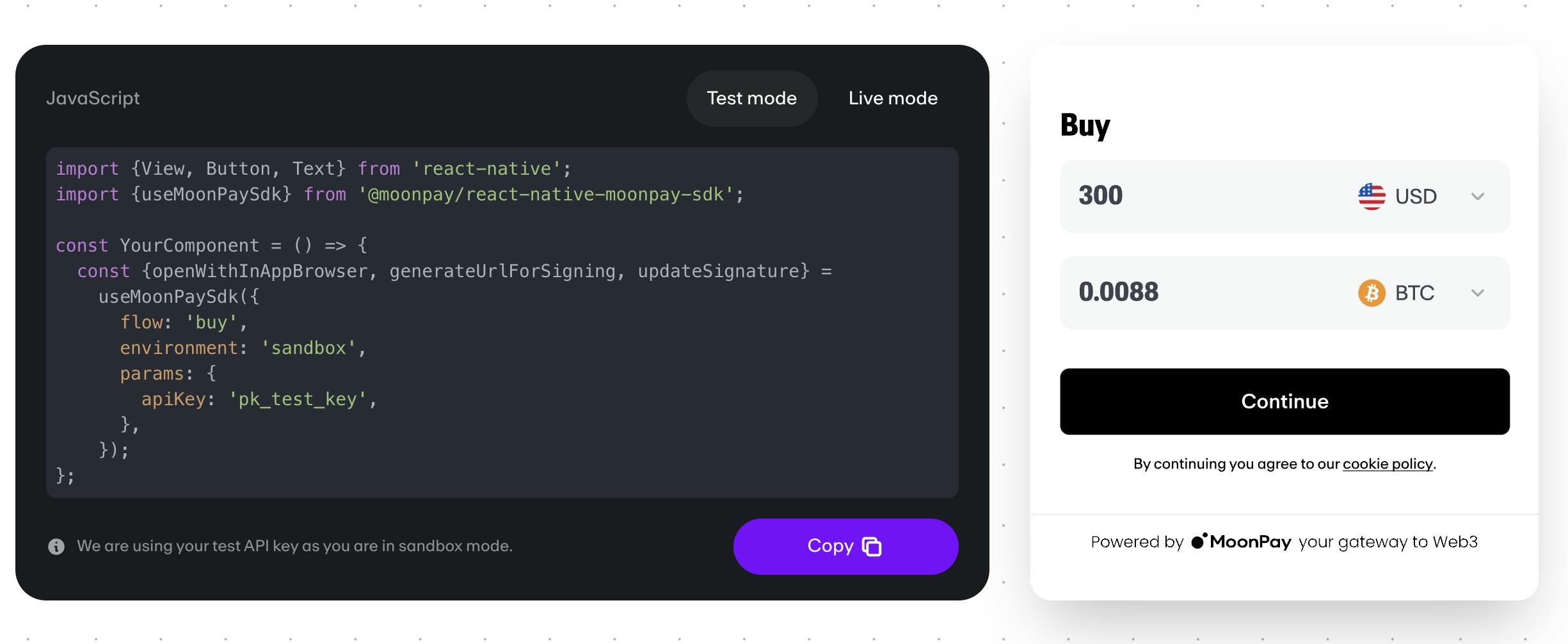

Source: MoonPay

MoonPay’s business product is a crypto on-ramp which the company says “can be integrated into [a user’s] app or website in 10 minutes” with a snippet of code. MoonPay’s business product supports a variety of payment methods from credit cards like Visa and Mastercard, to wire transfers, Bank transfers, and Apple Pay, and allows end-users to open a BTC or ETH wallet directly if they don’t already have one.

MoonPay handles card processing for business customers so they don’t have to deal with chargebacks, fraud, or disputes. It employs over 50 support staff, an AML monitoring system, a proprietary fraud engine, and a full anti-fraud stack for this purpose. Its crypto on-ramp product supports over 30 fiat currencies and over 110 cryptocurrencies across more than 160 countries as of April 2024.

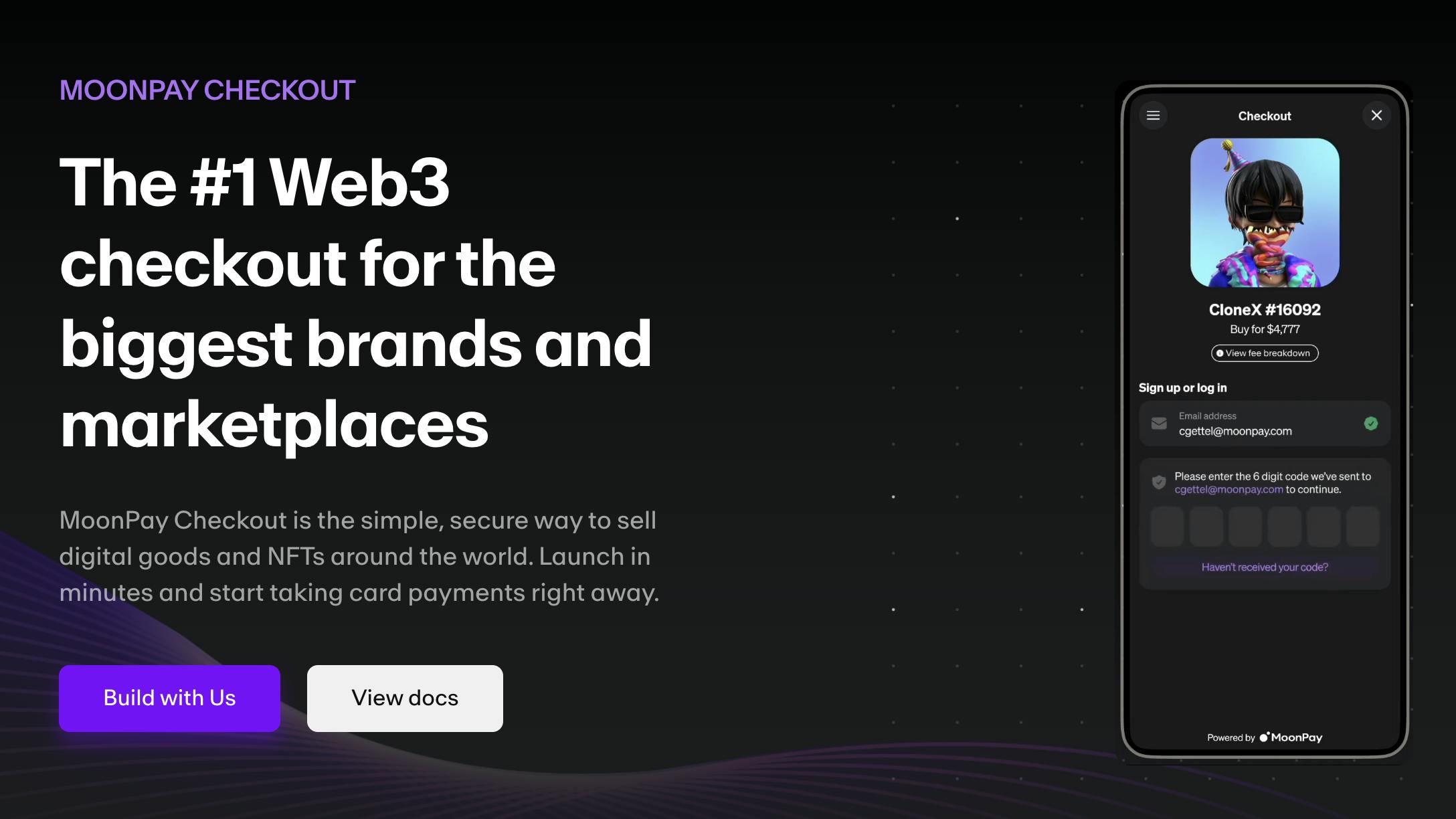

MoonPay Checkout

Source: MoonPay

In January 2022, MoonPay launched a credit card checkout tool for NFT purchases called NFT Checkout, which later became MoonPay Checkout. This was the first product of its kind, built to allow creators and marketplaces to reduce friction for users to buy and sell their NFTs.

The launch of NFT Checkout was intended to expand the addressable market for NFTs — there were about 2.8 billion credit cards on earth as of 2021, compared to only about 68 million crypto wallets. To aid with the launch, MoonPay partnered with well-known NFT brands, such as OpenSea. MoonPay checkout supports major credit cards such as Visa, Mastercard, and American Express, among other payment methods.

HyperMint

In 2021, despite 50x growth in NFT volume, many creators had yet to issue their own NFTs. In June 2022, CEO Ivan Soto-Wright announced a new addition to the MoonPay product suite called HyperMint, which is a self-service infrastructure platform and Web3 API through a no-code platform that enables users to:

Write, design, and deploy smart contracts.

Create, manage, mint, and sell tokens to end users.

Route funds, royalties, and distribute NFTs at scale.

The main customers of HyperMint are creators and brands who, as MoonPay highlights, deal with, “project-killing complexity, untrusted systems and partners, and prohibitive costs.”

Moonpay Concierge

At the height of the NFT market in 2022, interest in certain NFTs was common — and high net-worth individuals were no exception. MoonPay Concierge is a by-referral-only white glove service for NFT purchases. For example, celebrities will set a budget to purchase a BAYC NFT. MoonPay then buys up enough Ethereum to purchase the NFT, invoice the customer via a wire transfer, and send the NFT to the celebrity.

Market

Customer

MoonPay has a variety of customers that vary across its products. First, it sells to consumers with a consumer-facing wallet and mobile app that enables users to buy, sell, and swap cryptocurrencies. As of April 2024, the company had over 15 million individual users.

Secondly, it sells on-and-off-ramp crypto infrastructure to business partners like Metamask, Phantom, Bitcoin.com, OpenSea, Sorare, and Uniswap.

Source: MoonPay

Third, the MoonPay Checkout product partners with businesses like Magic Eden, ENS, and Sweet to provide a check product for NFTs and digital collectibles.

Source: MoonPay

Fourth, Hypermint has attracted notable customers including Universal Pictures, Faze, and Death Row Records as of April 2024. Finally, with the launch of MoonPay Concierge, MoonPay began targeting high-net-worth individuals, including high-profile celebrities.

Market Size

MoonPay has consistently positioned itself as enabling as many people as possible to participate in the crypto ecosystem with its first crypto payments platform. Strategic partnerships and integrations have allowed it to expand its addressable market within the industry including both crypto and NFT payments.

Although crypto markets are known for their volatility, there has been a steady increase in both crypto adopters and the global crypto market cap over the past decade, with the market cap of crypto rising from $6.8 billion in April 2024 to $2.7 trillion in April 2024. The global cryptocurrency market cap reached an all-time high of $3 trillion in November 2021. Meanwhile, the NFT market was valued at $36.1 billion in 2023 and was projected to grow to $217 billion by 2023.

Competition

Crypto On Ramp

A more frictionless payment on-ramp from fiat to crypto is key to increasing the size of the crypto ecosystem, which may be still relatively early in the adoption curve. There are quite a few companies in this space, with the major players in 2022 being MoonPay, Wyre, Transak, and Simplex. In addition, several of the major crypto exchanges announced competing products in early 2021, including Coinbase Pay, FTX Pay (although FTX has since filed for Chapter 11 bankruptcy after a case of massive fraud), and Bifinity.

These products compete to provide the easiest way to convert a user's fiat to crypto at the best price possible. In practice, some of the differentiating factors include the number of unique payment methods supported, available countries, cryptocurrencies supported, L1/L2 chains supported, UI/UX, fee structure, available exchange rate, onboarding experience, and analytics. MoonPay was early to market, but large exchanges like Coinbase have a scale advantage.

NFT Checkout and HyperMint

The NFT payment and NFT minting space are less crowded, with a few competitors, including CrossMint and Paper.xyz. CrossMint users can purchase NFTs through crypto or credit cards, create NFTs and send them to a crypto wallet or email address, and/or spin up a crypto wallet. Paper allows users to create wallets through their email addresses and purchase NFTs with credit cards or crypto wallets.

Business Model

MoonPay makes money by taking a percentage of total transactions. The major transaction types are buying and selling crypto, and buying or selling NFTs. The company charges a 4.5% processing fee for buying or selling crypto via credit cards and a 1% fee for bank transfers (with a $3.99 minimum). For NFTs, it charges a 4.5% fee with a $0.50 minimum. HyperMint’s pricing is no longer disclosed on the company’s website as of April 2024, possibly as a result of the volatility in the NFT market following the product’s initial release.

Traction

MoonPay described itself as “PayPal for crypto” since it allows for crypto transactions between parties without an intermediary. From its founding date until November 2021, MoonPay passed a number of significant milestones— including processing more than $2 billion in transactions for more than 7 million customers, reaching $150 million in revenue, increasing its transaction volume 35x, signing 250 partners across 160 countries, and supporting 30 fiat and 90 cryptocurrencies. In May 2022, the company said it had been profitable since launching its platform in 2019.

Source: MoonPay

MoonPay has been able to attract a number of high-profile partnerships. In June 2022, it announced a partnership with Mastercard which was intended to allow cardholders to buy NFTs. In December 2022, MoonPay announced a partnership with Uniswap Labs, one of the largest decentralized exchanges by exchange volume.

In February 2023, NFT marketplace Magic Eden announced that it had partnered with MoonPay to make it easier for new users to onboard and purchase NFTs using credit cards. That same month, MoonPay announced a similar deal with LooksRare.

However, the crypto downturn that began in 2022 may have impacted MoonPay’s traction. In March 2023, it was reported that Moonpay had let go of at least 40 staffers in the prior six months, but the company did not see them as layoffs and positioned them as part of its ongoing efforts to smart scale the team. As CEO Soto-Wright told a news outlet in December 2022:

“We want to be financially disciplined. I don’t see us making huge increases in our headcount until we feel really confident about how the team is operating.”

MoonPay also said at the time that it was continuing to hire. In August 2023, however, another report stated that it has fired at least 50 people since late 2022 and continued to cut staff as of late June.

Valuation

In November 2021, MoonPay closed a $555 million Series A at a valuation of $3.4 billion led by Tiger Global and Coatue with participation from Blossom Capital, Thrive Capital, Paradigm, and NEA. Additional investors, disclosed in April 2022 as contributing $87 million towards the Series A round, included Justin Bieber, Maria Sharapova, and Bruce Willis, for a total of 60 investors. MoonPay stated at the time that this represented the highest-valued Series A of any bootstrapped crypto company. As of April 2024, MoonPay’s total funding had reached $650.7 million. However, in Q1 2023, MoonPay cut its internal valuation for common shares by 72%, in line with broader market trends affecting other crypto companies at that time.

Key Opportunities

Ongoing Crypto Adoption

Onboarding one billion users to crypto was MoonPay’s stated mission at the time of its Series A. One July 2022 report estimated that crypto users would reach the 1 billion mark as soon as 2030. The ongoing adoption of cryptocurrency implies a greater volume of transactions and use cases for MoonPay’s products, which translates into greater revenue. If MoonPay is able to maintain or expand its position as the global onramp for crypto, it stands to substantially benefit from the continued adoption of cryptocurrencies.

Partnerships

Despite a cooling market in 2022, the rise of NFTs hinted that partnerships, such as those MoonPay secured with Mastercard and Magic Eden in 2023, may be key to MoonPay’s future growth if more and more IP continues monetized by the biggest brands, creators, and enterprises globally using NFTs. The current differentiating factors between competitors will become less and less obvious, so building unique relationships via partnerships will be critical for MoonPay as large brands are looking to expand into NFTs.

Key Risks

Digital Asset Regulation

As governments around the world continue to focus their attention on the crypto landscape (including both cryptocurrencies and NFTs) regulation may become more difficult to keep up with, including the KYC and AML laws that companies like MoonPay will need to comply with. Given the major value add of MoonPay to cover the costs and time dealing with chargebacks, it is possible it may need to scale back certain product offerings in particularly heavy-handed regulatory environments, and/or risk spending significant time caught up in legal challenges.

NFT Market Volatility

MoonPay’s flagship product is its fiat-to-crypto on and off-ramp. Trading volume on NFTs dropped 97% from January to September 2022. With several unique product launches from late 2021 to 2022 within the NFT space, MoonPay’s gambit with HyperMint may prove less valuable unless the NFT market doesn’t recover.

Summary

MoonPay aims to increase cryptocurrency adoption globally by positioning itself as the best way for brands, creators, companies, and average users to participate in crypto with as little friction as possible. While NFT volumes have dropped, the long-term adoption of cryptocurrencies and blockchain technology in digital payment systems continues to grow. MoonPay has established itself as a prominent crypto on-ramp for both individuals and businesses, and stands to gain from the ongoing adoption of cryptocurrencies across the globe.