Thesis

Dealing with contracting or contract management can be a highly inefficient process. One 2022 survey found that contract and procurement managers spend 25% of their time on low-value, low-complexity activities. Further, 26% of an organization’s workforce typically works on contract management. At any one time, the average Fortune 2000 company manages 20-40K contracts. The average lifecycle of a contract from bid to signature ranges from eight days (NDAs) to 74 days (licensing agreements), with any number of possible complications in the process. The average cost of a simple contract is $6.9K and up to 40% of its value can be lost without close governance.

Contract Lifecycle Management (CLM) software is meant to address inefficiencies stemming from contract management and procurement. Companies with better contracting technology can increase their revenue by 9% and decrease their claims and disputes by 20%. Even though most firms use some form of software to organize their contracts, only 12% use intelligent CLM to analyze an overview of the organization’s contracts. It takes an average of three to four weeks to get a contract approved, but using CLM software reduces that time by an average of 82%. Intelligent CLM drastically changes the business model by reducing 50% of the required legal resources.

That’s where Ironclad comes in. Ironclad handles a variety of contract types from NDAs to sales contracts. Ironclad’s co-founder and Chief Architect, Cai GoGwilt, stated the company’s mission as “enabling a new form of collaboration that will make everyone happier with the final product”. Ironclad seeks to distinguish itself from the field of competing CLM software through offering greater flexibility in implementation, and the ability to utilize insights from data to optimize the CLM process.

Founding Story

The founder of Ironclad, Jason Boehmig (CEO), started his career at Lehman Brothers as a bond trader. During the financial crisis, he decided to go to Notre Dame Law School and ended up becoming a lawyer for tech-oriented law firm Fenwick & West in San Francisco. Boehmig worked on a variety of legal contracts for startups and found the process to be long and tedious.

In August 2014, he met Cai GoGwilt, a former Palantir software engineer, at a legal technology conference. Soon after, the duo began working on the idea for a company to simplify the contract creation and management process, with a vision that expanded beyond just the legal department and encompassed everything from HR to Operations.

After having served as CTO for 9 years, GoGwilt stepped into the role of Chief Architect in February 2023. In his place, Jason Li, who had previously served as SVP of Engineering, stepped into the CTO role.

Product

The contract lifecycle is an involved process including contributions from different business units (legal, IT, sales) with steps such as template creation, contract review, and contract execution. As opposed to some SaaS companies that choose to focus on a single stage within the lifecycle, Ironclad’s product extends across the contract lifecycle.

Source: Easy Software

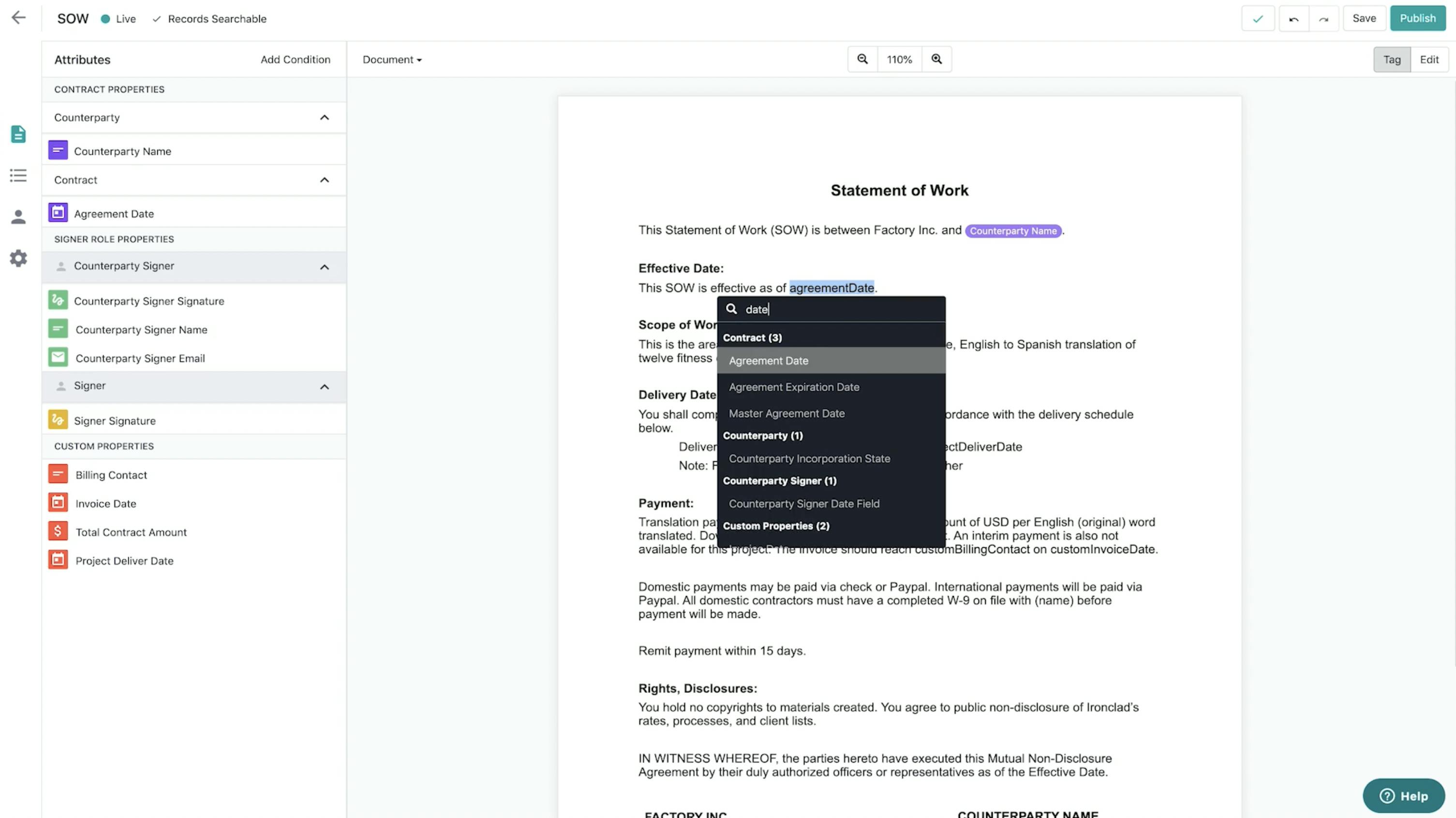

Ironclad’s core CLM product includes several modules: (1) workflow designer, (2) editor, (3) repository, and (4) reporting. In addition, Ironclad offers Clickwrap, a digital acceptance platform.

Workflow Designer

Source: Ironclad

Workflow Designer is a drag-and-drop tool to create contracts while ensuring the components of each contract are tracked, correct, and easy to adjust. Teams can create a contract workflow by uploading a template, tagging any fields that need to be provided by the requestor, and adding approvers and signers. Having standardized workflows for each type of contract allows customers to identify potential fields that violate the compliance clauses automatically.

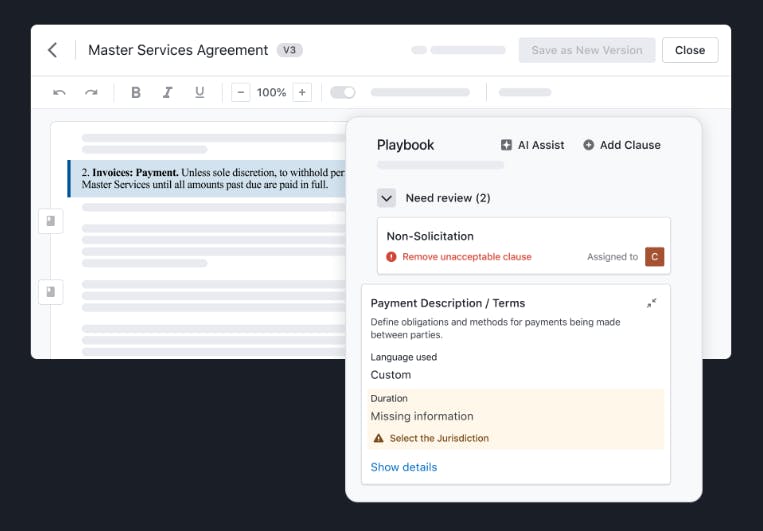

Editor

Source: Ironclad

Ironclad’s editing module is similar to Google Docs in functionality where users can collaborate on specific sections of a contract, leave comments, review different versions, and assign each other responsibilities in the creation process for a contract.

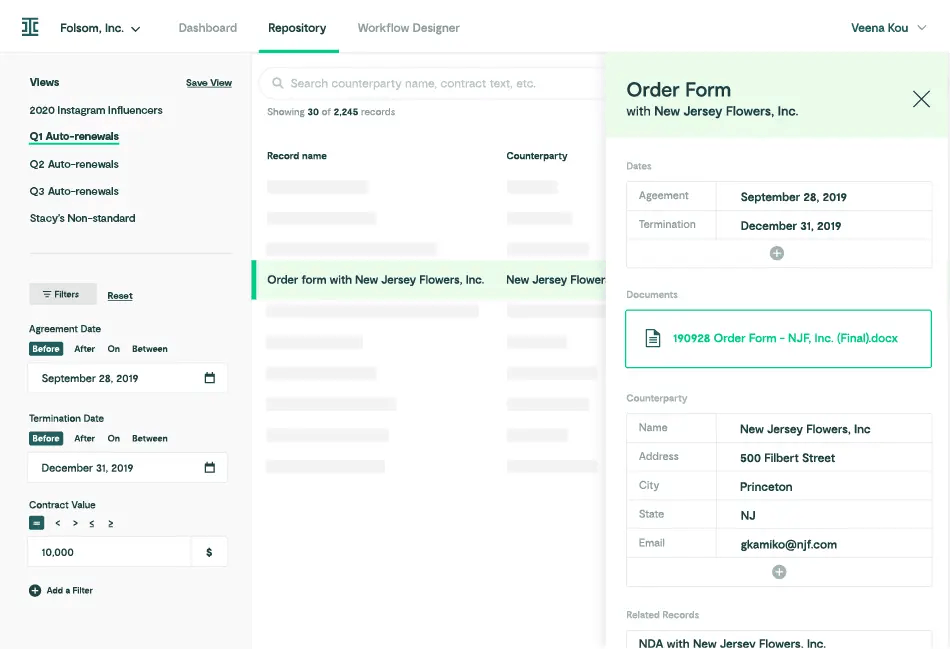

Because the average Fortune 2000 company is managing 20-40K contracts, it can be difficult to keep track of every clause and counterparty. Ironclad’s contract repository helps to store a customer’s contracts and makes navigating them more simple. For example, the repository offers a snapshot of a contract’s metadata in viewing mode, allows for advanced filtering by specific dates and terms, and lets users sort them by specific characteristics.

Repository

Source: Ironclad

Ironclad users can leverage the company’s platform as a single repository for all its contracts. This provides a view into context across contracts, as well as a place to mass upload contracts across departments. Ironclad claims to be able to “automatically tag and store 194+ AI-detected contract metadata properties.” Universal search enables users to find content across their contract base, as well as visualize contract data including “KPIs, renewals, contractual obligations.”

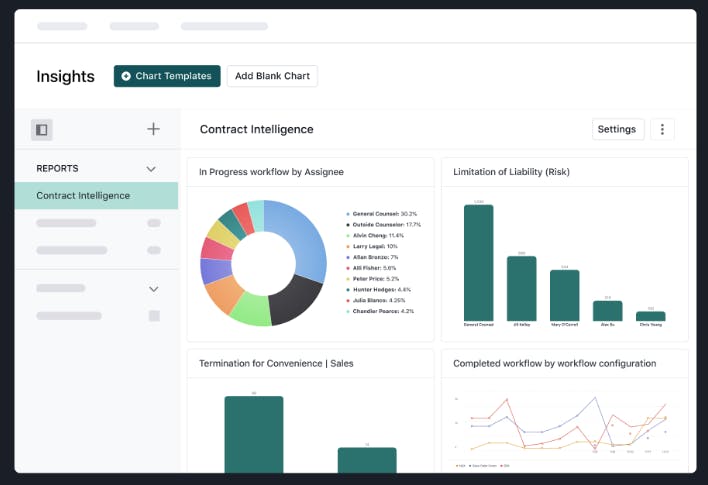

Reporting

Source: Ironclad

The length of time and complexity of managing the contracting process can make it difficult to keep track of. In addition, a company’s contracts represent a significant overview of its operations. Being able to extract data from that collection of contracts can give customers better insights into the various relationships they have with other companies. Ironclad’s reporting module allows customers to visualize their contracts as they move through the CLM process, and identify any potential bottlenecks for specific contracts.

Ironclad Contract AI

In September 2022, Ironclad announced an AI layer for their product to “transform the way companies create, understand, and control their contracts.” Ironclad AI automatically extracts contract data so that companies can search, sort, and read them faster. The product can also review and negotiate contracts with clicks and replacement features.

In April 2023, the company released AI assist, a generative AI-powered contract negotiation tool utilizing OpenAI’s GPT-4 to aid legal teams in generating contract redlines based on pre-approved legal guidelines. In September 2023, Ironclad announced Contract AI (CAI), a “radically new take on an AI chatbot, allowing users to generate complex contract analyses across their contract database through an easy-to-use chat interface.”

The development of CAI was expedited by Ironclad’s release of Rivet, an open source “visual programming environment… to enable step-by-step visibility into CAI’s analysis process and partially to allow developers to collaborate on building complex chains of logic, test them, iterate, and display the execution of the chain.”

Clickwrap

Source: Ironclad

In addition to its core CLM product suite, Ironclad also has a product called Clickwrap specifically designed for embedding legal agreements online. Clickwrap enables customers to interact with the right contract at the right time, without having to manage documents, instead signing contracts like NDAs right in a customer’s digital interface.

Market

Customer

The customer base for CLM software can sometimes be concentrated, as the largest companies will always have the largest number of contracts to manage. However, Ironclad’s positioning to serve a variety of contracts (not just legal ones) could be one differentiator in attracting potential mid-market companies to organize their contracts all in one place. Ironclad currently has 1K+ customers paying on a subscription-based model, including large organizations such as MasterCard and Snap.

Source: Ironclad

Market Size

There remains widespread inefficiency in how companies typically manage contracts; delays are in part attributable to lags in contract review processes and the use of disorganized contracts. As a result, the market for CLM software continues to grow. About 65% of companies across industries use some form of CLM software, whether off-the-shelf or self-developed. The total CLM market size grew from $300 million in 2012 to $20 billion in 2020.

In 2020, two of the largest accounting firms commented that “contract lifecycle management tools will be a significant part of [our] push to expand [our] share of the legal services market”. In 2021, legal tech startups raised over $9 billion in funding.

Competition

The CLM software market is fragmented with about 200-300 companies total and a few large players including Ironclad. Some notable players in this space occupy some different niches, including DocuSign CLM (as mentioned), legacy platforms like Conga and Icertis, and Evisort (an emerging AI-powered player). Other direct and adjacent players include companies like LinkSquares, Lexion, Agiloft, and PandaDoc. The market has already seen consolidation, however, for example with DocuSign’s 2018 acquisition of SpringCM. Most forecasts expect continued consolidation in the future.

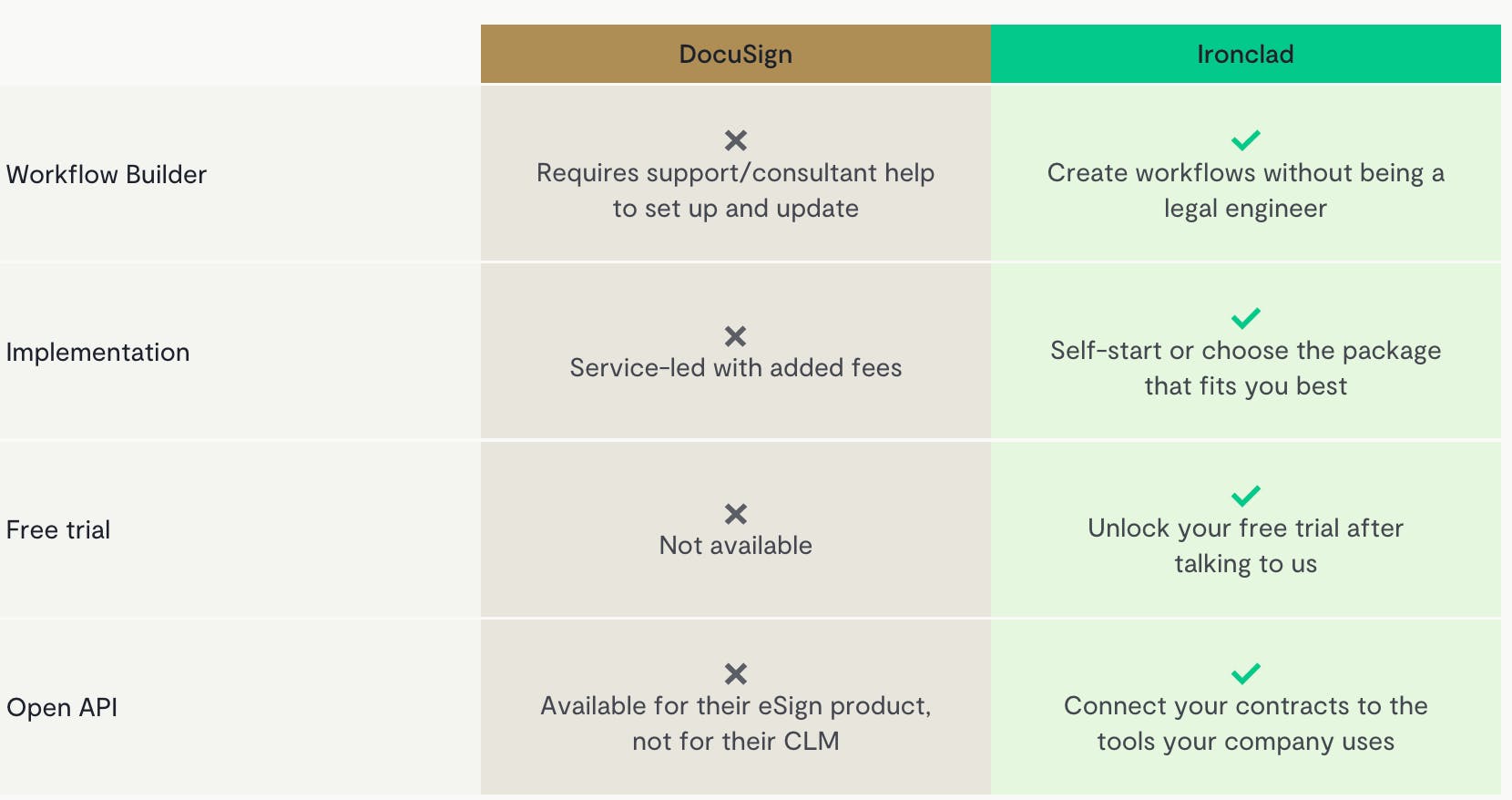

DocuSign CLM

According to Ironclad, many of DocuSign’s customers switch to Ironclad, reportedly because its software is more intuitive and easy to use. Among a crowded field of competition, Ironclad seeks to differentiate by balancing adaptability, integrations, and collaboration. Additionally, Ironclad’s recent strategic entrance into providing contract insights could be a driver of additional growth going forward.

DocuSign has grown its user base from 900K customers in 2021 to 1.4 million in 2023. The acquisition of SpringCM brought the e-signature company more deeply into the contract management space in 2018. DocuSign is now arguably one of the largest competitors to Ironclad. Ironclad has a dedicated page to distinguishing itself from DocuSign specifically.

This difference comes down to the integrability of products — according to Ironclad CEO Jason Boehmig, “Ironclad offers a more integrated variety of contracting tools, while DocuSign's tools are a little more fragmented”. Ironclad purports to provide more flexibility and customization when it comes to editing and creating workflows, as well as leveraging more open APIs than DocuSign.

Source: Ironclad

Conga / Apttus

Apttus, now part of the Conga platform, is a CLM vendor focusing on what the company calls “middle office” solutions, such as quote-to-cash, revenue management, and ecommerce management. Apttus' software was initially developed for the Salesforce customer relationship management platform but has since been integrated with Microsoft Azure and IBM Cloud as well. In May 2020, Apttus merged with CLM specialist Conga, adopting the Conga name as part of the merger. Apttus serves over 300 customers, including more than 70 of the Fortune 500. Some unverified estimates place Apttus's 2022 annual revenue at $102.7 million.

Icertis

Icertis is one of the older players within the CLM industry, along with Apttus, both having been founded in 2009 and 2006 respectively. Icertis has a number of partnerships with Fortune 500 companies such as Microsoft, Google, Accenture, Boeing, and Costco. Icertis has been focusing its efforts on specific verticals to maximize performance within those verticals. For example, there is a dedicated Icertis Contract Intelligence (ICI) product for Banking and Financial Services (BFSI) which provides templates and exemplary workflows for banks and insurance companies. There are also ICI products for Healthcare, CPG/Distribution, and other industries. In January 2022, the company reported revenues “north of $100 million.”

Evisort

Evisort is an AI-focused CLM company that focuses on leveraging NLP in their product. Evisort’s revenue more than doubled in 2021, and it launched an Automation Hub in October 2022 which allows users to train their own AI model code-free in order to recognize clauses specific to their use cases. Ironclad’s flagship products mostly focus on the contract creation and organization process, as opposed to generating data insights.

Business Model

Due to the nature of Ironclad’s software, it primarily works with larger corporations. Pricing varies based on the type of products, specific use cases, and the number of users with a starting price of $500/user/month. In September 2022, Ironclad started a strategic partnership with Zip, a company providing intake-to-procure solutions. The integration allows employees to initiate a spending request and automatically forwards the contract to Ironclad for legal review. Once approved, it will be sent back to Zip to process.

Traction

As of April 2022, Ironclad has processed a total of more than 1 billion contracts, growing its user base by 195% year-over-year, with customers such as OpenAI, Snap, L’Oréal, and MasterCard. That number increased to 1 billion contracts annually as of November 2023. Additionally, in November 2023, the company had an estimated 1.7K customers, with more than 60% of them using Ironclad’s AI products.

In announcing a Series E fundraise which valued the company at $3.2 billion, Boehmig mentioned that Series A investors had initially thought that his idea of managing the ecosystems of contracts seemed too ambitious, but he stood by it. As of January 2024, the company has over 500 employees. In September 2021 the company hired Helen Wang as CFO, who was previously CFO at eBay Global Payments, and Leyla Seka, previously an executive at Salesforce, as COO in preparation for a future IPO. However, in December 2022, Seka stepped down as COO.

Some sources have estimated the company’s revenue over time, though some of them were contested by Ironclad’s CEO. According to The Information, Ironclad ended January 2021 at ~$13 million in revenue, up from $6 million the previous year. In January 2022, Boehmig indicated the company had grown 150% year-over-year, which could indicate revenue in January 2022 time was ~$30 million.

Valuation

As of January 2024, Ironclad had raised a total of $334 million. In January 2022, Ironclad raised a Series E round of $150 million at a valuation of $3.2 billion. The company is backed by a number of investors including Sequoia, Accel, and Y Combinator. Assuming January 2022 revenue of $30 million, that valuation would represent a 106x revenue multiple at the time.

Key Opportunities

AI-Driven Data Insights

Automation of contract management may not be enough to be market leader in CLM going forward, as more CLM platforms offer the ability to manage the contract creation and execution process. In the future, leveraging AI on contract data will become more table stakes. For instance, Tram Phi, DocuSign’s Senior Vice President, and General Counsel, explained that the guiding principles of DocuSign CLM are: (1) an integrated and unified experience and (2) the democratization of AI. Leveraging AI within a CLM platform can reduce time spent by 80% compared to more standard CLMs. Ironclad has already demonstrated its approach with Ironclad AI. Maintaining AI leadership will be a critical piece of staying competitive.

Building a System of Record

Ironclad’s platform today represents an end-to-end CLM tool. Their expansion into AI-driven insights has demonstrated the value of the data platform they have. Going forward, Ironclad can establish itself, not just as a workflow tool and data storage repository, but as a system of record for customers to leverage in making business decisions.

Key Risks

Crowded Competitive Landscape

Ironclad has a number of direct and indirect competitors in the CLM category. In addition to those discussed previously, other names include PandaDoc, SirionLabs, CobbleStone Systems, Symfact, and Apttus among many others. With so many competitors in the space, differentiation can be more difficult. There are different niches within CLM that can be filled by particular companies, but as any platform attempts to scale, they will ultimately be forced to compete with each other to expand to adjacent markets and to sign the limited number of enterprise clients. If Ironclad isn’t able to establish a durable moat, it will likely struggle over the long term.

Data Security and Privacy

As CLM software handles sensitive contract data, there is a risk of data breaches or unauthorized access if proper security measures are not in place. Organizations must ensure that the CLM software they choose provides robust data security features such as encryption, access controls, and regular backups. Additionally, organizations will remain skeptical of the vendor's reputation and track record in terms of data security practices. To increase customer acquisition, Ironclad needs to ensure all regulatory compliance is handled and adequate data protection measures are implemented for the crucial safeguarding of confidential contract information, protecting against potential legal and financial consequences, and maintaining the trust of stakeholders.

Summary

The contract management and procurement process has a number of inefficiencies. Many CLM companies are competing to improve different aspects of that process. Among these, Ironclad’s platform oversees contracts across stages from creation to review to execution, and it provides opportunities for collaboration from different departments. Ironclad is relying on intuitive user experience, combined with data-driven insights and AI to position itself as a leader in the CLM market. Going forward, Ironclad will have to demonstrate both superior security and use of AI as the contract management space becomes more automated.