Thesis

There are 33.2 million small businesses in America. They make up 99.9% of all US businesses. Small businesses are responsible for 63% of new jobs created from 1995 to 2021. However, small businesses struggle to meet changing customer expectations, rising costs, and the service delivery landscape. Technology is advancing rapidly, and customers are expecting more. Businesses often attempt to use disparate, unconnected tools to manage home service operations. They often take job requests over voicemail, manually input customer data into spreadsheets, look up locations in a map app, and use a calendar to check availability and schedule teams. These inefficient systems often stand in the way of growth.

In 2022, the addressable market for home services was $657.4 billion. 6.1 million people worked for 2.5 million businesses doing in-home services. Meanwhile, the total supply of housing units rose to 143 million in 2022, with the average age of housing units rising to 47 years. As the number of home service businesses continues to grow, the labor supply for home services also appears to be increasing. Because of this, home service providers have turned to technology in recent years to keep up with customer demands. The COVID-19 pandemic has expedited this transition, so now customers expect a professional, convenient, tech-forward experience from small businesses.

Jobber is an all-in-one platform to help small home service businesses modernize their operations, increase earning potential, and meet evolving consumer expectations. It supports businesses through the full customer lifecycle — sending quotes to scheduling crews, dispatching jobs, invoicing customers, and accepting credit card payments.

Founding Story

Source: Jobber

Jobber was founded in 2011 by two software developers, Sam Pillar (CEO) and Forrest Zeisler (CTO). Both are graduates of the University of Alberta in Canada.

Pillar and Zeisler met at a cafe in Edmonton while working as freelance software developers. The duo decided to work together after discussing the projects they were working on. Pillar had experience building custom applications for non-profit organizations and small service businesses. He recognized the need for better tools to operate and grow such businesses. With this in mind, he and Zeisler spent time consulting with as many home and field service businesses as they could to learn about their functional needs for management tools, during which they quickly learned how important it would be to create a tool that would be easy to use.

After discussing the need for a product like Jobber’s future offering with many business owners, in the summer of 2010, the pair began developing an application. They launched it in beta with a batch of test companies. Despite being buggy, feedback was positive, and the duo continued development, officially launching to the public in September 2011. Launching to the public brought on its challenges across support needs, continued development of Jobber’s product roadmap, and business development.

Product

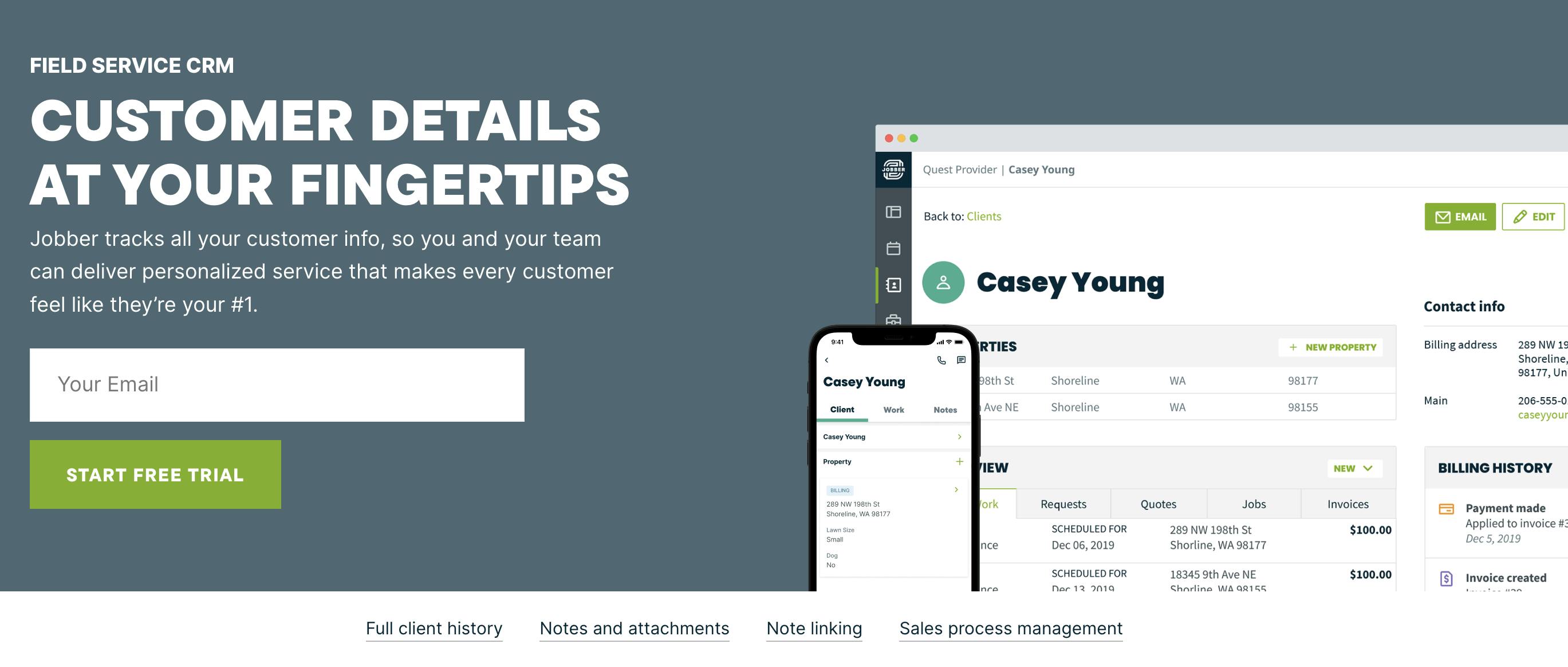

Client Manager

The client manager helps companies track client details and deliver personalized services. This includes access to a complete and organized client history, with past quotes, jobs, visits, invoices, and billing data available. It also includes client search tools to find information across clients, jobs, and invoices. Users can add linkable notes and attachments to a client account. Jobber offers sales process management tools, such as automatic lead labeling integrations with Mailchimp.

Source: Jobber

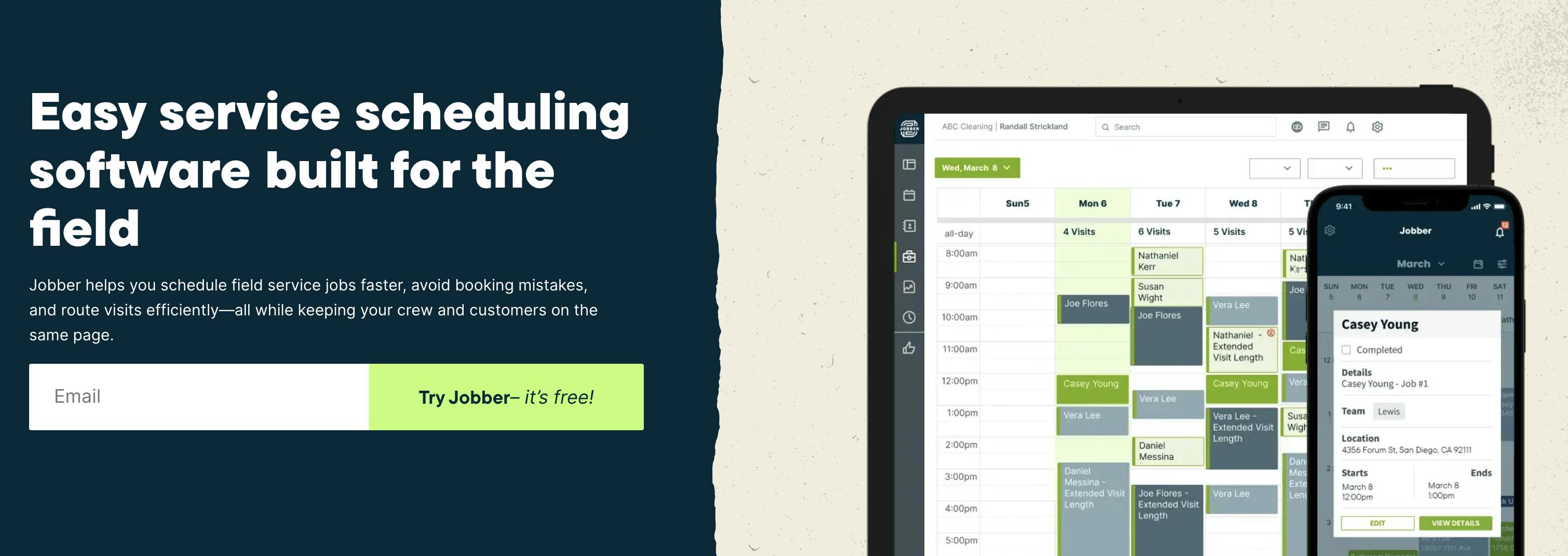

Scheduling and Dispatching

Jobber offers a variety of scheduling and dispatching features for field service companies. This includes online appointment booking that automatically schedules jobs based on set preferences. Additionally, Jobber offers calendar management functionality, including drag-and-drop calendar tools that let companies view and assign worker schedules across multiple views. Automatically generated fleet mapping, GPS, and routing features are also available through Jobber, as well as automated team-wide push notifications and visit reminders.

Source: Jobber

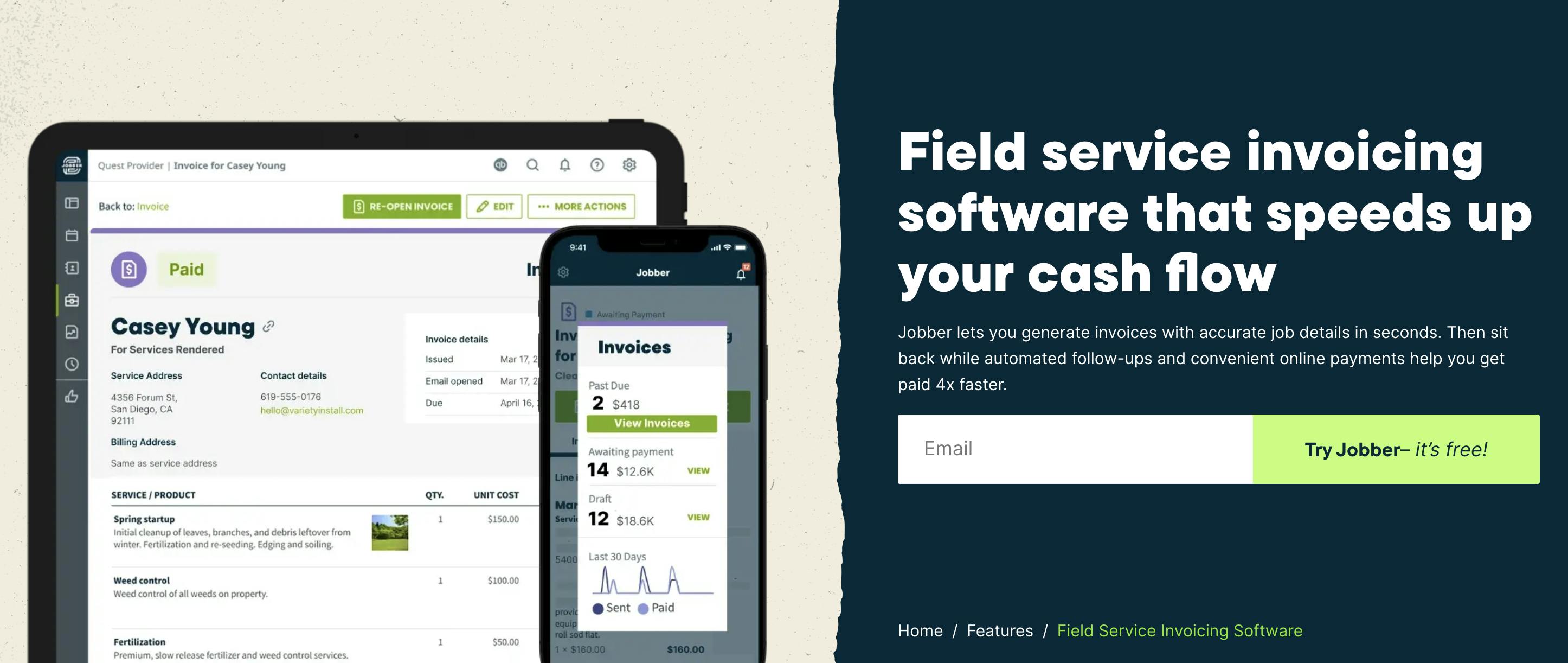

Invoicing and Follow-Ups

Jobber’s field service invoice software help companies easily create and deliver invoices, check invoice statuses, and send customers reminders of outstanding payments. Jobber’s automatic invoice feature offers personalization options for branding, contact information, and messaging.

Source: Jobber

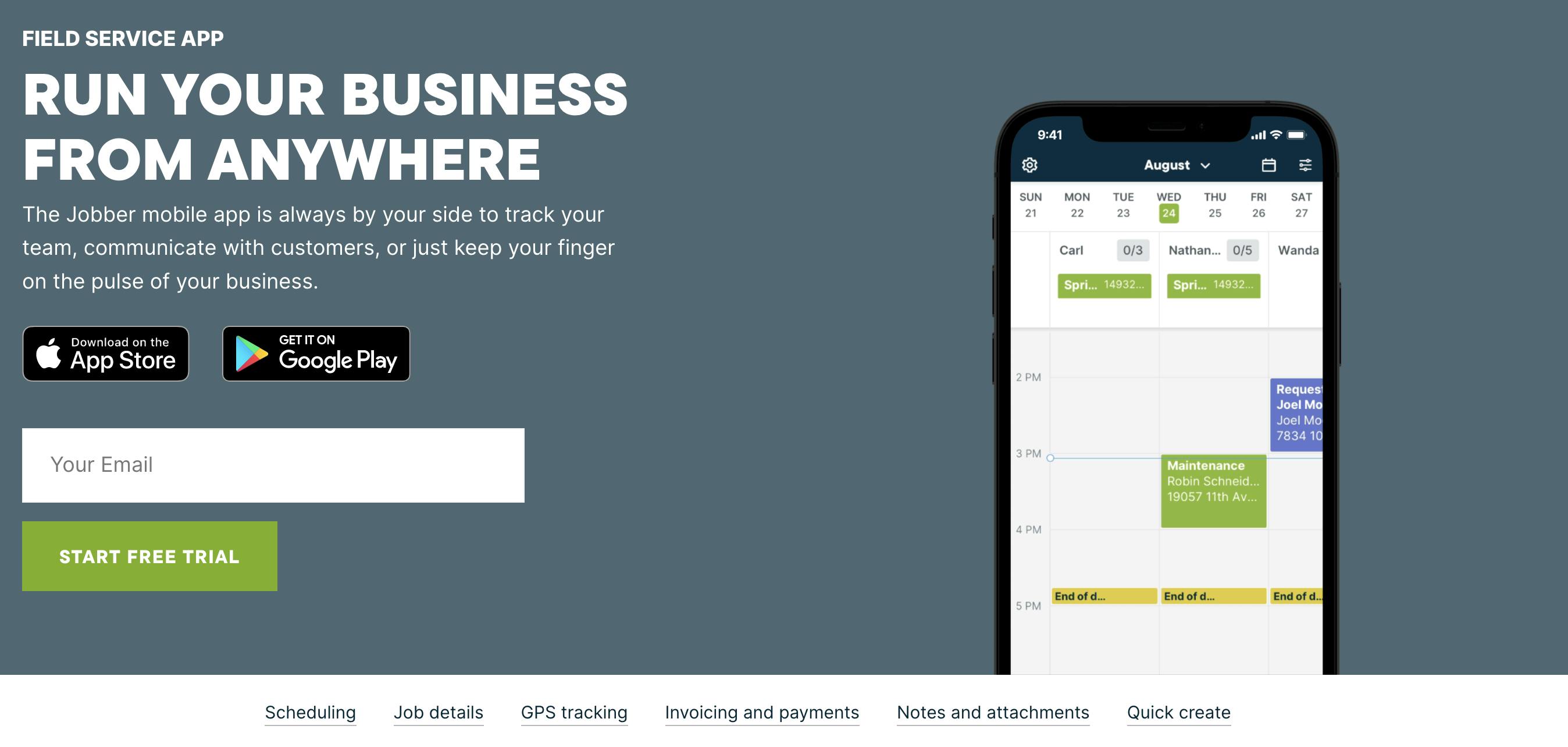

Mobile App

Jobber offers a mobile app so home service businesses and workers can operate on the go. It has built-for-mobile scheduling and calendar tools, job assignment features, team progress indicators, and more. It also provides access to client information and details, notes and attachments functionality, GPS tracking, invoicing and payments, and expense tracking.

Source: Jobber

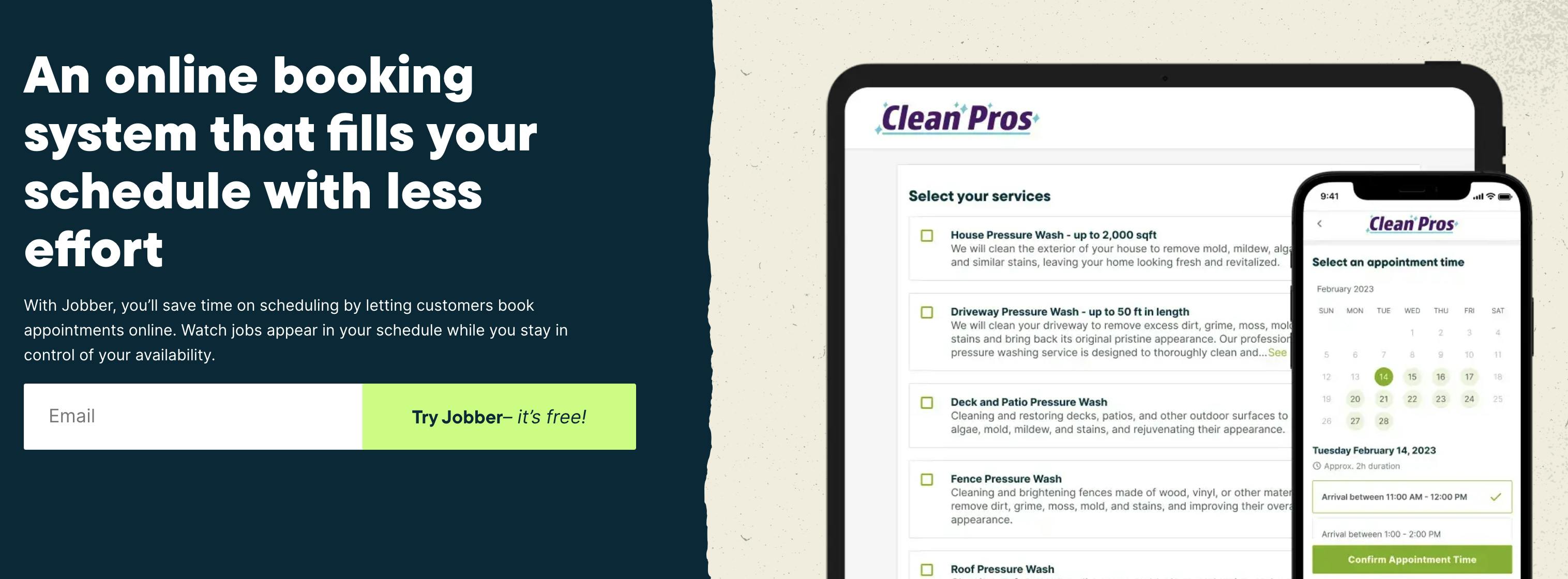

Online Booking

Jobber offers an online booking functionality for businesses and their customers. Users can list descriptions of their services online, including estimated prices and work durations, set schedule preferences, including earliest availabilities and buffer times, assign workers, and update team calendars based on schedule availability.

Source: Jobber

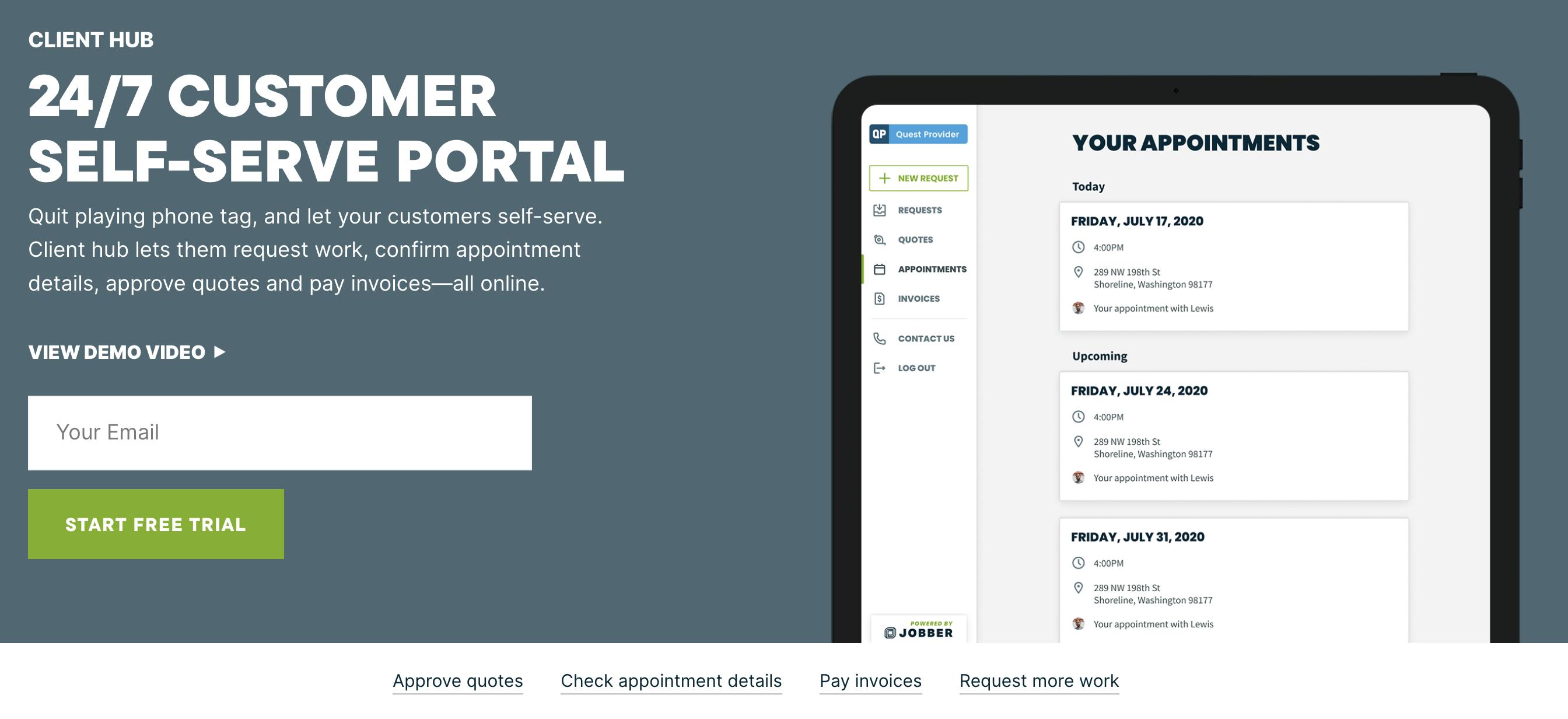

Client Hub

Jobber’s platform includes a self-serve client hub for the customers of home service companies using Jobber. With this client hub, clients can accept quotes, pay deposits, invoices, and tips, request changes, sign signatures, check past and upcoming appointment details, request follow-up work, and submit referrals over email, text, or social media. Once clients have scheduled the work, they can see who’s coming and when. They can check on which invoices are outstanding and print any receipts.

Source: Jobber

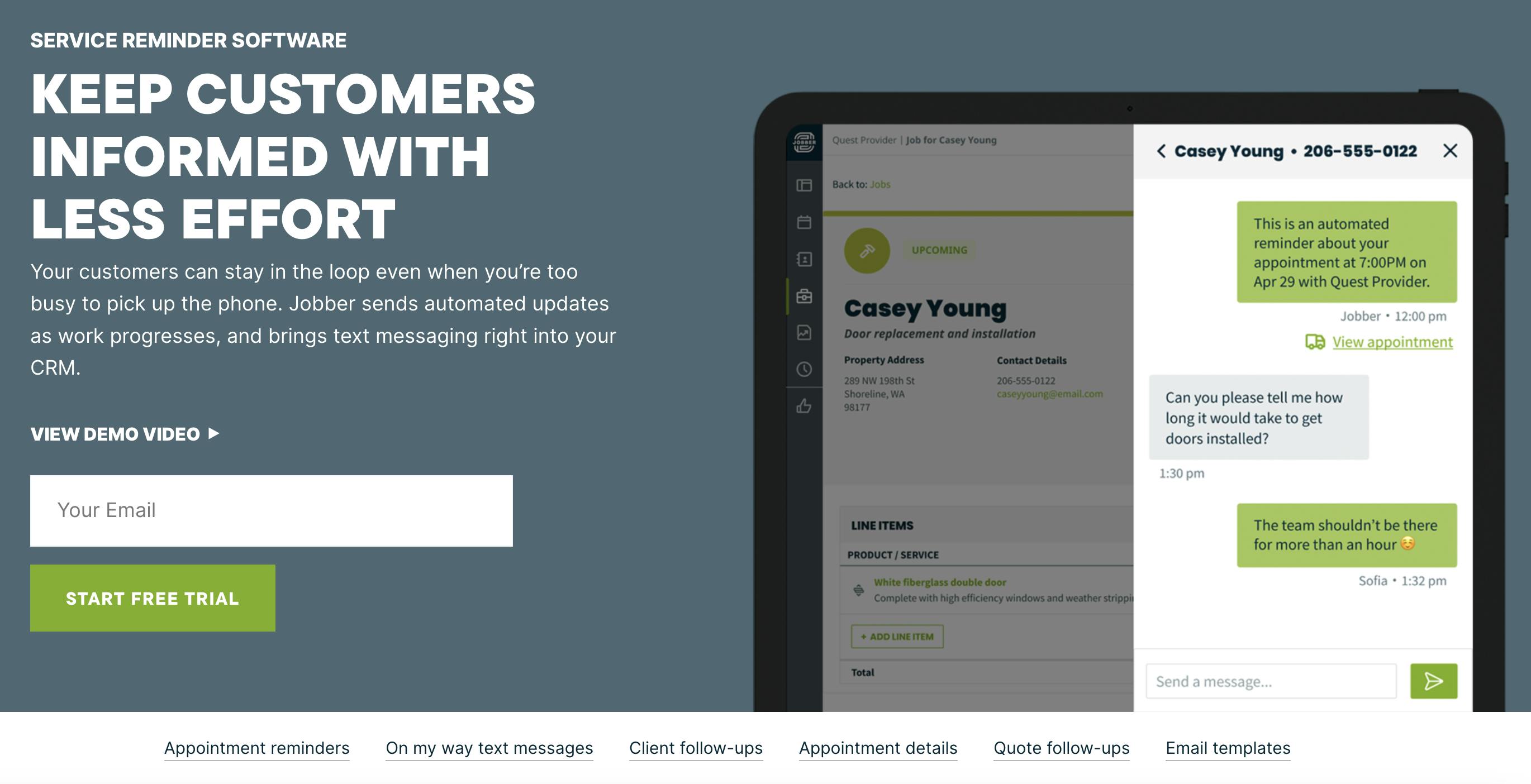

Customer Communications

Jobber offers a customer communications functionality for companies and their customers. This includes customizable appointment email and text message reminders, on-my-way text messages, quote follow-up emails, and feedback requests. Jobber also offers email templates and two-way text messaging management.

Source: Jobber

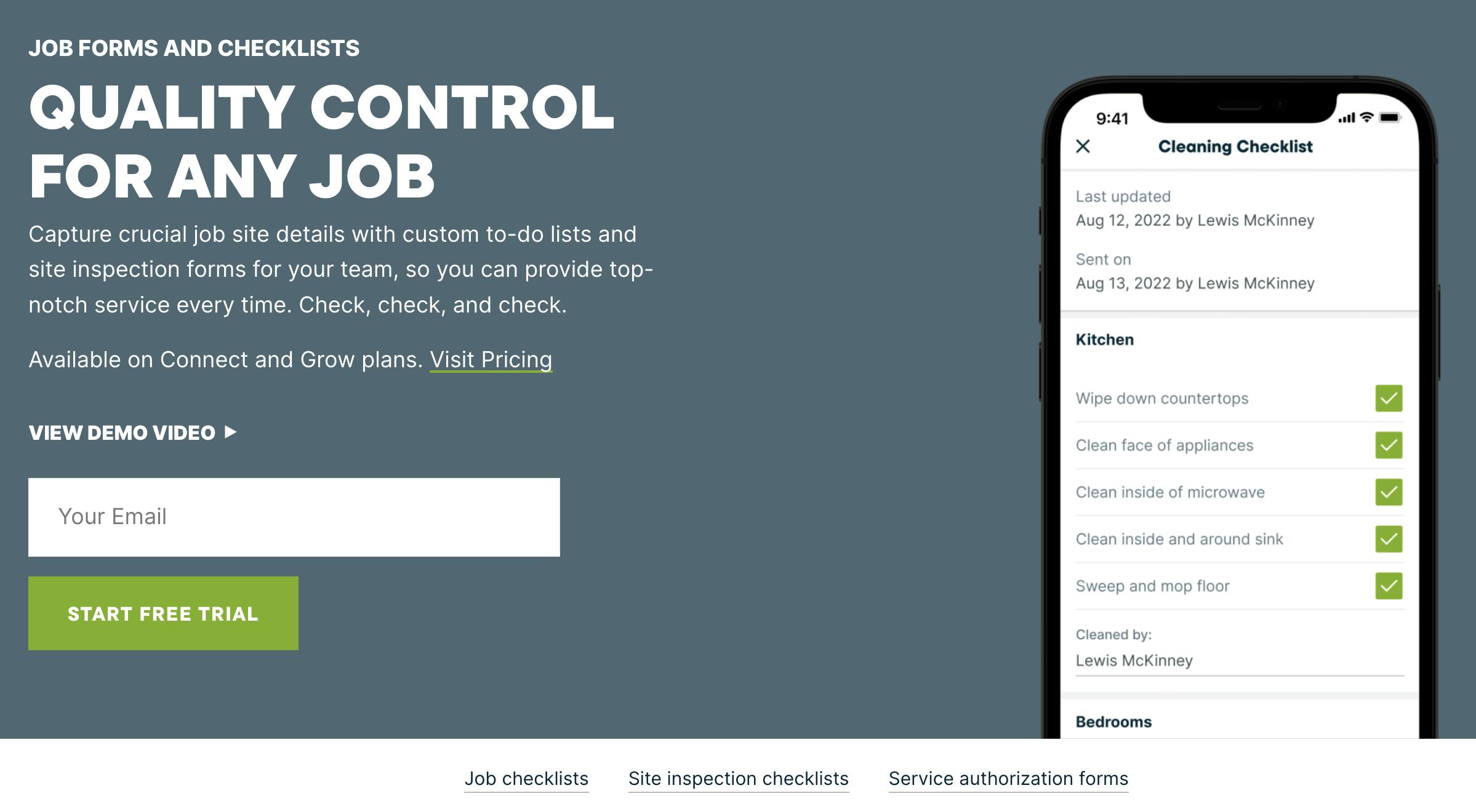

Job Forms

Jobber offers a variety of features to help home service companies ensure high levels of quality control on the job. It offers job checklists to help standardize workflows, create accountability, and ensure tasks are consistent from job to job. It also offers site inspection checklists that record on-site safety, facilities, chemicals, and equipment details.

Source: Jobber

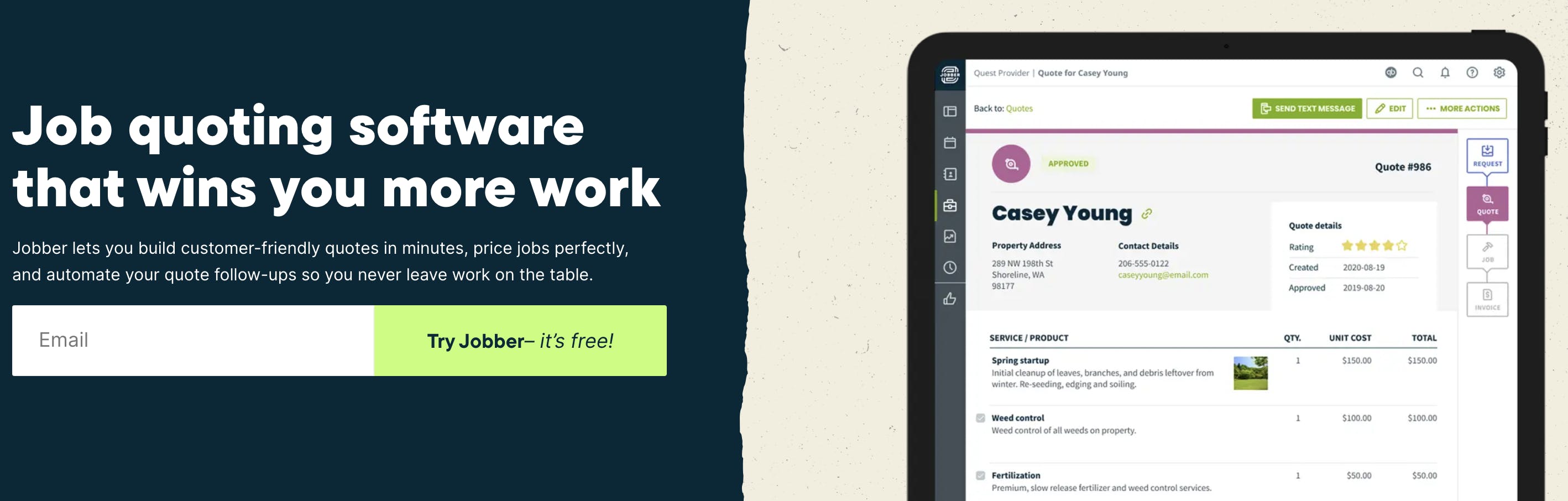

Quoting and Follow-ups

Jobber lets home service workers create professional quotes, view estimated margins, modify pricing, add optional line items for upselling customers, offer consumer financing through Wisetack, automate quote follow-ups, and approve and request changes to quotes their customers make in their online client hubs.

Source: Jobber

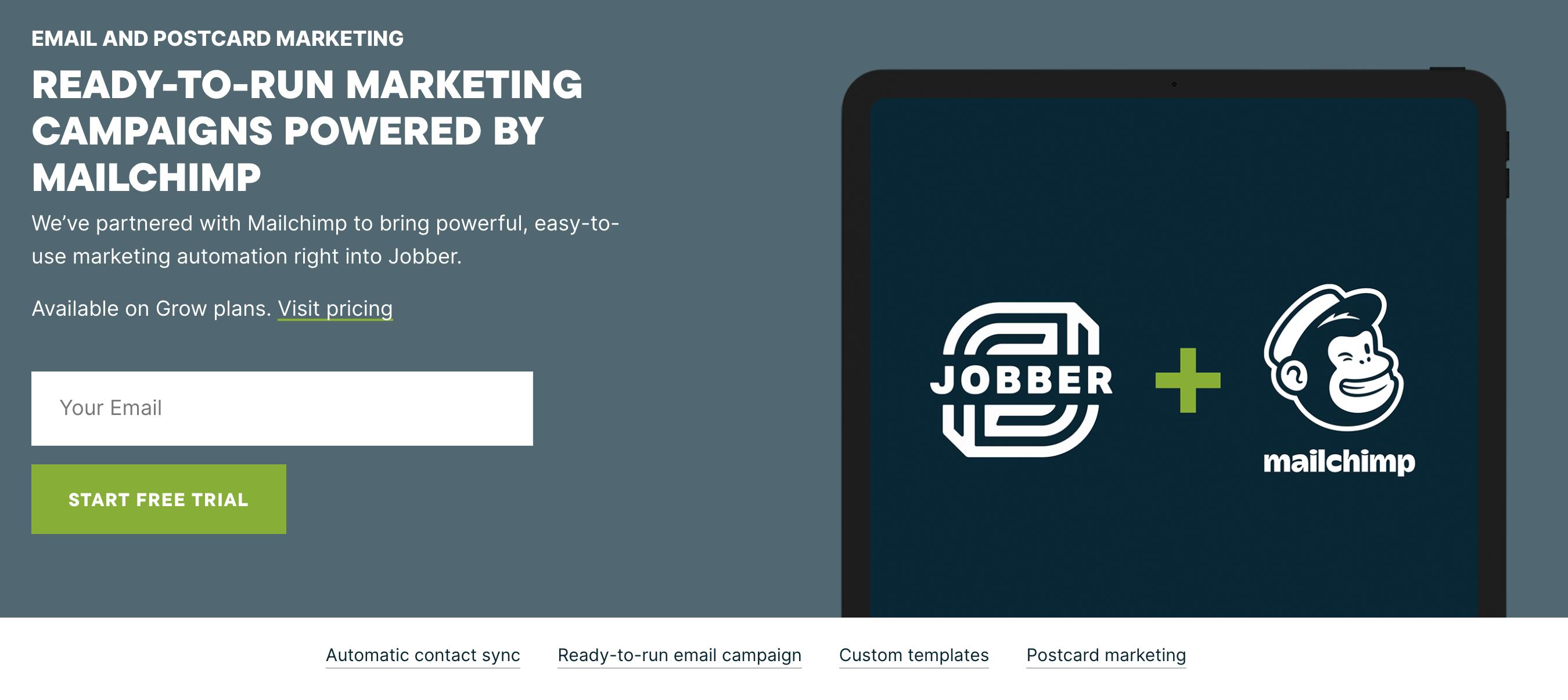

Email and Postcard Marketing

Through integration with Mailchimp, Jobber offers marketing automation within its platform. Features include automatic contact syncing, professionally designed email and templates, automated branded re-engagement campaigns, and postcard marketing.

Source: Jobber

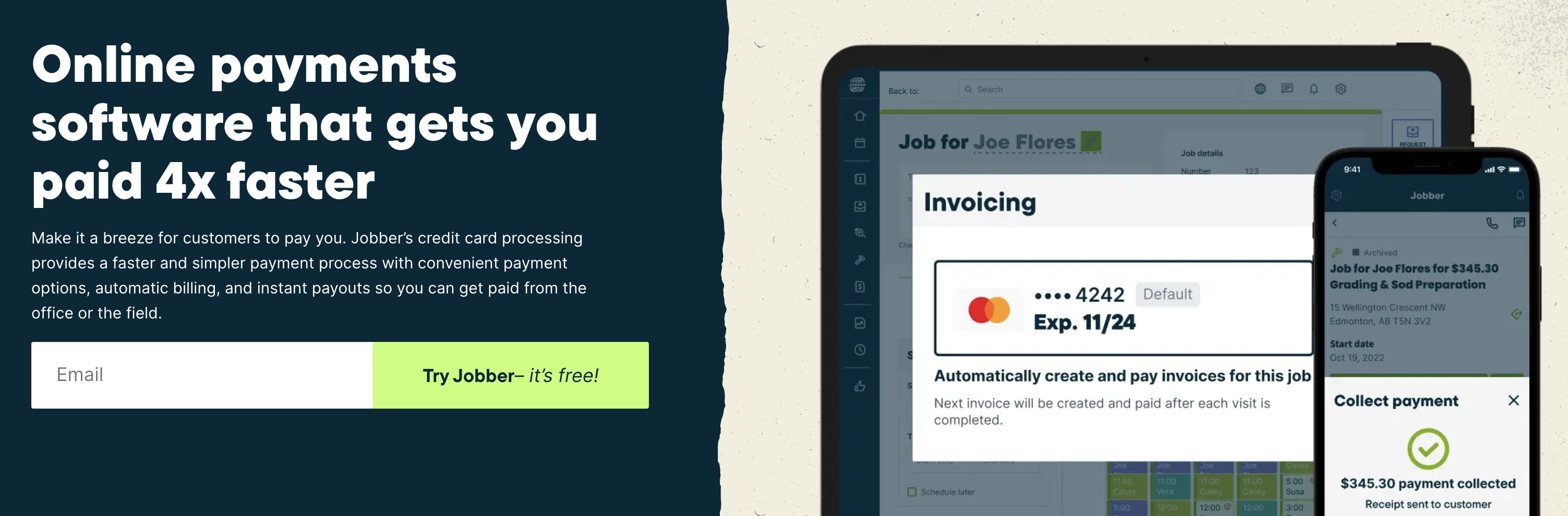

Credit Card Processing

Jobber allows home service businesses to get paid online. Jobber offers tools for instant payouts, automated credit card payments, and a physical Jobber card reader device for home service businesses to use in the field.

Source: Jobber

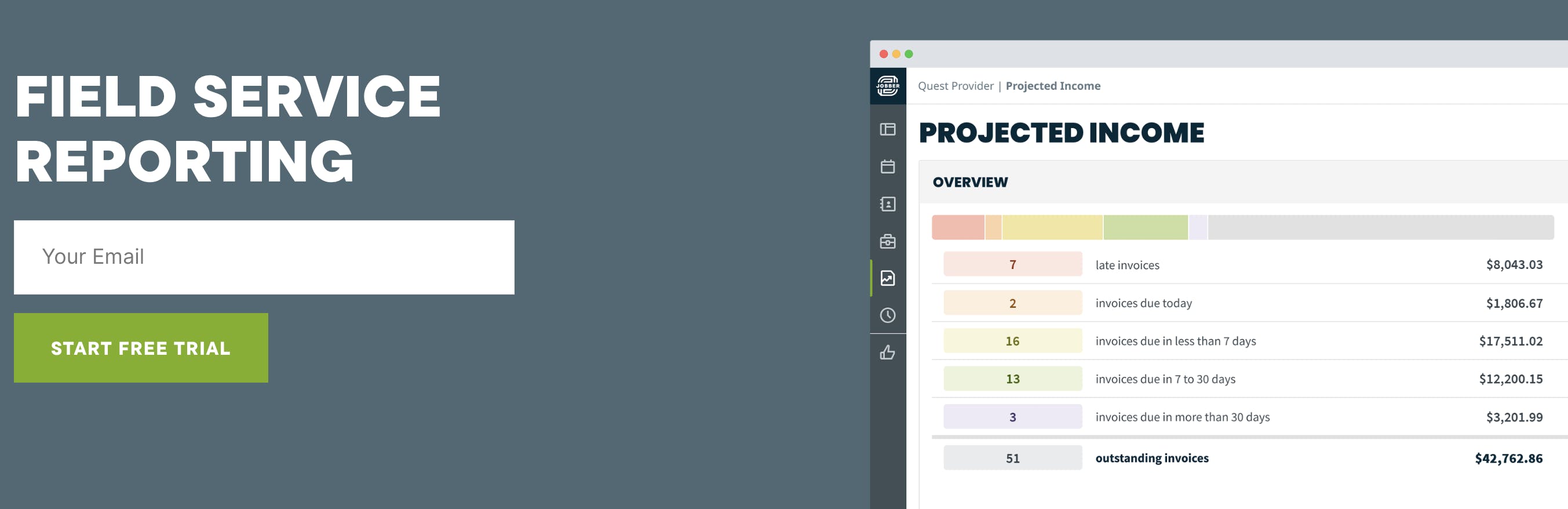

Reporting

Jobber offers over 20 built-in reports and dashboards for a live look into their business performance, exportable to an Excel or CSV file. Reporting categories include financial reports on projected income, taxation, payment, invoices, follow-up reports, service and work reports about visits, GPS tracking, time sheets, expenses, and client reports with details on balance summaries and feedback.

Source: Jobber

Market

Customer

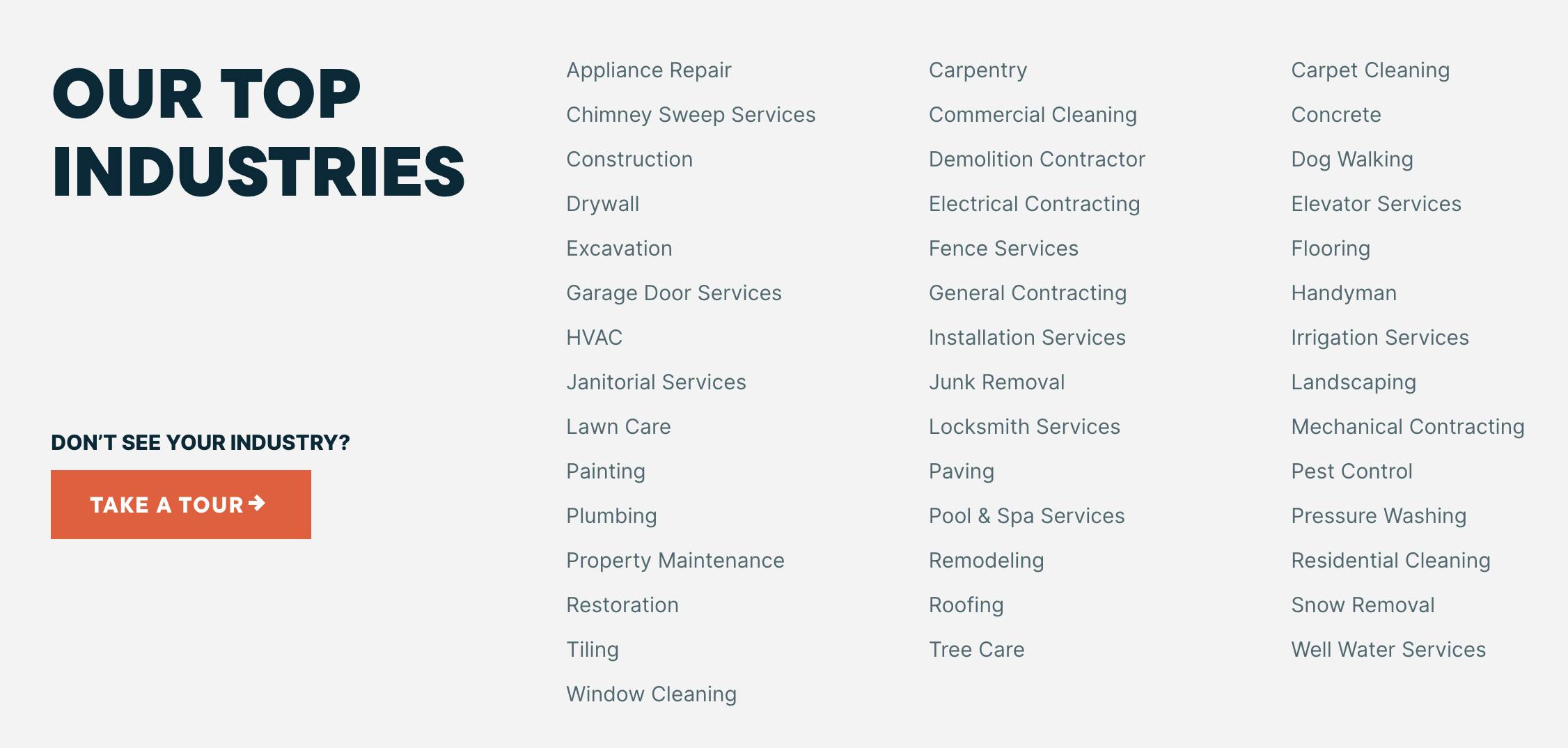

Jobber’s software caters to home service businesses across several industries, including but not limited to landscaping, lawn care, painting, residential cleaning, HVAC, general contracting, pest control, tree care, mobile pet services, and snow removal.

Source: Jobber

Whether a small business or a more established franchise, if a company provides services to clients at their own homes, Jobber can help them improve operations by providing tools to streamline workflows, automate manual processes, and enhance overall productivity to serve customers better and grow their businesses.

Source: Jobber

Market Size

In 2022, the total addressable market for home services reached $657.4 billion, up 10% year-over-year. That estimate includes a $475 billion home improvement market, with 152.5 million estimated projects in 2022, a $105.9 billion home maintenance market, with 419.7 million projects, and a $76.4 billion home emergency repair market, with 93.5 million projects.

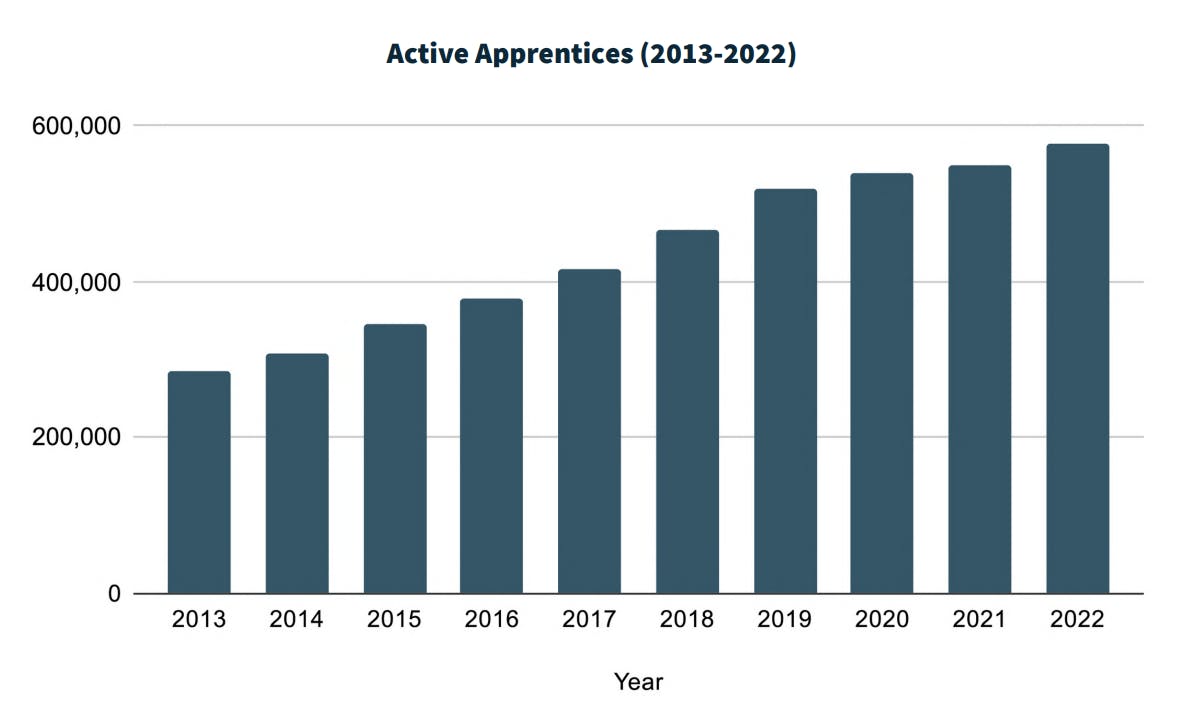

Additionally, in 2022, an estimated 6.1 million home service workers were distributed across 2.5 million businesses. Additionally, the total supply of housing units rose to 143 million, including 93.5 million single-family homes, with the average age of housing units rising to 47 years. Importantly, the labor supply for home services is also trending up.

Source: Jobber

In 2023, the field service management software market was estimated to grow 11.1%, with an annualized growth rate of 11.4% between 2018 and 2023. Additionally, the number of Field Service Management software businesses in the US grew 14.8% in 2023 and saw a 16.1% annualized growth rate between 2018 and 2023. While estimates value the field service management software market in the single-digit billions today, some expect growth to accelerate over the next decade, reaching a value as high as $29.9 billion by 2031.

Competition

ServiceTitan: ServiceTitan provides a comprehensive software platform for home and field service businesses. The company was founded in 2007 and has raised $1.1 billion as of May 2023. It offers scheduling, dispatching, CRM, invoicing, and analytics for commercial and residential use cases. ServiceTitan started in residential plumbing, HVAC, and electrical and expanded into garage doors, chimneys and commercial properties. It has a customer base of over 100K contractors as of May 2023. ServiceTitan acquired Aspire to move into landscaping in 2021.

Workiz: Workiz specializes in providing businesses with field and home service management solutions. The company was founded in 2015 and has raised $60.3 million as of May 2023. The company offers a comprehensive suite of tools designed to streamline and optimize various aspects of job management similar to Jobbers. Workiz's features include job scheduling, dispatching, invoicing, customer relationship management, online payment tools, and real-time communication capabilities. It targets a range of service-oriented sectors, such as plumbing, electrical, HVAC, and cleaning, catering to small and larger enterprises. Over 100K business professionals used it as of November 2021.

Housecall Pro: Housecall Pro, founded in 2013, is another Jobber competitor targeting small home services businesses. It offers a platform that, similar to Jobber, streamlines operations, including job scheduling, dispatching, payment processing, and customer management. As of May 2023, Housecall Pro has raised $175 million and is used by more than 30K HVAC, plumbing, electrical, cleaning, and other businesses.

BuildOps: BuildOps offers an all-in-one software solution for contractors to operate their businesses. It was founded in 2018 and has raised $98.8 million. It focuses on industries including HVAC, electrical, plumbing, refrigeration, and fire safety and offers features including scheduling, dispatching, invoicing, customer management, and a mobile app.

Beyond the competitors listed above, Jobber operates in a crowded field with many other players. These include companies like FieldEdge, mHelpDesk, Kickserve, Fieldpoint, FieldAware, Simpro, GoSite, FieldPulse, and more.

Business Model

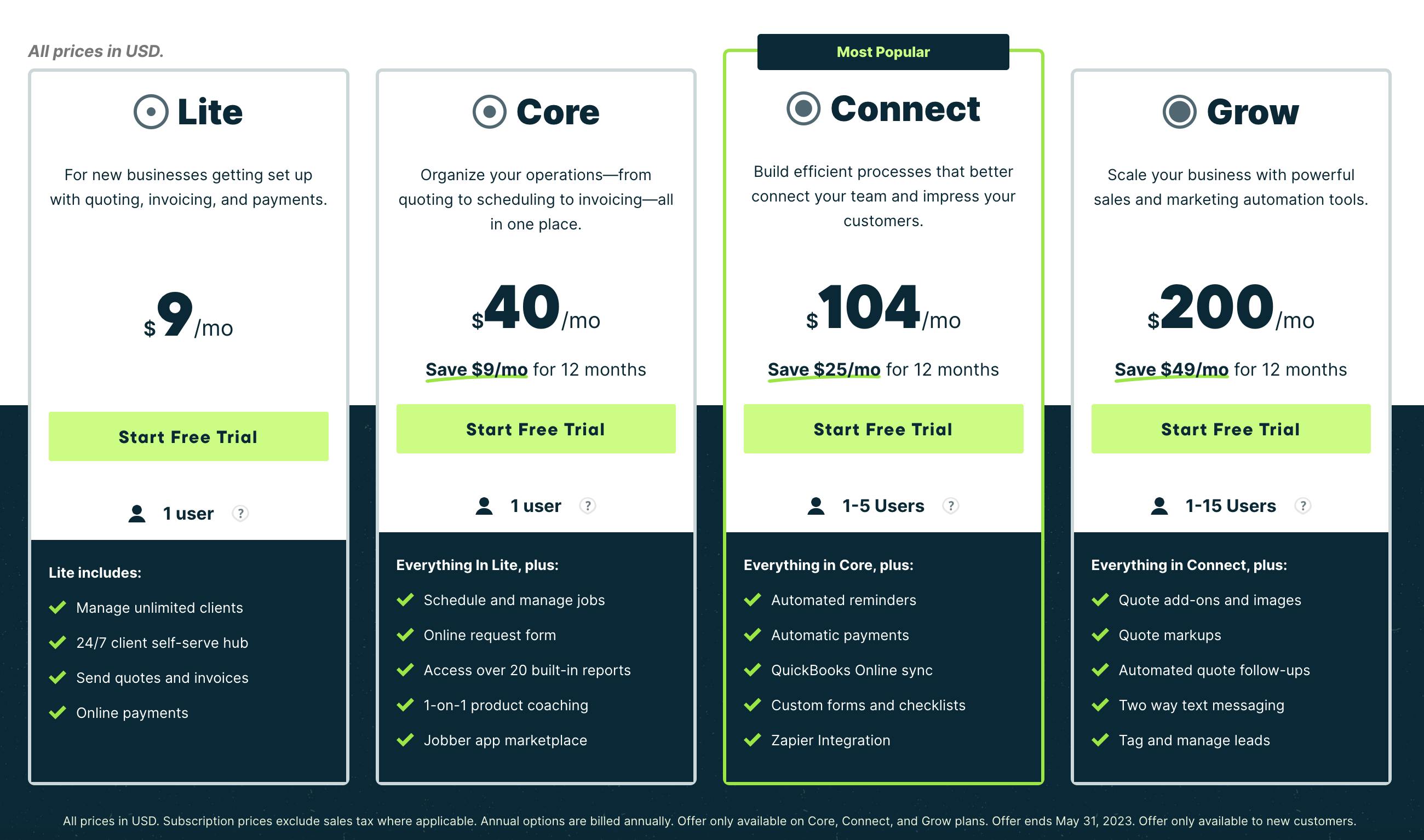

Jobber employs a subscription-based business model. Outside of a free 14-day trial, the company charges customers fees at monthly or annual rates for access to various features, depending on the plan they choose.

Source: Jobber

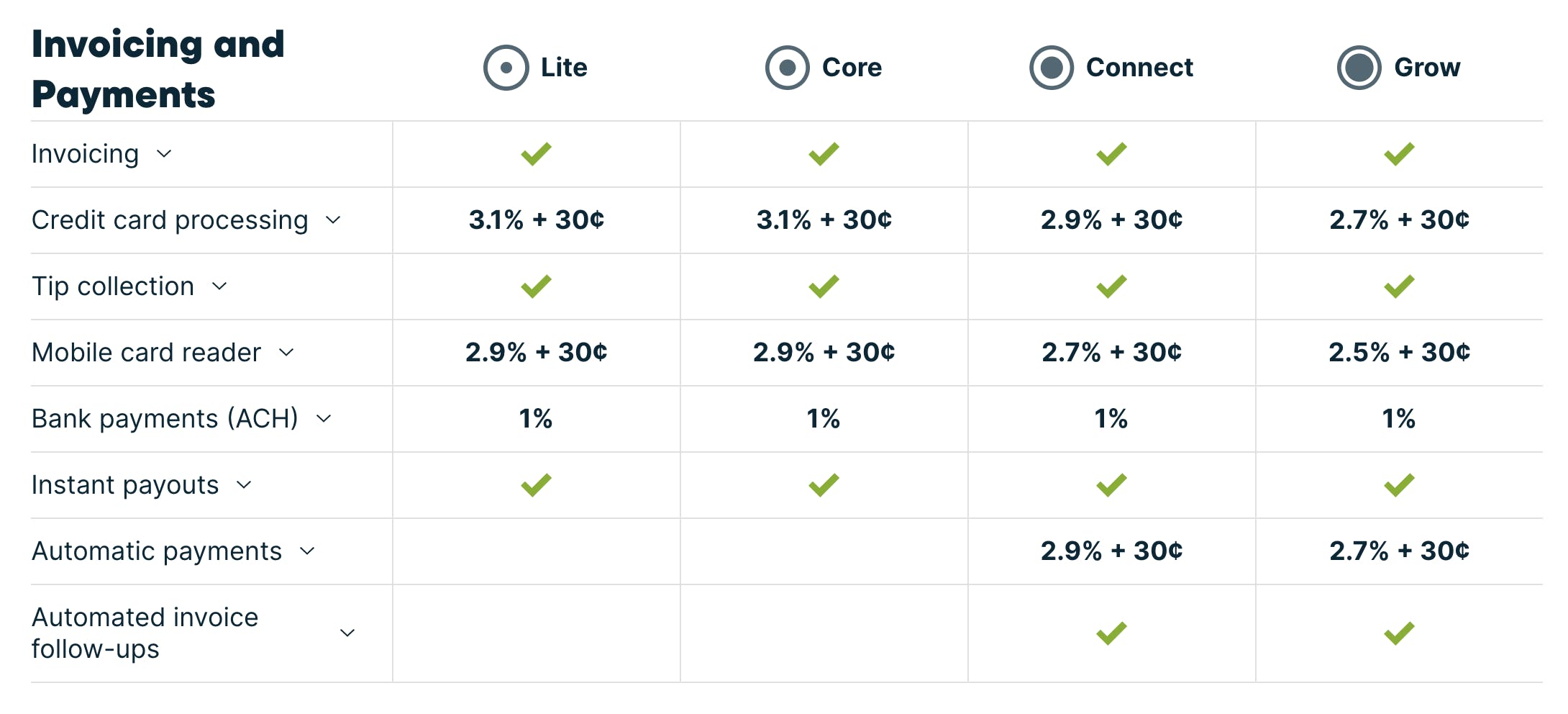

Jobber’s subscription tiers include Lite, Core, Connect, and Grow. The company also charges $29 per month for every extra user on an account and maintains various payment processing fees depending on the plan.

Source: Jobber

Traction

In 2015, Jobber said that more than 3.5 million people had been serviced by businesses using its platform since launch and that the company had processed more than $1 billion in invoices. In 2019, CEO Sam Pillar said that the company had experienced over 300% growth in revenue over the prior two years and was processing over $6 billion in services annually.

In August 2020, Jobber and Stripe announced an expanded partnership to offer flexible financing options and instant payouts to customers in North America. At the time, companies using Jobber had serviced over 10 million people, and its customers were still delivering more than $6 billion in services annually. That year, the company increased recurring revenue by 90%. As of January 2021, Jobber had 100K customers in 47 countries, processed more than $15 billion in services, and employed more than 250 people. That year, Jobber saw 80% growth in Jobber Payments volume, having processed $1.7 billion to date.

In February 2023, the company said it had 600 employees and that $13 billion was billed and collected on its platform across 27 million households in the prior year. CEO Sam Pillar also said revenues were up three-fold in the prior two years, above $100 million annually. As of May 2023, Jobber was used by more than 200K service professionals across more than 60 countries.

Valuation

Jobber has raised $183.5 million in total funding to date. It raised a $100 million Series D round in February 2023 led by General Atlantic. Other investors in the company include Version One Ventures, Summit Partners, Tech Pioneers Fund, and Point Nine. The company has not publicly released its valuation.

Key Opportunities

International Expansion

By offering productivity tooling that is intended to have universal appeal across the home services industry, Jobber has the potential to expand its business globally by targeting new market geographies and increasing its presence in existing ones. Around the globe, growth in service management will likely be driven by companies needing to digitize and optimize their business processes, reduce operational costs, and enhance customer satisfaction. Jobber can leverage its positioning as an easy-to-implement, easy-to-use, easy-to-get-help platform to be the name of choice for small and growing field service industry businesses around the world.

Advancements in AI

Advancements in AI present a significant opportunity for Jobber's business. With the emergence of new LLM systems, Jobber can leverage the home and field service industry-specific historical data compiled across its platform to integrate generative AI features throughout its products, improving automation and ease of use across messaging and calendars. Doing this can further help field service companies optimize operations, reduce costs, and improve customer satisfaction.

Demand for Collaboration Software

The productivity management software market is growing rapidly. Additionally, as the number of apps companies use rises, teams of all kinds will likely become frustrated by the “toggle tax,” spending time managing work across multiple platforms. This is likely increasingly true in the home and field services industry, which is still early in industry-wide digitization. Given its robust feature set and user-friendly interface, Jobber is well-positioned to capitalize on this trend.

Key Risks

Competitive Landscape

The number of Field Service Management software businesses in the US grew 14.8% in 2023 and saw 16.1% annualized growth between 2018 and 2023. The competitive landscape could prove a challenge for Jobber, particularly in limiting its ability to expand and retain its customer base and market share. With more options, the potential for customer churn becomes a larger risk, and retaining existing customers is critical for Jobber's long-term success. Jobber must continuously enhance its product, provide excellent customer support, and build strong relationships with its clients to reduce churn rates and maintain customer loyalty.

Market Risks

Macroeconomic and market conditions could impact Jobber's business negatively. For example, consumers may cut back spending on non-essential home services in an economic recession or downturn, possibly reducing demand for some of Jobber's service sectors. Supply chain and inflationary pressures may also increase home service prices and reduce demand. Further, technological changes in the industry could also impact Jobber's business, such as a down-the-road shift toward automated solutions that cannibalize Jobber’s business model by improving worker productivity so much that they reduce the need for additional seats on Jobber’s platform, though this may be unlikely.

Jack of All Trades, Master of None

Jobber markets itself as an easy-to-use tool that checks the boxes for a large variety of field and home services companies across various sectors. While this opens Jobber up to a wider net of potential customers, an issue that may arise is that the company may lose focus, and its product might not be the highest quality option on the market for any particular use case. This may eventually harm Jobber’s ability to appeal to new customers or remain a useful option with existing customers as their businesses scale.

Summary

As with any service industry, home service businesses face challenges in managing their operations, billing and invoicing, scheduling appointments, tracking job progress, and handling customer communication. These challenges persist at a time when, last year in the United States, the $657.4 billion home services market was estimated to be growing an estimated 10% year-over-year across a total volume of 665.6 million home improvement, maintenance, and emergency repair projects.

Jobber launched in 2011 and has raised $183.5 million in funding as of May 2023. Jobber aims to digitize, streamline, and improve home service operations by offering a comprehensive, scalable software platform that integrates various home service business functions. While the company faces significant competition, it has also seen significant traction, helping more than 200K businesses operate more efficiently, scale more effectively, and improve customer satisfaction.