Thesis

The US is the second largest passenger vehicle market in the world, with more than 290 million registered vehicles. Automotive services include mechanical and electrical inspection, maintenance, and repair of automobiles. Routine services, such as oil changes and tire repair, as well as non-routine services, such as rust-proofing and exterior painting, are all considered part of the service industry. In July 2022, there were 283K auto mechanic businesses in the US. Between 2013 and 2022, the industry added over 35K establishments, and the global automotive repair and maintenance market reached nearly $750.8 billion in 2021.

Yet, in terms of technological innovation, this industry has remained stagnant for the past few decades, resulting in a poor customer experience. Most businesses in the space still operate on pen and paper, phones, and spreadsheets. Many auto repair shops are independent and resource-constrained. As a result, owners get bogged down with manual tasks and cobbling together disparate tools for critical business functions like invoicing, scheduling, forecasting, and parts ordering. Many use old, clunky software downloaded on the local onsite machines.

Shopmonkey is a cloud-based, modern management system that simplifies the complexities of running an auto-repair business from appointments, billing, and payments to ordering parts and managing inventory. The company helps repair shops consolidate tools, save time, and streamline their operations by equipping them with vertical software to run, manage and grow their business. Leveraging the playbook written by other vertical SaaS players serving SMBs, such as Toast for restaurants or ServiceTitan for home services, Shopmonkey is building the all-in-one solution auto-repair shops.

Founding Story

Ashot Iskandarian founded Shopmonkey in 2016. His family left Armenia in 1992 after the collapse of the Soviet Union. In his youth, his parents worked at gas stations in California, and he would hang around trying to help. He started spending time at local car mechanic shops, learning how to fix cars. His family later moved to the Bay Area when his parents worked at Apple and Intel. After graduating from San Diego State University, Iskandarian worked as a product manager at Financial Engines, Xactly, and Intacct, on financial management software for SMBs. However, his passion for ‘wrenching’ never went away.

Iskandarian observed how shop owners were struggling with bad software, costing them time and money and frustrating their customers. He realized auto repair shops needed better software customized to their needs to help them manage and grow their business and started writing code for Shopmonkey in January 2017. He then quit his job to pursue Shopmonkey full-time in July 2017. As Iskandarian put it:

“Shopmonkey is really just a combination of my love of motorsports, my love of software, and the calling that I believe I have to serve the people in this industry and repair shops specifically.”

Iskandarian went full-time on the project after raising $75K of start-up capital from friends and family. He recruited a Ukrainian software engineer named Yuri Khmelevsky, who later went on to become the VP of Engineering. While Yuri was developing the product, Iskandarian was doing everything else, from selling to design and customer support.

Product

Source: Shopmonkey

Workflows

Shopmonkey’s drag-and-drop workflow product allows shop owners to move a job through their shop from start to finish with a click. They can tailor the workflow to fit their needs, convert work orders into invoices, and automatically archive completed jobs.

Estimates

Owners can use pre-built jobs and pricing to generate estimates quickly using Shopmonkey. They can easily access parts and labor guides within any estimate, automatically import vehicle data using the mobile app’s scanning technology, or look up manually by year, make, or model.

Customer Interactions

Shopmonkey enables customer communication to live in one interface. This helps owners spend less time on the phone and work faster with e-signatures and digital messaging for approvals and feedback. Shopmonkey also sends appointment reminders and notifies confirms or cancels appointments.

Inventory Management

Shopmonkey inventory management helps manage and track inventory in real-time based on the estimates and the jobs completed. It sends alerts when the shop is low on inventory and enables ordering from third-party partners such as WorldPac or Epicor.

Workforce Management

Shopmonkey workforce management enables shop owners to assign jobs to their staff, manage schedules and payroll, track shifts, and keep tabs on parts and labor commissions produced by each employee.

Payment Processing

Shopmonkey payment processing enables shops to accept payments, send invoices, and streamline accounting.

Reporting

It lets owners have analytical views of operational metrics, including sales and payment summaries, vendor purchasing trends, customer outstanding balances, cost trends, and profitability.

Market

Customers

Shopmonkey started by targeting independent car repair shops in the US. In the US, nearly 70% of the shops are independent and 53% generate less than $500K in annual sales.

The target persona and buyers of Shopmonkey are shop owners, but the product is used by multiple stakeholders. Technicians employed at a shop using Shopmonkey can use the mobile app to manage their shifts and track their jobs. Meanwhile, the shop’s customers engage with the product to communicate and pay for the service. Finally, Shopmonkey’s Quickbooks integrations and reporting can be used to help the shop’s accountants.

Business Model

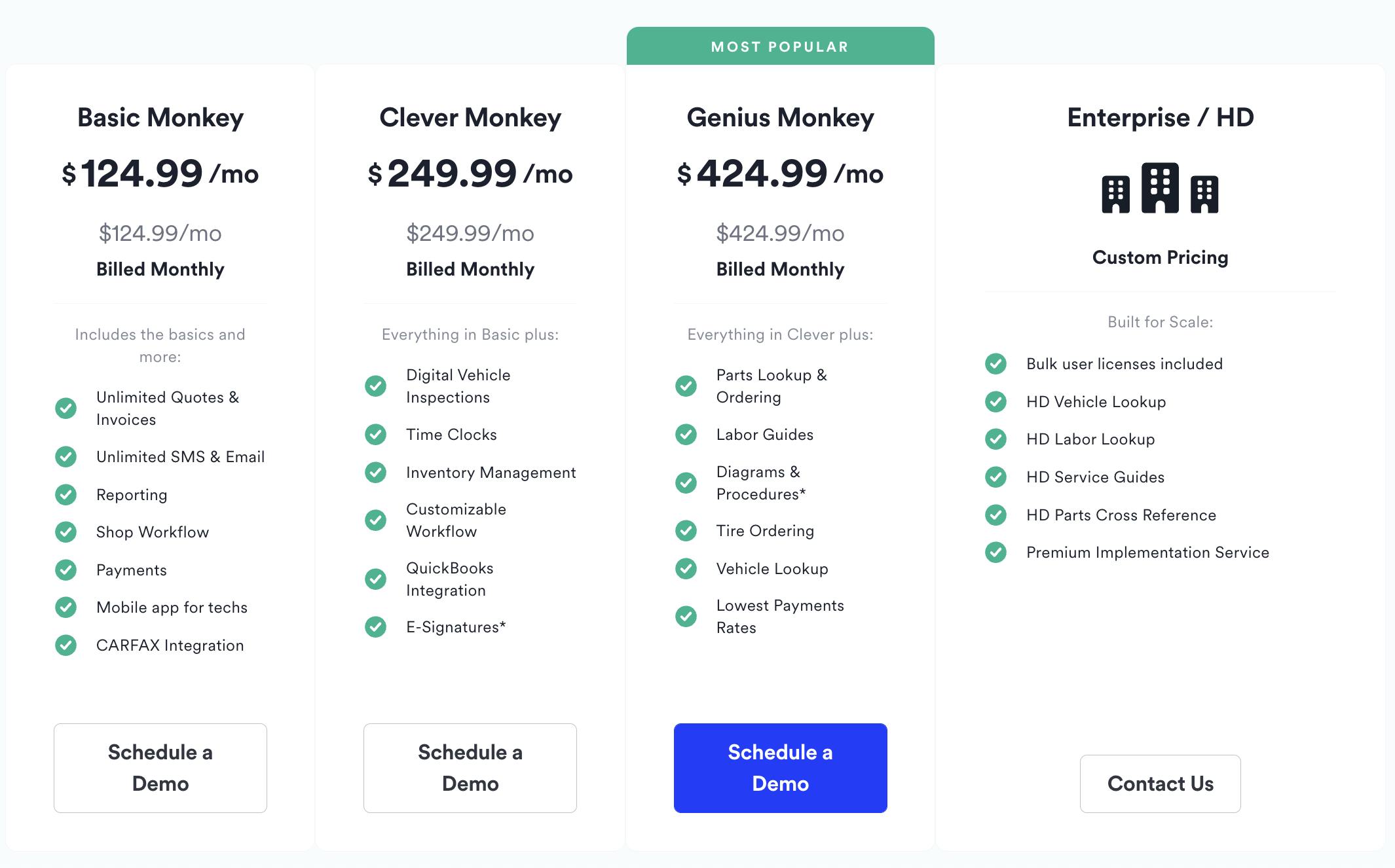

Shopmonkey primarily generates revenue from both subscription plans and transaction fees. All subscription tiers include the cloud-based platform, workflow management, staff management, payments, estimates, communications, reporting, support, invoicing, and more.

Source: Shopmonkey

The take rate on payments is a function of how much volume it processes and whether the card payments were made in-person or online. Besides these two revenue streams, the company also offers revenue-share-based financing via Shopmonkey Capital and charges a flat fee.

Source: Shopmonkey

Market Size

In 2021, US consumers spent $194.9 billion on maintaining and repairing their motor vehicles. In the fourth quarter of 2021, there were 239K auto repair and maintenance centers in the US. Between 2010 and 2021, the industry added over 17.7K establishments. The global automotive repair and maintenance market reached nearly $750.8 billion in 2021, having increased at a compound annual growth rate (CAGR) of 3.8% since 2016. Some estimates indicate there are 400K individual auto repair shops in the US that Shopmonkey could go after.

Competition

AutoLeap - An all-in-one auto repair shop software that helps to keep complete track of the repair business – from scheduling appointments to managing technicians and generating invoices. It was founded in 2019 in Canada. It announced its $18 million Series A in October 2021, led by Bain Capital. It operates both in Canada and in the US. It goes beyond what Shopmonkey does by offering marketing campaigns, online reviews management, and fleet management for repair shops working with B2B customers.

Tekemetric - Tekmetric is management software for auto repair shops. Businesses can perform vehicle inspections, build repair orders, manage inventory, track jobs, and communicate with customers. It was founded in 2016 in the US and announced it had raised a growth round in March 2022 from Susquehanna. It has 3K customers in the US and Canada. Compared to Shopmonkey, it has a unique feature called Tekmetric Multi-Shop for people owning and managing several shops.

Shop-Ware - Another shop management software company that wants to become an all-in-one platform. It was founded in 2013. It announced a $15 million Series A led by Insight Partners. It operates in North and South America and serves independent and multi-location shops. Like AutoLeap, it offers fleet management for B2B customers. Like Tekemetric, it’s able to serve multi-shop owners. Unlike Shopmonkey, it does not offer payment processing.

Mitchell1 - Started in 1918 as a book publisher selling books with information for technicians and consumers to repair cars. Today, it sells products to independent repair shops, including an end-to-end shop management solution like Shopmonkey, a solution for technicians to access OEM repair information, and a solution for shops to manage their marketing activities. Mitchell 1 is part of a broader industrial group called Total Shop Solutions, selling auto repair physical and digital products.

Traction

In 2022, Shopmonkey revenue run rate hit $7.2 million in revenue. In July, the said it crossed 1K customers. It had over 5K customers in December 2022.

Valuation

In July 2021, Shopmonkey announced it had raised a $75 million Series C co-led by Index and Bessemer at an undisclosed valuation, with participation from returning investors Headline and I2BF and new investor ICONIQ Growth. It raised $25 million in its Series B, led by Bessemer Venture Partners, with participation from Index Ventures, e.ventures, and I2BF.

Key Opportunities

International Growth

Shopmonkey began its operations in US. Since then, it has expanded to Canada and it could expand into other geographies like Latin America or Europe to continue to increase its customer base and addressable market.

Enterprise Growth

Shopmonkey has historically targeted independent car repair shops, but the company is now also going after franchises. In August 2022, it announced that Byrider, which is a US-based car dealership franchise with 148 locations in the United States, would deploy Shopmonkey into its network. It’s a different go-to-market motion with a longer sales and deployment cycle. It has the opportunity to build an enterprise version of the product and go up the market to lock in larger and longer contracts.

Financial Services

Shopmonkey already offers payment processing and working capital funding. In 2023, it’s planning to release a BNPL product. In the future, Shopmonkey could offer other financial services, including payroll or insurance, to integrate further into its customers' business, increase revenue and reduce churn.

Key Risks

Changing Landscape for Repair Shops

By 2024, the industry will be short 642K technicians, spread out among automotive, diesel, and collision specialties. The auto car repair market will change dramatically in the next two decades, driven by several trends like the shift from fuel cars to electric vehicles, the reduced proportion of independent shops, and the looming technician workforce shortage. Shopmonkey’s future is tied to the future of repair shops.

Product Stagnation

Shopmonkey operates in a competitive market with several venture-backed players pursuing the same vision of becoming the one-stop shop for car repair businesses, horizontal software players building verticalized offerings, and incumbents trying to shift to cloud-based software. Shopmonkey is going to have to sustain product velocity and differentiation to remain relevant as more repair shops embrace digital tools.

Summary

Shopmonkey strives to be an all-in-one platform for independent auto-repair shops which has attracted 5K customers in the United States and Canada. It started in 2016 and raised $110 million in funding from investors like Index, Bessemer, Iconiq, and Headline. Shopmonkey is currently growing the business in several directions at the same time: (i) increasing ACV per customer by embedding financial services into its platform, (ii) going upmarket by selling the platform to franchises, and (iii) expanding into adjacent verticals such as trucks repairs or tire shops.