Thesis

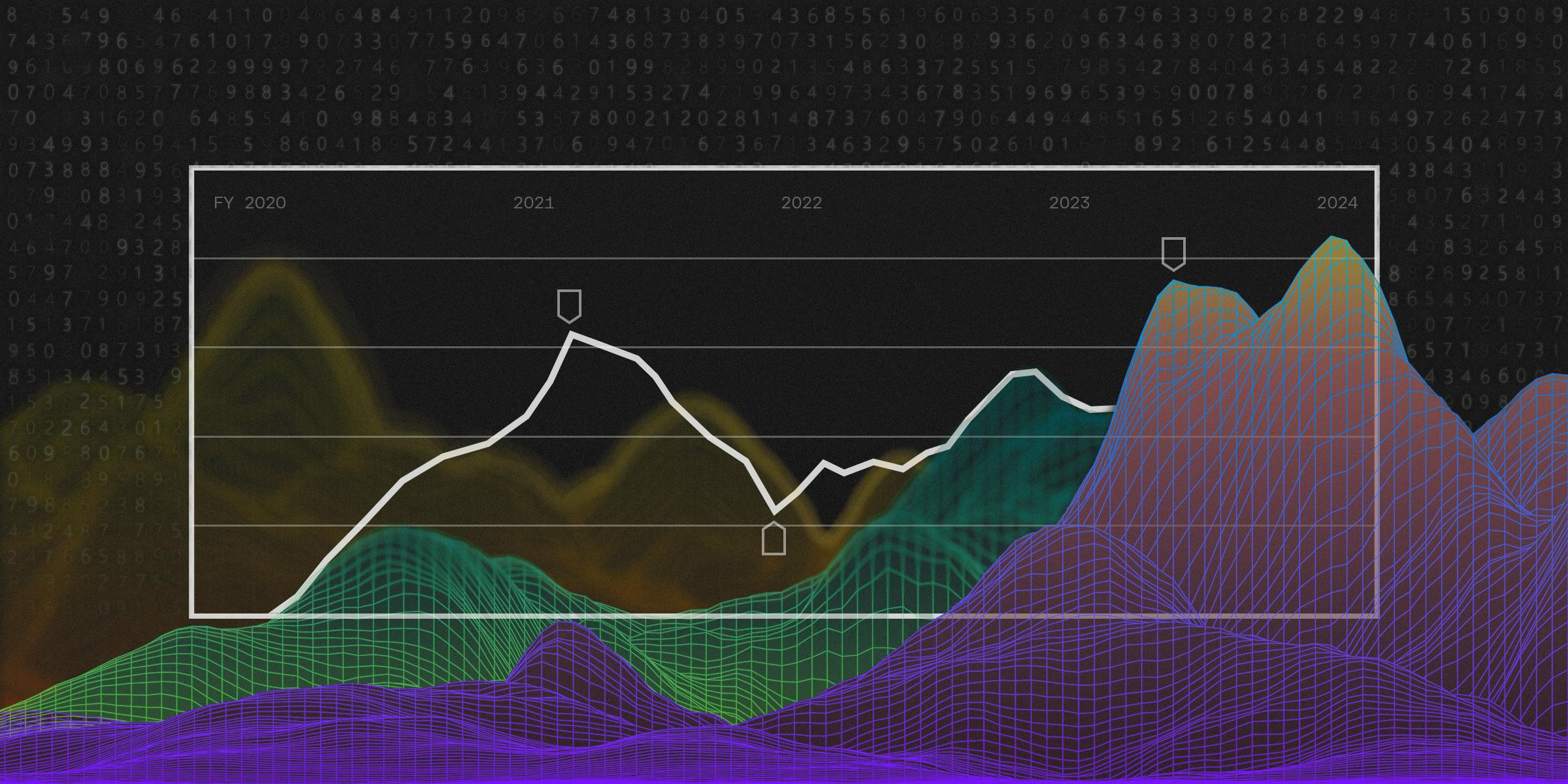

Over the past two decades, the proliferation of software meant that there’s a tool for almost any function at a company. But that presented a problem. It’s really hard to track, manage, and negotiate software spend when the number of tools is growing faster than the team. As of August 2023, the average company uses over 250 SaaS solutions, and worldwide software spend is expected to reach over $900 billion in 2023. SaaS spending is now the third largest cost item on company balance sheets behind payroll and real estate. Yet companies often leave money on the table because they are not effectively renegotiating contracts or monitoring cost savings, resulting in a massive opportunity for spend management.

In addition to this wave of SaaS spend, companies are facing a macroeconomic correction that started in 2022 and has required companies to reduce spending across the board. In a November 2022 survey, 42% of executives said that cost-cutting would be a priority in 2023, not including headcount reductions. A number of enterprises stated that cost-cutting would target a 7% reduction in spend. In SaaS, that would translate to $63 billion in spend reduction.

That’s where Vendr comes in. Vendr is a SaaS buying, procurement, and spend management platform. It helps enterprises purchase software by negotiating purchase terms on their behalf to be more favorable. Enterprise software contracts are negotiated between the buyer and vendor before being signed, making the purchase process opaque. Skilled negotiation by the seller causes most customers to overpay for software by 20-25%. Vendr aims to close the gap between customer and vendor.

Founding Story

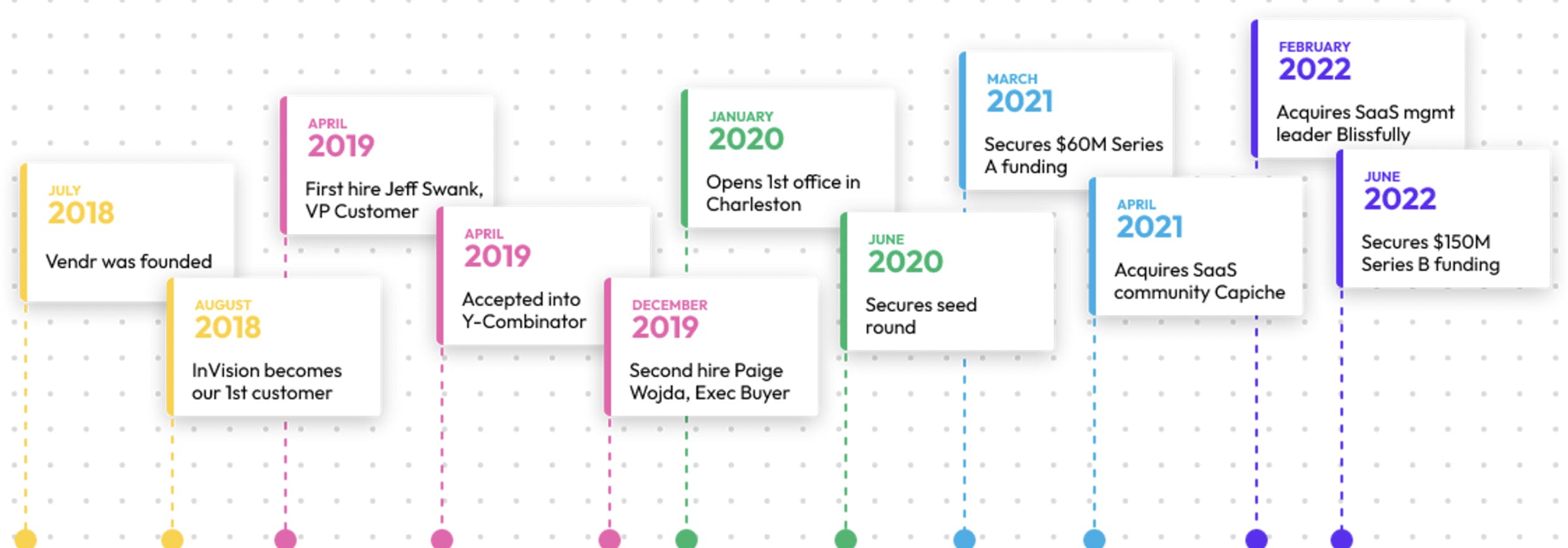

Vendr was founded in 2019. Ryan Neu, the CEO of Vendr, spent the majority of his career selling software at companies like InVision and Hubspot. Neu was repeatedly frustrated by the inefficiencies in the system for negotiating and buying software. He founded Vendr in 2018 to improve the sales process, and the company was later accepted into the S19 cohort of Y Combinator. Initially, the company was focused on changes in SaaS buying that had been occurring over the course of several years. Neu described the trend this way:

“We see software sales actually going away because most people are tired of being sold to, they are tired of being persuaded, they want to transact. Vendr was created to allow people to transact software without actually having to talk to people.”

Roughly 18 months after the company’s founding, the COVID-19 pandemic hit. This had the effect of further reshaping the process for procuring software, given the inability of people to buy and sell in person. As a result, Vendr became more important in virtual procurement during COVID.

In February 2022, Vendr announced its acquisition of Blissfully, a SaaS management company that helps organizations manage their suppliers, unlock visibility into their SaaS applications, and identify potential cost savings. With the acquisition, Vendr intends to complete the SaaS buying lifecycle, uniting both procurement and vendor management. Blissfully founders Ariel Diaz and Aaron White joined Vendr as Chief Strategy Officer and CTO respectively after the acquisition.

Source: Vendr

Product

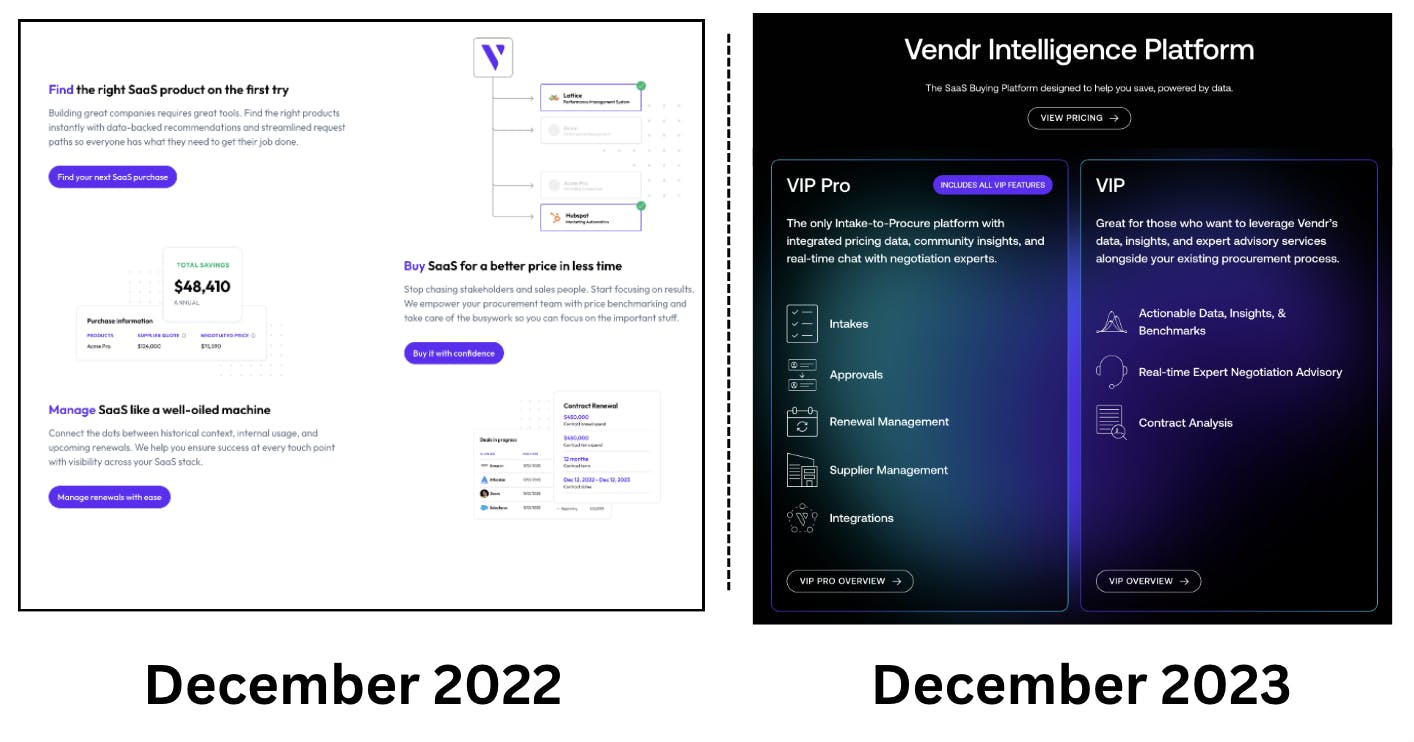

Initially, Vendr’s platform focused on the SaaS buying process, with modules centered on workflows to find (discovery), buy (procurement), and manage (spend management). Increasingly, Vendr has evolved its product messaging to focus on the entire vendor intelligence lifecycle including modules around data benchmarks, expert negotiation advisory, and contract analysis. More advanced features include modules around (1) intakes, (2) approvals, (3) renewal management, (4) supplier management, (5) integrations

Source: Vendr; December 2022, December 2023

Buyer Guides

Source: Vendr

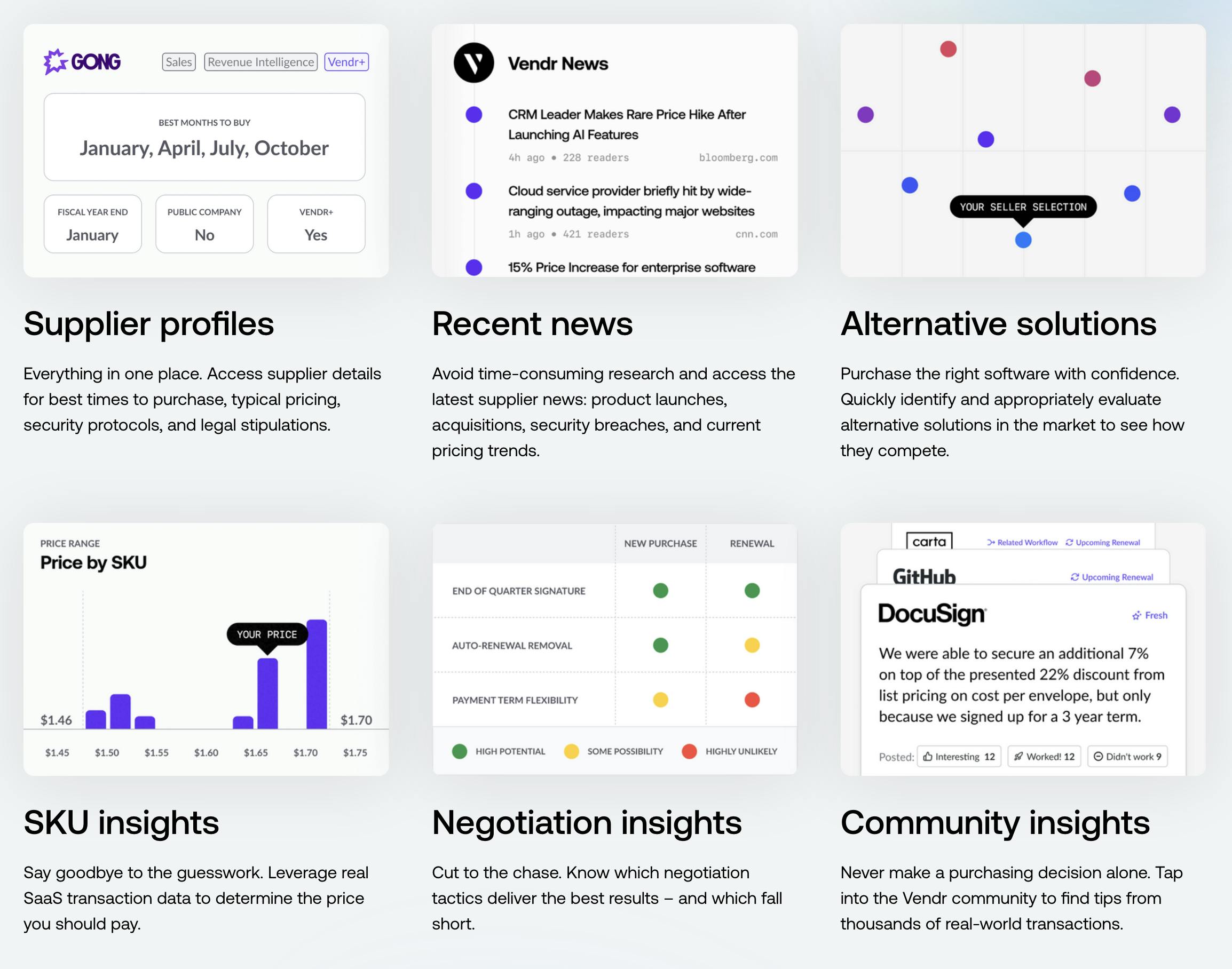

A core part of Vendr’s platform is informing users around specific elements of the procurement process. Vendr has compiled insights across hundreds of different vendors, such as Figma, ZoomInfo, Atlassian, DocuSign, and others to share perspective on negotiation tactics, typical spend and savings, perspective on a vendor’s different SKUs, and feedback from other Vendr users.

In addition to providing broad information on a variety of vendors, Vendr also provides the Vendr+ designation for specific vendors. Some customers indicate that relying on the Vendr+ status has allowed them to go through a procurement process from beginning to end in “about a week from beginning to finish.” Vendors who have the designation have proven to be high quality, high volume, and fairly priced.

Source: Vendr

Negotiation Advisory

Source: Vendr

Vendr also provides direct access to advisors for 1x1 advice in understanding a particular procurement process. In addition to generalized advice, these experts can also provide real-time support through a procurement process with questions about a specific vendor.

Contract Analysis

Source: Vendr

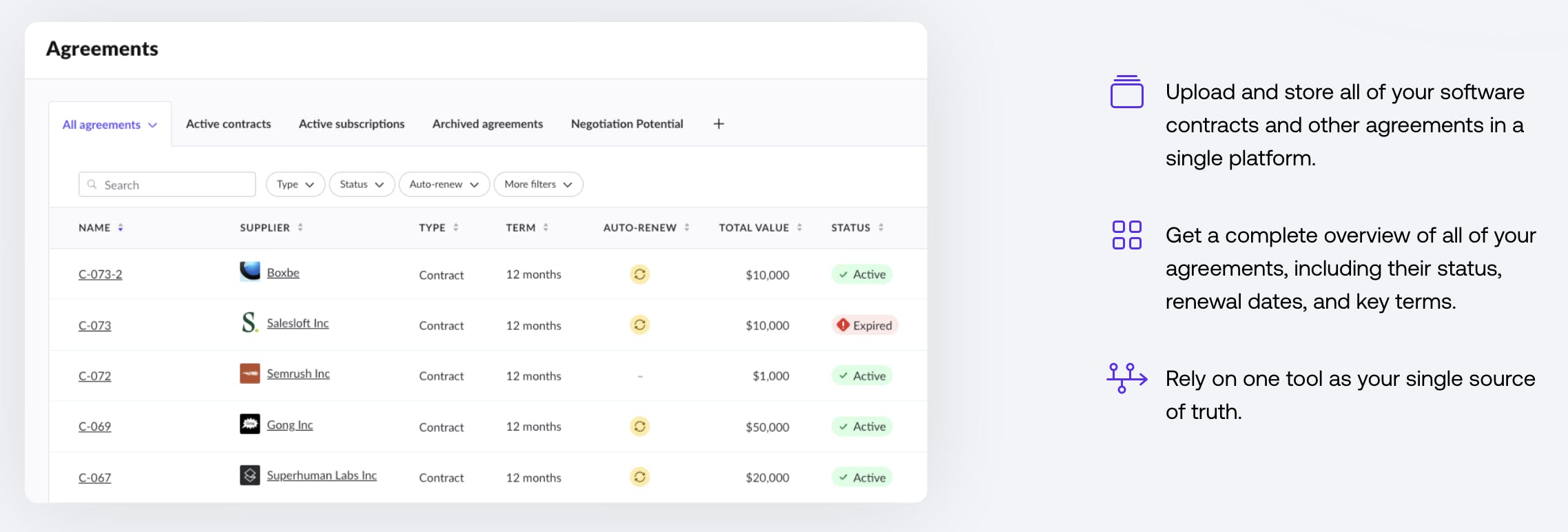

As the purchasing process progresses to the contracting phase customers can use Vendr to track all of their contracts, including details such as status, renewal dates, and key terms. For a typical procurement team, there is a meaningful amount of data entry to keep track of specific commercial terms for a contract. For example, some procurement specialists can spend “roughly half of their working hours [on] repetitive tasks like creating and updating documents. Another 10% of their time is dedicated to manual data entry alone.” Vendr claims to enable users to reduce that manual data entry significantly by extracting key terms for those contracts.

Intakes

Source: Vendr

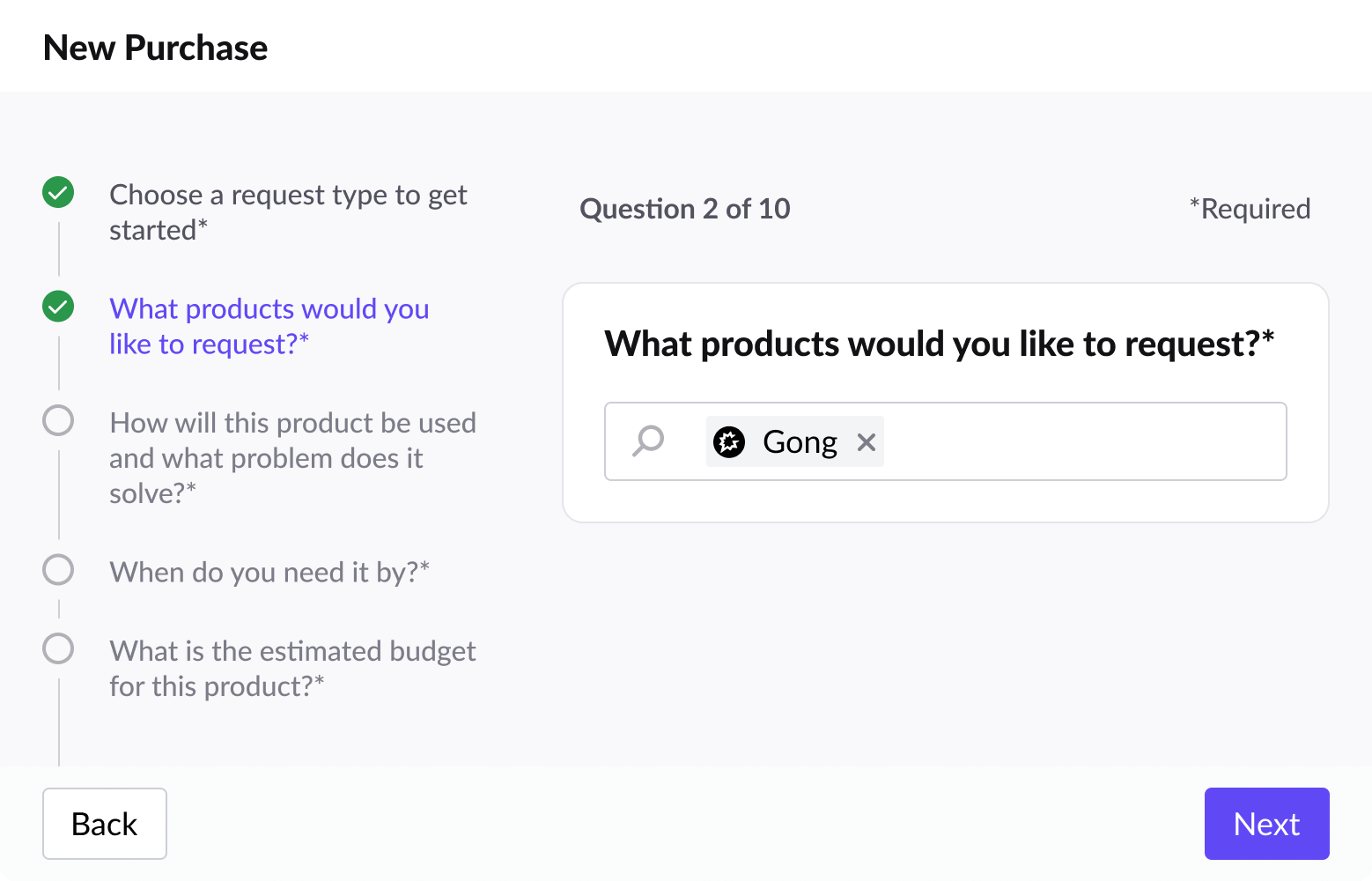

The first module in the Vendr Intelligence Plus (VIP) tier of Vendr’s product starts with the intake process. For every procurement process, the customer needs to ingest specific information. Employees within the Vendr customer can fill out an ingestion form indicating whether the purchase is a new purchase, renewal, upgrade, etc. From there, the employee can leverage templates and dynamic questioning to collect all the necessary information for that particular purchase. From there, Vendr’s product will progress the intake form through a workflow of approvals.

Approvals

Source: Vendr

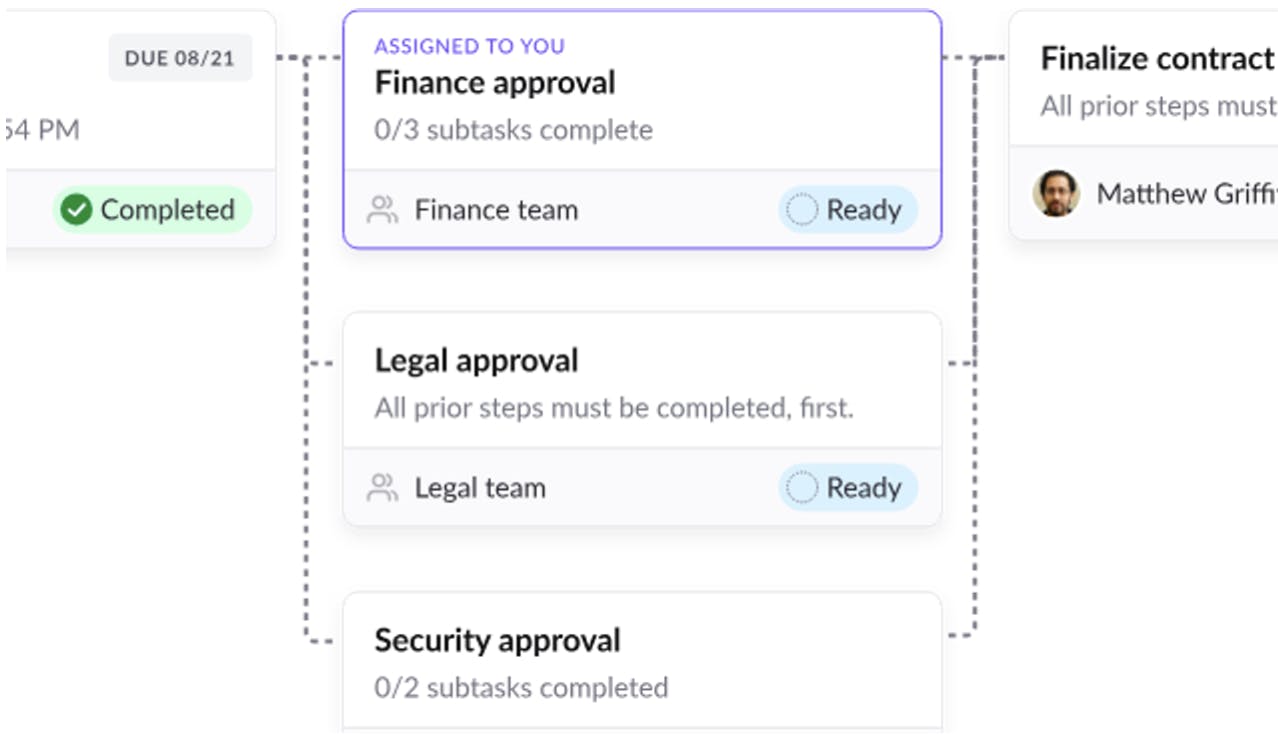

For firms with 100+ employees, there are typically seven people involved in the purchasing process. Once a purchase request has been ingested into Vendr’s platform it can automatically alert the necessary stakeholders to approve certain elements of a purchase. This type of approval workflow creation also enables customers to track and audit the various purchases they’re making with greater transparency.

Renewal Management

Source: Vendr

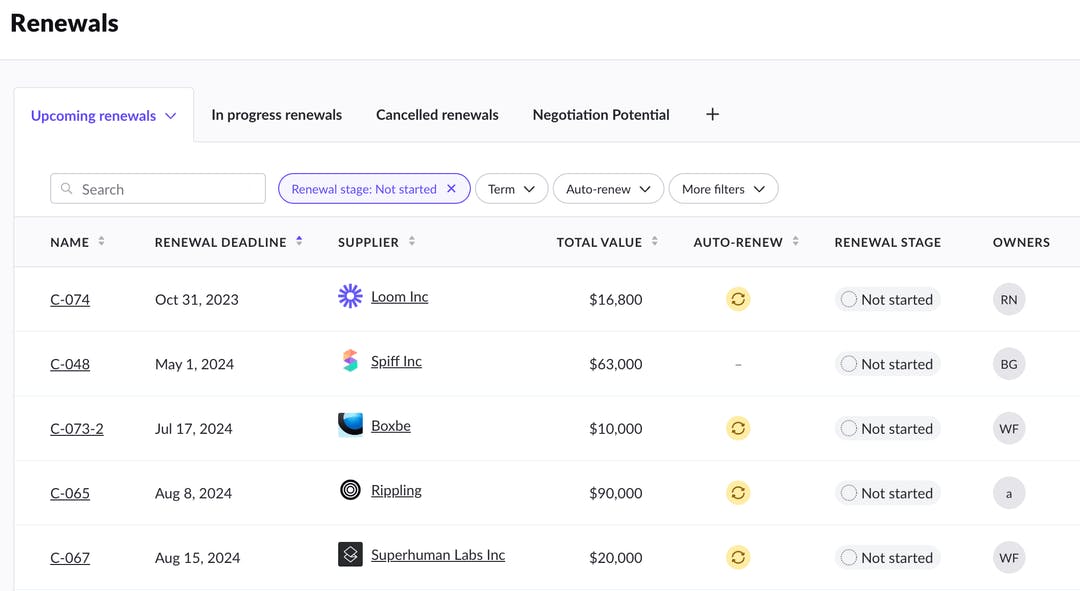

From a vendor’s perspective, SaaS contracts are built in hopes of ensuring as much renewal as possible. 89% of SaaS contracts include an automatic renewal clause. Accidental renewal leads to a significant amount of wasted SaaS spend, with the average company seeing ~31% of SaaS spend going to waste. Vendr’s platform not only allows for tracking renewal dates and details but can also collect user sentiment within an organization to inform whether a renewal will be met positively or negatively.

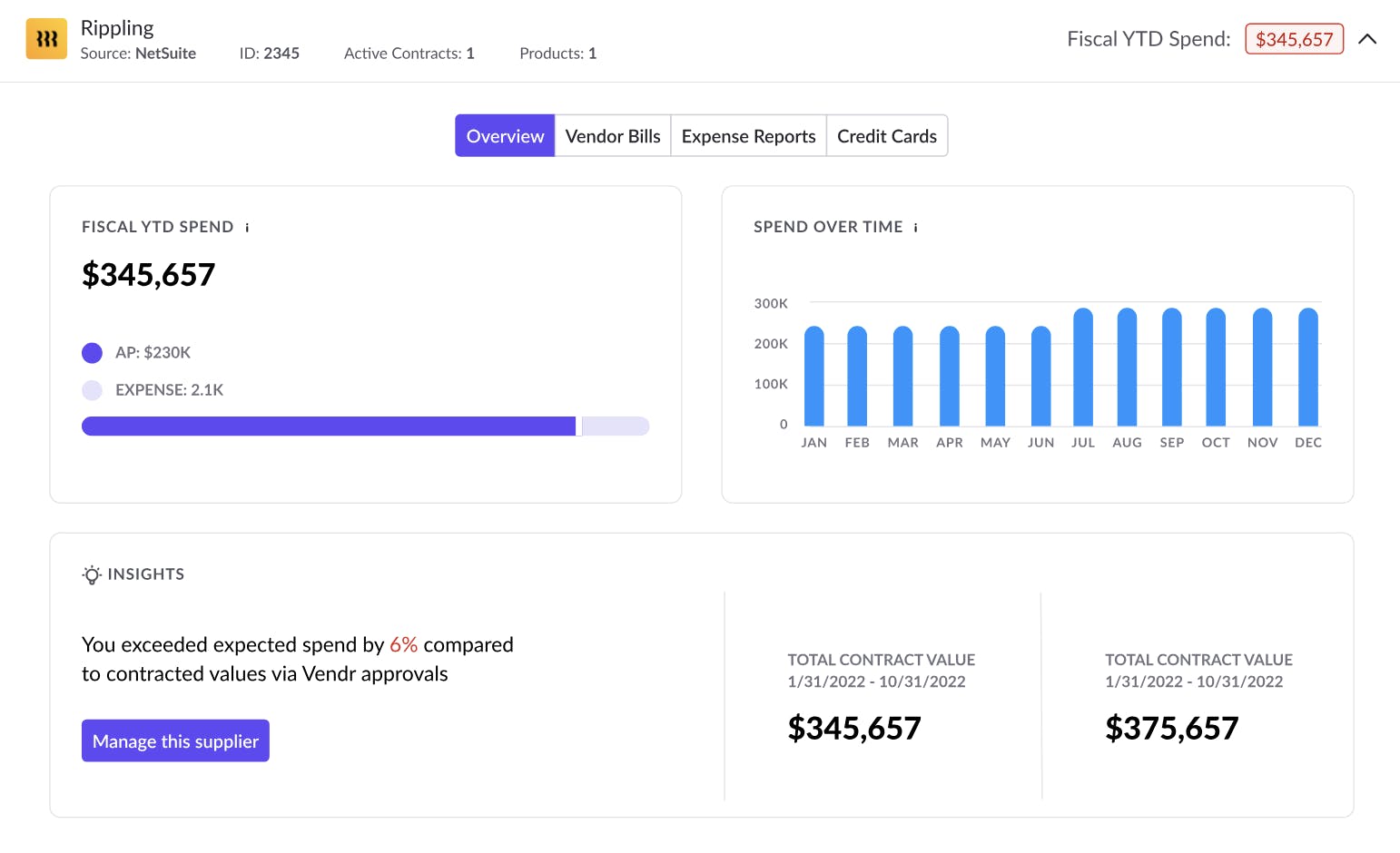

Supplier Management

Source: Vendr

Each vendor represents a meaningful amount of data in terms of spend, usage, efficiency, and user sentiment. Vendor profiles can be created at the point of ingestion when a purchase is first made. From there, context on that vendor can be managed over time to better understand a particular vendor within an organization.

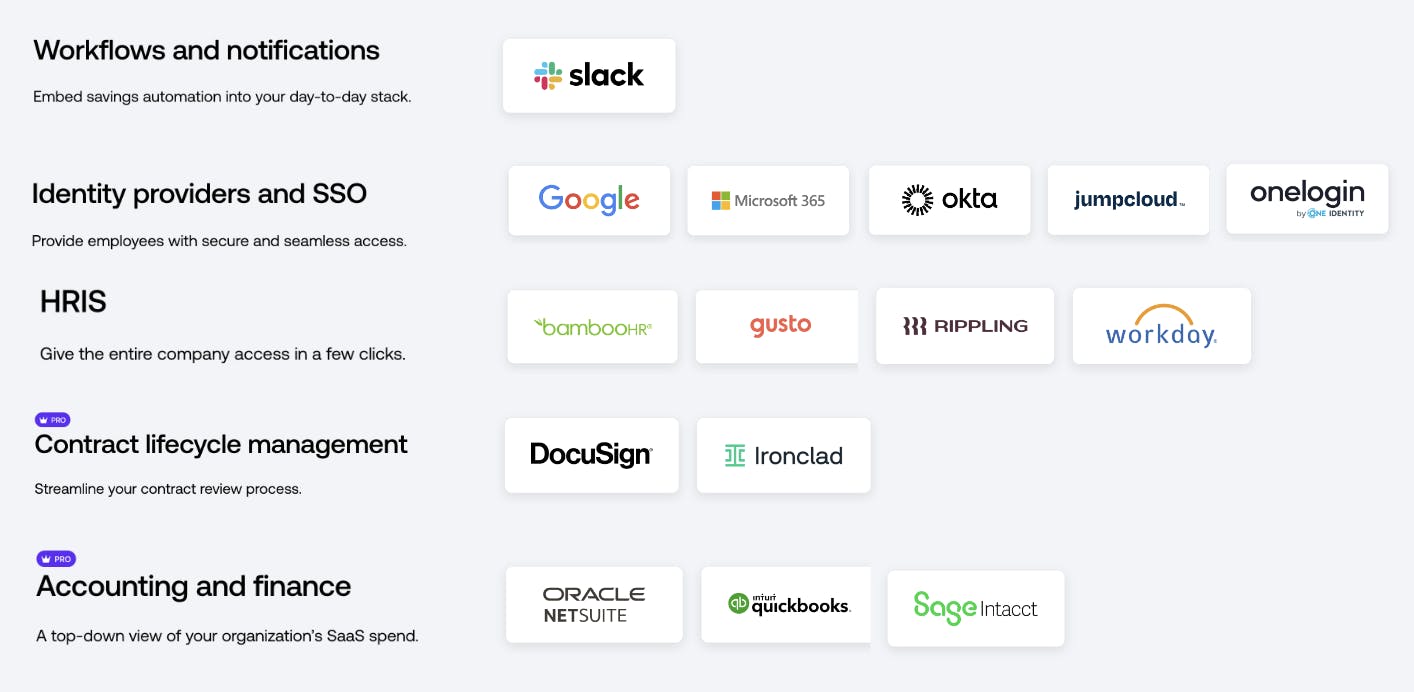

Integrations

Source: Vendr

Vendr provides a number of integrations that can connect directly to the procurement process. For example, connecting to Slack can allow a company to set up reminders on upcoming contract renewals through Slack notifications. Connecting to financial and accounting systems can allow analysis of expense trends. Finally, connecting DocuSign can increase the efficiency of the procurement process by building signatures directly into the workflow.

Market

Customer

While Vendr can support both enterprises and small organizations, the pain points in procurement are typically more acute as an organization grows larger, with 100+ employees and significantly more SaaS applications. As of December 2023, Vendr claimed to serve more than 500 customers globally including companies like Brex, Lattice, Hubspot, Webflow, and Canva.

Source: Vendr

A typical enterprise-level Vendr customer will leverage 300 SaaS tools, representing ~$350K of monthly spend. Typically these customers will have a dedicated procurement department or have specific procurement functions within specific verticals such as finance, IT & security, and legal. Vendr claims to be accessible for each of these departments offering customizable solutions. The company’s solution is more optimal for larger organizations as it allows teams to automate day-to-day tasks without outsourcing it to procurement or finance teams.

Market Size

Worldwide software spend is expected to reach over $900 billion in 2023, up 11.8% from $807 billion in 2022. The industry has seen a massive proliferation of SaaS with the rise of enterprise application software, infrastructure software, and managed services. As of August 2023, the average company uses over 250 SaaS solutions, up from 130 in 2019.

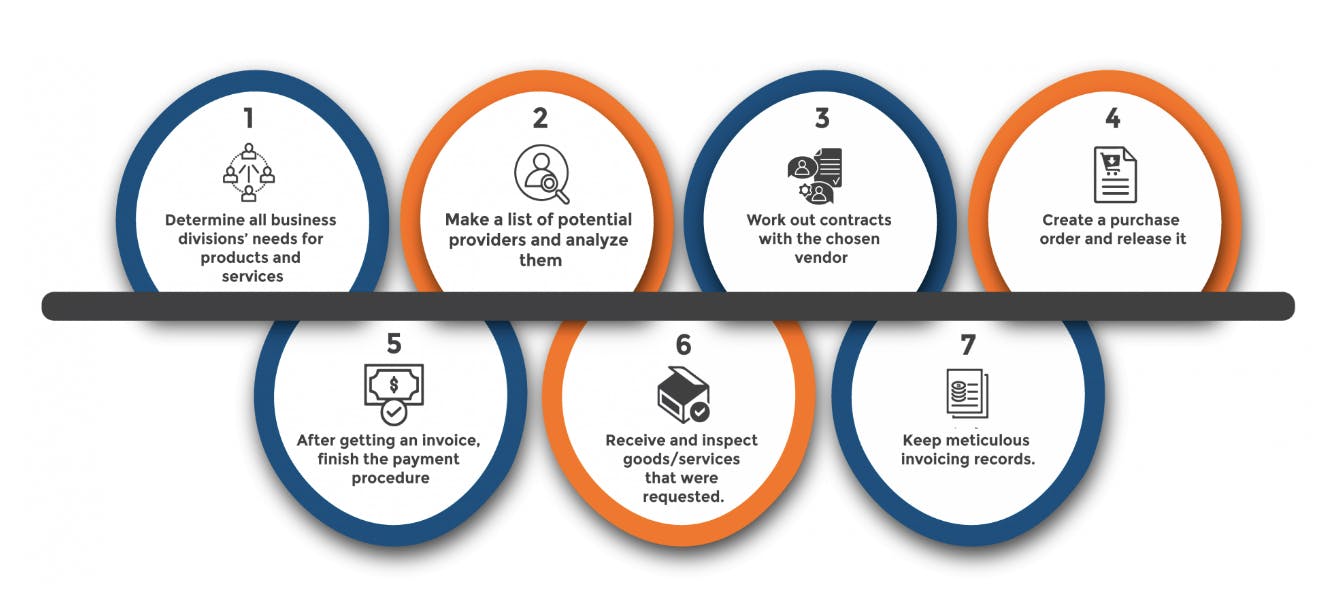

As supplier options and spend increases, so does the complexity. Buying and managing software is becoming more time-consuming and expensive for three key reasons:

SaaS pricing is highly variable: Pricing is dependent on time of year, company size, sales rep, and many other factors. Usage-based pricing model is becoming more prevalent, but the black box is also growing. Without comparable data, it’s hard to know whether you are getting a fair deal.

The software landscape is increasingly difficult to track: With the growing number of new options, it’s hard to validate whether you made the right decision on the solution and pricing.

The software buying process is disjointed and manual: All software vendors need to be managed from original purchase to renewal and expansion. However, most companies are not properly equipped to effectively manage these tasks at scale as the buying process requires a manual lift from multiple departments, including procurement, legal, and finance.

Source: Simfoni

Given macroeconomic conditions, reducing spend inefficiencies is top of mind for every company. Vendr’s SaaS buying and spend management platform benefits from rising software reliance, focus on cost control, and complex software buying processes.

Competition

SaaS Buying

SaaS buying (“negotiation-as-a-service”) was Vendr’s initial product, and Vendr claims to be the world’s first SaaS buying company. A few competitors have entered the market since Vendr’s launch in 2019.

Tropic: Tropic is a US-based Series B startup focused on SaaS buying and management space. The company claimed to have over 300 customers as of December 2022. Tropic notes a few areas of differentiation with Vendr, stating that Tropic is more unbiased since it does not take commission fees from suppliers (while Vendr does) and that Tropic offers a full procurement service, while Vendr only offers a negotiation service.

Ramp:* Ramp is a finance automation platform that helps businesses spend less time and money. Founded in 2019, it has raised $1.4 billion in total. Ramp raised $550 million in debt financing and $200 million in equity at a $8.1 billion valuation in March 2022. Ramp promises “guaranteed savings on SaaS with Ramp’s expert negotiators.” Ramp claims to provide its customers with a 3x ROI.

Sastrify: Sastrify is a Germany-based Series B startup focused on SaaS buying. Founded in 2020, it has raised a total of $55 million. In May 2023, it raised a $32 million Series B led by Endeit Capital. As of 2023, Sastrify has a dominant position in Europe, growing more than 400% from 2022 to 2023 in the region, and it claims that its platform is more automated and affordable than its U.S. counterparts. However, Sastrify only offers procurement. Customers will still need to look for other SaaS management platforms for support. It is also scaling a global team that will focus more on the United States.

SaaS Spend Management

With the acquisition of Blissfully, Vendr aims to take on SaaS management incumbents including Zylo, Productiv, and BetterCloud. All of these players offer a set of API integrations into enterprise software usage, designed to help specific departments optimize their usage and spend.

Zylo: Zylo enables companies to organize, optimize, and orchestrate SaaS. It also offers SaaS negotiation professional service. Zylo specifically serves the IT, procurement, software asset manager, and CIO departments that may want to outsource the negotiation aspect of SaaS management. Zylo is a more mature product with marquee customers like Salesforce and GitHub. However, Zylo’s negotiation offering was only released in 2021, leaving it with less data and traction than Vendr.

Productiv: Productiv helps CIOs unlock business value by understanding application engagement. Productiv’s spend management and procurement solutions are smaller pieces of the business, but its competitive moat lies in the strength of its benchmarking data. Productiv has a larger book of enterprise customers, including Meta and Dropbox, who have more robust procurement organizations and data points. As such, some customers pointed out Productiv is able to deliver stronger insights and recommendations than other vendors.

Contract Management

Finally, Vendr’s expansion into contract management in January 2023 introduced another landscape of competitors that the company is contending with, namely companies who are specifically focused on contract lifecycle management (CLM).

Ironclad: Ironclad was founded in 2014 and provides a CLM product that includes several modules: (1) workflow designer, (2) editor, (3) repository, and (4) reporting. Ironclad has raised a total of $334 million over 8 rounds. In January 2022, Ironclad raised a Series E round of $150 million at a valuation to $3.2 billion. Ironclad seeks to distinguish itself from the field of competing CLM software through offering greater flexibility in implementation, and the ability to utilize insights from data to optimize the CLM process.

Icertis: Icertis is one of the older players within the CLM industry, having been founded in 2009. Icertis has a number of partnerships with Fortune 500 companies such as Microsoft, Google, Accenture, Boeing, and Costco. Icertis has been focusing its efforts on specific verticals to maximize performance within those verticals. For example, there is a dedicated Icertis Contract Intelligence (ICI) product for Banking and Financial Services (BFSI) which provides templates and exemplary workflows for banks and insurance companies. There are also ICI products for Healthcare, CPG/Distribution, and other industries.

Evisort: Evisort is an AI-focused CLM company that focuses on leveraging NLP in their product. Evisort’s revenue more than doubled in 2021, and it launched an Automation Hub in October 2022 which allows users to train their own AI model code-free in order to recognize clauses specific to their use cases. Ironclad’s flagship products mostly focus on the contract creation and organization process, as opposed to generating data insights.

Business Model

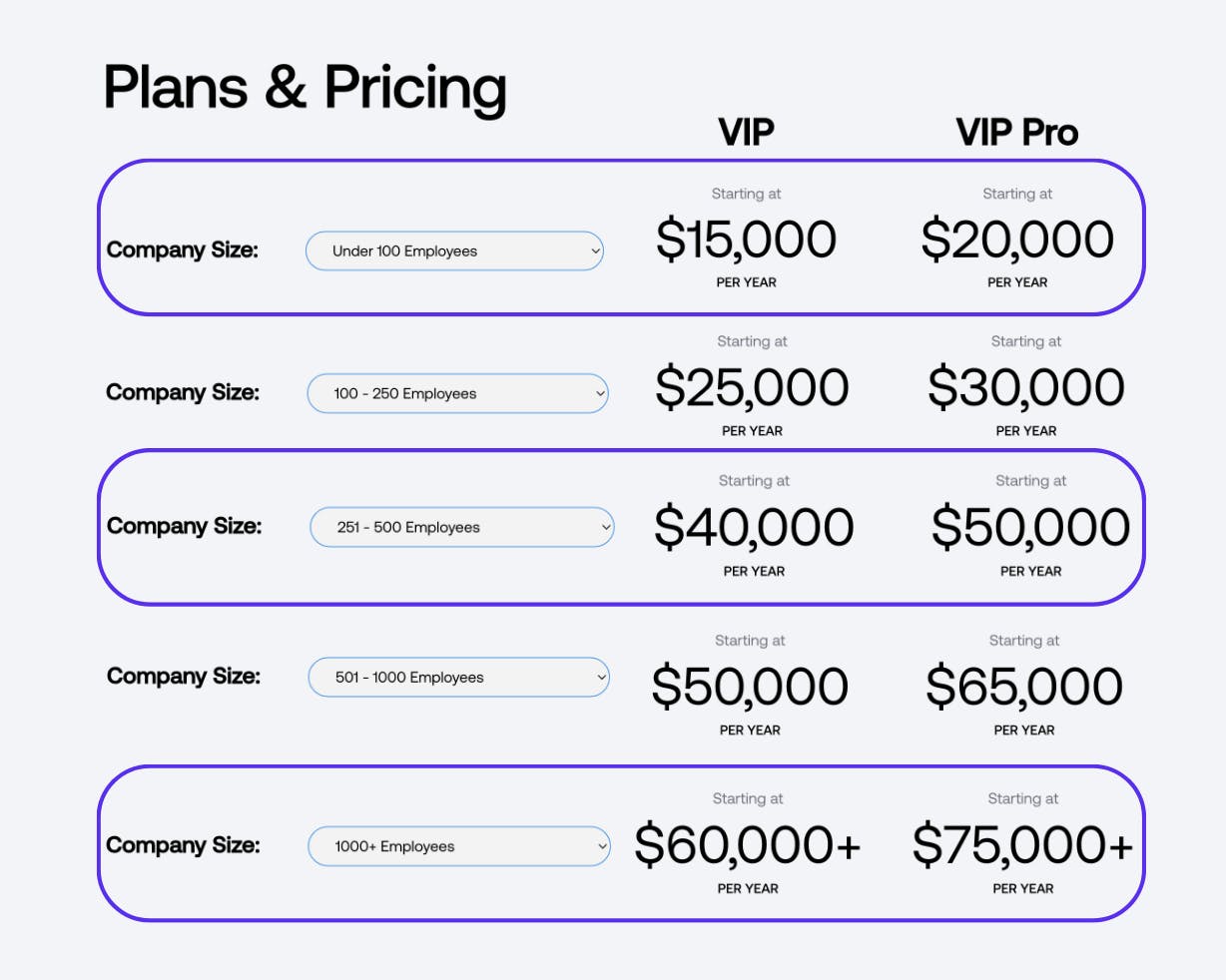

Source: Vendr

Vendr’s pricing estimates vary depending on the size of the company from under 100 employees up to 1K employees. Previously, Vendr claimed a money-back guarantee, ensuring that a customer’s pricing tier would be more than made up in guaranteed savings. However, as of December 2023, that guarantee wasn’t prominent on the company’s website.

In addition to subscription pricing for its customers, Vendr has the ability to monetize other aspects of its business. On the supplier side, Vendr can charge vendors for promoting their products or listing them on its site. Vendr competitors like Tropic and Spendflo claim that “Vendr requires commissions to list suppliers,” and can sometimes receive kickbacks for pushing solutions from specific vendors, regardless of fit. Whether this monetization potential introduces perverse incentives is unverified.

Traction

As of December 2023, Vendr claimed to have over 500 customers, including Brex, Lattice, Hubspot, and others, claiming to have saved customers $250 million. The company has supported $2.5 billion in SaaS purchases across 2.6K suppliers. In 2021, Neu shared the company had grown revenue by 3x since 2020, implying $12 million of revenue. Some unverified sources estimate Vendr’s 2023 revenue at ~$94 million.

Valuation

As of December 2023, Vendr had raised $216 million in total funding. In June 2022, Vendr raised a $150 million Series B at a $1 billion valuation co-led by Craft Ventures and SoftBank’s Vision Fund. Previous investors in the company include Tiger Global, Y Combinator, and Sozo Ventures.

Key Opportunities

Pricing Product for Sellers

Vendr has a large data library across various vendors’ pricing structures. As a result, the company has the opportunity to leverage this data to provide pricing recommendations to those same vendors and help them win deals against their competitors. Some Vendr customers with software products of their own expressed interest in a product like this provided that the data they receive is anonymous. It would also serve as an edge to help Vendr expand use cases for the sales department.

Cloud Cost Optimization & Marketplace

Beyond subscription software spend, Vendr can expand into adjacent categories such as cloud cost intelligence. Platforms like CloudZero and CloudHealth are even more granular than Blissfully or Zylo, diving deeper into compute levels (e.g. EC2 on AWS) and computing spend. Vendr can further deepen its value proposition and expand use cases by expanding into this category through acquisition or in-house development.

Key Risks

Retention

Once customers have largely optimized their spend after year 1 or 2, the savings that Vendr is able to monetize decreases, potentially leading to a decline in net revenue retention. Vendr is valuable for customers consistently growing out of their existing contracts or adding new vendors every year. If customers are doing neither, there is a possibility that customers will churn after optimizing savings in the initial years.

Spend Management Players Expanding into Procurement

In 2021, Ramp acquired Buyer, a negotiation-as-a-service company, and now offers Procurement as part of its core spend management offering. The combination is powerful, as Ramp already has a full purview of its customers’ spend data and does not require additional onboarding like Vendr. Similarly, Brex, Airbase, and Divvy have the opportunity to build fast follows. More competition gives software buyers optionality but weakens third-party negotiators’ value propositions as the service becomes commoditized.

Vendors Transitioning to Transparent Pricing

Vendr benefits from the lack of transparent pricing in the software industry. However, there are also organizations known for transparent pricing, such as Atlassian, regardless of the customer’s size. To speed up negotiations and customer onboarding, suppliers could do two things: make pricing transparent, and simplify the sales process. This not only makes it easier for customers to navigate the purchasing process but also reduces reliance on procurement teams. This is already the case for many small organizations (e.g. self-serve).

Summary

Vendr has continued to expand its platform from a simple buying platform to a broader procurement platform. However, the business runs the risk of being commoditized if vendor pricing is standardized and competitors from adjacent categories continue encroaching on Vendr’s existing product surface area. Moving forward, Vendr’s success will be dependent on its ability to deepen its procurement workflow offerings, grow its data library, and strengthen its position through category expansion.

*Disclosure: Contrary is an investor in Ramp through one or more affiliates.